Import-Export Tax Reports¶

Requirements

This tutorial requires the installation of the following applications/modules:

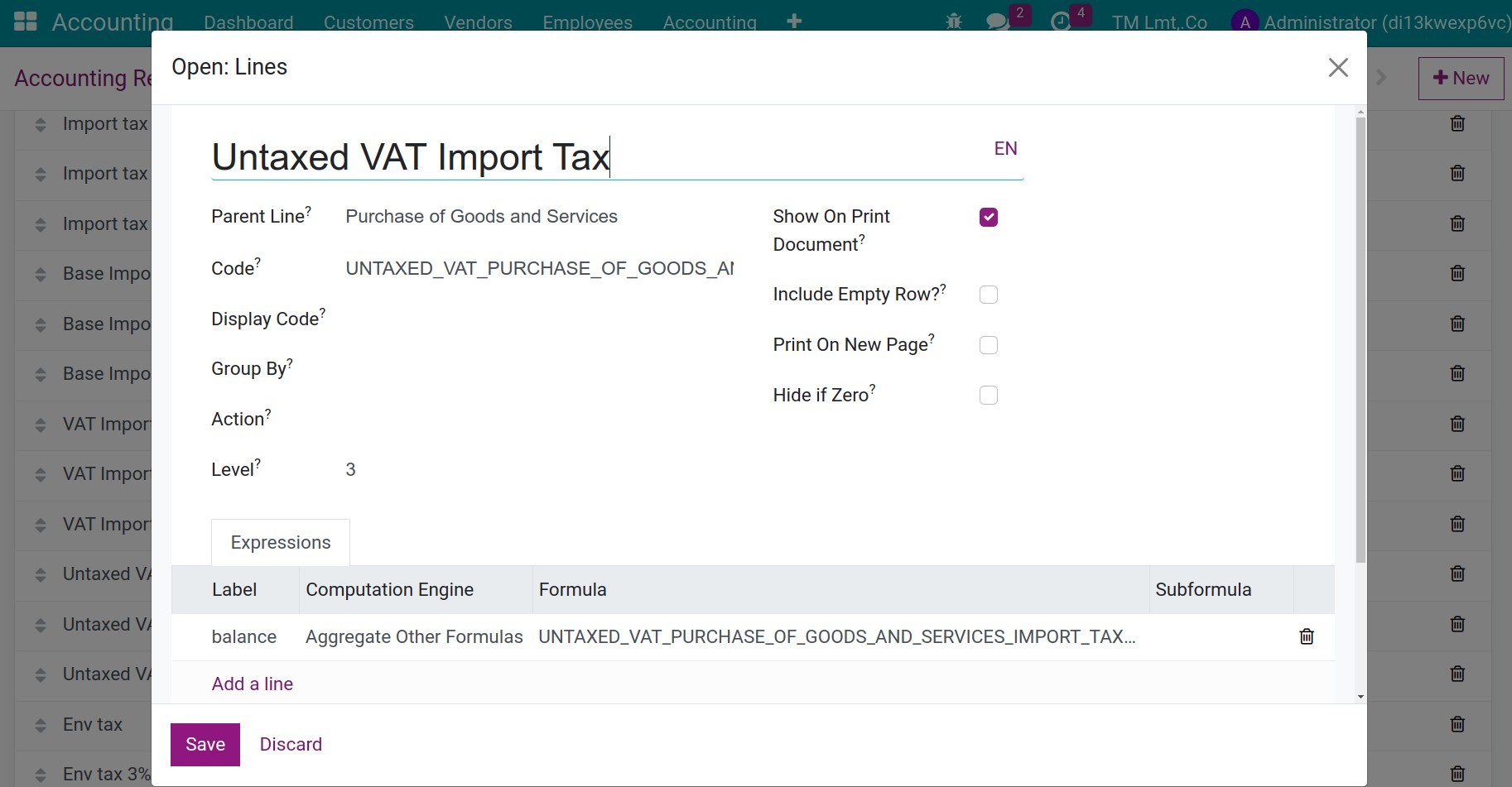

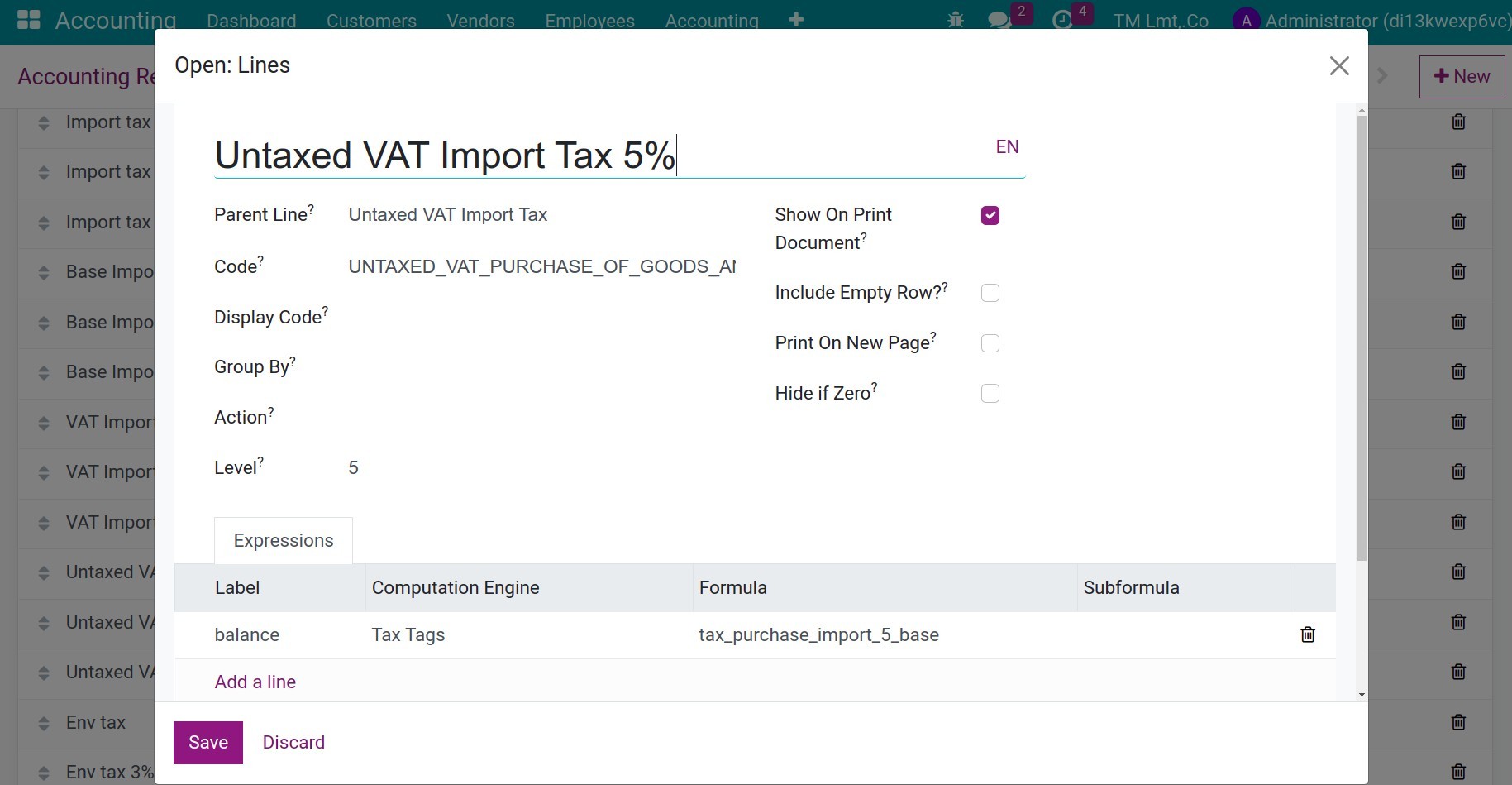

Tax Reports Configuration¶

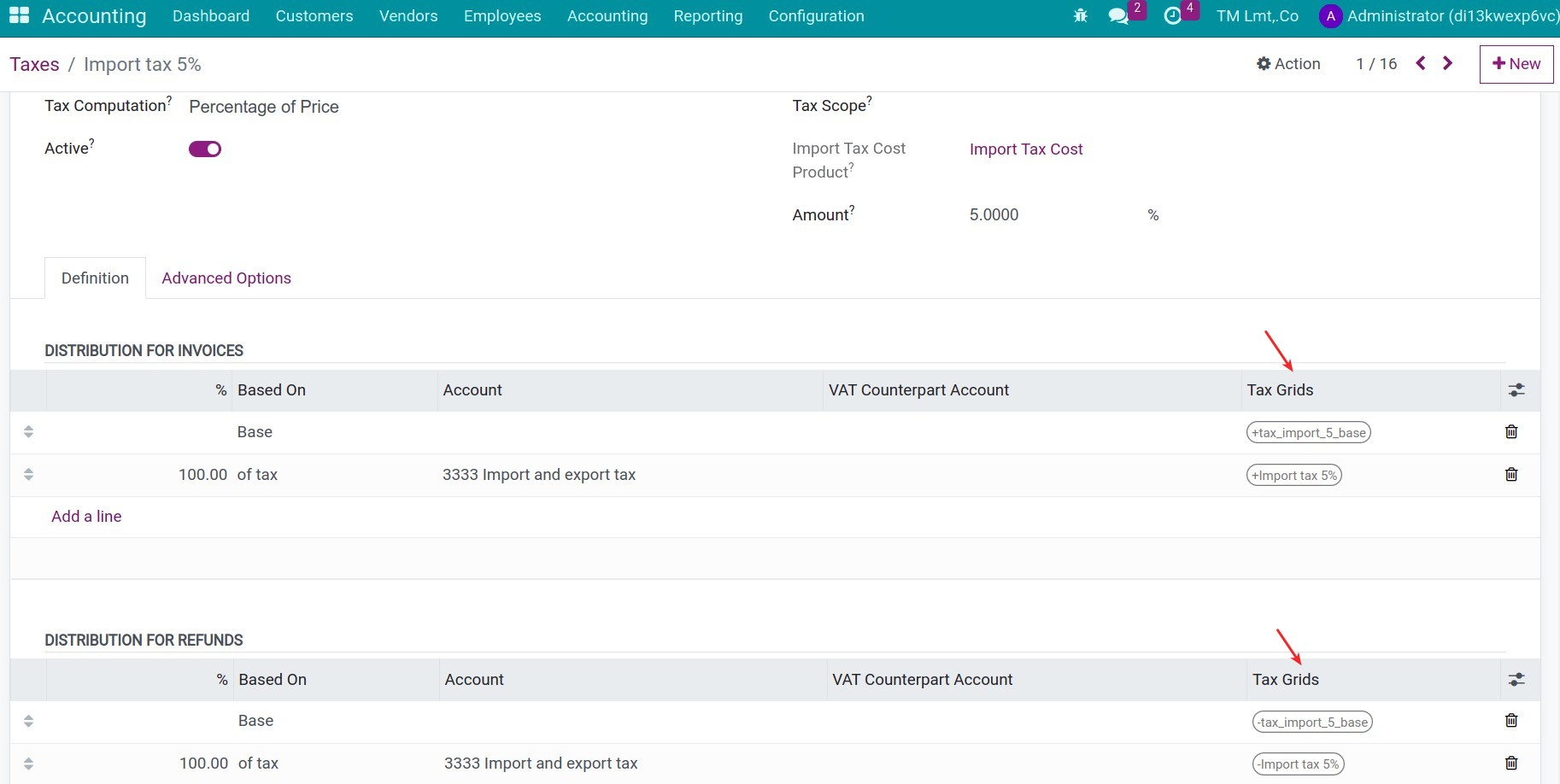

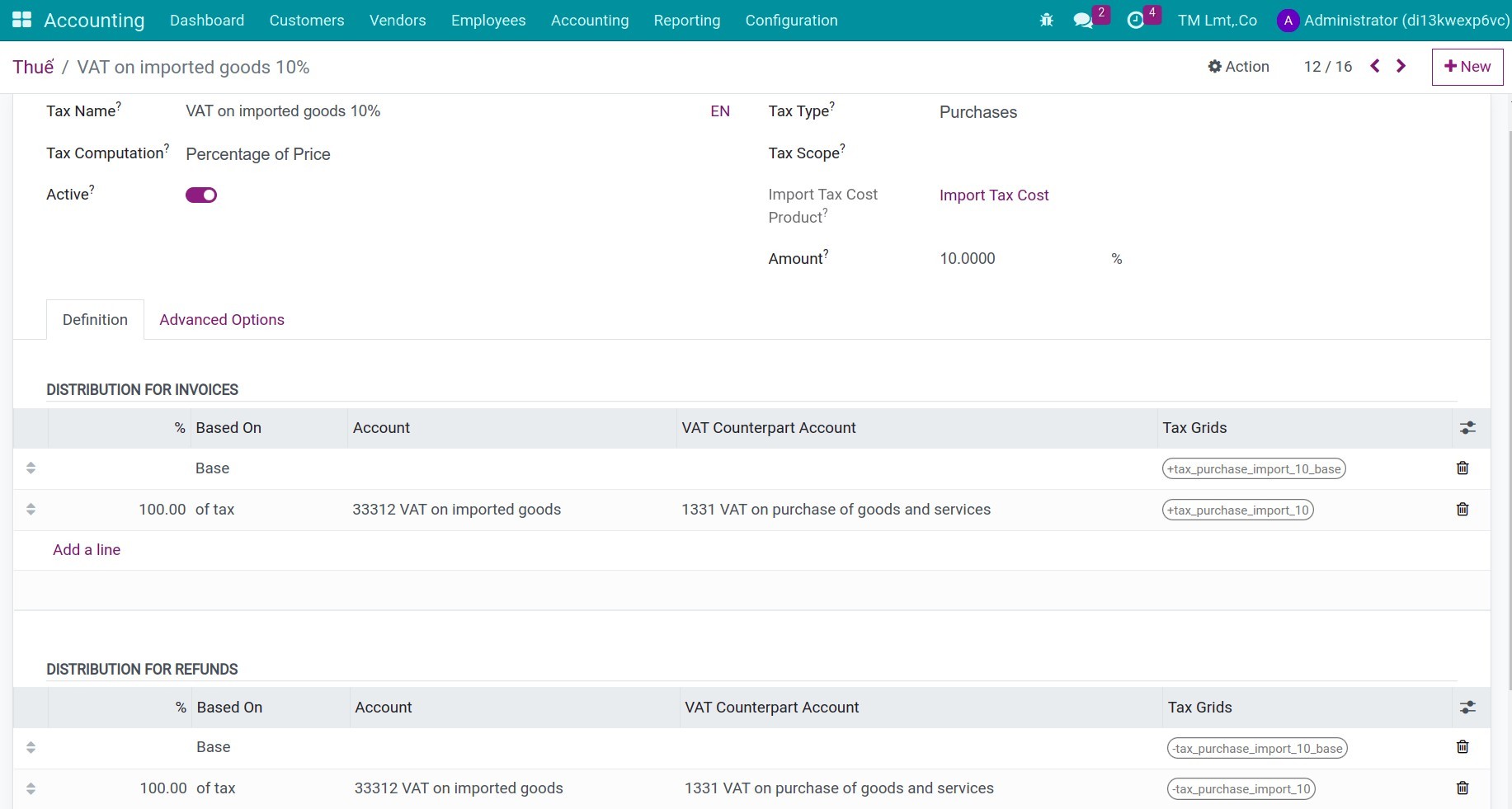

The system already has default export and import tax rates of 0%, 5%, and 10%. If other tax rates arise, you will need to create additional tax types and corresponding tax grids to ensure the data is reflected in the reports.

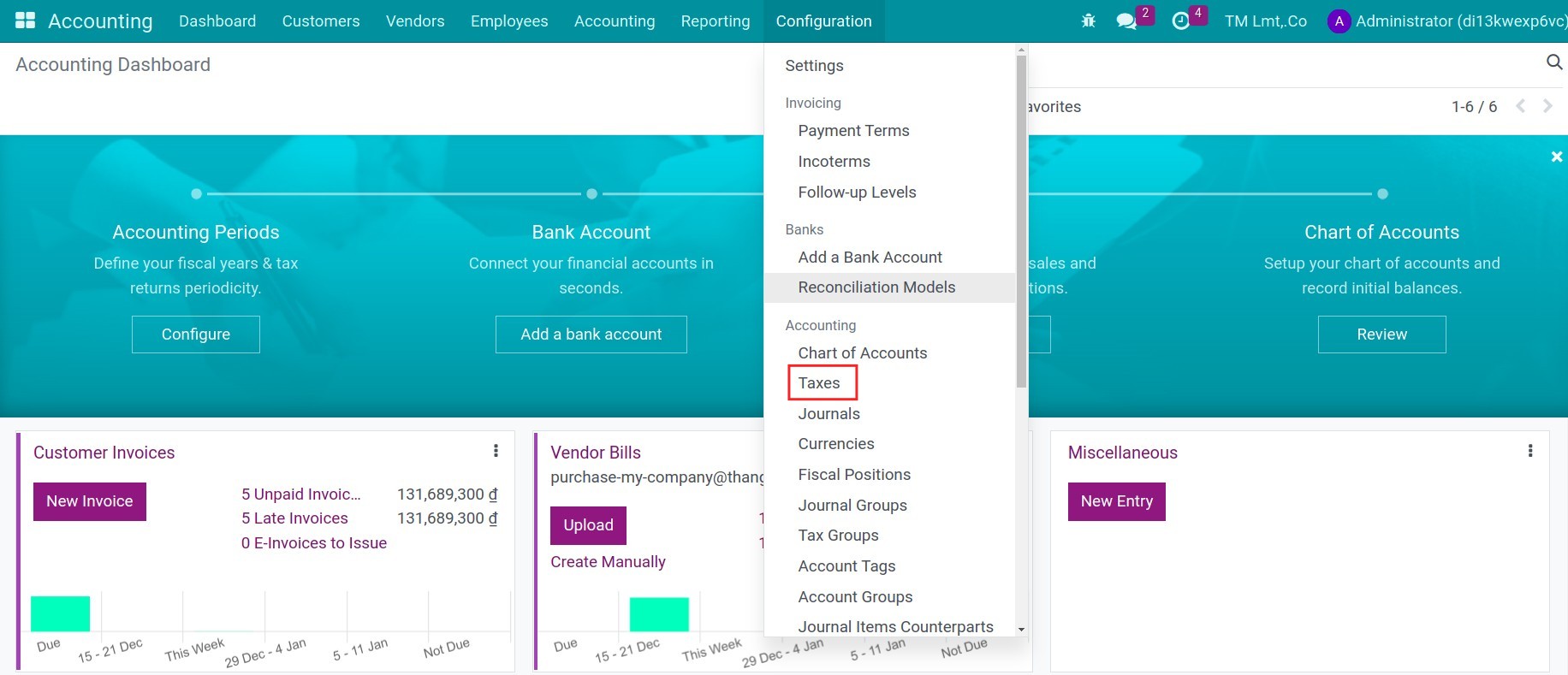

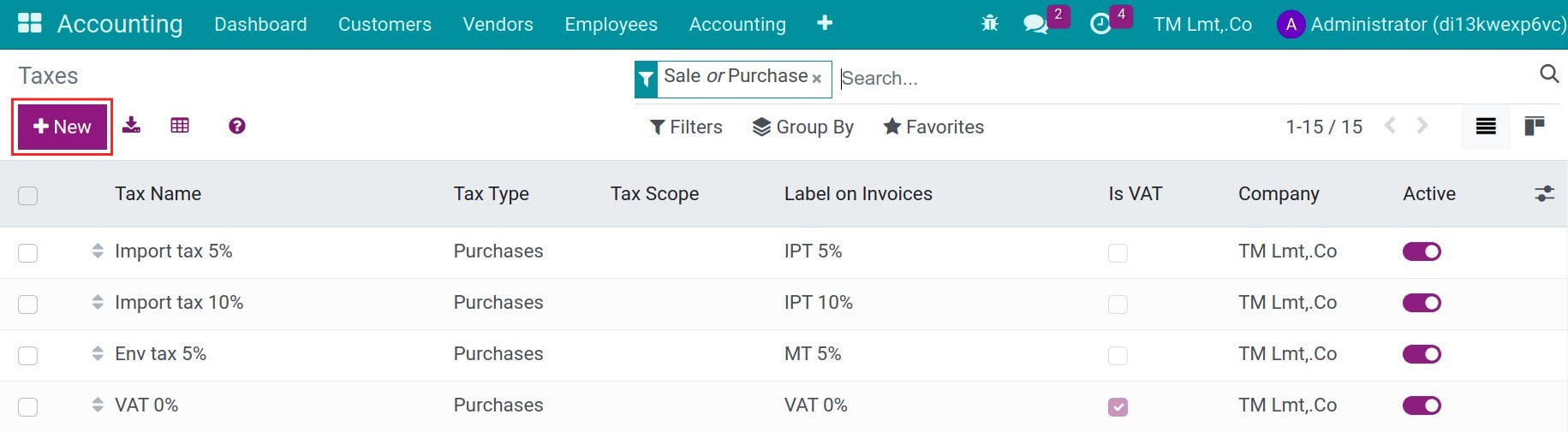

To create a new import tax or export tax, navigate to Accounting > Configuration > Taxes, press New and input the information:

You can refer to the articles Configuration taxes on import/export and Tax reports using tax grids for configuration.

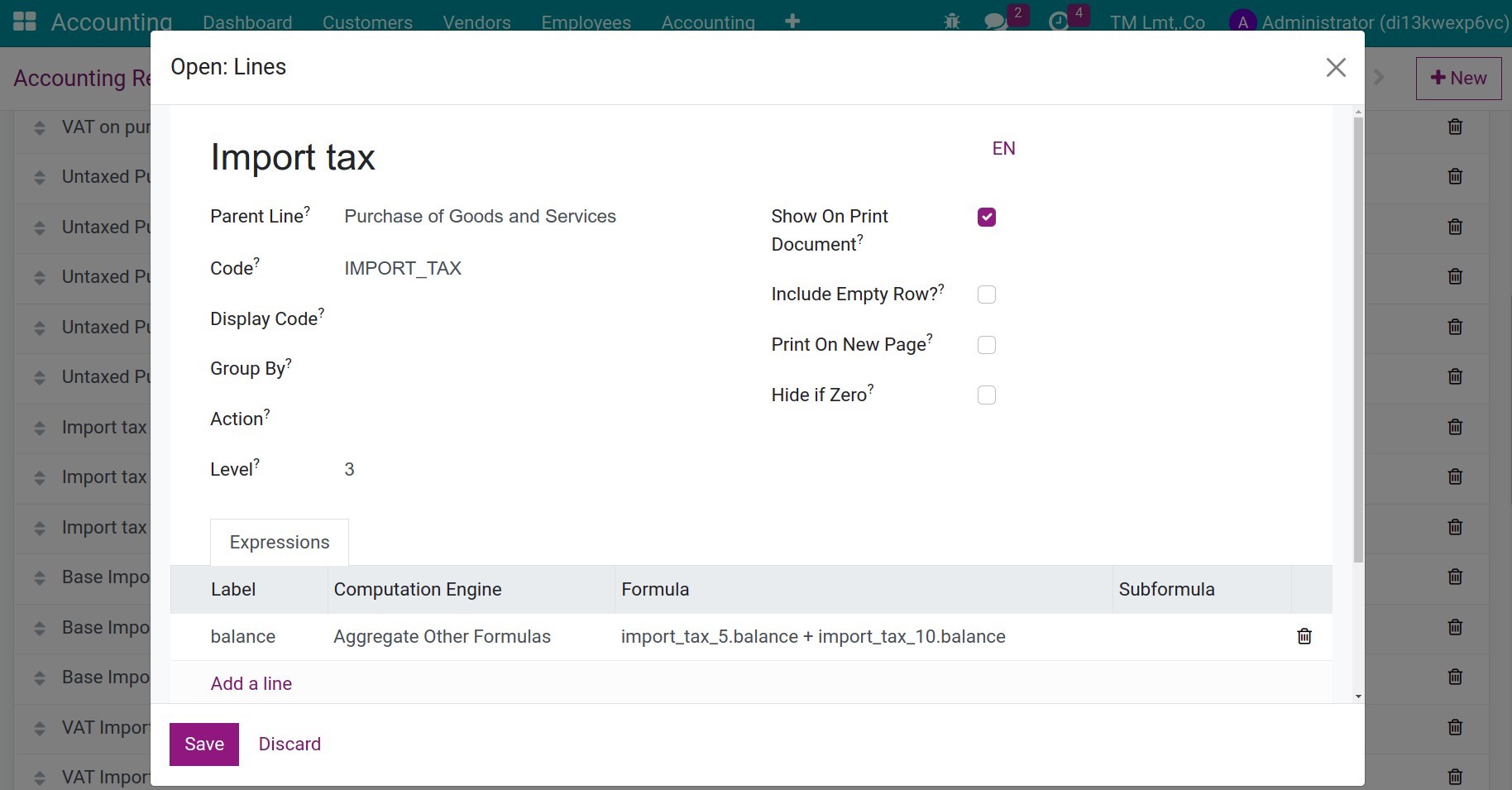

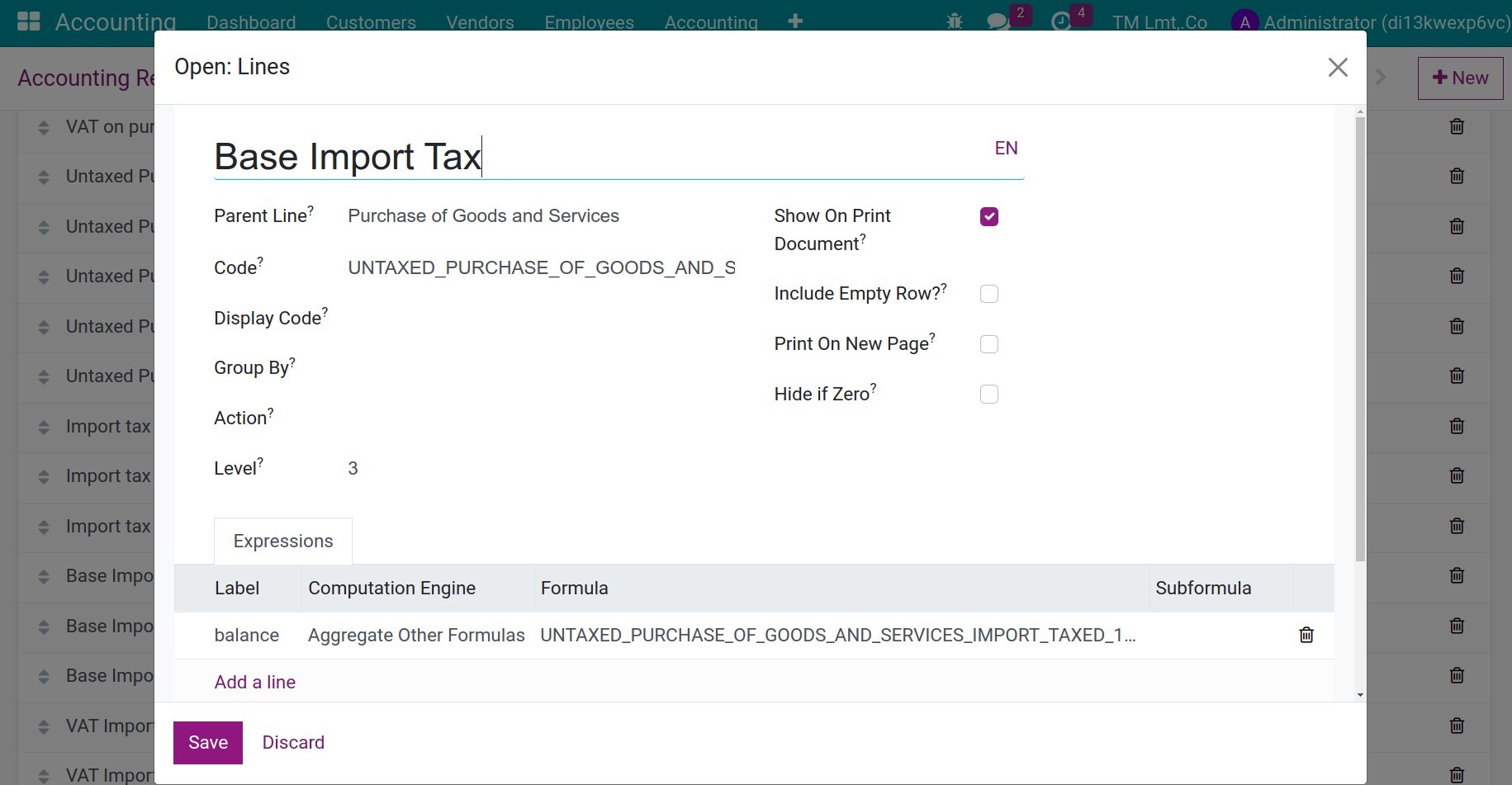

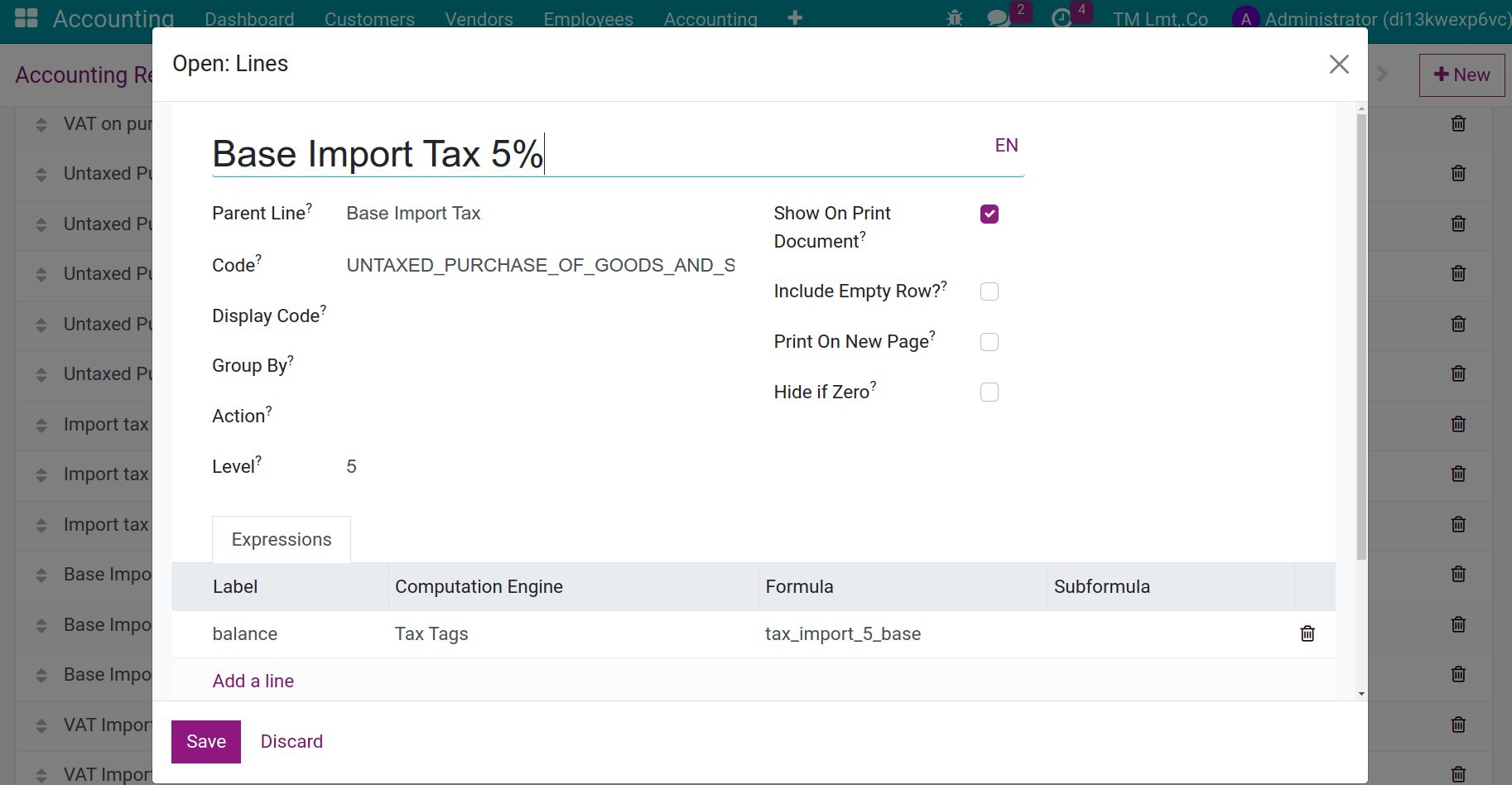

Import tax

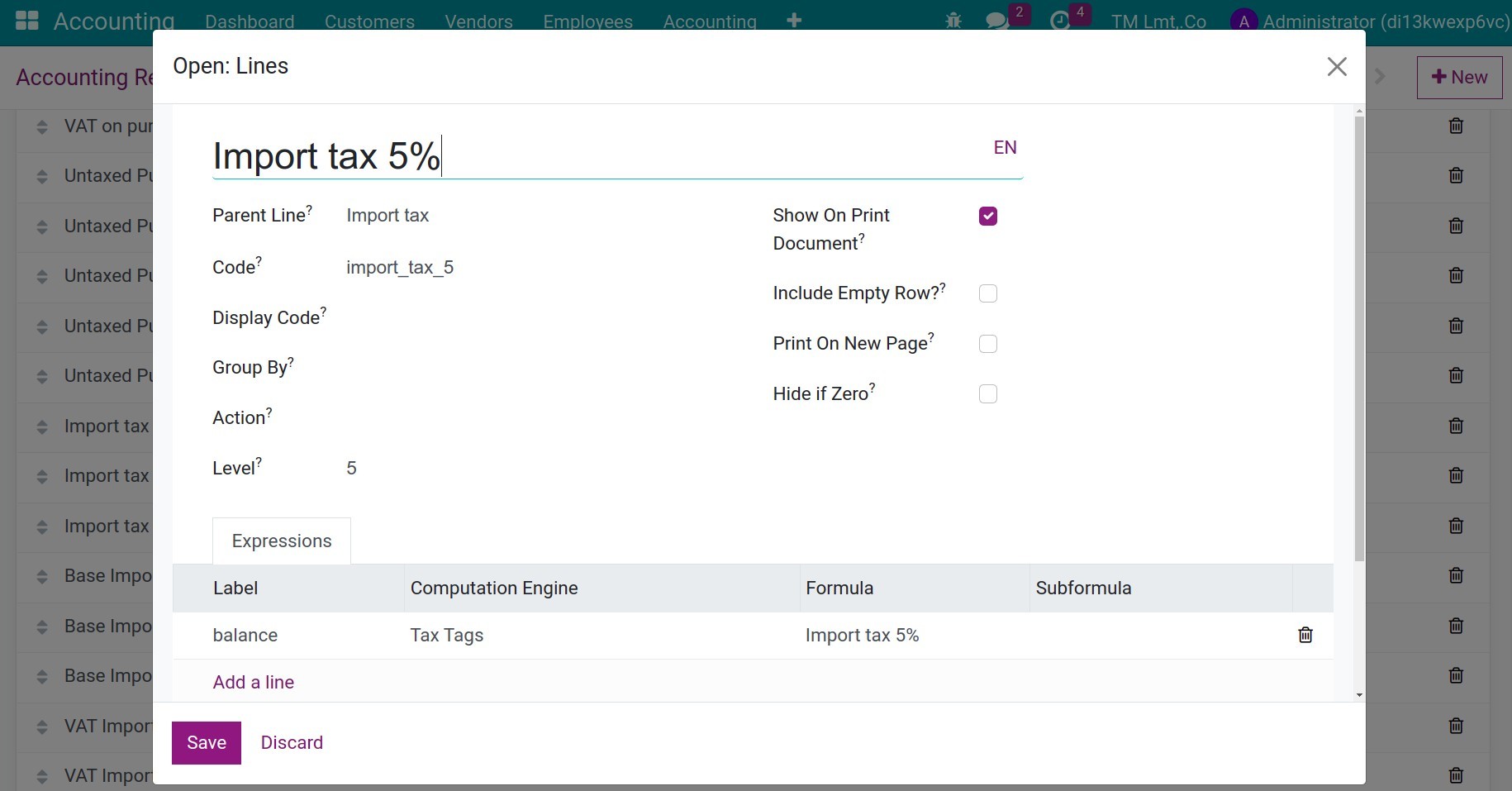

Base of import tax

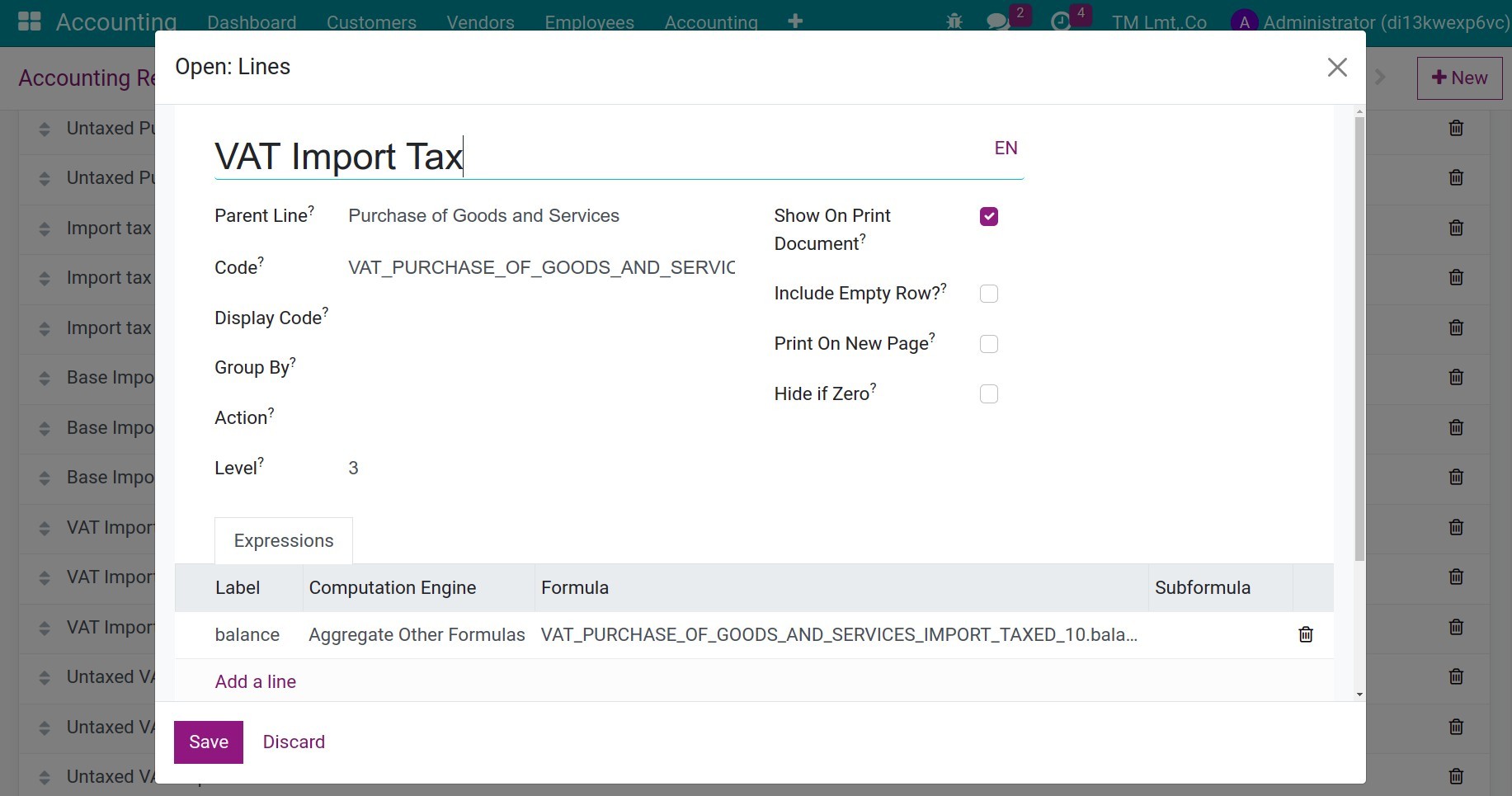

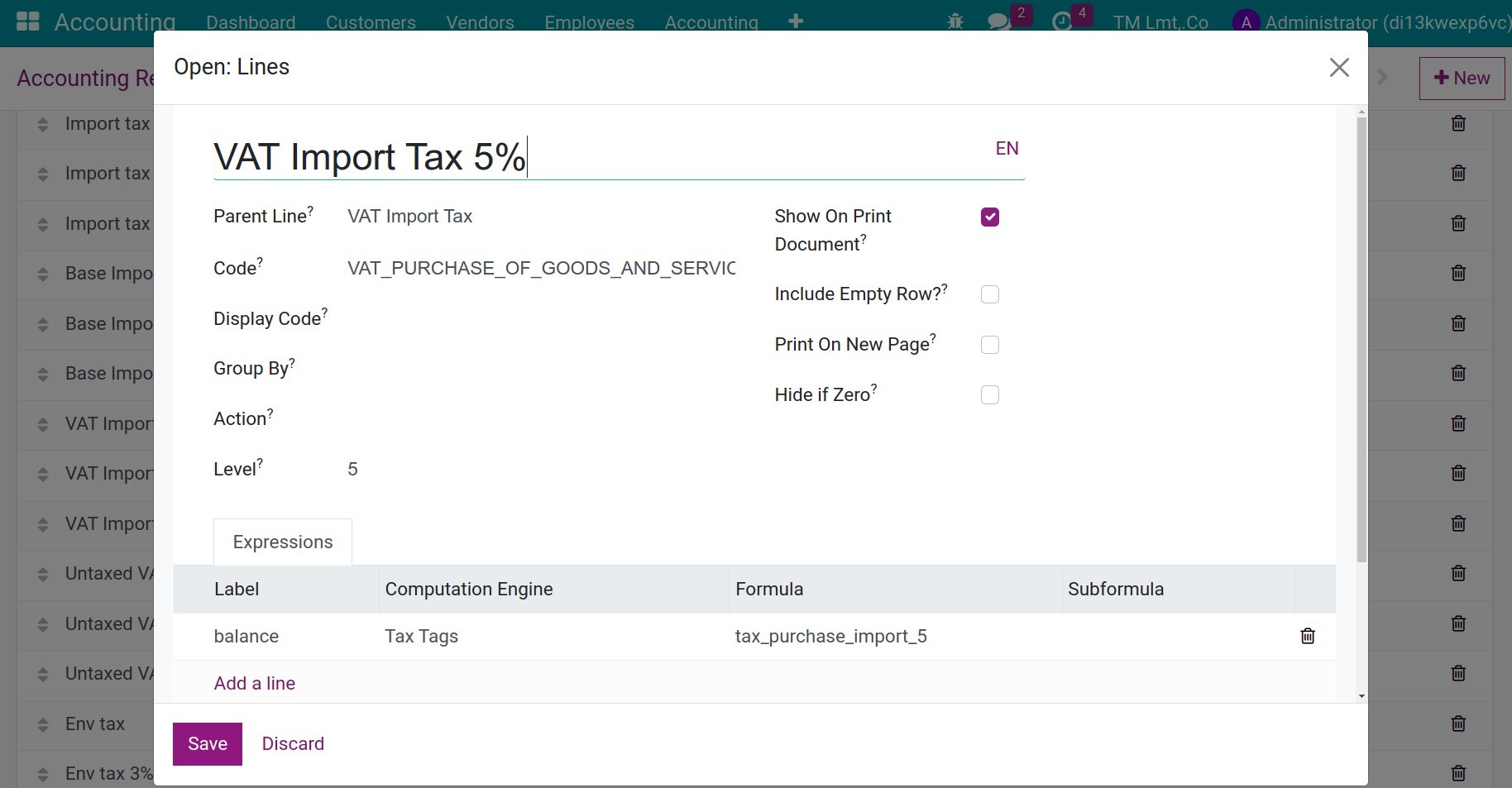

VAT of import goods

Base of VAT of import goods

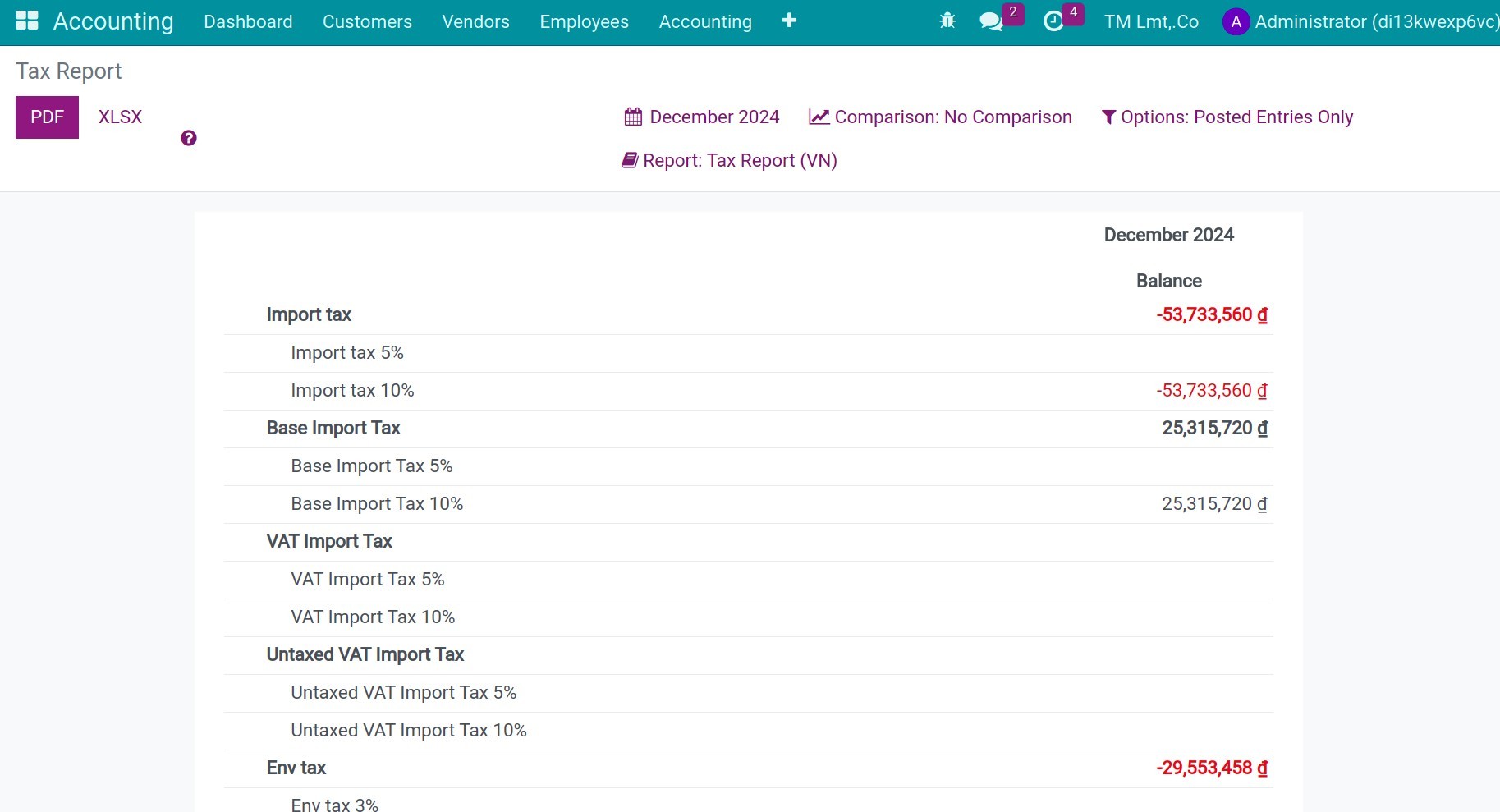

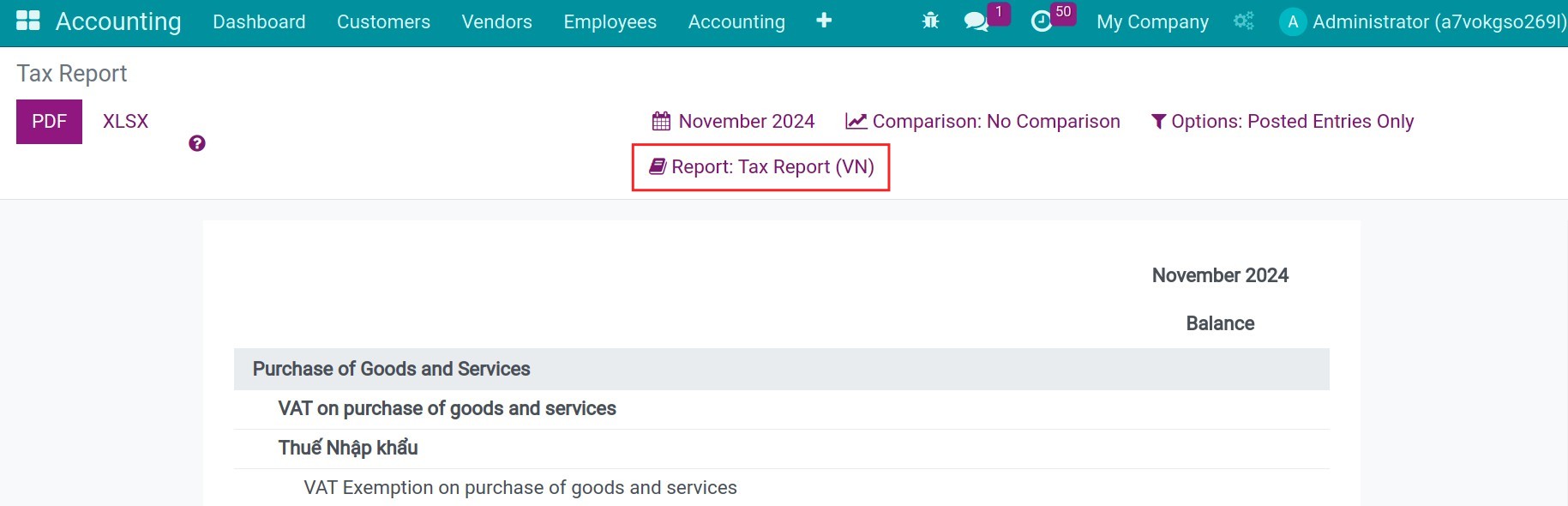

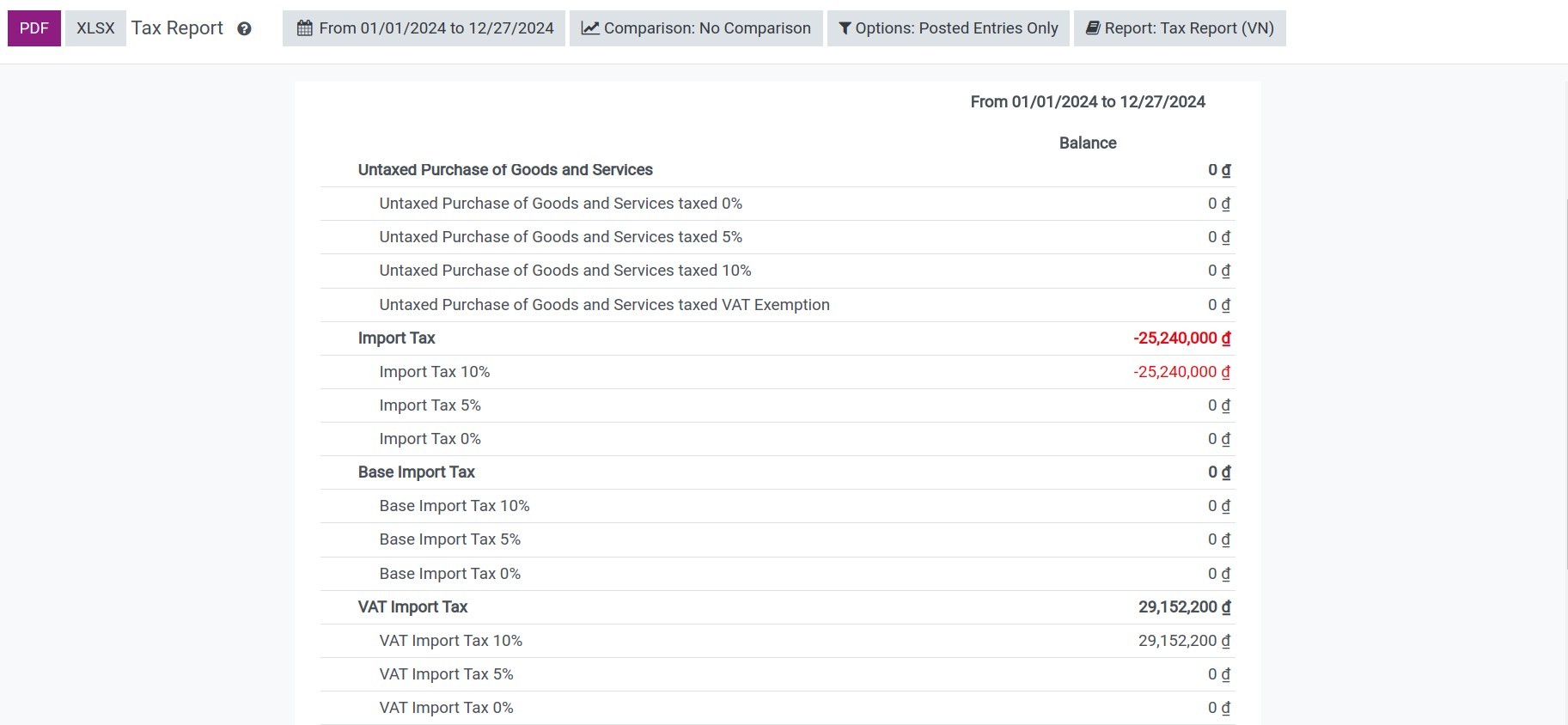

After configurating, you will see it on the report:

What data could shown on tax reports¶

The value of transactions shown on the tax report will depend on whether those transactions are associated with the corresponding tax grid. In Viindoo, we have the default rules to automatically apply the tax grid on the journal items corresponding with the taxes.

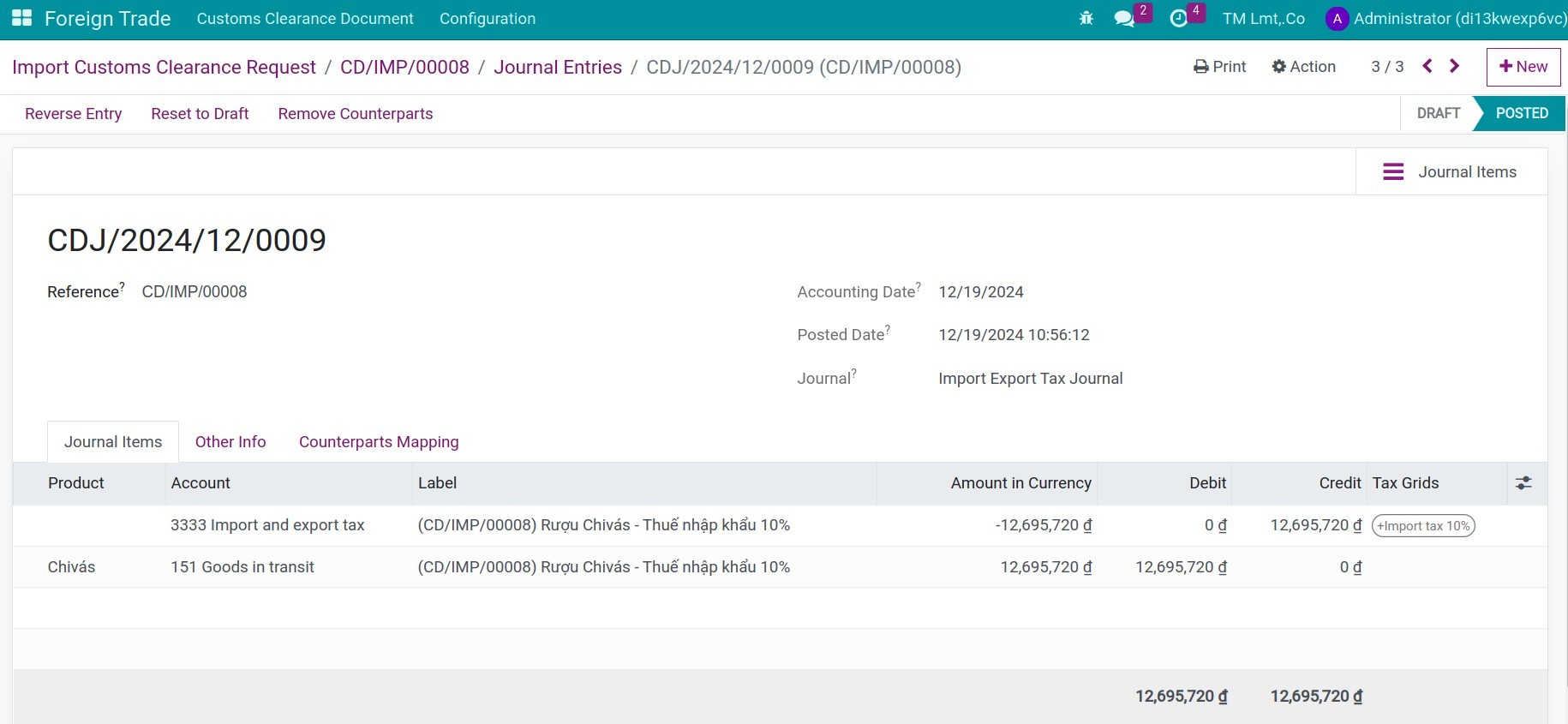

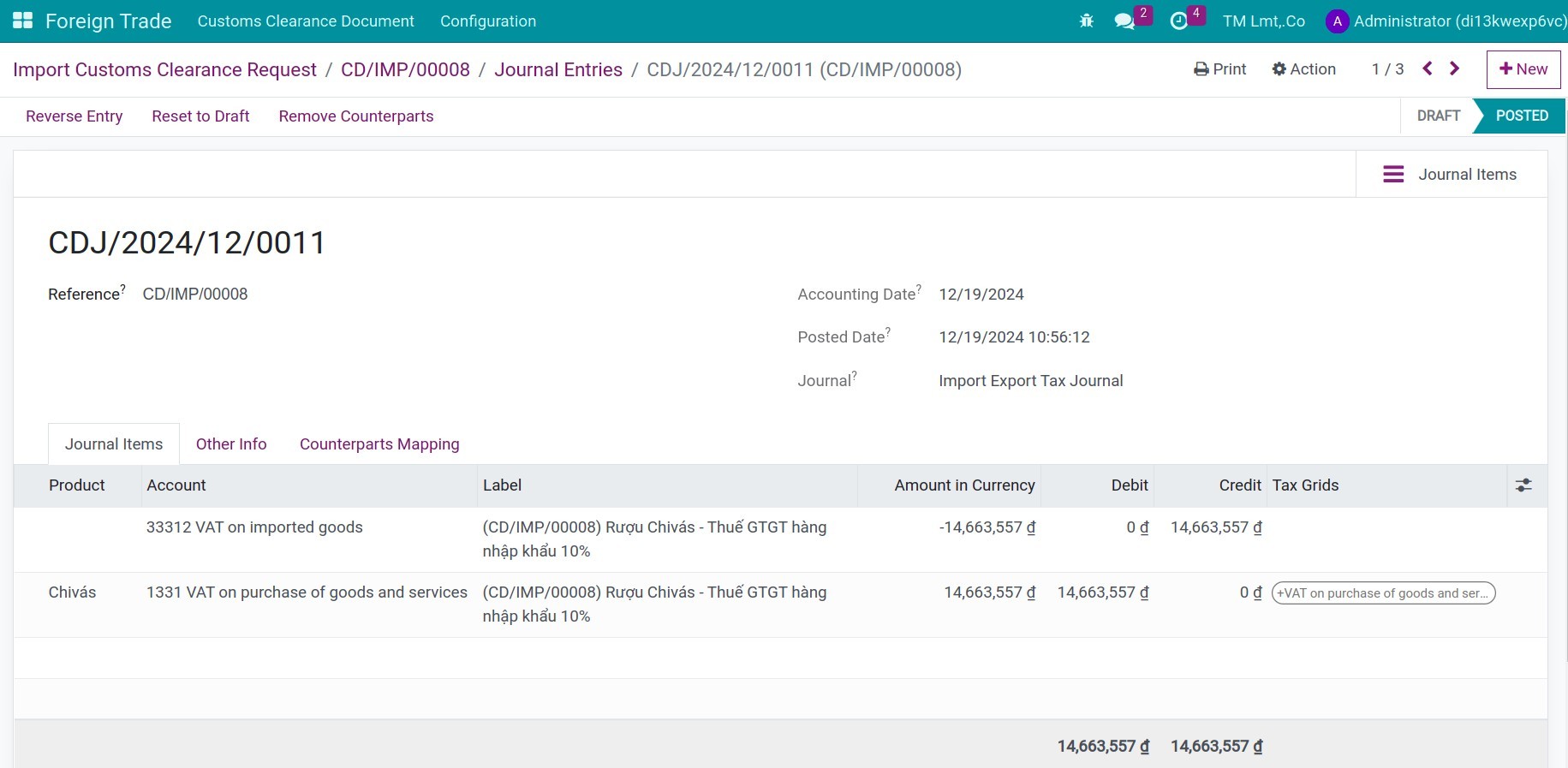

For example, when a import custom clearance request is validated, with the configuration of all relative taxes, all the journal items will be applied to the corresponding tax grids:

Import tax

VAT for impor goods

Corresponding Journal items

Warning

If the taxes you use aren’t configurated the tax grids, you will not see it in the generated journal items.

Tax Reports¶

To see the tax reports, navigate to Accounting > Reportings > Tax Report, choose the report type is Tax Report (VN):

To see all the journal items that summarize the number, press the number on the report, and you will be navigated to the Journal Items window:

See also

Related article

Optional module