Accounting configuration for salary rules¶

To record salary costs, employee liabilities, insurance liabilities, labor union fees, etc., and other related payments, Viindoo provides integration between the Payroll app and the Accounting app when installing the Viindoo Accounting & Finance app.

Requirements

This tutorial requires the installation of the following applications/modules:

General settings¶

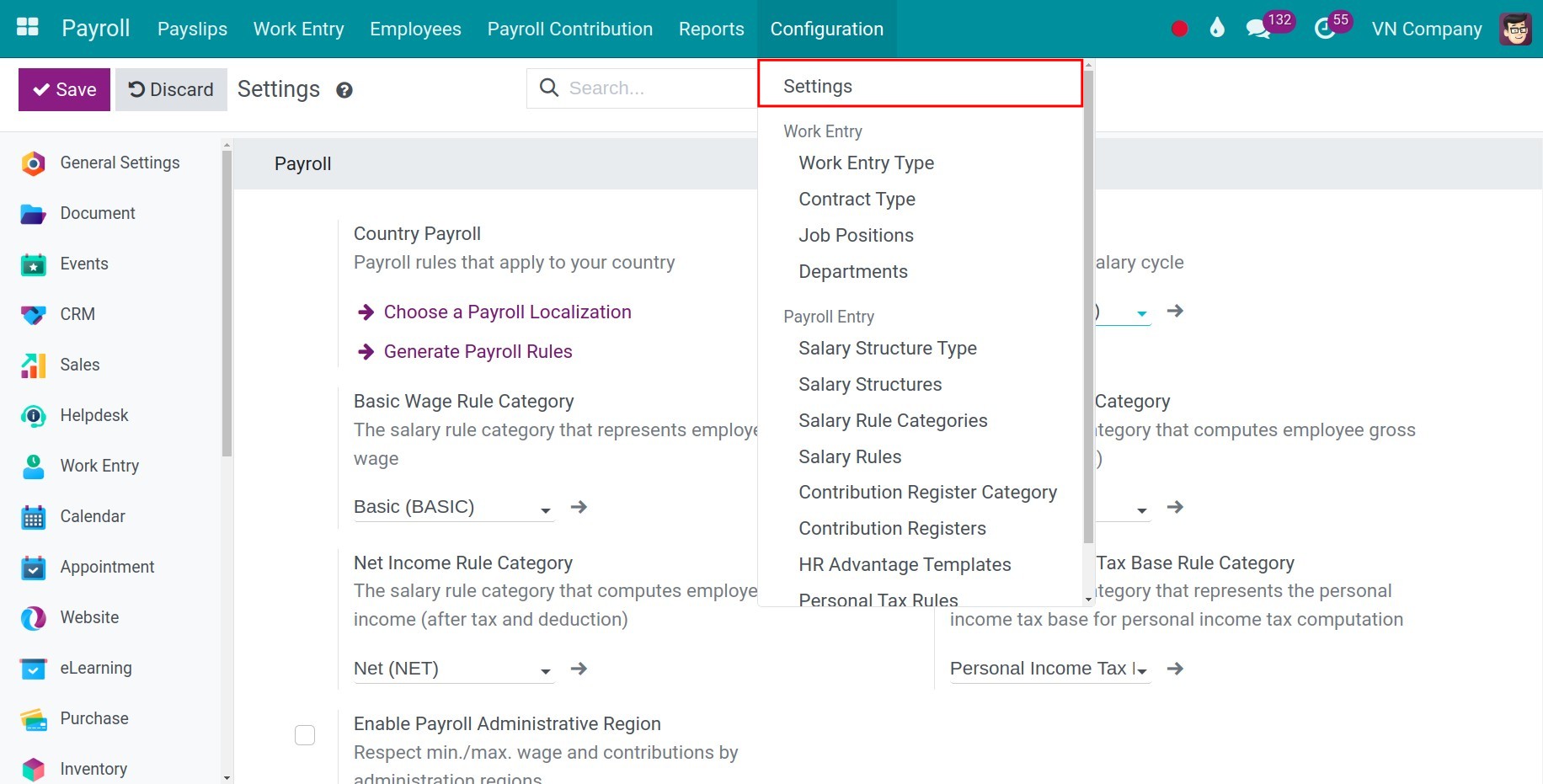

Navigate to Payroll ‣ Configuration ‣ Settings then go to the Accounting section:

From here, you can enable the following features:

Payroll Entries: Post payroll entries in accounting automatically;

Payslip Batch Journal Entry:

General Employee Payable Account: Select a payable account to record employee payable accounting entries.

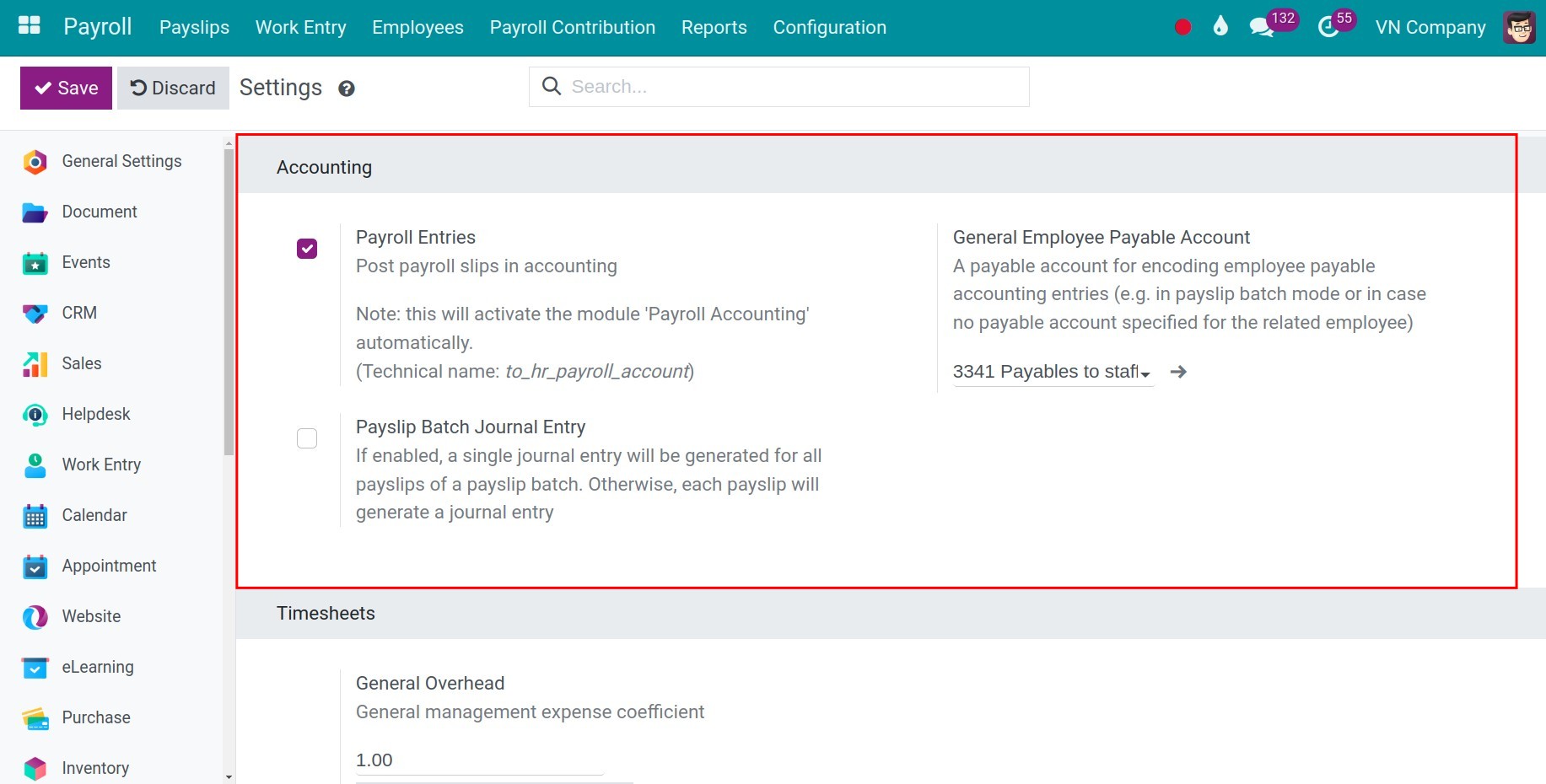

Configure salary rules¶

To configure a salary rule, navigate to Payroll ‣ Configuration ‣ Salary Rules, check off the Structure filter then find the salary rule that you need to work on. You go to the Accounting tab:

Generate Journal Item: Enable if you want to create journal items for the salary entries.

Force Encoding with Employee: If enable, accounting journal items generated by this rule will always be encoded with the private address of the employee as accounting partner, no matter the company’s Payslip batch journal entry mode is enabled or disabled.

Debit Account: Select the debit account for accounting entries.

Credit Account: Select the credit account for accounting entries.

Tax: Declare the tax type for accounting entries (if any).

You need to configure an expense account on each salary rule when you don’t distinguish salary costs for each department or each employee. In case you want to distinguish salary costs for each department or each employee, you need to configure an expense account on each department/labor contract..

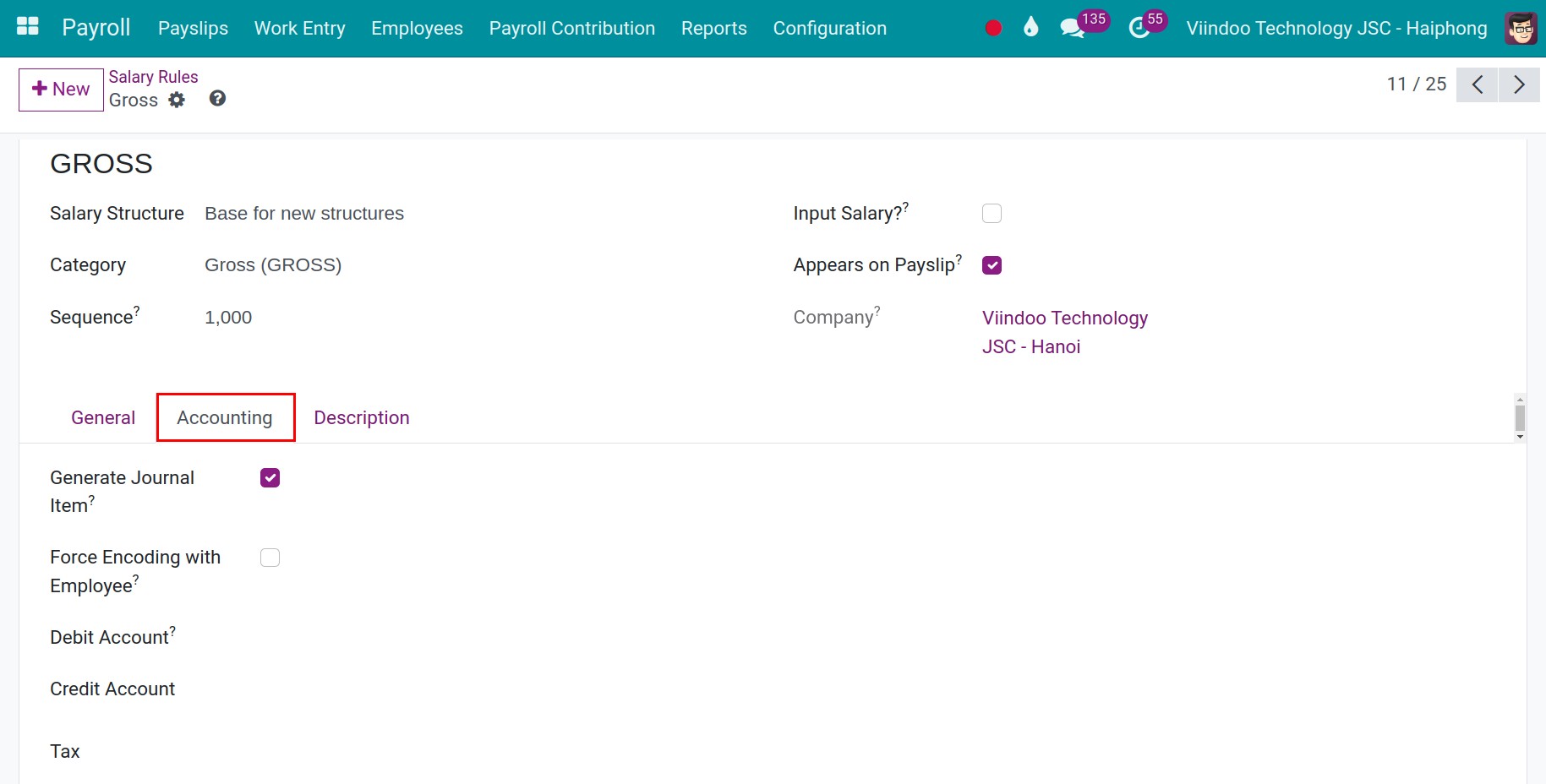

Record the salary costs on each department: Configure the expense account on the department’s settings.

To set up an expense account for each department, navigate to Payroll ‣ Configuration ‣ Departments and configure the accounting account on the Expense Account field:

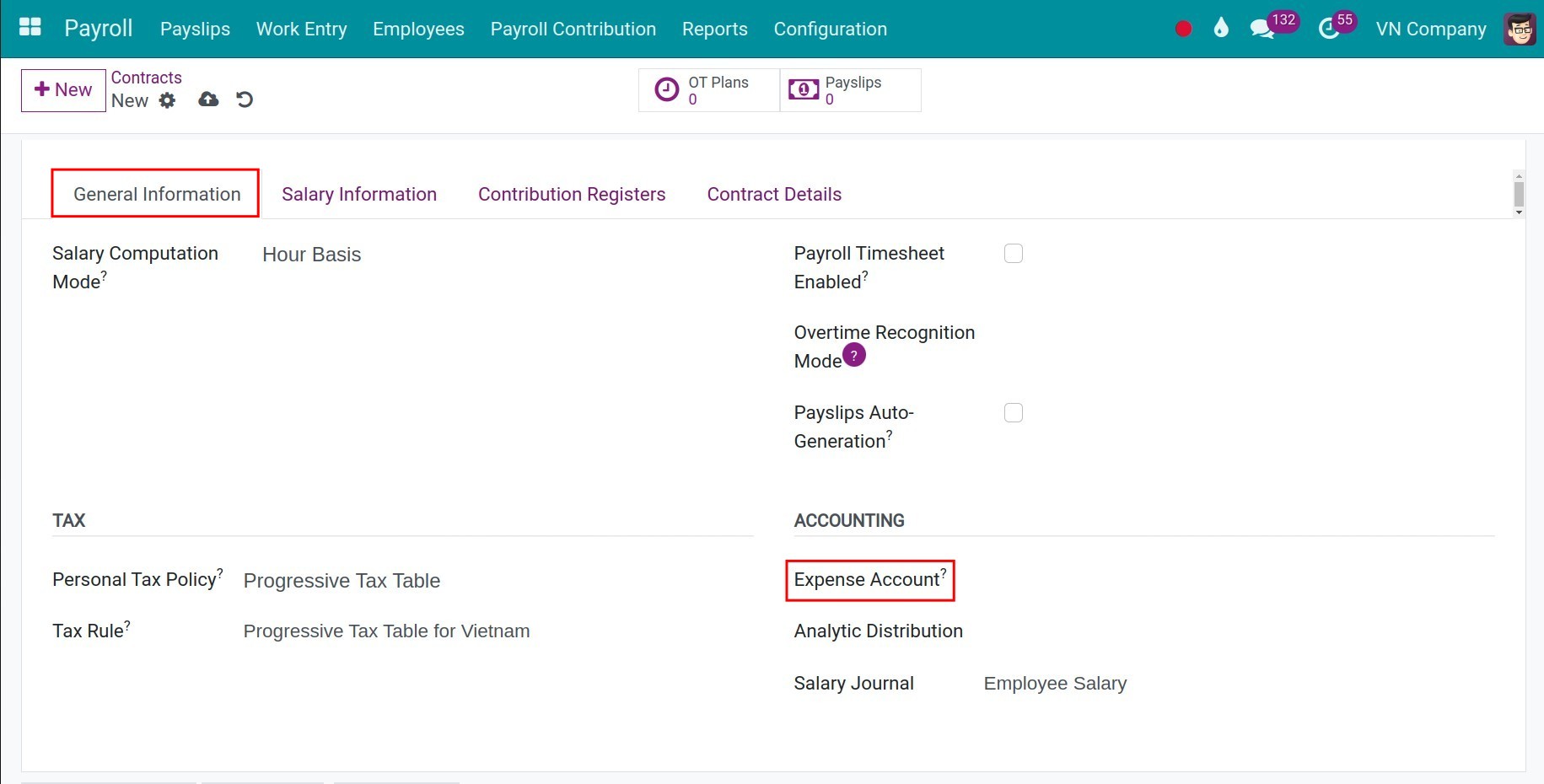

Record the salary costs on each employee: Configure the expense account on the labor contract settings.

To set up an expense account for each employee contract, navigate to Payroll ‣ Employees ‣ Contracts, find the contract that you need to configure, and select an account for the Expense Account field:

Note

In case all three places have an expense account configured, the software will prioritize in order: salary rules, contract, and the last one is department.

Salary rules examples¶

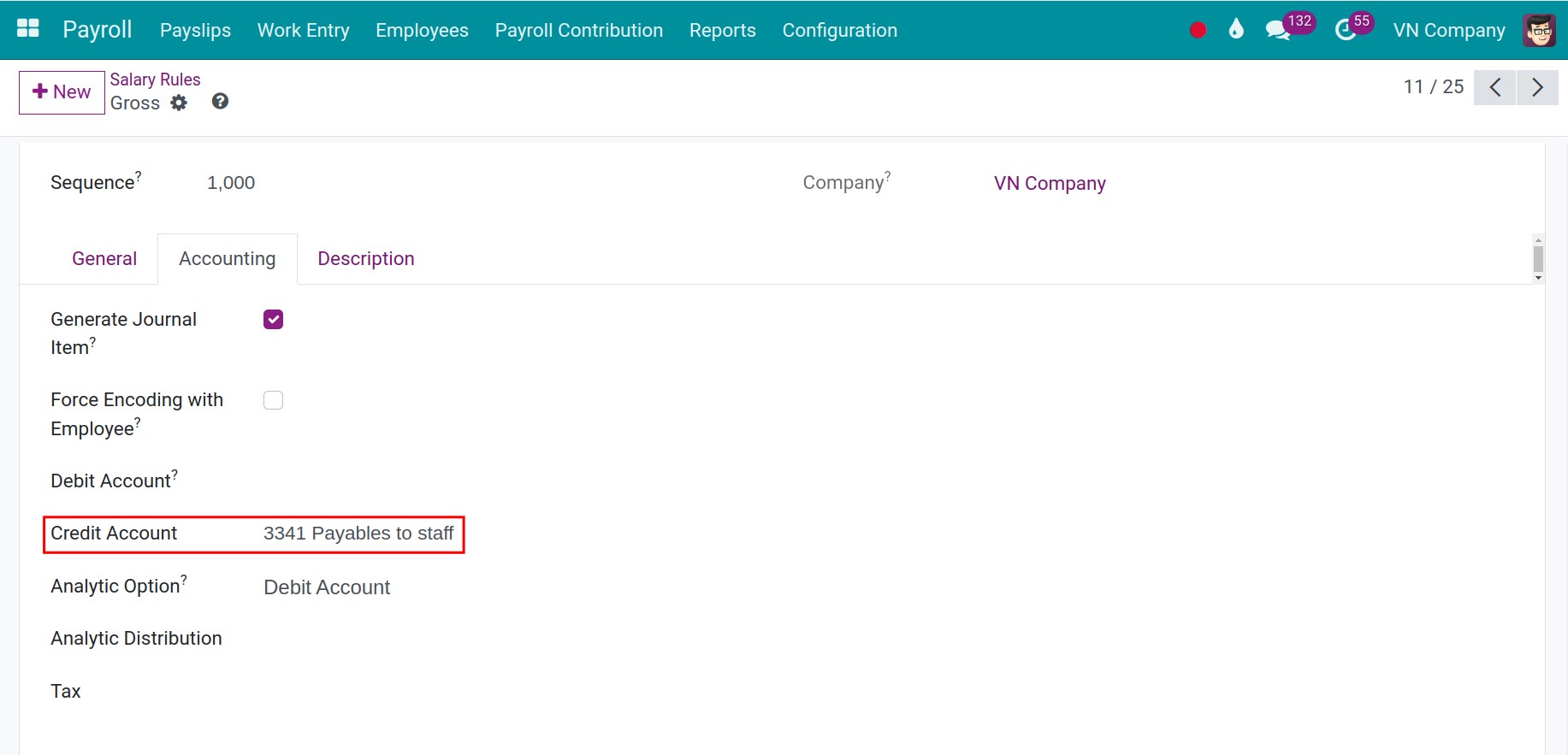

1. Gross salary rule

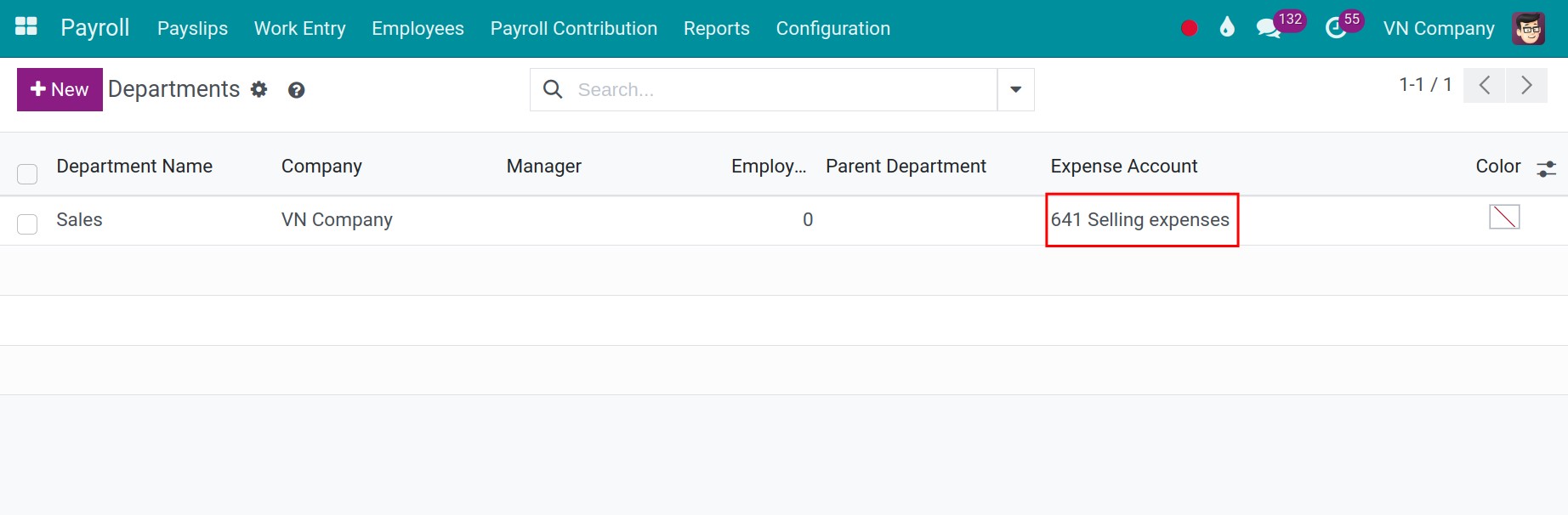

For the Gross salary rule, configure the accounting accounts as follows:

Debit Account: Select a debit account for the expenses entries of your company. Leave empty if you want to record salary costs for each employee or department.

Credit Account: Select the Payables to staff account.

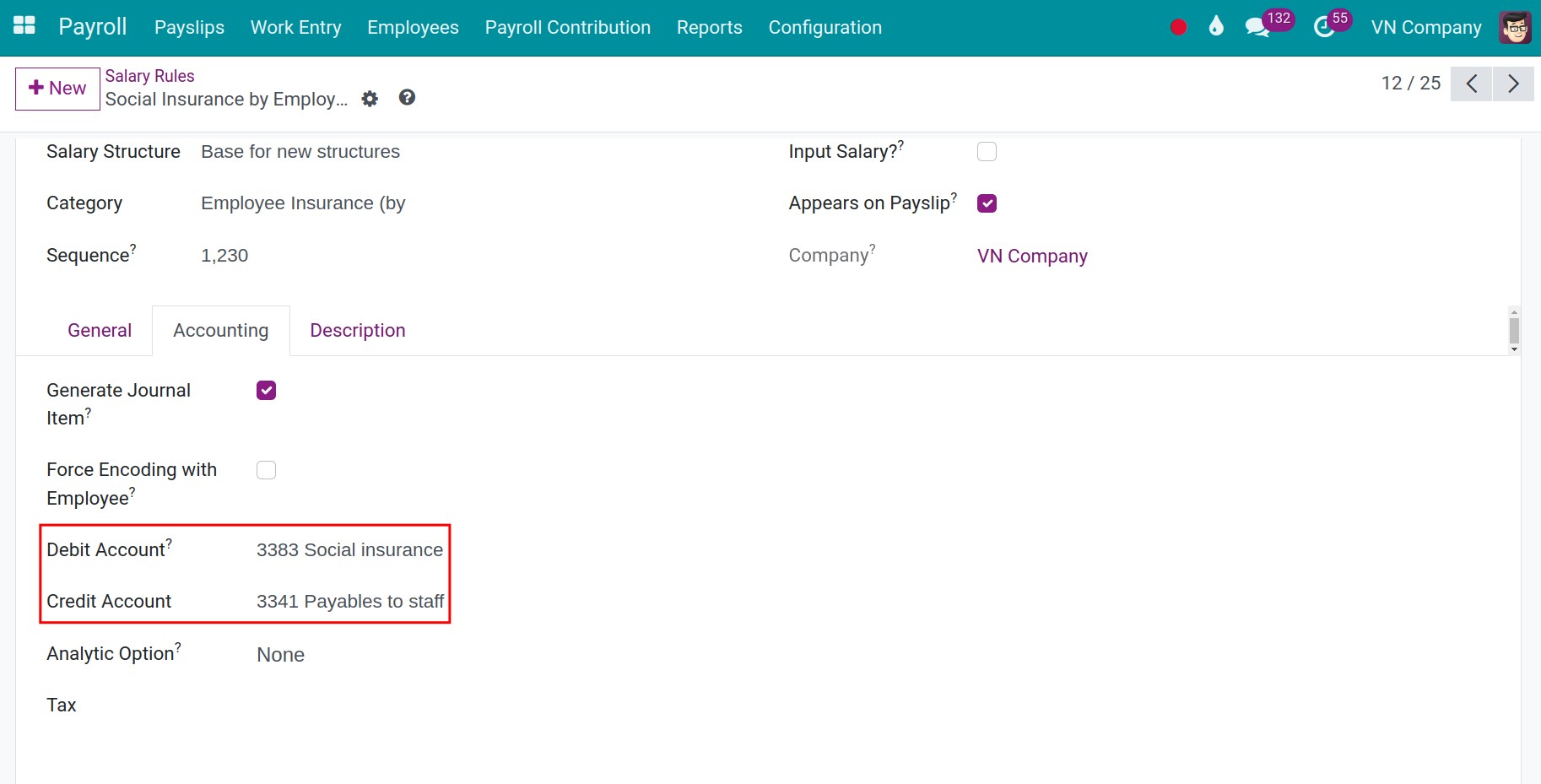

2. Salary rules for employee insurance, labor union fees, personal income tax

For salary rules related to employee contributions such as insurances, including social insurance, health insurance, unemployment insurance, labor union fees or personal income taxes, etc., configure the accounting accounts as below:

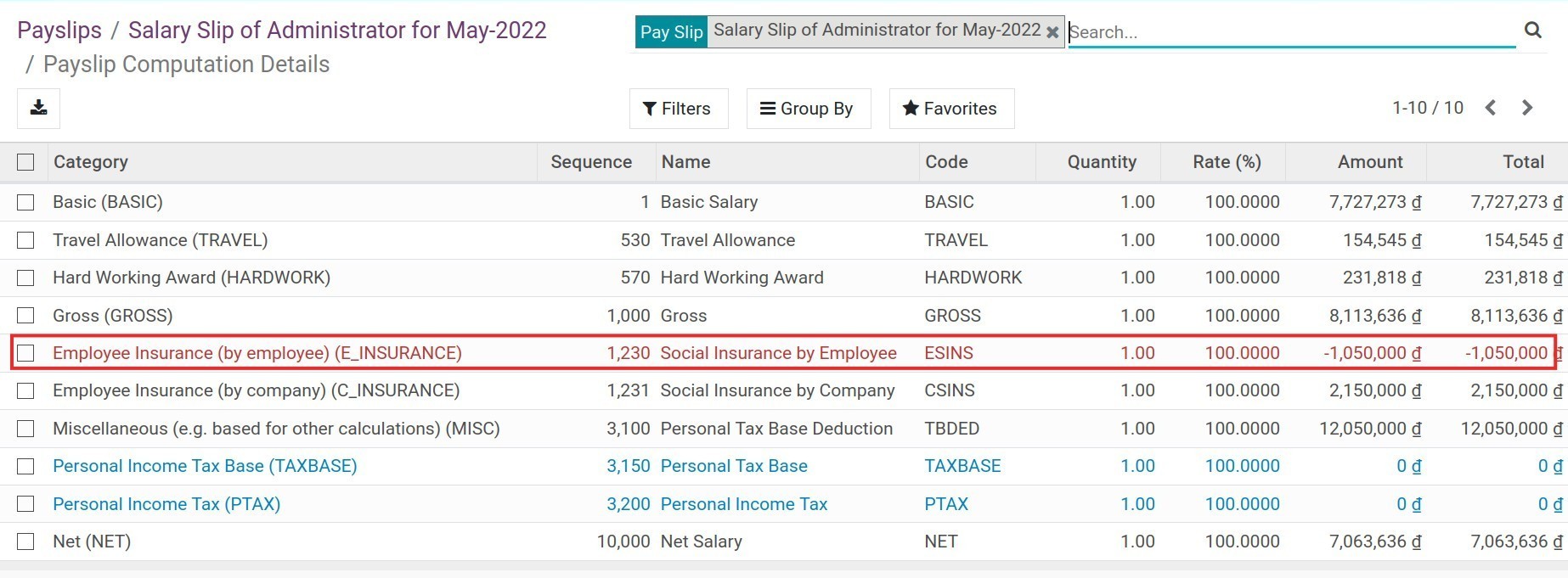

Because the Employee Insurance (by employee) on payslip is “-” amount:

Therefore, you need to enter the following information:

Debit Account: Select an accounting account to record the employee’s contributions.

Credit Account: Select the Payables to staff account.

When there is a journal item, the system registers Debit 3341/Credit 3383.

Note

For journal items related to the Payables to staff account, if this account is not configured on salary rules, the General Employee Payable account will be used instead. In this case, the Payables to staff account will be reconciled automatically between debit and credit.

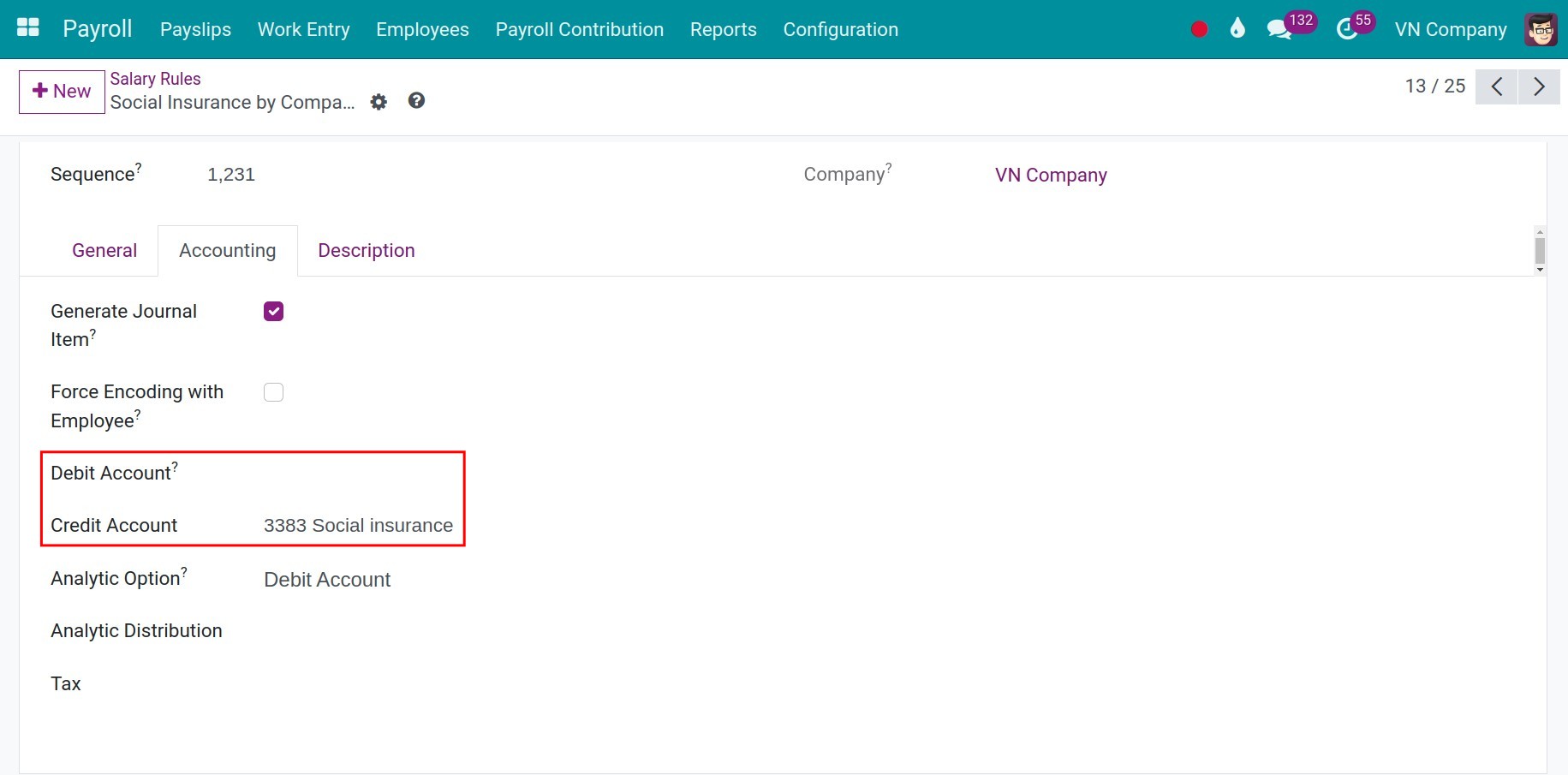

3. Salary rules related to company expenses

You can configure accounting accounts for salary rules related to company expenses such as social insurance, health insurance, unemployment insurance, labor union fees, etc. as follows:

Debit Account: Select the debit account that records the company’s expenses entries. Leave empty if you want to record expenses on each department’s account.

Credit Account: Select the reciprocal account of the company’s expenses account.

See also

Related article

Optional module