Depreciation of Fixed Assets¶

General concept¶

Depreciation of an asset refers to an accounting method used to allocate the cost of an asset to its production and business expenses during its depreciation period.

Enterprises can actively decide the time to calculate the depreciation of Assets. However, Enterprises must comply with the time frame for depreciation issued by the authorities.

In Vietnam, you can see more details of the time frame for depreciation in Circular 45/2013/TT-BTC on the regime of management, use and depreciation of fixed assets.

Requirements

This tutorial requires the installation of the following applications/modules:

Depreciation of Assets¶

In previous articles, we showed you how to create a new Asset, and Asset Categories. In this article, we will show you how to check, configure information for each asset, and how to activate the asset depreciation.

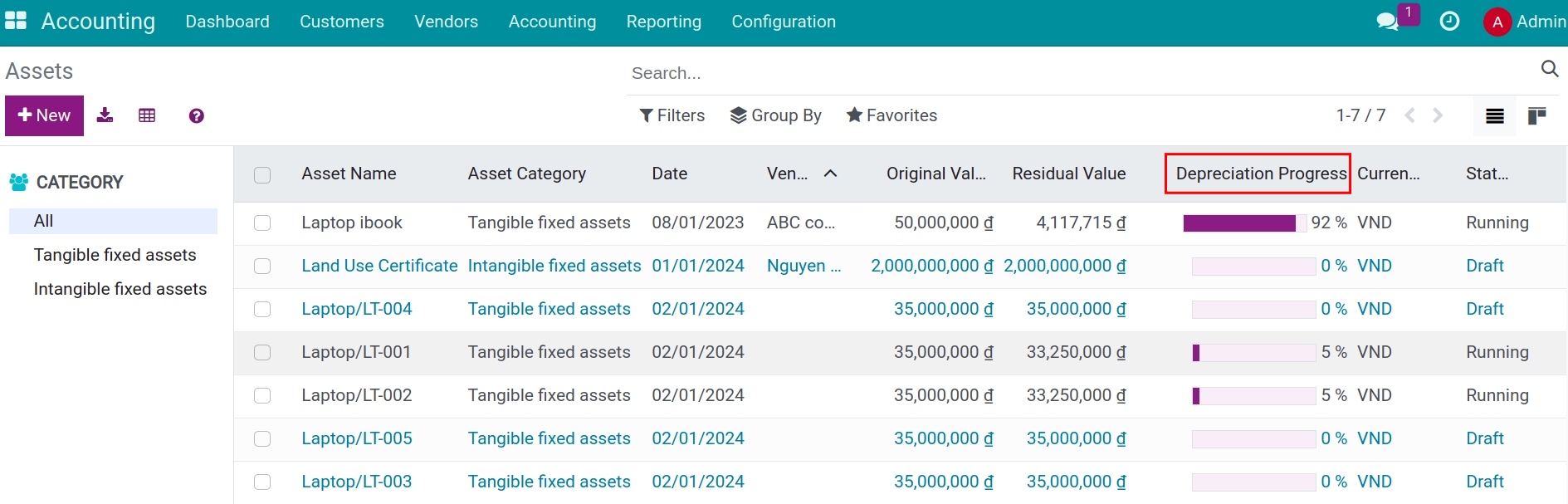

Navigate to Accounting > Accounting > Assets.

The image above shows a list of Assets that have been created in Viindoo. The Status column shows whether the Asset has begun to depreciate.

Check the depreciation of assets¶

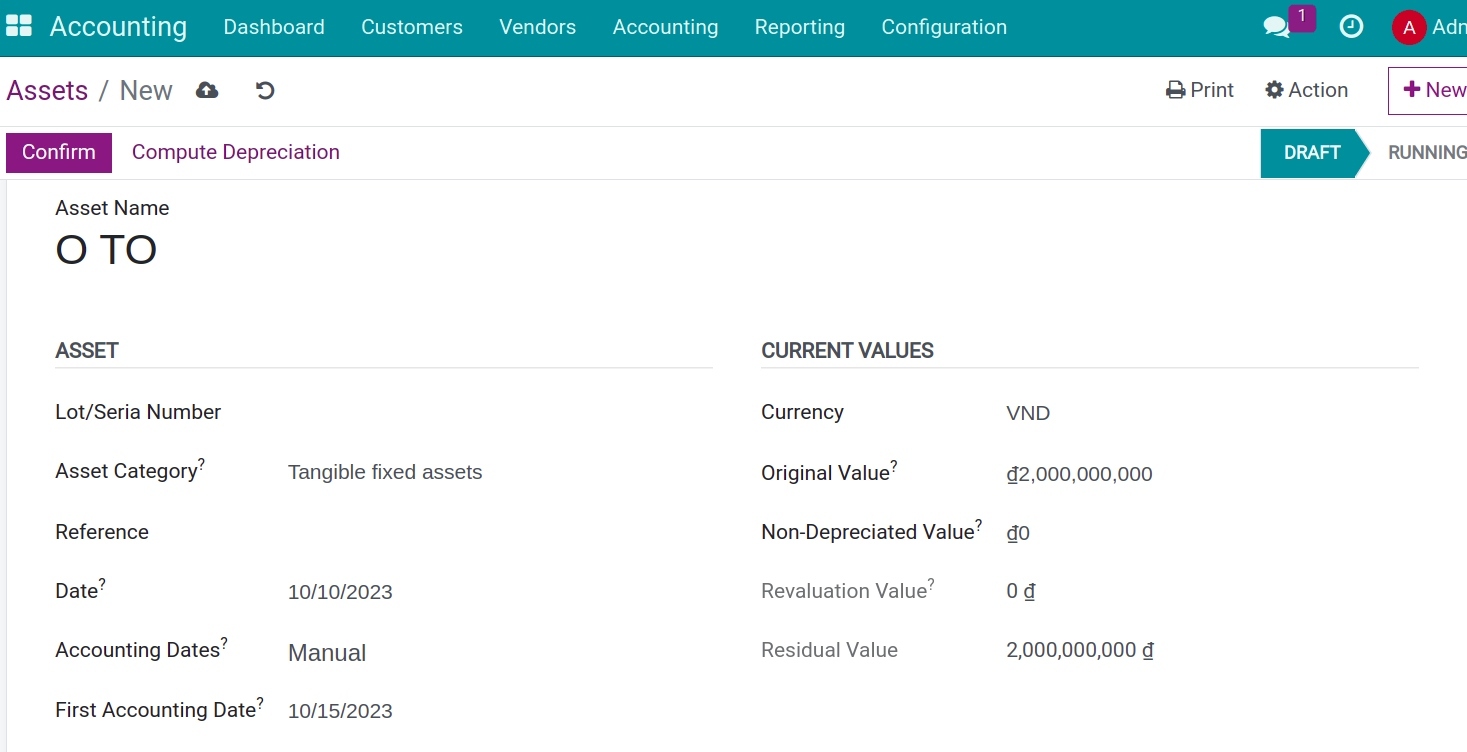

Click on each Asset that is in Draft status then check each displayed information.

See also

In this guideline, we will show you how to set up and calculate linear depreciation in Viindoo software. You can easily do the same with the other two methods: Degressive and Accelerated Degressive.

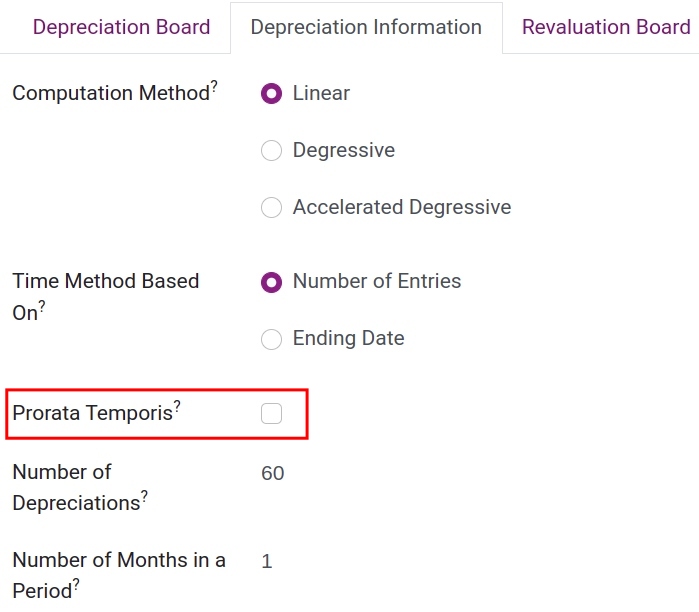

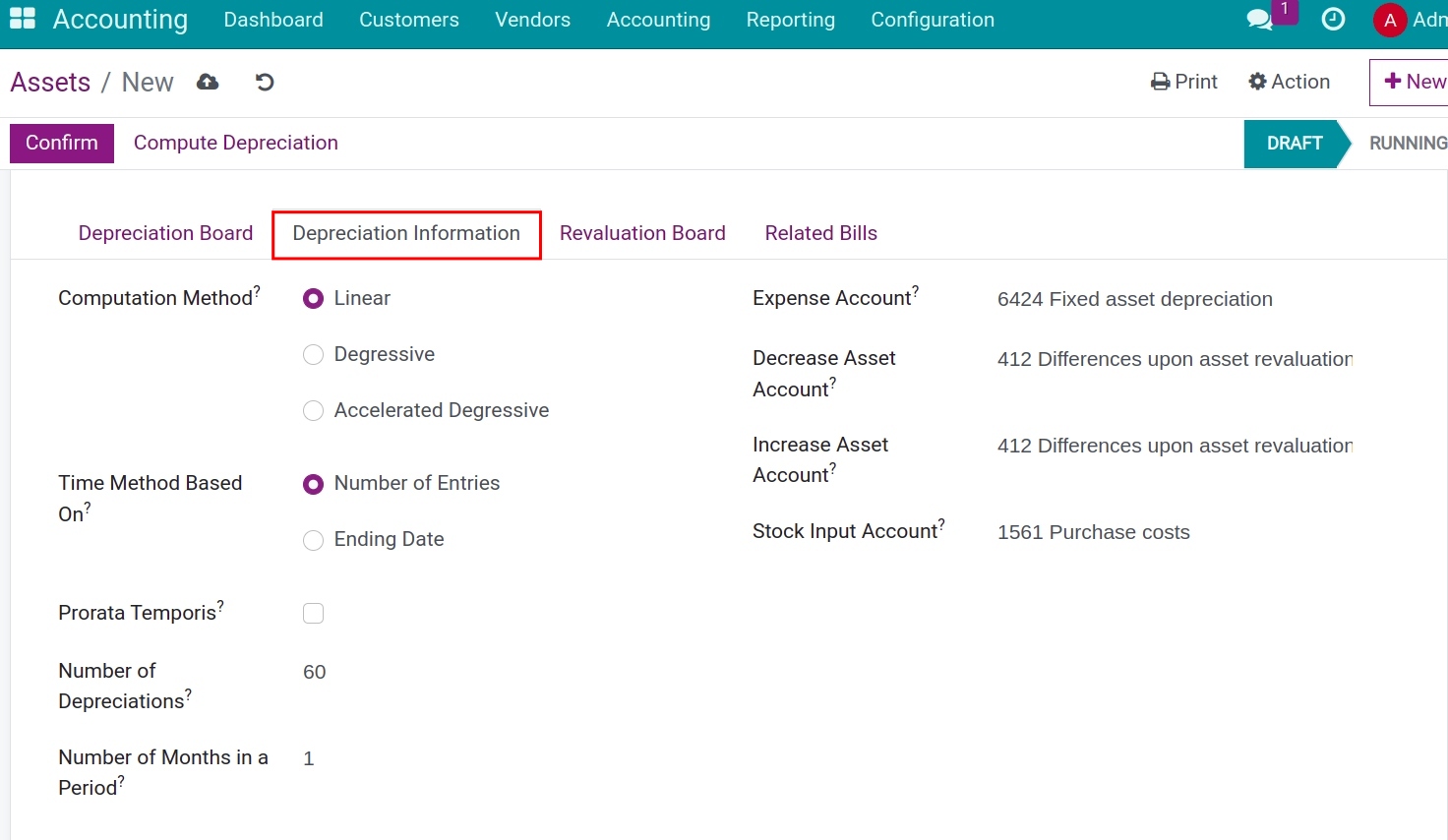

On the Depreciation tab, choose Computation Method is Linear. You need to care about Prorata Temporis: Ticking or not ticking this field will directly affect the depreciation calculation.

Case 1: Prorata Temporis is not ticked.

![Depreciation Information tab when Prorata Temporis is not ticked.]()

By setting as the example above:

Number of Depreciations is 60

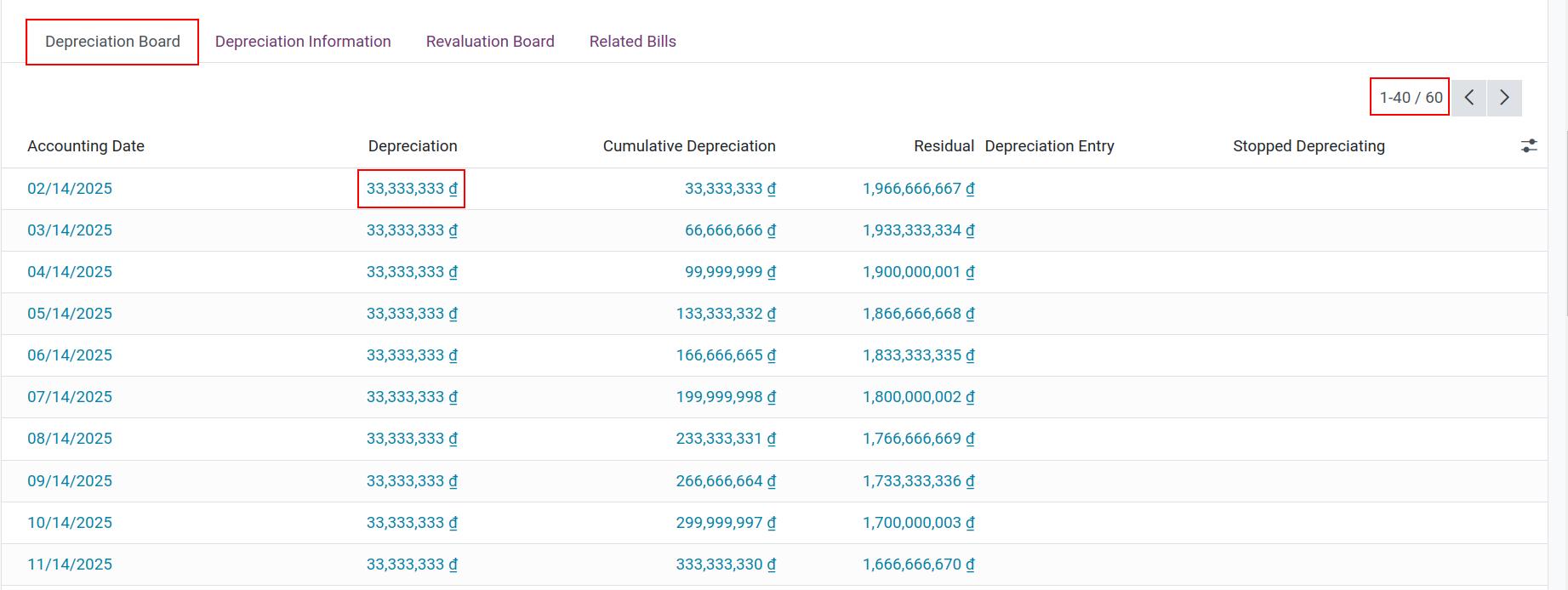

Depreciation Board with 60 created depreciation entries.

Value of each depreciation entry: Calculated by dividing the Original Value by the Number of Depreciations:

2.000.000.000 / 60 = 33.333.333.

![Depreciation Information tab with Linear method when Prorata Temporis is not ticked.]()

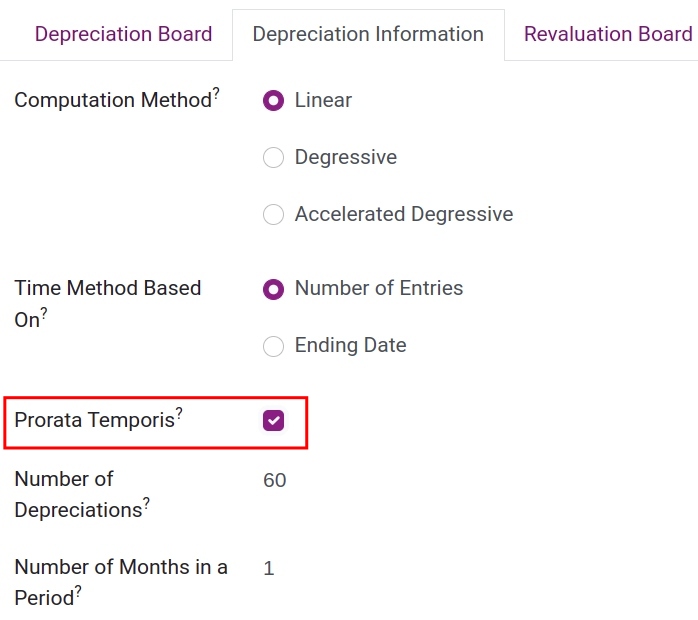

Case 2: Prorata Temporis is ticked.

![Depreciation Information tab when Prorata Temporis is ticked.]()

With the same setting as case 1, but Prorata Temporis is ticked:

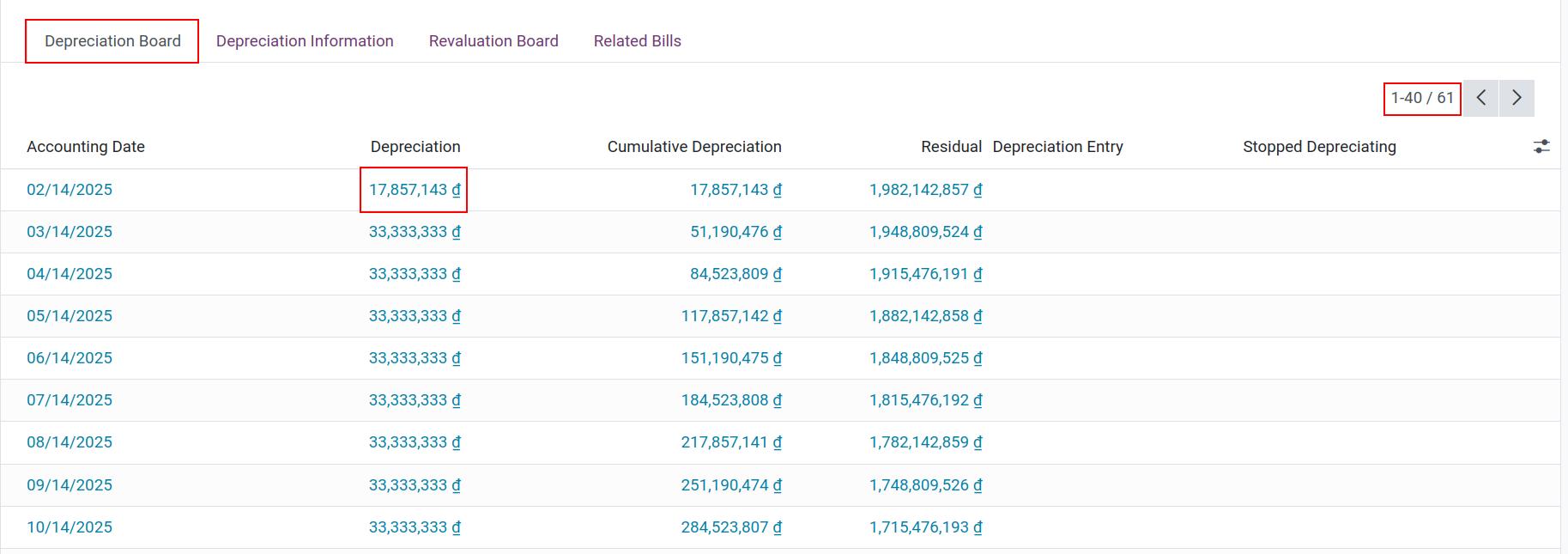

Depreciation Board with 61 created depreciation entries.

First depreciation entry value: Calculated from Date in Asset Information.

According to the example above, the field Date is 14/02/2025, then the first depreciation entry value is calculated as:

(2.000 000.000 / 60 / 28 ) * 15 = 17.857.143.

In which:

60 is the Number of depreciation entries.

28 is the number of days in Febuary.

15 is the number of days from 14/02/2025 to 28/02/2025.

![Depreciation Information tab with Linear method when Prorata Temporis is ticked in Viindoo.]()

Start to depreciate¶

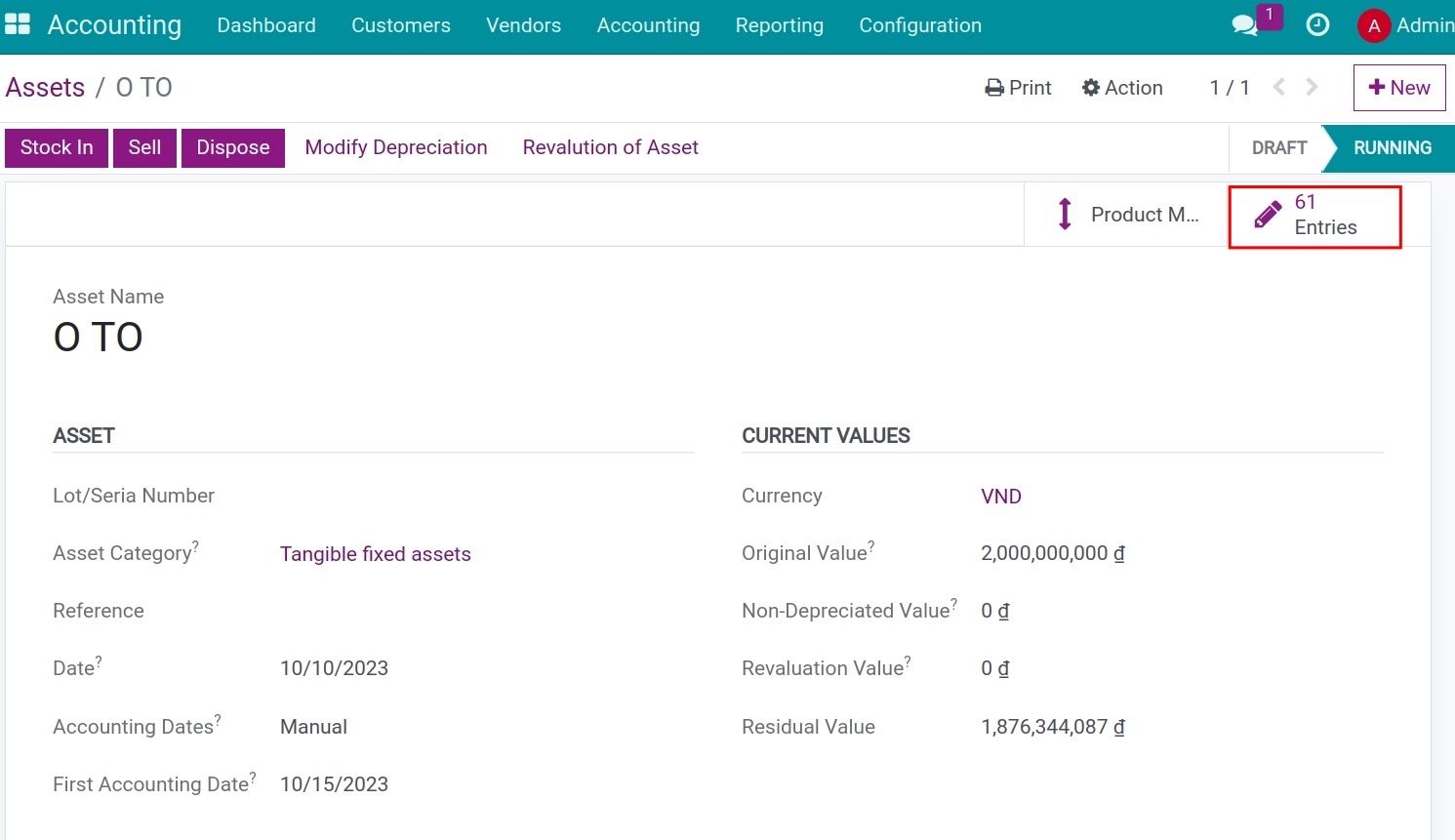

After you enter all the information, click Confirm. The asset will move to the Running status.

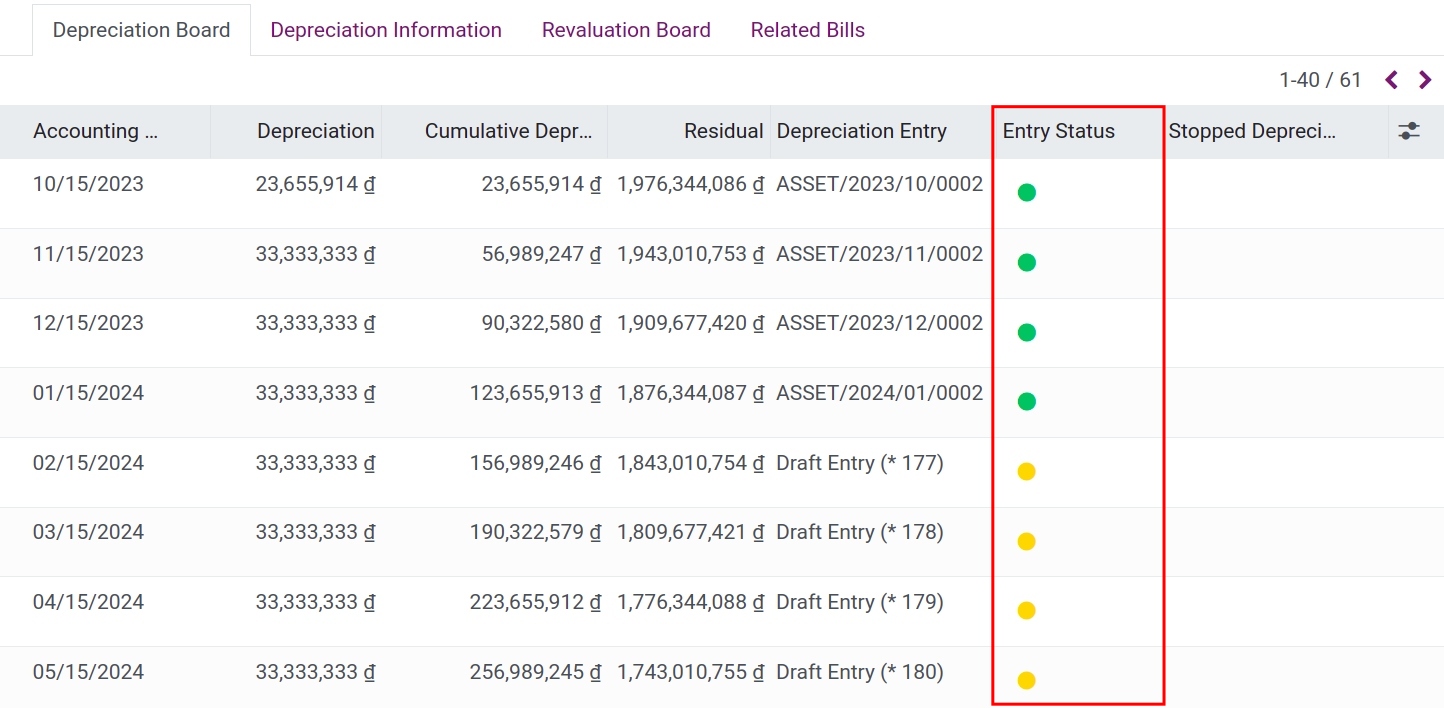

On the Asset form, the Entries button is displayed. Click on the Entries button, you will see all of the depreciation entries of this Asset. In the Depreciation Board tab, the Depreciation Entry Status column shows when the Asset is depreciating, what is the Cumulative Depreciation and the Residual Value of the Asset.

You can record the depreciation value of an asset by clicking on and posting each Draft entry.

Note

On top of that, Viindoo software supports users by periodically checking the Depreciation entries in Draft status that meet the date condition to posting them automatically.

See also

Related article

Optional module