Production costs configuration¶

For manufacturing enterprises, besides accounting operations for purchasing and selling activities, there are other accounting operations for manufacturing such as recording direct or indirect product-related costs, allocation costs, production costs, etc. This article will show you how to configure the accounting accounts for each production stage.

Requirements

This tutorial requires the installation of the following applications/modules:

Set up accounts for product categories of production activities¶

For example, to manufacture a Table (finished product), the company needs to purchase raw materials to produce semi-finished products which are Table legs and Table surfaces, and then assemble them as a Table.

For the settings related to product categories of each raw material, semi-finished product, and finished product category, you can access Inventory > Configuration > Product Categories and see details in the Managing product categories article. You need to set up the accounting rules for each of these product categories as follows:

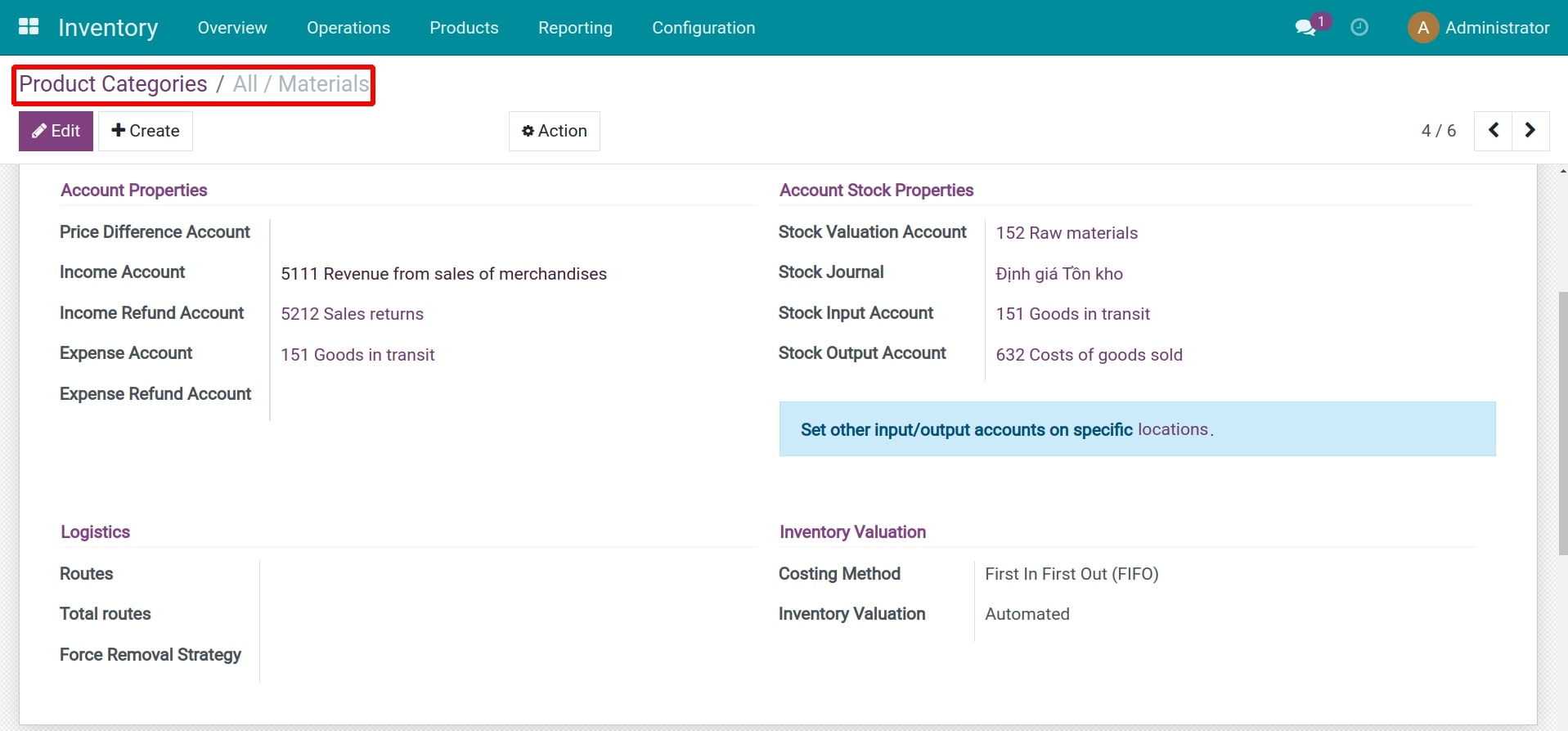

Raw material products category:

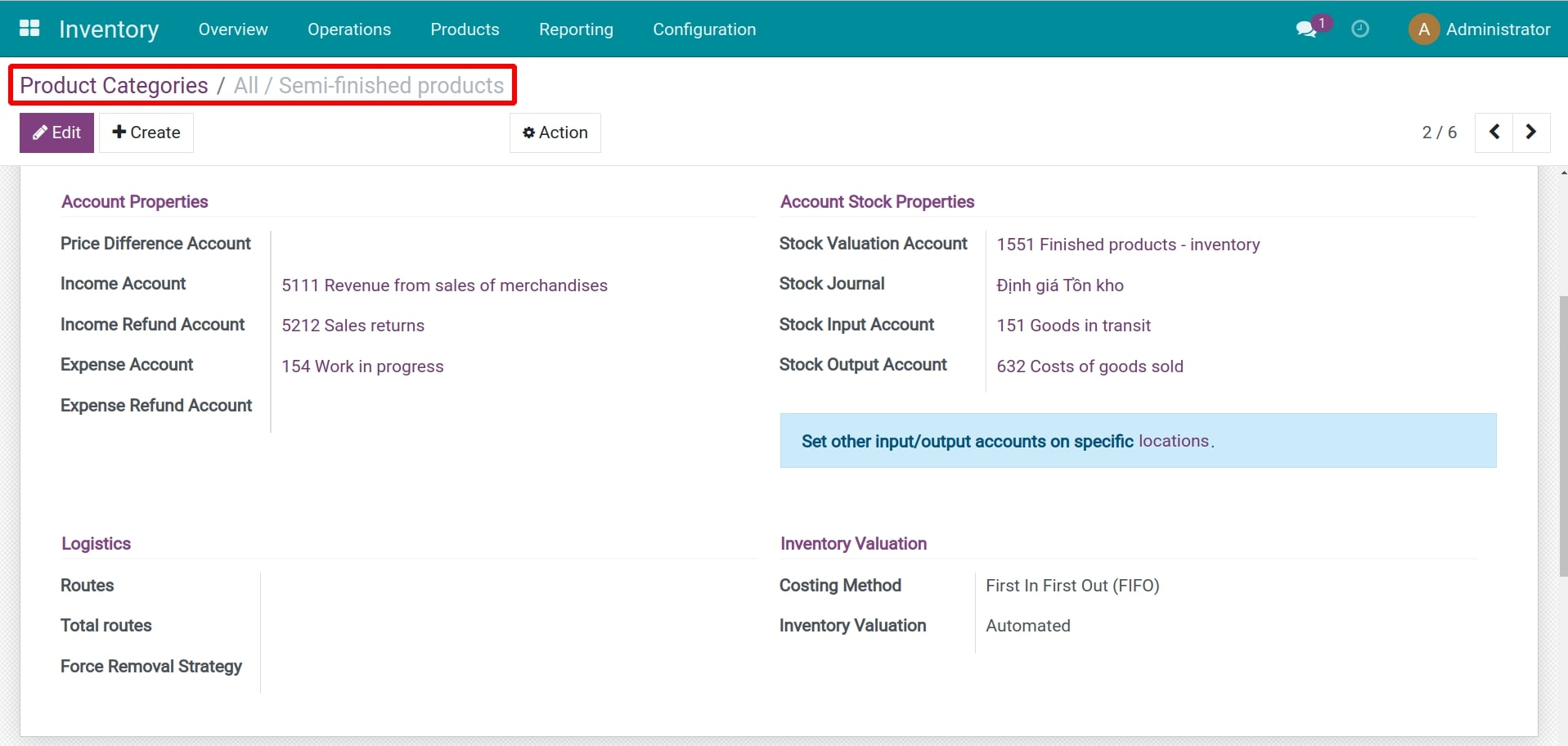

Semi-finished products category:

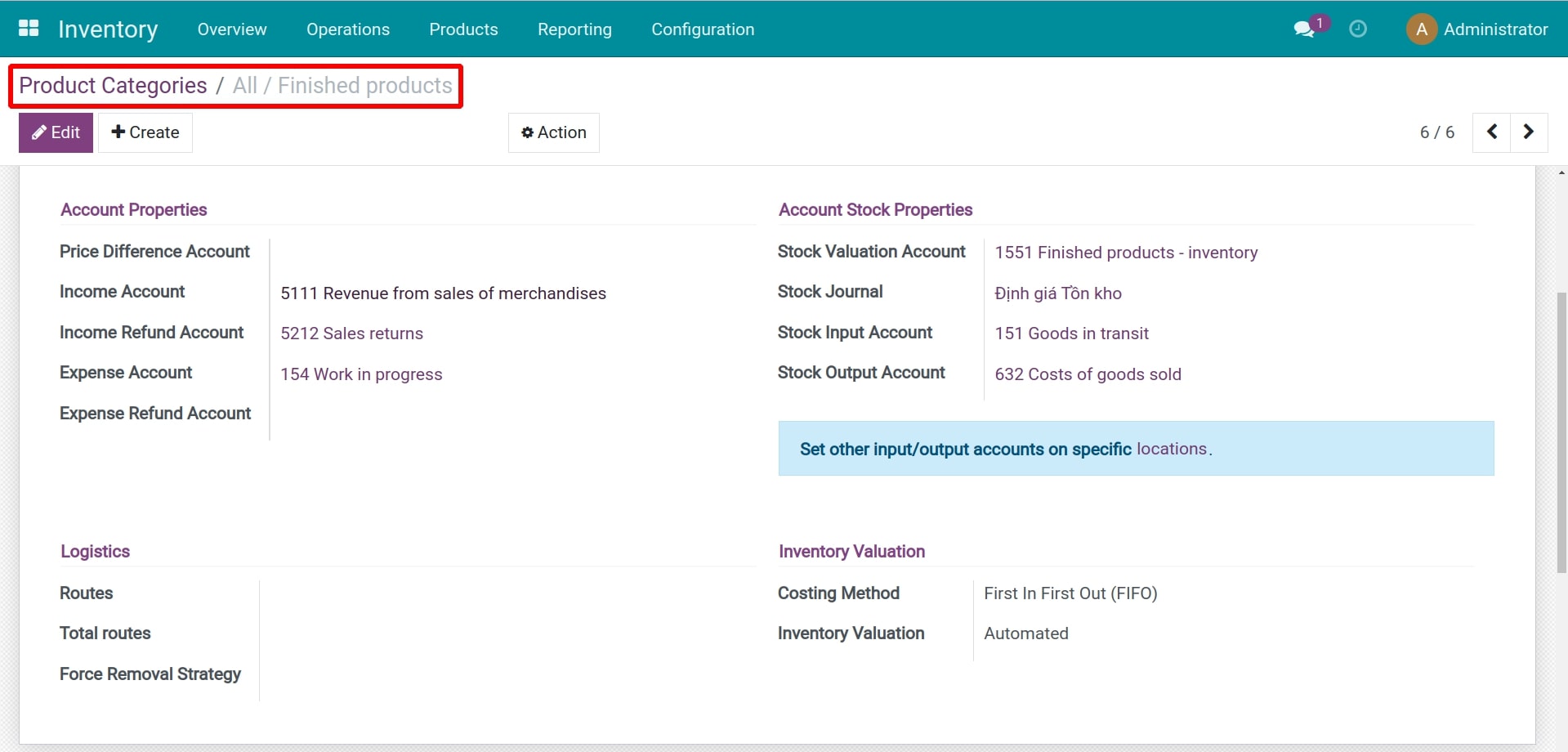

Finished products category:

Configure accounting accounts on the production location¶

A production location is a place where semi-finished and finished products are produced from raw materials. The creation time of these production-related journal entries corresponds to the moment raw materials are transformed into semi-finished and finished products. You need to do the following steps:

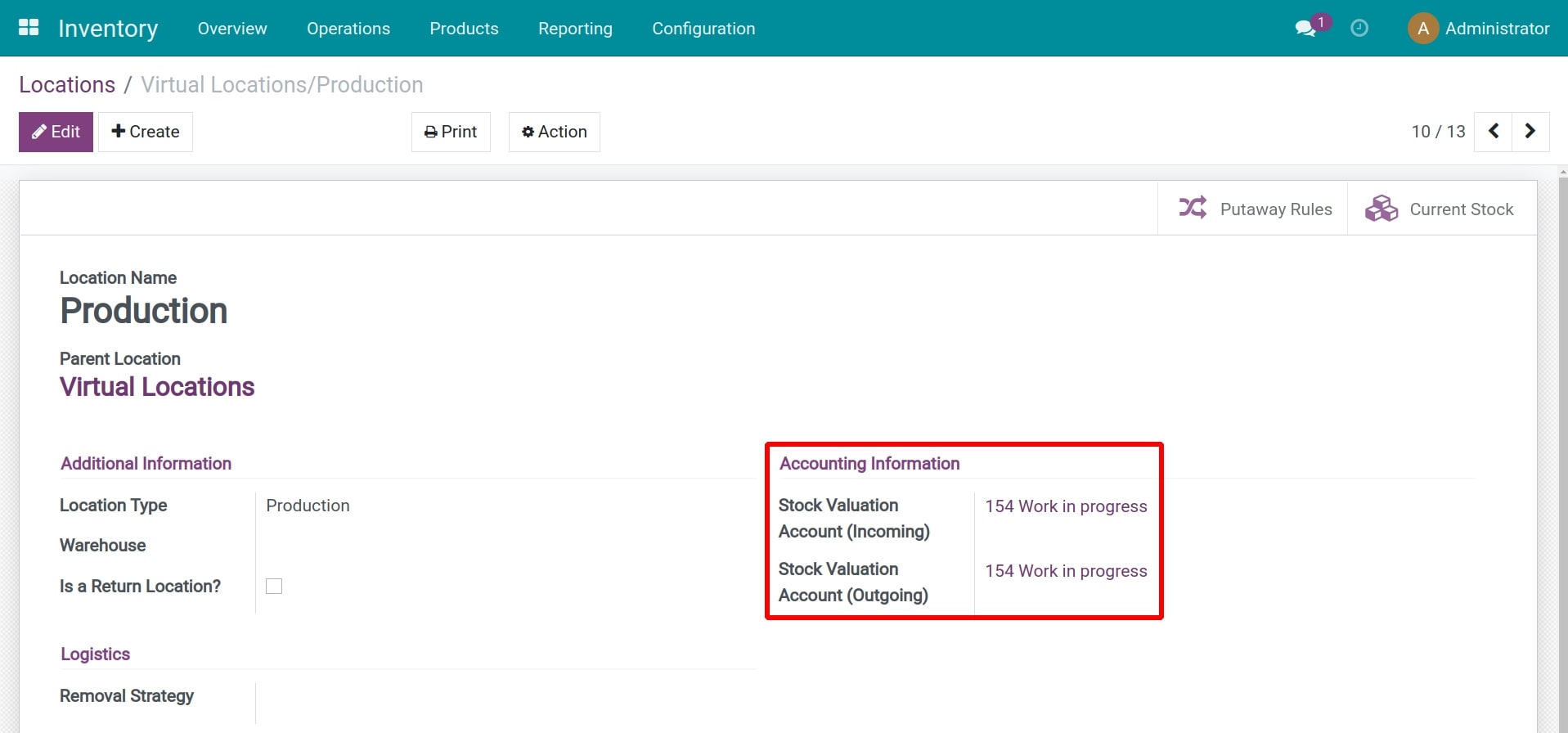

Navigate to Inventory > Configuration > Location, turn off the default filters, select the location type as Production and fill in the accounting accounts in the Accounting Information section:

This setting allows the system to automatically make journal entries to the Work in Progress account when:

Transfer the materials to production locations. E.g: Debit (DR) Work in Progress account/Credit (CR) Raw materials account.

Record the semi-finished or finished products. E.g: DR Finished products account/CR Work in Progress account.

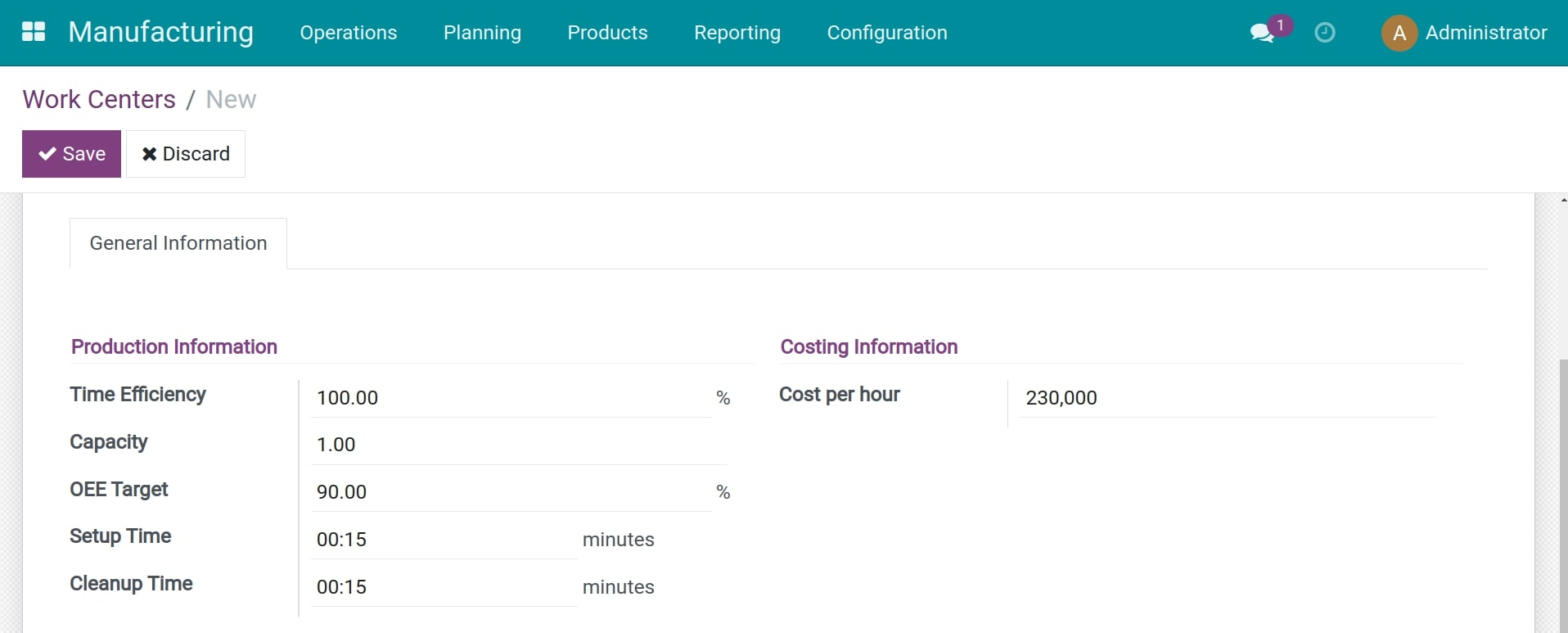

Configure the cost information on the Work center¶

See details about the configuration of the cost information on the Work center.

Note

- The cost per hour of the work center is estimated based on the costing method of each enterprise, it could be:

Costs per hour of the direct production workers (including salary, bonus, other benefits, etc.)

Costs of the production machines (fuel, depreciation per hour, maintenance and repair costs allocated by running hours, etc.) used for each stage.

From time to time, businesses can adjust this cost according to their demand.

Production cost accounting¶

The typical manufacturing process for finished products includes the following steps: produce semi-finished products from raw materials, then produce finished products from these semi-finished products and other raw materials.

For example, in a table manufacturing company, there are 2 steps to produce a table:

Step 1: Transfer wood materials from stock for the production of semi-finished products such as Table legs, Table surfaces and then store the semi-finished products in stock.

Step 2: Transfer semi-finished products - Table legs and Table surface to manufacture the finished product and store them in a warehouse.

Step 1: Transfer wood materials from stock for the production of semi-finished products such as Table legs, Table surfaces, and then store the semi-finished products in stock.

To manufacture semi-finished products, refer to the Manage the manufacturing of the semi-finished products article.

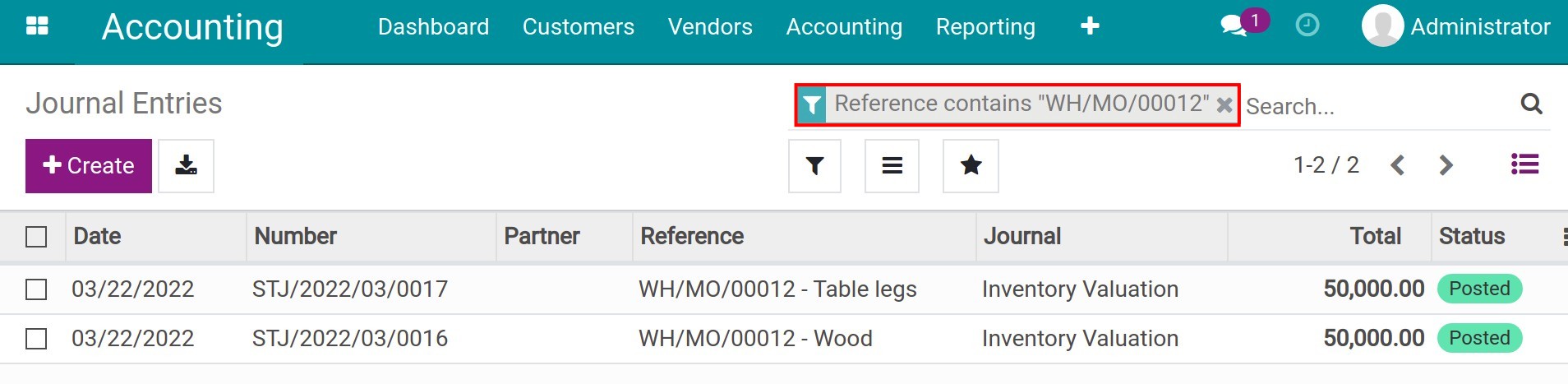

After finishing the semi-finished product production process, navigate to Accounting > Accounting > Journal Entries and use the filter tool: Reference contains the manufacturing order of the semi-finished products.

Accounting entries related to the work orders for the semi-finished products are:

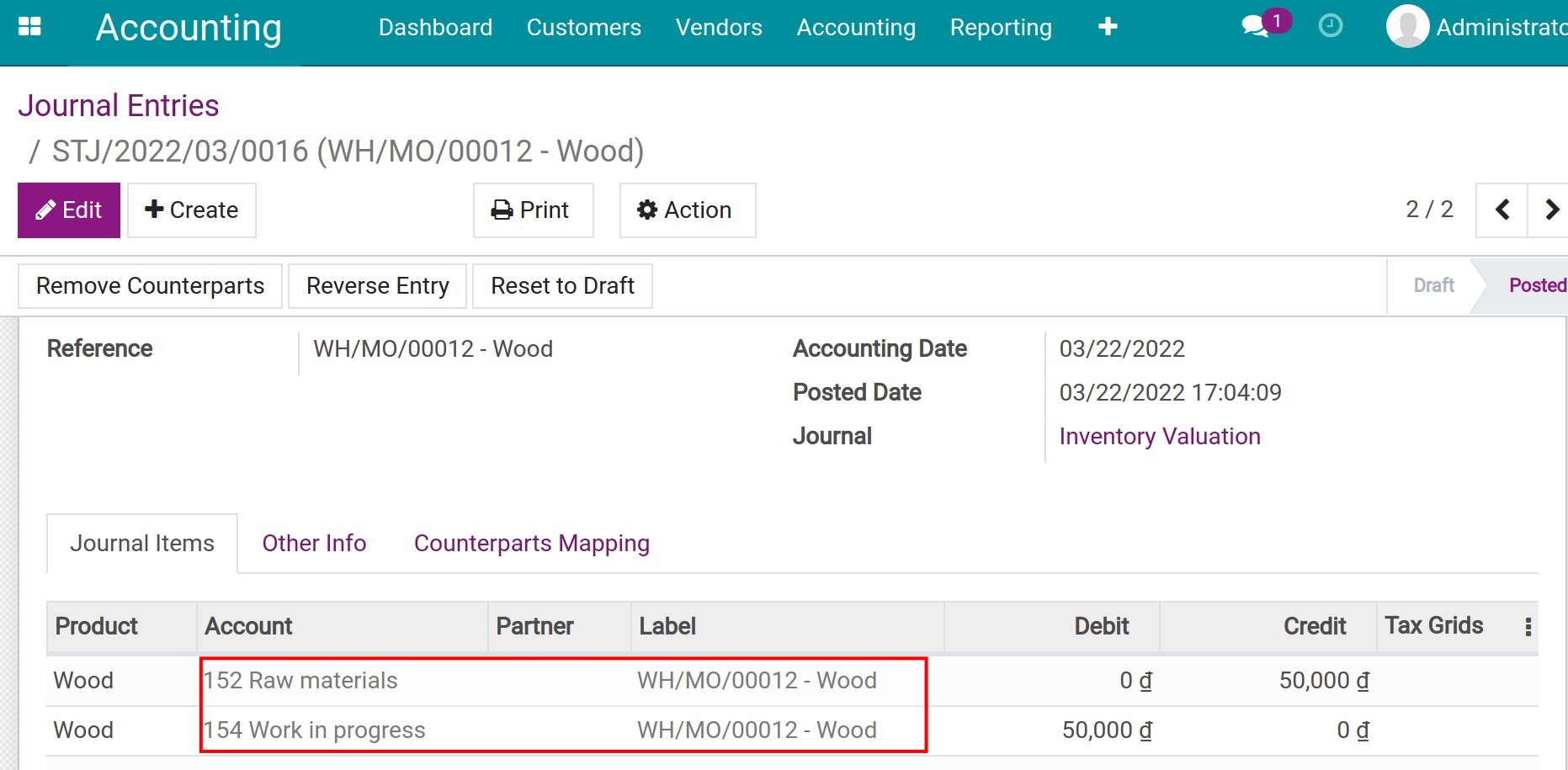

Transfer raw materials which are Wood and Wood panel to manufacture:

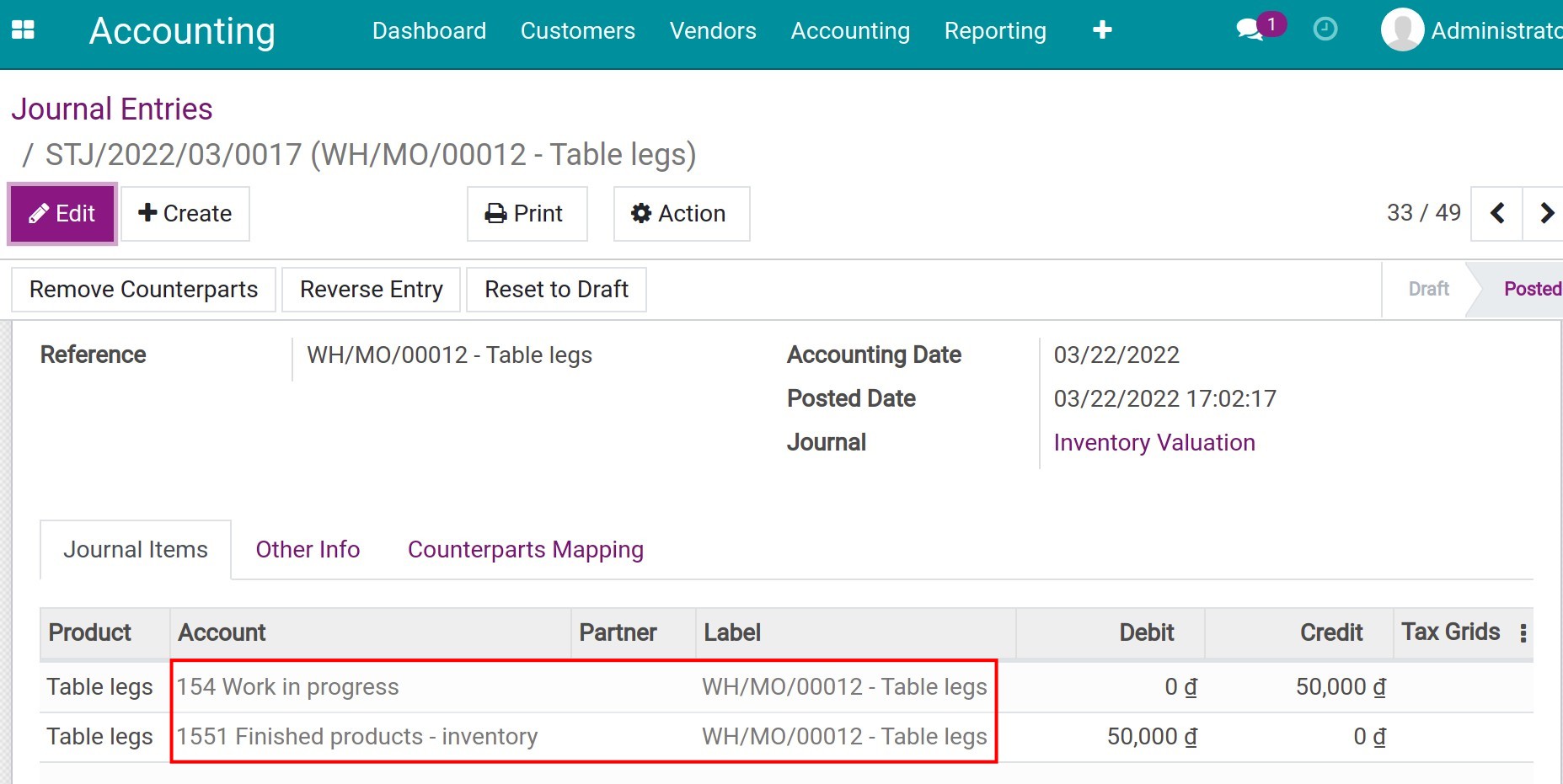

Transfer the semi-finished products which are Table legs and Table surfaces to the warehouse:

Step 2: Transfer semi-finished products - Table legs and Table surfaces to manufacture finished products and store them in a warehouse.

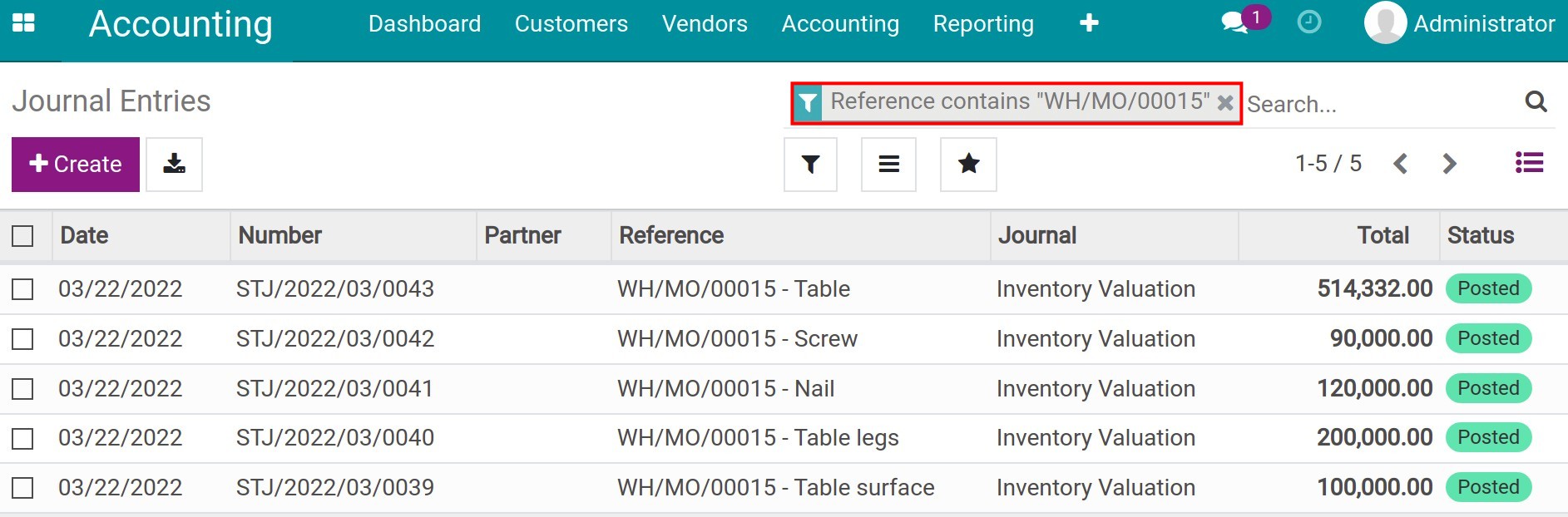

Similar to the managing and manufacturing process of the semi-finished products, when the production process of the finished products has been marked as Done, navigate to Accounting > Accounting > Journal Entries and use the filter: Reference contains the manufacturing order of the finished products.

Accounting entries related to the work orders for the finished products include:

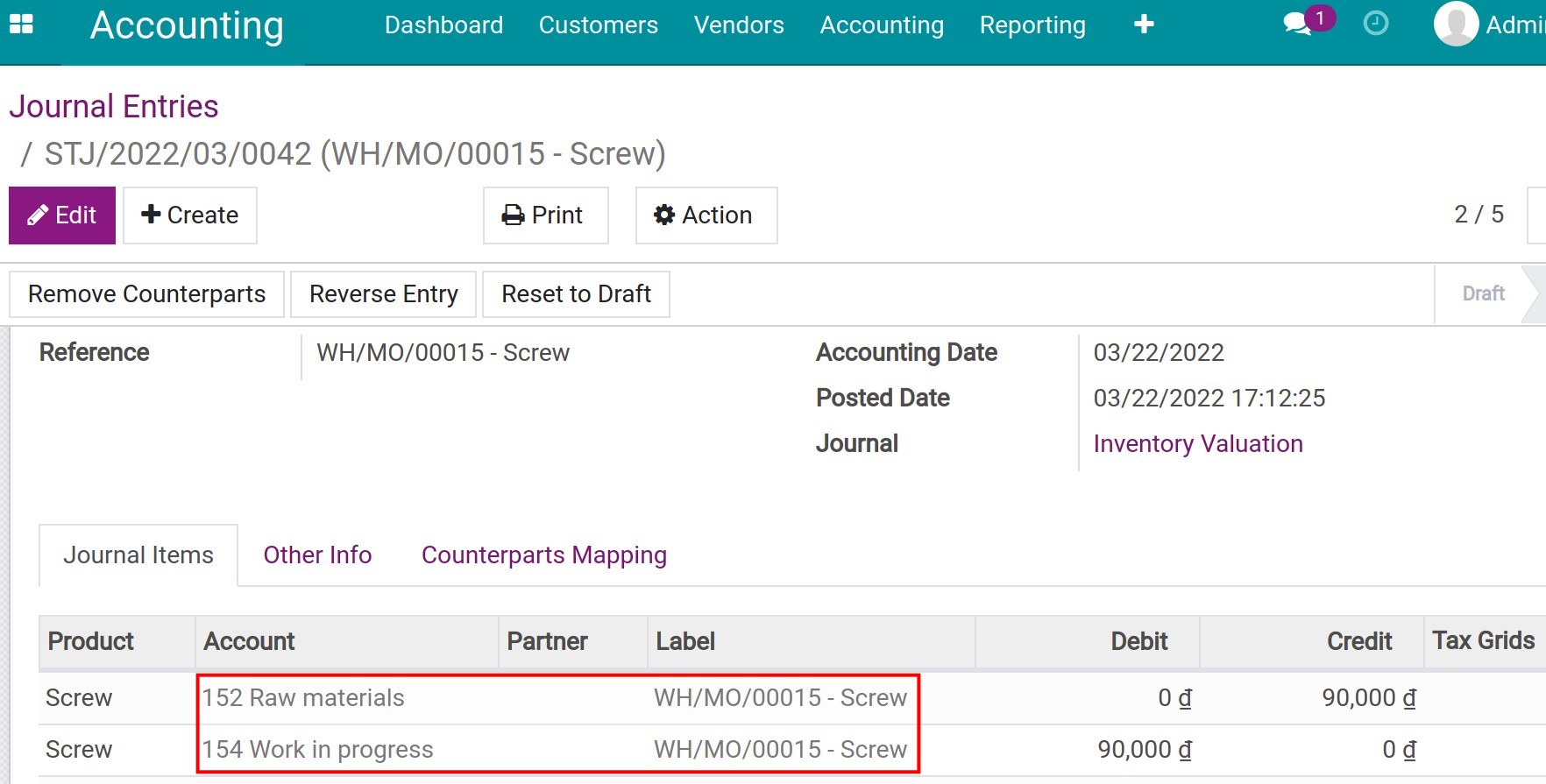

Transfer the materials which are Screw and Nail to manufacture the Table:

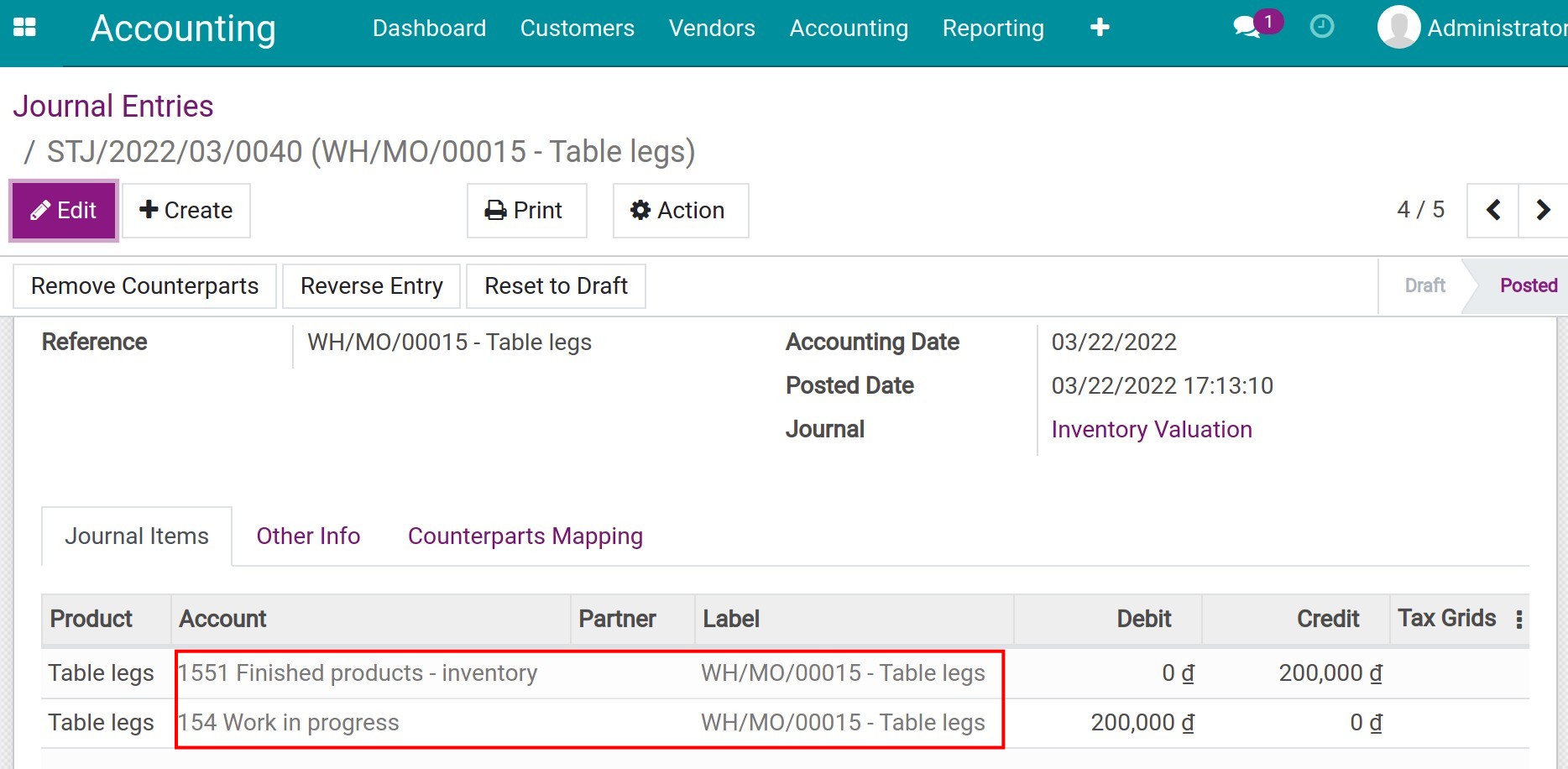

Transfer the semi-finished products which are Table legs and Table surfaces to manufacture the Table:

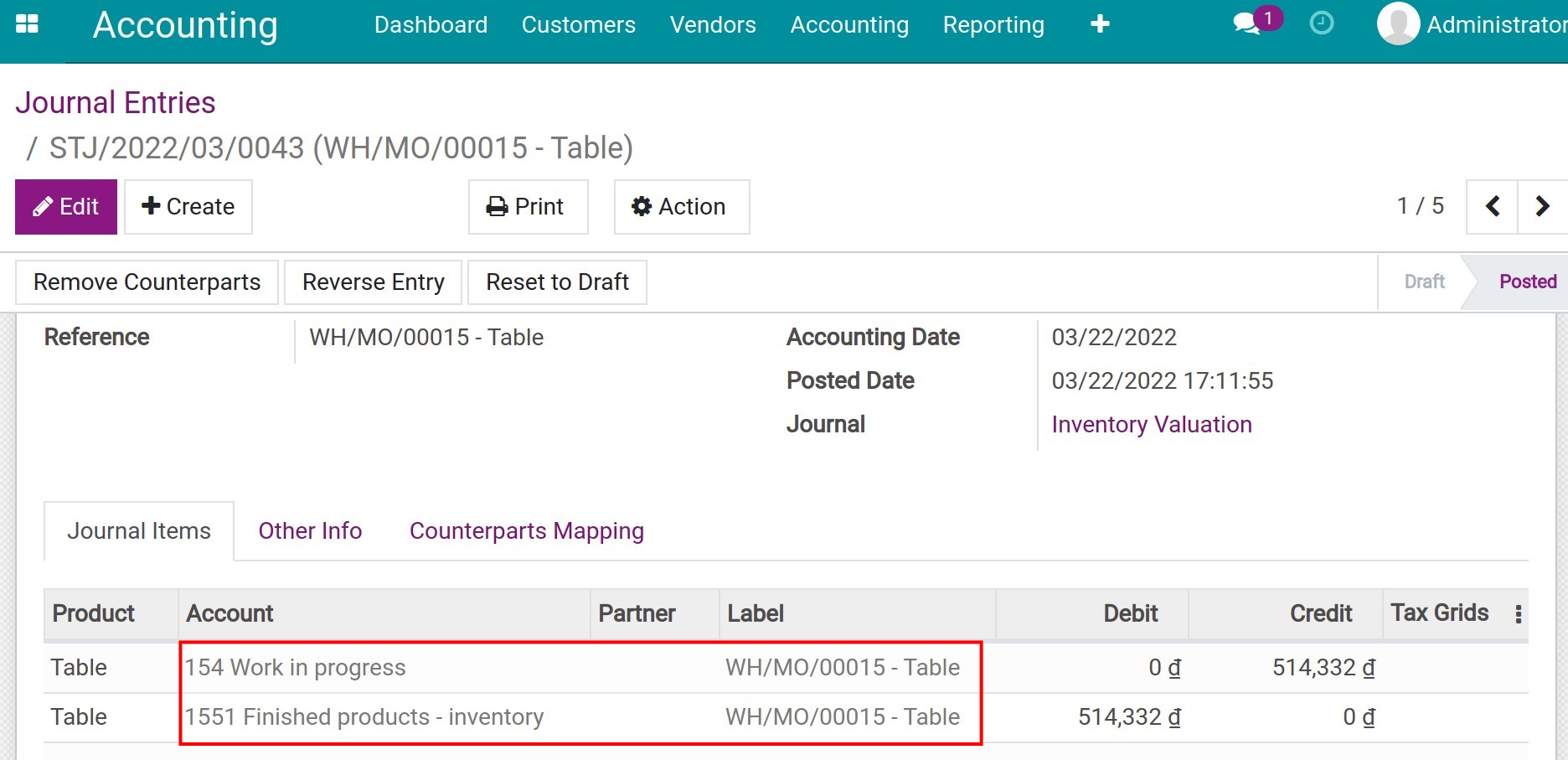

Transfer the finished product - Tables to the warehouse:

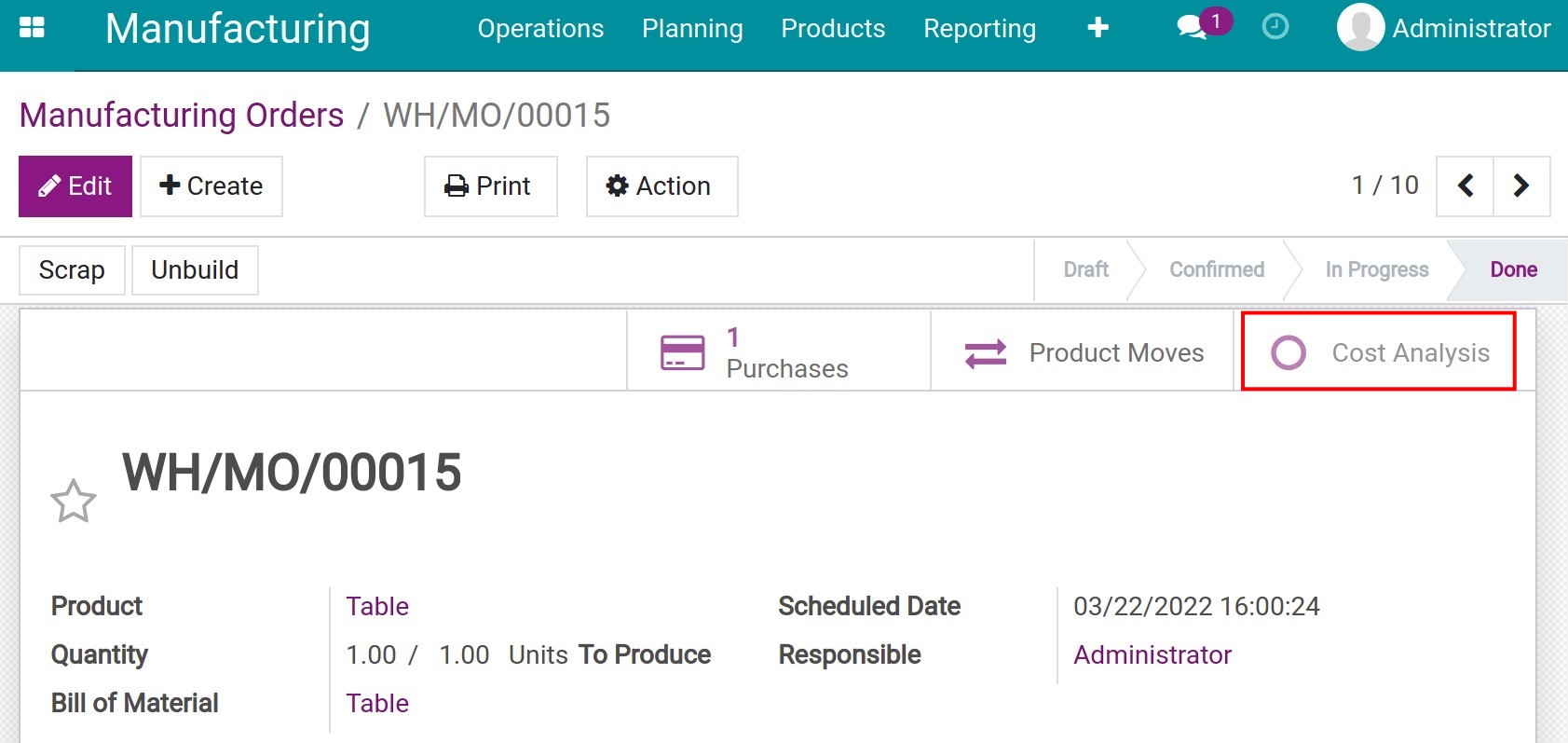

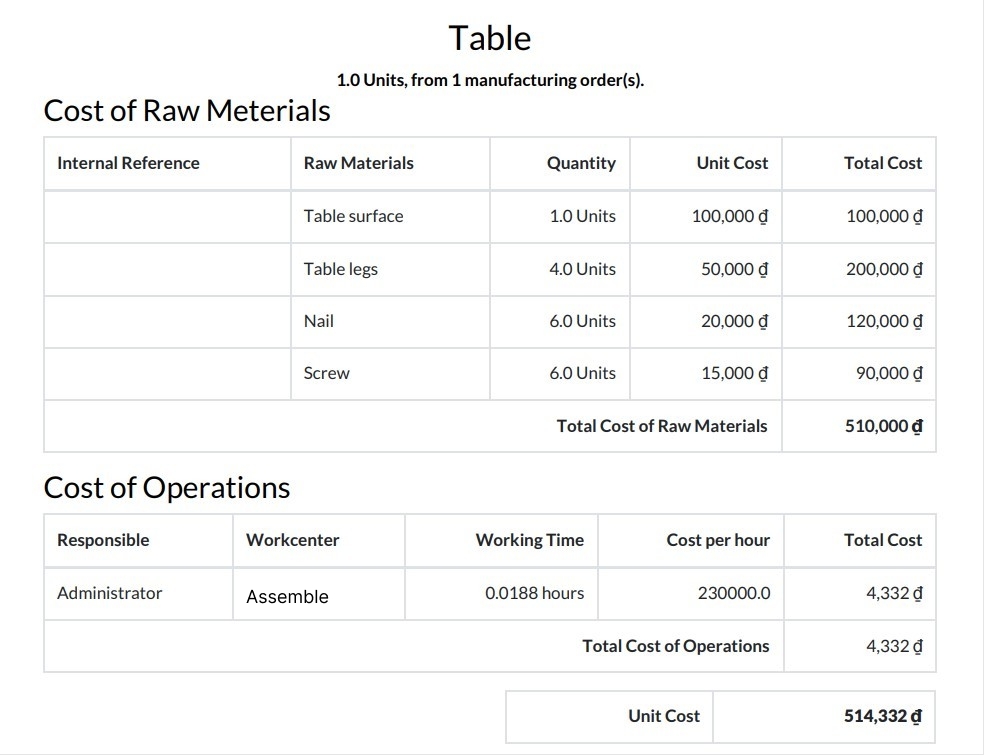

Navigate to Manufacturing > Operations > Manufacturing Orders, turn off the default filter, select the manufacturing order of the Table, then click on Cost Analysis.

The system will automatically calculate detailed costs that occurred during the production of the finished products.

See also

Related article

Optional module