How to apply cut-off in Viindoo Accounting¶

Viindoo provides the Cut-off feature that helps you to separate the total revenue/expense on a Customer Invoice/Vendor Bill at different times. In this article, I will write about the case when you need to separate the expense, you can do the same with the revenue.

Requirements

This tutorial requires the installation of the following applications/modules:

Tip

In order to implement the following steps, make sure you understand the operations of the Vendor Bill on the Viindoo system.

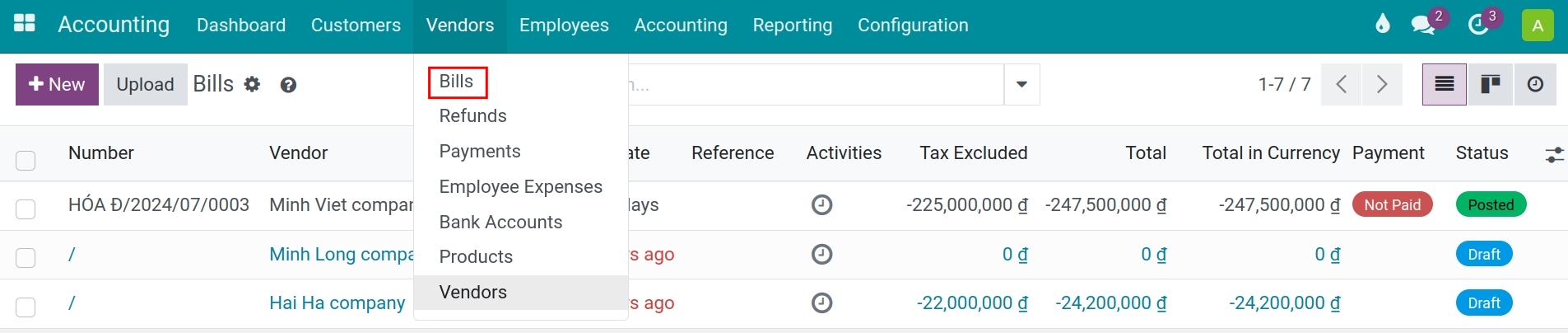

Firstly, go to Accounting > Vendors > Bills and select the invoice to adjust the recorded expense.

Note

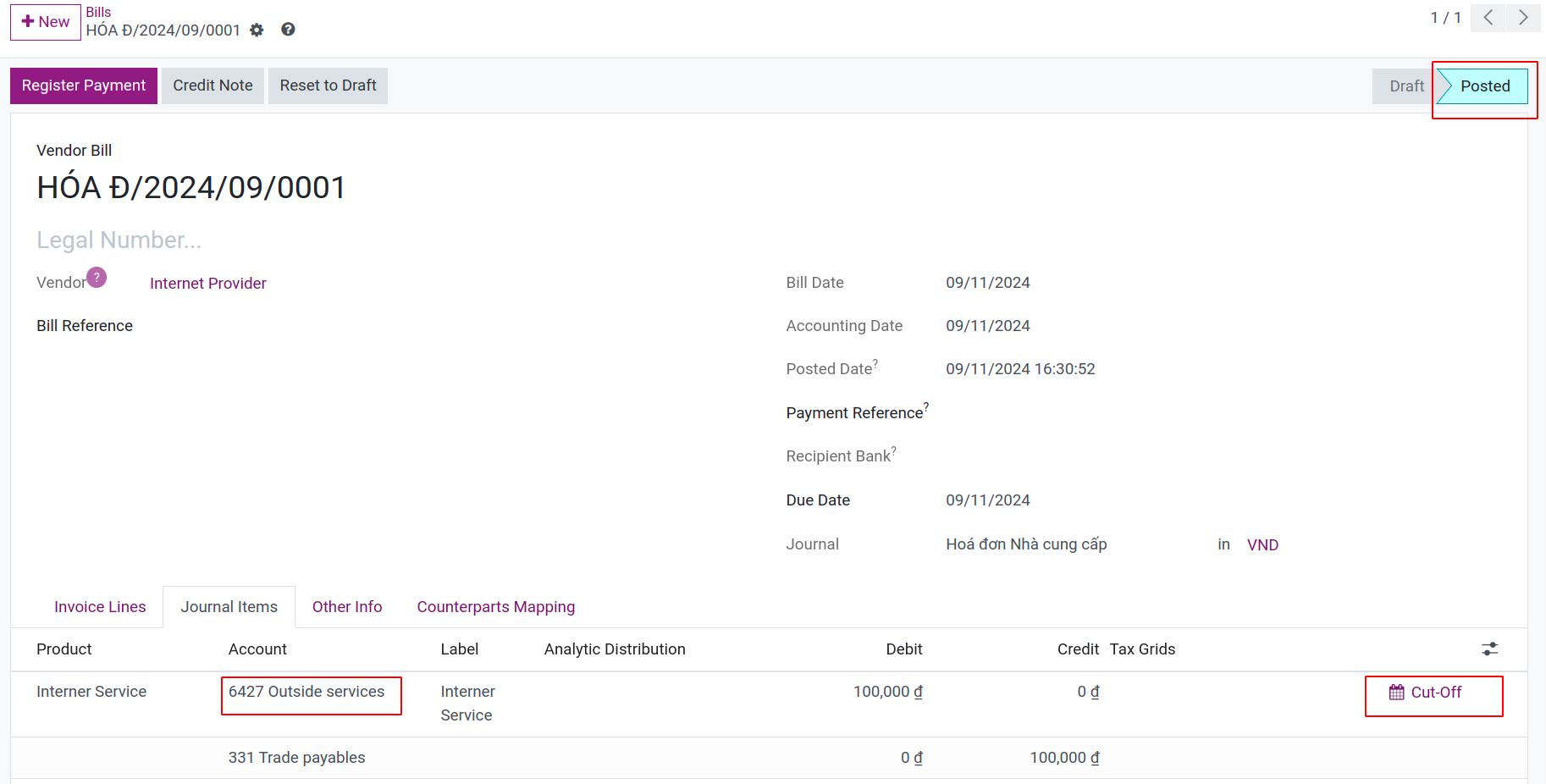

This feature is just available on the posted journal entries and the journal items of the Profit and Loss type.

In the Journal Items tab, at the recorded value of the expense account, you click on the Cut-off button.

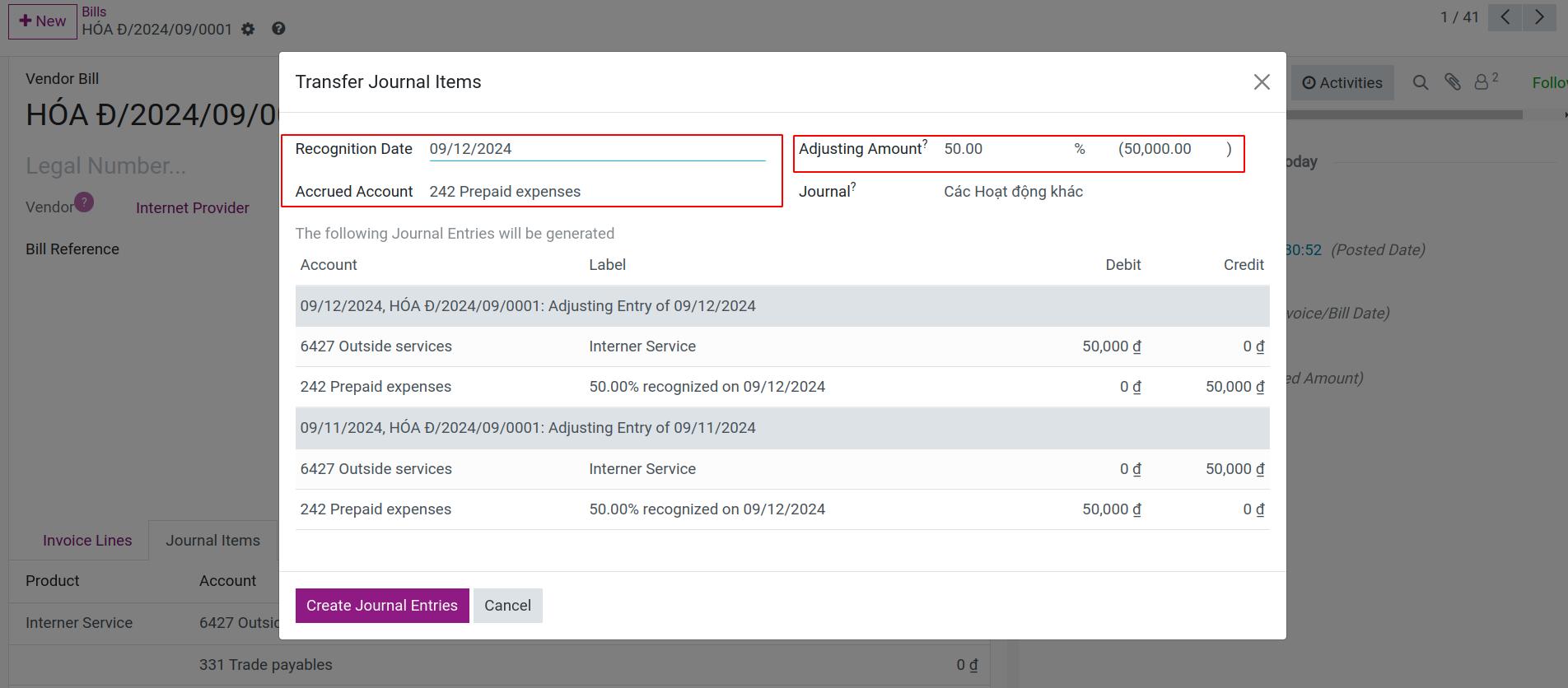

A pop-up window will appear for you to enter the parameters of the auto-generated entries which will separate the expense.

You enter the following parameters:

Recognition Date: the time at which the expense is separated from the bill is considered as valid.

Accrued Account: the temporary account to transfer the amount to be separated from the expense before re-recording to the expense account at a valid time (Example: TK 242 - Prepaid expenses).

Adjusting Amount: the amount needs to be separated from the expenses (Example: 50%).

Journal: journal applied on auto-generated entries.

You can preview the entries that will be generated by this setting under The following Journal Entries will be generated.

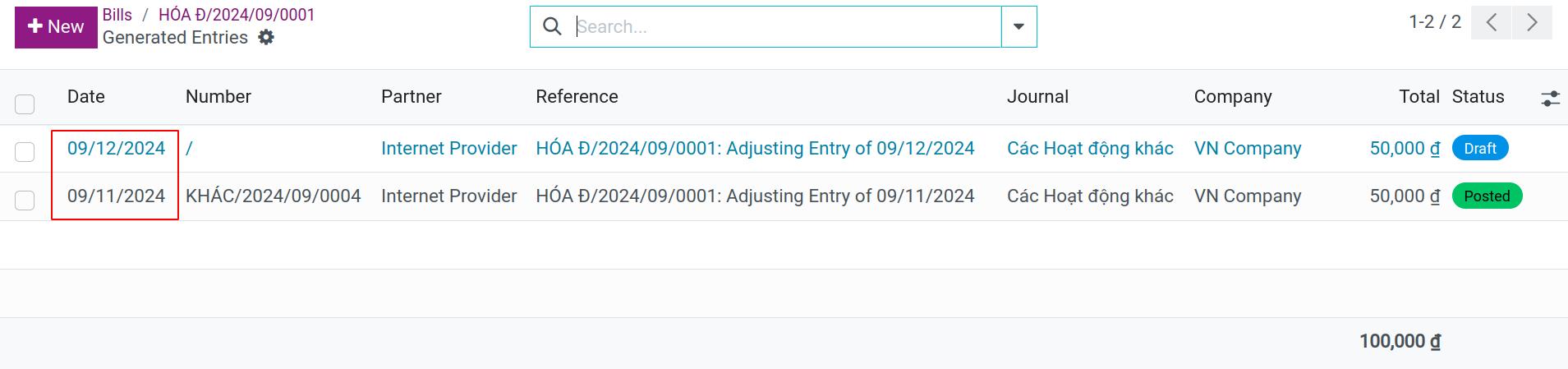

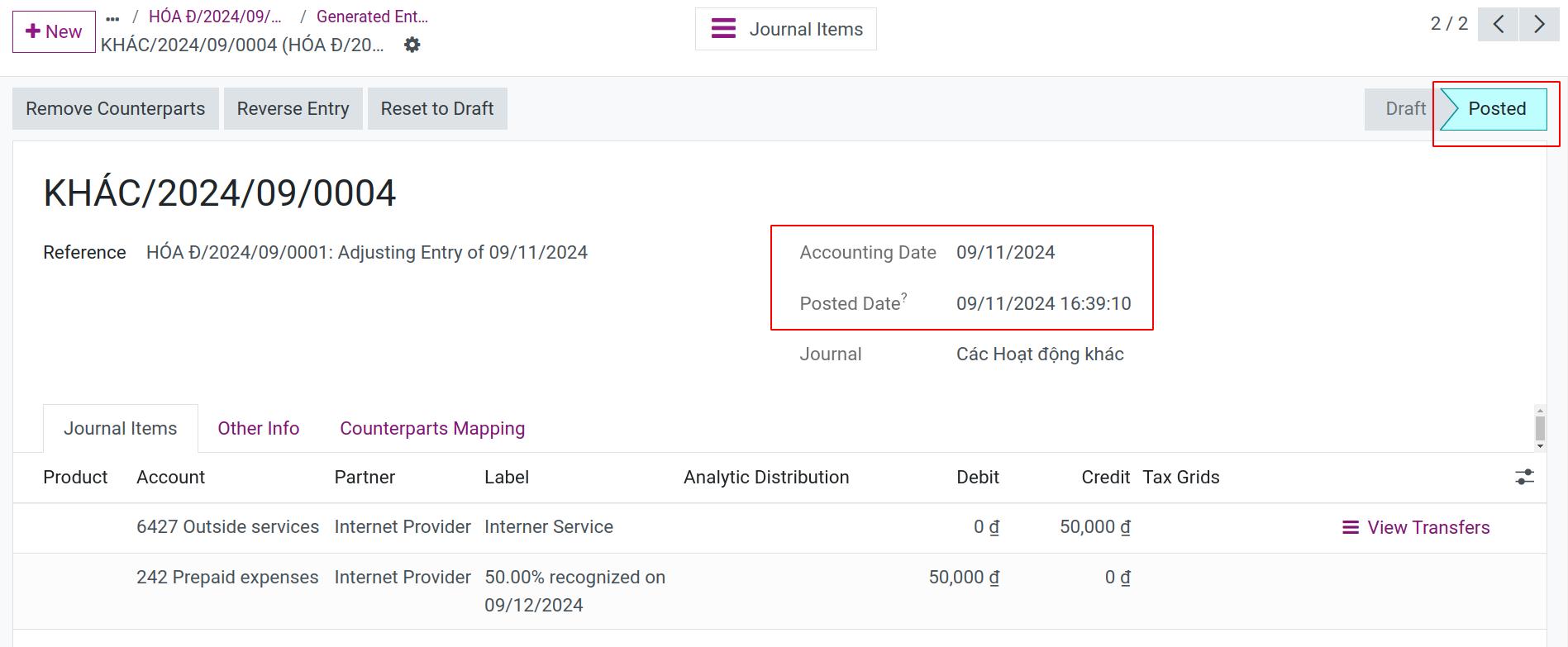

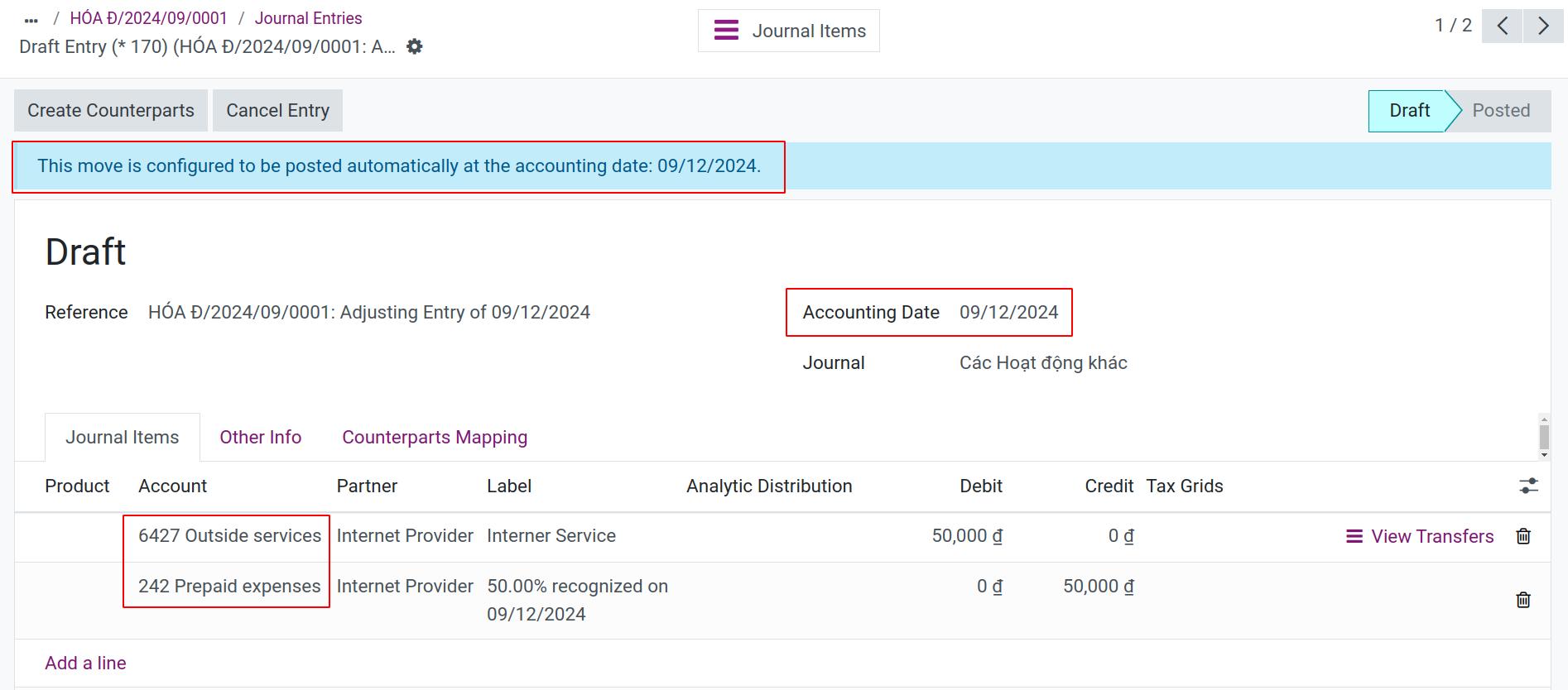

The entries generated after you select Create Journal Entries are as:

The system behaves as follows:

The first entry in the Posted status will record a decrease in the value of the expense account according to the ratio divided in the Adjusting amount field and be adjusted to the Accrued Account.

The second entry in the Draft state, where the unreconciled expenses are not yet recorded, will be temporarily accounted for in the Accrued Account. The system will automatically post to recognize the pending expense at the valid recognition date set in the Recognition Date field.

If Recognition Date is in the future, the entry will be configured to be automatically posted on that date, and if it is in the past, the entry will be posted immediately.

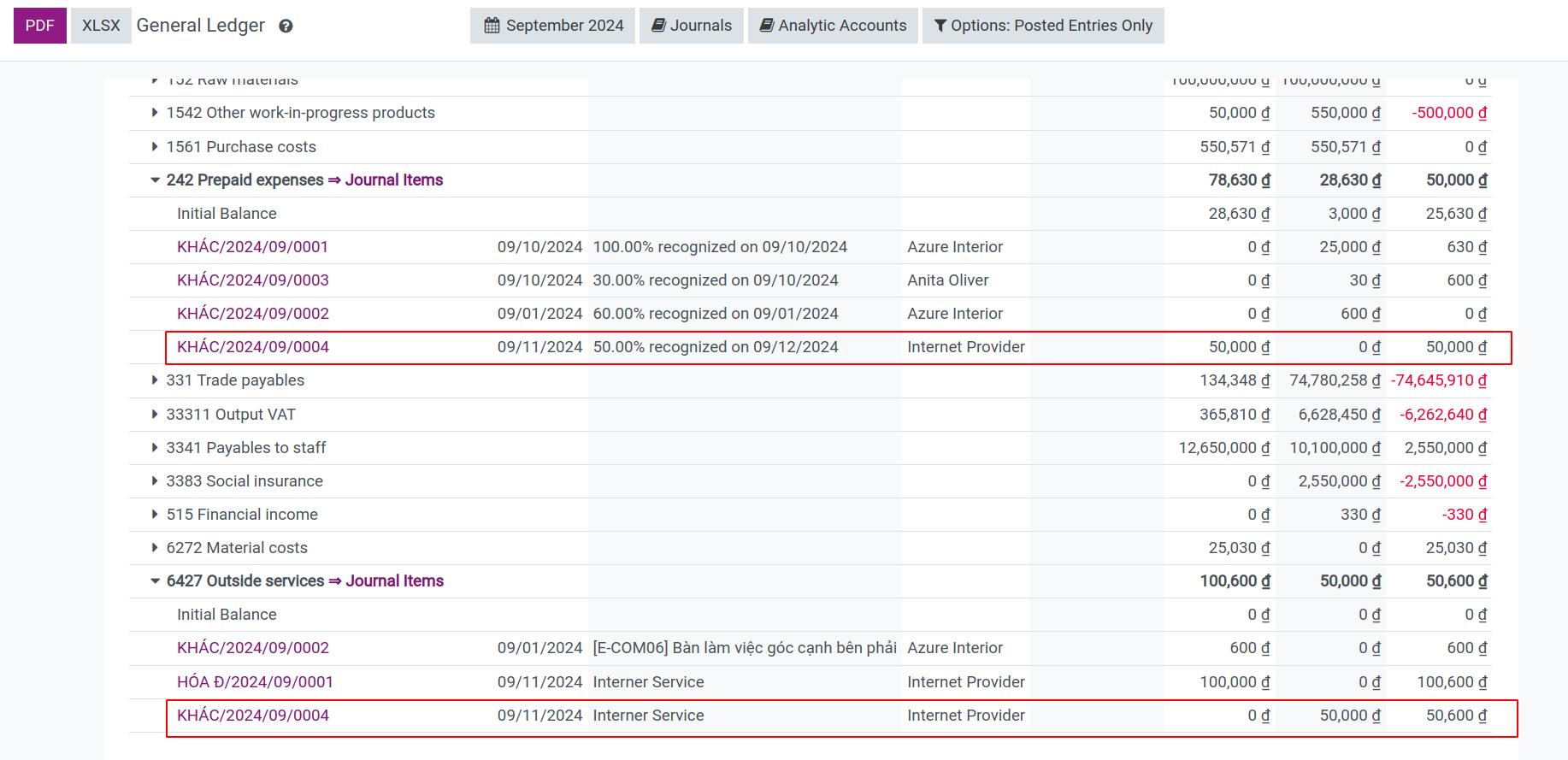

Now check the General Ledger, you can see that the expense recorded on the original Vendor Bill has been split in two, the remaining amount will be recorded in account 242.

See also

Related article

Optional module