Configure Cash Rounding method¶

Requirements

This tutorial requires the installation of the following applications/modules:

There are various situations in accounting and payment where you have to round cash to the smallest currency, for example, summing sales order amount, taxing, etc. Each country has different rules in cash rounding. Viindoo Accounting application offers two strategies (modify as tax amount and add a rounding line) with three methods (half-up, up, and down).

Cash rounding configuration¶

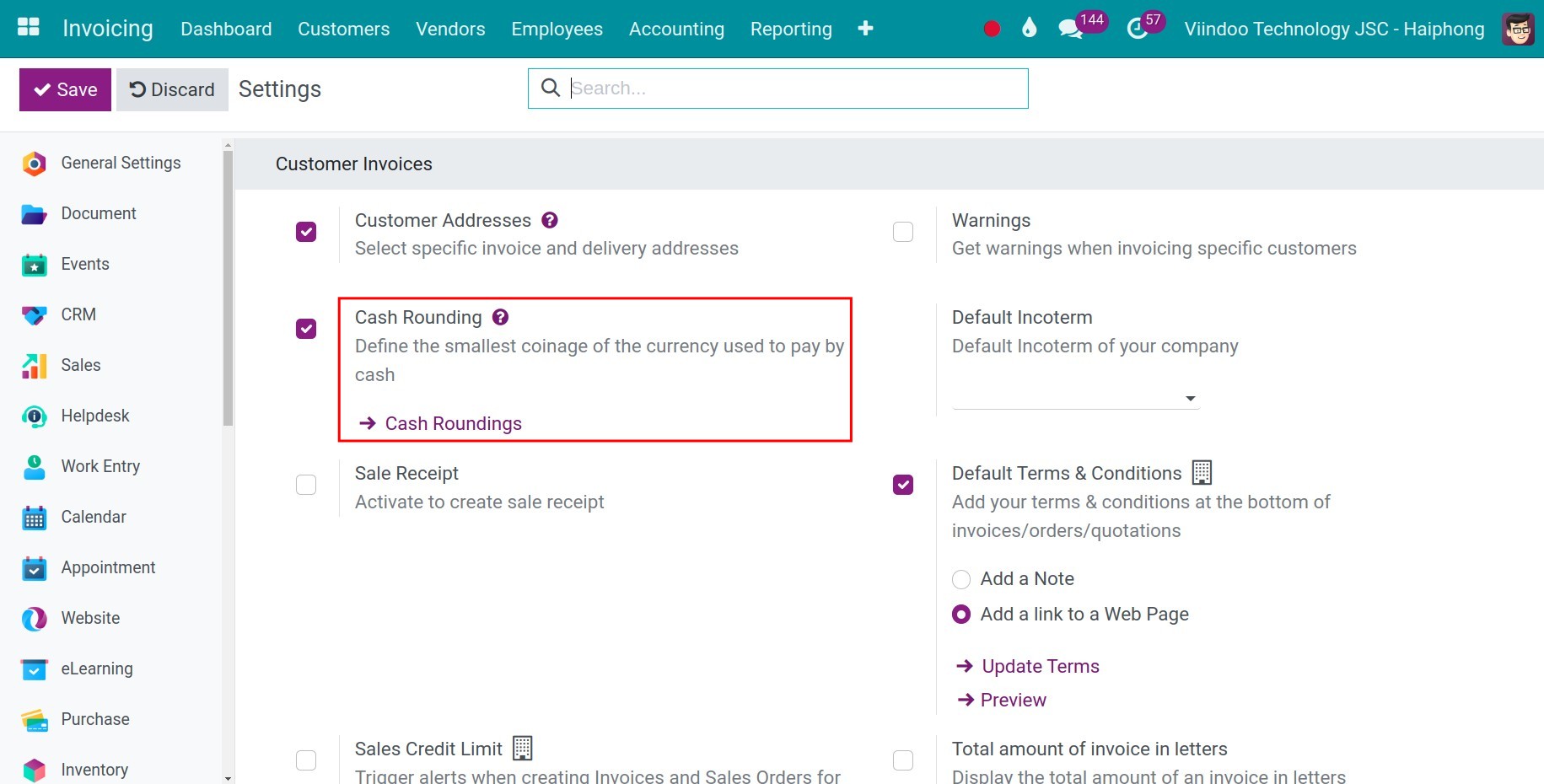

To configure Cash rounding, go to Accounting ‣ Configuration ‣ Settings then activate the Cash rounding feature by checking the Cash Rounding option and pressing the Save button.

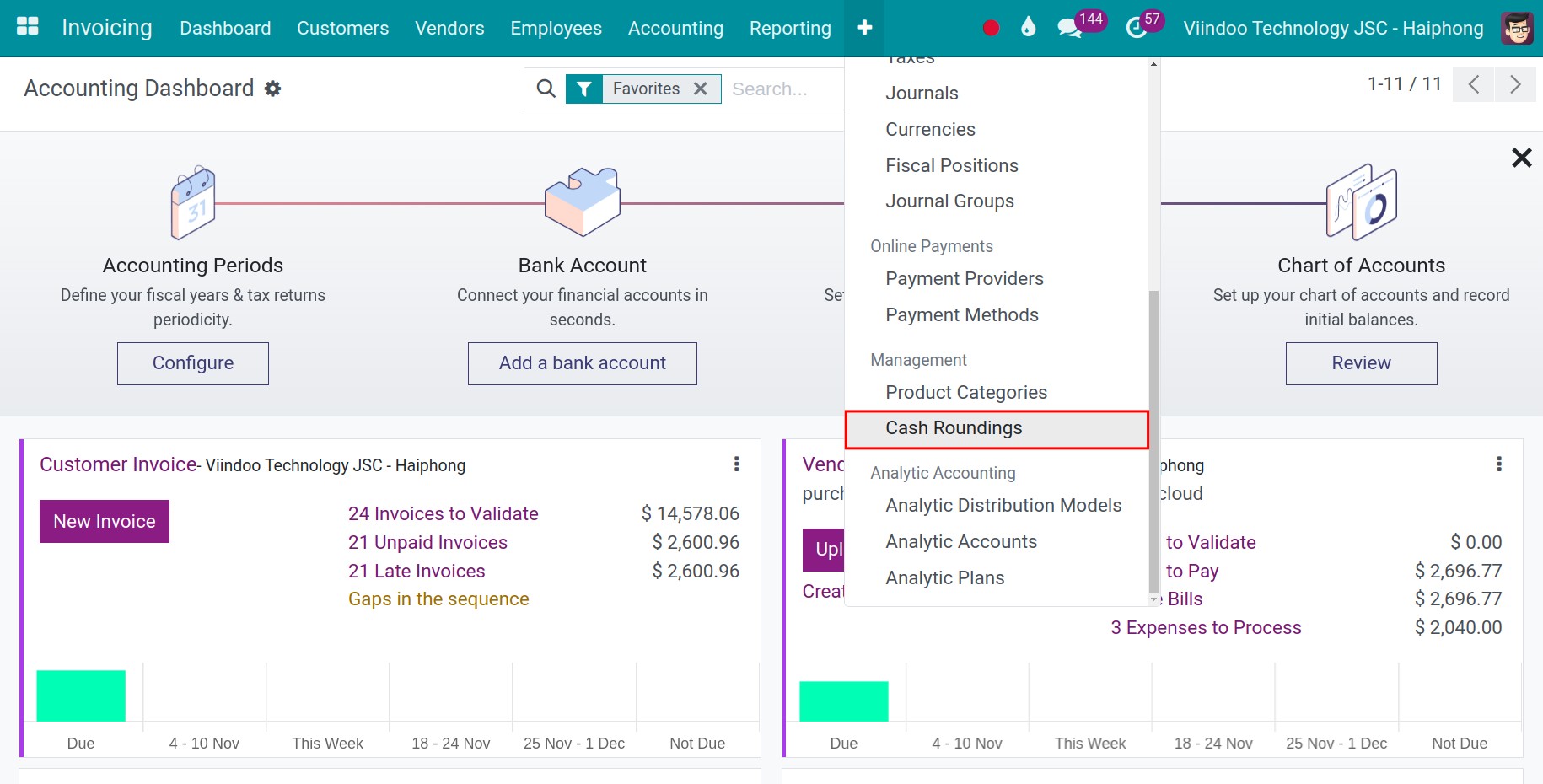

Next, back to Accounting application, access to Accounting ‣ Configuration ‣ Cash Roundings:

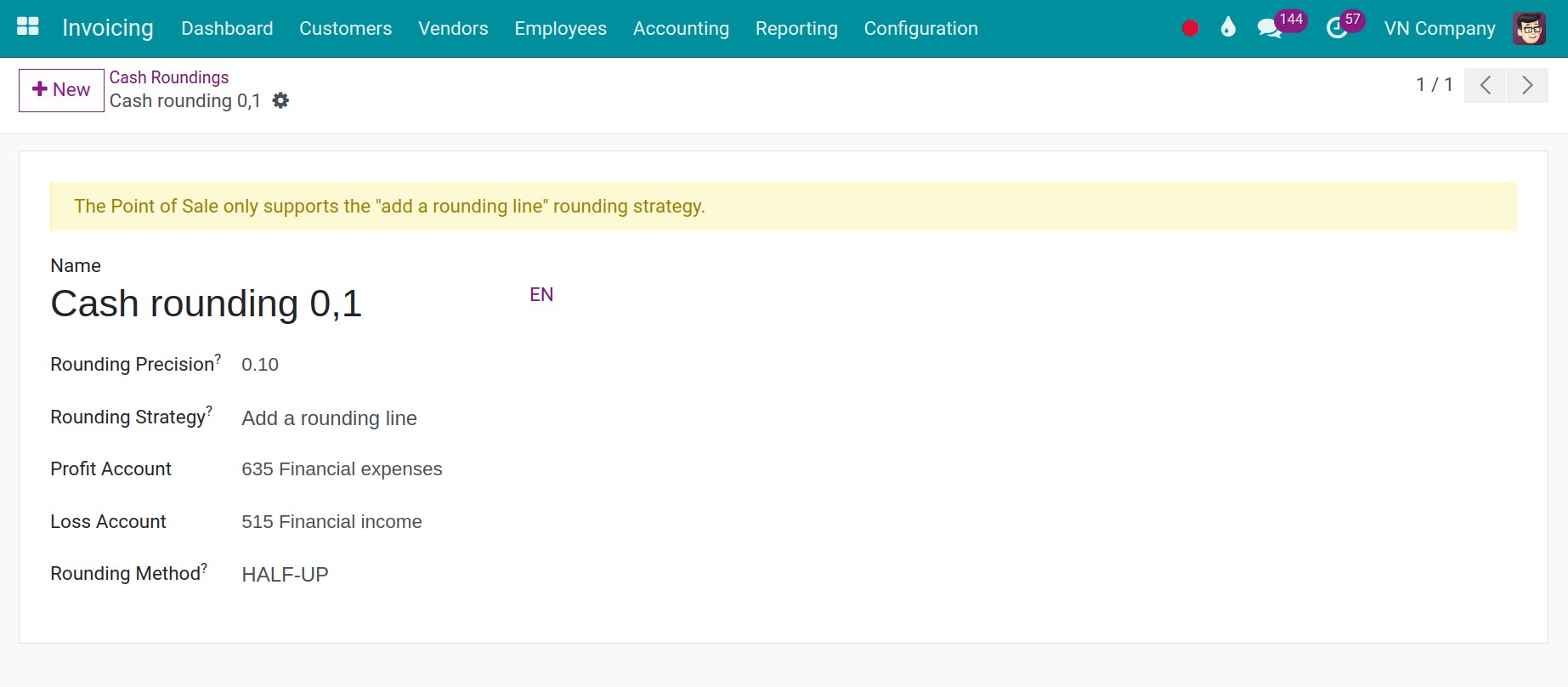

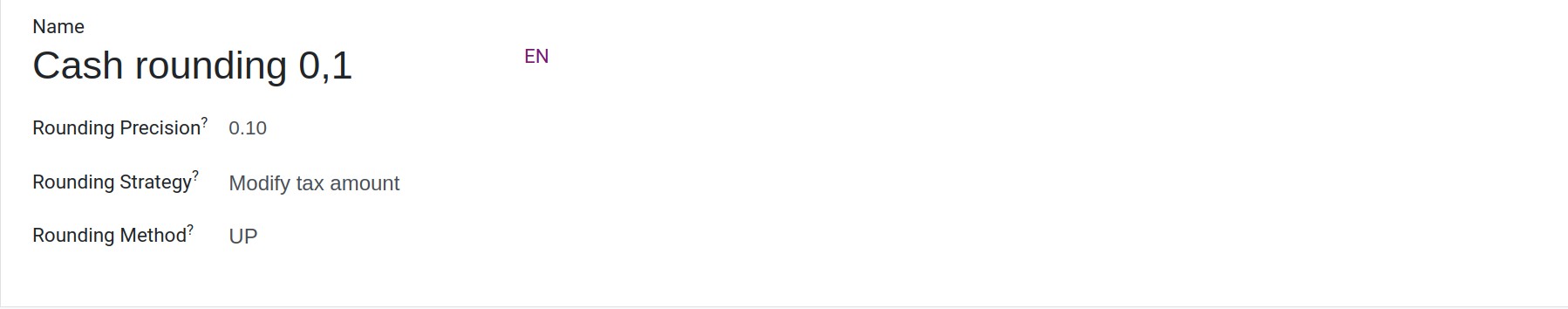

Select +New and fill in the form:

Name.

Rounding Precision: Define the non-zero smallest value of coinage that you want to round.

Rounding Strategy: Viindoo offers two strategies:

Add a rounding line: A line is automatically created to record the rounding. The different value after rounding is recorded in the profit or loss Account.

Profit Account: Records profit made from roundings, like Financial income.

Loss Account: Records loss from roundings, like Financial expenses.

Modify as tax amount: The tax amount will be rounded the value based on the below rounding methods and there is no rounding line created.

![Cash rounding- Modify as tax amount - Viindoo Accounting]()

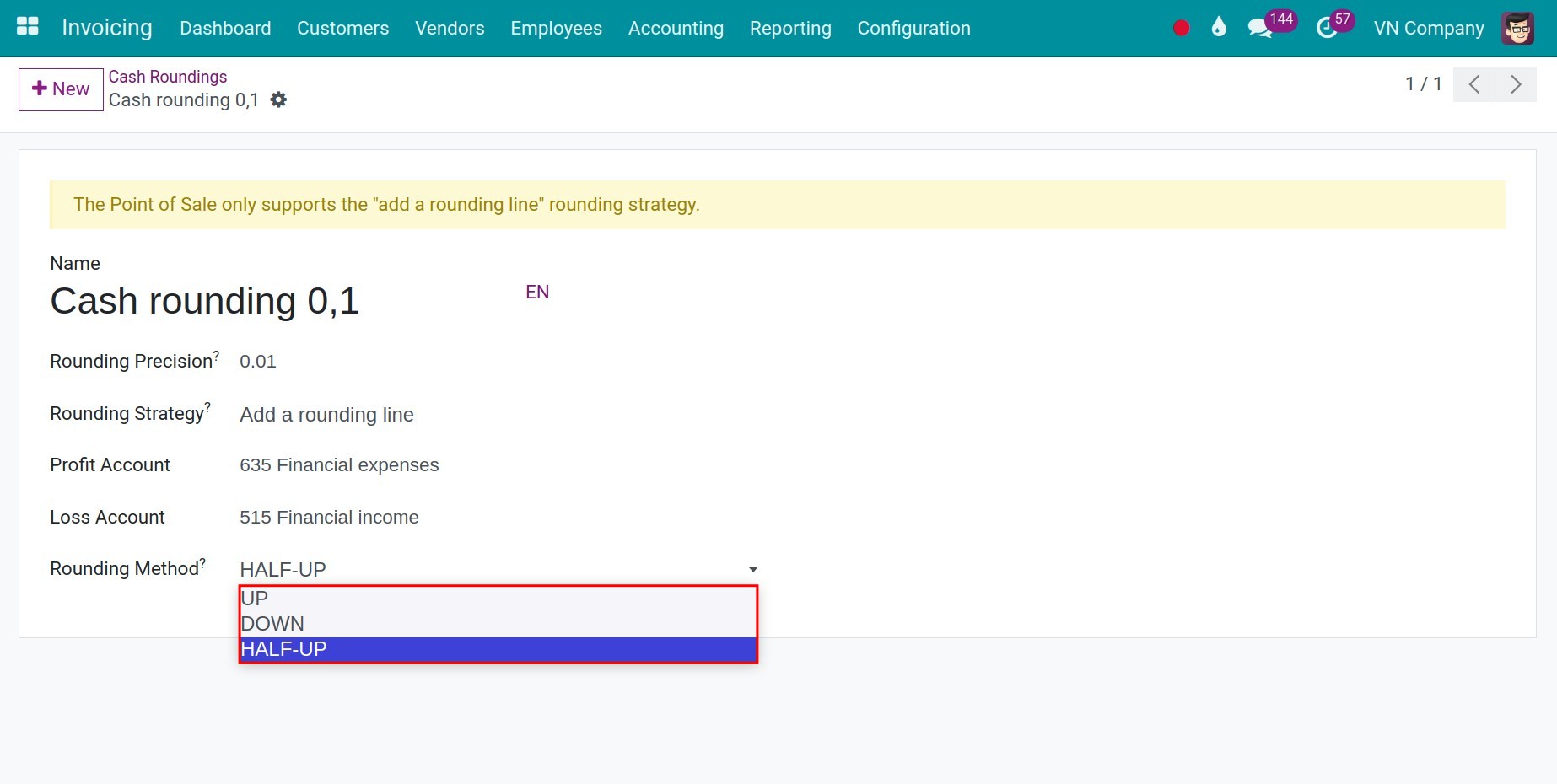

Rounding methods: Viindoo offers three methods

Up: The value is rounded up based on the rounding precision.

Down: The value is rounded down based on the rounding precision.

Half-up: This method is used in case of the fractional values. If the value is greater than or equal to half, round up. Otherwise, it will be rounded down.

After filling in the information, the system will automatically save, or you can choose to save manually.

Apply cash roundings on invoices¶

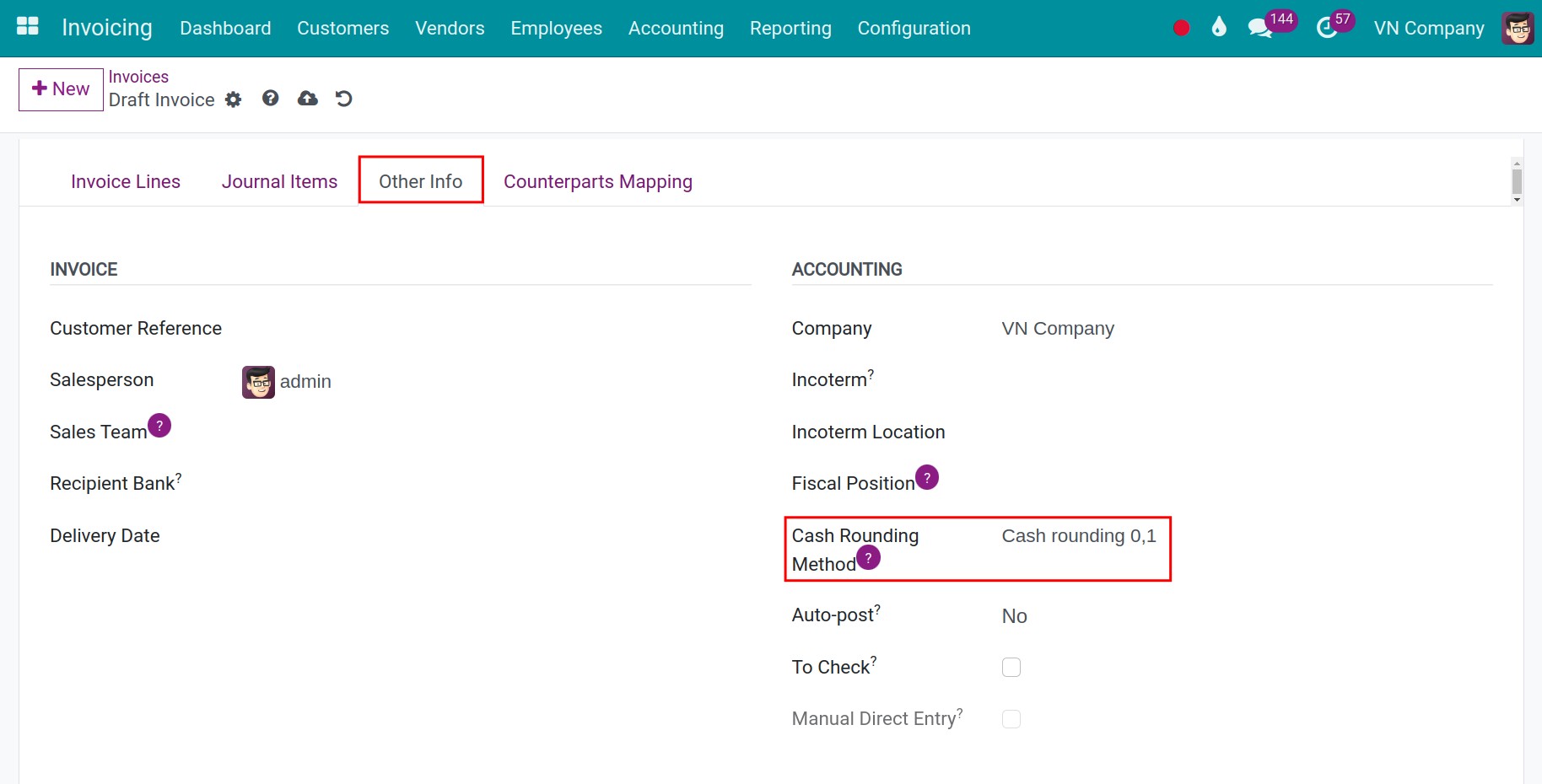

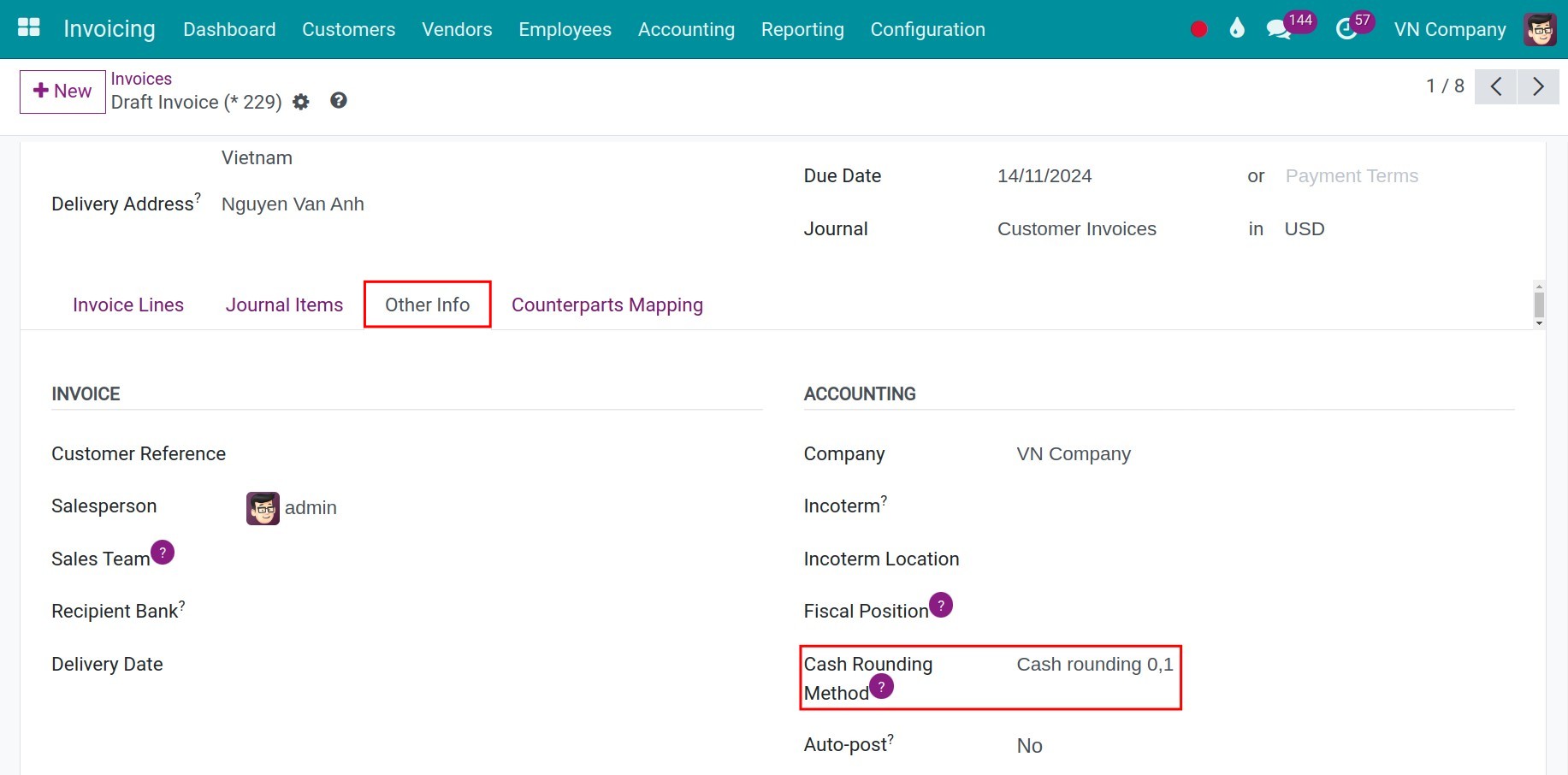

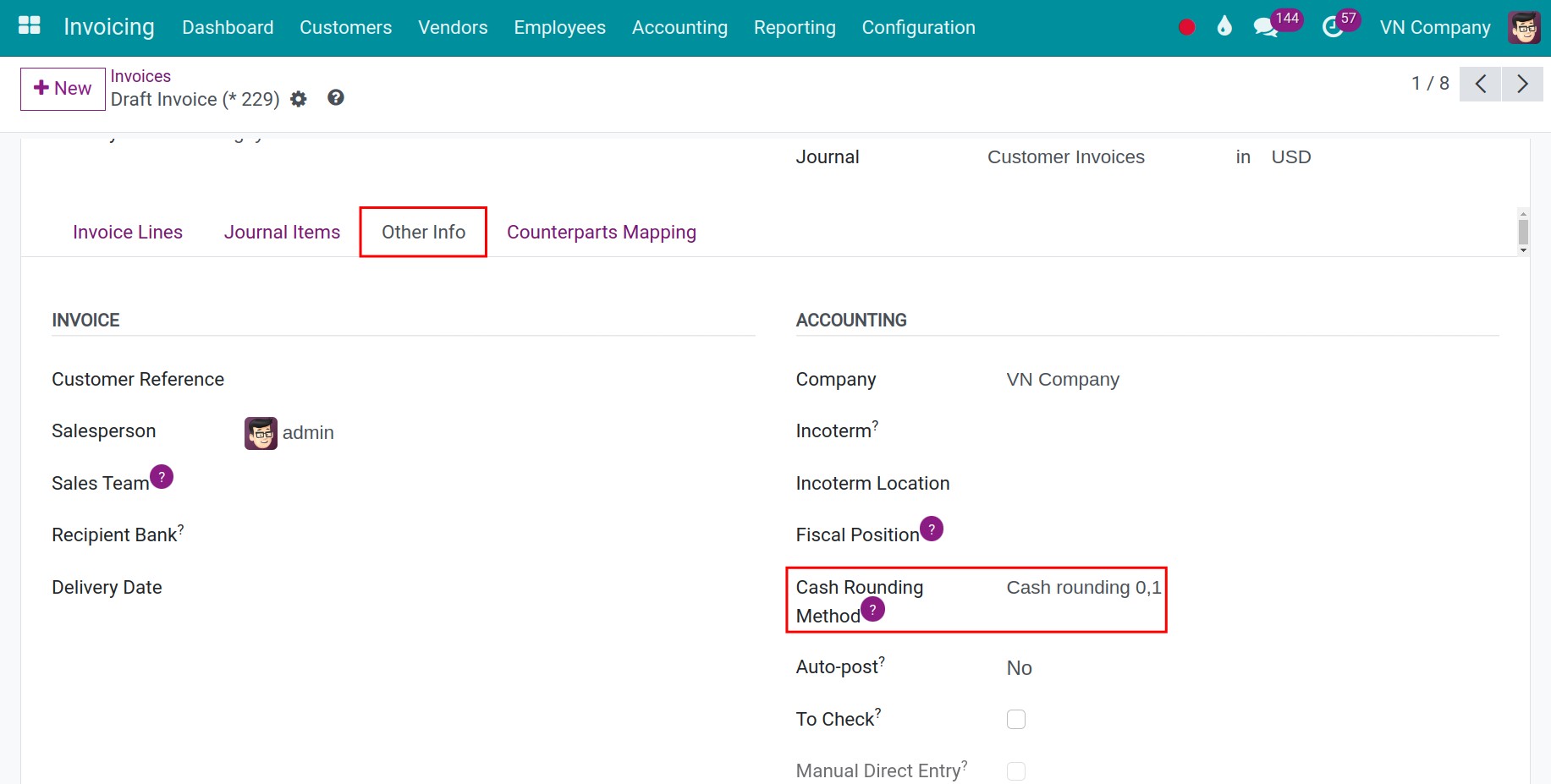

On the draft invoice interface, open the Other info tab to select the Cash rounding rule:

Examples¶

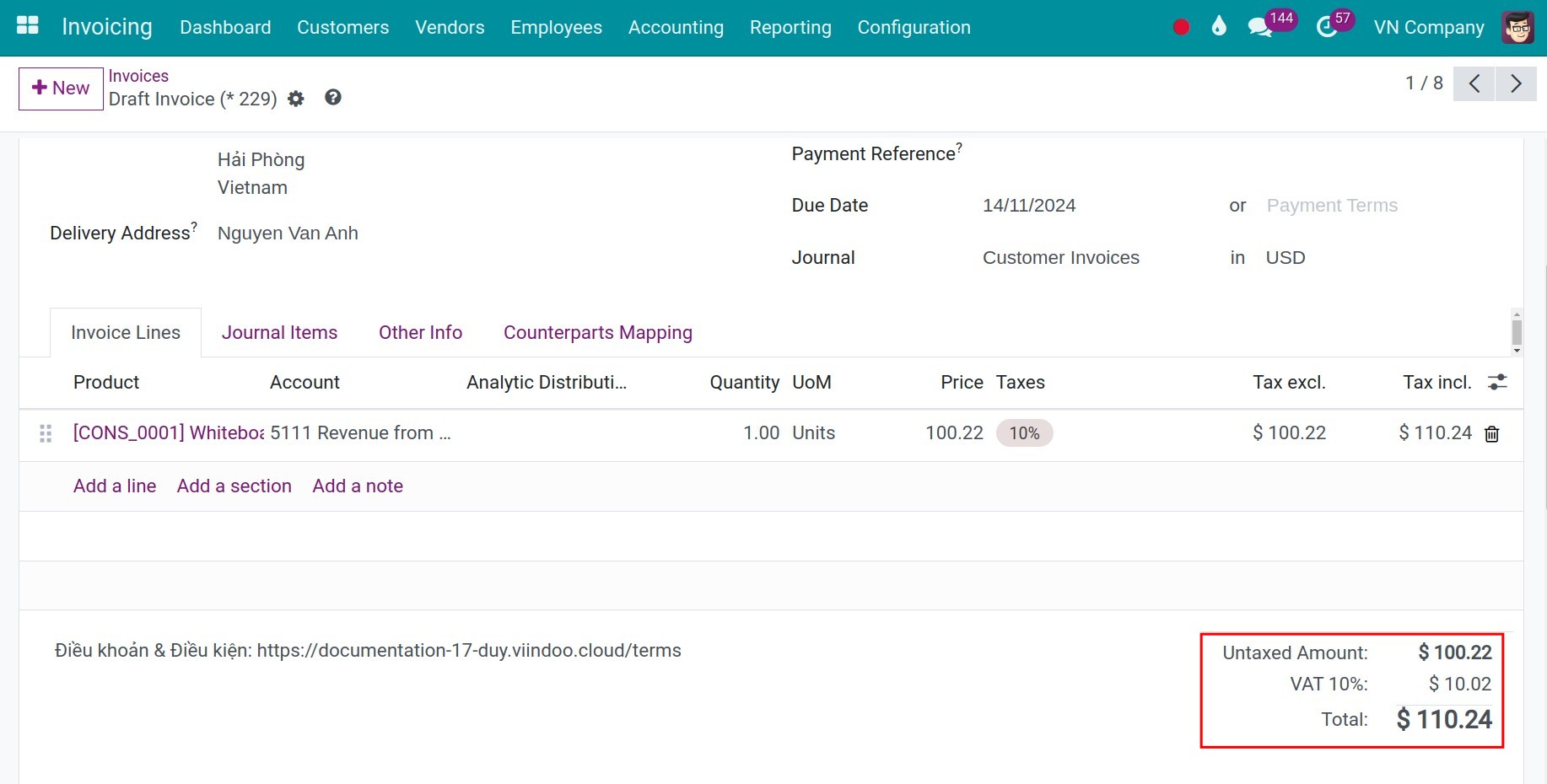

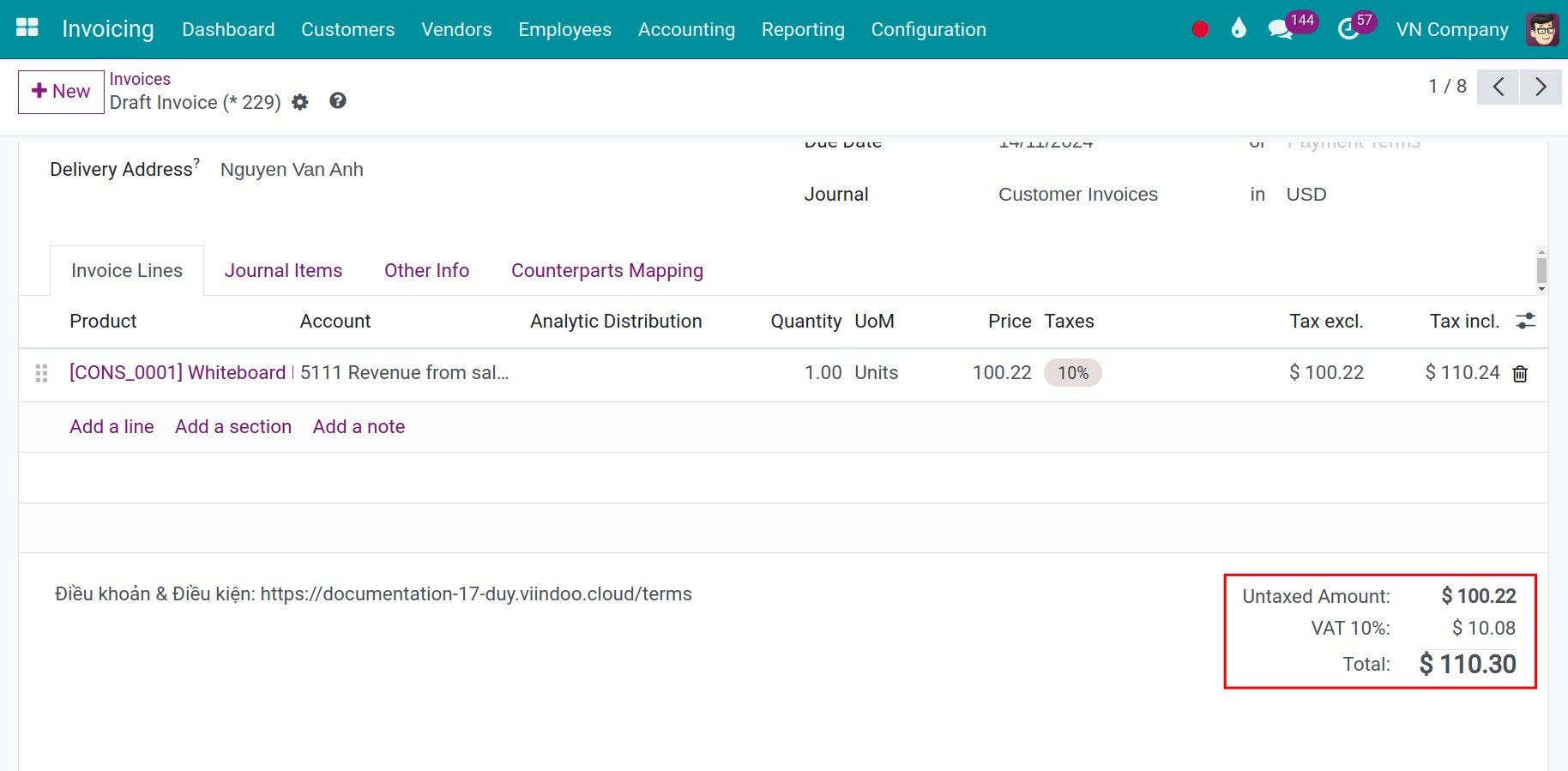

A sales invoice with information below:

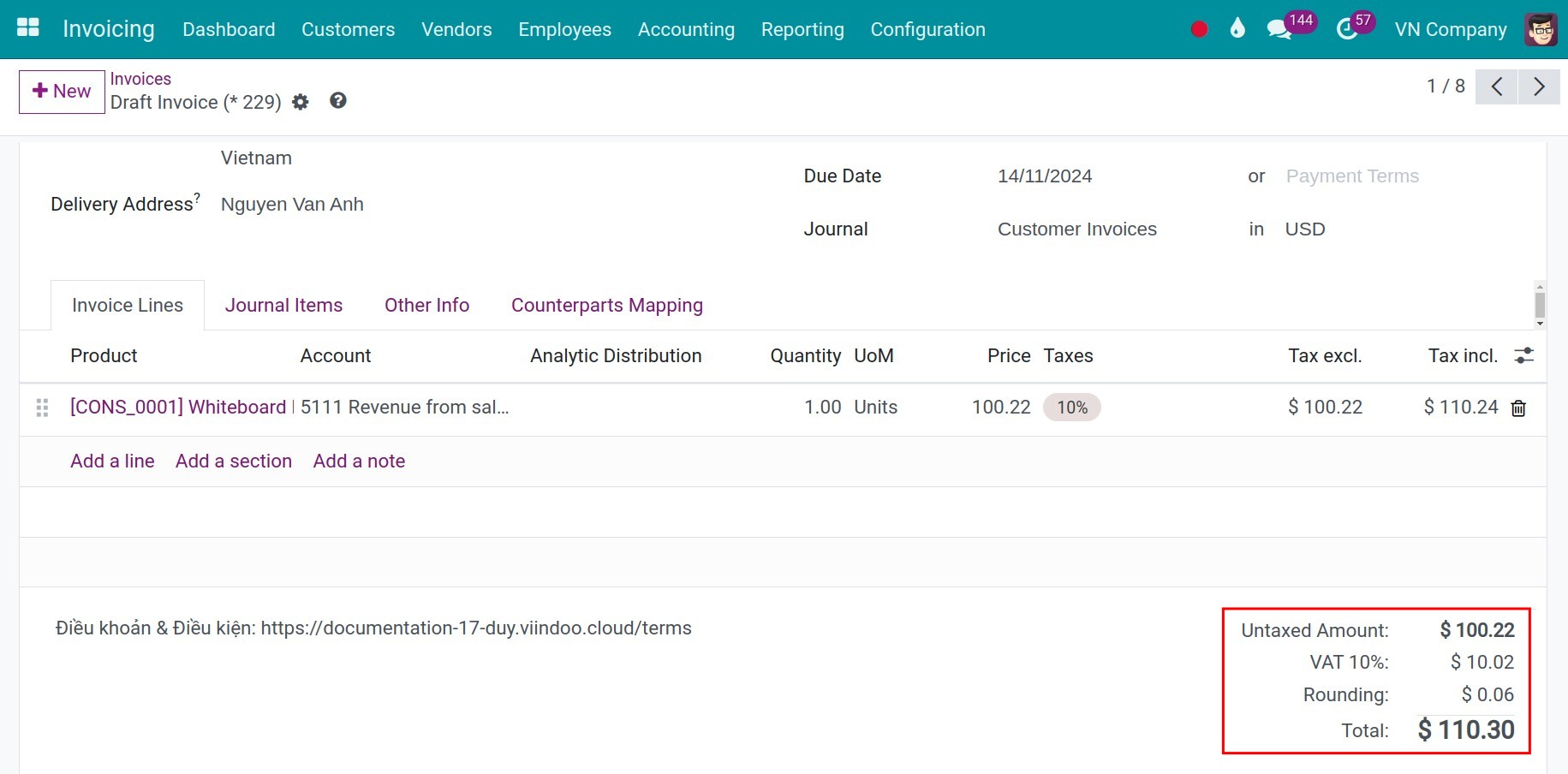

Case 1: Create a cash rounding rule by adding a rounding line:

Rounding precision: 0,1.

Rounding strategy: Add a rounding line.

Rounding method: Up.

Apply the rounding rule to invoice:

At that time, in the total amount section of the invoice, an additional line will appear to round the total amount from 110.24 USD to 110.30 USD:

Note

The total is rounded to the nearest multiple of the smallest denomination, which may be higher or lower than the initial total.

Case 2: Create a rule which is rounded up by modifying as tax amount:

Rounding precision: 0,1.

Rounding strategy: Modify as tax amount.

Rounding method: Up.

Apply the rounding rule to invoice:

The tax amount on the invoice is adjusted from 10,02 USD to 10,08 USD in order to round up the total value of the invoice from 110,24 USD to 110,30 USD.

We hope that the above examples help you understand better the difference between the two cash rounding strategies in the Viindoo Accounting app.

See also

Related article

Optional module