Issue e-invoice by integrating Viindoo with Viettel’s S-Invoice service¶

Nowadays, e-invoice has become a trend in digital transformation. E-invoices are integrated into enterprise management systems, accounting software, etc., helping to synchronize data, optimize usage time, and save printing, issuing, and storage costs for enterprises. For authority agencies, e-invoice plays an important role in managing trades transparently. To satisfy enterprises’ needs for managing e-invoices, Viindoo has integrated e-invoices into the Viindoo enterprise management system. Viindoo not only integrates e-invoices for VietNam enterprises but also supports e-invoice formats according to other countries’ standards with localization modules.

In this article, we will learn how to Integrate Viettel’s S-Invoice with Viindoo.

Requirements

This tutorial requires the installation of the following applications/modules:

How to integrate with S-Invoice¶

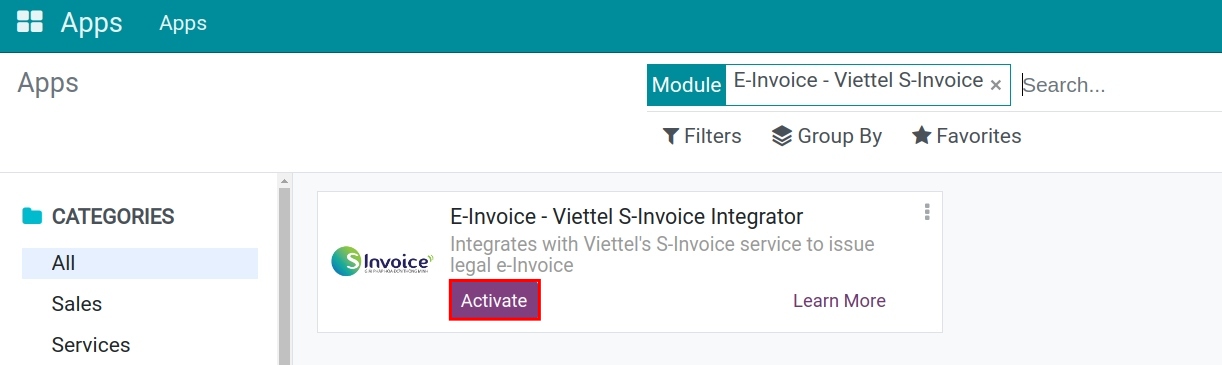

Install the module¶

Go to Viindoo Apps, search for E-Invoice - Viettel S-Invoice on the search bar, and press Activate.

Declare the integration information¶

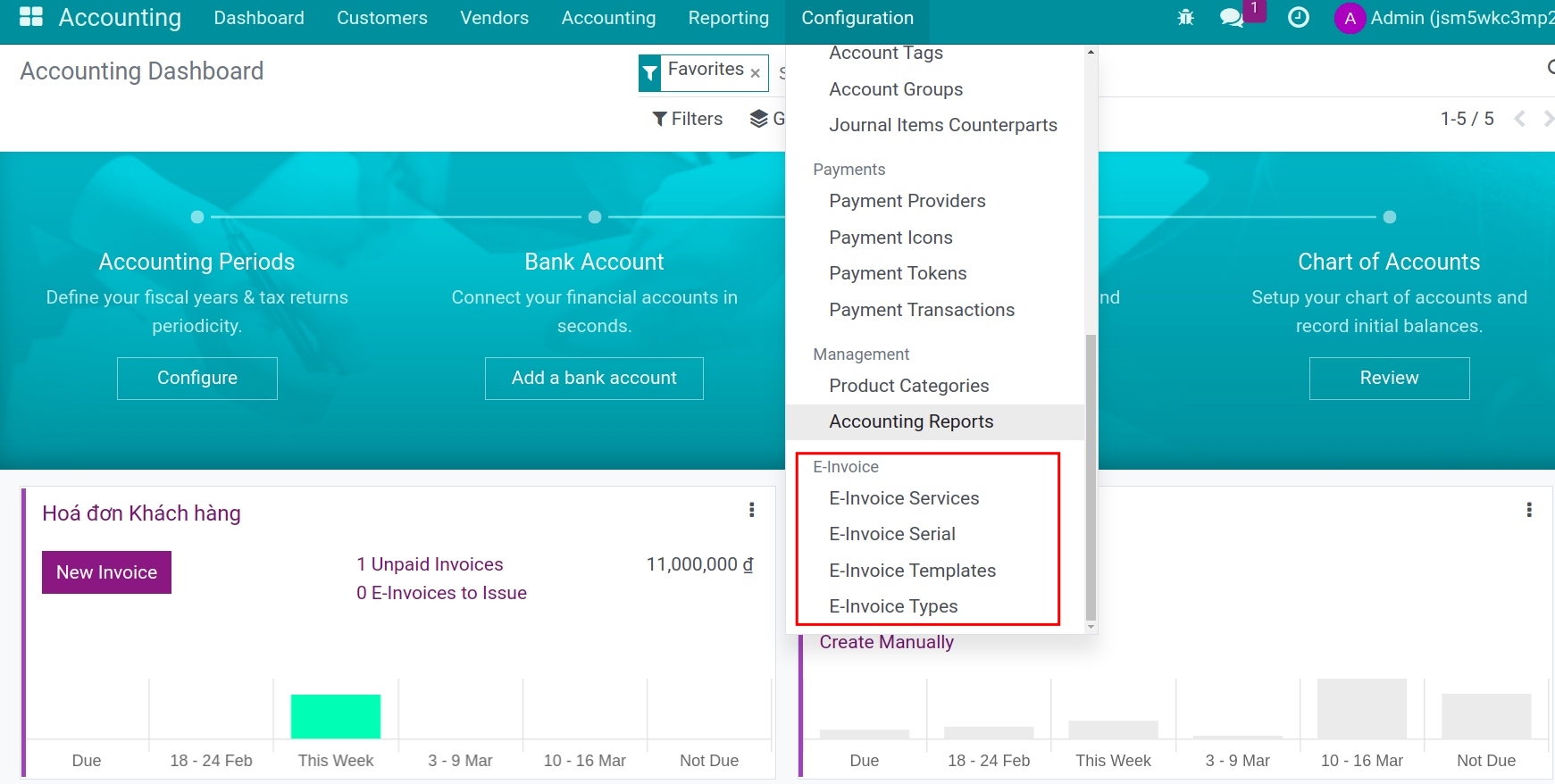

After installing the E-Invoice - Viettel S-Invoice module, to declare the E-invoice information, navigate to Accounting > Configuration > E-invoice.

Follow the steps below to declare:

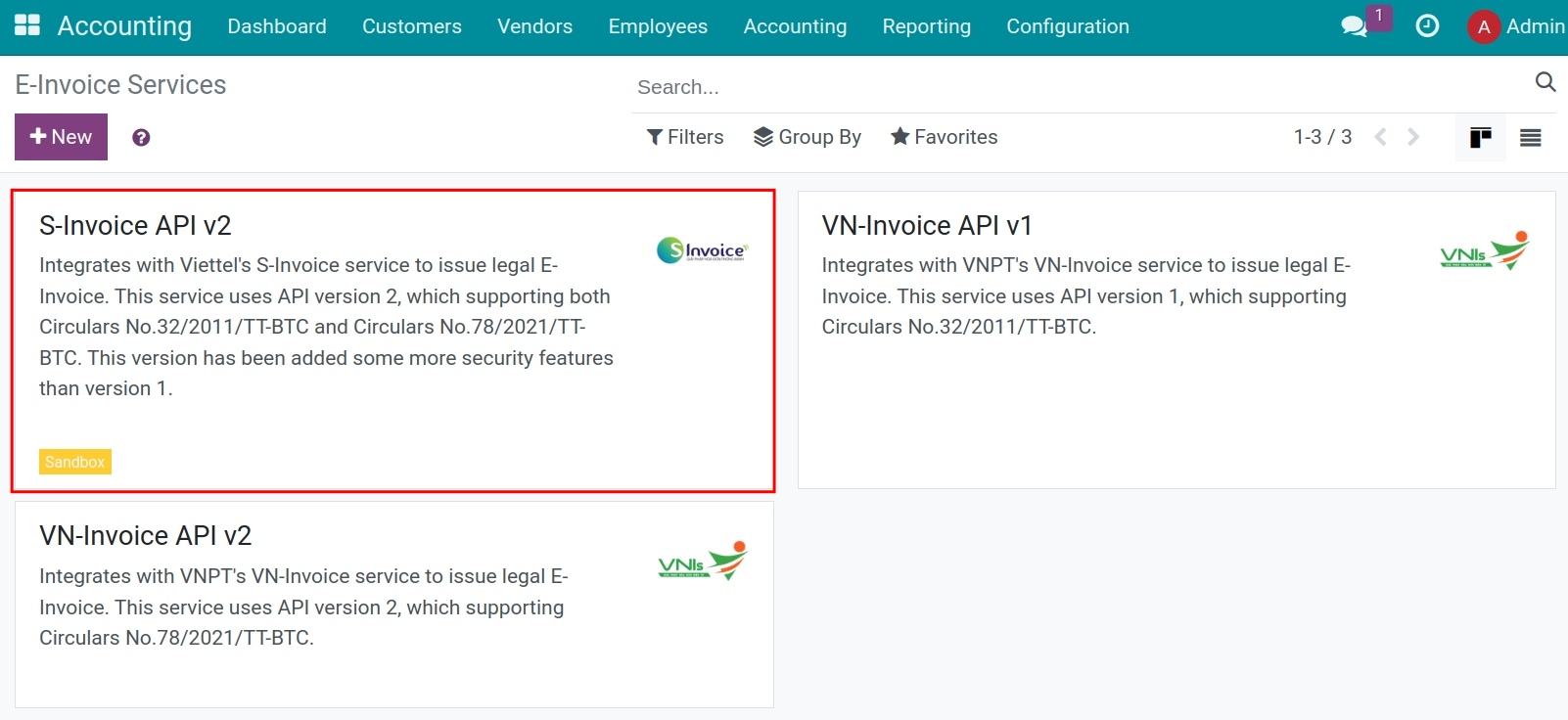

Step 1: E-Invoice services¶

Here, you will see S-Invoice services supported by Viindoo.

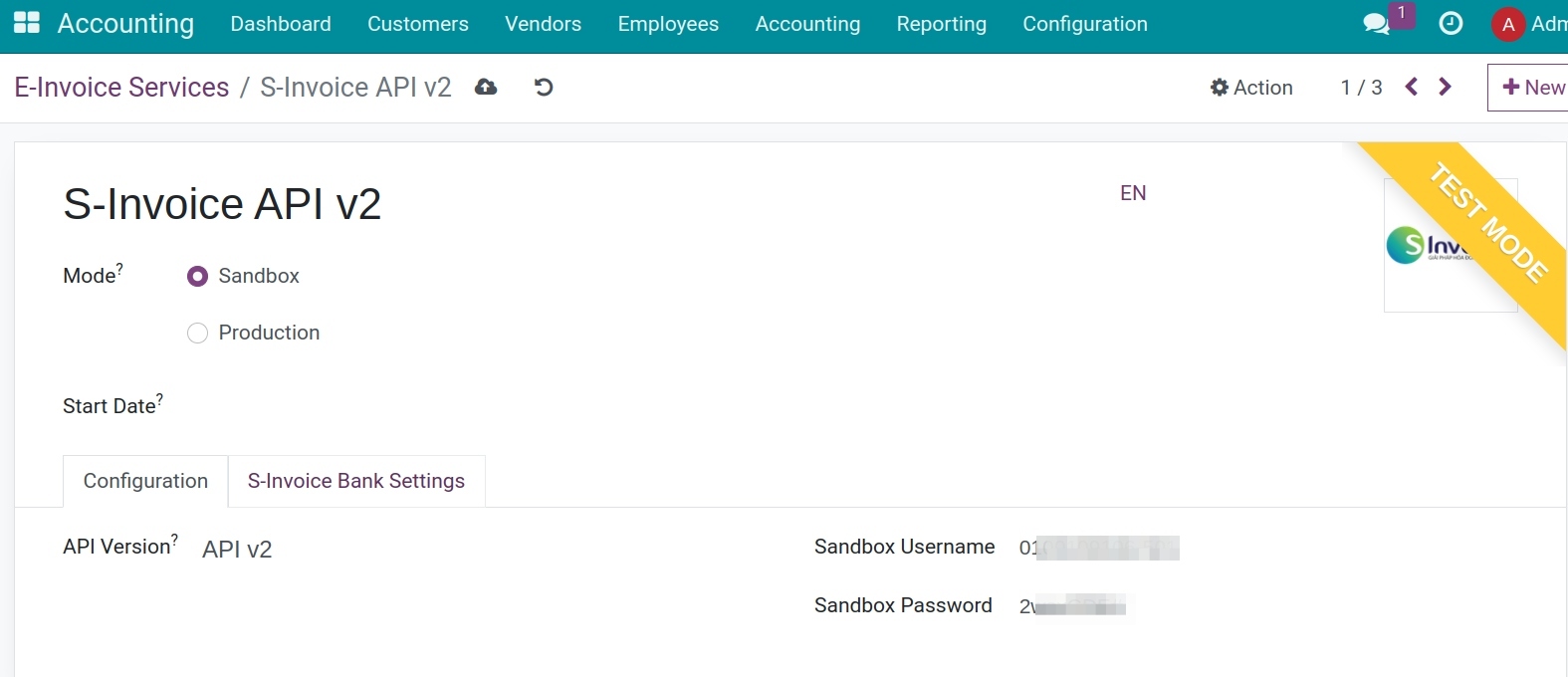

Here you provide the necessary information for invoice integration:

Note

The information you use to declare in the Viindoo system (e.g. user name, password, e-invoice’s serial, template, type, etc.), will be provided by the E-Invoice service provider.

The setting information in this article is only a reference for the test mode.

Step 2: Declare the e-invoice’s Serial/Template/Type¶

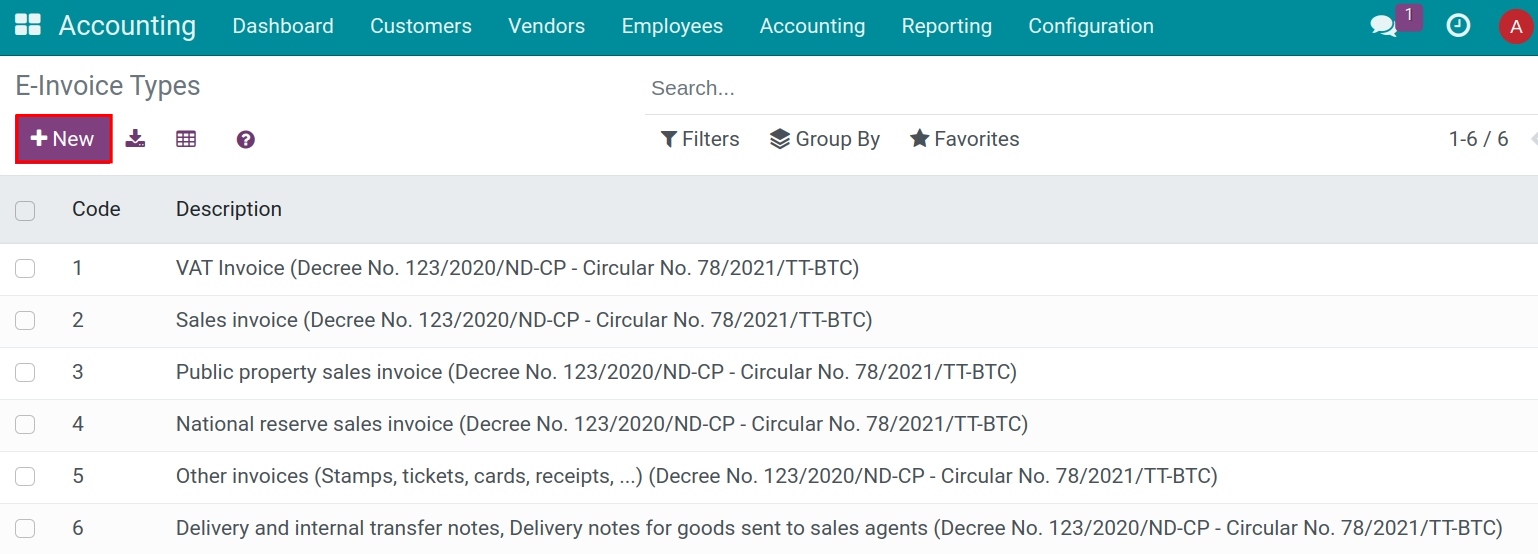

Declare E-invoice types¶

On the E-invoice types view, press New to create new e-invoice types to make them easier to use and declare.

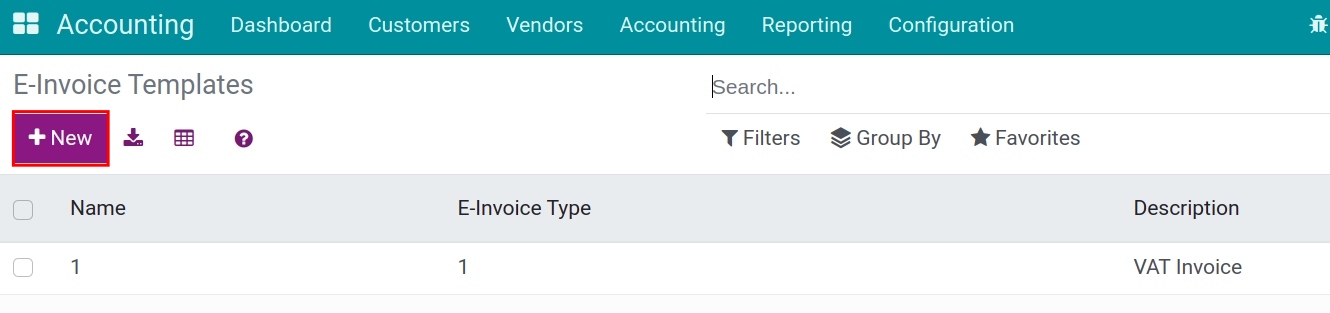

Declare e-invoice templates¶

On the E-invoice templates view, press New to create new e-invoice templates that your enterprise registers with the tax authority.

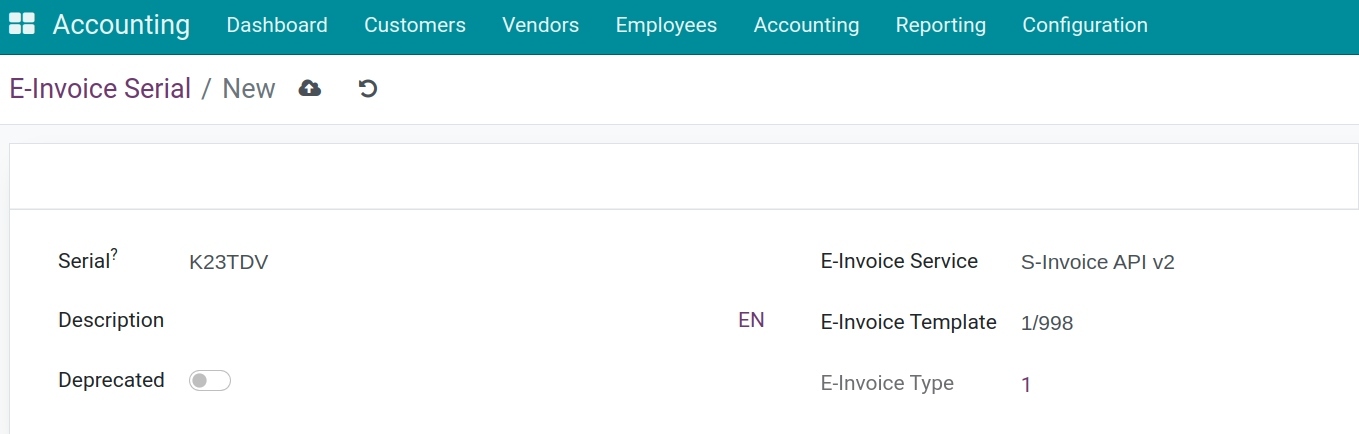

Declare e-invoice’s Serial¶

On the E-invoice Serial view, declare the exact serial that your enterprise has registered with the tax authority.

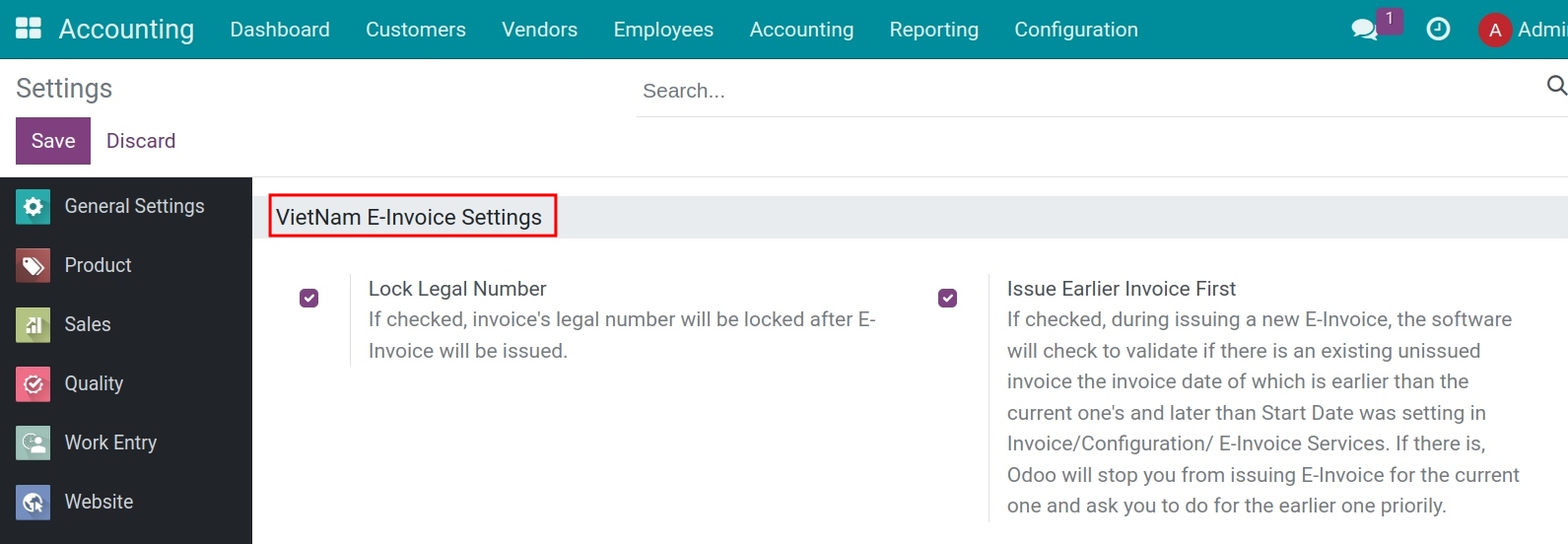

Step 3: Declare, and set up the system’s General settings¶

Navigate to Accounting > Configuration > Settings > E-Invoice Settings.

Selectable fields:

Lock Legal Number;

Issue Earlier Invoice First.

Press Save to finish step 3.

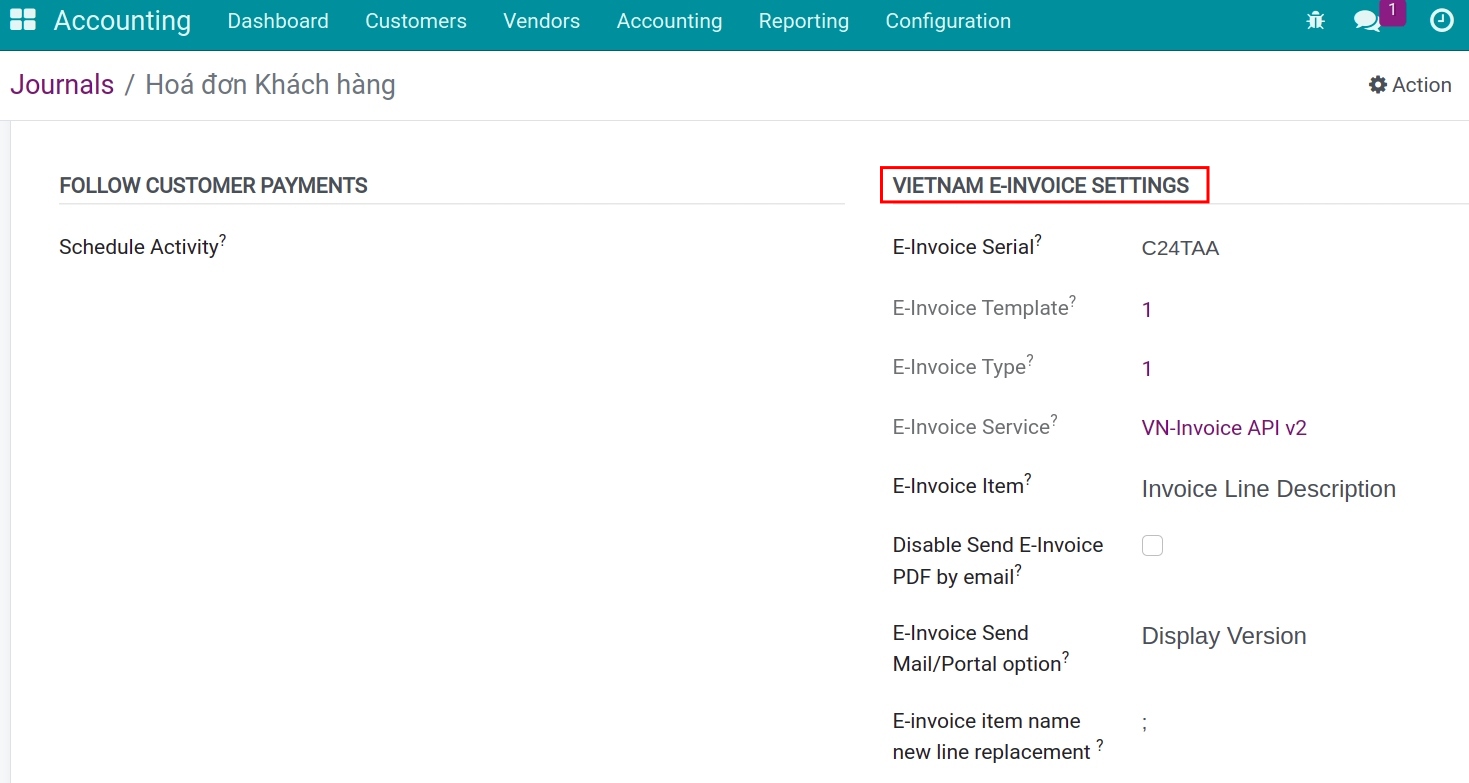

Step 4: Settings on Customer Invoice Journal¶

Navigate to Accounting > Configuration > Journals, select the Customer Invoice journal. At the Advanced Settings tab, enter the needed information for issuing the e-invoice.

In which:

E-invoice Serial: The serial that your enterprise registered with the tax authority declared in step 2;

E-Invoice Template: The number of invoice templates that your enterprise registered with the tax authority declared in step 2;

E-Invoice Type: This is the invoice type that your enterprise registered and declared in step 2;

E-invoice service: This is the version that has been registered by the Enterprise in step 1;

E-Invoice Item: This field will allow you to select the information to bring to the description field for the Product/service name on the e-invoice:

Invoice Line Description: The content of the Label field on the customer invoice will be sent to the e-invoice;

Product name: The product name on the Product field of the customer invoice will be sent to the e-invoice.

Disable Send E-Invoice PDF by email: When you click Send and Print on invoice view, the system automatically attached the default PDF standard invoice to the email that you send to your customer.

If checked: The default PDF standard invoice will always be attached to the email sent to the customer;

If not checked: The PDF will be updated following the downloaded and attached to the email sent to the customer.

E-Invoice Send Mail/Portal option: Select the invoice version to attach to the e-invoice issuing notification email sent to customers:

Displayed Version: The system will attach the Representation e-invoice version to the email.

Converted Version: The system will download and attach the Converted e-invoice version to the email.

E-invoice Item name new line replacement: When issuing the e-invoice, the product’s name and description will be displayed in the same line on the e-invoice. That’s why the character set here will mean “down a line” in the product description;

Issue E-invoice¶

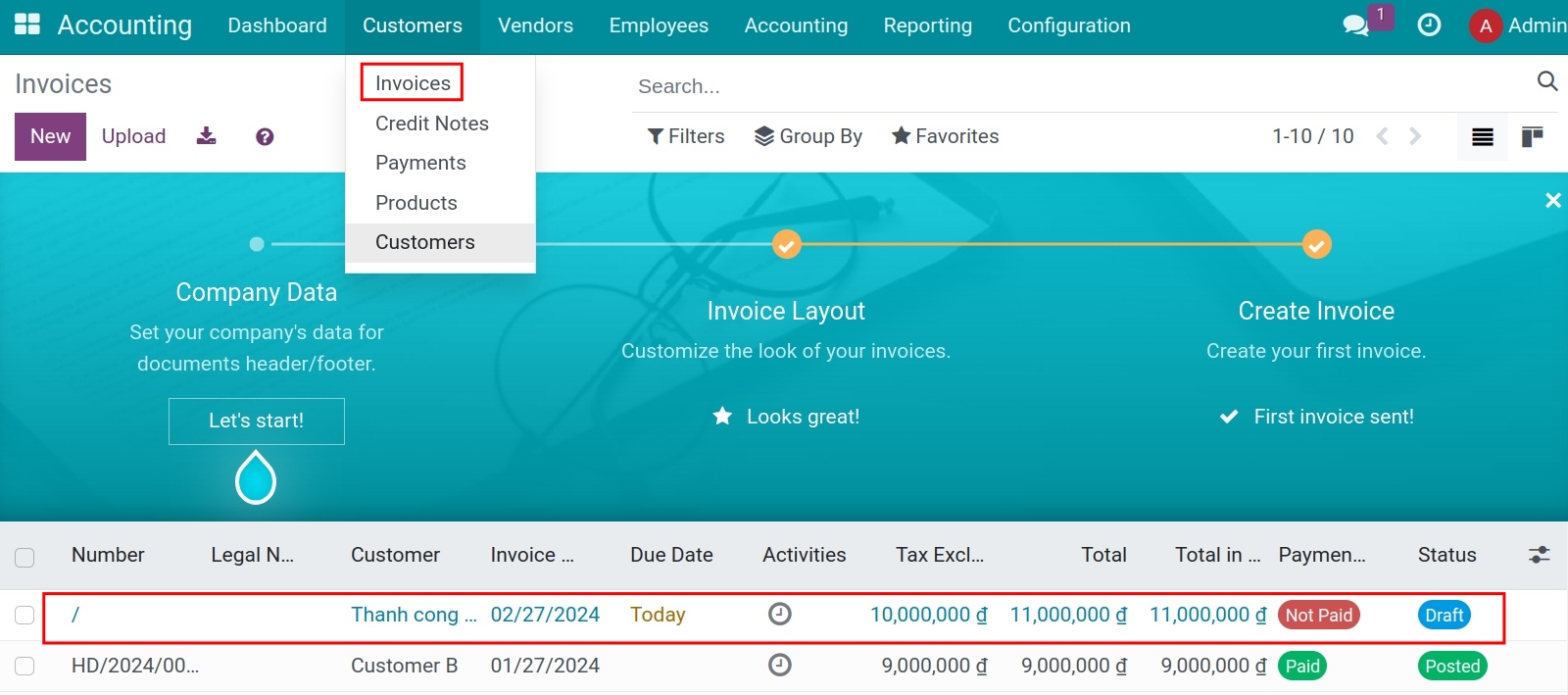

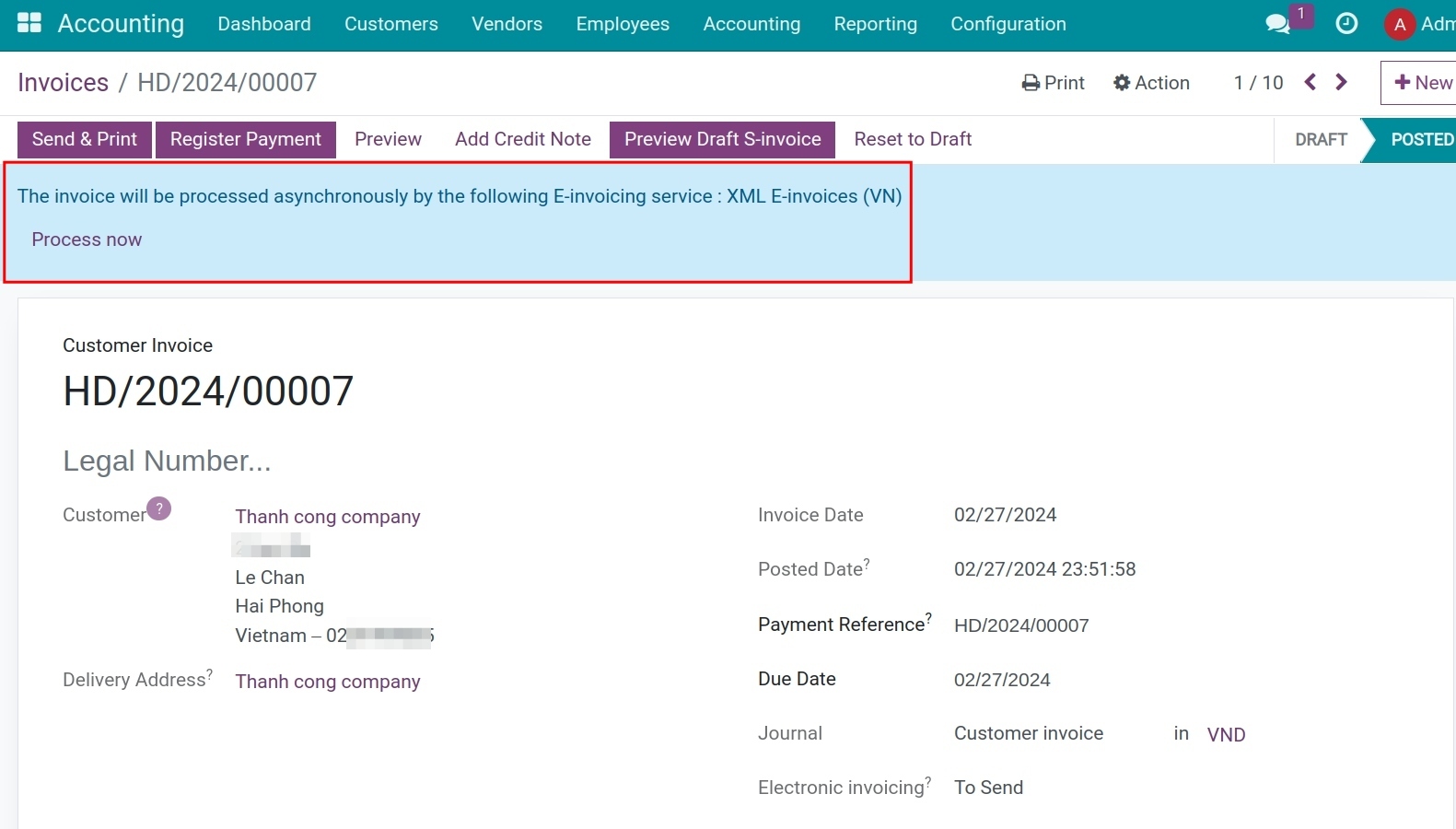

Navigate to Accounting > Customers > Invoices, on the invoices list, select an invoice to issue an e-invoice.

For example, you are issuing an e-invoice for Thanh Cong Company, the invoice date is 27/02/2024 with a total is 11.000.000 VND.

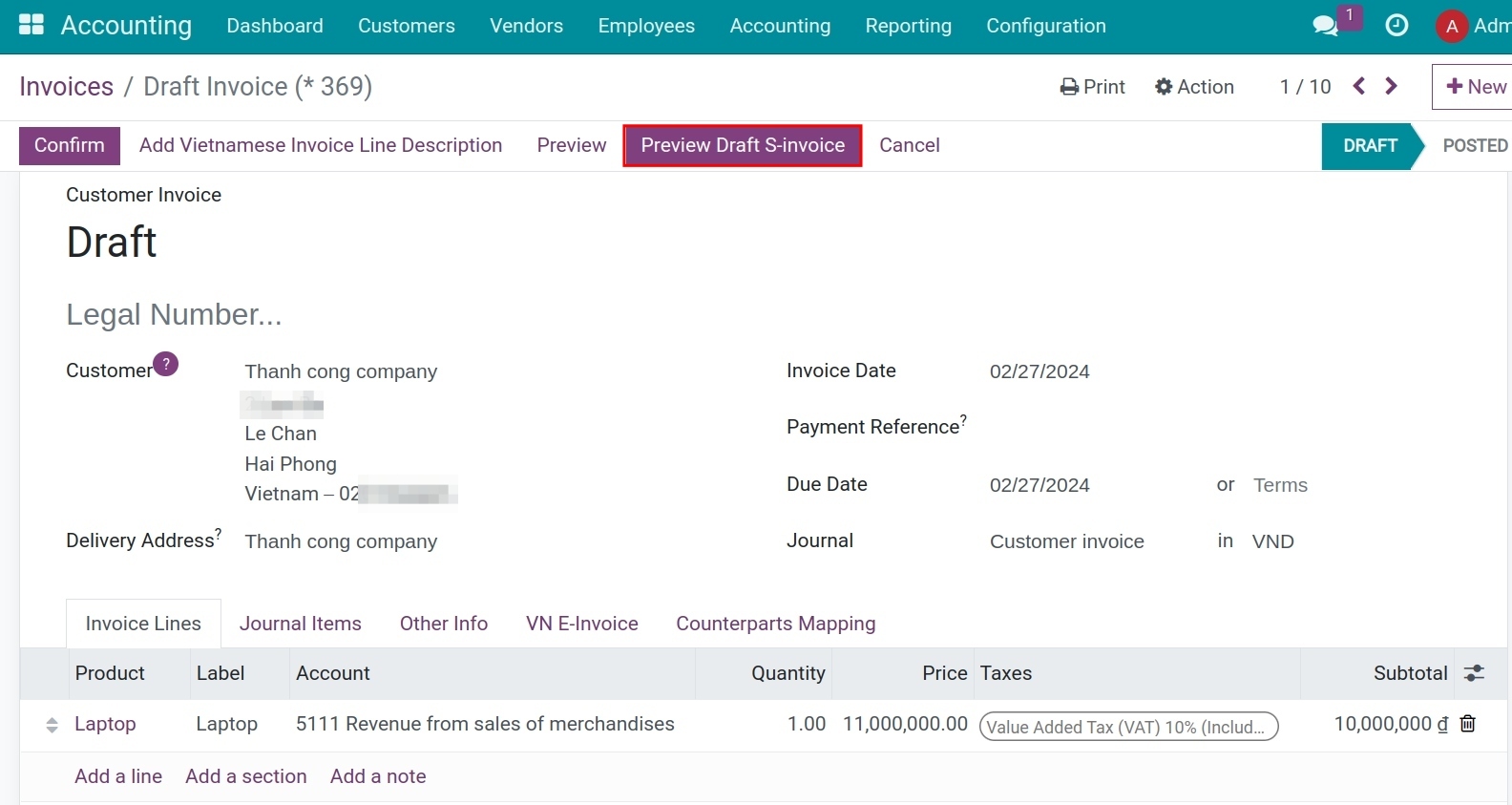

Step 1: Preview the electronic invoice¶

Before issuing the invoice, you select Preview Draft S-invoice to verify the information.

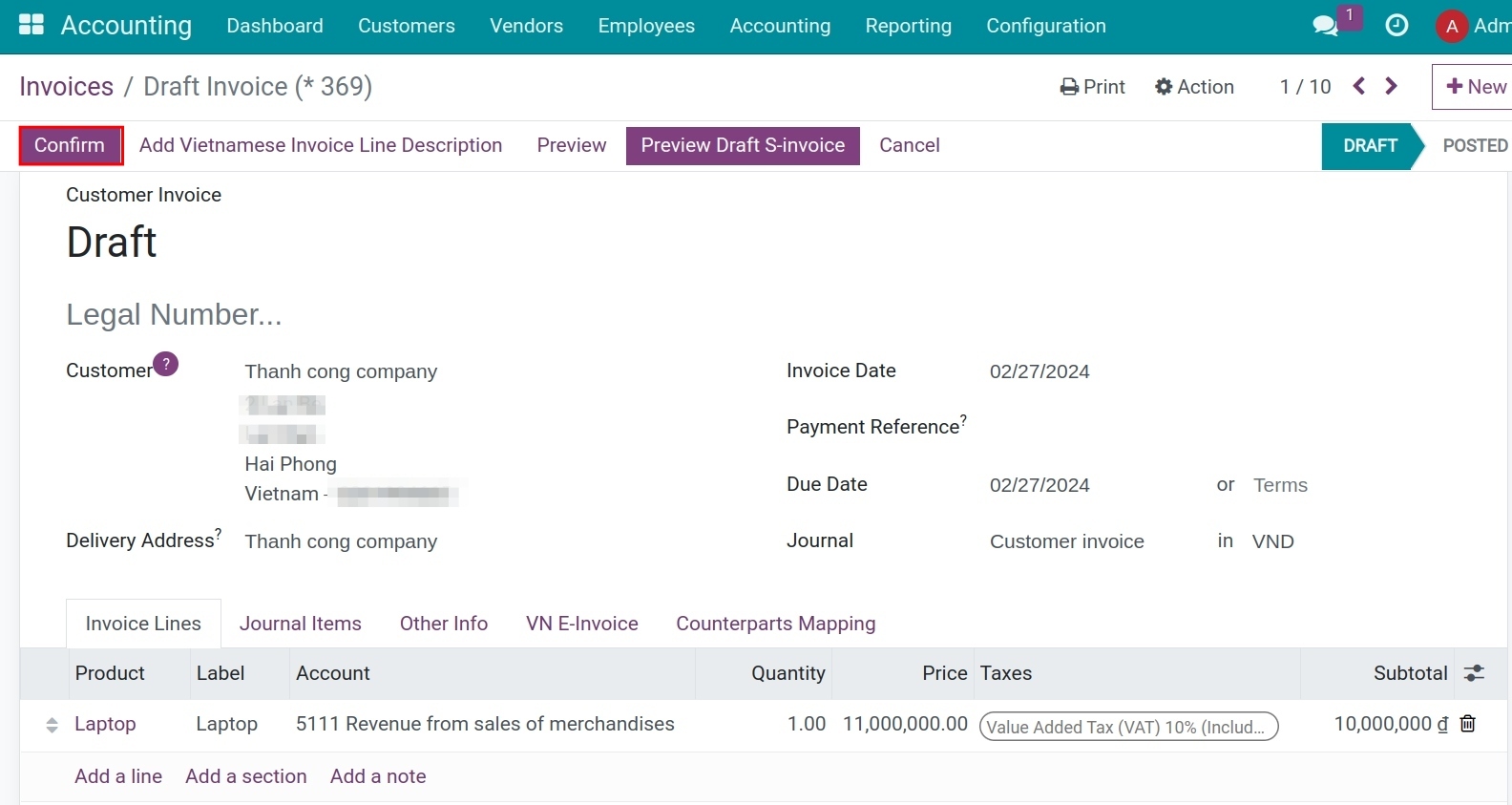

Step 2: Confirm the draft invoice¶

Review the customer invoice information: Tax code, address, etc. and press Confirm.

After confirmation, the system will display a notification about the processing of issuing the electronic invoice. Press Process Now to release the invoice.

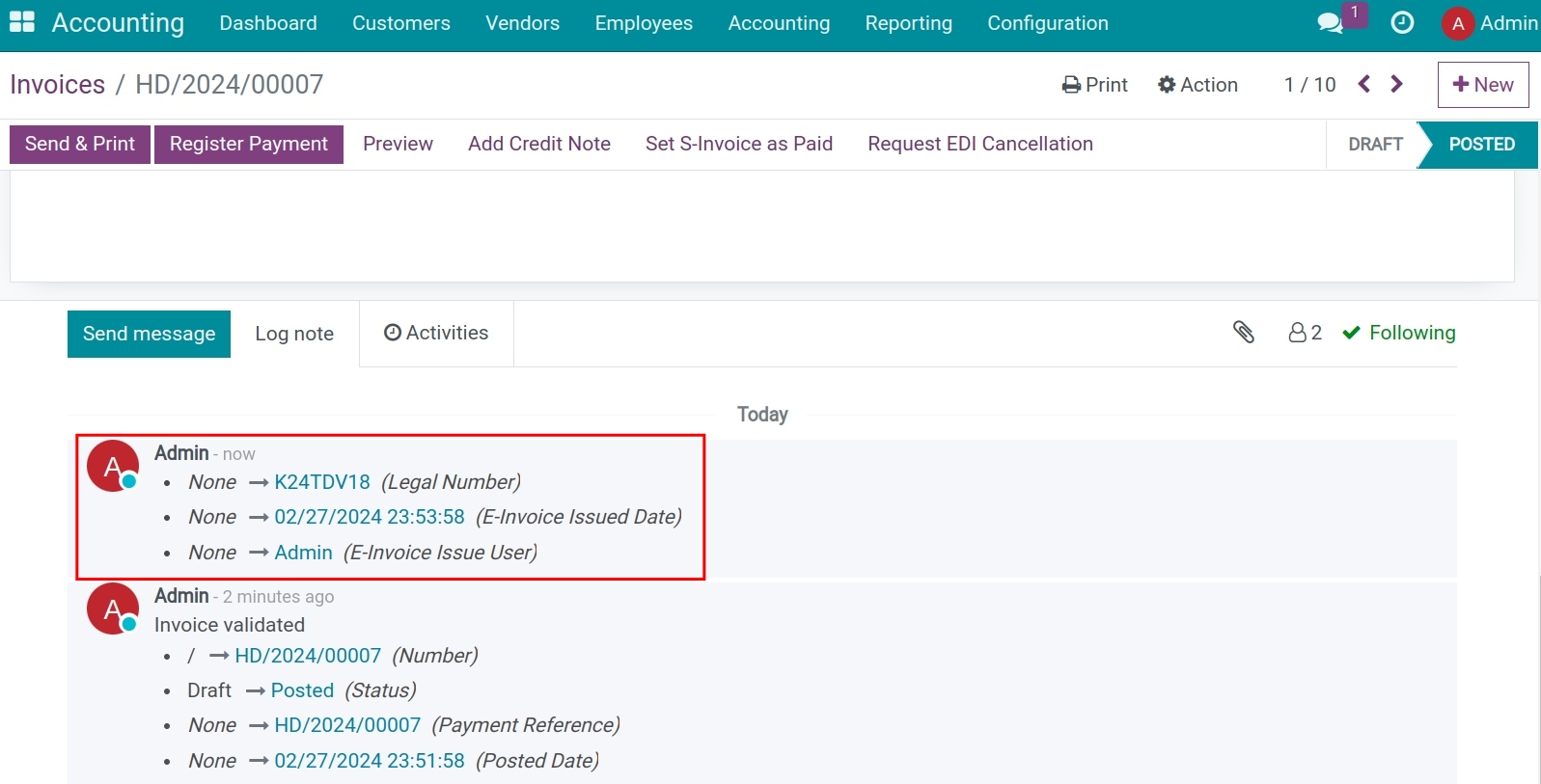

Drag the invoice down to the chatter section to verify the release information.

Note

In this step, you won’t see the Sign E-invoice step. That action is still implicitly handled because the server signature is already integrated into the e-invoice account.

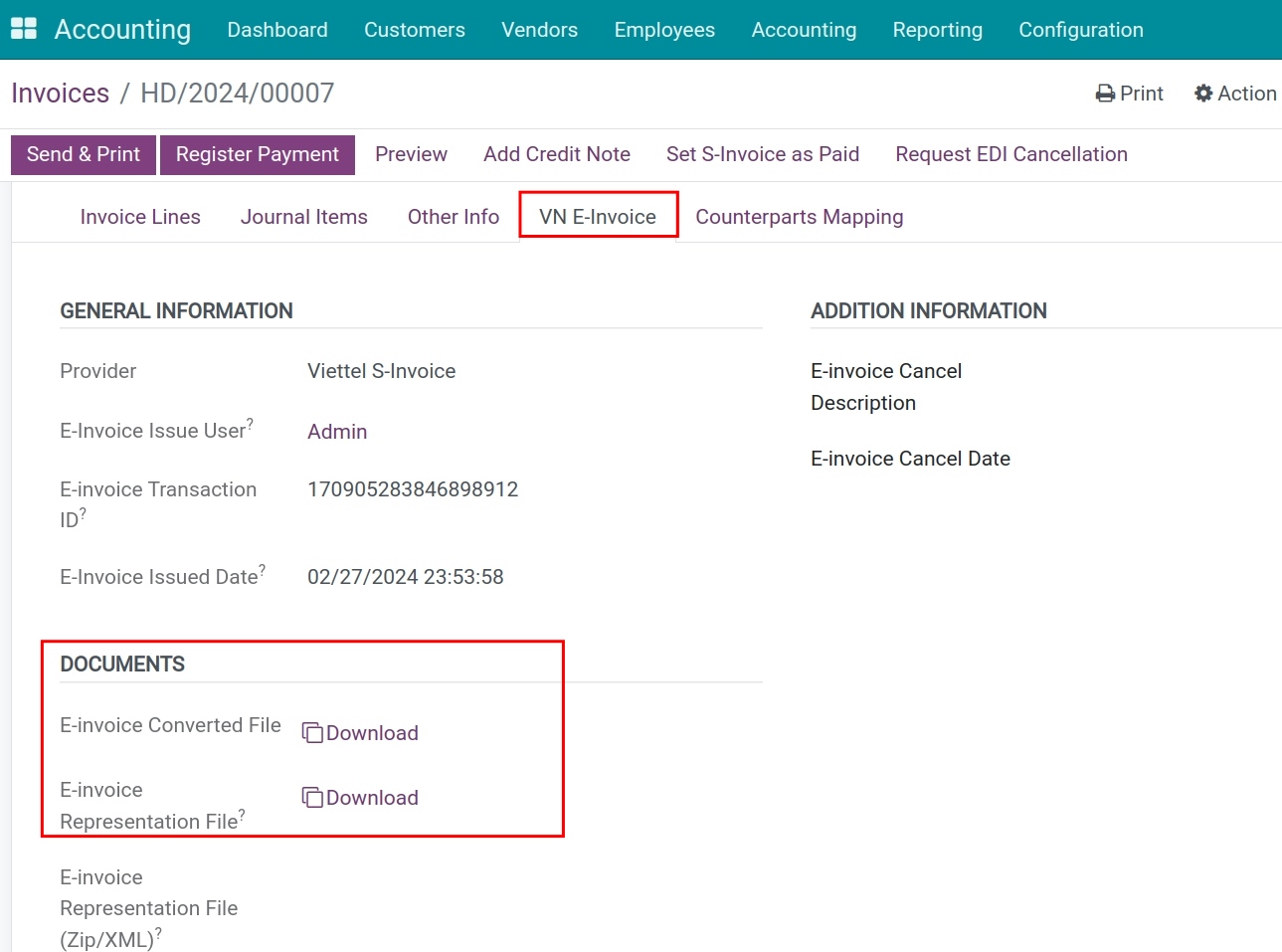

Step 4: Download E-Invoice¶

On the invoice interface, select the VN E-invoice tab, and under the Documents section. Press Download E-invoice Converted File or Download E-invoice Representation File:

This action will help you save and view the invoice in Viindoo.

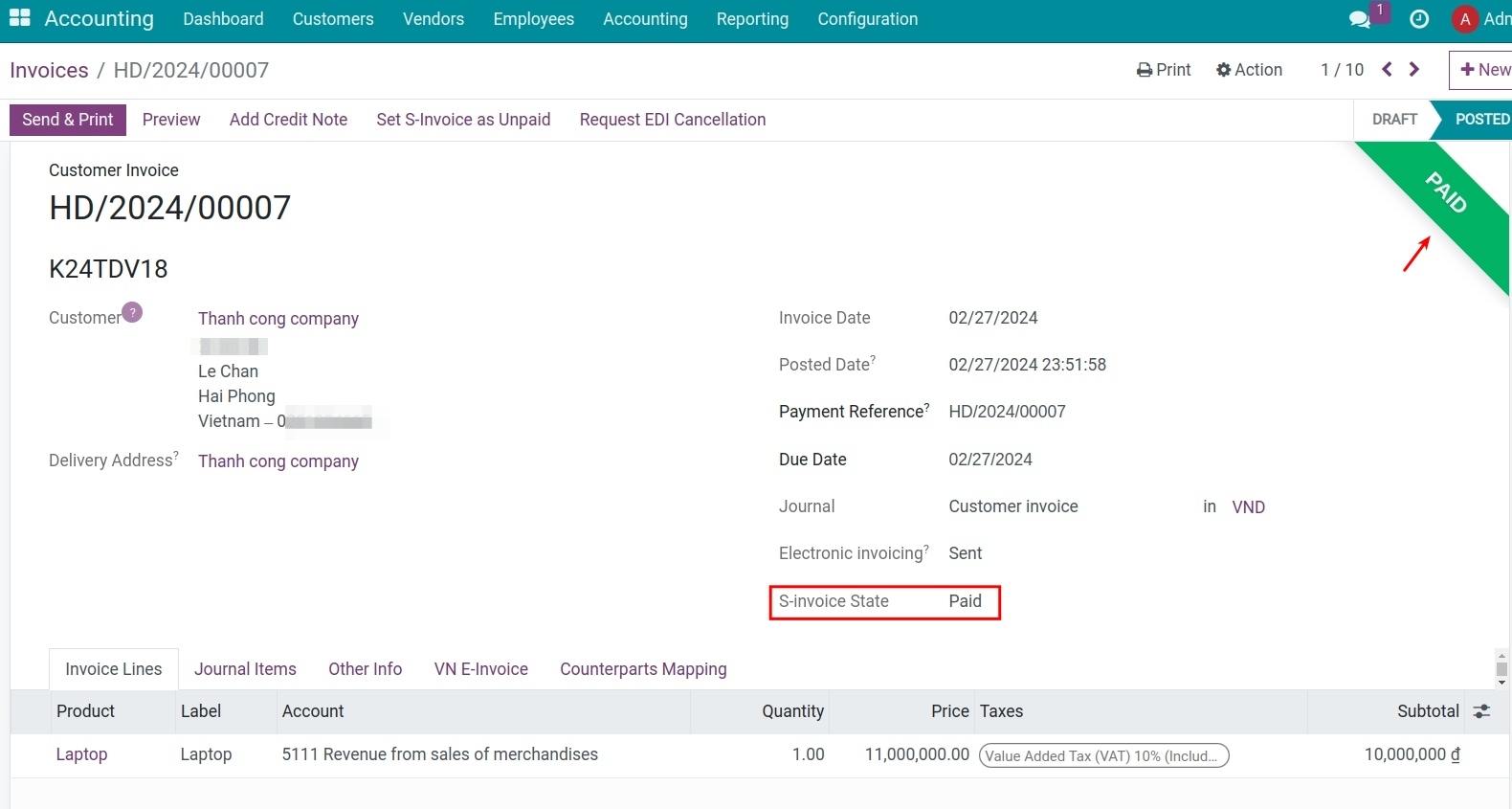

Step 5: Reconciliation after payment¶

After the invoice is reconciled:

Customer invoice in Viindoo: In the Paid stage;

E-Invoice Status: Is Paid.

Step 6: Send E-Invoice to customers¶

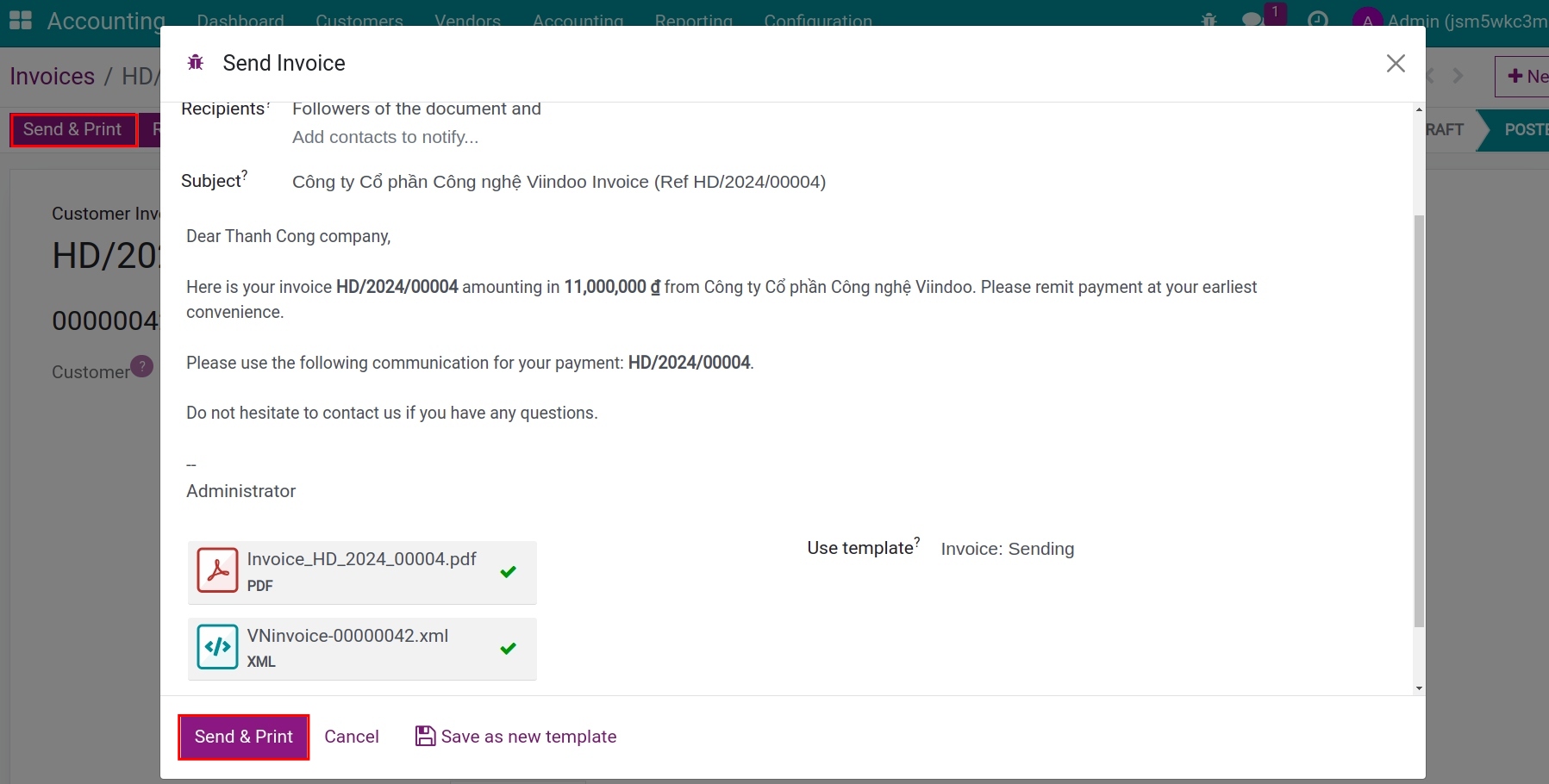

Press Send & Print to send the invoice to the customer:

Right after pressing Send & Print, a pre-made invoice show up with the invoice code, and value and attaches the PDF and ZIP file. You can send the default email template or edit the email and then press Send & Print to send the issue notification to the customer.

And just like that, you have finished sending the S-Invoice in Viindoo. In case the e-invoice needs to be edited or canceled, you can:

- Create a credit note.

- Cancel an issued e-invoice: see details as the following.

Cancel an issued e-invoice in Viindoo¶

In case the e-invoice is issued and you want to edit or cancel it, instead of accessing the e-invoice website, in the Viindoo system, follow the steps below:

Step 1: Declare invoice cancellation information¶

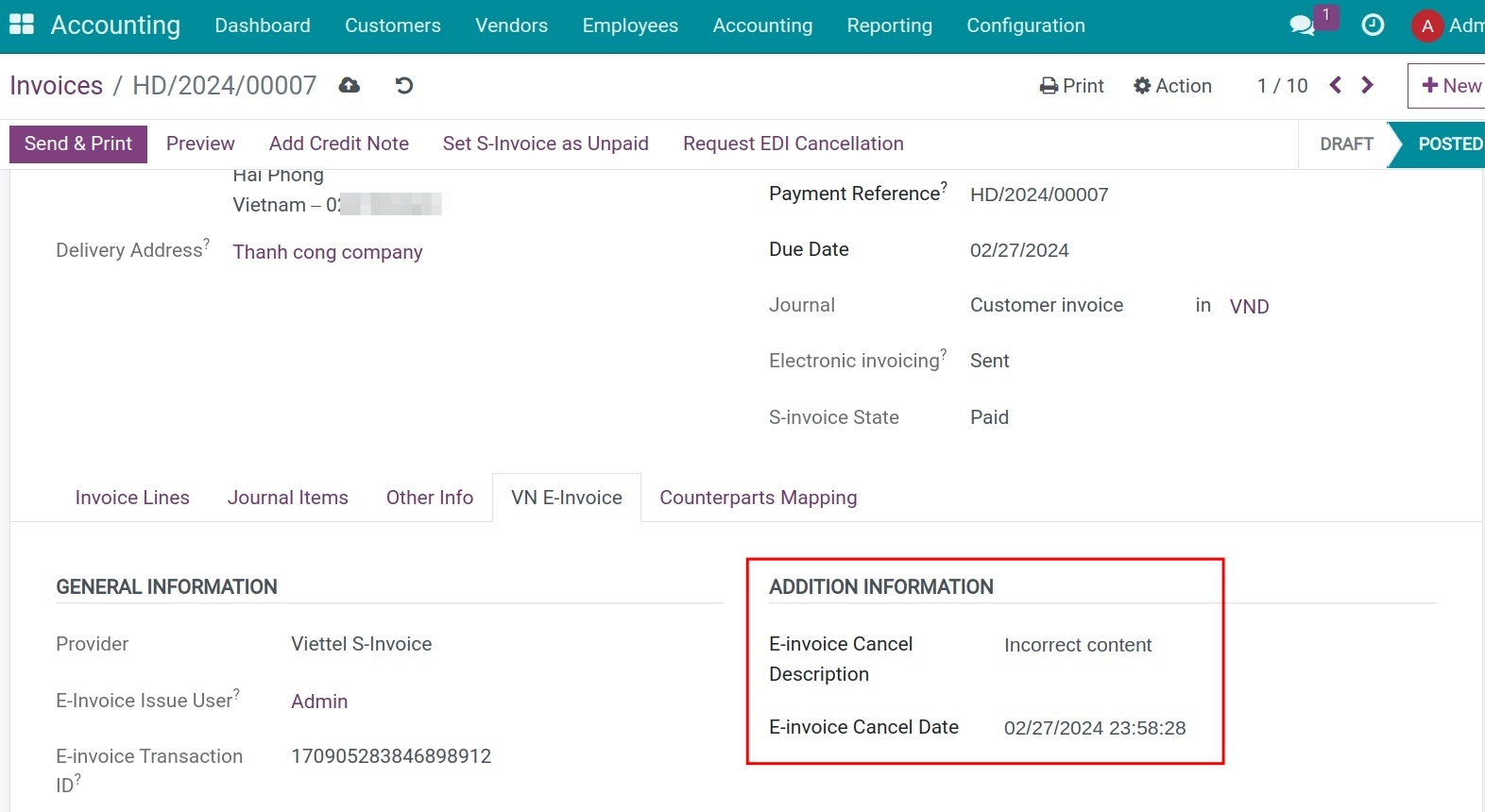

On the invoice interface, go to the VN E-invoice tab > Additional Information, fill in the following information:

E-invoice Cancel Description: Fill in the reason for cancelling the invoice

E-invoice Cancel Date: Select the date of invoice cancellation.

Step 2: Cancel the e-invoice in the Viindoo system¶

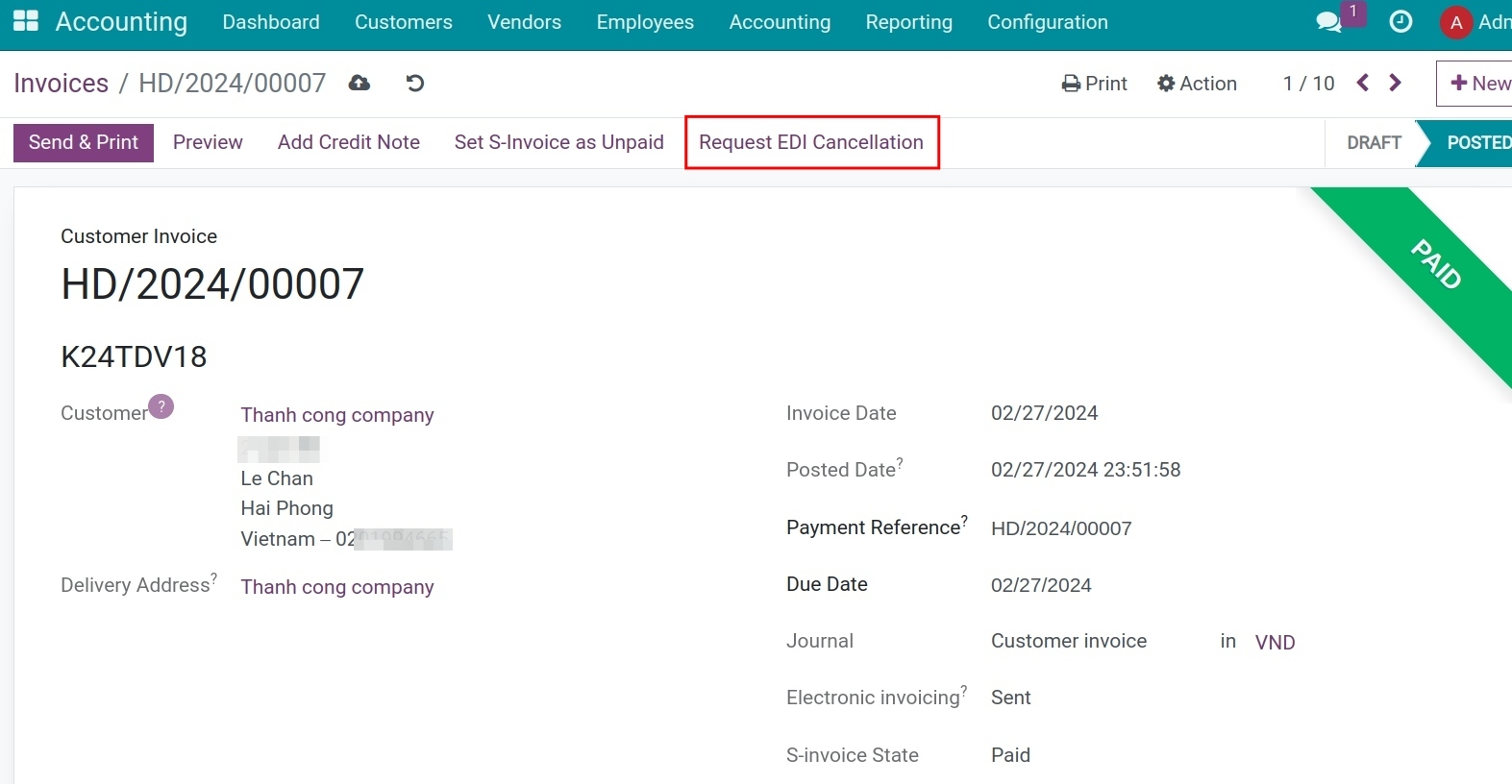

On the issued e-invoice, press Request EDI cancellation.

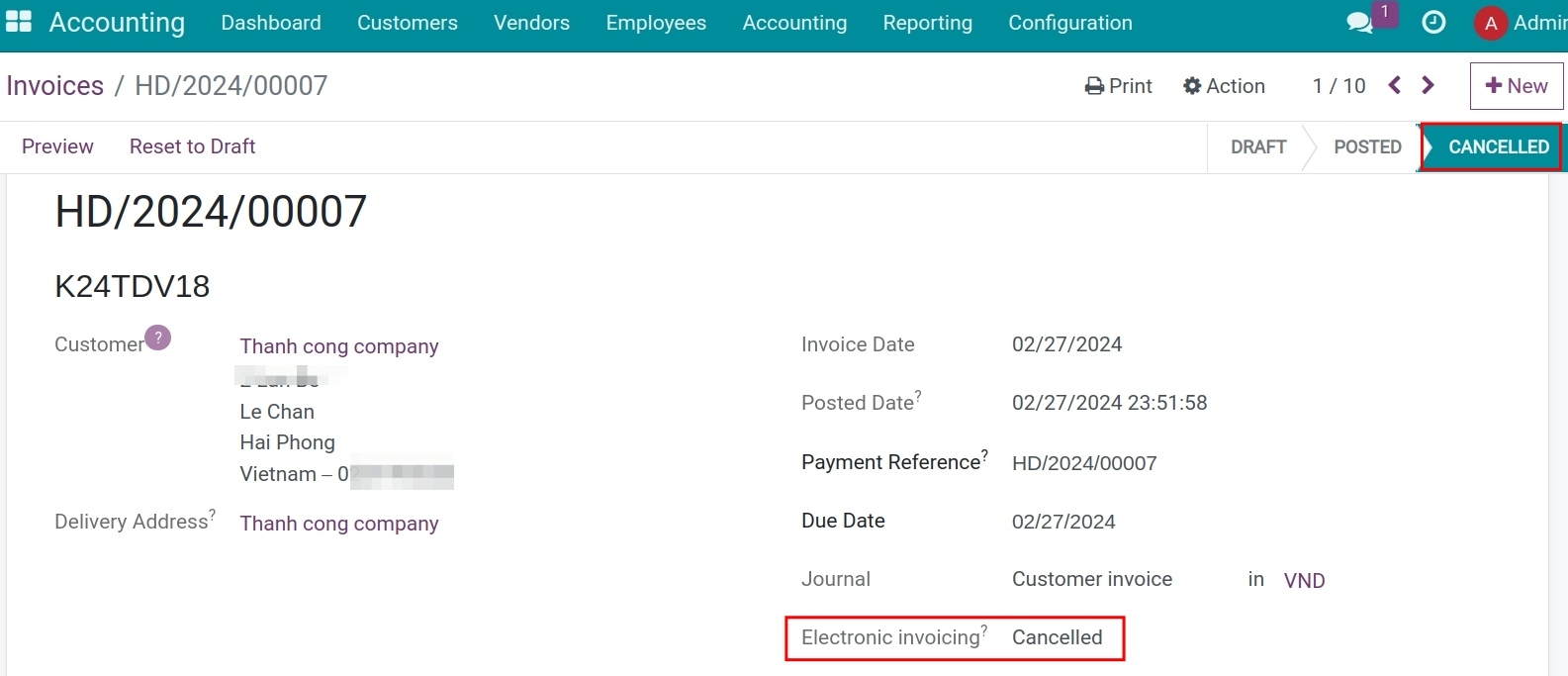

Press Process Now, the status of the electronic invoice is updated to Cancelled, the status of the system invoice is Cancelled.

To send the error notice to the tax authority, you need to access the S-Invoice system of Viettel.

See also

Related article

Optional module