Borrowing Management¶

Tracking credit agreements: terms, interest rates, disbursement dates, principal repayment dates, and interest is always essential for businesses to optimize their capital sources and make timely decisions, policies, or suitable financial solutions. Viindoo’s loan management software will help you store all transaction information on the same system, easily and accurately look up loan details, disbursement dates, and maturity dates.

Requirements

This tutorial requires the installation of the following applications/modules:

Loan Borrowing Contracts¶

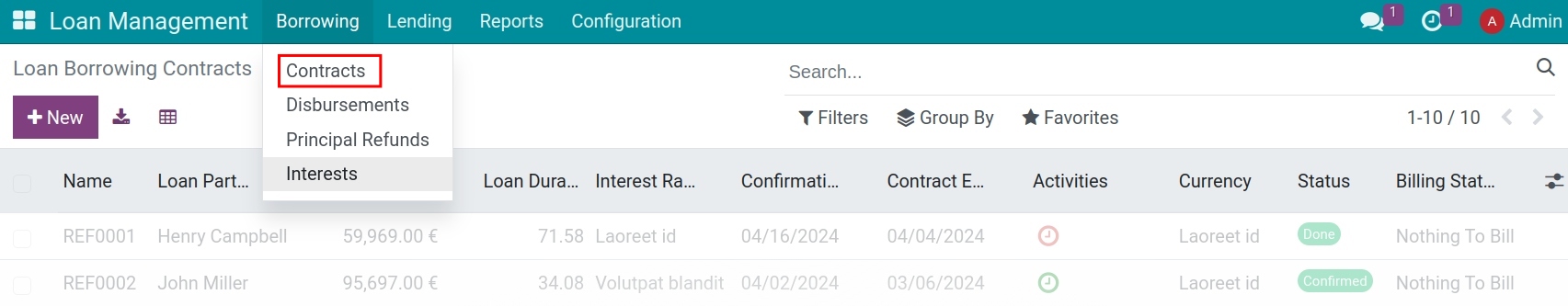

Access Loans > Borrowing > Contract, to new create additional contract:

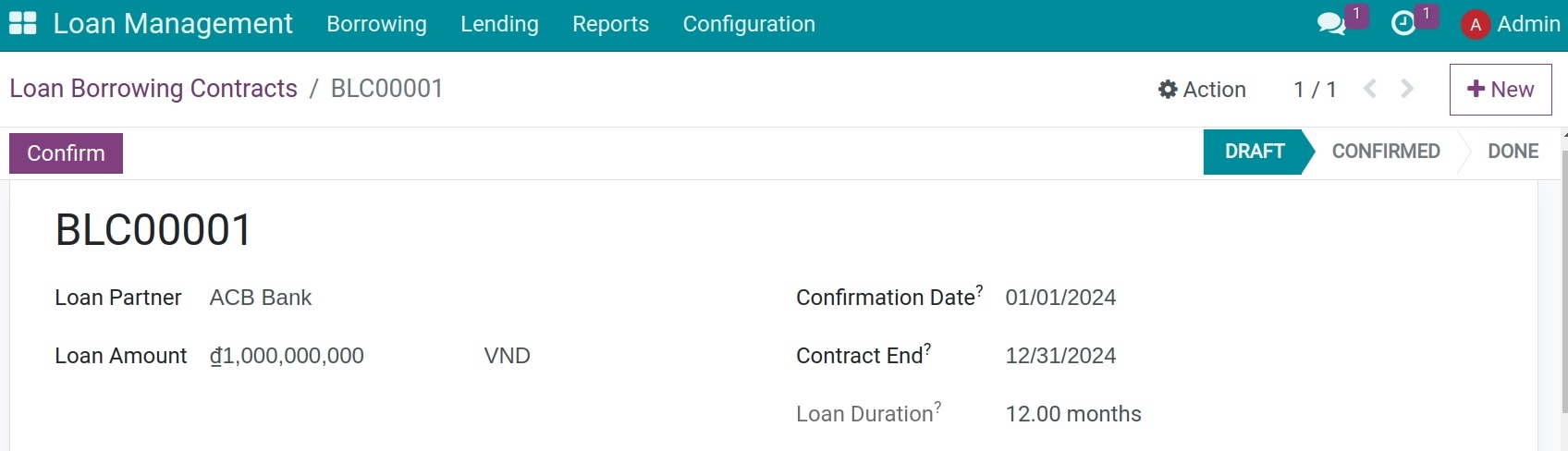

Fill in the information of a loan borrowing contract.

1. General information

Loan Partner: Information of the Lender;

Loan Amount: Principal loan amount according to the contract;

Confirmation Date: Principal loan amount according to the contract;

Contract End: The date on which the credit agreement concludes;

Loan Duration: The software will automatically calculate the term based on the confirmation date and end date. The term is calculated in months.

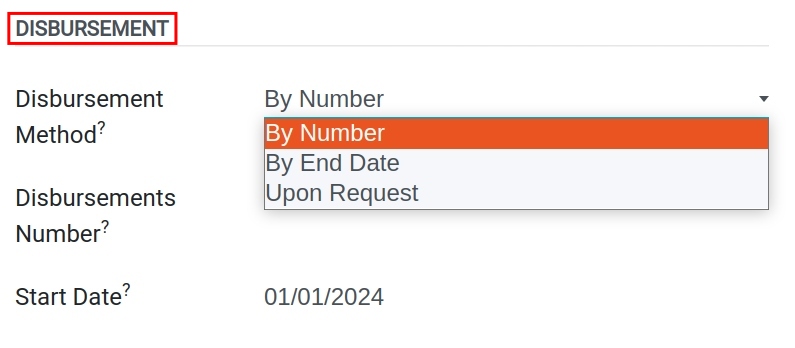

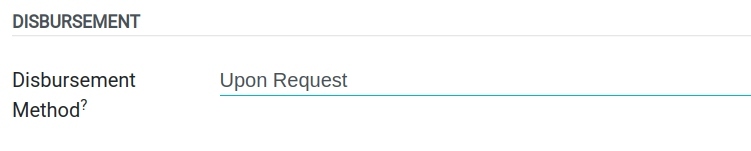

2. Disbursement

Setting the disbursement method:

By number: The loan amount will be disbursed in multiple installments. The first disbursement amount will depend on the Start Date field, and the amount for each disbursement will depend on the value entered in the Disbursements number field.

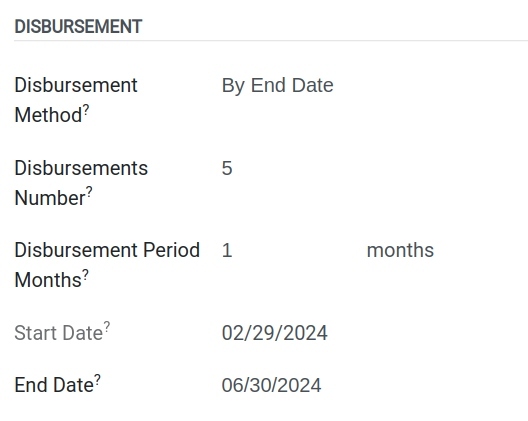

By end date: The loan amount will be disbursed in multiple installments. In this case, you first select the End Date, then fill in the Disbursements number and Disbursement Period Months. The software will automatically calculate the Start Date for the first loan disbursement.

Upon request: Disbursement will be made as requested. The user will manually record a disbursement if needed.

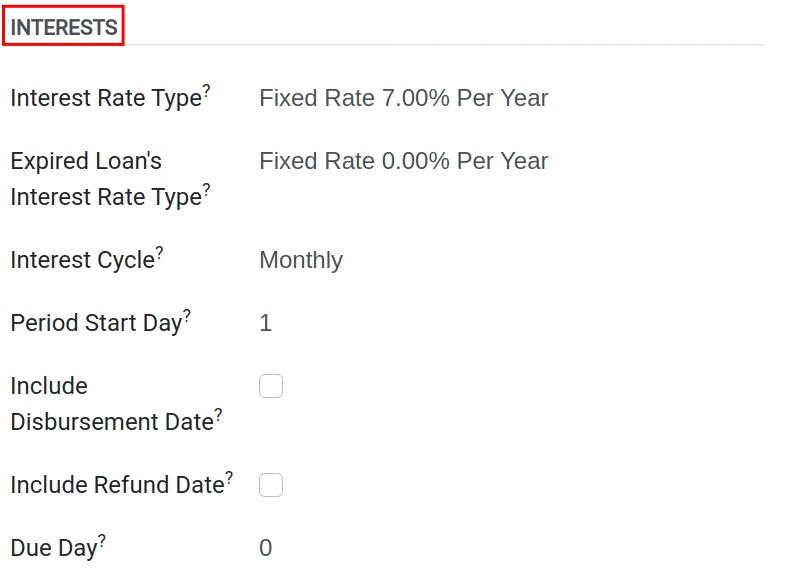

3. Interest

Interest rate type: Select the interest rate type that matches the contract you set in the previous step. Or create a new one by clicking the arrow pointing downwards in the right corner of the box, then choose Create and Edit.

Expired Loan’s interest rate type: This blank text box is for recording the payable amount of interest of unpaid principal after the due date. Create a new one by clicking the arrow mark then choose Create and Edit.

Interest cycle: The period for interest calculation of the contract:

Weekly: Each interest amount will be calculated in a period of 07 days;

Monthly: Each interest amount will be calculated in a period of a full month;

Quarterly: Each interest amount will be calculated for the period of a quarter;

Biannually: Each interest amount will be calculated for the period of six months;

Annually: Each interest amount will be calculated for the period of a year.

- Period start day: The beginning date of a cycle is counted from the date that the interest calculation is recorded. The default value is 1, which means the cycle is standard (week starts from Monday, month starts from the 1st date).

Example: A loan on 17th April 2024 with the monthly interest cycle and period start day is 5 means first interest calculation period is from 17th April 2024 to 04th May 2024, and the next period is from 05th May 2024 to 04th June 2024.

Include disbursement date: If checked the box, the interest computation will start from the date when the disbursement is made. Otherwise, the computation will start from the following day.

Include refund date: If checked the box, the interest computation includes the date when the principal is paid. Otherwise, the computation will start from the following day.

- Due day: The due day of interest payment is counted from the last date of an interest cycle. The default value is zero means the due day is the last day of an interest cycle. A positive value (+) means the due day is AFTER the last day of an interest cycle. A negative value (-) means the due day is BEFORE the last day of an interest cycle.

Example: A loan with the first interest computation is from 17th April 2024 to 04th May 2024, (+)2 in this blank text box means the due date of the first interest payment is 06th May 2024, (-)2 means the due date of the first interest payment is 02nd May 2024.

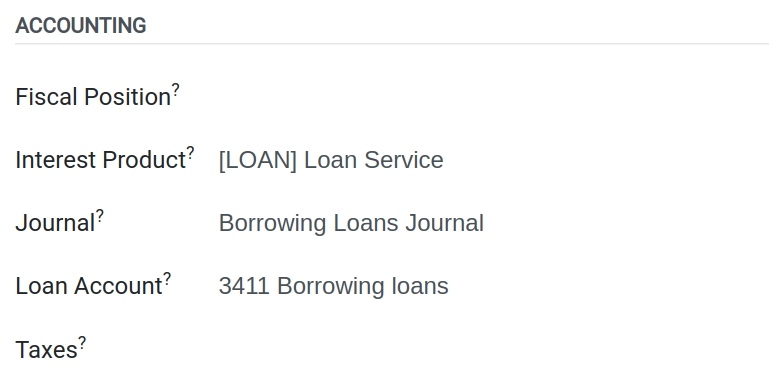

3. Accounting

Default setting of software is shown in the above picture, click the arrow pointing downwards to change. In Vietnam, loan interest is not subjected to value-added tax, so it can be left blank.

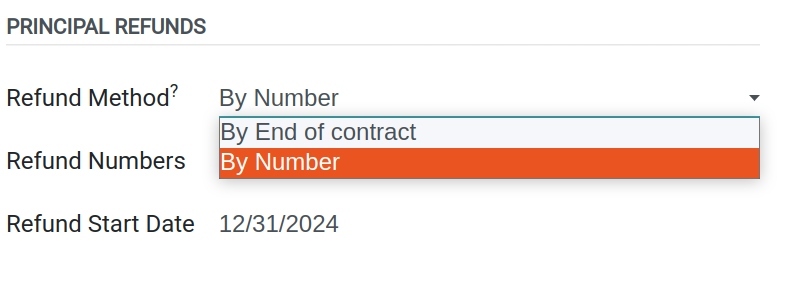

4. Principal refunds

By number: the principal will be divided to be paid for numerous times. The first date is set in the “refund start date box”, the payment amount depends on the value set in the “refund numbers box”.

By end of contract: the principal will be paid once the contract ends.

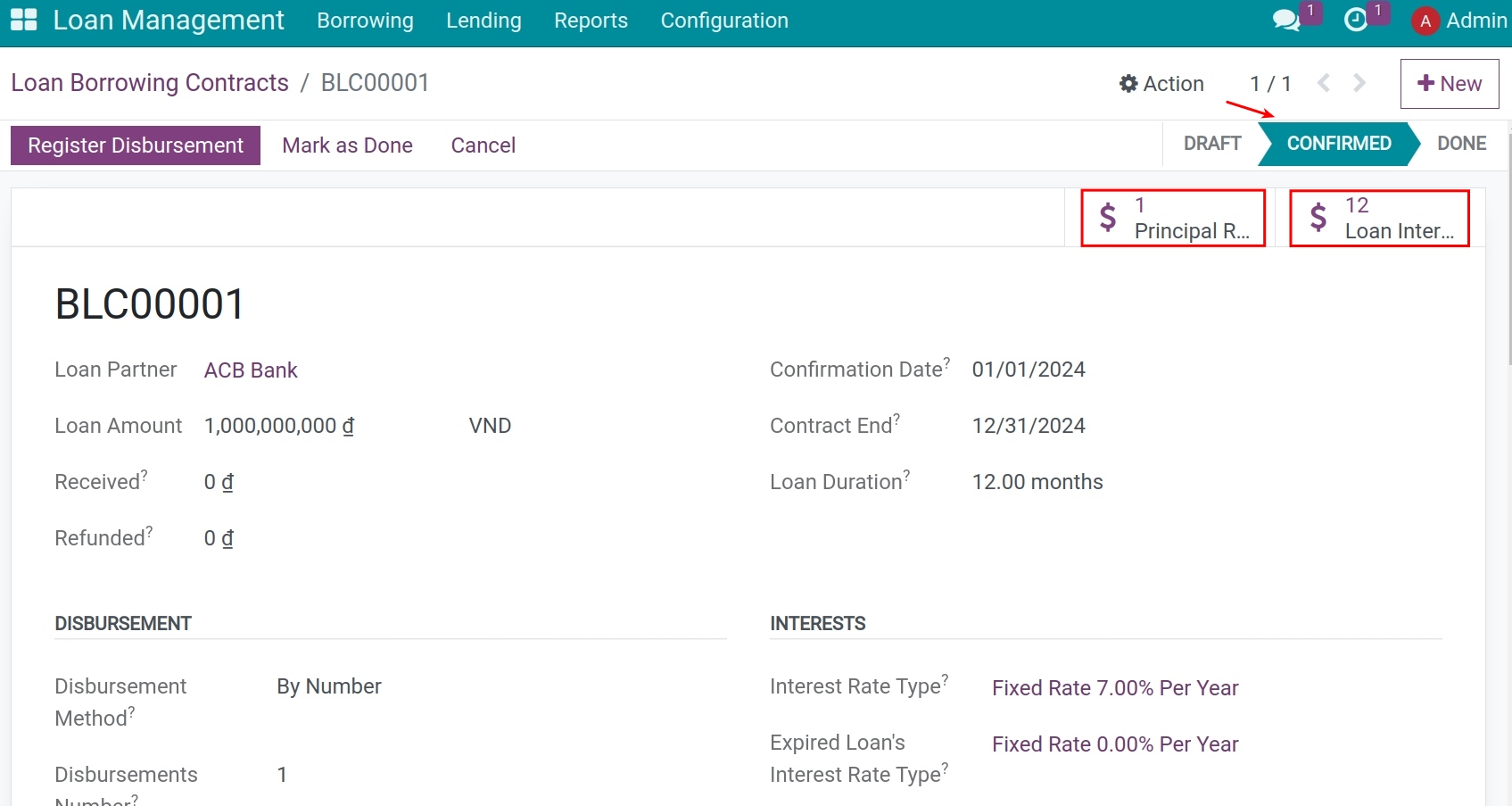

After filling in all the necessary information and saving, the system will generate the contract number. At this point, when you press Confirm, the software will transition from Draft status to Confirmation, while automatically calculating and generating all relevant data (interest payment schedule, principal repayment schedule, disbursement schedule) for you to track later on.

Record a disbursement amount¶

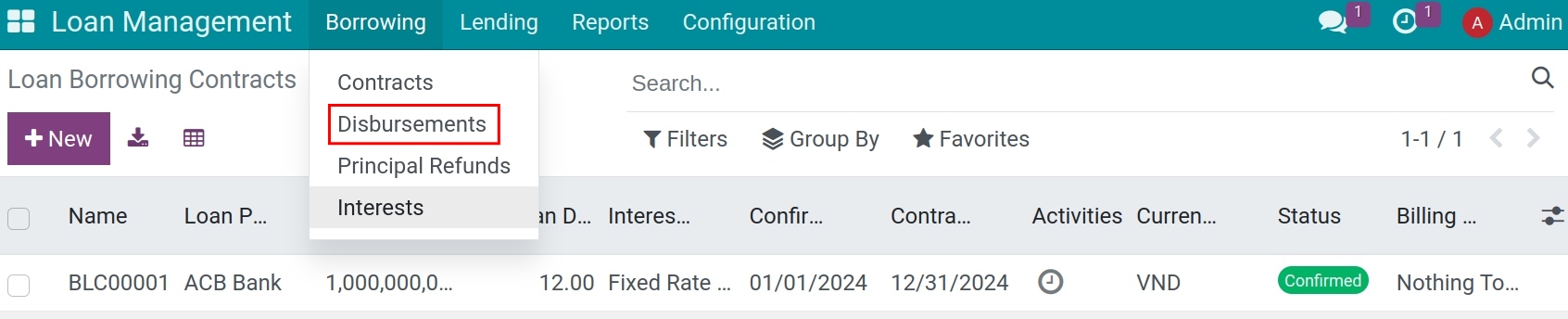

Access Loan/Loan Management > Borrowing > Disbursements.

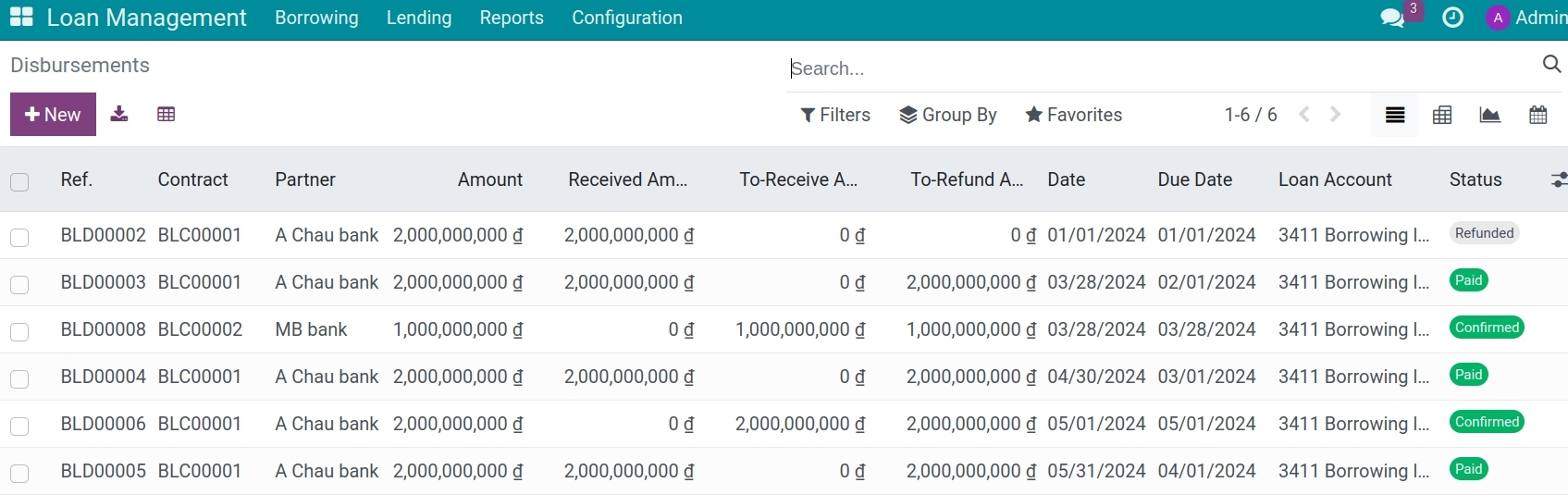

Disbursement items will be displayed in the form of a list.

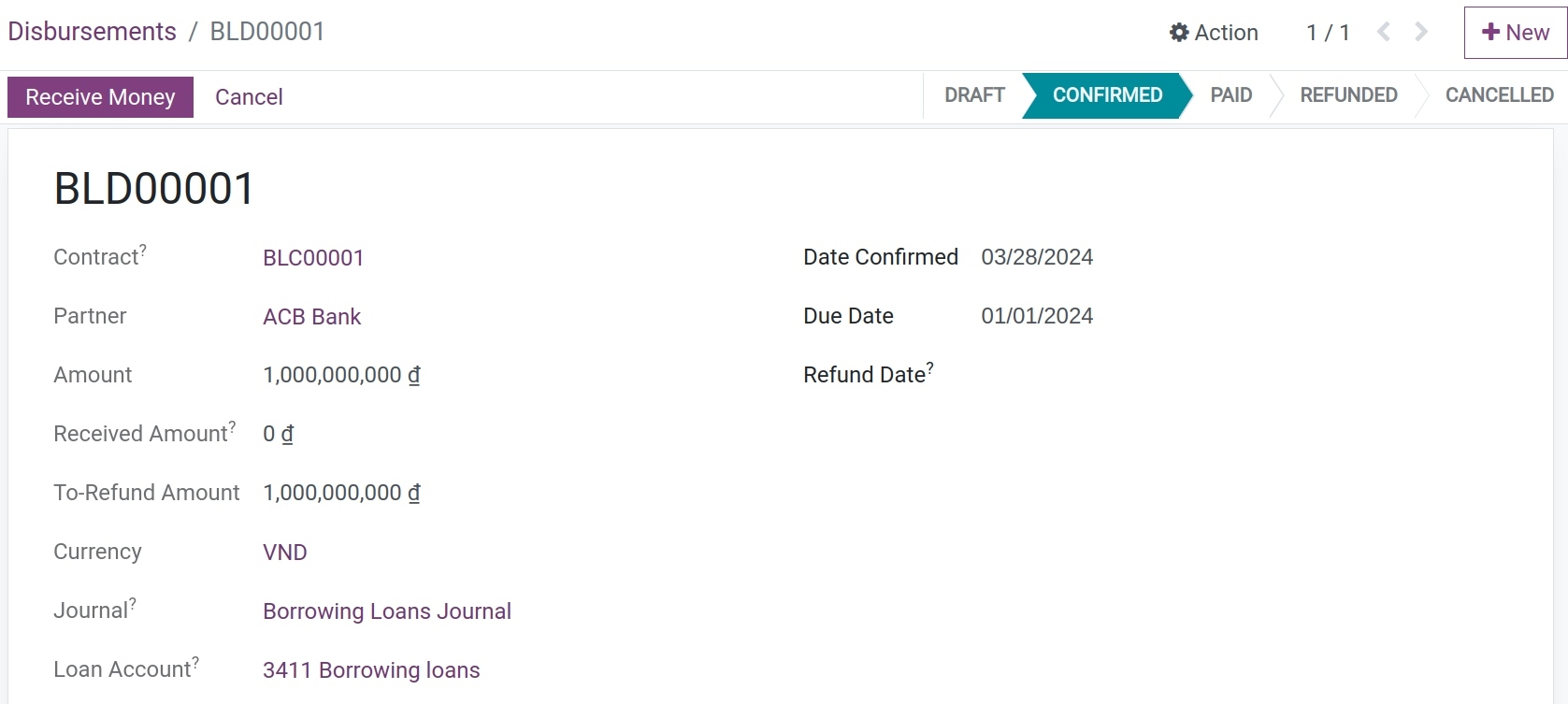

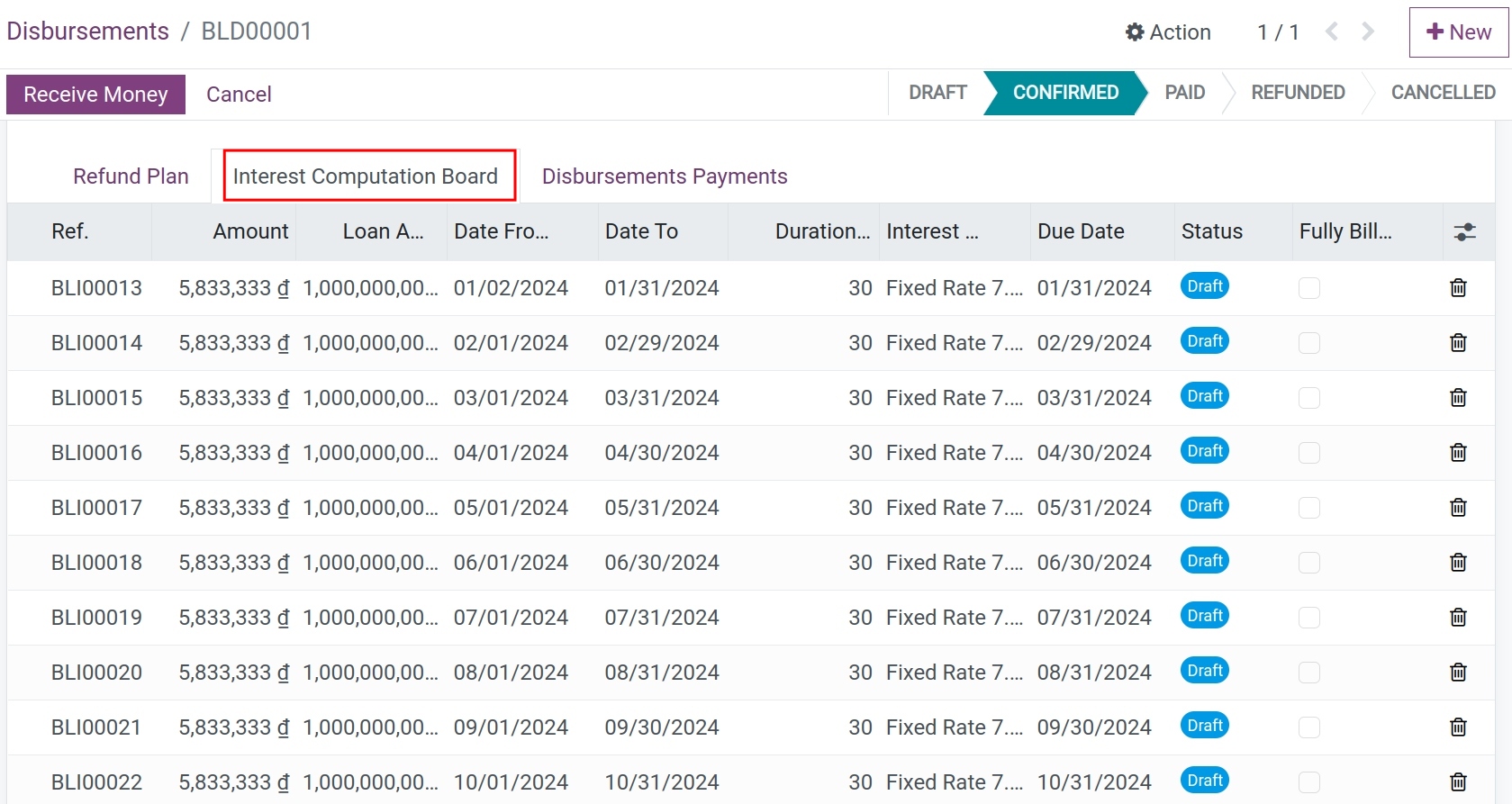

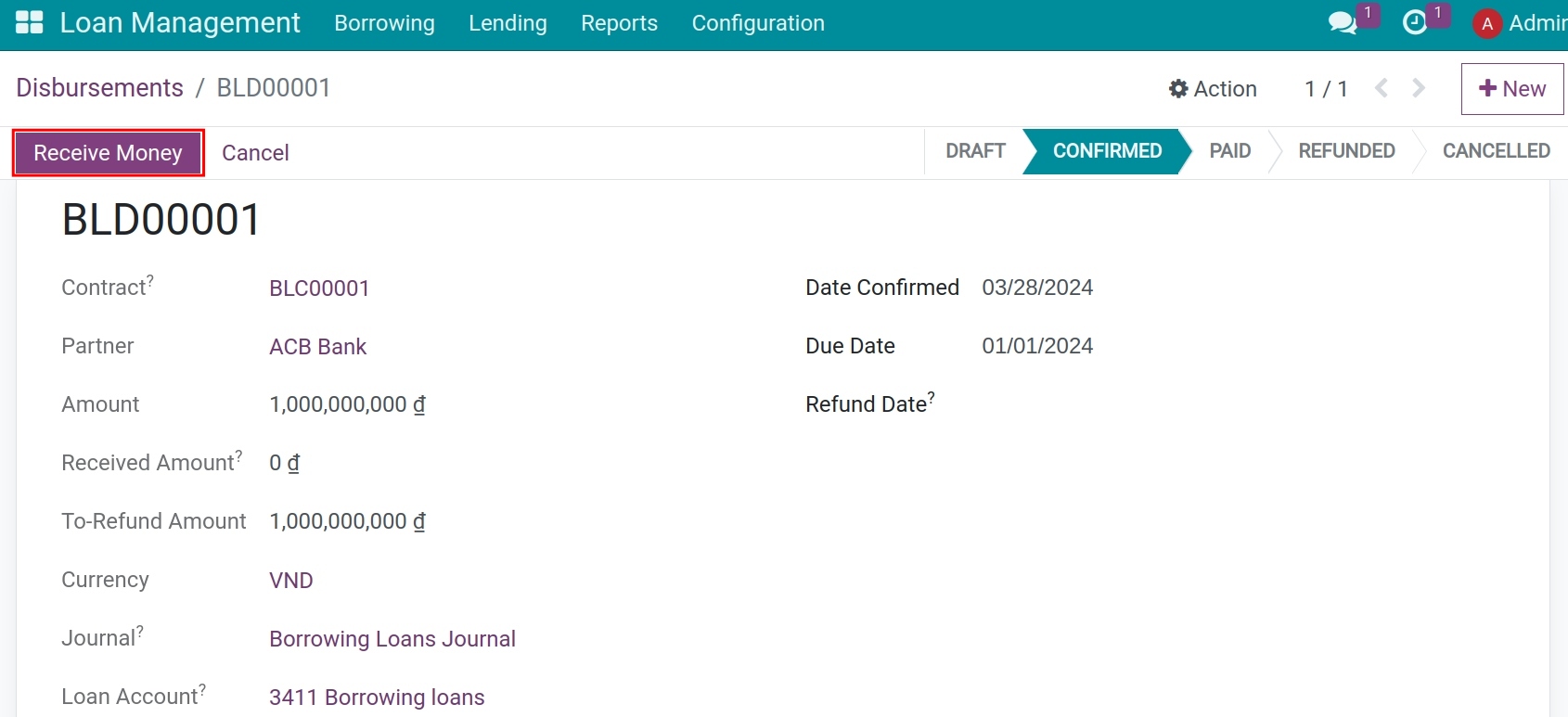

Click on a confirmed disbursement item, and all information regarding the loan contract will be inherited here, while the system will also automatically calculate the Refund Plan and Interest computation board to the selected cycle in the contract.

To record a disbursement, click Receive Money.

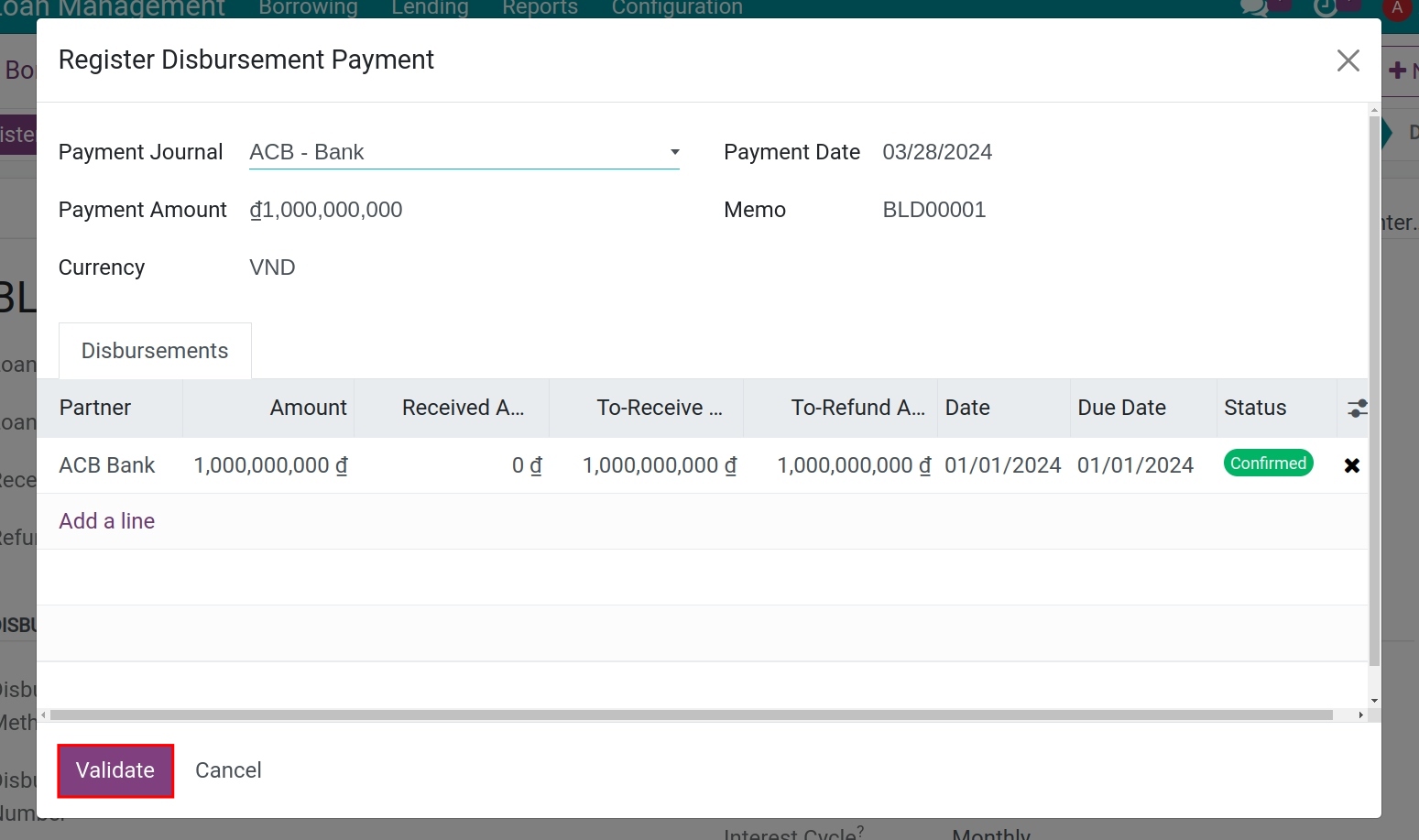

At this point, the Register Disbursement Payment window is displayed. Review the information once more and click Confirm.

Payment journal: Allow to choose the bank (VND) if disbursed to a bank account or Cash (VND) if received the disbursement in cash.

Payment amount: This is the disbursement amount. Based on the information in the Contract, the application will automatically calculate and then show a default amount. This can be changed if there’s a difference.

Payment date: The date you receive the disbursement amount. The application will set the default date as today. This can be changed if there’s a difference.

Currency: Specify the currency type you will receive. The system will automatically use the default currency of the business. It can be changed if there is a difference.

Memo: Enter a reference or easily searchable content for future reference.

Note

A bank can have multiple loans. You need to accurately check the amount according to the contract and the date before confirming receipt of the funds.

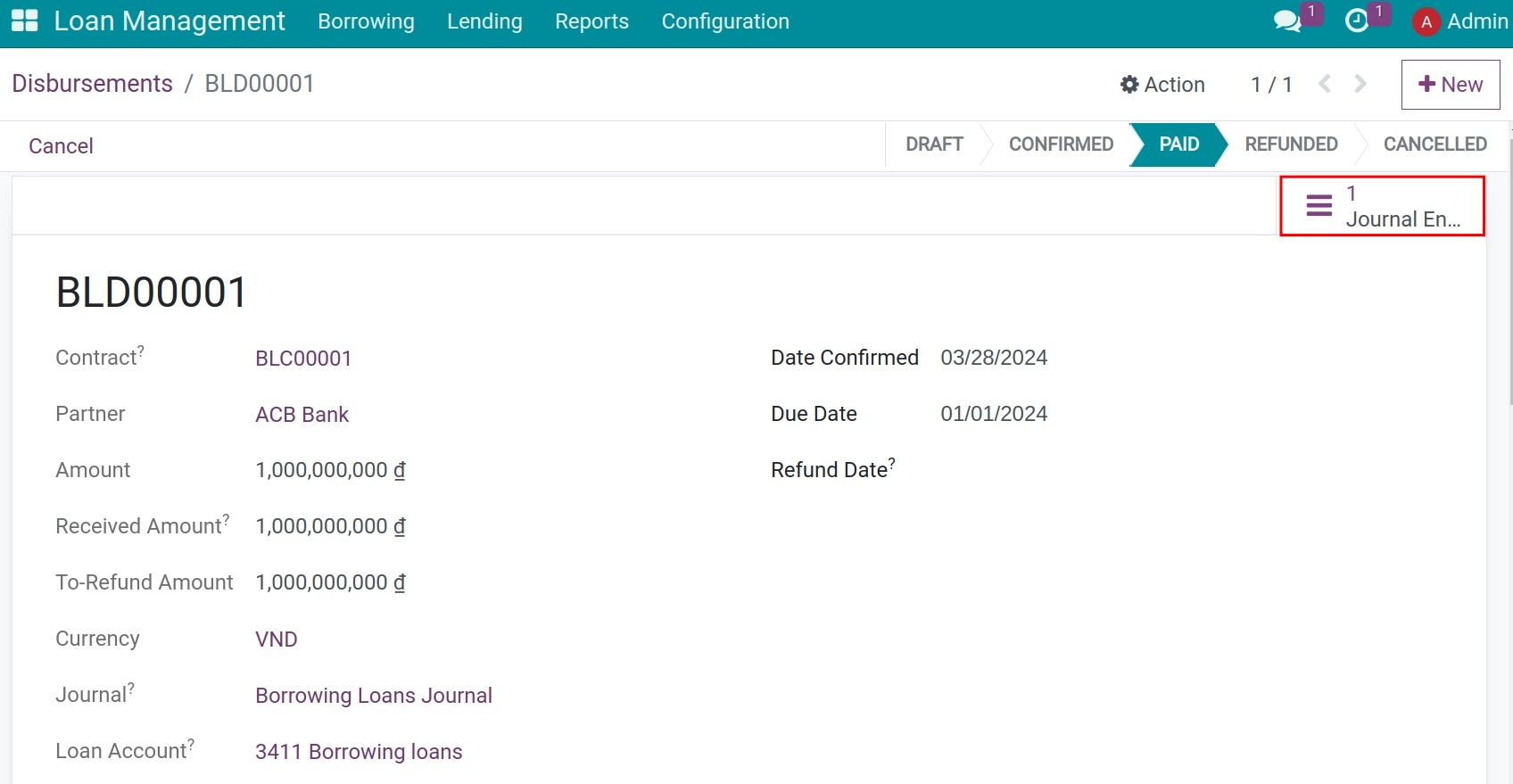

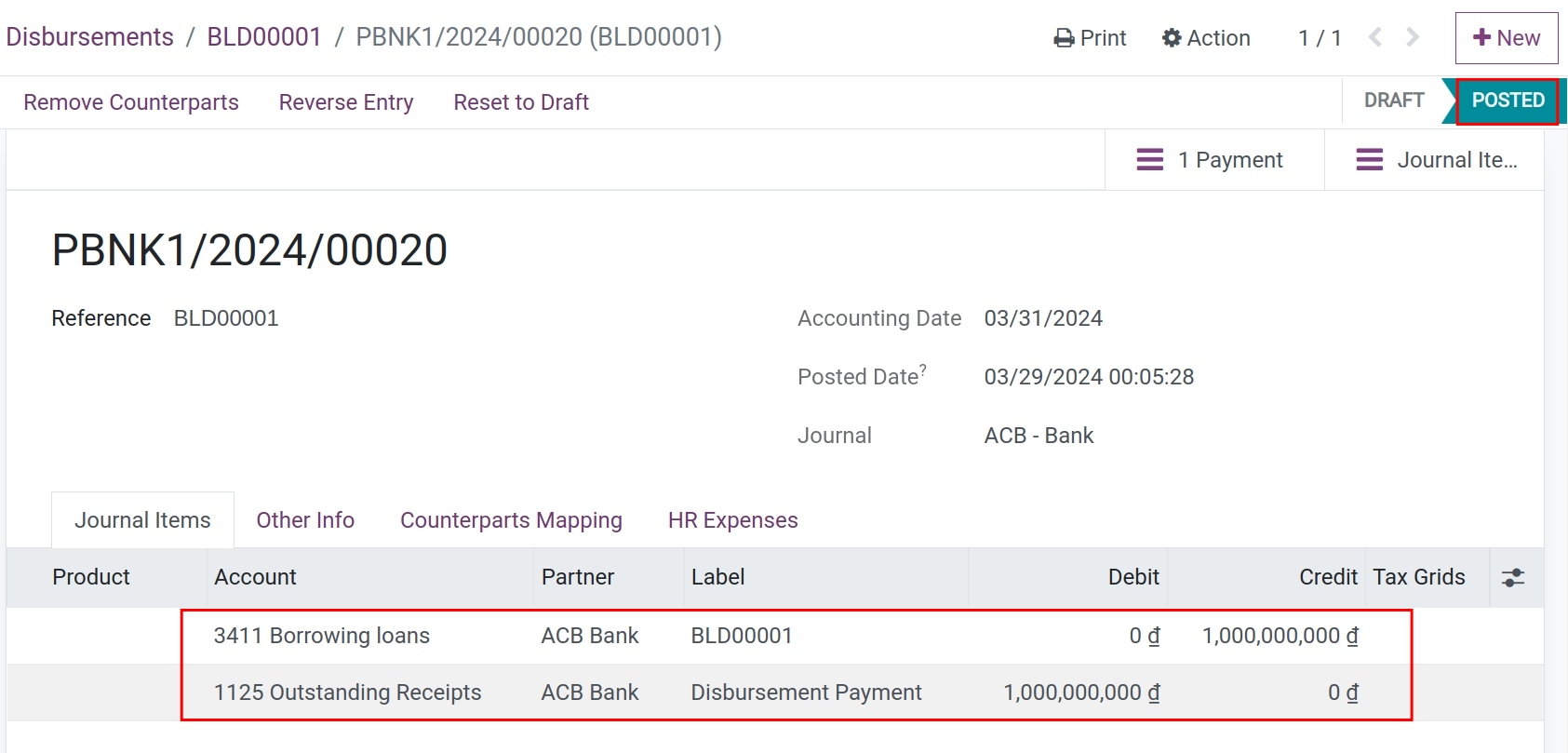

The loan status changes from Confirmed to Paid. An entry is also automatically recorded at the same time. Click Journal Entry to view the details.

Monitor Interest Payments¶

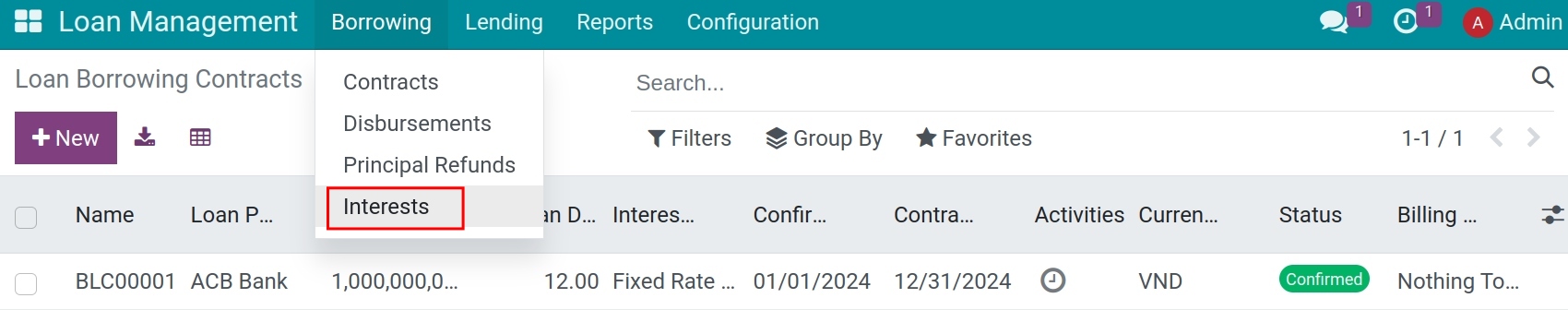

Click Borrowings, then go to interests

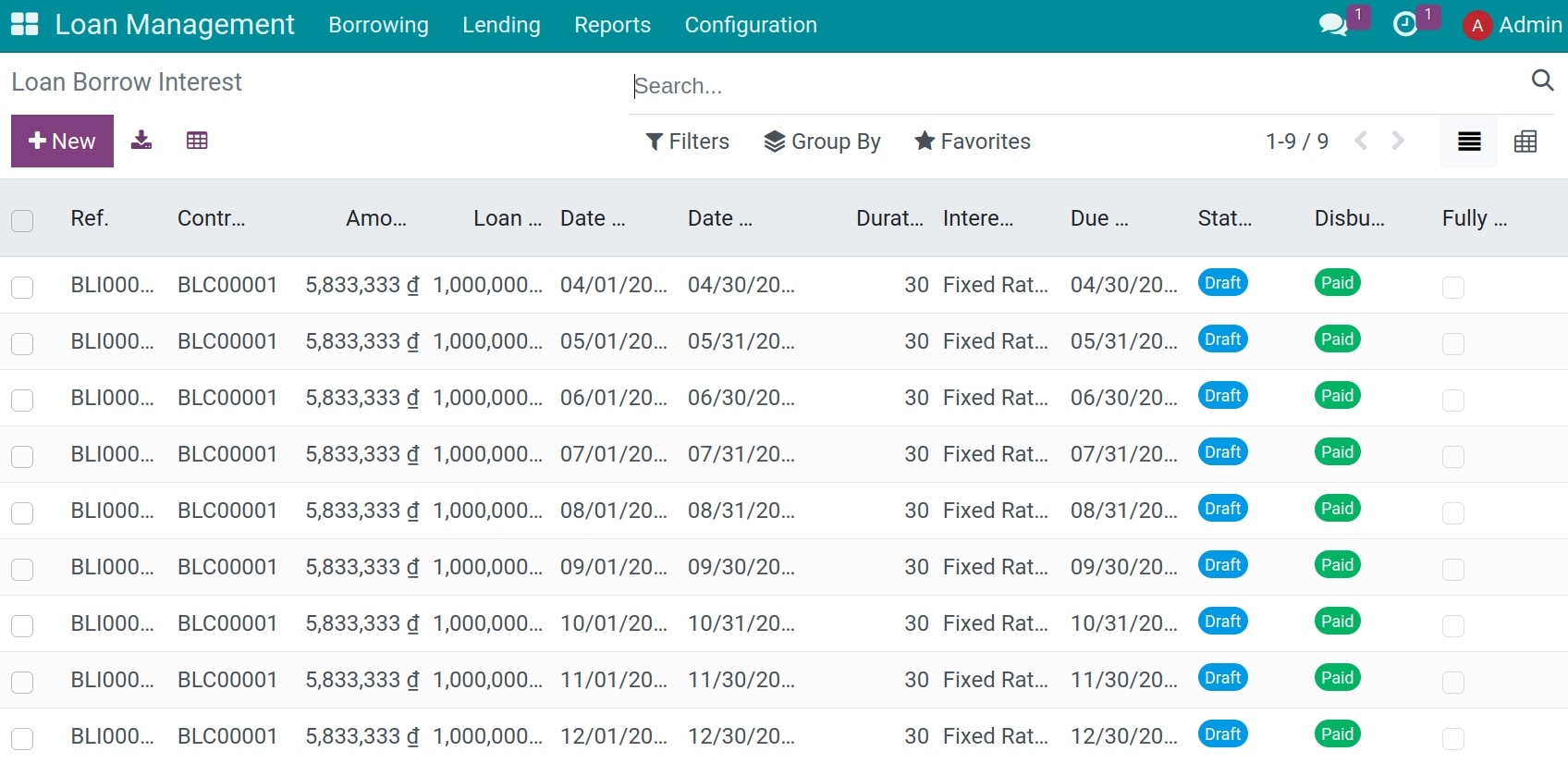

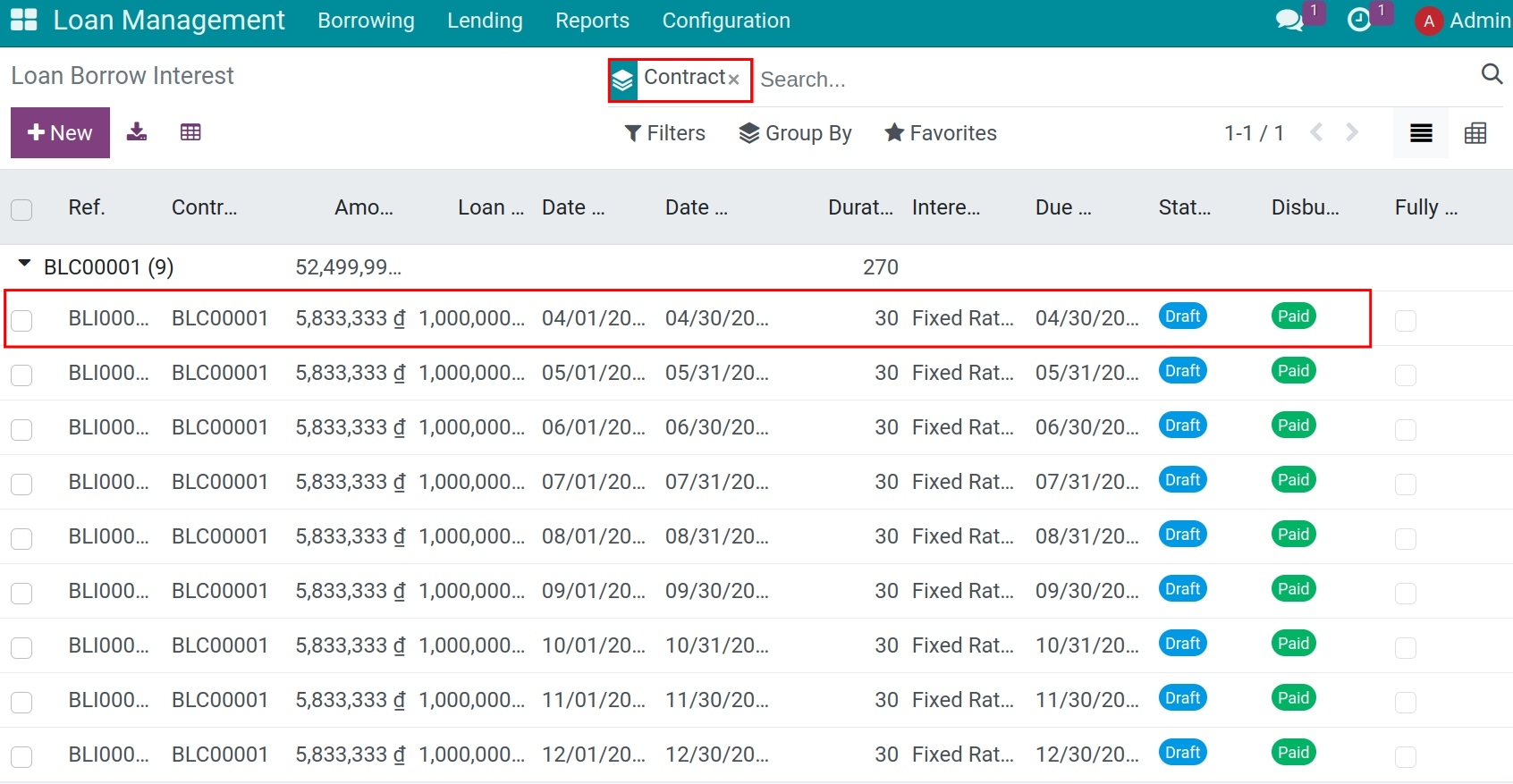

The information of all interest payments will show up on the screen, as the picture below.

Utilize the filter options to group and track interest payments by each contract and disbursement. When receiving an interest statement from the bank, select a loan with the corresponding interest term.

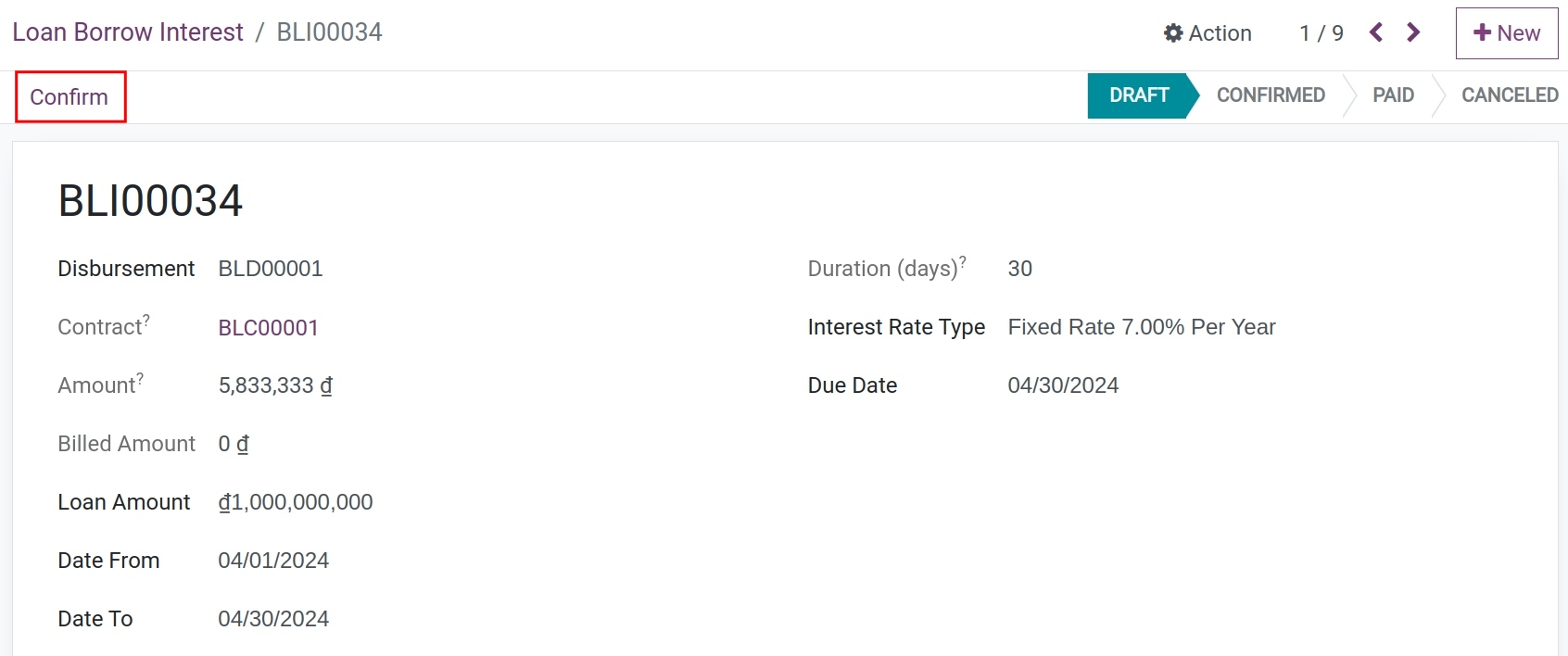

Verify the information, then click Confirm to change the interest status from Draft to Confirmed.

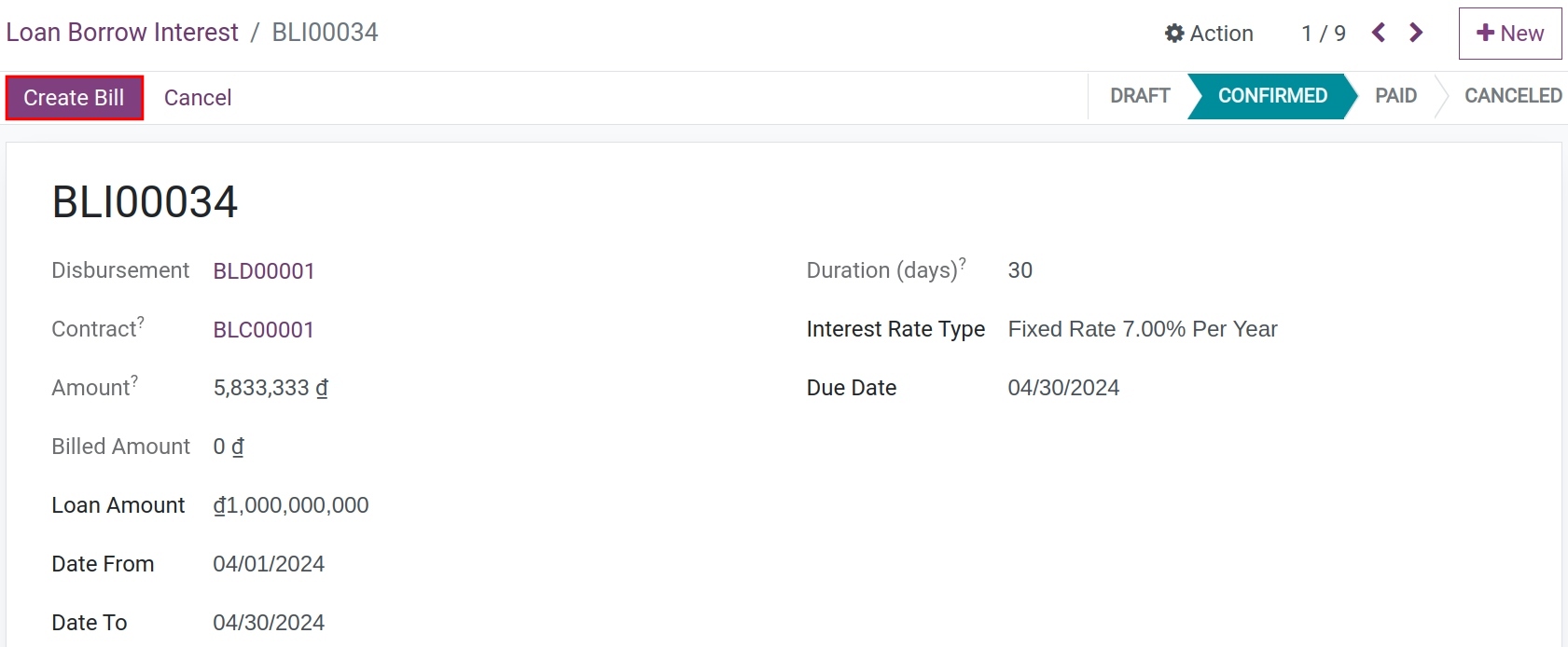

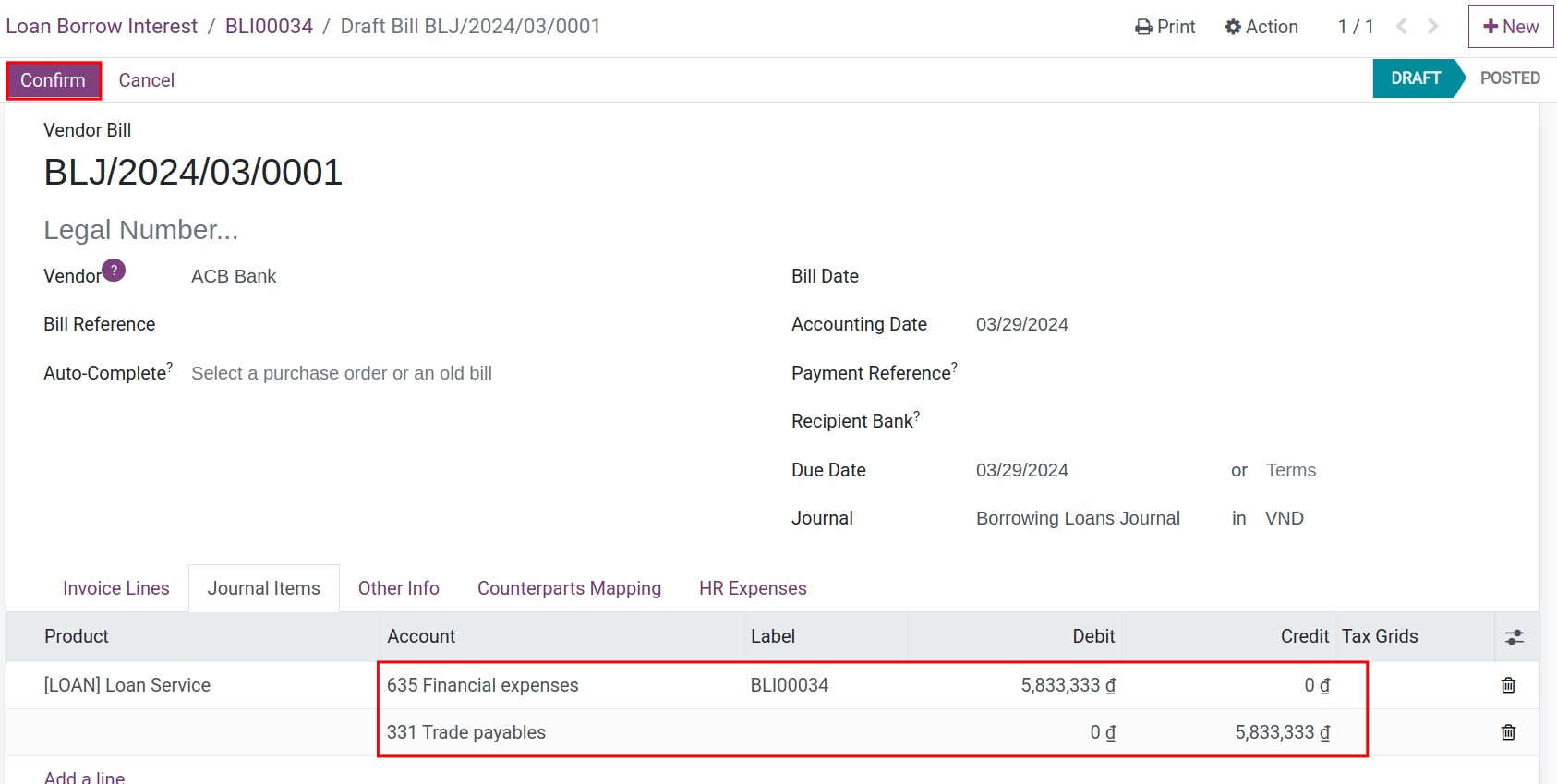

After confirming, select Create invoice to record the journal entry.

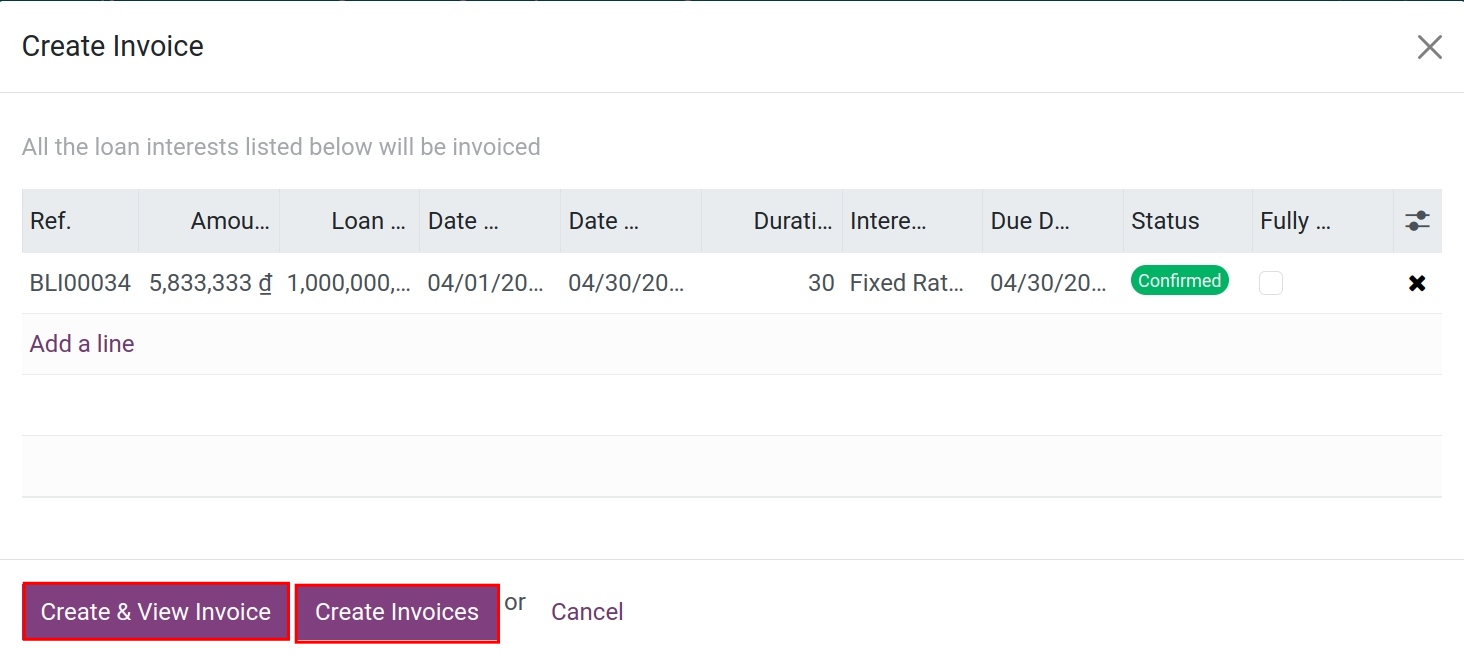

At the Create Invoice screen, choose create and view invoice if you wanna see the draft version of the invoice, or click create invoice to record immediately.

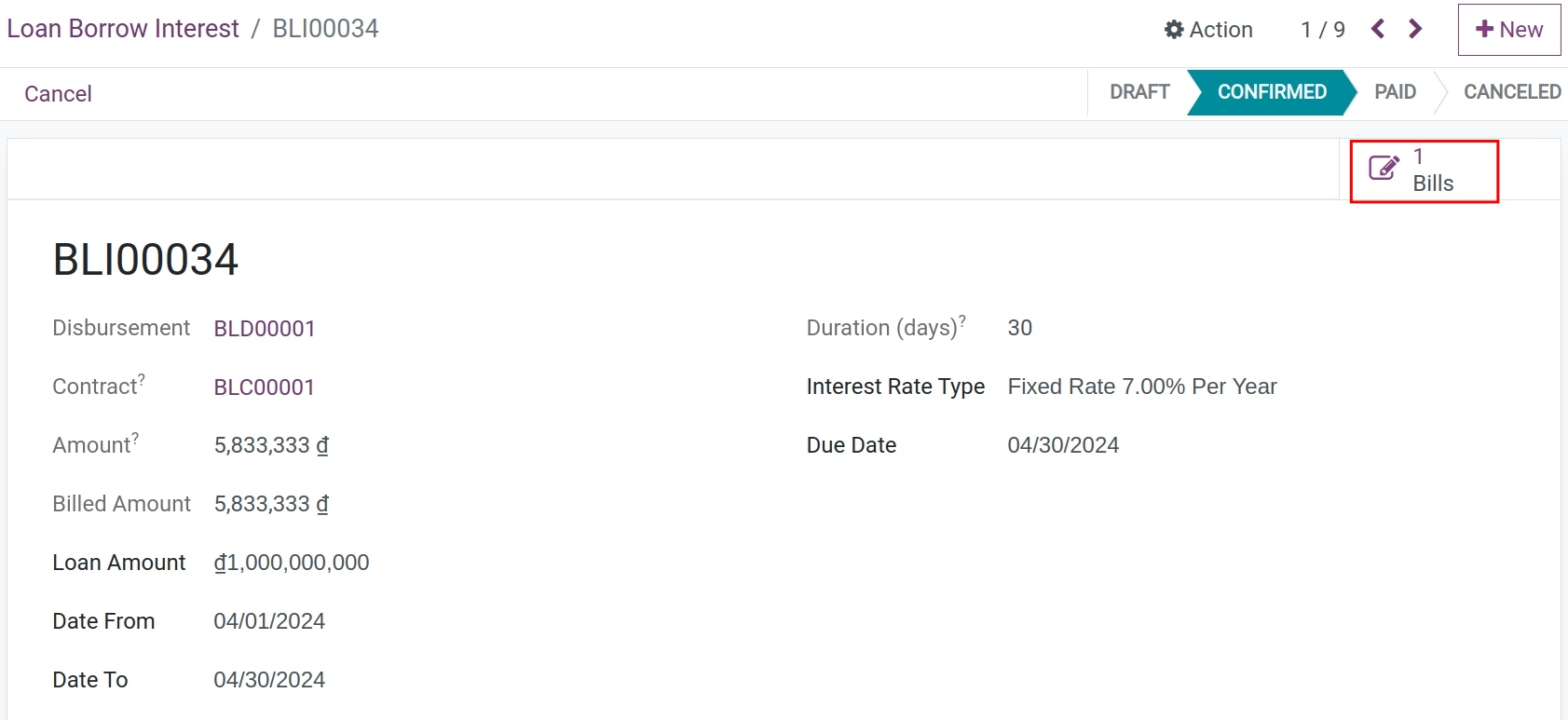

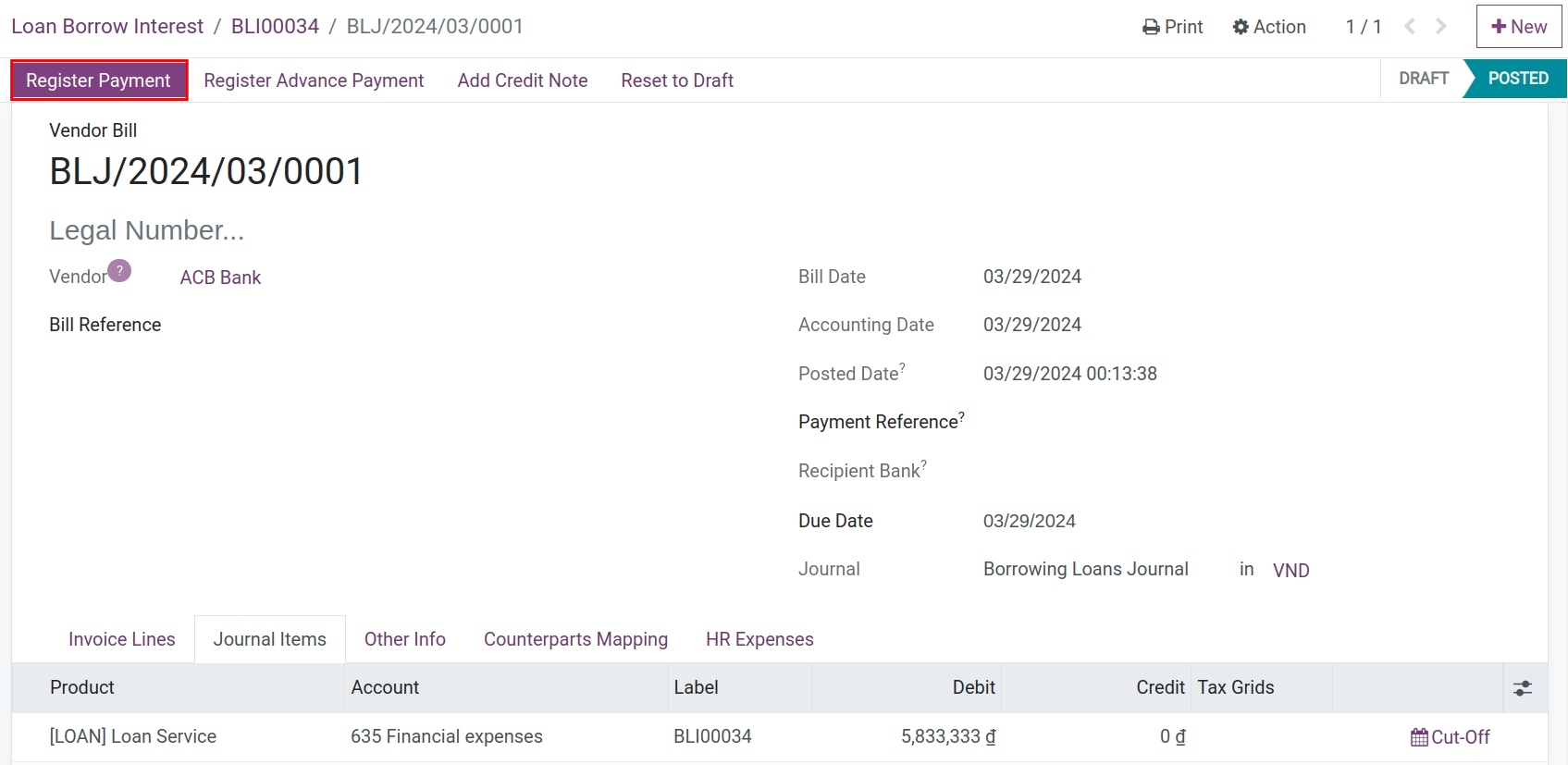

Go back to the interest interface, then select Invoice to switch to the supplier invoice interface.

Here, after you confirm the invoice, the system will record the interest payment to be made and automatically post it to the corresponding accounting account. Click Record Payment if you want to make this interest payment to the bank.

The sequence of steps for paying interest is similar to paying regular invoices. Please refer How to record customer payments.

Record principal refunds¶

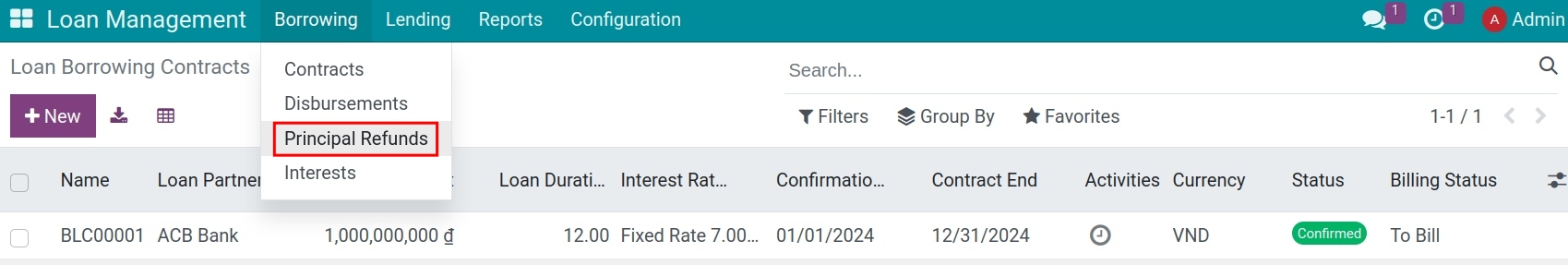

Click Borrowings, then go to principal refunds:

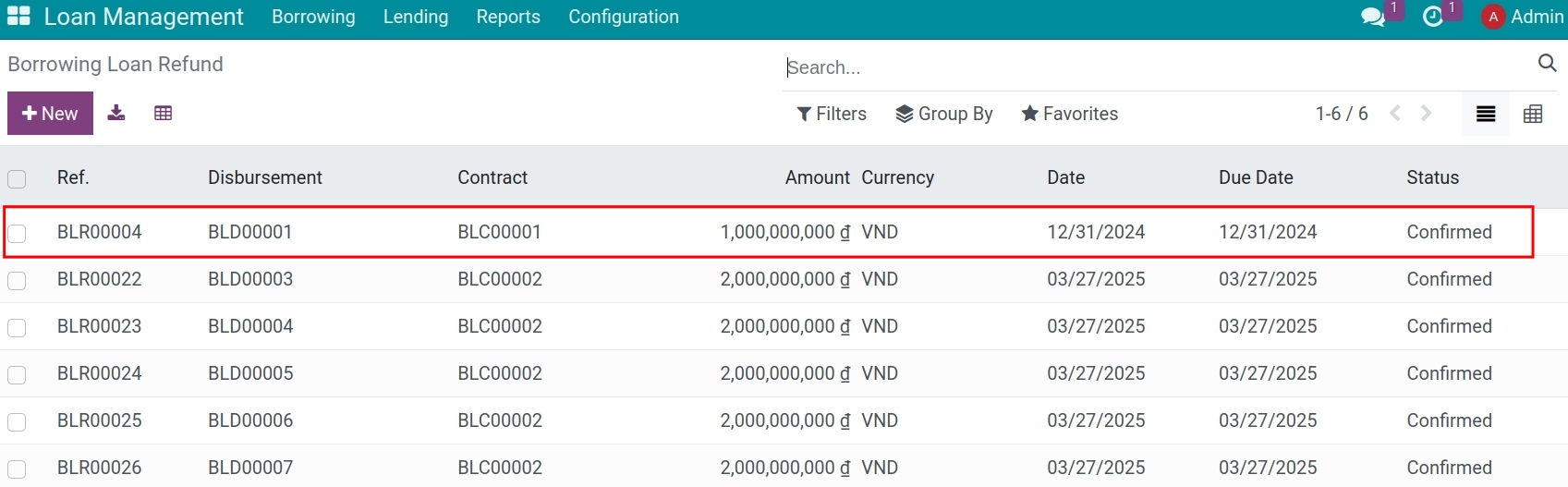

The loans are displayed in the form of a list. Select the loan that needs to be repaid, and proceed with the following steps:

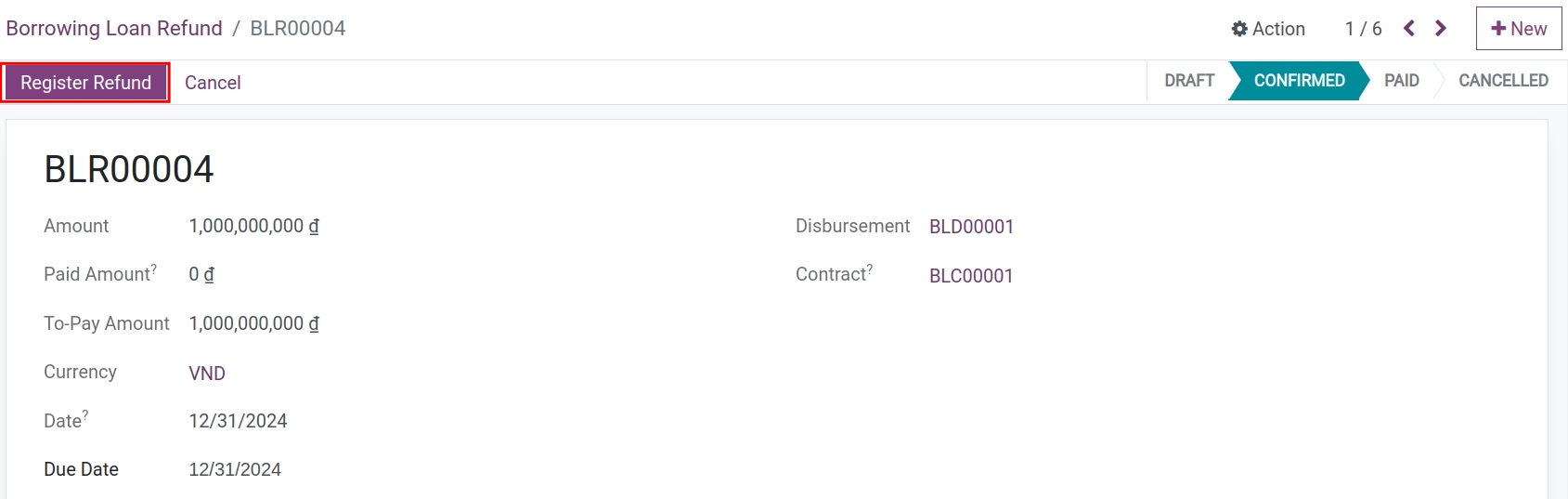

Click on Register Refund.

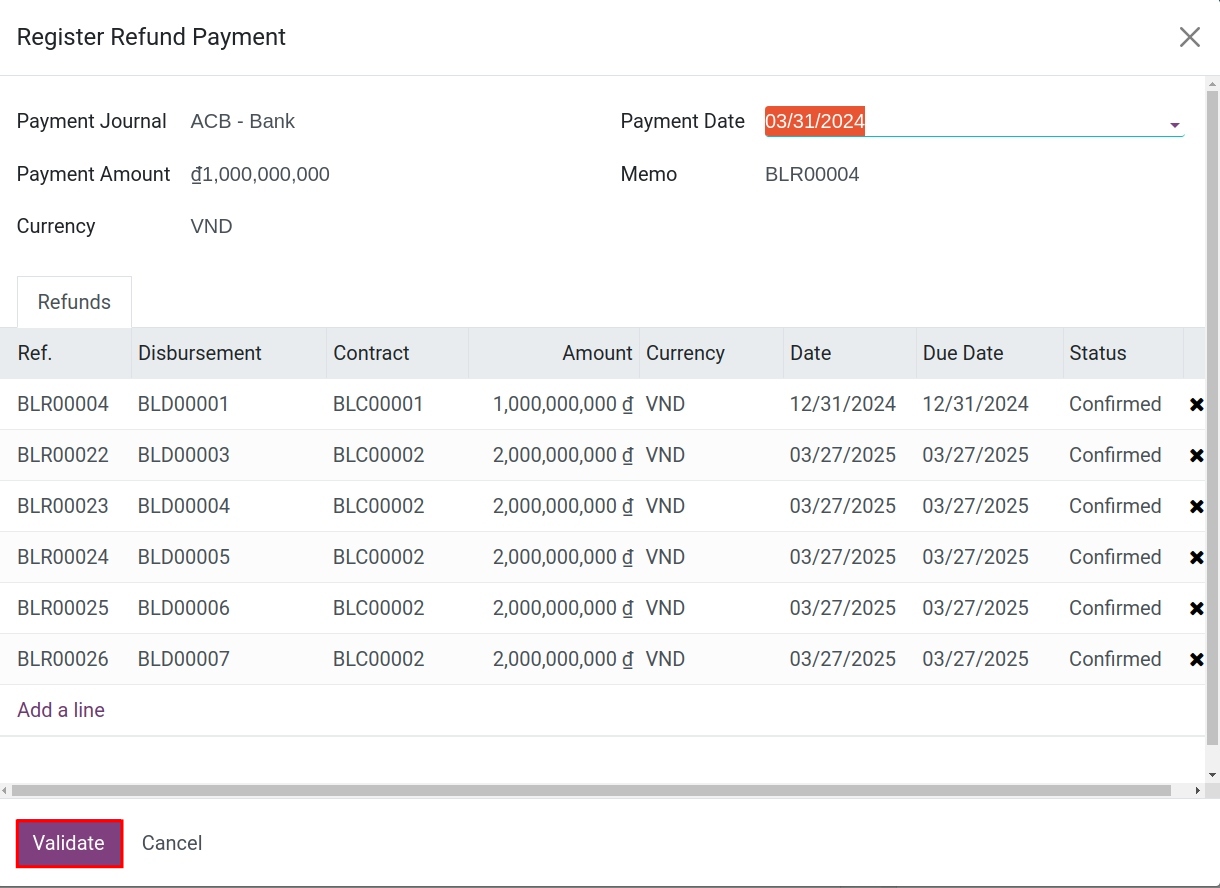

Verify the information and click Confirm on the principal repayment confirmation window.

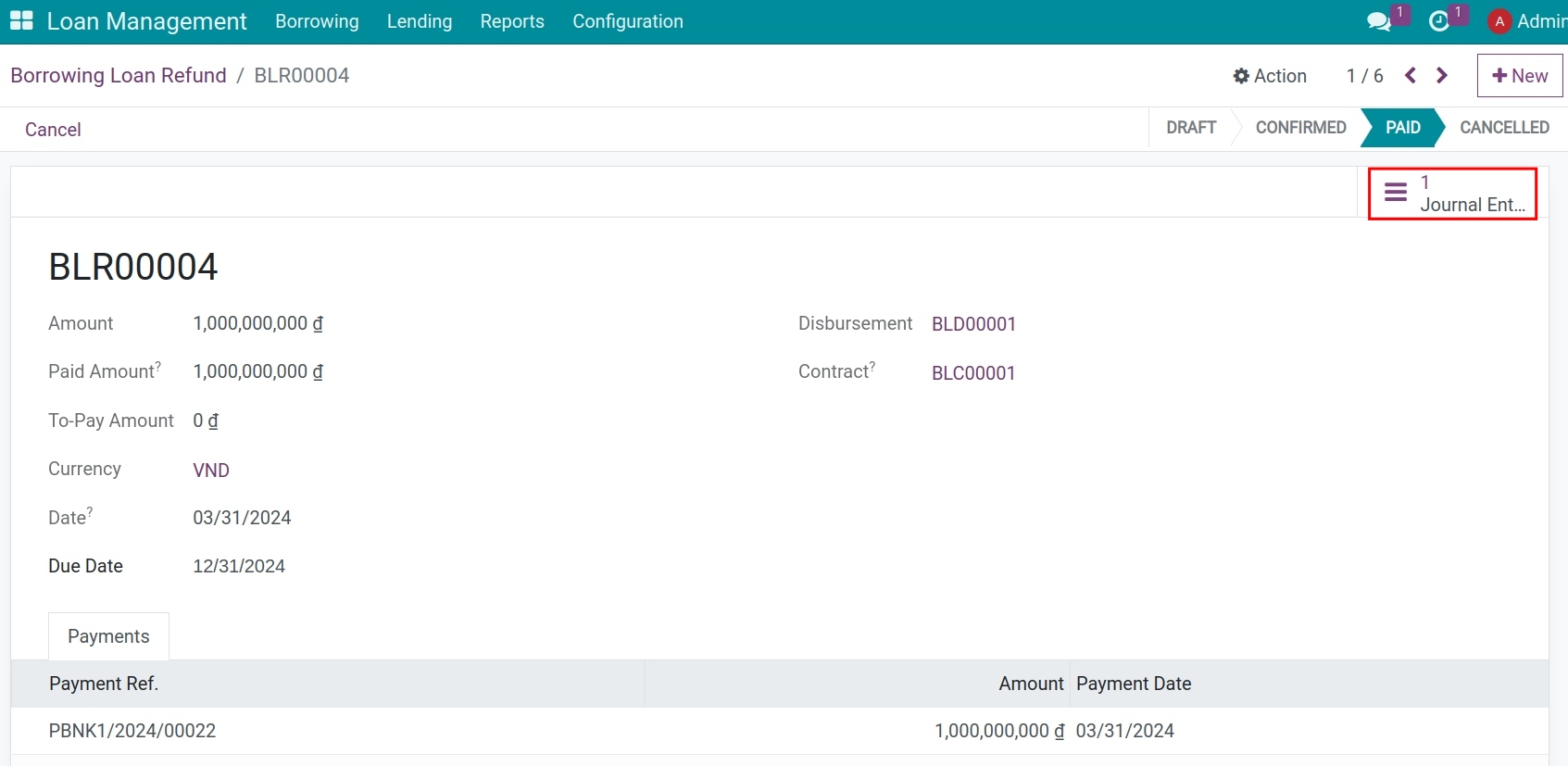

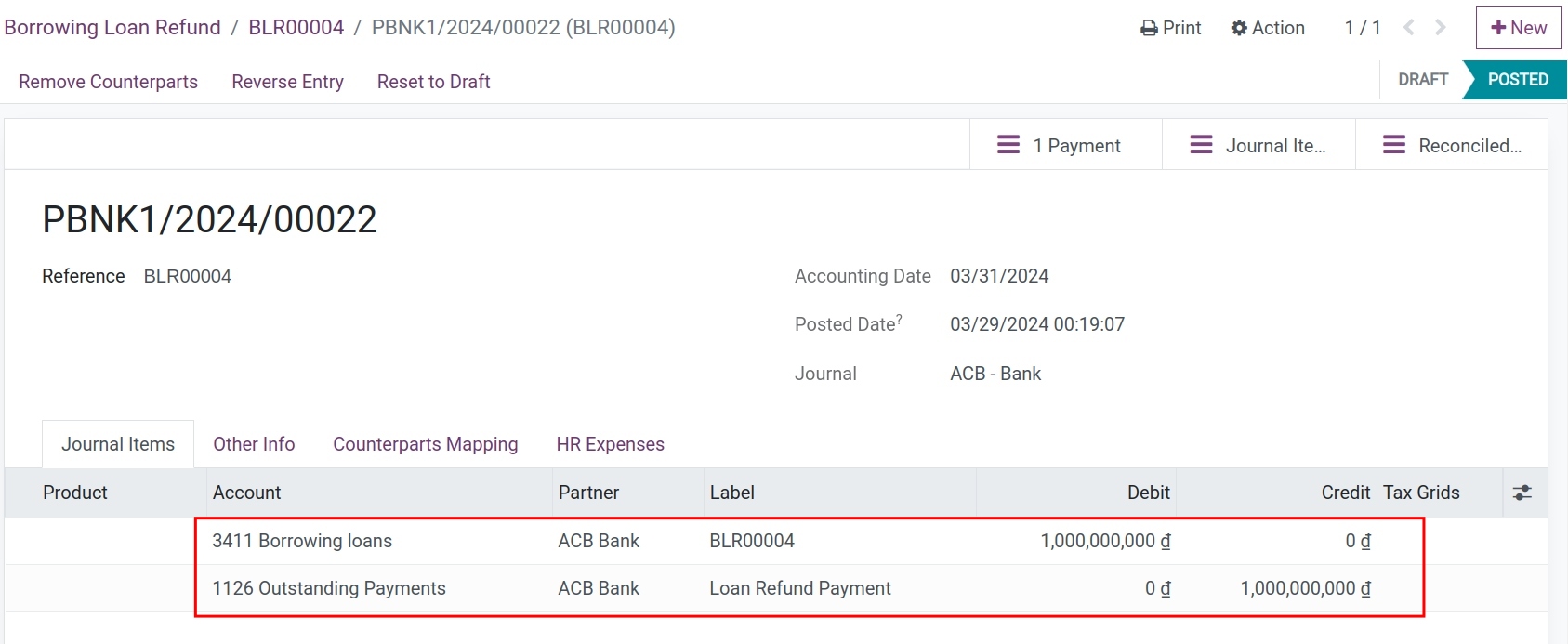

After confirmation, the status of the loan will change to Paid, as shown in the displayed image. A corresponding journal entry will also be automatically recorded.

See also

Related article

Optional module