Configure charts of accounts and depreciation method for Assets Category¶

Assets of an enterprise are both tangible and intangible resources owned, controlled, and distributed by that enterprise, to create economic value.

Viindoo brings to customers different ways to create an asset:

Create assets directly at the Assets menu;

Create assets from Vendor bills;

Create assets from Stock receipts - Stock deliveries.

Whatever the approach you choose, you still need to create an Asset Category first. This is the place to classify and track an asset. An asset belonging to this Asset Category will inherit all configurations of that category. Each asset might have its own characteristics that need to be configured differently from the settings of the asset category. This topic will be explored in other articles. In this article, we will focus on how to set up an Asset Category.

Requirements

This tutorial requires the installation of the following applications/modules:

Module Installation¶

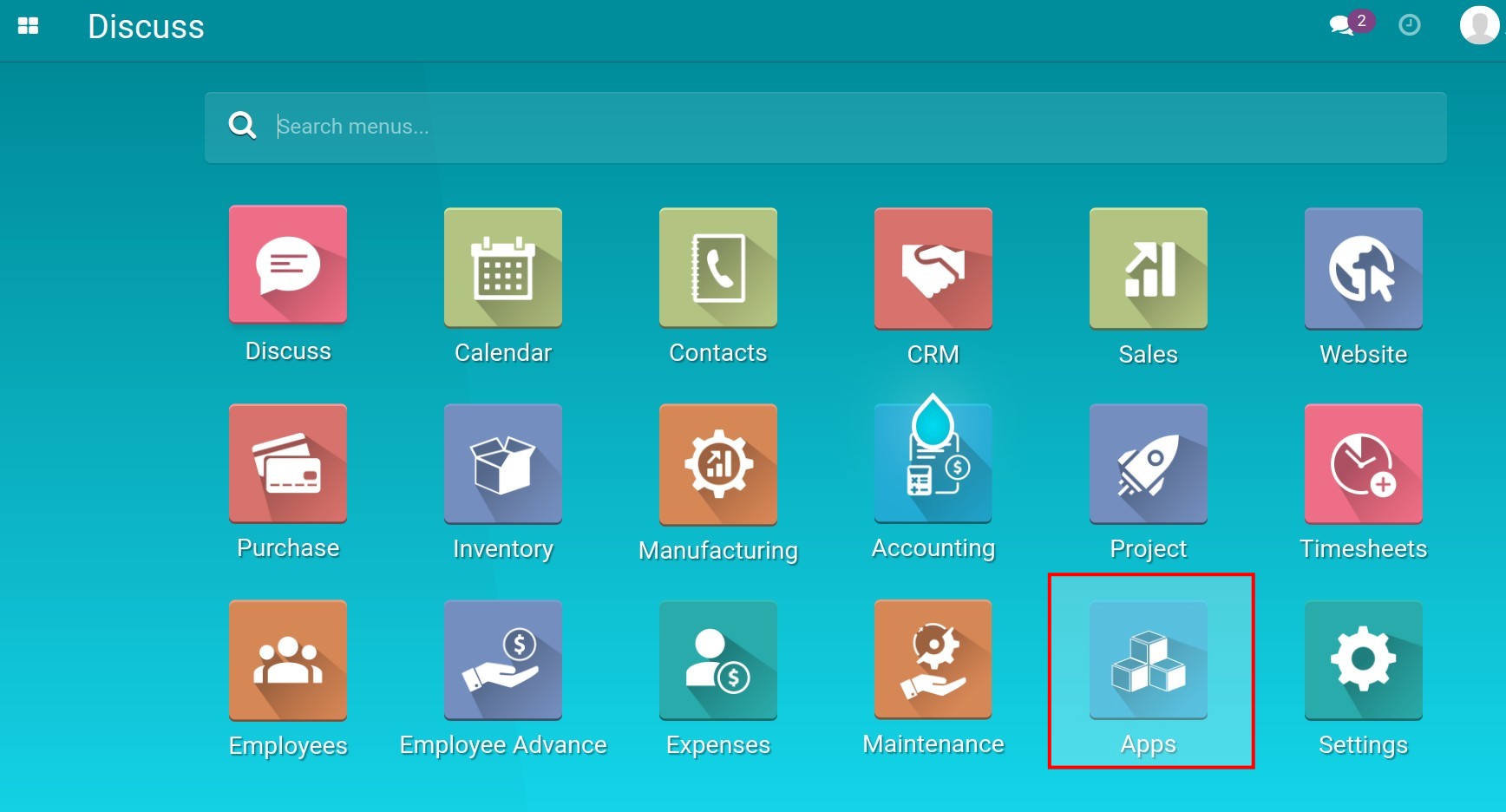

To begin the installation, navigate to the Viindoo Apps in the main menu.

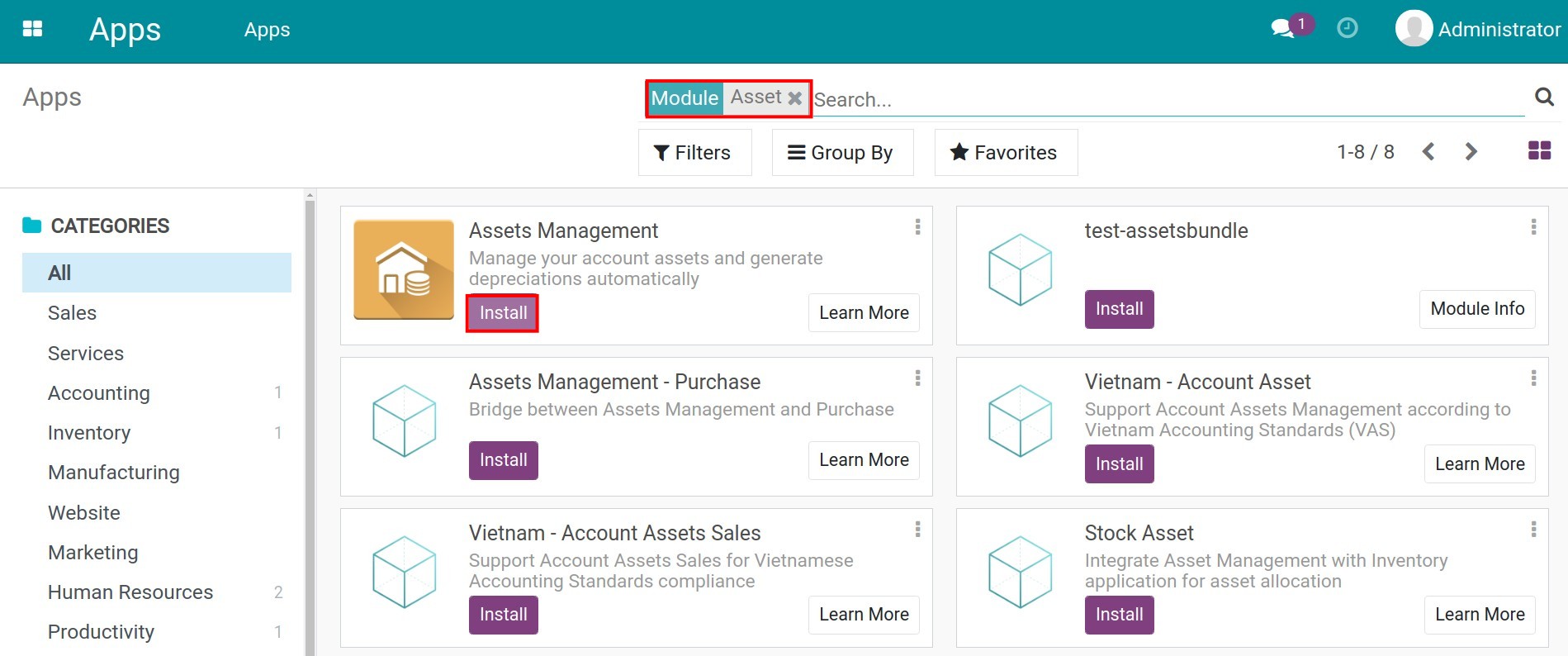

You can install the module by typing the keyword Asset on the search bar and clicking on the Install button.

Configure Asset Category¶

To reduce time in creating a new asset, you can create an asset category beforehand. Having a dedicated asset category is very useful when your company frequently uses one asset type or assets have similarities such as: being used by one department, having similar depreciation period, etc. Normally, the person that can create a new asset category in the system is the Administrator of the Accounting app.

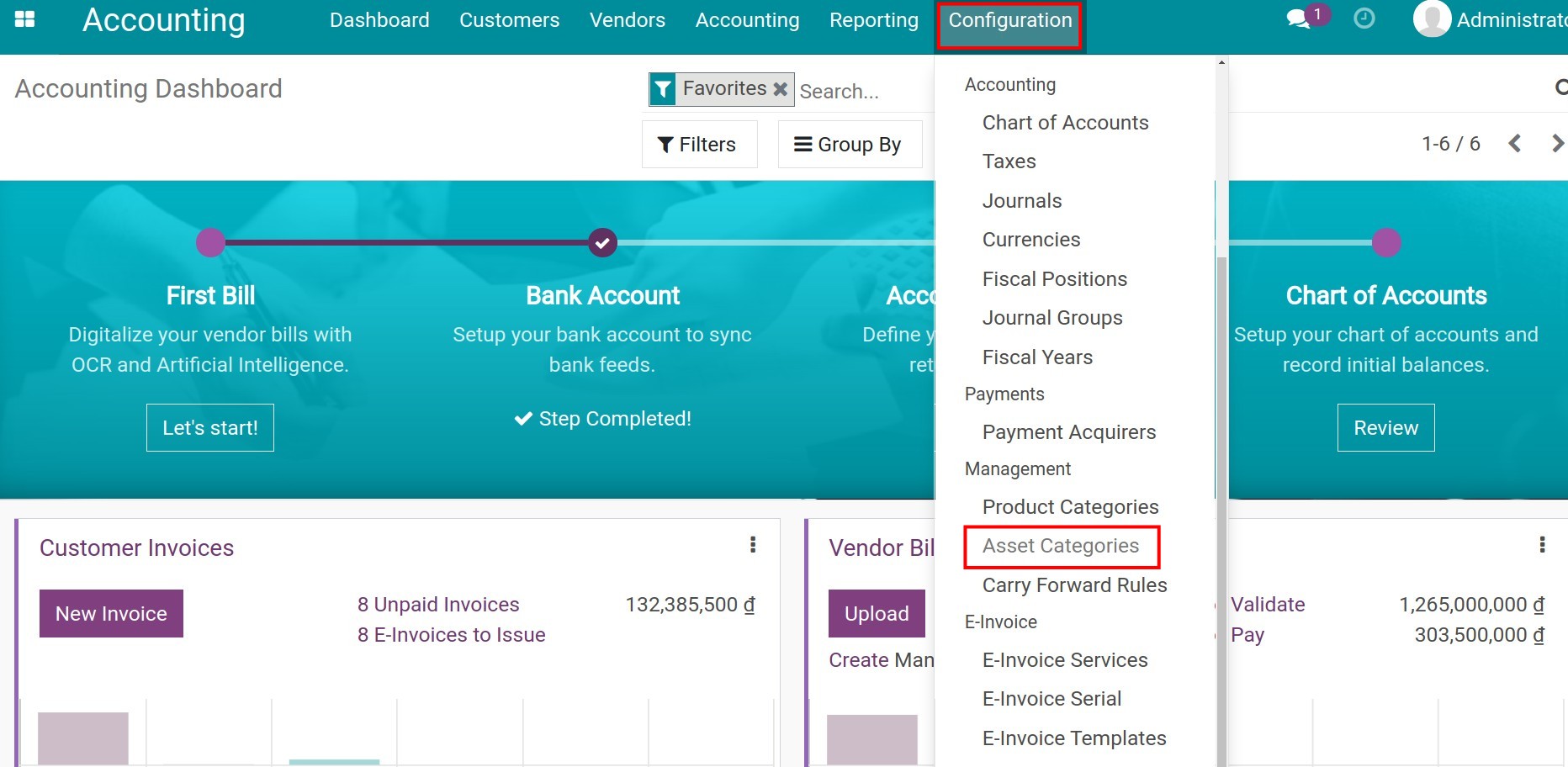

To create a new asset category, navigate to .

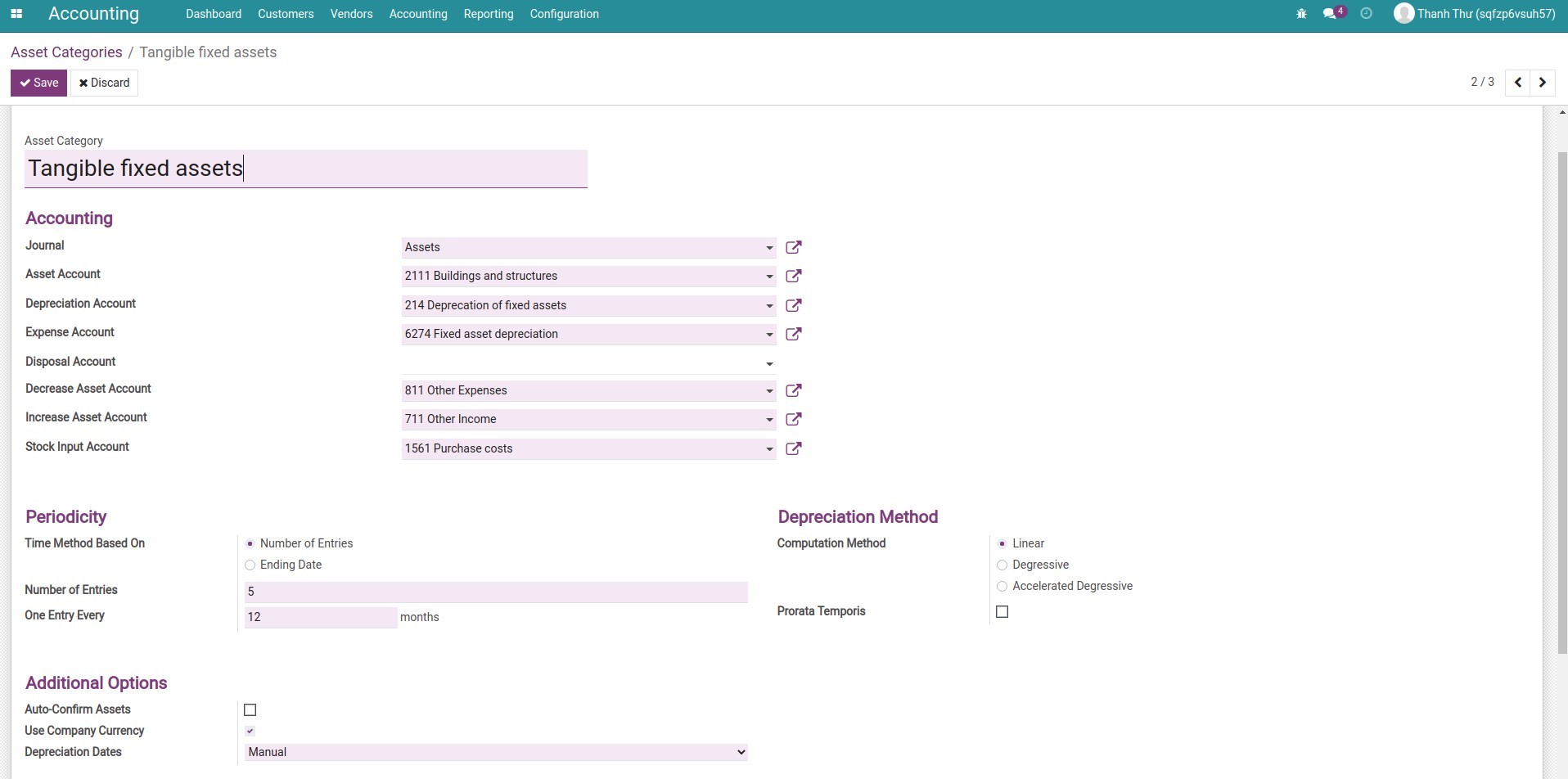

Then, you need to configure information for this newly created asset category.

Above is the example to set the information of Asset Category.

Asset Category¶

In this field, you have to put a suitable asset category name for management and monitoring purposes.

Accounting¶

In this section, you need to add the following required information:

Journals: Choose the appropriate journal which will be used to record the entries.

Asset Account: An account to record the purchase or use of the asset at its original price.

Depreciation Account: An account that holds the depreciation amount of the asset.

Expense Account: An account to record depreciation amount as expense periodically.

Decrease Asset Account: An account to record the decreasing value in the revaluation of the asset.

Increase Asset Account: An account to record the increasing value in the revaluation of the asset.

Note

This information can be adjusted for each Asset to suit different purposes.

See also

Periodicity¶

In this section, you need to add the following information:

Time Method Based on: Select one of the two options to depreciate an asset by the Number of entries or Ending date.

Number of Entries:

Number of Entries: Enter the number of depreciation times needed to depreciate an asset.

One Entry Every (Period Length): The time measured by month(s) between two periods of depreciation.

Ending date:

One Entry Every (Period Length): Similar to the Number of Entries, it’s the time measured by month(s) between two periods of depreciation.

Ending date: Enter the day that the depreciation stops.

Depreciation Methods¶

Viindoo provides 3 depreciation methods:

Linear method;

Degressive method;

Accelerated degressive method.

Prorata Temporis:

Enabled: Indicates that the first depreciation entry for the assets belonging to this asset category is calculated from the asset date instead of the first day of January or the start date of the Fiscal Year.

Disabled: Indicates that the first depreciation entry for the assets belonging to this Asset Category is calculated by dividing evenly according to the number of depreciation, starting on the first day of January/Start date of the Fiscal Year.

See also

Additional Options¶

Auto-Confirm Assets: If enabled, the system will automatically confirm the assets of this category when created by invoices.

Use Company Currency: If enabled, the value of assets generated from invoices for this category will always be converted to the company’s currency.

Depreciation Dates:

Based on the last day of the month: The depreciation entry will be colligated and displayed on the last days of the month.

Manual: Depreciation entry will be displayed depending on the manually configured date of the accountant.

Clicking on the Save button, the process of creating Asset Category is completed.

Furthermore, you can use this function in managing a group of assets related to instruments, tools, and prepaid expenses.

See also

Related article

Optional module