Steps in the bank reconciliation process¶

Accountants can generate many money transactions daily. When there is a difference between the balance in the bank accounts and the balance on the books of accounts, you must trace each line on the bank statement to reconcile. Let’s think about it: if the number of transactions is up to hundreds of lines, how will you compare it quickly and accurately? Viindoo Accounting app will help you check and detect mistakes with just a few clicks.

Requirements

This tutorial requires the installation of the following applications/modules:

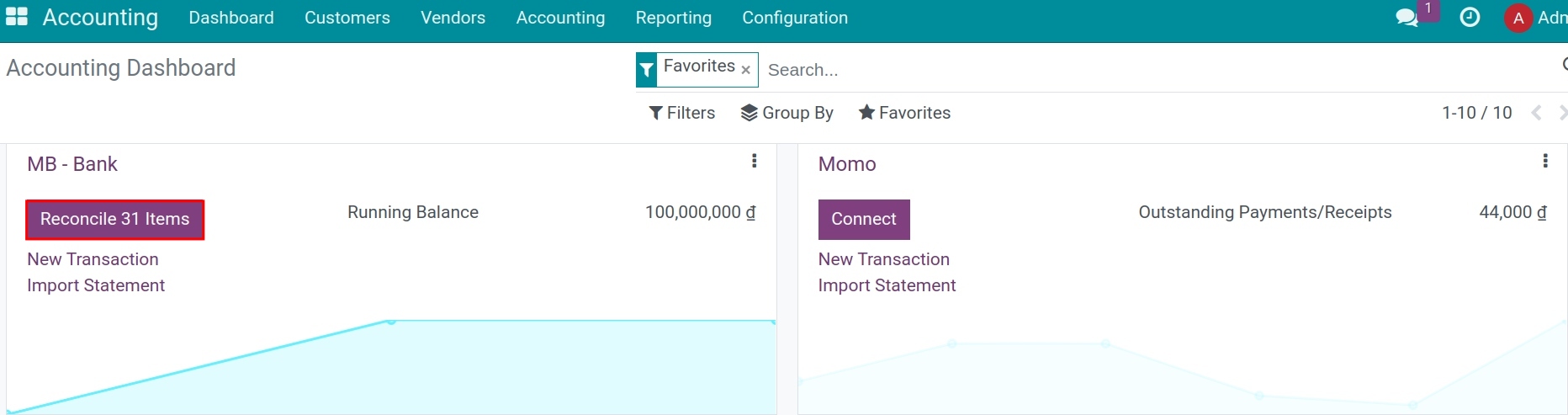

Bank Reconciliation View¶

After adding transactions or importing a bank statement, the Bank Deposit Ledger in the accounting information table will display the number of transactions that need to be reconciled. Click on Reconcile to view the details. You can use the filters Reconciled or Unreconciled to easily manage the reconciliation process.

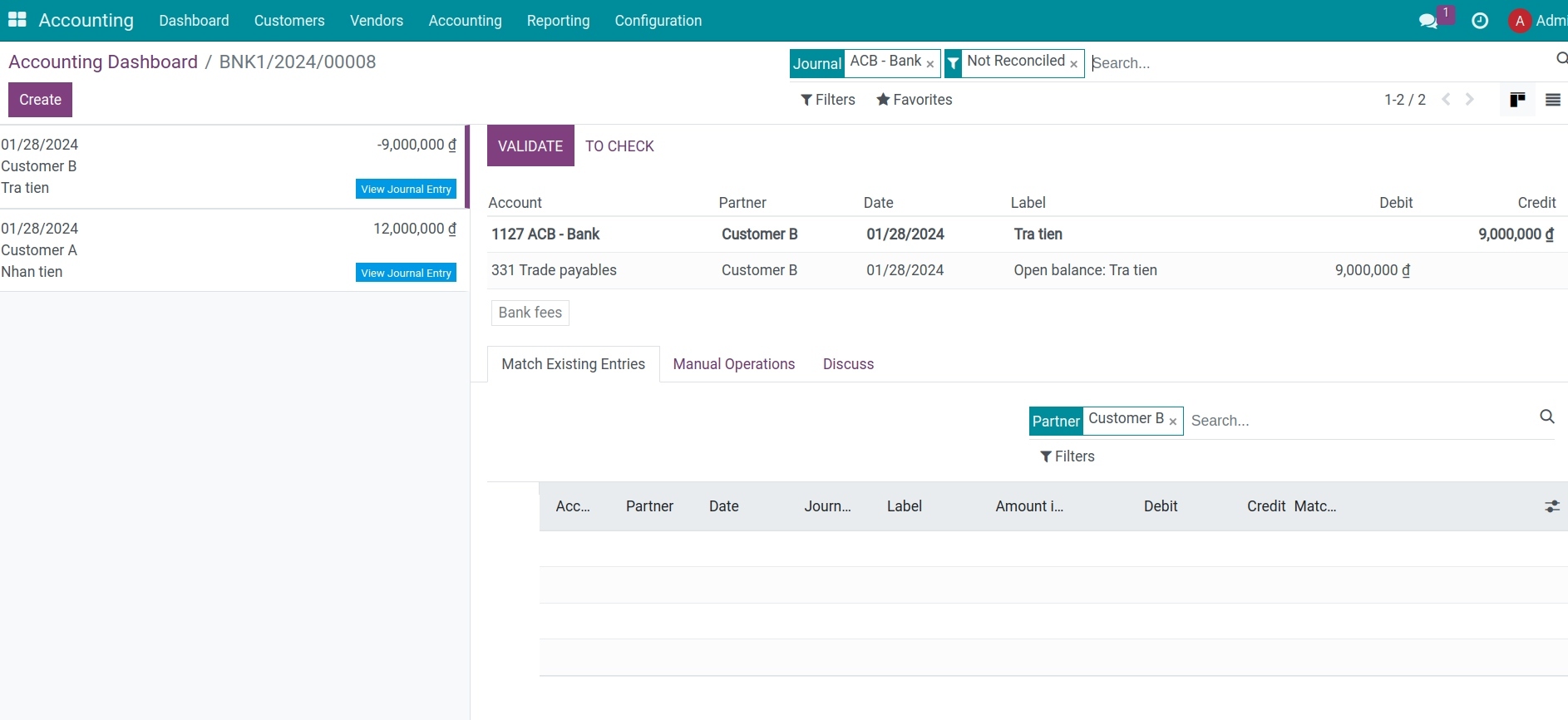

In the detailed bank reconciliation view, it is structured into three separate sections: transactions, matching journal entries, and result journal entries.

Transactions: Displayed on the left side, it includes all the bank transactions.

Matching Journal Entries: The system will search for matching information on the bank statement, such as the correct partner, correct amount, and correct accounting account, to match with the previously made payment vouchers. You can use the existing Journal Entry tools, manual operations, or the matching model button to reconcile.

Result Journal Entries: This will be displayed when you select To check.

Select a transaction from the unmatched bank transactions.

Determine the matching counterpart. There are several options to determine the matching counterpart, including matching with existing Journal Entries, manual operations, group payments, and the matching model button.

If the result journal entry is not fully balanced, balance it by adding another existing matching journal entry or reducing it through a manual operation.

Click Confirm and move on to the next transaction.

Tip

If you are not sure how to reconcile a particular transaction and would like to deal with it later, use the To Check button instead. All transactions marked as To Check can be displayed using the To Check filter.

Some use cases in the reconciliation process¶

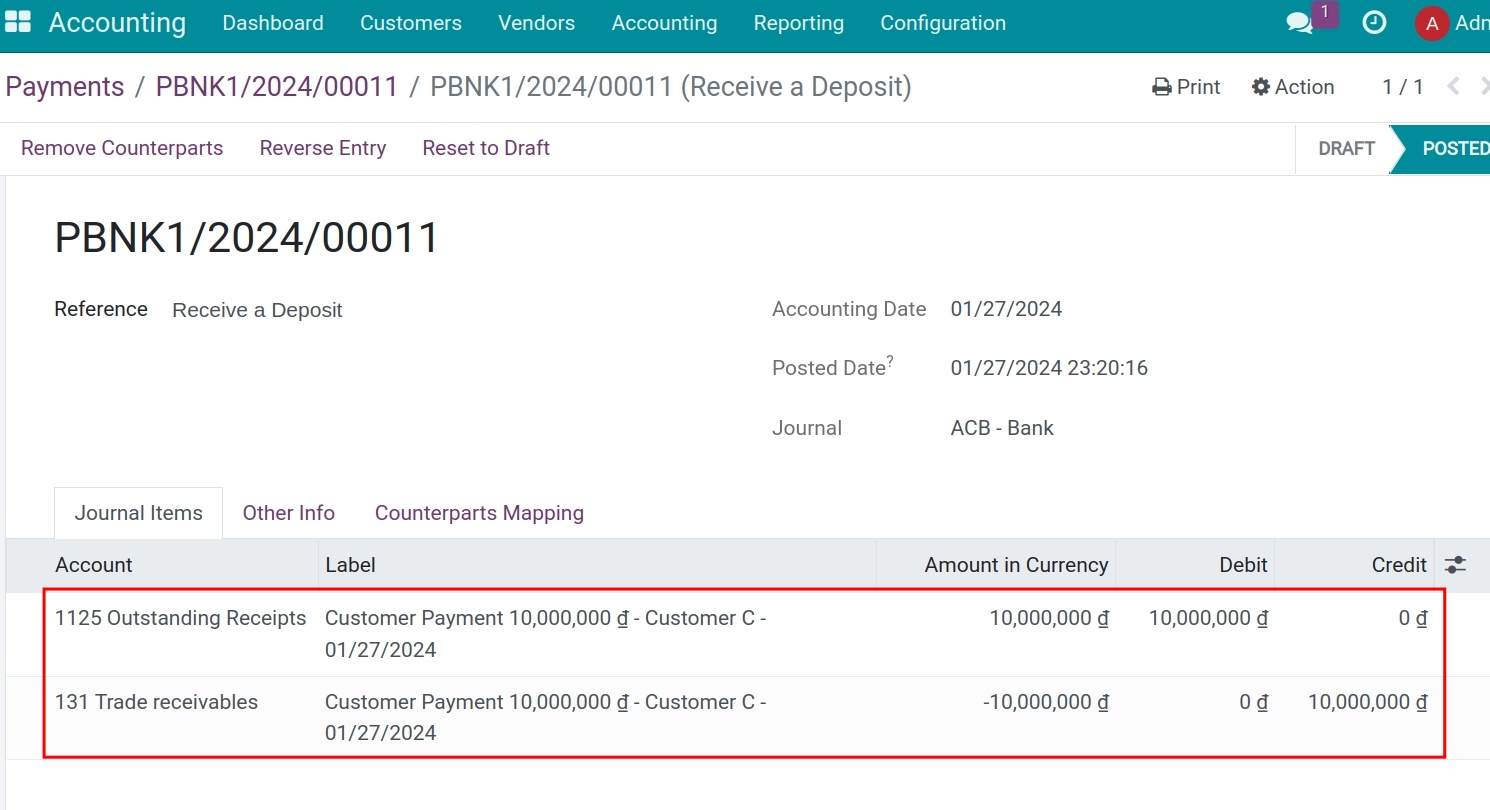

Bank transactions are recorded in the temporary account in the general ledger until the reconciliation. At this point of reconciliation, the system will modify the journal entry by replacing the temporary bank account with the corresponding accounts receivable, accounts payable, or outstanding accounts. Let’s understand with a specific case:

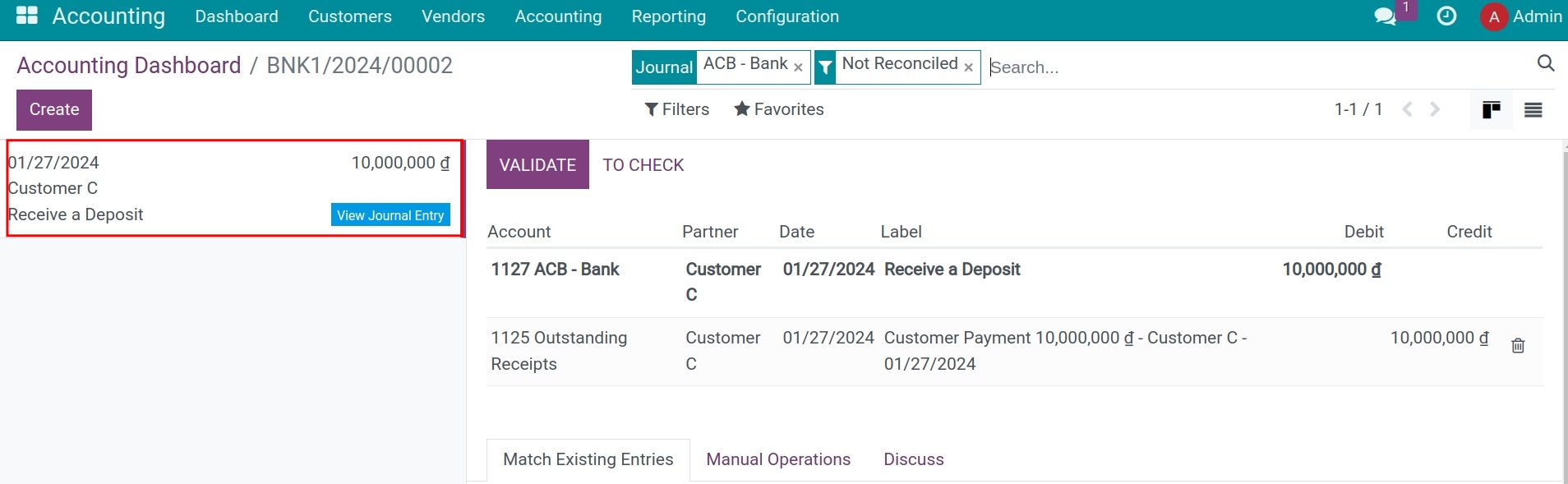

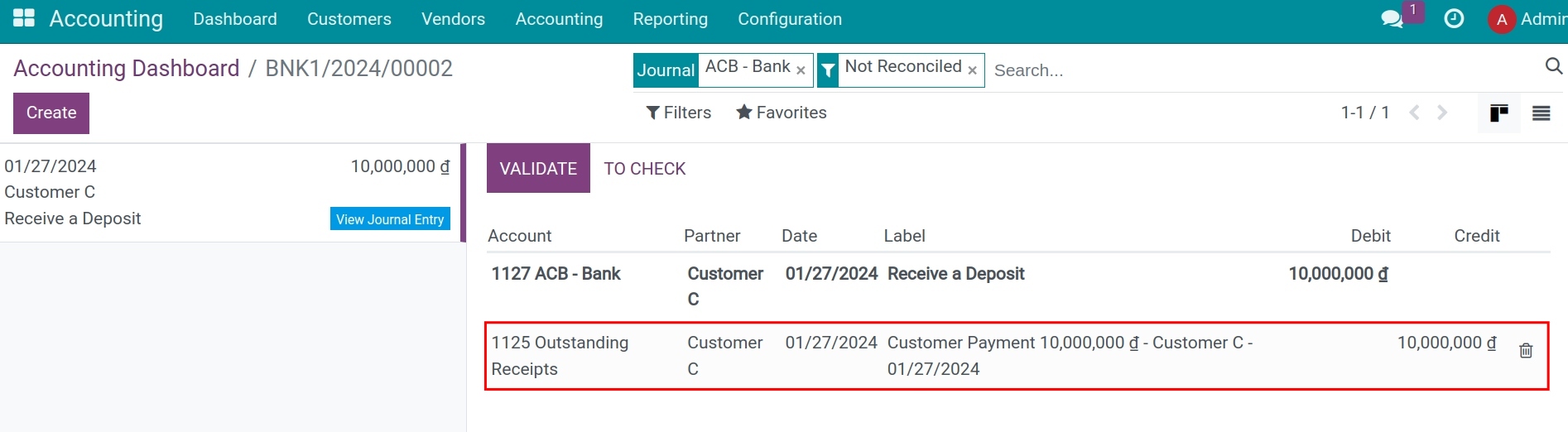

Situation 1: Reconciling a bank statement with a payment voucher¶

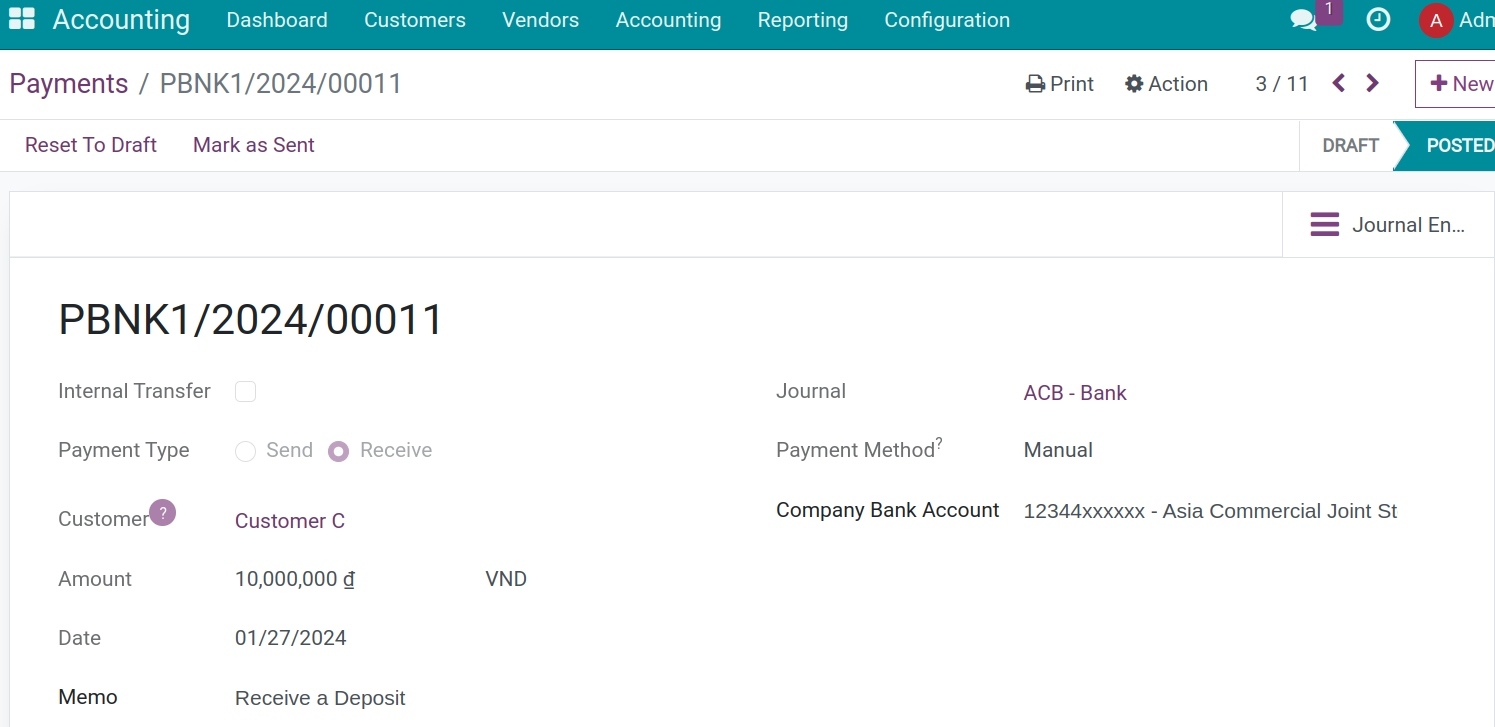

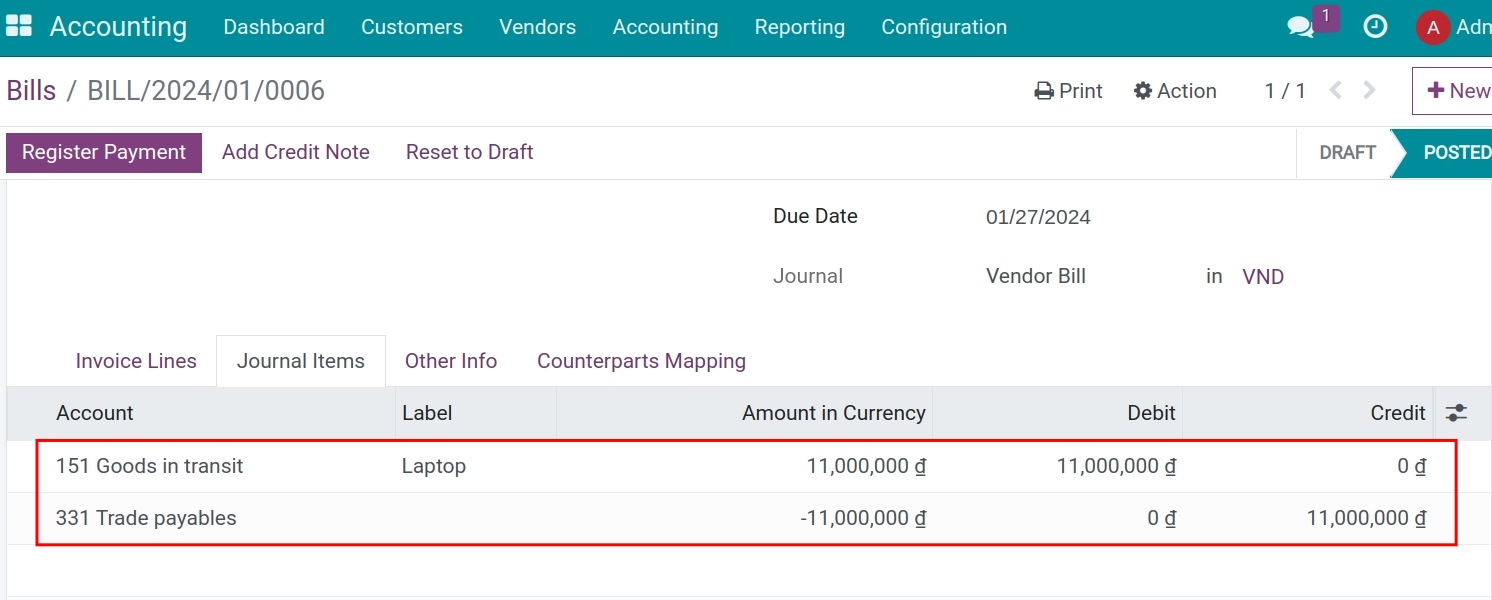

Expenses paid and received are recorded in the prepaid accounts before confirming the payment on the system.

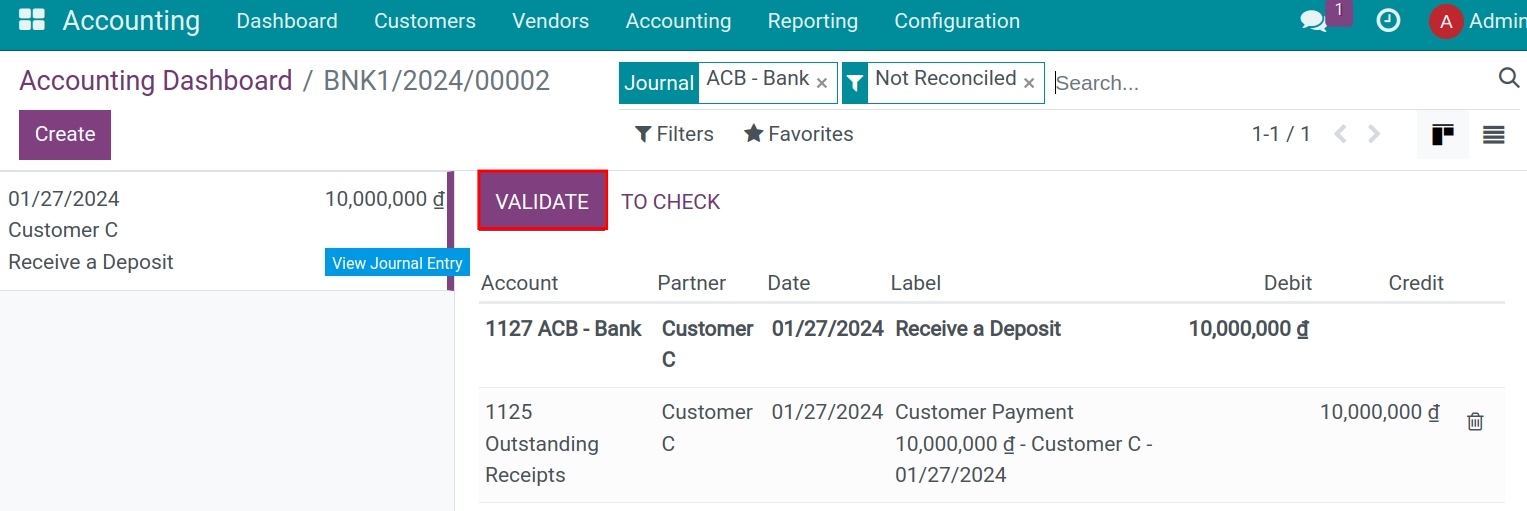

Incoming and outgoing funds confirmed on the bank statement are recorded in the cash accounting account and matched with the temporary account.

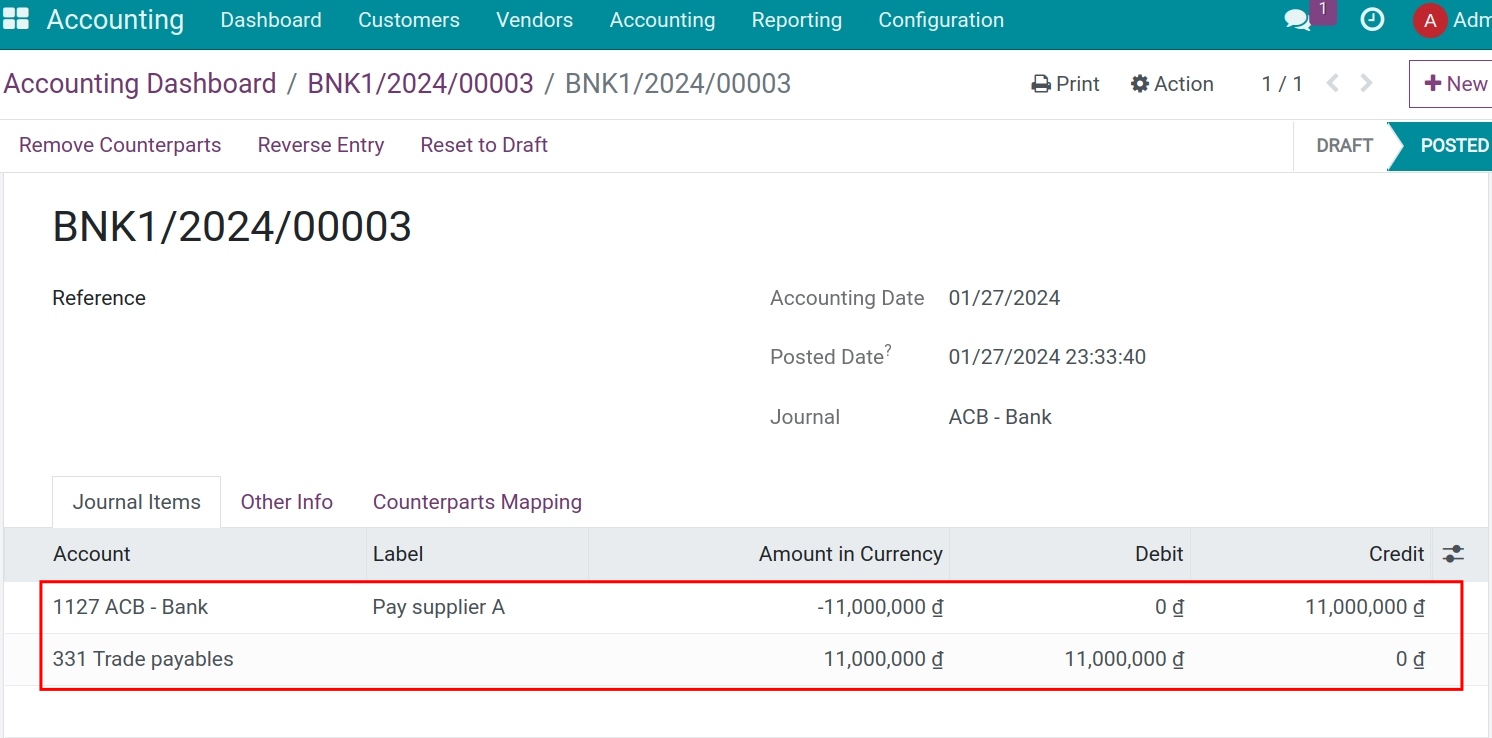

Click Confirm and view the journal entry in the journal.

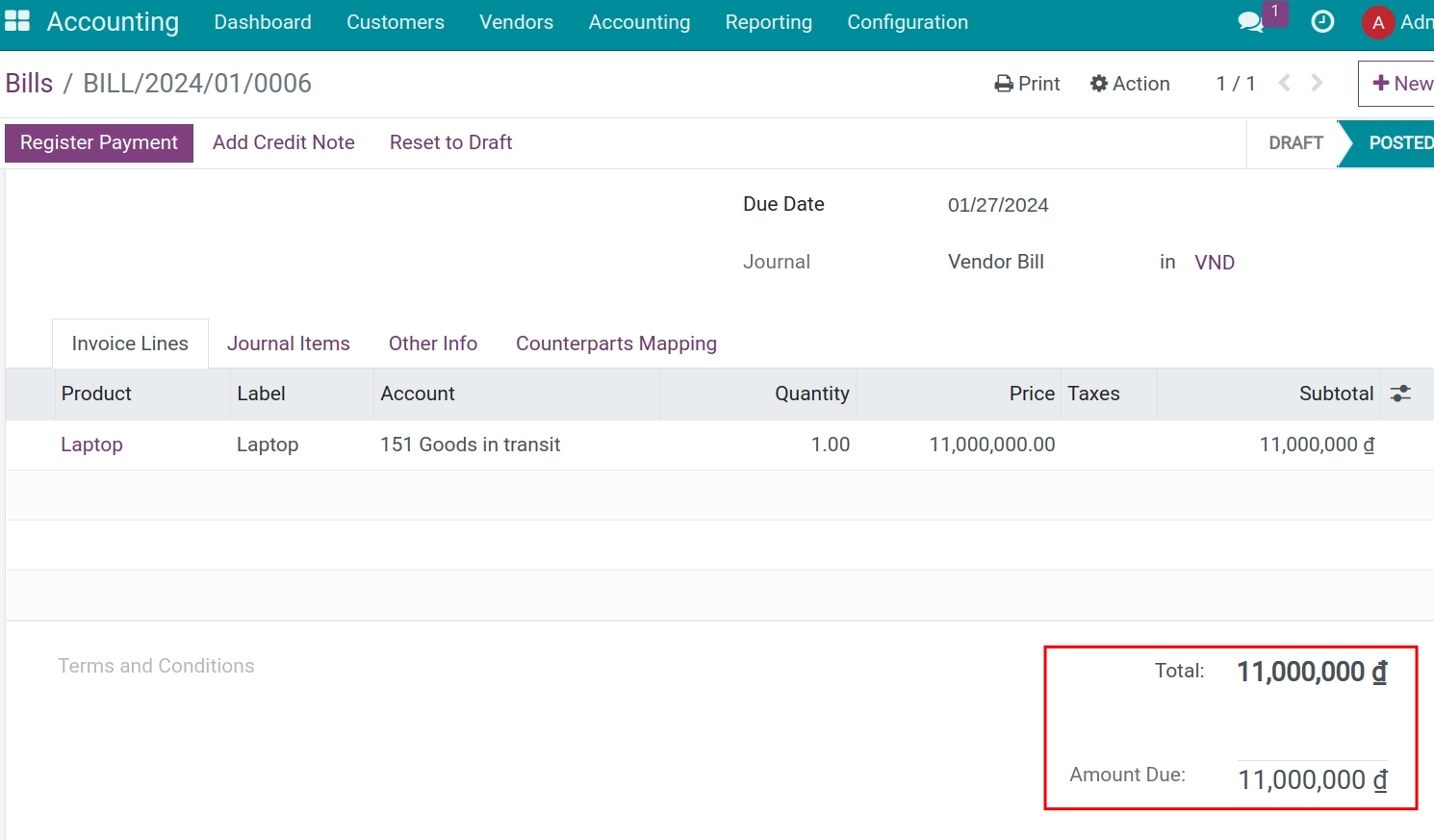

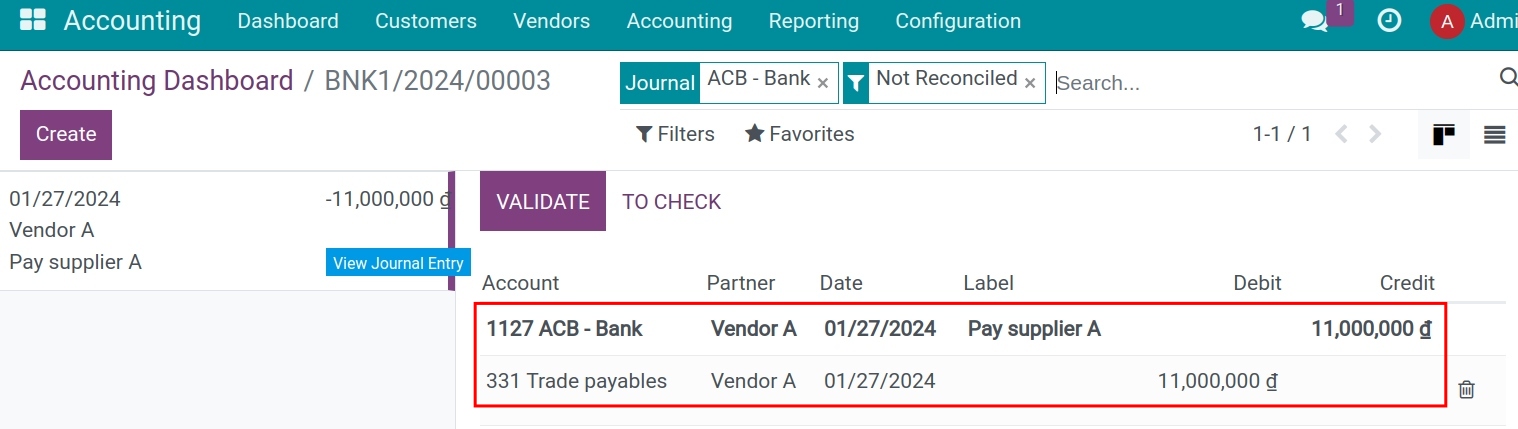

Situation 2: Reconciling without a payment voucher¶

Add transactions and reconcile. Incoming and outgoing funds confirmed on the bank statement are recorded in the cash accounting account and matched with the accounts payable account.

Click Confirm and view the generated journal entry.

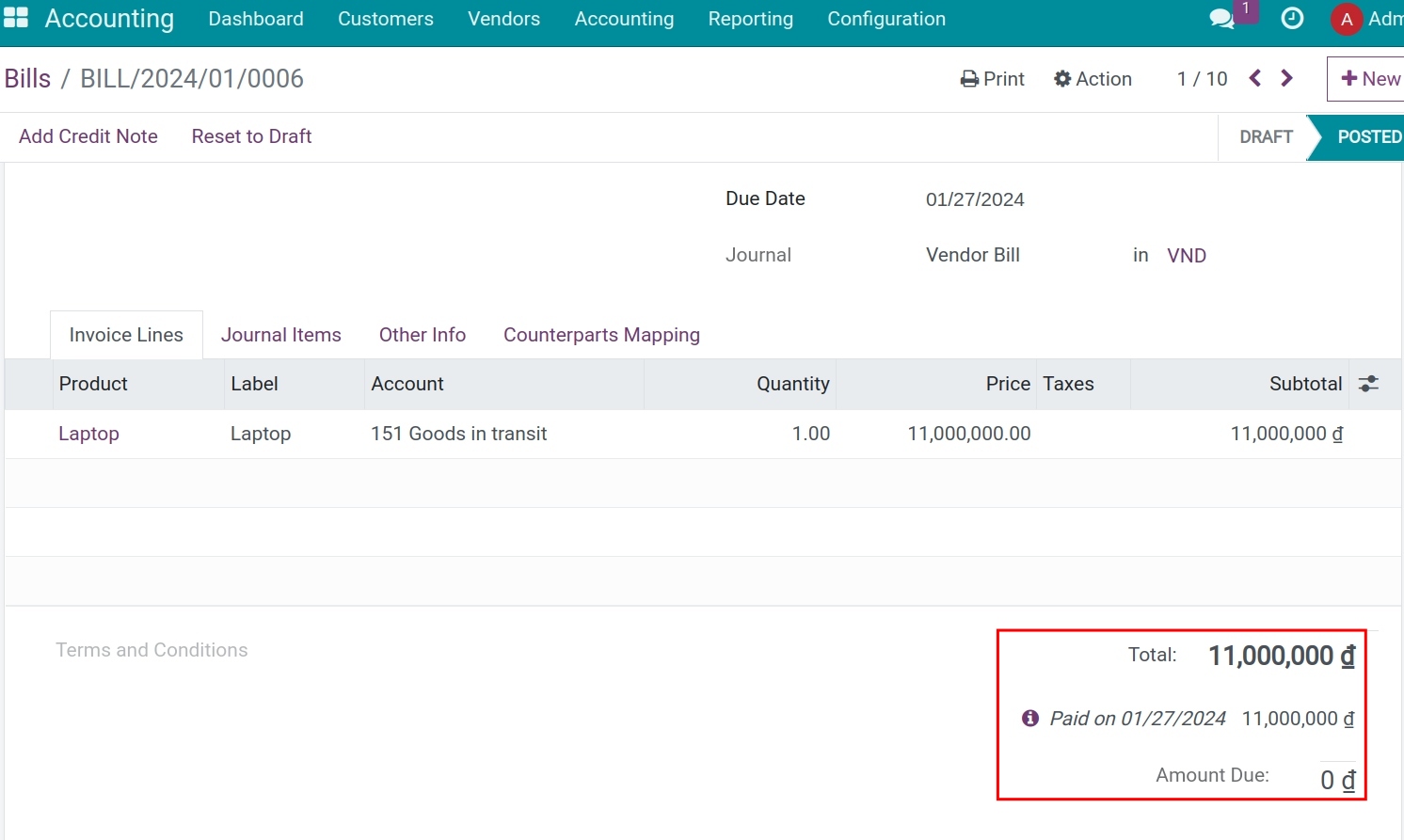

At this point, the invoice is also reconciled and changed to a paid status.

Situation 3: Reconciliation of transactions without invoices or payment receipts¶

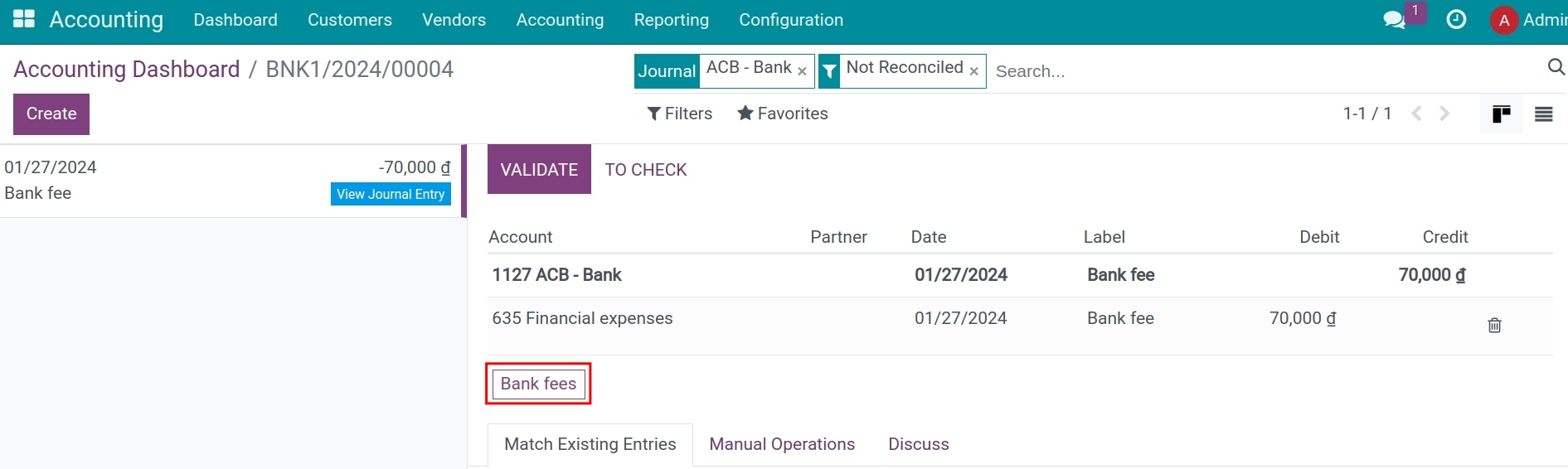

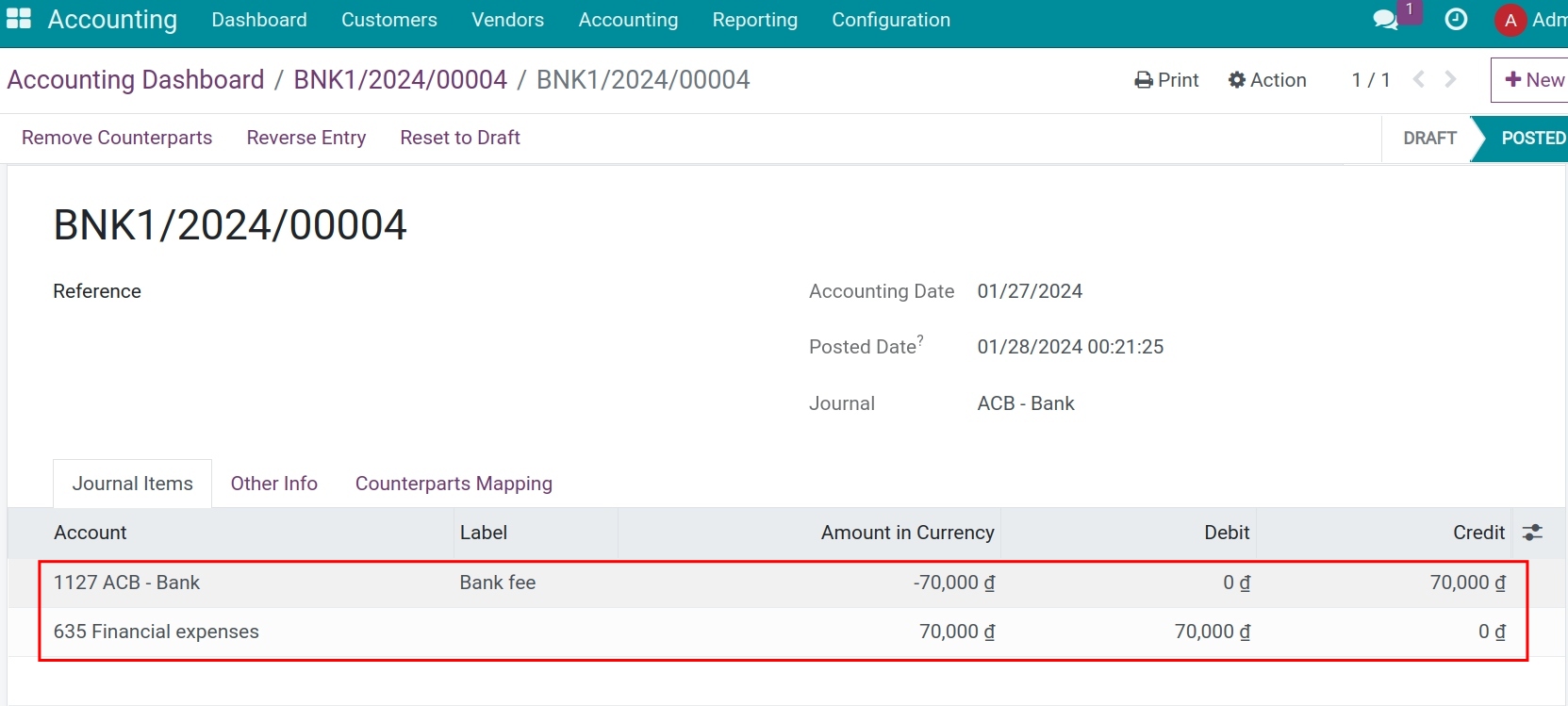

With payments that have a recurring cycle such as bank fees, capital gains, etc., which have not been recorded on the system, you can use the established reconciliation models. Read more on the Reconcile deposit interest and bank fees article.

At the reconciliation view of the bank statement, choose the suitable button corresponding to reconciliation models and press Validate.

See also

Related article

Optional module