How to use Credit Notes in Viindoo Accounting¶

A credit note is a financial document issued by sellers to buyers to notify them that credit is being applied to their account. Credit notes are used in the following cases:

Goods returned from customers;

Pricing mistakes on customer invoices;

Etc.

There are two ways to issue a credit note:

Requirements

This tutorial requires the installation of the following applications/modules:

Create a credit note directly on the invoice¶

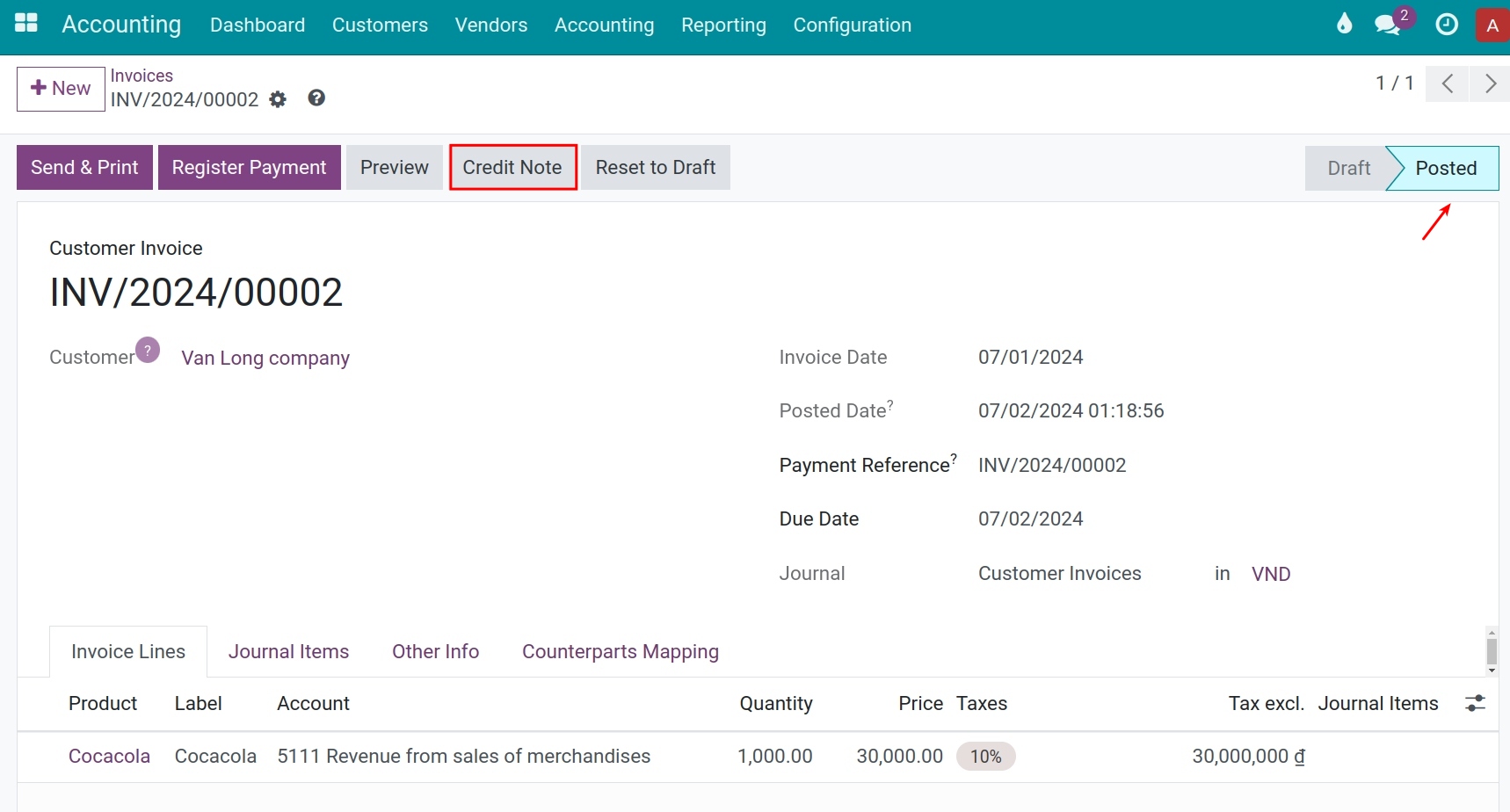

Navigate to Accounting ‣ Customers ‣ Invoices, select the invoice to create a credit note, and click Credit Note:

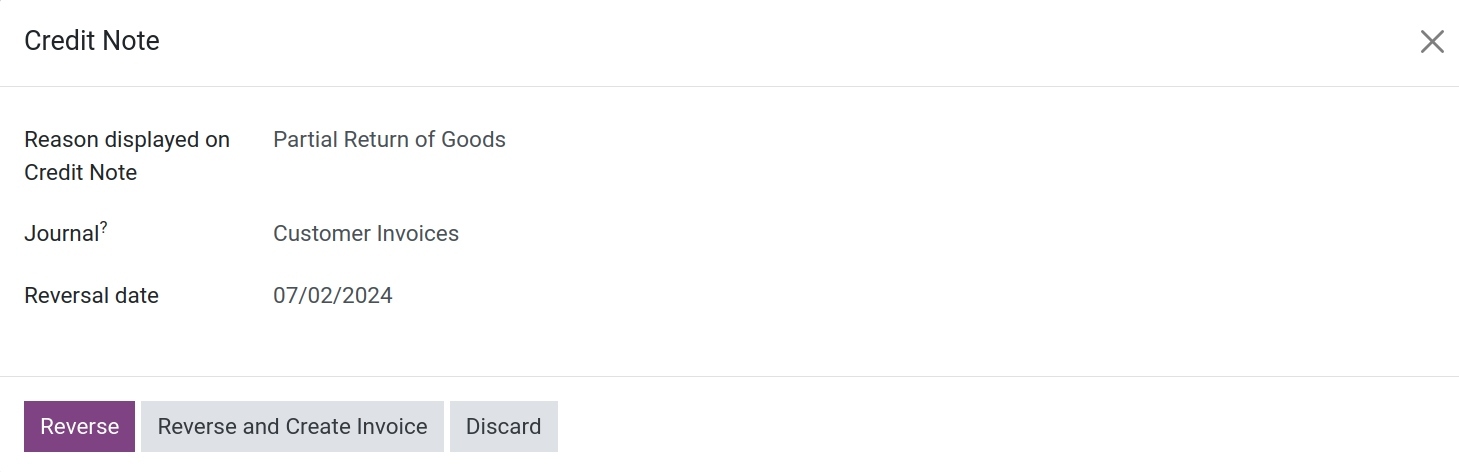

After that, a pop-up window appears:

At this stage, you need to take notice of the below fields:

Reason displayed on credit note: Ensure that you provide a detailed explanation to facilitate future reviews.

Journal: Choose a journal to register generated entries from this credit note and should be compatible with your invoice type. In this case, you choose Customer Invoices Journal.

Reversal date: You can choose the date at the time of adjustment.

After filling in the information, you select either Reverse or Reverse and Create Invoice depending on the specific scenarios:

1. Reversed

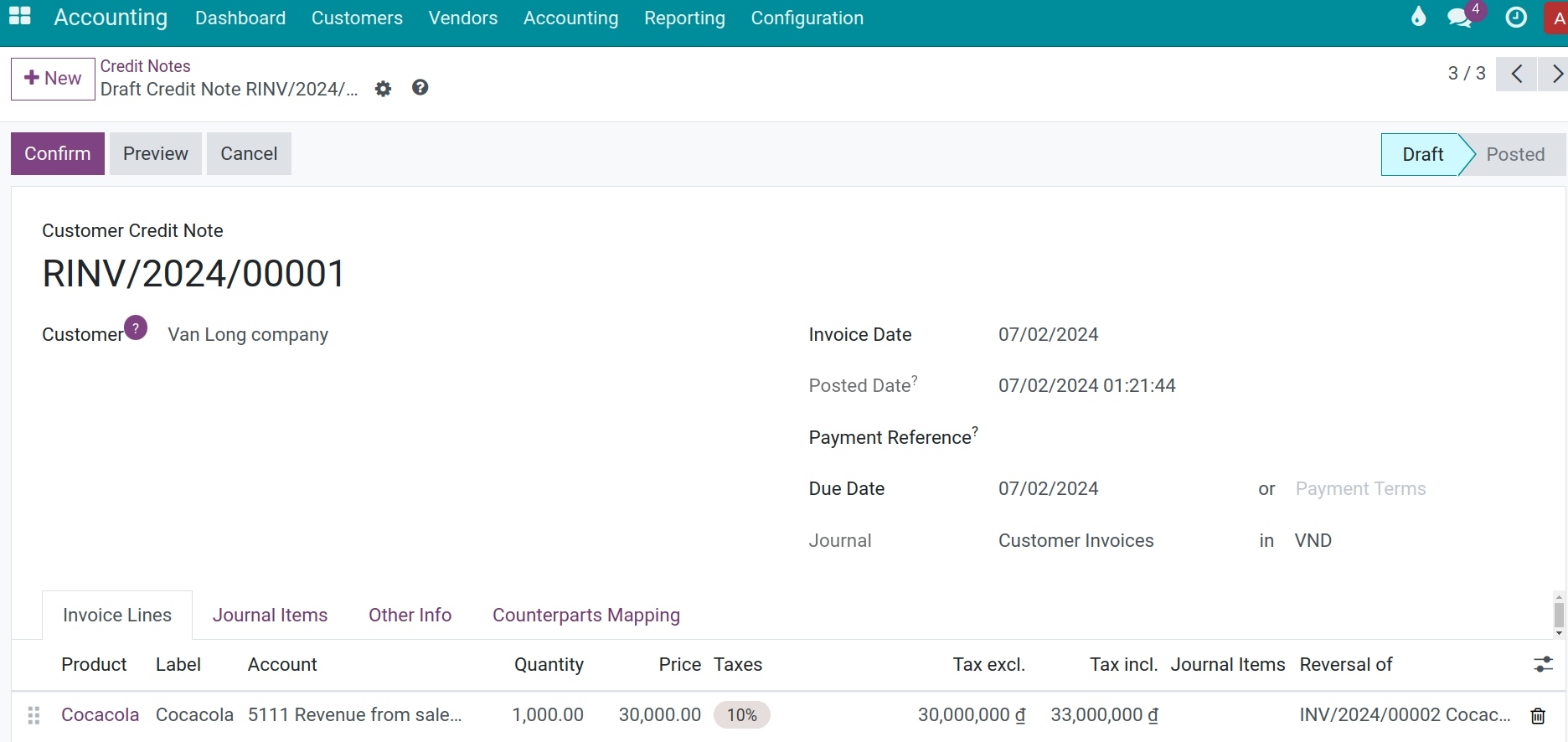

When clicking Reverse, the system will automatically generate a draft adjustment invoice with complete data derived from the original invoice.

Two situations may occur as follows:

Case 1: Full refund

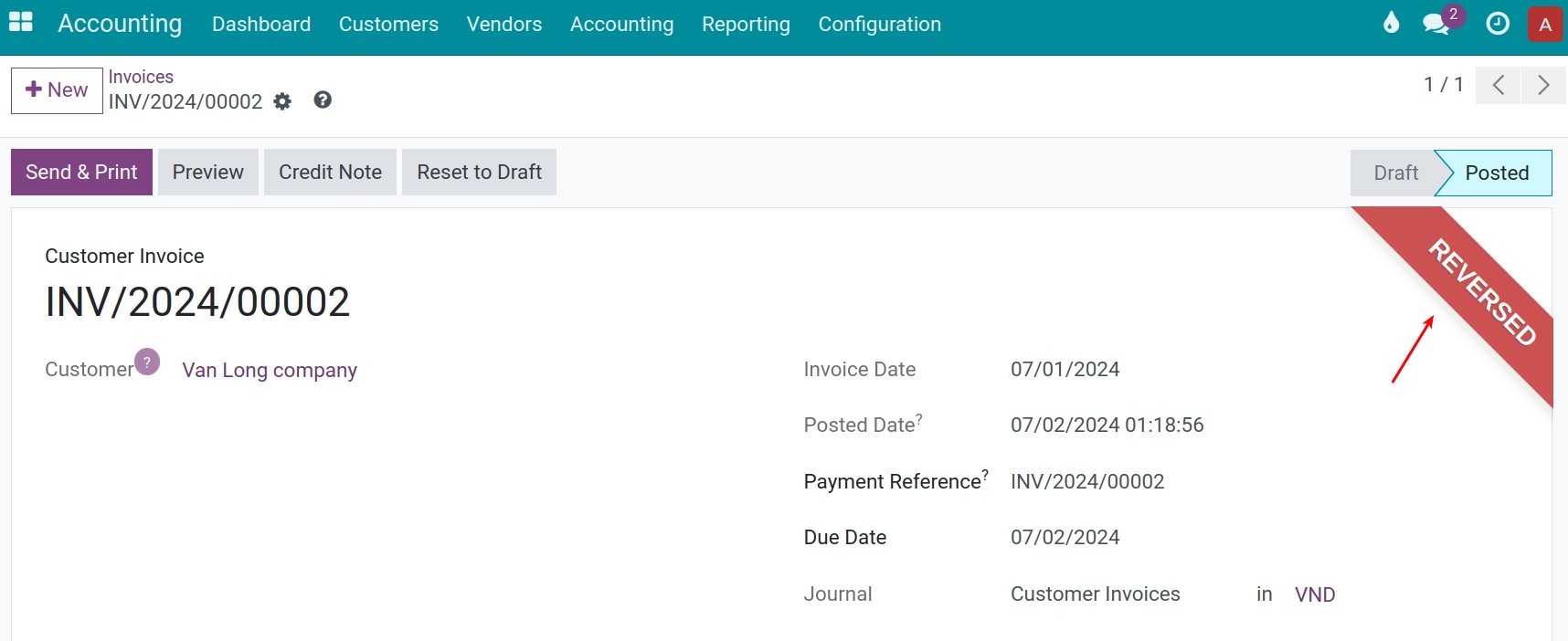

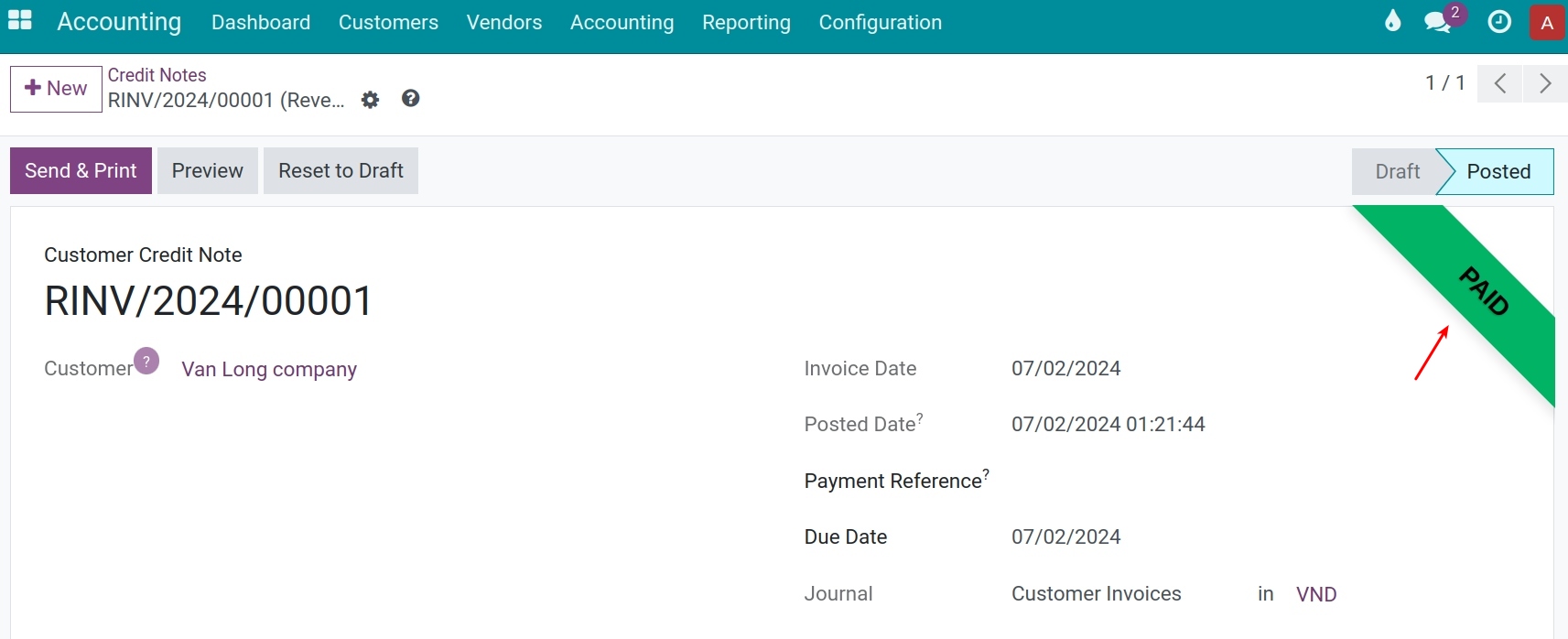

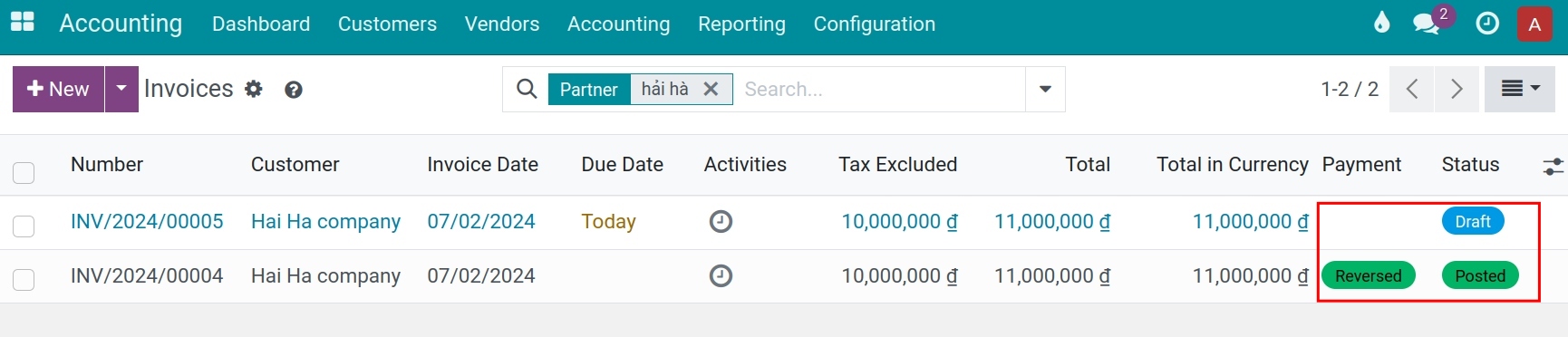

Click to confirm the reduction adjustment invoice, the system will automatically Confirm and reconcile it with the original invoice. The original invoice will display the status Reversed, and the Credit Note will display the status Paid.

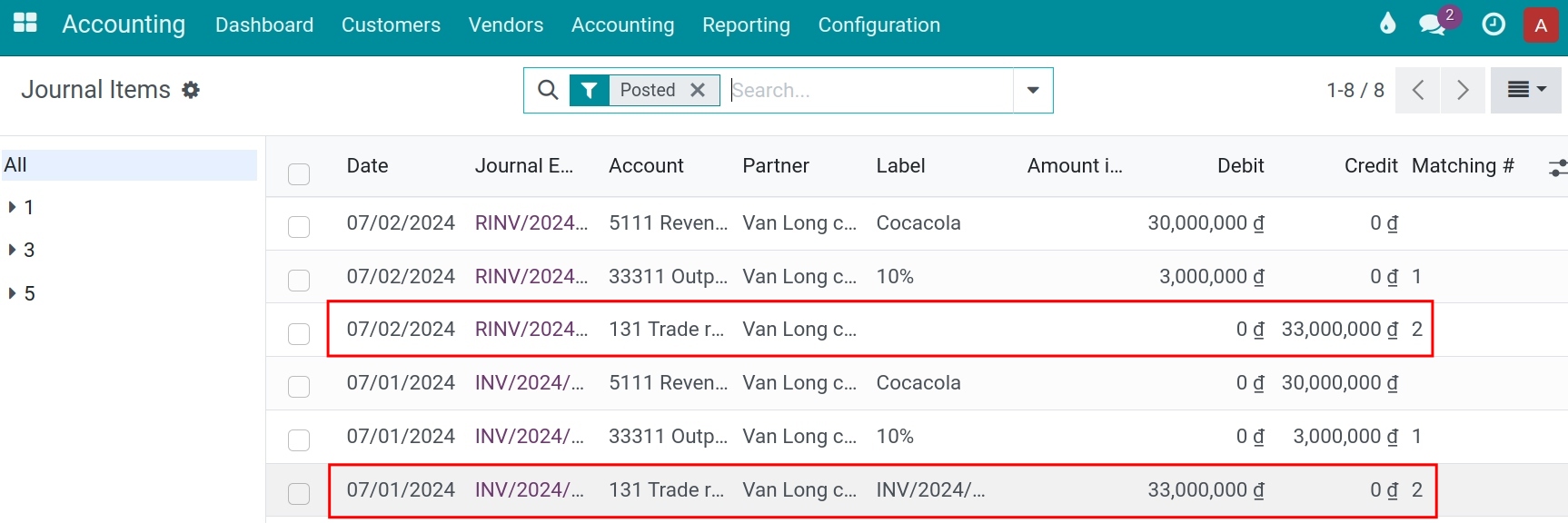

You can now navigate to Accounting ‣ Accounting ‣ Journal Items to view the reconciled entries:

Note

Journal Items only displays when you activate developer mode.

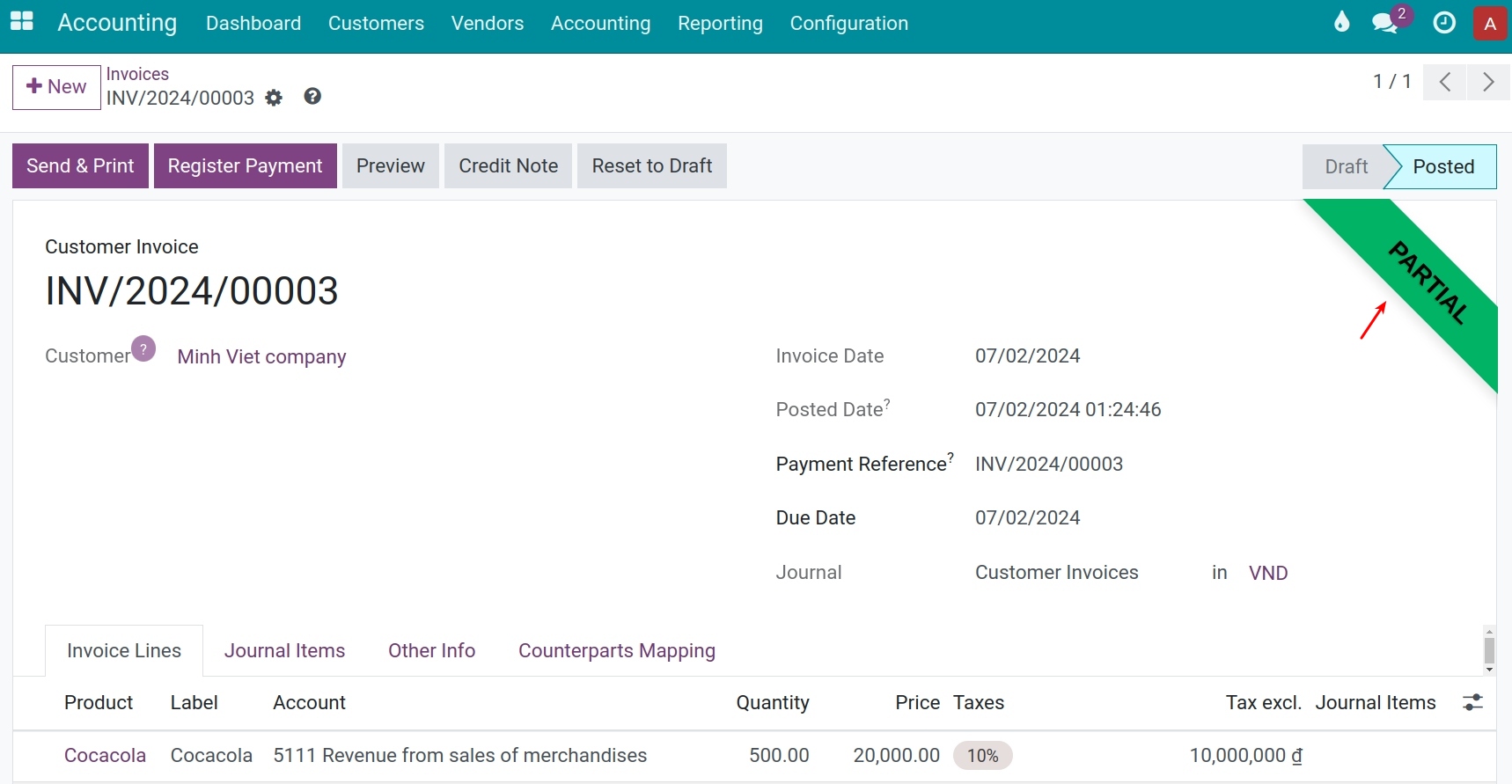

Case 2: Partial Refund

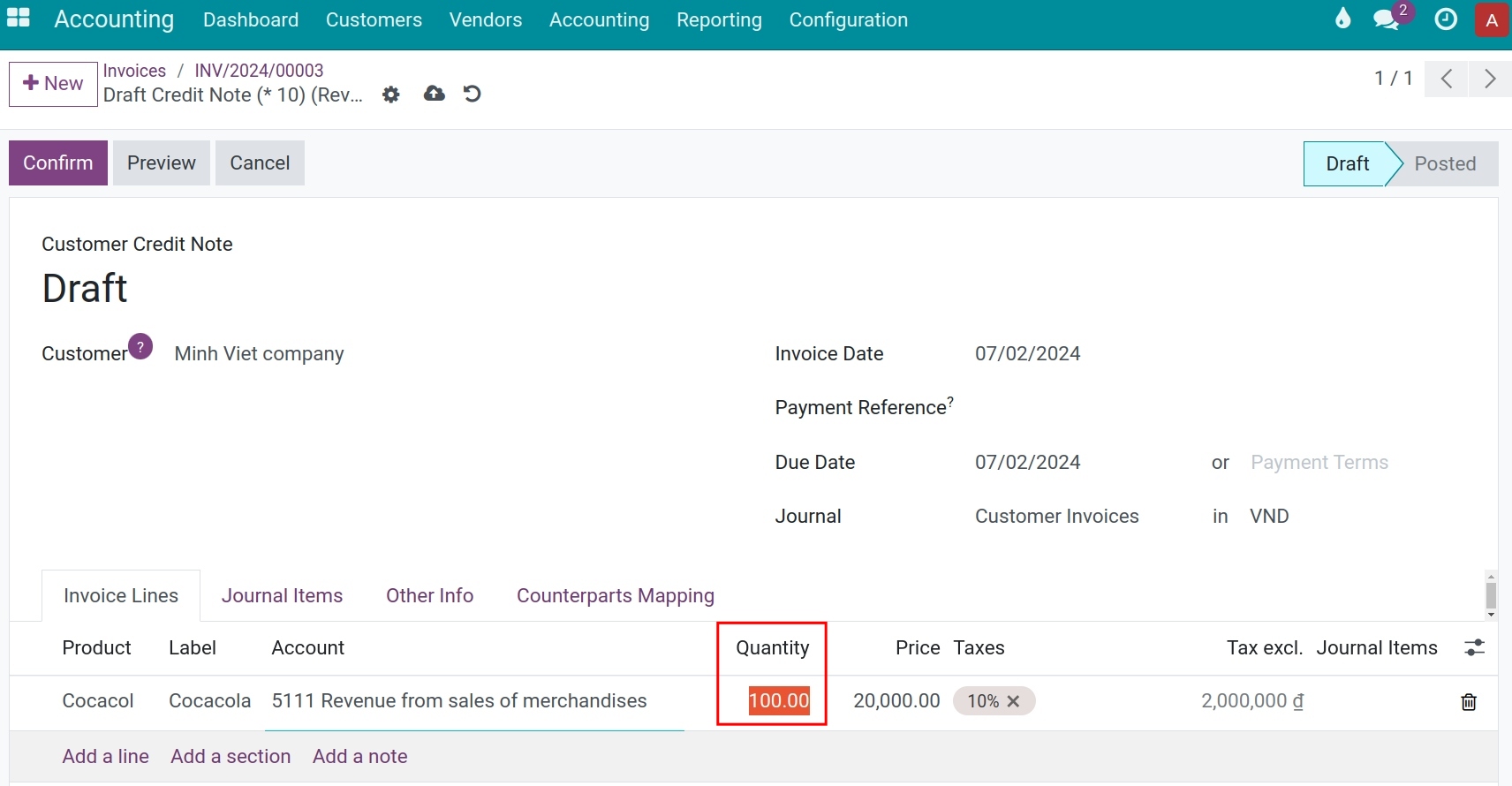

If a partial refund is issued, you fill in the information about the quantity or price that needs adjustment.

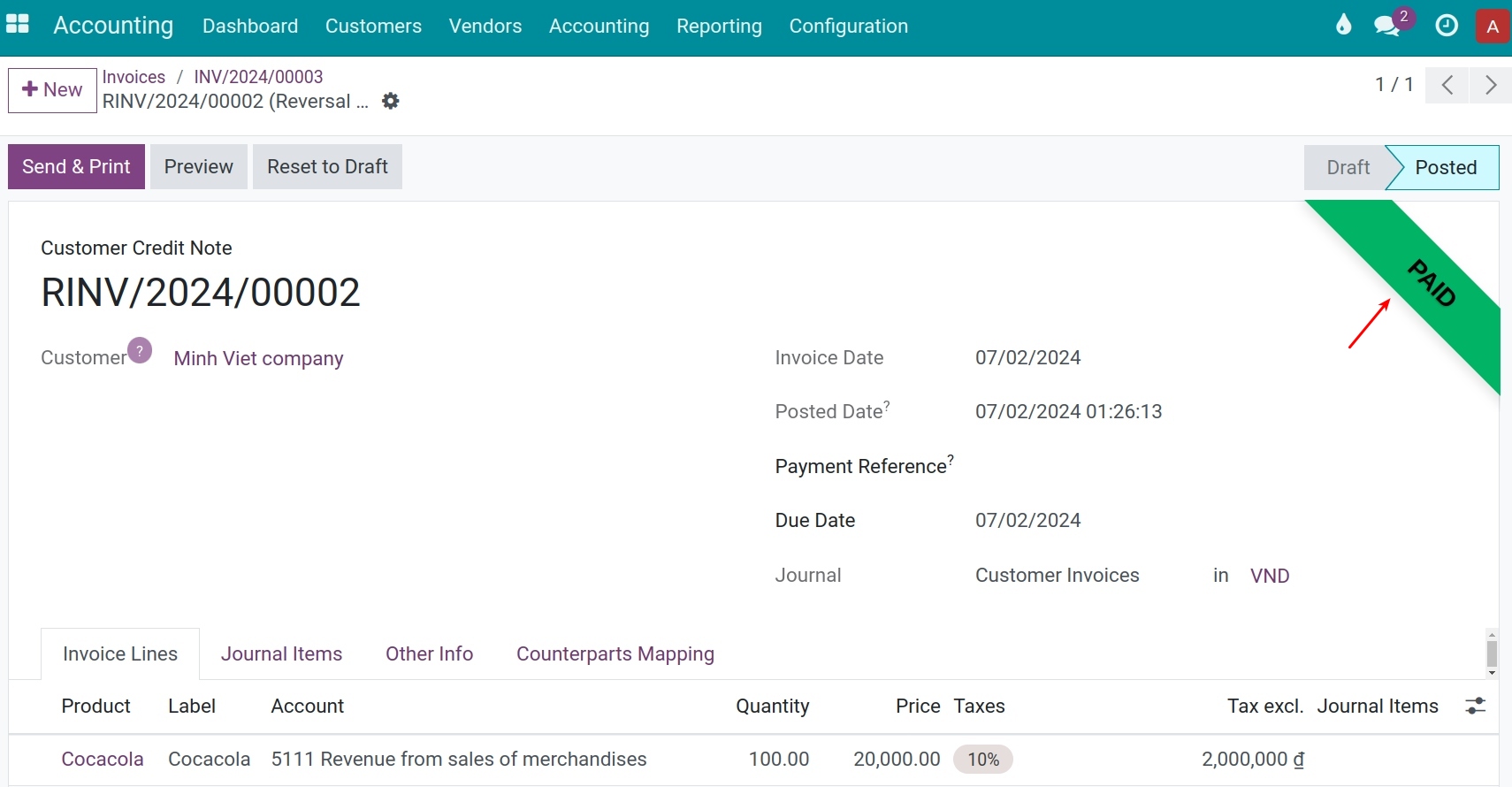

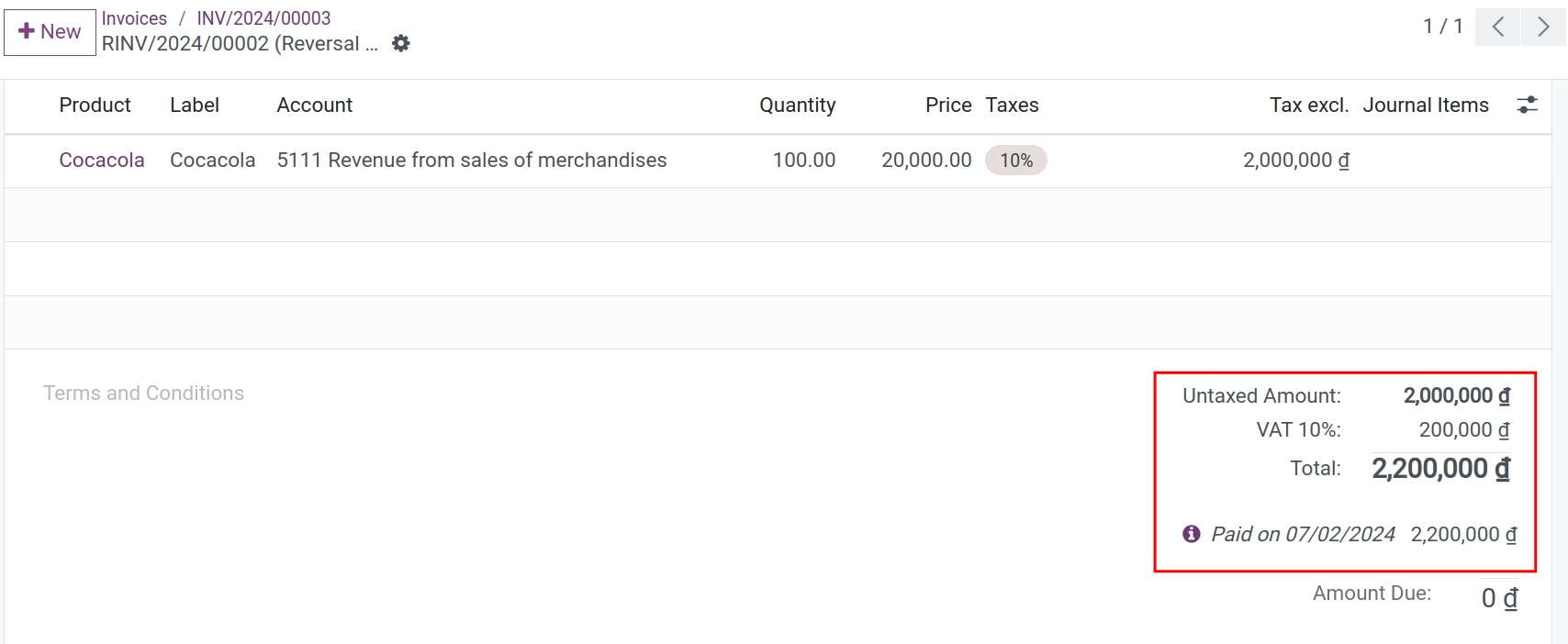

Click Confirm to validate the credit note (reduction invoice). On the credit note, the status will change to Paid.

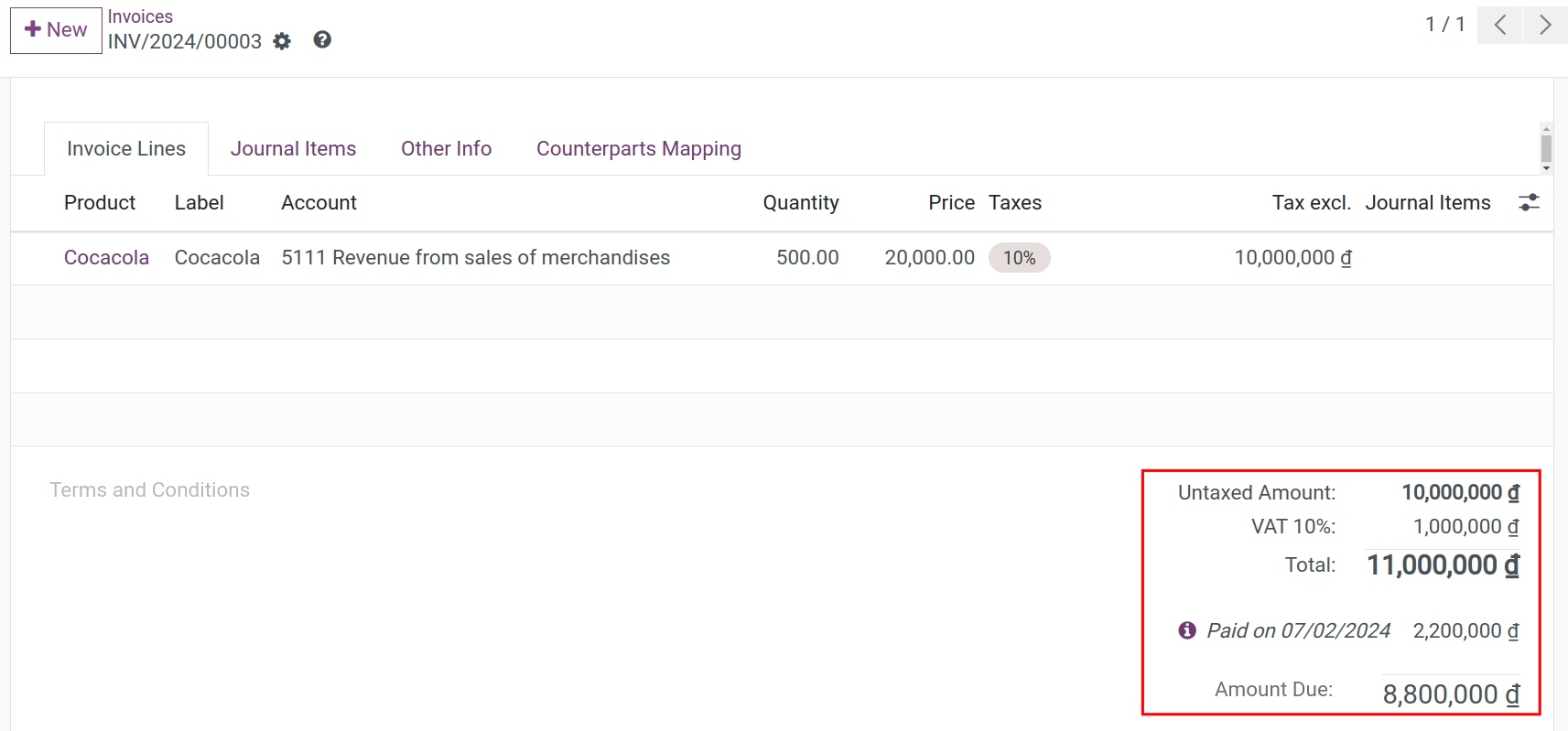

The original invoice will show the status Partially, and the outstanding amount will be reduced by the value of the credit note.

Note

For fully-paid invoices (in Paid status), only one credit method, which is Partial Refund, will be available.

If the invoice is partially paid, the pre-paid amount will be noted as an outstanding payment for this customer after creating a credit note.

2. Reverse and create invoice

The credit note is automatically confirmed and reconciled with the original invoice. Also, the system will automatically duplicate the new draft invoice according to the original invoice.

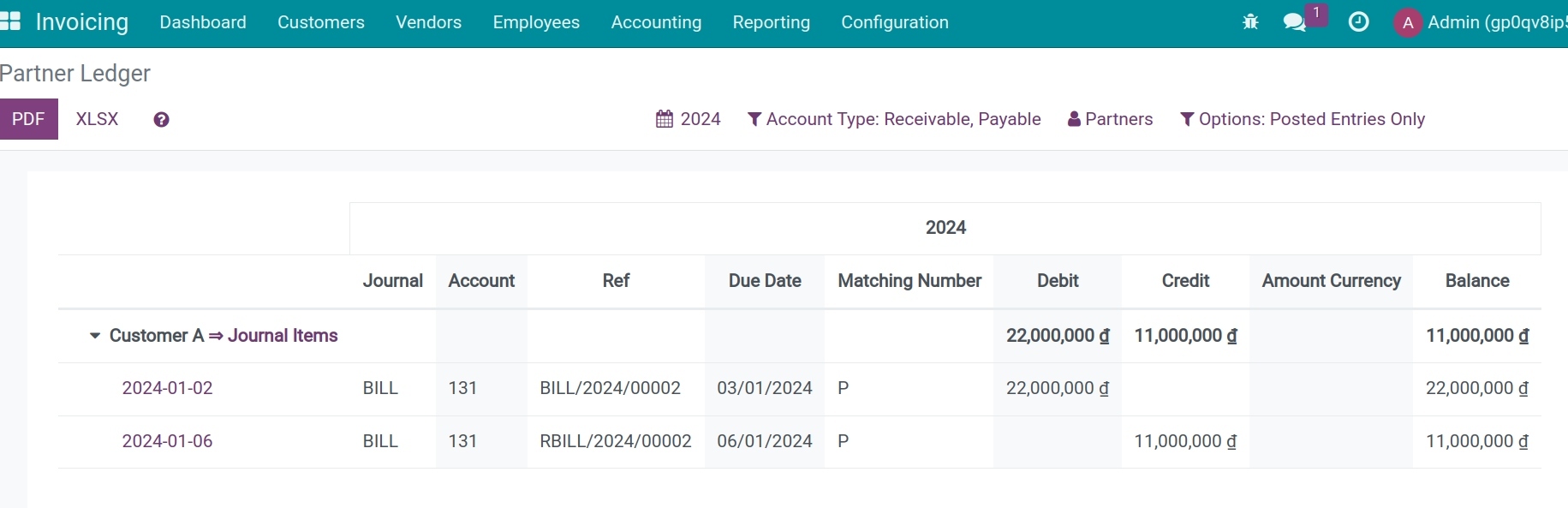

After the credit note is confirmed, you can view changes in the customer’s liabilities by accessing Accounting ‣ Reporting ‣ Partner Ledger:

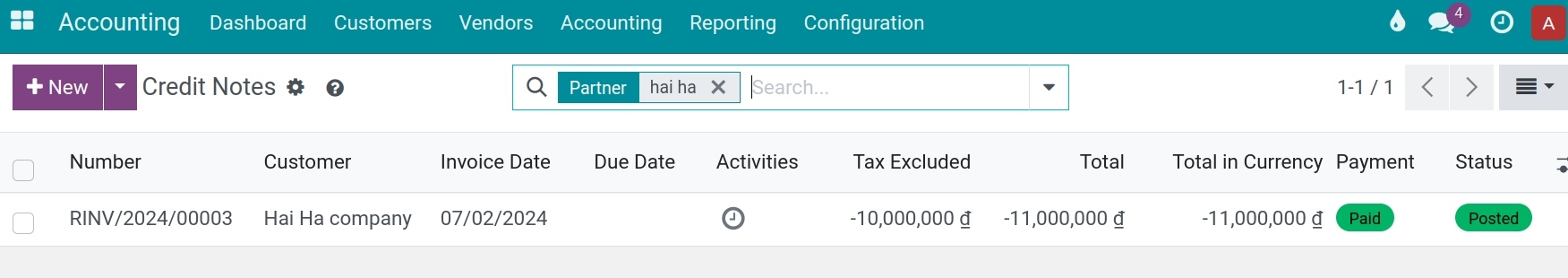

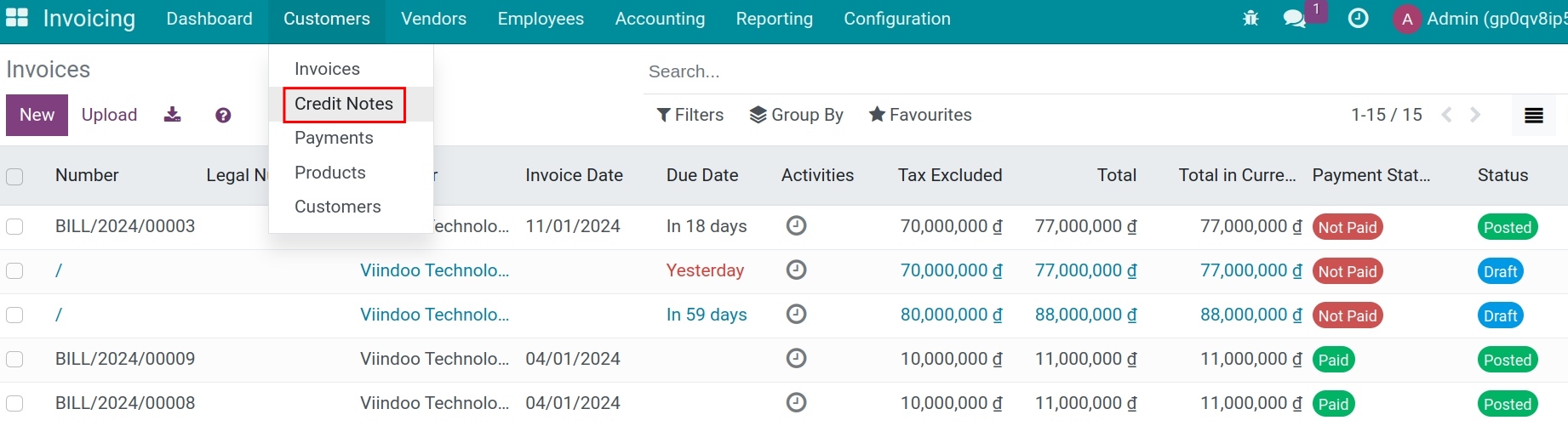

Create a credit note manually¶

To create a credit note manually, you can also navigate to Accounting ‣ Customers ‣ Credit Notes, click +New.

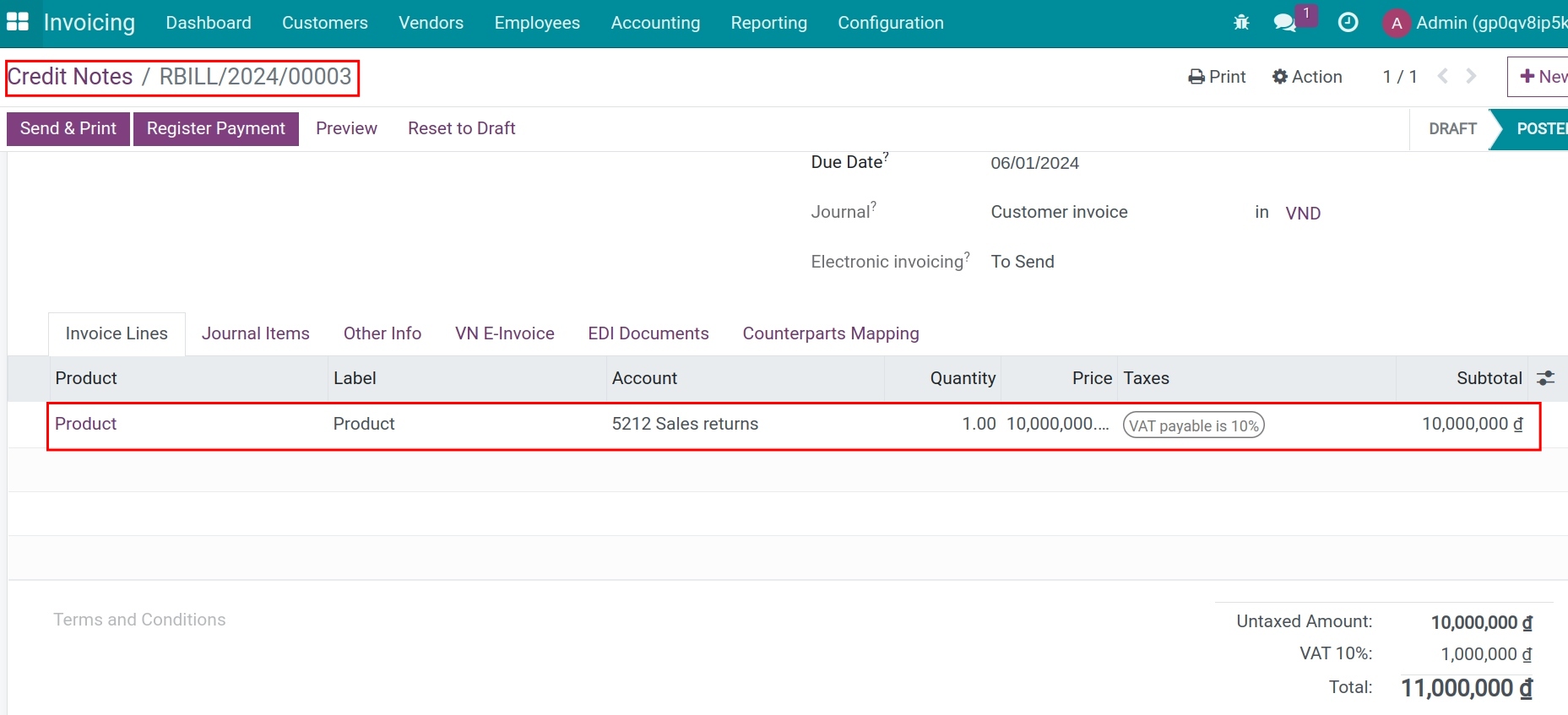

Then fill in the credit note:

The information on the credit note is similar to the regular invoice. You can see more at How to create invoices. You can then also find out the customer’s remaining entries or liabilities at Partner Ledger.