Inputs Salary¶

Viindoo’s Payroll management app gives you the ability to manage irregular salary components such as holiday bonuses in Viindoo, with flexible salary rules that are easy to set up for monthly payroll.

Configuration¶

We need to use inputs salary because businesses may occasionally have irregular payments that are still processed within the regular salary cycle, such as bonuses, fines, and other variable amounts. Additionally, if your company has flexible salary rules, the inputs salary feature allows you to configure and manage these exceptional payments accurately and efficiently within the payroll system, ensuring compliance and clarity in employee compensation.

General configuration¶

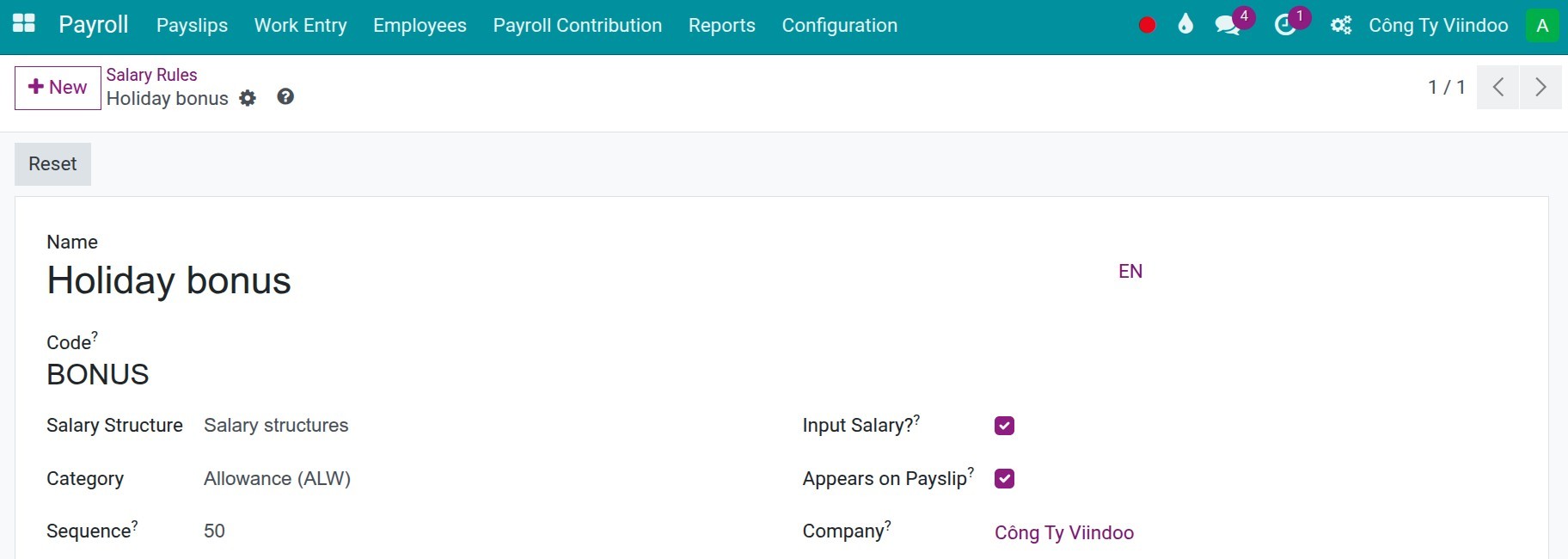

To configure the inputs salary rules, navigate to Payroll > Configuration > Salary Rules, press New to create a new salary rules:

In while, some important information you need to noted as follows:

Name: Input the name of the salary rules.

Code: The code to define this salary rule on other rules and to be used for calculation.

Sequence: Enter the sequence number for this salary rule. By correctly setting the sequence number, you can control the order of salary rule calculation, ensuring that dependent rules are executed in the correct sequence. For example: If the Gross rule has sequence number 500, any rule that needs to be used for its calculation (such as the bonus or deductions) should have a smaller sequence number to ensure it is applied first.

Input Salary: Select this option.

Appears on Payslip: Select this option.

Displayed Condition on Payslip¶

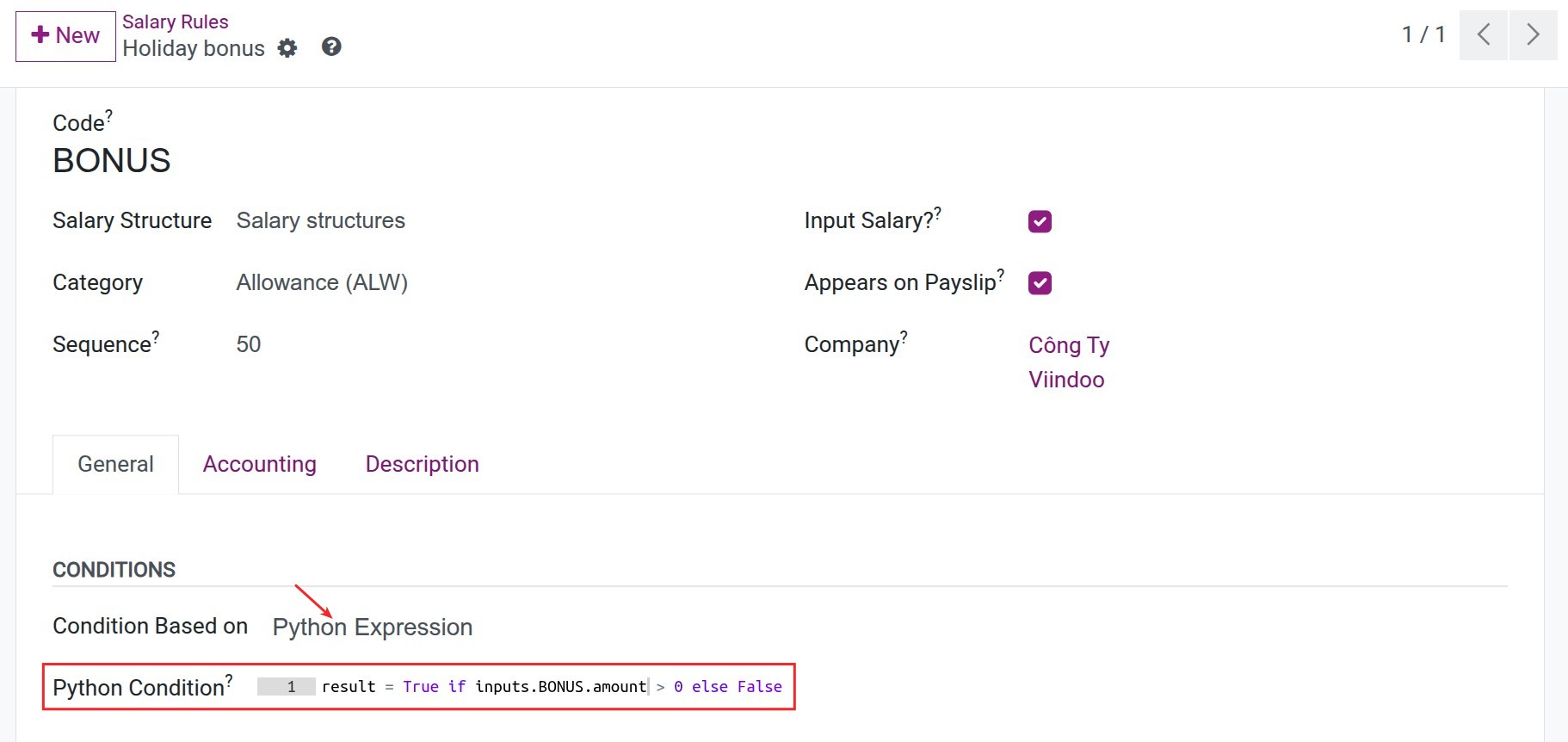

On the General tab, Condition Based on defines the condition under which this salary rule will be visible on the employee’s payslip.

You can choose one of these options:

Always True: When this option is selected, the salary rule will always be displayed on the employee’s payslip, regardless of whether its amount is zero or not.

Python Expression: This option allows you to define the condition under which the salary rule appears on the payslip using Python code. For example: “result = True if inputs.BONUS.amount > 0 else False”. In this case, the salary rule will only appear on the payslip if the amount of the BONUS input is greater than zero.

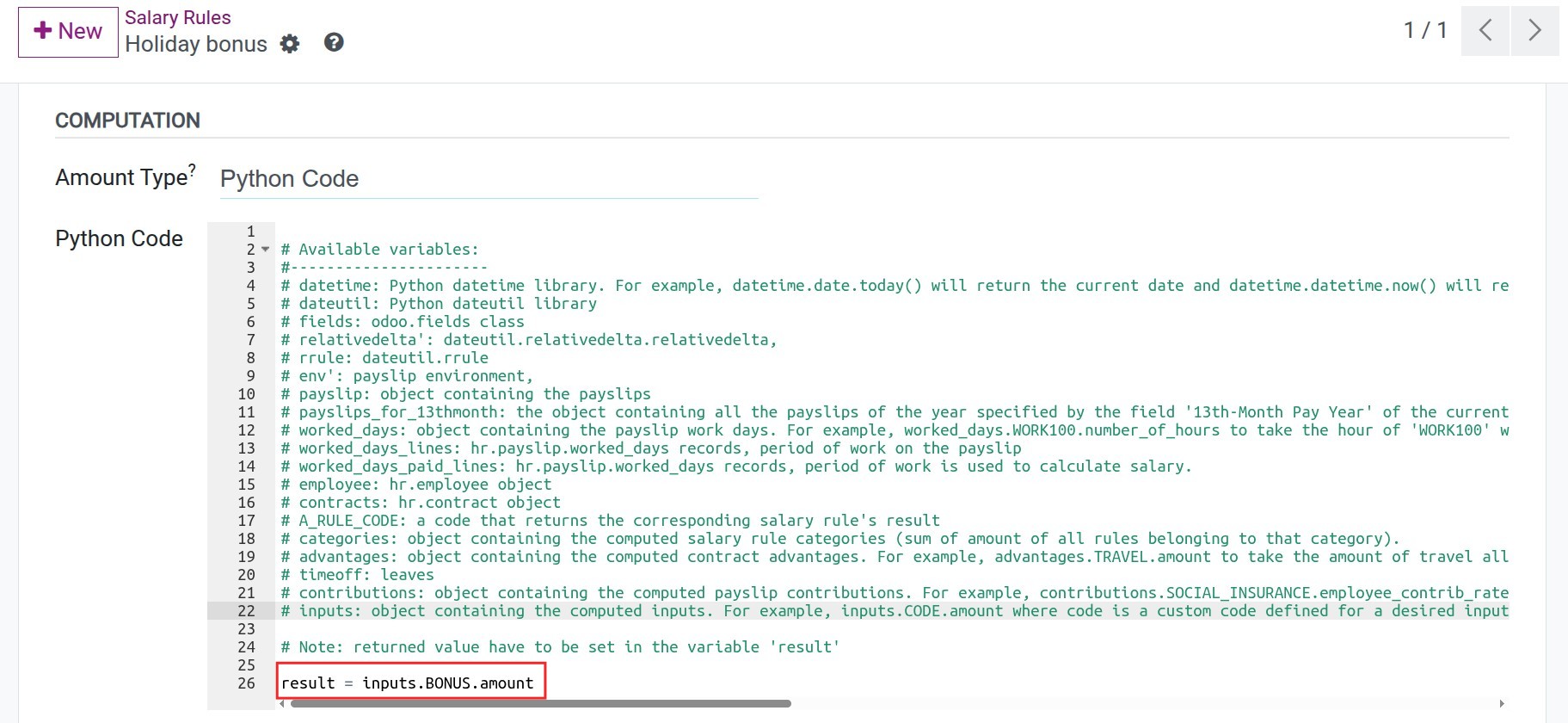

Computation rule configuration¶

Defines how the amount of this salary rule is calculated. Select the Python Code option to apply a custom calculation, then enter the appropriate logic in the Python Code field.:

Enter the python code: result = inputs.BONUS.amount (to add the amount) or result = -1 * inputs.BONUS.amount (to subtract the amount).

Then Save to complete.

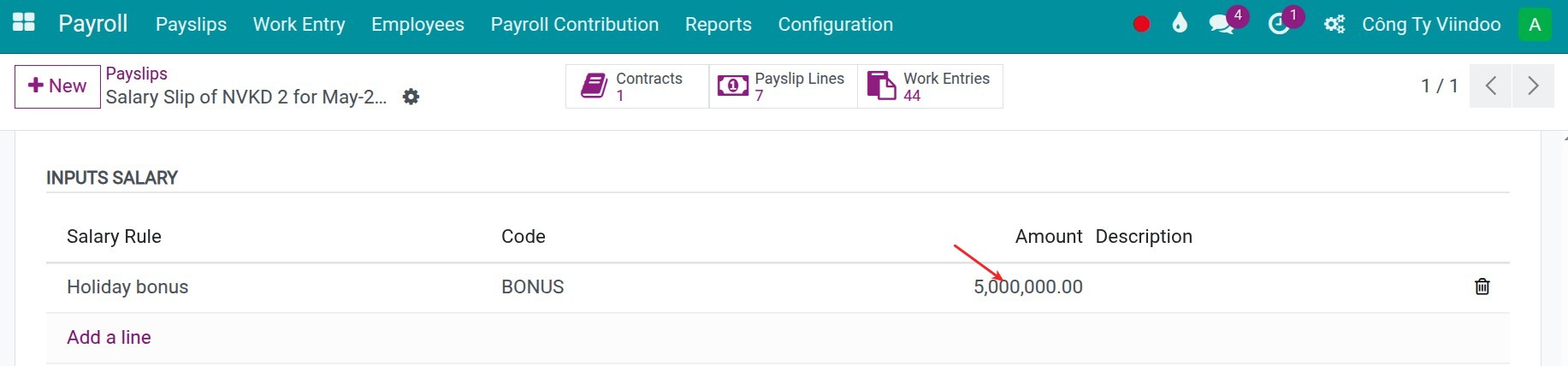

Proceed with calculating the salaries¶

Once the salary rule setup is complete, you can proceed to calculate the payslip. To do this, either create a new individual payslip or generate a batch of payslips. Open a payslip, navigate to the Work Information tab, and scroll down to the Input Salary section. Here, you can manually enter the corresponding amount for each employee under the appropriate input code (e.g., BONUS).

In case you want to enter the inputs salary for all employees by importing from an Excel file, you can do as follows:

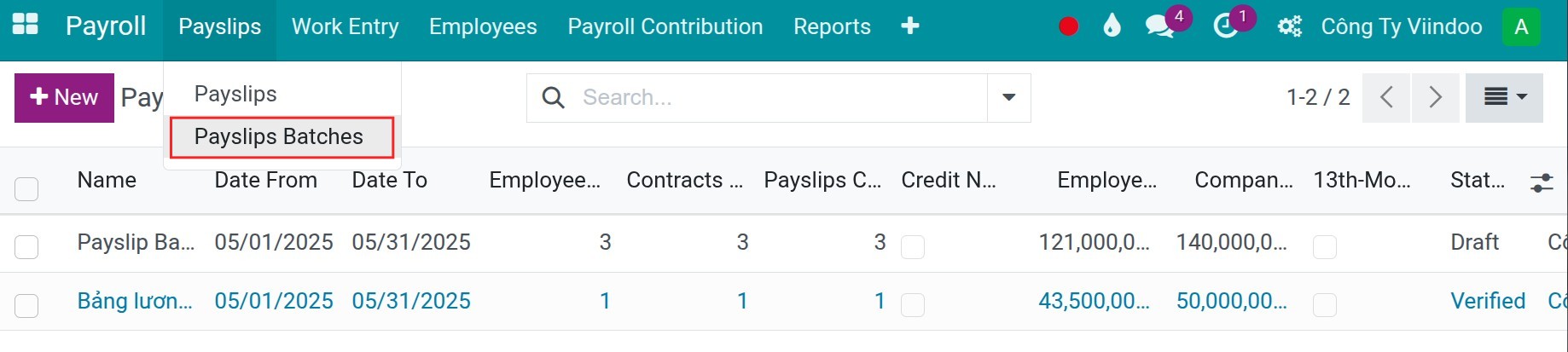

Navigate to Payroll > Payslip > Payslip batches, choose the needed payslip batch.

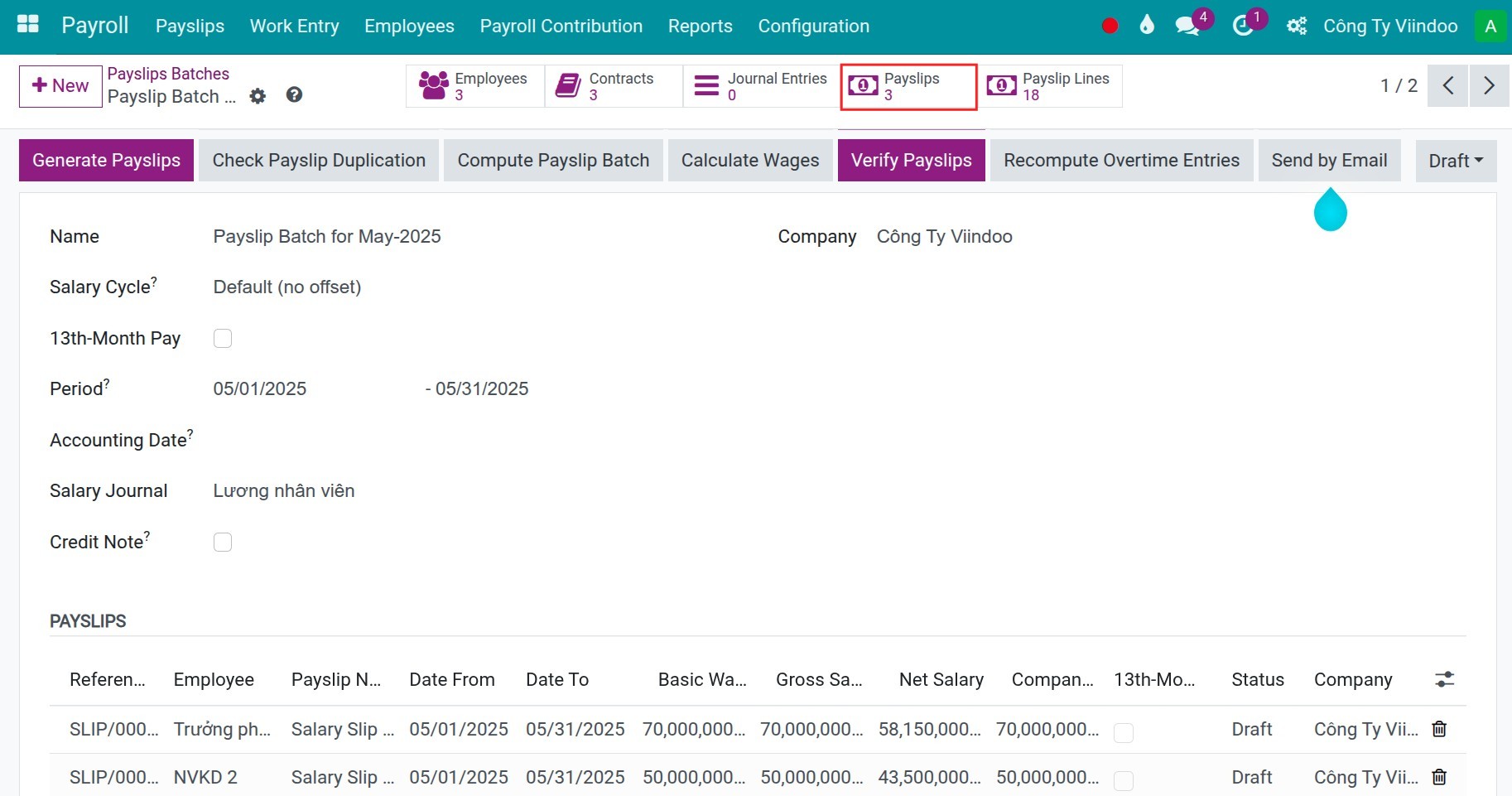

Open the payslip batch, press to the button Payslips:

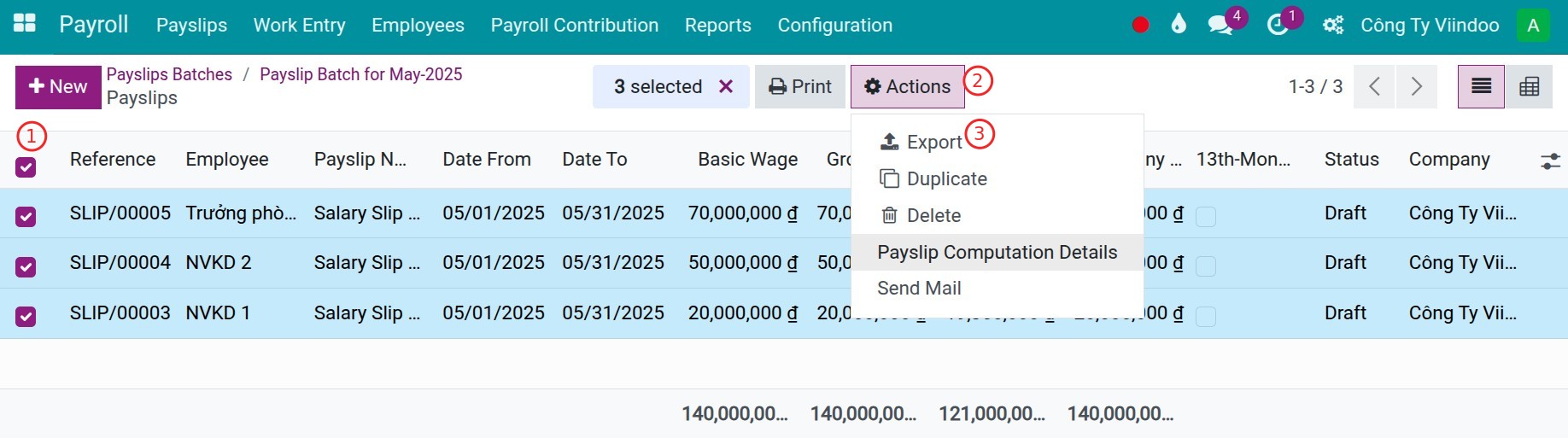

Select all the employees payslips, press Action > Export:

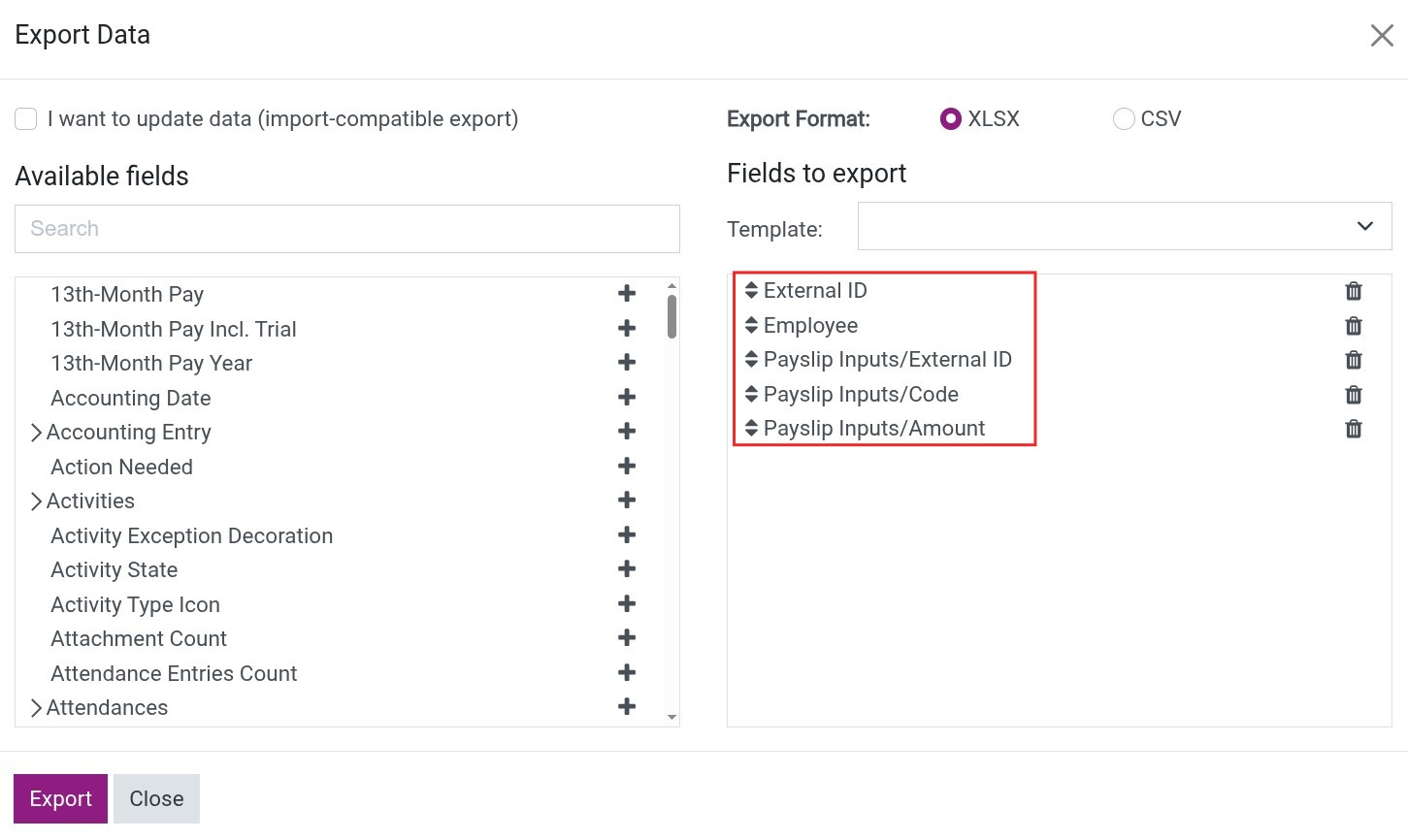

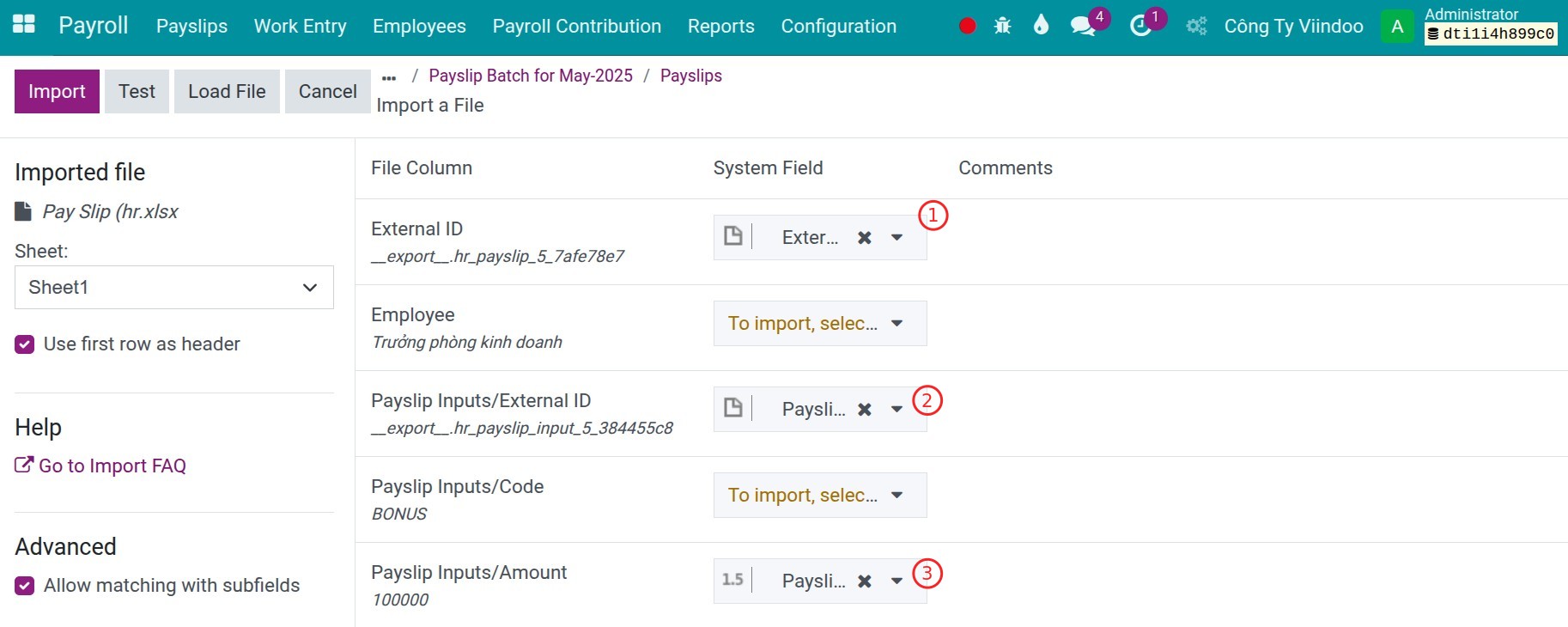

Choose all the field on the picture, then press Export.

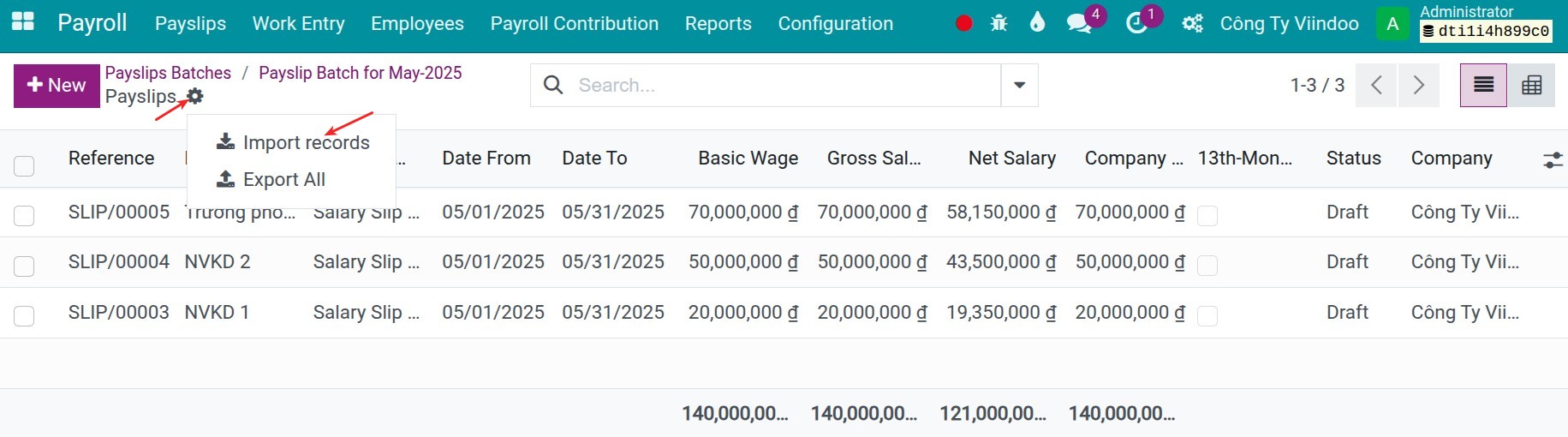

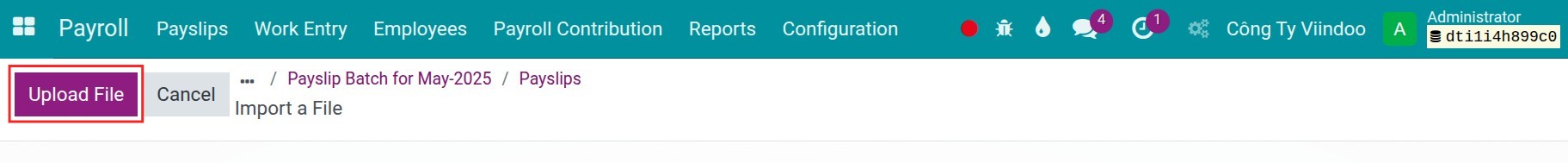

Now, you can enter on the Excel file the inputs salary of each employee by its code, then import into the system. Press the Gear icon, choose Import records:

Then press Import.

Warning

After entering all employee’s inputs salary, you need to click the Compute Sheet button on the individual payslip or the Compute Payslip Batch on the payslip batch, depending on which one you have created.