Asset disposal¶

When an asset is put in use and the depreciation process already started, you still can perform other activities such as Sell, Dispose or Modify according to your needs. In this article, Viindoo will introduce you to the Asset Disposal feature.

Case 1: Dispose a depreciated Asset¶

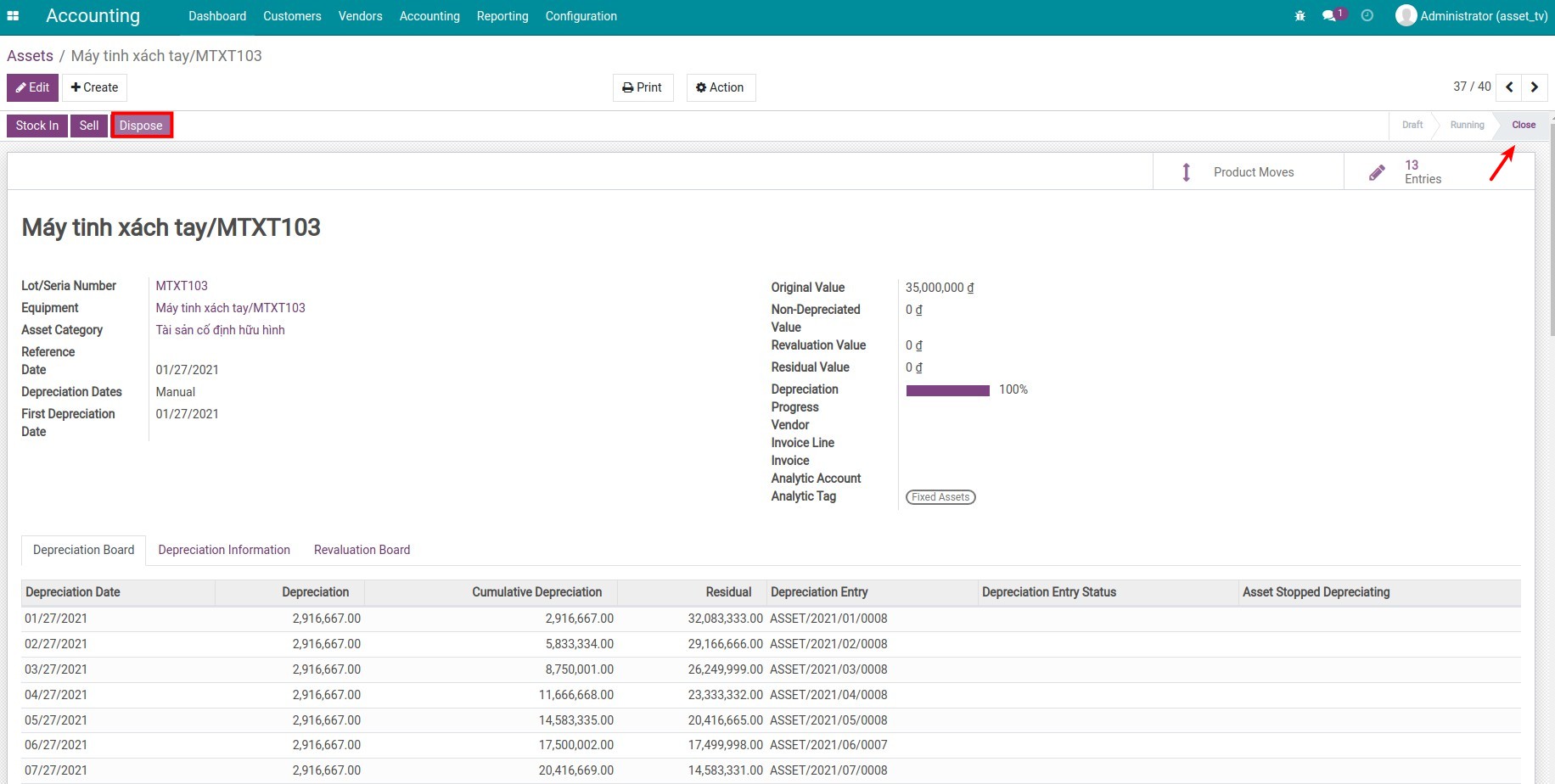

On the depreciated Asset view, its stage is set as Close, press on Dispose.

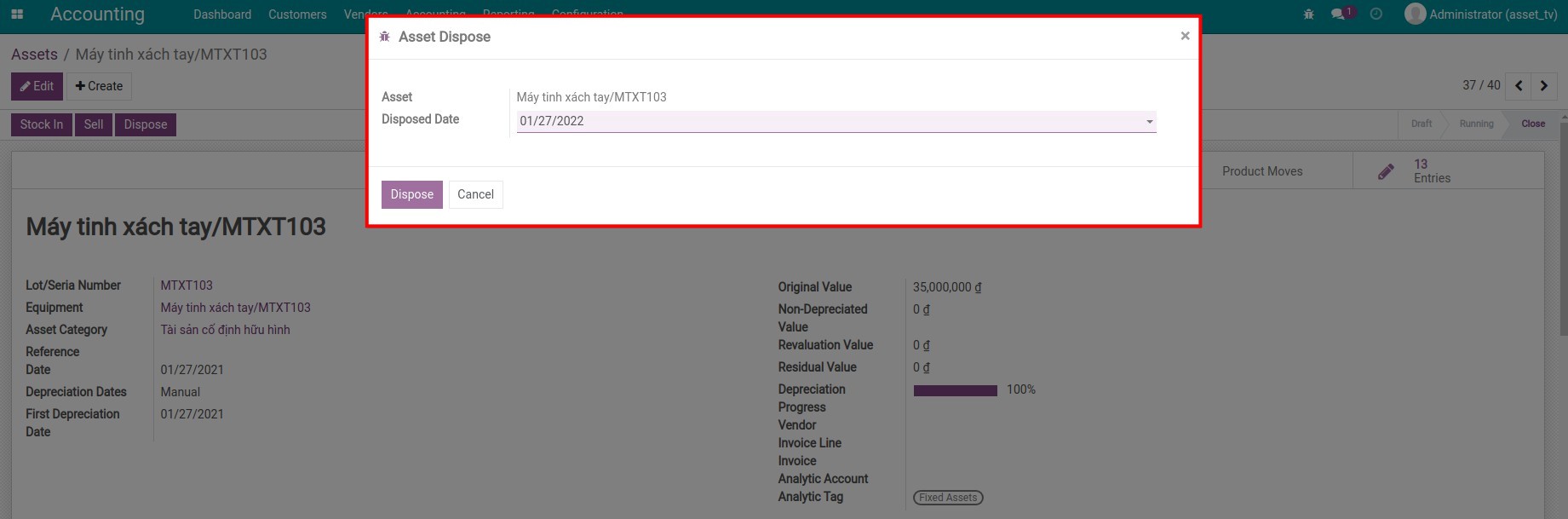

Here is where the system asks for the Disposed Date.

Note

The Disposed Date must be after the accounting date of the last journal items.

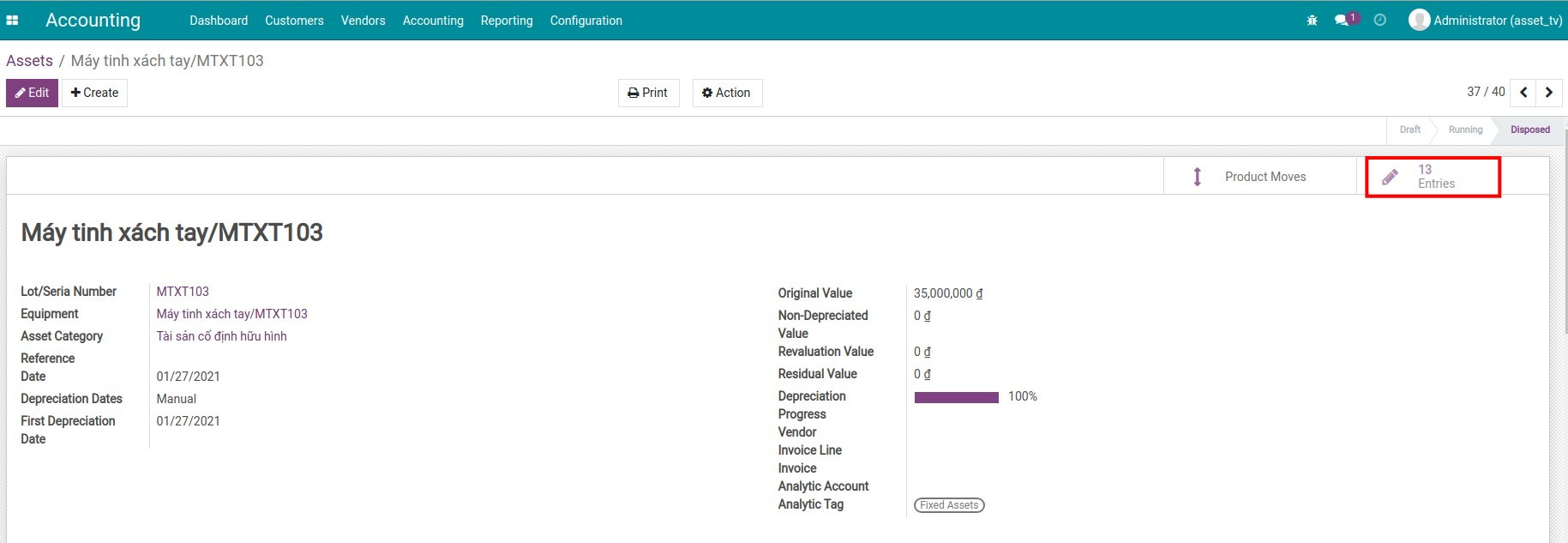

Press Dispose. The Asset stage will be changed from Close to Disposed. At the same time, the system will suggest a Journal entry for the Asset disposal in the Draft stage. To see this entry, go to Entries.

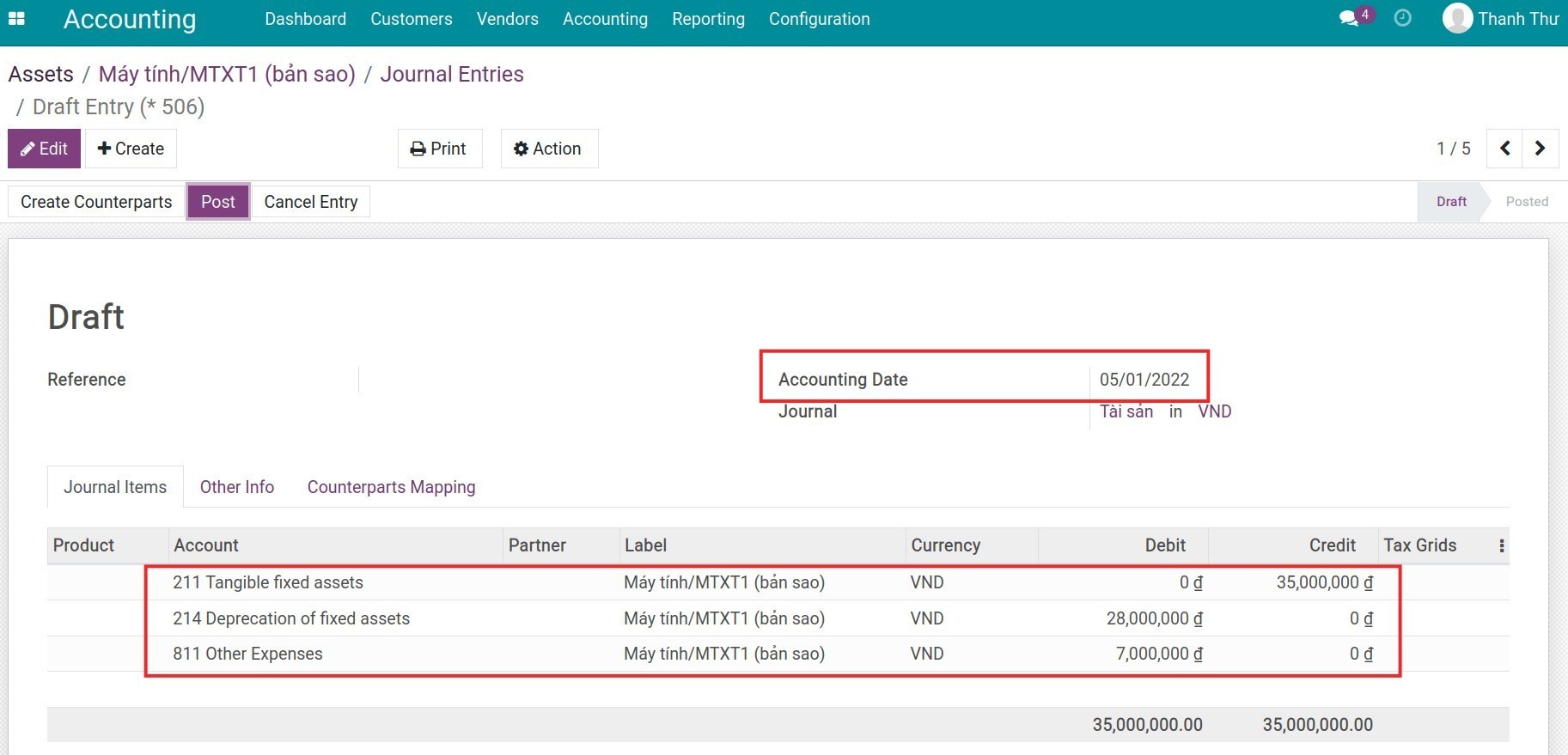

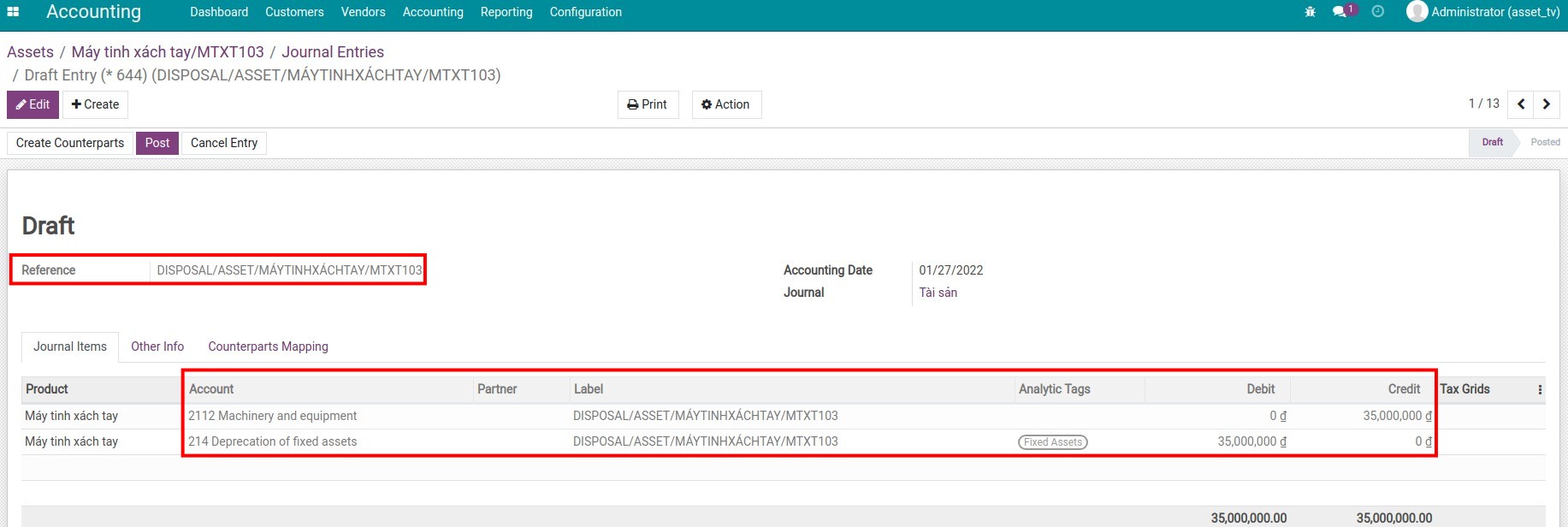

Below is an example of the Depreciated Asset disposal entry.

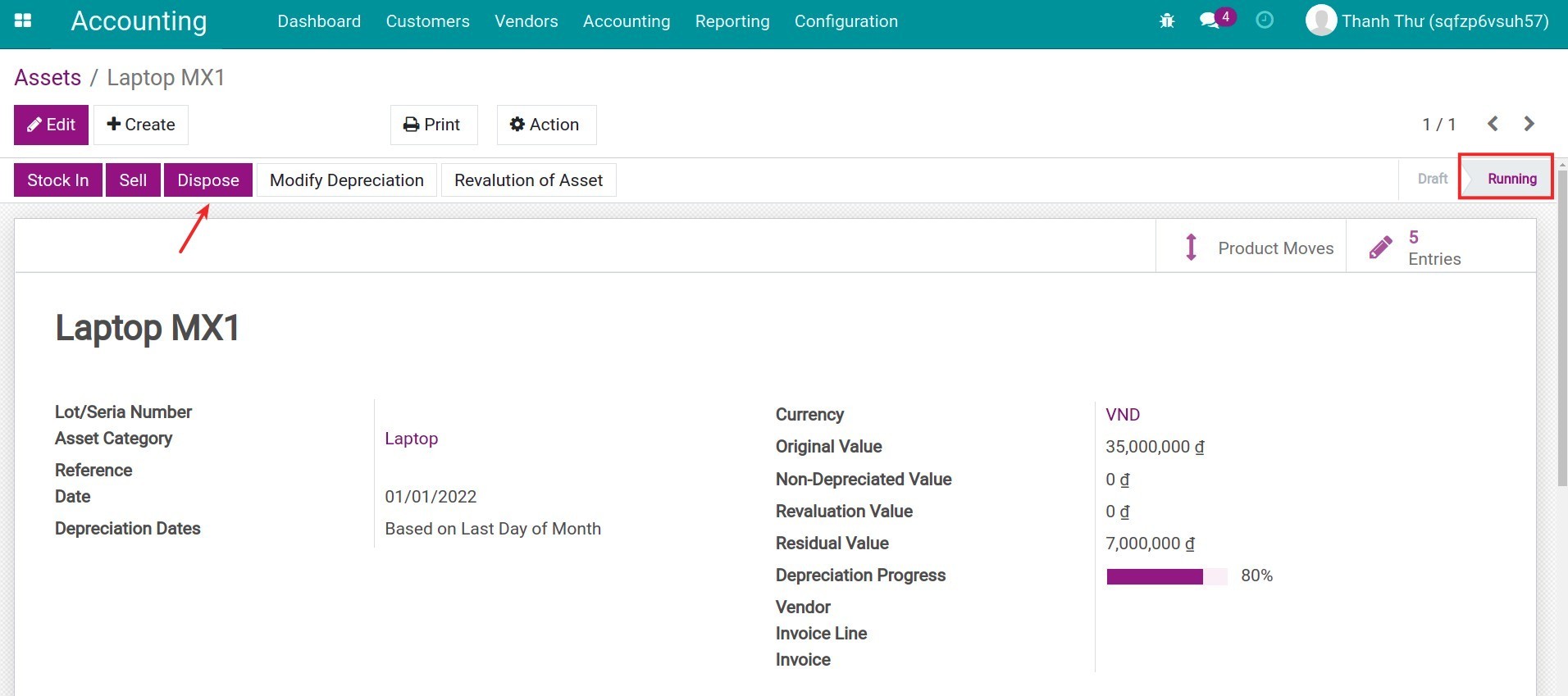

Case 2: Dispose an Asset while being depreciated¶

On the Asset form which has the depreciation in the Running stage. Choose Dispose.

Similar to the first case, the system asks for a Disposed Date.

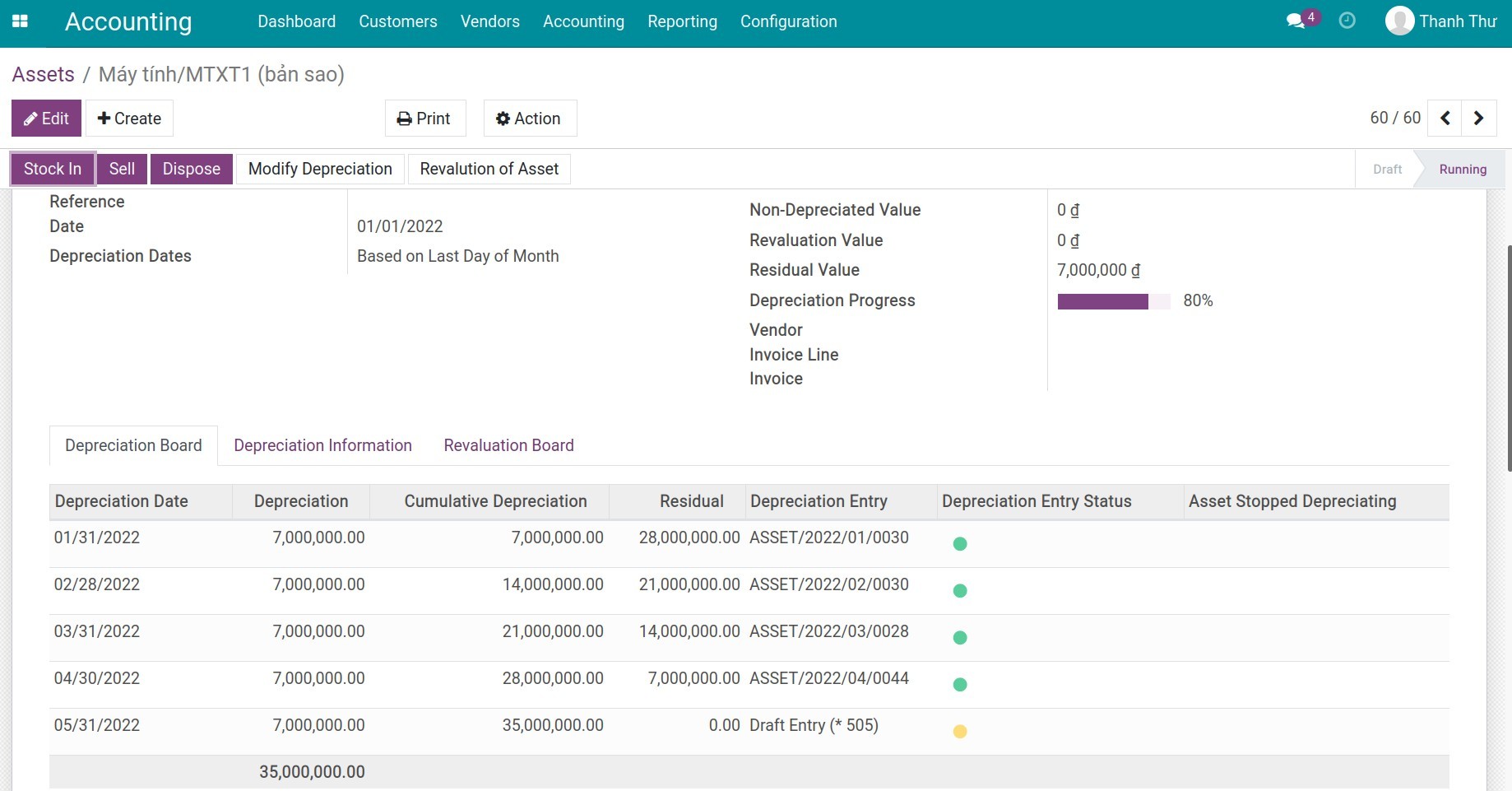

Dispose asset at the beginning of the next depreciation period.

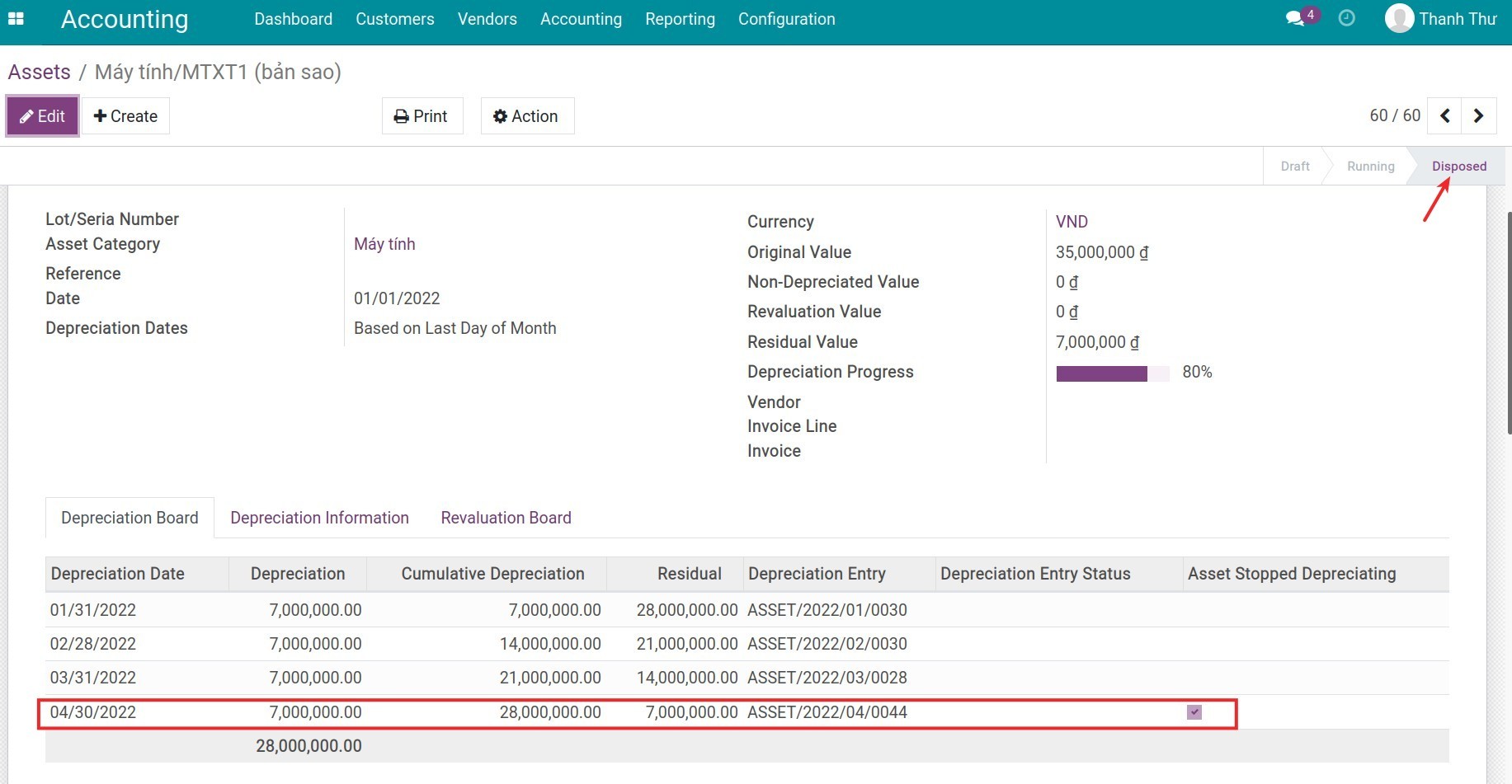

In this example, the nearest depreciation date is 04/30/2022, change the Disposed Date to 05/01/2022 then press Dispose, and the Asset stage will be changed from Running to Disposed. This Asset will stop being depreciated at this time.

![On the same day as the next amortization period]()

The system will then suggest an Asset disposal entry in stage Draft. To see this journal entry, choose Entries similar to the previous example.

![Asset disposal]()

Dispose asset on a day different with the beginning of the next depreciation period.

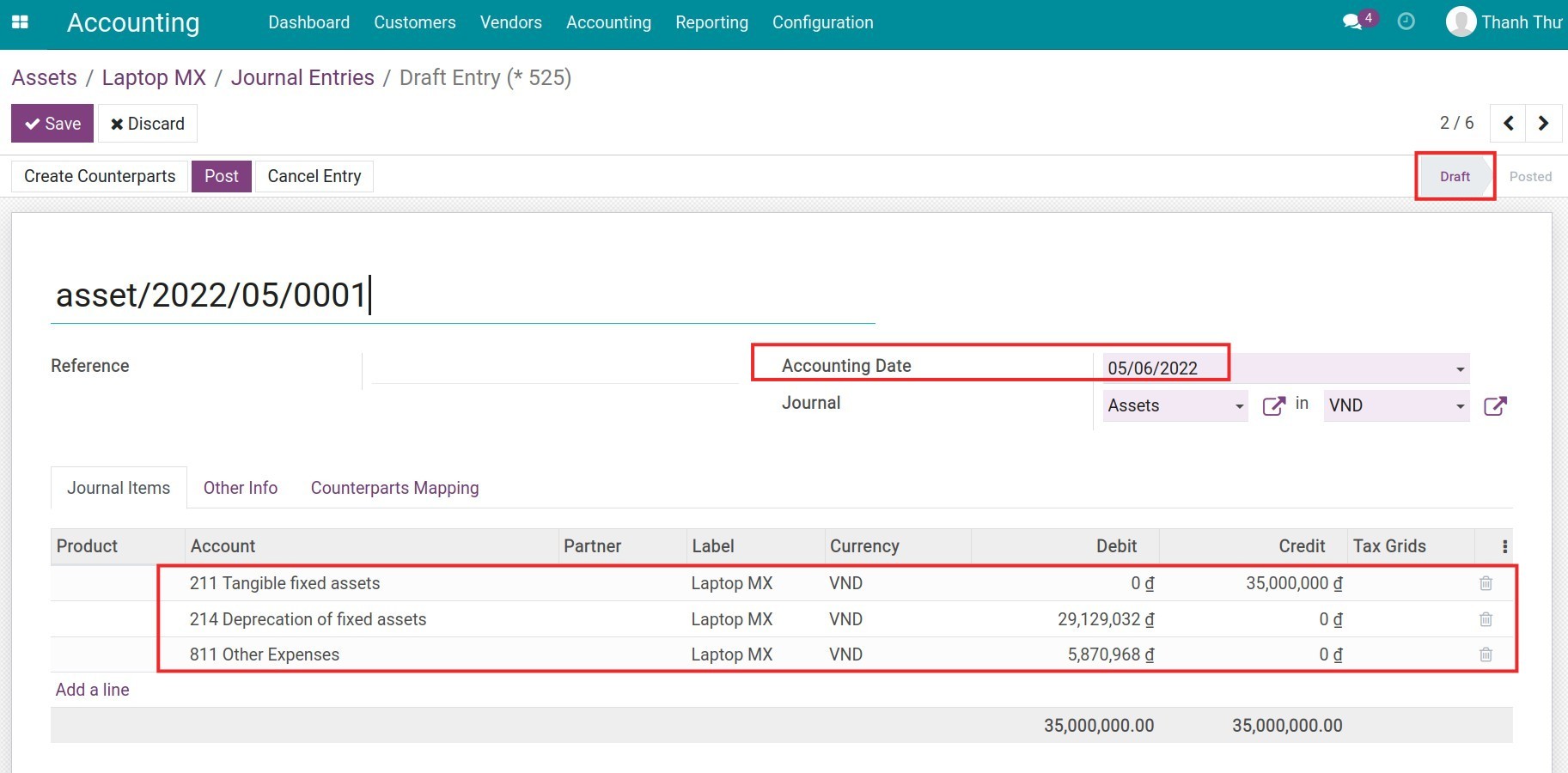

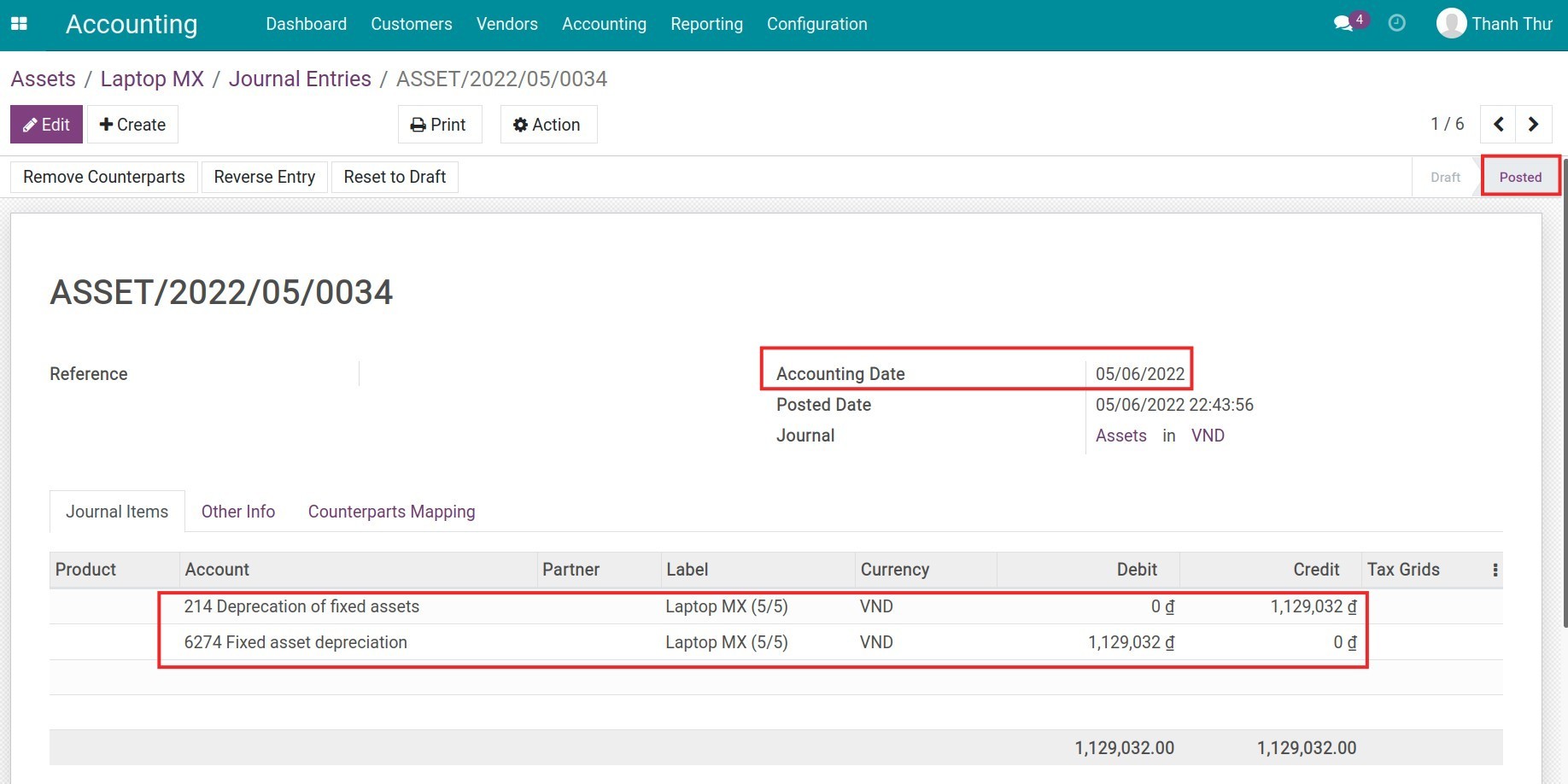

In this example, the nearest depreciation date is 04/30/2022, change the Disposed Date to 05/06/2022 then press Dispose, and the Asset stage will be changed from Running to Disposed. The system will calculate the depreciated value of the last period and a Journal entry will be created to adjust the depreciated value of said period to stage Posted.

To see this Journal Entry, press on Entries.

Wipe out Asset entry:

![Wipe out Asset entry]()

Adjust the depreciated value Asset entry:

![Depreciation adjustment entry on Viindoo]()

See also