Default Taxes¶

Definition¶

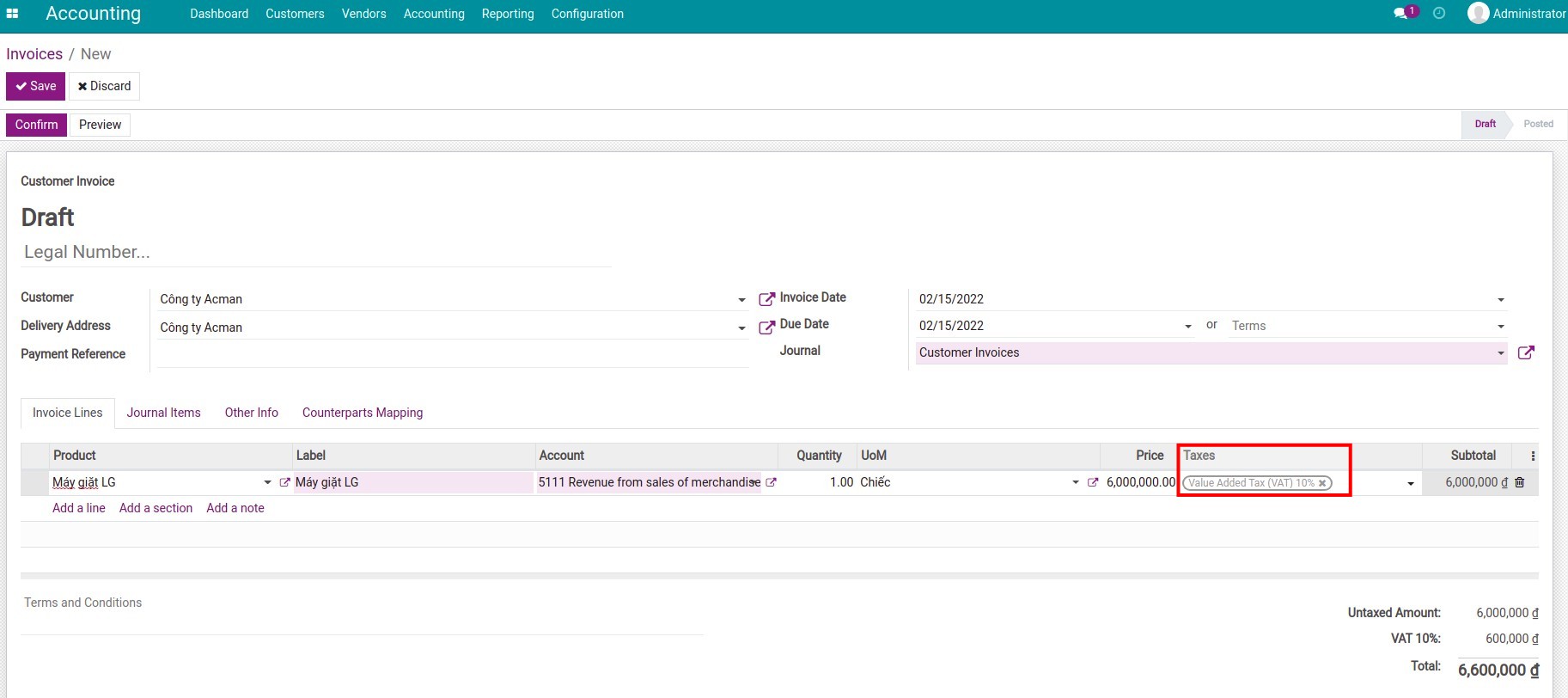

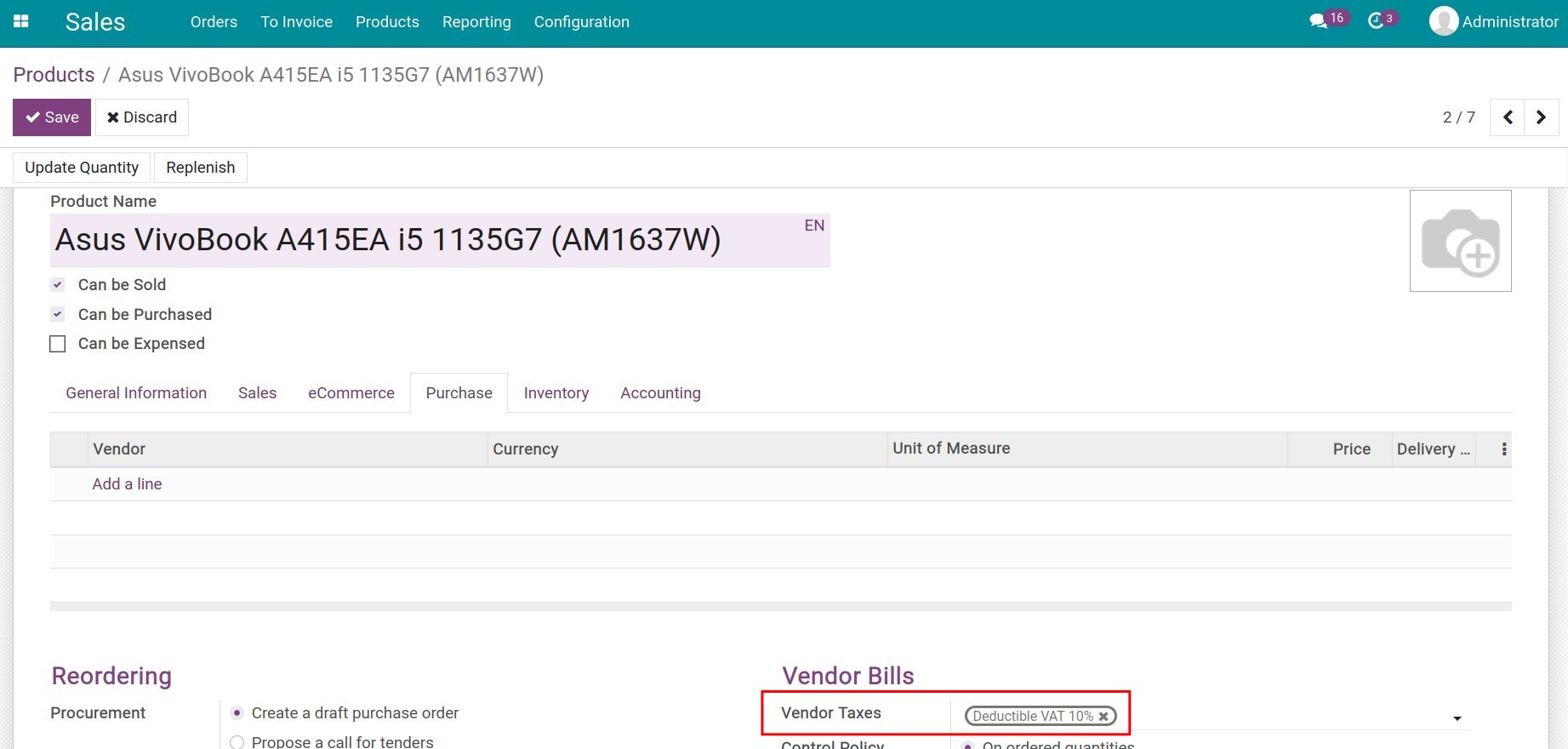

Default taxes are pre-configured taxes that will be applied automatically in new product creation or tax-related transactions. For example, when an additional line is added to the invoices, orders, etc., if a product is selected then a tax rule is automatically added. The tax amount will be calculated according to the tax rate established on the chosen tax rule.

In the Viindoo Accounting app, taxes will be configured by default when:

Set up the initial database and choose a country for the system.

Configure default taxes¶

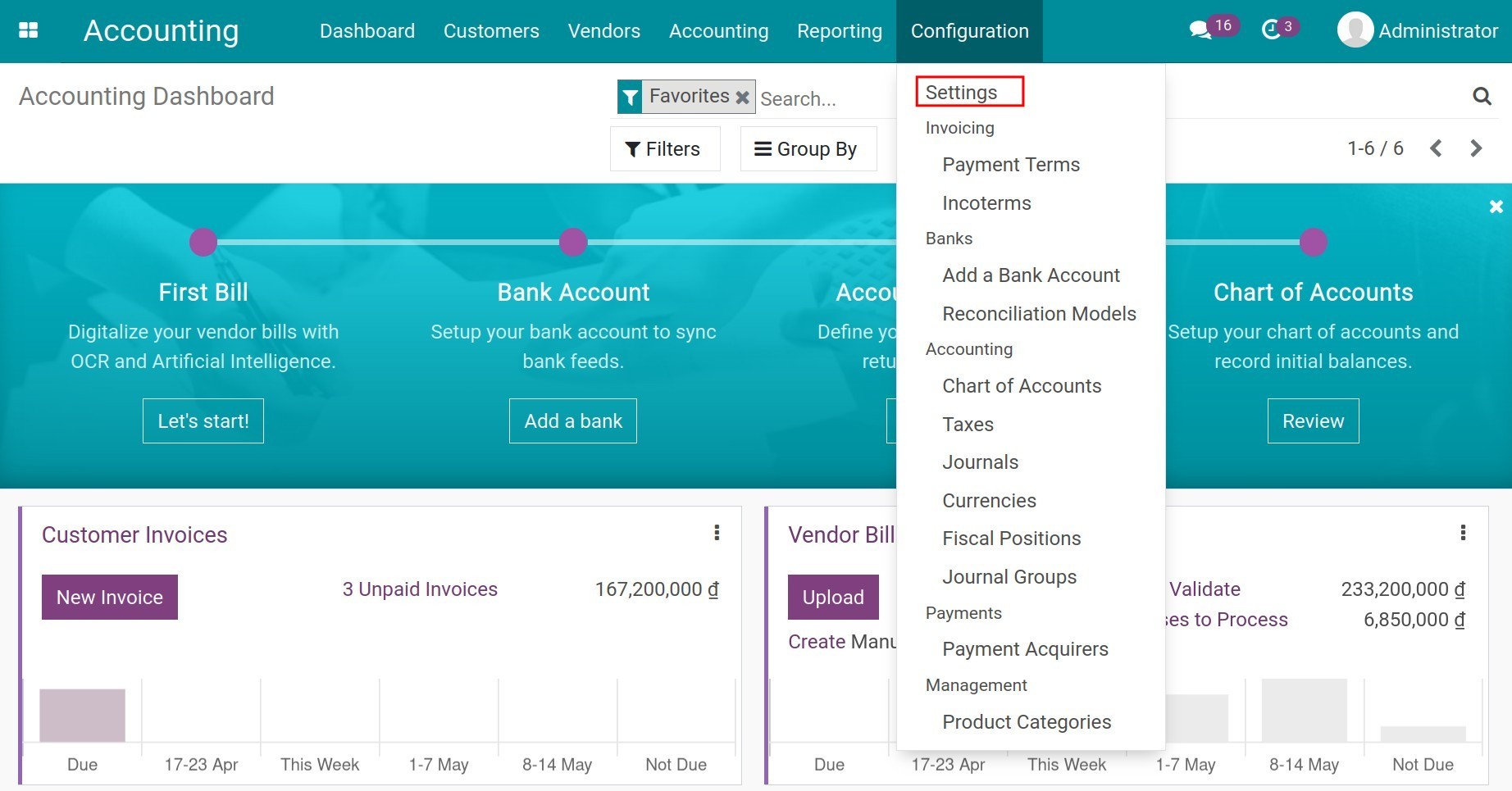

To change the default taxes, navigate to and search for Default Taxes.

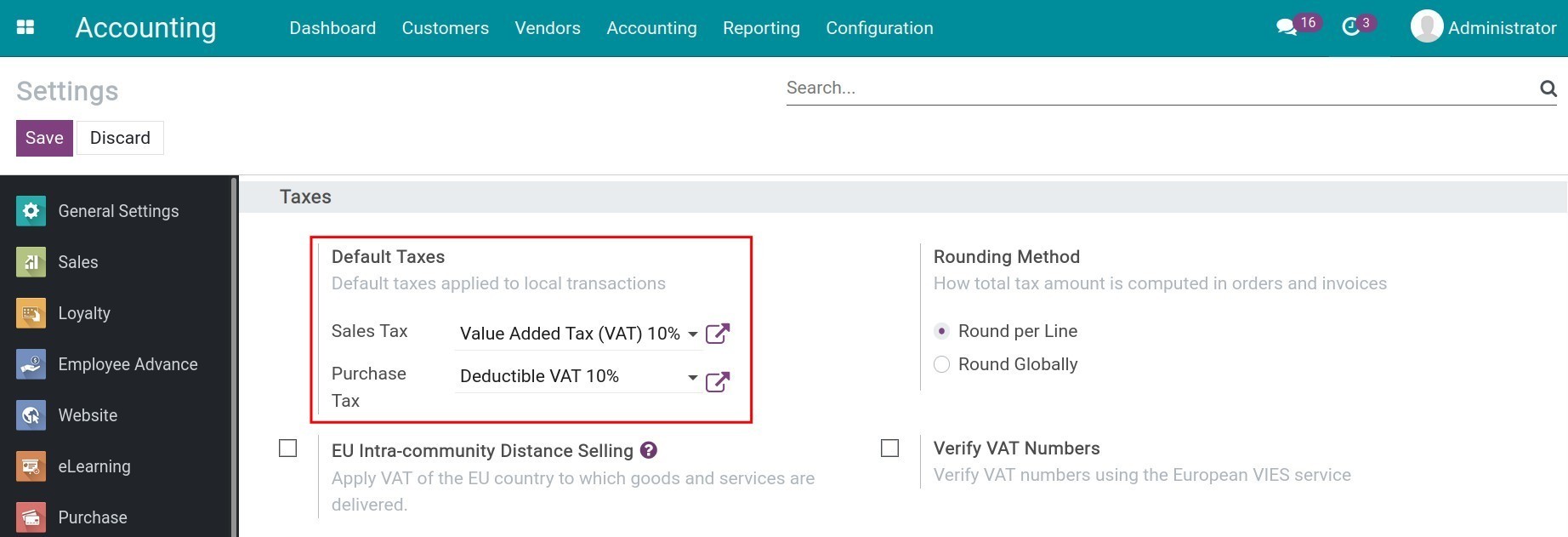

Here you can configure two types of tax:

Sales Tax: Default tax applied only on sales operations.

Purchase Tax: Default tax applied only on purchase operations.

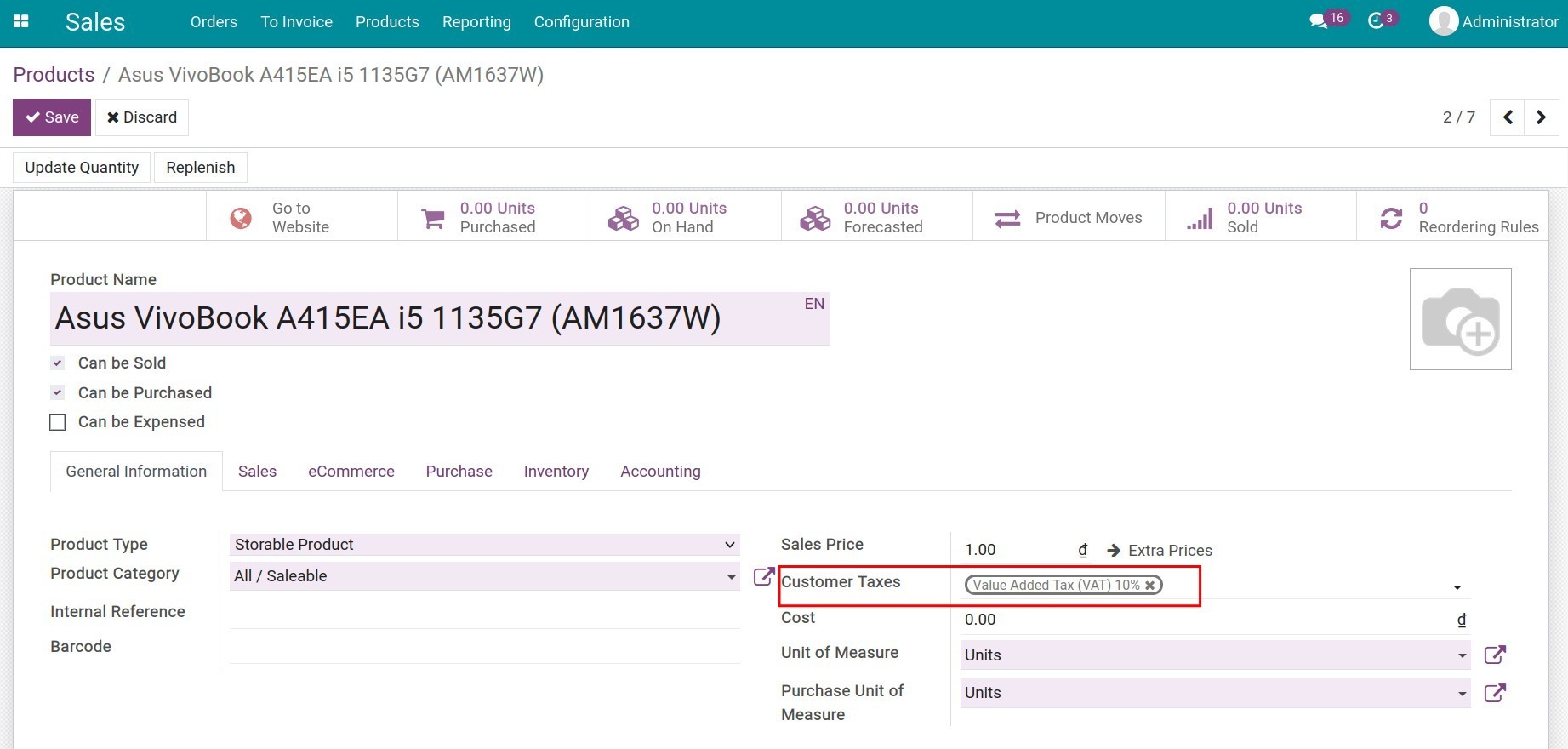

You can change the default taxes in accordance with your company’s tax and press Save. When you create a new product, these default taxes will be automatically added to the product.

Note

If the database has multiple companies, then each company can set different default taxes.