Configuration taxes on import/export¶

Import taxes configuration¶

The import taxes includes:

Import tax;

Excise tax;

Environmental tax;

Value added tax (VAT); etc.

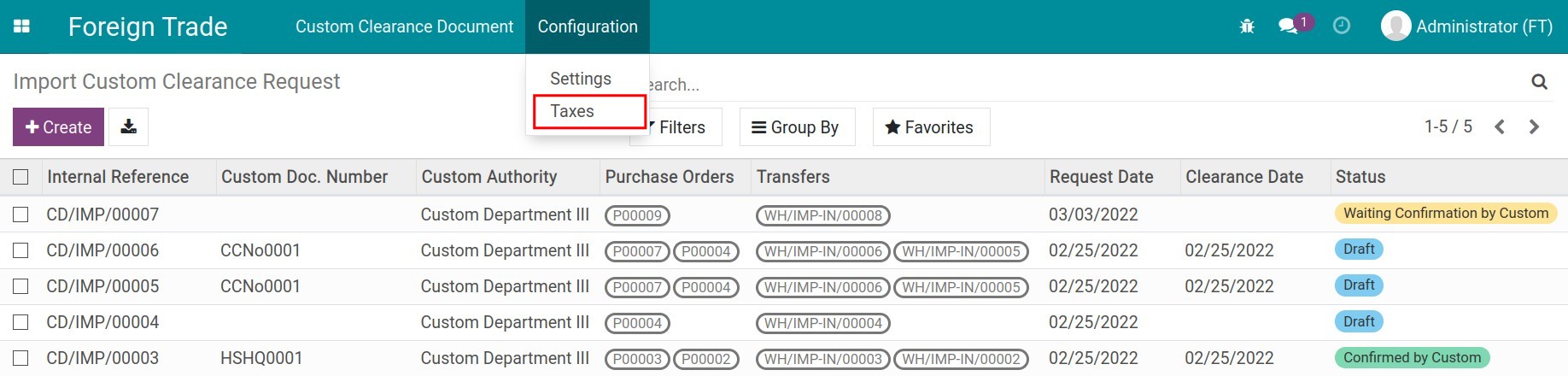

To create a new tax, you navigate to Foreign Trade > Configuration > Taxes.

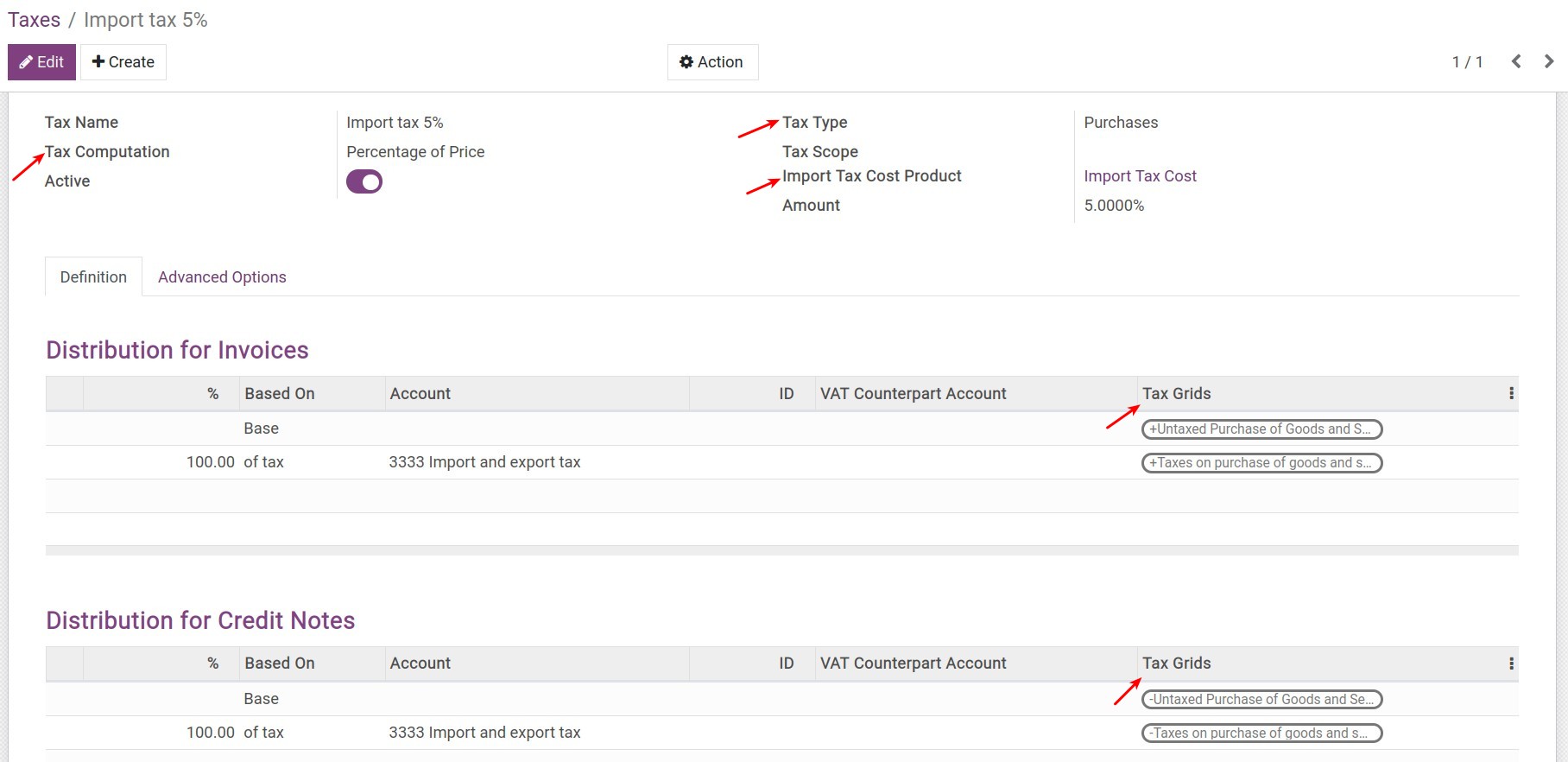

Clicking on the Create button and follow the steps in this article Taxes and tax rules configuration. With taxes applied in import, you will need to pay attention to the following information fields:

General information area:

Tax Computation: Select the tax calculation as Percent of Price.

Tax Type: Select the Purchases option.

Import Tax Cost Product: When the Tax Type you selected above is Purchases, the system will automatically suggest an Import Tax Cost Product. This product is used to record the related import expenses or the landed costs.

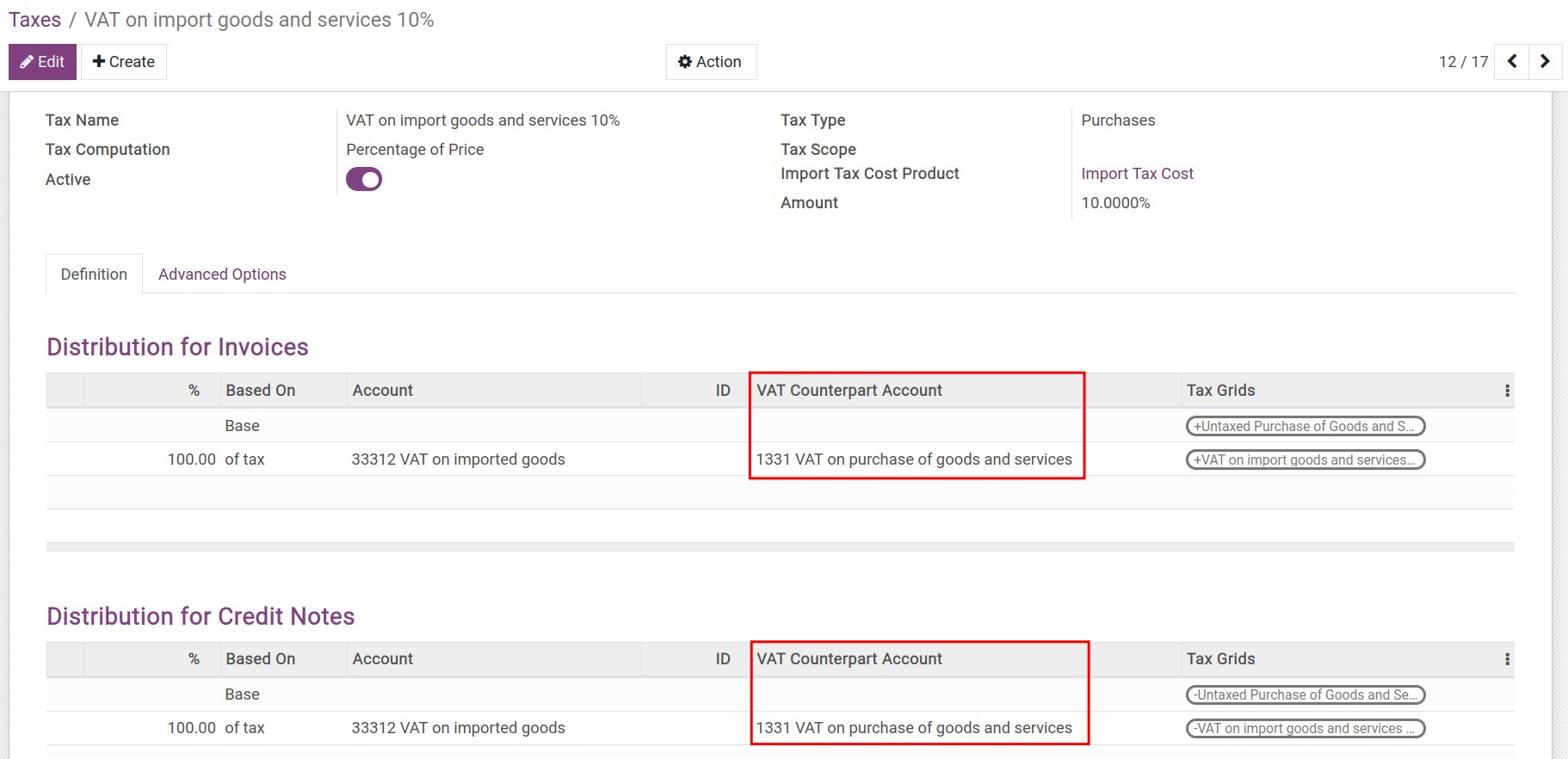

Definition tab:

Account: Select an account corresponding to the taxes.

VAT Counterpart Account: No configuration required.

Tax Grids: Select the corresponding tax grid for the taxable value and the tax value. In case the system does not have the necessary tax grids, you can create a new tax grid.

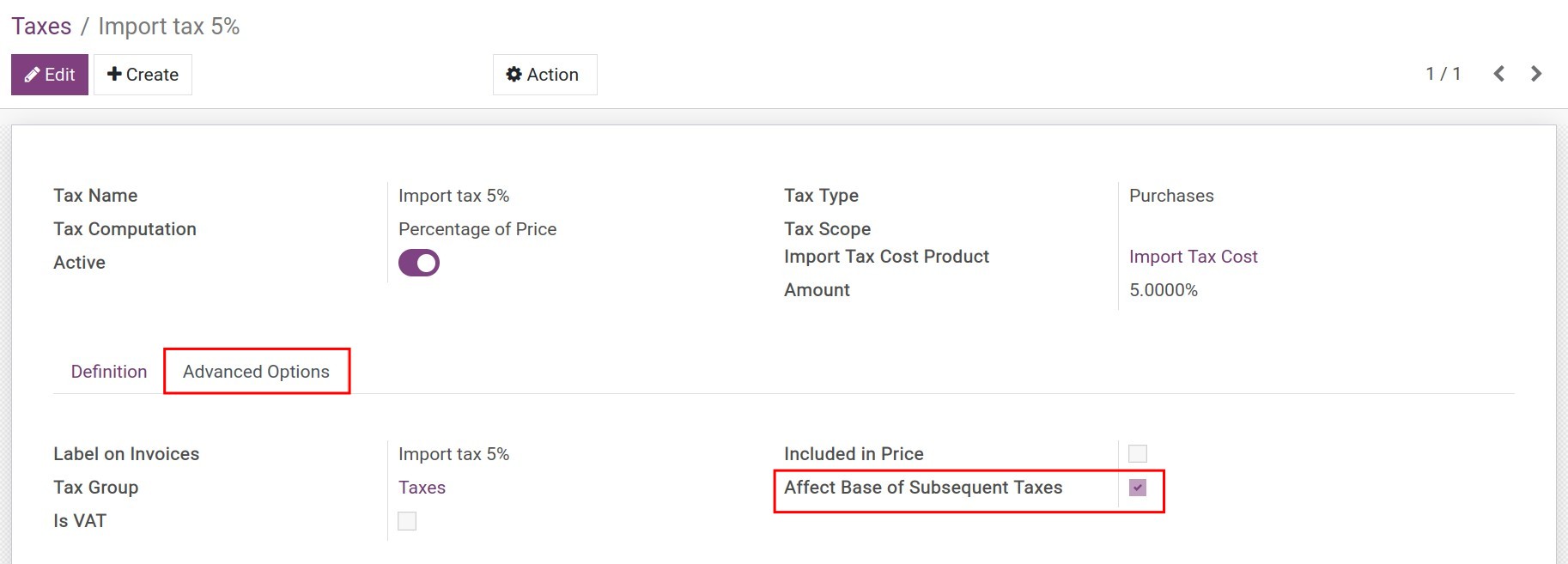

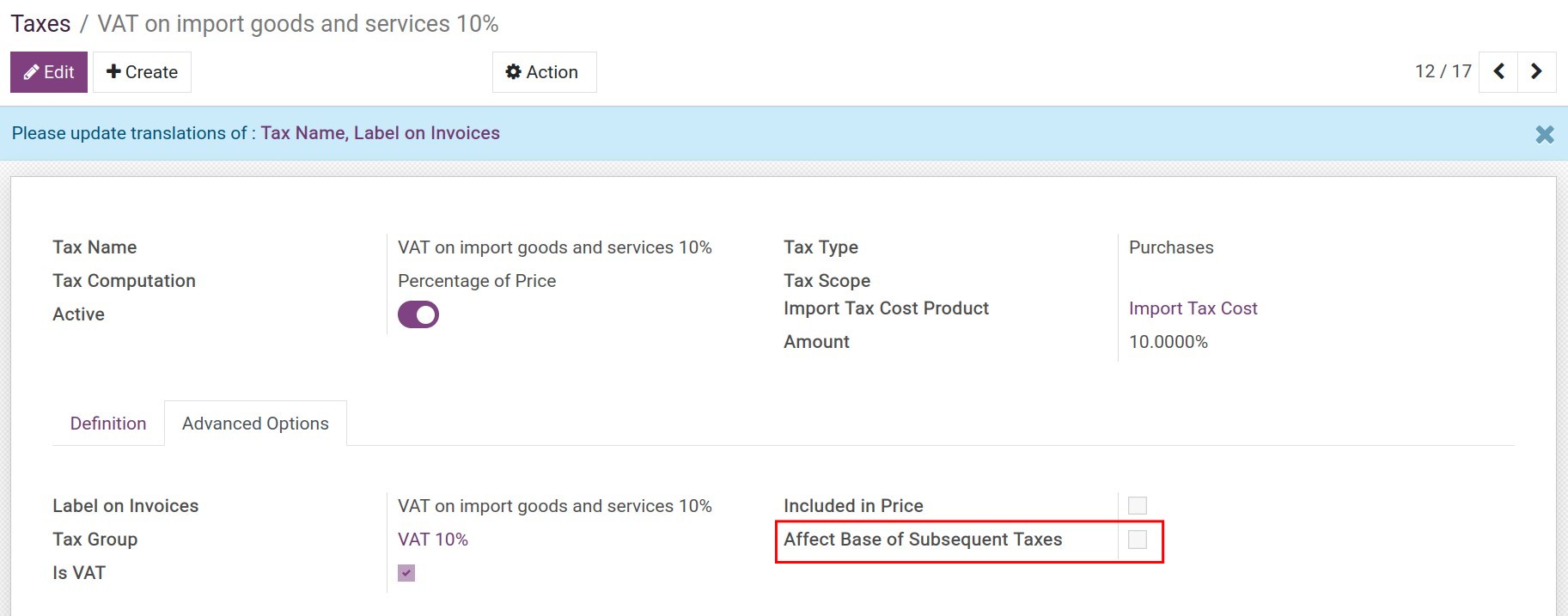

Advanced Options tab:

Activate the Affect Base of Subsequent Taxes feature. Depending on the tax calculation sequence, the following taxes are calculated according to the taxable value and the tax rates of the previous taxes. For Instance: Taxes such as excise tax, environmental tax, etc., if these taxes are being applied, those values will be calculated based on the dutiable value which included the import tax.

Tip

To arrange the calculation order of taxes, simply sort them in the list of taxes. The tax which is calculated first will be put on first by the drag and drop feature.

Value-Added Taxes (VATs) configuration¶

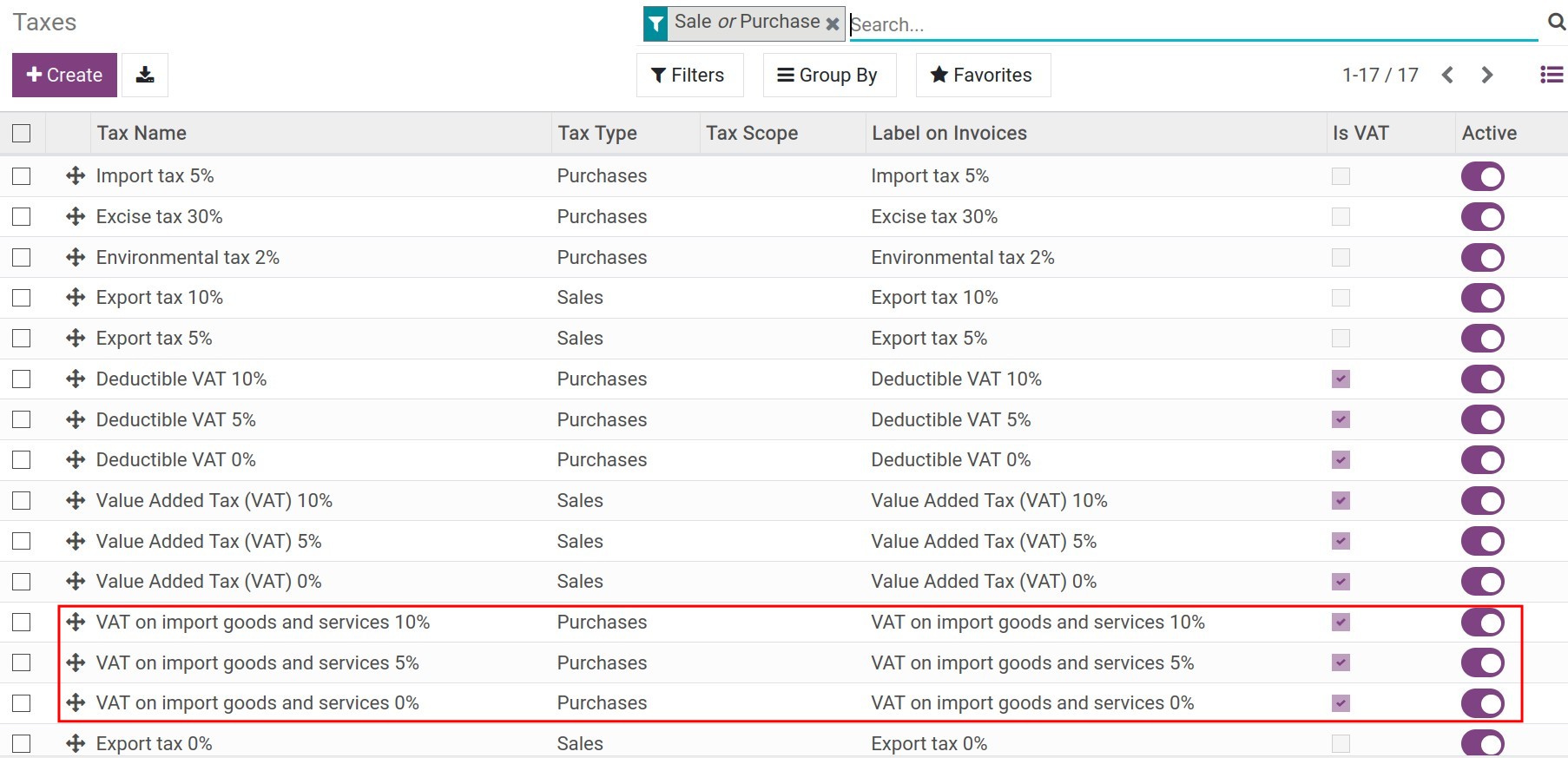

The system had already been created for you some of default VATs on the imported goods. You navigate to Foreign Trade > Configuration > Taxes to view:

However, depending on the localization of your company, you will need to configure a VAT Counterpart Account. The selected account in this field is for the entry of the VAT on the imported goods.

In addition, with the VAT on the imported goods, you will not need to activate the Affect Base of Subsequent Taxes feature. Because the value of this tax will be calculated after all of the taxes applicable to the imported goods.

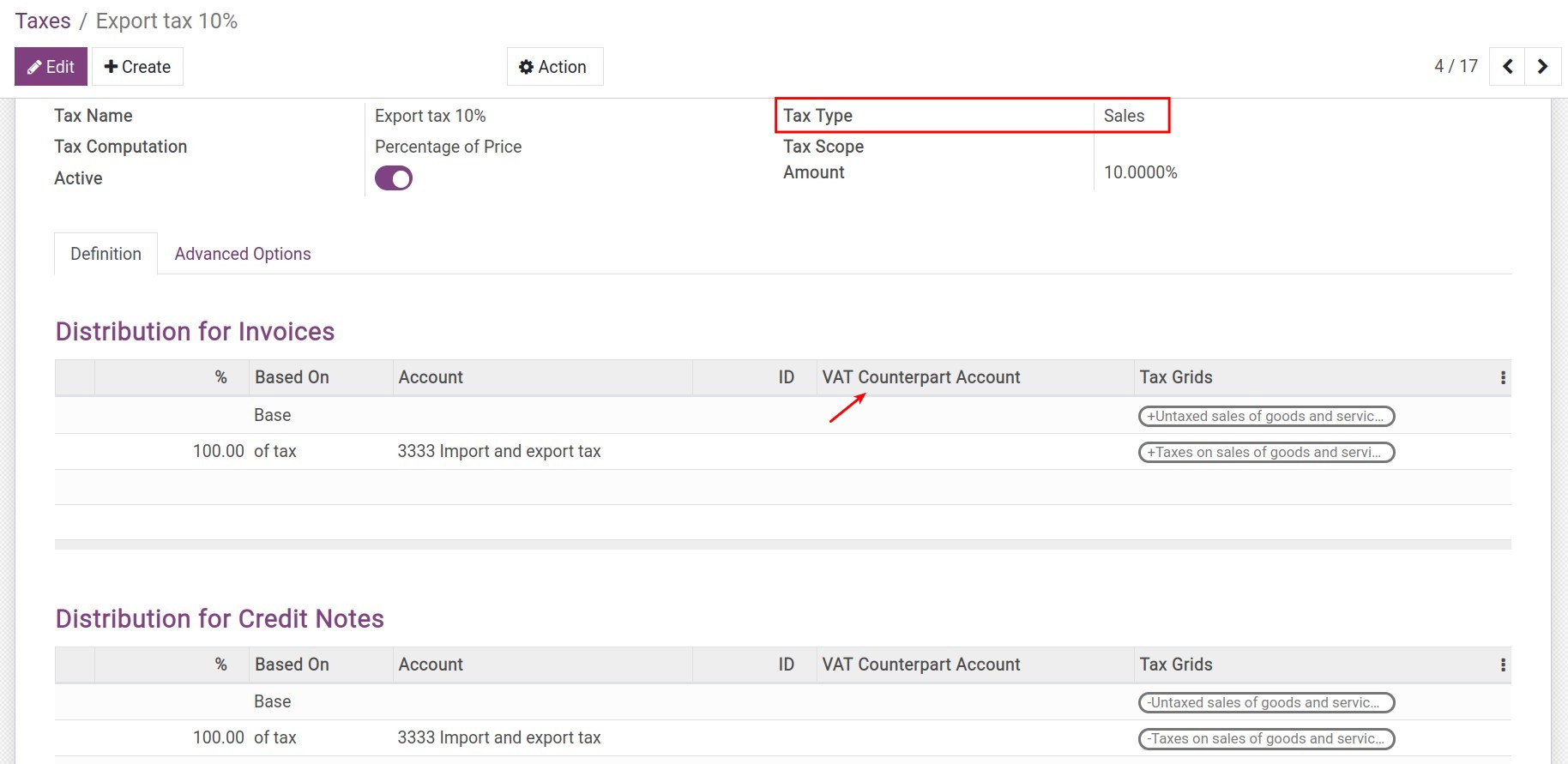

Export taxes configuration¶

Similar to the import taxes, you do the same as creating import tax, but there are some changes in the following fields:

Tax Type: Select the Sales option.

Import Tax Cost Product: This field does not appear when selecting the option above.