Adjust Product Cost After Receiving Inventory¶

In Inventory Accounting, product cost adjustments are sometimes necessary due to differences between the purchase order price and the actual vendor bill price. This can happen when suppliers offer discounts, apply additional fees, or update pricing after delivery.

Viindoo Accounting provides a seamless solution to handle such cases by automatically adjusting inventory valuation and generating corresponding journal entries. This guide will walk you through the process of adjusting product costs after receiving inventory, ensuring accurate financial records and cost control.

Requirements

This tutorial requires the installation of the following applications/modules:

Adjust purchase unit price¶

Normally, in the purchasing process, when you confirm the corresponding receipt, the valuation is calculated based on the unit price stated in the purchase order. However, in certain cases, the actual price on the vendor bill may differ, such as when the vendor offers a discount. So, how can you handle this situation in Viindoo Accounting?

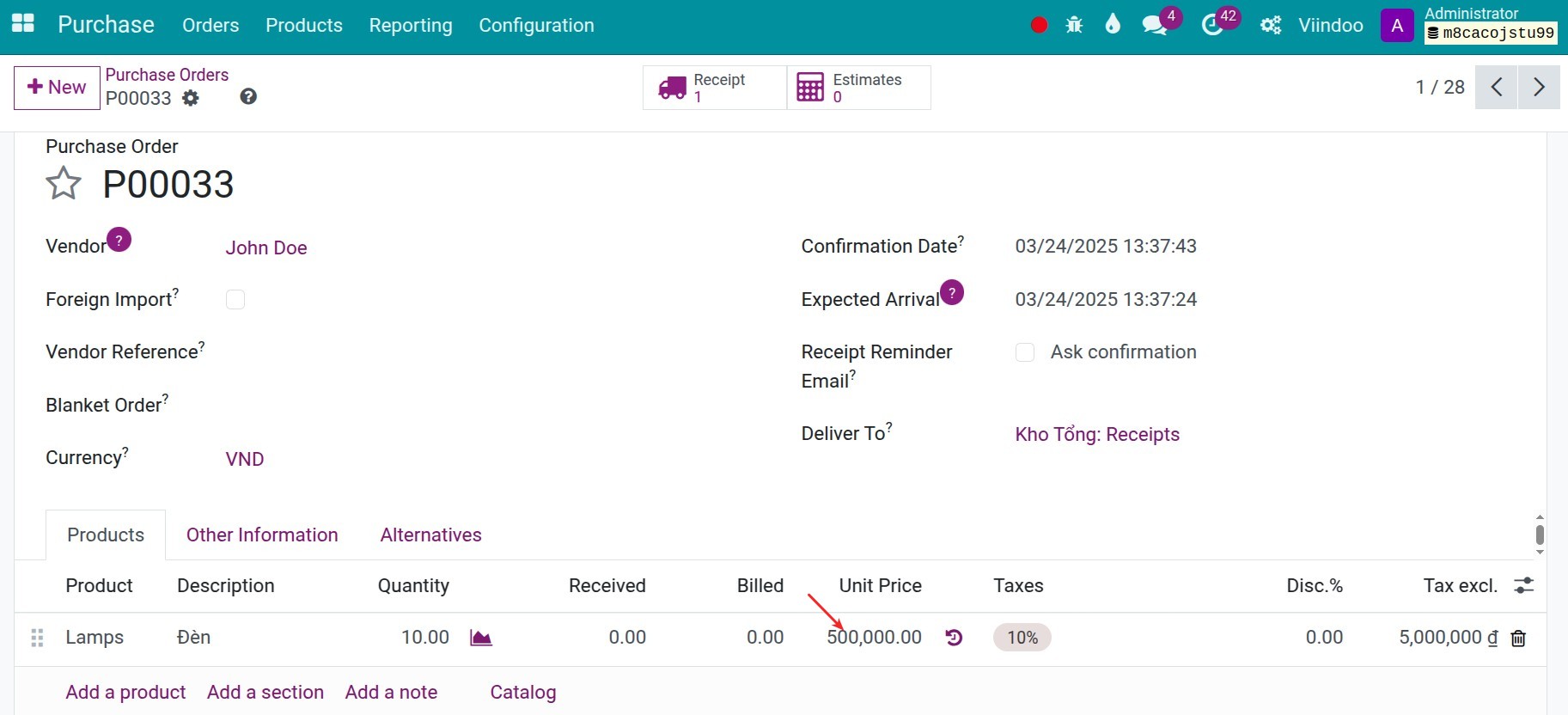

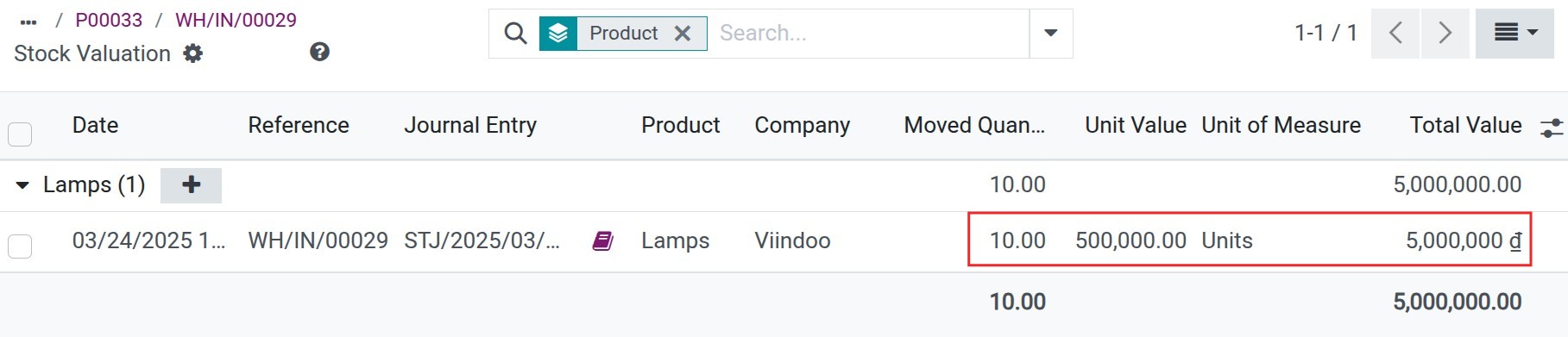

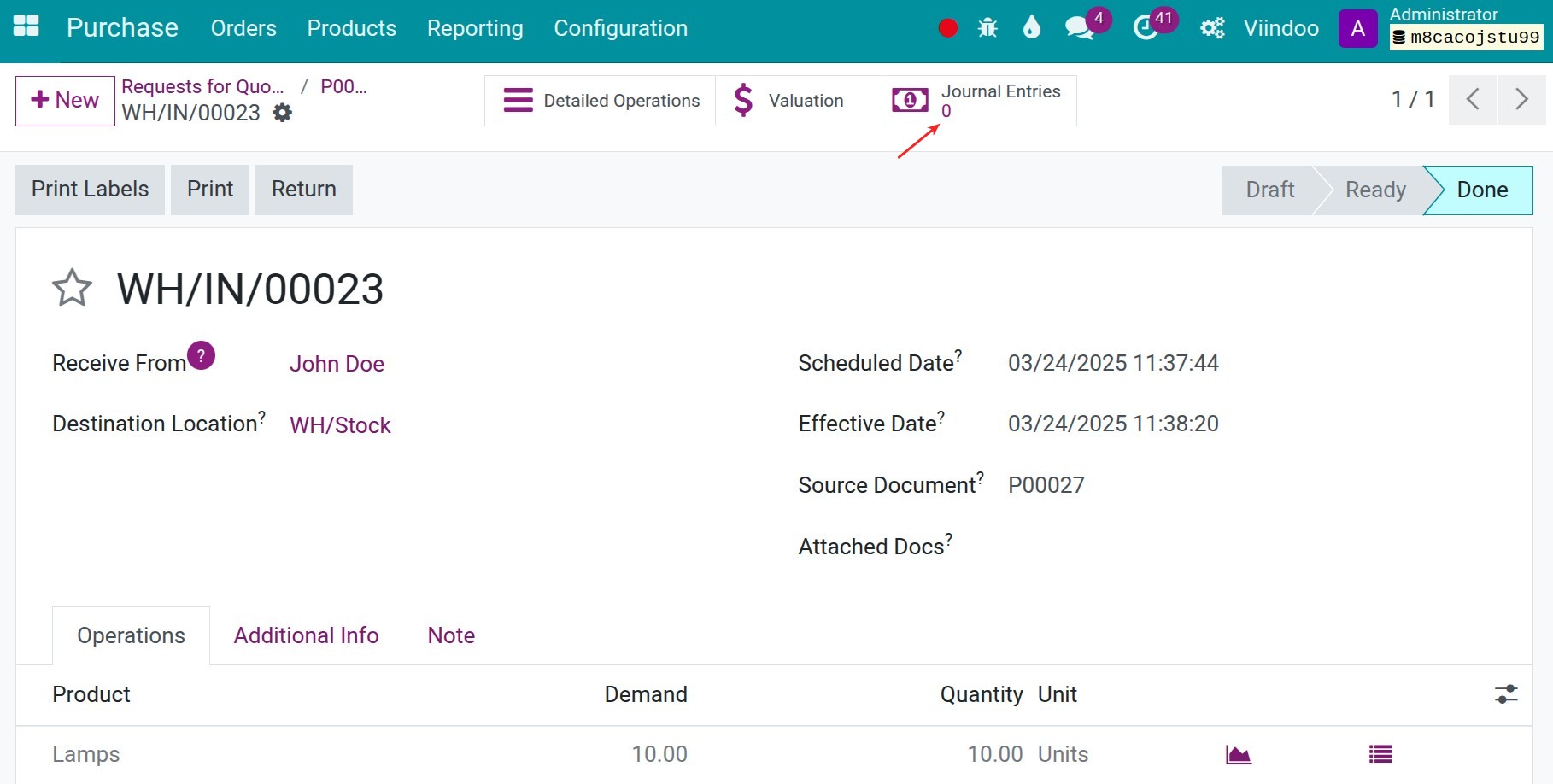

First, at the initial stage, you receive the product based on the unit price stated in the purchase order.

You can review the journal entry and its corresponding valuation:

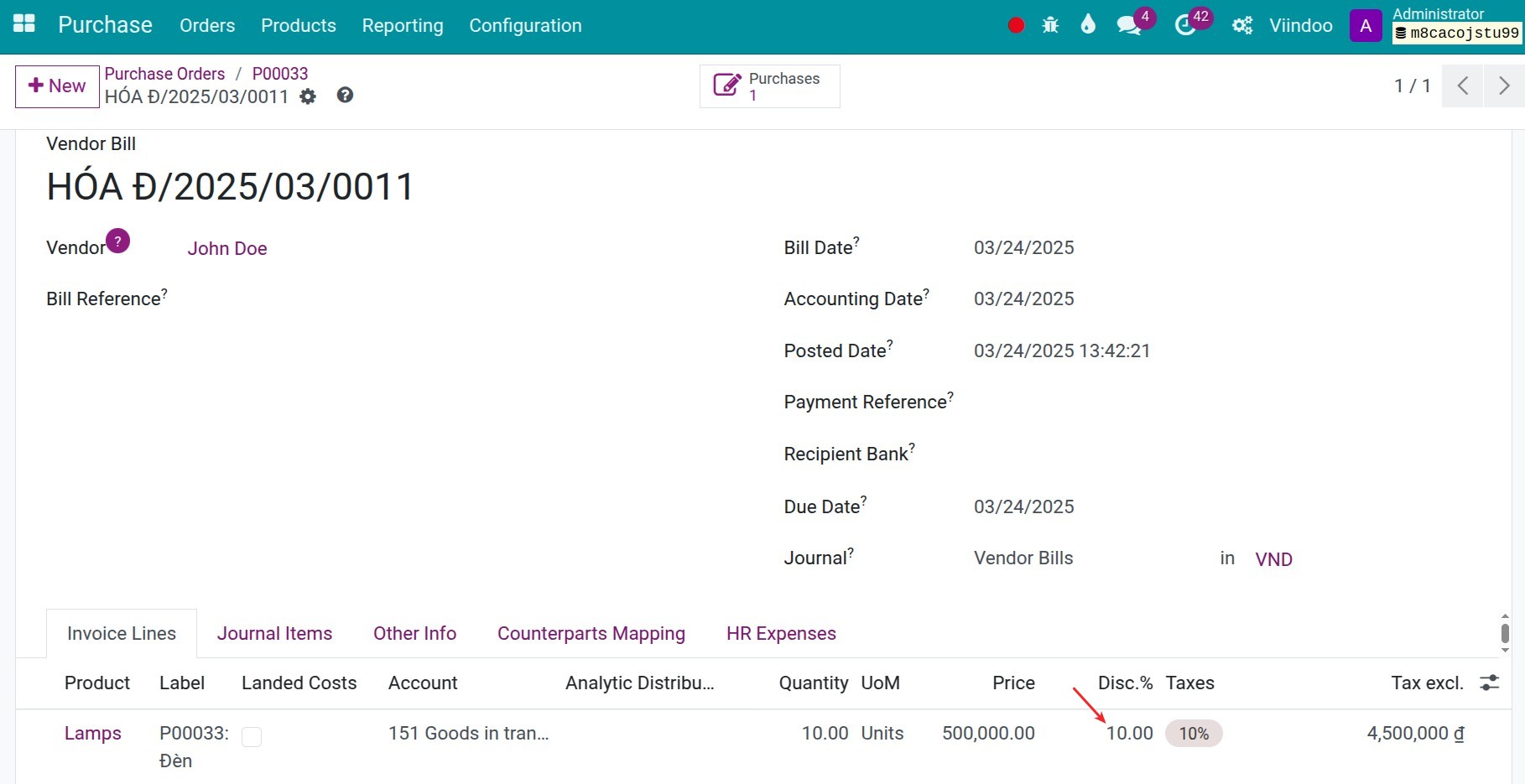

Then, when issuing the vendor bill for this purchase order, you can update the unit price for the product accordingly such as enter the discount.

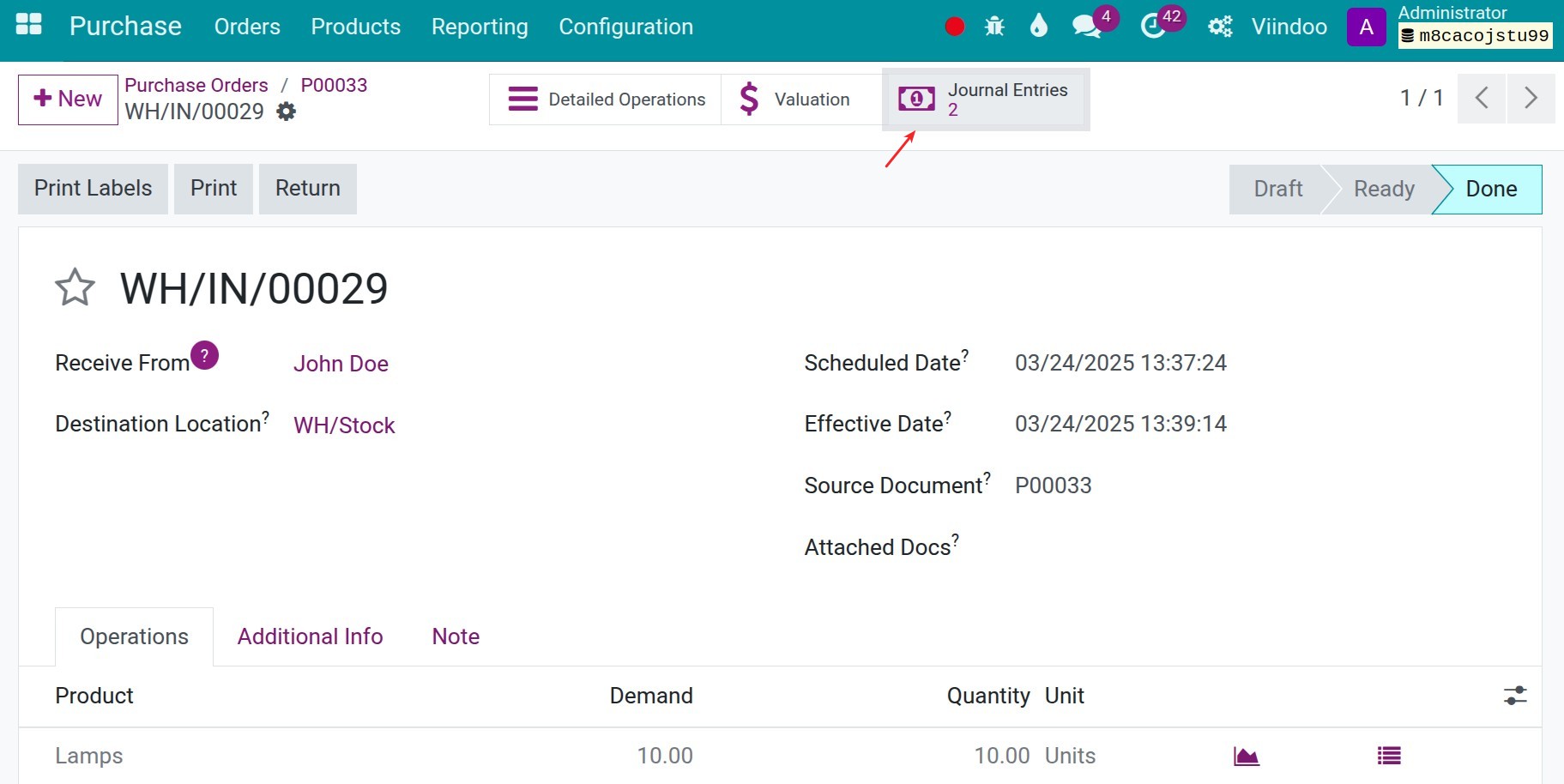

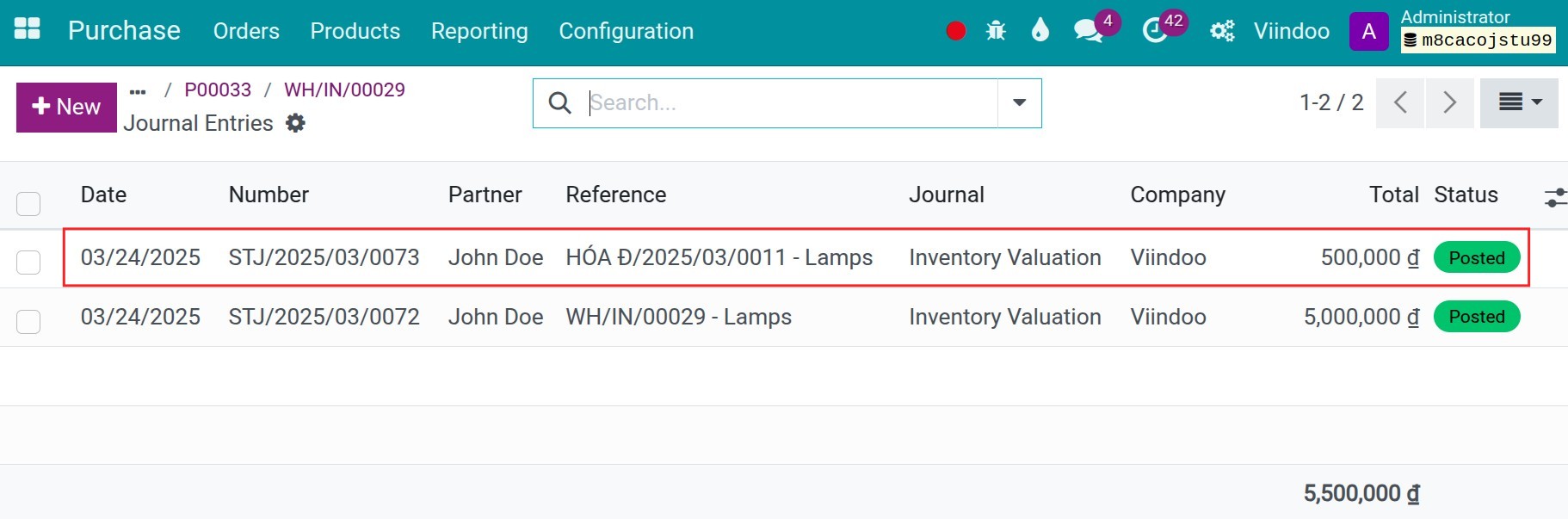

After posting this bill, the system will automatically generate adjustment journal entries for the differences. You can review them in the receipt note.

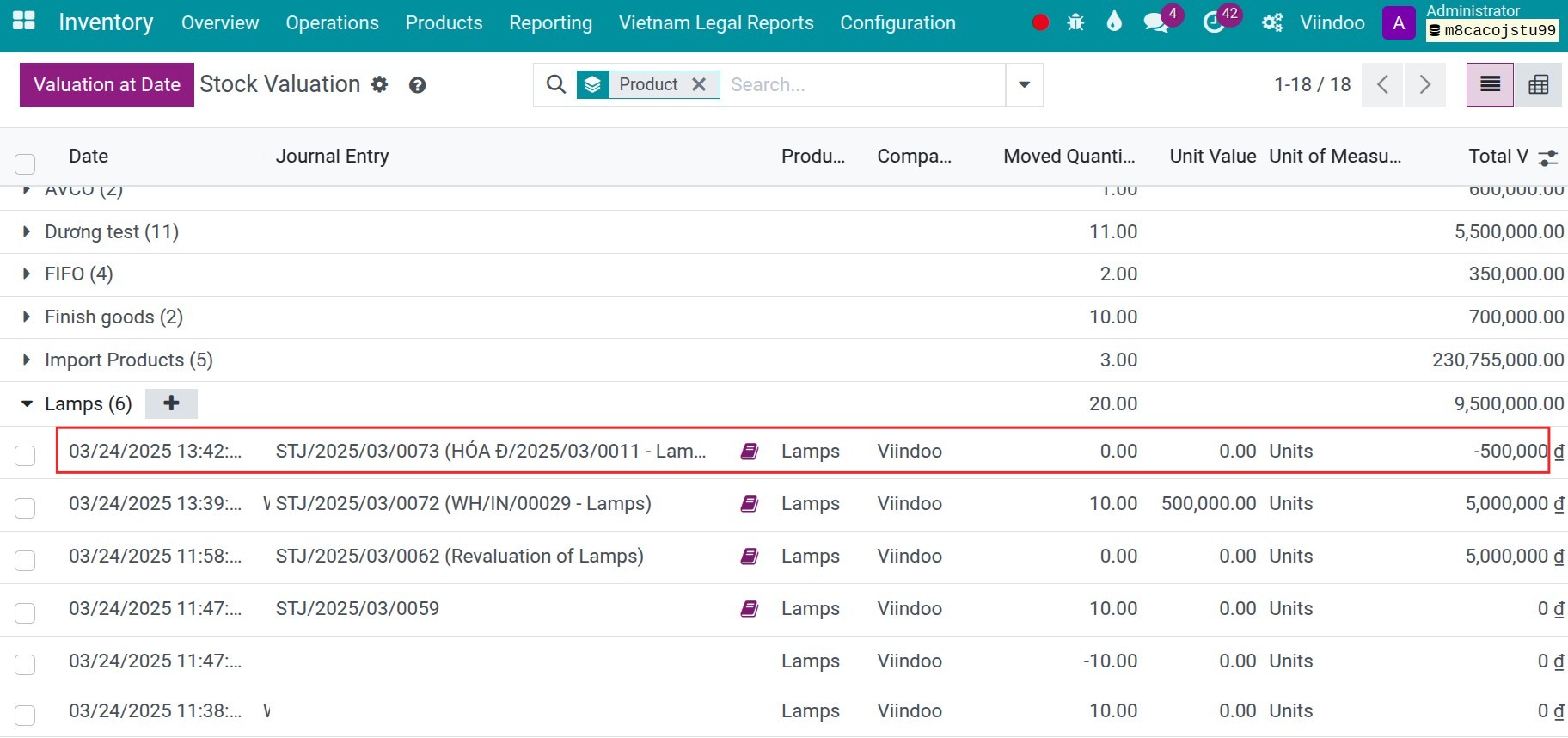

Return to the Valuation Report to review the adjusted valuation and its corresponding journal entry.

Warning

If the product is delivered out of stock before you post the bill, the adjustment will not apply to the outgoing product. But you can manually do the adjustment by using the Journal Entry.

Change the inventory valuation method¶

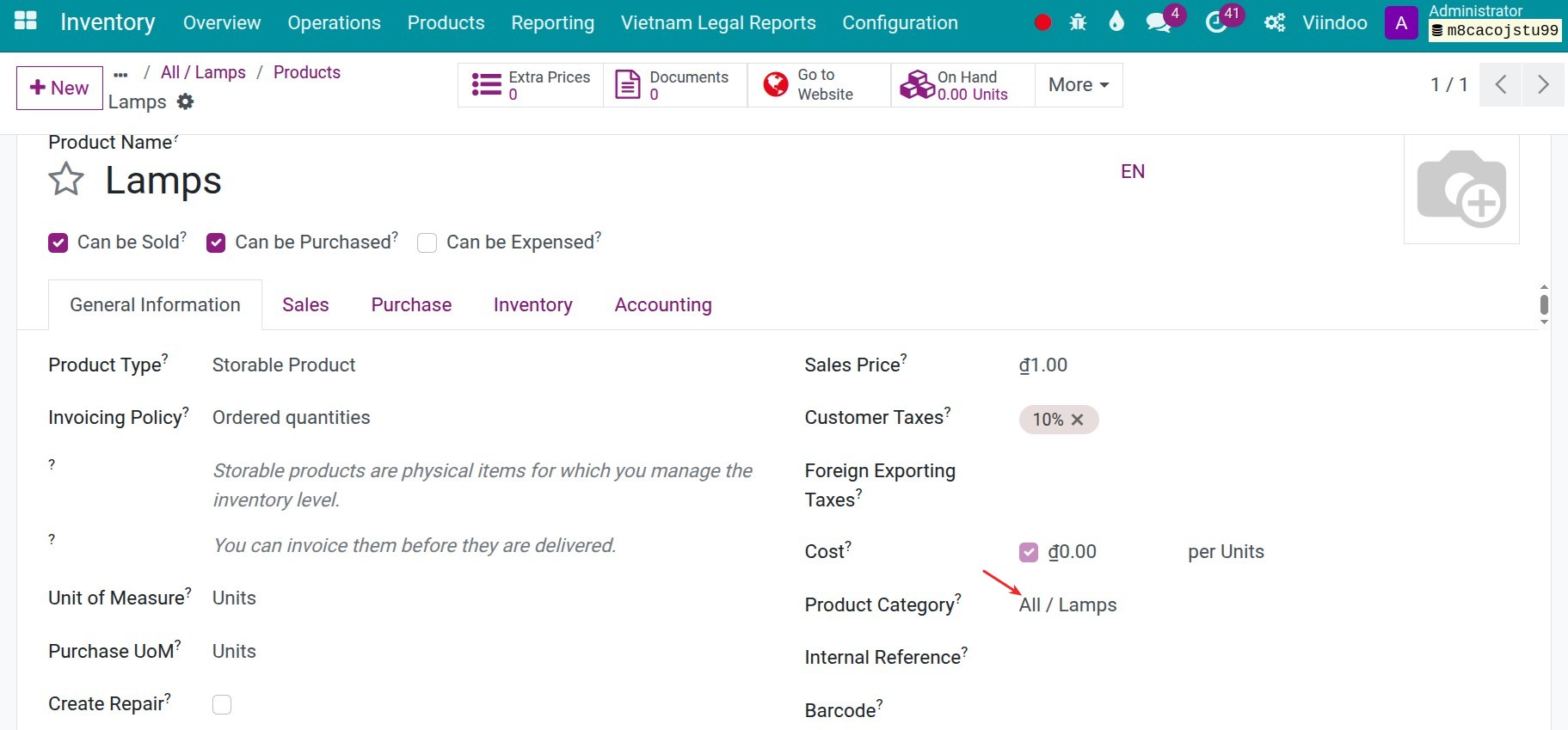

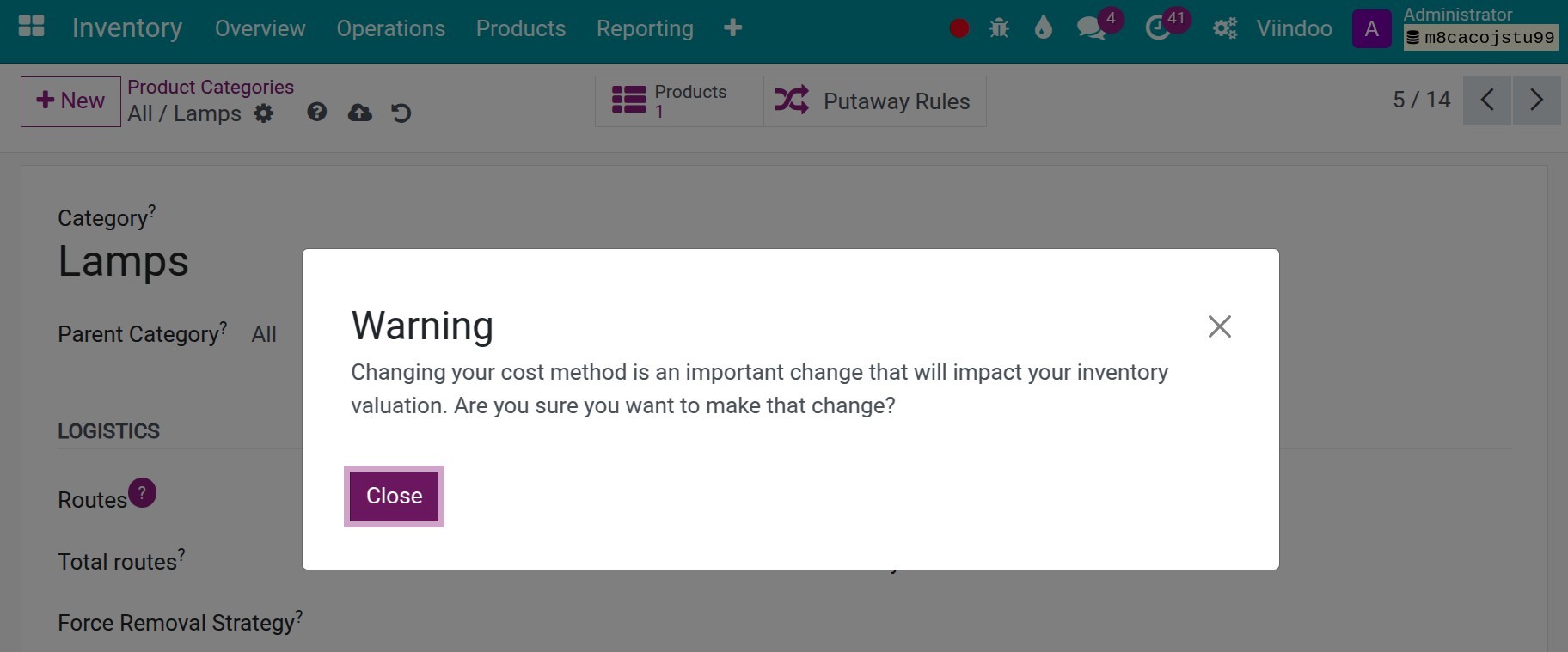

Normally, when reorganizing product categories in the system, you must configure the Costing Method for each category. However, in certain cases, you may need to modify the Costing Method. This adjustment directly impacts the cost valuation of products within that category. The system will automatically generate new stock valuations along with corresponding journal entries. It is important to note that all past transactions remain unaffected by this adjustment.

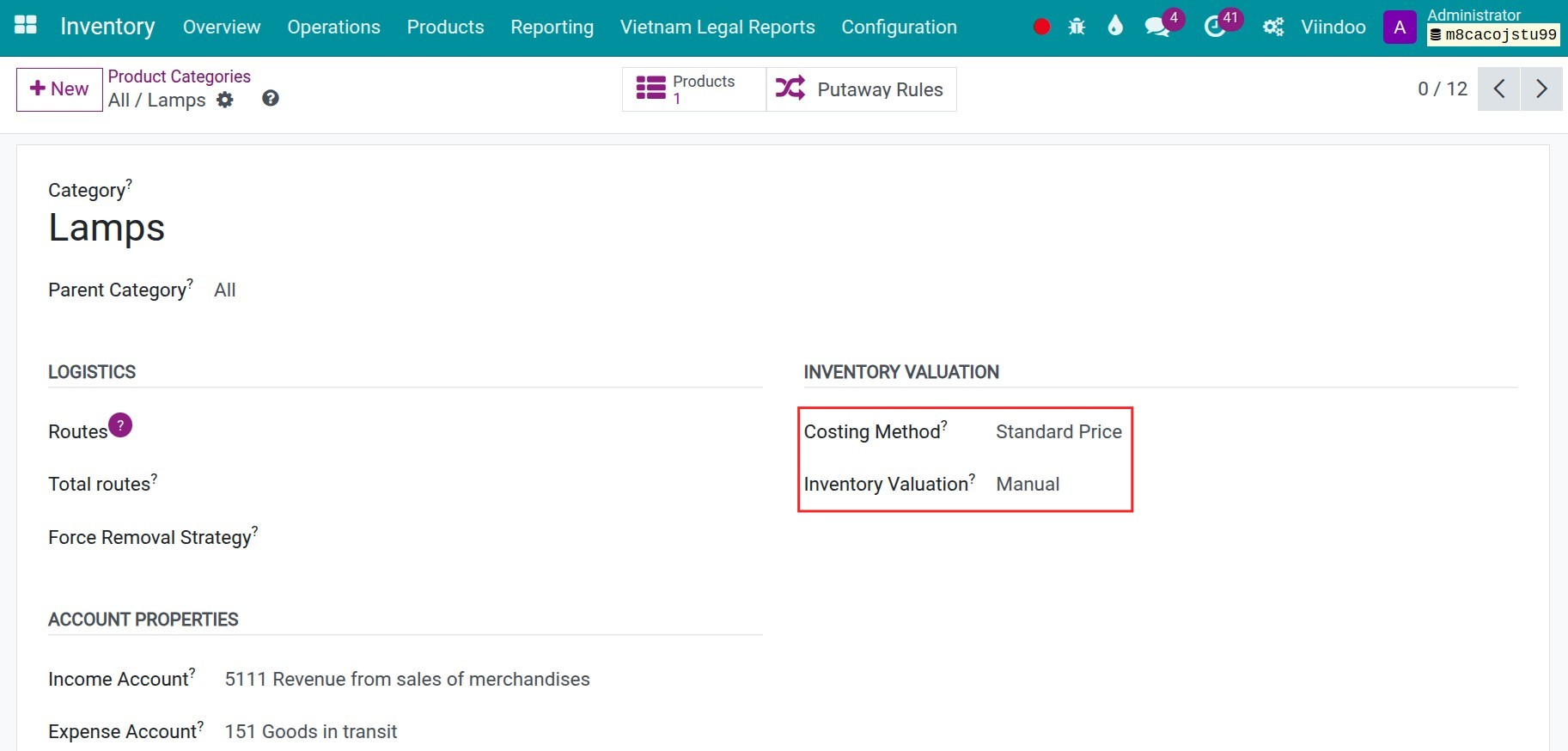

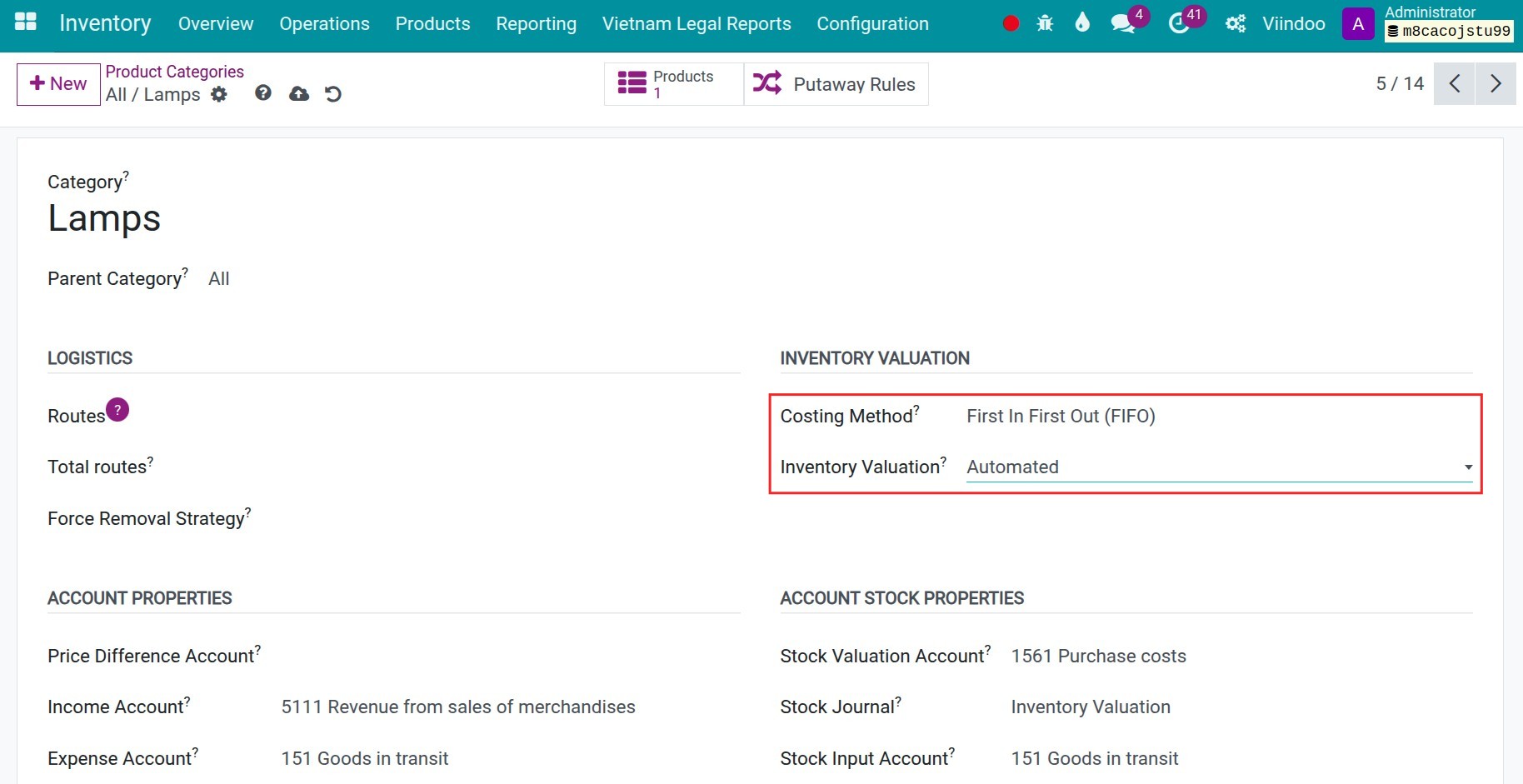

For example, in the Lamps category, in the beginning the Cost Method is Standard Price and the Inventory Valuation is Manual:

When the purchasing transaction is complete, the receiving product is done, you can not see the stock valuation and the corresponding journal entry.

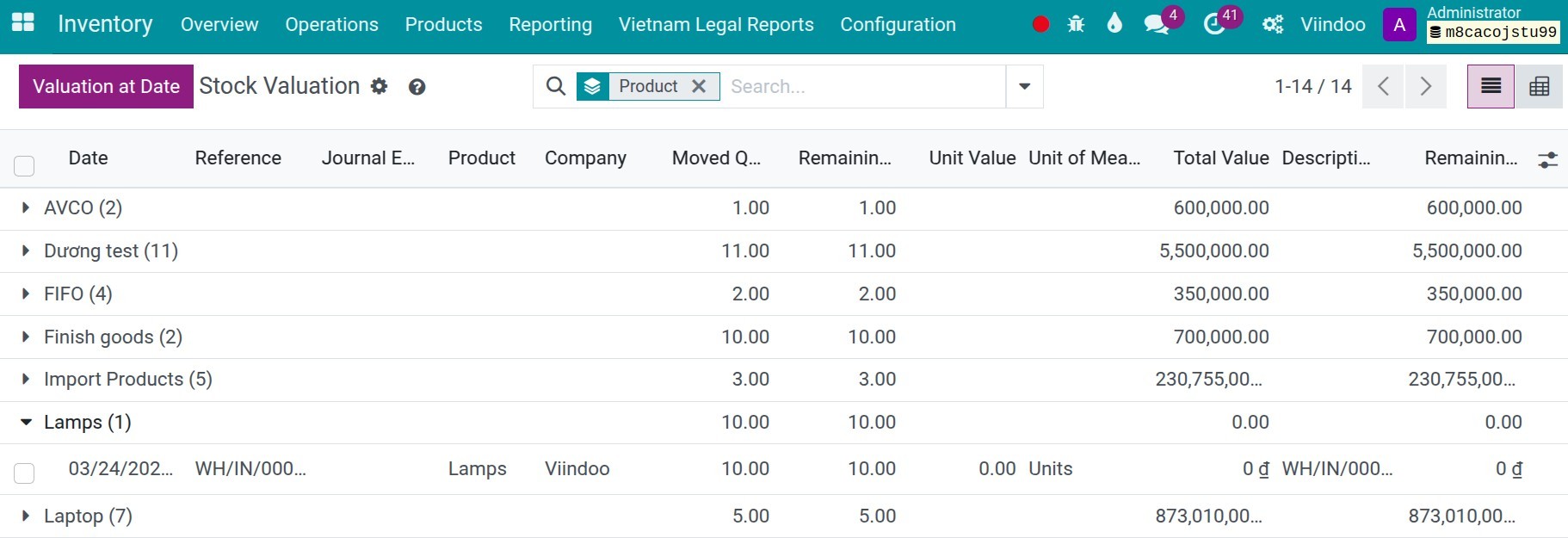

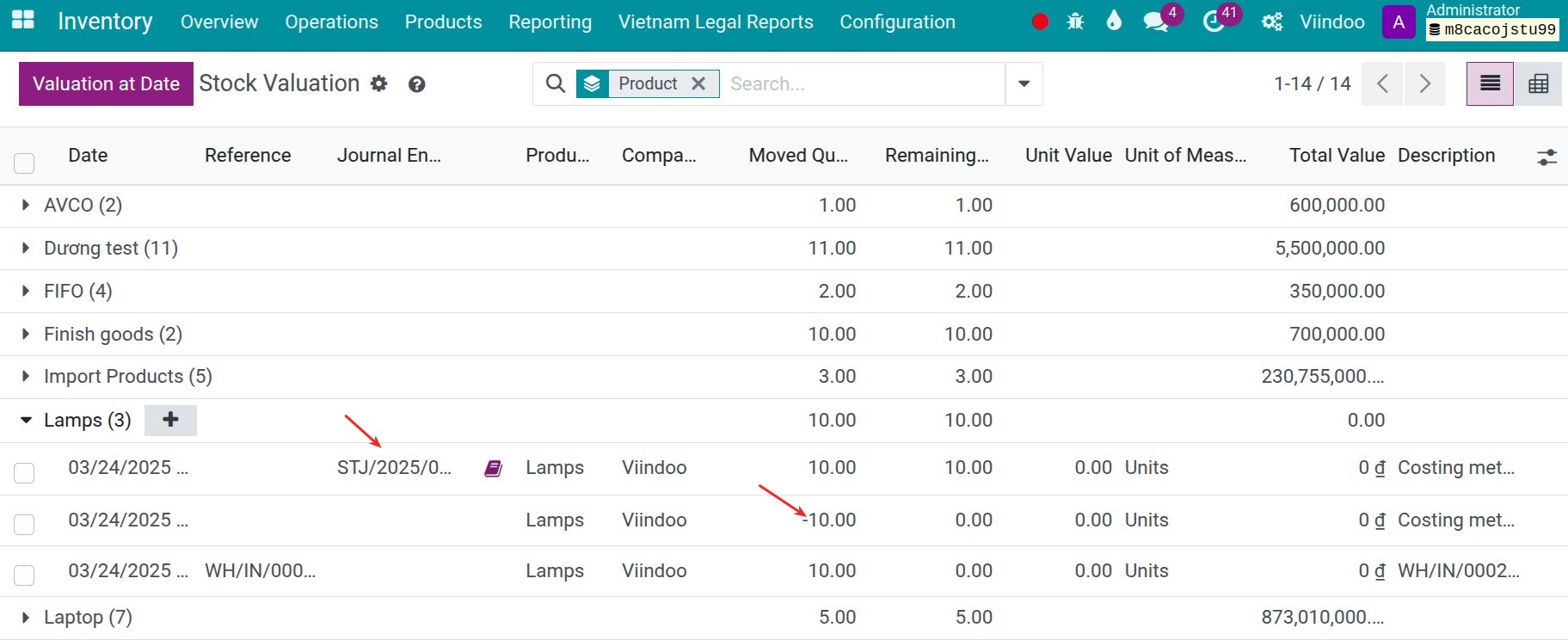

In the Valuation report:

Now, when you need to change the setting of the Standard category to FIFO, and the inventory valuation is Automated, navigate to Inventory > Configuration > Product Category to select and open the Lamps category and change the needed information. A warning message will appear notifying the change in the costing method:

After doing that, navigate to Inventory > Reportings > Valuations to see the valuation report:

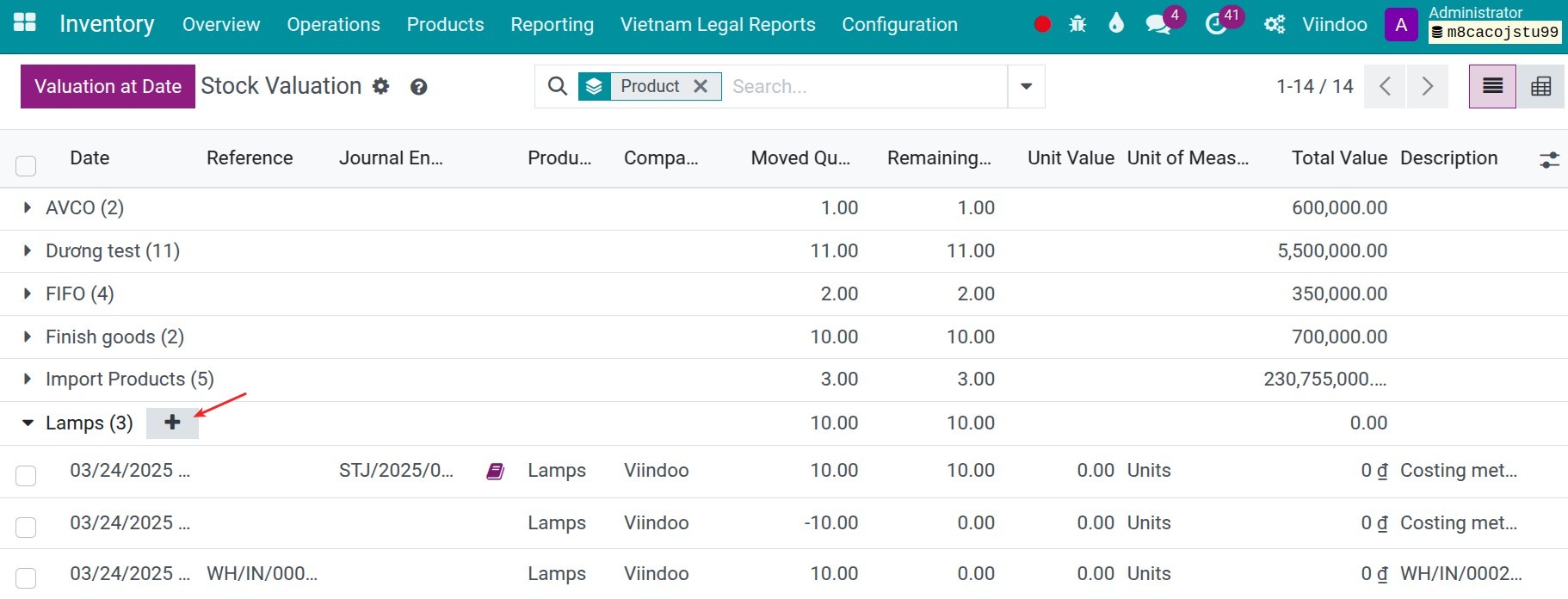

The system will automatically generate a new inventory valuation to reverse the remaining stock and its valuation. In this case, under the Standard cost method, the product’s cost valuation is based on the price set in the product interface. If no price is set, the valuation will be zero. To update the valuation for the product (applicable only to the stock quantity), click the Add icon:

Note

This feature is only available for products classified as Storable and still have stock.

This feature is only accessible to users with Administrator access right in the Accounting and Inventory apps.

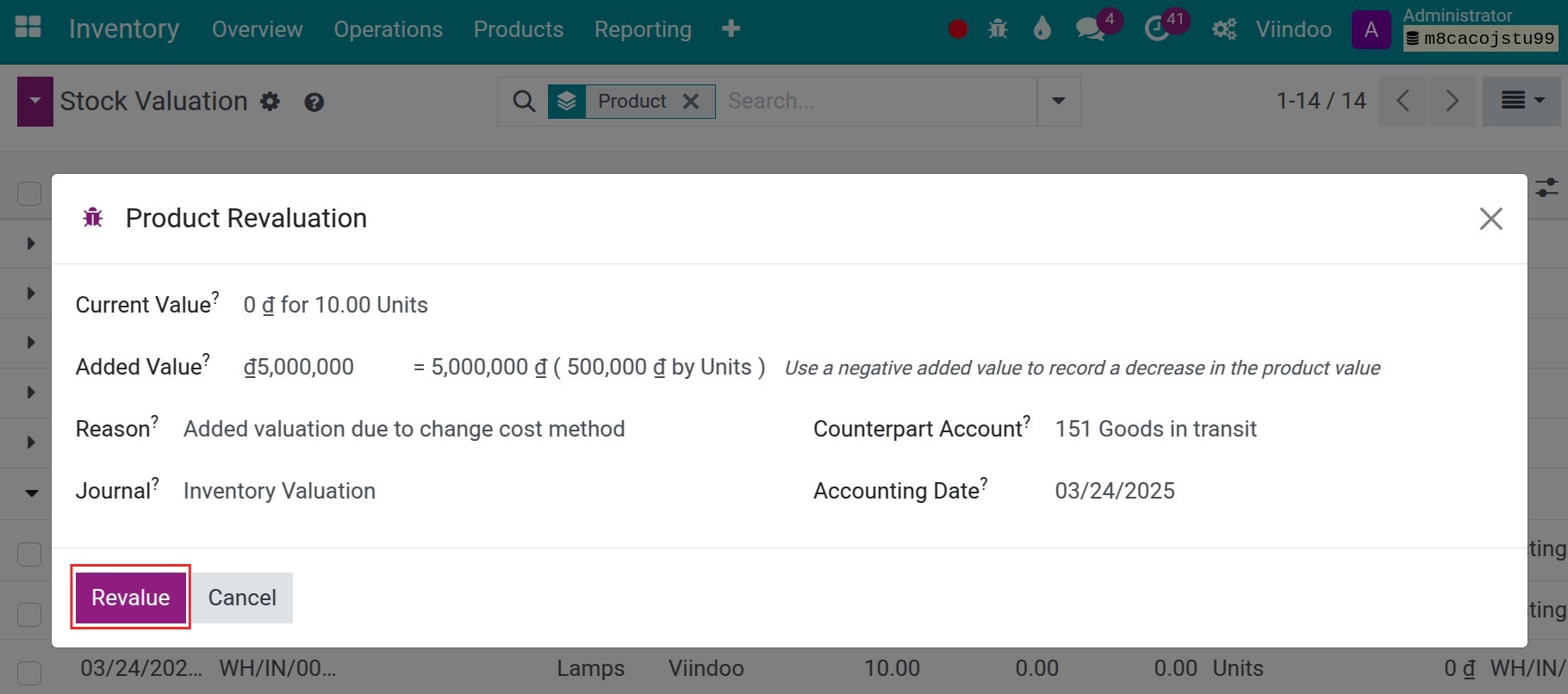

Current Value: The existing valuation corresponding to the stock quantity of this product.

Added Value: The total value added to adjust the valuation for the stock quantity.

Reason: Specify the reason for the adjustment.

Journal: Select the Inventory Valuation journal.

Counterpart Account: The account that offsets the Stock Valuation account for this product.

Accounting Date: The date recorded for the adjustment journal entry.

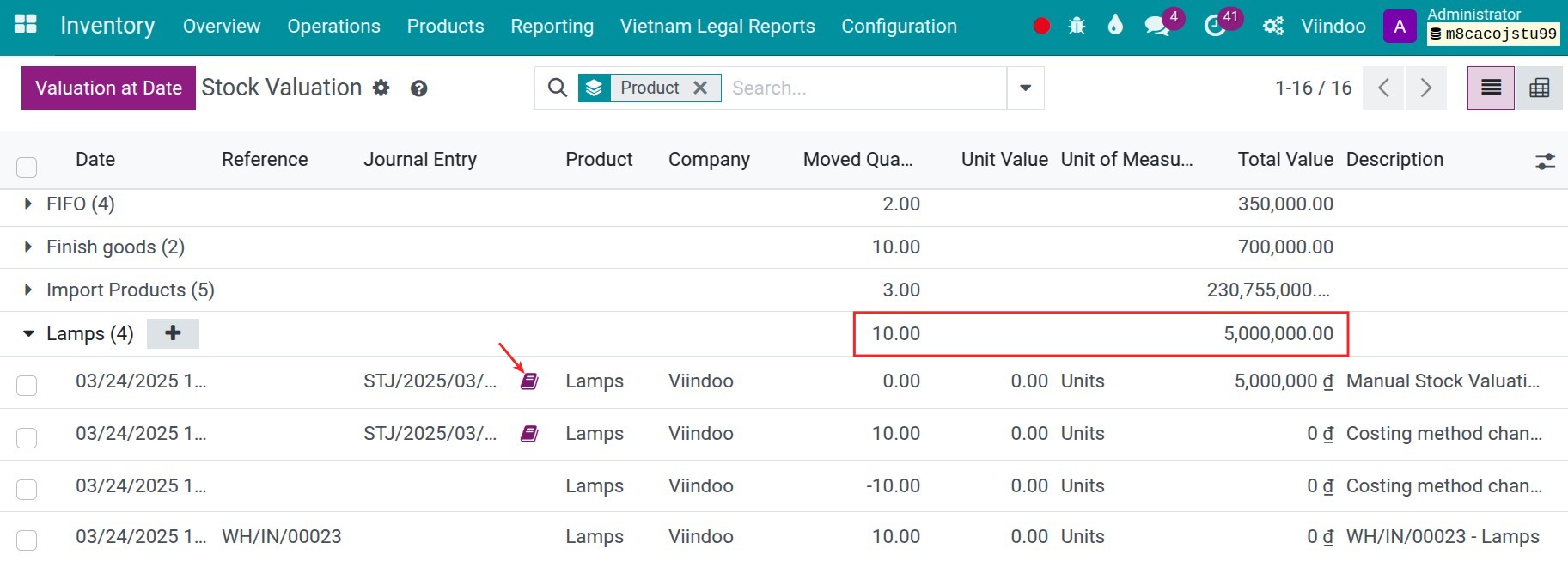

Press Revalue to complete and see the valuation report:

Warning

This feature allows you to adjust the valuation of the stock quantity. However, it does not apply to products that have already been removed from stock.

You can manually adjust the value of outgoing stock using a Journal Entry.

See also

Related article

Optional module