Salary Rules and Salary Rule Categories¶

In the Viindoo Payroll app, the salary rules are defined as formulas for calculating the norms in employee payslips. To be able to manage employee salaries in the system, this article will show you how to set up and apply salary rules in the process of salary calculation.

Salary Rule Categories¶

Activate the developer mode to view Salary Rule Categories.

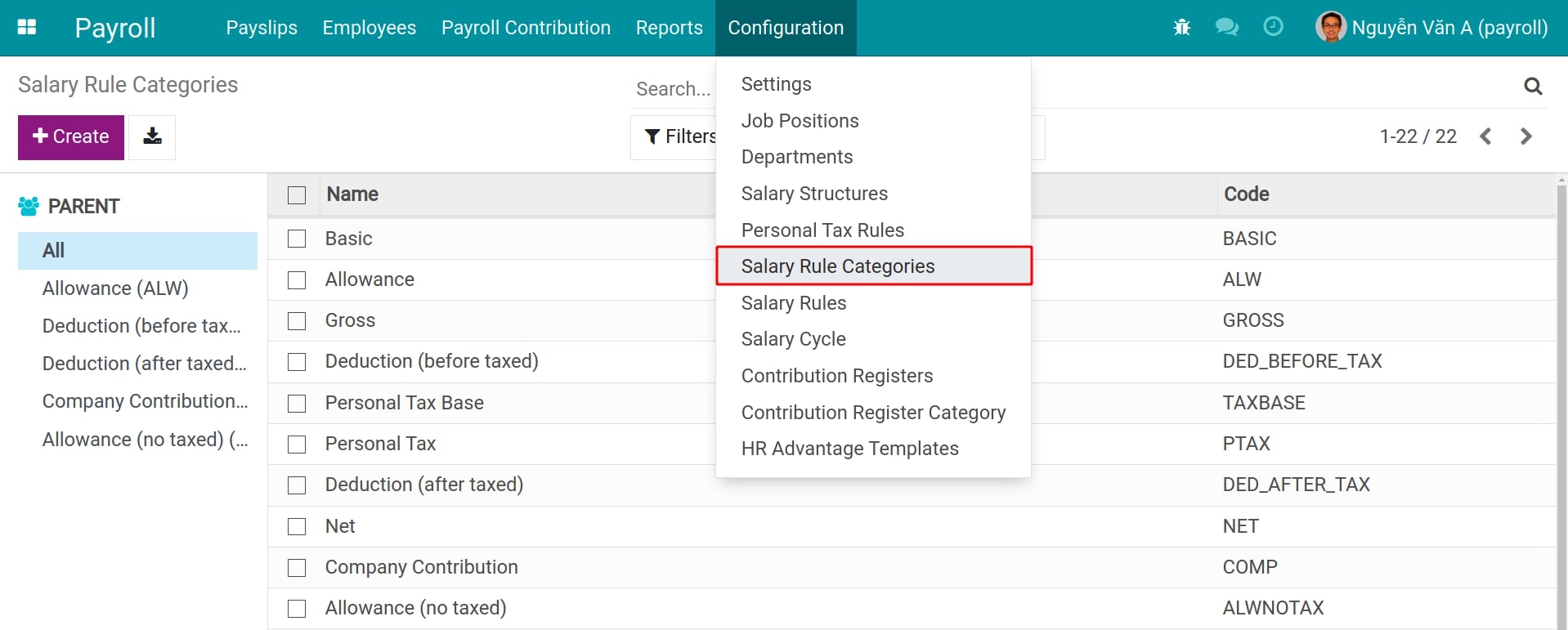

Salary rules will be allocated to the respective categories. Navigate to .

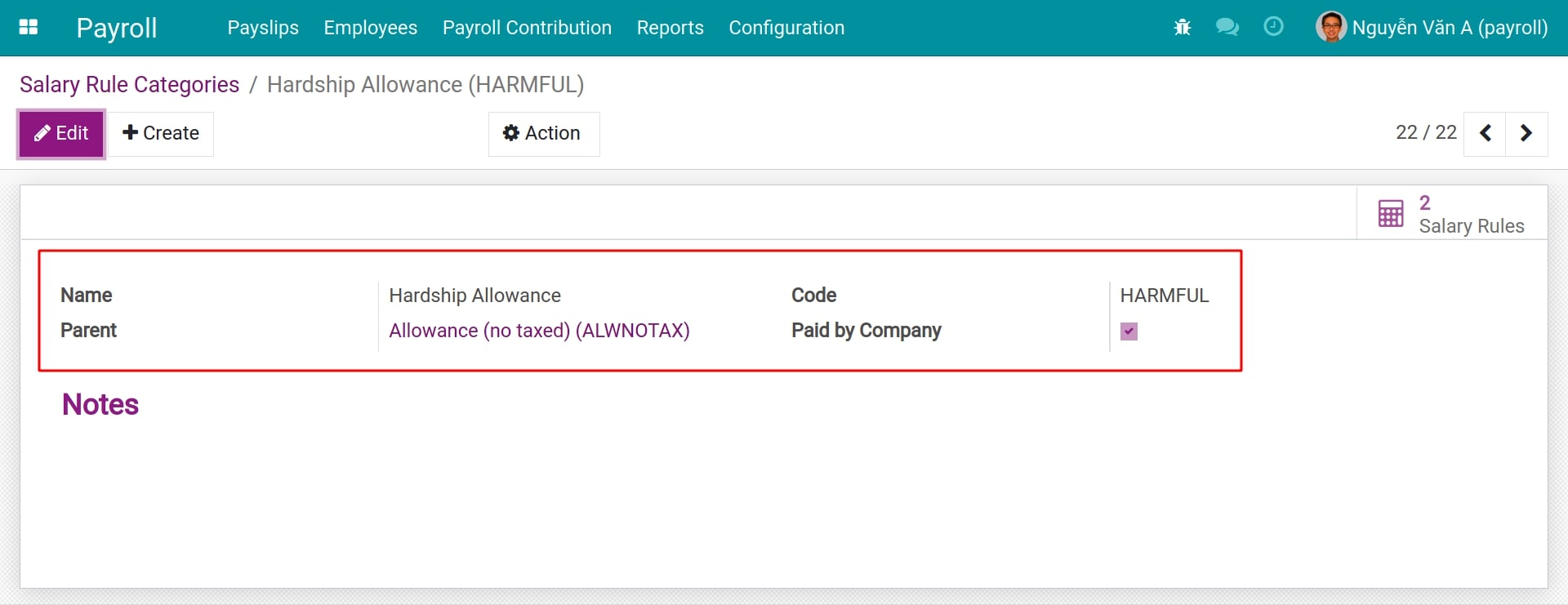

Select an existing category, you will see the following information:

Name: The name of the salary rule category.

Parent: Select a category to be the parent category of this current category. The parent one will consist of the salary rules of all the children.

Code: The code can be used to include the calculation formula for the salary rule.

Paid by Company: When enabling this option, the values generated by this category will be included in the company’s expenses.

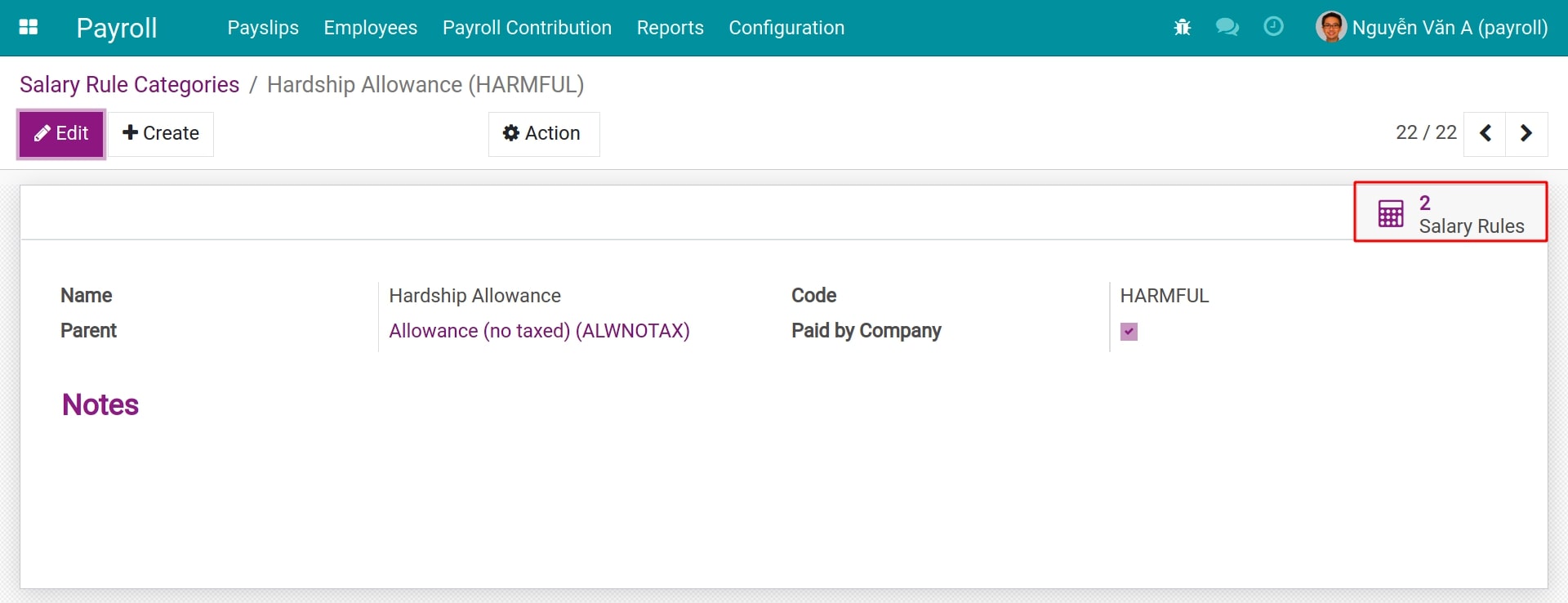

You can view how many salary rules there are in this salary rule category by pressing the button in the upper-right corner of the record.

Salary rule configuration¶

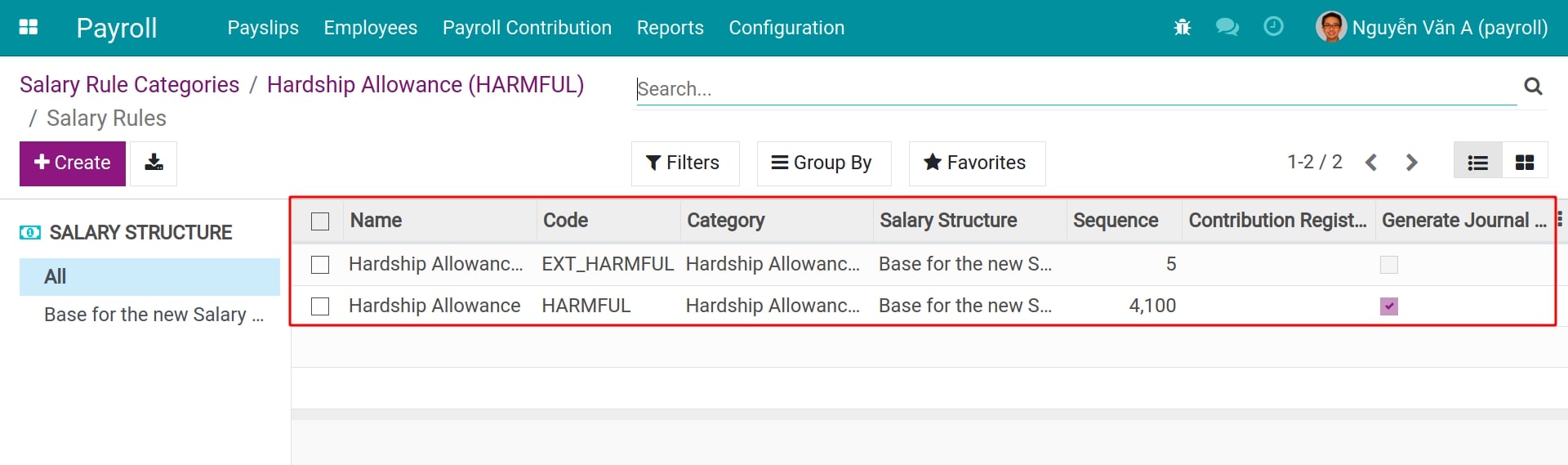

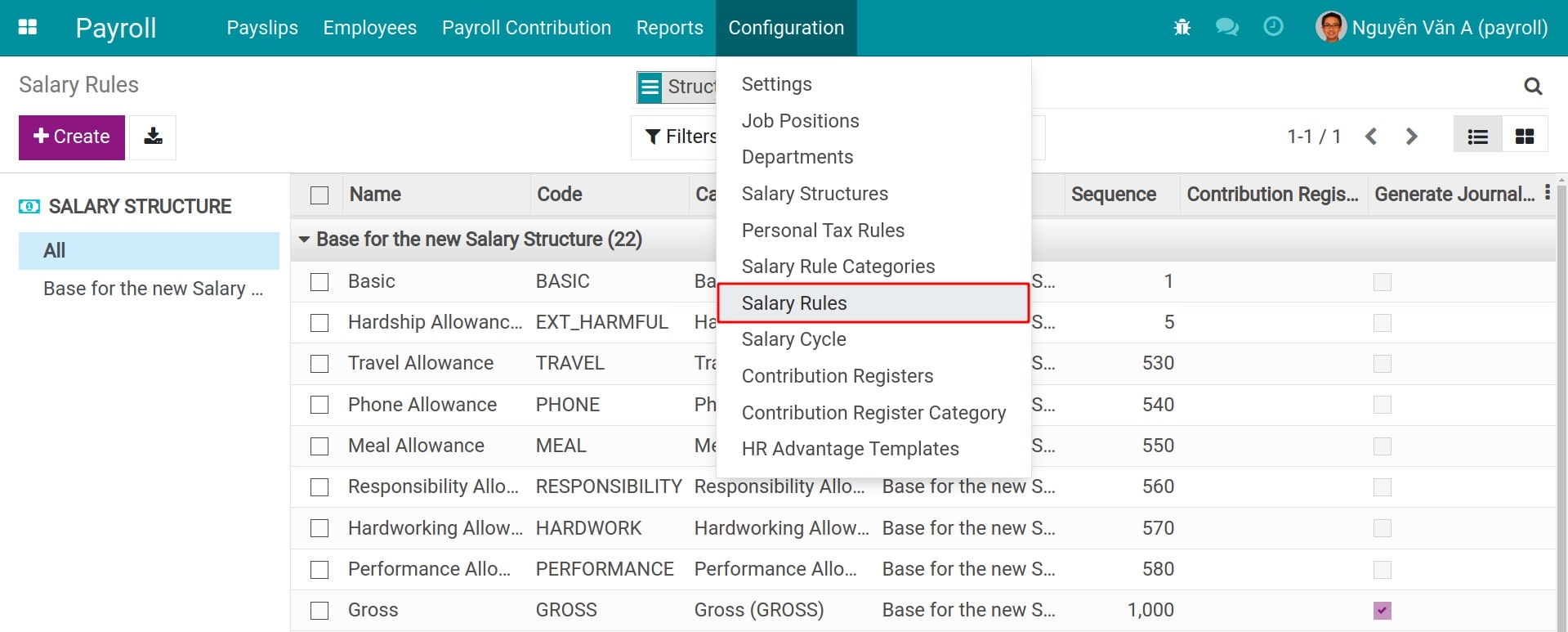

Navigate to to view the list of salary rules. You will see the following information:

- Salary structure directory tree:This directory tree contains all the salary structure folders that the enterprise has set up on the Viindoo payroll app. You can select a salary structure to see whether the salary rules belong to itself or sub-structures.

- Salary structure grouping:When you open this view, by default, the salary rules are all grouped by the categories of salary structures in the All folder.

See also

Basic fields on Salary Rule record¶

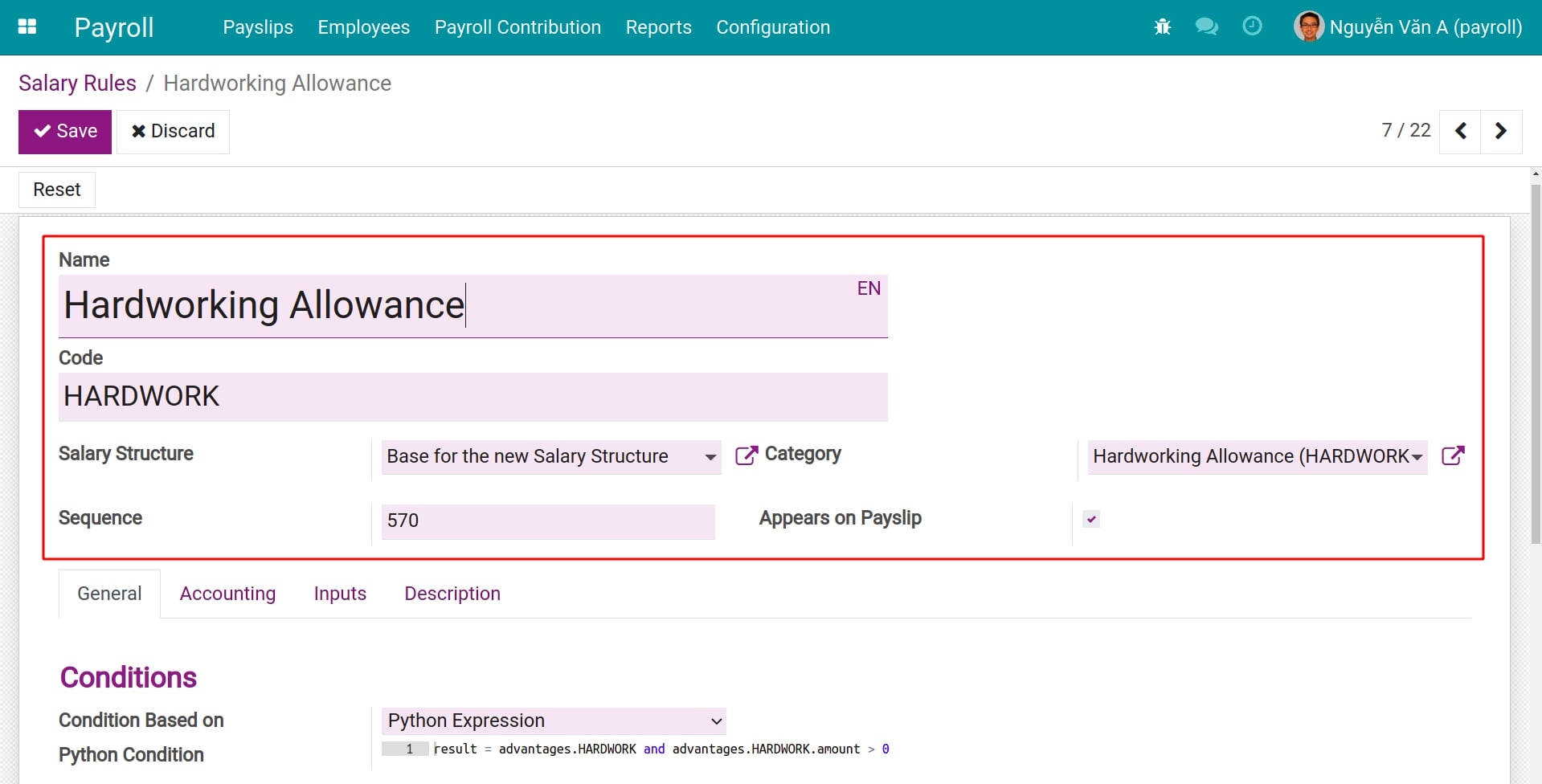

Select an existing salary rule and hit the Edit button to edit the configuration:

- Name:The name of the salary rule. For instance, Base Salary, Health Insurance, Telephone Allowance, etc. Name the salary rule exactly for the job you want to do with it.

- Code:The unique identifier for this salary rule. This code will be used to write calculation formulas for other salary rules. Therefore, you need to set the correct code of the salary rule to minimize errors that cause the salary rule to work improperly.

- Salary structure:A salary rule is used to calculate One and Only One salary structure; It is impossible to reuse a salary rule for multiple salary structures at the same time.

- Category:A salary rule will only belong to one group of salary rules. Salary rule groups can also be fed into formulas, which aggregate the results of all salary rules that fall within the same group.

- Sequence:Used to arrange the calculation sequence of the salary rule (the salary rule with a smaller number will be calculated before the rule with a bigger number).

Tip

The sequence number of salary rule A is required to be less than the sequence number of salary rule B in case we want to use the value of salary rule A to calculate salary rule B.

- Appears on PayslipCheck on this option if you want to display the result of this salary rule on the corresponding payslip.

Fields in General tab¶

In the General tab, you will be able to set up the calculation conditions and computation formulas for the salary rule.

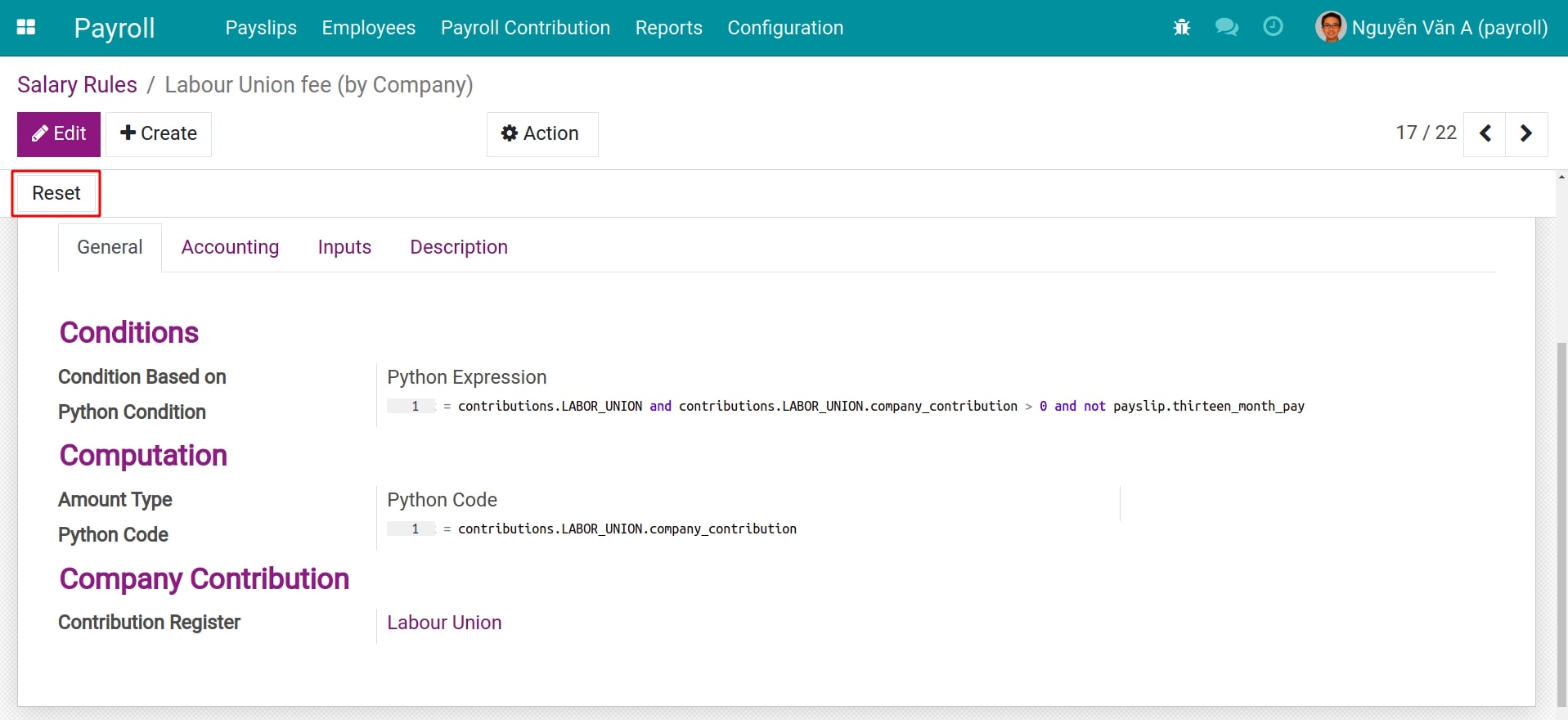

- Conditions:This is the condition for this salary rule to be enabled for calculation. For payslip records that don’t meet this condition, the pay rule will be ignored.

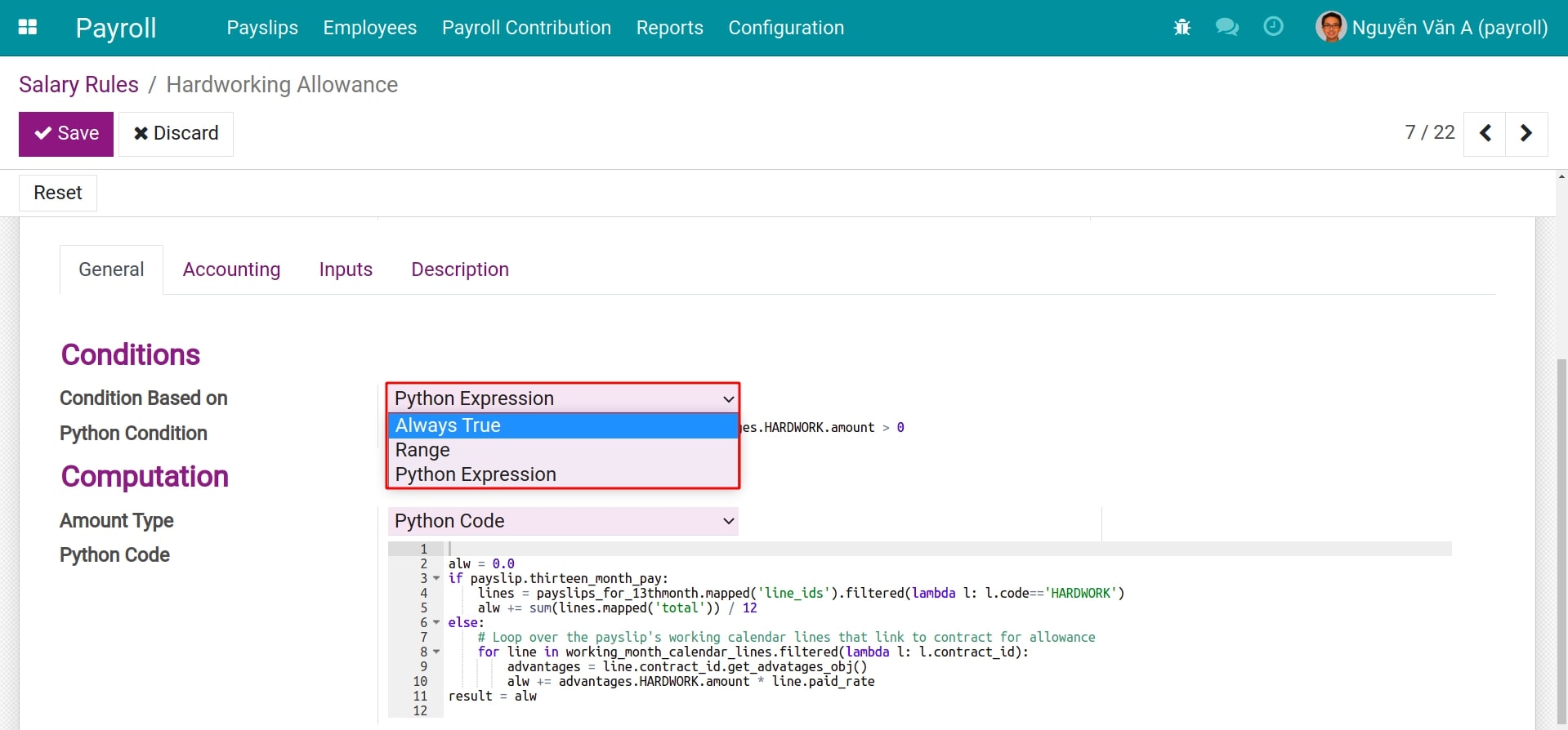

![Calculation conditions for salary rule Payroll Viindoo]()

- Condition Based on:You will need to select the type of condition for the salary rule. There are 3 types of conditions you can choose from:

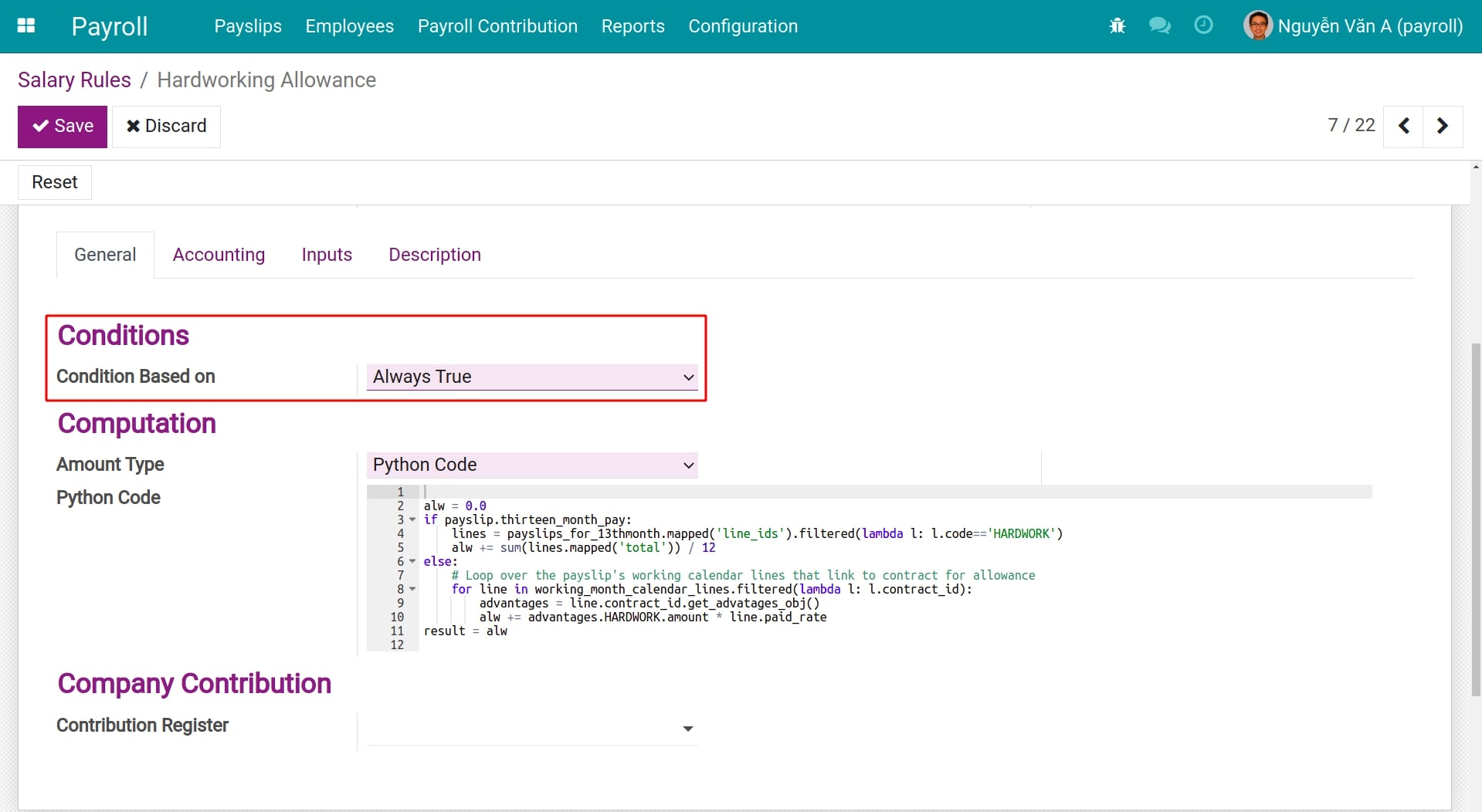

- Always True: For unconditional salary rules.

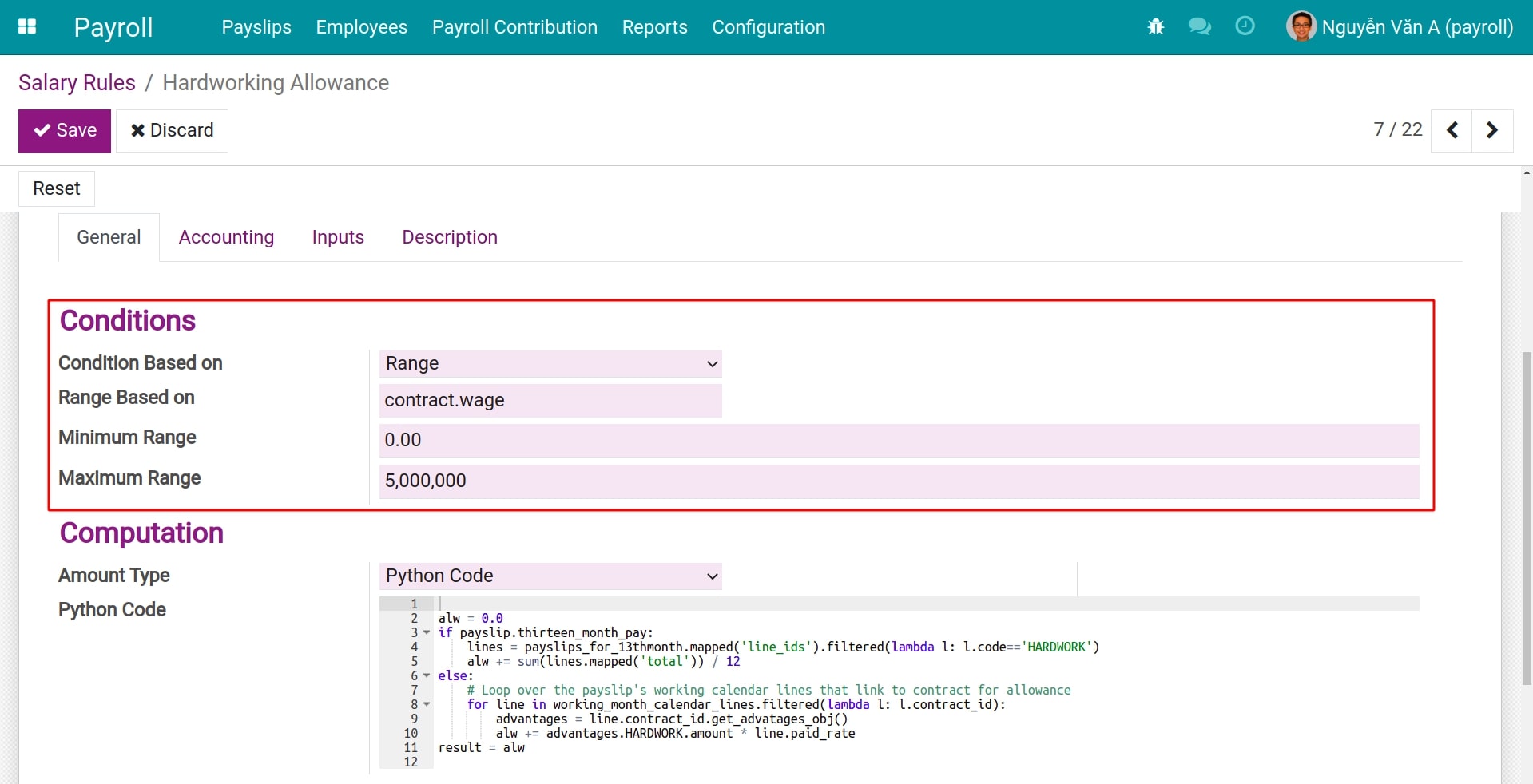

- Range: You need to select a field as the basis for the range of the condition. For example, you select the contract.wage field to get the base salary on the employee’s employment contract. If the min-max range is selected between 0 and 5,000,000, this salary rule will only apply to payslips with a base salary within the range.

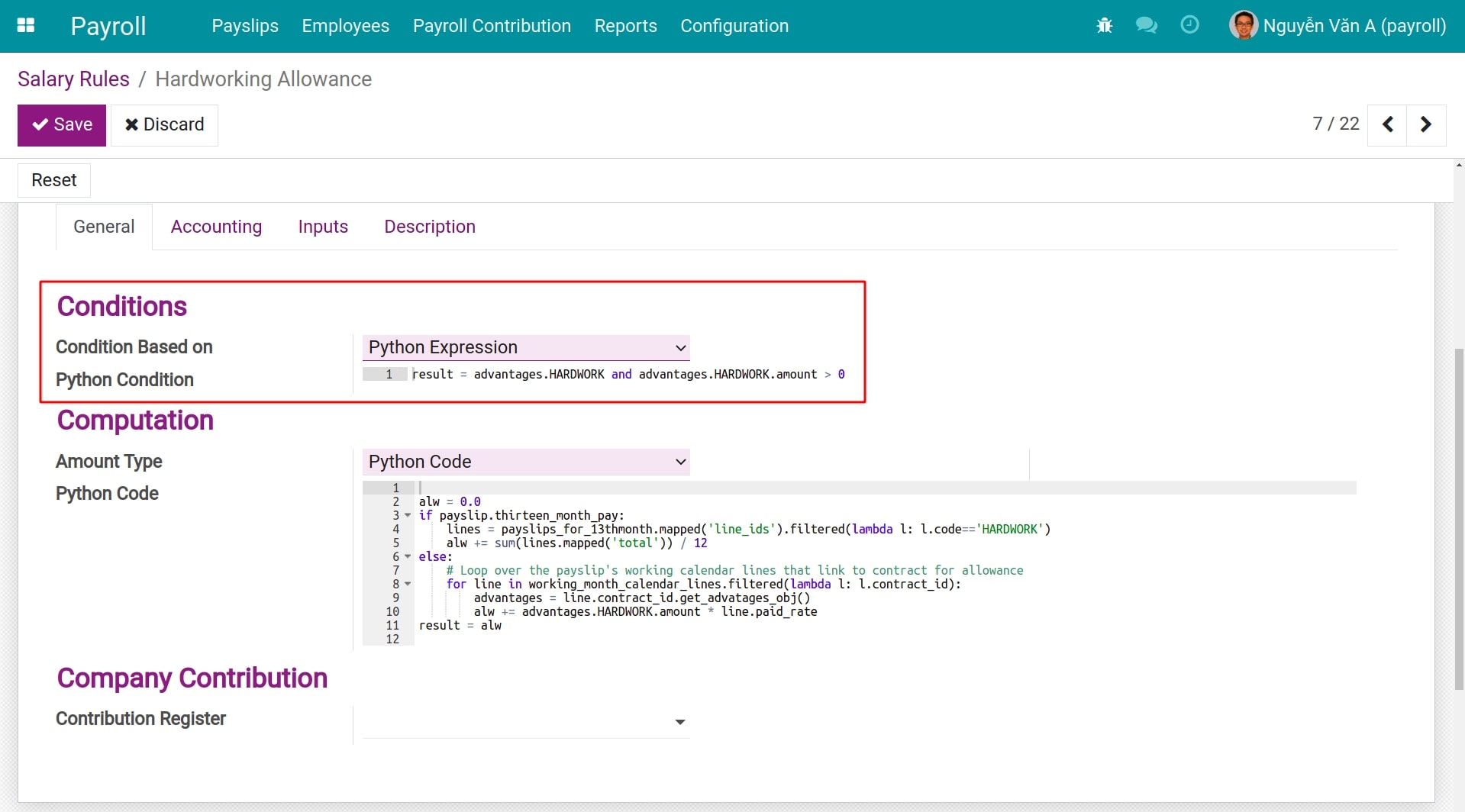

- Python Expression: Setting up the condition by code using the programming language Python.

![Always True condition Salary Rule Payroll Viindoo]()

![Range condition Salary Rule Payroll Viindoo]()

![Python expression condition Salary Rule Payroll Viindoo]()

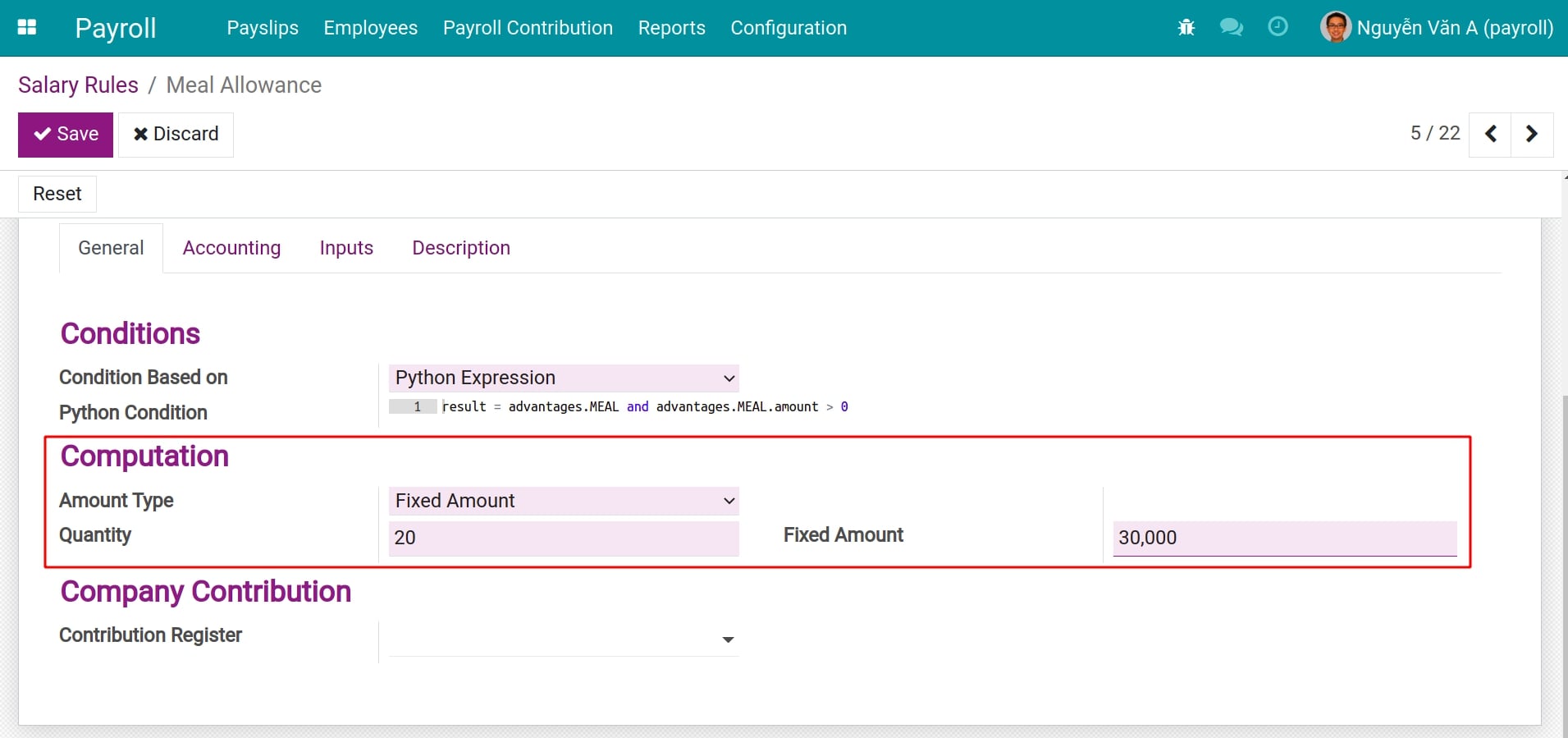

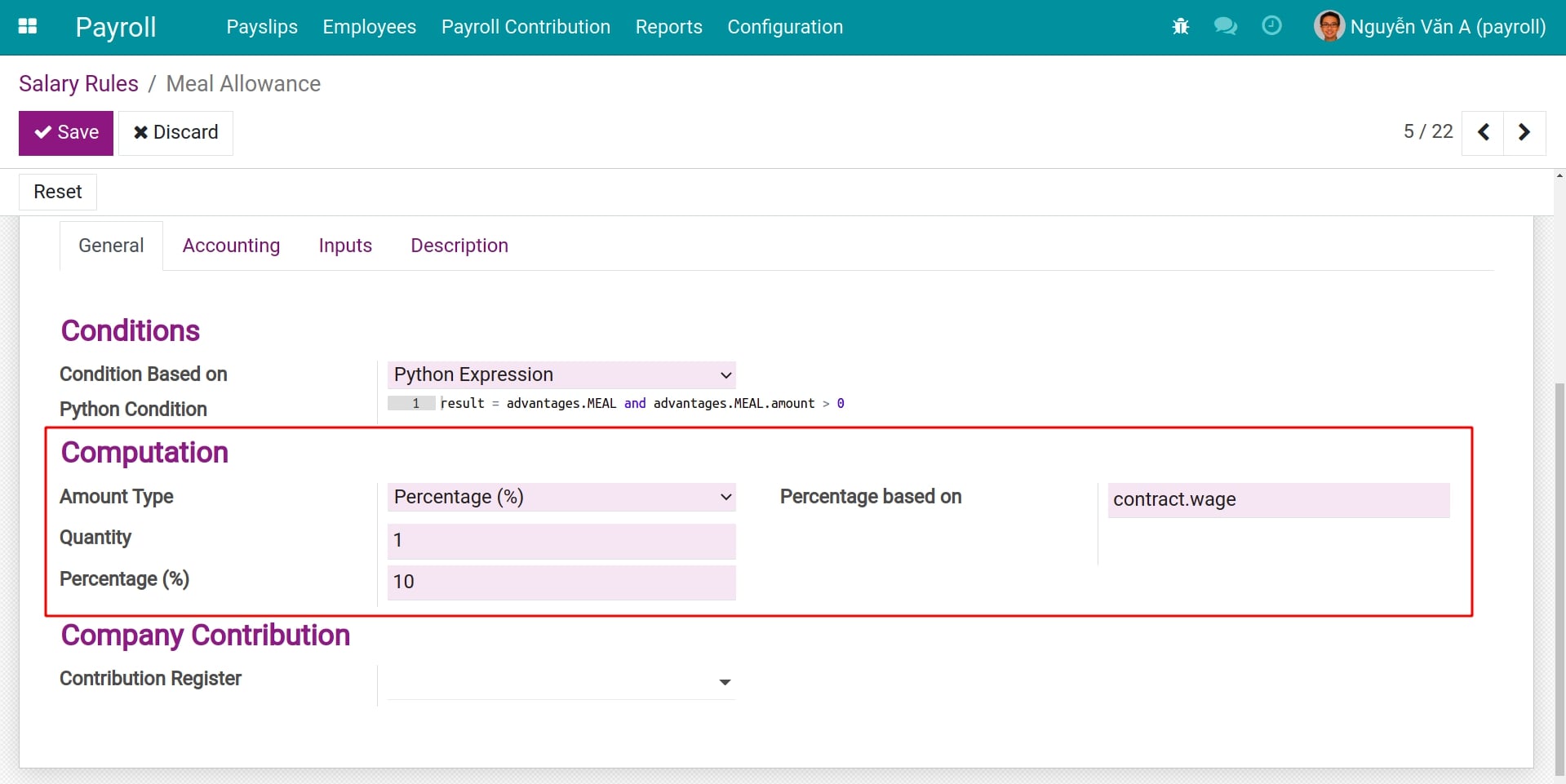

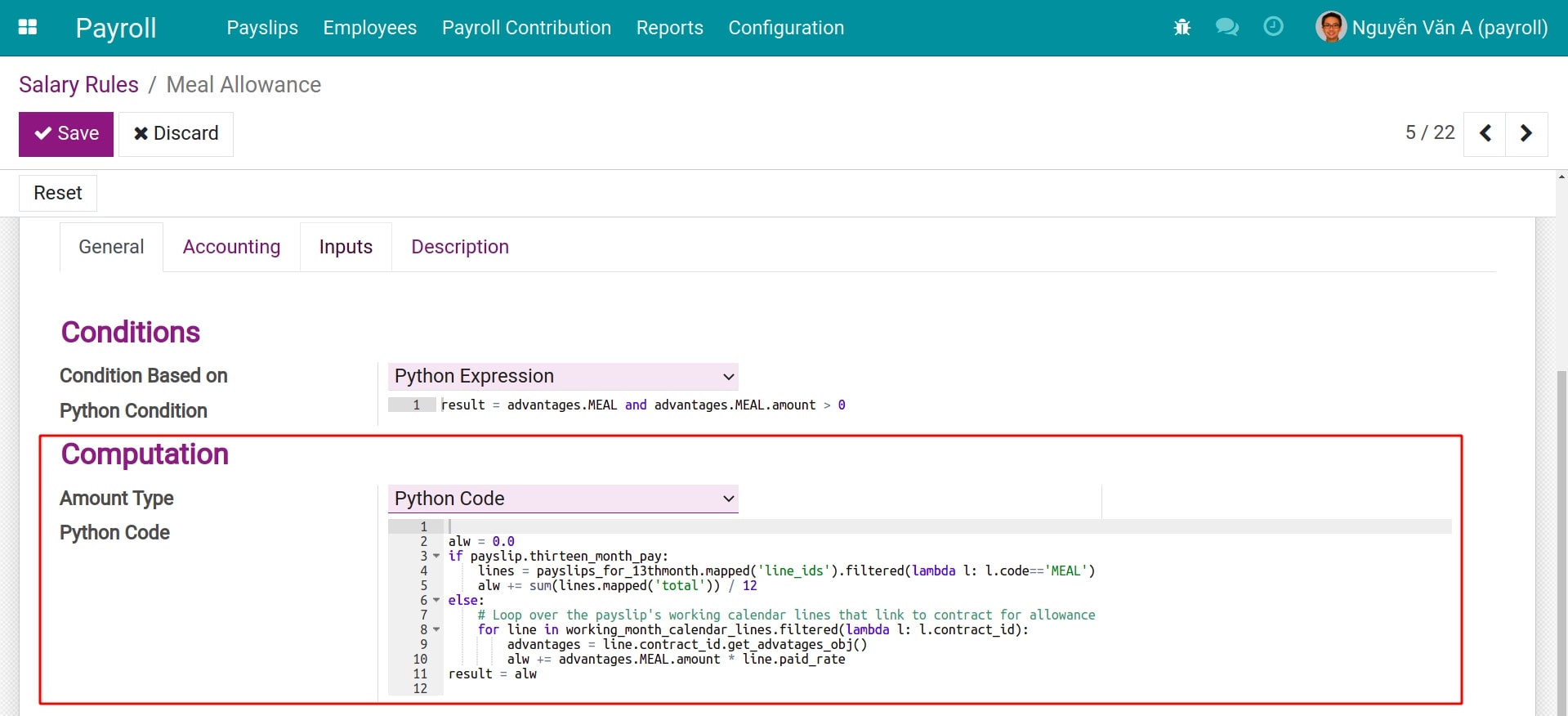

- Computation:Similar to the Conditions, you can select an option among the followings:

- Fixed Amount: Assign a fixed value to this salary rule. For instance, for the salary rule of a meal voucher, the Fixed Amount is 30,000 and the Quantity is assigned by default each month as 20.

- Percentage (%): Select a field as the basis of calculation on the field Percentage based on. The result of the salary rule will be calculated based on Percentage (%), Quantity and the result retrieved from the field Percentage based on.

- Python Code: Writing the formula using the programming language Python.

![Fixed Value calculation formula type Salary Rule Payroll Viindooz]()

![Percentage calculation formula type Salary Rule Payroll Viindoo]()

![Python expression code calculation formula type Salary Rule Payroll Viindoo]()

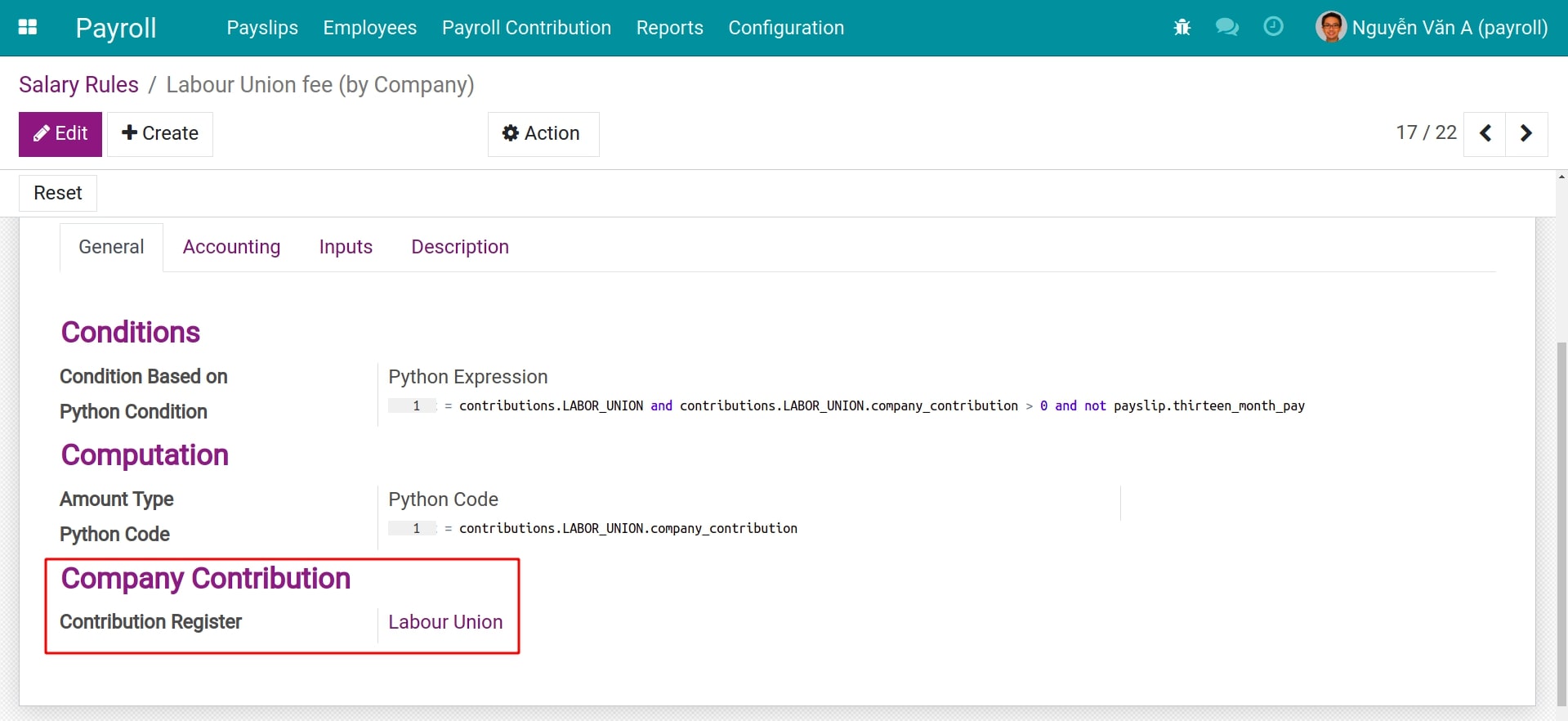

- Company Contribution:Select if the salary payment of the employees is also partly paid to a third party. (Refer to Contribution Register and Contribution Register Categories).

![Contribution Registered Third Party on Payslip Payroll Viindoo]()

If you have adjusted the initial settings of the condition and computation formula of a base salary rule, you can press the Reset button to restore it to its original state.

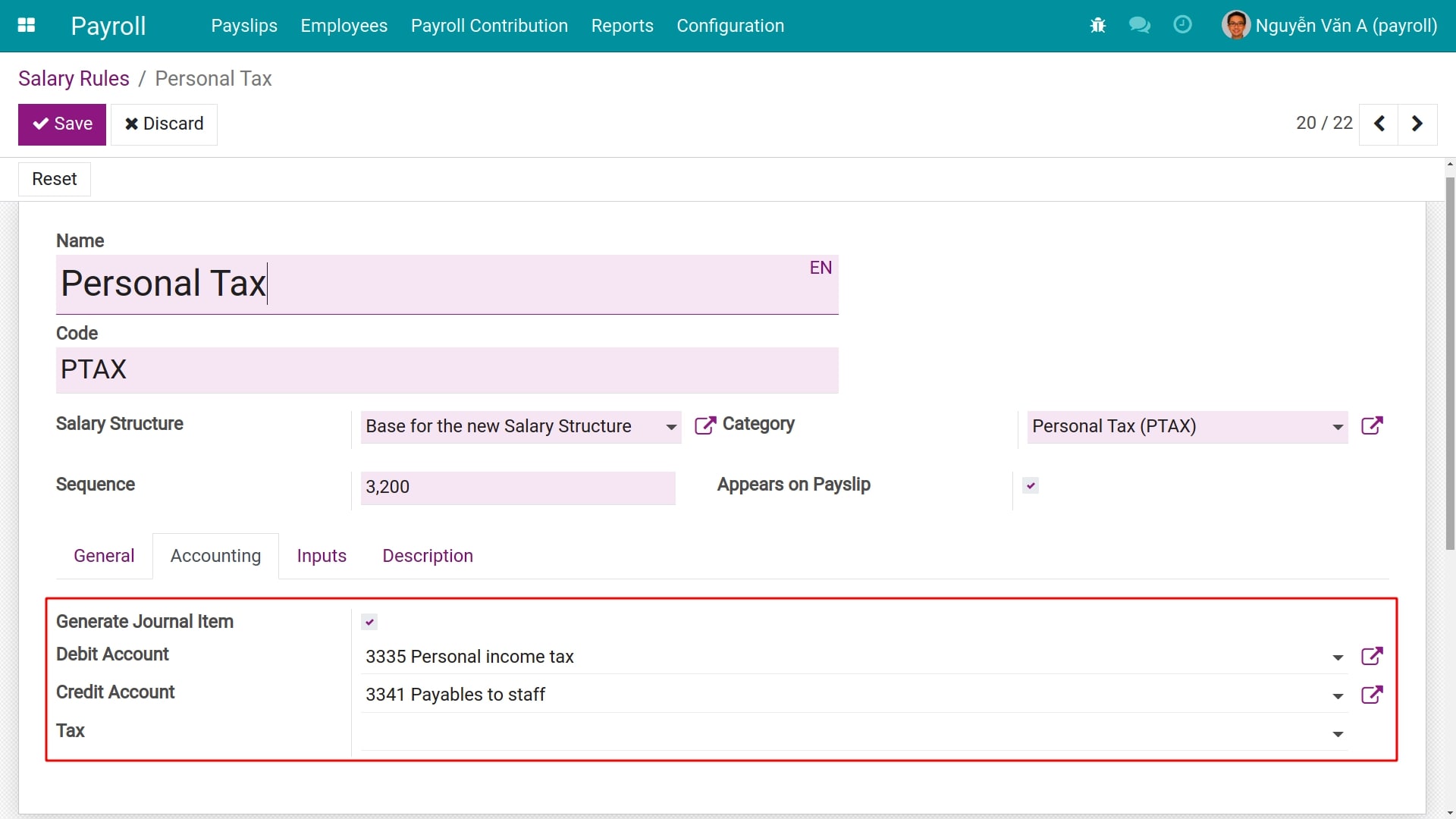

Fields on the Accounting tab¶

On the tab Accounting, check on the option Generate Journal Item to display the fields Debit Account and Credit Account. Select the desired accounts if you want the resulting accounting entry of this salary rule to be recorded in the respective accounting account.

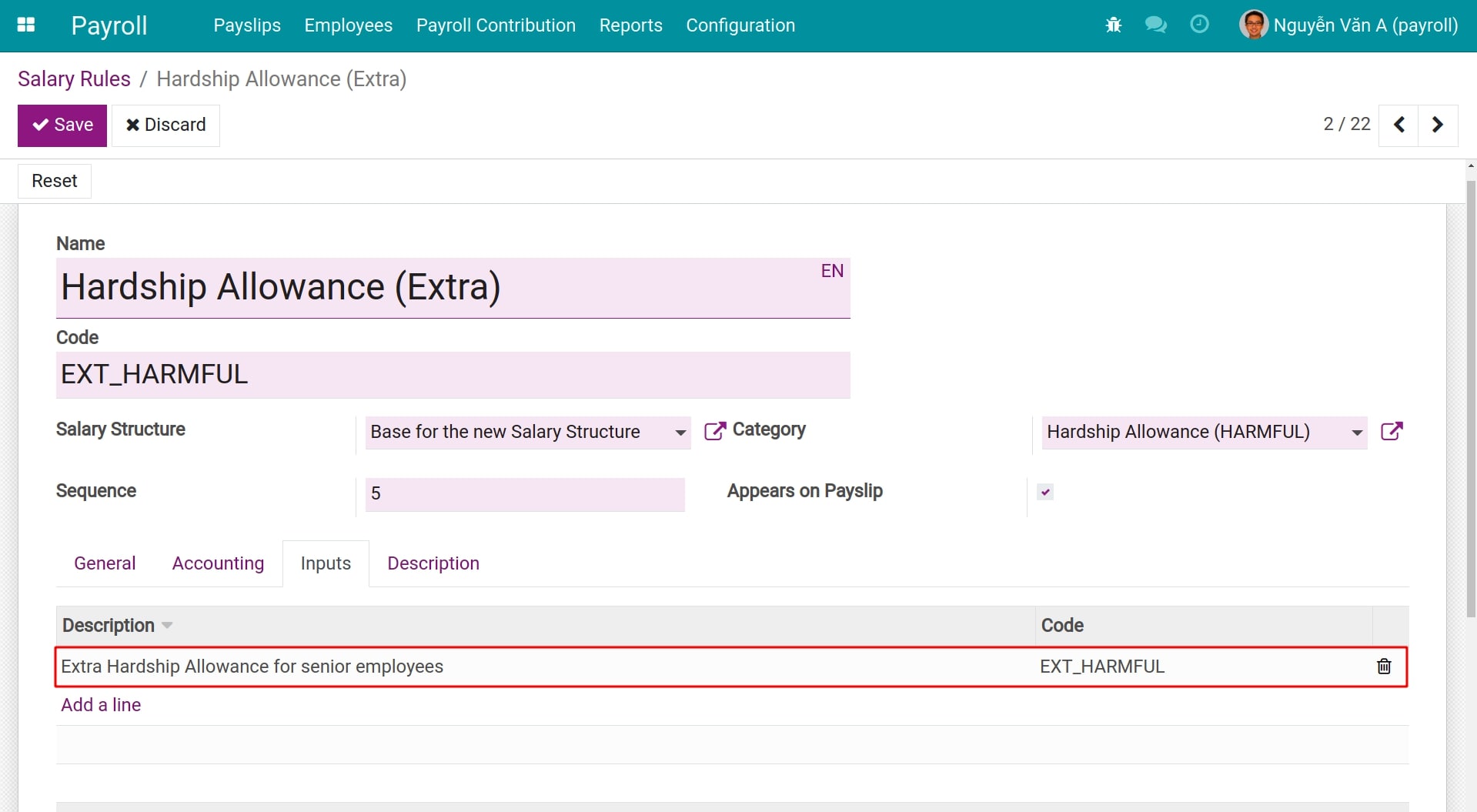

Fields on the Inputs tab¶

The Inputs tab allows you to specify manual entries on employee payslips. These salary rules usually apply to non-routine payments such as: Unscheduled bonuses, Holiday bonuses, etc. The Code field will be used as the calculation object in the payslip and the Description field will be used to display the name in the payslip. Please refer to this article How to create Payslip for more details..

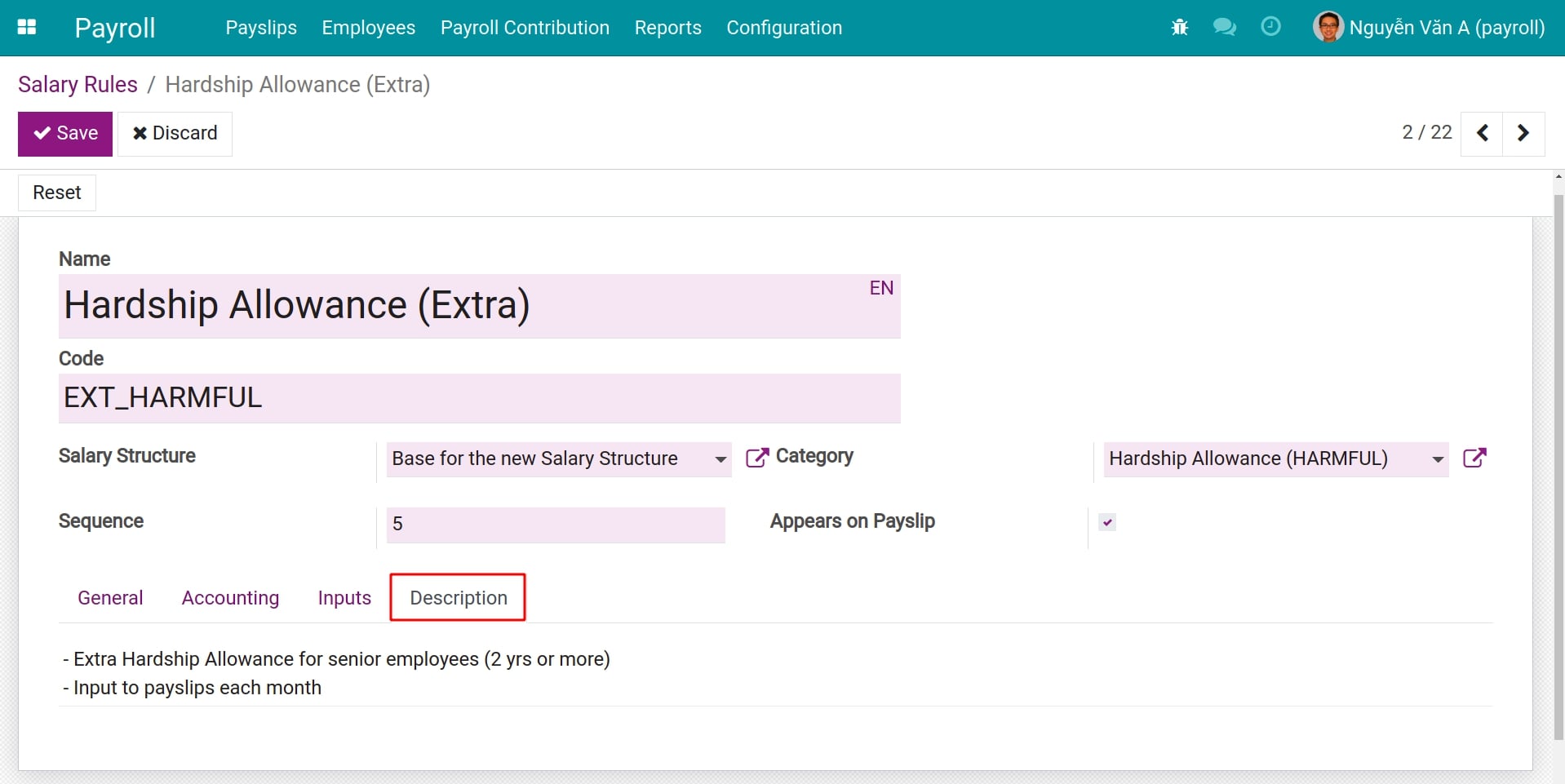

Fields on the Description tab¶

You can write down a detailed description of how this salary rule works so it is easy to remember and review when needed.

See also