Steps to activate Cash Rounding in PoS¶

When making a payment at the shop or restaurant, you may see the amount on the bill/invoice is odd to the small unit and makes it difficult to pay in cash. But with Viindoo software, you completely round up when paying in the Point of Sale app (PoS).

Settings¶

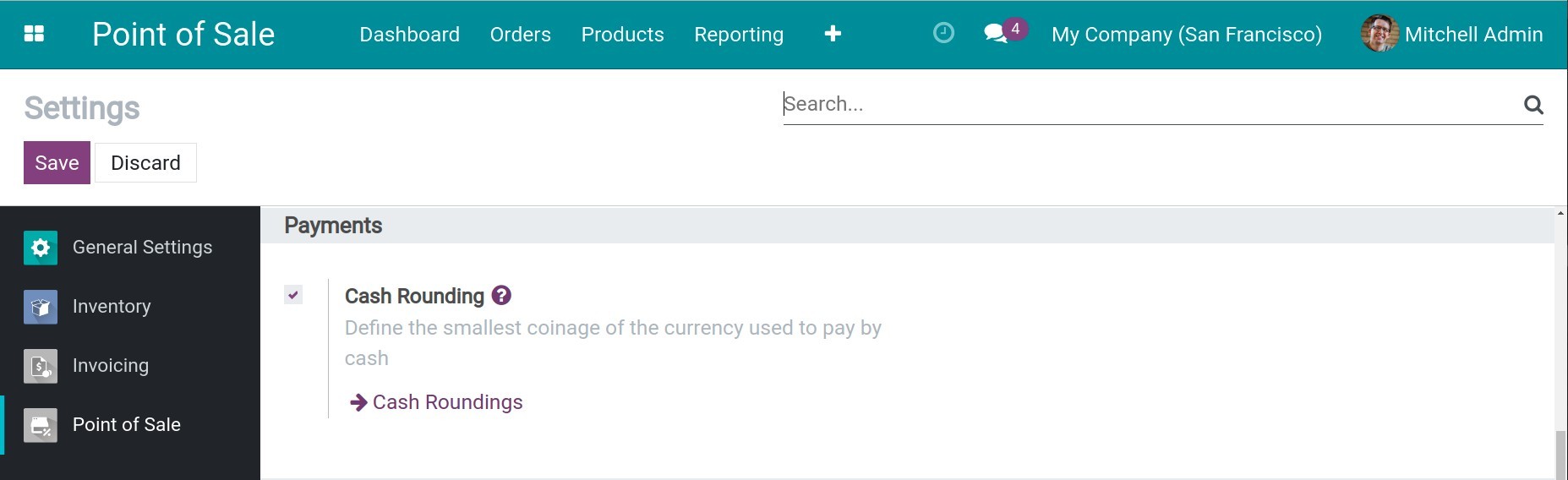

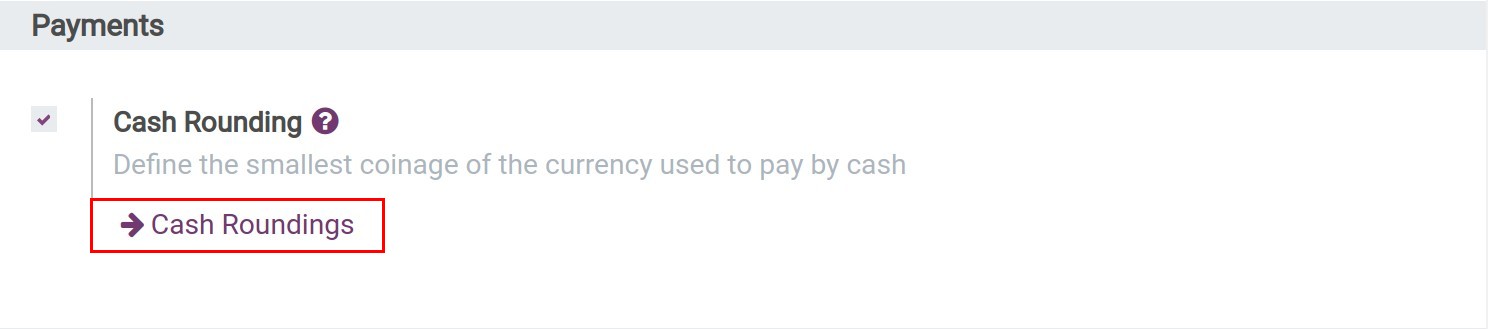

To set up the cash rounding feature, you need to navigate to Point of Sale ‣ Configuration ‣ Settings and find the Payment section. Check on the Cash Rounding ‣ Save.

After enabling the feature, you can set your cash rounding rules by clicking on → Cash Roundings.

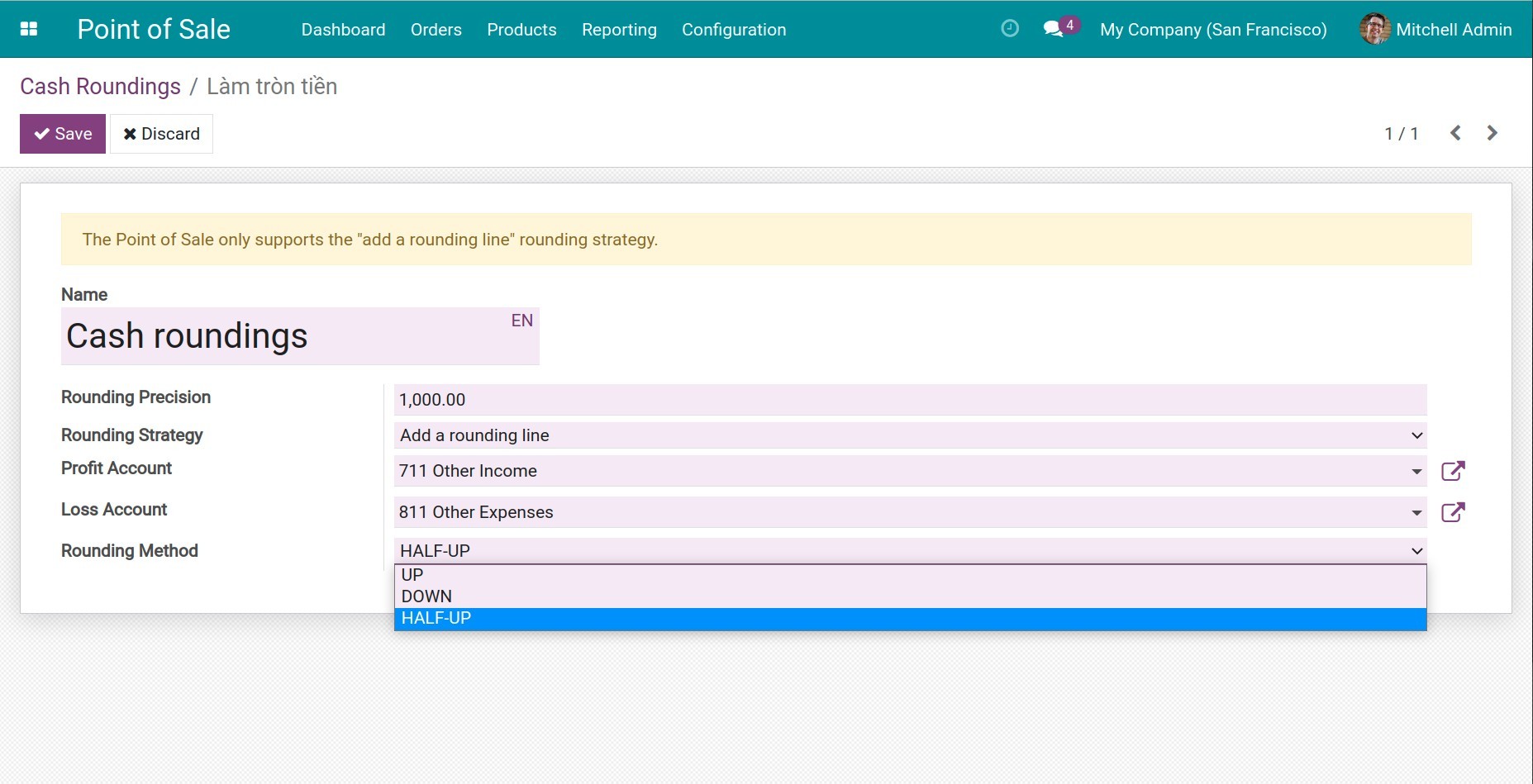

The system will navigate to where you can set up cash rounding rules. Click on Create and fill in all criteria to create a rule:

Cash rounding Name: Used for your internal note for payments.

Rounding Precision: Usually enter the smallest cash value of the currency is applied to payment.

- Rounding Strategy:

Add a rounding line: There will be an extra line showing the rounded amount immediately below the principal on invoice when making payment. If you select this strategy, you need to define both a profit and loss account.

Profit Account: The difference that arises from rounding up will be credited to this account.

Loss Account: The difference that arises from rounding down will be credited to this account.

Modify tax amount: Rounding manner will be used for tax value.

Note

The PoS only supports the “add a rounding line” rounding strategy.

- Rounding Method:

UP: Increase the sum to rounded precision.

DOWN: Reduce the sum to rounded precision.

HALF-UP: It will be upon the total bill to round based on the rounding accuracy.

If the odd balance of principal is more than one-half value of the rounding precision, the sum will be rounded up.

If the odd balance of principal is less than one-half value of the rounding precision, the sum will be rounded down.

E.g.: The total amount of invoice is 202,006. The rounding precision is 1,000.

Total amount after rounding up is 203,000.

Total amount after rounding down is 202,000.

The odd balance of total amount is 6 and less than one-half value of the rounding precision is 500, therefore, the total amount after rounding half-up is 202,000.

If the principal is 202,506, the total after rounding half-up is 203,000 because the odd balance of total is 506 and more than one-half value of the rounding precision is 500.

How to apply rounding rules to the PoS?¶

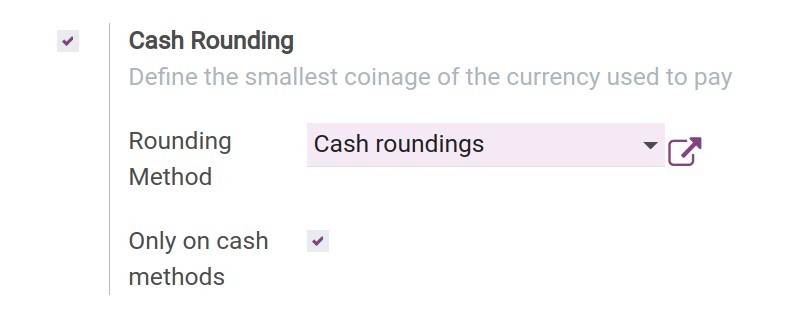

Once you’ve set up the cash rounding rules, you continue to set up the PoS to apply these rules. Navigate to Point of Sale ‣ Configuration ‣ Point of Sale, select one or various PoS that need to be applied. In the Payment section:

Check on the Cash Rounding item.

Select the rounding method created in the previous step.

Check on the Only on cash methods item.

Click on Save to finish the configuration.

Here is an example to better understand how the rounding method works.

Example: Set up a rounding rule with the followings criteria:

Rounding Precision: 1,000.

Rounding Strategy: Add a rounding line.

Rounding Method: HALF-UP.

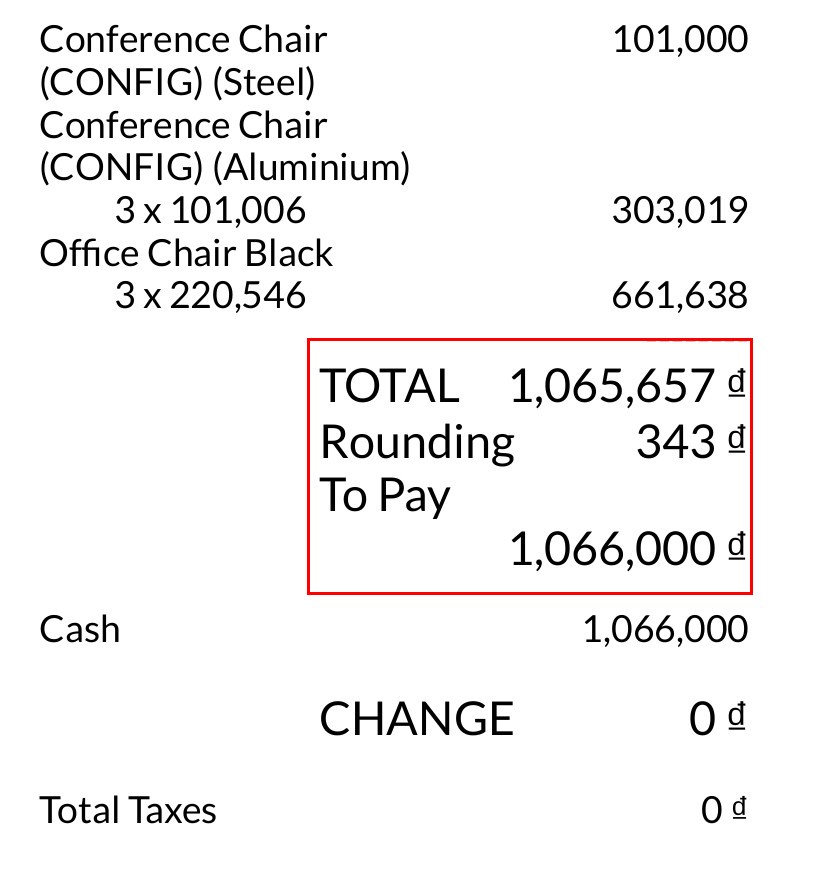

The total amount of the invoice is 1,065,657. After applying the rounding rule, the total amount is 1,066,000. You can see the principal and the rounding total below on the invoice.

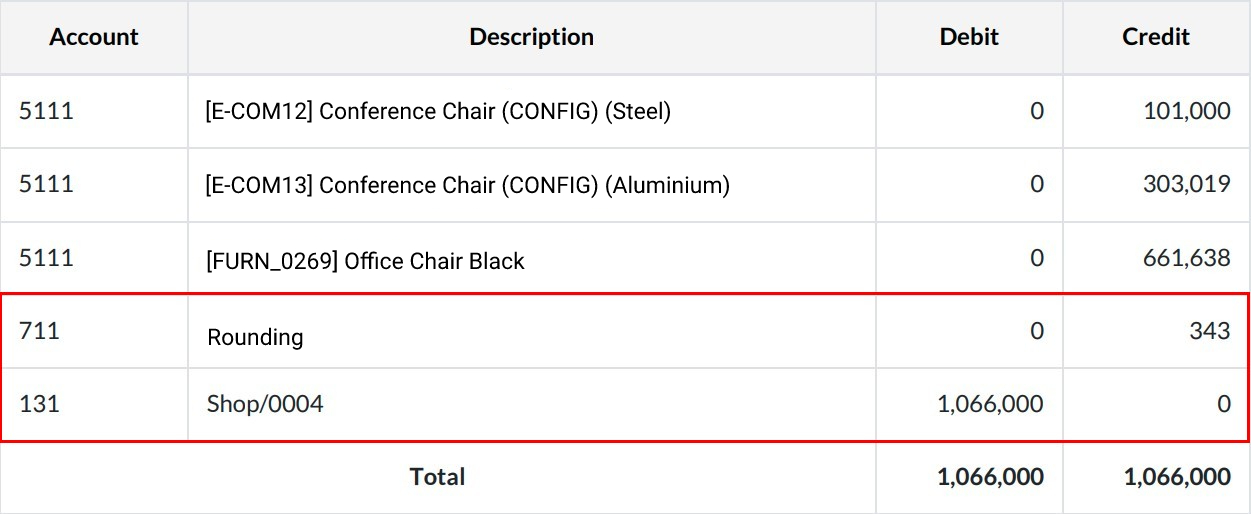

After posting the invoice, a journal entry will be generated as configuration in the rounding rule.

Going through the guide of setting rules and a few examples, you will understand how to use the cash rounding rules to better support your PoS transactions.