How to create Purchase Receipts¶

Purchase Receipts is a document confirming the completion of payment and delivery of the Supplier’s products/services. In Vietnam, according to Article 18 of Circular 39/2014/TT-BTC, the products/services which a payment value of less than 200,000 VND can still include as Allowable Expenses for Corporate Income Tax Deduction if eligible.

Requirements

This tutorial requires the installation of the following applications/modules:

Configure the Purchase Receipts feature¶

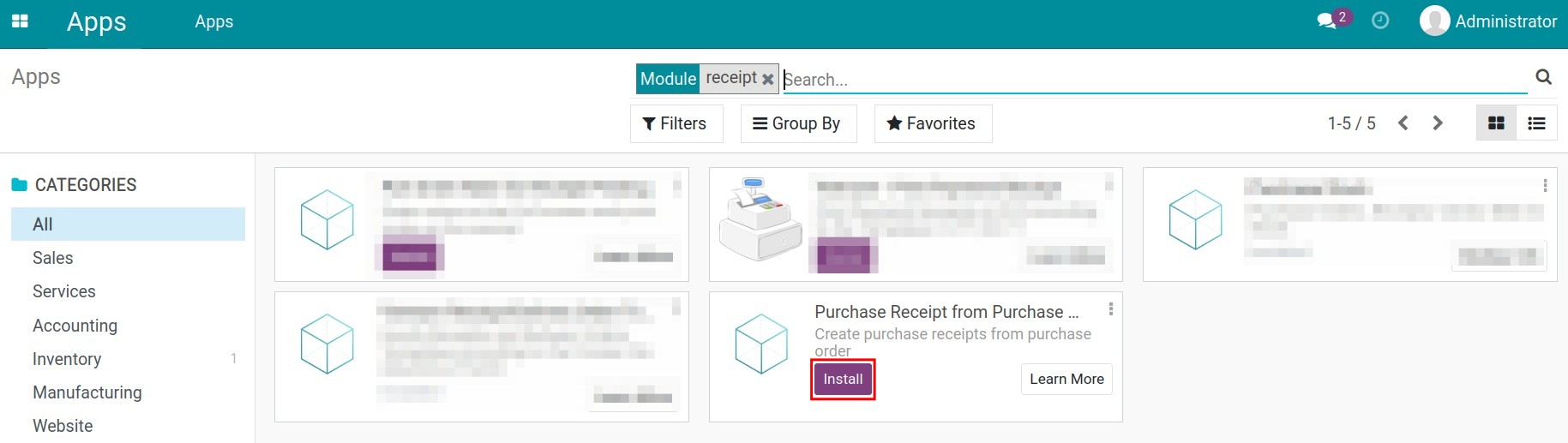

To use this feature on the Accounting application in Viindoo, you need to install the Purchase Receipt module by going to Apps and then using Filter to search for the Purchase Receipts (to_purchase_receipt) module. Click Install to install the module.

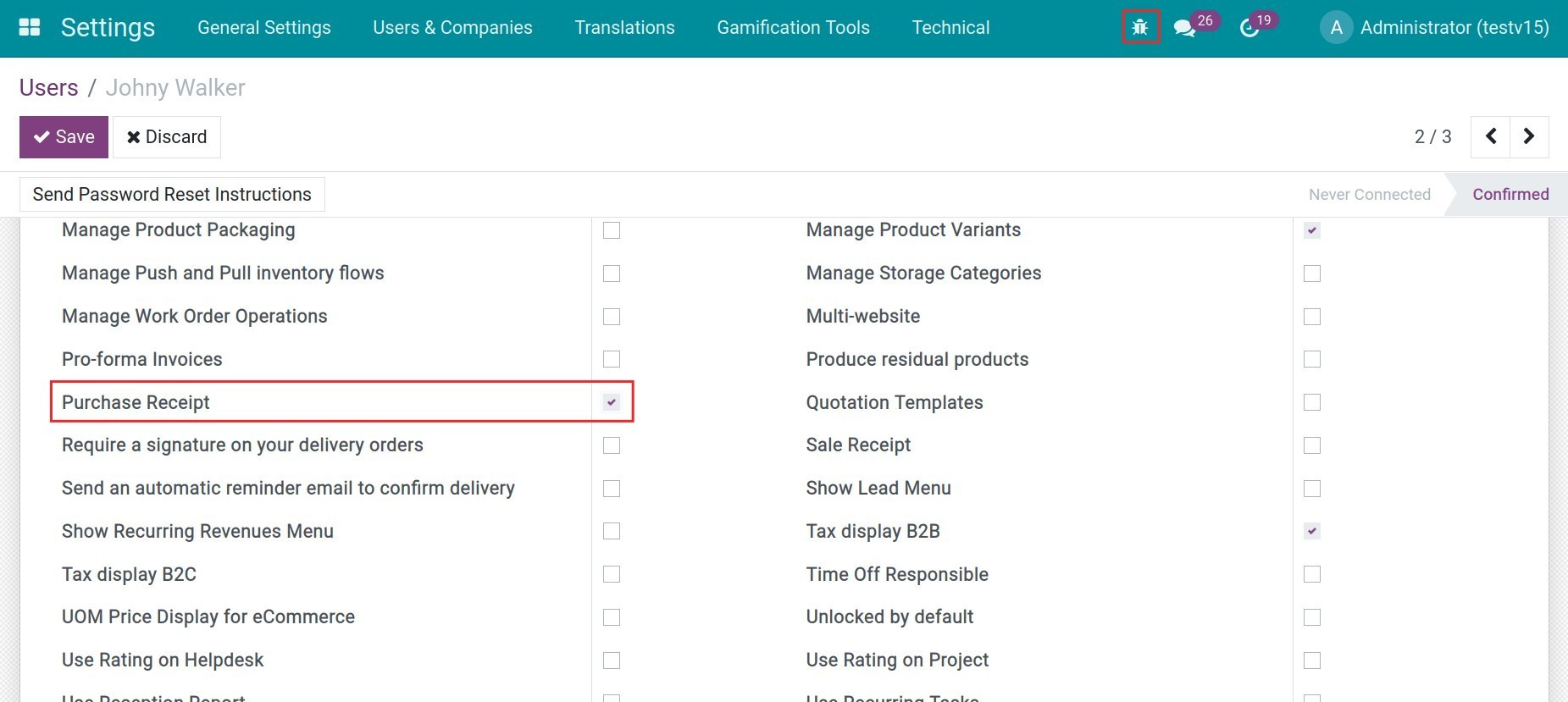

After installing the module, you need to configure the advanced access right for accountant by navigating to , activate the developer mode and choose Purchase Receipt:

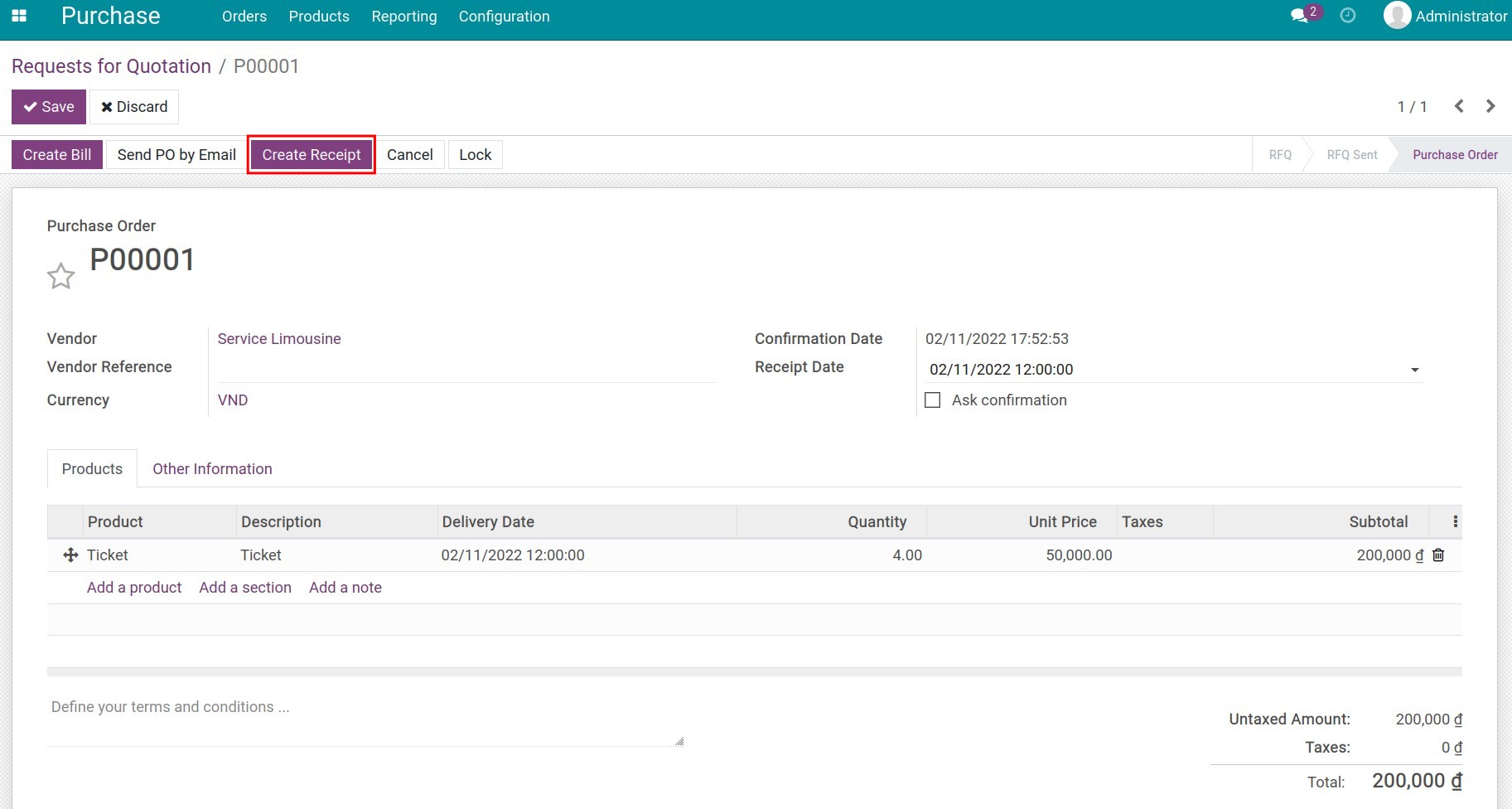

Next, after confirming the purchase order, you will see a Create Receipt button next to the Create Bill one:

Note

For purchase orders that have already been invoiced, you will not be able to create a purchase receipt on the purchase orders form.

Similar when it comes to Vendor Bills, you can directly create a purchase receipt and take advantage of information from the purchase order.

How to use Purchase Receipt¶

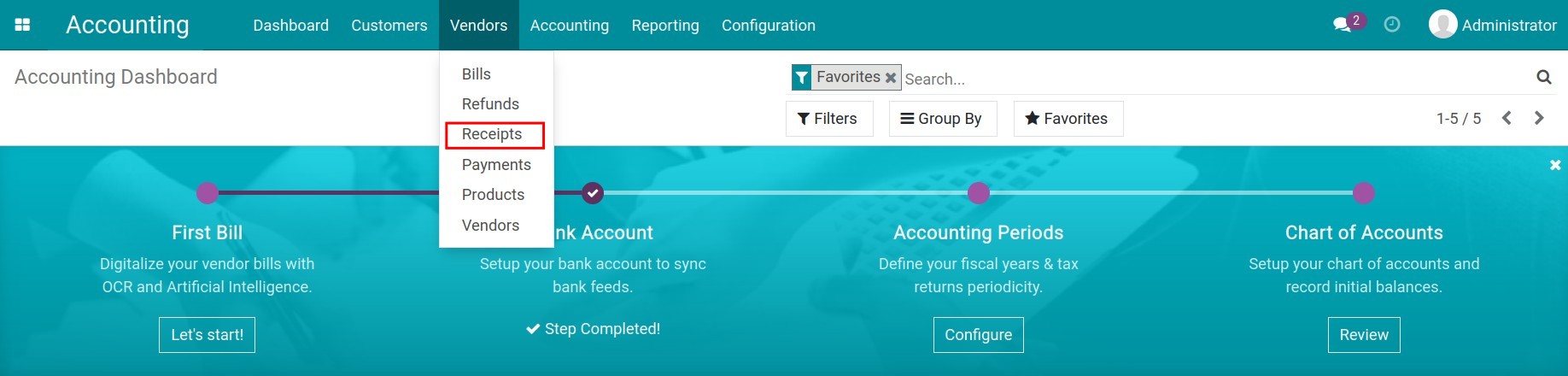

To record a new purchase receipt, navigate to :

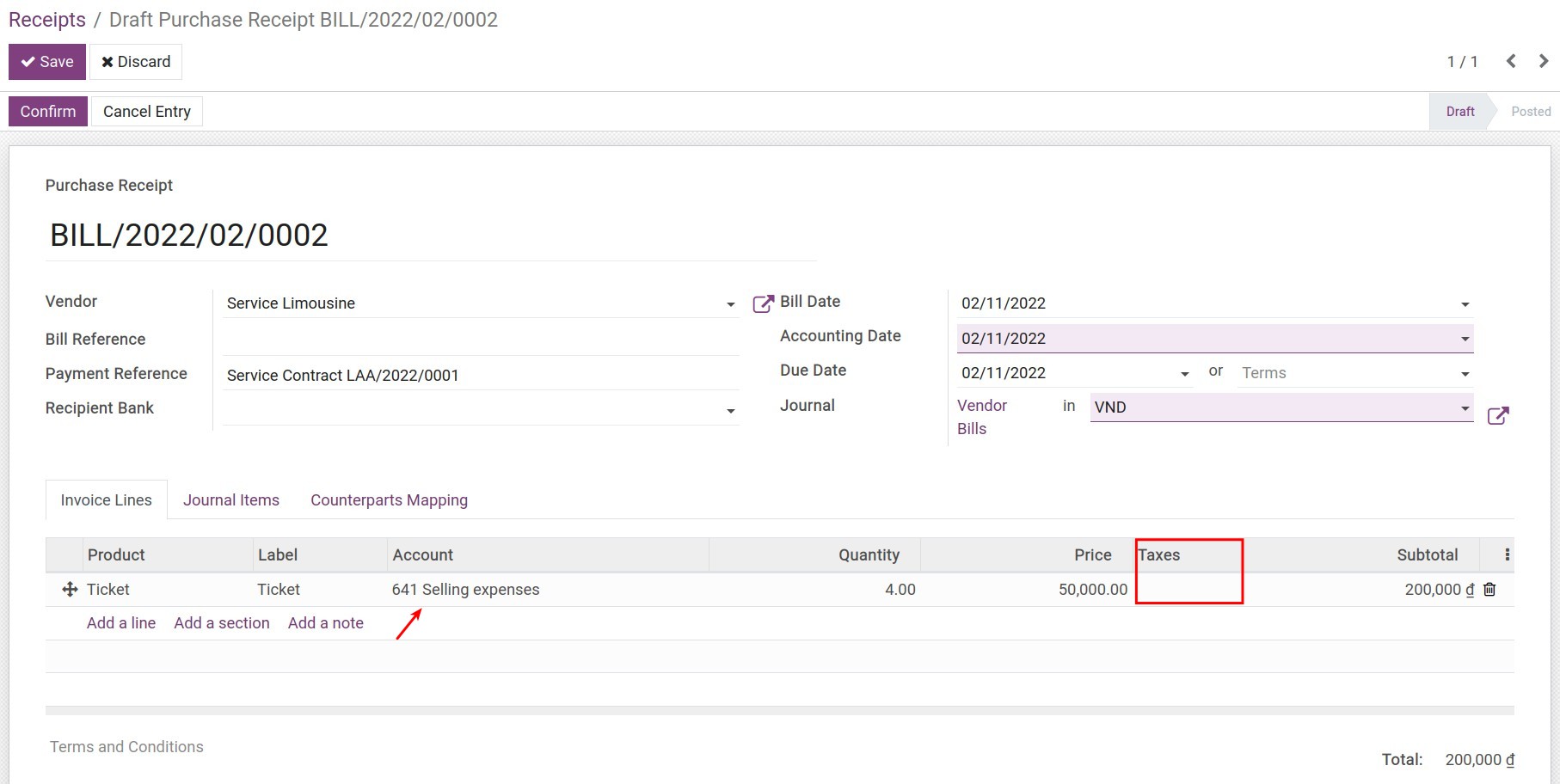

Click on the Create and fill out it the form in the similar steps to create Vendor Bills:

Tip

Purchase receipts do not record tax, so on the receipts form, you can uncheck the Taxes. In addition, you can also change the accounting account when confirming the purchase receipt by selecting the accounting account in the Account or you can also configure the default account on Product Category of the Product.

See also

Related Article

Optional Module