Process of customer invoicing, payment and reconciliation¶

Each company has its own invoicing and payment policies and there might be even more policies applied flexibly on each product or service type. Therefore, in order to facilitate the process, Viindoo offers a versatile flow of invoicing and payments. You can choose to have:

Issue an invoice before delivering products;

Deliver products then issue an invoice;

One order per invoice;

One order split into various invoices;

One order per payment;

One order split into various payments;

One payment for multiple invoices;

etc.

Requirements

This tutorial requires the installation of the following applications/modules:

Configure invoicing policies¶

Viindoo Accounting app supports two invoice issuing methods:

Invoice what is ordered : Customers will be invoiced once the sales order is confirmed.

Invoice what is delivered : Customers will be invoiced only when the delivery is done.

Create a draft invoice¶

You can create a draft invoice in 2 ways:

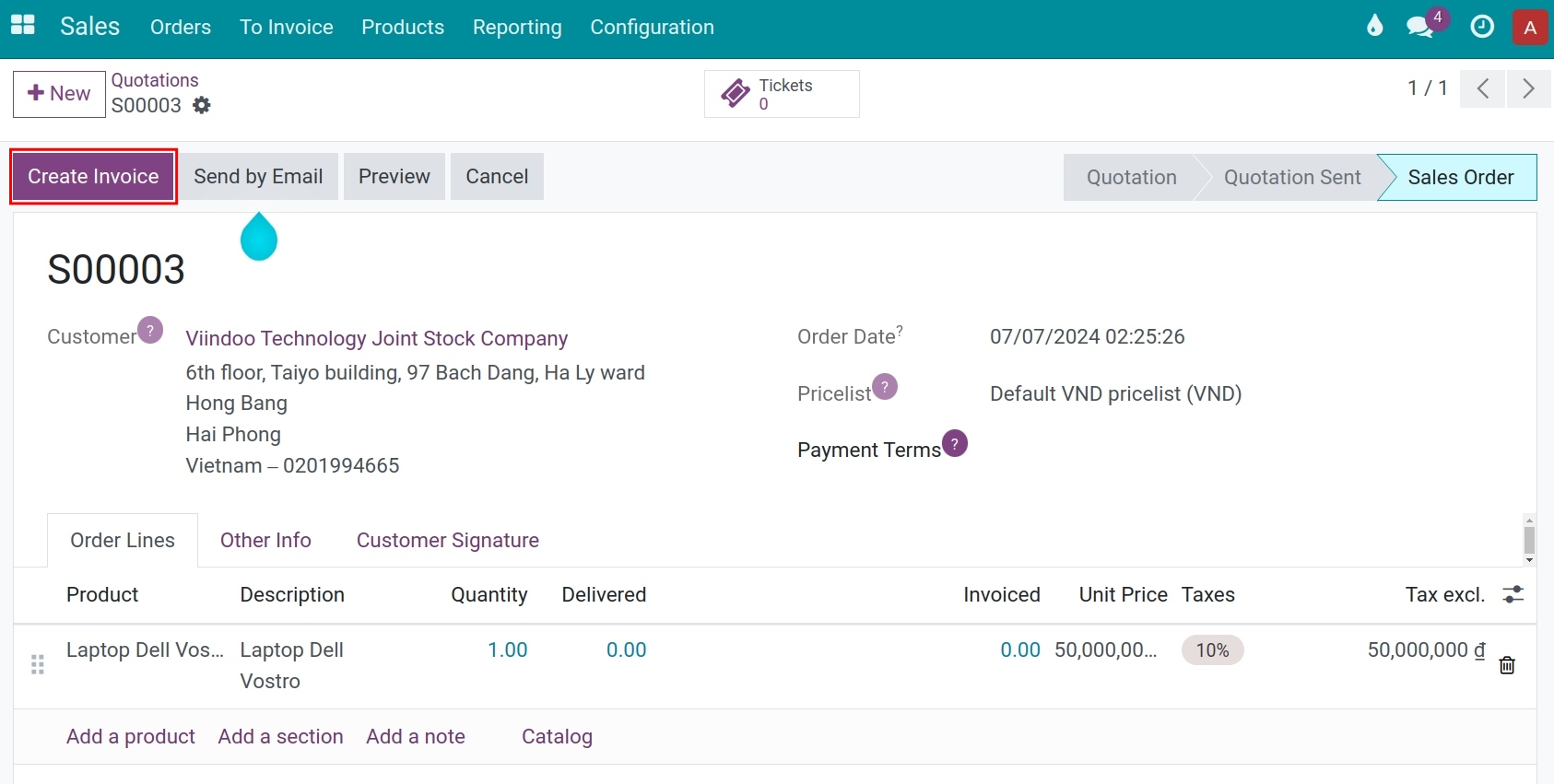

Salesperson can create draft invoices right from the sales order interface . In this case, the created draft invoices will inherit all necessary information for payment such as information about the ordered product/service and delivery, information regarding payment terms, etc. from the sales order.

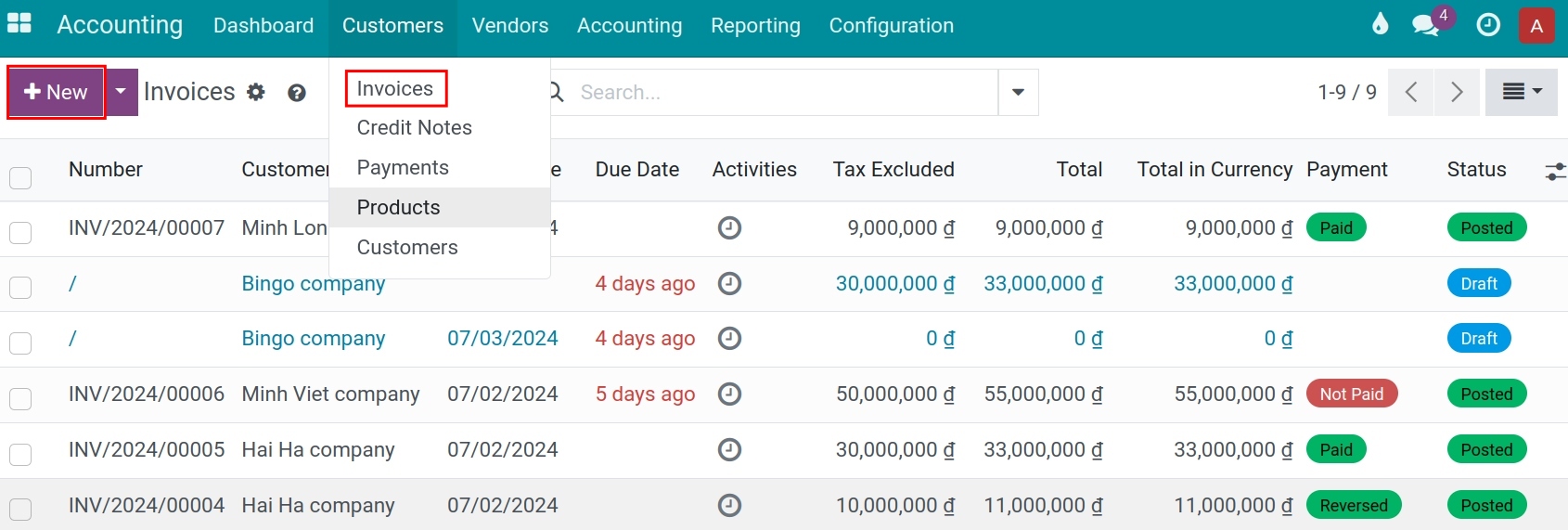

The accountant can also create a draft invoice by navigating to Accounting ‣ Customers ‣ Invoices ‣ +New.

Note

If you create a draft invoice from Accounting app, you can’t link invoice with the sales order.

Confirm an invoice¶

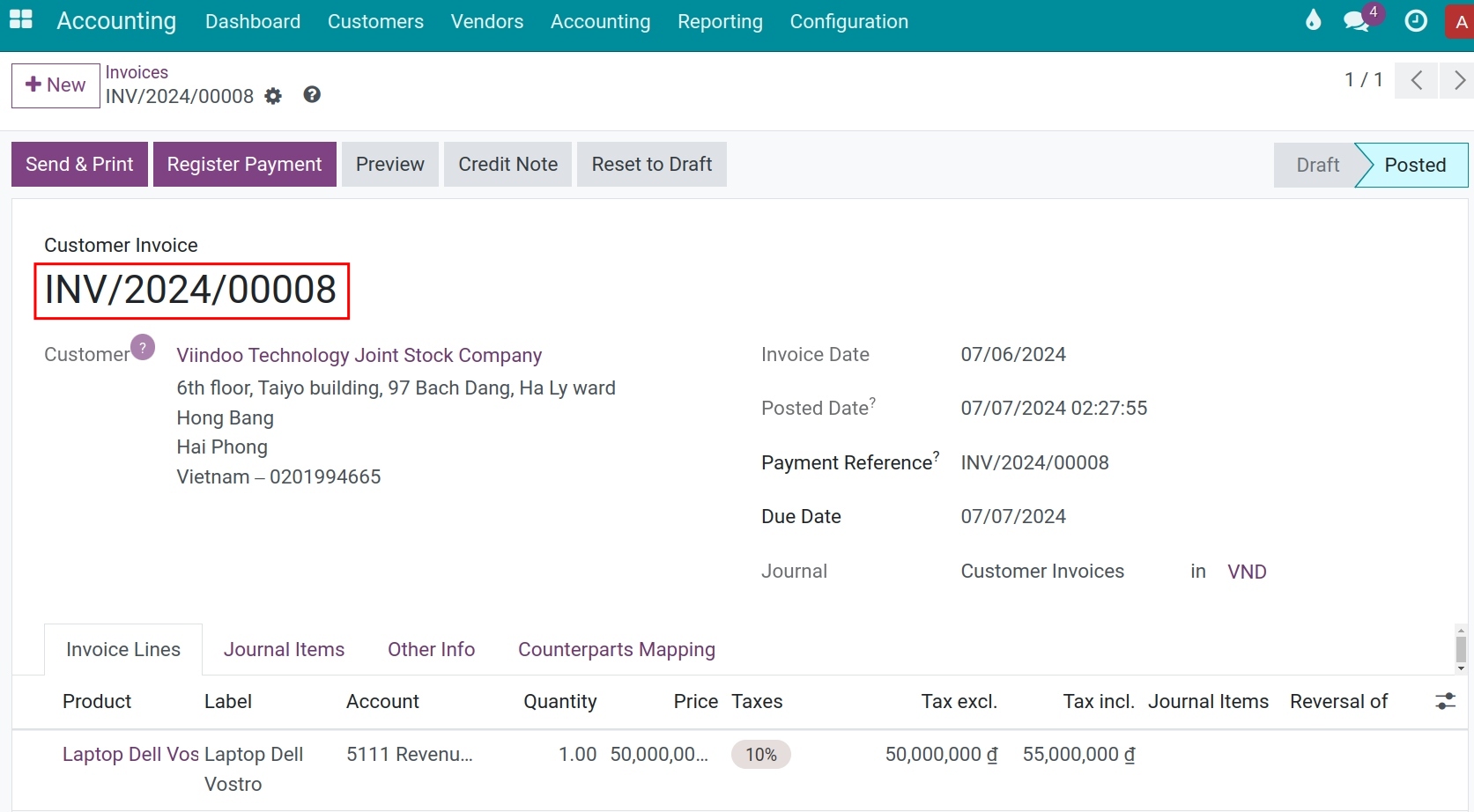

When confirming an invoice, Viindoo will automatically generate a unique invoice number to track across the entire system. Additionally, Viindoo supports businesses in tracking VAT invoice numbers for tax reports by installing the application Legal invoice number.

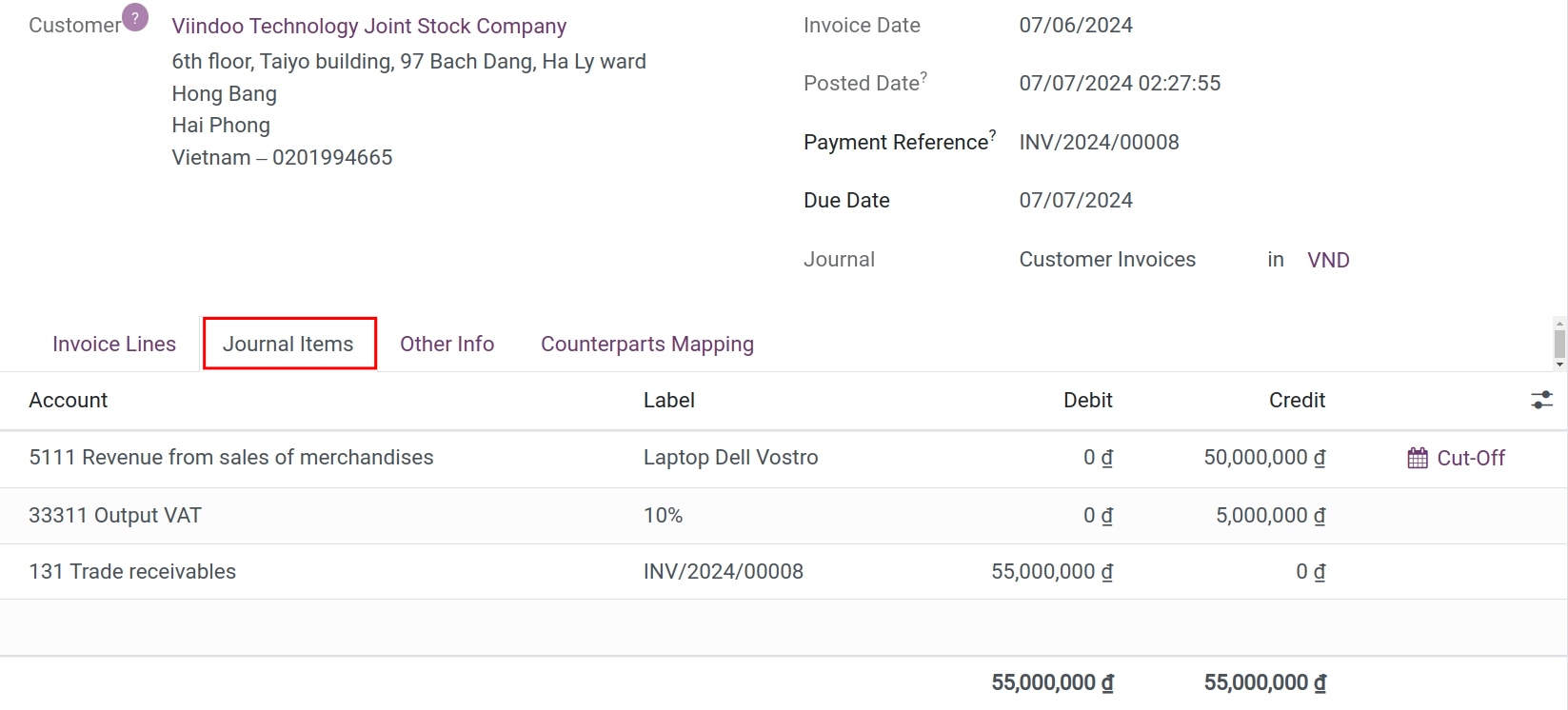

A single journal entry related to this invoice will also be posted once the invoice is validated. You can see more details of the entry from the tab Journal items on the invoice form view.

Note

Invoices in draft state will have no impact on the accounting system numbers. Only when these invoices are validated then the new data is recorded and updated in accounting journals.

Send invoices to customer¶

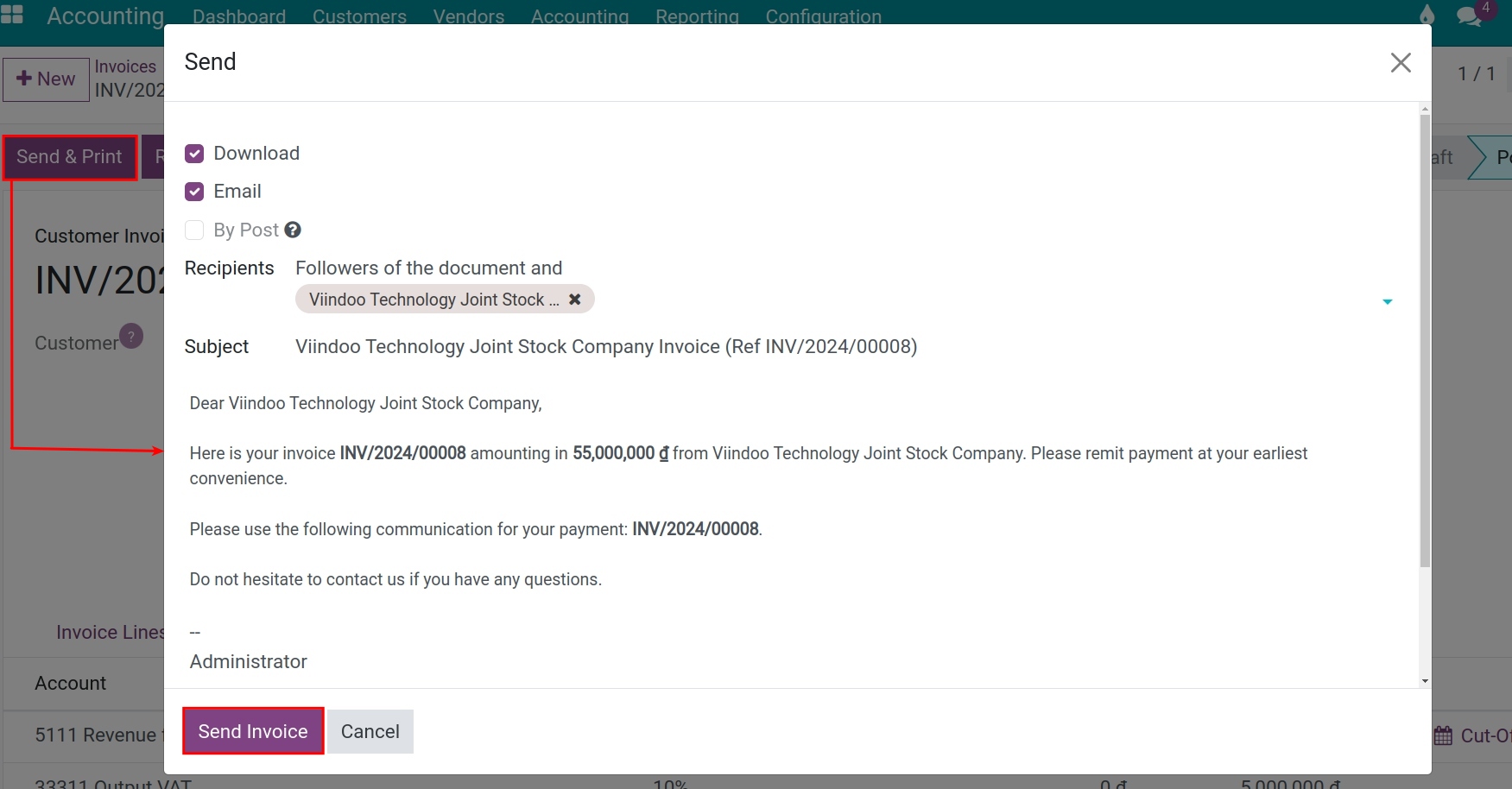

After validating customer invoices, you can send those to your customer directly using Send & Print function from the invoice interface:

From here, you can write or edit the email message (you can also save it as a new email template if you would want to reuse it in the future) and hit Send invoice button to send the message via email with the PDF version of the invoice as an attachment to your customer.

Note

When an email message is generated, the software recognizes customers’ preferred languages set up on their contact details and updates the email template language accordingly.

Payments¶

There are two ways to register payments:

Register bank statement & payment reconciliation¶

Register bank statement¶

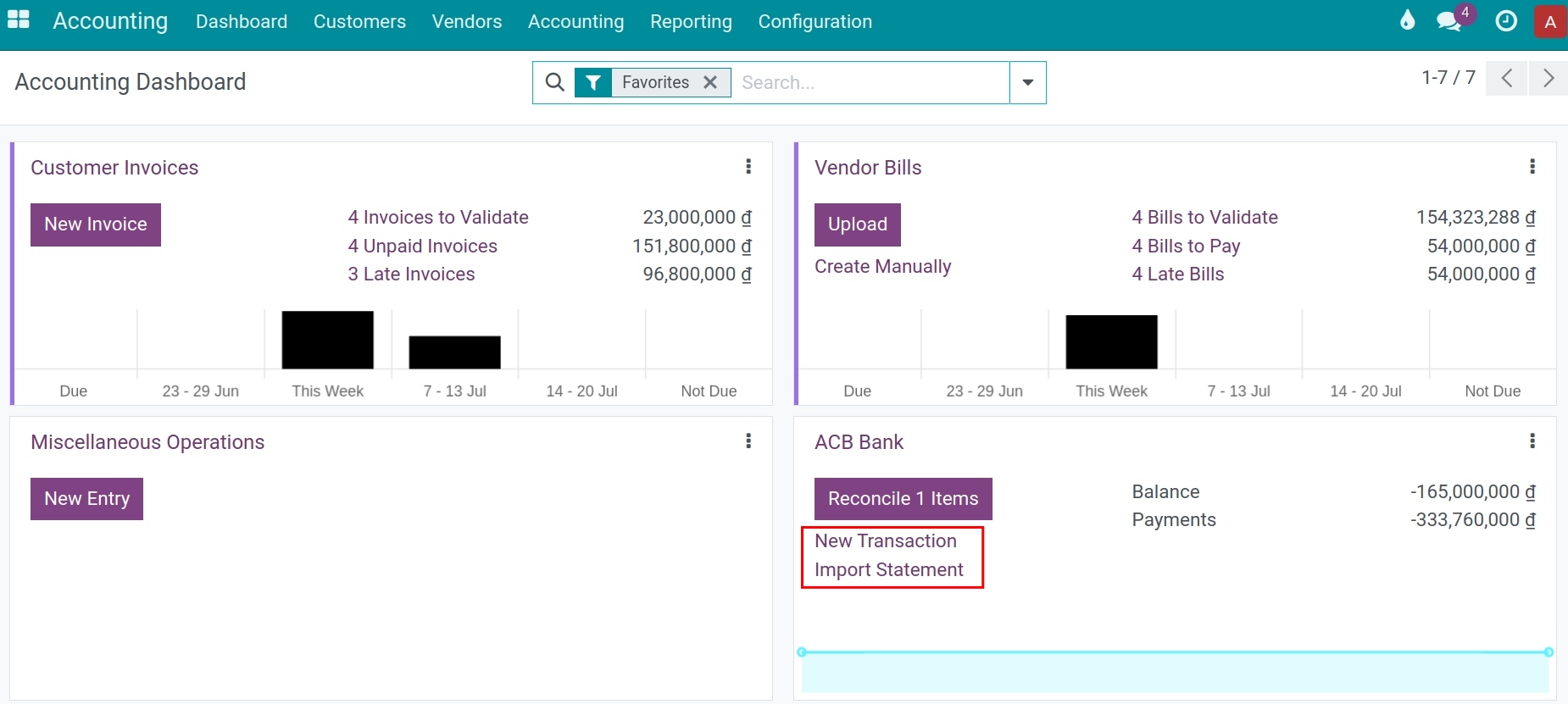

With Viindoo, you can register bank reconciliation manually or import them in bulk from CSV, XLSX or RJE files. To do so, navigate to Accounting ‣ Dashboard, choose journal of the bank, choose New Transaction or Import Statement to record the bank statement:

Payment Reconciliation¶

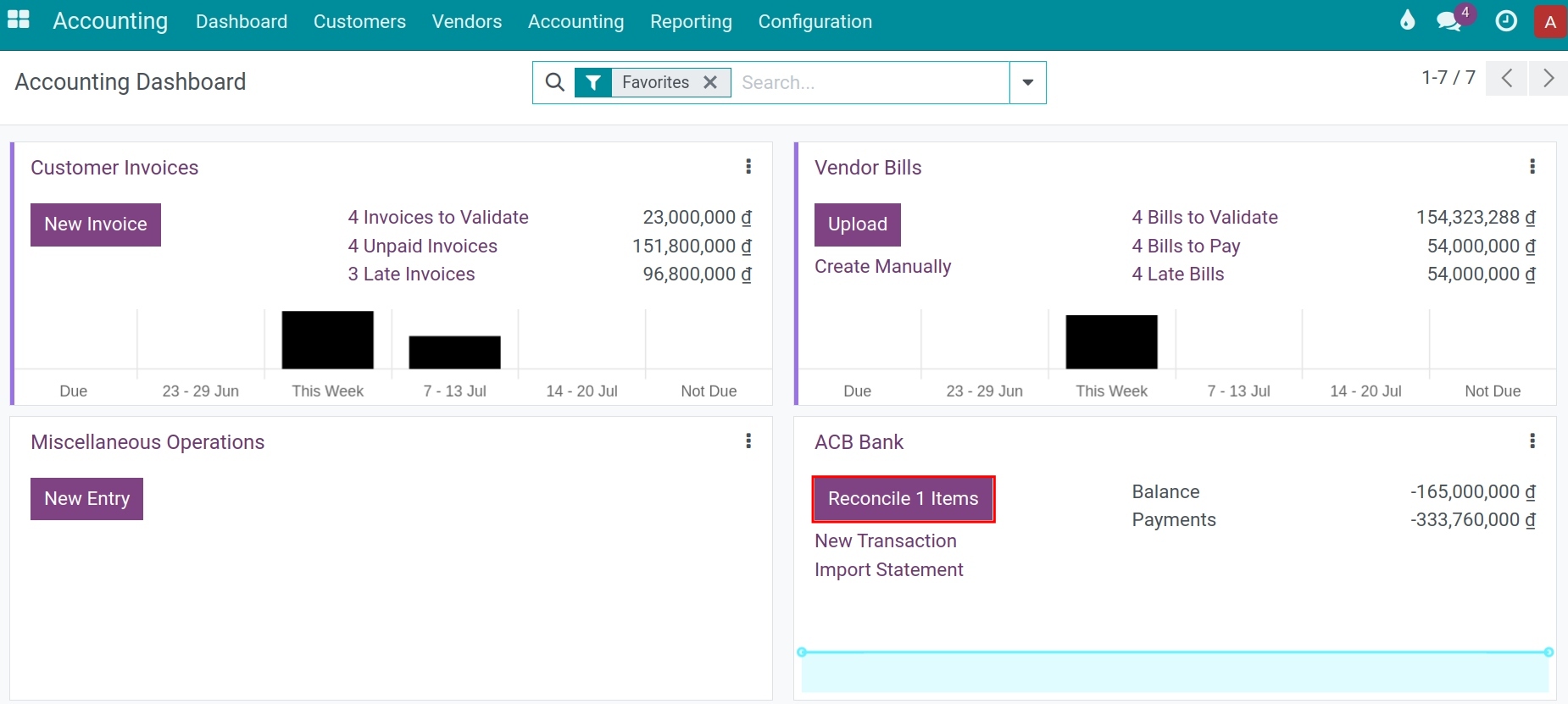

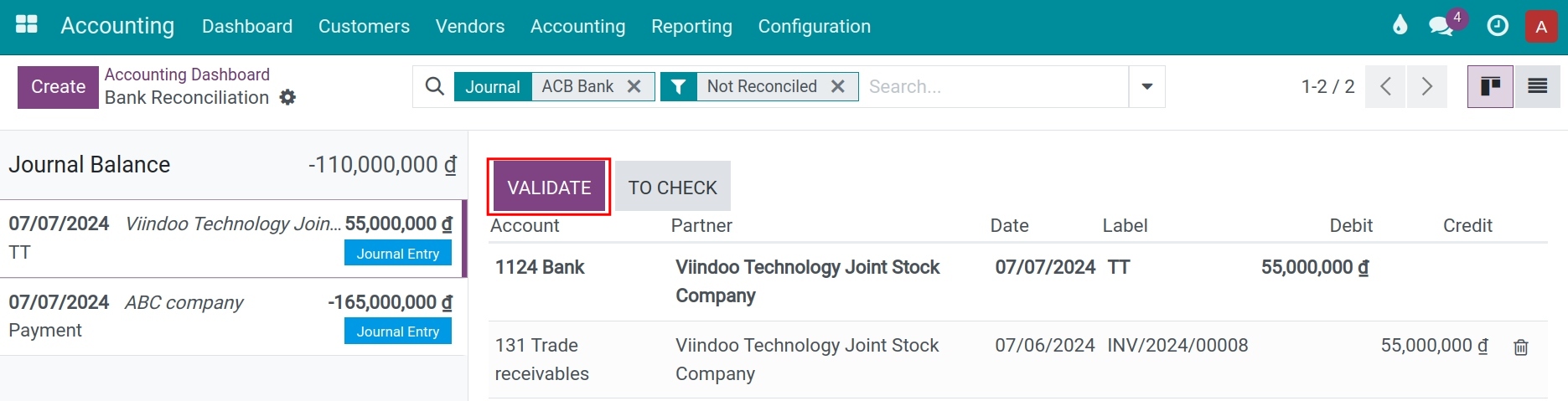

After adding and saving the transaction, the journal in the accounting information table will display the number of transactions that need to be reconcile.

Click to select, review and Confirm each amount from the payment against this bank statement.

Keep track of a payment¶

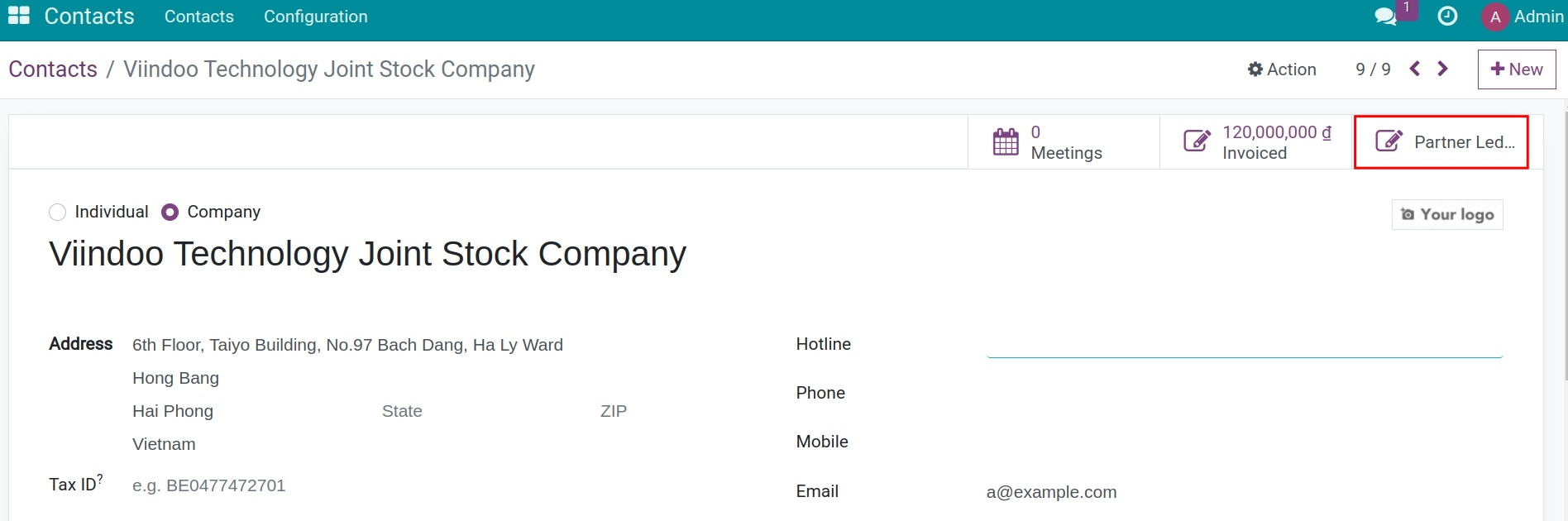

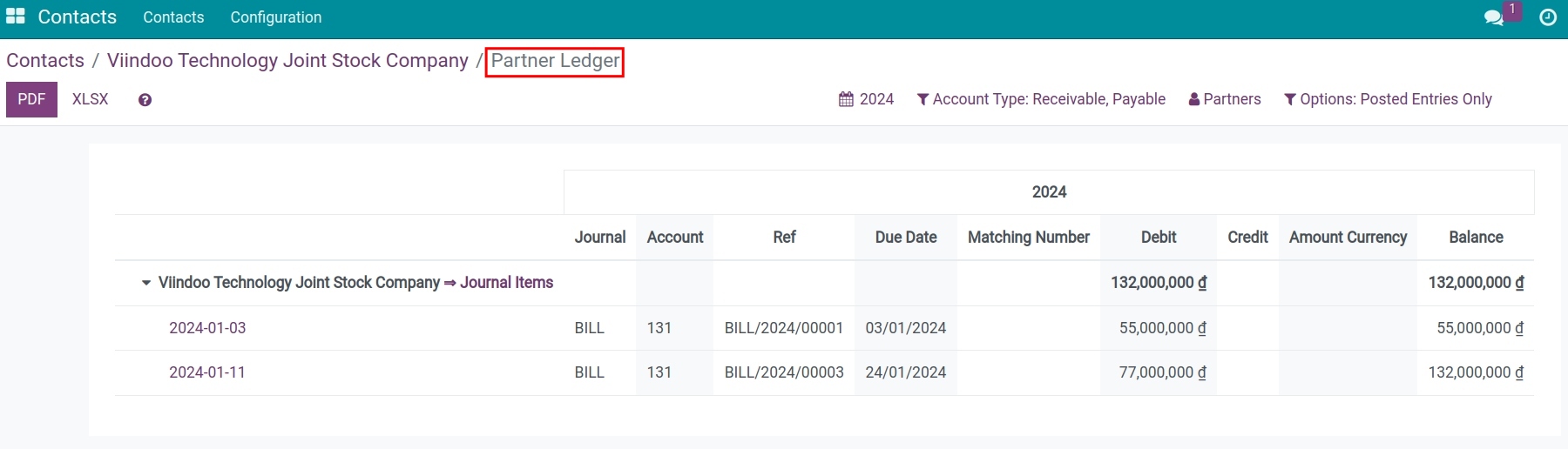

In preparation for reducing the delay of customers’ payments, as a liabilities accountant, you need to closely monitor and regularly stay in touch with customers. With Viindoo, you can track due debt directly on customer’s contact. Navigate to Contacts > select the customer > select Partner Ledger.

Here, you can view the outstanding balance of that customer:

Reporting¶

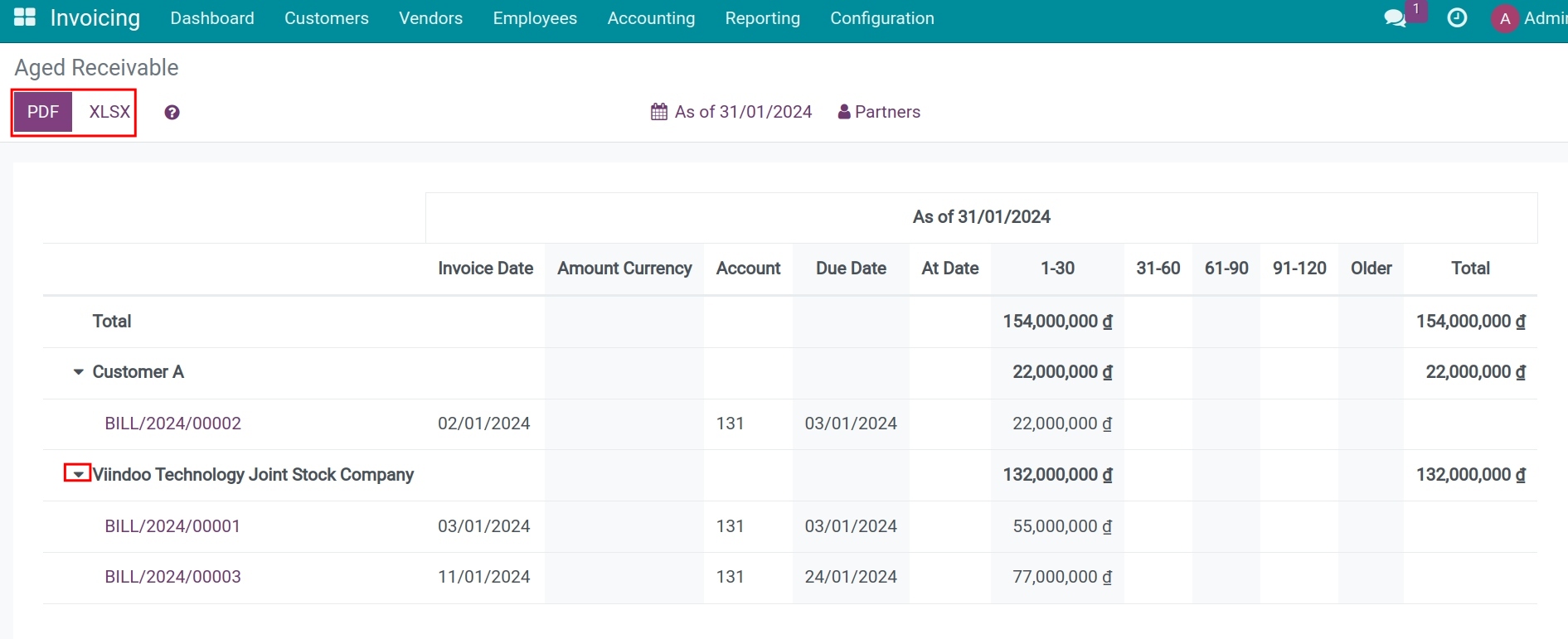

Payments due can be monitored by navigate to Accounting ‣ Reporting ‣ Aged Receivable:

In each report, you can click on the customers’ names to see the details of each transaction or export as PDF and XLSX.

See also

Related article

Optional module