Personal tax rules¶

Create the Personal Tax Rules¶

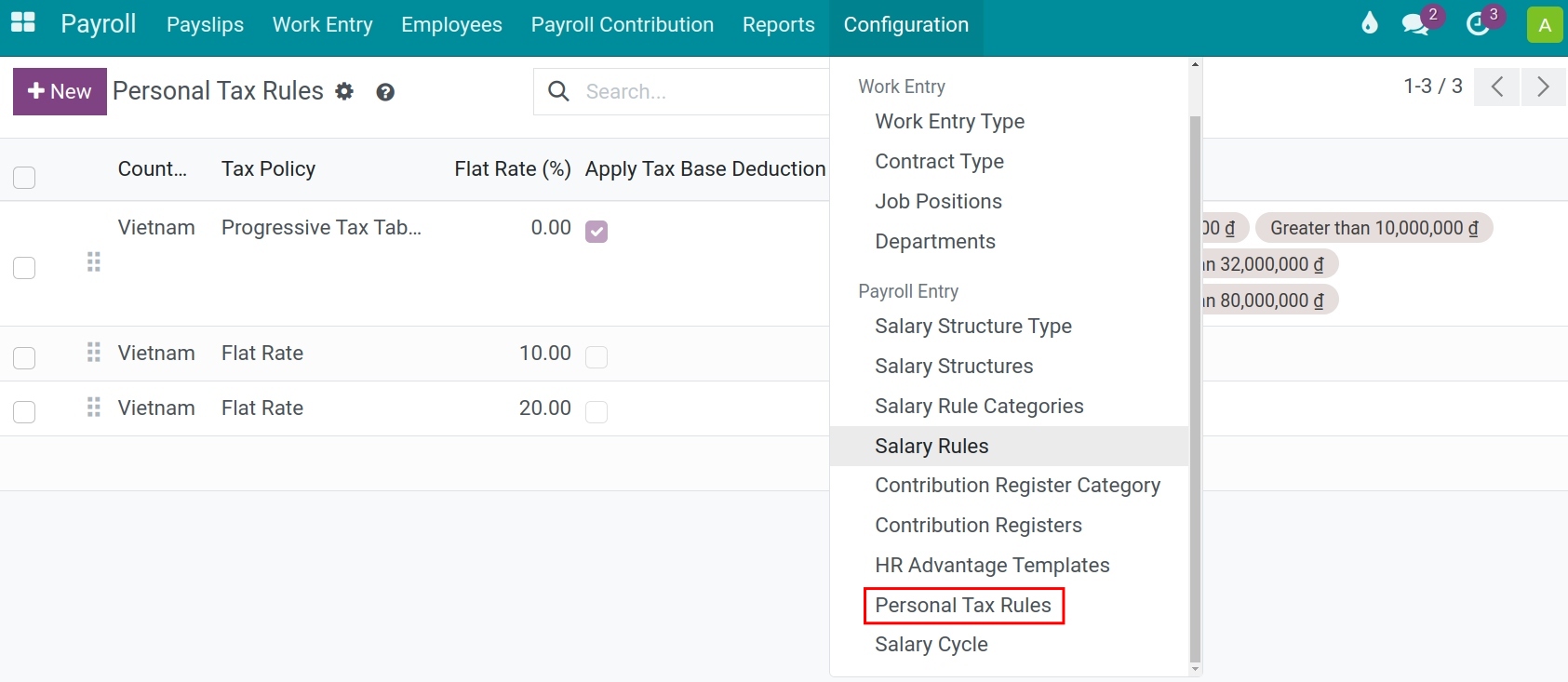

To configure the Personal Tax Rules in Viindoo Payroll Management app, you navigate to :

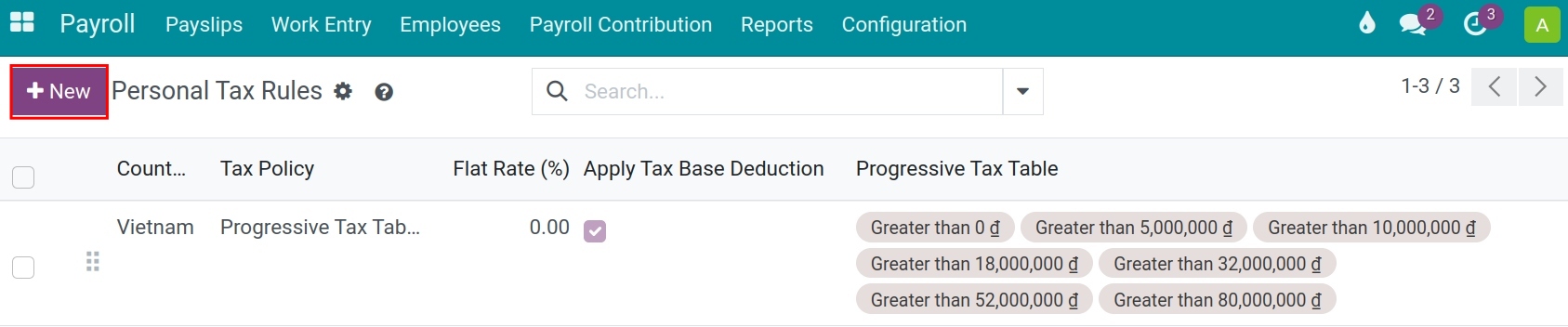

To create a new one, click on the New button:

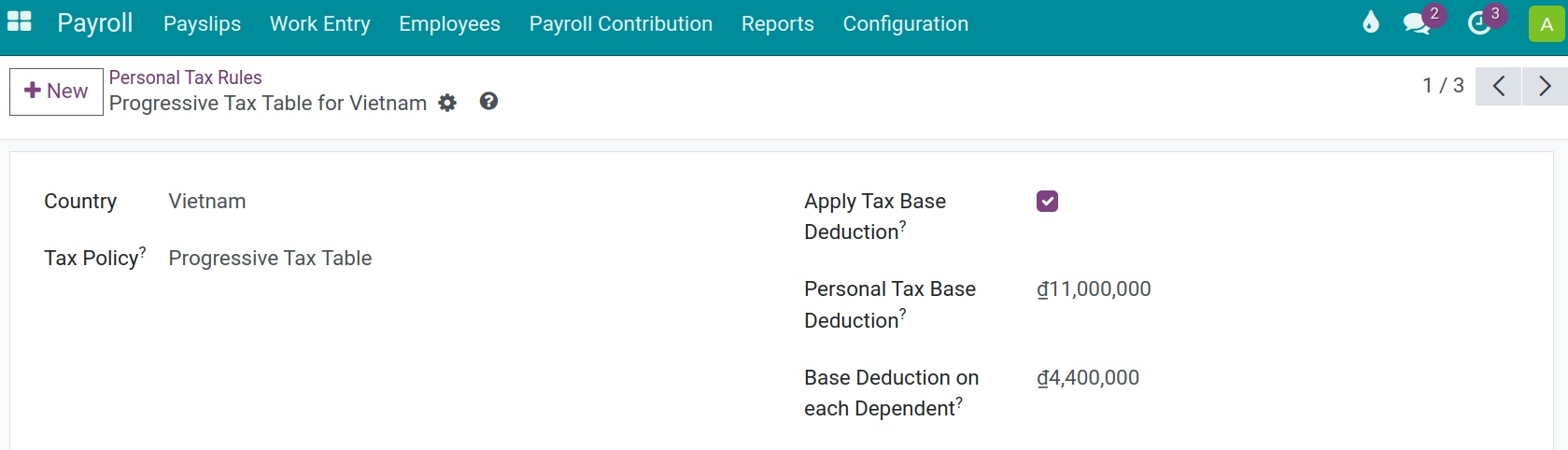

Fulfill the information as below:

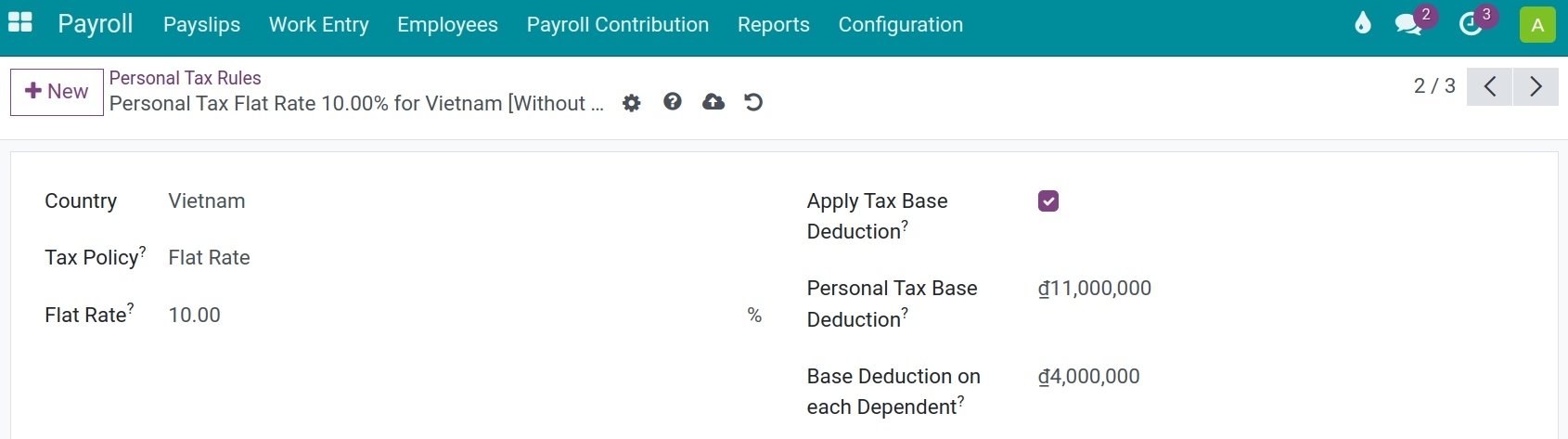

- Country:You need to select a country that corresponds to the personal tax schedule. In the current example, the selected country is Vietnam.

- Tax Policy:Viindoo system supports 2 types of tax calculation policies, Progressive Tax Table and Flat Rate.

- Apply Tax Base Deduction:Enable this option to allow the base deduction and the dependent deduction when calculating the personal taxes. When enabling this option, the system will show you 2 more data entry fields:

- Personal Tax Base Deduction: Enter the data of family deduction for individual taxpayers.

- Base Deduction On Each Dependent: Enter the corresponding family deduction data for each dependent.

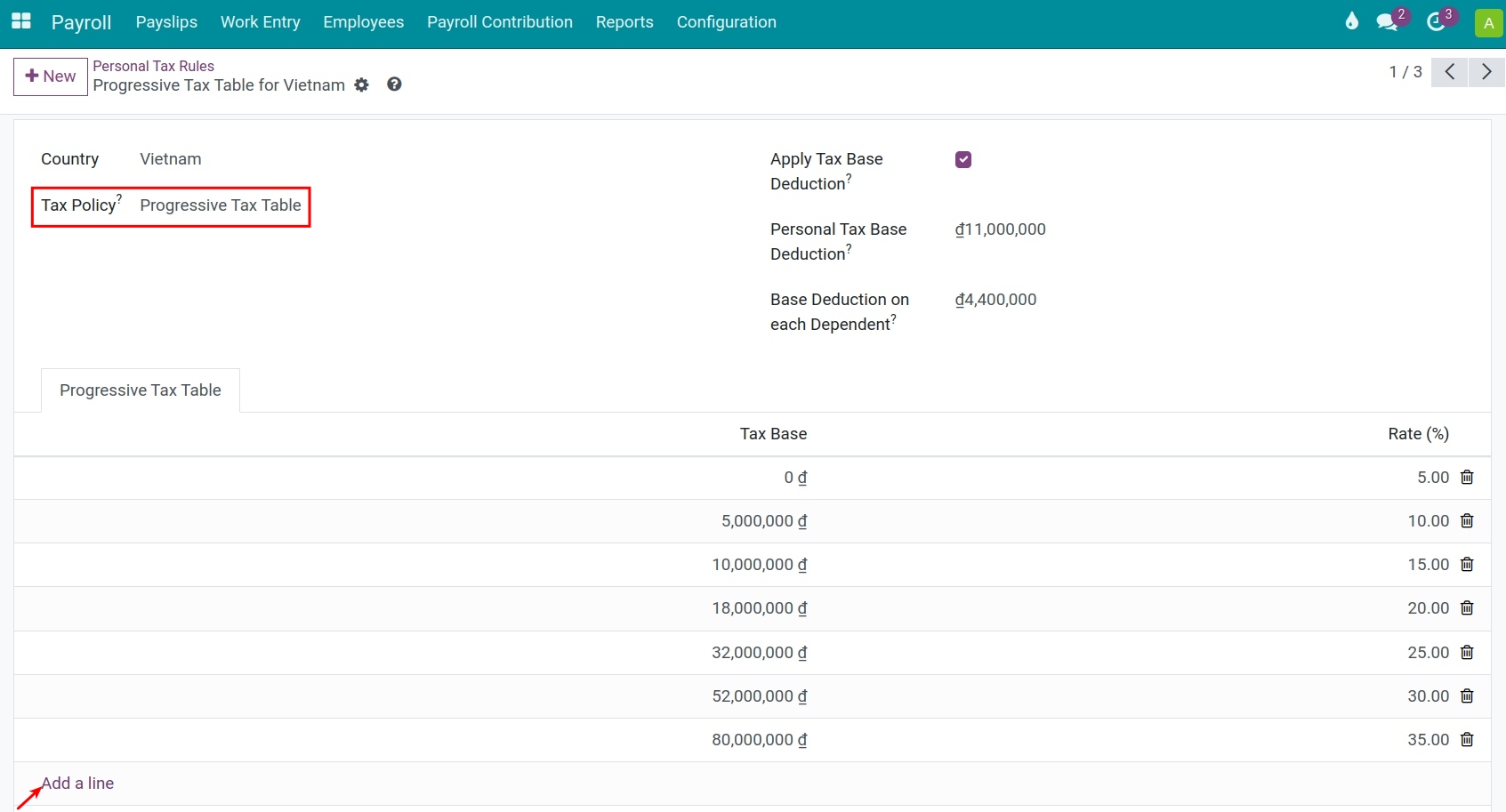

Progressive Tax Table Policy¶

This tax schedule will calculate the personal tax based on each income level. Choose option Progressive Tax Table on the Tax Policy field:

- Tax Base:The value of taxable income level corresponding to each tax rate.

- Rate (%):The tax rate is applied to the income within the tax level.

Press Add a line to input more ratio level. For instance: Line 1 and line 2 have the tax bases are 0VND and 5.000.000VND, with the rate of line 1 is 5%. Therefore, the tax base amount from 0VND to 5.000.000VND will have to pay 5% of the total taxable income. Similarly, on the last line, the tax base amount from 80,000,000 to above will be calculated to the personal tax 35%.

Flat Rate Policy¶

When you select the Flat Rate, you will see a Flat Rate field appear. Enter the tax rate you want for the tax table.

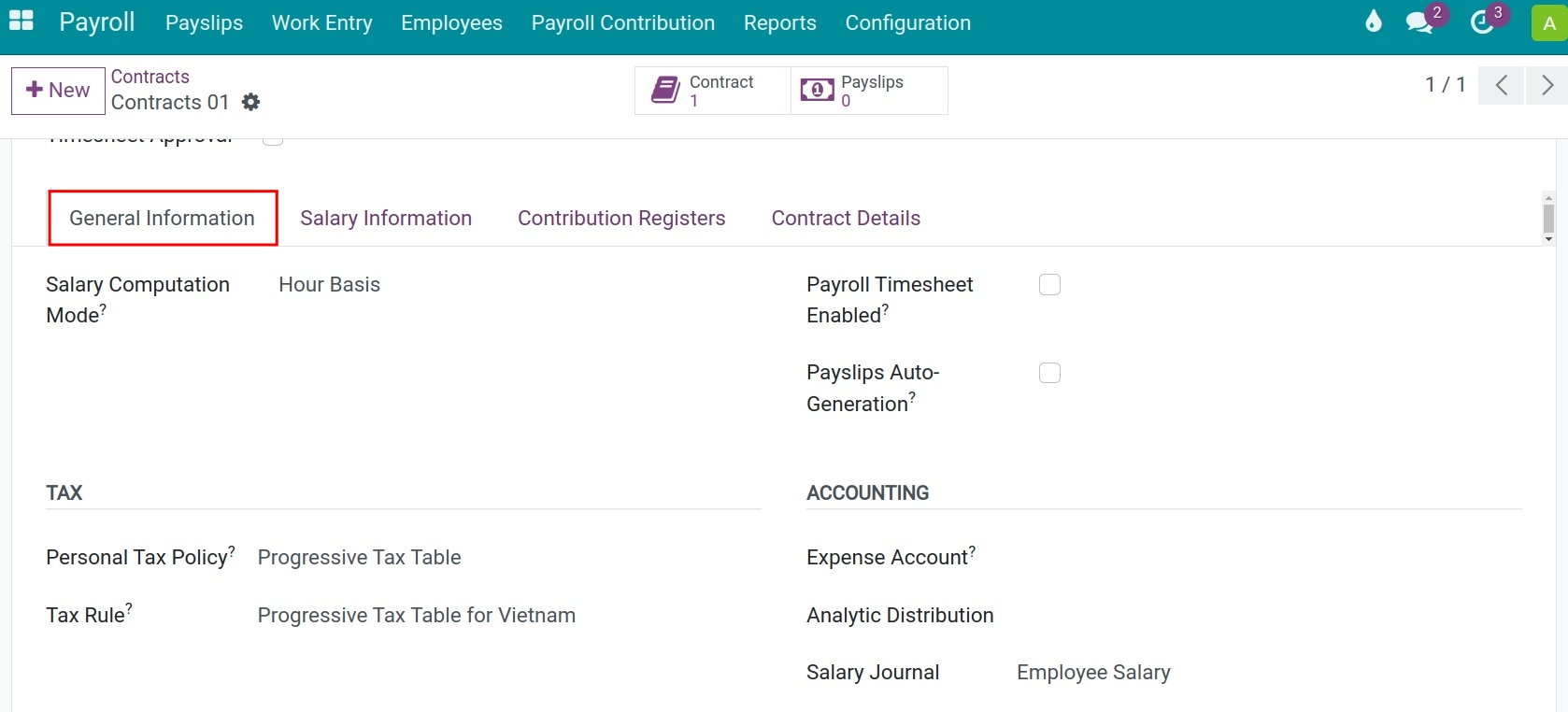

Personal tax rules configuration for Contracts¶

Navigate to and open the contract that needs to modify the personal tax rules. On the contract, you click on the General Information tab. You will find Personal Tax Policy and Tax Rule fields. You can select from a number of the tax policies and the tax rules which corresponding to that policy.

Calculate personal tax rules on payslips¶

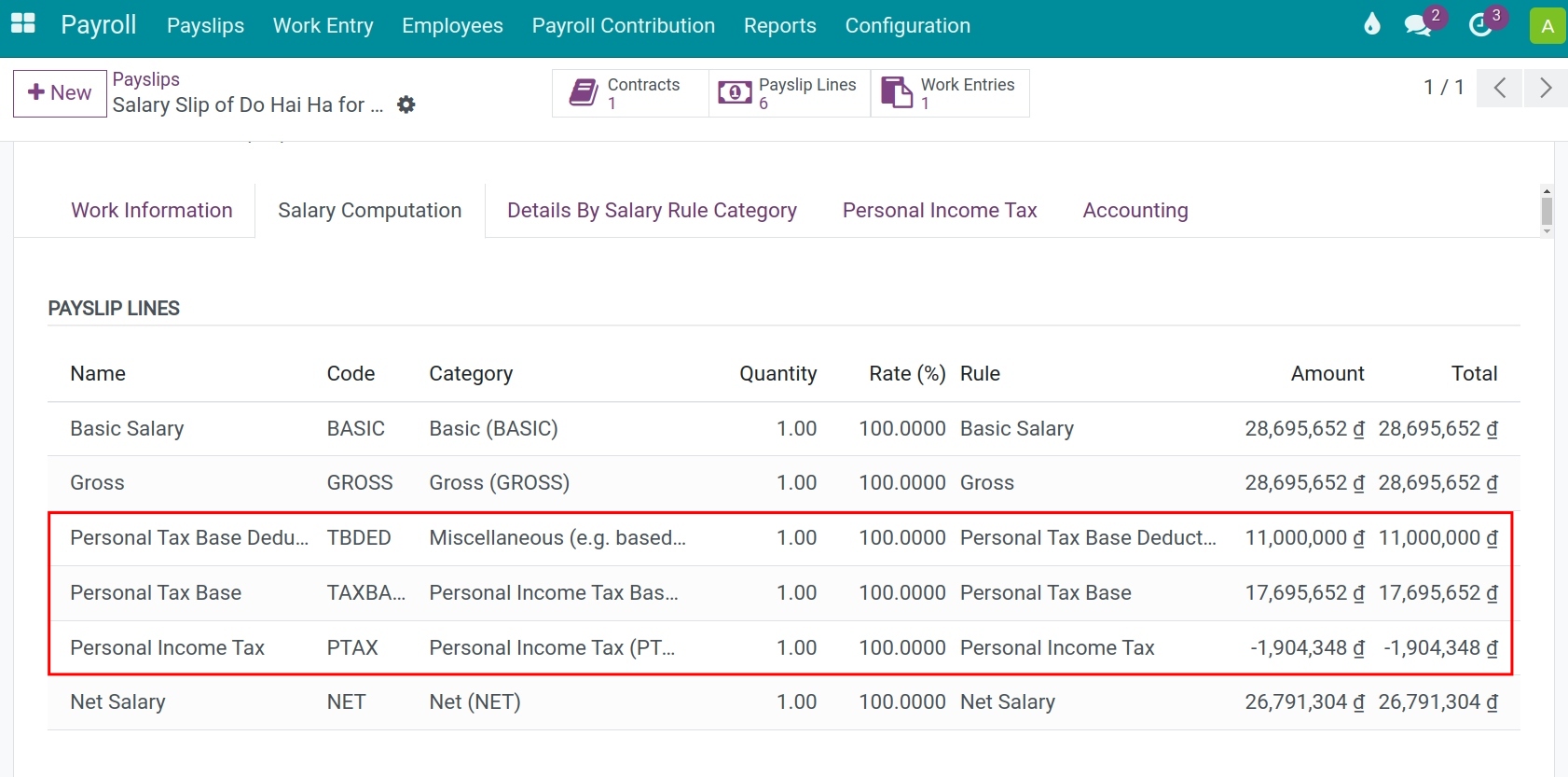

After setting the personal income tax rule in the contract, this rule will be used in salary rules as follow to compute the amount of personal income tax payable by the employee.

You can see the amount of personal tax on the employee’s payslips:

See also

Related article

Optional module