Create an accounting journal entry¶

In daily accounting operations, there are some scenarios where the accountant needs to manually create journal entries to record generated transactions such as uncollectible debts, receiving the capital contribution, evaluating foreign exchange differences at the end of an accounting period, etc. Even though creating a journal entry separated from an accounting transaction is not encouraged, you can still do it quickly with the Viindoo Accounting software.

Requirements

This tutorial requires the installation of the following applications/modules:

Create a journal entry¶

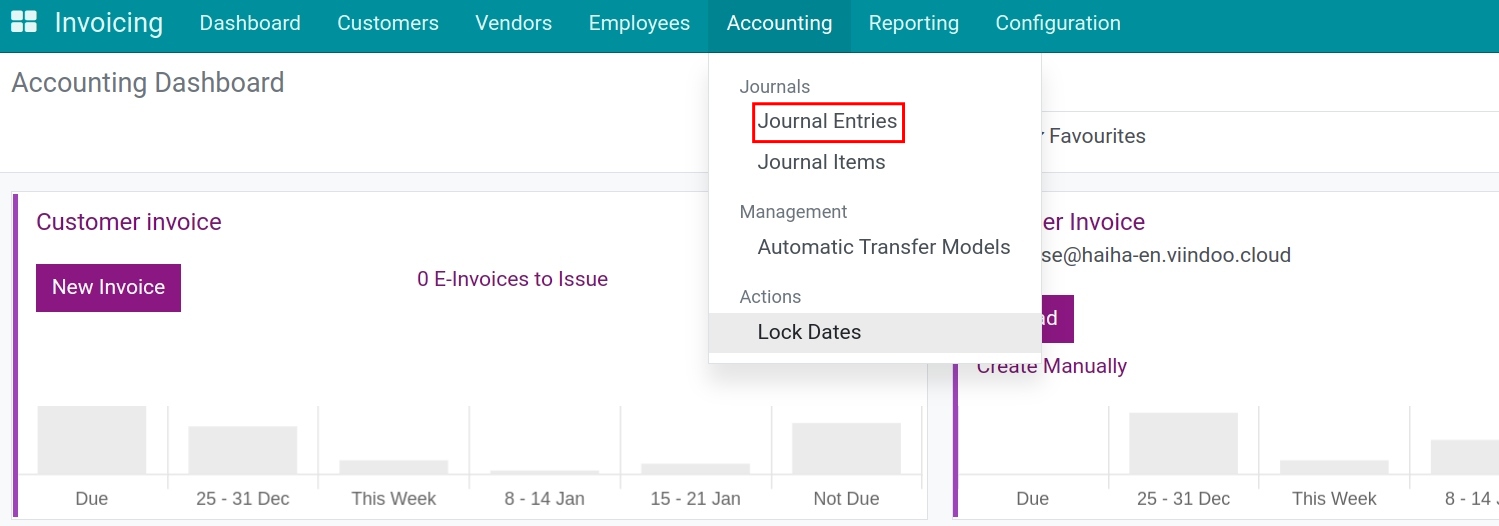

To view all the journal entries in your system, navigate to Viindoo Accounting > Accounting > Journal Entries.

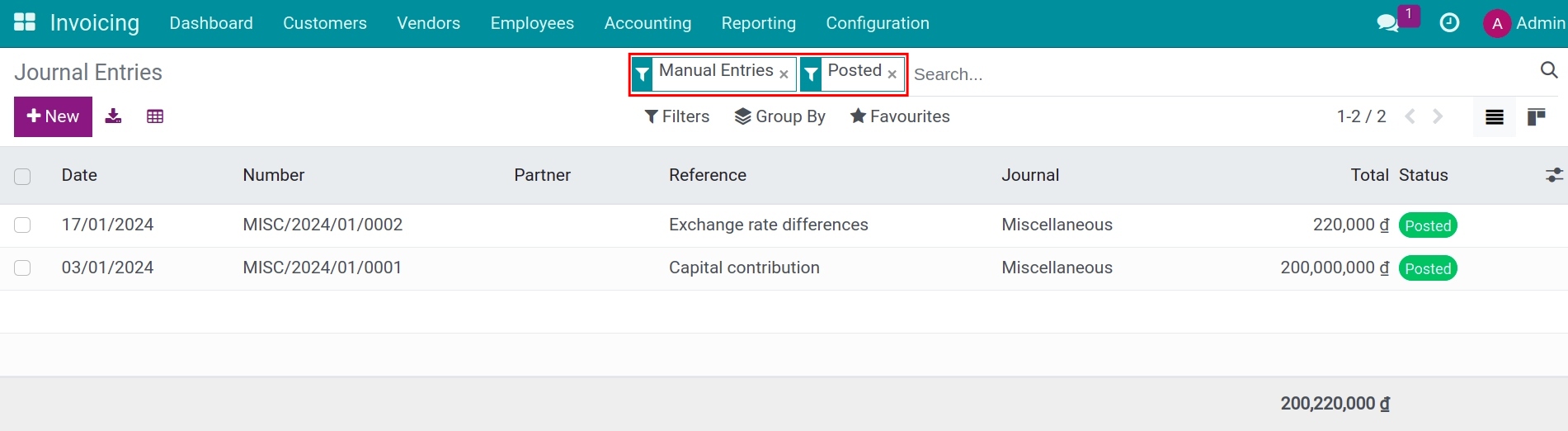

By default, this view displays all the miscellaneous and manually created entries in your system.

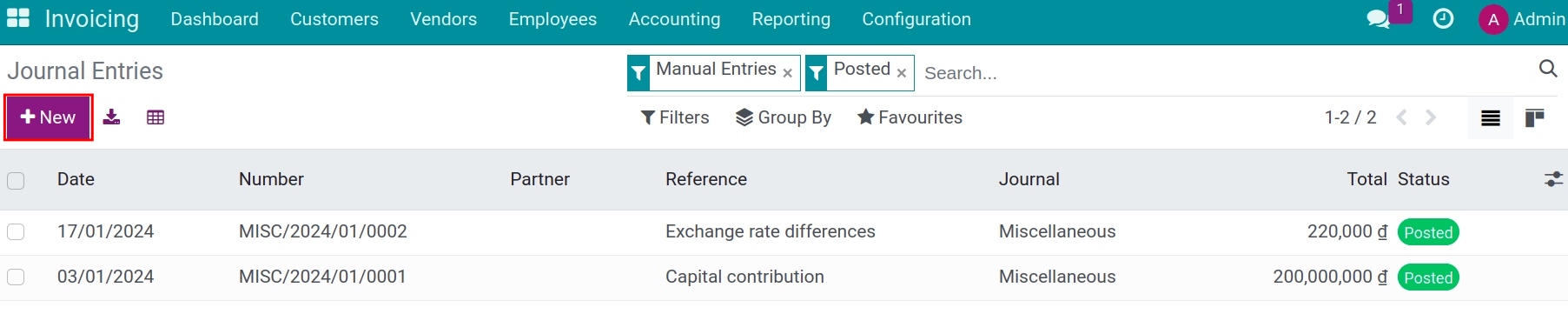

However, you can use the filter and grouping tool to find the entries according to your needs. Press +New to start generating a new journal entry.

General Information¶

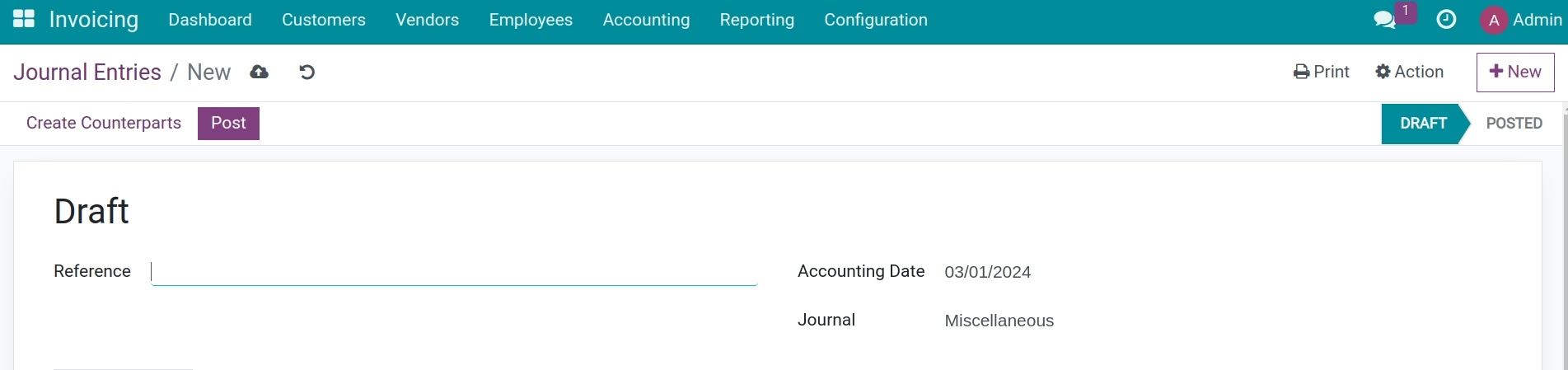

Fill in the basic details for the new accounting journal entry, including:

Reference: A brief description of the entry’s content to facilitate future reference and reconciliation of entries.

Accounting Date: The date on which the entry is recorded in the journal.

Journal: The system suggests the default journal Miscellaneous. However, you can choose another option that aligns with the nature of the accounting entry.

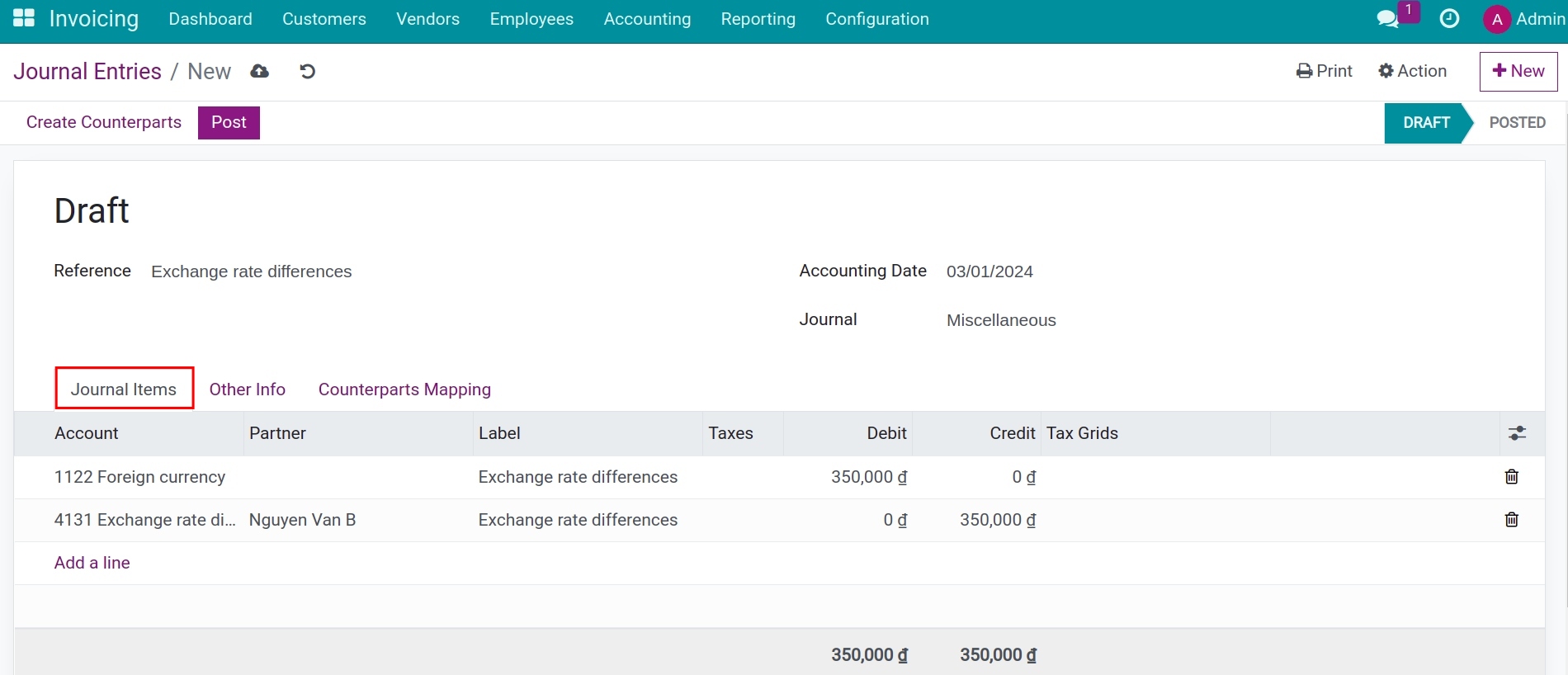

Journal Items¶

Click Add a line to generate all the journal items related to this journal entry by adding the following information:

Account: Select the account that will be debited/credited in this journal item.

Partner: Select the affected partner in this journal item. For example a customer, a vendor, a tax authority, etc.

Label: A brief description of this journal item.

Taxes: Taxes that applies on the base amount of this journal item.

Debit: The amount that will be debited by the transaction.

Credit: The amount that will be credited by the transaction.

Tax Grids: Select the tax grid applied to this journal item (if applicable).

Make sure that the Debit balance is always equal to the Credit balance in order to be compliant with the accounting principles.

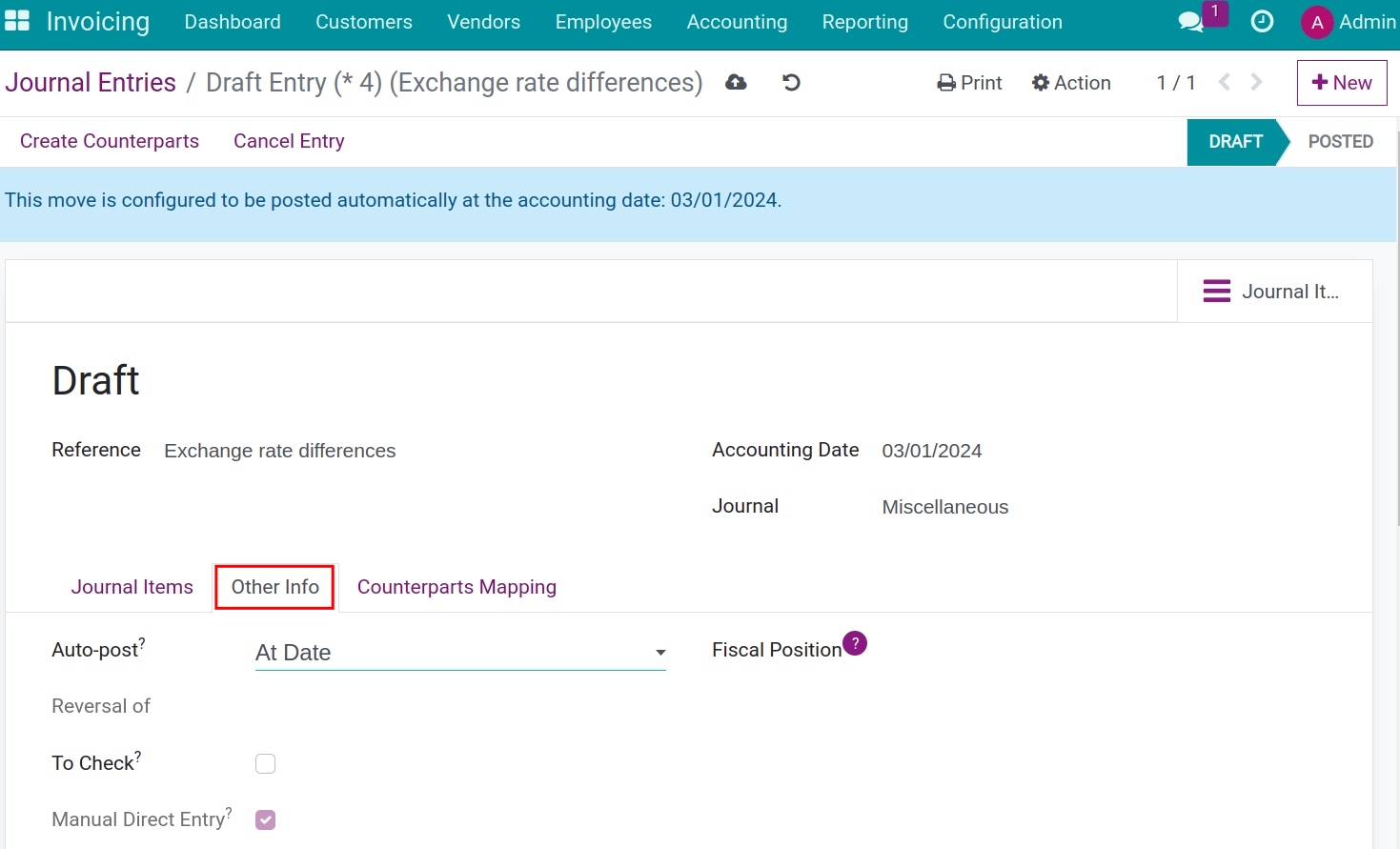

Other Info¶

In this tab, you can define some other information and action for the journal entry that you are creating, such as:

Auto-post: Choose whether the journal entry should be automatically posted to the ledger on the accounting date or not.

Reversal of: Indicates the reverse journal entry of the one that is being created.

To Check: Enable when you are not sure of all the related information while creating this transaction and require further review.

Manual Direct Entry: For any manual journal entry, this checkbox will be automatically checked to identify journal entries of this type and also facilitate any future review.

Fiscal Position: Apply the default fiscal position of the partner.

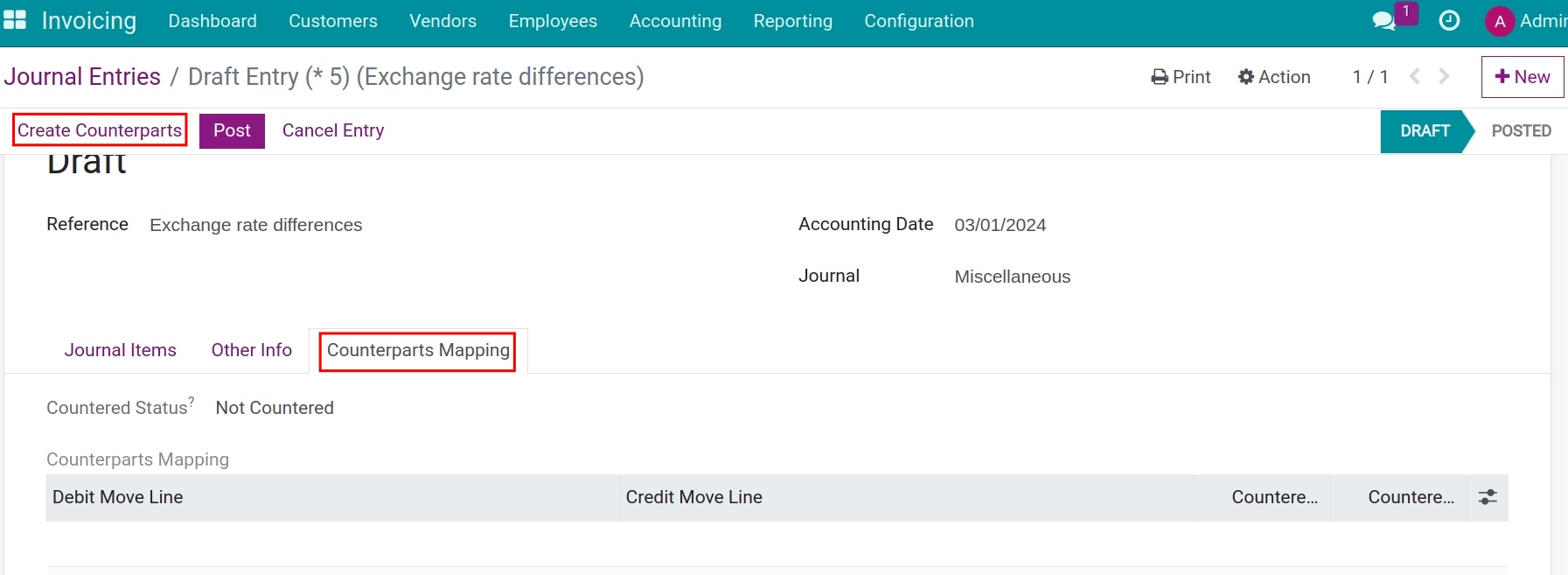

Counterparts Mapping¶

Press Create Counterparts to map the counterparts of this journal entry, all the information related to the entry will be displayed in the Counterparts Mapping tab.

The Countered Status indicates the current situation of the journal entry, whether it’s partially, fully, or not-yet-countered.

When you finish adding, the system will automatically save the entered information, or you can choose to save manually. Then, you can chooose Post it to the related accounting journal.

See also

Related article

Optional module