Create reconciliation model for deposit interest and bank fees¶

The bank statement reconciliation feature of Viindoo Enterprise Management Solutions makes checking and controlling money data simpler. In this process, there are transactions that often arise or are repetitive, which makes the accountant spend extra time on picking up data for accounting such as Bank fees, Deposit interest , etc. Setting up the Reconciliation model beforehand will speed up these tasks for the treasurer.

Requirements

This tutorial requires the installation of the following applications/modules:

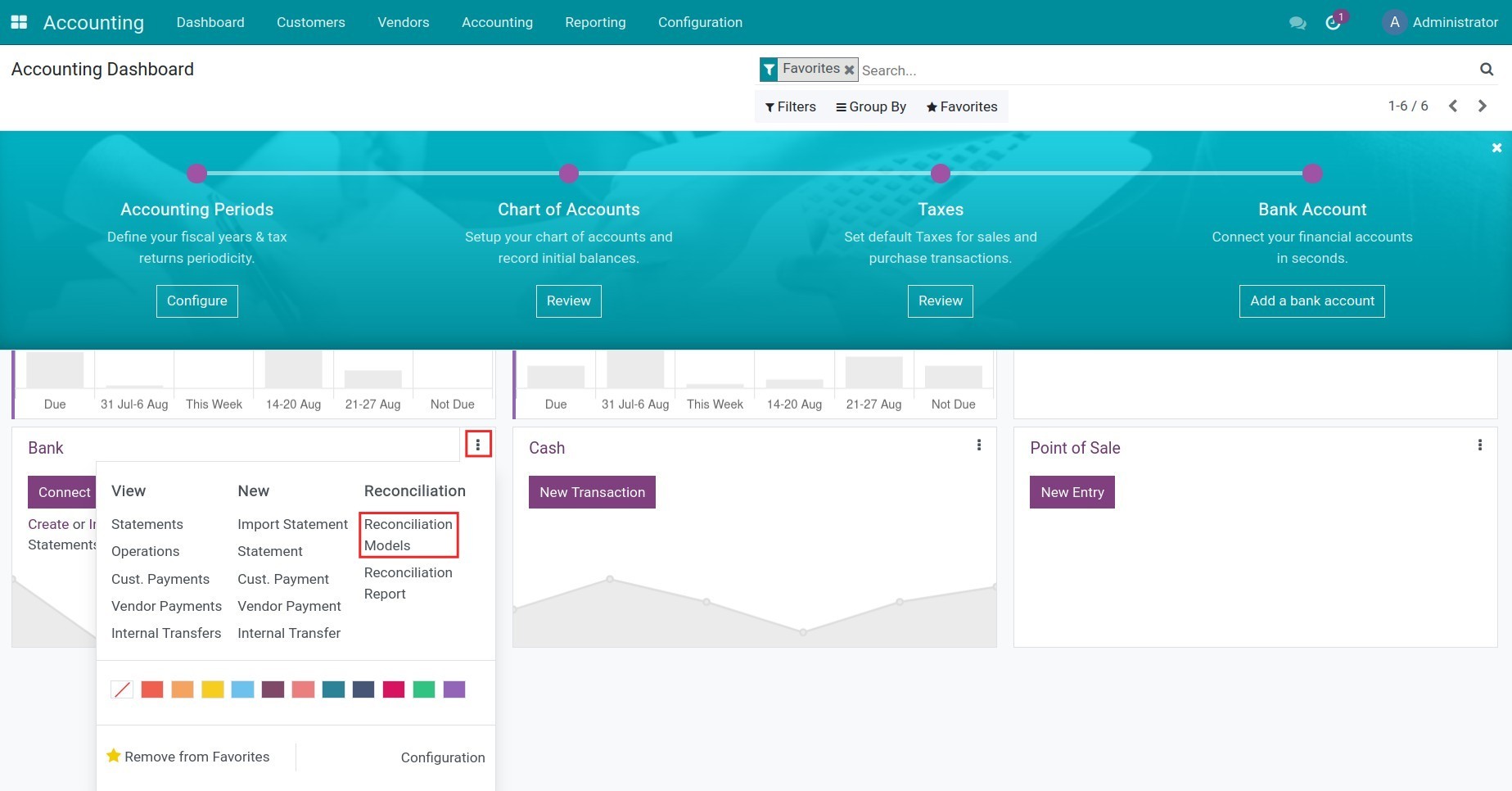

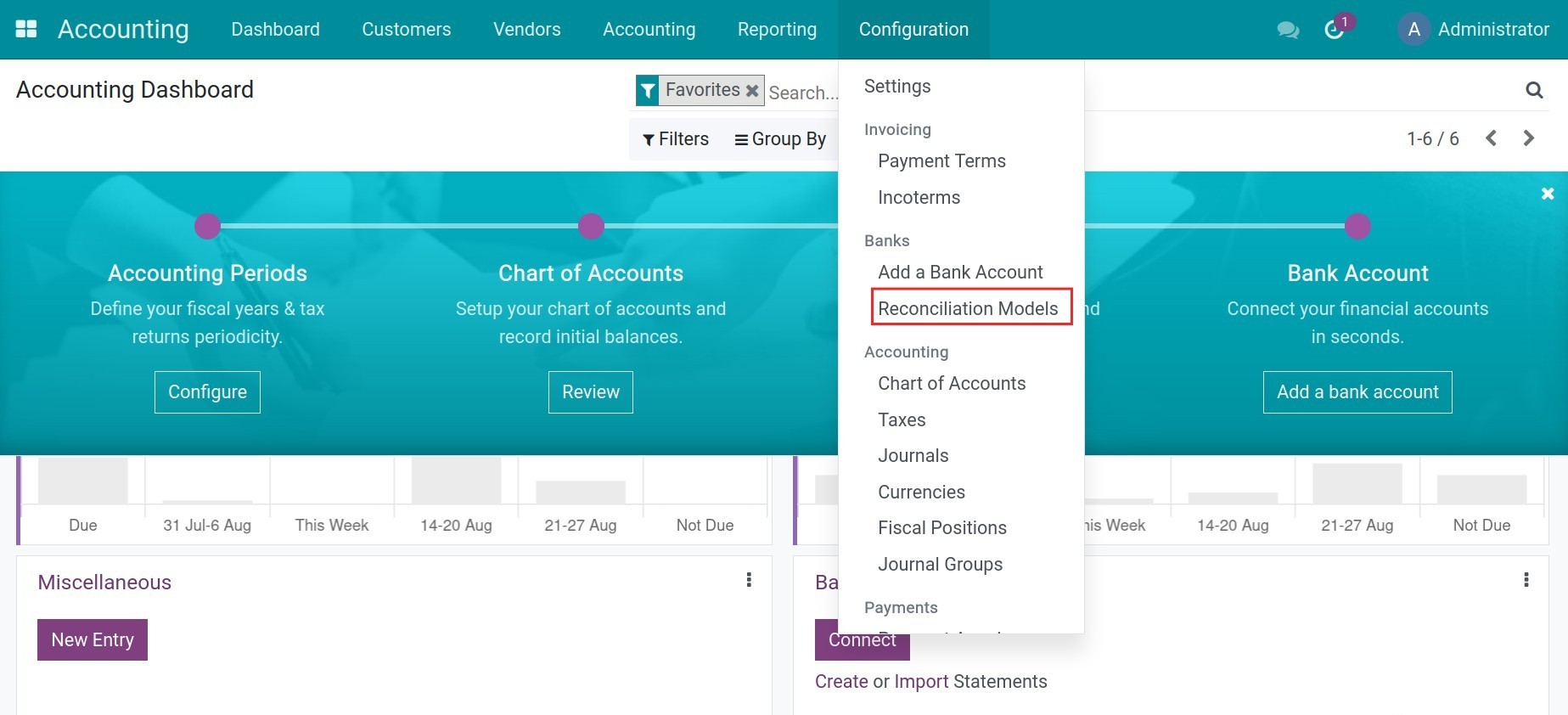

Reconciliation models¶

Button to generate counterpart entry.

Rule to suggest counterpart entry.

Rule to match invoices/bills.

Rule to suggest counterpart entry¶

This reconciliation model suggests right away the counterpart values need to be confirmed. The automation is done based on the set of conditions configured on said model.

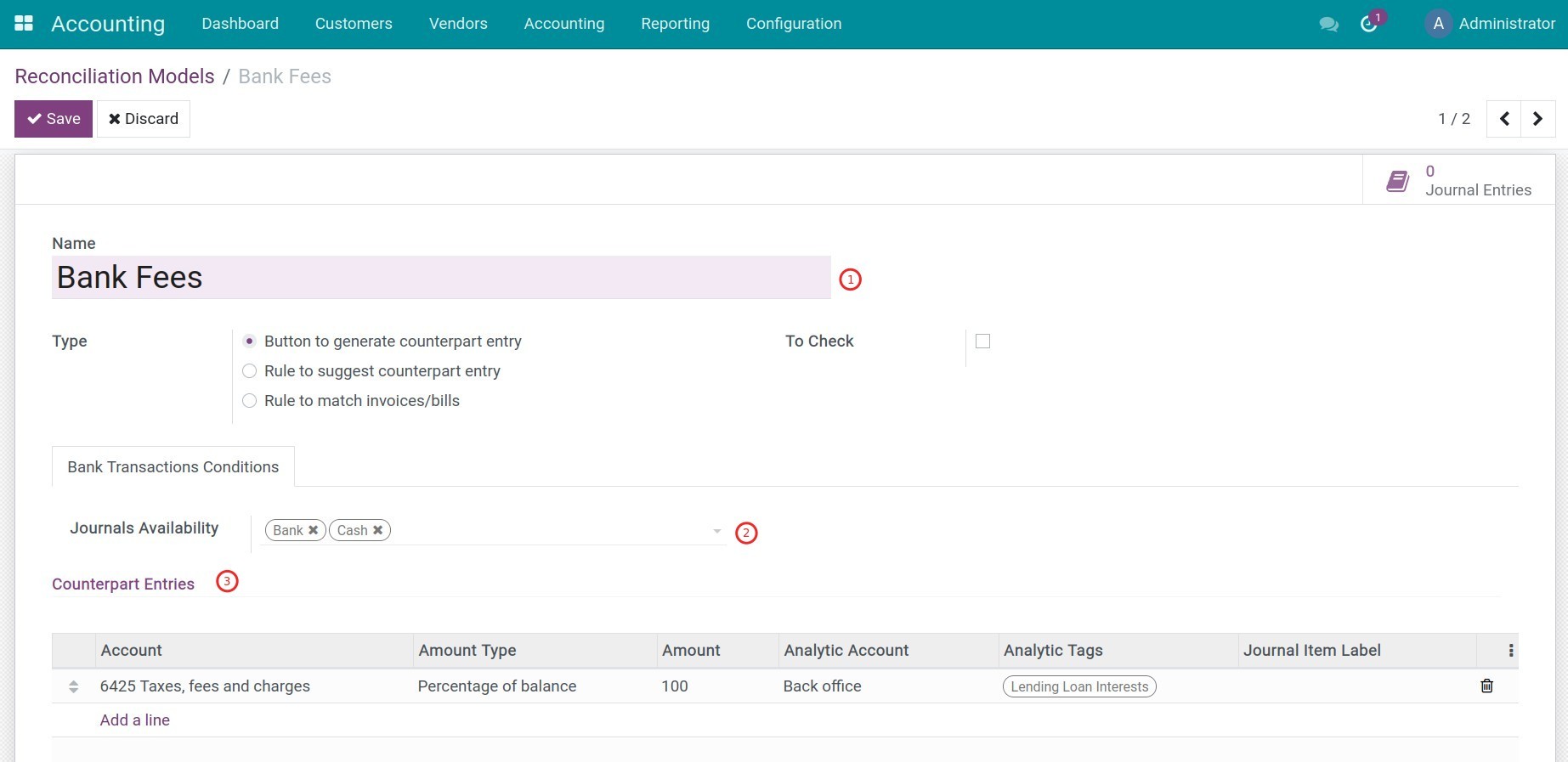

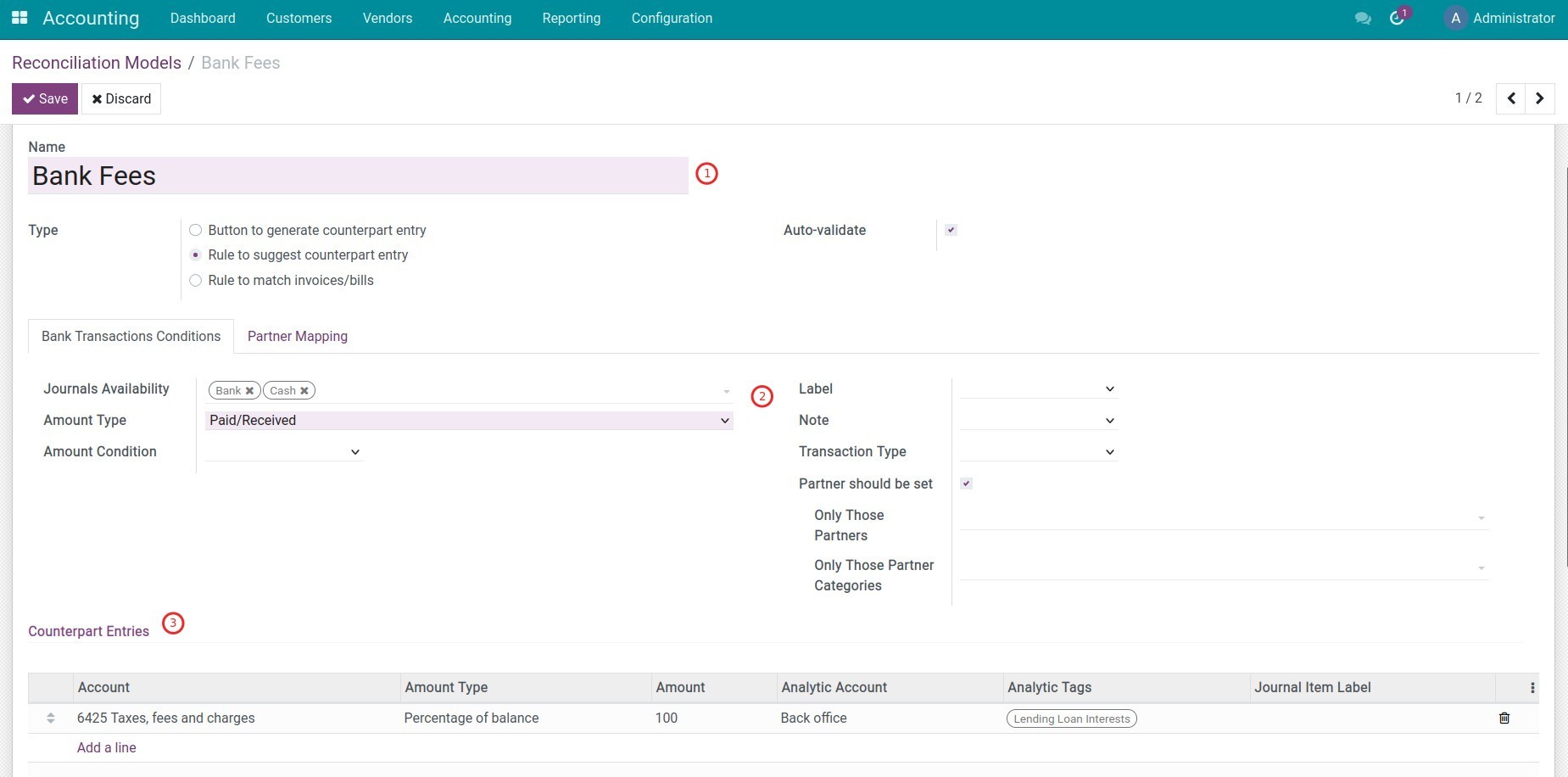

Reconciliation model information:

Name: Add a short and comprehensive name.

Type: Choose Rule to suggest counterpart entry.

Auto-validate: If checked, when reconciling a bank statement, the reconcile action is automatically confirmed and journal items will be created based on the configuration of the reconciliation model.

Tab Bank Transactions Conditions:

Journals Availability: The reconciliation subject will be displayed with the chosen journal.

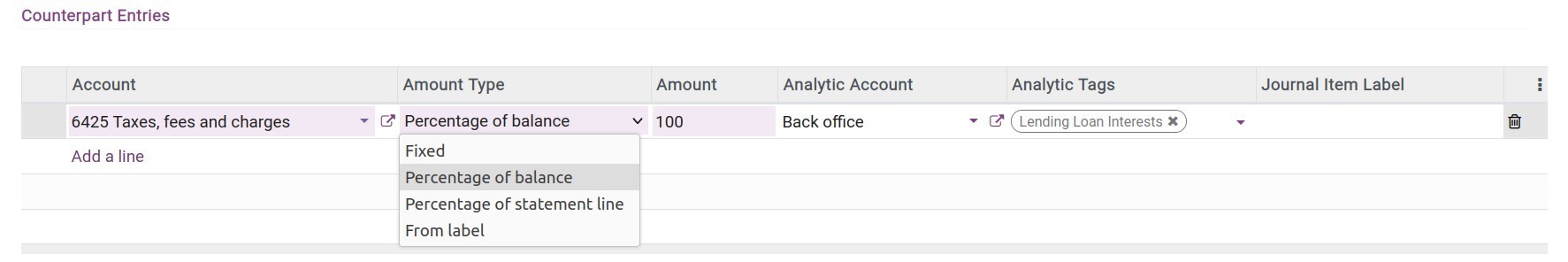

Amount Type: The reconciliation is applied for the following transaction types:

Amount Received: Applies to received money only.

Amount Paid: Applies to the paid money only.

Amount Paid/Received: Applied for both types.

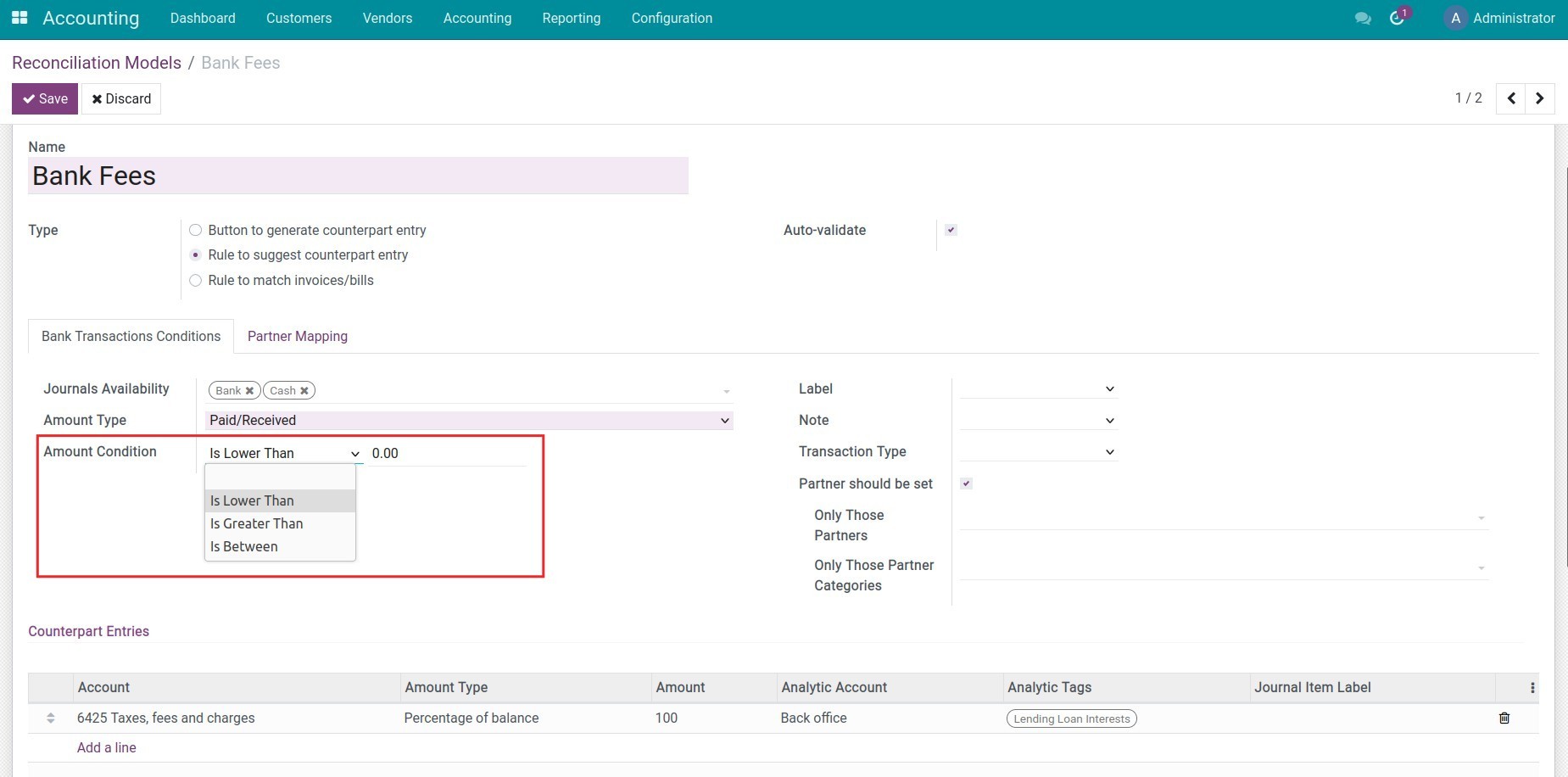

Amount Condition: The reconciliation will be applied when the amount of money is smaller, bigger, or in a determined range.

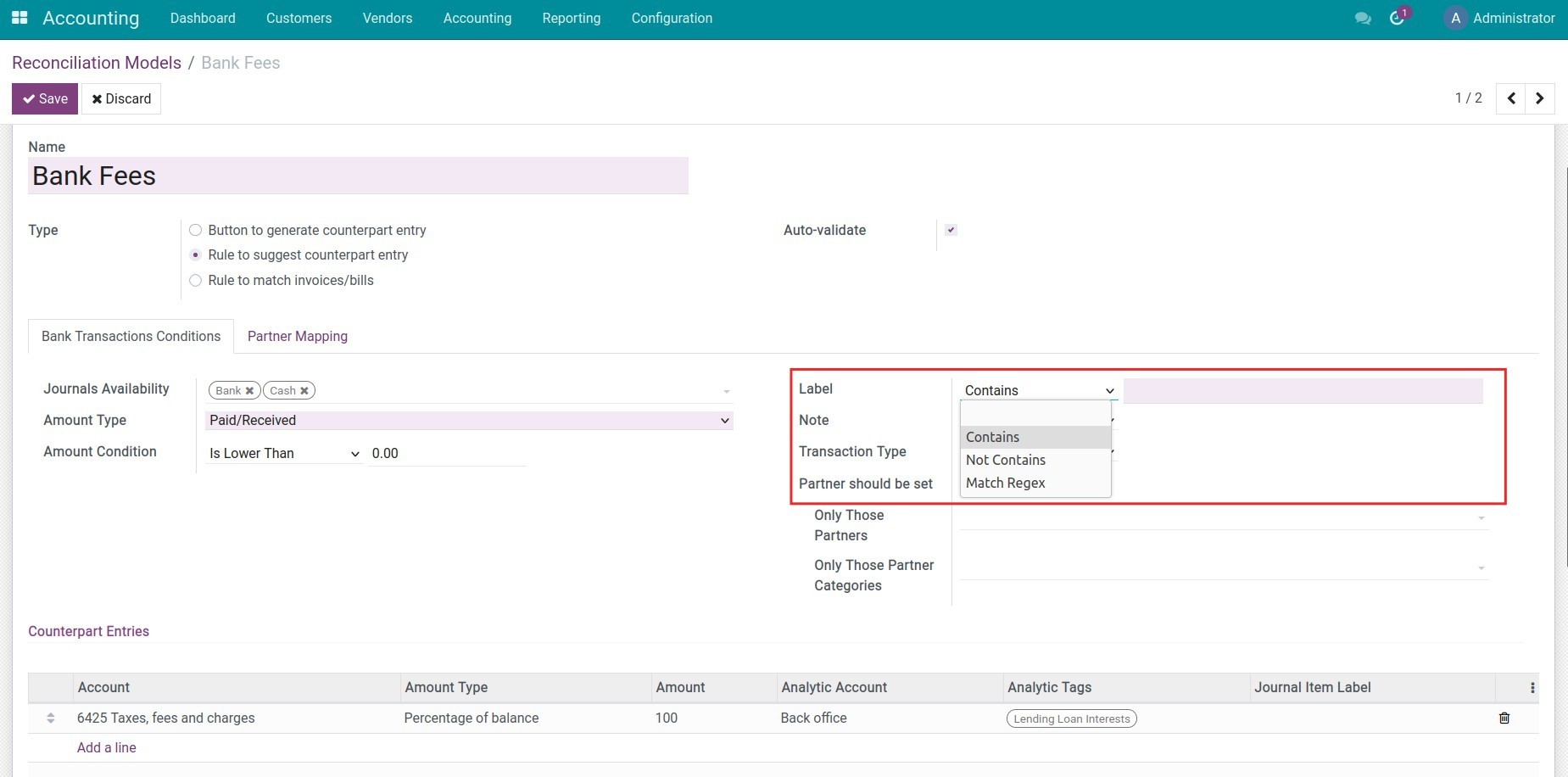

Label: The reconciliation will be automatically confirmed if the transaction’s description:

Contains: The description must contain the value written in this field.

Not Contains: The description does not contain the value written in this field.

Match Regex: Determine the content based on your own rules.

Note

Regex is the abbreviation of Regular Expression. Regular Expression is extremely useful in extracting information from a piece of text. It looks for characters in the text that match a specific rule.

Note: The reconciliation is applied only on transactions that satisfy the conditions on the note (similar to the Label field).

Transaction Type: The reconciliation model is applied only on transactions that satisfy the conditions (similar to the Label field).

Partner should be set: If checked, the reconciliation mechanism is applied to Customers/Providers. These subjects can be reduced with the following conditions:

Only Those Partners.

Only Those Partner Categories.

Counterpart Entries: Refer to the settings of the Button to generate counterpart entry model for more information.

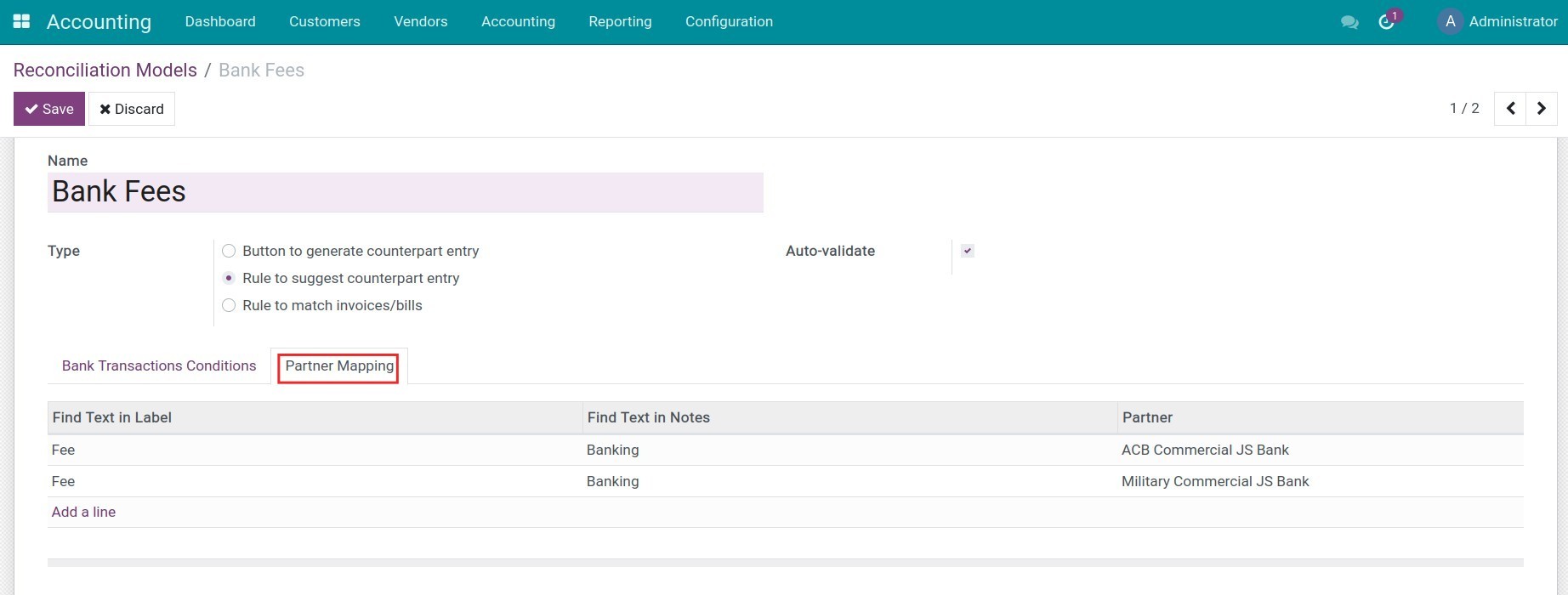

Tab Partner Mapping: You can create multiple conditions for partner mapping, each line is a corresponding partner with the find conditions in the Label and Notes fields.

Press Save. With the above example, the conditions set for the reconciliation model are:

Label contains: fee.

Counterpart Entries:

Account: 6425

Amount Type: Percentage of balance.

Amount: 100

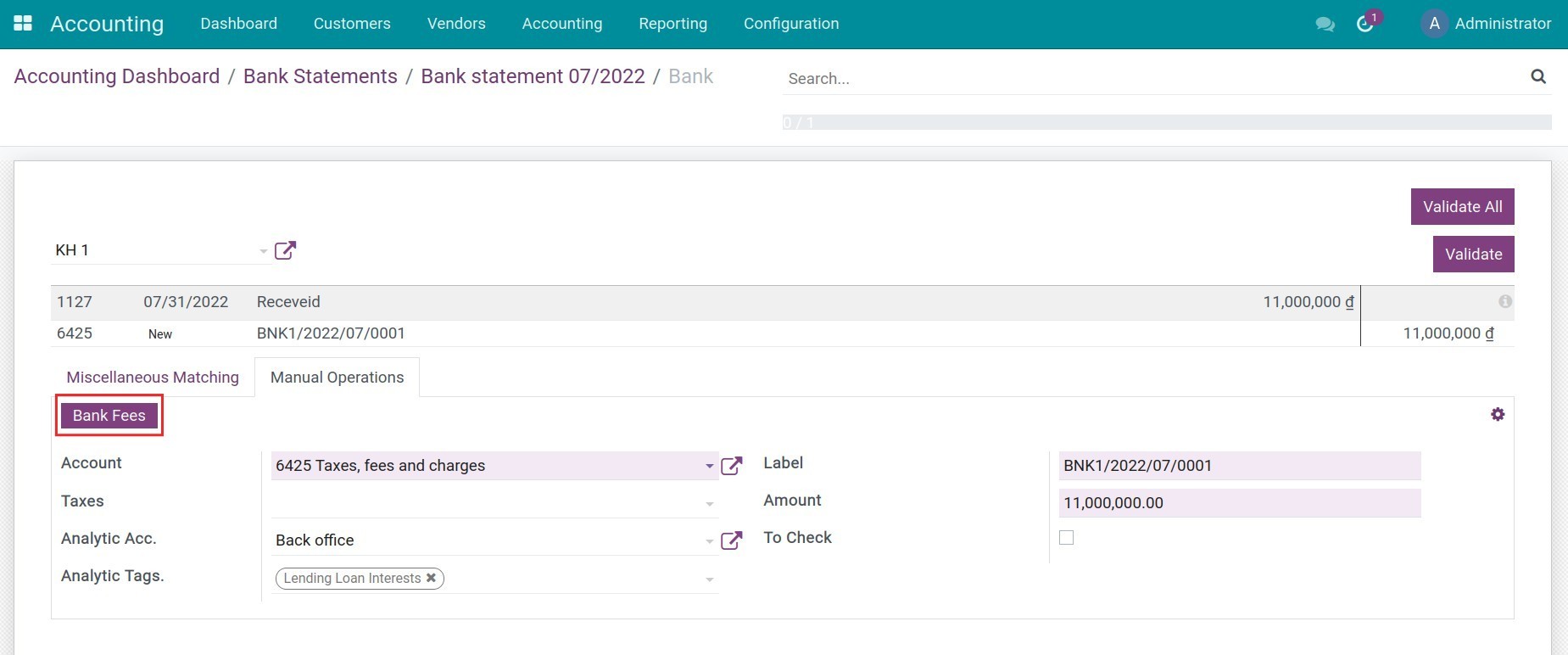

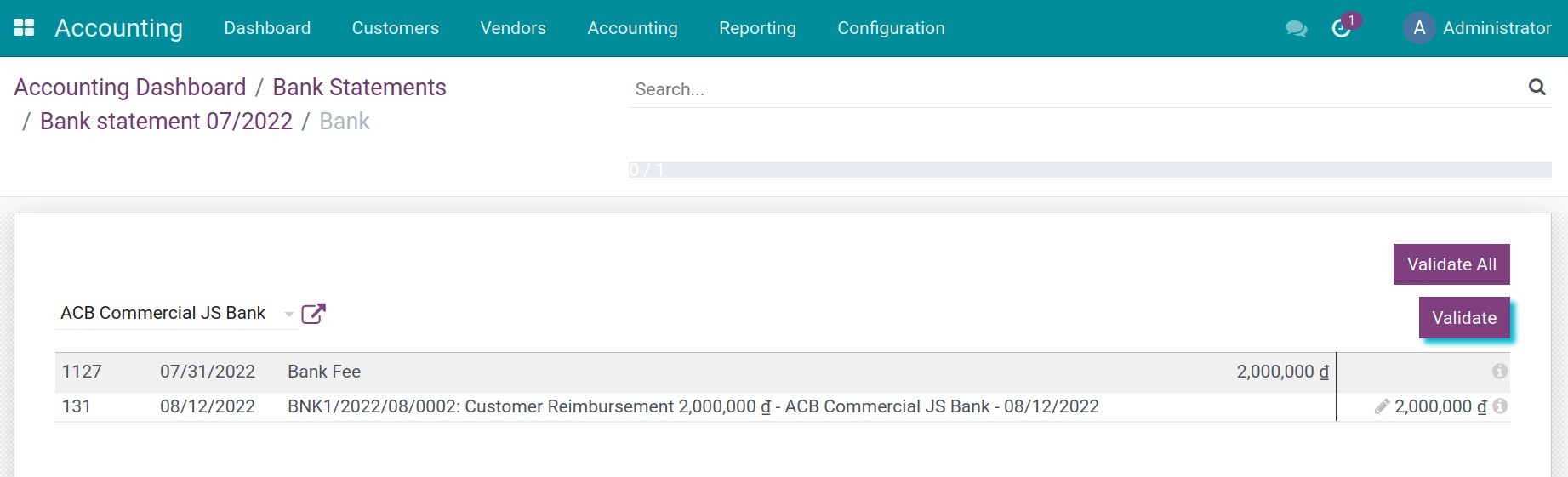

When you create a bank statement and select Reconcile, the system will automatically search and match each journal item with the bank statement as in the image below.

Finally, you have to validate the bank statement to finish the reconciliation process.

Rule to match invoices/bills¶

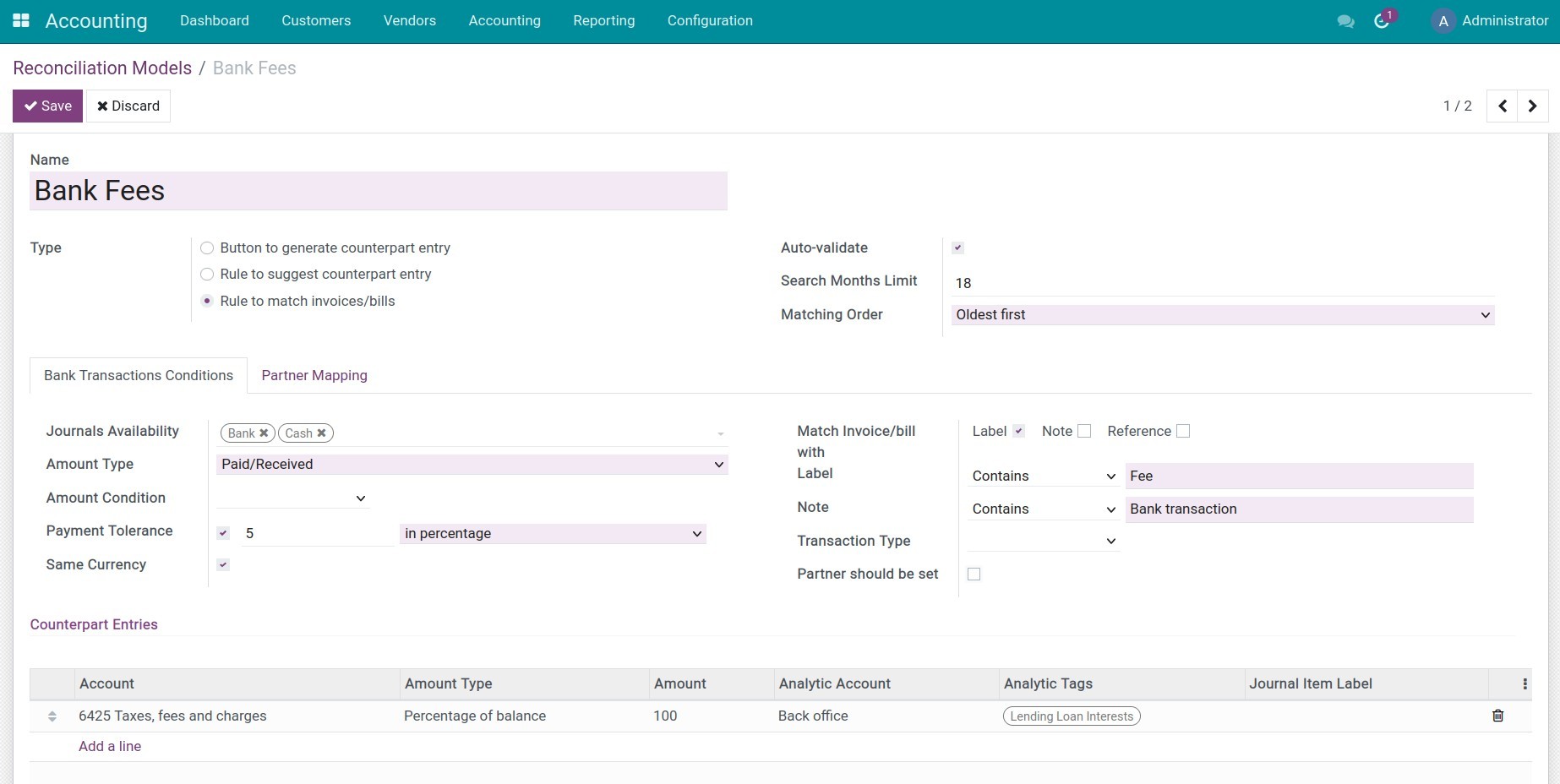

This type of reconciliation model will automatically choose the right customer invoice or vendor bill that matches the payment amount. The configuration for this model is similar to the one for the Suggestion counterpart values model. However, you need to pay attention to the following fields:

Reconciliation model information

Past Months Limit: Number of months in the past to consider accounting incursions when this condition applies.

Matching Order: Choose the transactions matching order, there are 2 options:

Oldest first.

Newest first.

Tab Bank Transactions Conditions

Same Currency: If checked, only the journal items in the same currencies can be reconciled.

Payment Tolerance: The acceptable payment amount difference in percentage or in absolute amount. This will be used in case of underpayment.

Match Invoice/bill with: If checked, it will increase the ability to find the exact invoice that matches the payment.

Tab Partner Mapping: Fill the information to map partner.

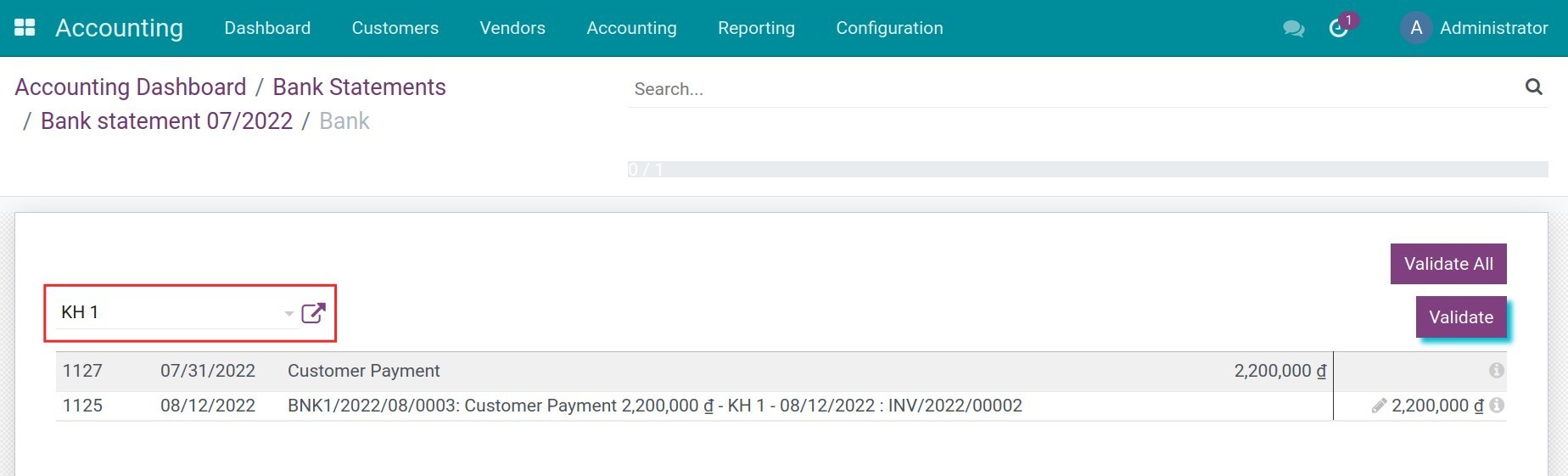

Click Save. You need to add the full name of the customer or provider when reconciling from a bank statement. The system will search and match the invoice that was created earlier.

Then press Validate to proceed with the reconciliation and also Validate the bank statement.

See also

Related article

Optional module