Tax reports using tax grids¶

In Viindoo Accounting App, the Tax report had been built according to the Tax grids which are configured on each type of the Taxes.

Requirements

This tutorial requires the installation of the following applications/modules:

When you use the Vietnam Chart of Accounts - Circular No. 200 or 133 which is set up in the configuration section of the Accounting app, the system has created several tax grids which frequently used by enterprises. However, you can adjust (add or subtract) the tax grid to get accurate information on the report, you do the following steps:

Create a tax grid on the Accounting app¶

A tax grid is created as a family tree. To make it easier to understand how to create a tax grid, let’s figure out the actual need that the enterprises want to track the expenses related to the taxes of the purchased goods and services. For example, you want to create a new purchase tax grid for 15% of goods and services. You do the steps below:

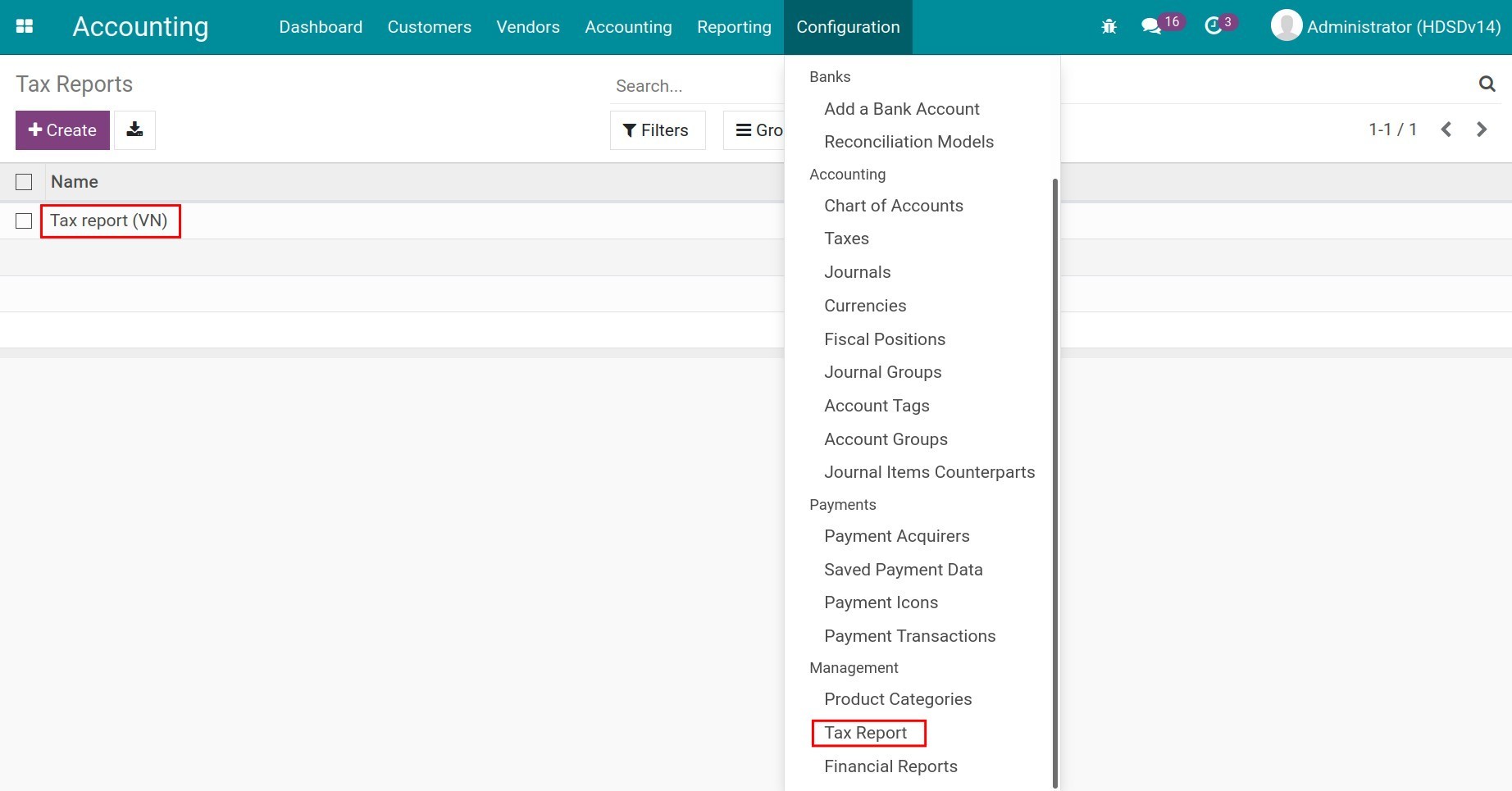

Create a Tax report¶

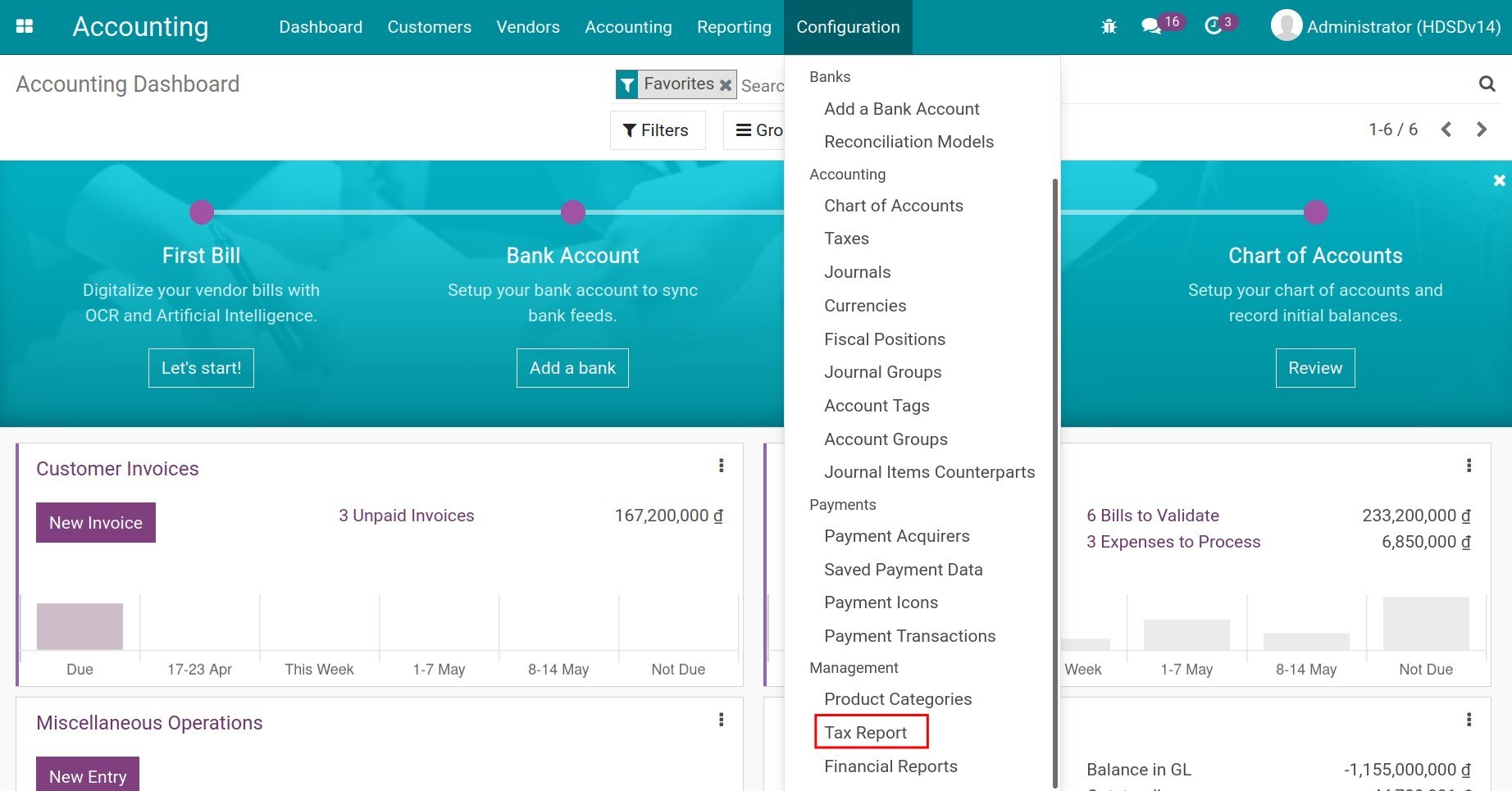

To create a tax grid, you enable the Developer mode, then access . You can choose an existing tax report or create a new one by clicking Create.

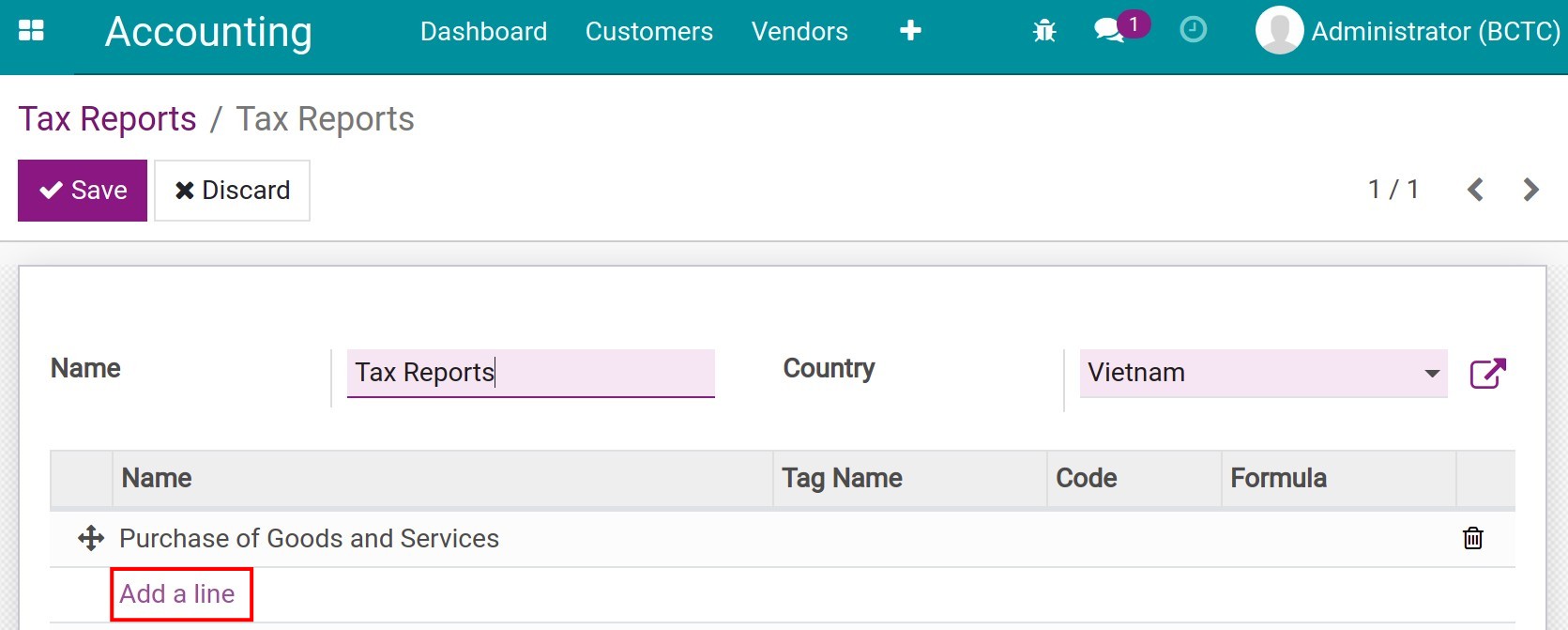

The system display the information as below:

Name: Completed name for this report line. It will be used in the tax report.

Country: Select the country for which this report is available.

Click Add a line to create a root report line or choose an existing one to see details.

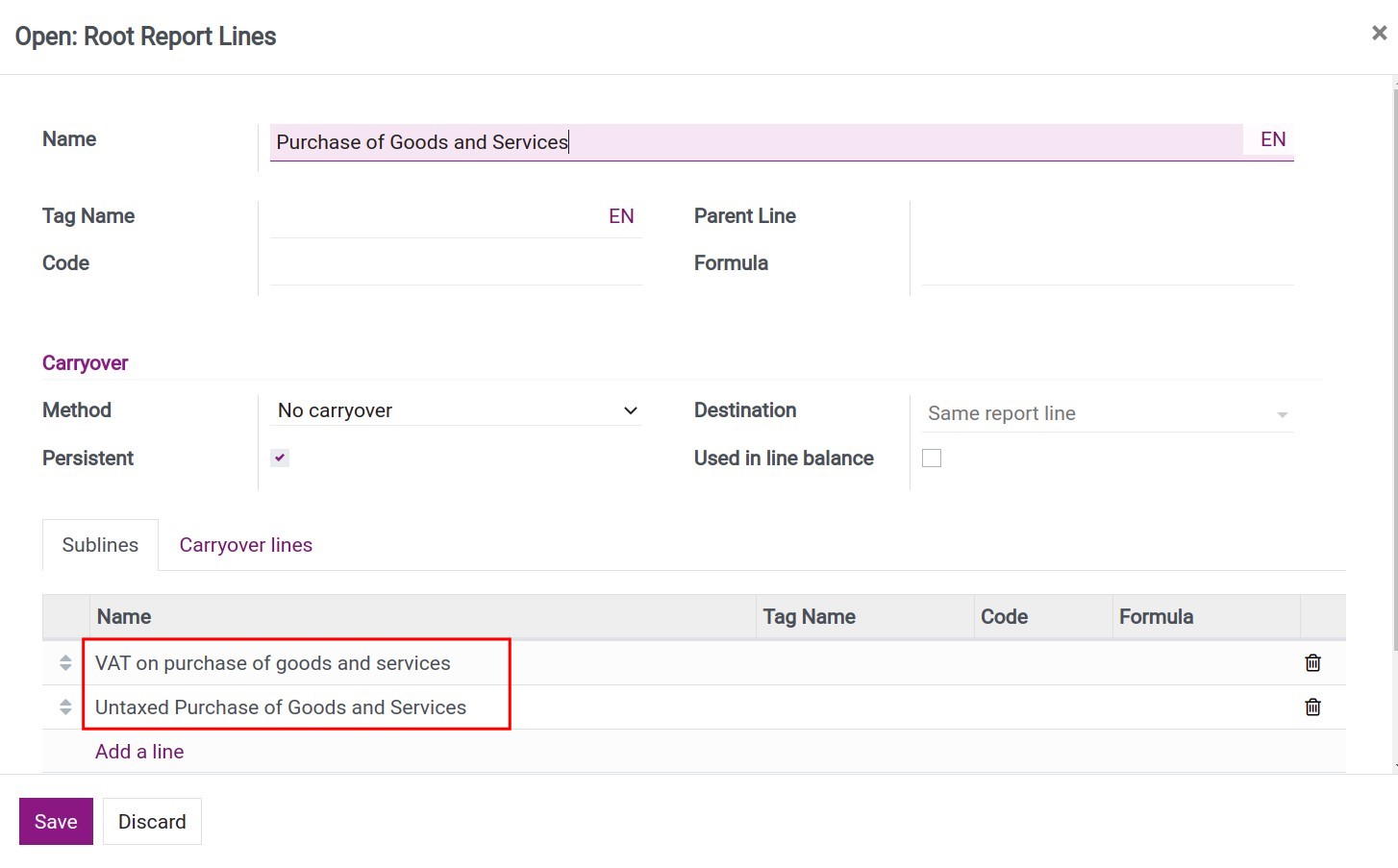

Create a root report line¶

The system display the details of root report line:

Name: Completed name of this report line.

Tag Name: Short name for tax grid corresponding to this report line. If you leave it empty, this report line doesn’t correspond to any grid.

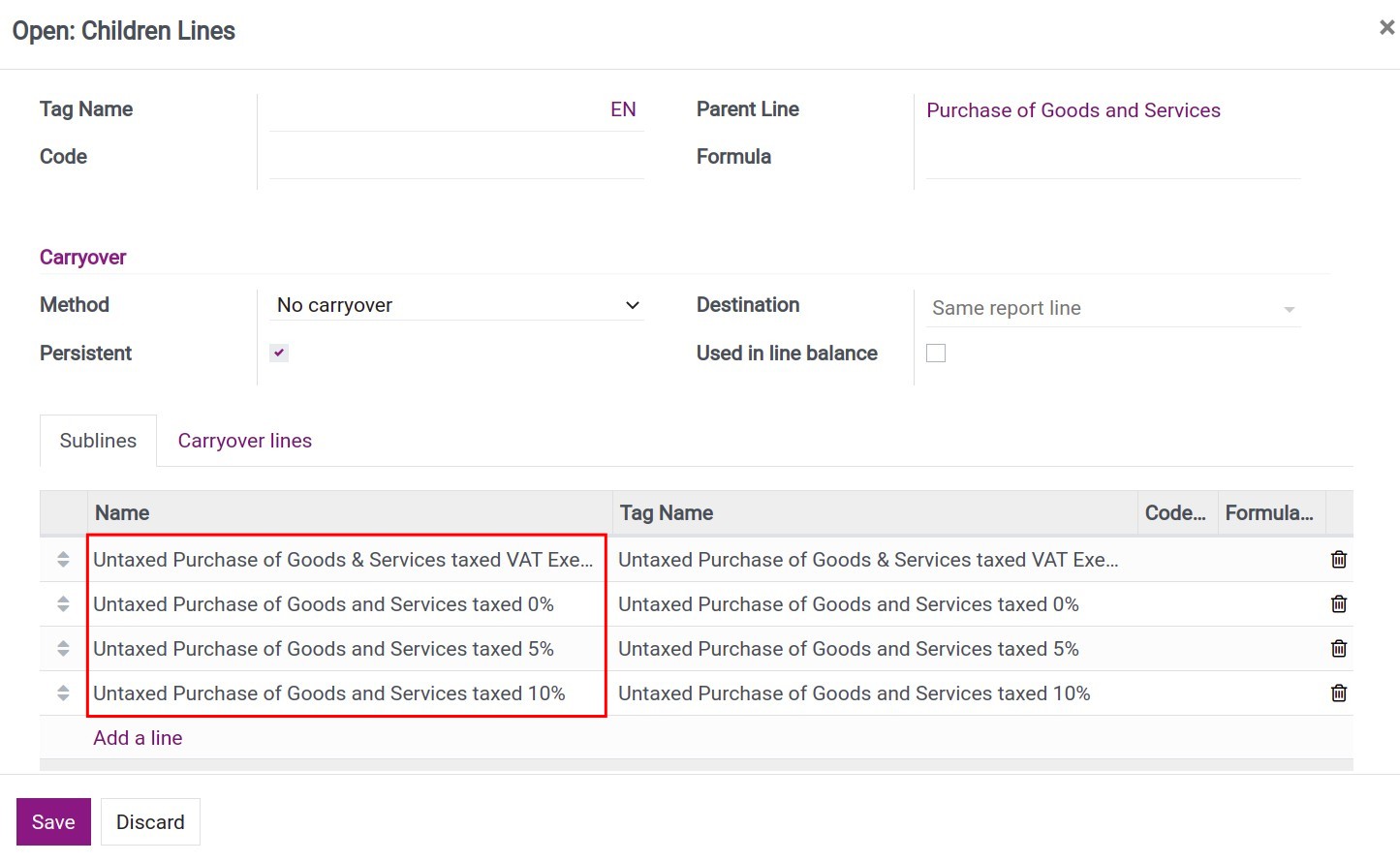

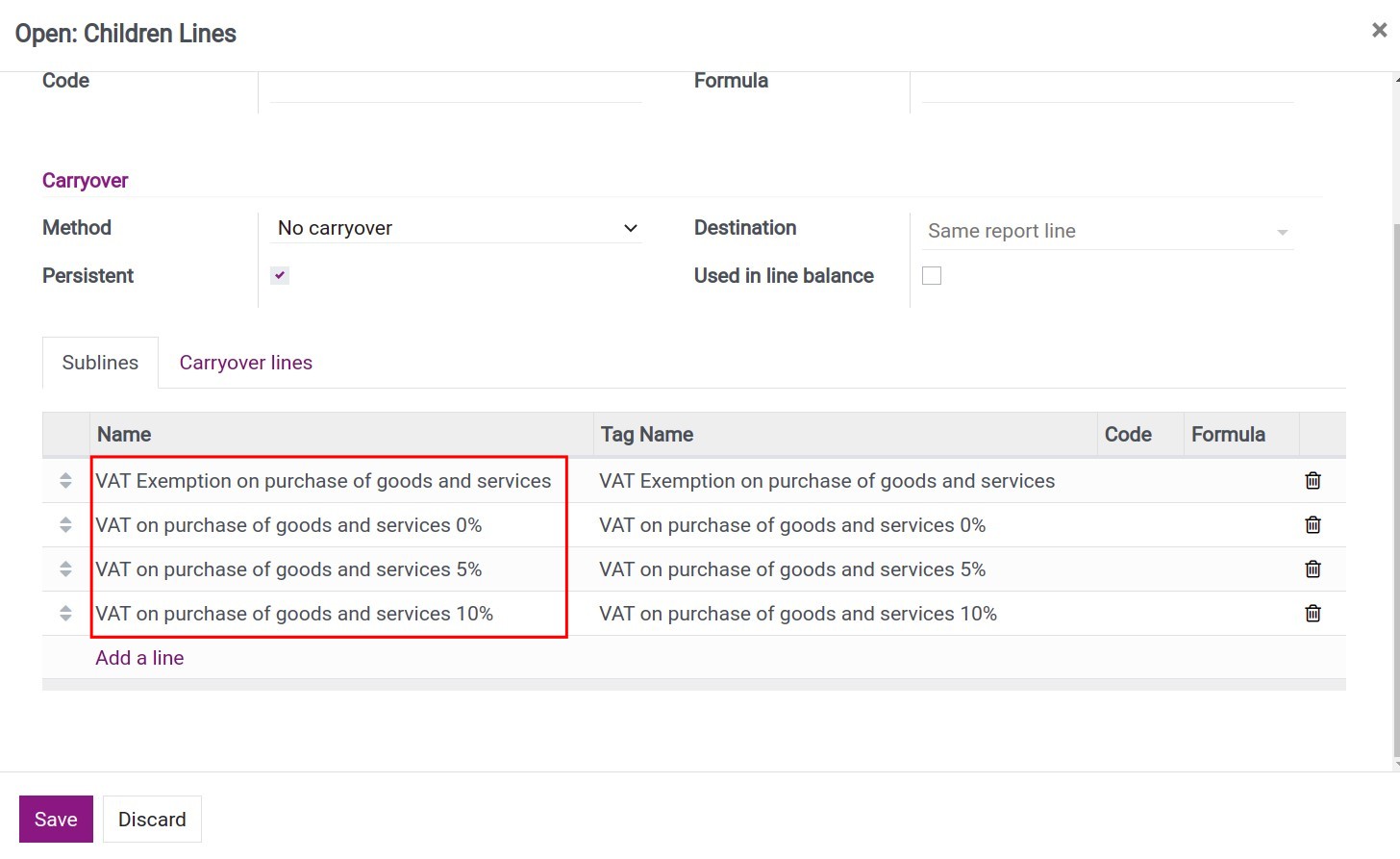

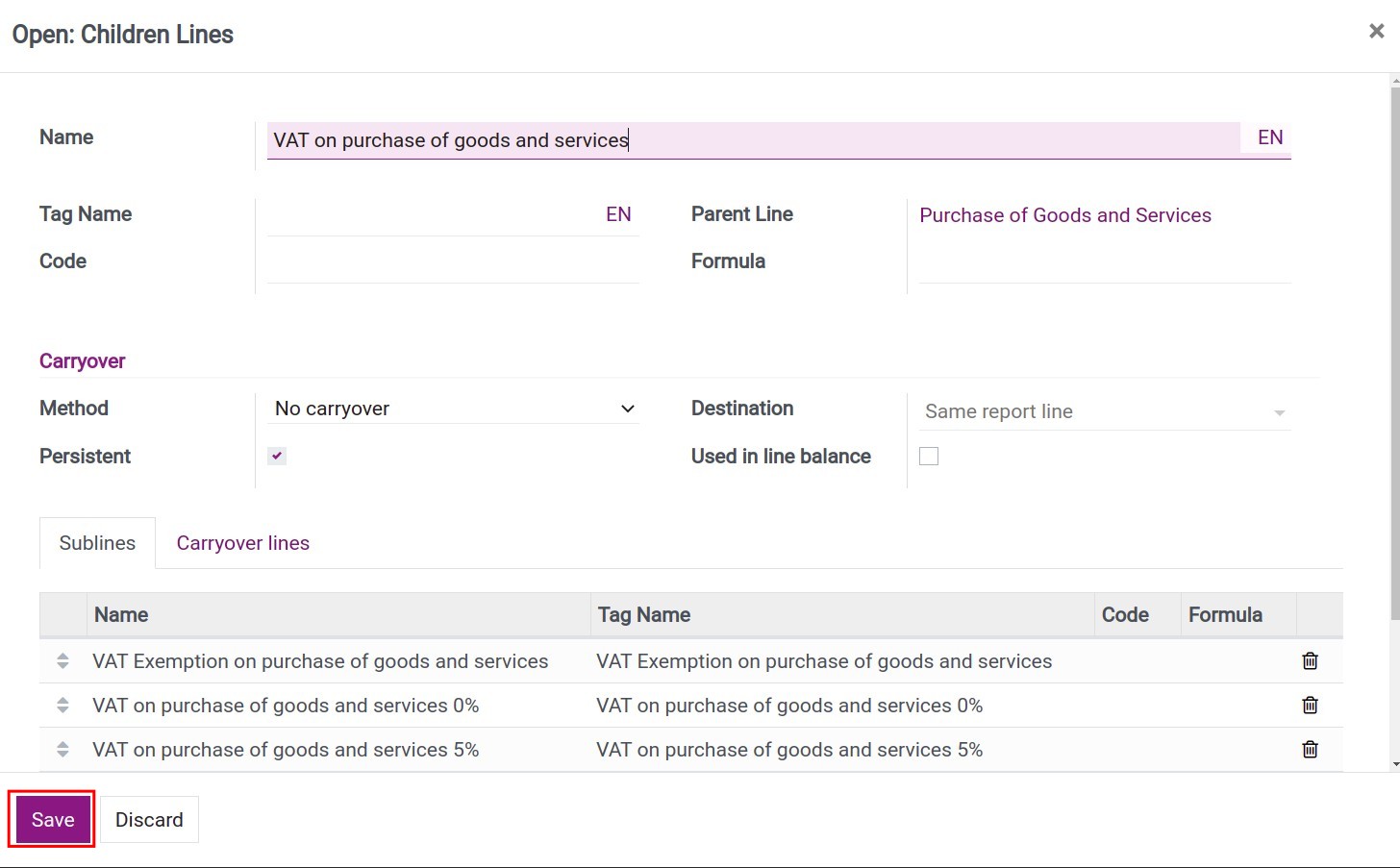

Create a child line to display on the report¶

Select Add a line to add a group of purchased goods and services, which will include the groups of its value and related taxes.

Name: Completed name of this report line.

Tag Name: Short name for tax grid corresponding to this report line. If you leave it empty, this report line doesn’t correspond to any such grid.

Parent line: Parent of this report line.

Click Save to save information.

Corresponding to the above example, we will have 2 different report lines as below:

Values of purchased goods and services:

![Create a value line of goods on the tax grids]()

VATs on purchase of goods and services:

![Create a tax children line on the tax grids]()

If you want to create more children lines, continue to use Add a line in each parent line.

Note

On the tax children lines, the Tag Name field is required to enter.

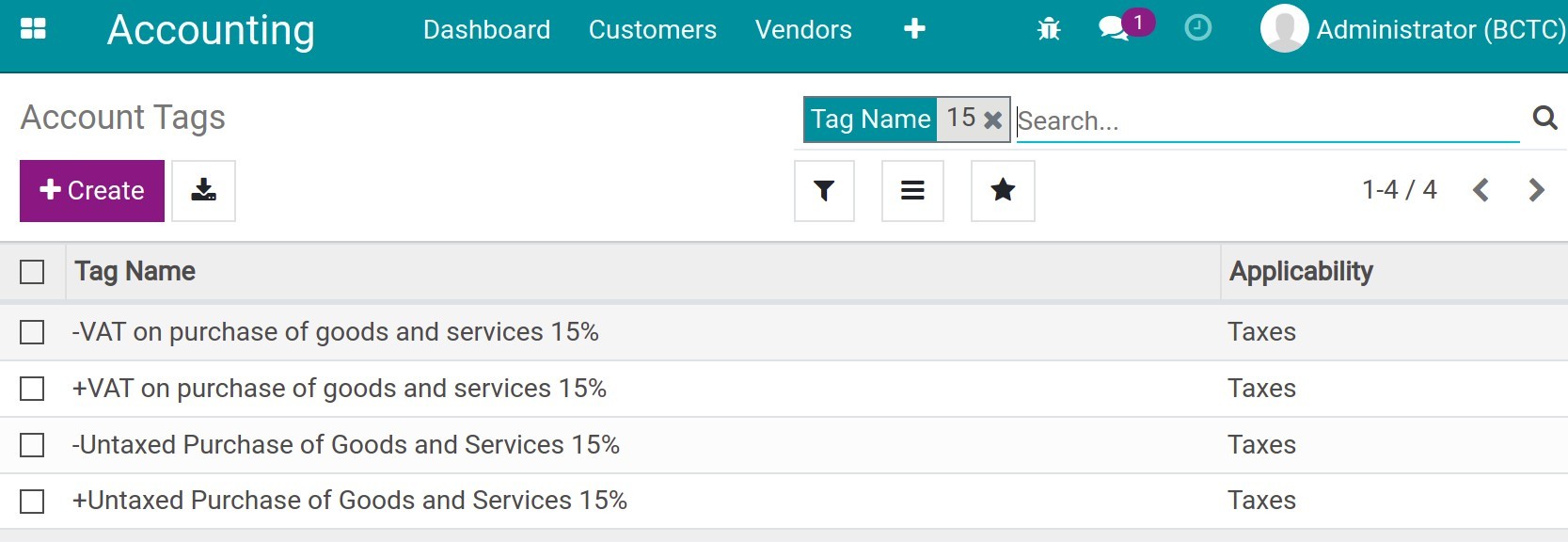

Hit on the Save button, the system will automatically generate the corressponded account tags for the Taxes configuration.

You navigate to to view and verify the existed account tags.

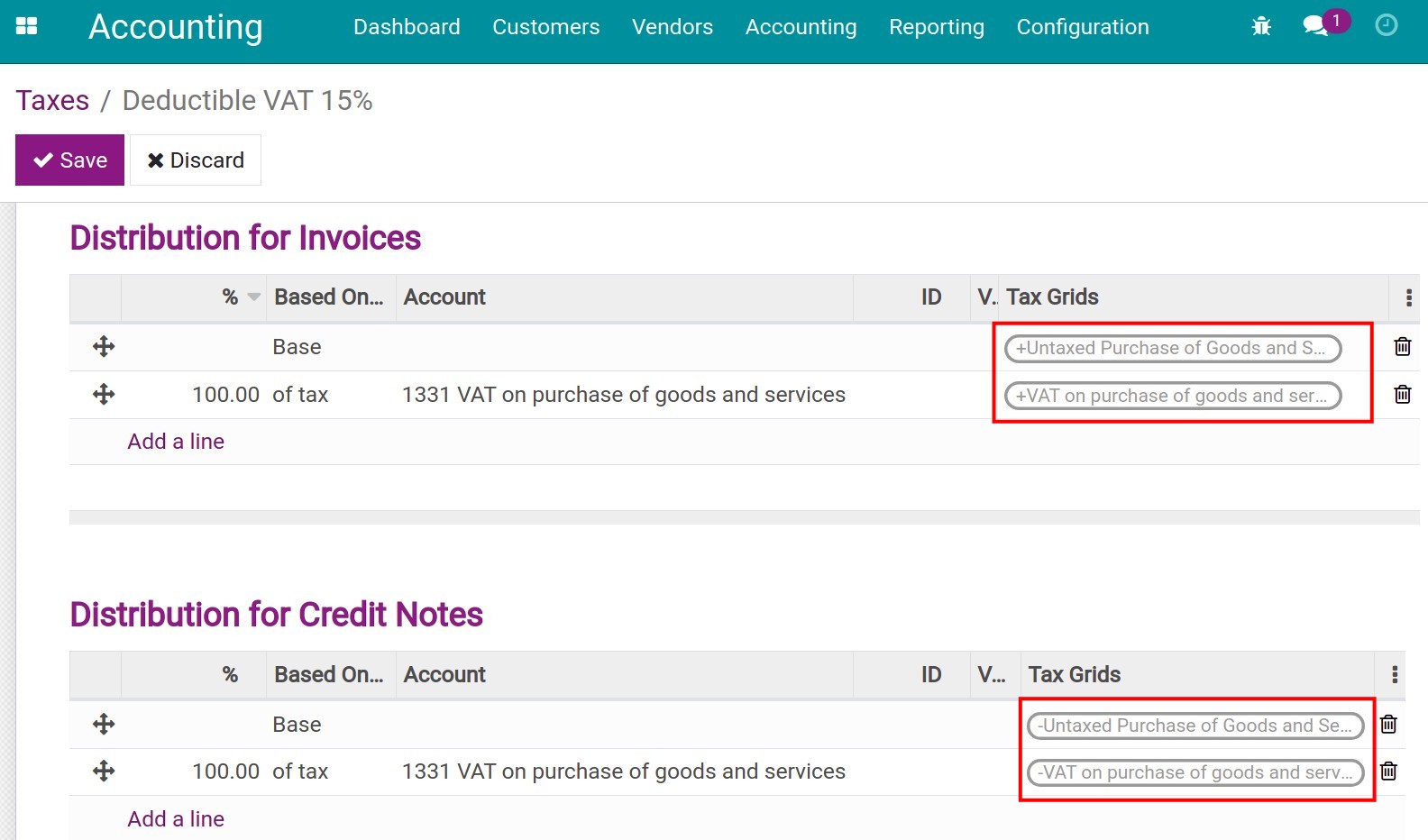

Connection between taxes and tax grids¶

On the new tax creation view, you select the account tags to fill in the corresponding tax grid for the data collection on the tax report.

Note

Tags with the positive sign (+) are used for the invoices distribution.

Tags with the negative sign (-) are used for the credit notes distribution.

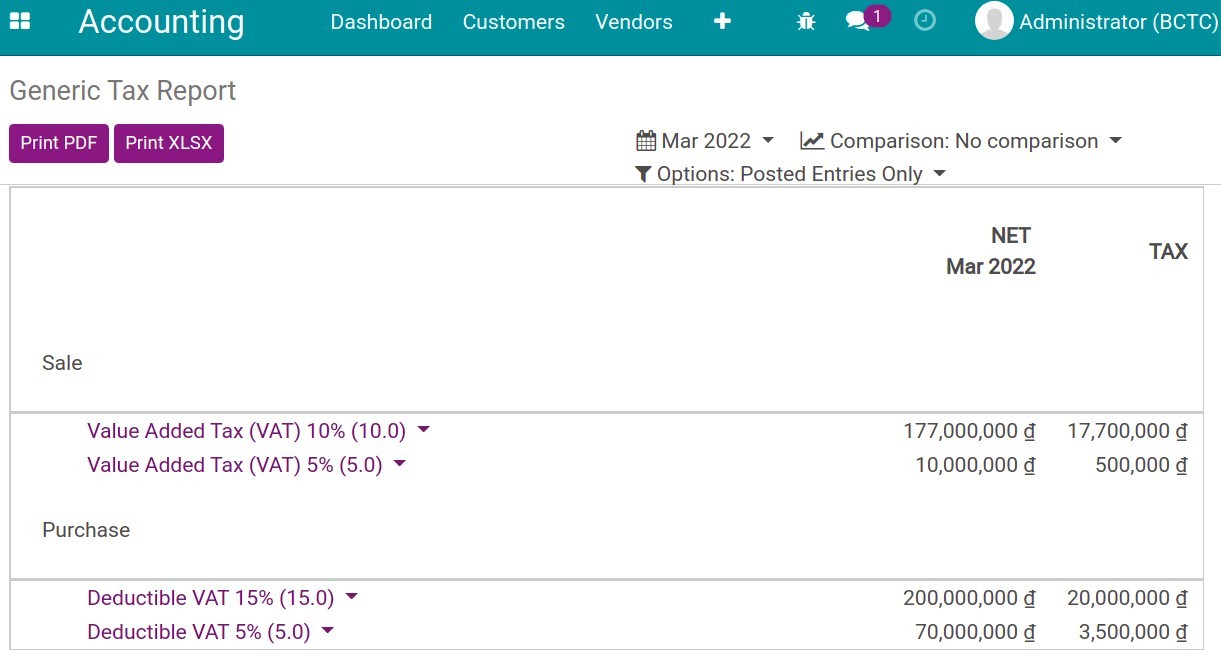

View Tax report¶

When you need to see the tax data, you can access .

All the data related to the value of goods and the corresponding tax will be shown here.

See also

Related Article

Optional Module