Getting Started with Foreign Trade¶

The Viindoo Foreign Trade & Logistics Management app is a part of Viindoo All-in-one Enterprise Management Solutions, which was built to support businesses in monitoring the import and export process of goods and assist in the calculation of costs incurred during import and export, etc.

Notable features¶

Manage foreign trade partners’ information;

Manage custom clearance documents;

Integration with the Inventory app to manage the entire goods movement related to import and export activities;

Declare import/export taxes and tax rates that can be applied by default to each product. Automatically record all the import/export costs as landed costs, track and allocate warehouses costs;

Record and allocate other costs related to the import/export activities to the cost of goods sold;

Manage tax liabilities, monitor tax payment deadlines on each declaration;

Automatically generate journal entries for each export/import operation.

How to install¶

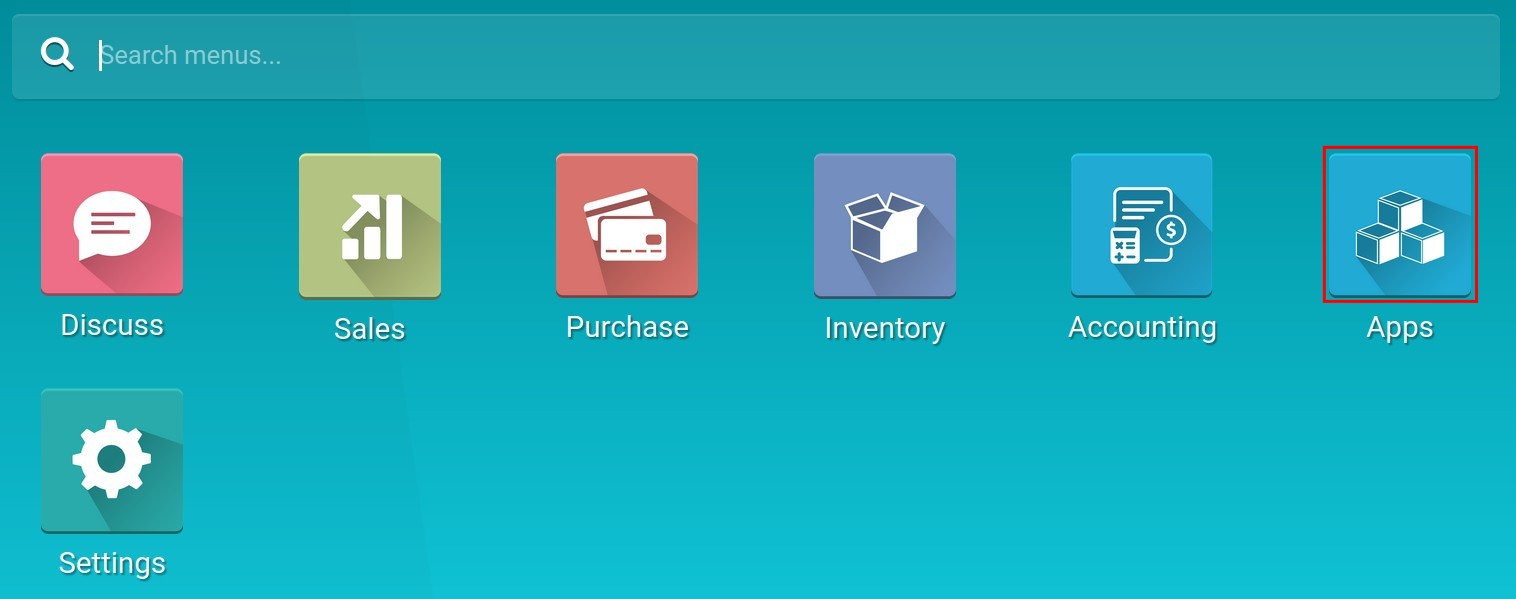

To install the Foreign Trade app, navigate to Viindoo Apps.

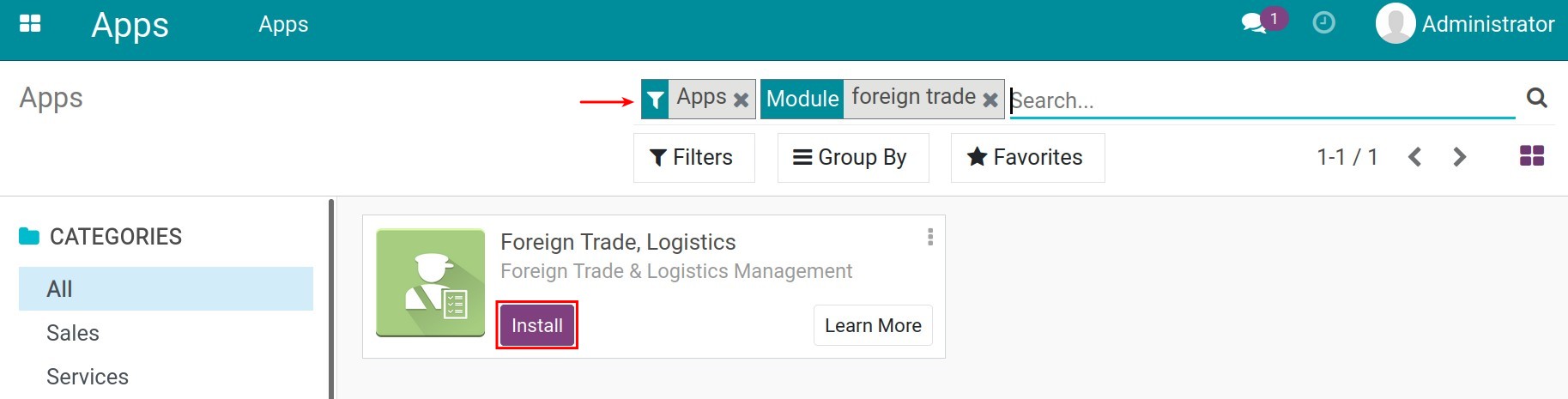

Use the search tool to look for the Foreign Trade module and install.

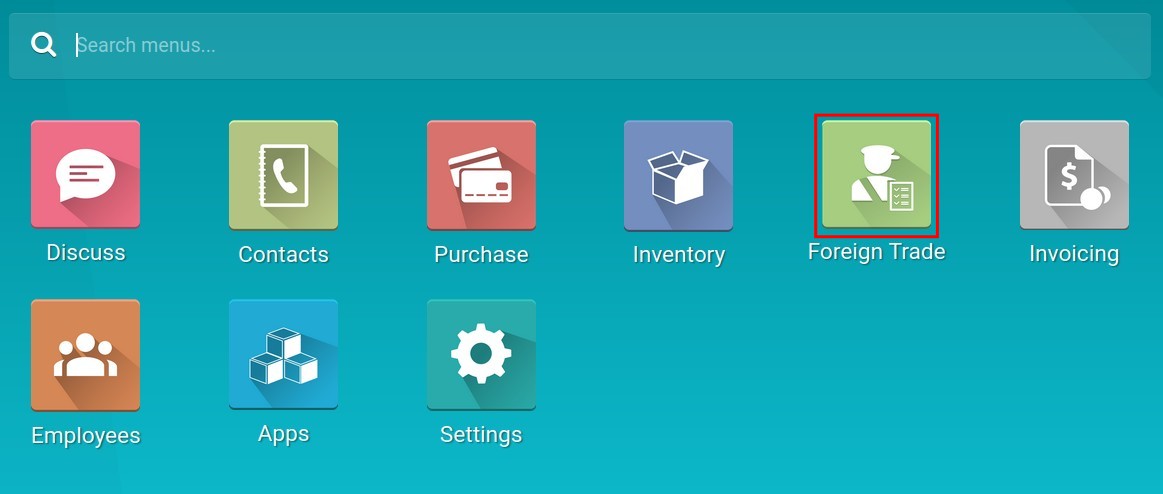

Once the installation is finished, the Foreign Trade app is displayed on the overview.

Configure access rights¶

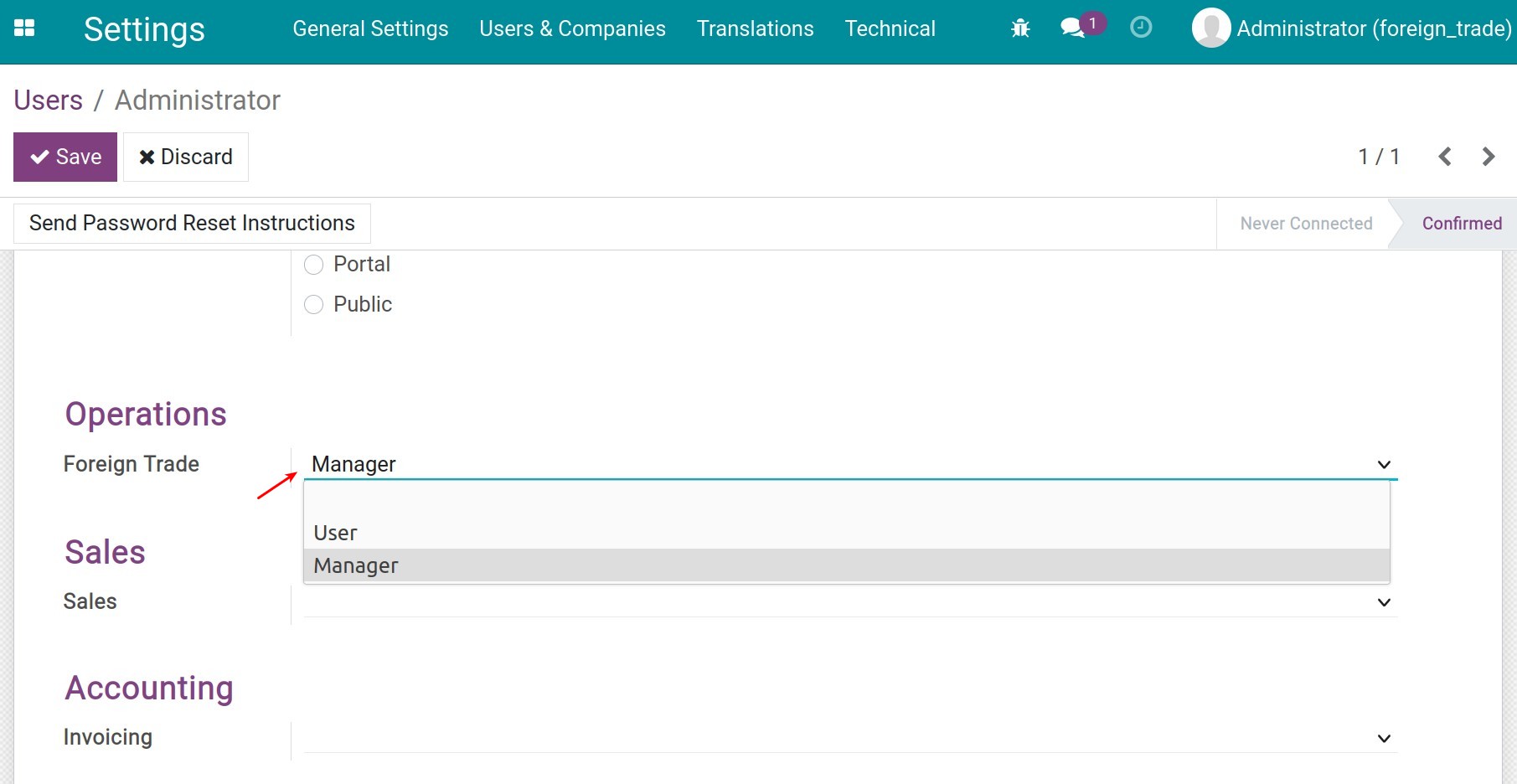

The Viindoo Foreign Trade app supports three levels of user access rights to flexibly assign responsibilities and roles in the foreign trade operations to your employees:

Empty: Cannot access and see the Foreign Trade app.

User:

Create custom clearance documents;

Can see the list of import/export taxes;

Calculate taxes value.

Manager:

Full access rights to the Foreign Trade app.

To configure the user’s access rights, navigate to Settings ‣ Users & Companies ‣ Users, choose the user account that you want to configure, go to the Access Rights tab and select the suitable rights.

General settings¶

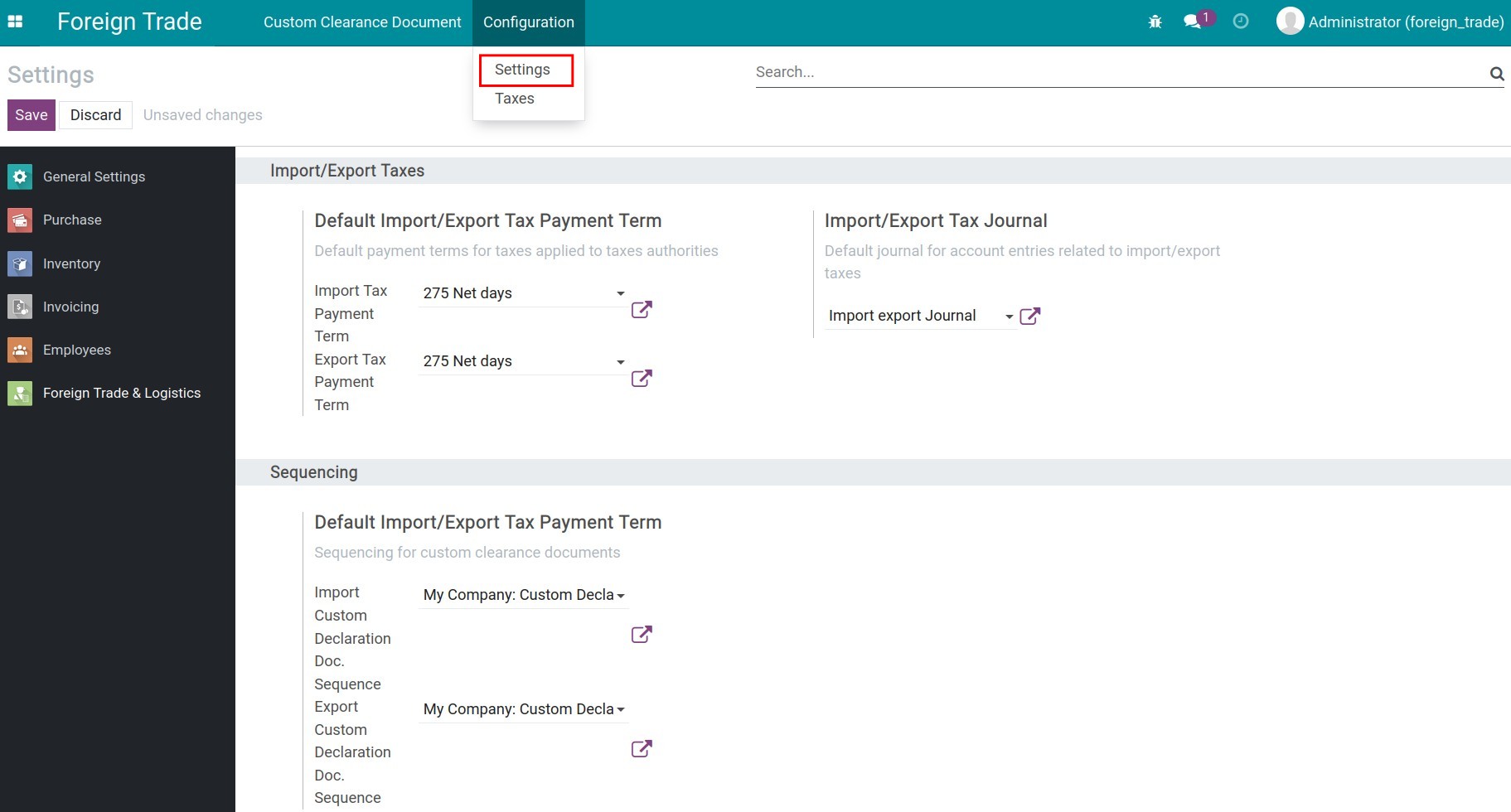

To configure the general settings for the Foreign Trade app, navigate to Foreign Trade ‣ Configuration ‣ Settings.

Import/Export Taxes:

Default Import/Export Tax Payment Term: This is where you can configure the default payment terms for taxes applied to taxes authorities.

Note

These default import/export tax payment terms will be applied to the customs clearance document when you calculate the import taxes and export taxes.

Import/Export Tax Journal: This is where you can configure the default journal for account entries related to import/export taxes. An Import/Export tax journal will be automatically generated by the system to record the account entries related to import, export taxes. Depending on the purpose and needs, you can choose or create a new journal.

Sequencing: This is where you can configure the sequence for custom clearance documents.

Note

Sequencing for import/export custom clearance documents will be automatically generated by the system. You can modify it if needed. However, keep in mind that this sequence will only affect the future documents, the existing documents still have the old sequences.