Manage taxes in a cash basis taxpayer¶

Viindoo Accounting Software provides the Cash Basis feature to help your business easily record taxes incurred when they are defined as valid according to the cash basis accounting method.

Requirements

This tutorial requires the installation of the following applications/modules:

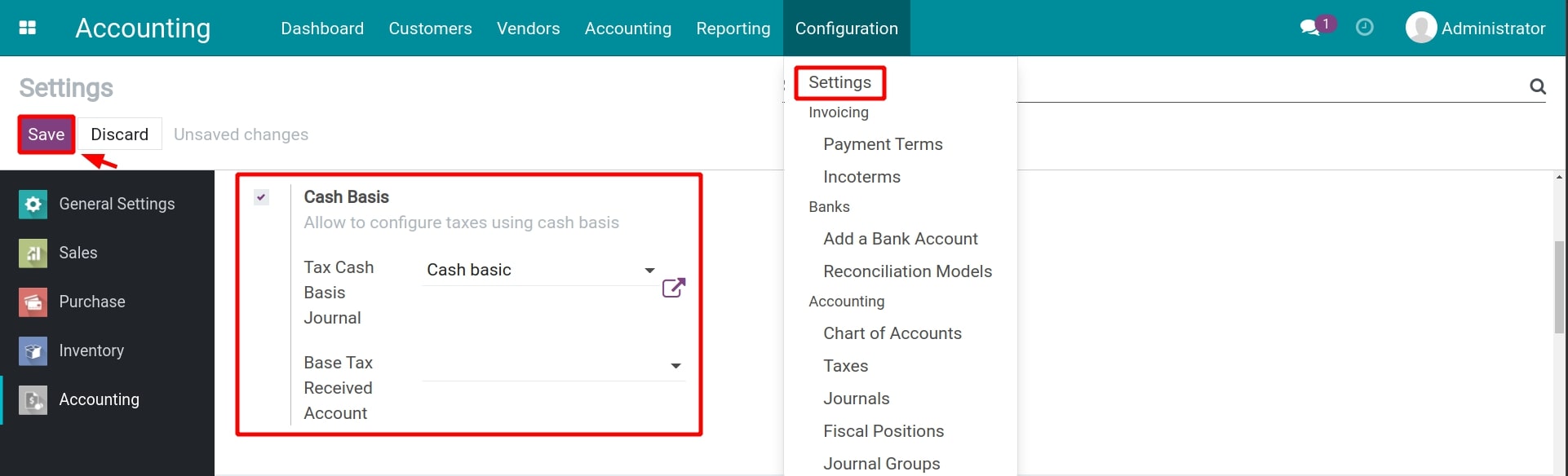

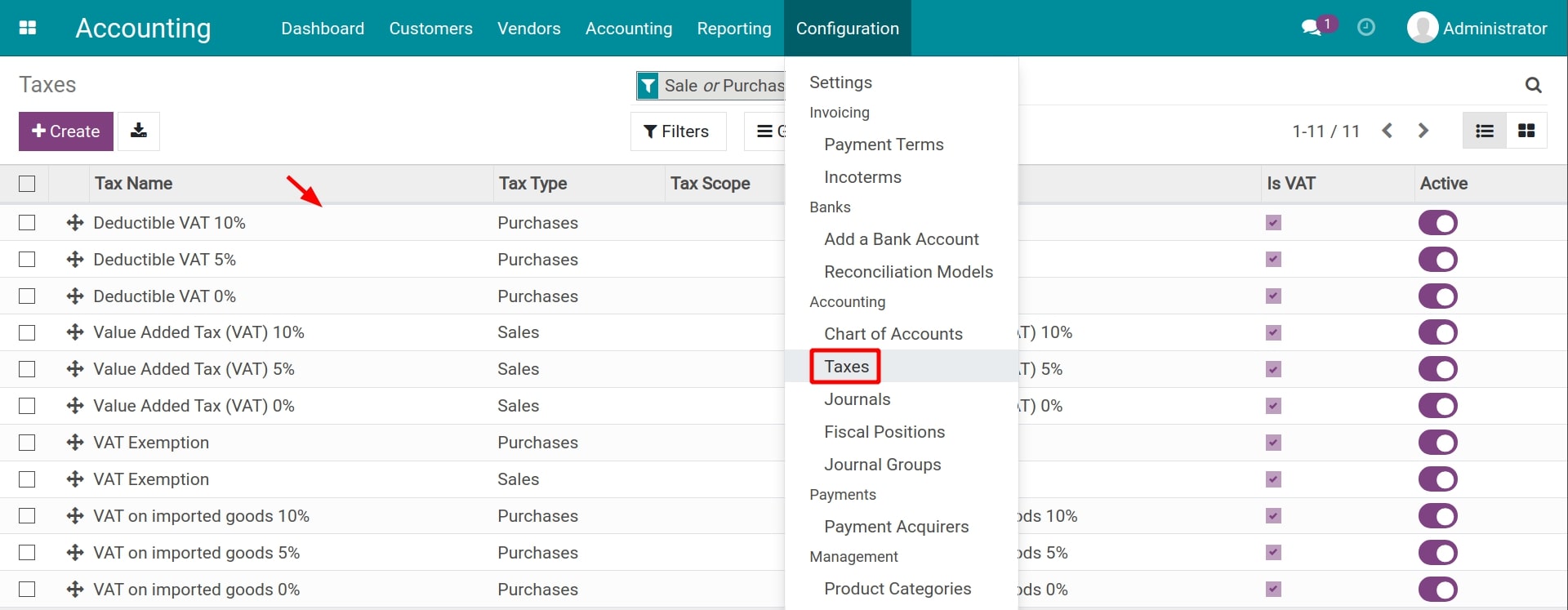

Manage cash basis taxes¶

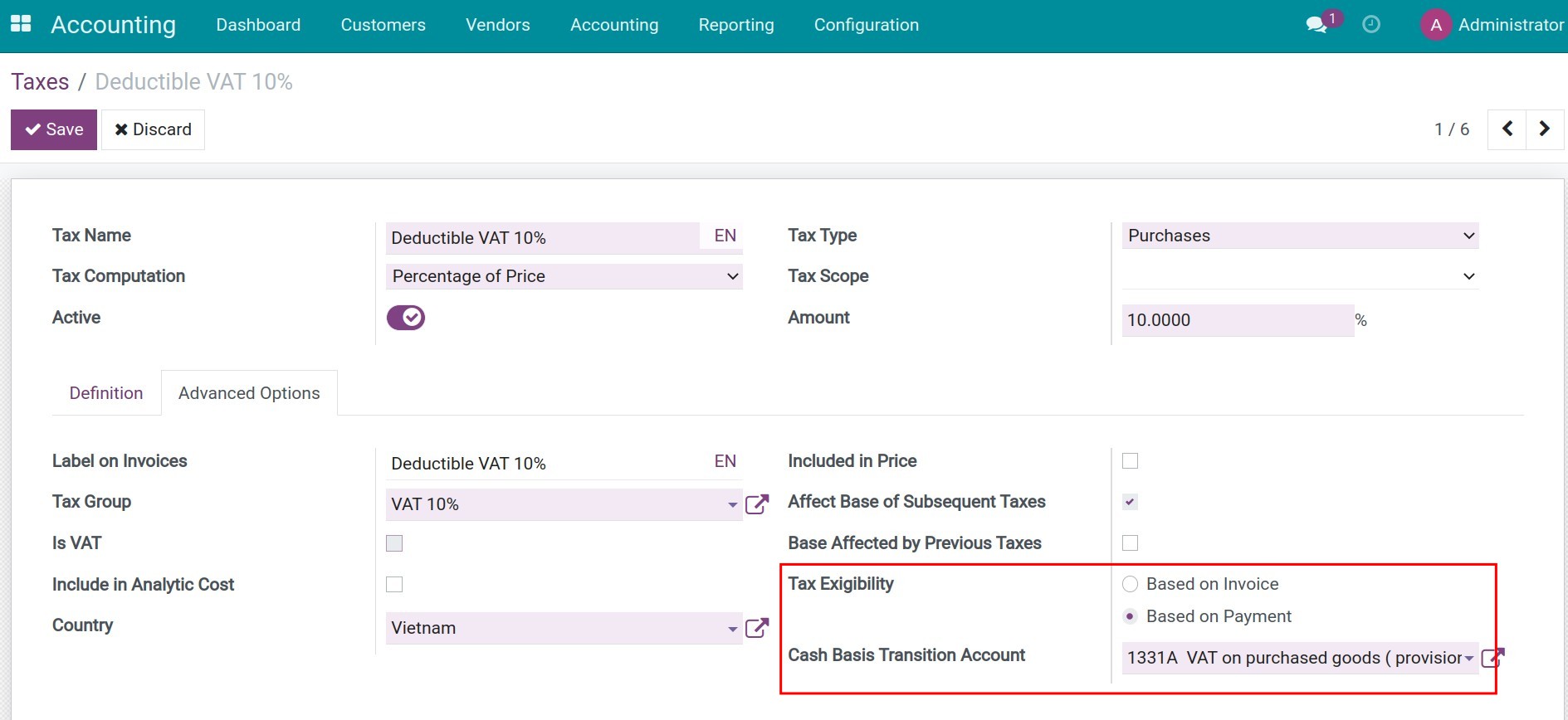

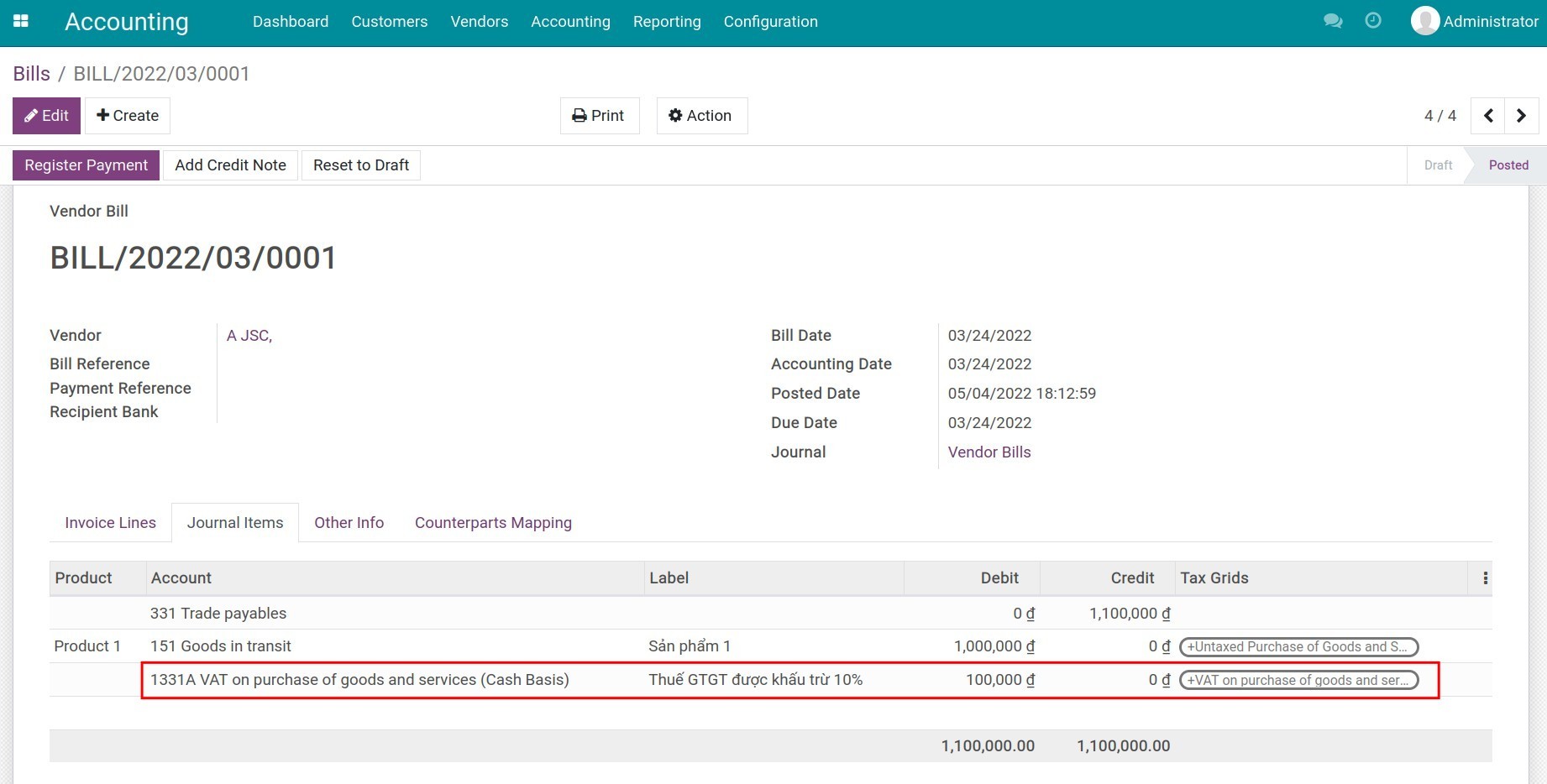

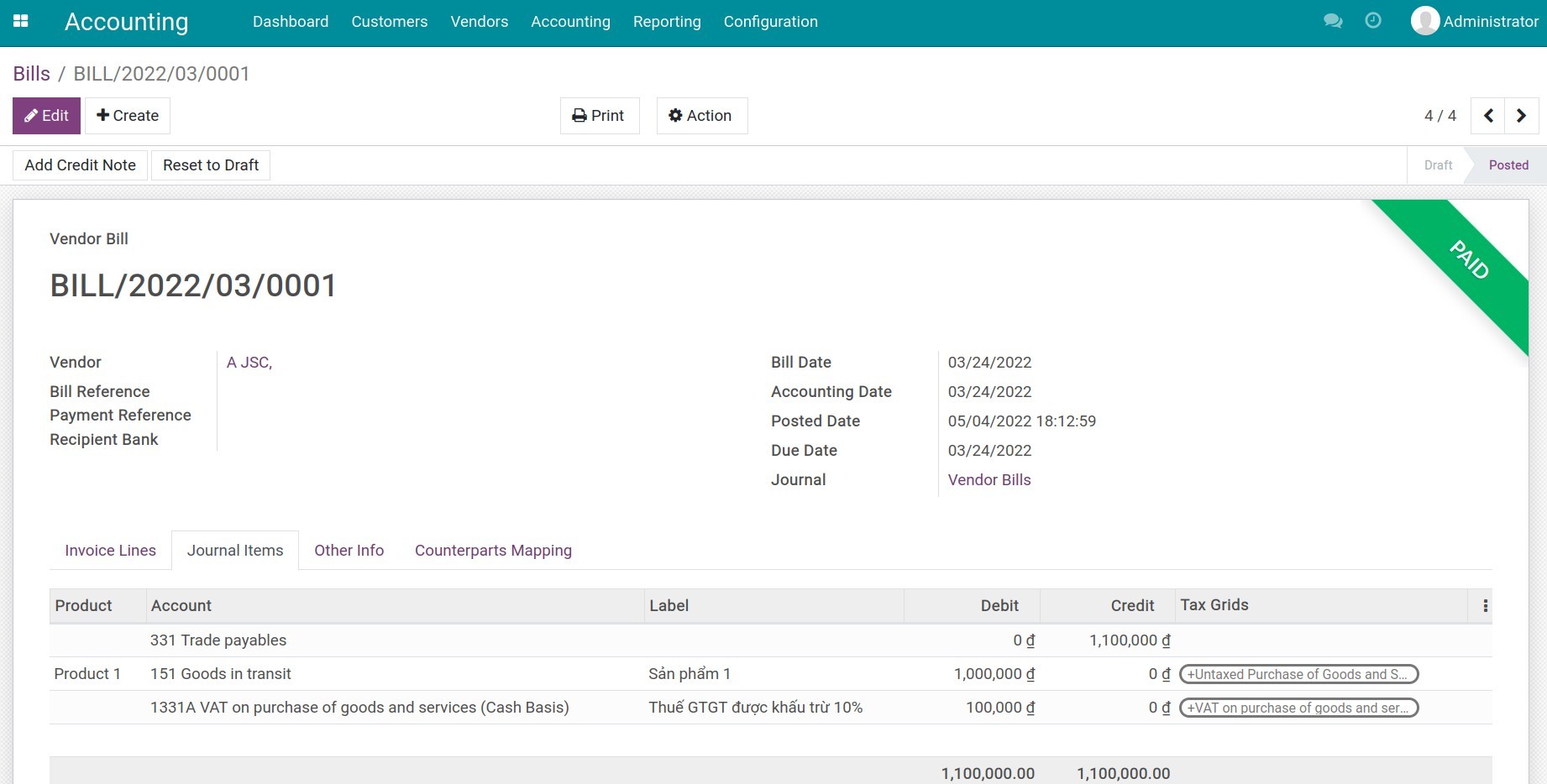

With the cash basis taxes management, the taxes incurred on unpaid invoices and vendor bills will be recorded in the transitional account.

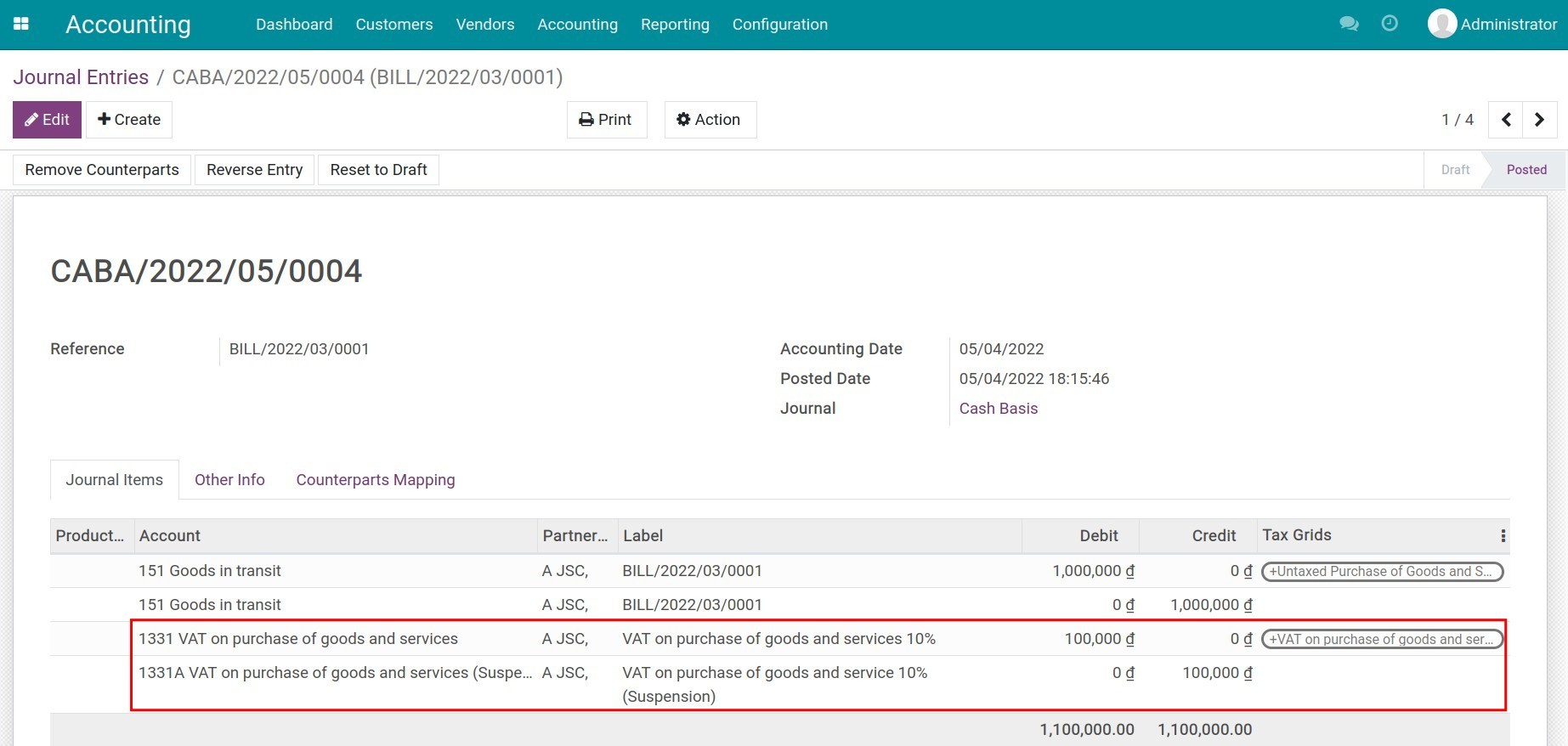

Once the invoice/bill is paid, a journal entry recording the transition of taxes from the transitional account to the main account will be created.

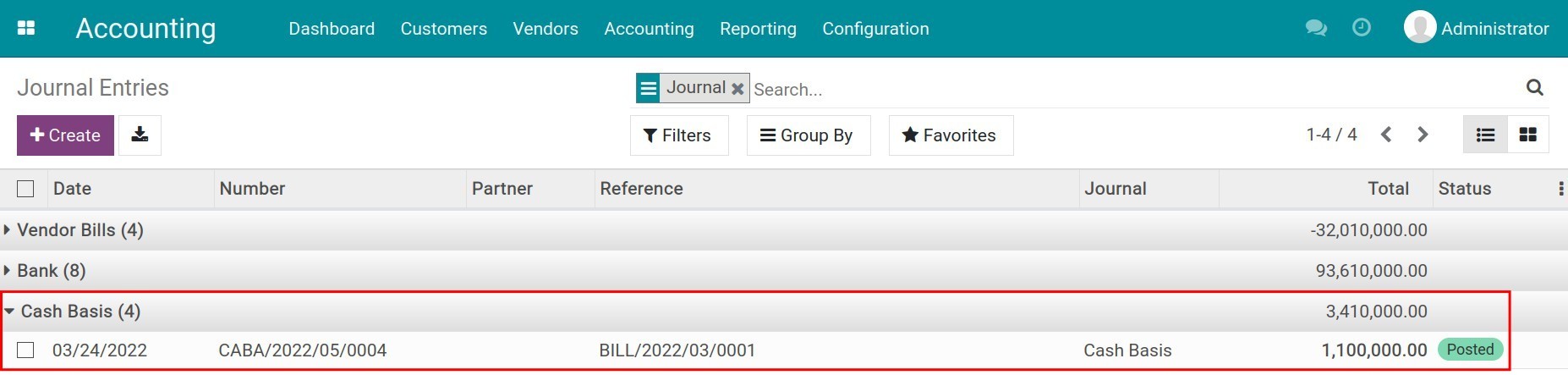

You can navigate to to group by Journal to easily review this newly created entry.

See also

Related Article

Optional Module