Reconcile deposit interest and bank fees¶

The bank statement reconciliation feature of Viindoo software makes checking and controlling money data simpler. In this process, there are transactions that often arise or are repetitive, which makes the accountant spend extra time on picking up data for accounting such as Bank fees, Deposit interest, etc. Setting up the Reconciliation model beforehand will speed up these tasks for the treasurer.

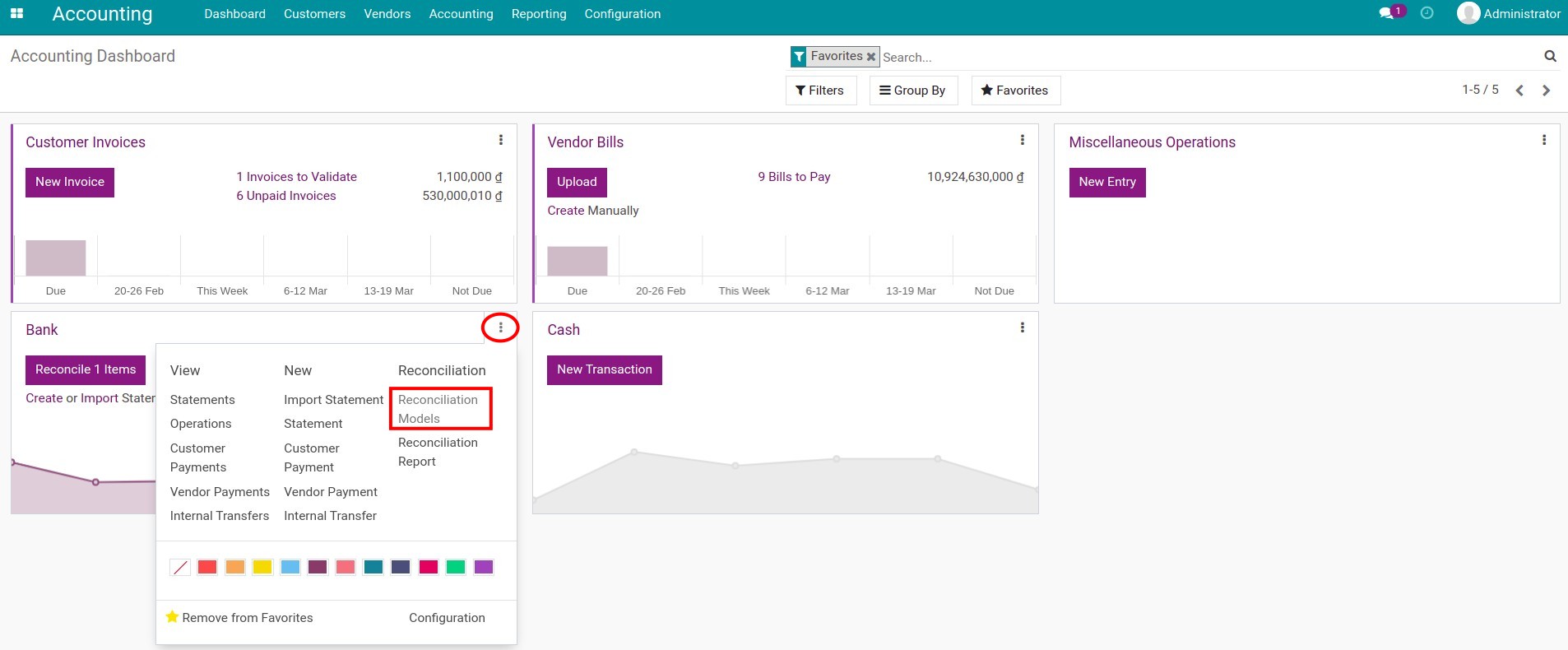

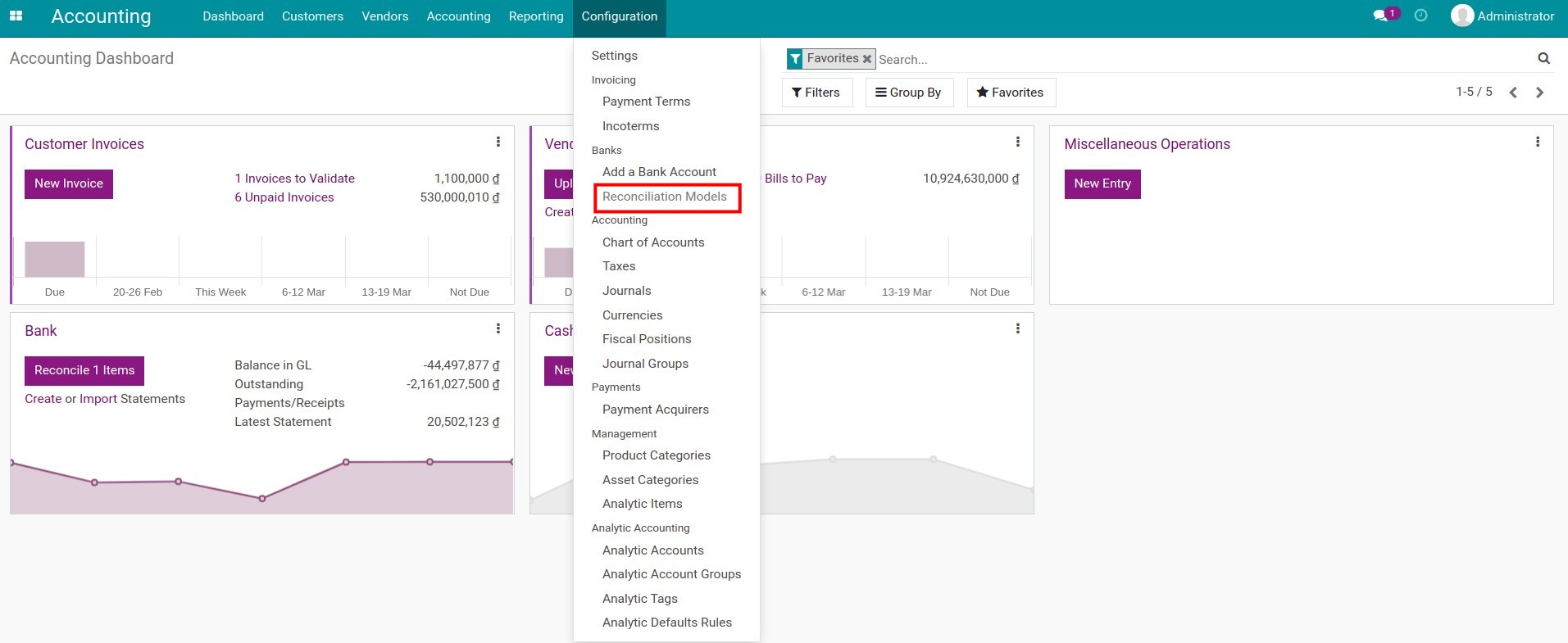

Reconciliation models¶

Manually create a write-off on clicked button.

Suggest counterpart values.

Match existing invoices/bills.

Suggest counterpart values¶

This reconciliation model suggests right away the counterpart values need to be confirmed. The automation is done based on the set of conditions configured on said model.

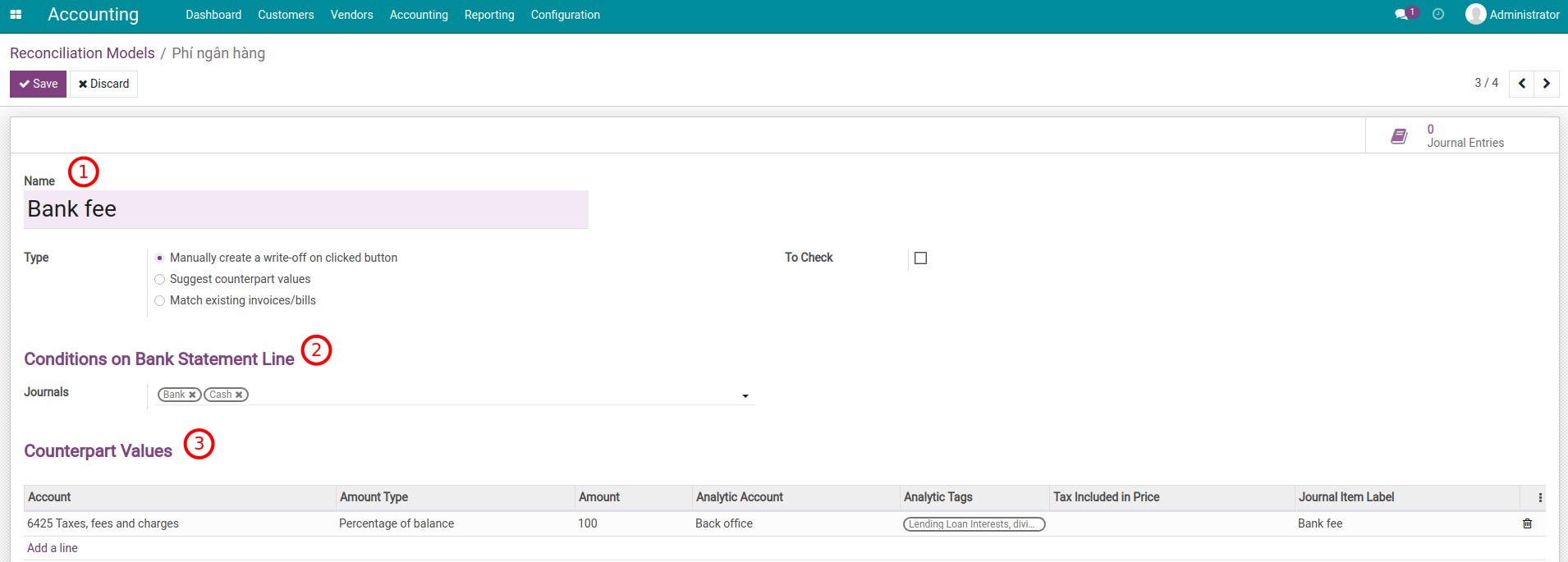

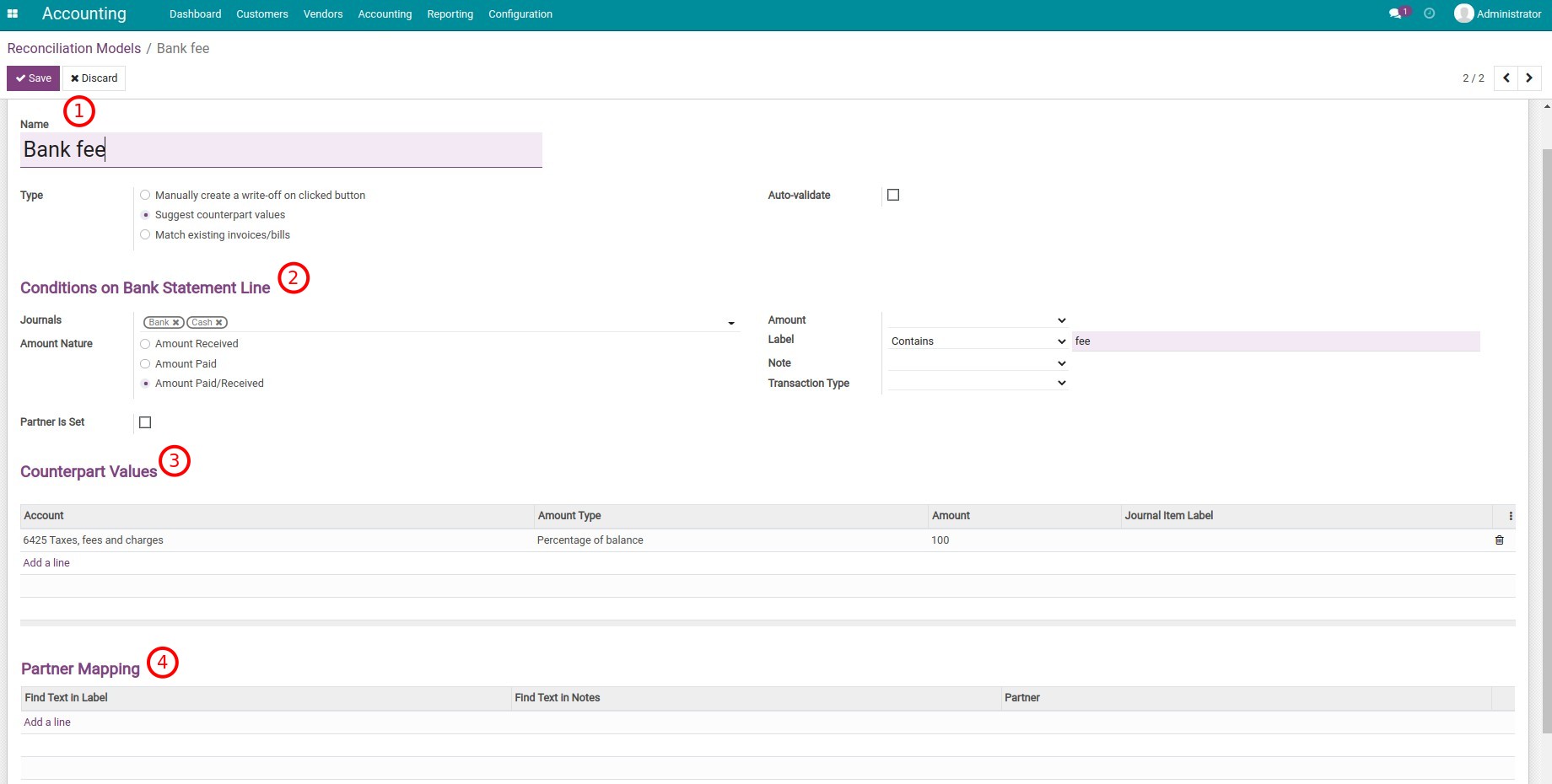

Reconciliation model information:

Name: Add a short and comprehensive name.

Type: Choose Suggest counterpart values.

Auto-validate: If checked, when reconciling a bank statement, the reconcile action is automatically confirmed and journal items will be created based on the configuration of the reconciliation model.

Conditions on Bank Statement Line:

Journals: The reconciliation subject will be displayed with the chosen journal.

Amount Nature: The reconciliation is applied for the following transaction types:

Amount Received: Applies to received money only.

Amount Paid: Applies to the paid money only.

Amount Paid/Received: Applied for both types.

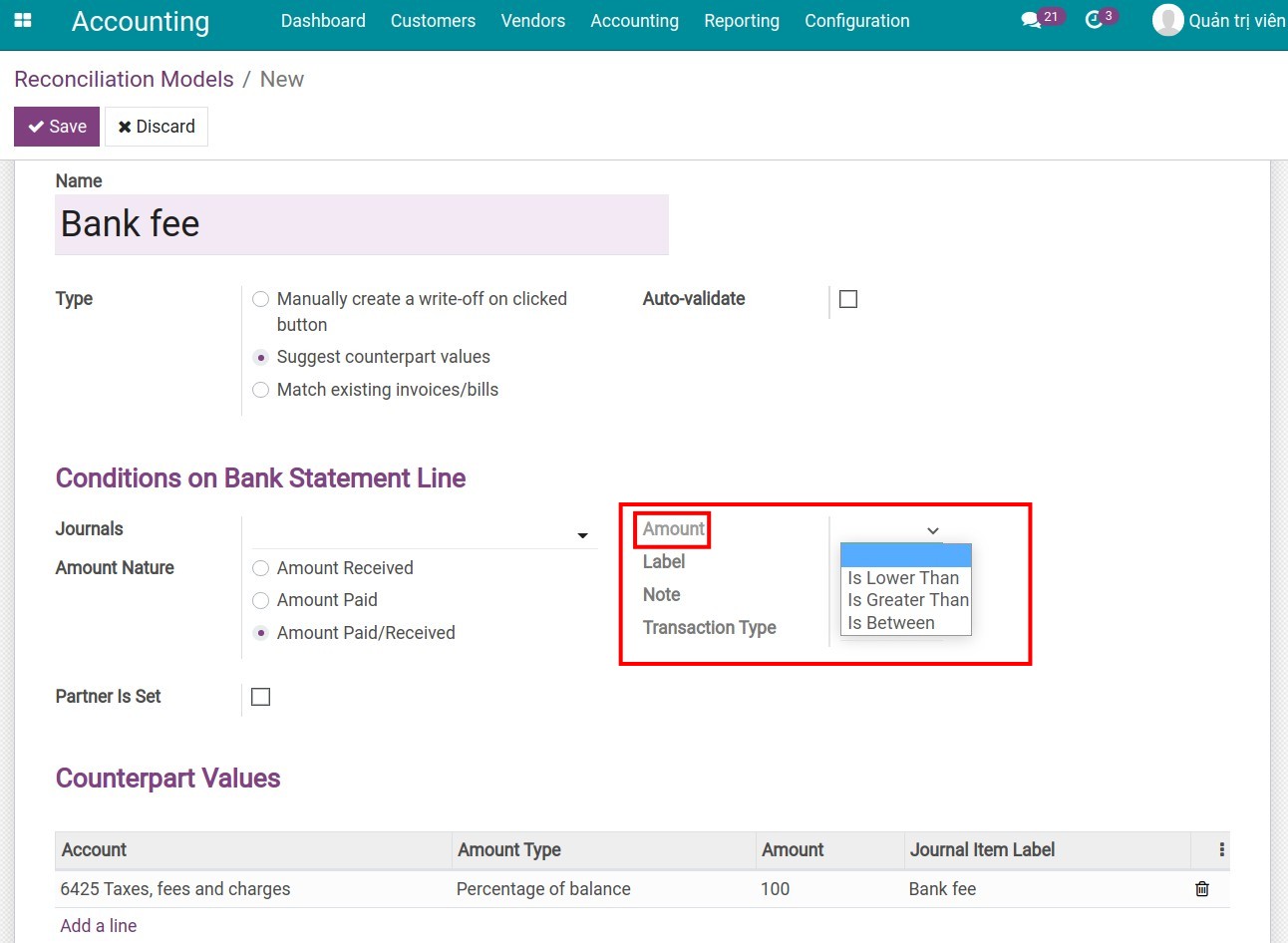

Amount: The reconciliation will be applied when the amount of money is smaller, bigger, or in a determined range.

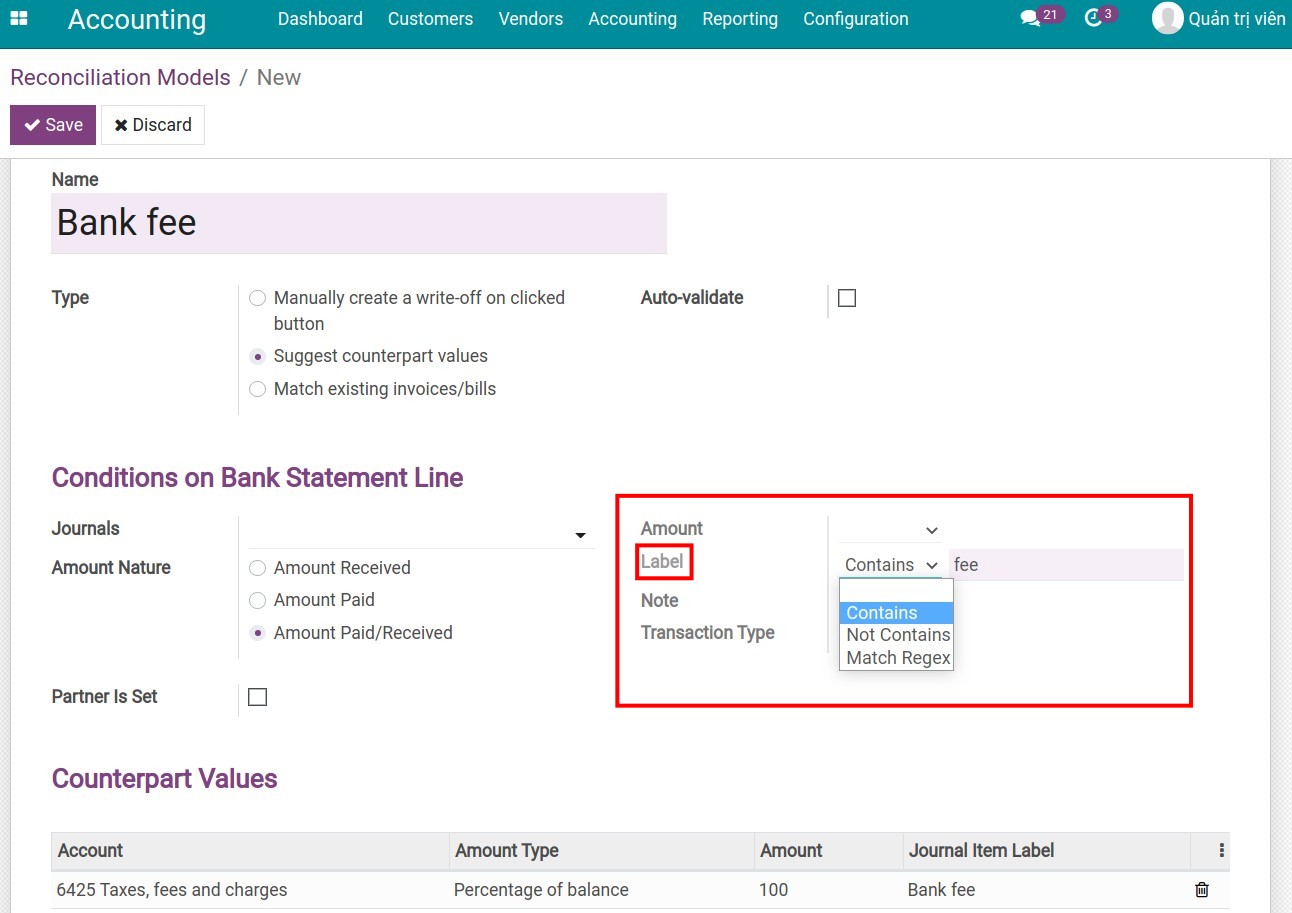

Label: The reconciliation will be automatically confirmed if the transaction’s description:

Contains: The description must contain the value written in this field.

Not Contains: The description does not contain the value written in this field.

Match Regex: Determine the content based on your own rules.

Note

Regex is the abbreviation of Regular Expression. Regular Expression is extremely useful in extracting information from a piece of text. It looks for characters in the text that match a specific rule.

Note: The reconciliation is applied only on transactions that satisfy the conditions on the note (similar to the Label field).

Transaction Type: The reconciliation model is applied only on transactions that satisfy the conditions (similar to the Label field).

Partner Is Set: If checked, the reconciliation mechanism is applied to Customers/Providers. These subjects can be reduced with the following conditions:

Restrict Partners to.

Restrict Partner Categories to.

Counterpart Values: Refer to the settings of the Manually creating a write-off on clicked button model for more information.

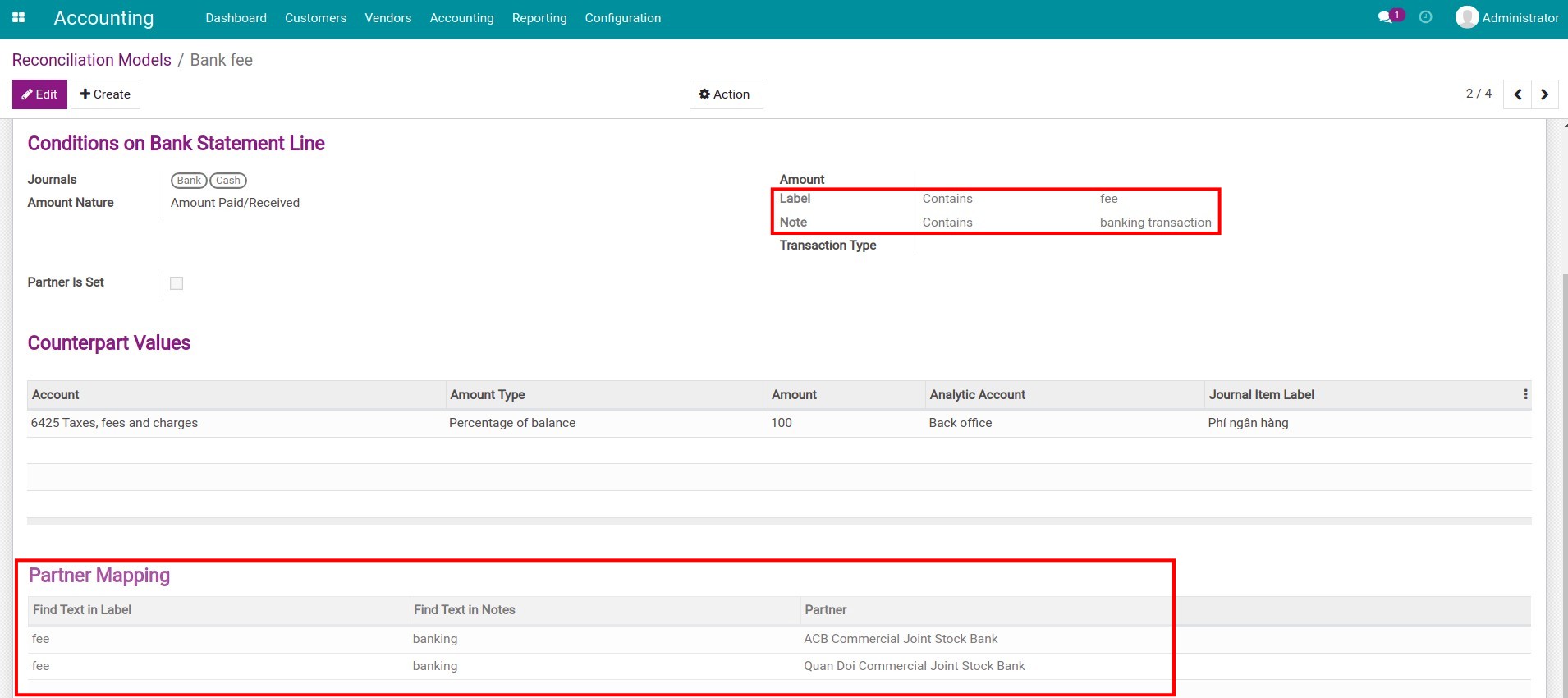

Partner Mapping: You can create multiple conditions for partner mapping, each line is a corresponding partner with the find conditions in the Label and Notes fields.

Press Save. With the above example, the conditions set for the reconciliation model are:

Label contains: fee.

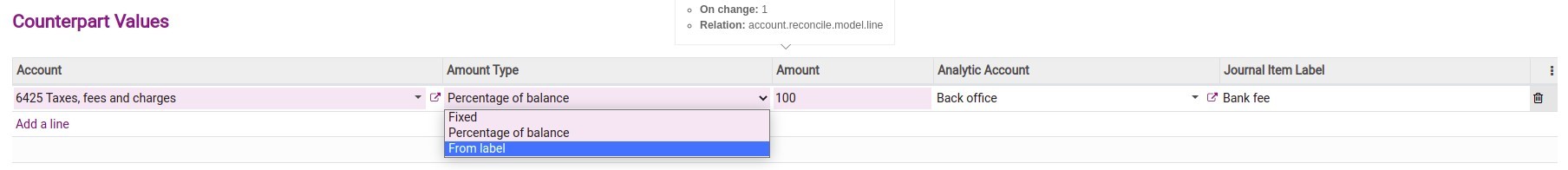

Counterpart Values:

Account: 6425

Amount Type: Percentage of balance.

Amount: 100

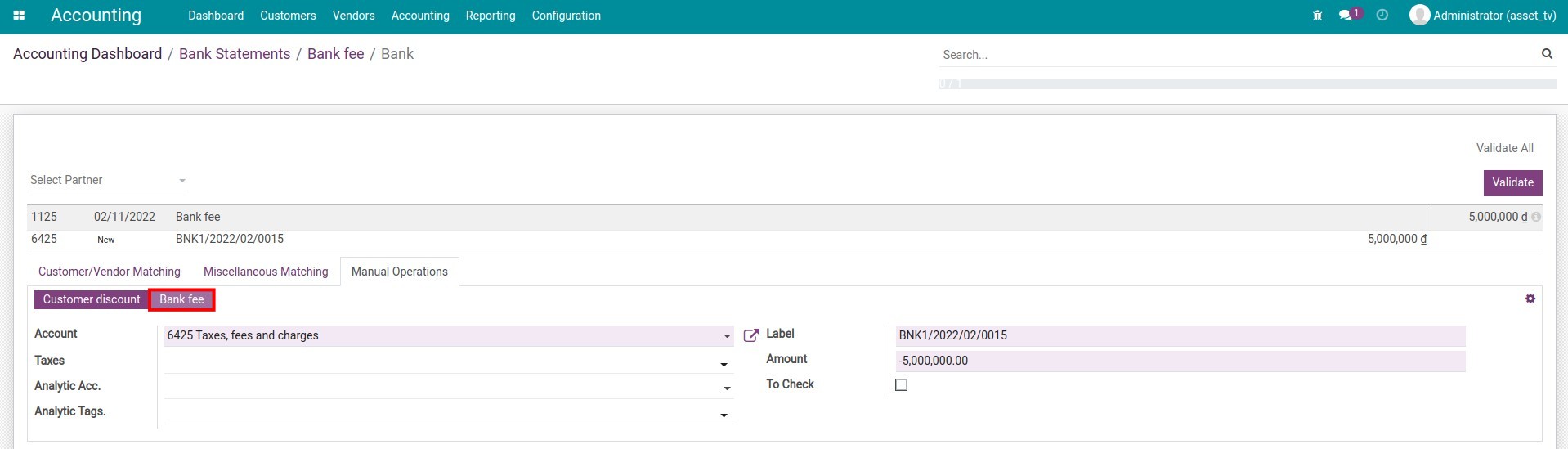

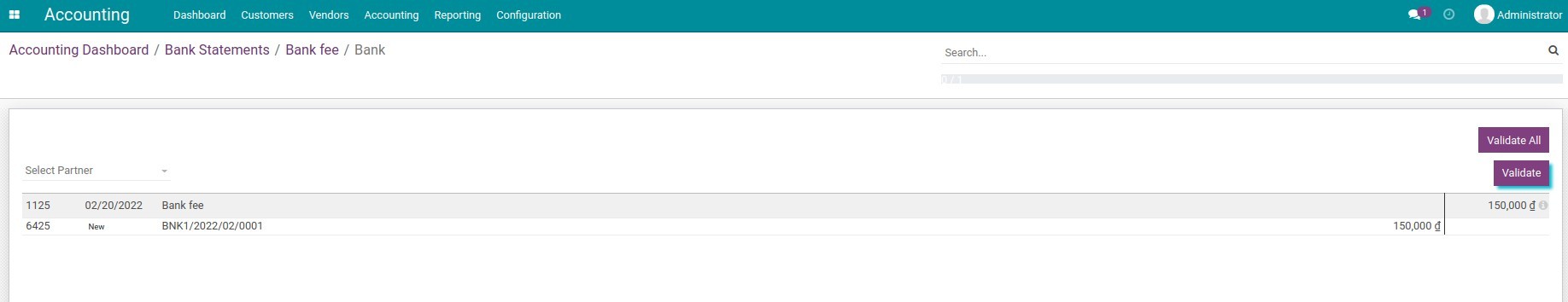

When you create a bank statement and select Reconcile, the system will automatically search and match each journal item with the bank statement as in the image below.

Finally, you have to validate the bank statement to finish the reconciliation process.

Match existing invoices/bills¶

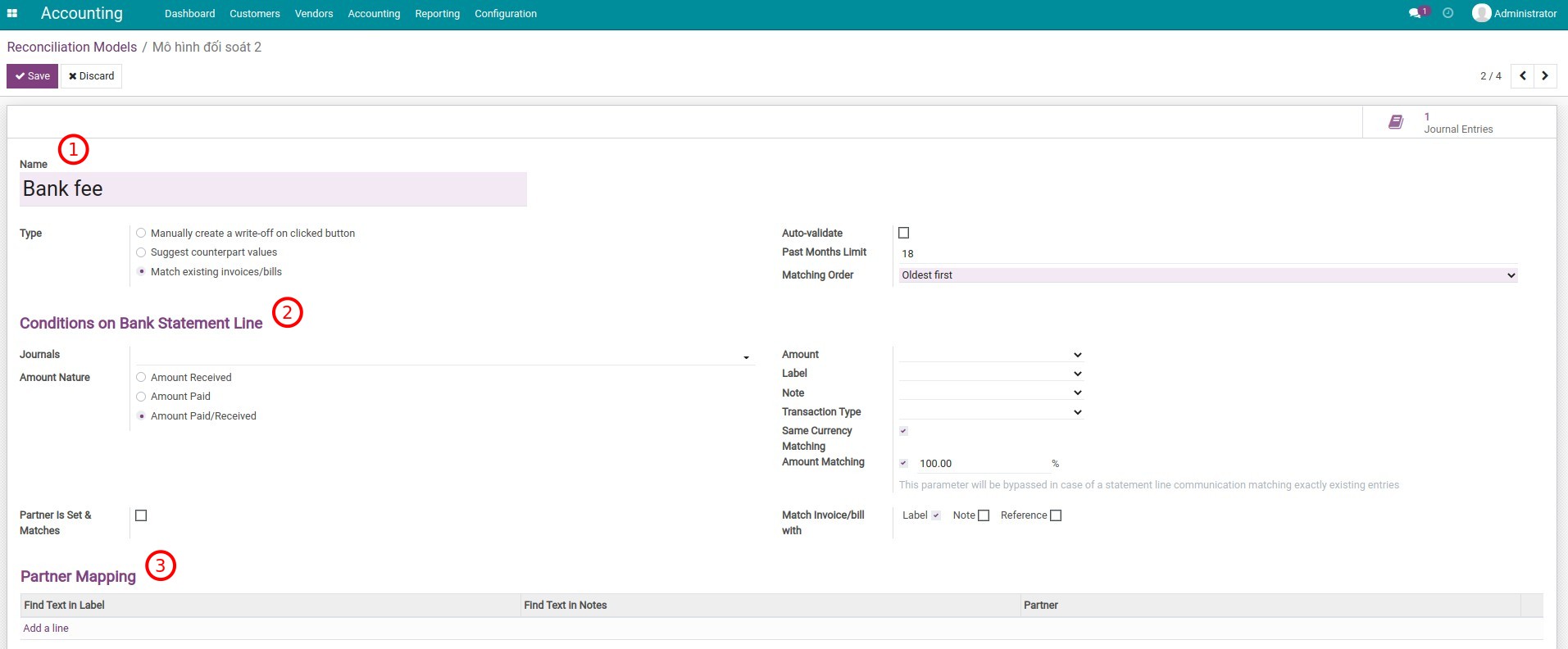

This type of reconciliation model will automatically choose the right customer invoice or vendor bill that matches the payment amount. The configuration for this model is similar to the one for the Suggestion counterpart values model. However, you need to pay attention to the following fields:

Reconciliation model information

Past Months Limit: Number of months in the past to consider accounting incursions when this condition applies.

Matching Order: Choose the transactions matching order, there are 2 options:

Oldest first.

Newest first.

Conditions on Bank Statement Line

Same Currency Matching: If checked, only the journal items in the same currencies can be reconciled.

Amount Matching: Recommend the remaining balance to match the amount in the cash book.

Match Invoice/bill with: If checked, it will increase the ability to find the exact invoice that matches the payment.

Fill the Partner Mapping information following this instruction.

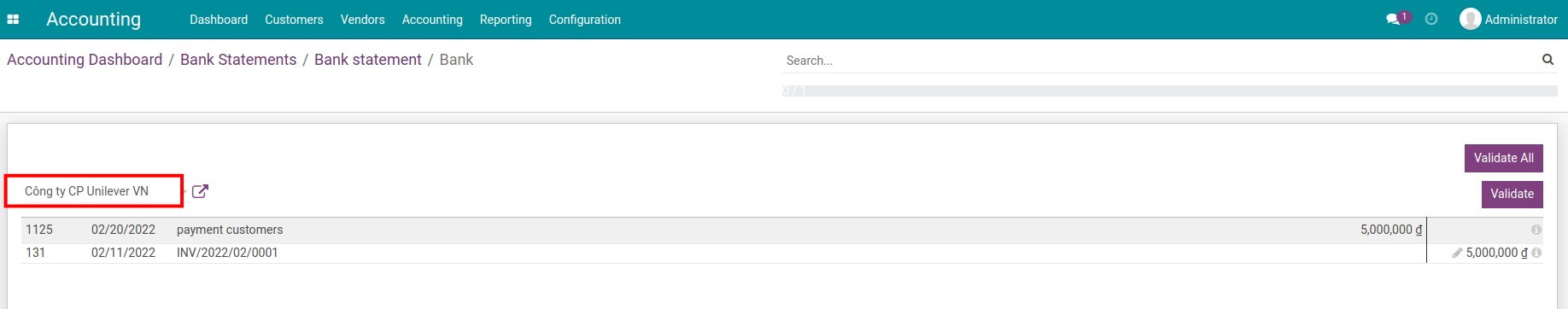

Click Save. You need to add the full name of the customer or provider when reconciling from a bank statement. The system will search and match the invoice that was created earlier.

Then press Validate to proceed with the reconciliation and also Validate the bank statement.