Import Process in Viindoo¶

Normally, during the process of importing goods from other countries, you need a lot of information such as:

Foreign trade partner;

Vendor currency;

Taxes applied for the imported goods;

The purchase order with the vendor;

Stock receiving;

Import custom clearance request;

Taxes payment, etc.

The Viindoo Foreign trade management software will assist you in managing this information during the import process.

Requirements

This tutorial requires the installation of the following applications/modules:

Initial Configurations for Import Process¶

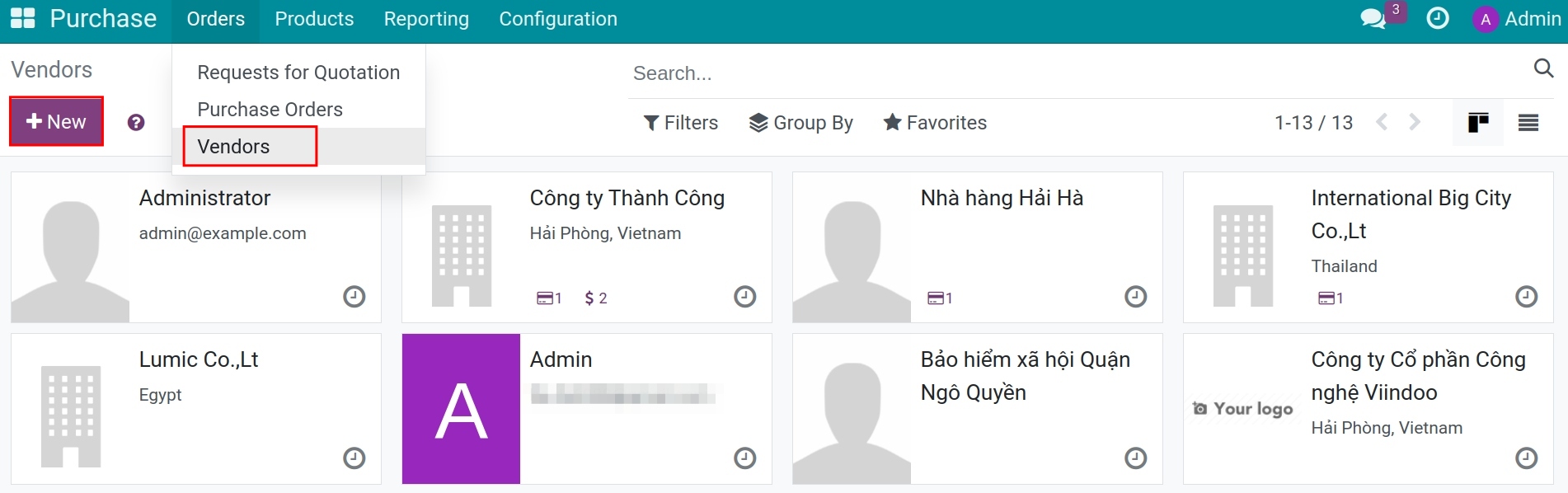

Manage the foreign trade partners list¶

To create a foreign trader partner, navigate to Purchase ‣ Orders ‣ Vendors ‣ New:

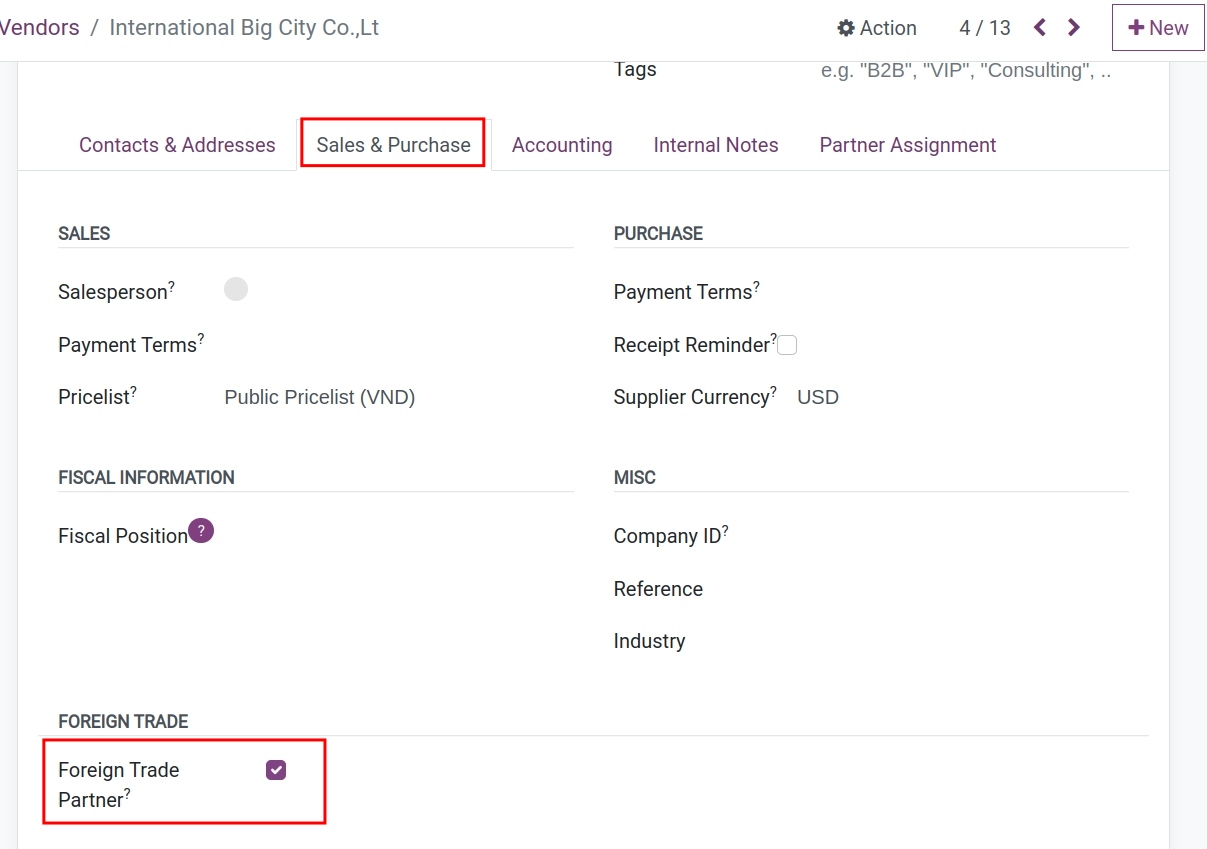

Check out the similar steps to create a contact. However, in the Sales & Purchase tab, you need to enable the Foreign Trade Partner feature:

Note

In case the vendor’s country is different from your company’s, the system will automatically mark the vendor as a Foreign Trade Partner.

You can manage and seach for the foreign trade partner’s information by using the Foreign Trade Partner filter:

See also

Vendor’s currency¶

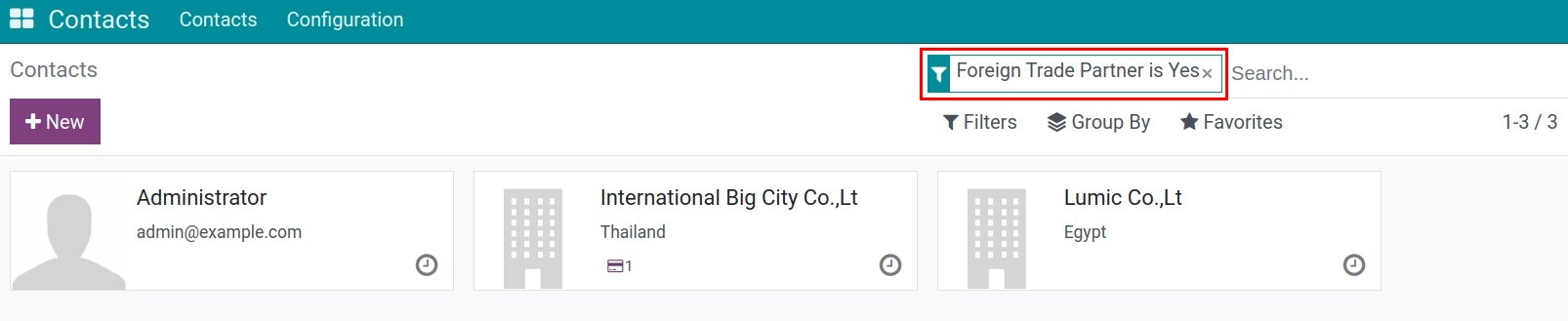

When the Multi-currencies feature is activated, you can set the default currency for each vendor by navigating to Purchase ‣ Orders ‣ Vendors, choose the vendor and move to the Sales & Purchase tab, choose the default currency at Supplier currency field. Or choose directly at the purchase order of that vendor:

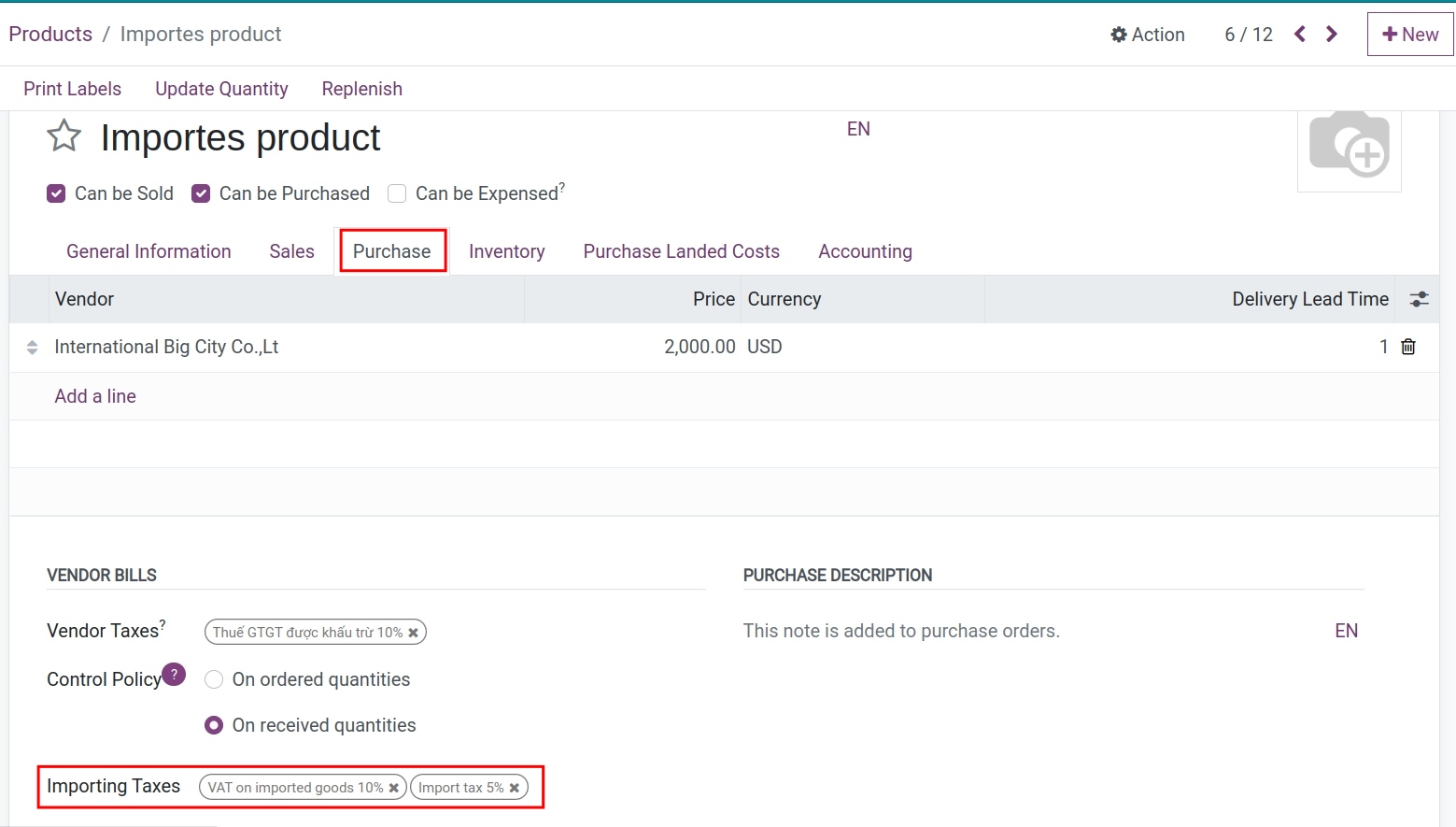

Set up taxes for each product¶

When importing, depending on each product, you will need to set up importing taxes, special consumption taxes, environment taxes, etc. You can refer to the Apply import/export taxes to products article for more information.

You can configure the default import taxes for each product when creating a new Custom clearance document by navigating to Purchase ‣ Products ‣ Products, find the product needs to be configured, go to the Purchase tab, find the Importing Taxes field and select the taxes that should be applied when importing this product:

Imports Process¶

Import Purchase orders¶

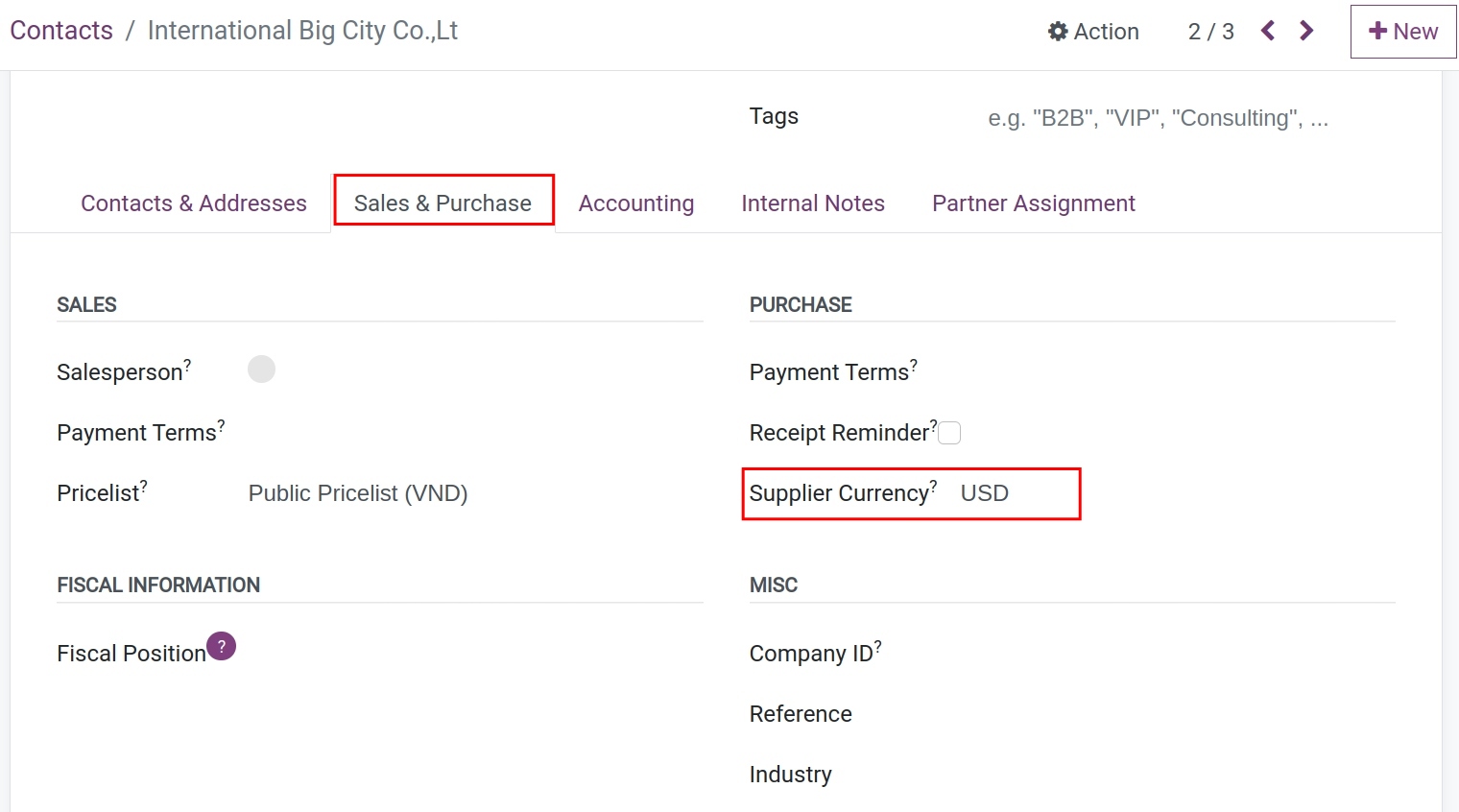

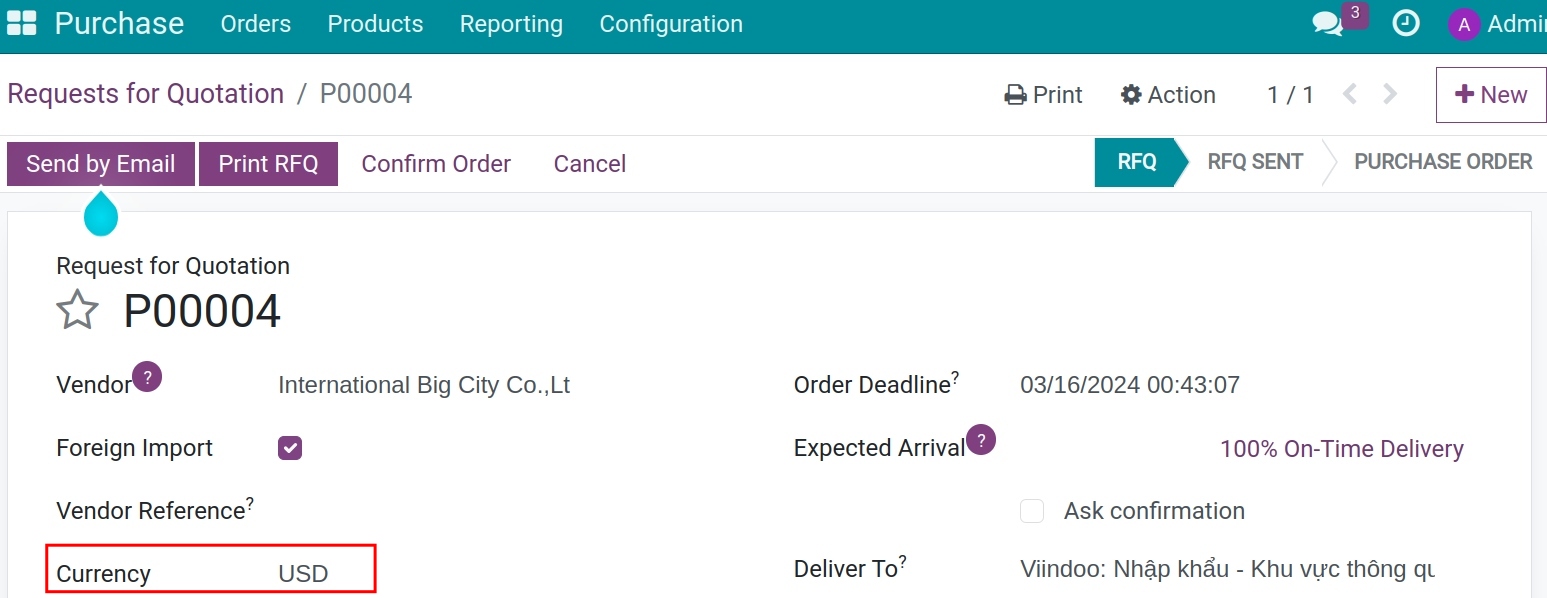

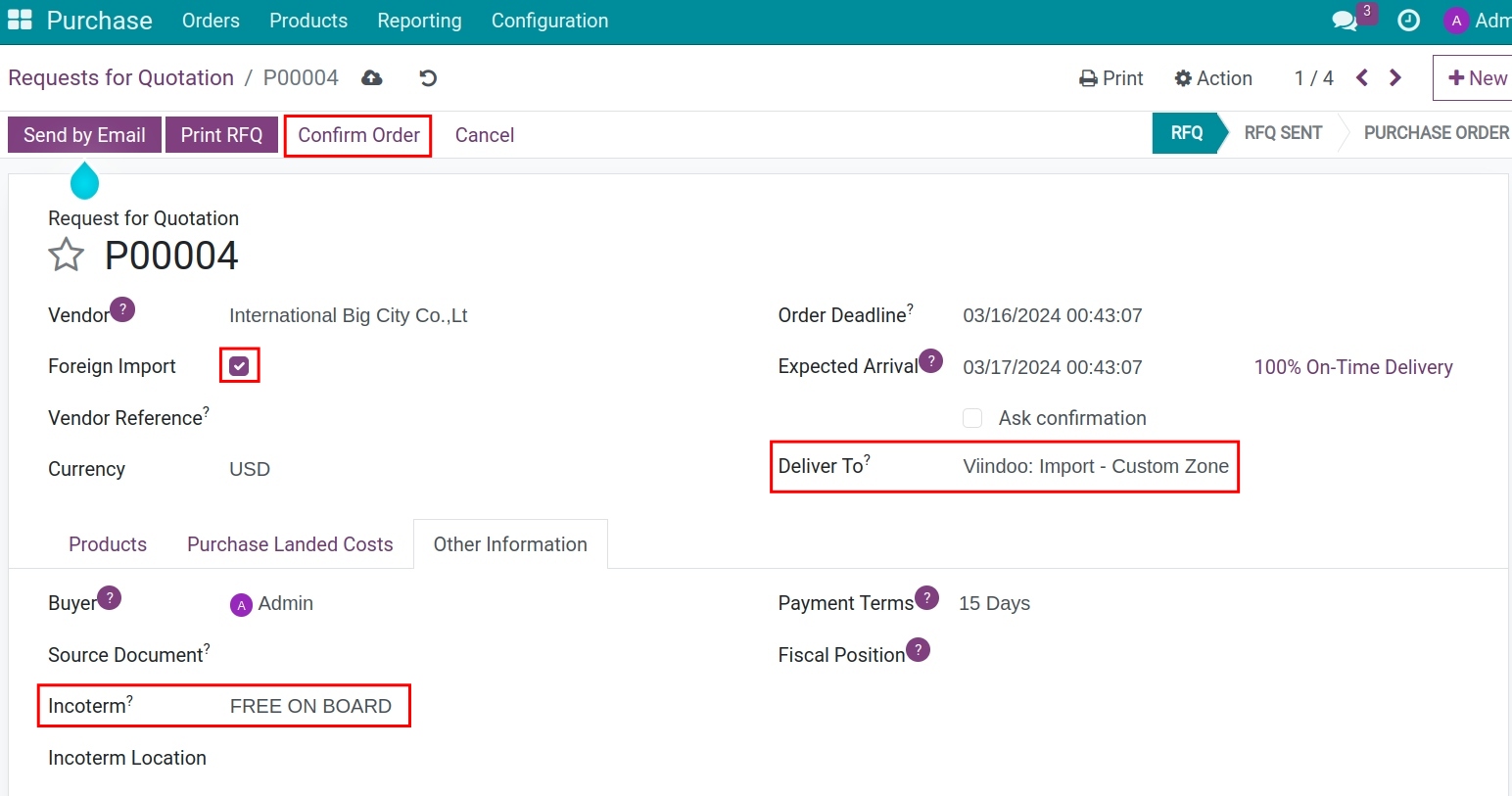

To create a purchase order for importation, navigate to Purchase ‣ Orders ‣ Purchase Orders then add all the information similar to when you create a normal purchase order. However, on the purchase order view, you need to pay attention to the following fields:

Foreign Import: Is automatically checked if the vendor above is a Foreign Trade Partner;

Deliver To: The Import - Custom Zone warehouse is set as the first delivery location by default. In case your company has various import custom warehouses, you need to choose the warehouse again;

Incoterm: Select the suitable Incoterms from the list.

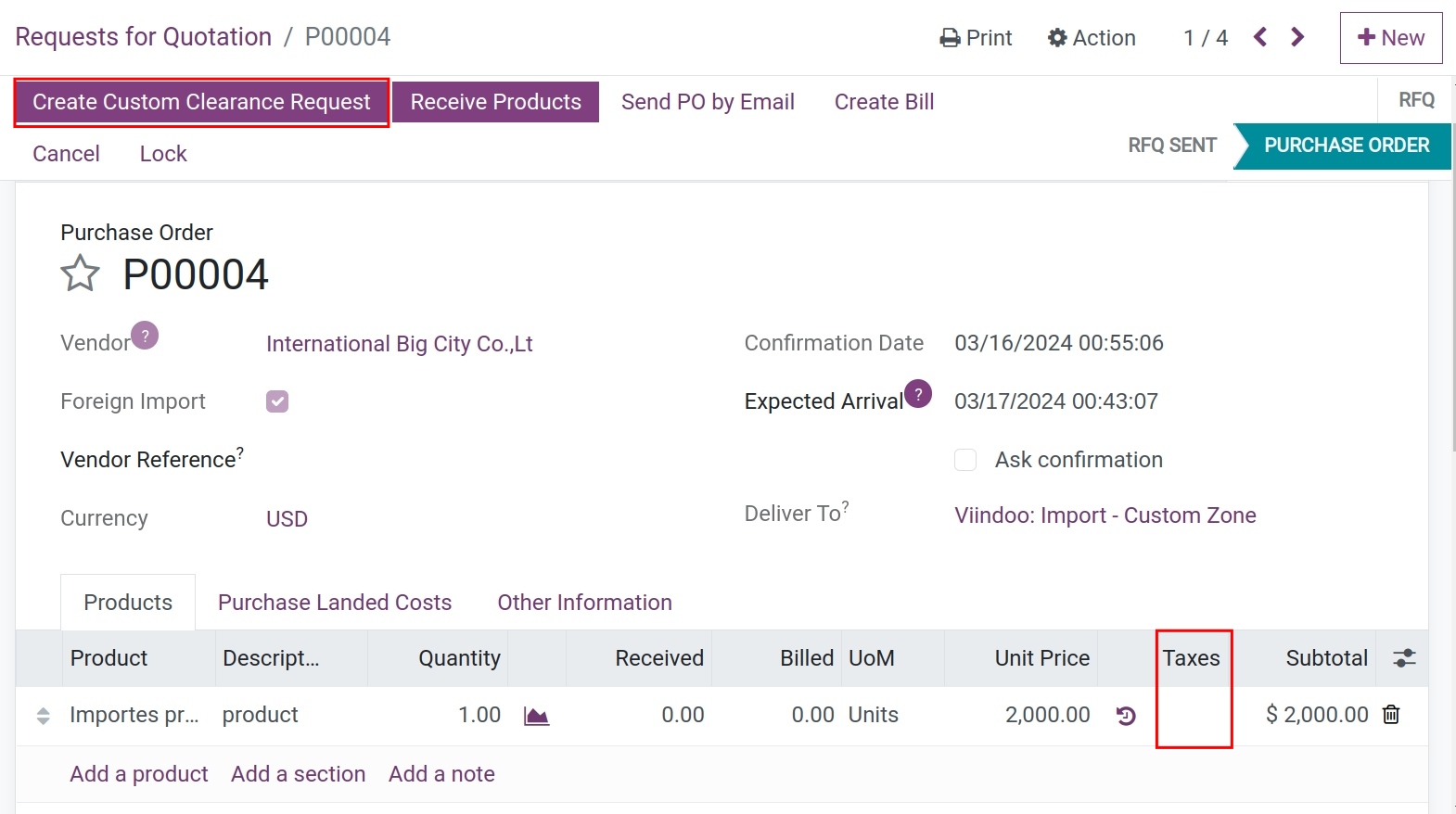

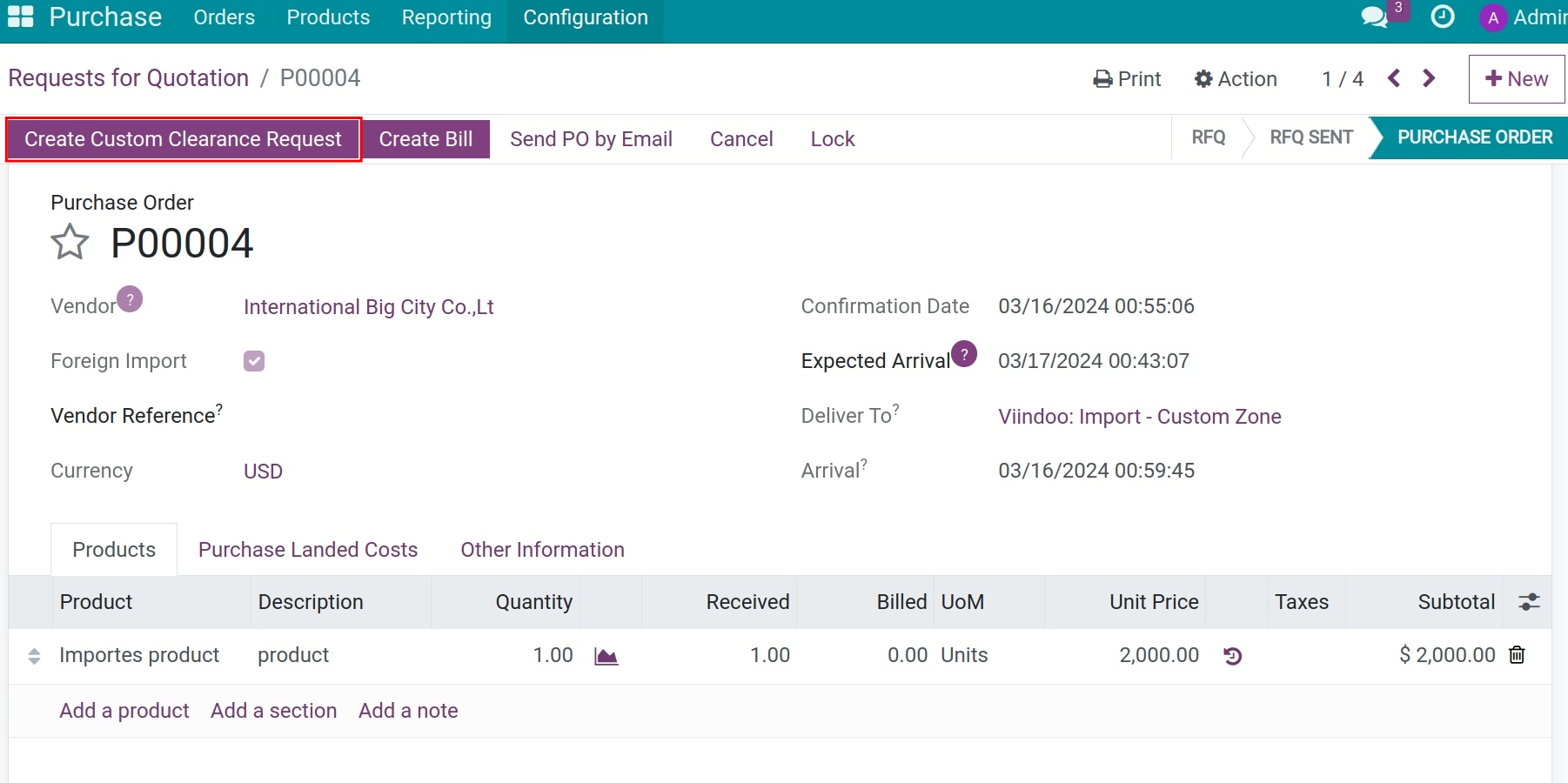

Once Confirm Order is pressed, on the purchase order view, the Create Custom Clearance Request button will appear to create an import declaration form for this order:

Warning

On the purchase order for the importation, you don’t need to declare the applicable taxes on the purchase order, only do this on the custom clearance request. The taxable value on the import declaration form will be calculated by the value of this order.

Payments¶

For payments related to import transactions, they are similar to regular payments; however, the key difference is that they are made in foreign currency. Therefore, you will need to enter the exchange rate on the payment date before proceeding to create the bill and the payment for the import order.

To input the exchange rate, please see the article of Exchange rate.

The Purchasing Staff will create a draft bill from the import purchase order.

The Accountant will validate the bills and make payments.

Note

If the exchange rate on payment is different from the exchange rate on the bill date, the system will generate the difference journal entries automatically to make sure the partner debts are accurate.

If the exchange rate on the Customs Clearance is different from the exchange rate on the bill date, the system will generate the difference journal entries automatically to ensure the import transaction will work based on the exchange rate on the Customs Clearance.

Receiving stocks at custom zone¶

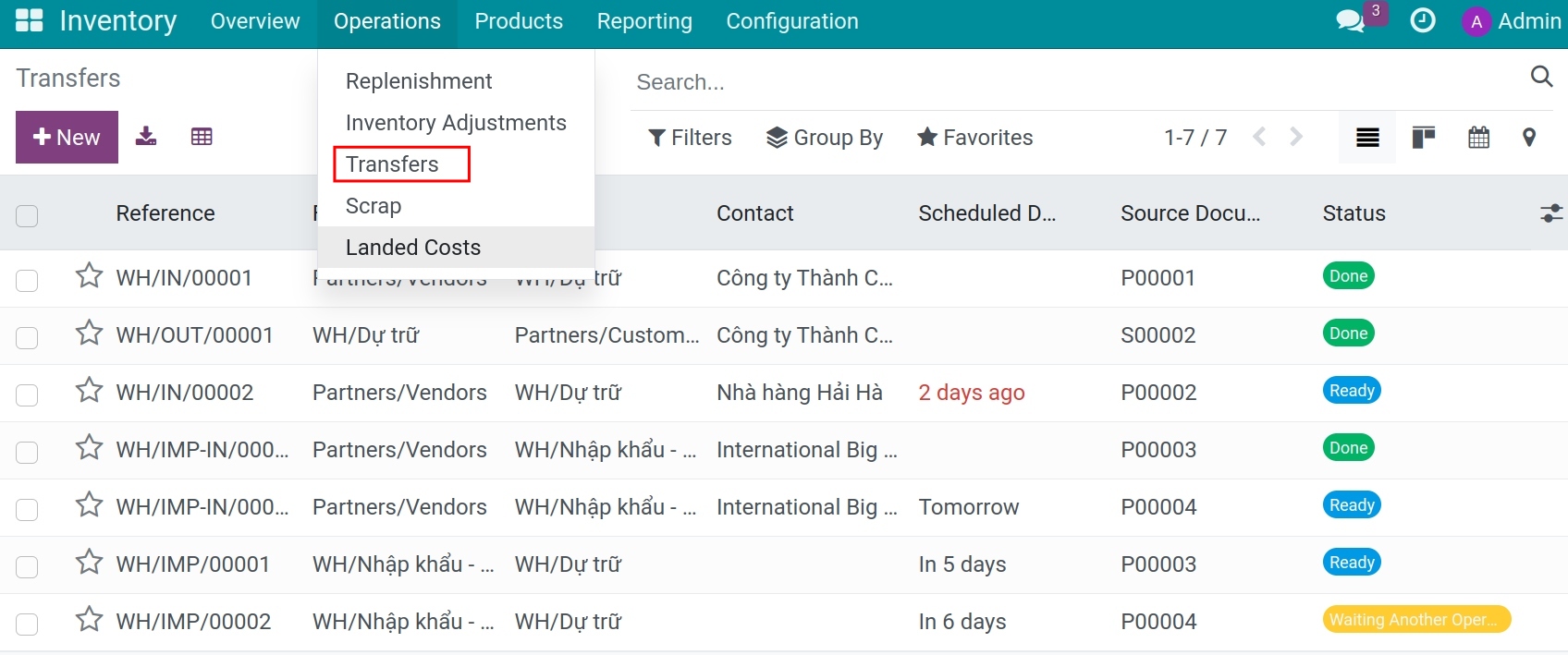

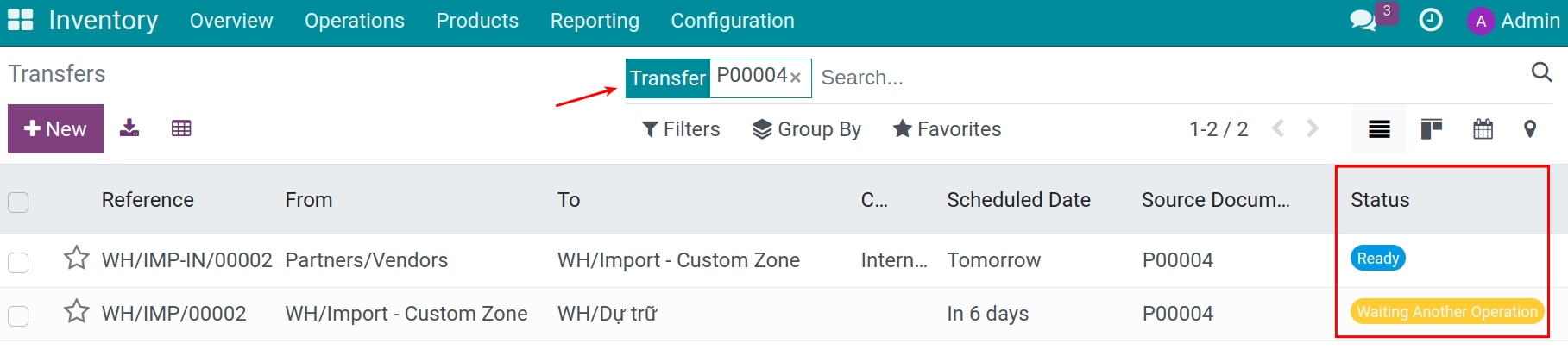

When stocks are delivered to the custom zone, the warehouse employee is responsible for validating the delivery by navigating to Inventory ‣ Operations ‣ Transfers:

Use the filters to search for the order receipt. The system automatically generates two stock receipts:

Transfer from vendor warehouse to custom zone: In the Ready status;

Transfer from custom zone to stock warehouse: In the Waiting Another Operation status.

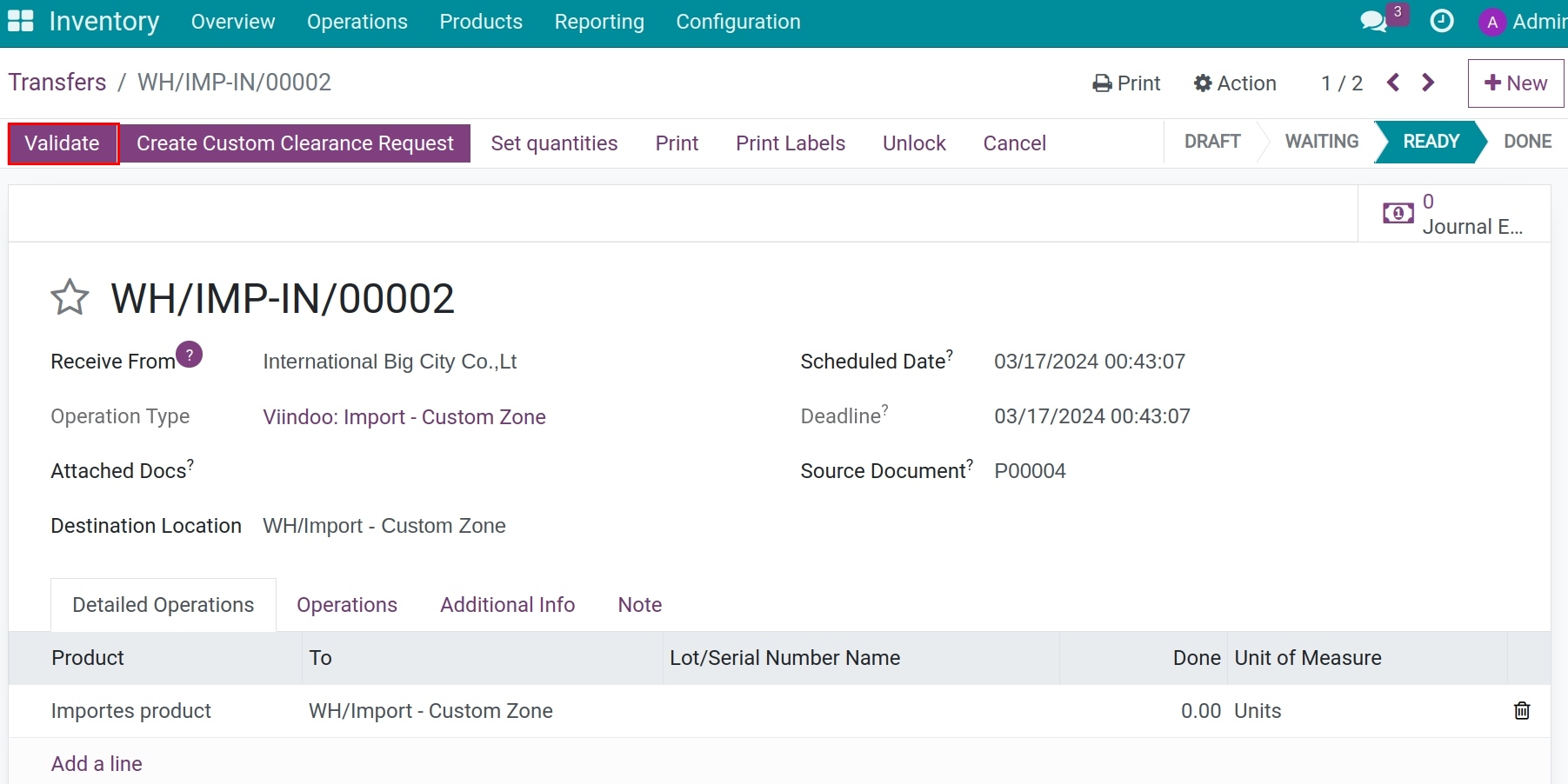

At this step, press Validate the transfer from vendor warehouse to custom zone:

Note

Once the products are cleared for import, the warehouse employee will validate the transfer from the custom zone to the stock warehouse to finish the import process.

Customs Clearance Management¶

After the purchase orders are confirmed, you can press the Create Custom Clearance Request button on the purchase orders to create import custom clearance requests.

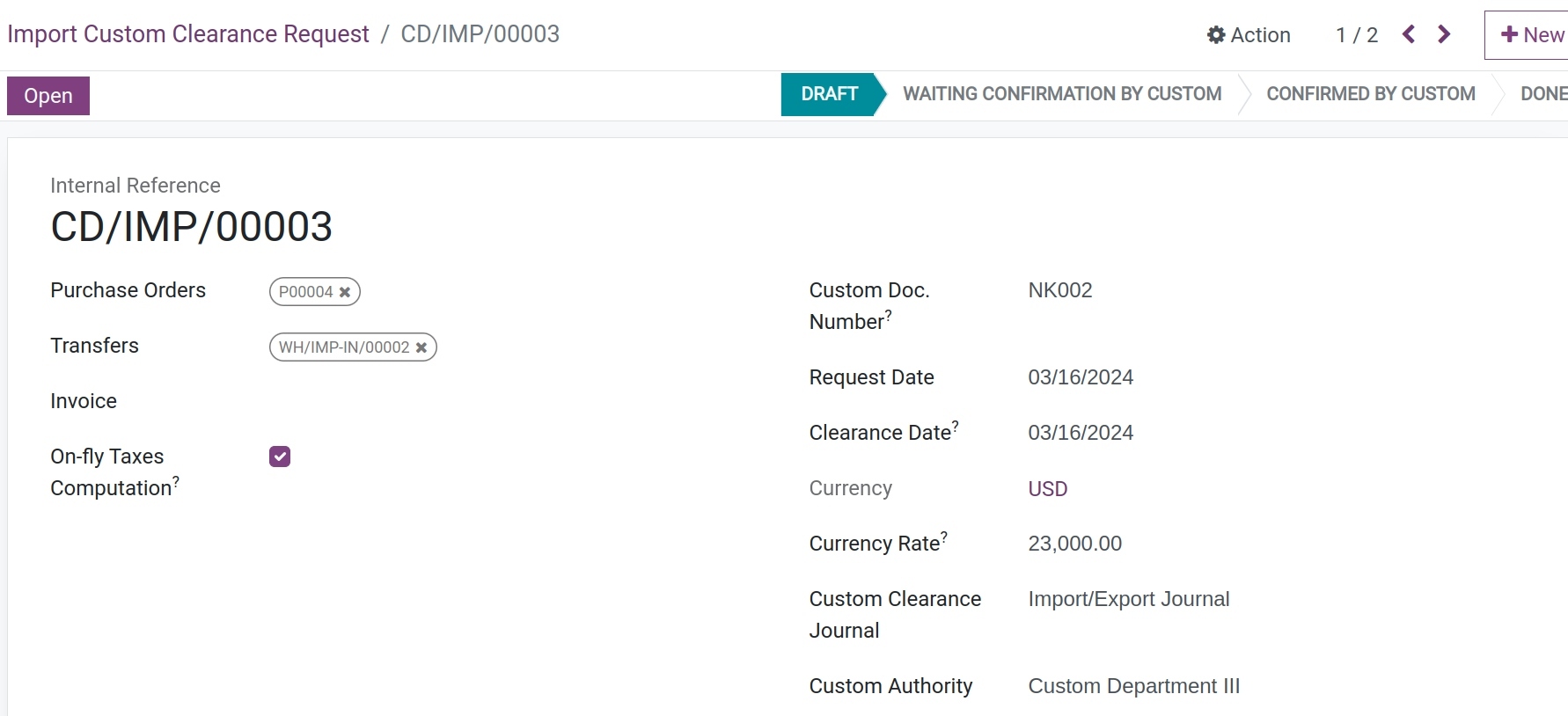

On this view, add the following information:

General information:

![General information on custom clearance request - Viindoo foreign trade app]()

Custom Authority: Choose a custom authority as the recipient.

Internal Reference: The customs clearance request number that the system generates for internal tracking;

Purchase Orders: The Purchase order will be automatically filled in here, in addition, you can add other purchase orders that need to be declared in this import custom clearance request;

Transfers: The respective transfers of the declared purchase orders above;

Invoice: Select the respective invoices of the purchase orders;

On-fly Taxes Computation: If checked, when there is a change in the taxable value, the system will automatically recalculate the corresponding value;

Custom Doc. Number: The number on the custom clearance request;

Request Date: The import custom clearance request creation date on the system;

Clearance Date: The custom clearance request open date;

Currency: Automatically use the purchase order currency;

Currency Rate: The currency rate on the custom declaration form;

Custom Clearance Journal: Record import and export journal entries. The Import/Export Journal will be used by default, but you can use other journal to track the activities;

Operations information:

![Product information on the import custom clearance request - Viindoo foreign trade management]()

The product information is inherited from the declared purchase order above.

Product;

Quantity;

Unit of Measure;

Unit Price;

Taxes;

Currency Taxable Value.

Besides, there are other fields such as:

Expense Taxable Value: Record the costs created during the import process (landed cost) that you declared on the Extra Expenses;

Taxable Value: The value that is being used to calculate the taxes amount. This value is equal to (Currency Taxable Value + Expense Taxable Value) * Currency Rate.

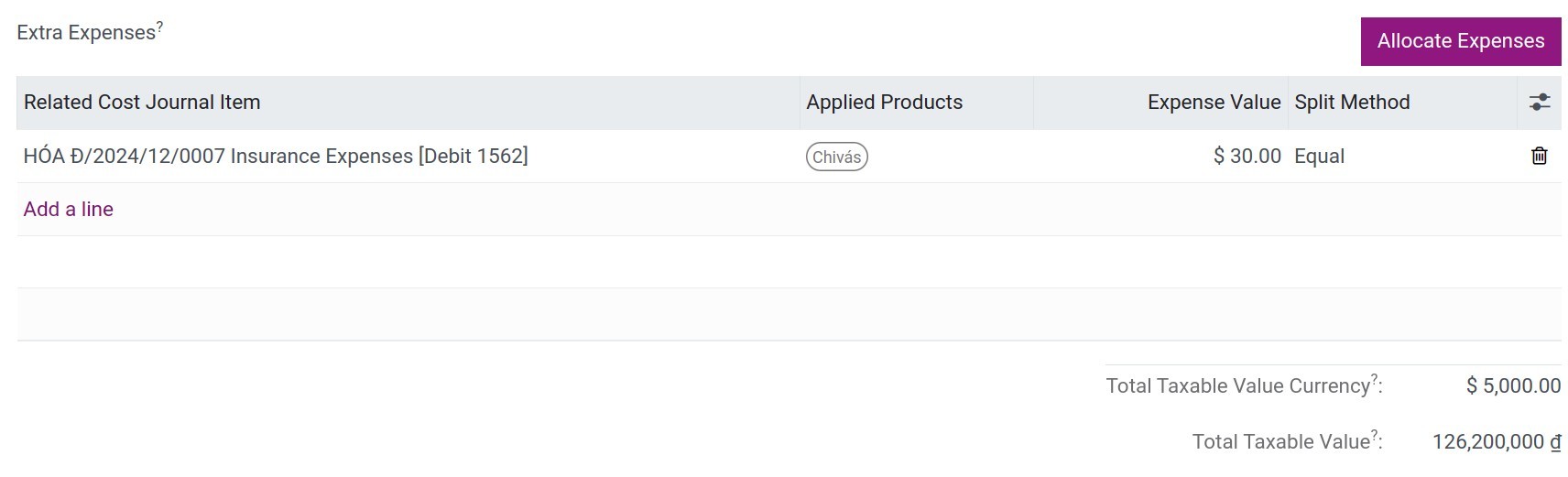

Extra Expenses:

Here is where you can declare the list of extra expenses of the import transaction. To add it, click on Add a line to add the following information:![Product information on the import custom clearance request - Viindoo foreign trade management]()

Related Cost Journal Item: Choose the journal item of extra expenses that be declared on vendor bills;

Applied Products: Select products that incur the chosen landed cost;

Expense Value: The value of the landed cost, it will come from the related cost journal items;

Split Method: Select one of the three split methods that the system supports: By Quantity, Equal, and By Taxable Value.

Then press on the Allocate Expenses button to allocate the landed cost to the taxable value of the corresponding purchase order.Taxable Value:

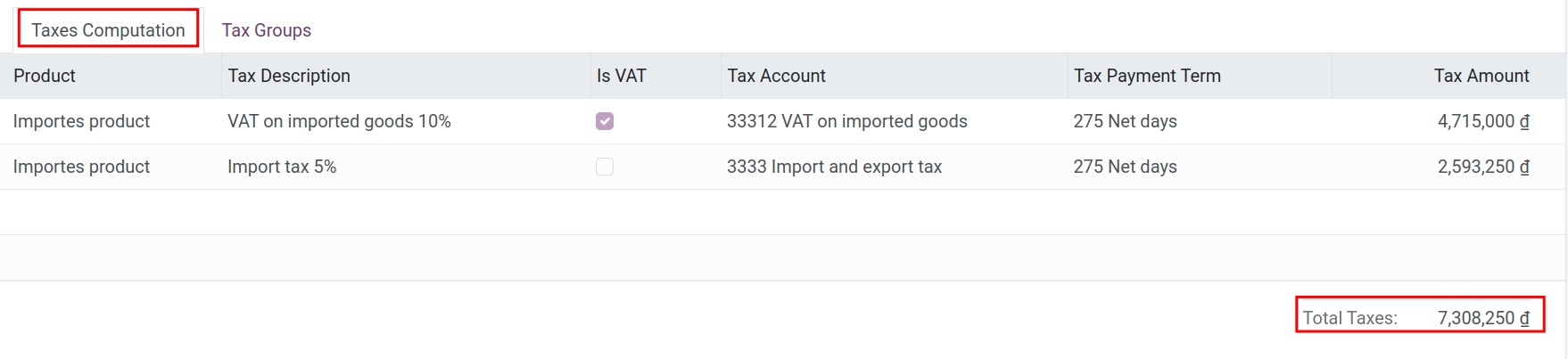

Taxes Computation tab: See the taxes list and the respective value of each type applied to a determined product in each order as well as the total tax payable for the whole request.

![Calculate taxable value on the custom declaration form - Viindoo foreign trade app]()

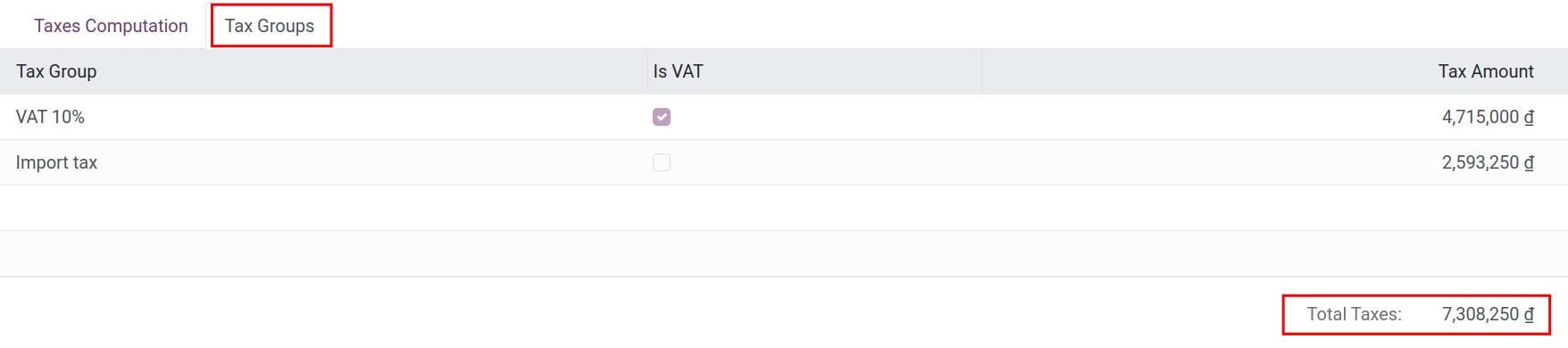

Tax Groups tab: To view the list of applied tax groups and the total taxes amount of each one.

![Tax groups - Viindoo foreign trade management]()

After adding all the required information to the request form, press Open at the top of the custom request view.

Import Expenses Control¶

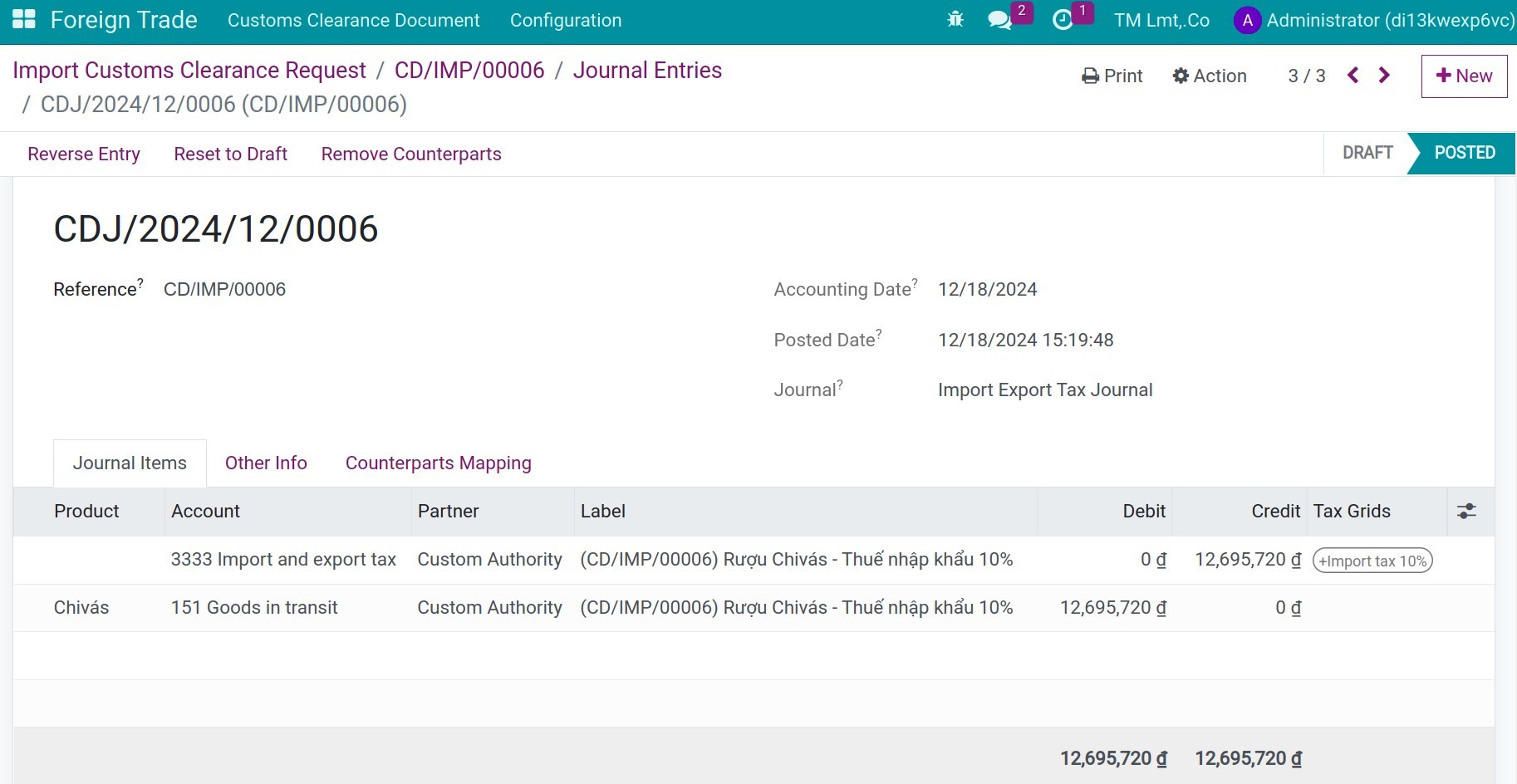

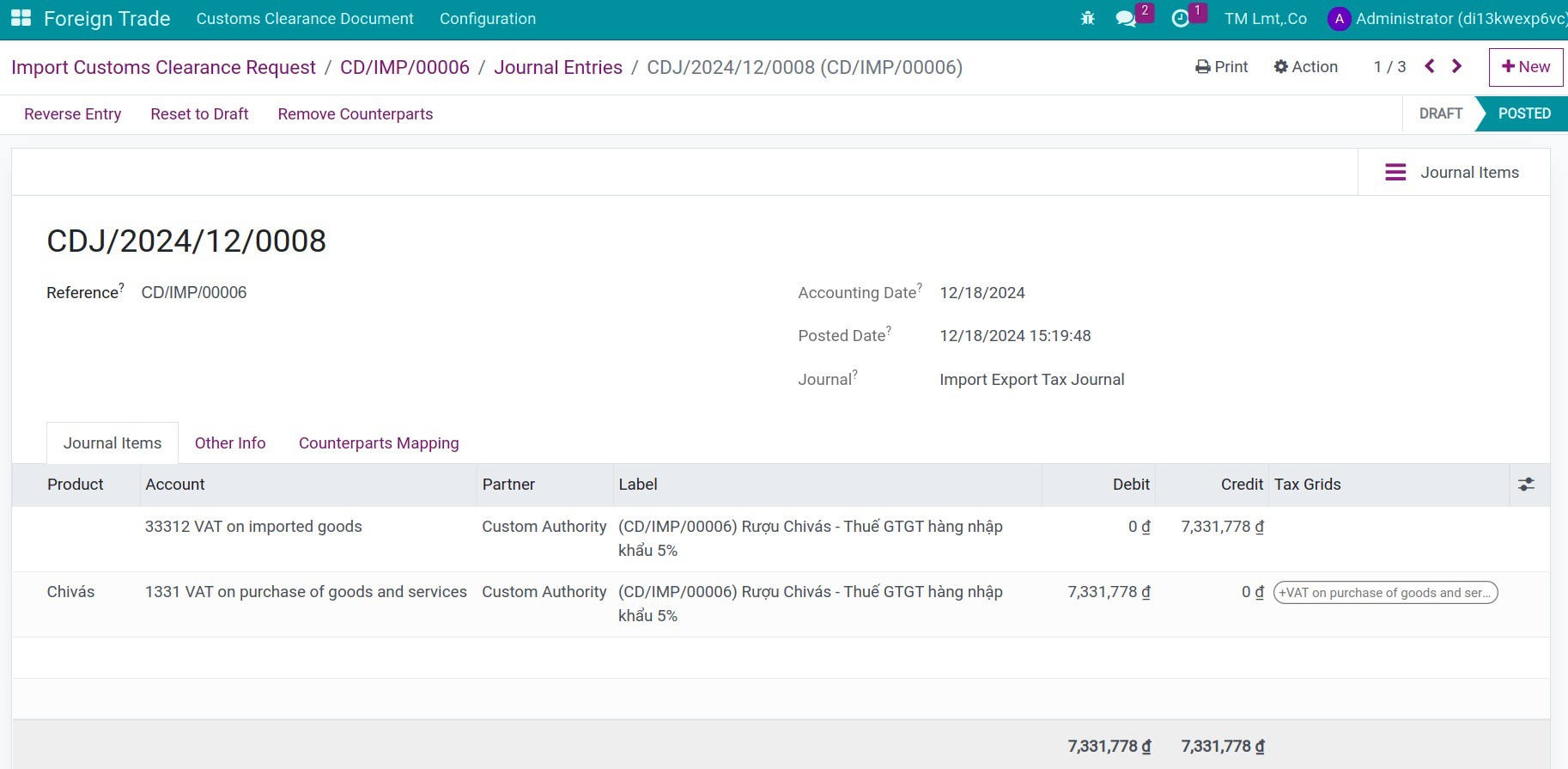

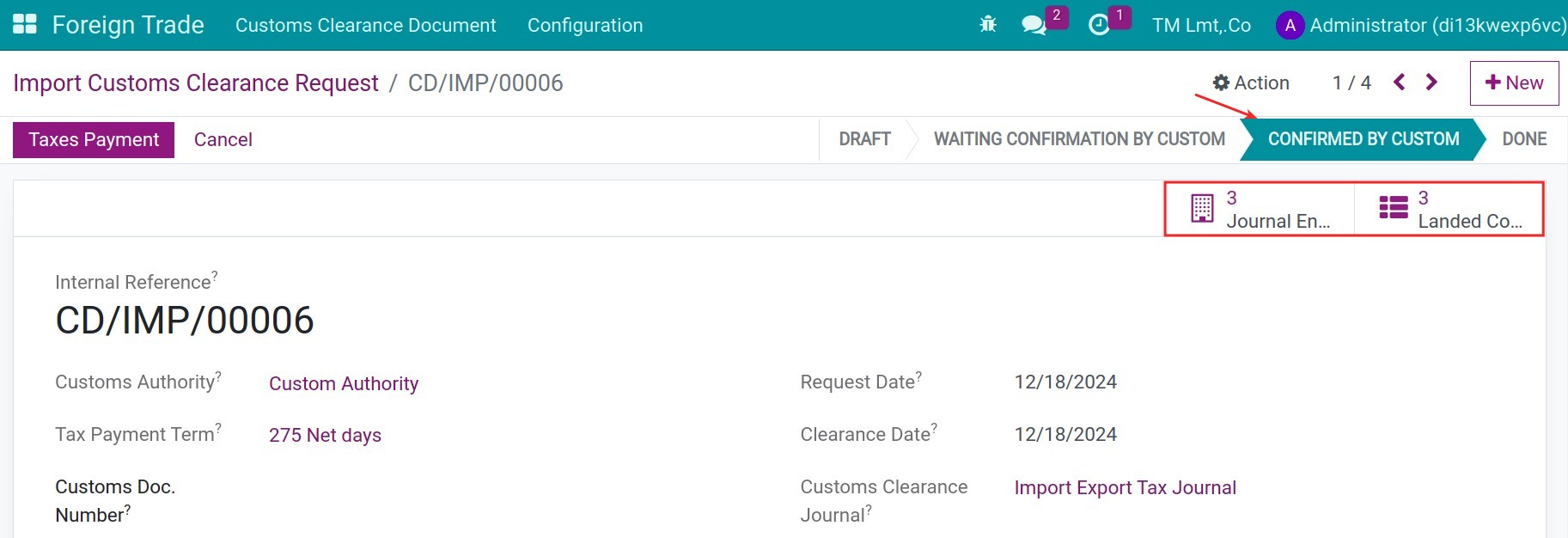

After recheck all the information on the custom clearance, you press to Confirmed by Custom button. You will see all the journal entries and respective landed cost.

The journal entries of taxes such as import tax, excise Tax or VAT for import goods, etc;

![import tax]()

![vat for import goods]()

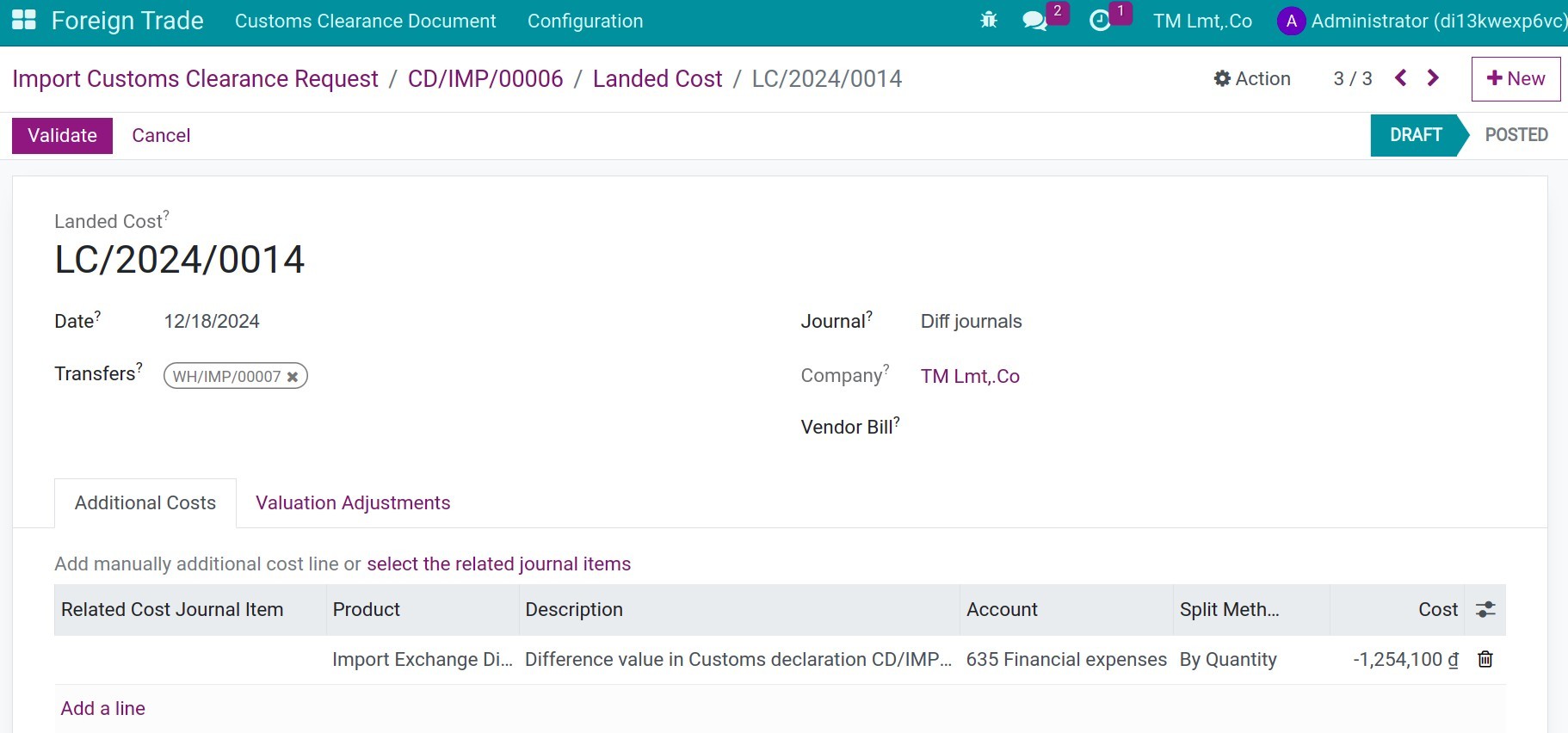

The landed cost for allocating value to the goods’ valuation:

The value of taxes and extra expenses will be allocated to goods valuation![landed cost]() If the exchange rate on the Customs Clearance is different from the exchange rate on the bill date, the system will generate the difference journal entries automatically to ensure the import transaction will work based on the exchange rate on the Customs Clearance.

If the exchange rate on the Customs Clearance is different from the exchange rate on the bill date, the system will generate the difference journal entries automatically to ensure the import transaction will work based on the exchange rate on the Customs Clearance.![landed cost for exchange diff]() Press Validate to allocate value for the goods valuation.

Press Validate to allocate value for the goods valuation.Note

If the exchange rate on the Customs Clearance is more than the exchange rate on the bill date, the value of landed cost will be positive to supplement the input valuation.

If the exchange rate on the Customs Clearance is less than the exchange rate on the bill date, the value of landed cost will be negative to reduce the input valuation.

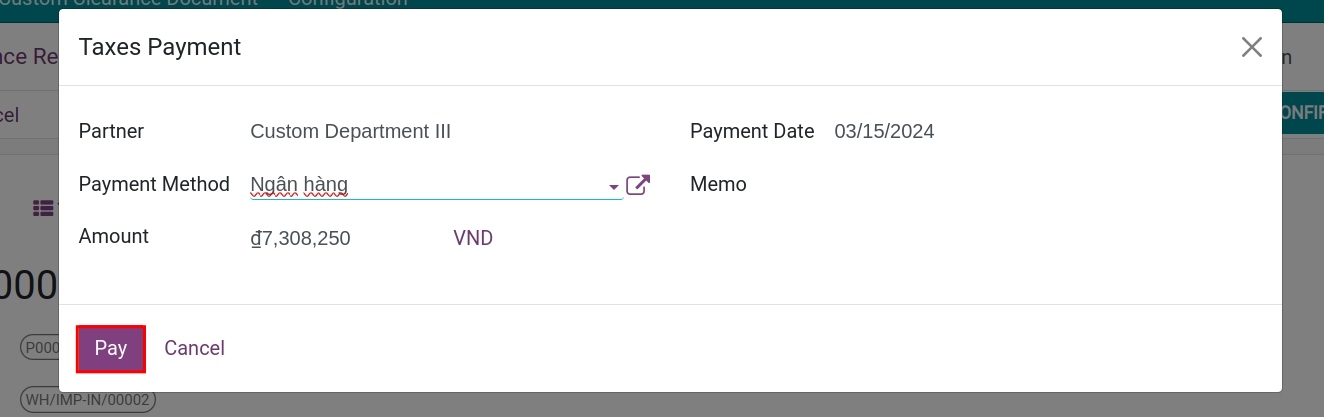

Taxes payment¶

When you press on Taxes Payment, a payment window will pop up where you need to add the following required information:

Partner: The custom authority selected on the import custom clearance request is set by default;

Payment Method: Select between Cash or Bank payment method;

Amount: The payment amount stated on the Taxes Computation tab;

Payment Date: Choose a taxes payment date;

Memo: The taxes payment description.

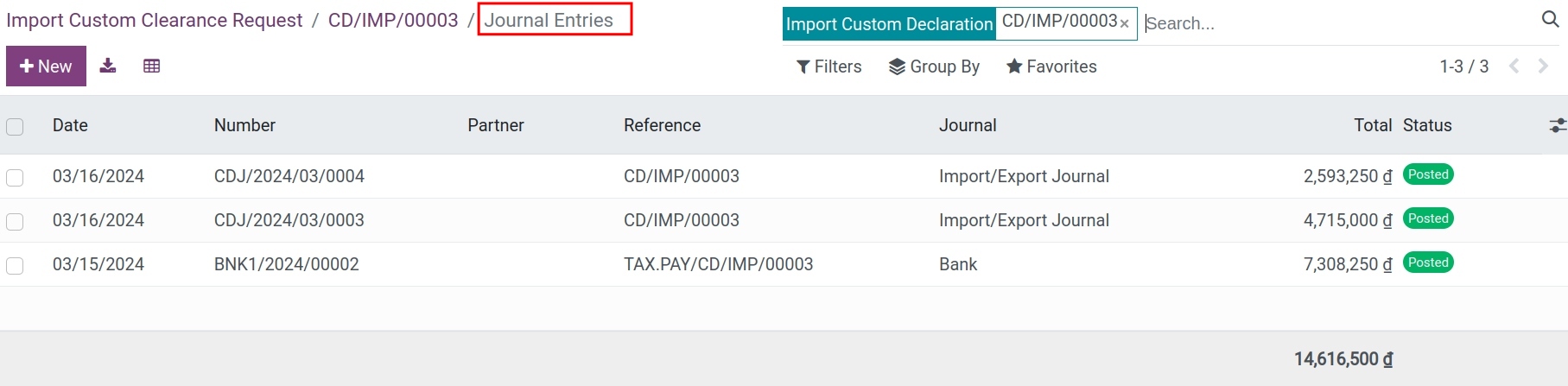

Once the payment is confirmed, press on to view details of the related math problems:

See also

Related article

Optional module