Balance carrying forward¶

At the end of each accounting period by month, quarter, or year, it is necessary to make accounting entries to transfer revenue and expenses as well as close accounts to prepare for financial statements, analytic reports, etc. from which the company will track business progress. A balance carries forward is the transfer of balances of tax accounts and accounts type 5, 6, 7, 8 to accounts type 9 in order to determine revenue and expenses, from which to calculate the company income tax and measure business profit.

Balance carrying forward entries include:

Tax payables balance carry forward;

Costs of goods sold balance carry forward;

Revenue - Sales of goods balance carry forward;

Financial revenue balance carry forward;

Financial expenses balance carry forward;

Selling expenses balance carry forward;

Administrative expenses balance carry forward;

etc.

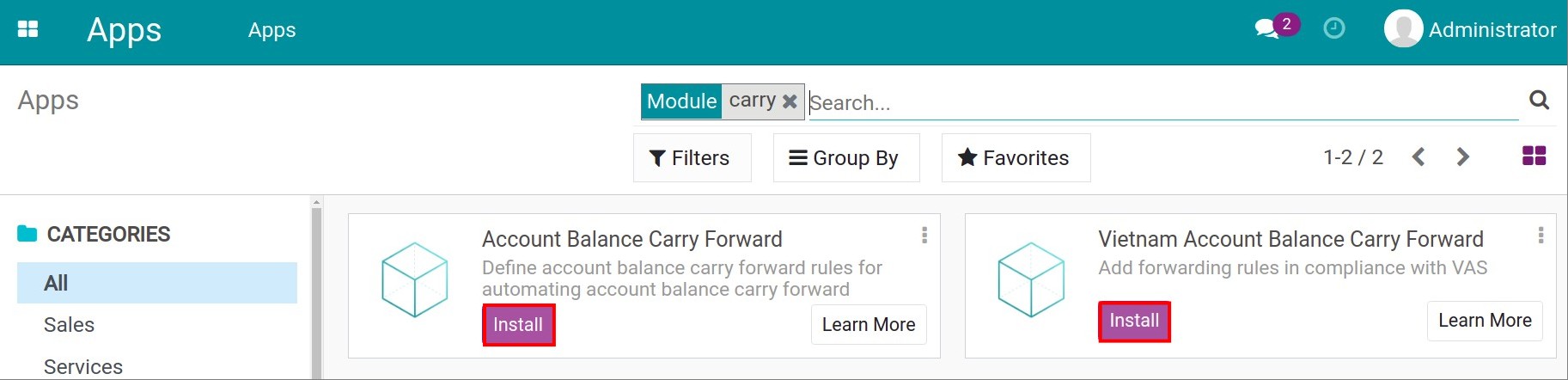

To use this feature, navigate to Viindoo Apps and install the following two modules:

Configure balance carry forward rules in Viindoo¶

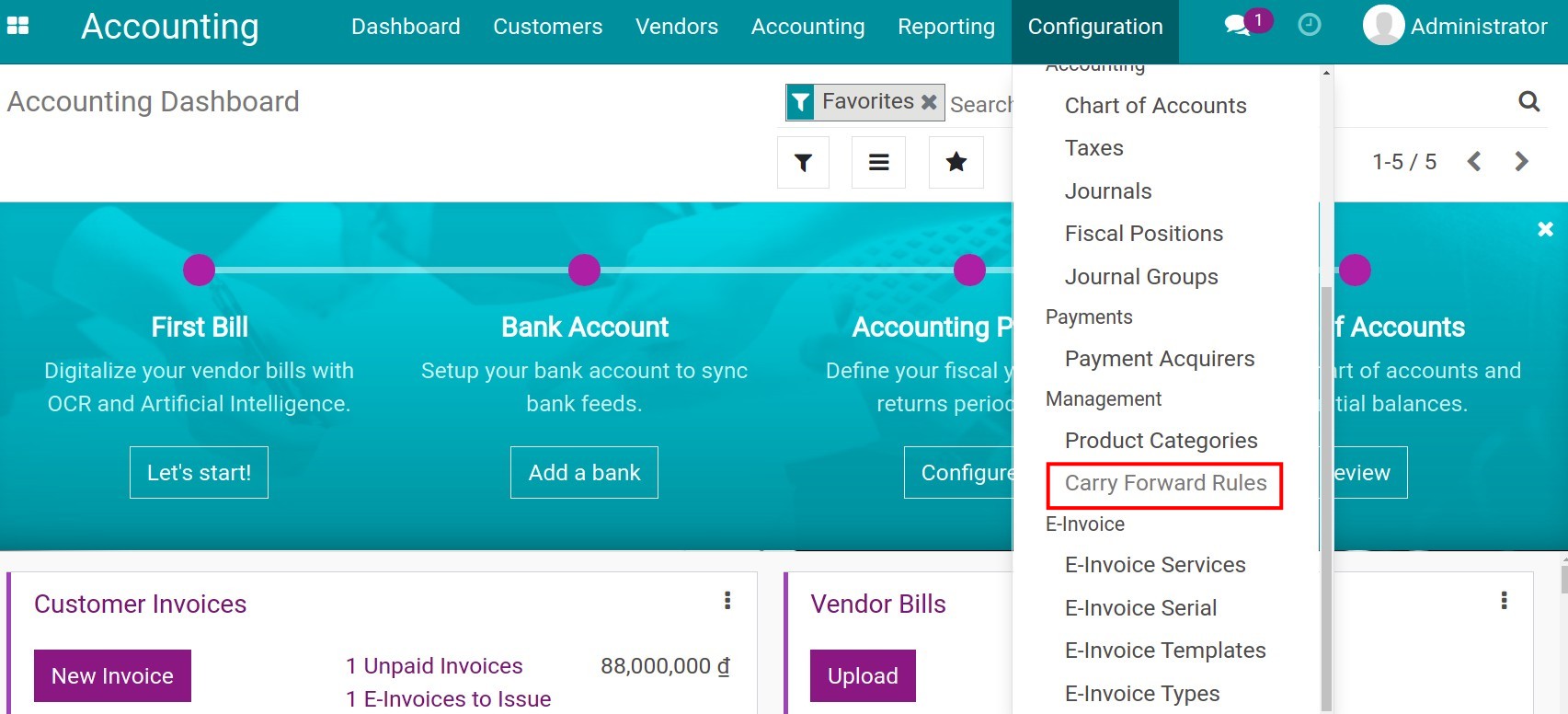

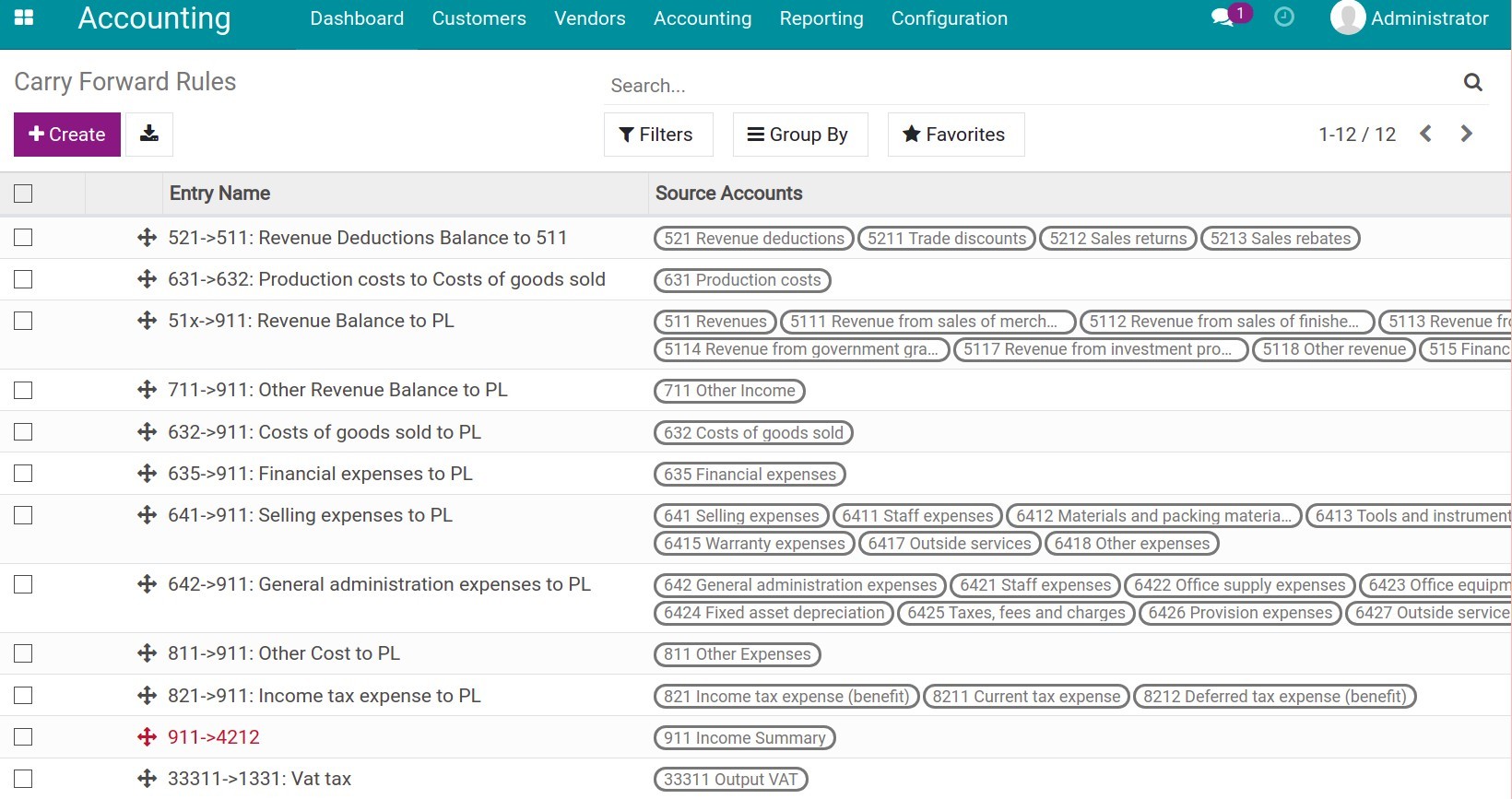

The balance carrying forward entries according to the Vietnam accounting standards are automatically generated. In case you want to check whether the carry forward rules are complete for your business type or not, or want to add another rule, you can navigate to Accounting > Configuration > Carry Forward Rules.

Balance carry forward rules according to the Vietnam accounting standards are configured as shown below:

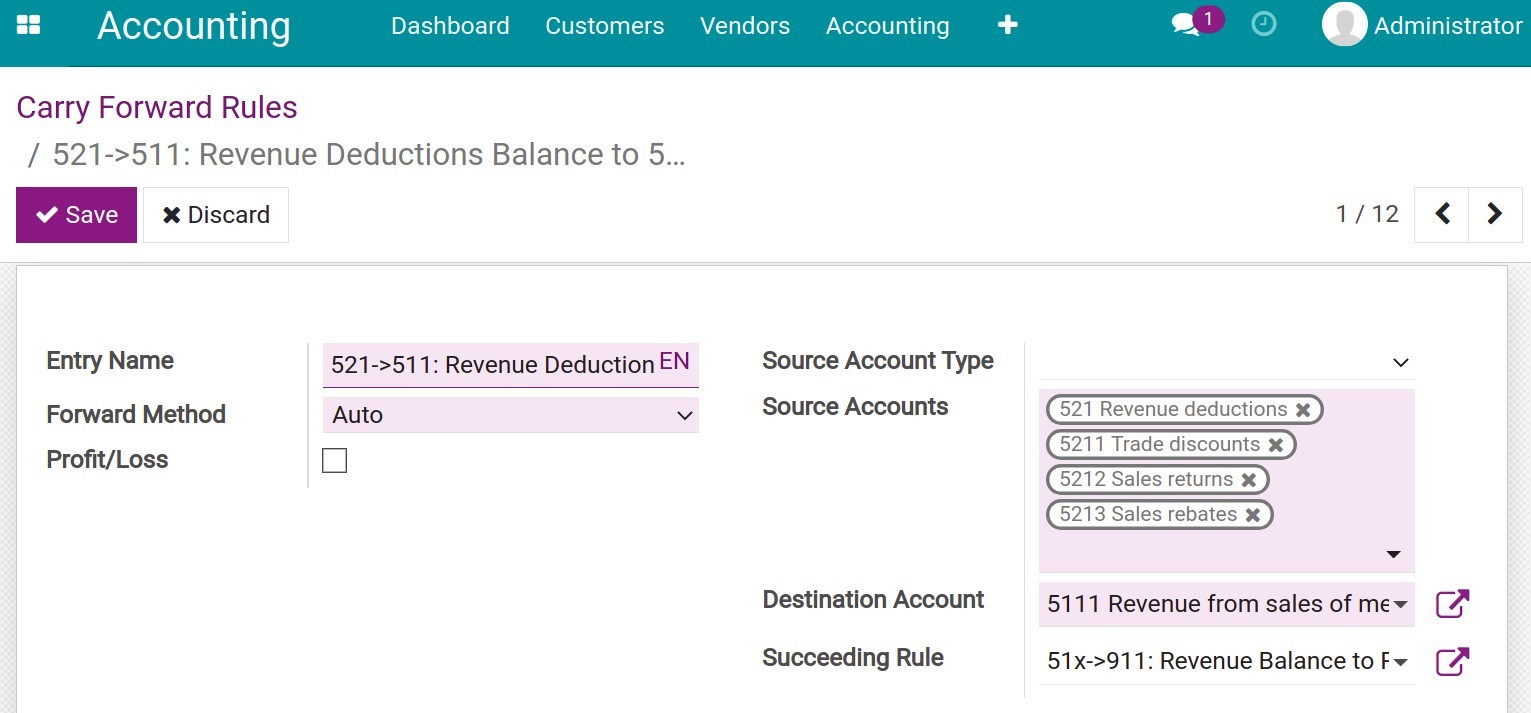

You can add another rule by pressing on Create and enter information:

In which:

Entry name: Add a recognizable and searchable name.

Forward method:

Auto: Users are supported with automatic balance carry forward from Debit accounts to Credit accounts and vice versa.

Debit > Credit: Performs only the balance carry forward of entries that have:

The source account is Debit.

The destination account is Credit.

Credit > Debit: Performs only the balance carry forward of entries that have:

The source account is Credit.

The destination account is Debit.

Profit/Loss: This selection is used for the carry forward rules from account 911 to account 421 at the end of the financial year.

Source Accounts: Accounts that need to be carried forward.

Destination Account: Recipient account of the balance carried forward.

Succeeding Rule: This rule is executed immediately right after the rule being set up is executed.

Account balance carry forward¶

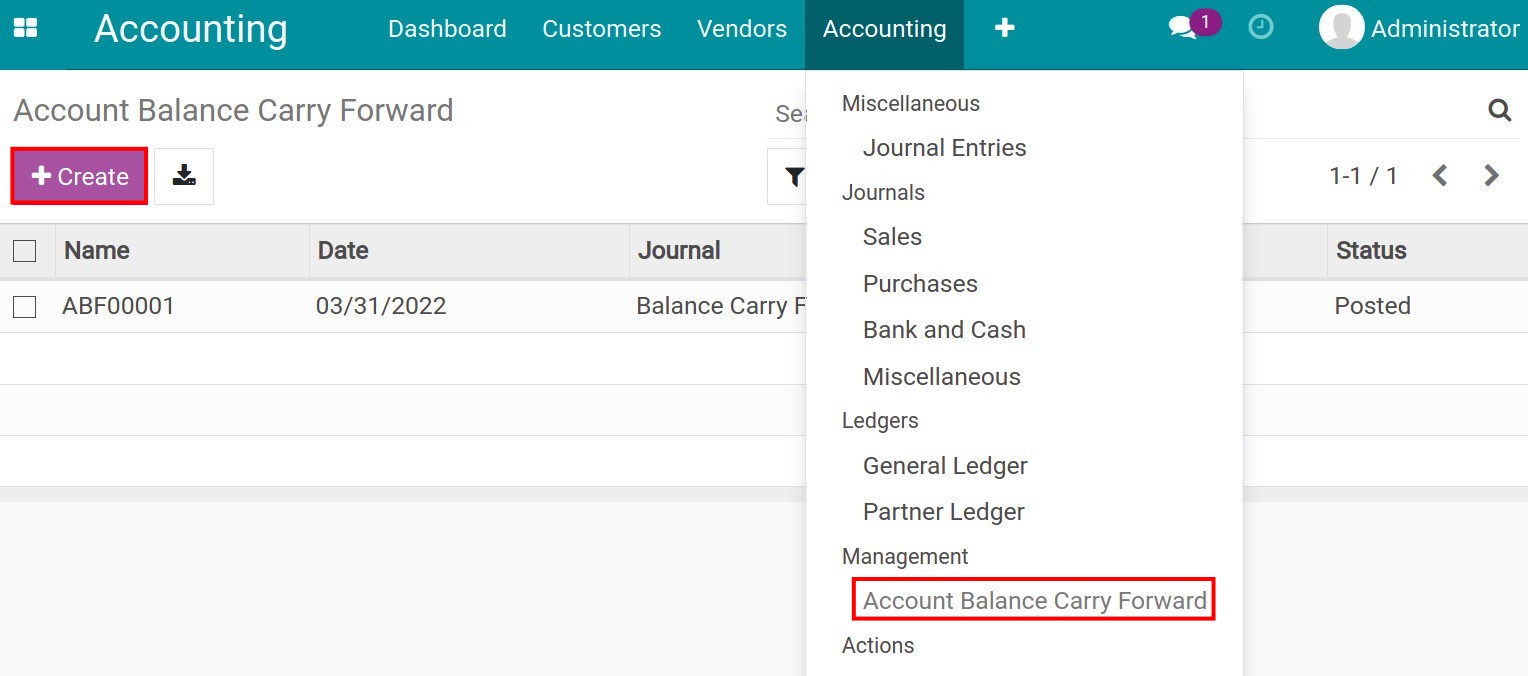

After the rules configuration, at the end of a period, the accountant performs the balance carry forward task by navigating to Accounting > Accounting > Account Balance Carry Forward and then clicking Create.

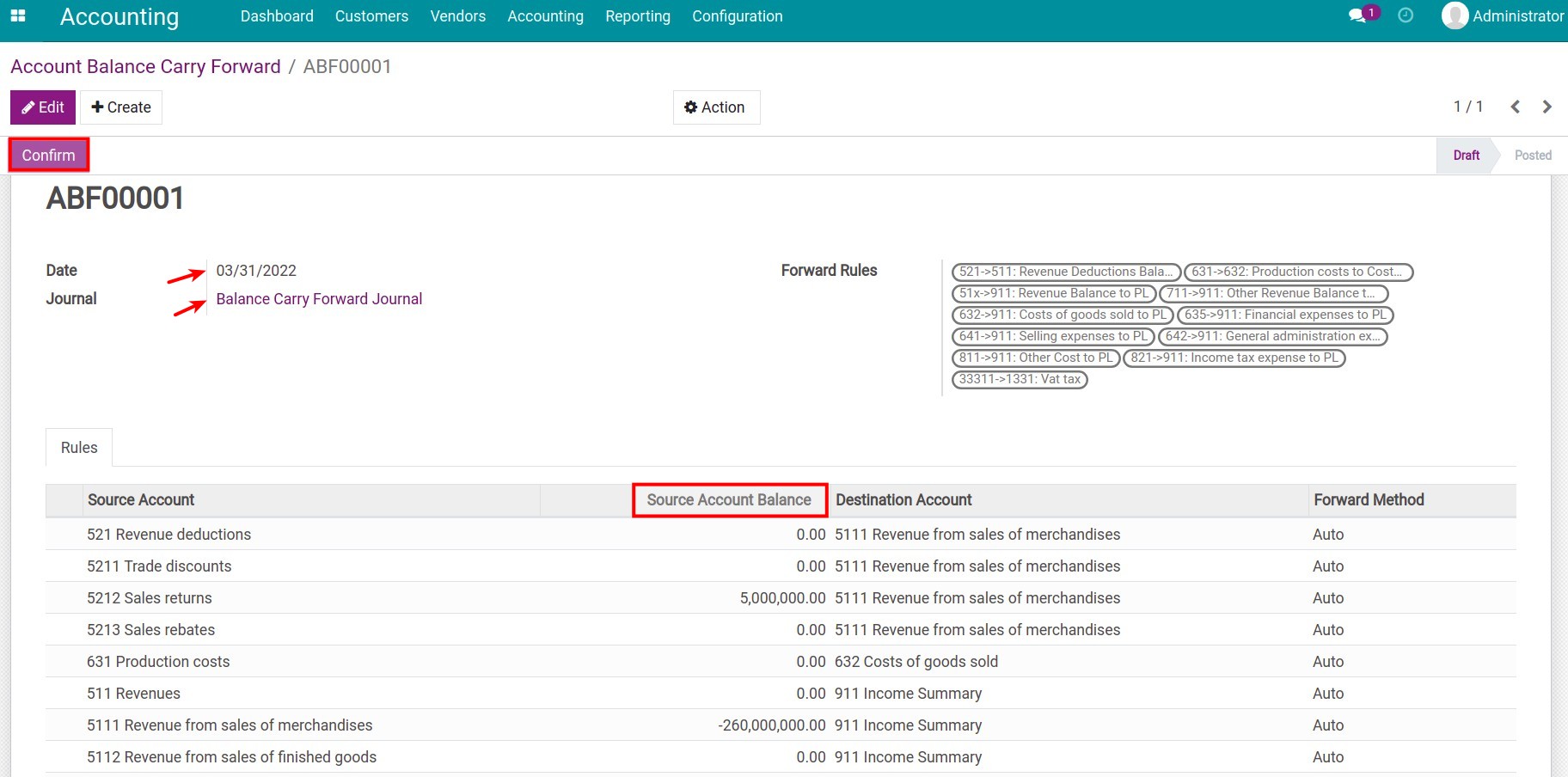

All the carry forward rules will be listed on this view. Add the carry forward Date, Journal and check the Balance at the Source Account Balance column in the details section of each rule.

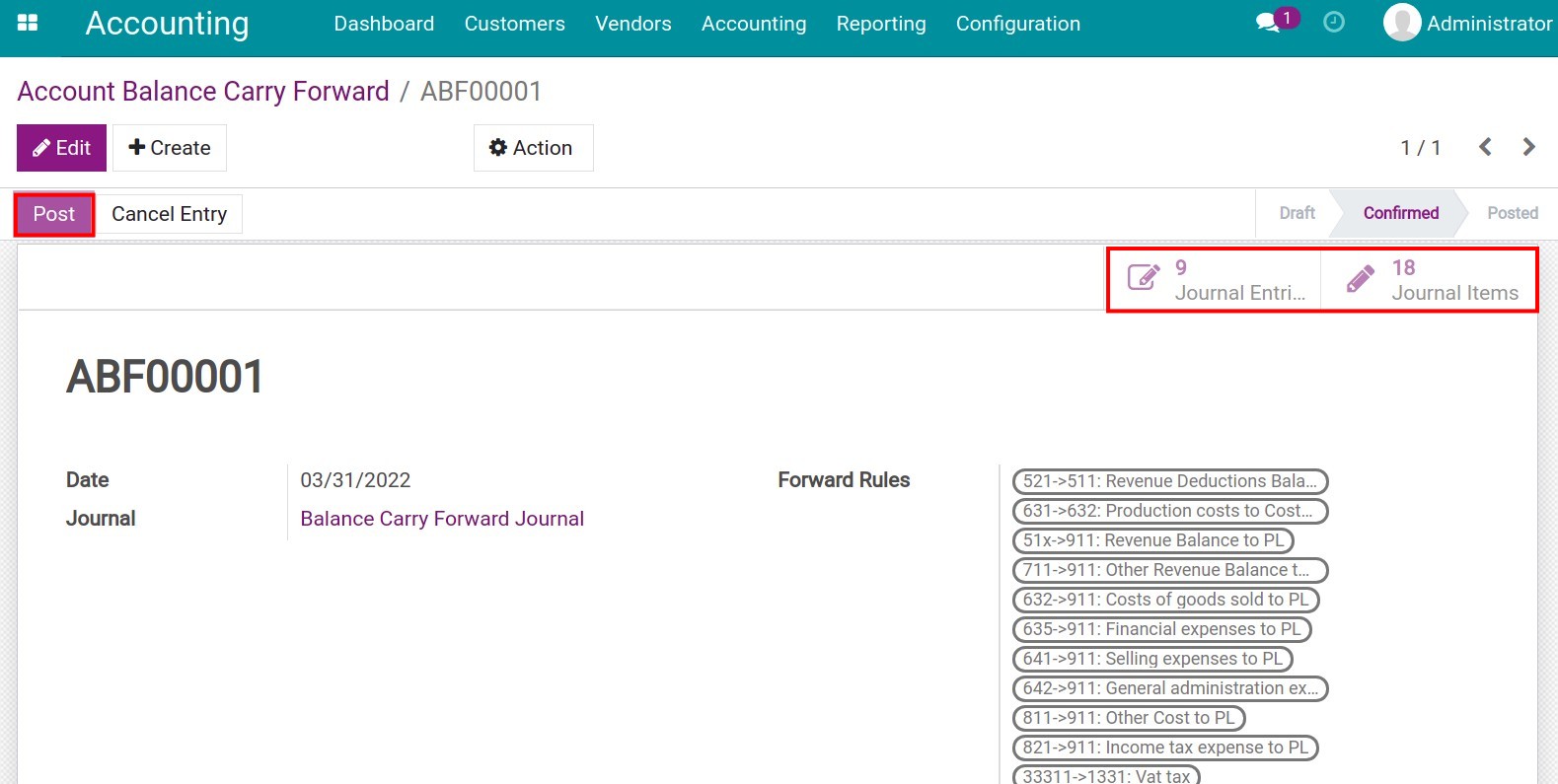

Press Confirm, and you will see a new interface with two newly added buttons which are Journal Entries and Journal Items. You can click on these two to view the new accounting entries in the Draft status.

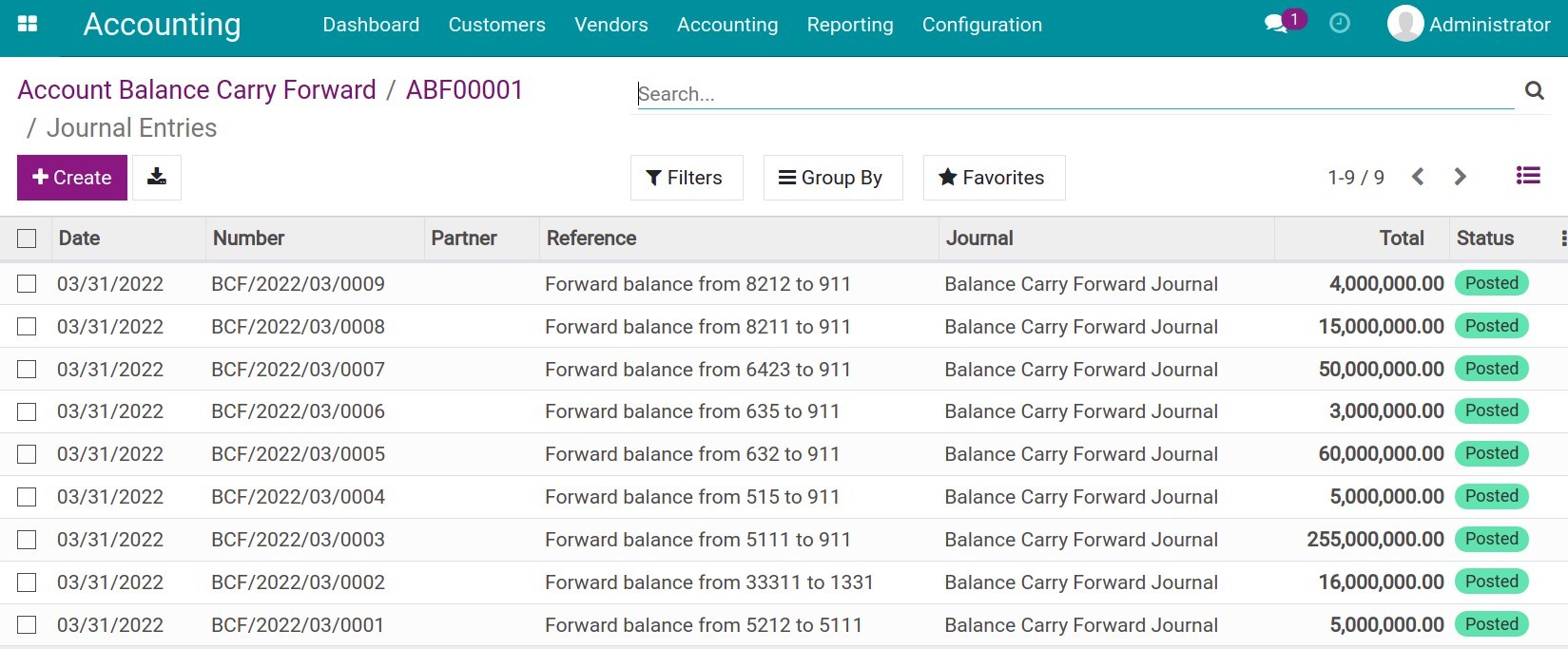

Press Post to complete the end-of-period balance carry forward. The journal entry status is also changed from Draft to Posted.

Note

If the carry forward date is the final day of the financial year, then the system will automatically add the profit/loss carry-forward rule to the list of rules to be carried forward on the Carry Forward Rules view.