Accounting reports available in Viindoo¶

In the Viindoo system, you can use a couple of general reports in various countries. To use this reporting system, navigate to Viindoo Apps and install the Accounting module.

For more information, you can refer to the How to configure Viindoo Accounting and Invoicing before using article.

Some featured general reports:

- GAAP Statements:

Profit and Loss;

Balance Sheet;

Cash Flow Statement.

- Partner Reports:

Aged Payable;

Aged Receivable;

Partner Ledger.

- Business Statements:

Executive Summary.

- Audit Reports:

Tax Report;

General Ledger.

etc.

General characteristics of the reports¶

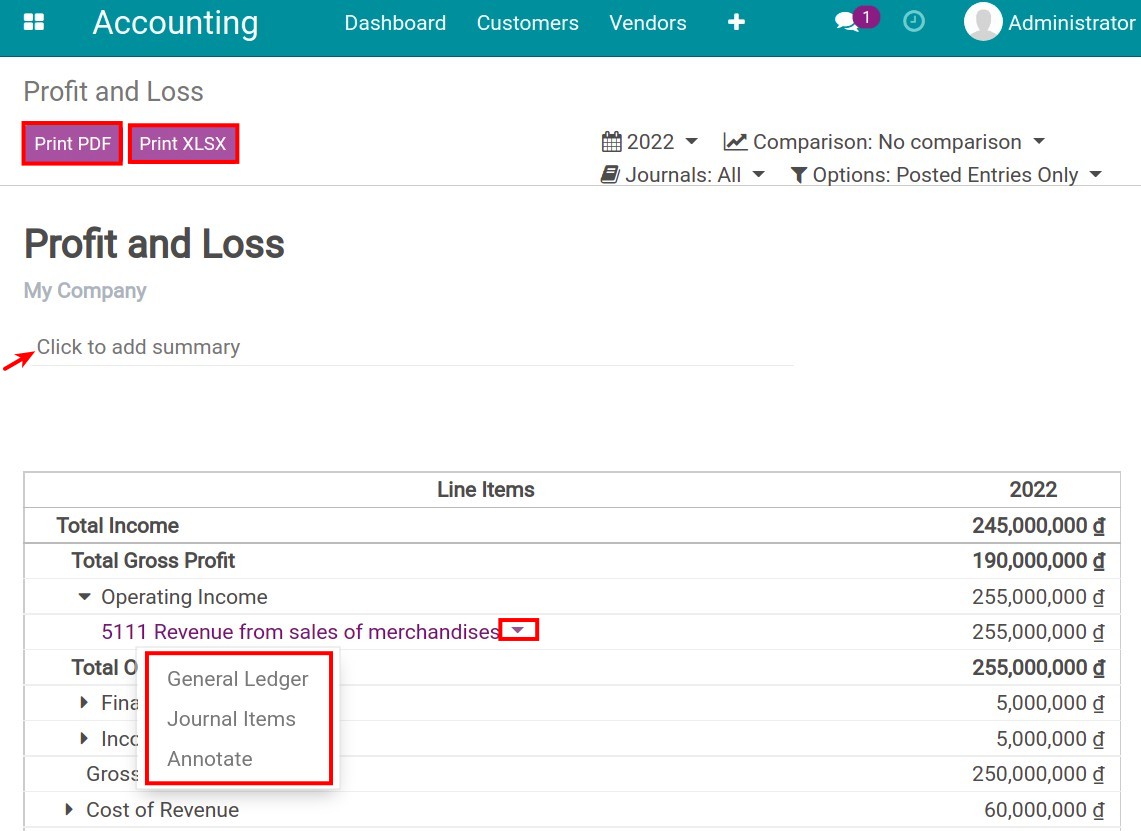

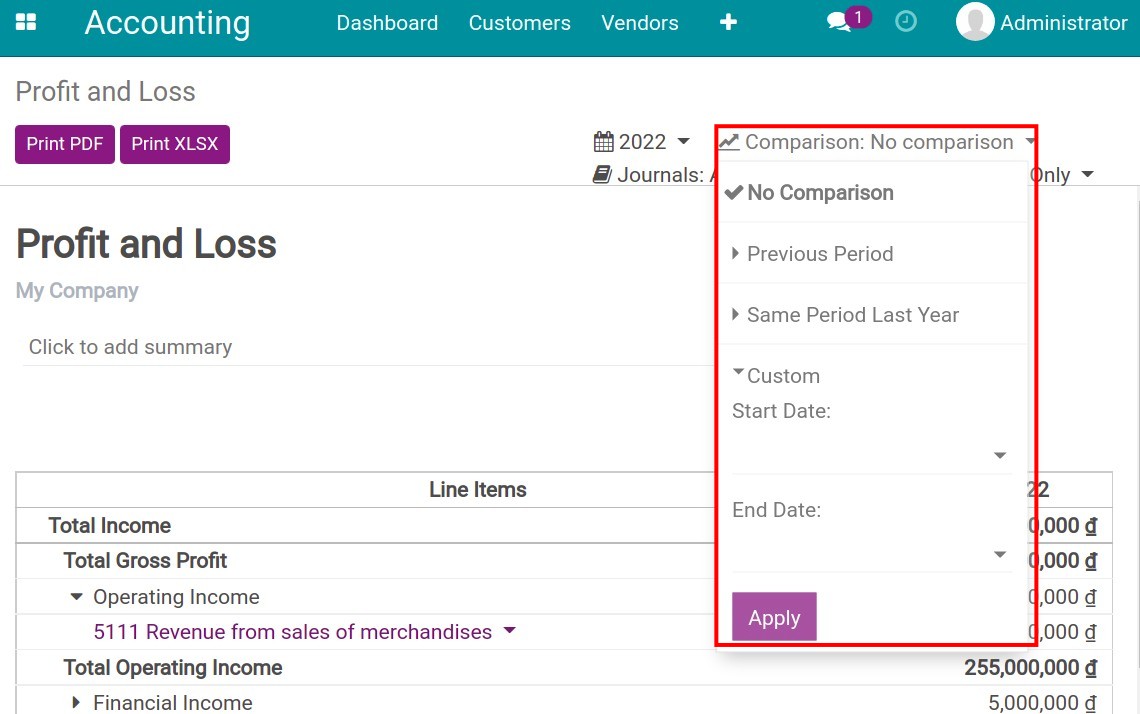

You can add content to the footnotes of report pages and print them to PDF or Excel files. To view specific data, you can click on an item in the report and see details in General Ledger or Journal Items.

You can compare data between different periods of time such as comparing with the previous one, with the same period of last year, or view data of a determined period. It’s a useful tool that helps you compare the fluctuation of each financial indicator, by selecting a certain time period.

General reports in Viindoo¶

To view reports, navigate to Accounting > Reporting and select a report according to your needs:

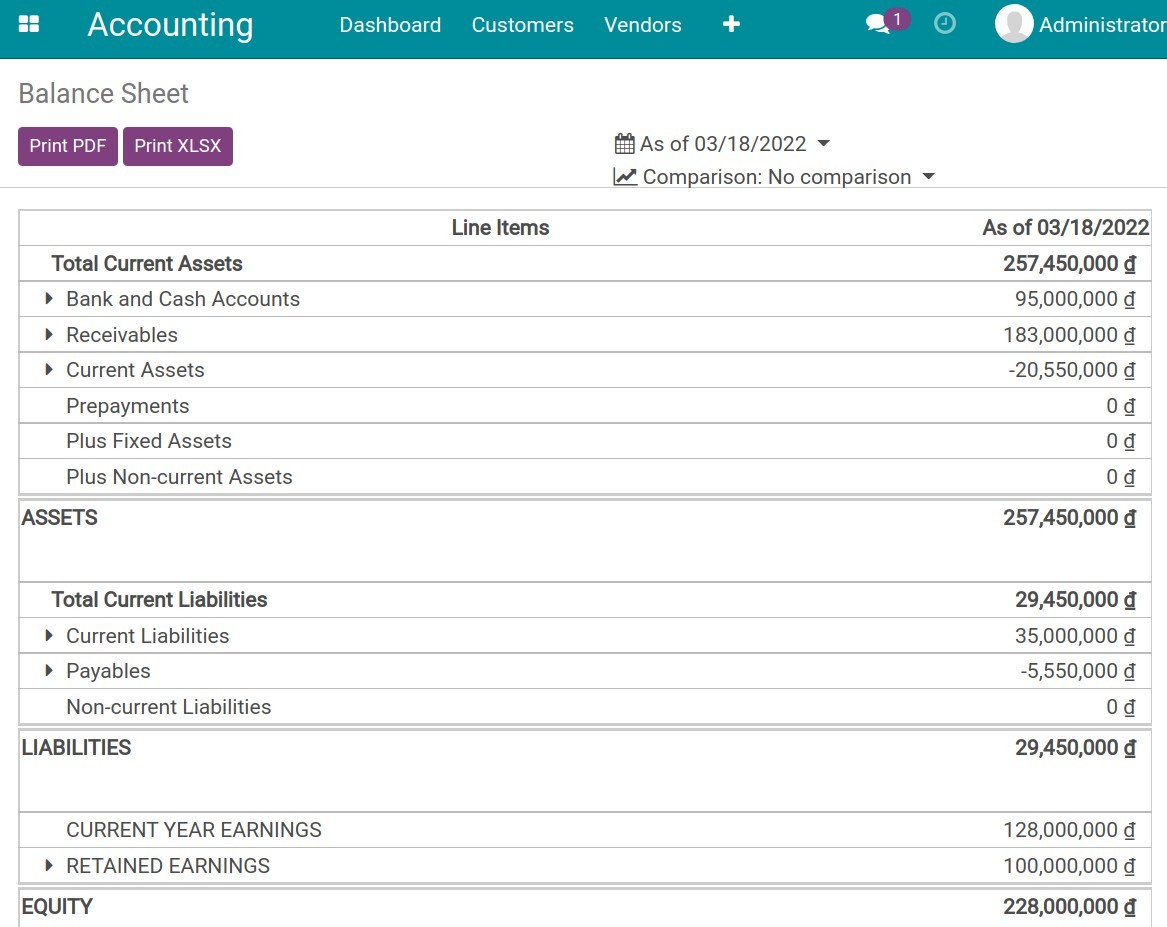

Balance Sheet¶

Balance Sheet shows a quick view of assets data, liabilities, and owner’s equity of your business at a certain time.

Note

See details about Balance Sheet according to Vietnam Accounting Standard.

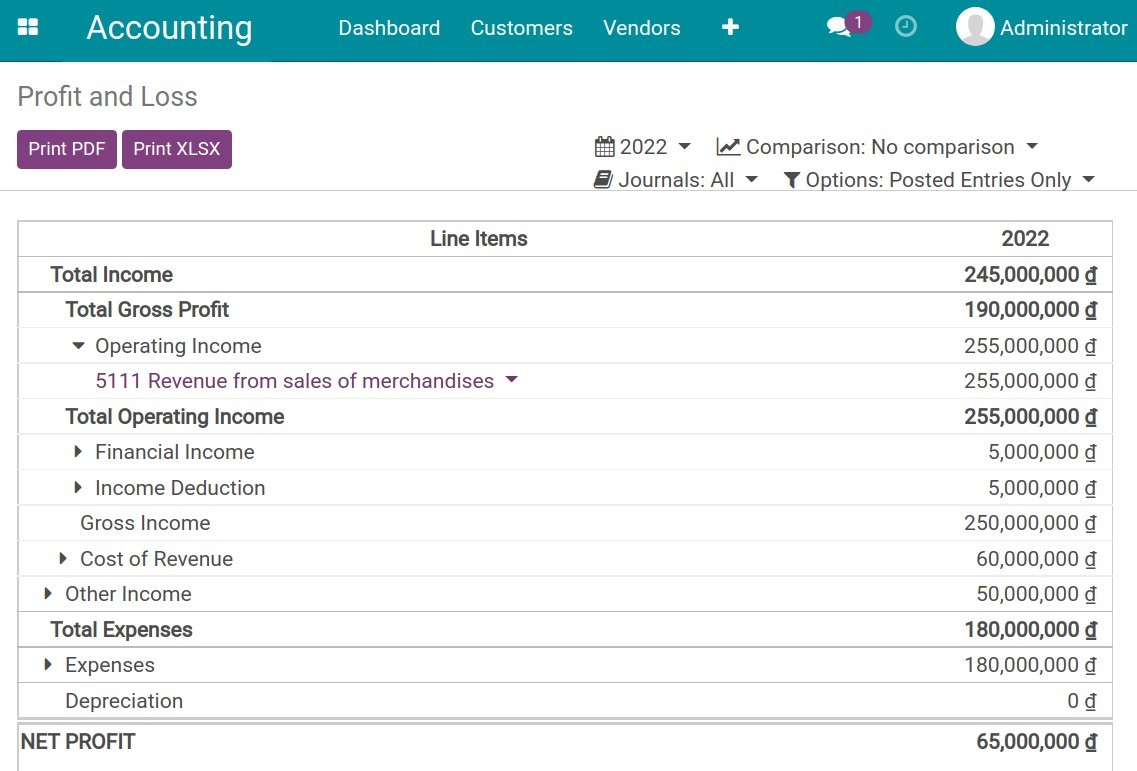

Profit and Loss¶

The profit/loss statement shows the balance between revenue and expenses in each accounting period. This report is a tool to present the profitability and business operation status of the business.

Note

See details about Profit and Loss according to Vietnam Accounting Standard .

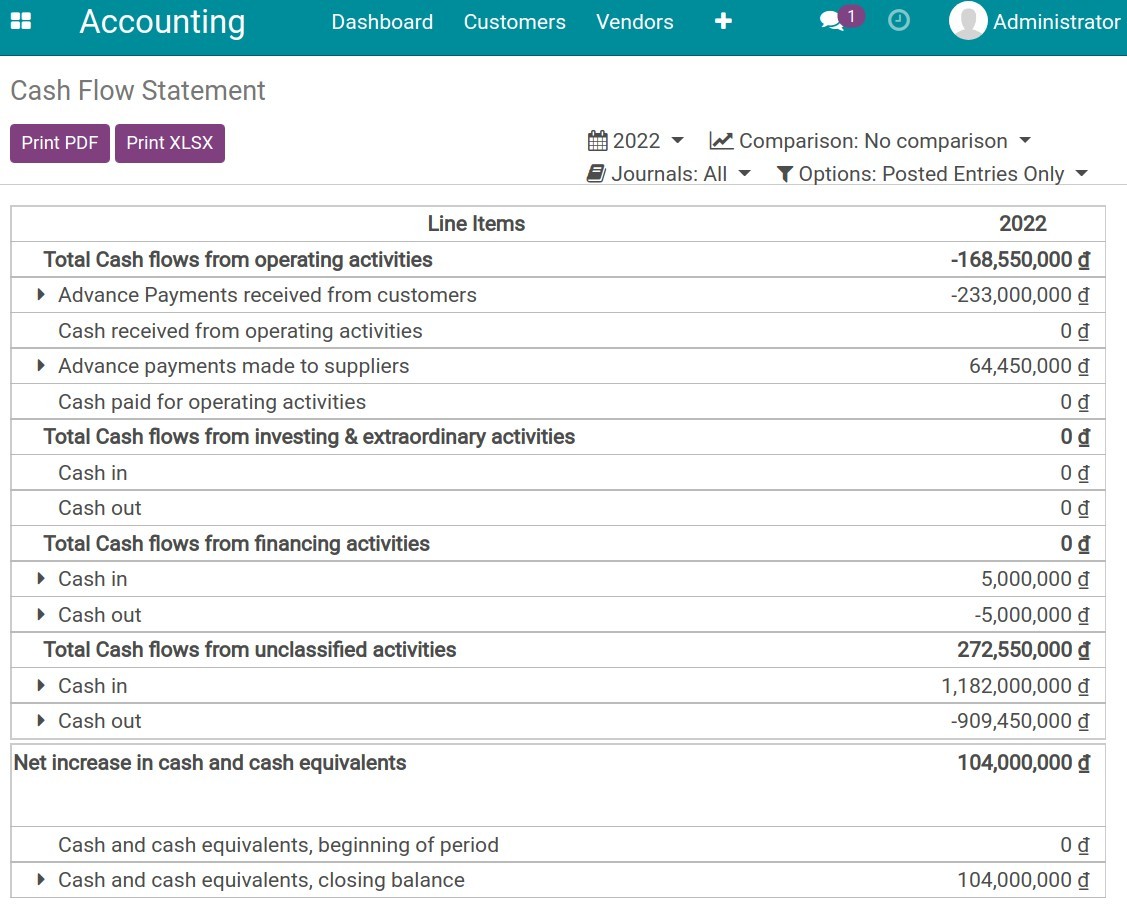

Cash Flow Statement¶

The Cash Flow Statement is a report that shows the cash inflows and outflows of a business in a determined period. This statement helps managers control the cash flow, balance the revenue and expenditure, and be proactive in finance.

Note

See details about Cash Flow Statement according to Vietnam Accounting Standard .

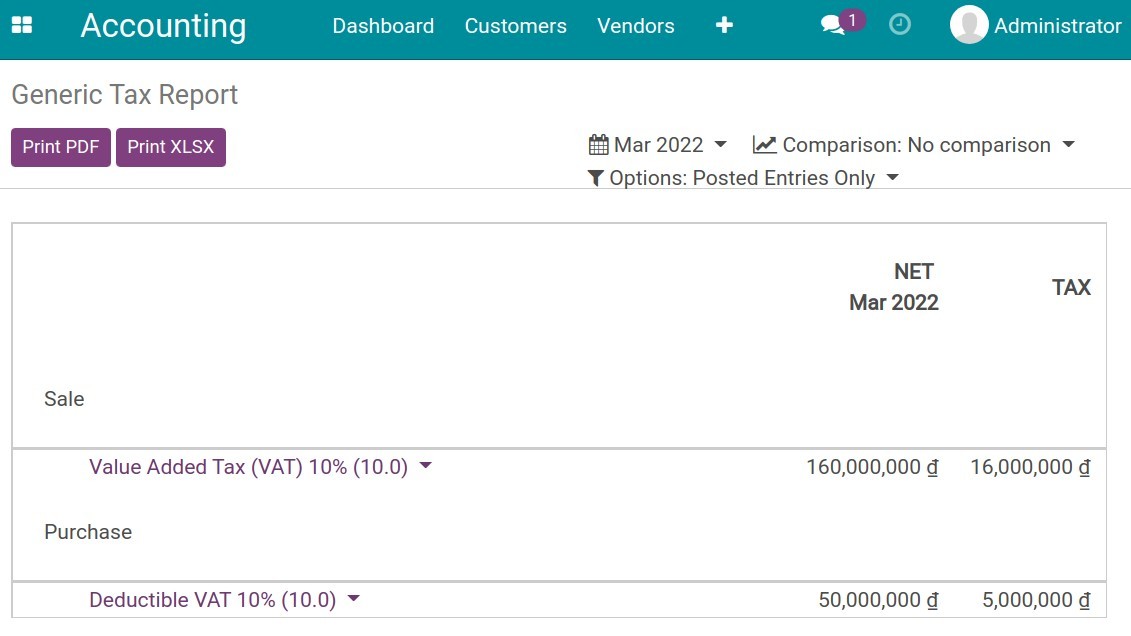

Tax Report¶

This report allows you to see the net amount and tax amount grouped by type of purchase and sale.

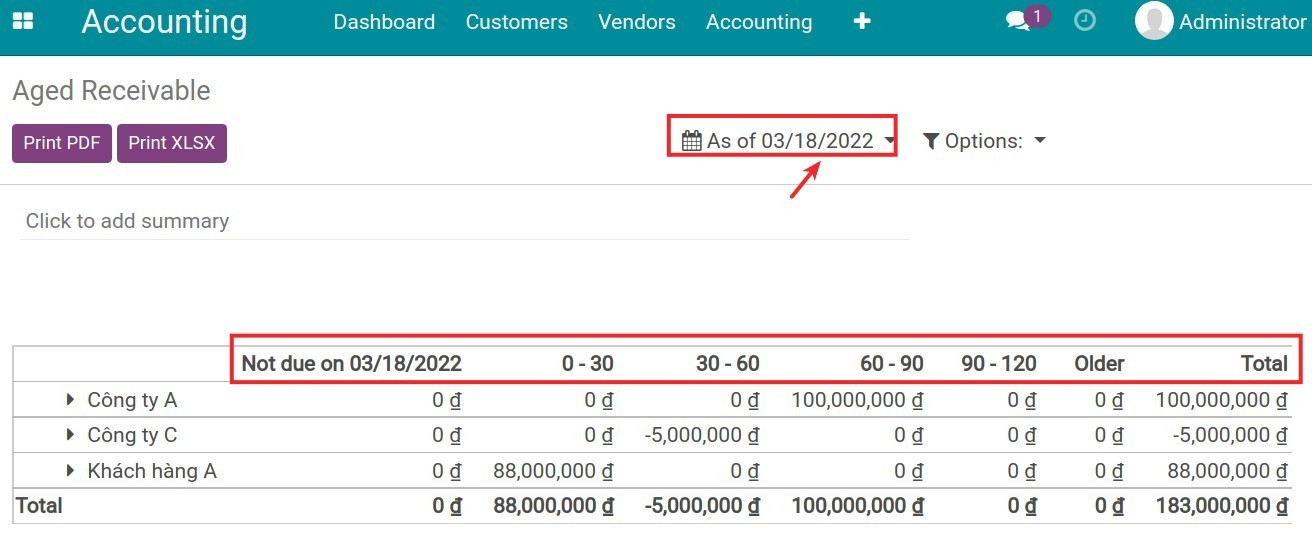

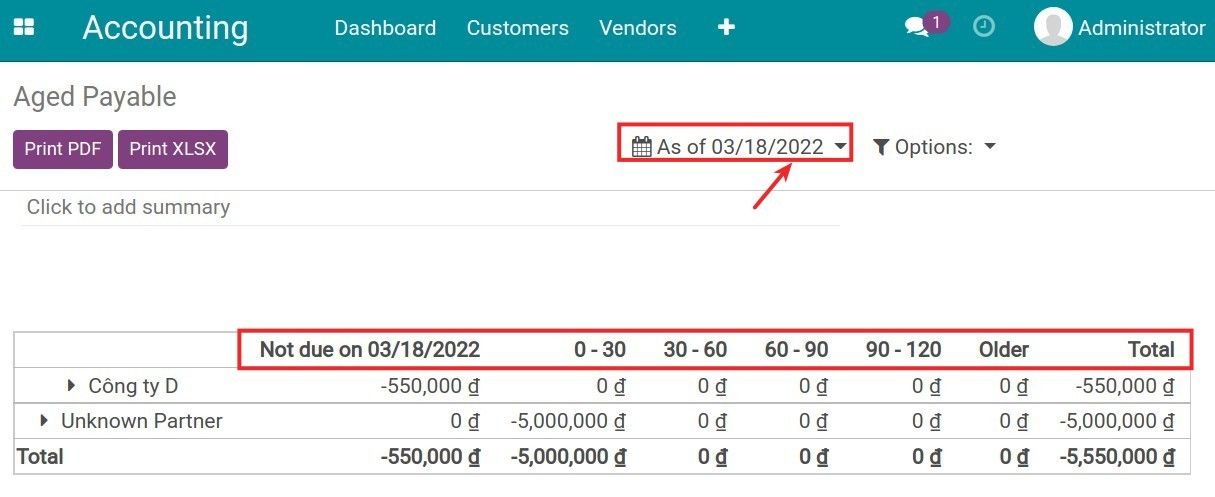

Aged Payable/Receivable reports¶

This is a type of payables/receivables report, used for tracking the payables/receivables of each customer and vendor by time purpose. There are two types: Aged Receivable and Aged Payable. These reports help businesses understand the due time of each debt for each partner. From there, businesses can come up with a reasonable method to collect the debt from each customer or pay the provider on time. This is the noticeable difference of the aged payable/receivable report compared to other payable/receivable statements.

Aged Receivable¶

Aged Payable¶

In which, at a specific time that you configured in this report:

Not due + a specific time: Undue payables/receivables.

0-30: Overdue payables/receivables overdue from 0-30 days ago.

30-60: Overdue payables/receivables from 30-60 days ago.

60-90: Overdue payables/receivables from 60-90 days ago.

90-120: Overdue payables/receivables from 90-120 days ago.

Older: Payables/receivables overdue for more than 120 days.

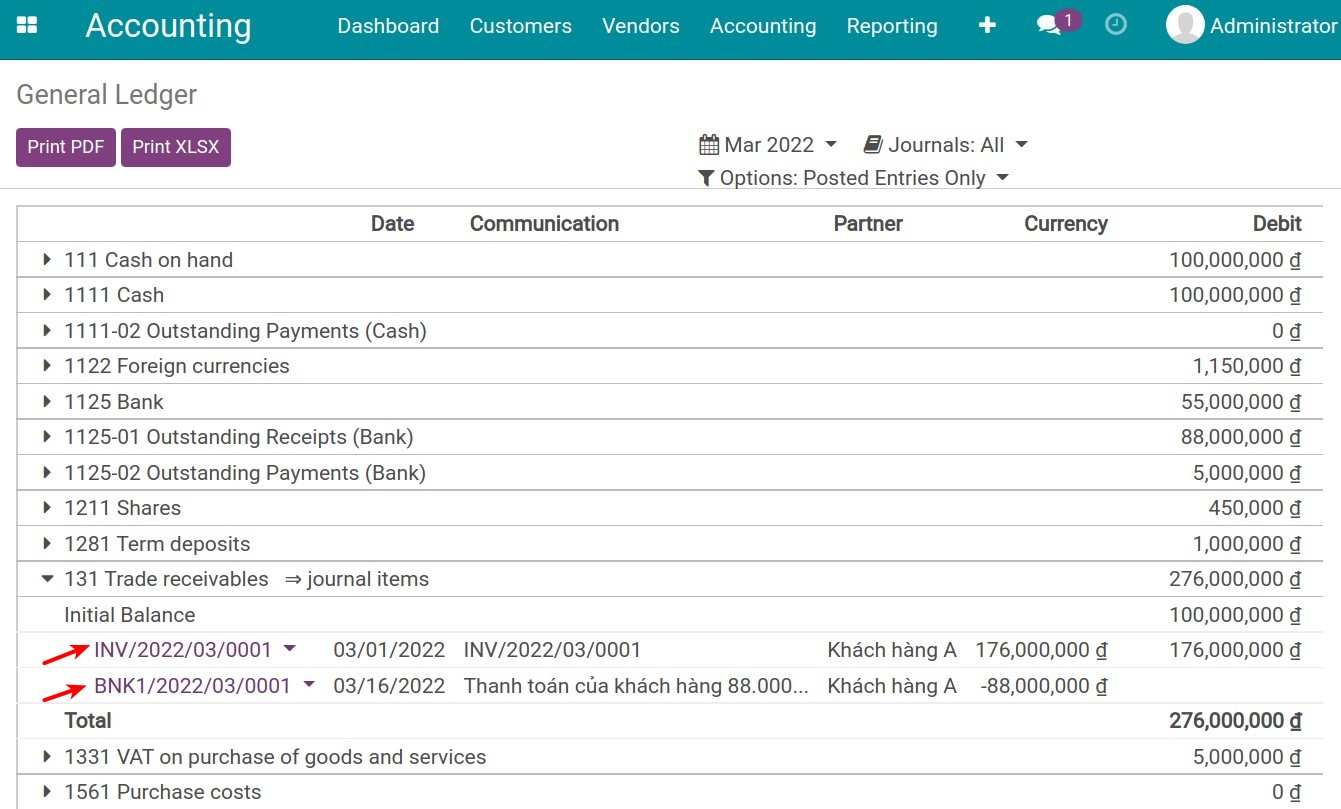

General Ledger¶

On General Ledger, each account will be displayed on a line and you can see details of each line by clicking on that journal entry.