Performing Tax Operations in Viindoo¶

Requirements

This tutorial requires the installation of the following applications/modules:

Corporate Income Tax (CIT)¶

In Viet Nam, Corporate Income Tax (CIT) need to posted on two periods. One is in the end of the recent quarter for provisional tax booking, one is in the end of year to corporate tax finalization.

Tax posting¶

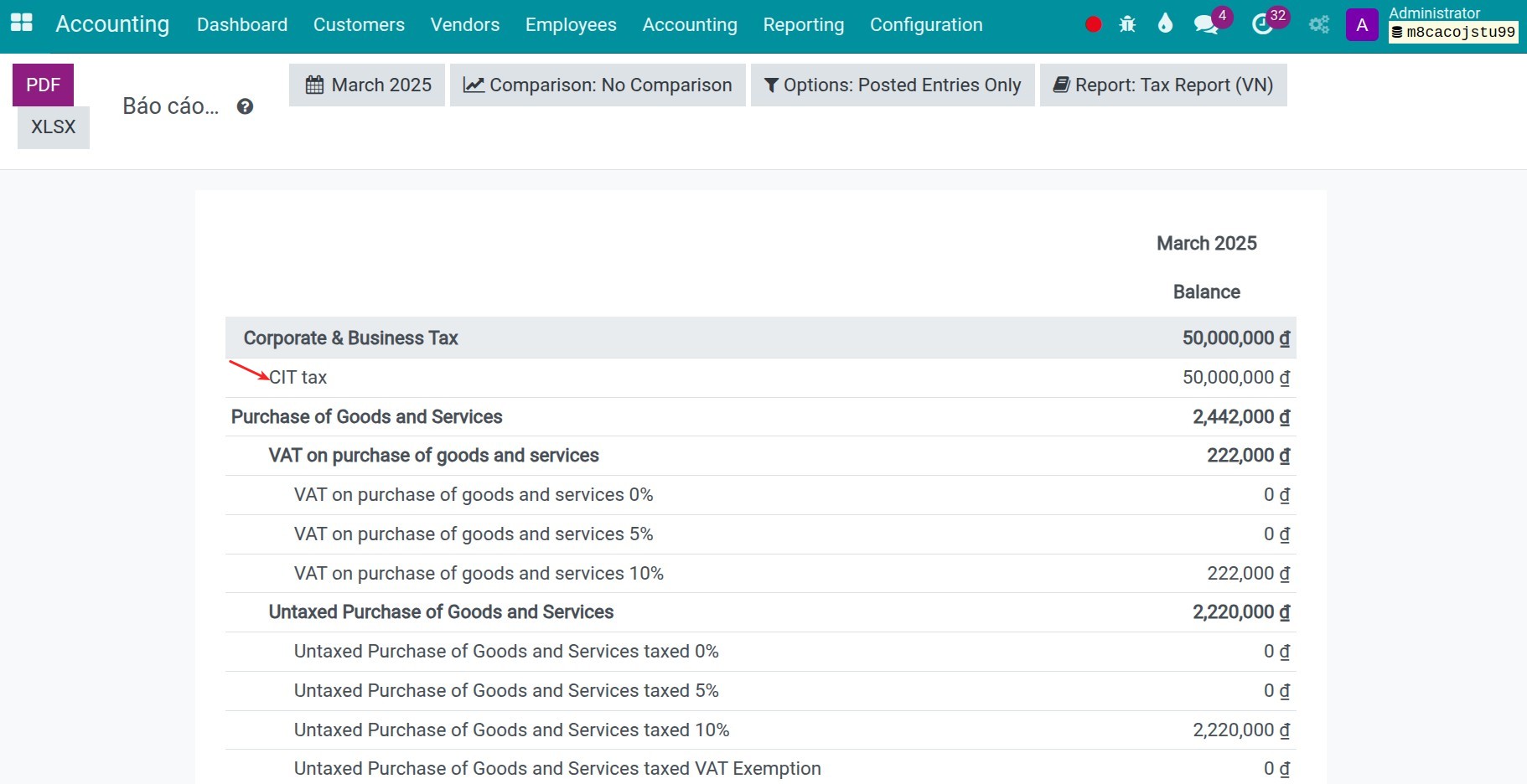

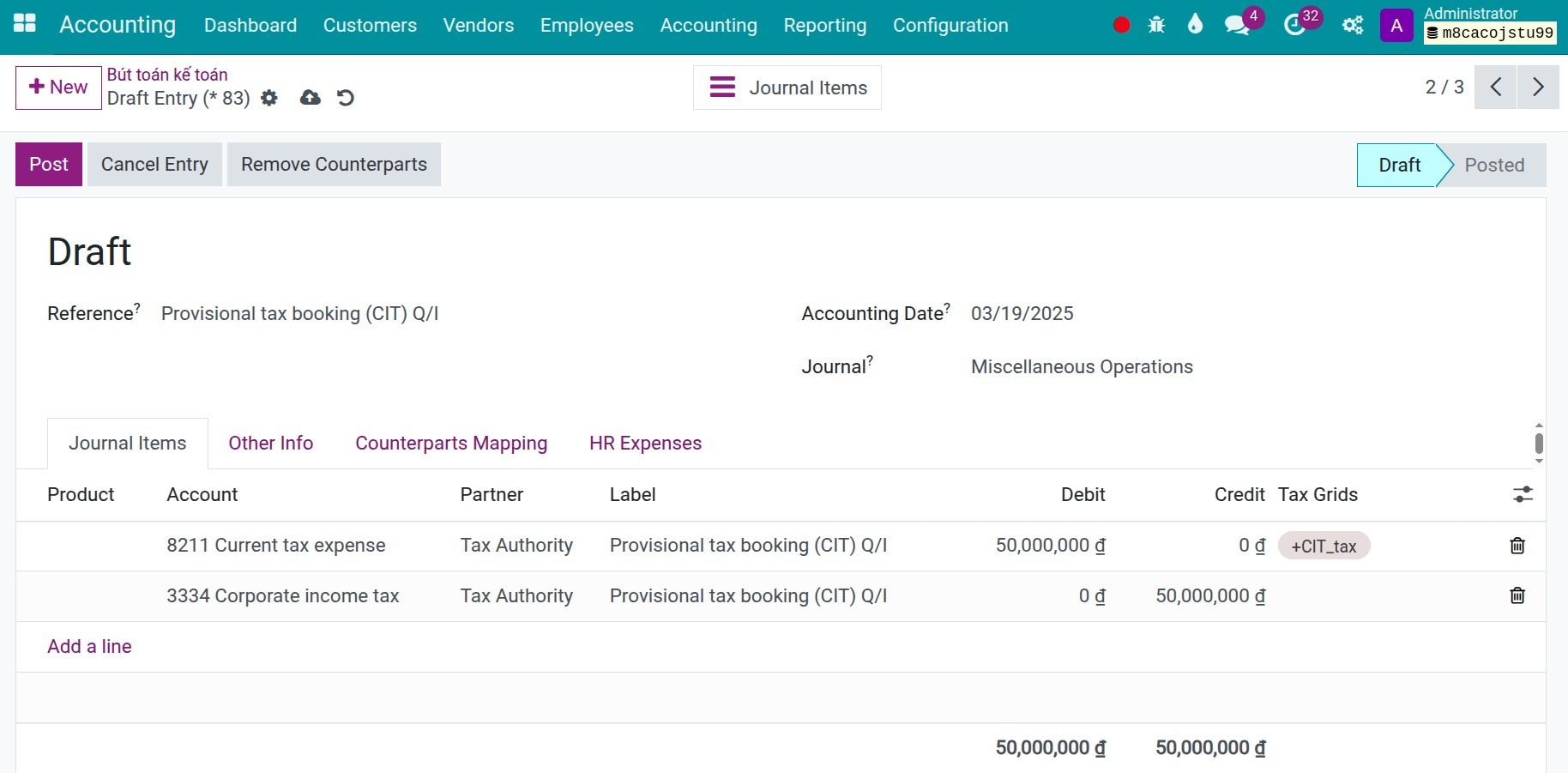

For provisional tax booking, navigate to Accounting > Accounting > Journal Entries, press New to create a new entry:

Reference: Input the reference information.

Press Add a line to:

Choose the debit and credit accounts in the Account field;

Choose the partner as the authority in the Partner field;

Input the details reference on Label field;

Input the amount in the Debit and Credit field;

If you want the CIT amount will appear on the Tax report, you can create a corresponding tax grids and choose it in the Tax Grids field.

![CIT tax on the tax report]()

Tax payment¶

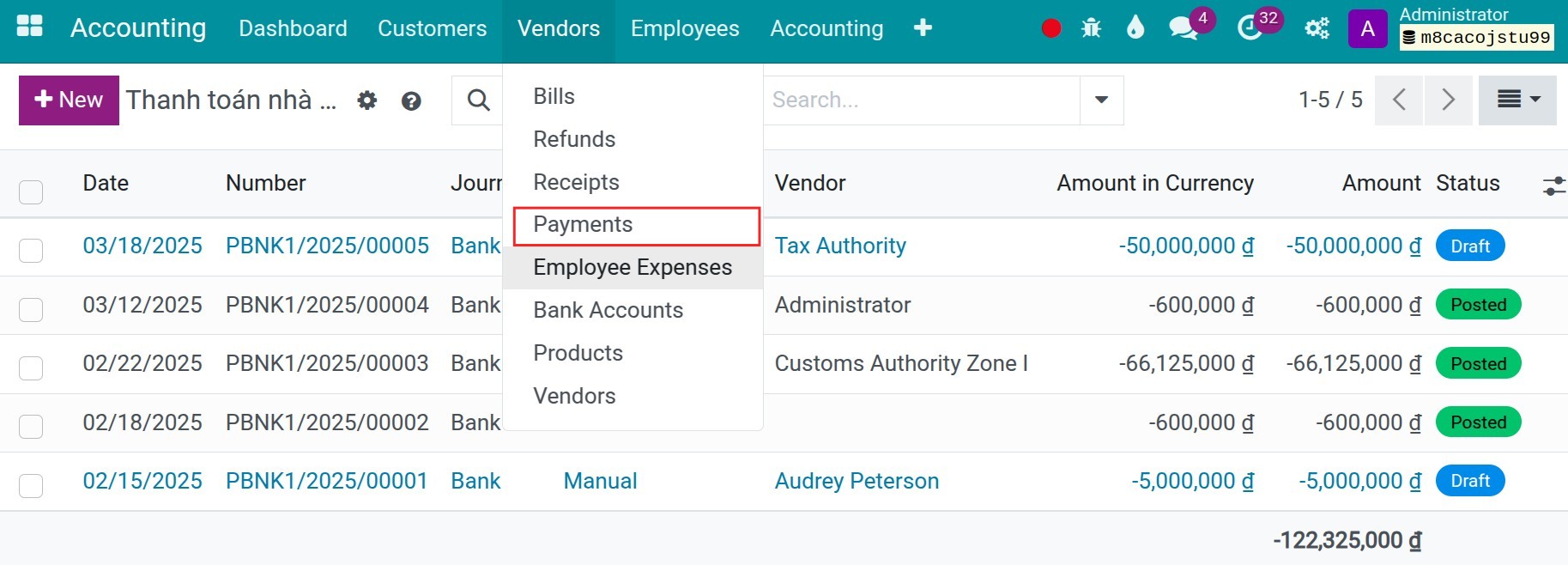

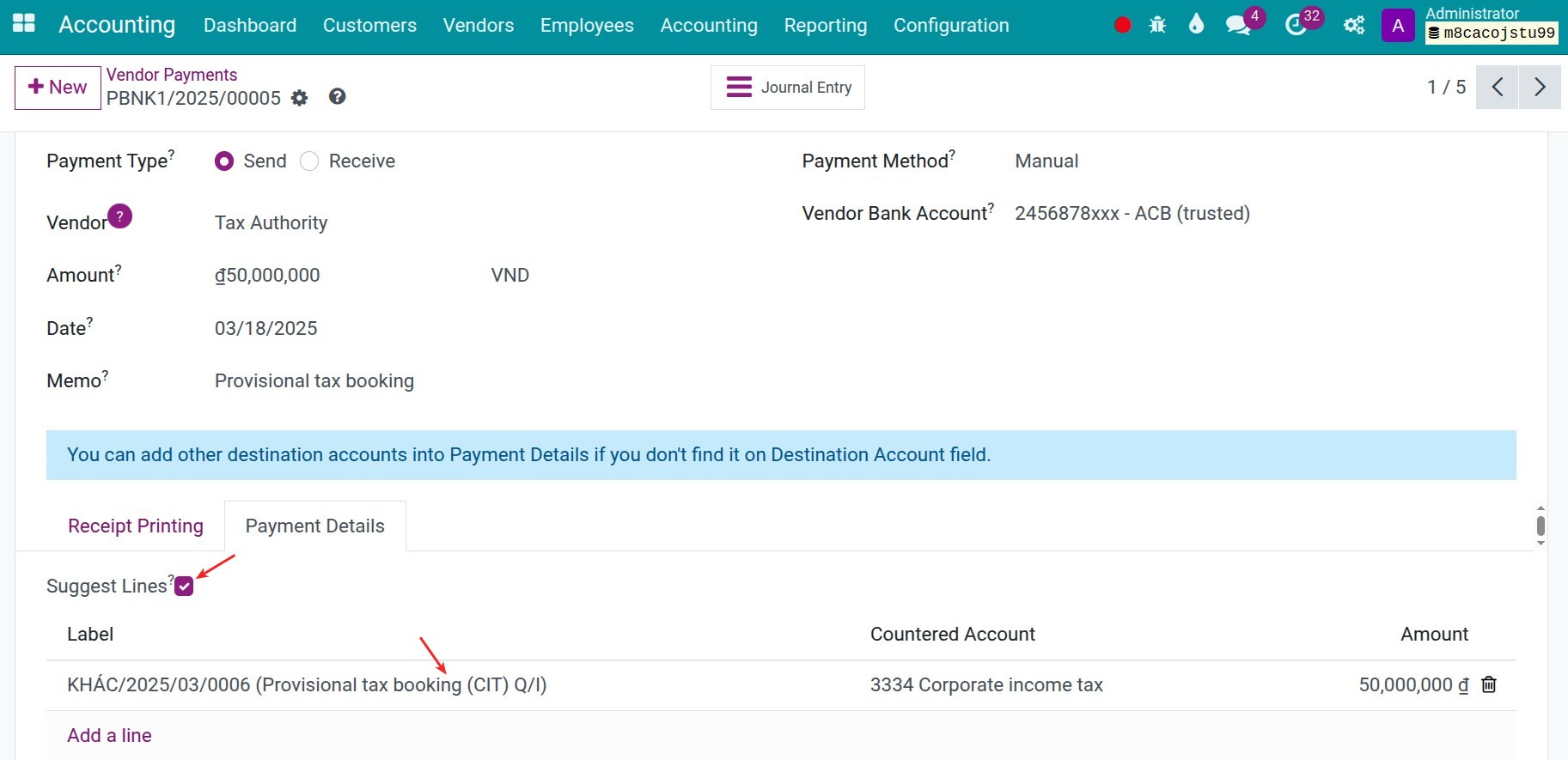

When doing a payment for the authority, navigate to Accounting > Vendors > Payments, press New to create a new payment:

Move to Payment Details tab, press to the Suggest Lines checkbox, the system will suggest all the journal items that related with the above Vendor.

Note

The Suggest Lines feature will work with all unreconciled journal items of the selected vendor above.

Press Confirm, then you can perform to do the reconciliation process for complete the payment process.

Tax finalization¶

After the finalization period and the business receives the tax finalization results, account will post the finalization journal entries. Navigate to Accounting > Accounting > Journal Entries, press New to create a finalization journal entry.

Value Added Tax (VAT)¶

Periodical VAT finalization¶

Accounting for output VAT is automatically processed when you select taxes on the vendor bill or perform an import goods transaction. Deductible VAT accounting is applied when taxes are selected on the customer invoices. At the end of the month or quarter (depending on the business tax period), the VAT settlement need to be performed.

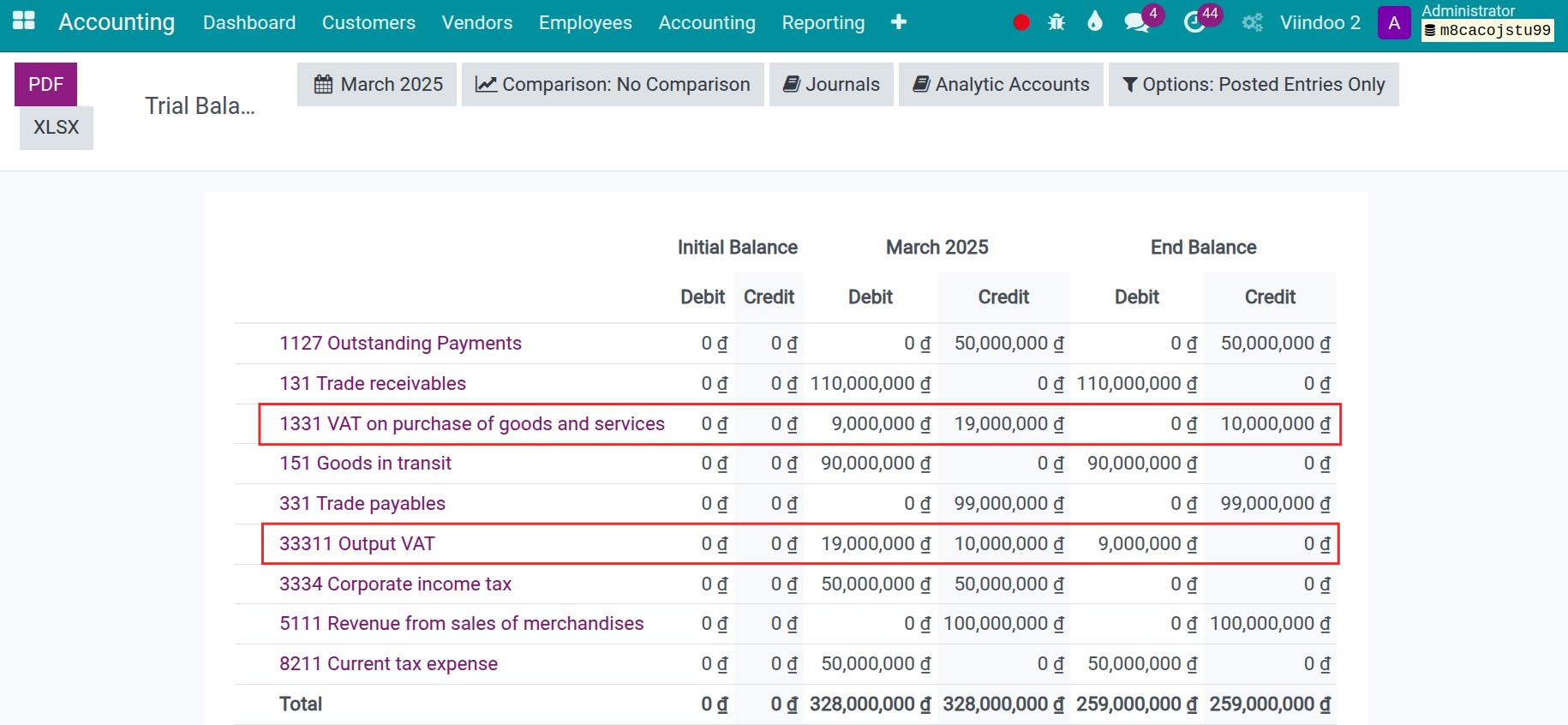

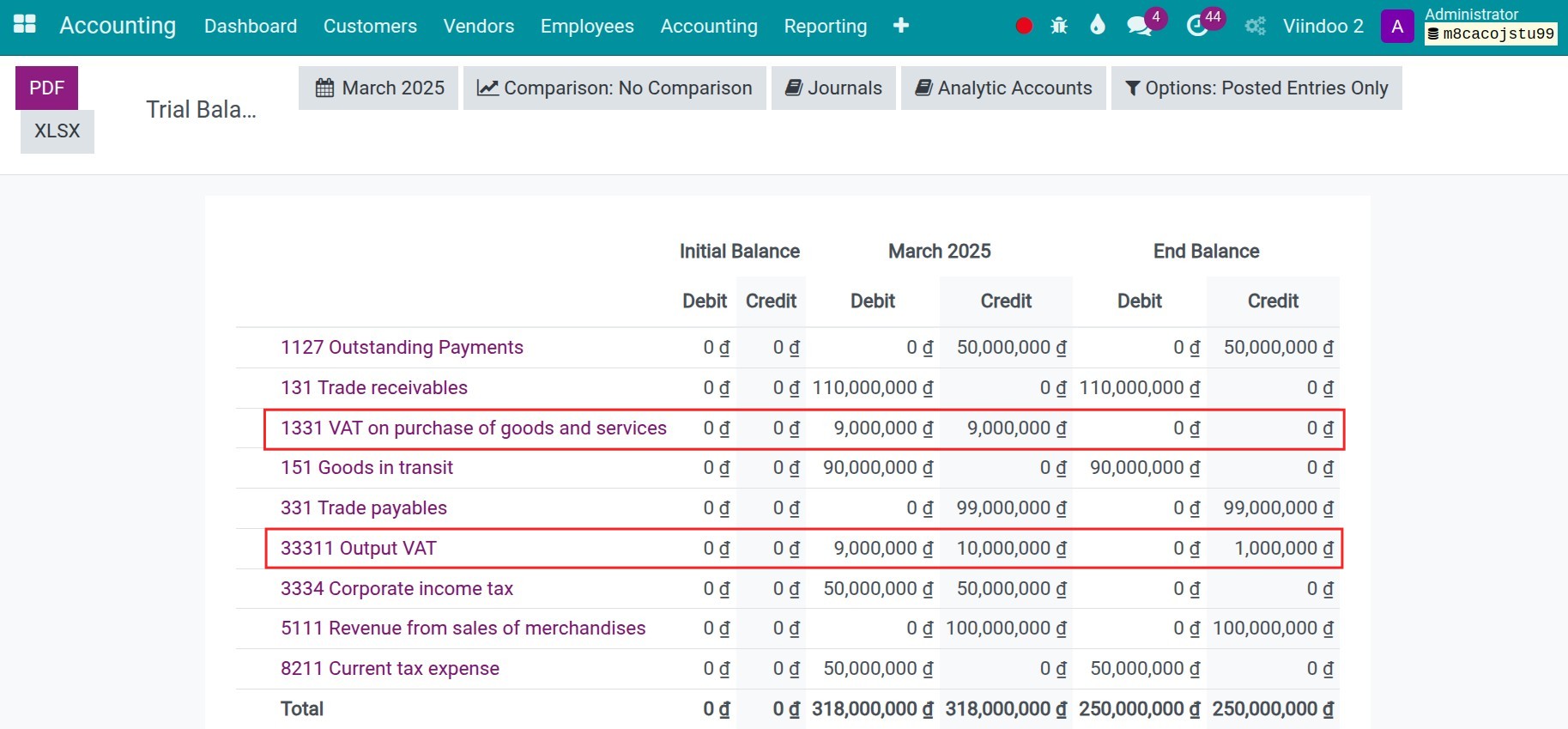

In Viindoo Accounting, you can review the Trial Balance to get the balance amount of the output VAT and deductible VAT.

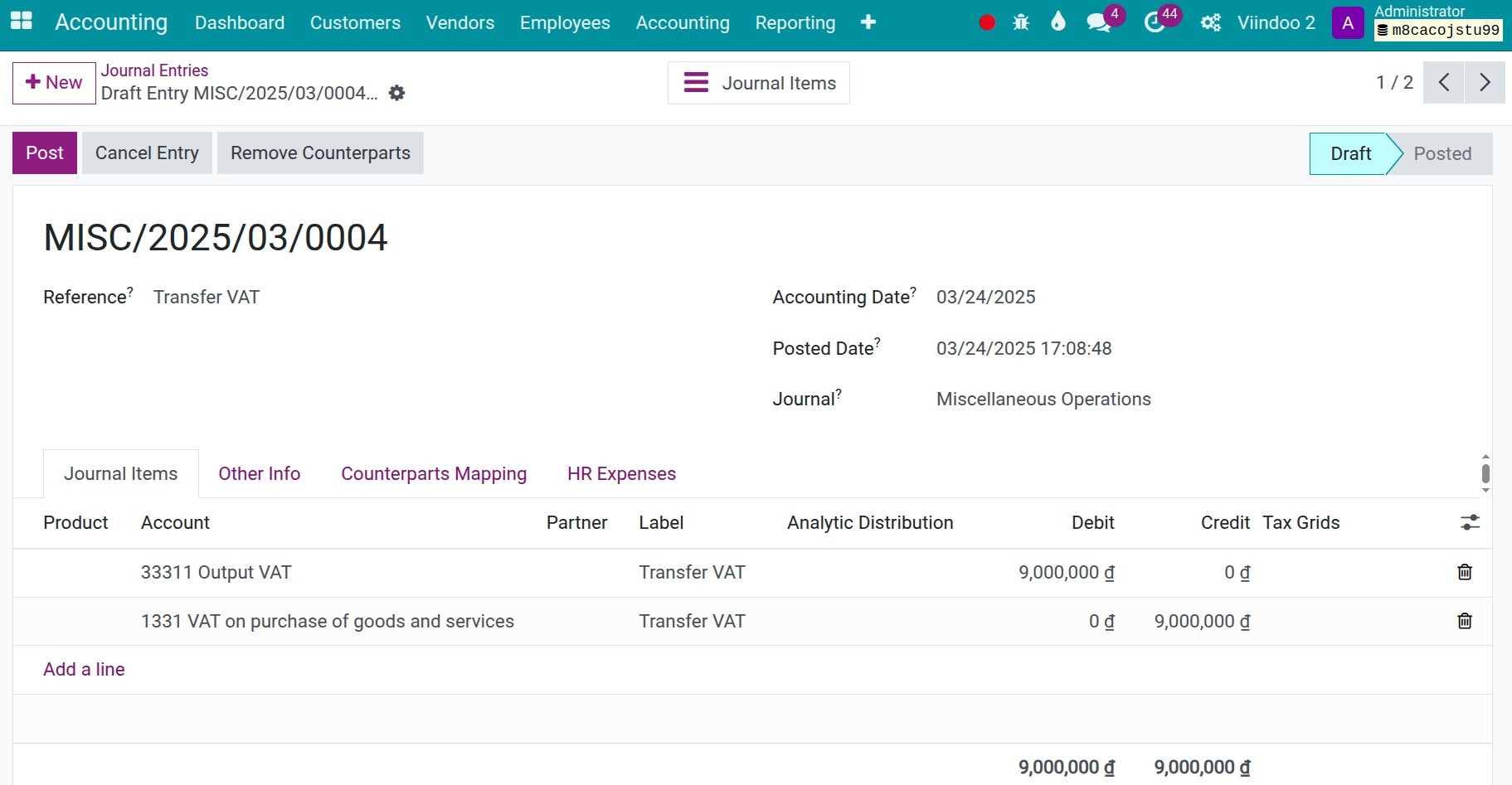

Then, navigate to Accounting > Accounting > Journal Entry to create a VAT finalization entry:

Note

You should make the transfer entry with the amount of the account that has a lower value.

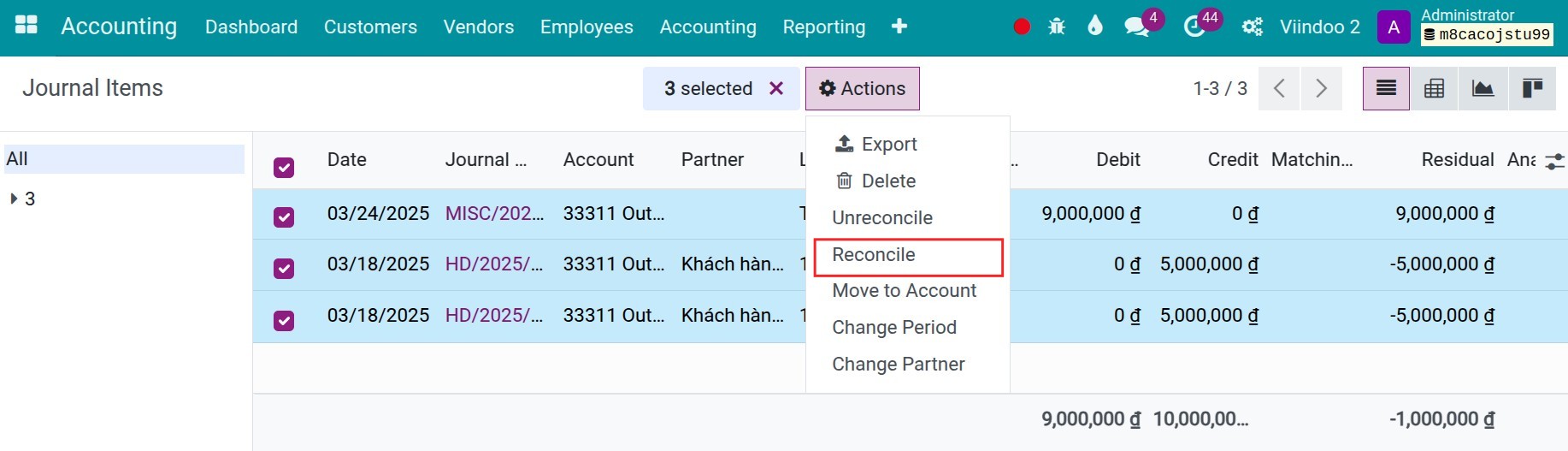

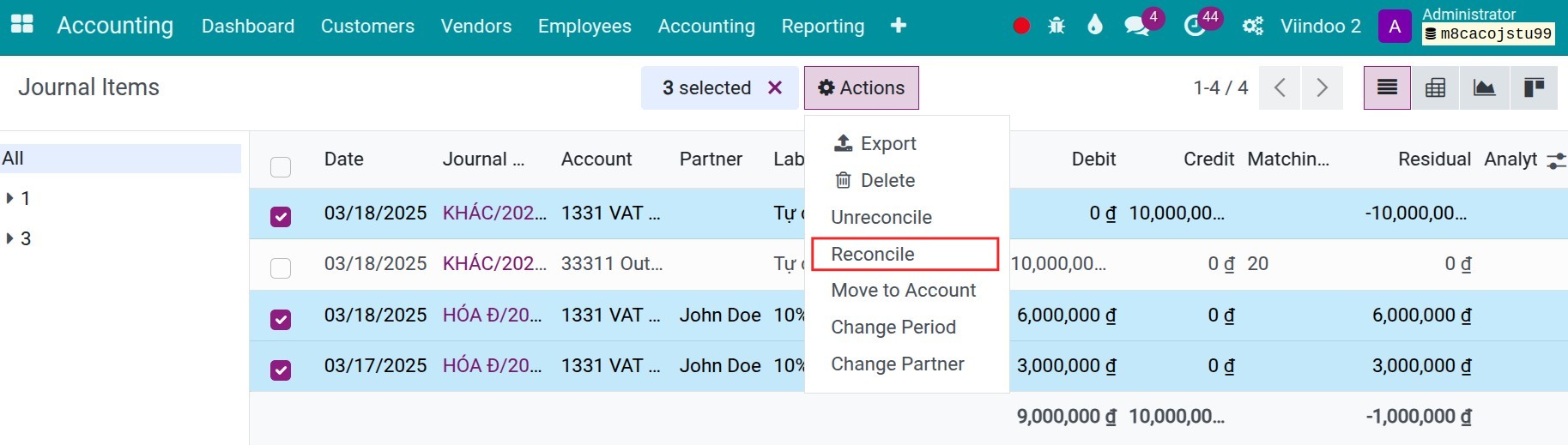

Next, navigate to Accounting > Accounting > Journal Items, use the filter to search the output VAT journal items, choose them, then press Action > Reconcile:

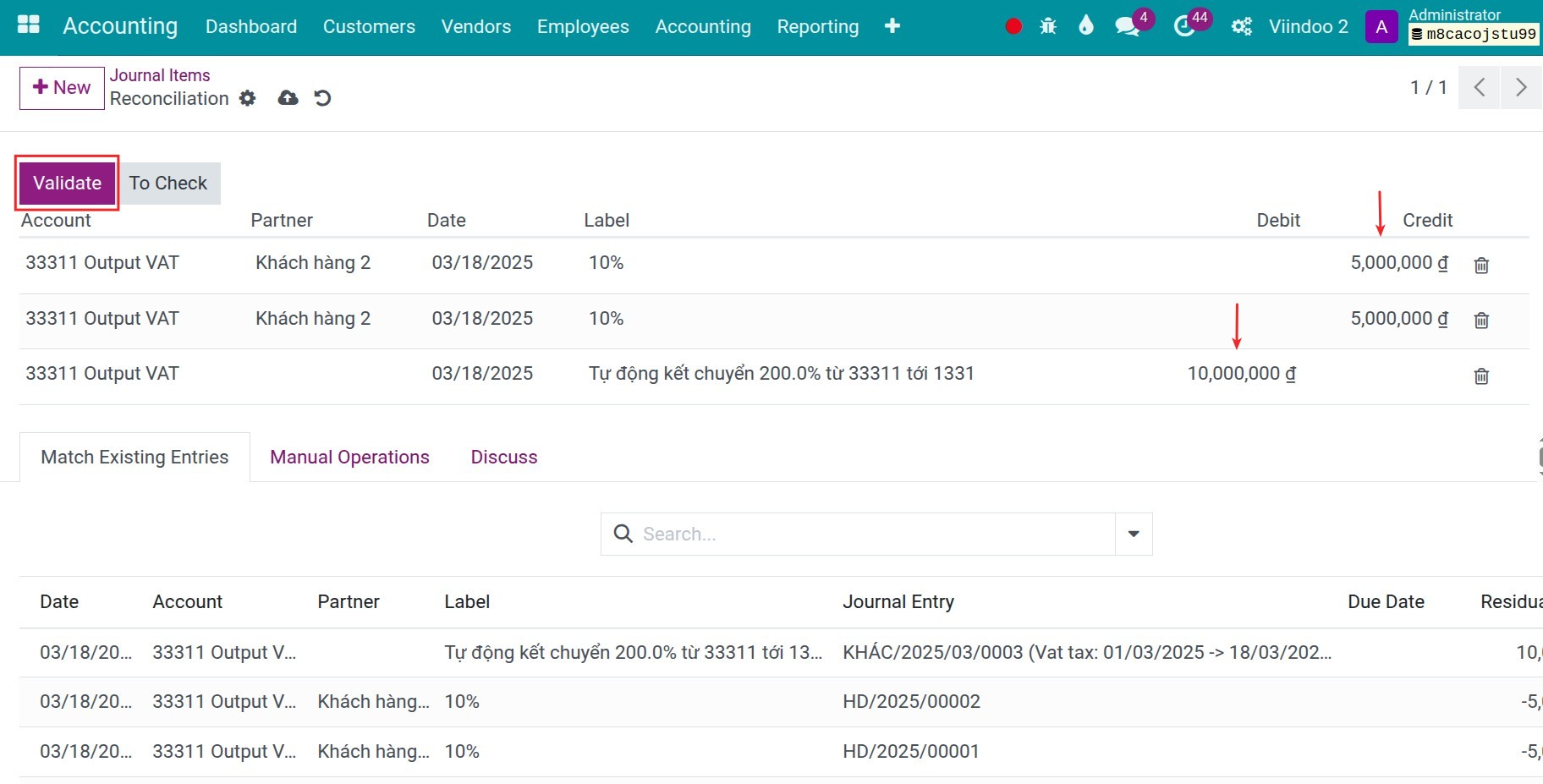

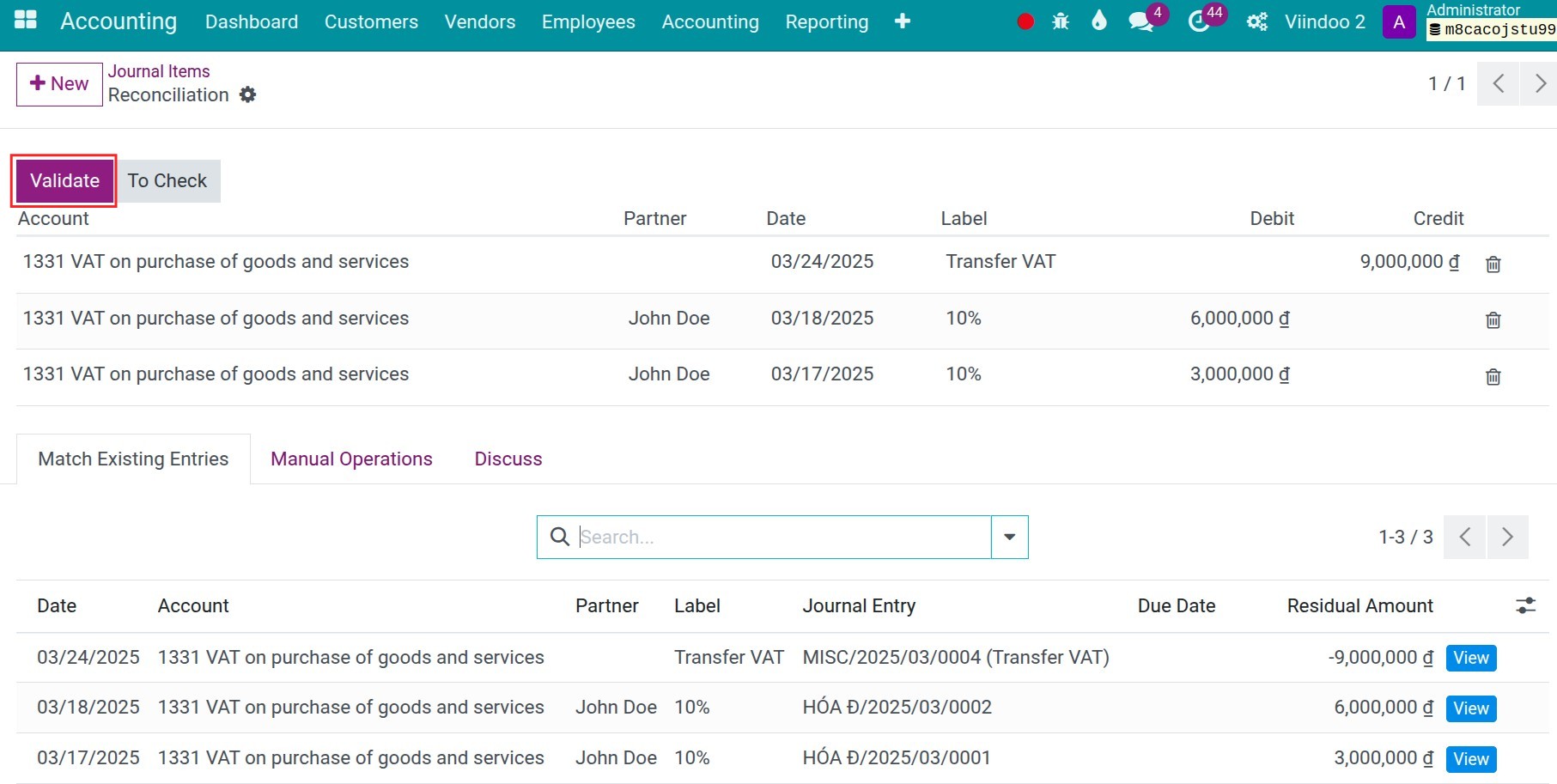

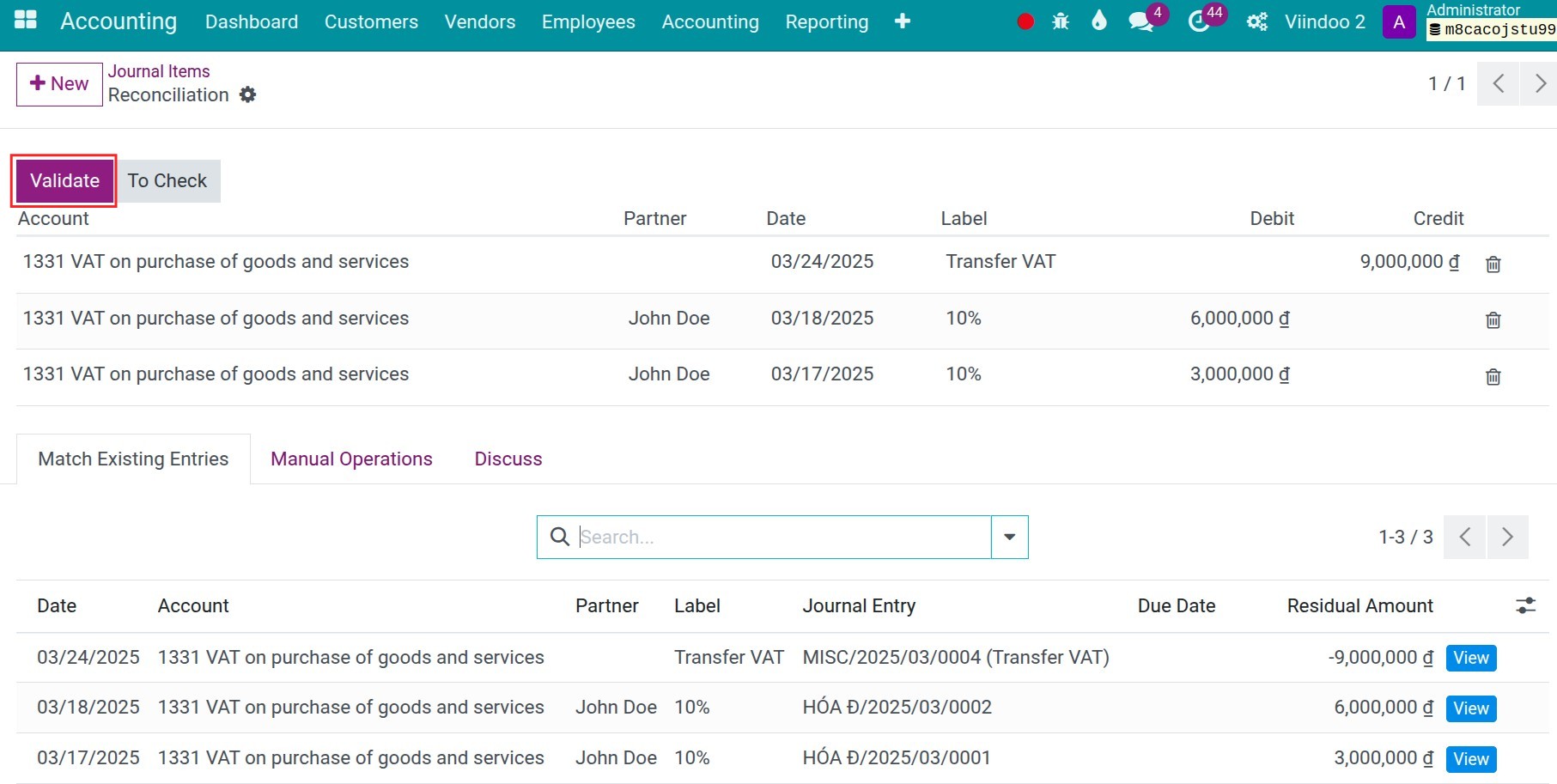

Then continue to reconcile with the deductible VAT:

For the account that offsets, you still keep the deductible VAT. It mean, you hang on the balance on this account. To do that, press to the offset item, move to Manual Operations tab and enter the deductible VAT in the Account field.

Note

You can only select the unreconciled journal items for reconciliation. This means that only journal items without a matching number should be chosen.

After reconciling, you can go to the Trial Balance to see the different amount, the remain amount need to be paid or be refund:

VAT payment¶

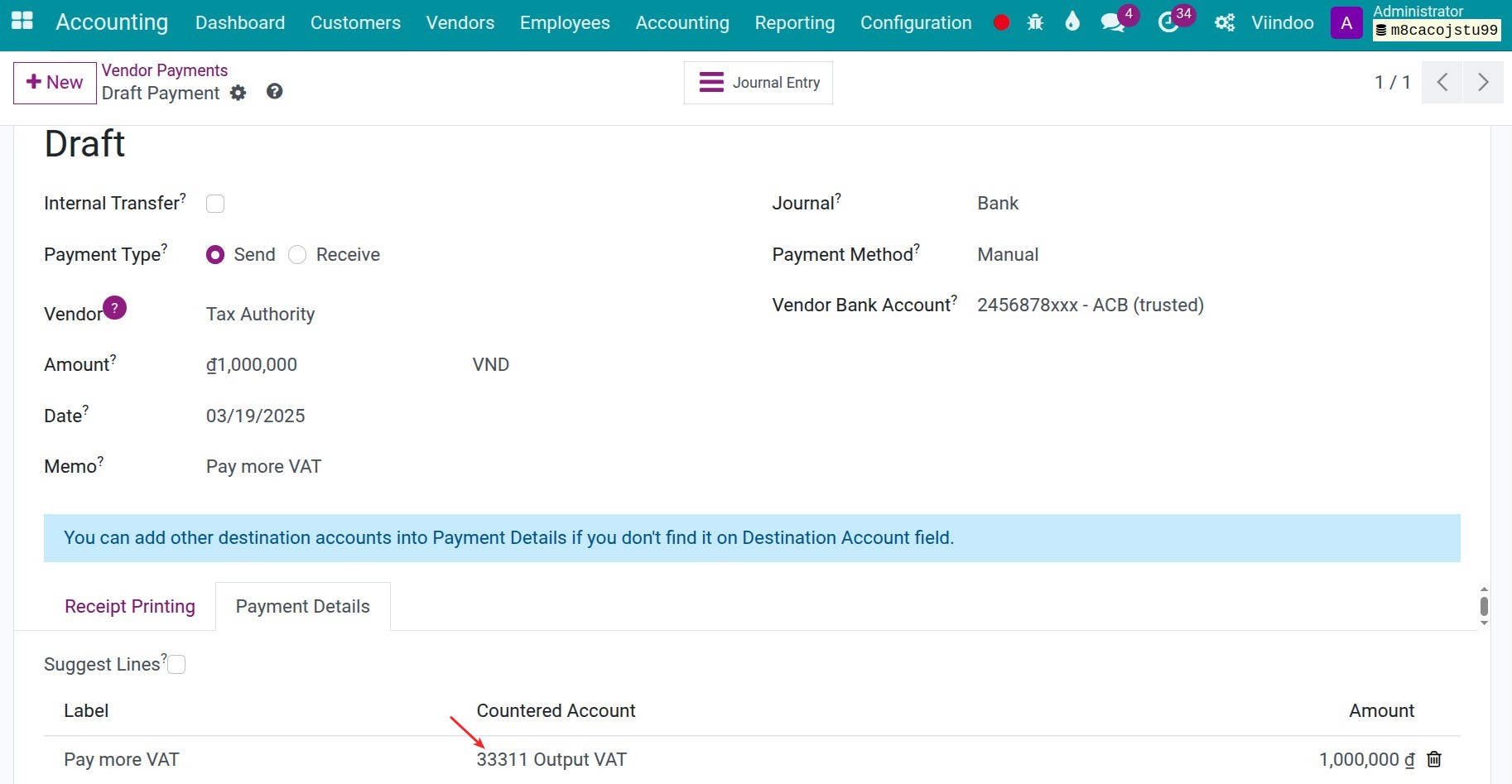

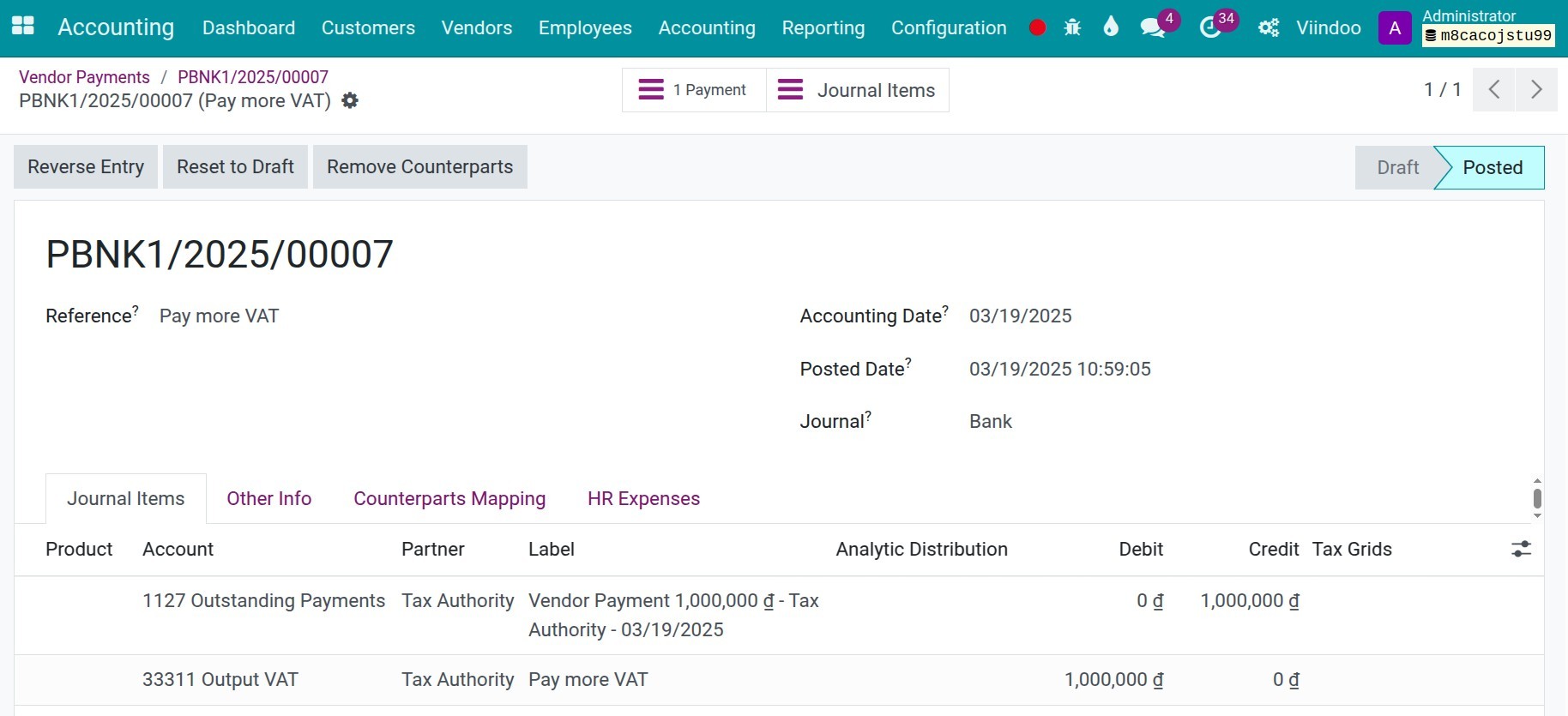

In case of the Output VAT is greater than deductiable VAT, the business will need to pay more the extra money. When you process to pay, navigate to Accounting > Vendors > Payments, press New to create a new tax payment with some special notes:

Payment type: Send;

Countered Account: The Output VAT account.

VAT refund¶

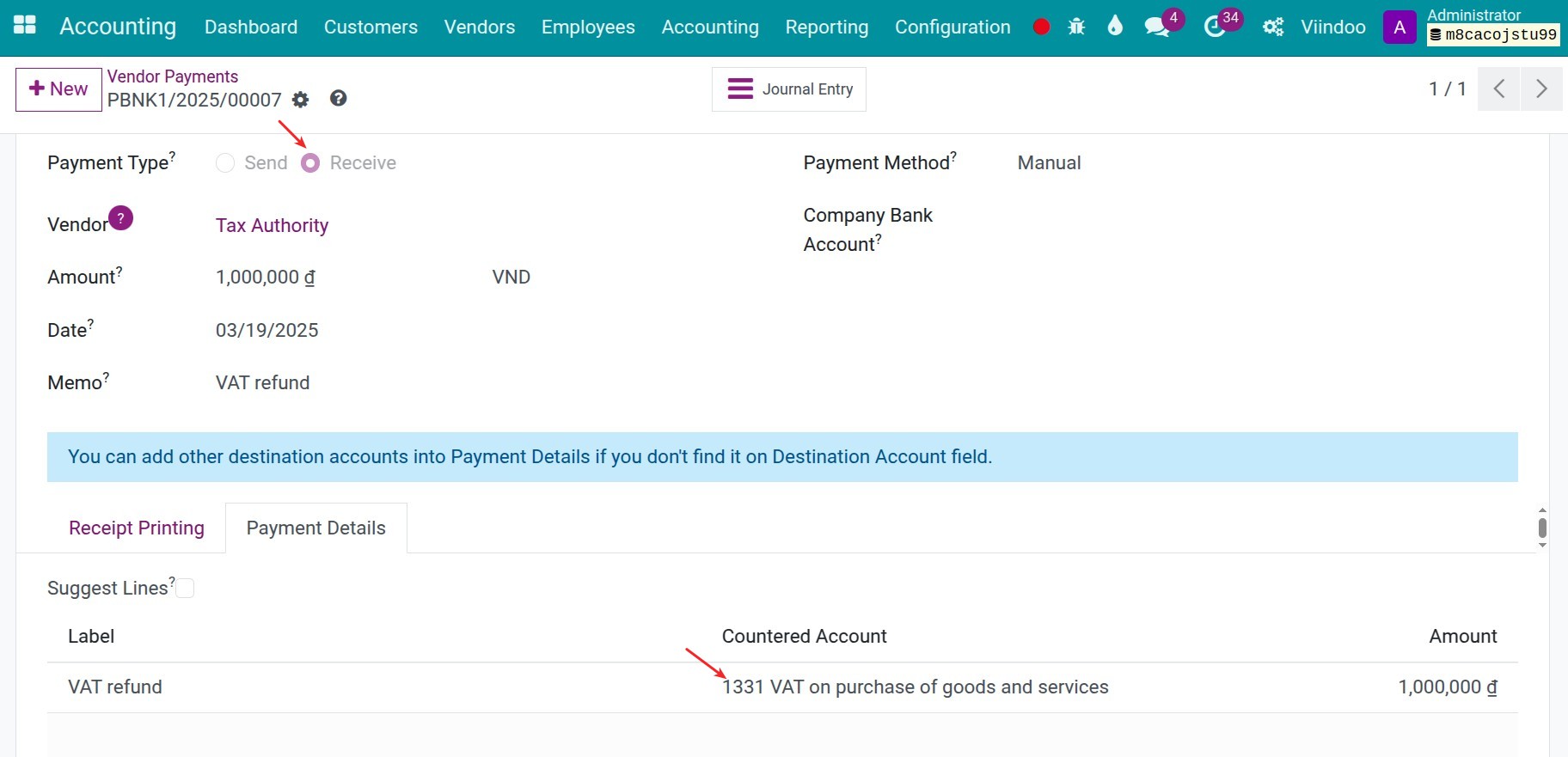

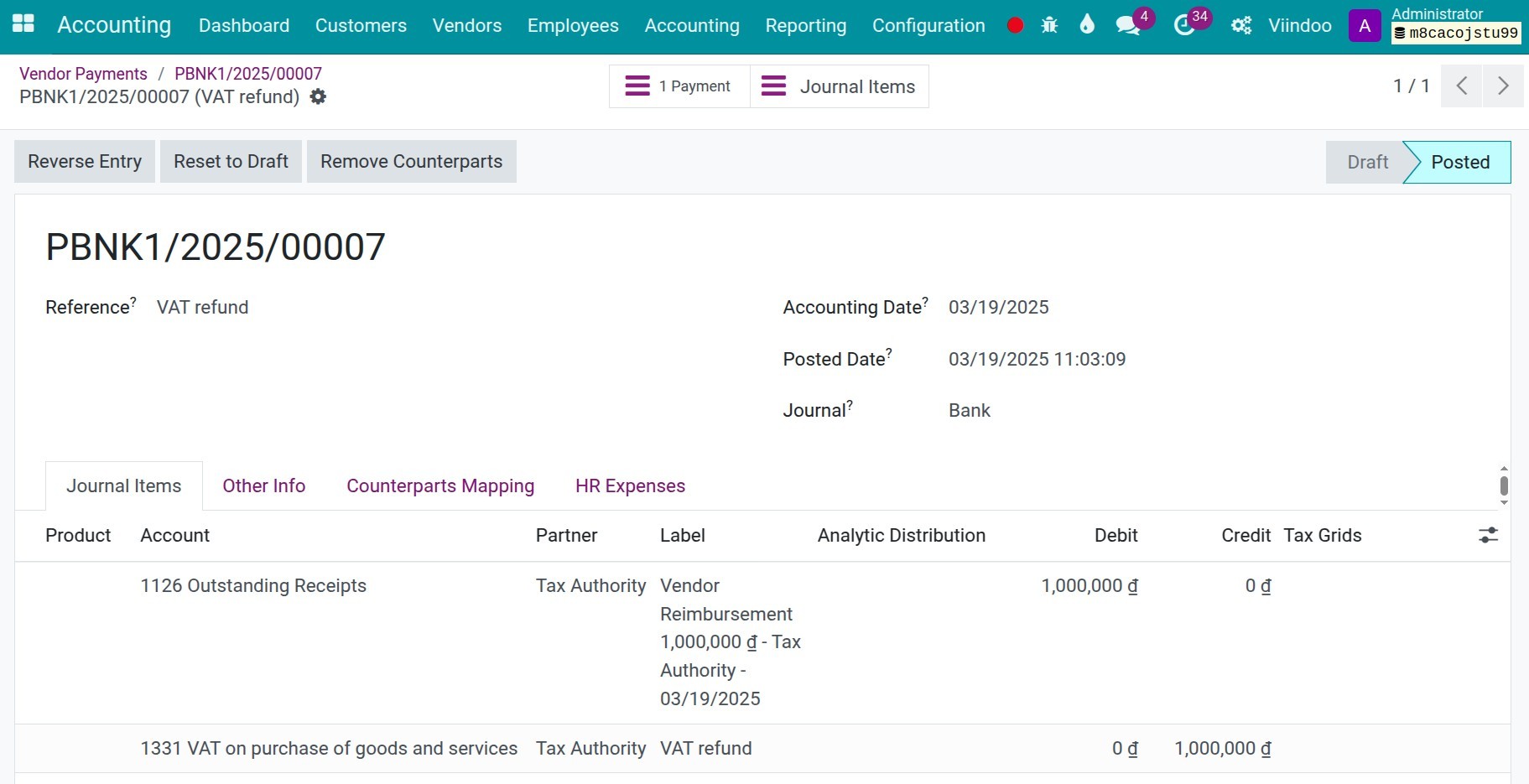

In case of the Output VAT is less than deductiable VAT, the business will receive the tax refund. When receive the refund, navigate to Accounting > Vendors > Payments, press New to create a new tax payment with some special notes:

Payment type: Receive;

Countered Account: The deductiable VAT account.

Import and Export Tax (IET)¶

For the Import tax, please follow this articles Process for Import Tax

For the Export tax, please follow this articles Process for Export Tax

For the IET report, please follow this guidance Import Export Tax reports

Personal Income Tax (PIT)¶

Periodical PIT¶

When you go through the Salary process with Viindoo Payrolls, all the salary journal items, insurance journal items and personal tax journal items.

Periodical PIT payment¶

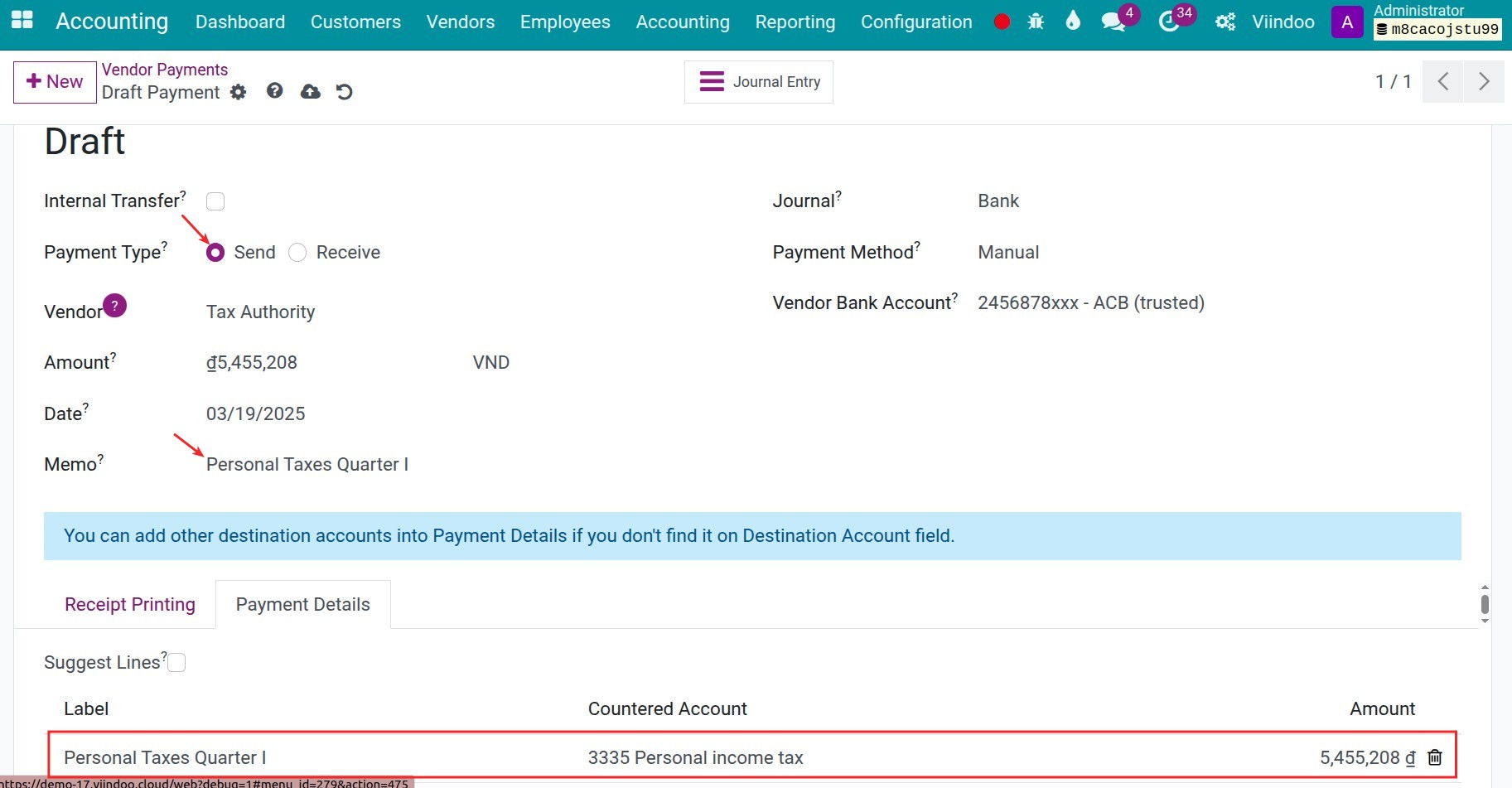

Every quarter or month (depending on the business taxes period), you need to state the personal taxes and perform the personal taxes payments. When doing a payment for the authority, navigate to Accounting > Vendors > Payments, press New to create a new payment:

Some informations that need to be noted:

Payment Types: Select Send.

Memo: Input the details of memo.

Move to Payment Details tab and input the below information:

Label: Input the details of memo.

Countered Account: Select the Personal income tax account.

Amount: Input the tax amount. You can go to the Trial Balance to see the balance of personal tax income.

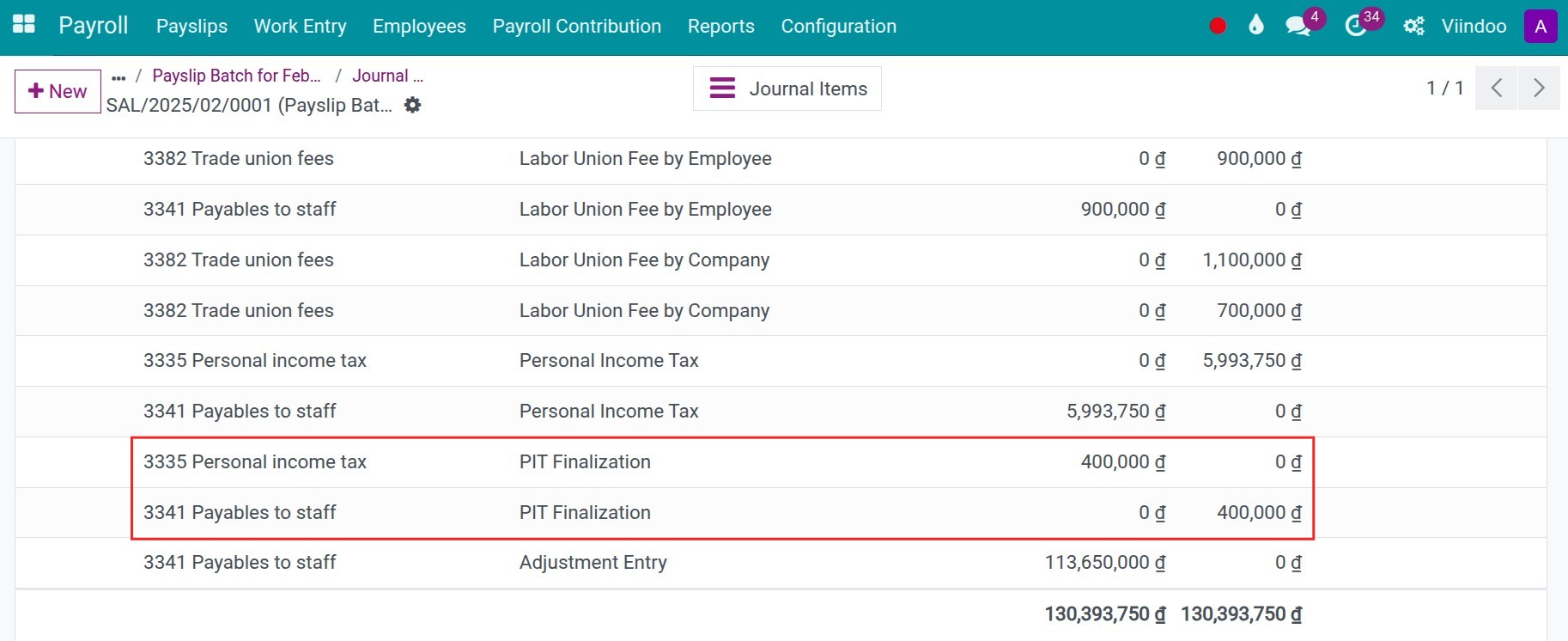

Annual PIT finalization¶

At the end of the year, after performing the personal income tax finalization, you can input the number of refunds or payments for each employee on their salary slips. The system will automatically post a finalization journal entry of PIT.

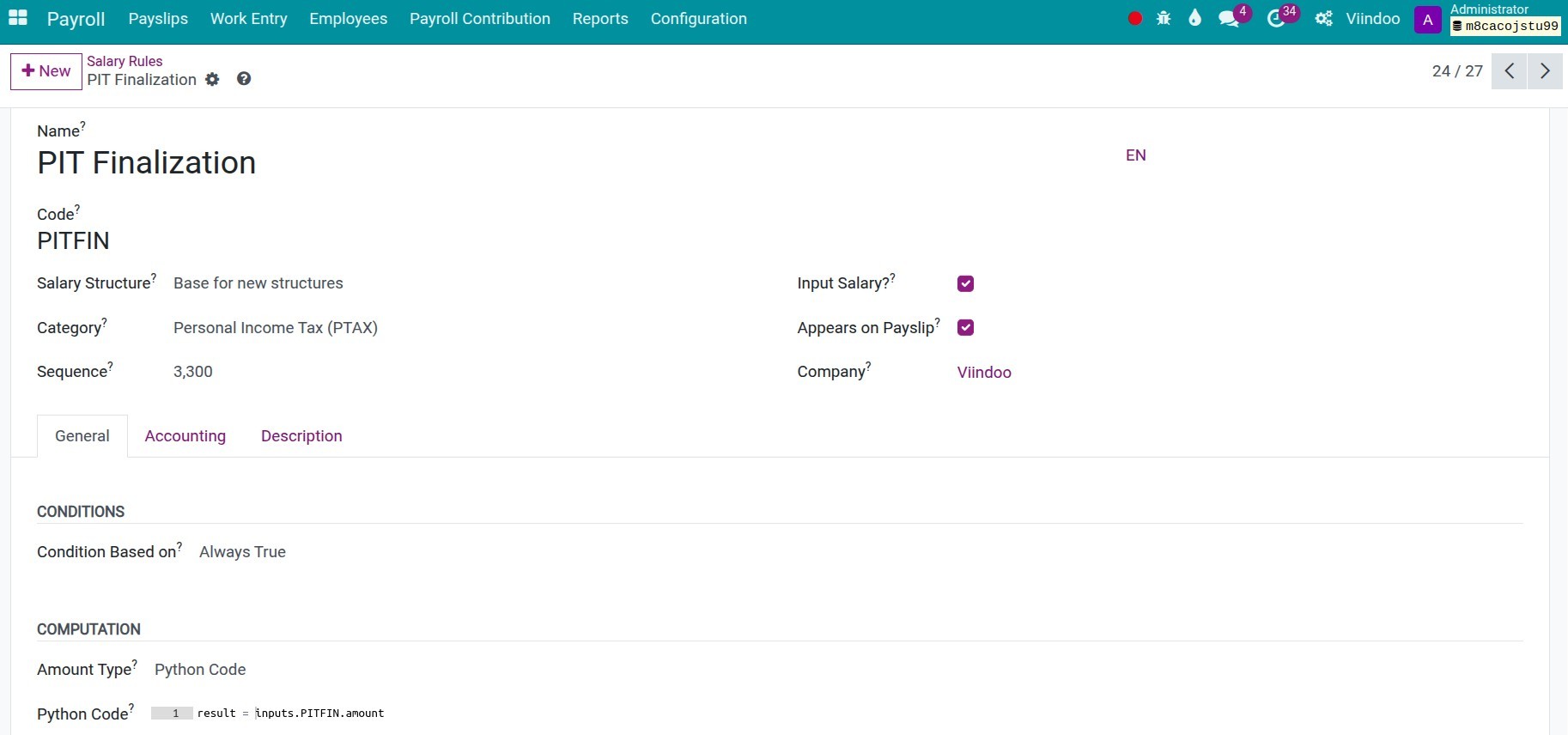

To do that, you need to state a Finalization PTI salary rule:

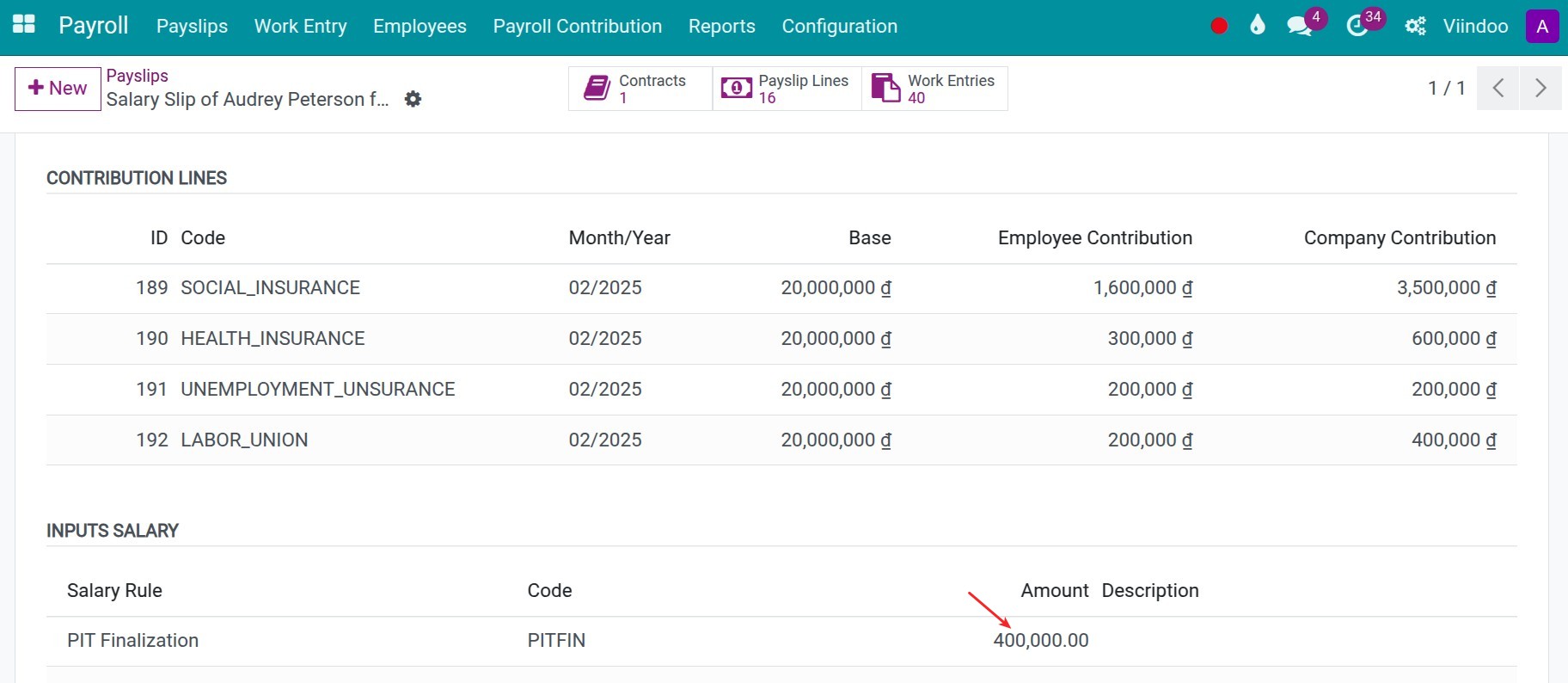

In each employee’s salary slip, input the amount according to the salary rule:

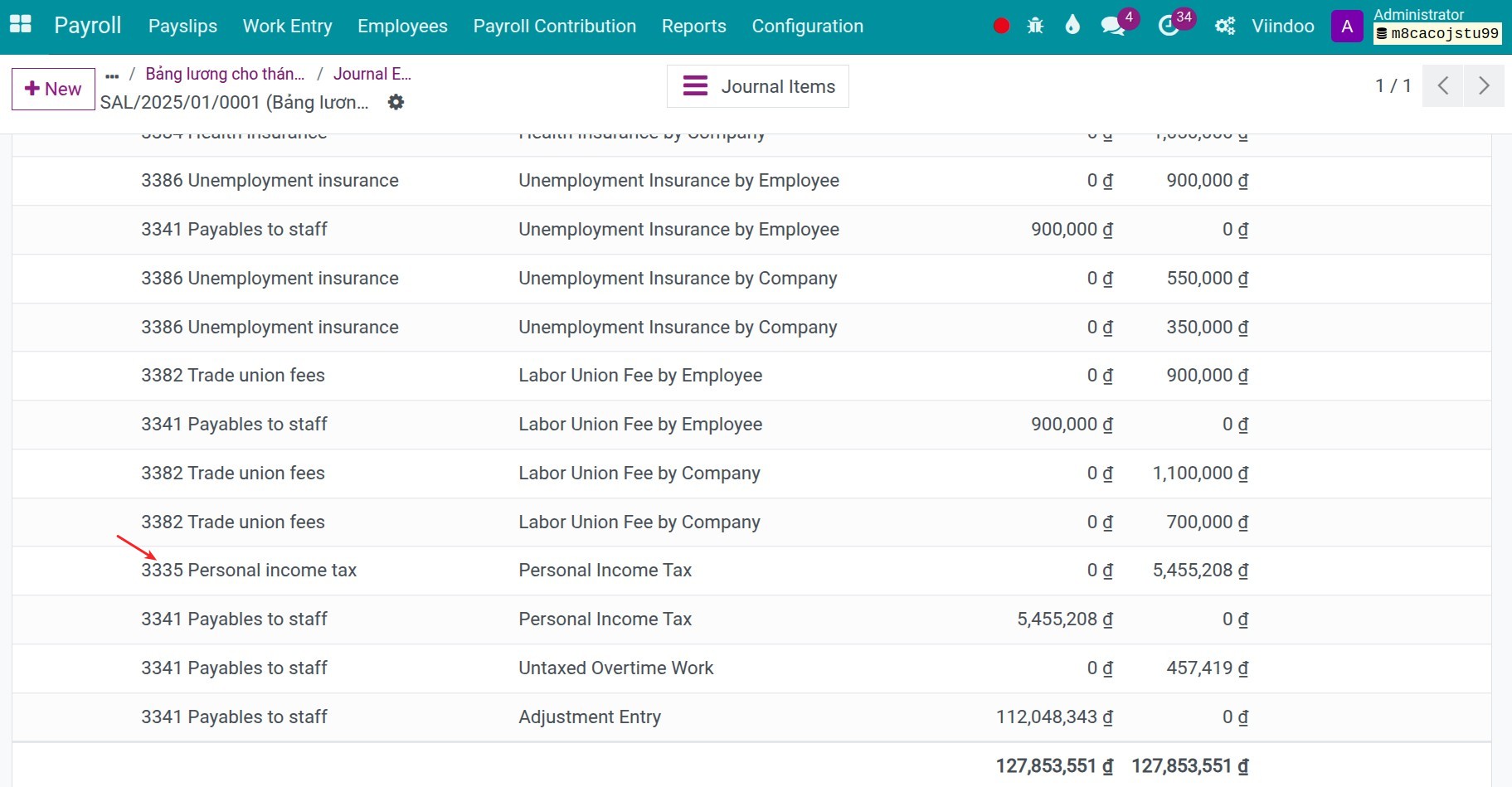

After confirming the salary batch, you can see the PIT journal items:

Note

This PIT refund can be deducted from the most recent period’s tax payment.

Other Taxes¶

Other taxes, such as land tax, environmental tax, property tax, etc., can be processed following the same steps as CIT.