Asset Revaluation¶

In reality, some common reasons for an asset revaluation are:

Upgrade an asset.

Dismantling one or some parts of an asset.

Revaluate tangible assets to determine business value.

Asset revaluation for purpose of a joint venture, capital contribution, division, consolidation, or dissolution.

Revaluation at the request of the authority.

This article will show you steps to revaluate an asset in the Viindoo Accounting app.

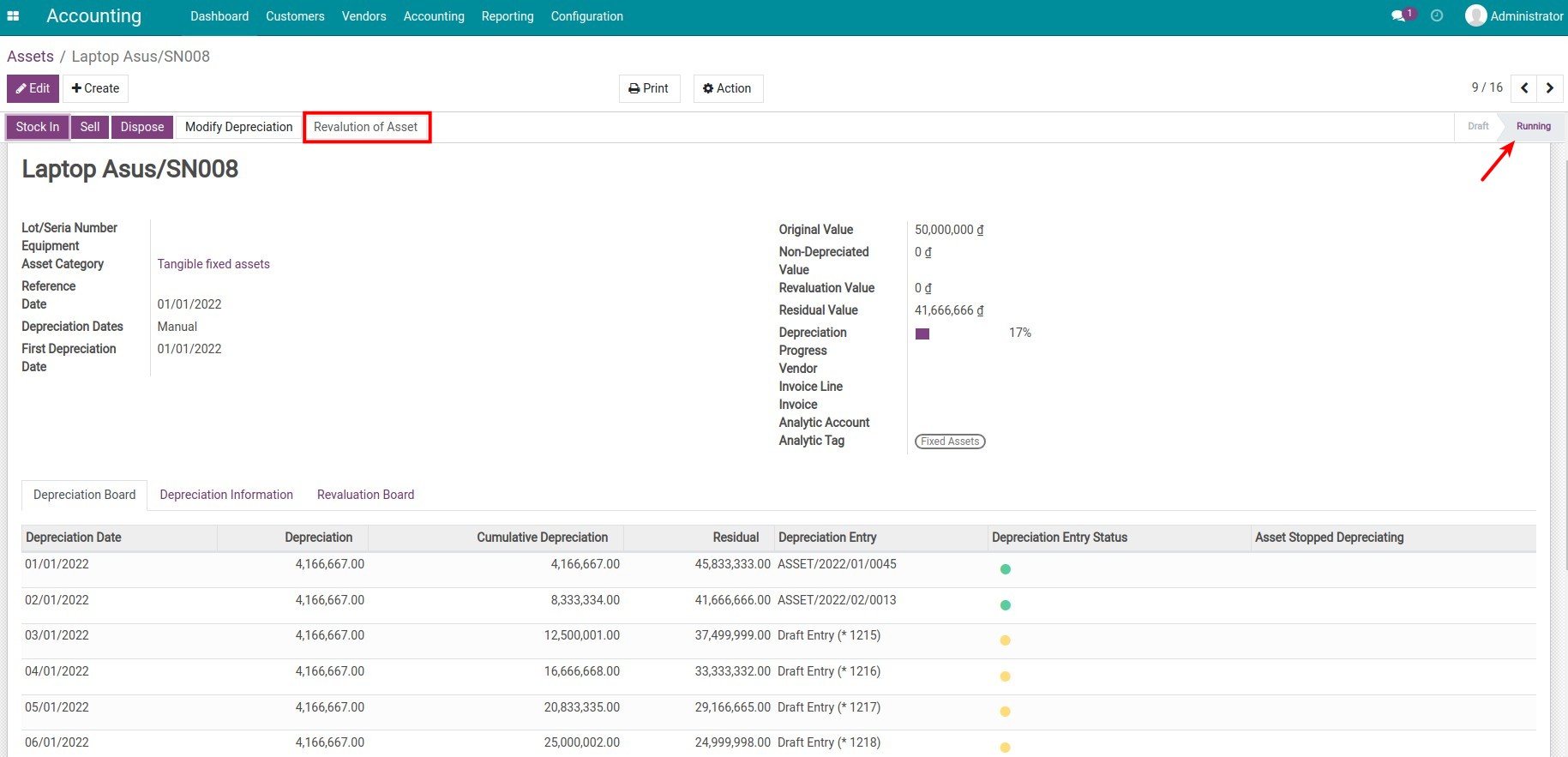

First, go to the asset view. The Asset you want to revaluate now has the Running stage.

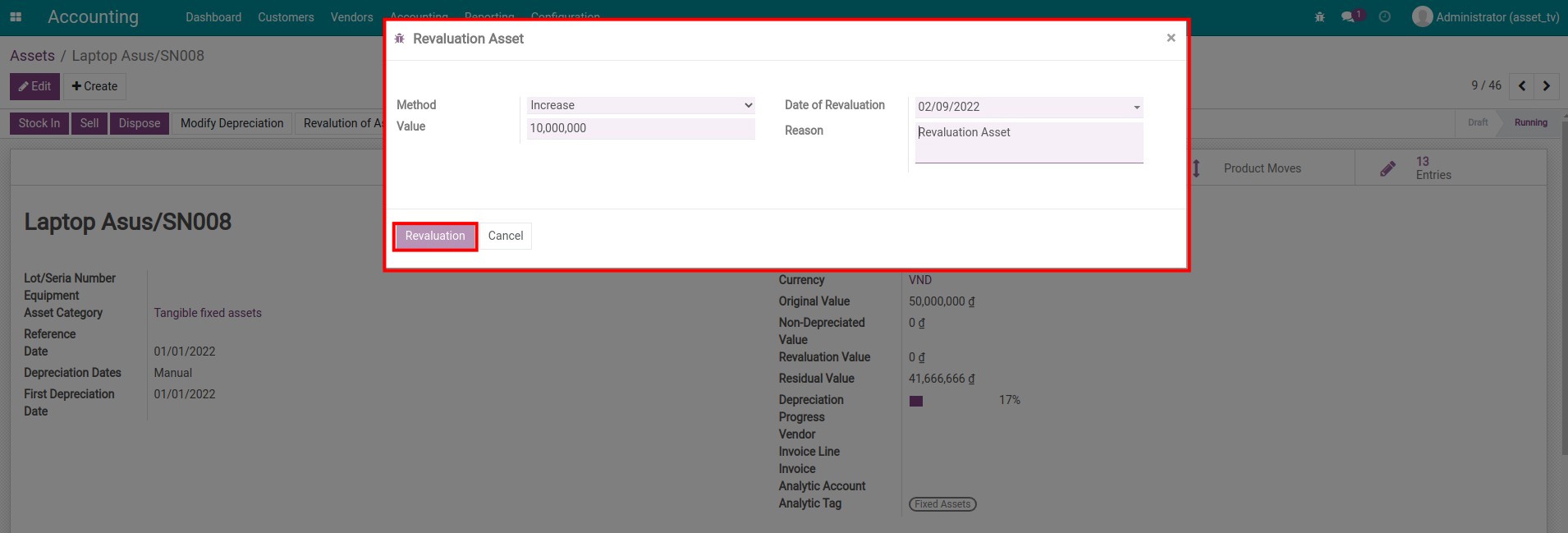

Press on Revaluation of Asset. A pop-up window appears where you need to add the following required information:

Method:

Increase.

Decrease.

Value: Add the increasing or decreasing amount from the value of the asset.

Date of Revaluation: The date when the asset revaluation is recorded.

Reason: The purpose of revaluating the asset.

Once you press on Revaluation, the system will re-calculate data of some fields on the asset as follows:

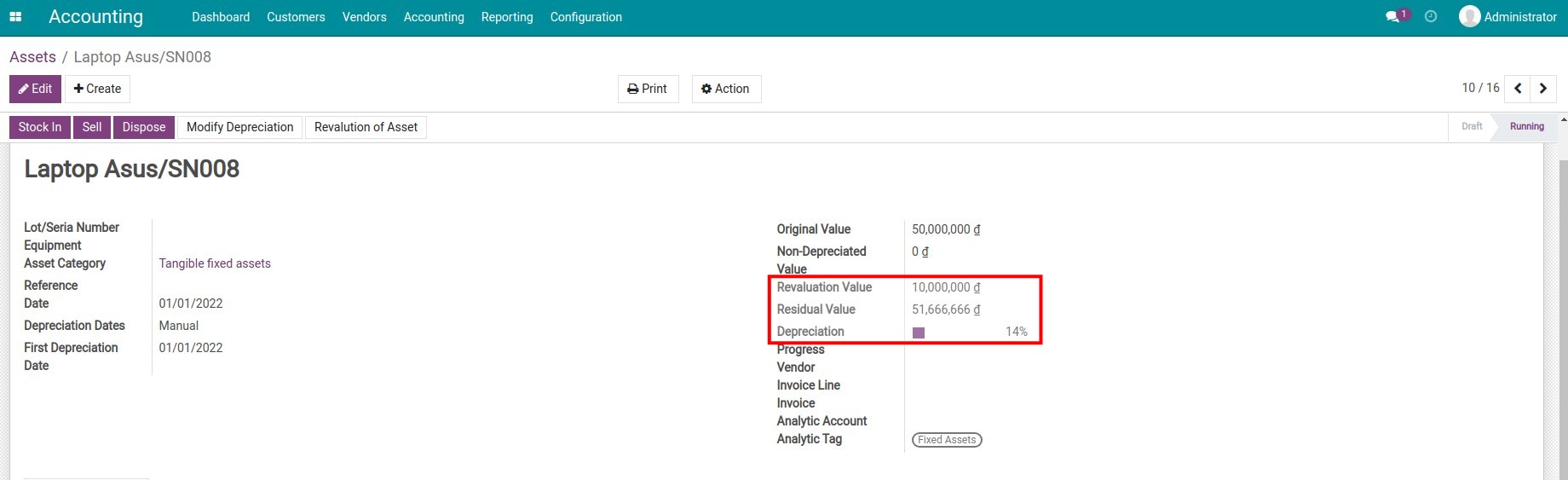

Asset information¶

Revaluation Value: Displays the increased or decreased value of the revaluated asset.

Residual Value: Recalculated as the Original Value plus (or minus) the Revaluation Value minus the Cumulative Depreciation value.

Revaluation Board¶

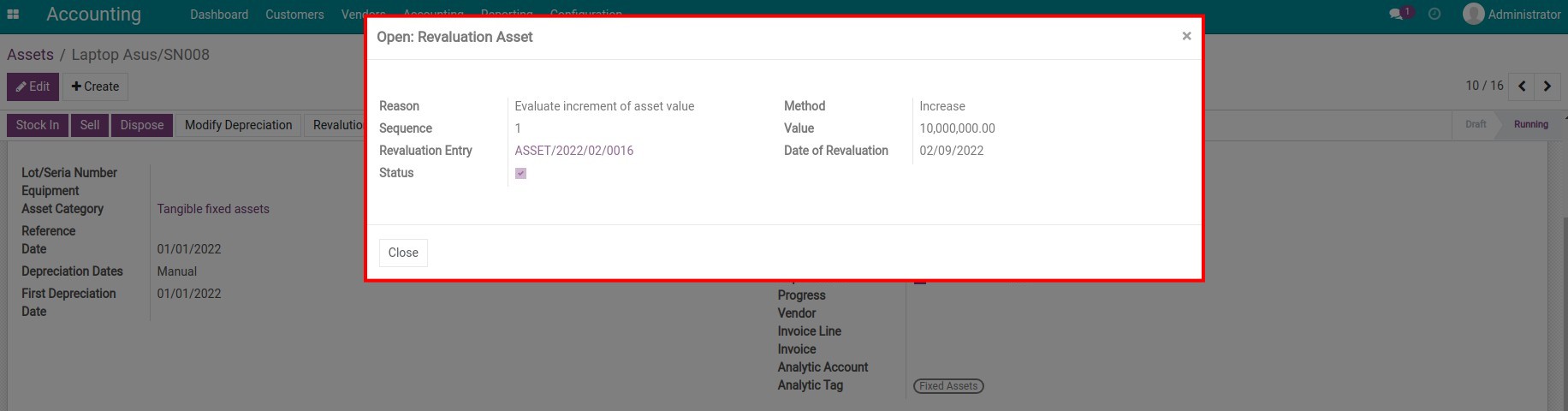

The system records an entry for each corresponding revaluation.

By pressing on each line, you can review the details of each asset revaluation operation.

![Pop-up window with details information and asset revaluation reason in Viindoo accounting software]()

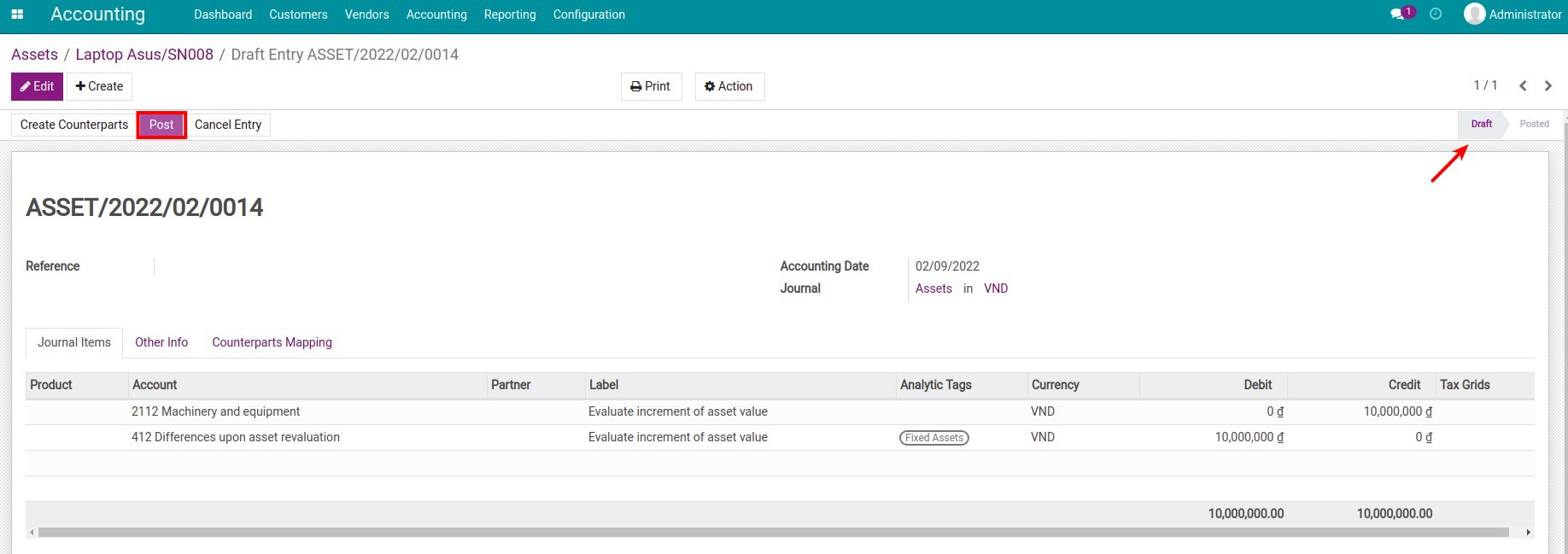

From here, you can post entries to the asset journal.

![Journal entry for asset revaluation in Viindoo accounting app]()

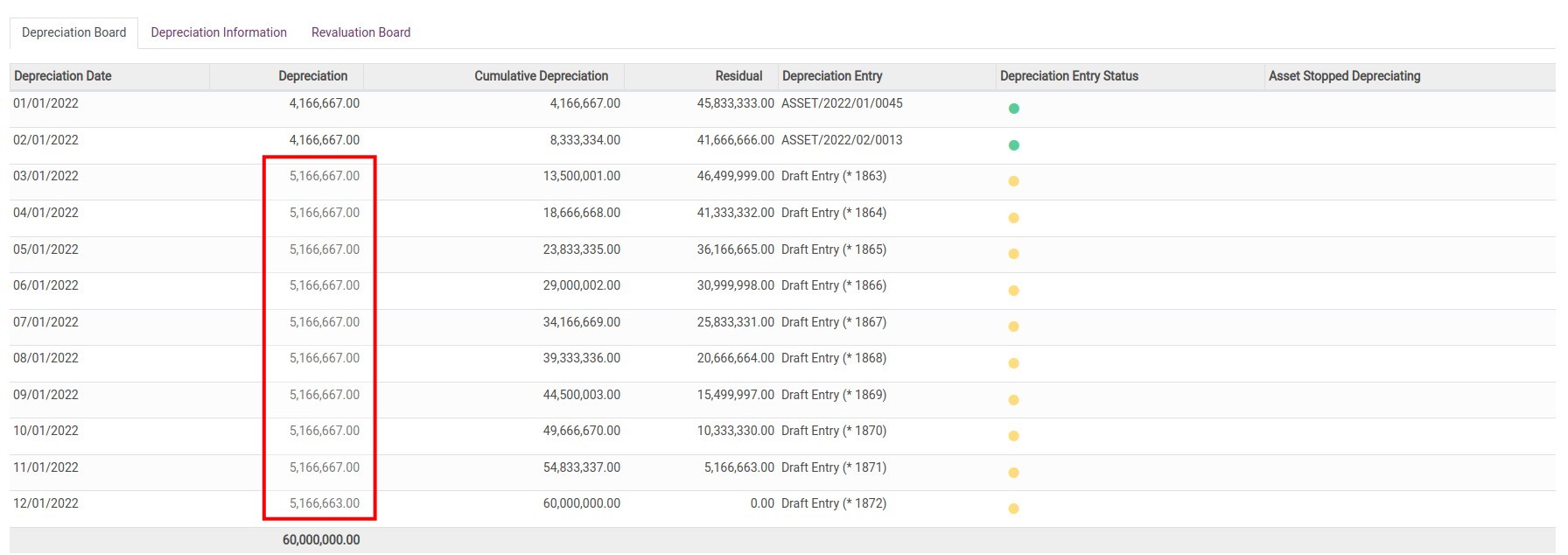

Depending on the increased or decreased value, the system adjusts the amortized value of the periods that have not been depreciated. The entries for the previous amortized periods are unchanged. To check this information, you can go back to the Depreciation Board tab.

Depreciation Board¶

Adjusted information are:

Depreciation: The Depreciation value of each amortization period is recalculated, starting from the adjusted month.

The Cumulative Depreciation and Residual columns are also recalculated according to the respective increased and decreased value.

See also