Using Fiscal Position in Point of Sale (PoS)¶

In some countries, there are regulations on changing the tax rate when there is a combination of the characteristics of the food (hot or cold, raw or cooked …) and the place of food (dining in or takeout or takeaway). Understanding these requirements, Viindoo software supports selecting different tax rates according to each situation by using the Fiscal Position feature in the Viindoo Point of Sale app.

Requirements

This tutorial requires the installation of the following applications/modules:

Setting up Flexible Tax at Retail Point of Sale¶

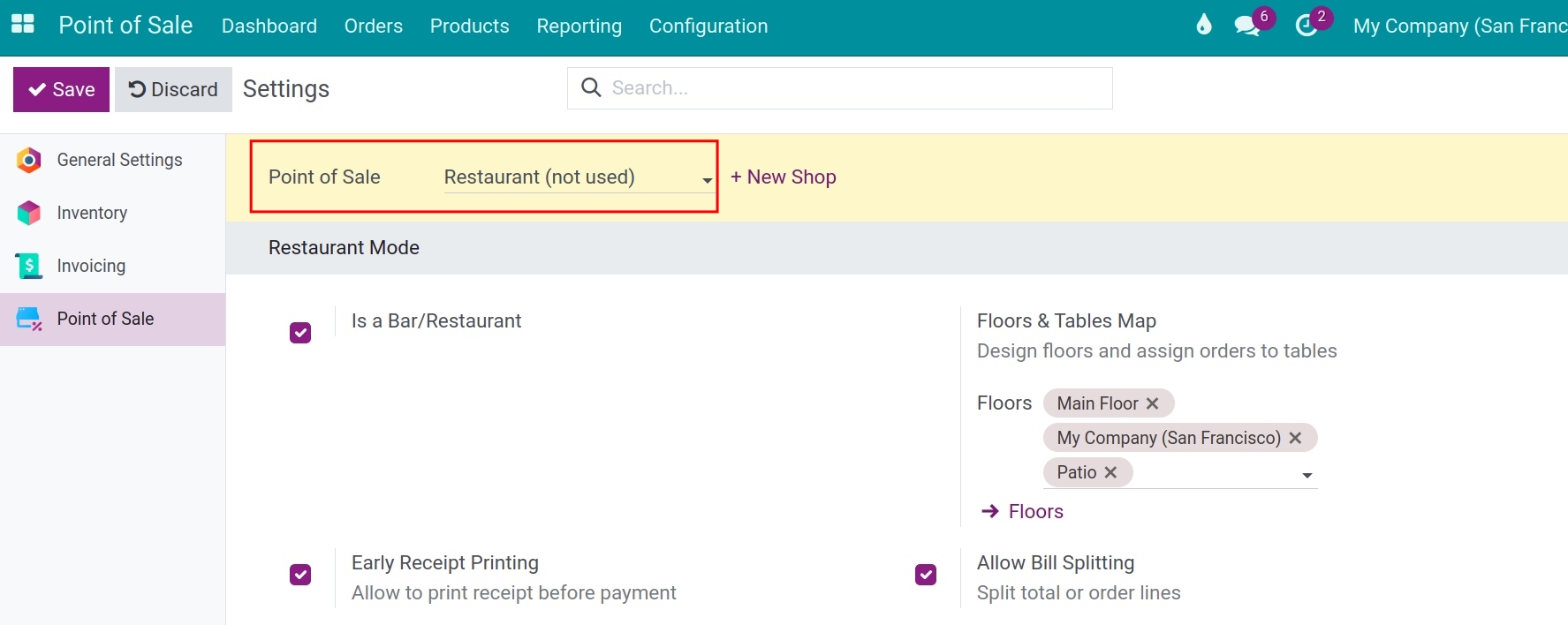

To set up Flexible Tax at the retail point of sale, navigate to Point of Sale > Configuration > Settings. In the Point of Sale field, select the desired POS to configure.

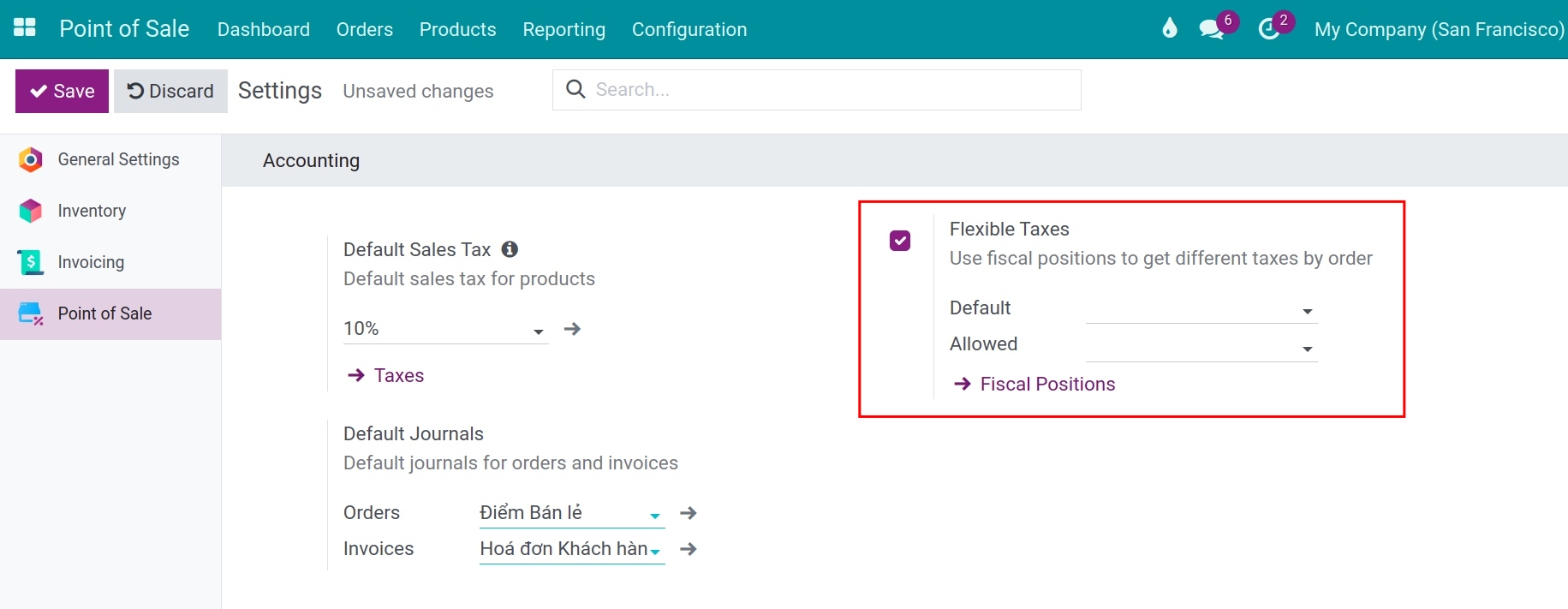

Navigate to the Accounting section and check the Flexible Taxes box. Click Save to save the changes.

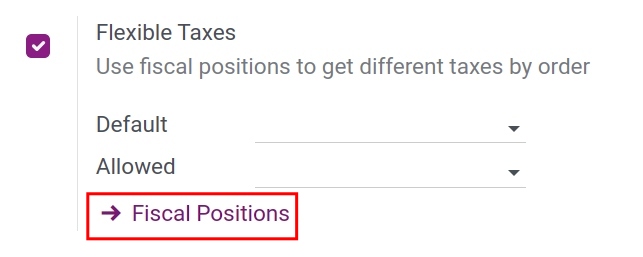

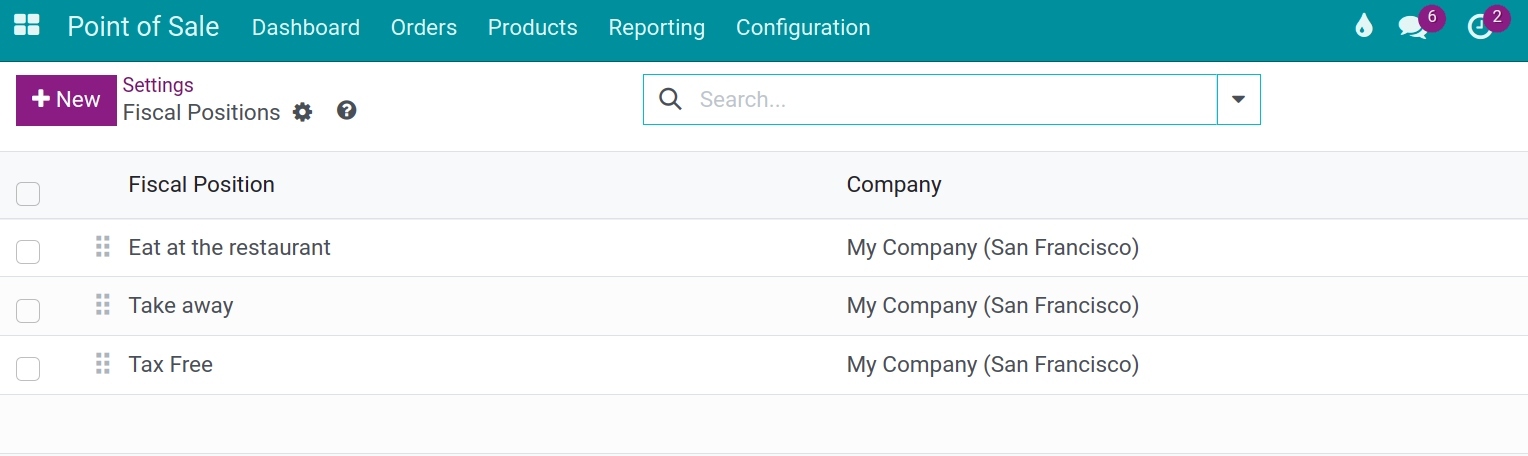

After saving, the system will return you to the interface for setting up flexible tax for the retail point of sale. Click on Fiscal Positions to configure the flexible tax.

For detailed instructions on configuring fiscal positions, refer to the article Steps to setup Fiscal Position (Taxes and Accounts).

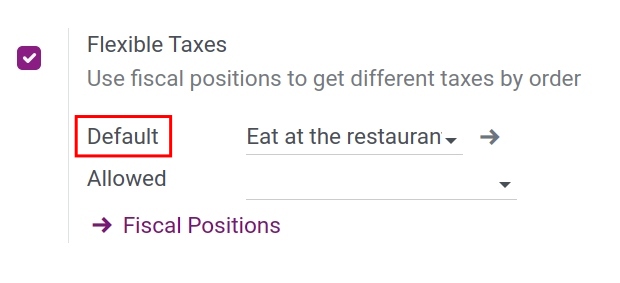

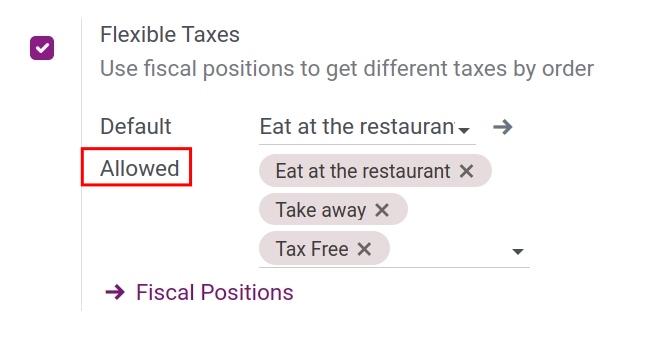

Once you have completed the configuration, go back to the POS setup interface. In the Default field, select the default fiscal position for the POS. This default fiscal position will be automatically suggested when creating a new sales order in a new session.

In the Allowed field, select the fiscal positions that are applicable to the POS.

Applying Flexible Tax at Point of Sale¶

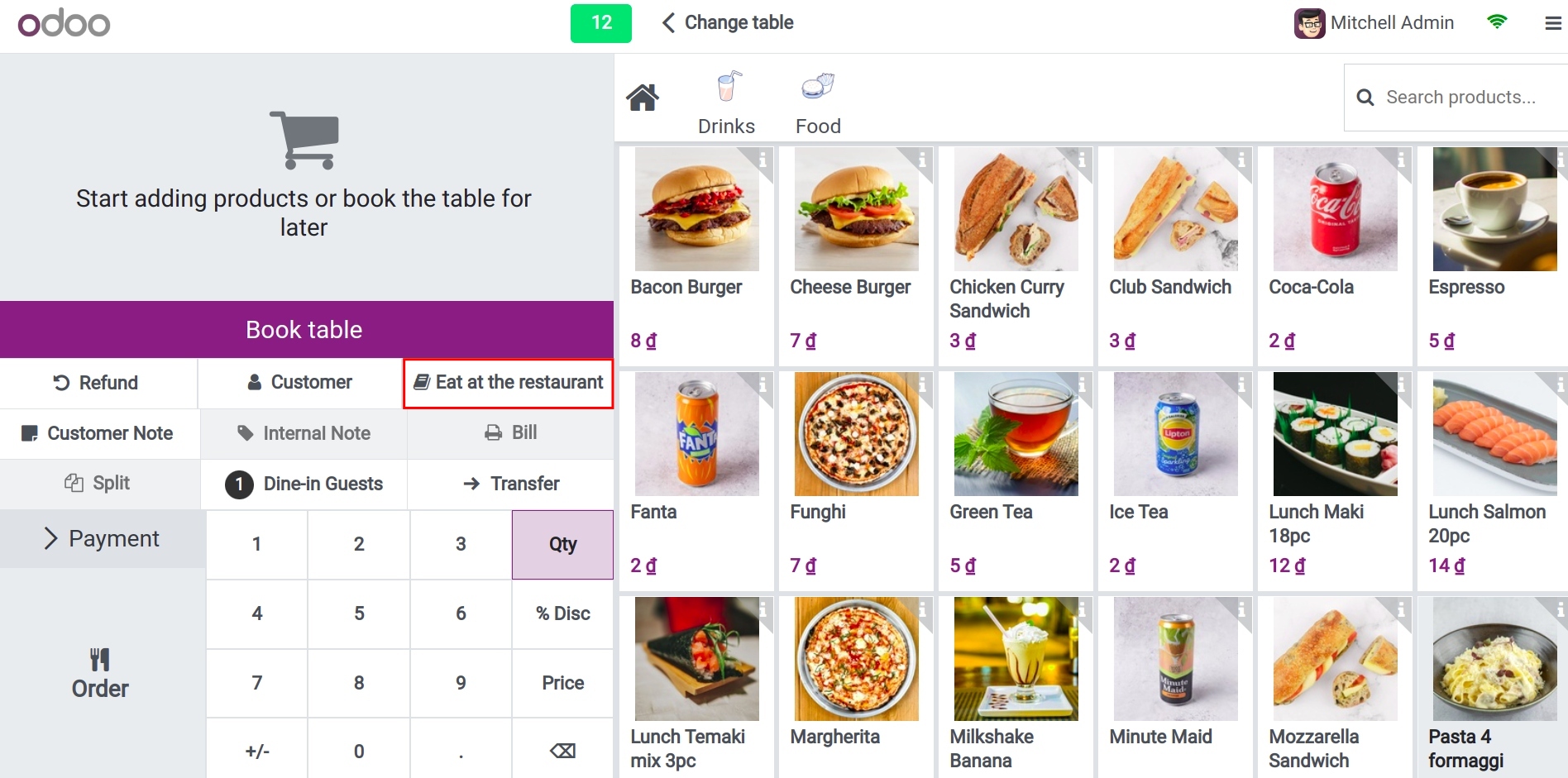

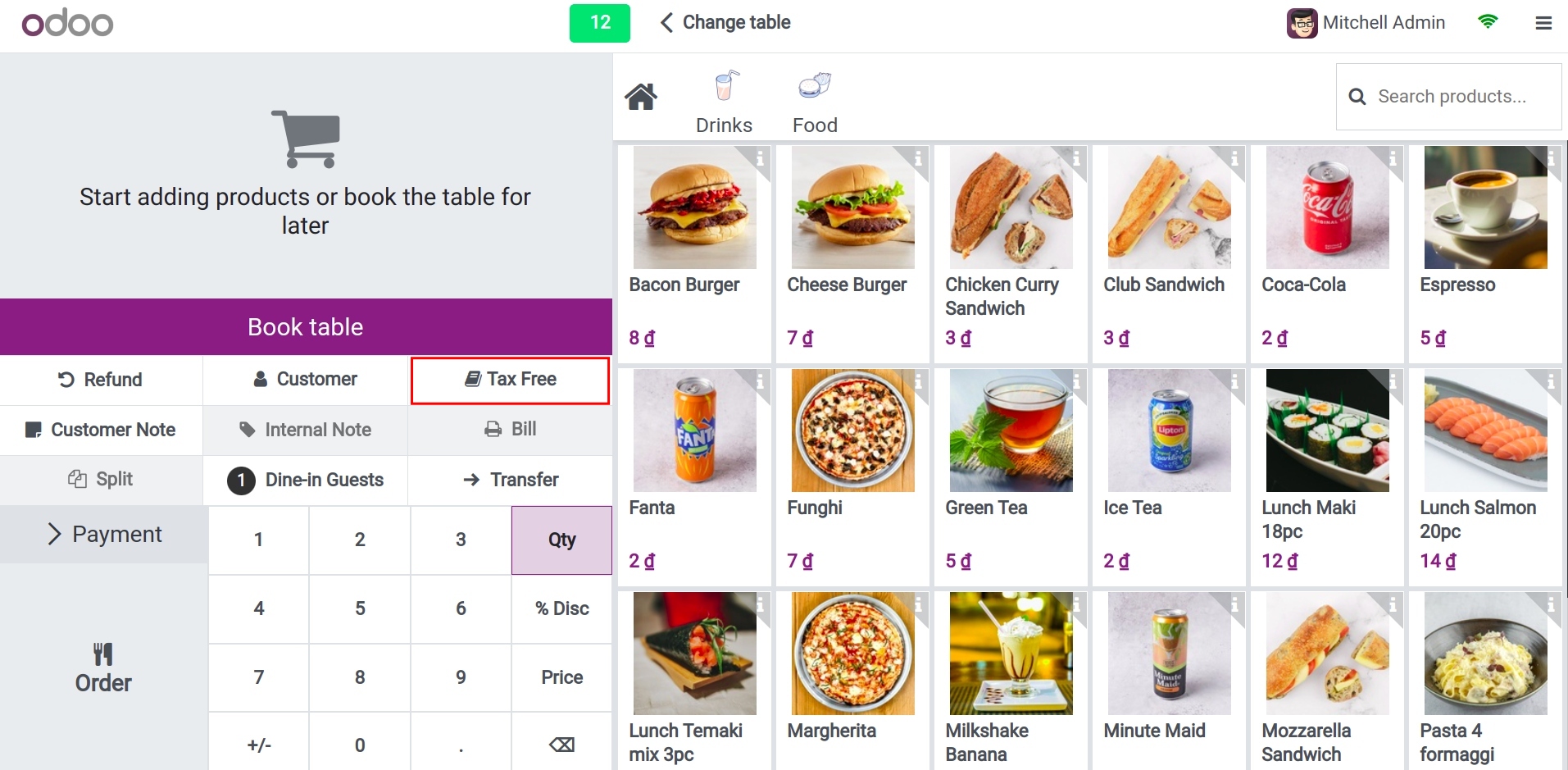

Navigate to Point of Sale application and create a new session. In the session interface, the system will automatically suggest the default fiscal position that was set up for the POS.

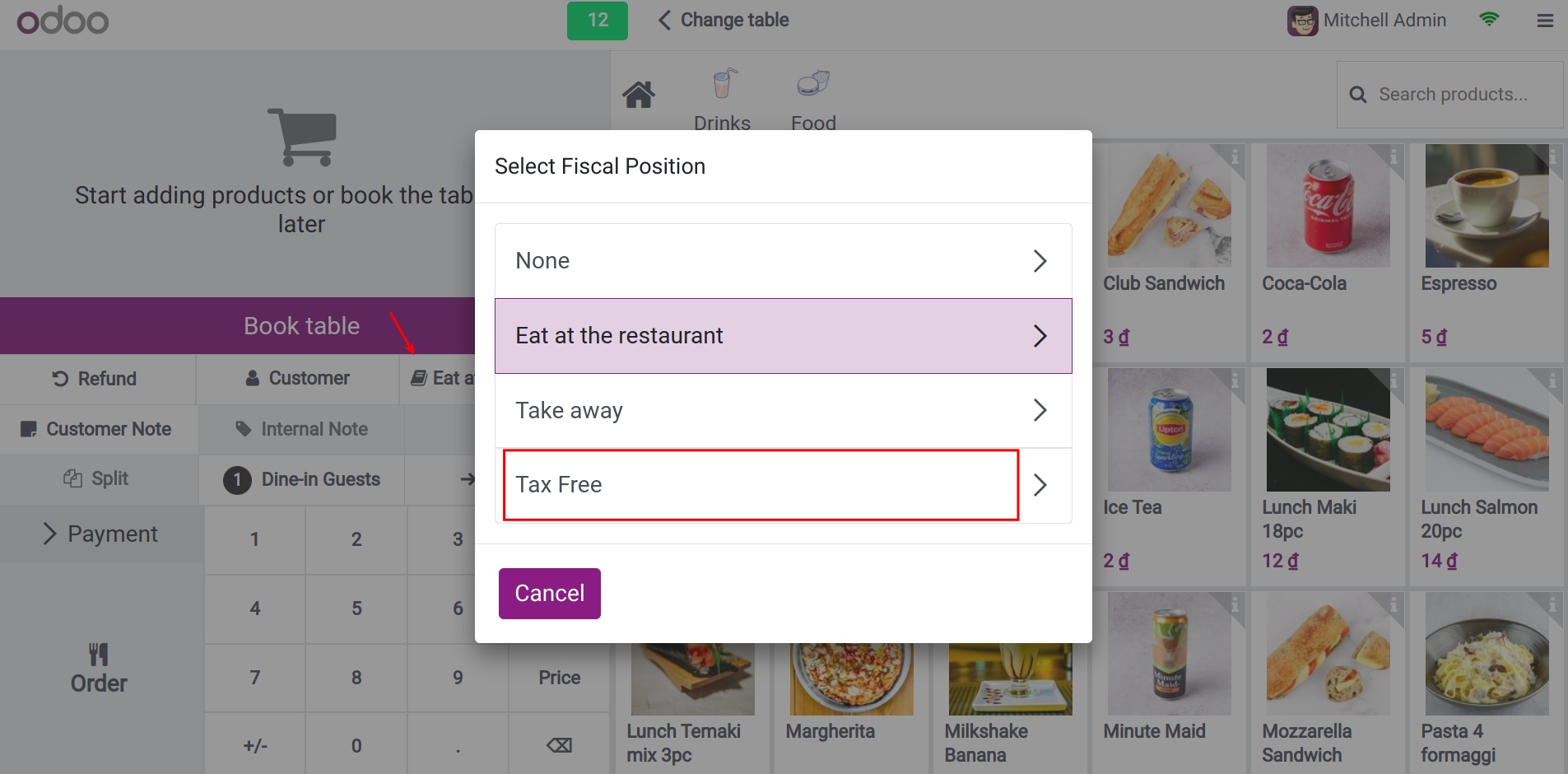

You can flexibly change the applied tax by clicking on the tax field and selecting a different fiscal position.

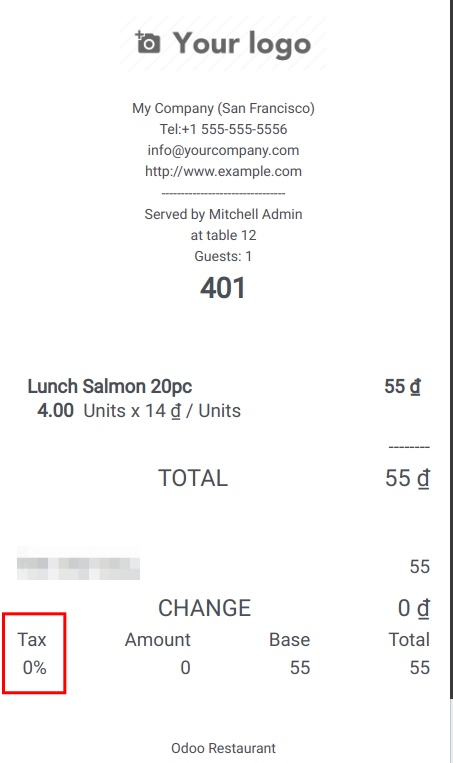

After selecting the tax, complete the order. The receipt will display the tax rate set up in the fiscal position you chose for the order.

See also

Related article

Optional module