Calculating overtime salary¶

This article will guide you on how to calculate the overtime salary in Payslips Batches (or Payslips) based on the employee’s contract salary, pay rate, and overtime hours.

General Configuration¶

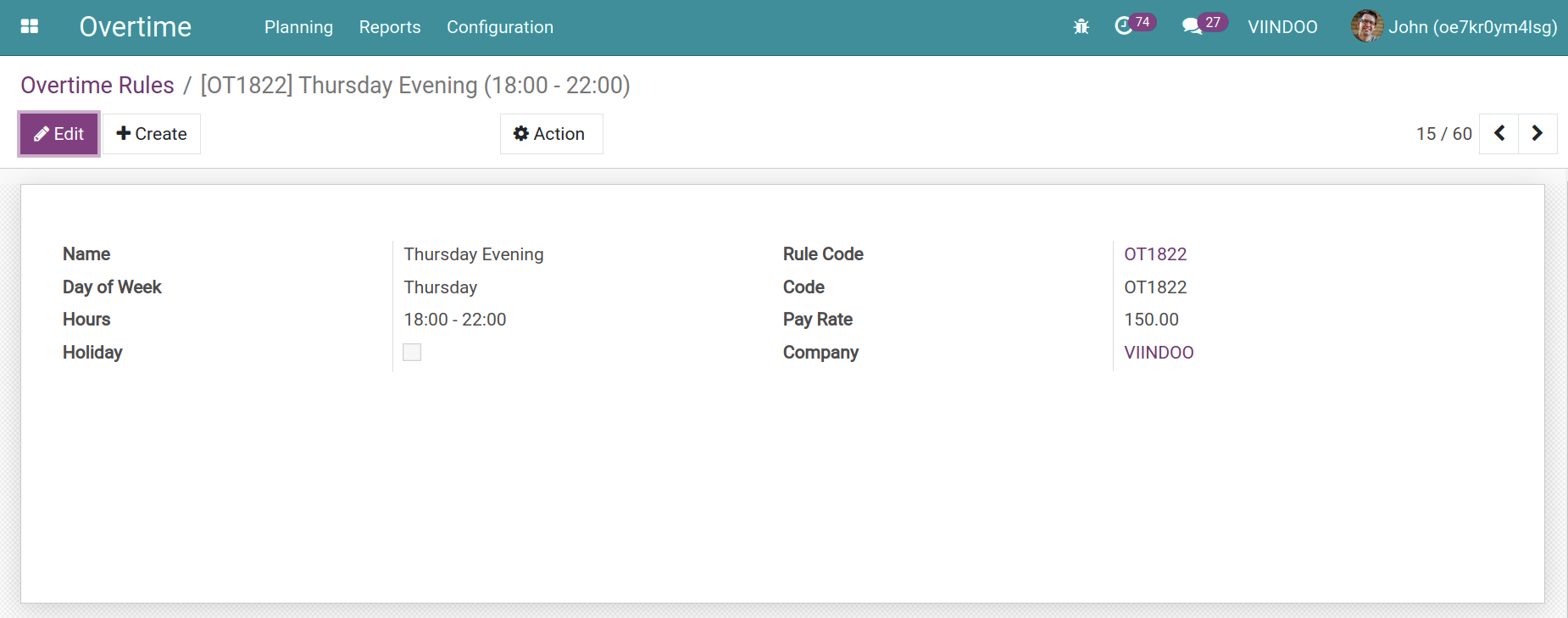

First, you need to define overtime rules for any time interval of a day with an overtime pay rate. This pay rate will be calculated in the overtime salary formula if the overtime period corresponds to the time specified in the overtime rules.

See more about how to create Overtime Rules by referring to Overview and Configuration of Viindoo Overtime

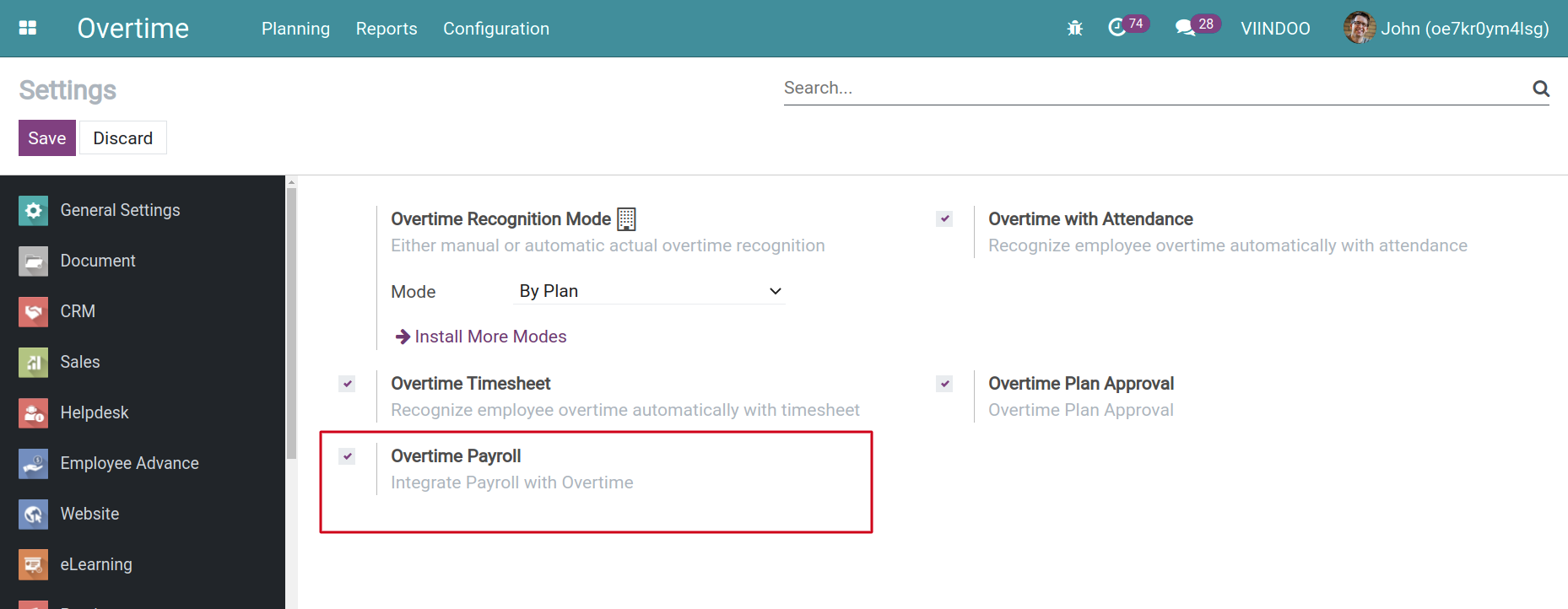

Activating Integration Overtime and Payroll¶

To calculate the overtime salary, you need to active Overtime Payroll. See more at Overview and Configuration of Viindoo Overtime.

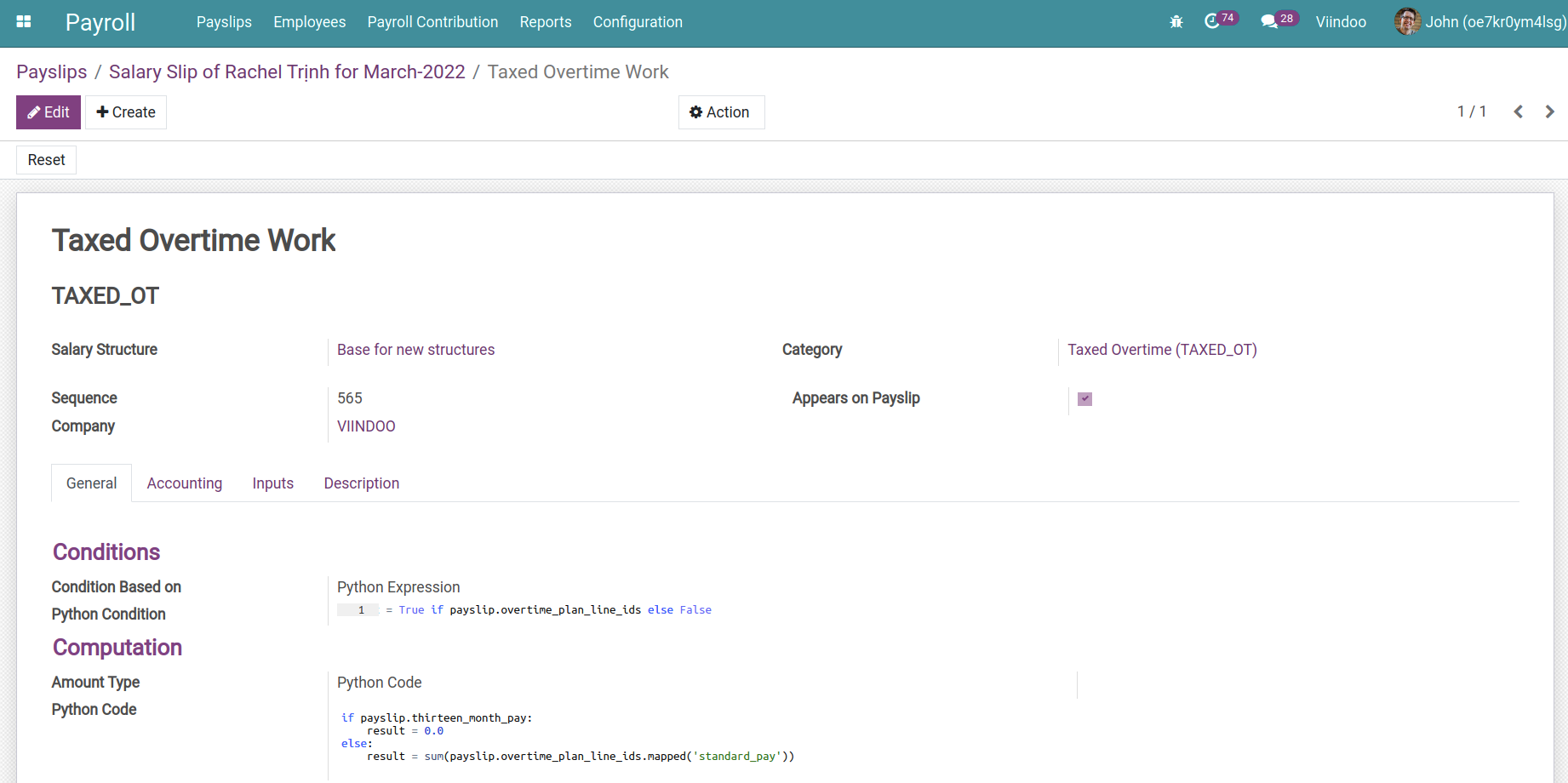

Define Overtime salary rules¶

When installing the Overtime Payroll, the overtime salary rule is automatically updated with pre-set formula and order.

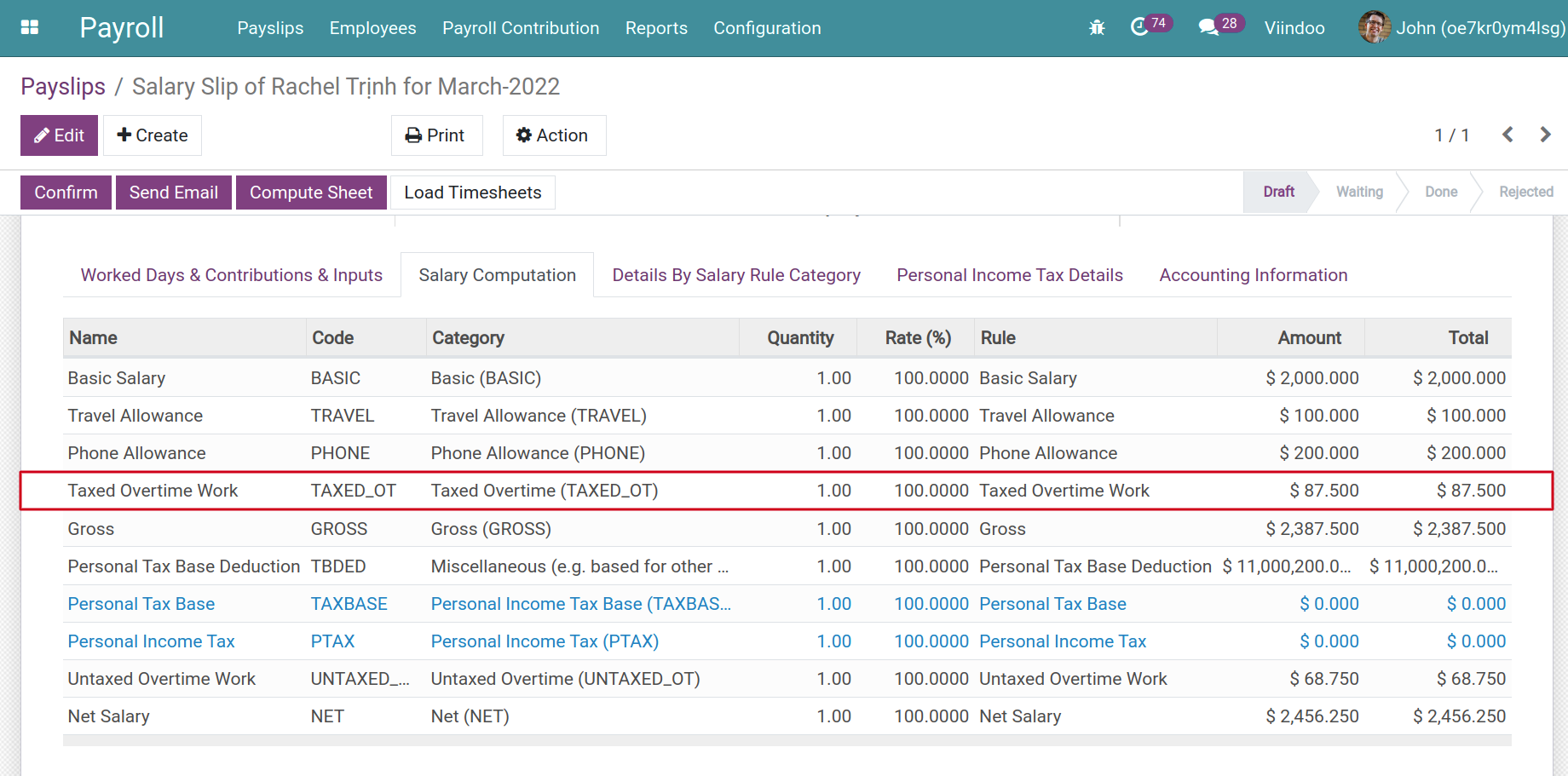

The value of the taxed overtime work on an employee’s payslips is the total overtime amount of the approved overtime plan lines for that month.

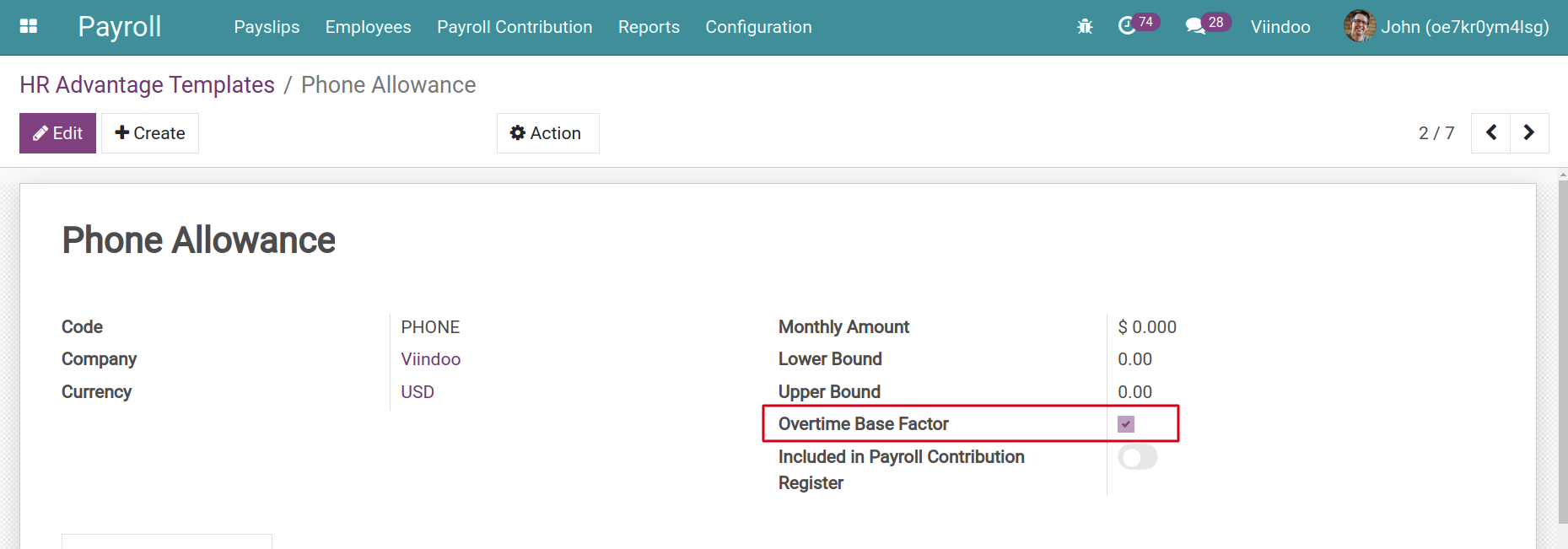

Configure Overtime Base Factor¶

To set up a monthly advantage, you navigate to . Then, you select the allowance you want to configure. Check Overtime Base Factor if you want this monthly allowance to be included in the overtime base amount for the overtime calculation.

Overtime Base mode on employee’s contract¶

The overtime salary rules will be calculated automatically based on the overtime period, the corresponding pay rate specified in the overtime rules and the Overtime Base Amount declared in the employee’s contracts.

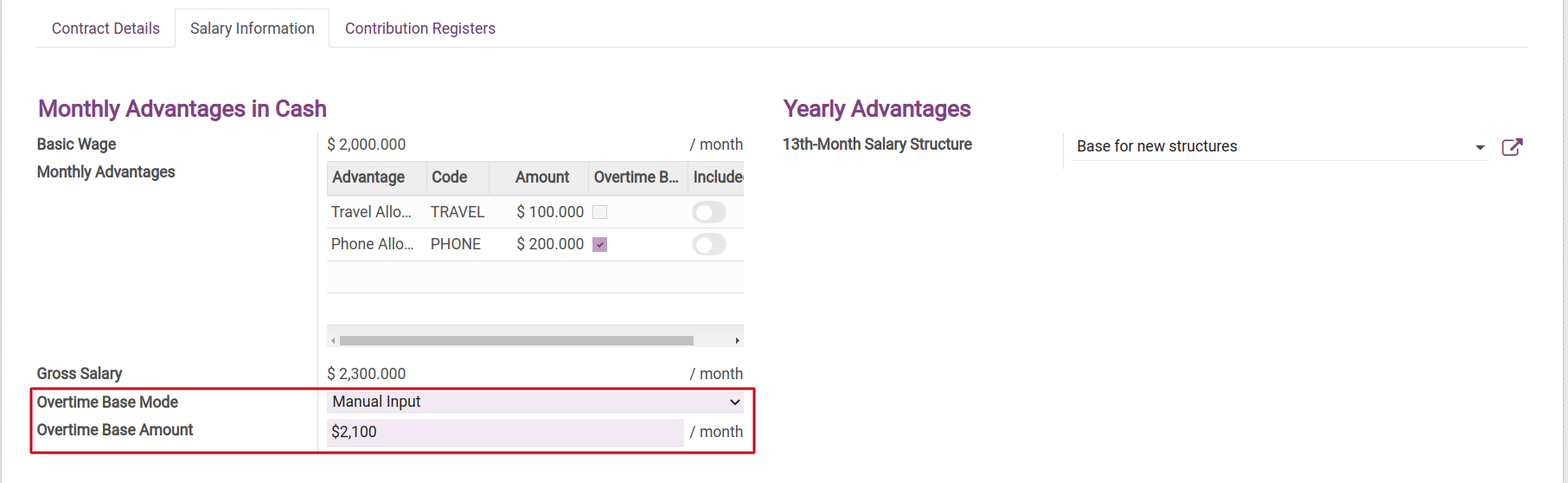

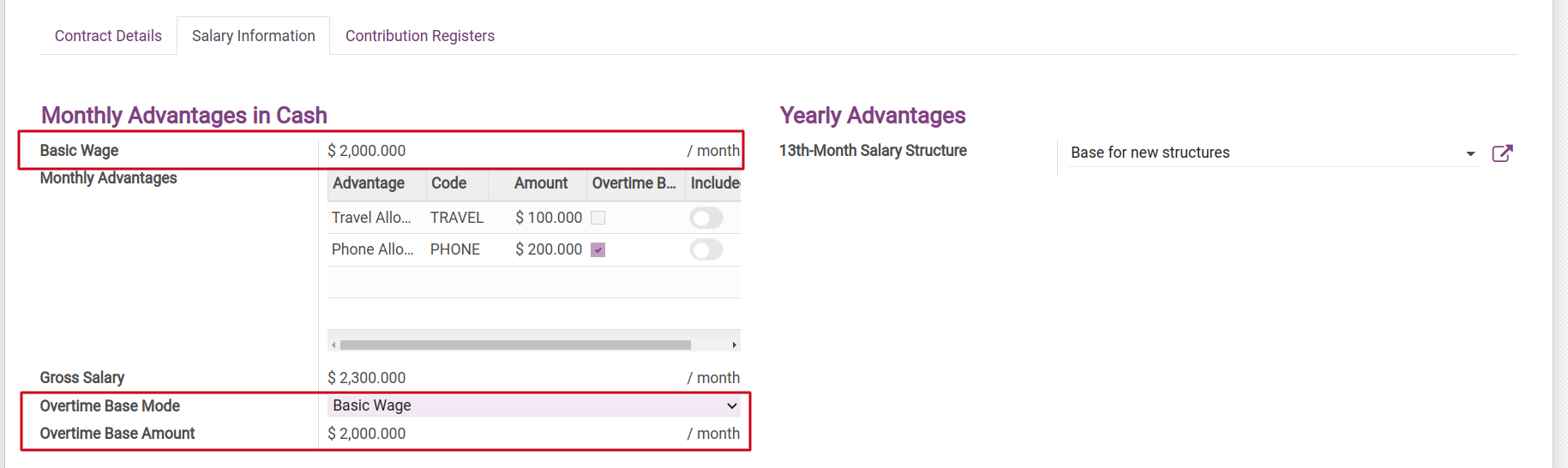

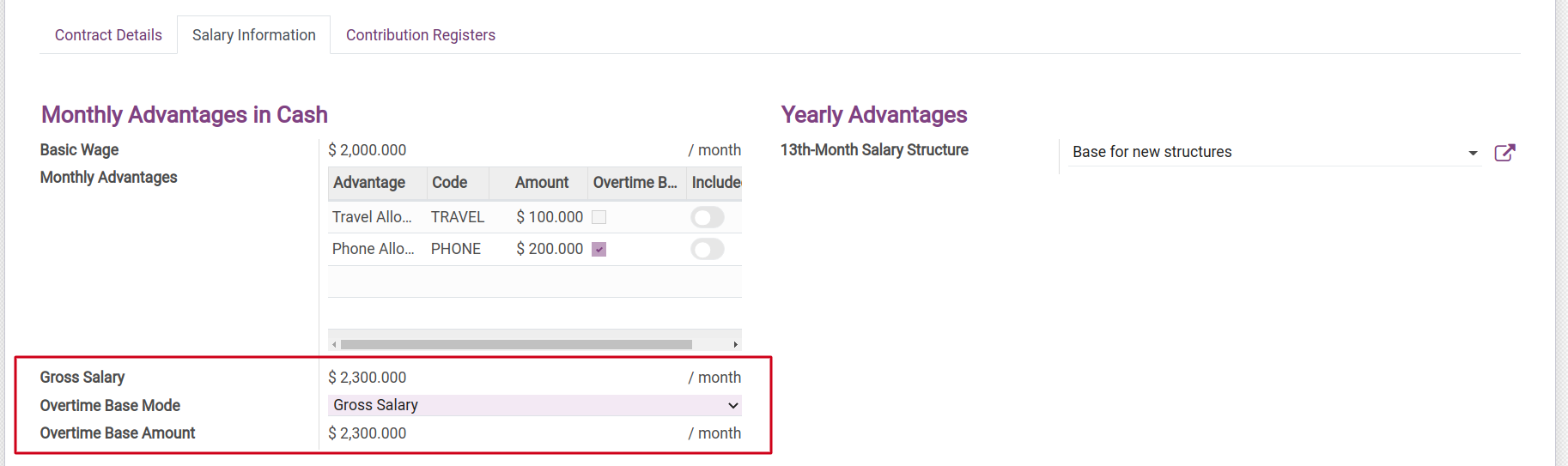

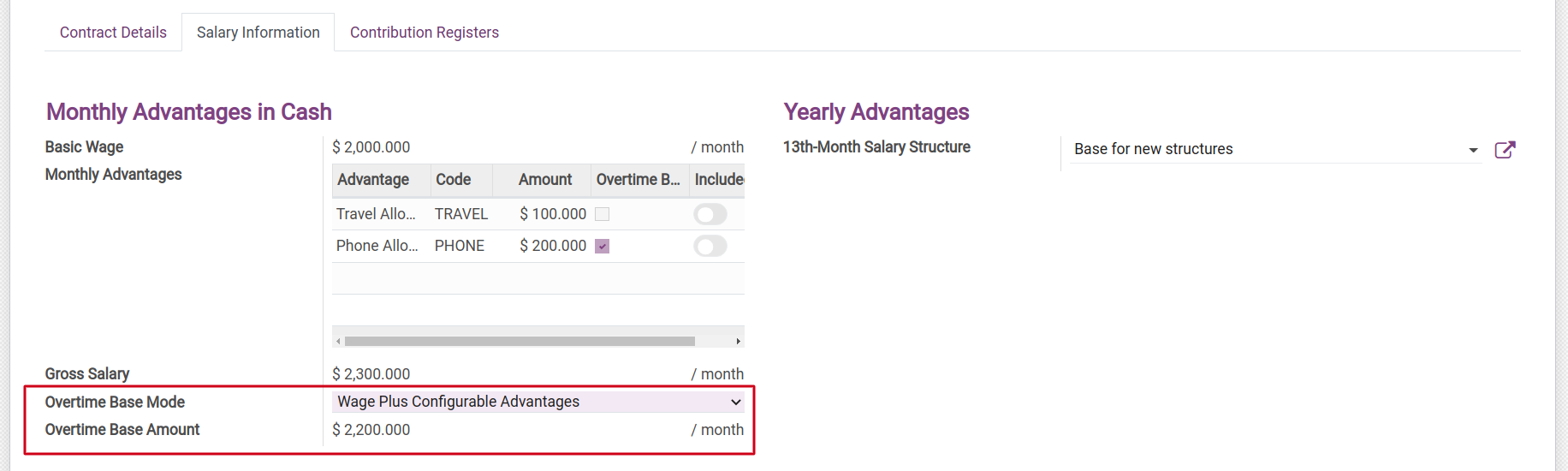

To set up the Overtime Base Amount, you navigate and choose the contract of employee to set up. At Salary Information tab, you choose one of 04 options for overtime calculation:

Manual input: You can define the overtime base amount manually on the contract.

Basic Wage: The overtime base amount is basic wage.

Gross Salary: The overtime base amount is Gross Salary specified on the contract (including the basic wage plus the monthly advantages).

Wage Plus Configurable Advantages: The overtime base amount is the basic wage plus the monthly advantages which are be checked as Overtime Base Factor. For example, on the following contract, the overtime base amount does not include Travel Allowance but includes Phone Allowance.

Integrating Overtime Request with Payslip¶

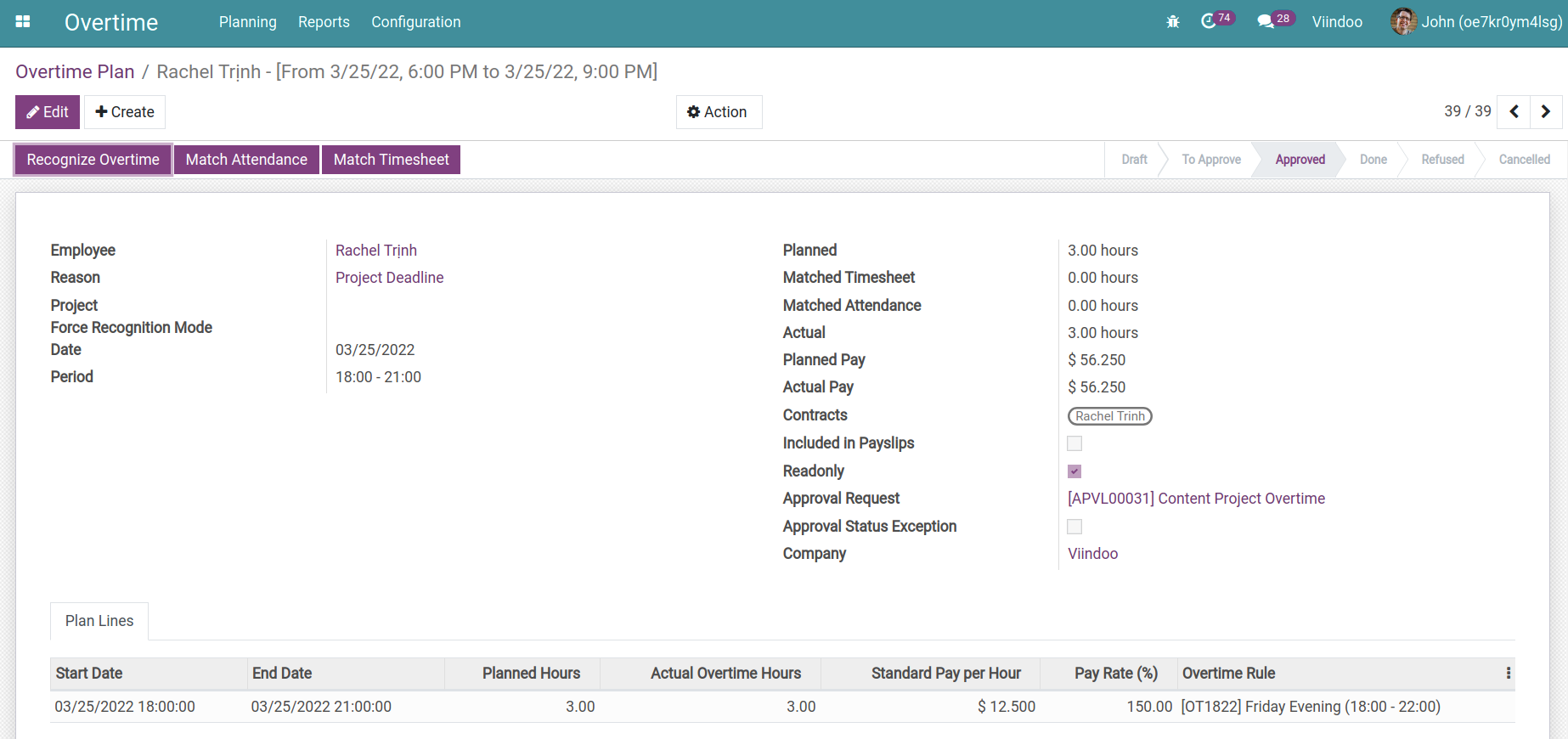

First, you need to create and approve an Overtime Request or Overtime plan. At the Plan Lines, the system automatically updates information related to the overtime period, actual overtime hours and corresponding overtime rules.

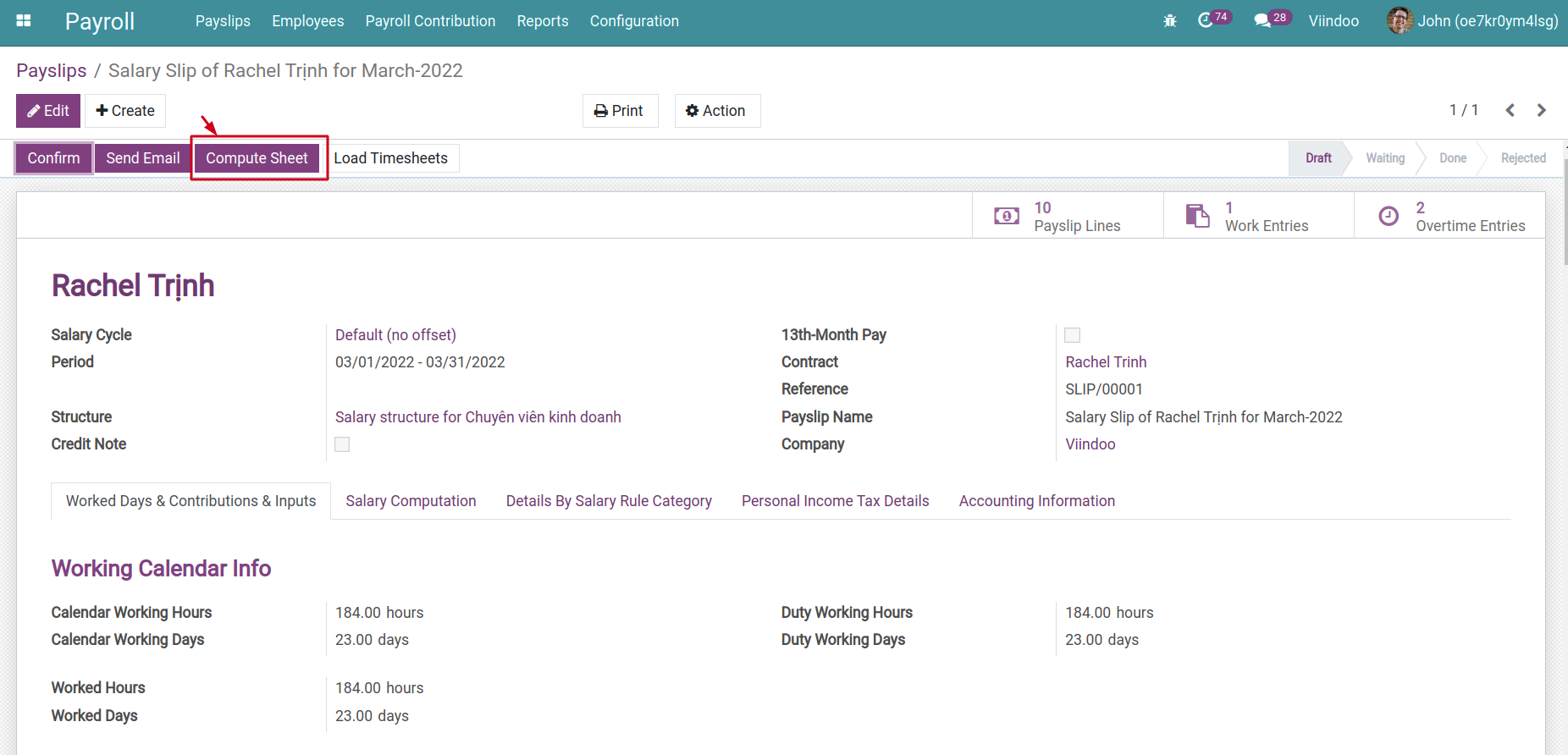

Then, users can create payslips that include overtime pay. You go to to create a new payslip and fill the information as instruction in Create Payslips. After that, hit Compute Sheet.

Note

Instead of creating payslips for each employee, you can create Payslips Batches for many employees. Refer to Create Payslips Batches. If overtime plan change after creating payslips batches, you can also recompute overtime entries at Payslips Batches view.

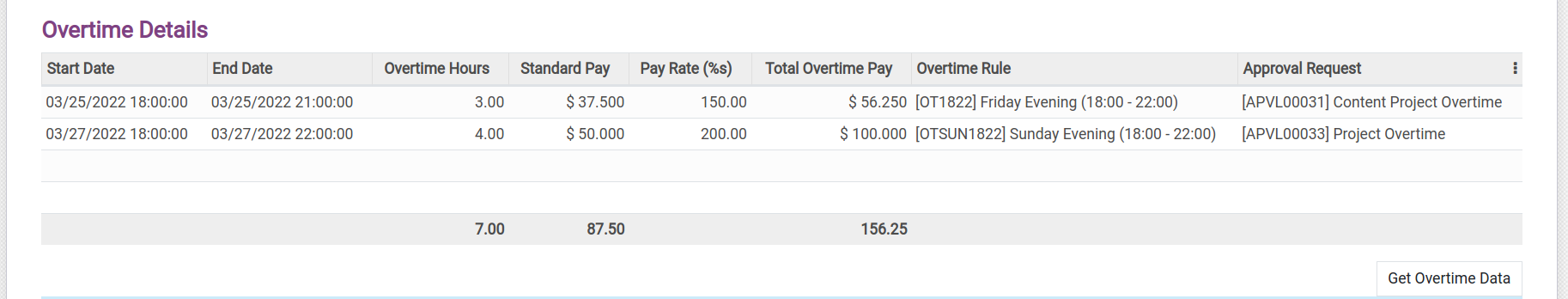

In the Worked Days & Contributions & Inputs tab, you can see Overtime Details on the payslips.

Start Date/ End Date: The start date and end date of the overtime period.

Overtime Hours: The actual overtime hours recognized by the selected Recognition Mode. Refer to Overview and Configuration of Viindoo Overtime.

Standard Pay: The actual overtime pay amount. The formula is: Standard Pay = Standard Pay per Hour * The actual Overtime Hours.

Pay Rate: The pay rate which is specified in the overtime rules.

Total Overtime Pay: The actual overtime pay amount that is calculated as: Total Overtime Pay = Standard Pay per Hour * Actual Overtime Hours * Pay Rate.

Overtime Rule: The overtime rule corresponds to the approved overtime period.

Approval Request: The related approval request.

In the Salary Computation tab, you can view the details of the payslip lines. In which, the payslip line related to overtime pay is the value according to the set overtime rules.