Using Fiscal Position in Point of Sale (PoS)¶

In some countries, there are regulations on changing the tax rate when there is a combination of the characteristics of the food (hot or cold, raw or cooked …) and the place of food (dining in or takeout or takeaway). Understanding these requirements, Viindoo software supports selecting different tax rates according to each situation by using the Fiscal Position feature in the Viindoo Point of Sale app.

Requirements

This tutorial requires the installation of the following applications/modules:

Configuration of Fiscal Position on a sales order¶

You need to activate this feature by following these steps:

Go into the Point of Sale application.

Navigate to .

Select (or create new) a point of sale.

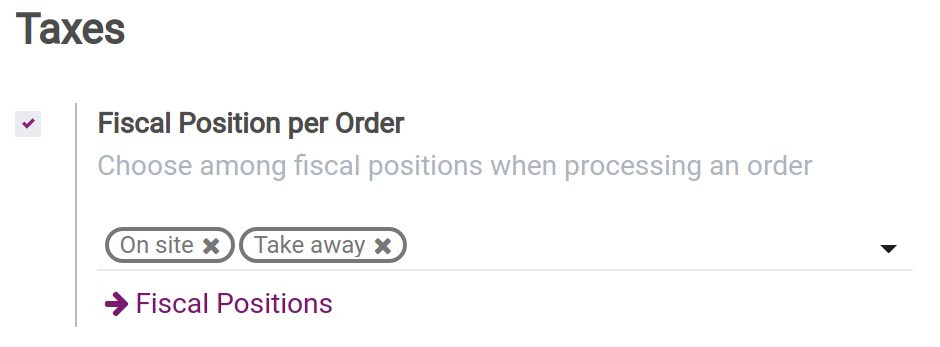

Scroll down to the Taxes section and enable the Fiscal Position per Order feature.

Note

You need to have at least one fiscal position configured to use this feature.

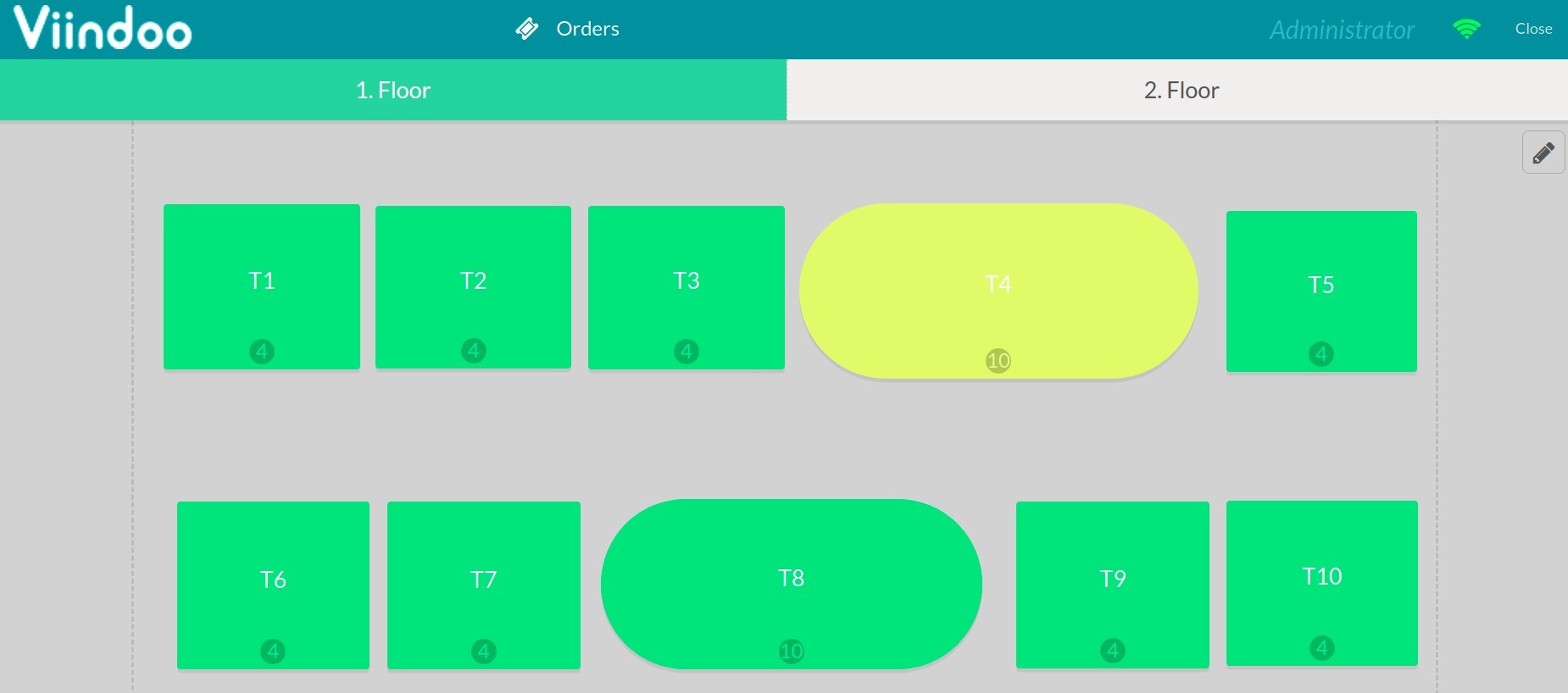

Then, navigate to the Dashboard menu and select a point of sale to start a New Session. It may take a couple of seconds to display the point of sale interface.

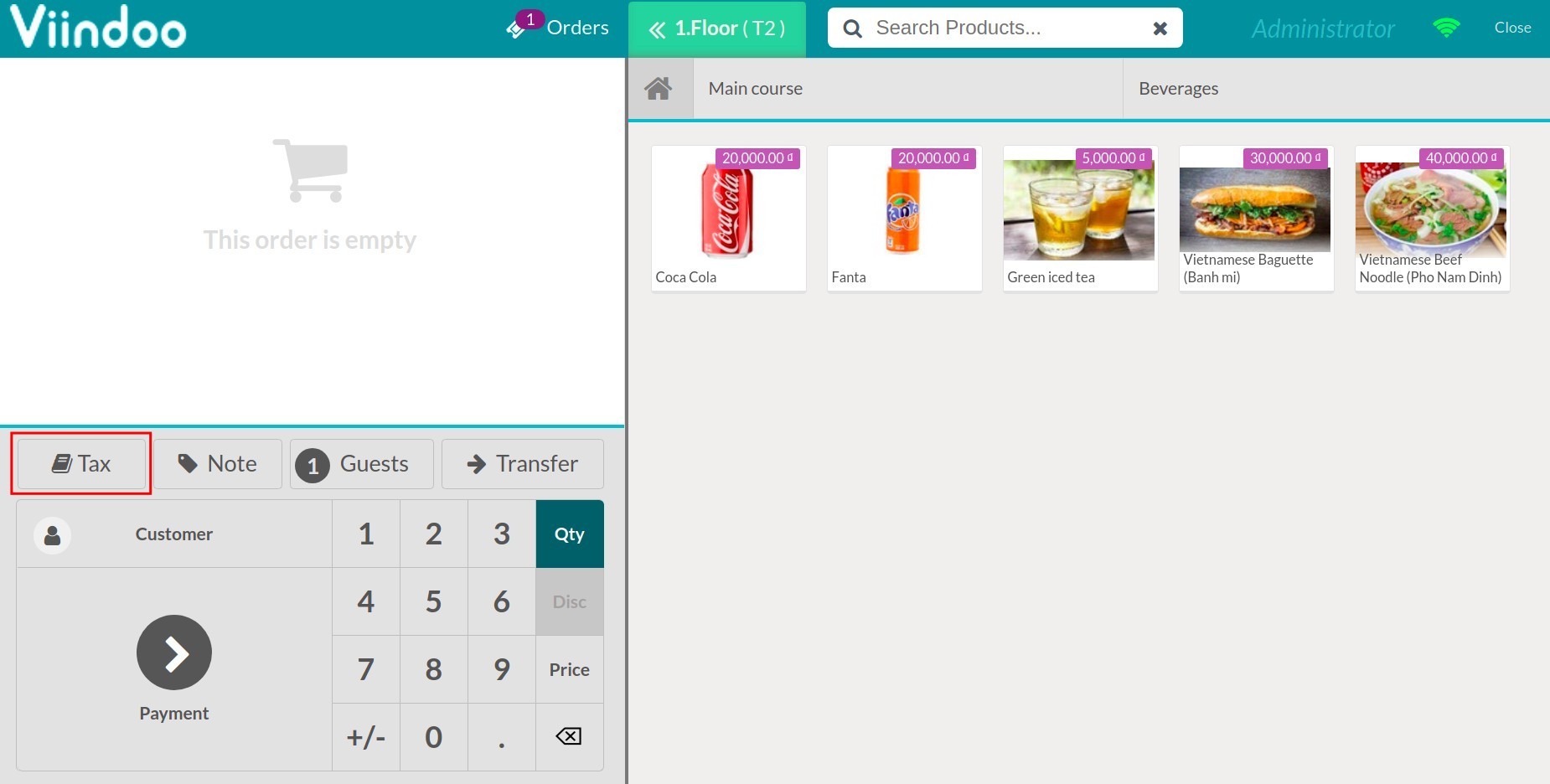

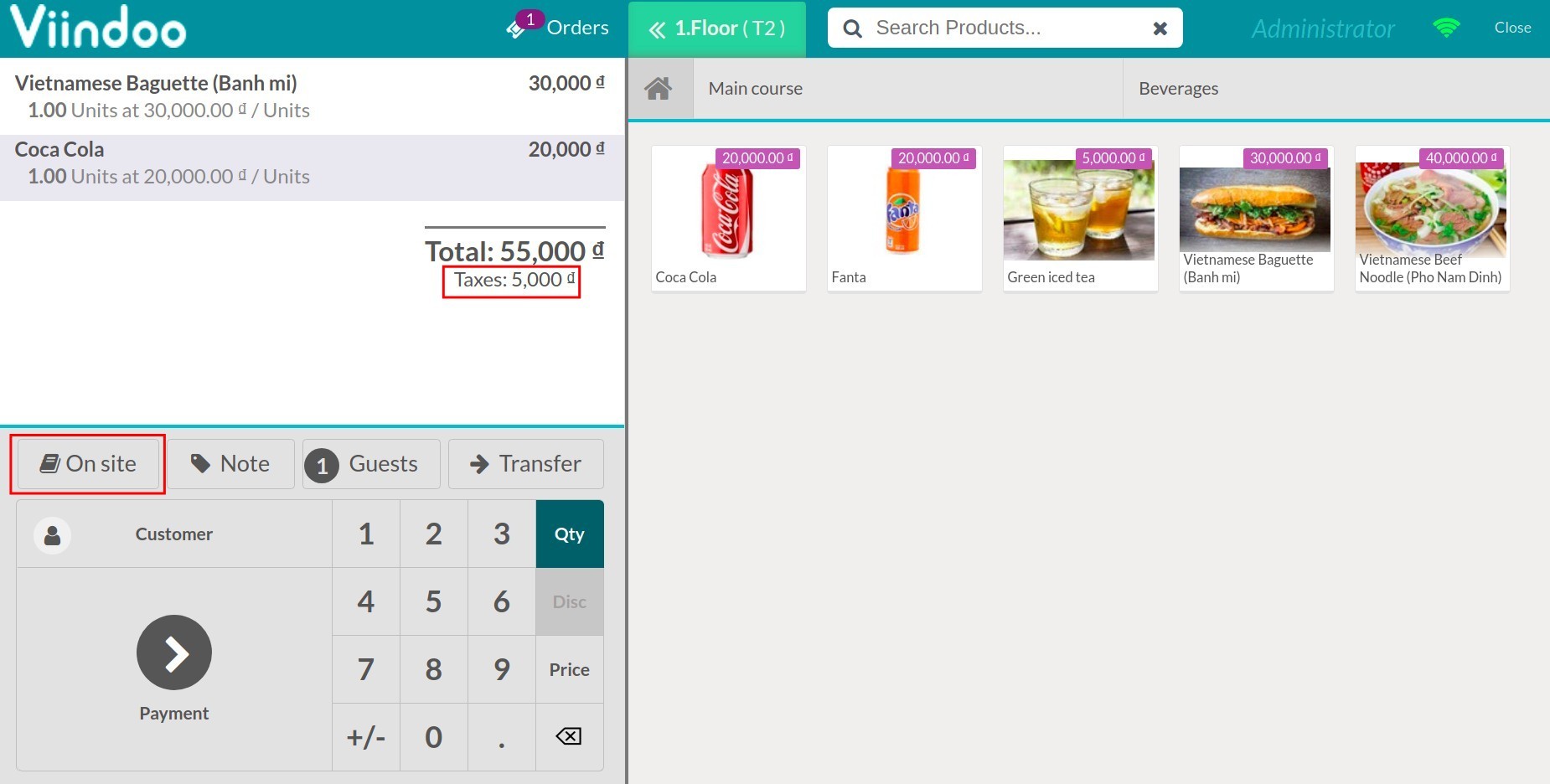

Pick a dining table at this point and add some products according to the customer’s demand. Then, click on the Tax button.

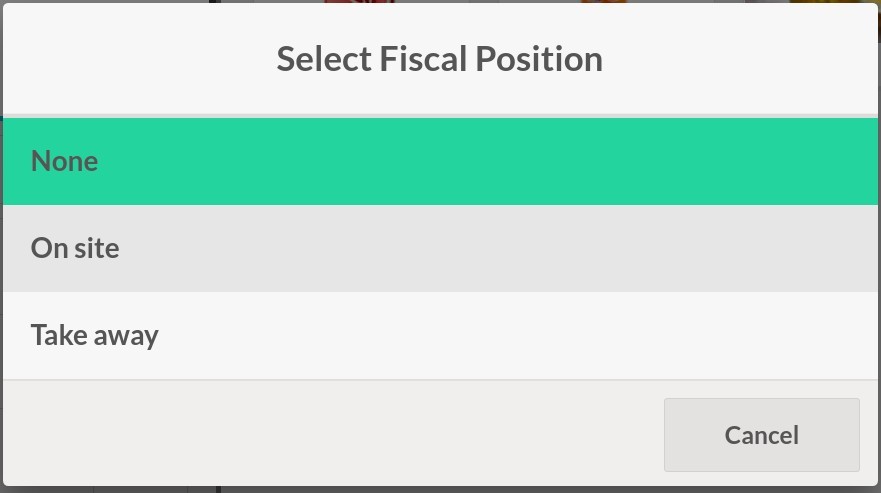

From here, you can select the adequate tax according to the configured fiscal positions, such as on-site or take away.

The tax amount of each product will be calculated automatically based on the configured tax.

Default fiscal position configuration¶

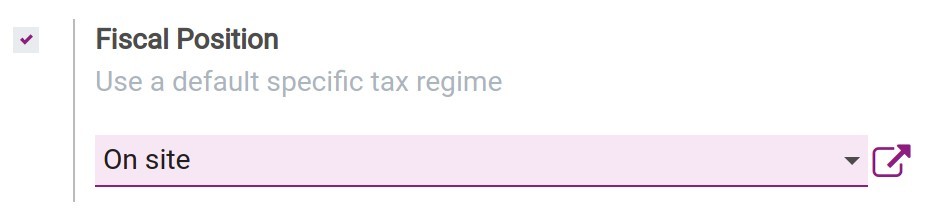

If you have set the default fiscal position, the system will automatically suggest this position when creating a sales order.

However, you can always change to another fiscal position if necessary. At the Point of Sale application, first, go to , select the location and tick on Fiscal Position.

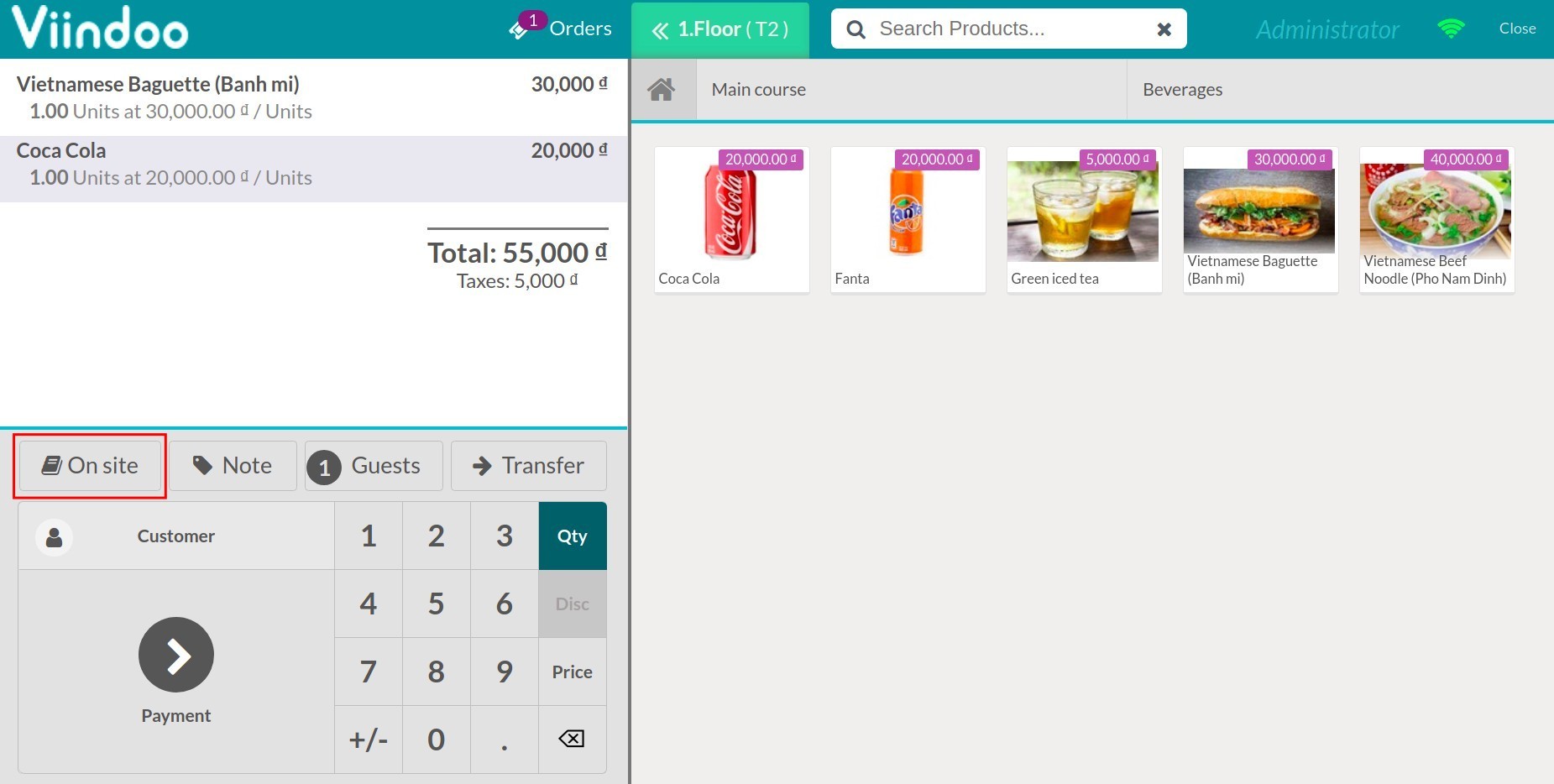

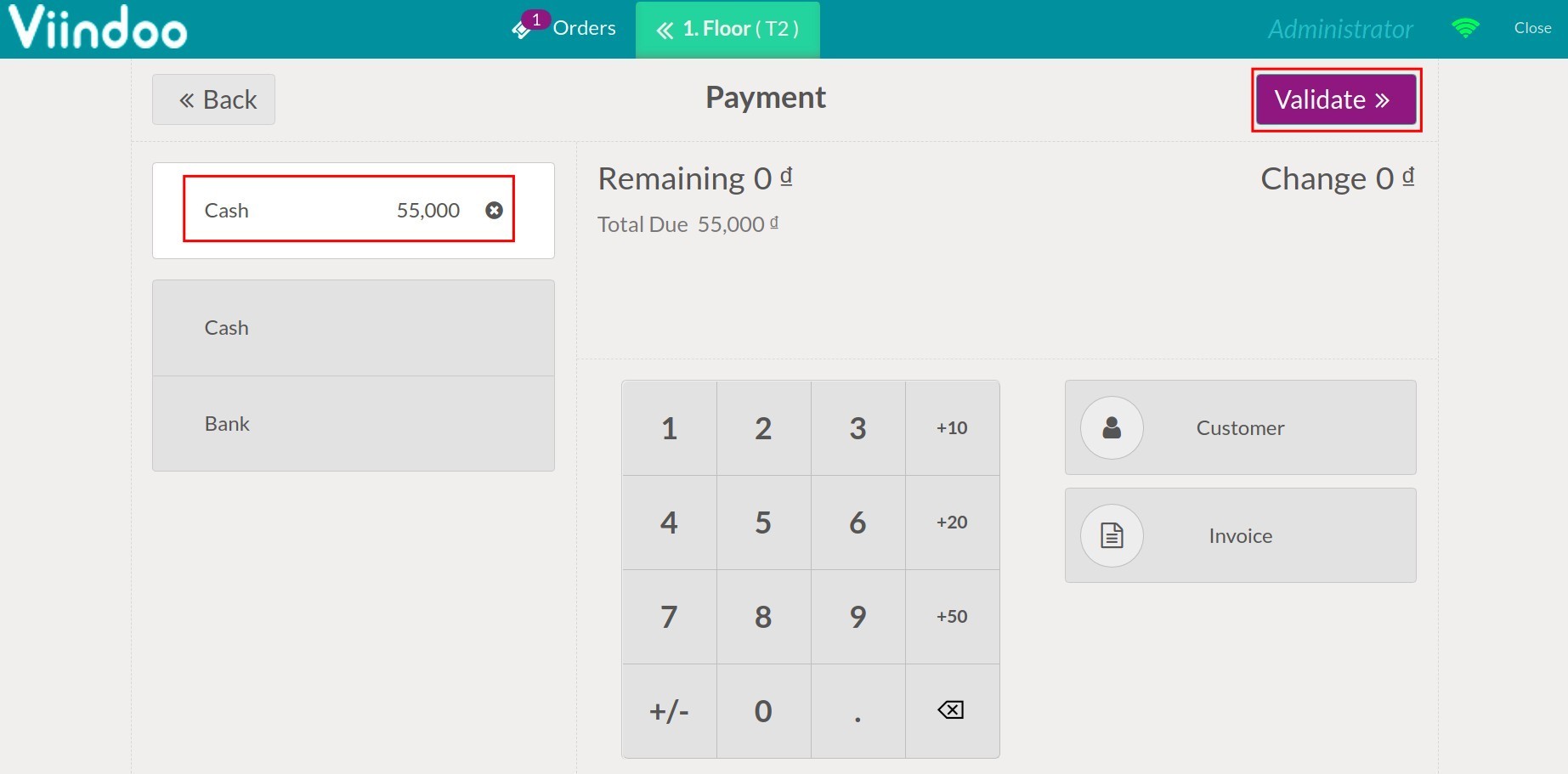

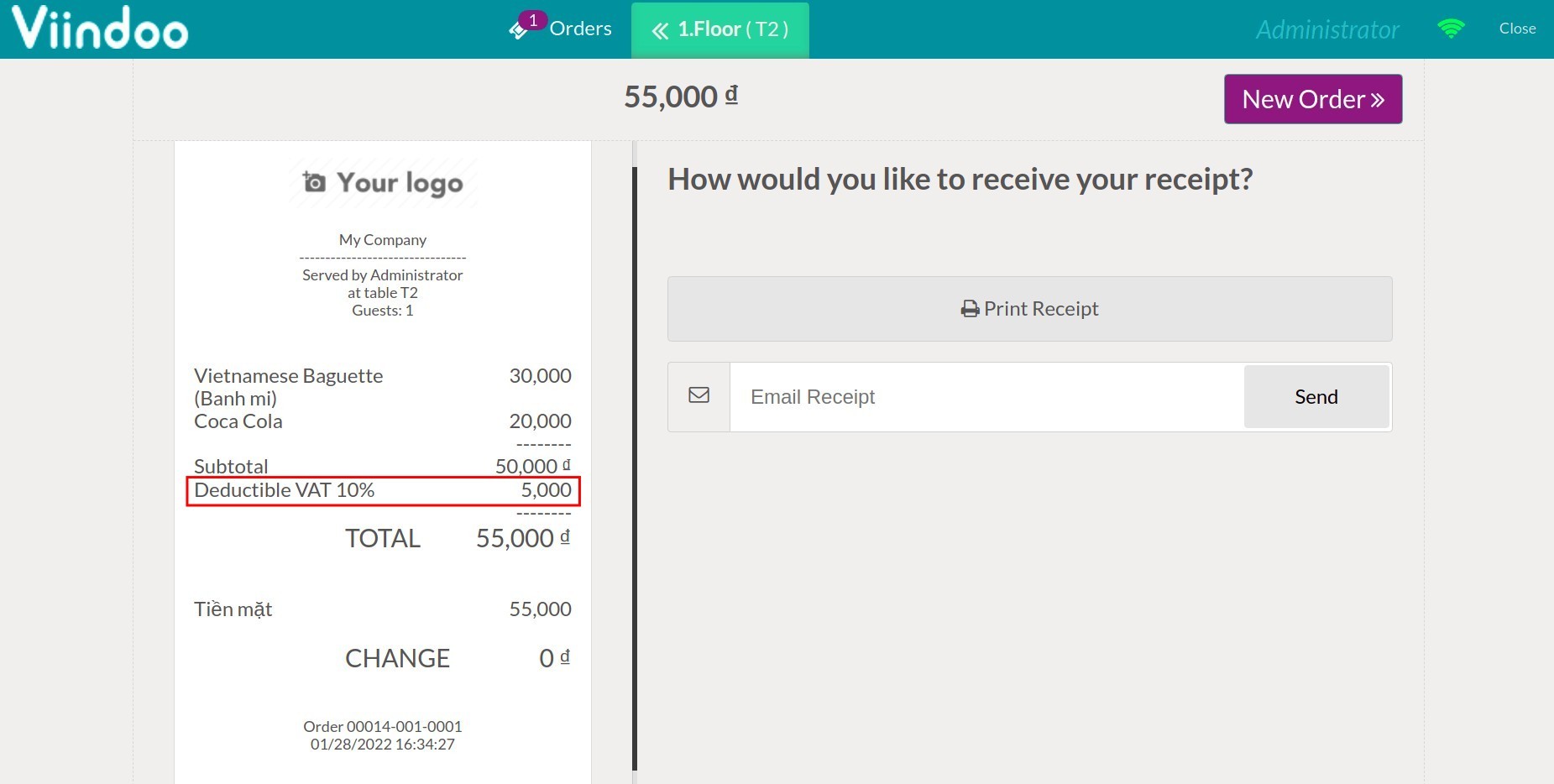

On the point of sale session, the Tax button is now displayed with the default fiscal position name. Press Payment and select a payment type, then press Confirm to finish the operation.

The calculated tax amount is displayed on the bill.

See also

Related article

Optional module