Time deposit transactions¶

This article will guide you through the process of creating a time deposit transaction, and record the time deposit interest and the final settlement.

Requirements

This tutorial requires the installation of the following applications/modules:

Make a time deposit¶

To record a time deposit transaction, you need to do the following steps:

Create a cash-out payment¶

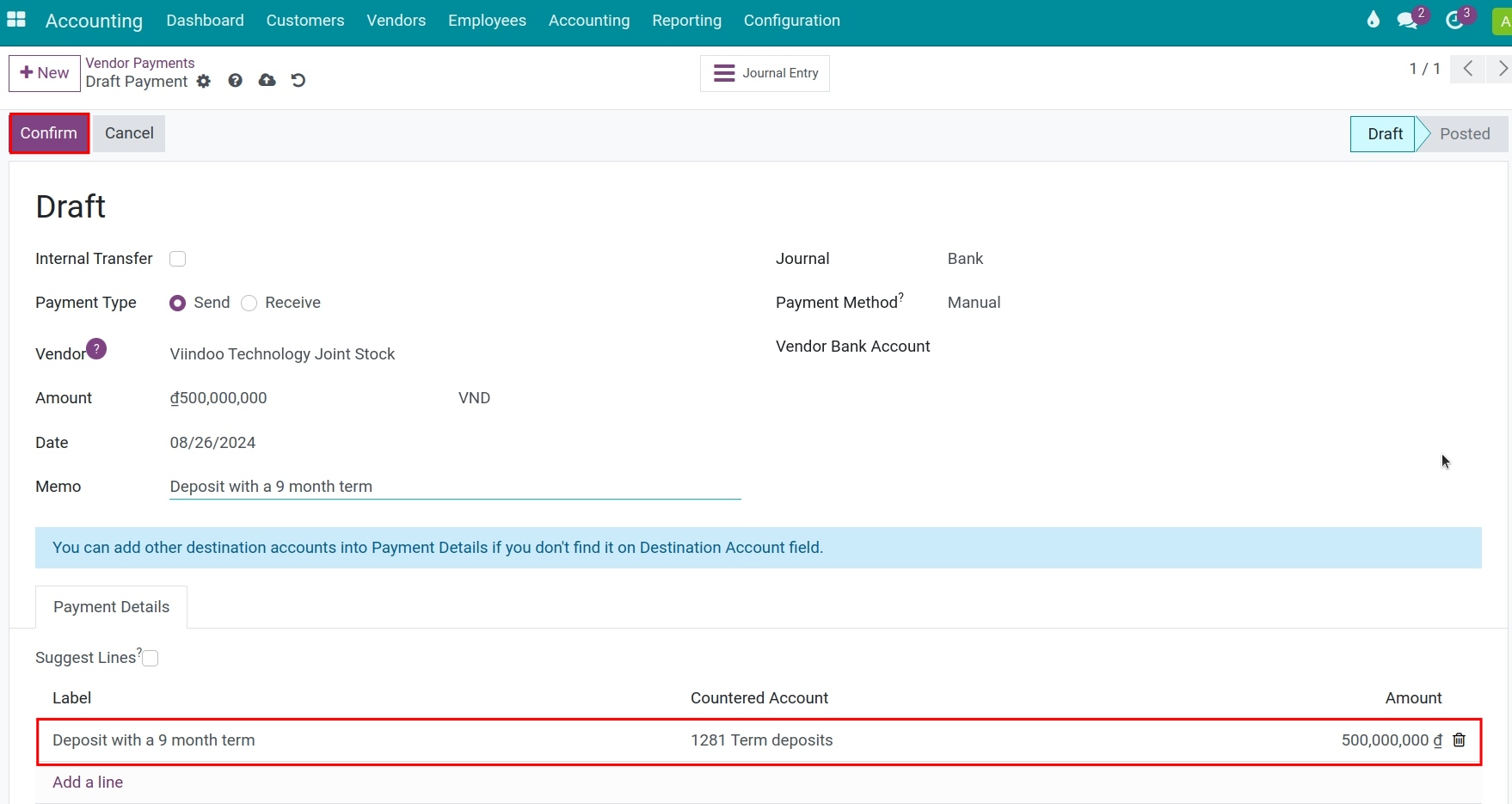

Payment Type: Send;

Vendor: Choose your company’s contact;

Amount: The value of this time deposit (This amount will be updated automatically according to the value that you add to the Payment Details area);

Journal: Choose the journal of the cash-out account;

At the Payment details tab, press Add a line to enter the payment details:

Label: Enter the payment description;

Countered Account: Choose the account that records the Short term investment until the due maturity date (For example 1281 - Time deposit);

Amount: Record the value of this time deposit.

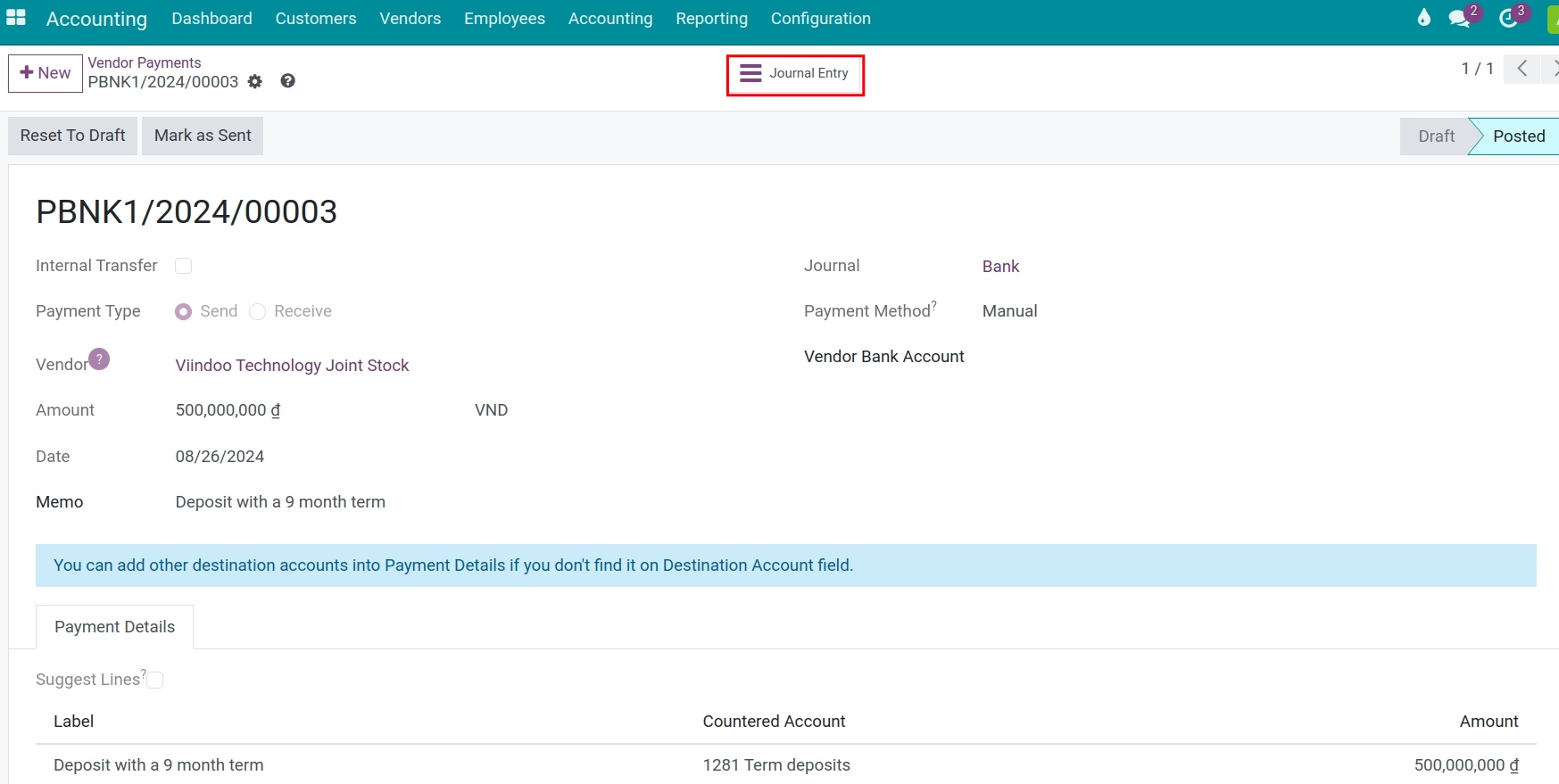

Press Confirm. Select Journal Entry to see the generated entries:![View journal entries in Viindoo]()

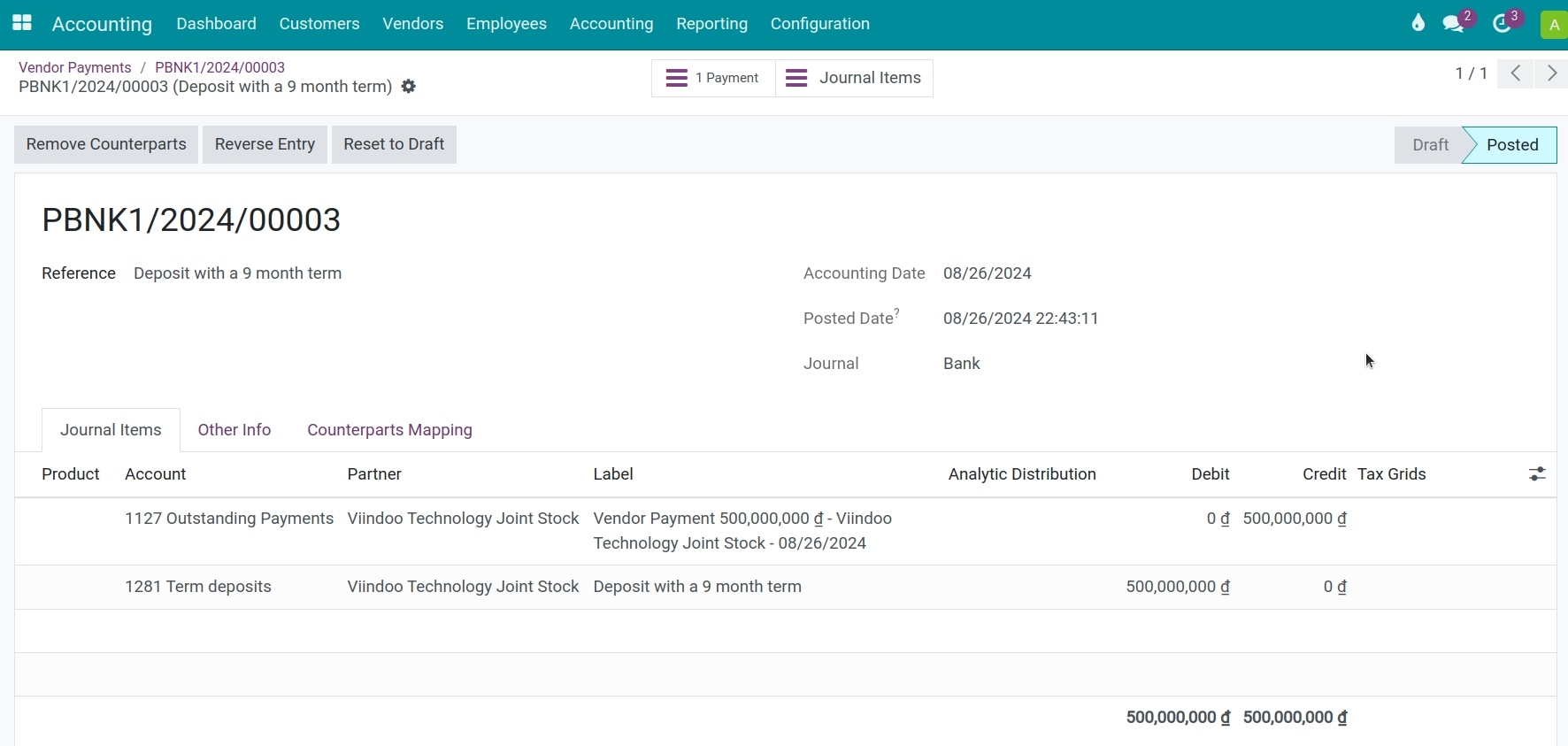

![Journal entries of time deposit transaction]()

Create a bank statement and reconciliation¶

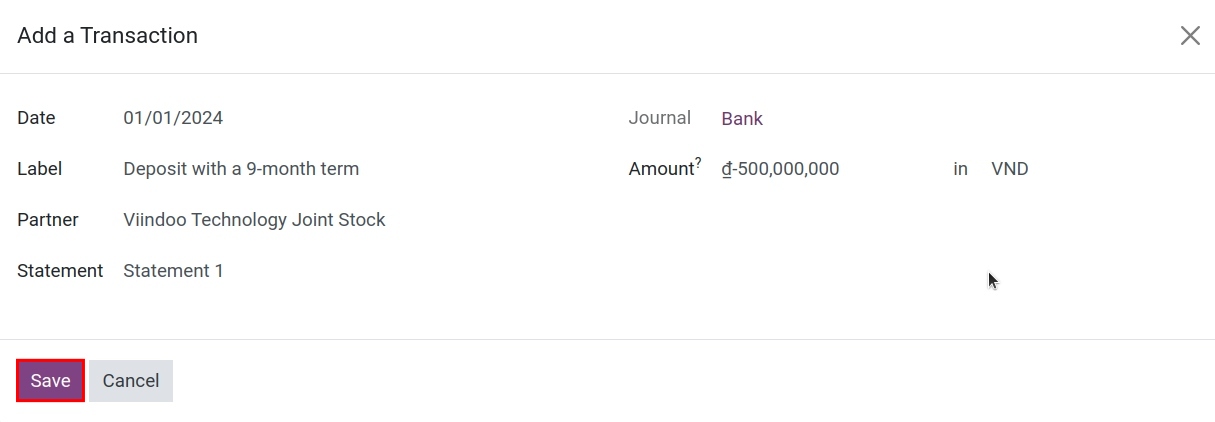

Navigate to Accounting ‣ Dashboard, select the bank account where you deposited the money, create a Transaction. Fill in the information about the partner and the amount:

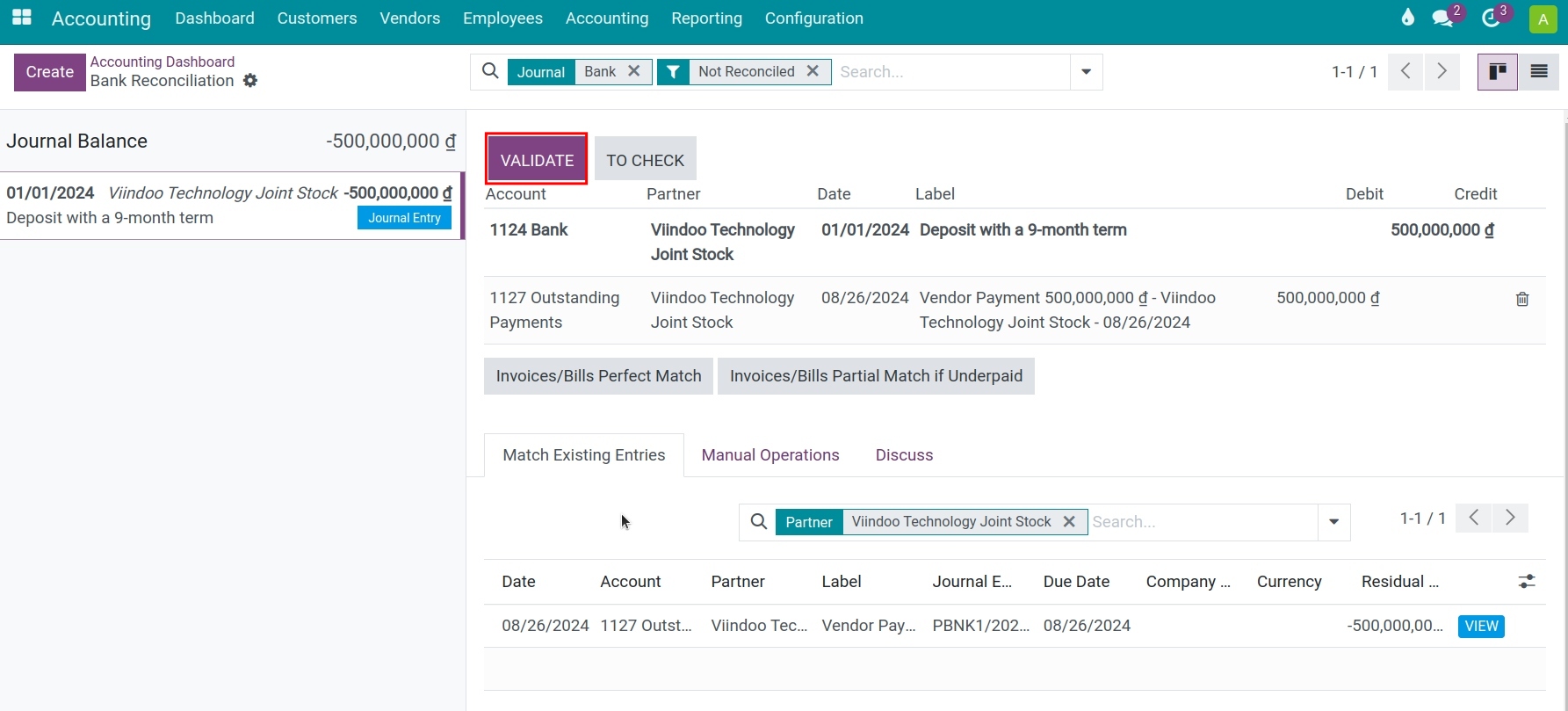

Press Save and reconcile with the previously generated payment voucher.

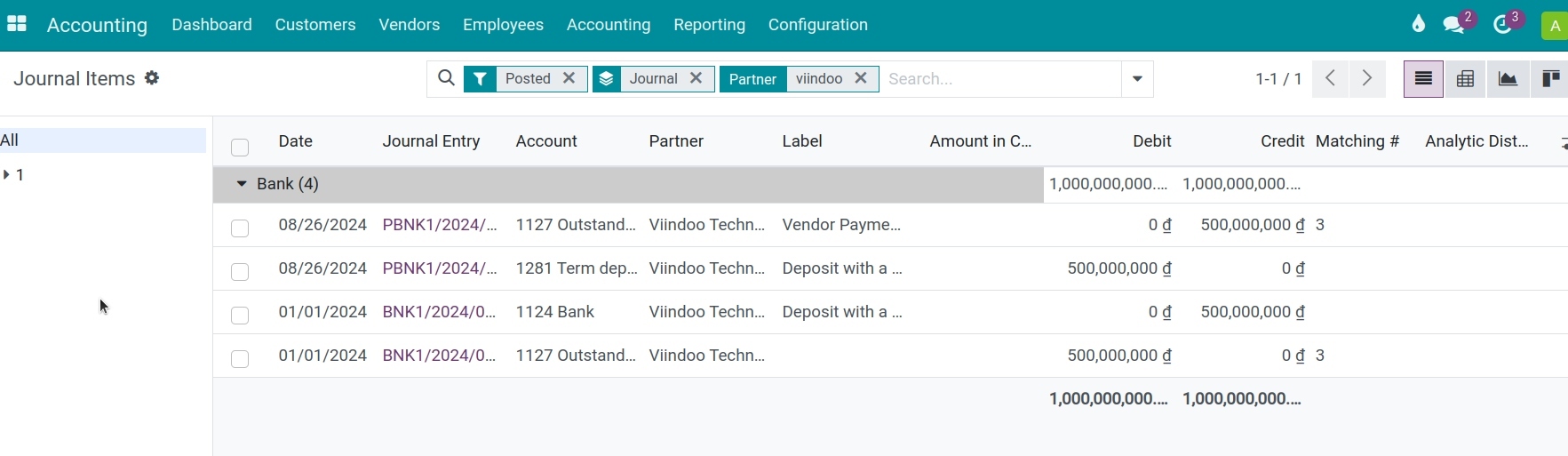

Access Accounting > Journal Items > Group by Bank Journal to view the entries generated during reconciliation and matched with the payment voucher.

Now, you have completed the recording of a time deposit transaction process in Viindoo Enterprise Management Solutions .

Recording deposit interest¶

Receive the principal amount together with interest¶

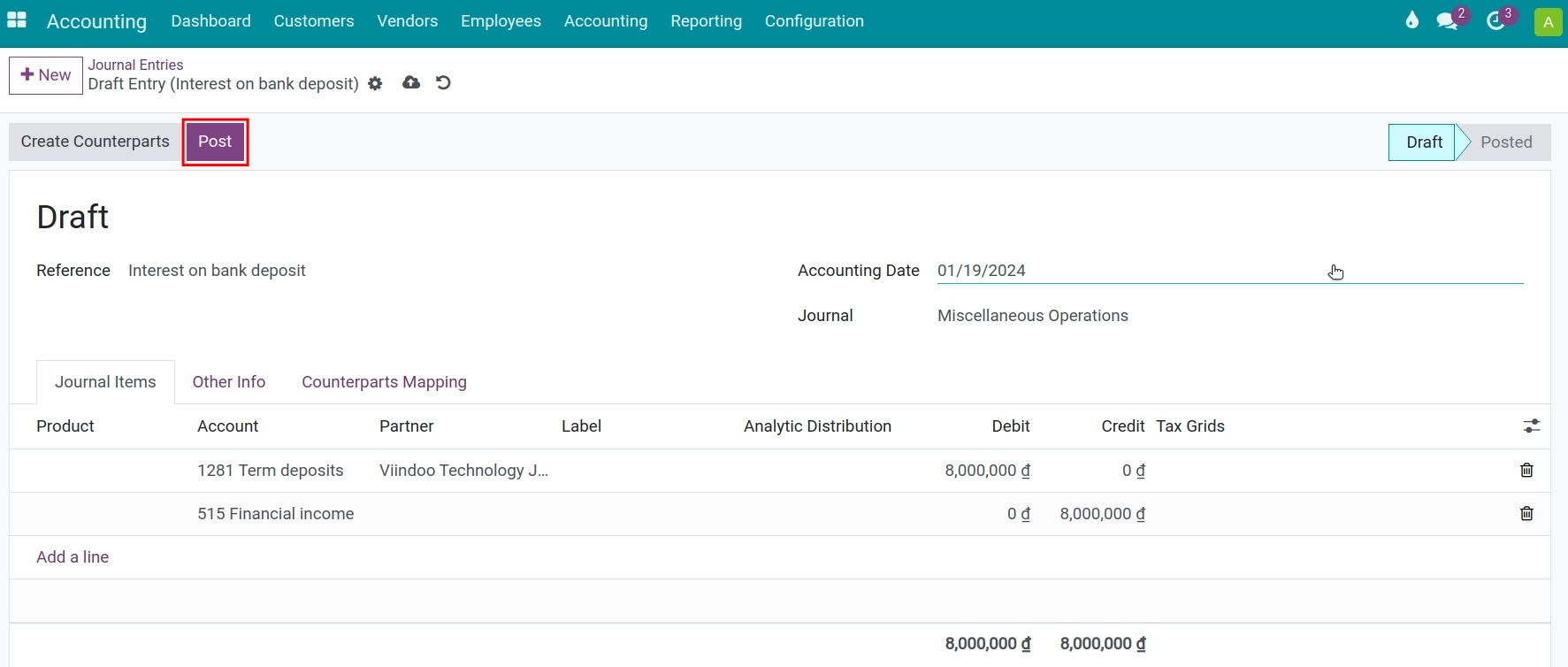

When you receive the time deposit interest document from the bank, navigate to Accounting ‣ Accounting ‣ Journal Entries, press New to create a new journal entry recording this time deposit interest. Press Add a line to enter the details of journal items:

In which:

- Reference: Enter the internal reference number for tracking such as the time deposit passbook or the time deposit account certificate, etc;

Accounting Date: The date that this transaction is recorded;

Journal: Choose the Miscellaneous journal;

Account: Select an account to record the increment of the Short term investment (e.g. Account 1281) and the increment of the Financial activities income (e.g. Account 515);

Partner: Choose your company’s contact;

Label: Descriptions for the journal items;

Debit/Credit: Enter the corresponding amount;

Receive only interest on maturity date at the current bank account¶

Follow the steps at Record the demand deposit interest.

Time deposit settlement¶

With the final settlement business, you will do the against steps with making a time deposit business.

Create a cash-in payment¶

Following the below steps:

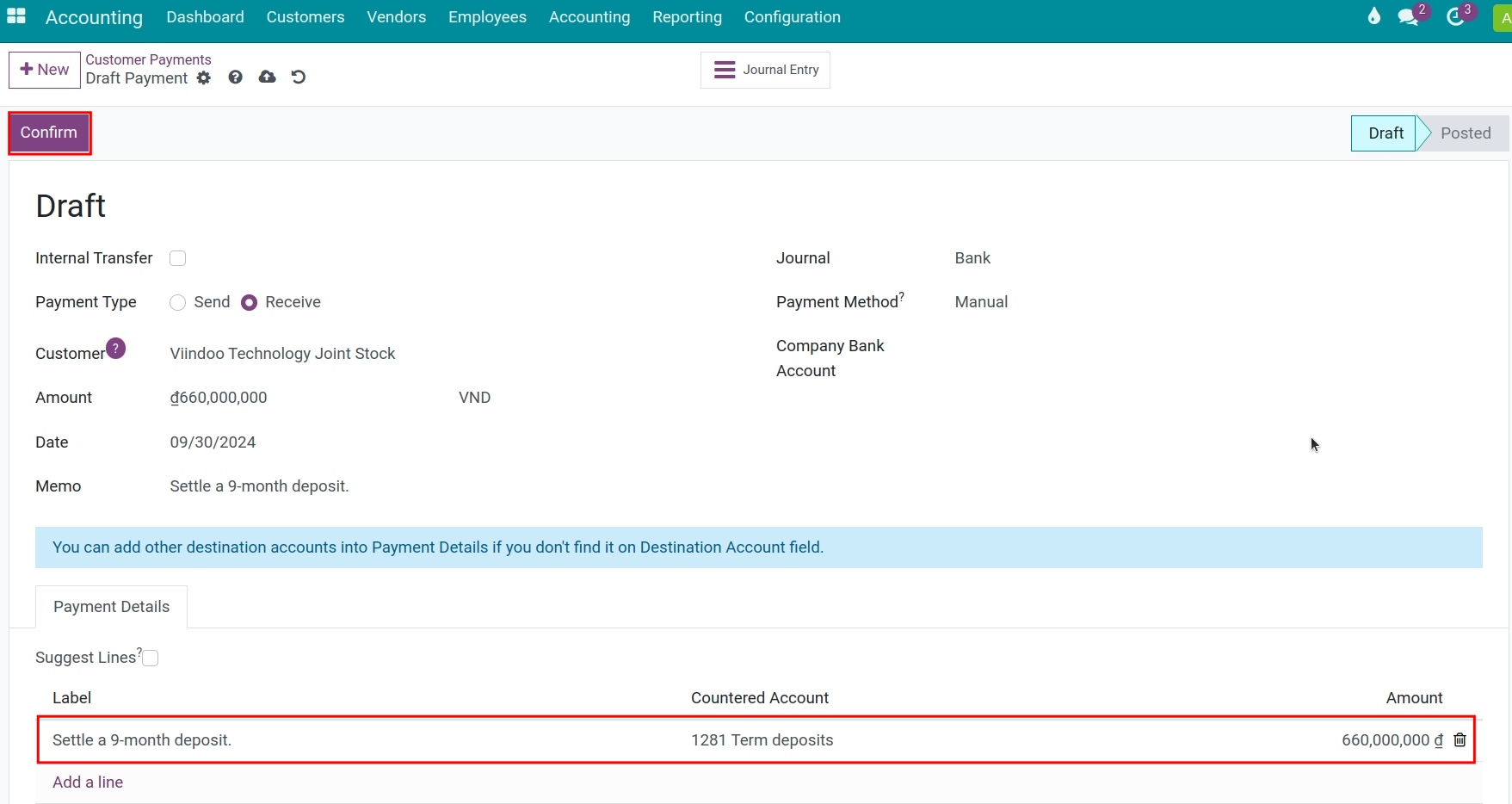

Navigate to Accounting ‣ Customers ‣ Payments, press New to create a payment:

![The time deposit settlement]()

In while:

Payment Type: Receive;

Customer: Choose your company’s contact;

Amount: The amount of settlement (This amount will be updated automatically according to the value that you add to the Payment Details area);

Journal: Choose the journal of the recipient bank account;

Recipient Bank Account: The bank account number will be suggested automatically based on the chosen journal above;

At the Payment Details tab, press Add a line to enter the details of payment:

Label: Enter the payment description;

Countered Account: Choose the account that records the Short term investment until the due maturity date (For example 1281 - Time deposit);

Amount: The amount of settlement.

Press Confirm after adding the above information.

Create a bank statement and reconciliation¶

When you receive the bank statement, you also need to create a statement and do the same reconciliation process as when you deposit your money.