Steps in the bank reconciliation process¶

Accountants can generate many money transactions daily. When there is a difference between the balance in the bank accounts and the balance on the books of accounts, you must trace each line on the bank statement to reconcile. Let’s think about it: if the number of transactions is up to hundreds of lines, how will you compare it quickly and accurately? Viindoo Accounting app will help you check and detect mistakes with just a few clicks.

Requirements

This tutorial requires the installation of the following applications/modules:

Steps in the bank reconciliation process¶

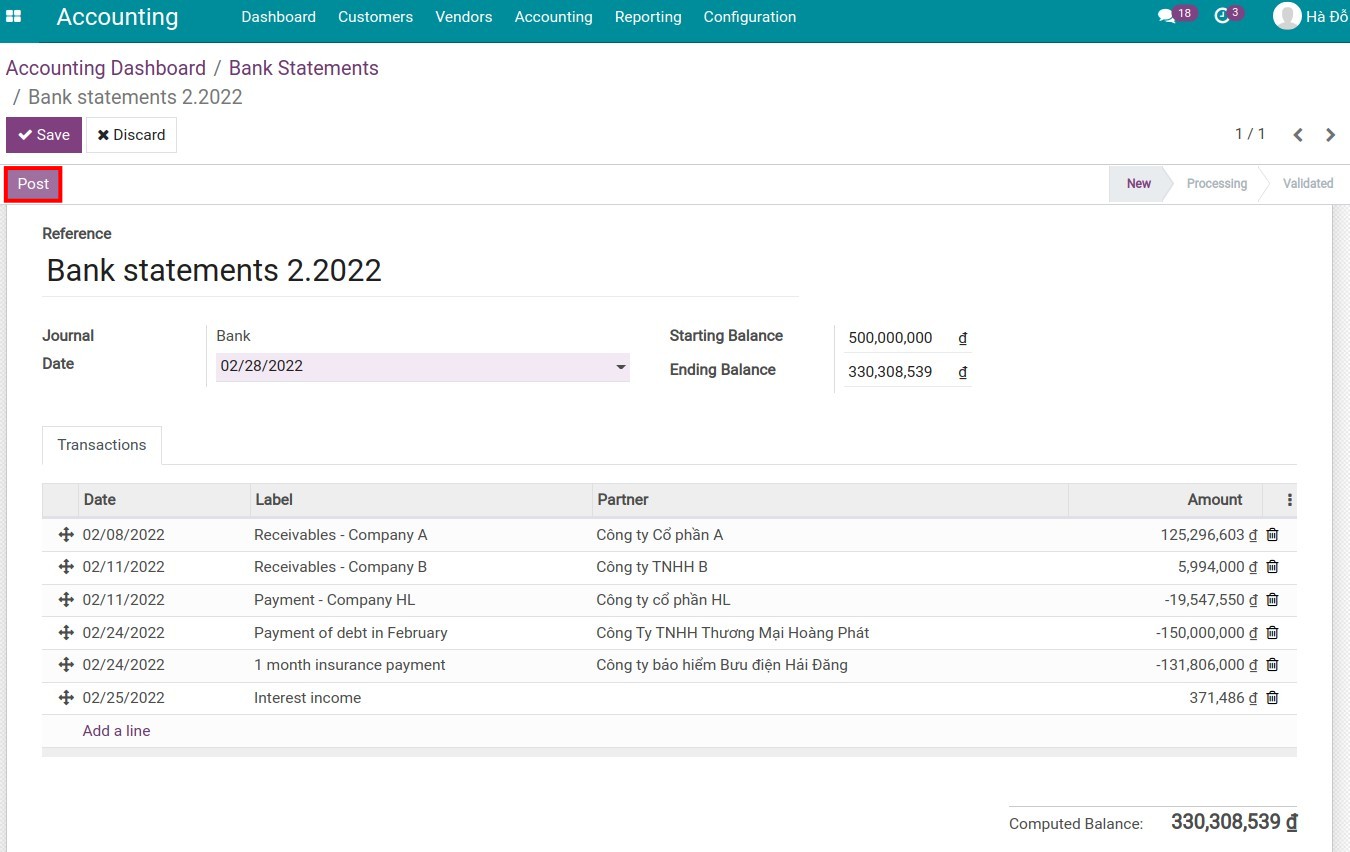

When you receive goods and make a payment to a supplier or finish a sale and receive money from a customer, proceed to create a payment. After that, the next step is to create a bank statement. On the bank statement form, you Post the bank statement to have its status changed from New to Processing.

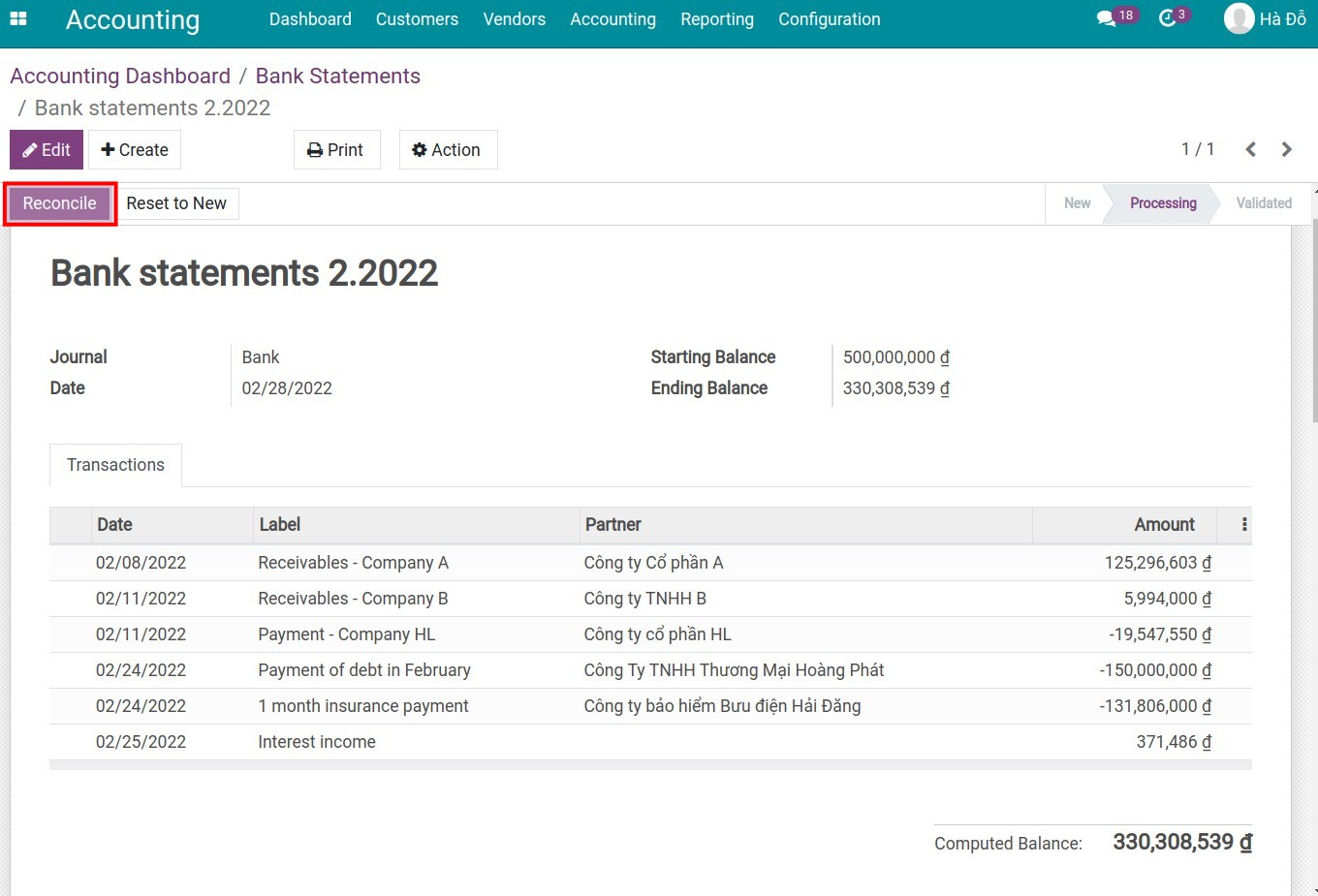

Press Reconcile to start the reconciliation process. At this step, the system will search for information on the statement such as the right partner, the right money amount, and the right account to match the payment made previously.

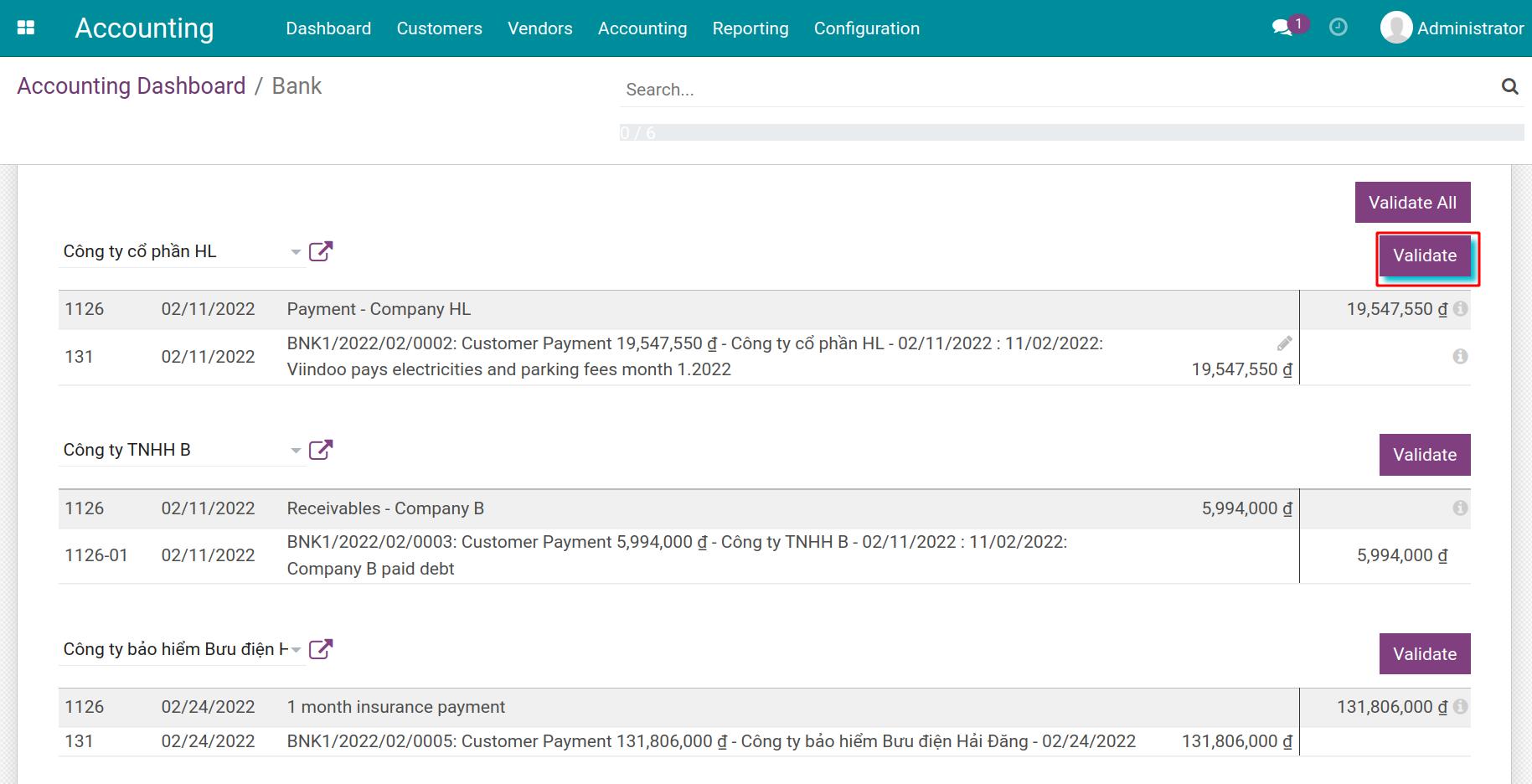

If all the information is perfect match, the reconciliation will be done automatically.

Review all the information on each reconciliation order to be confirmed. Click Validate to complete the reviewing process.

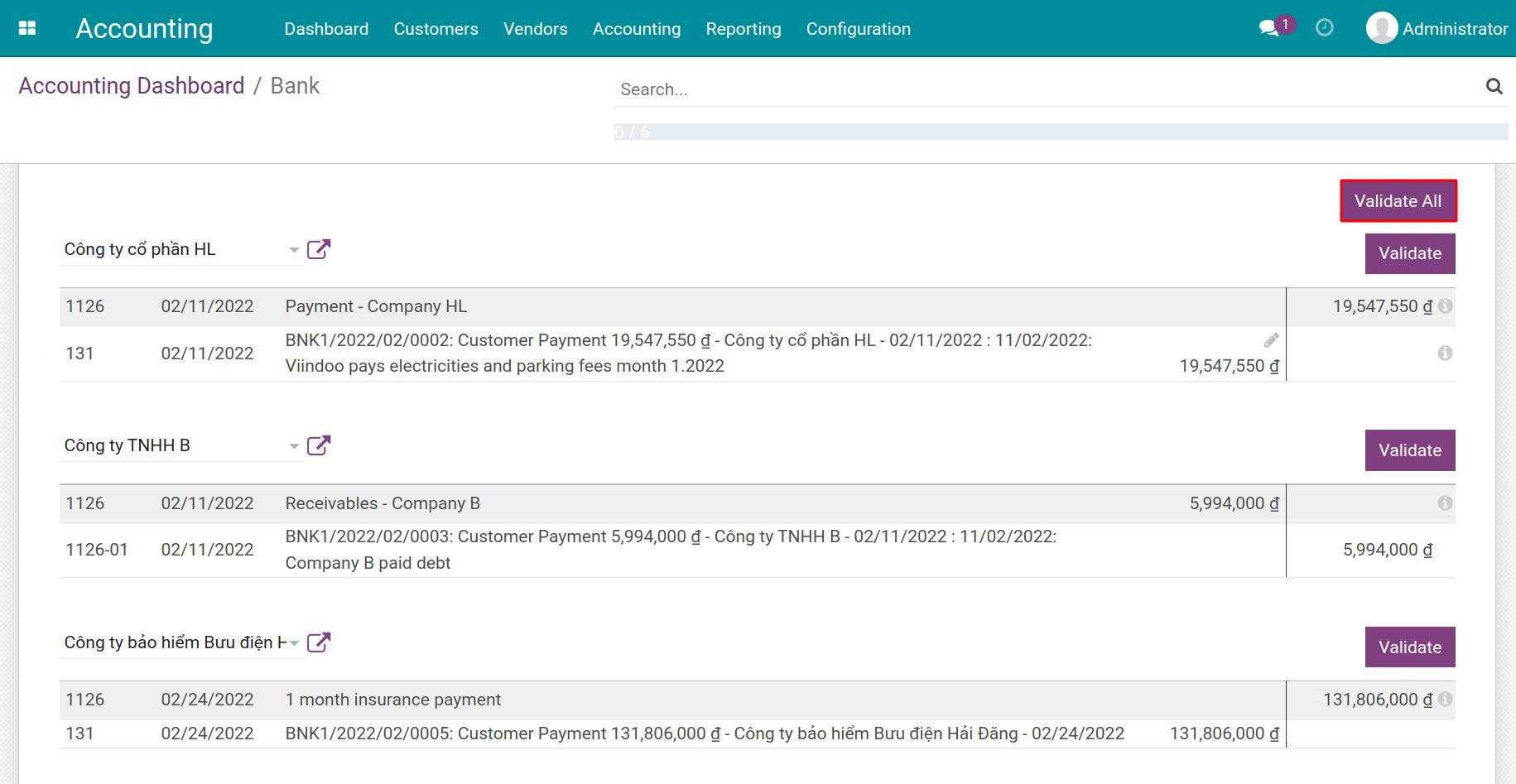

Besides, with bank statements that have multiple lines to reconcile, you don’t need to click Validate for each line. Check the information of the reconciliation orders thoroughly then click the Validate All button.

Journal entries of the bank statements¶

In Viindoo:

Money spent and received is recorded into an outstanding payment account when payment is confirmed on the system.

Cash in and out confirmed on the bank statement is recorded in a cash account and counter to a suspense account.

In bank statement reconciliation, the system automatically replaces the suspense account with the outstanding payment account.

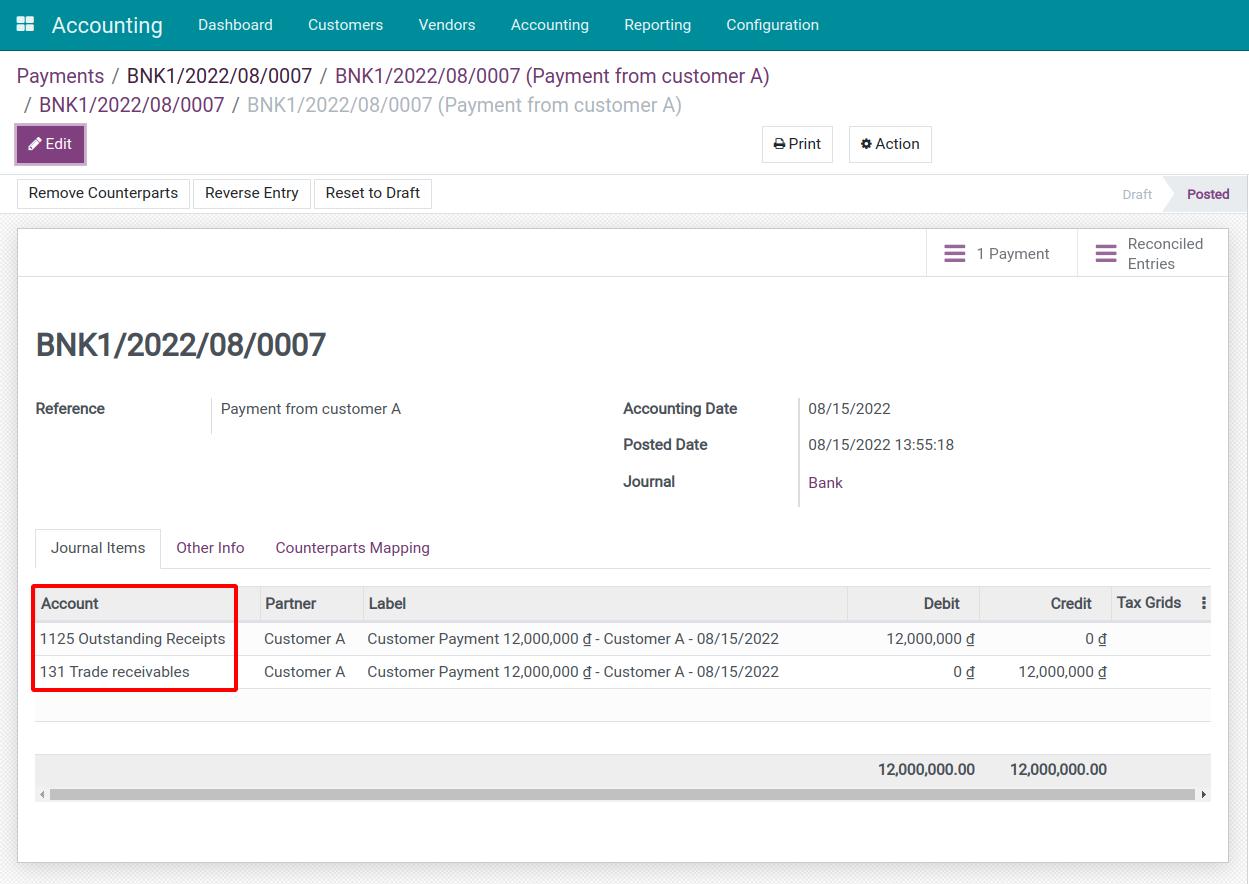

Upon validating a payment, a journal entry will be generated. This account reflects the money automatically taken from the selected journal: when collecting money, it will go to the Outstanding Receipts account, when paying, it will go to the Outstanding Payments account.

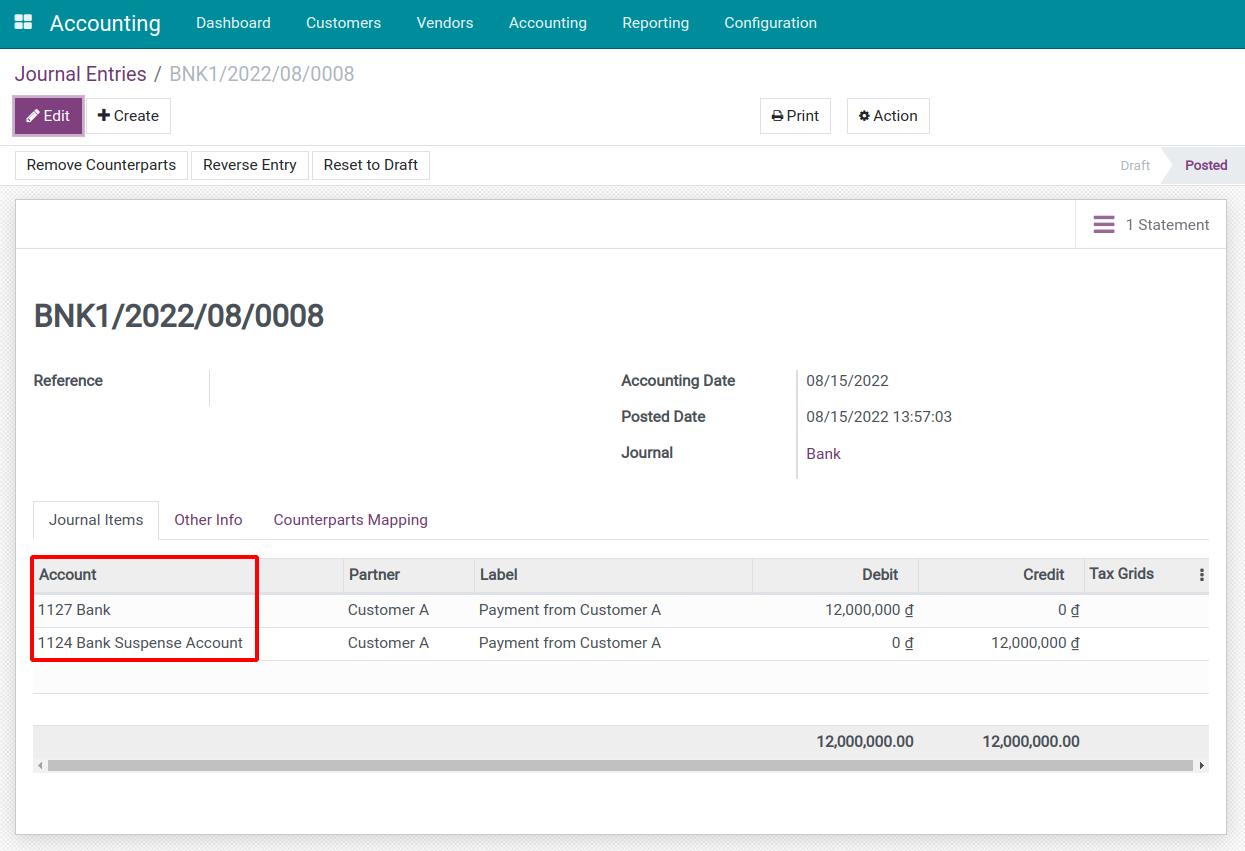

When the statement is Posted, the system will record the cash in - cash out through the Suspense Account.

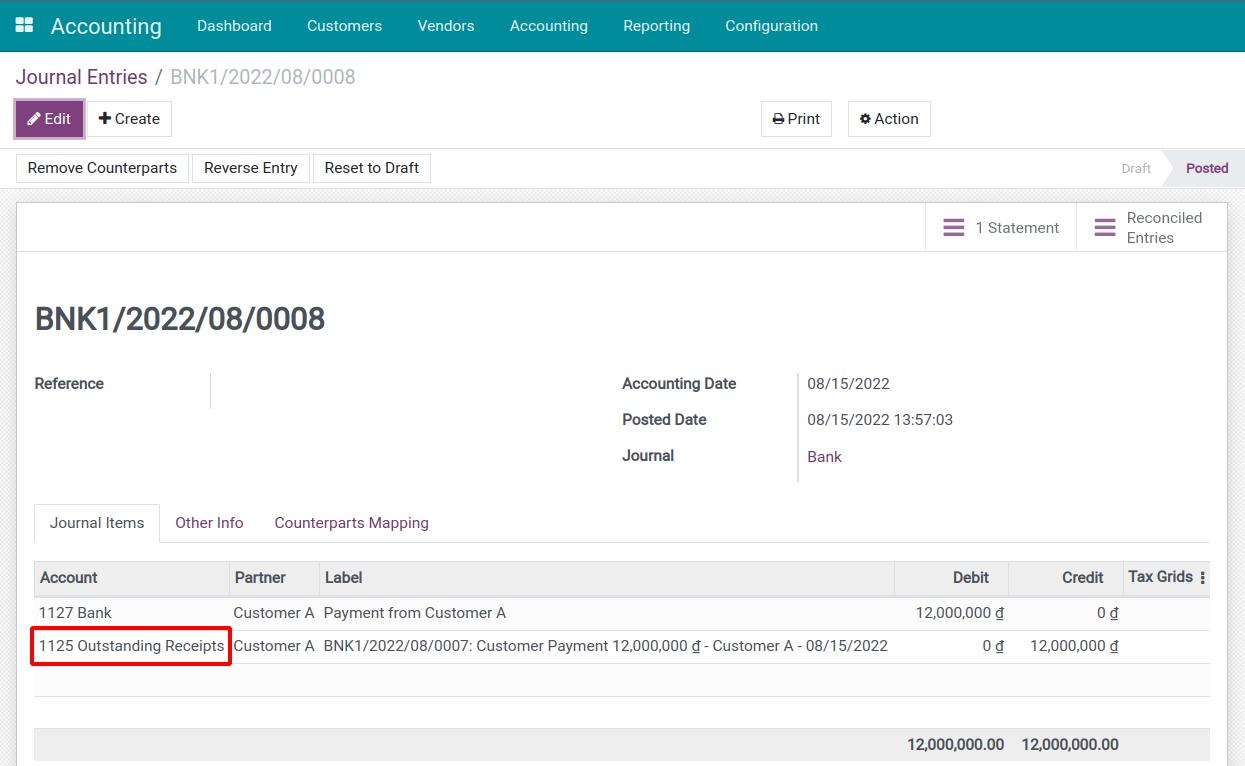

After the bank statement is reconciled, you will see the Suspense account is now replaced with the Outstanding Receipts account on the journal entry of the bank statement.

Some use cases in the reconciliation process¶

In the reconciliation process, occasionally you will encounter some situations as follows:

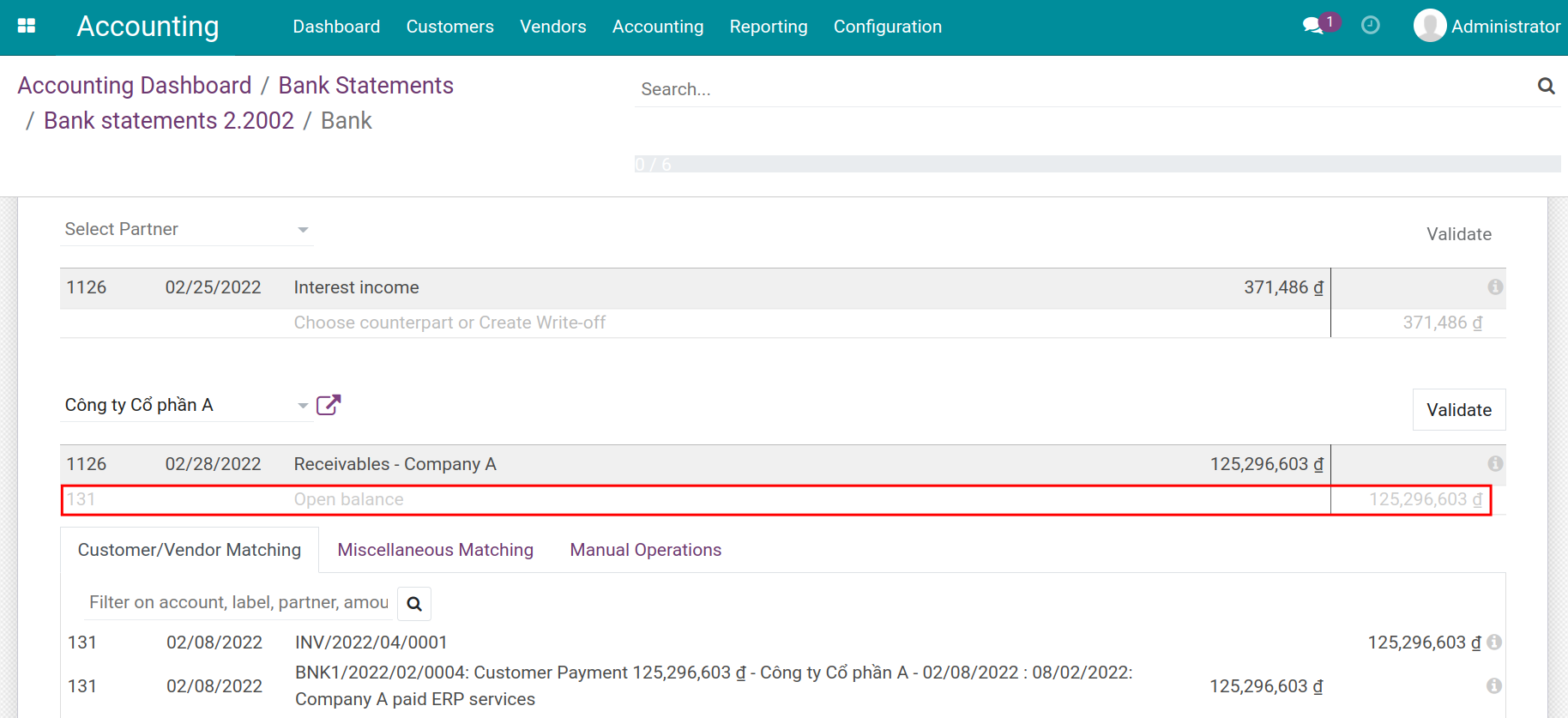

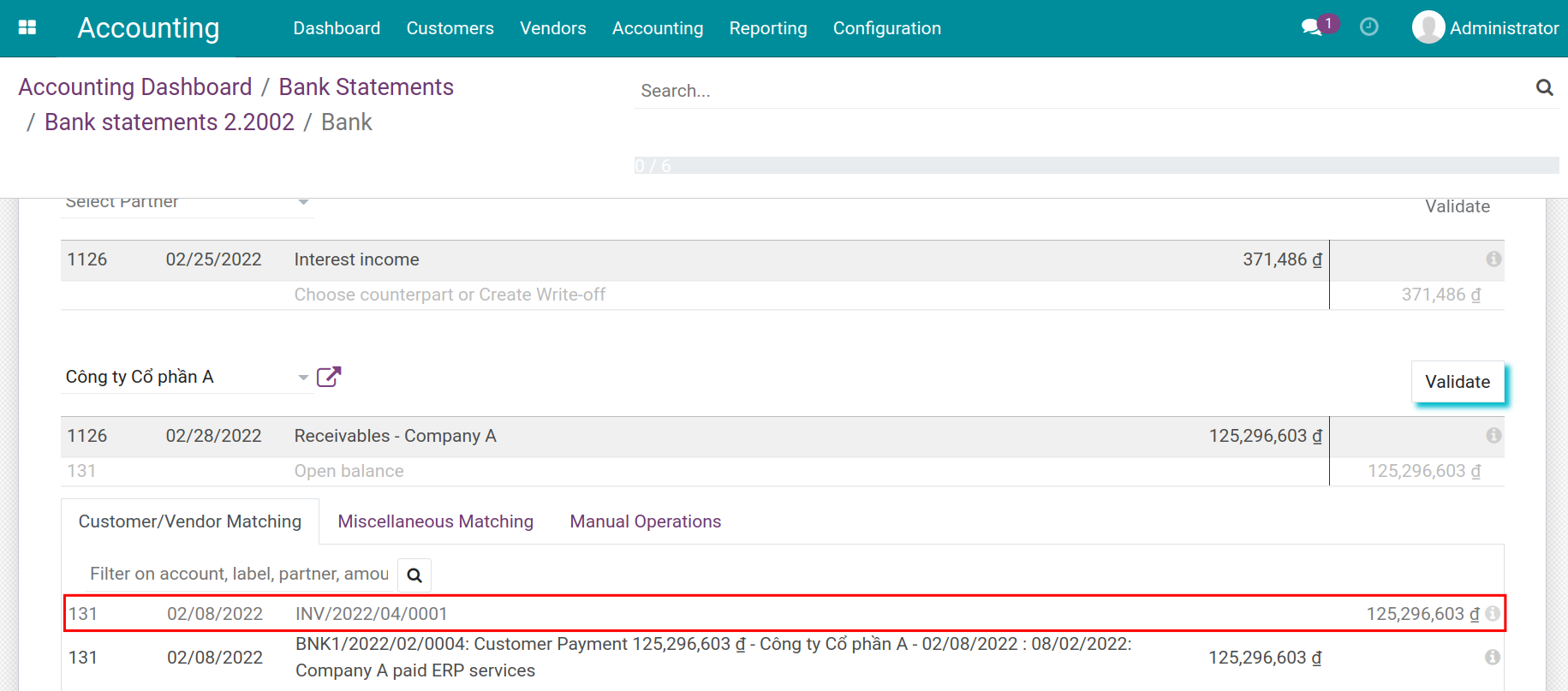

Situation 1: Invoice has been issued to the customer, on the bank statement there is a line for money receipt from that customer, but on the system, the payment has not been recorded and the debt has not been deducted yet. The system could not find the information to execute the reconciliation order.

On reconciliation view of bank statement, go to tab Customer/Vendor Matching. Based on the information from the bank statements, choose the counterpart that matches these statement lines. Then click on Validate to reconcile.

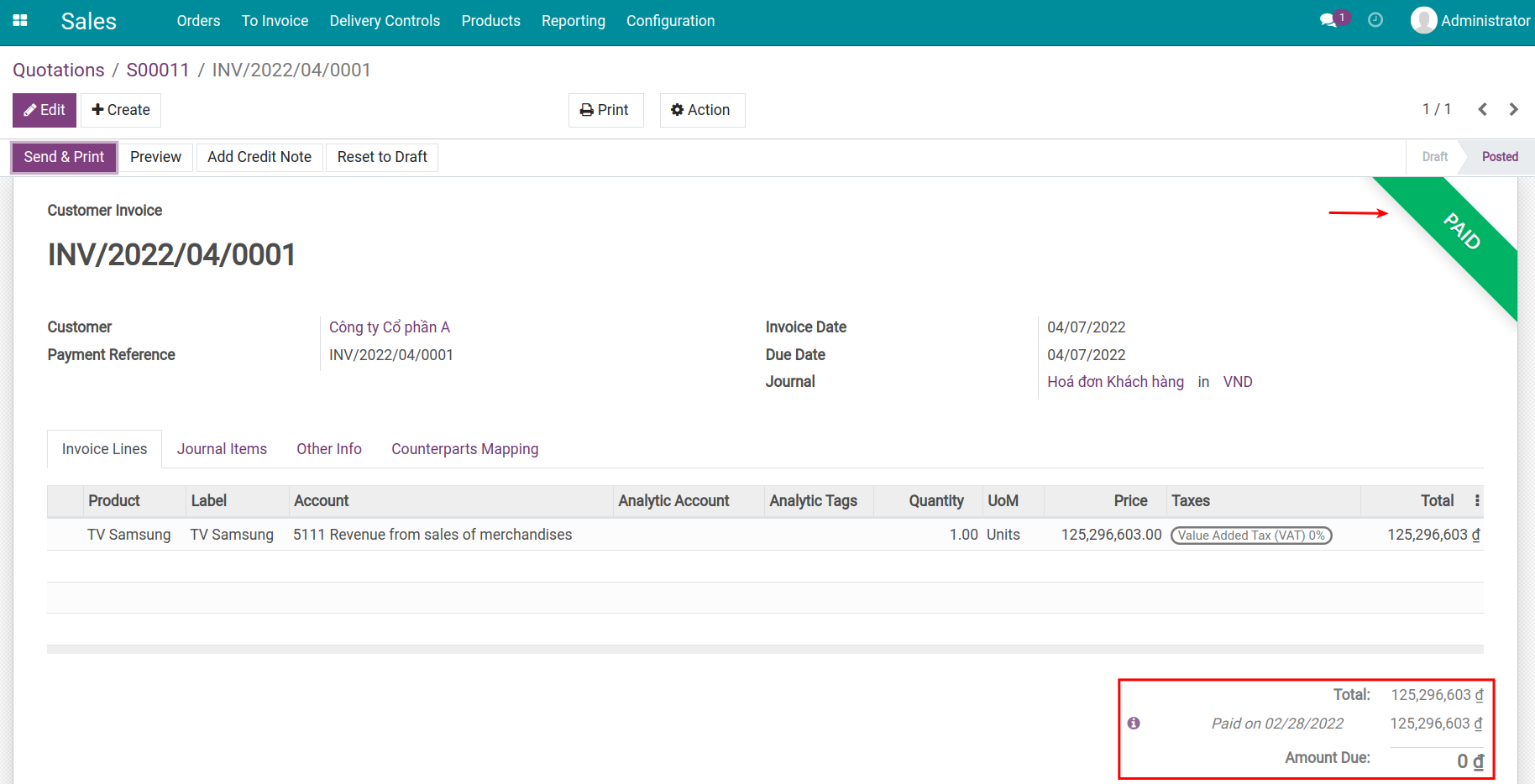

Navigate to the reconciled invoice, which is now marked with a Paid tag together with the payment information attached to it.

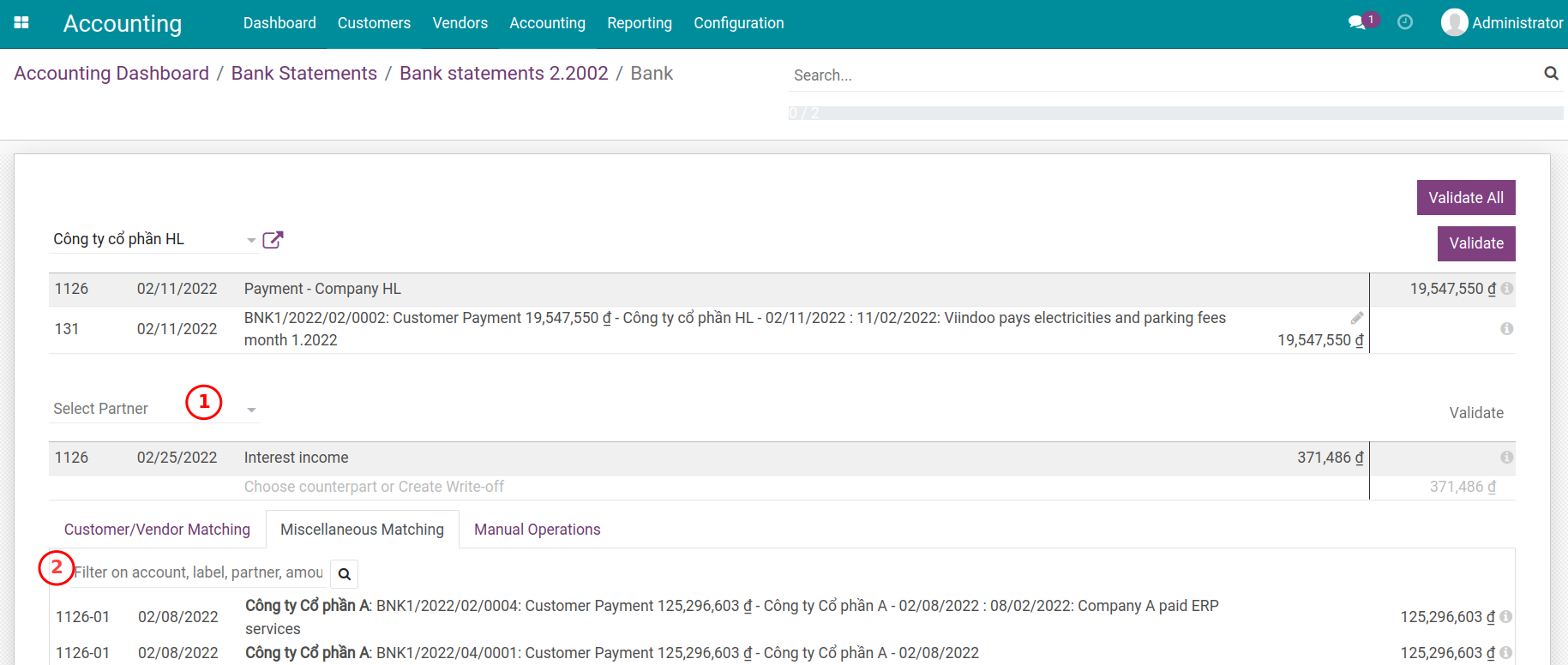

Situation 2: On the bank statements, there is a line of money received from the customer but the customer’s name is missing (Partner). The accountant also created a payment recording of that amount. When performing the reconciliation, the system could not find any information to suggest the matching.

At this step, you can Select Partner (1) or use the search tool on the Miscellaneous Matching (2) tab. Search for the right information and the correct journal items that have already been recorded.

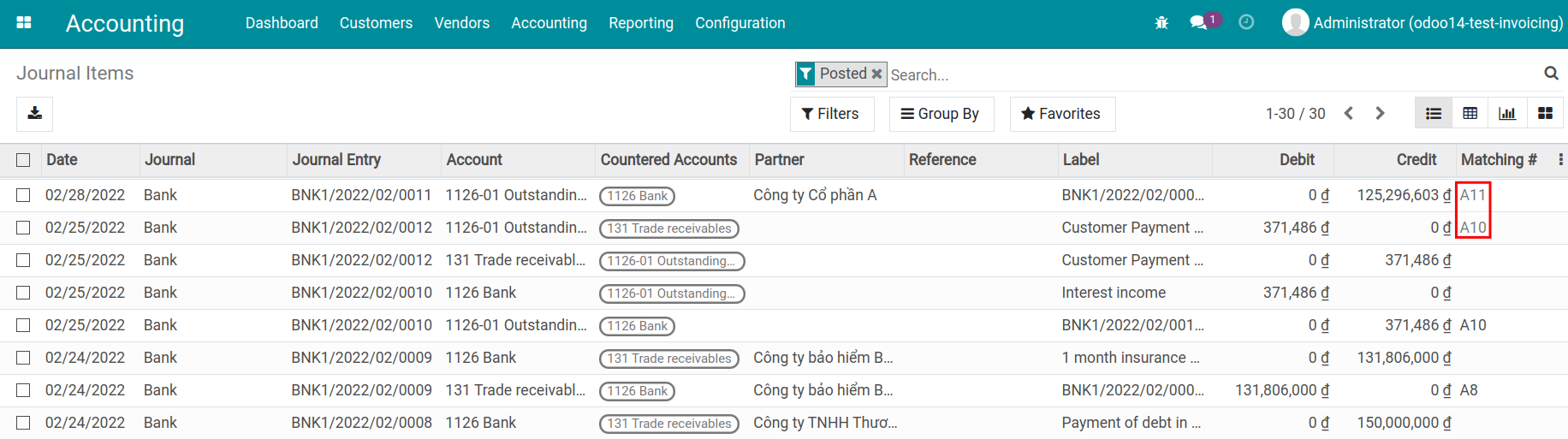

After being reconciled, the system will generate a matching number for the journal items. You can find this journal item matching number on the Accounting app by navigating to , filter the search by the partner’s name, and the reviewing is completed.

Note

To see the journal items and their matching number, you need to activate the developer mode. Read more on Activating developer mode article.

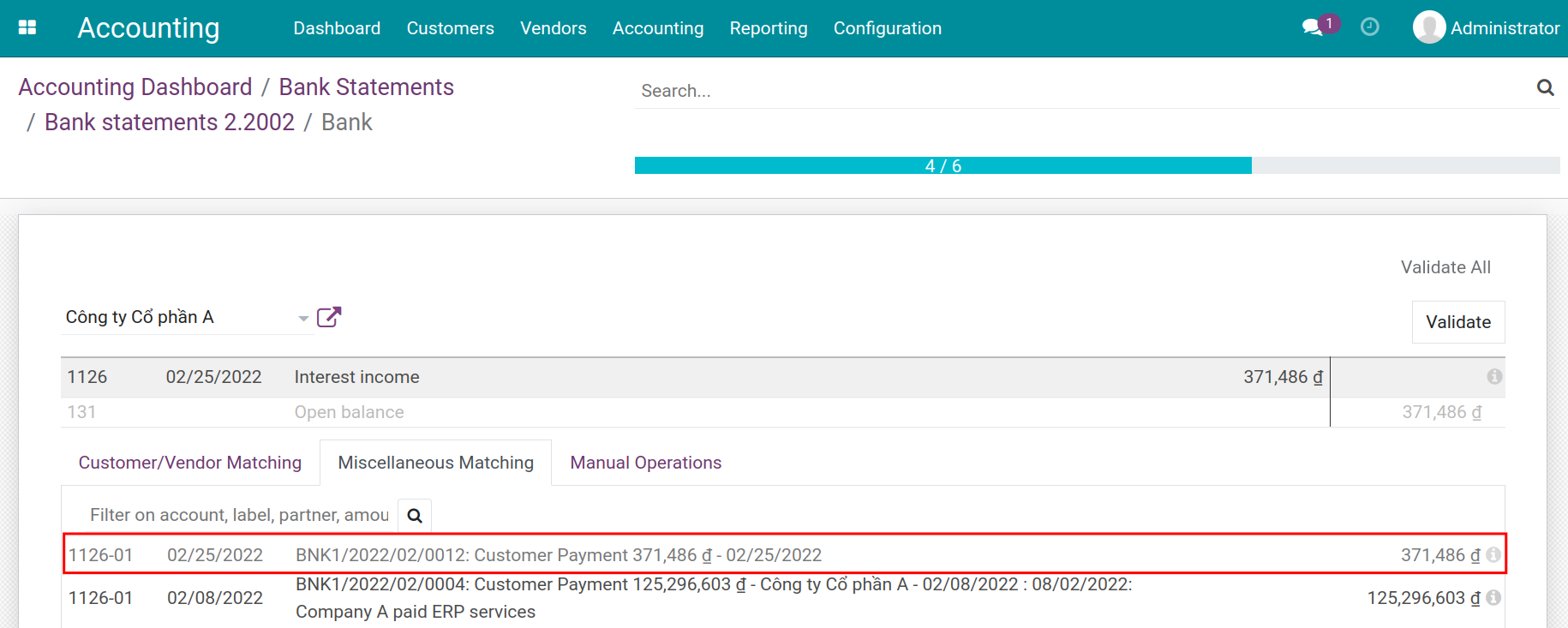

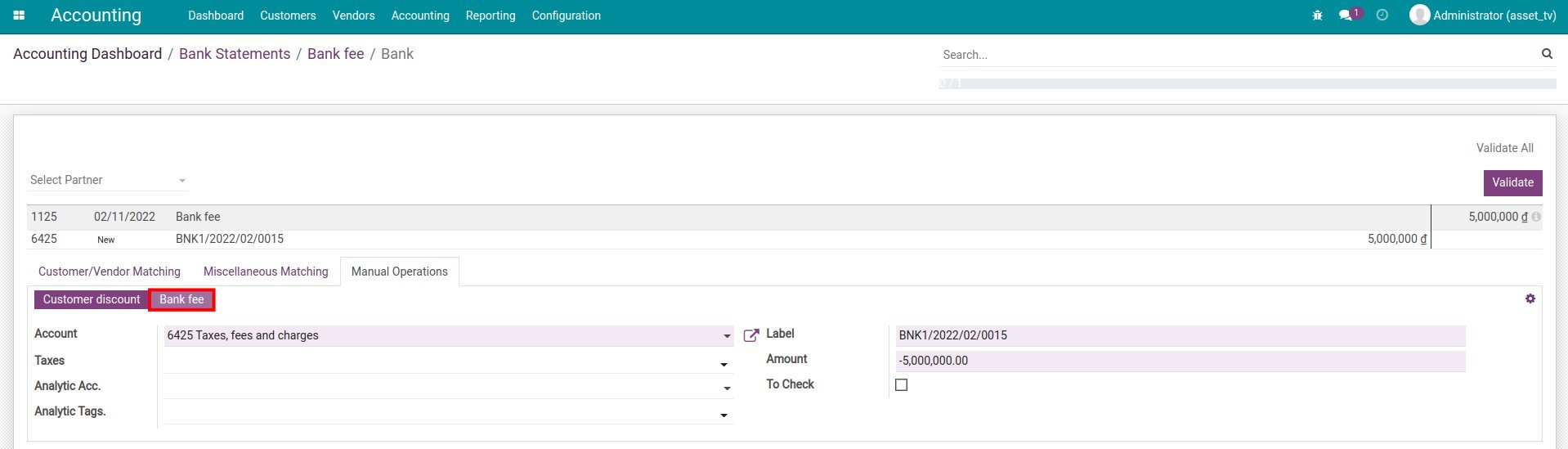

Situation 3: With payments that have a recurring cycle such as bank fees, capital gains, etc., which have not been recorded on the system, you can use the established reconciliation models. Read more on the Reconcile deposit interest and bank fees article.

At the reconciliation view of the bank statement, choose the suitable button corresponding to reconciliation models and press Validate.

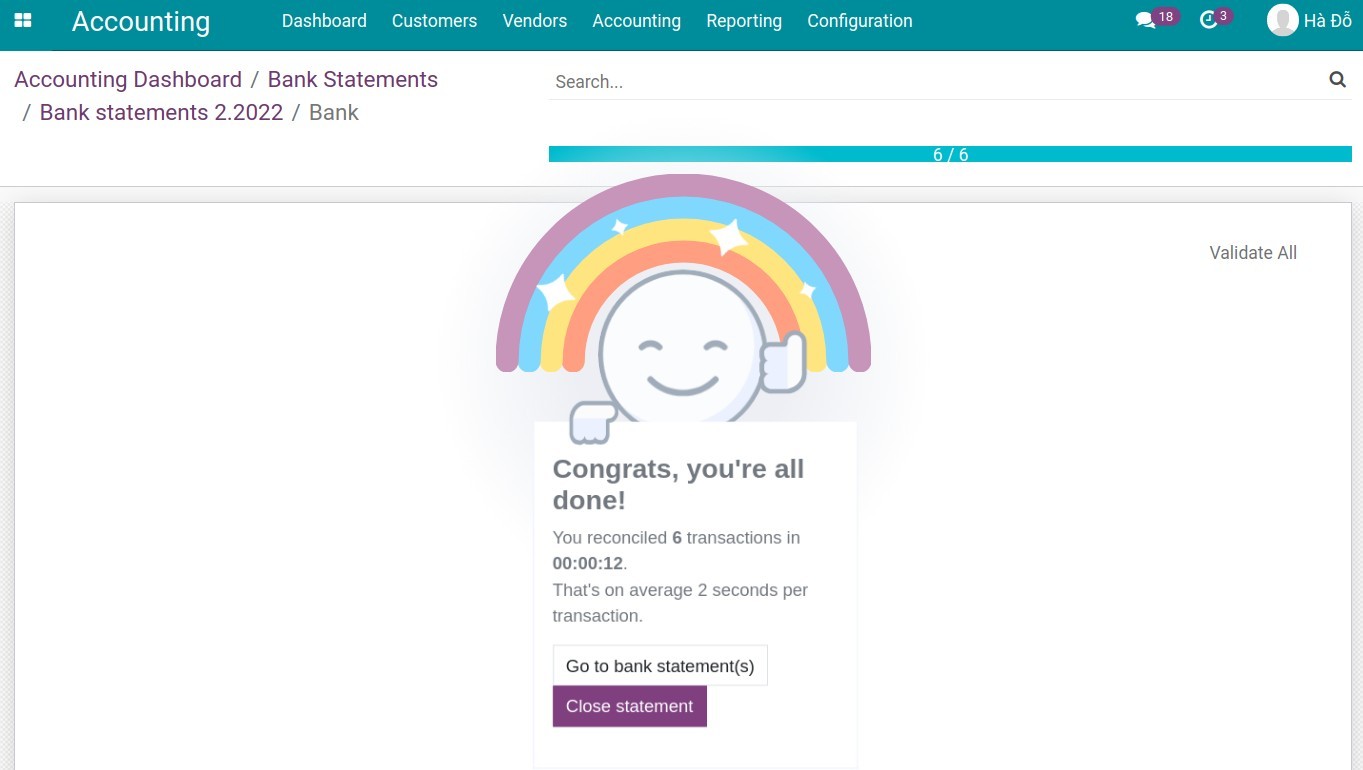

Once all the bank statement lines are reconciled, a notification will pop up as below.

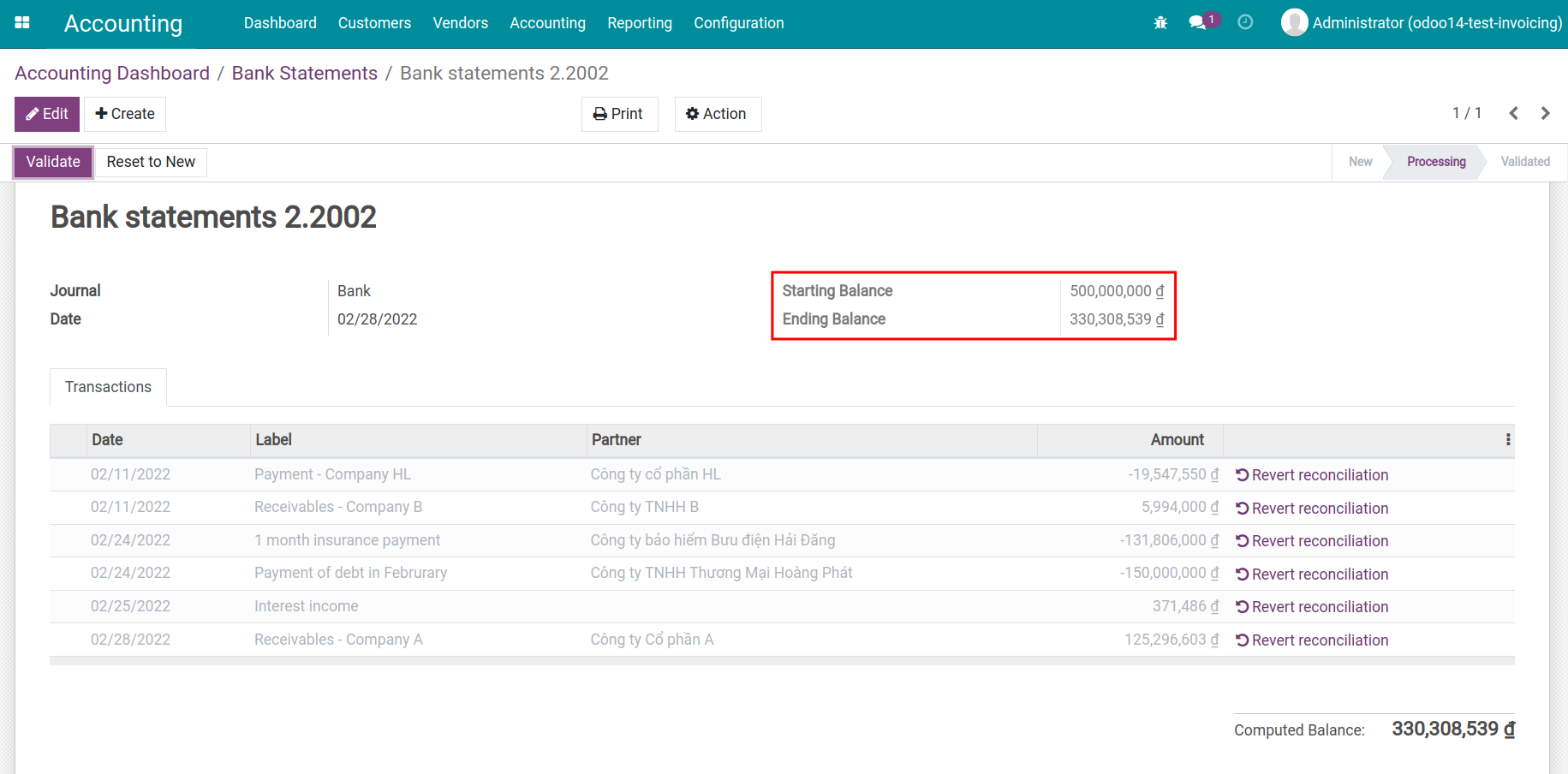

Do the final check for the starting and ending balance on the bank statement then press Validate. The bank statement status will be changed from Processing to Validated.

See also

Related article

Optional module