Cash on hand management¶

Cash statement creation¶

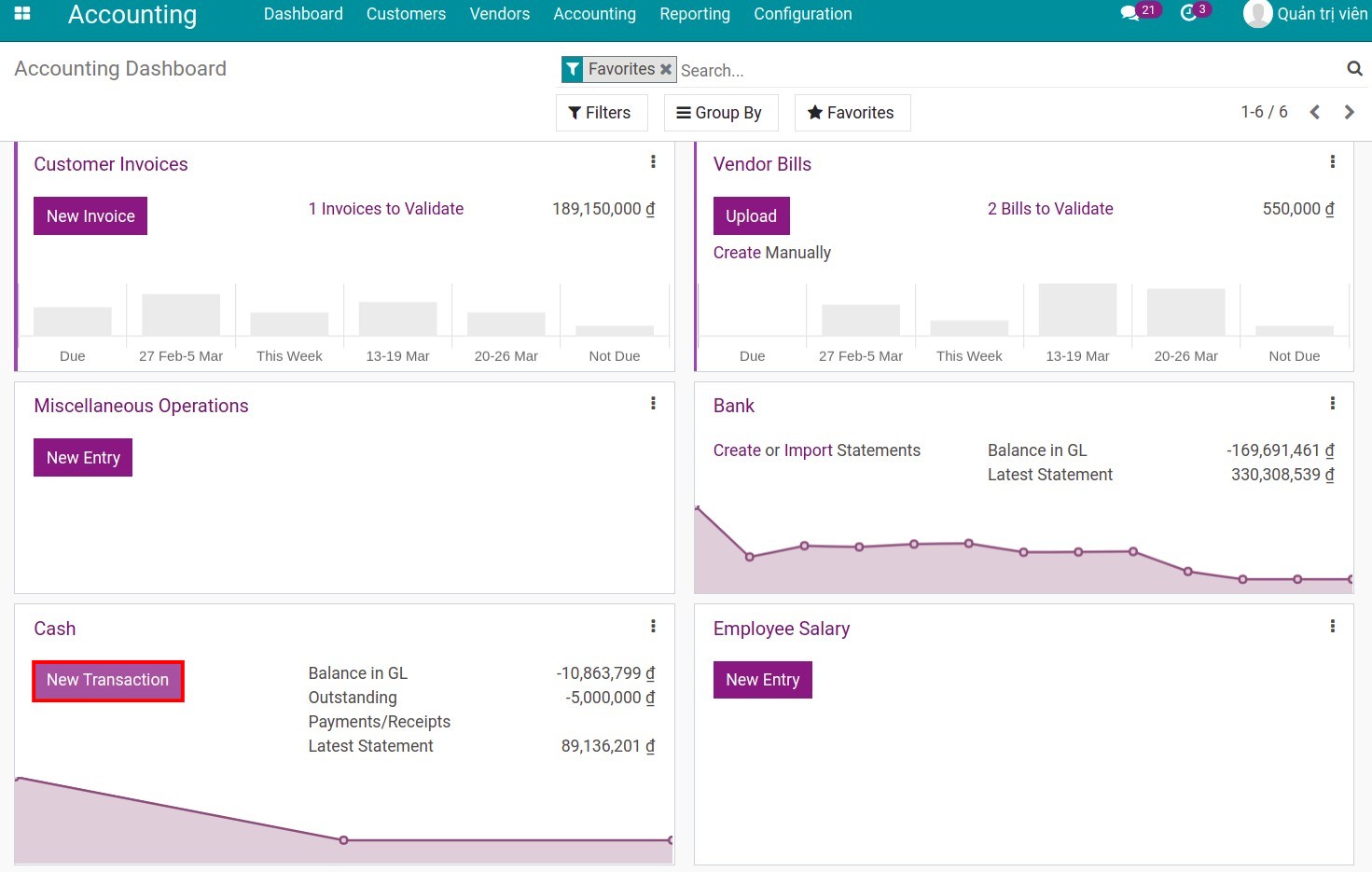

On the view Accounting Dashboard of the Accounting app, go to Cash section and hit New transaction.

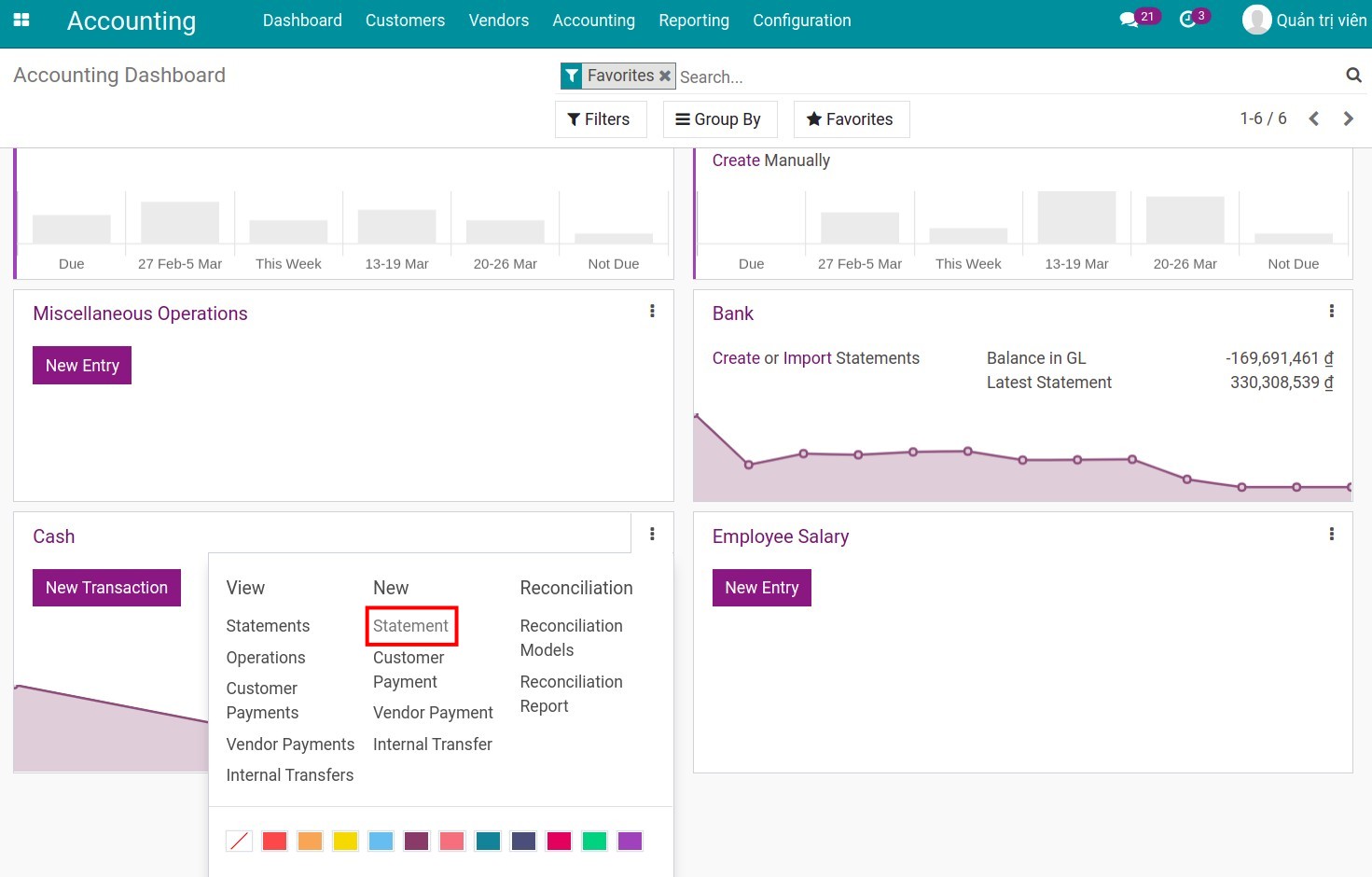

Alternatively, also in Cash section, hit on the Kebab menu icon (ie. three vertical dots icon) and select Statement on the New column.

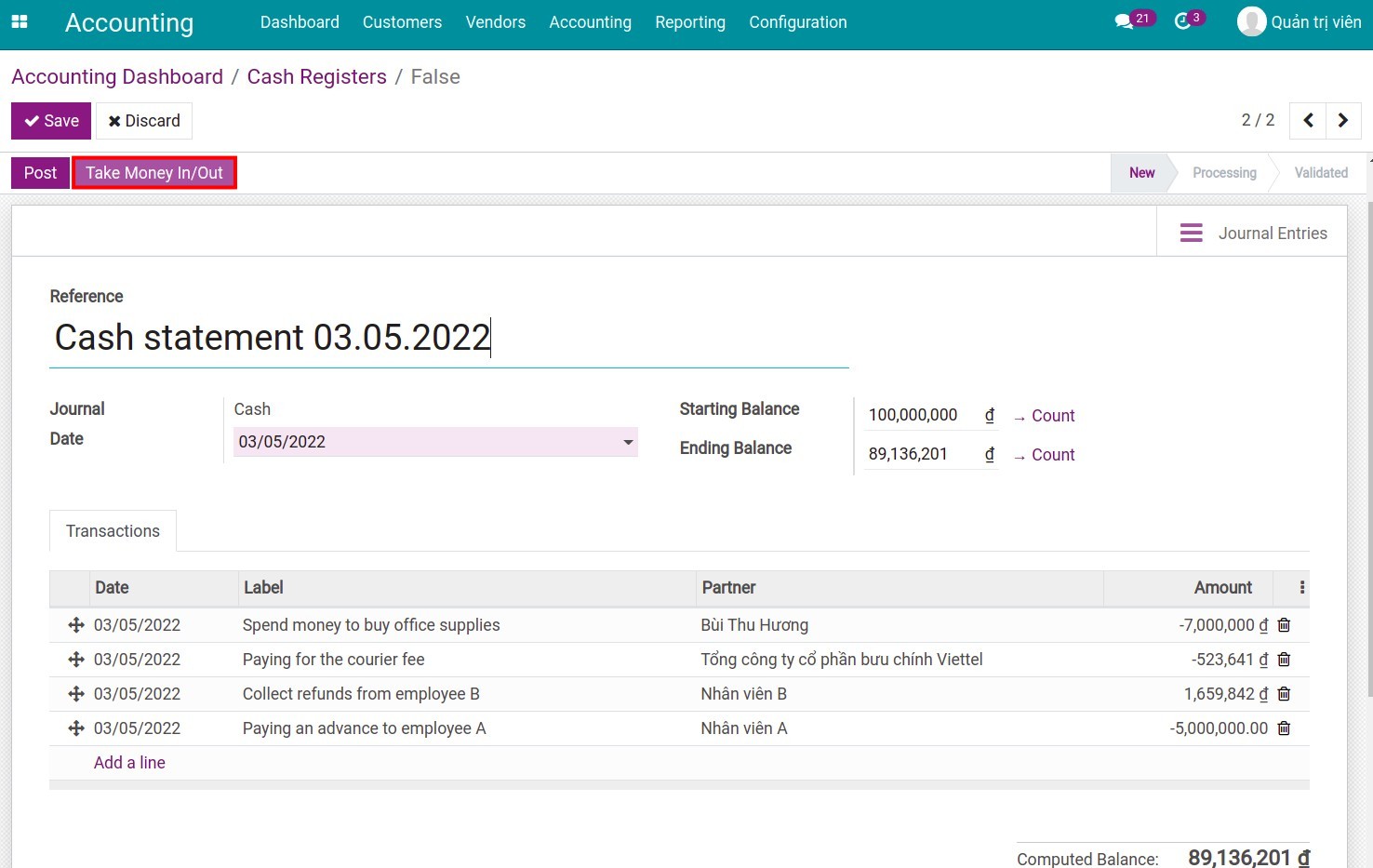

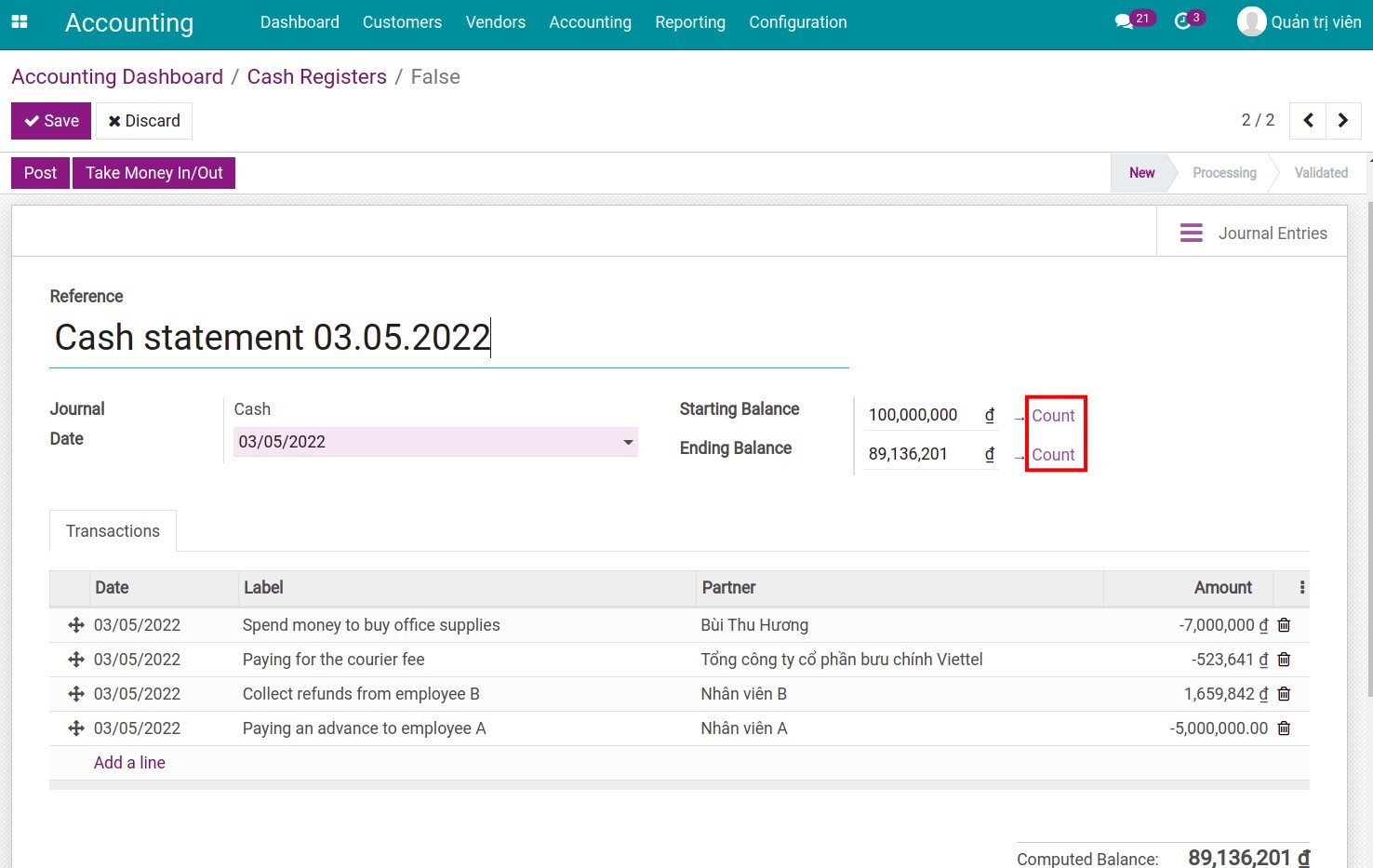

Recording on the cash statement is similar to recording cash receipts and cash payments in the cash journal. On this new view, enter the following information:

Reference: for information search purposes. There should be information of the time (e.g. date) so that it is easy to find and easy to read.

Journal: select the accounting journal in which you keep track of each cash on hand fund.

Date: the date the statement was created.

Starting balance: enter the actual balance in the cash on hand fund when the recording of the statement is started.

Ending balance: enter actual balance in cash on hand fund when the recording of the statement is stopped.

Computed balance: the formula is: starting balance + all the amounts of cash in/out transactions. This balance will be compared with the ending balance. When this balance is posted, a journal entry will be created to record the difference, if any.

Transactions tab: enter the details of cash transactions during the day.

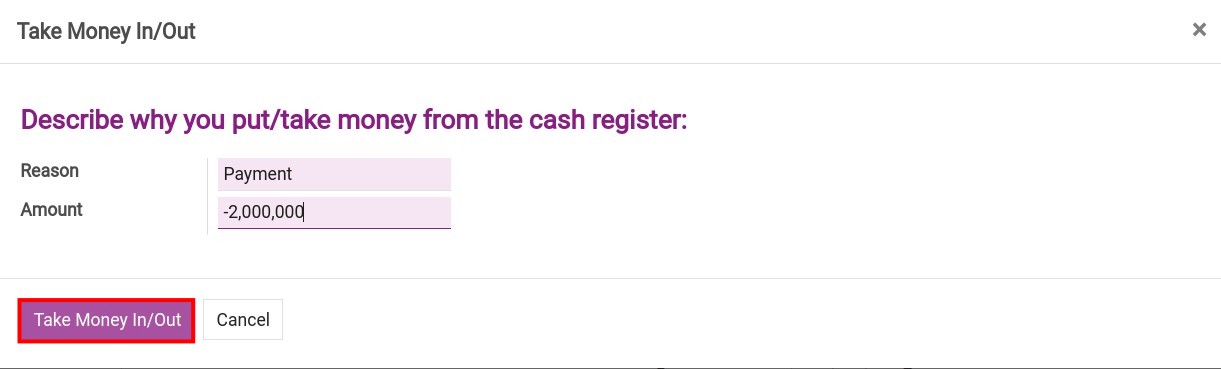

In addition, you can use the Take Money In/Out button to quickly enter the amount received or spent by briefly describing the content and the amount incurred. A new statement line will be created upon completion, and you will need to enter the partner information.

Note

Use negative numbers to record the money out. Use positive numbers to record the money in.

On the statement, the partner information must be filled in correctly and completely (the payer/receiver) for monitoring and reconciliation.

Cash on hand Counting¶

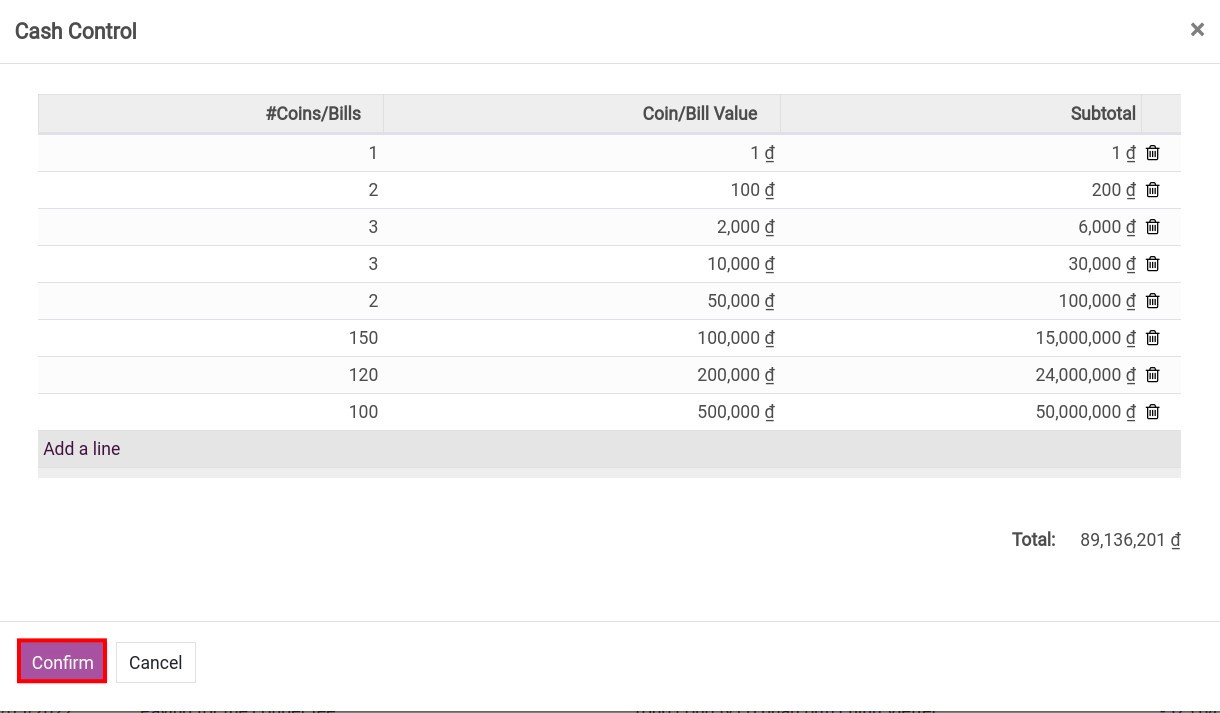

On the view of creating a statement, hit Count to perform an actual cash counting in the fund, which is based on the face value and the quantity.

Hit Confirm to complete the cash on hand counting.

Cash receipts/payments reconciliation¶

As you know, the reconciliation of the cashier’s statement with the accounting journals is necessary to make the funds transparent.

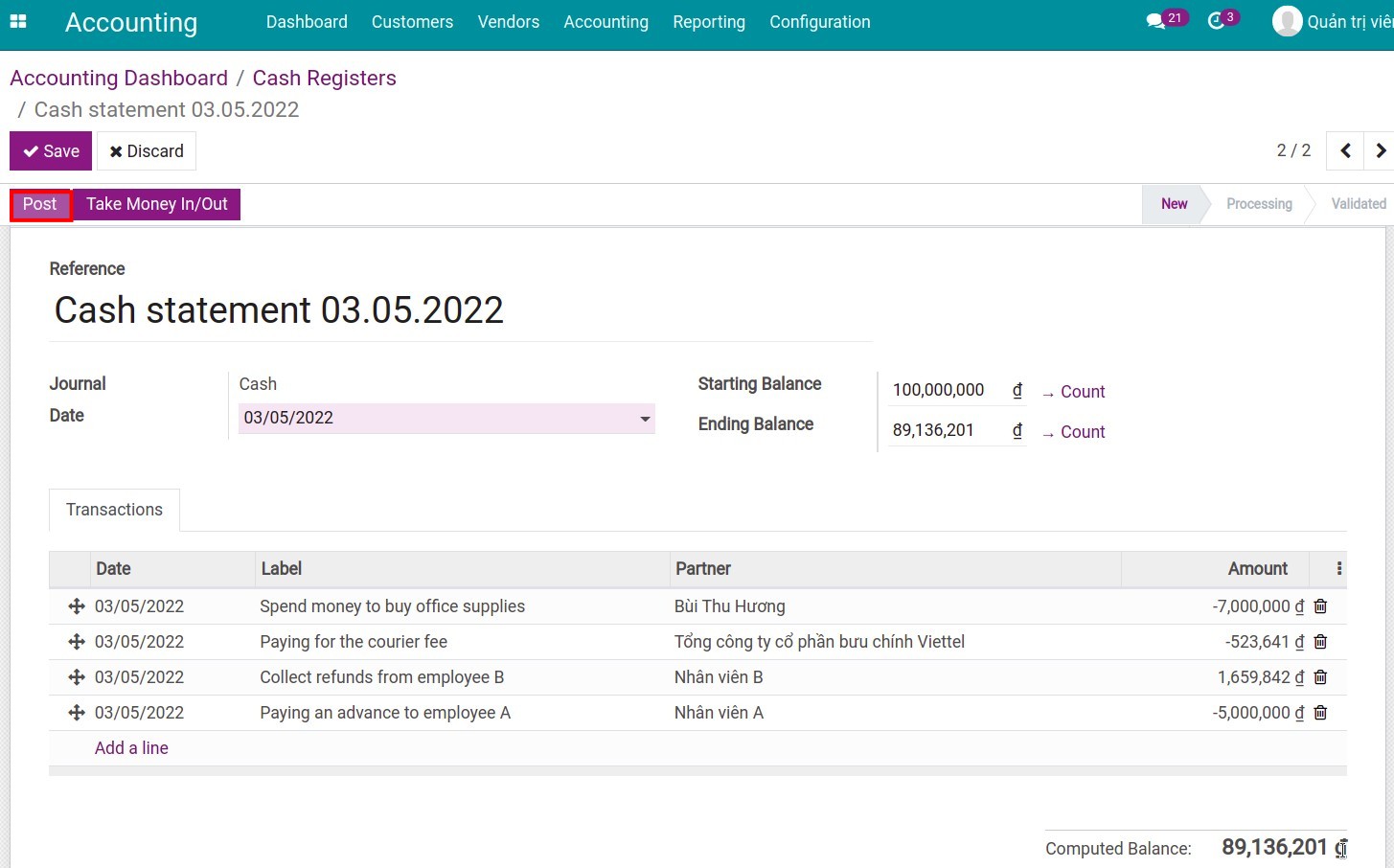

After entering the statement entry is completed, hit Post.

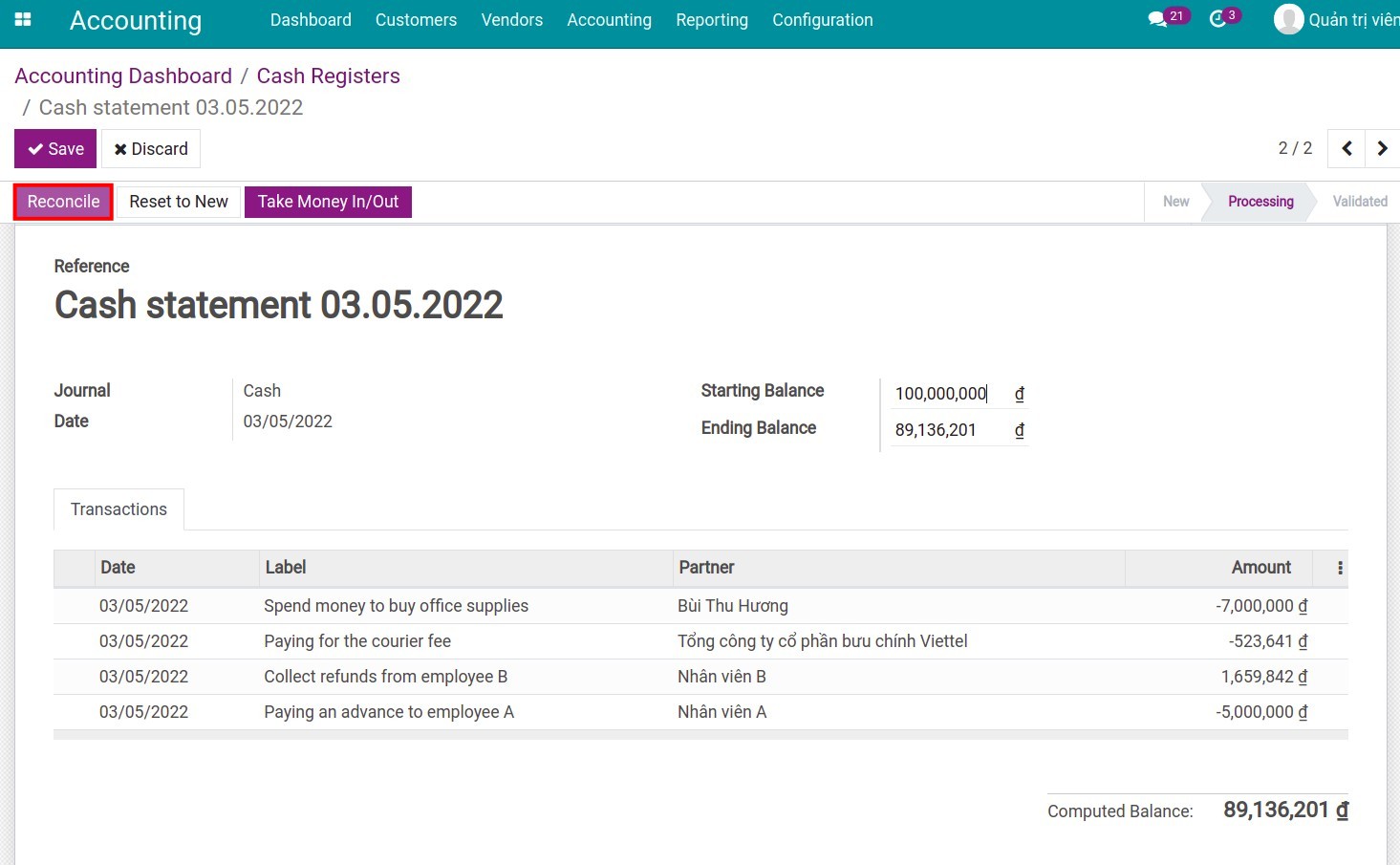

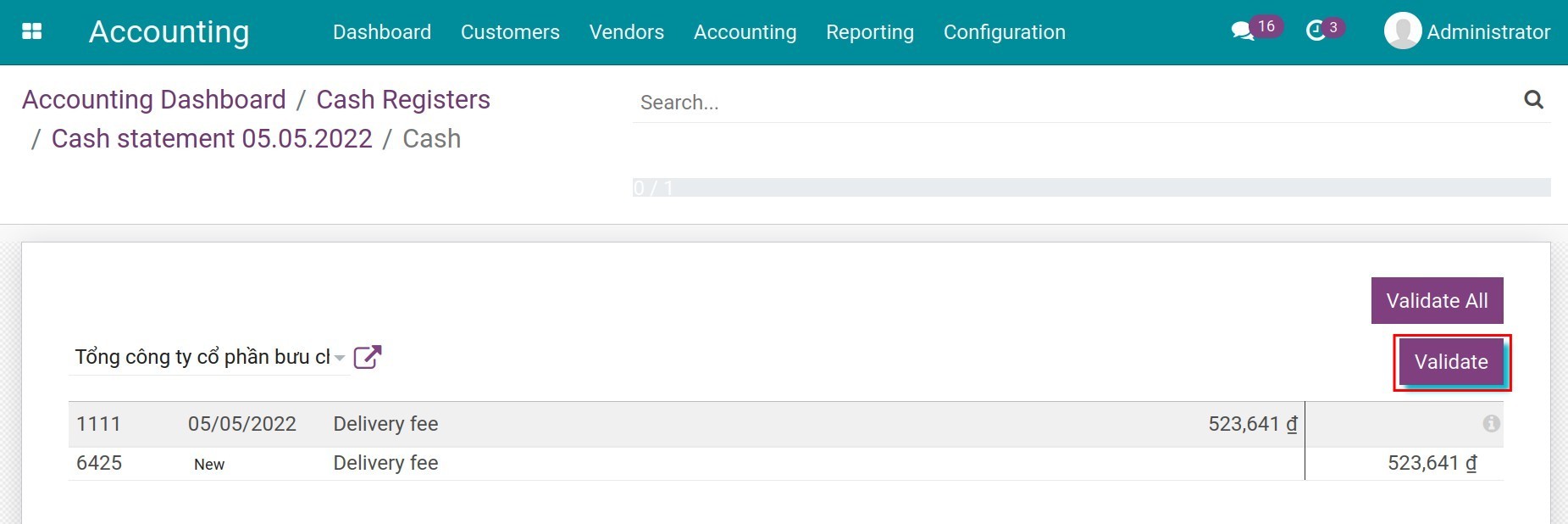

Hit the Reconcile button. The system will automatically identify and suggest the corresponding arising amounts.

Check the information and hit Validate.

At this step the behaviors of the system will be:

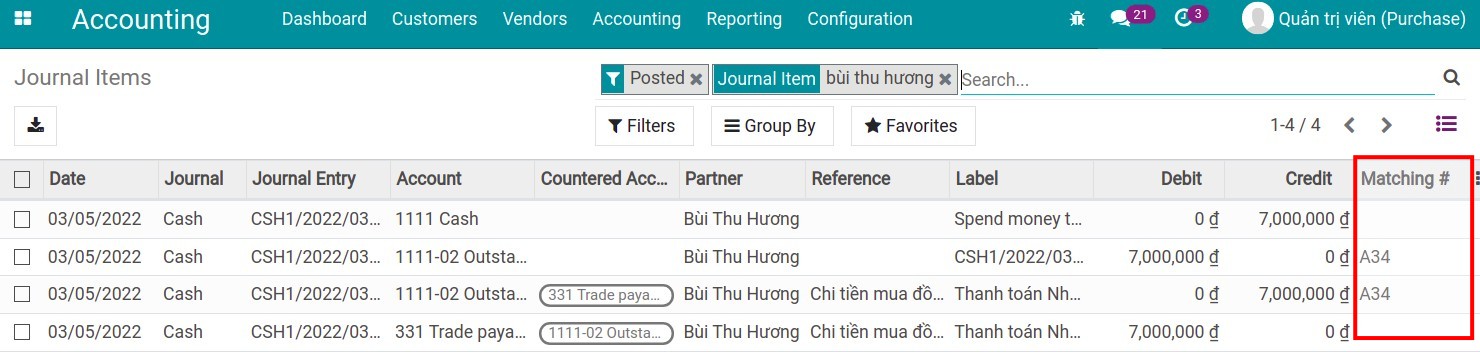

For a transaction that has a payment slip, the system will generate a matching code to identify this transaction as completed.

Note

To see the Journal Item and the matching codes, you must enable the developer mode in the system. Refer to here.

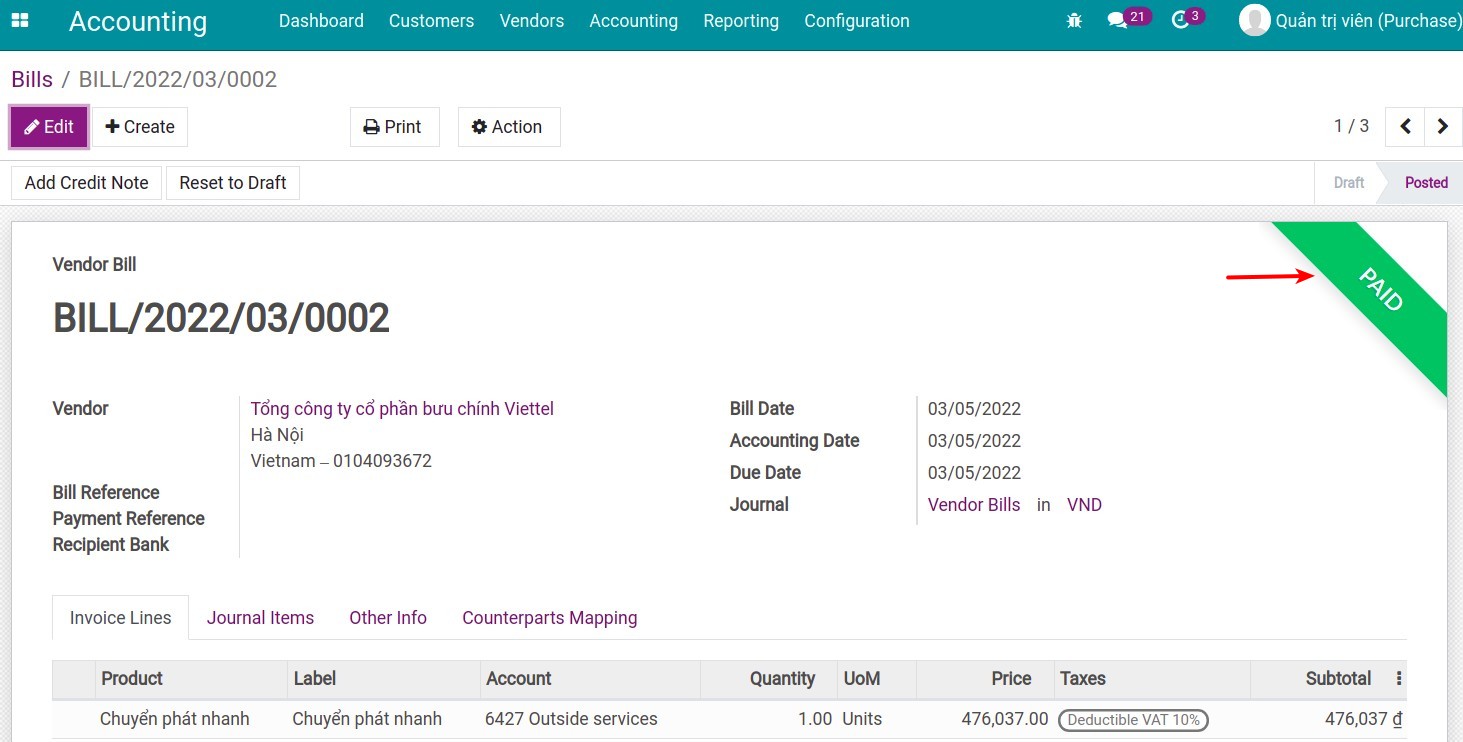

For a transaction that has not yet issued a payment slip but has a Vendor bill, the status of the invoice will be changed to Paid and the debt will be 0. A journal entry will be automatically created to register payment.

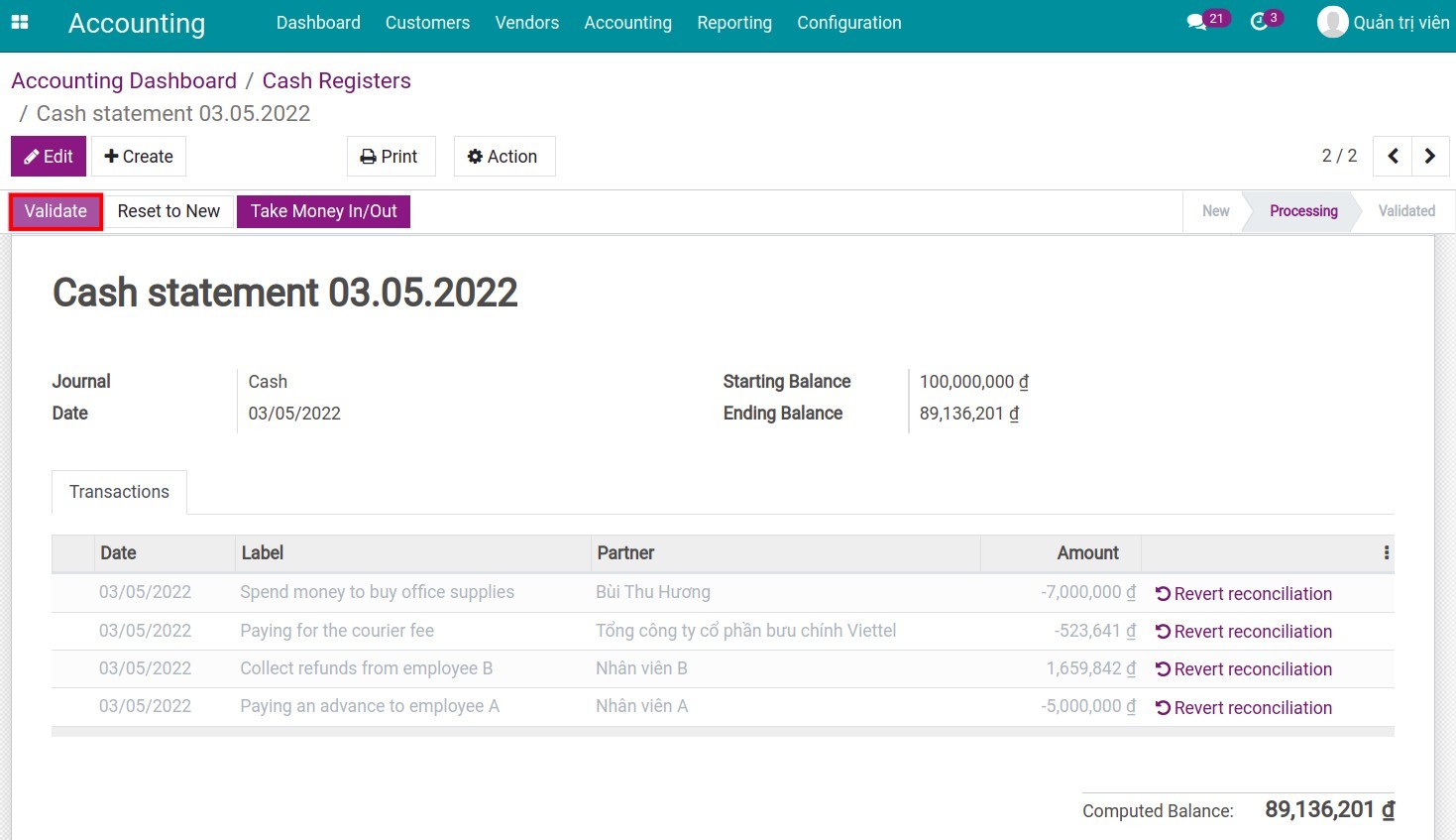

After the reconciliation and counting is completed, then do the saving and validation.

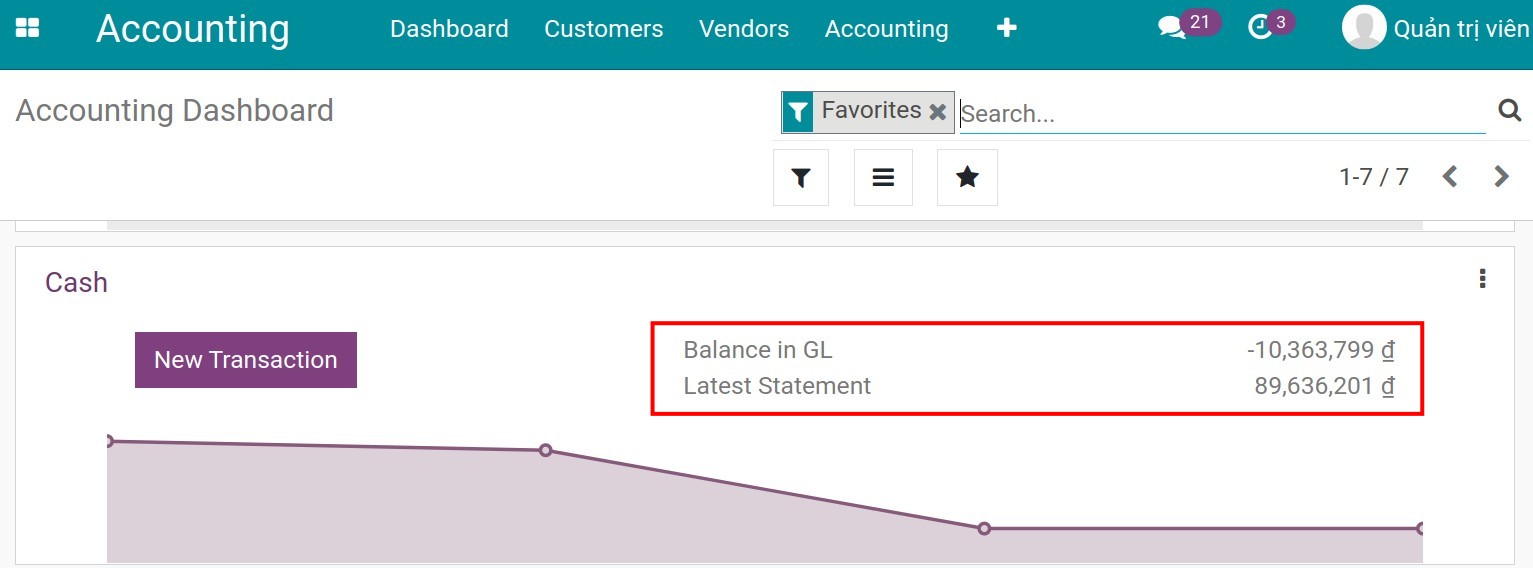

The status of the statement has been changed from Processing to Validated. On the view of the Accounting Dashboard, in the cash journal you will see the balance recorded in the General Ledger and the actual balance of the latest statement. If there is a difference you will also see the information here.

Cases occurring when counting cash on hand¶

Counting of excess funds¶

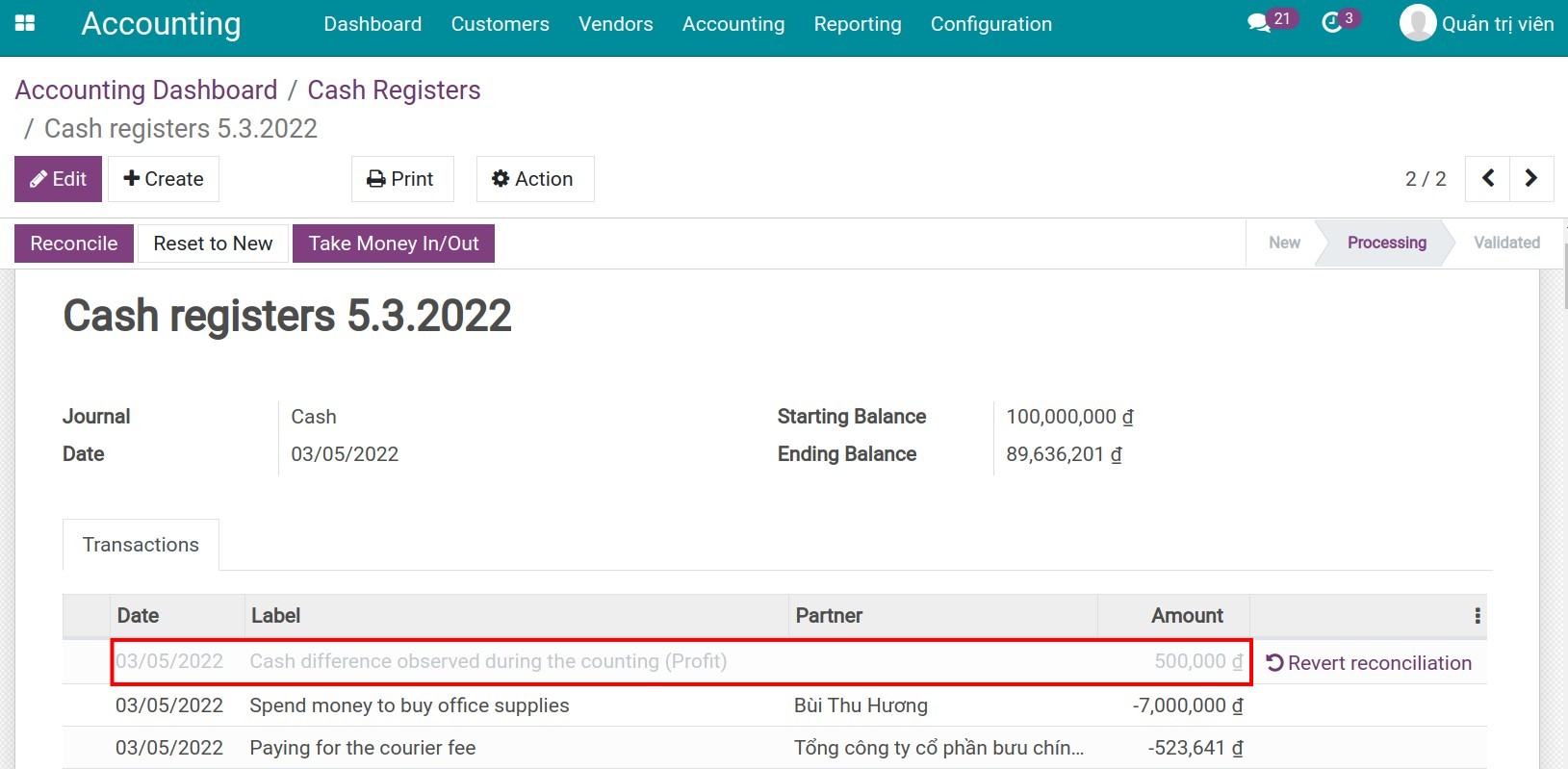

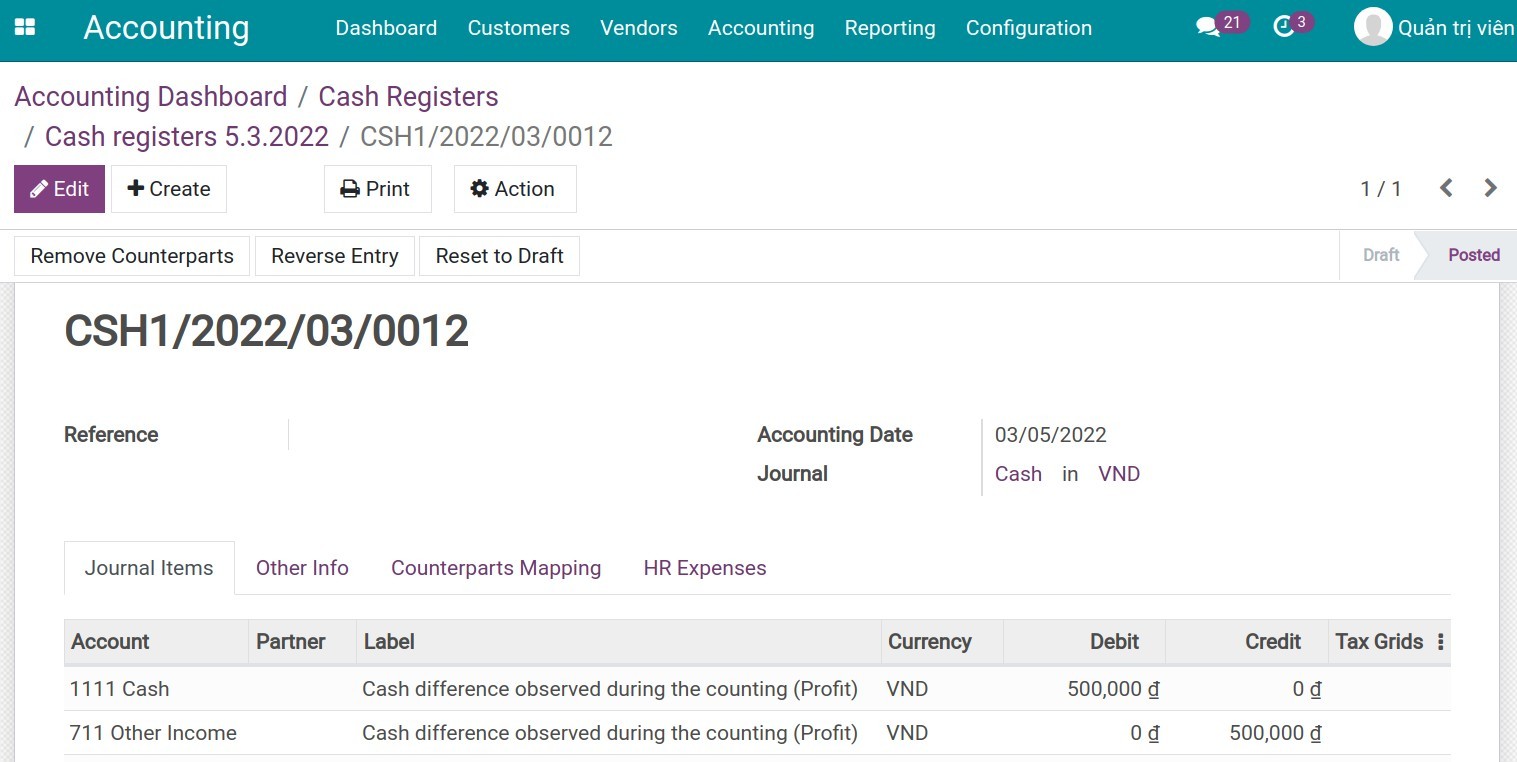

The ending balance after counting in the fund exceeds the computed balance. After saving and posting, the system will automatically generate a statement line recording the amount in excess with the content Cash difference observed during the counting (Profit).

Another accounting entry is generated, recording this cash difference as increase in the cash journal and the status of this entry is now Posted.

Counting of shortage of funds¶

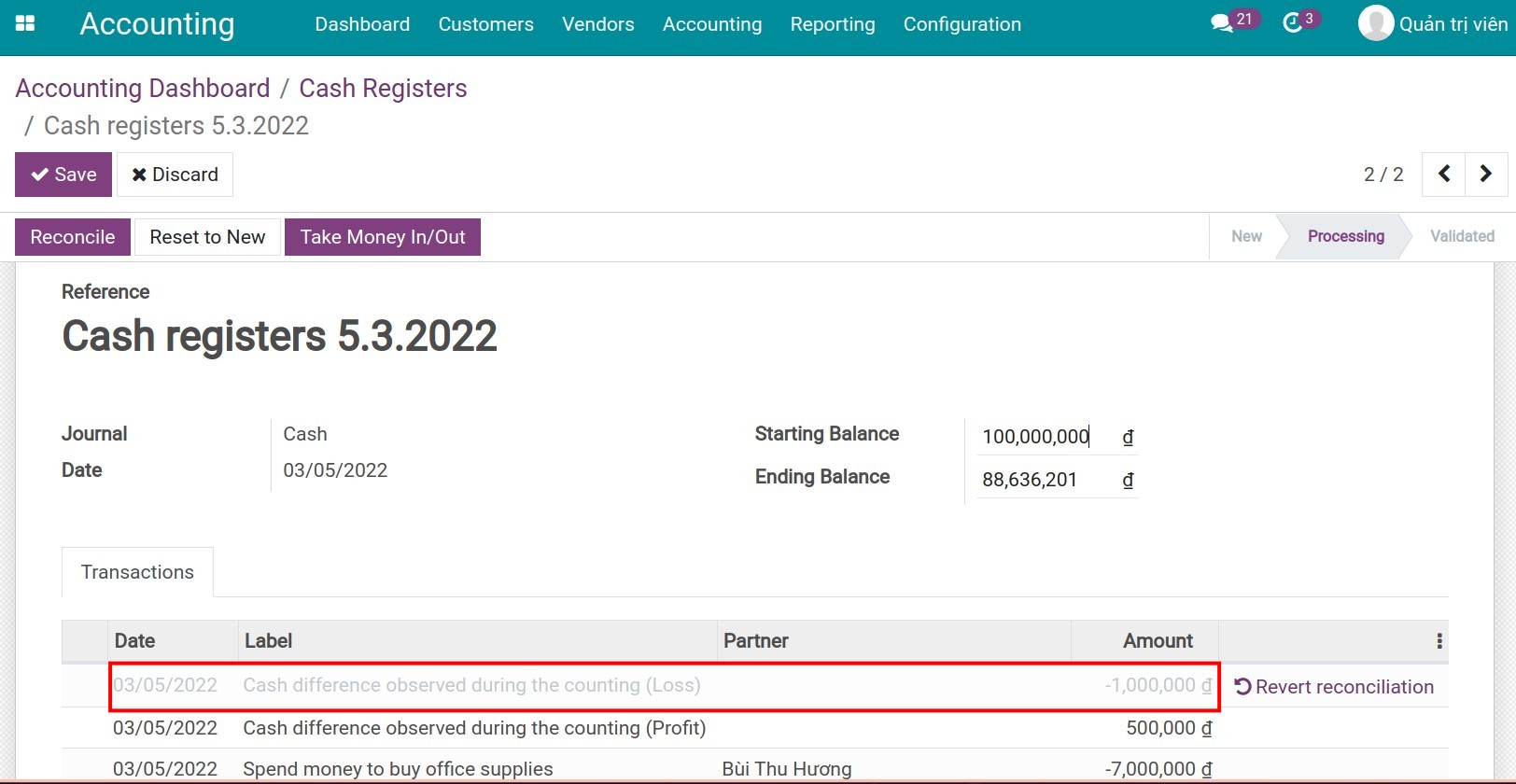

Similarly, when there is a shortage of funds, the system also automatically generates a statement line recording the missing amount with the content Cash difference observed during the counting (Loss). An accounting entry, which is also automatically generated, records this amount missing in the cash journal.

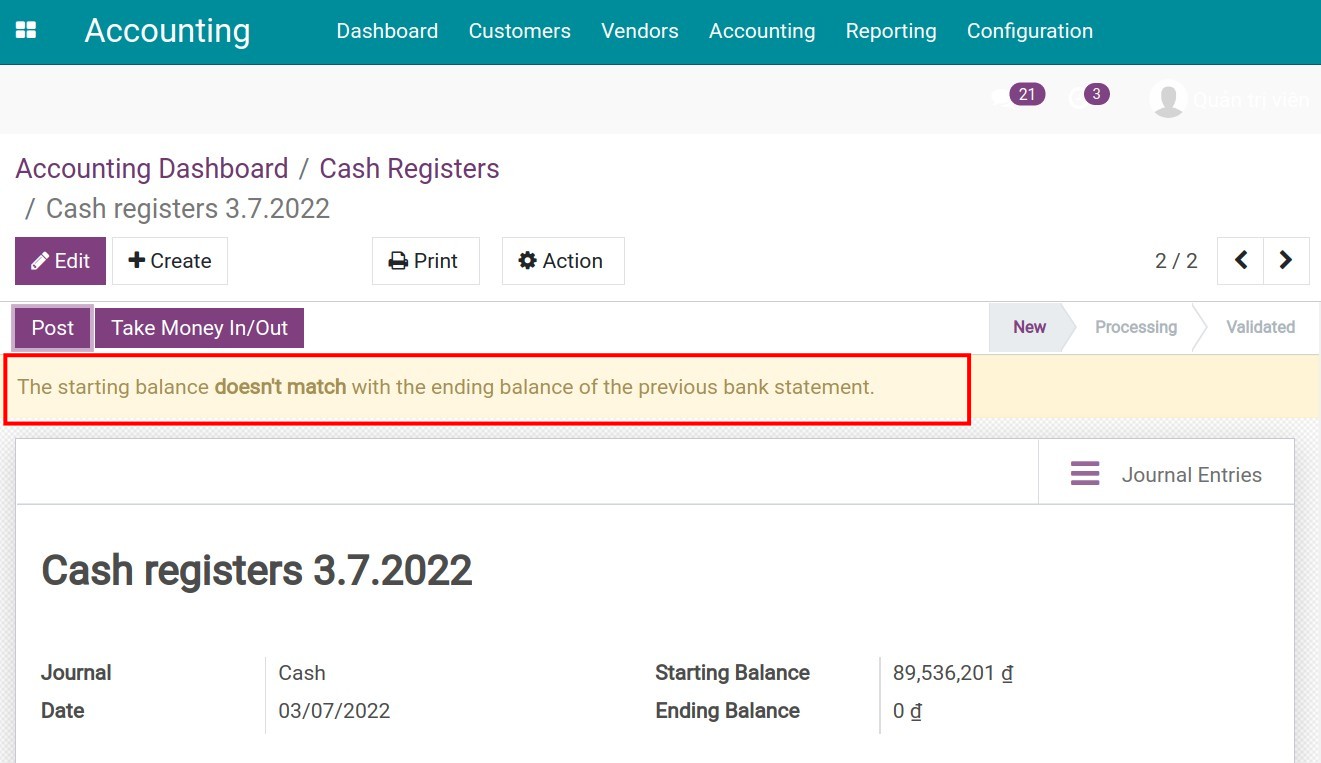

The difference between the starting balance of this period and the ending balance of the previous period¶

Normally, the system will automatically convert the ending balance of the previous period to the starting balance of the new statement. However, these data can be adjusted and if you do it, it will lead to data heterogeneity (mismatch). The system will display a warning as shown below.

Note

If you want to deactivate the warning, you must find the mistake and solve it by filling the matching starting balance.