Asset liquidation¶

Assets in enterprises constantly changing. In the course of operation, enterprises may arise the need to Liquidize assets. This article guides you through the steps of asset liquidation with Viindoo software.

Requirements

This tutorial requires the installation of the following applications/modules:

Case 1: Liquidize depreciating asset¶

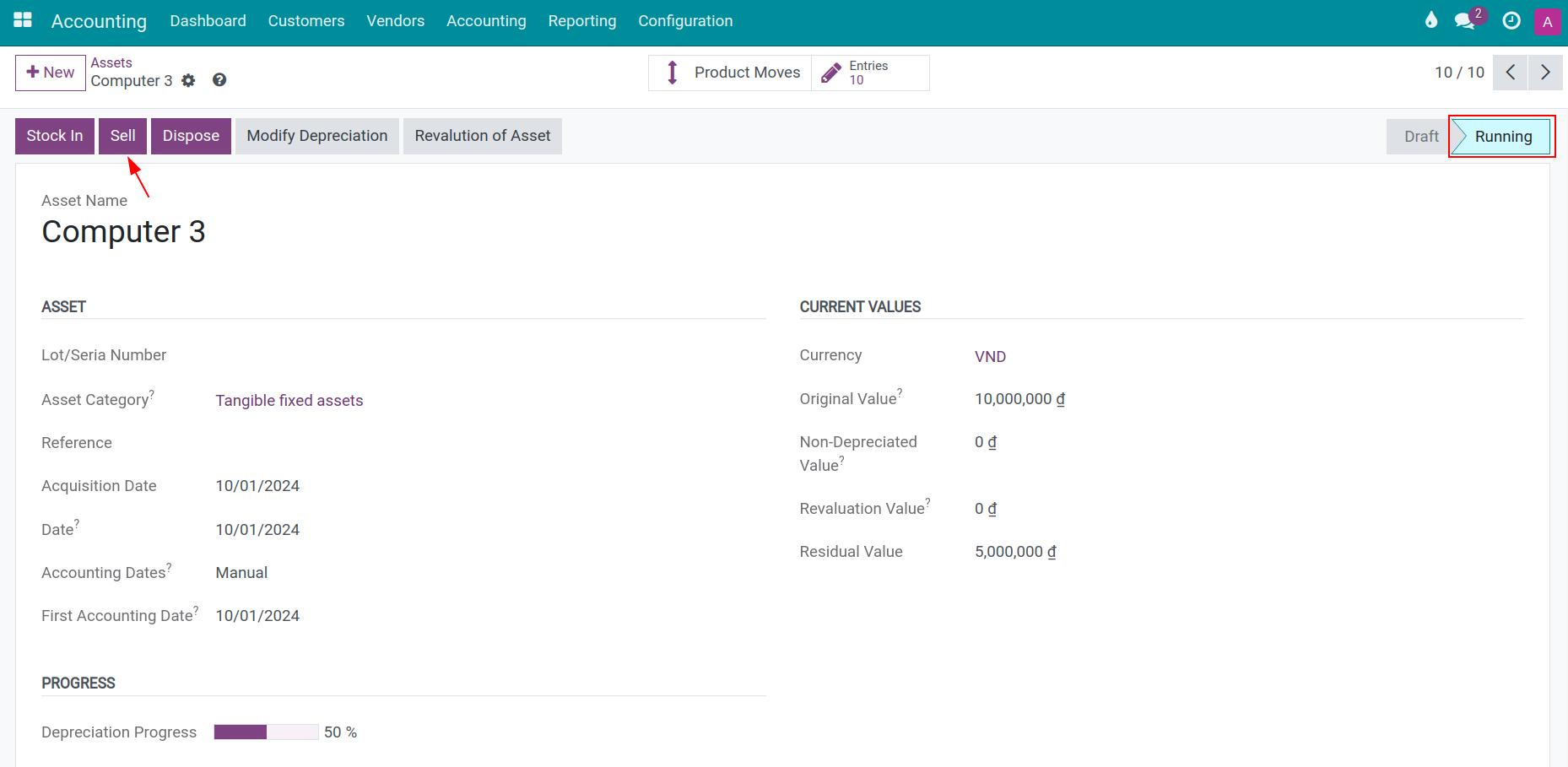

On the view of the asset in a running depreciation, choose Sell.

A pop-up window appears, asking for the following information:

Stopped Depreciating Date: The final date of the amortization period, a required field.

Sales Invoice Date: The invoicing date.

Note

Stopped Depreciating Date can be different from the Sales Invoice Date.

It’s necessary to post all the depreciation entries before the liquidation moment.

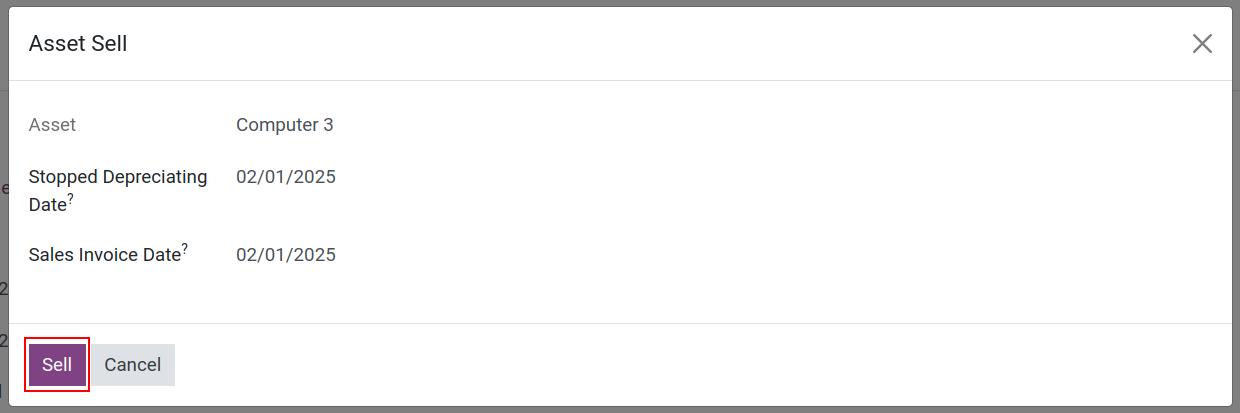

Press Sell. The asset will stop being depreciated, its stage will change from Running to Sold. The system then recalculates the depreciated value at the stopped depreciating moment to create a journal entry to adjust the previously recorded depreciation expense.

Press on Entries to check recalculated data by the system.

See also

Example:

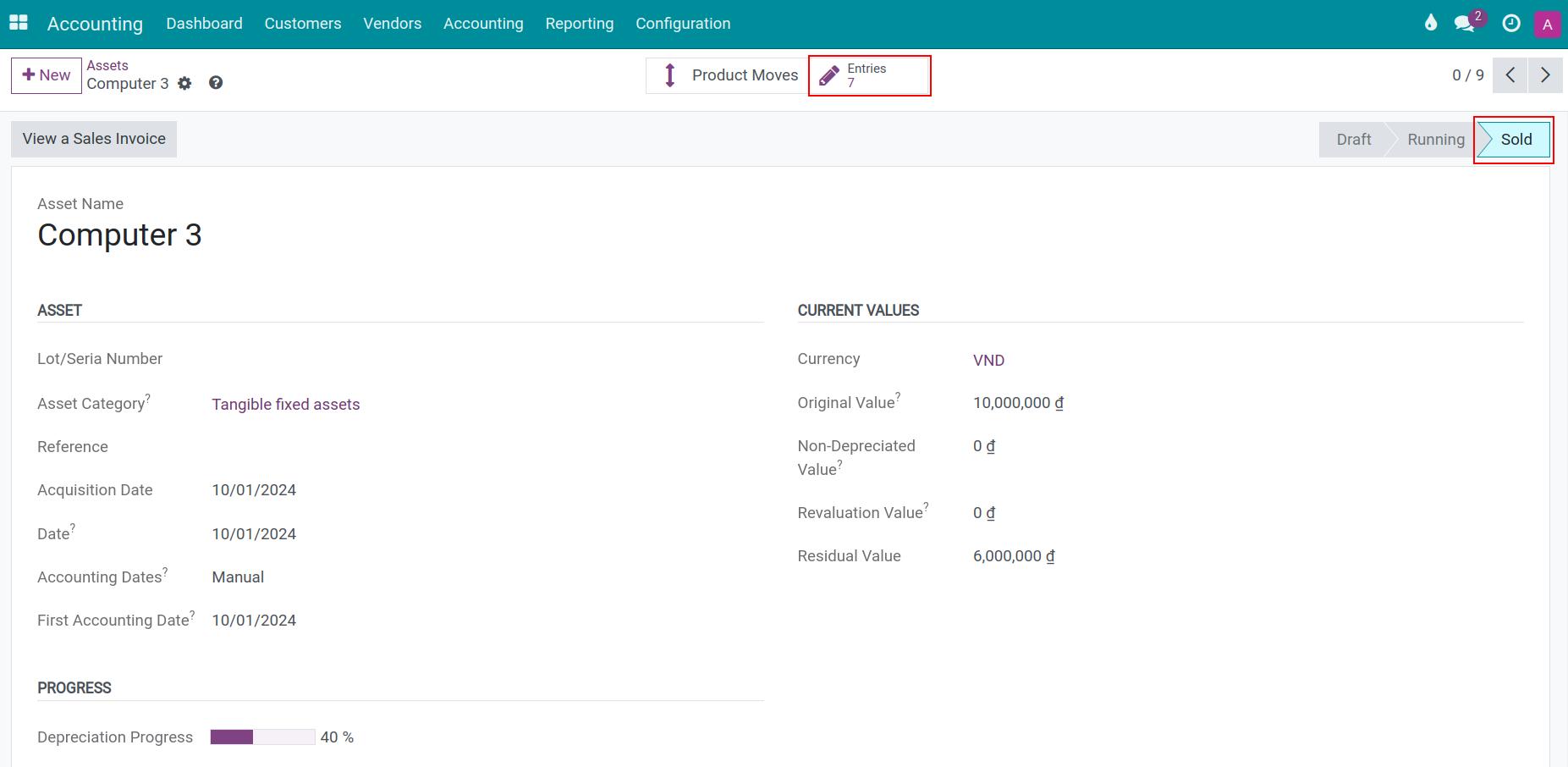

Laptop;

Original price: 35.000.000 VND.

First Depreciation Date: 08/01/2024.

Number of Entries: 10.

Depreciation method: Linear.

Recurrent Depreciated Value: 3.500.000 VND.

Recent days journal:

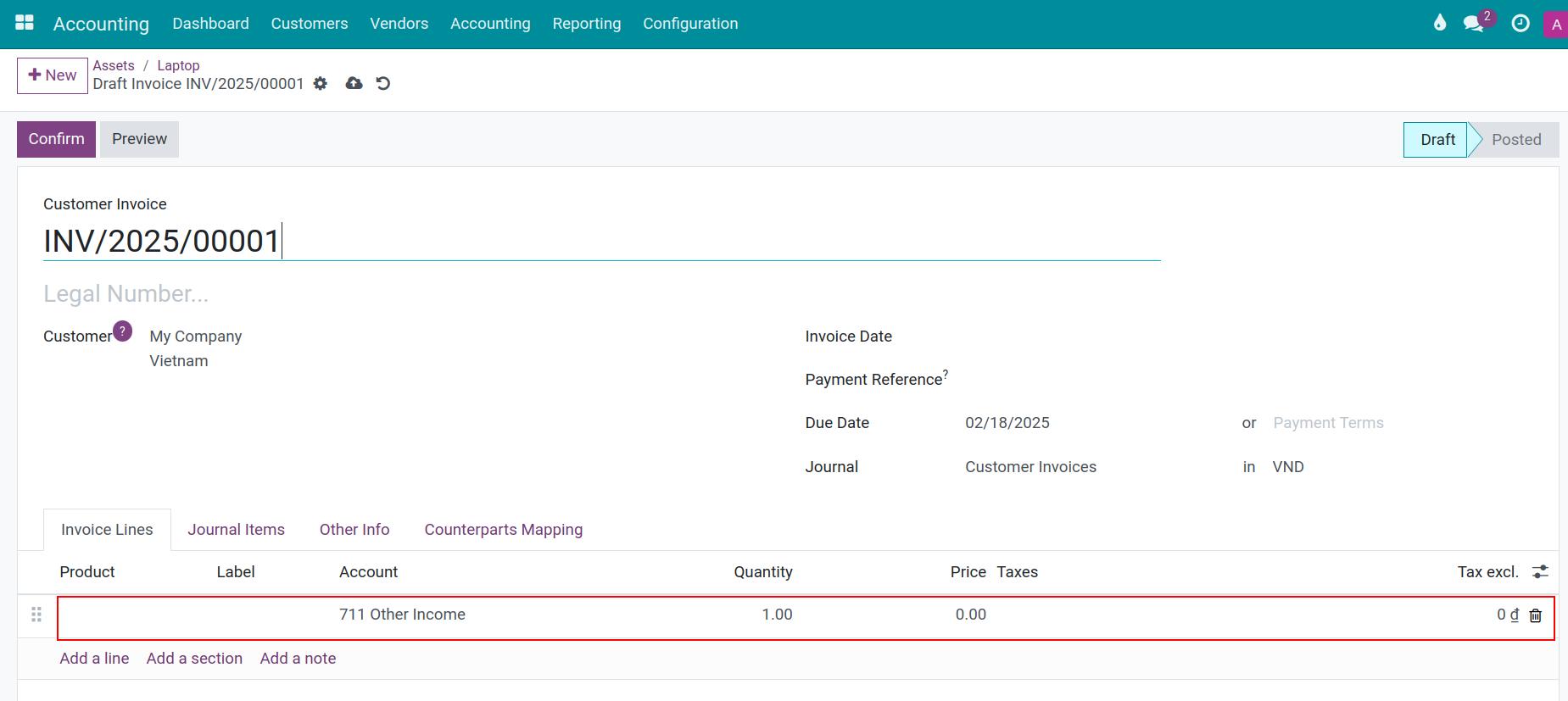

Press Sell, enter Accounting Date: 02/06/2025. The system suggests an invoice for asset liquidation in the Draft stage. You can add more information and record the liquidation profit.

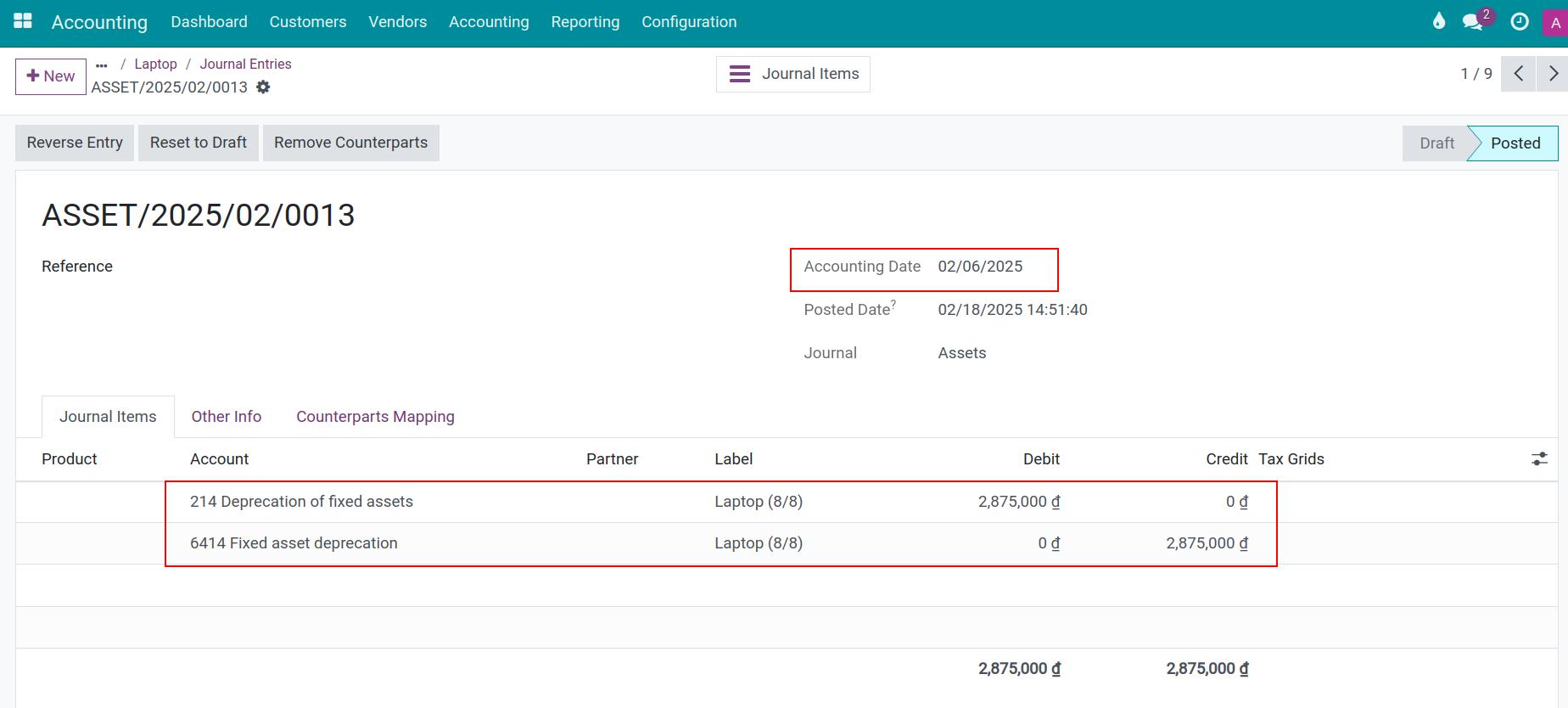

On the Asset view, recalculate the data as below: The Cumulative Depreciation in last entry (from 02/01/2025 to 02/28/2025) is 24.500.000, because you Sell the Asset on 02/06/2025 so the reduction (from 02/07/2025 to 02/28/2025) is 3.500.000 / 28 * (28 - 6 + 1) = 2.875.000 VND (February 2025 has 28 days):

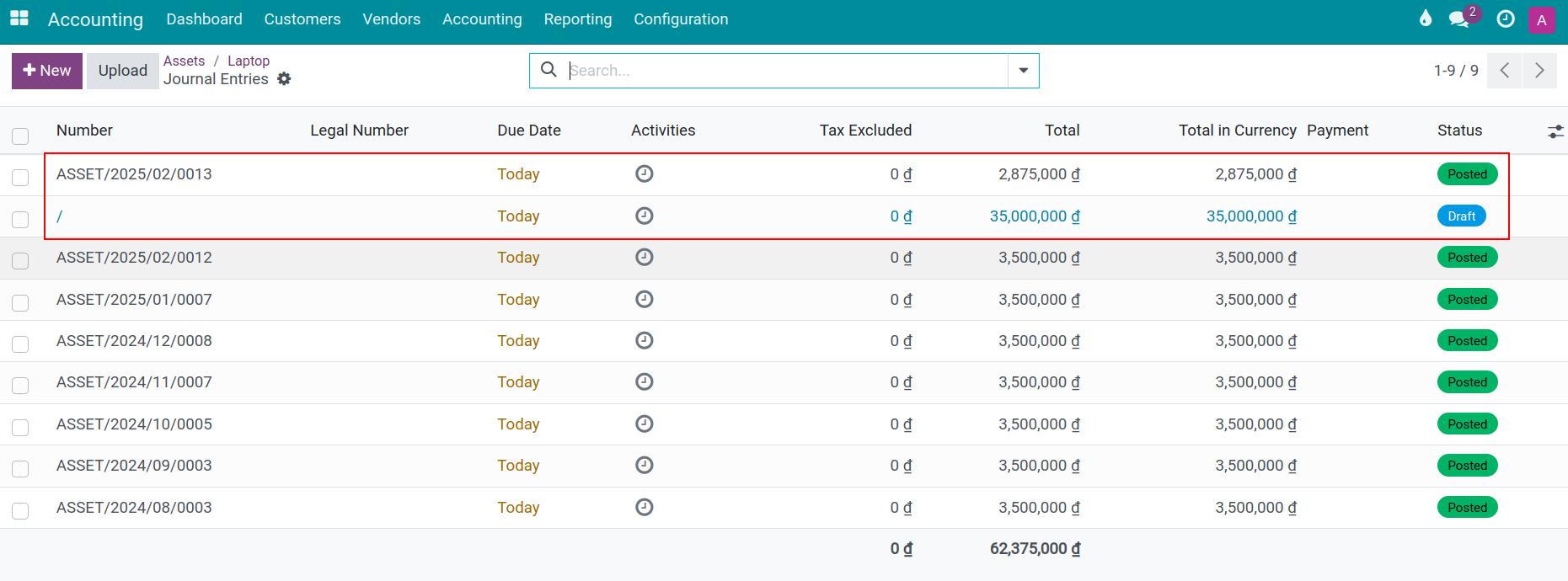

Press on the Entries button on the asset view to see all of the journal entries related to this asset. You can also click on the write-down depreciated value entries and the write-off asset entry to see details of corresponding journal items.

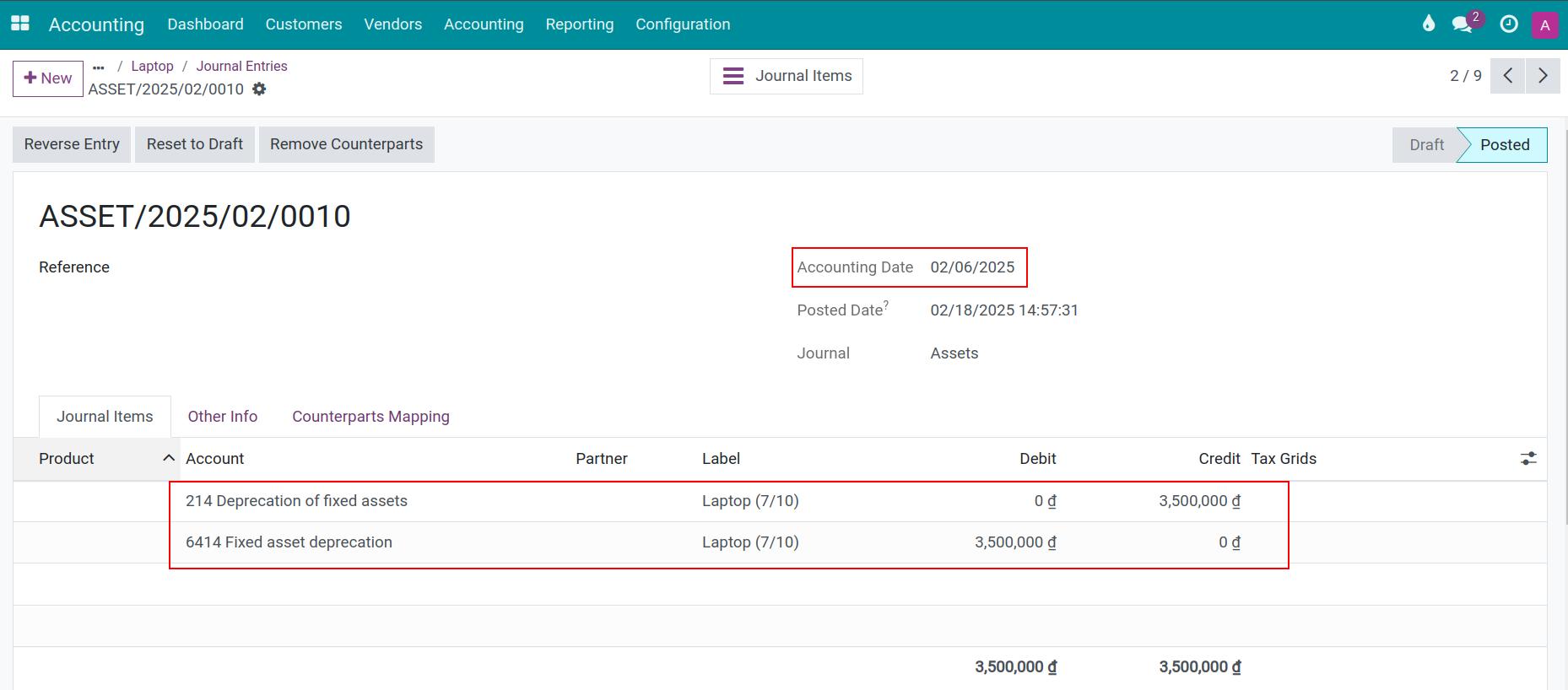

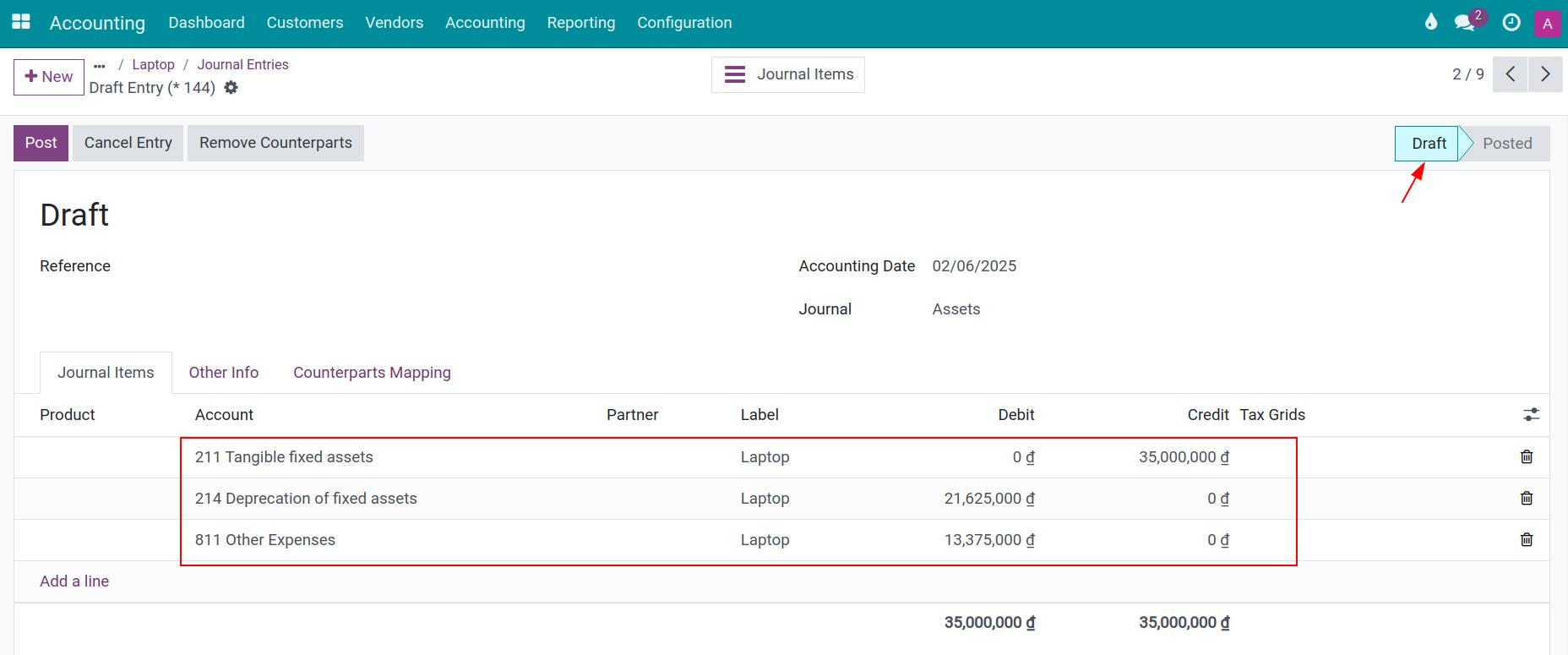

Write-down depreciated value entry:

Write-off asset entry in Draft stage:

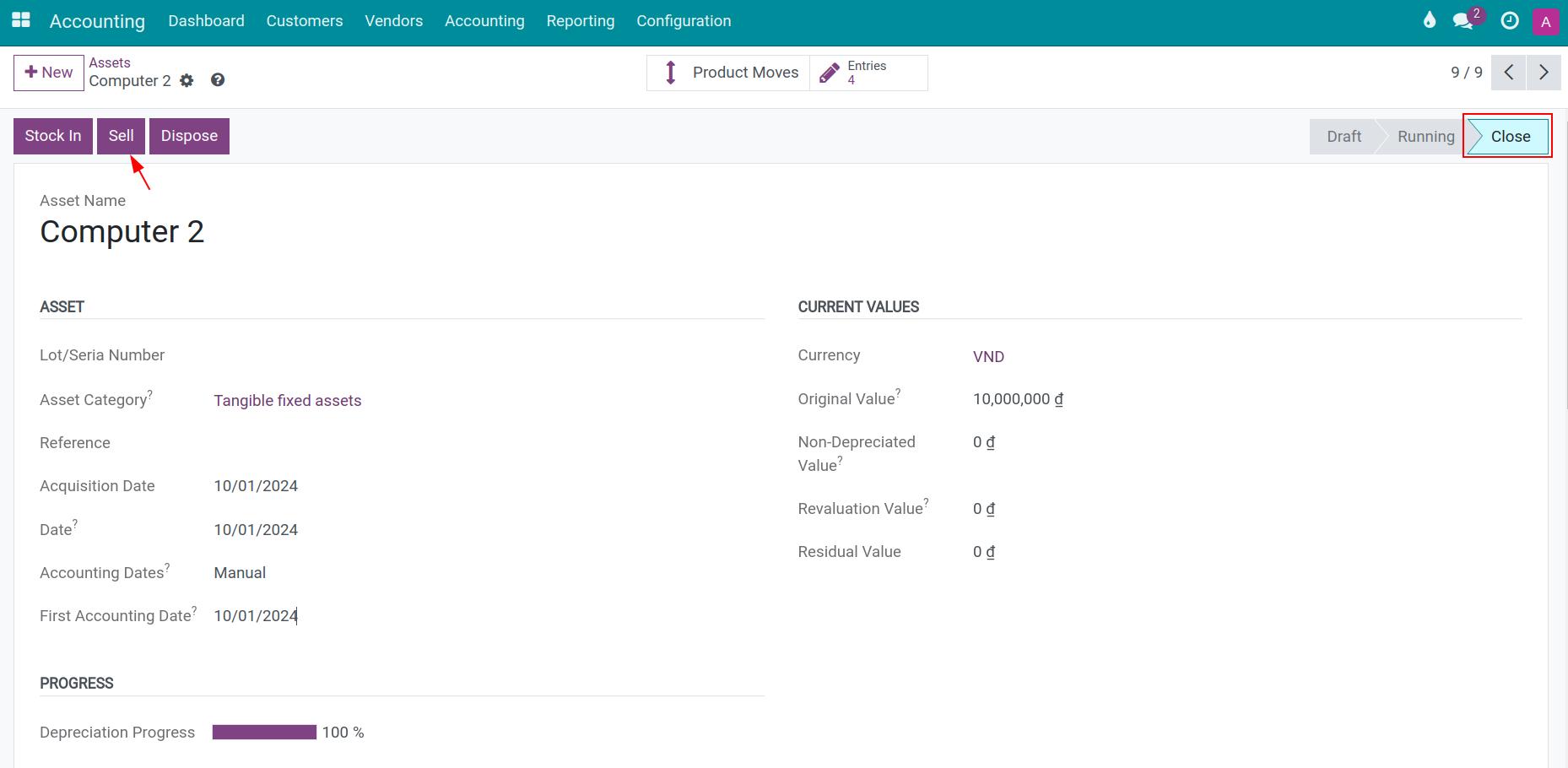

Case 2: Liquidize depreciated Asset¶

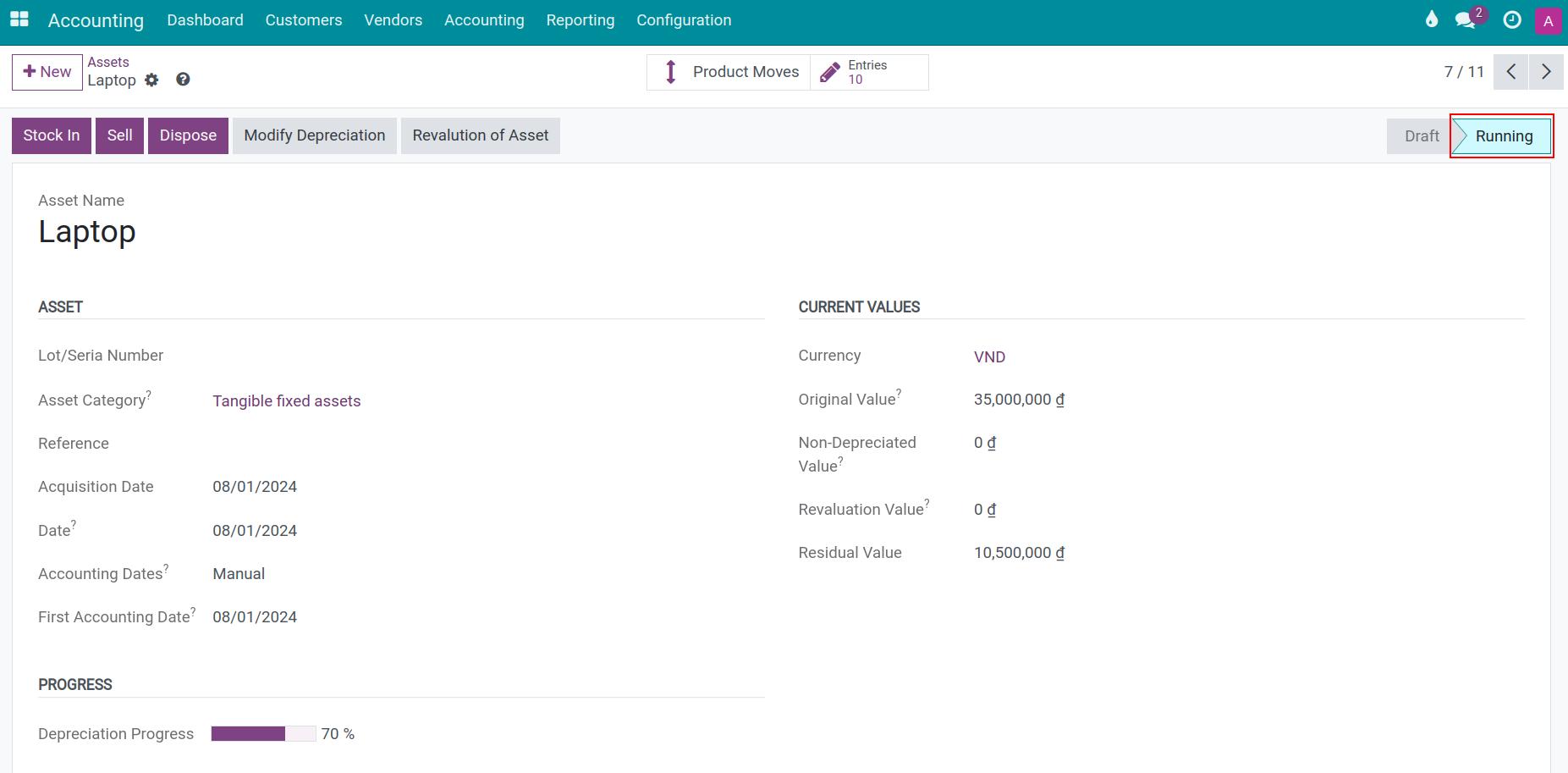

On the asset in stage Close, choose Sell.

Similar to the previous case, the system asks for Stopped Depreciating Date and Sales Invoice Date to record the asset liquidation. Choose dates accordingly and press Sell. System then suggests a draft invoice for asset liquidation.

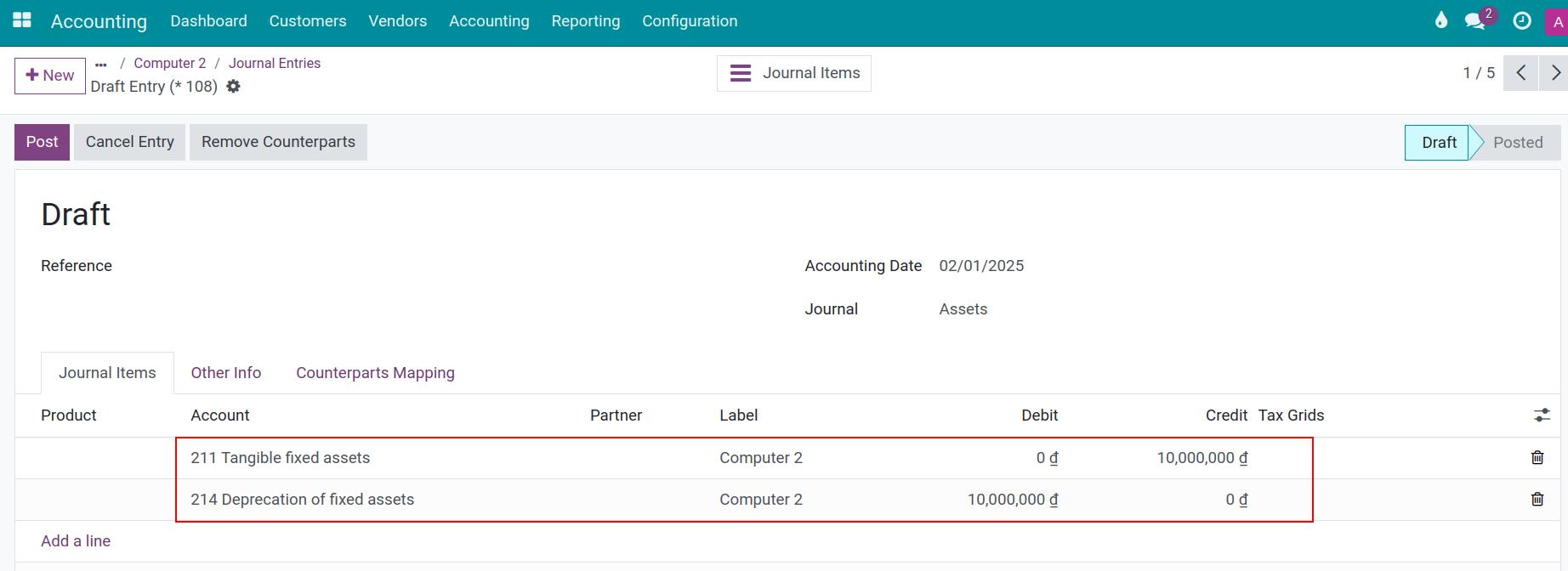

Simultaneously, write-off asset journal entries are created. You need to check the data on these entries and post them once done.

Now, the asset stage will change from Close to Sold. Record entries in the ledger to finalize the asset liquidation process.

See also

Related article

Optional module