Instruction

Instruction video: Cost & Revenue Deferral

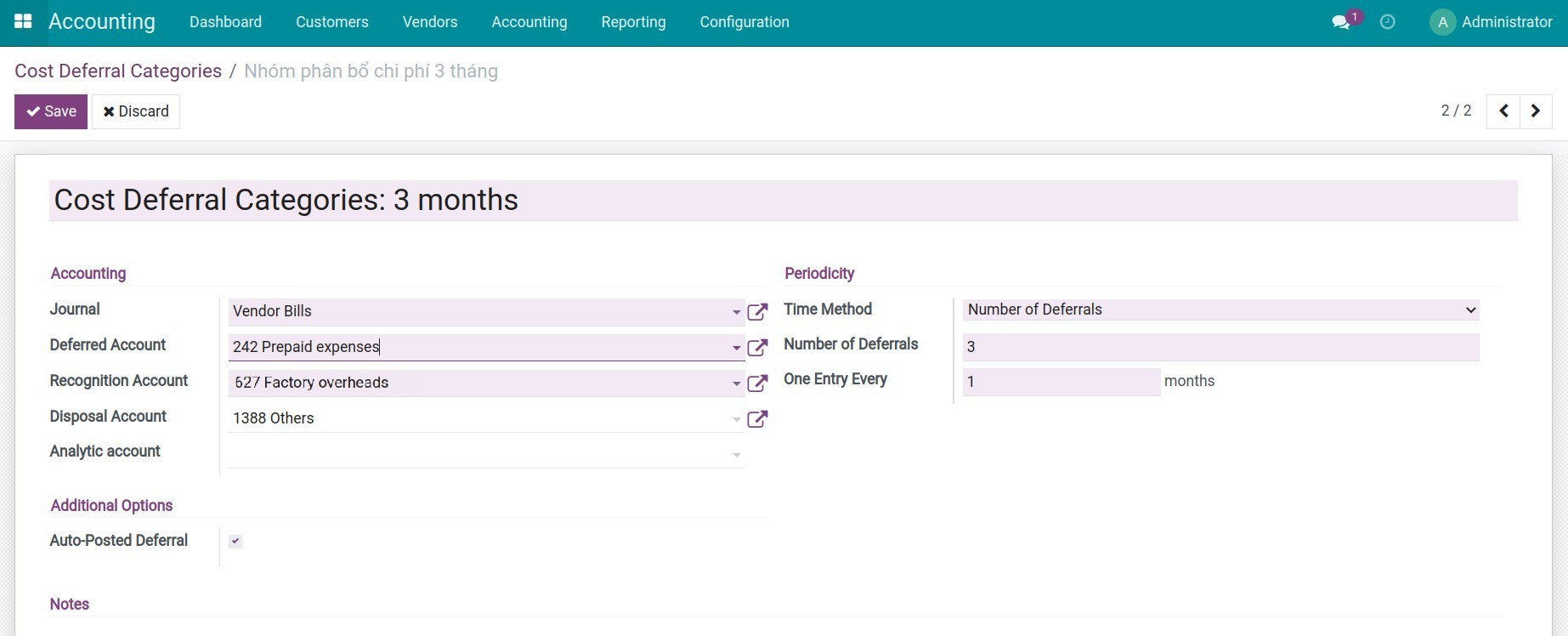

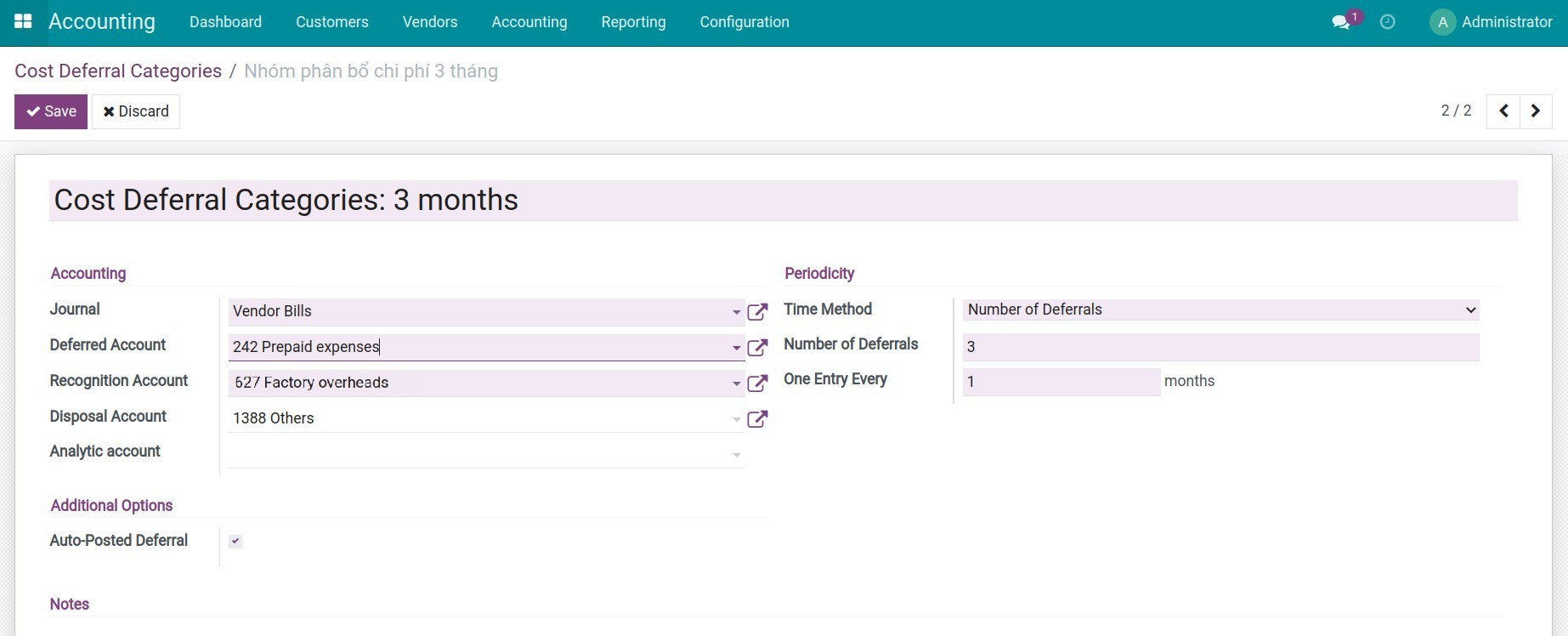

Create the Revenue Deferral Categories/Cost Deferral Categories

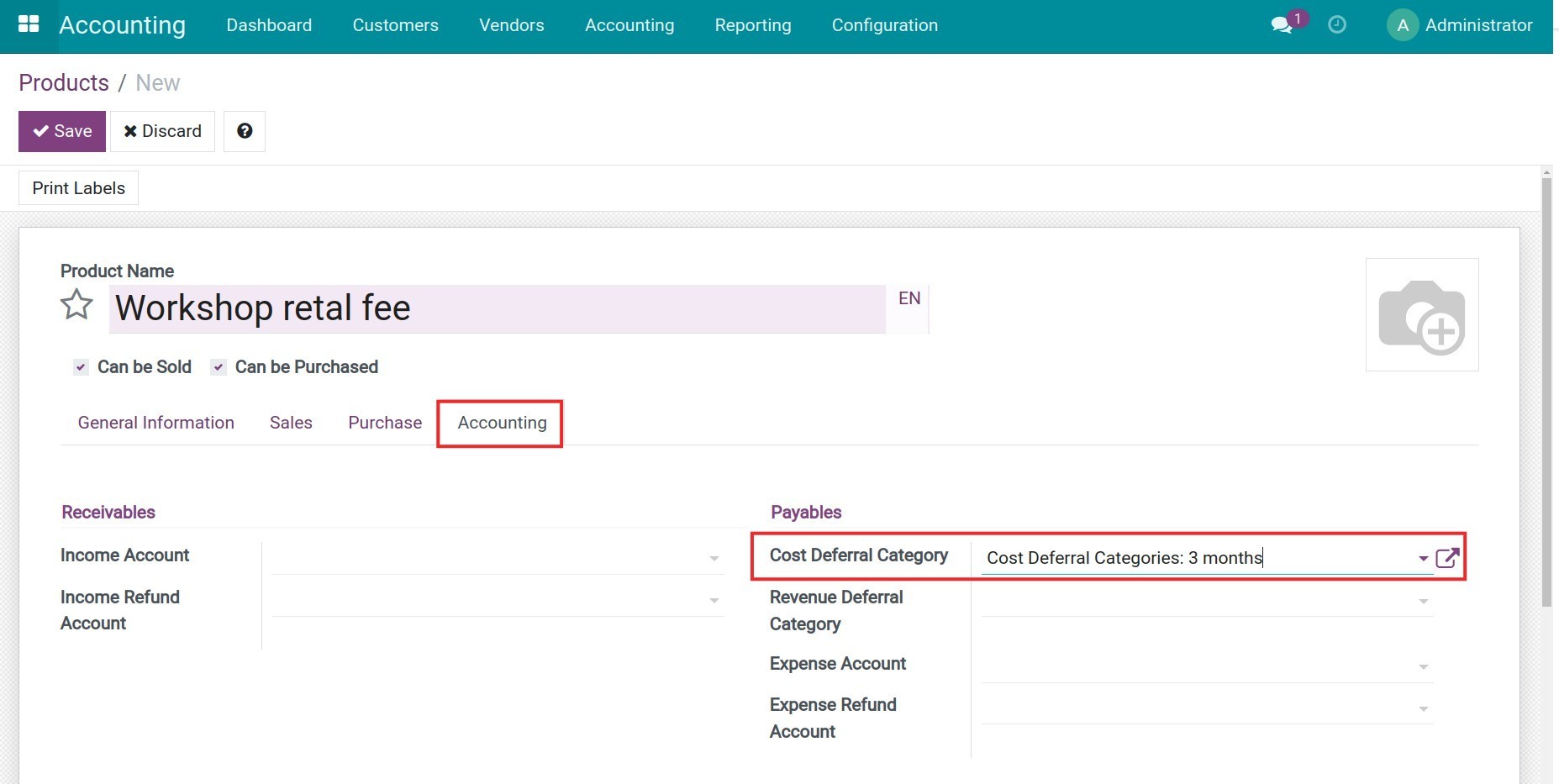

First of all, you need to create a cost/revenue deferral category to apply on products. You navigate to Accounting > Configuration, select Cost Deferral Categories or Revenue Deferral Categories according to your needs and then click Create.

You enter the following information:

- Accounting:

- Journal: select the journal for the entries of revenue/cost deferral in this group;

- Deferred Account: select an account to record revenue/cost;

- Recognition Account: select the account to record the deferred revenue/expenses;

- Analytic account: select the analytic account track revenue/cost, this will help the manager easily analyze revenue/costs.

Note: To use the Analytic account feature, you need to activate the Analytic Accounting feature in Settings > Accounting > Analytics.

- Periodicity:

- Time Method: select deferral method:

- Number of Deferrals: deferral by time:

- Number of Deferrals: enter the number of deferrals.

- One Entry Every: enter the number corresponding to the number of months of a deferral cycle. Example: enter 3, the software will defer every 3 months.

- Ending Date:

- One Entry Every: enter the number corresponding to the number of months of a deferral cycle. Example: enter 3, the software will defer every 3 months.

- Ending Date: enter deferral ending date.

- Additional Options:

- Auto-Posted Deferral: check the box if you want the deferral entries to be automatically entered.

- Notes: enter notes for additional information.

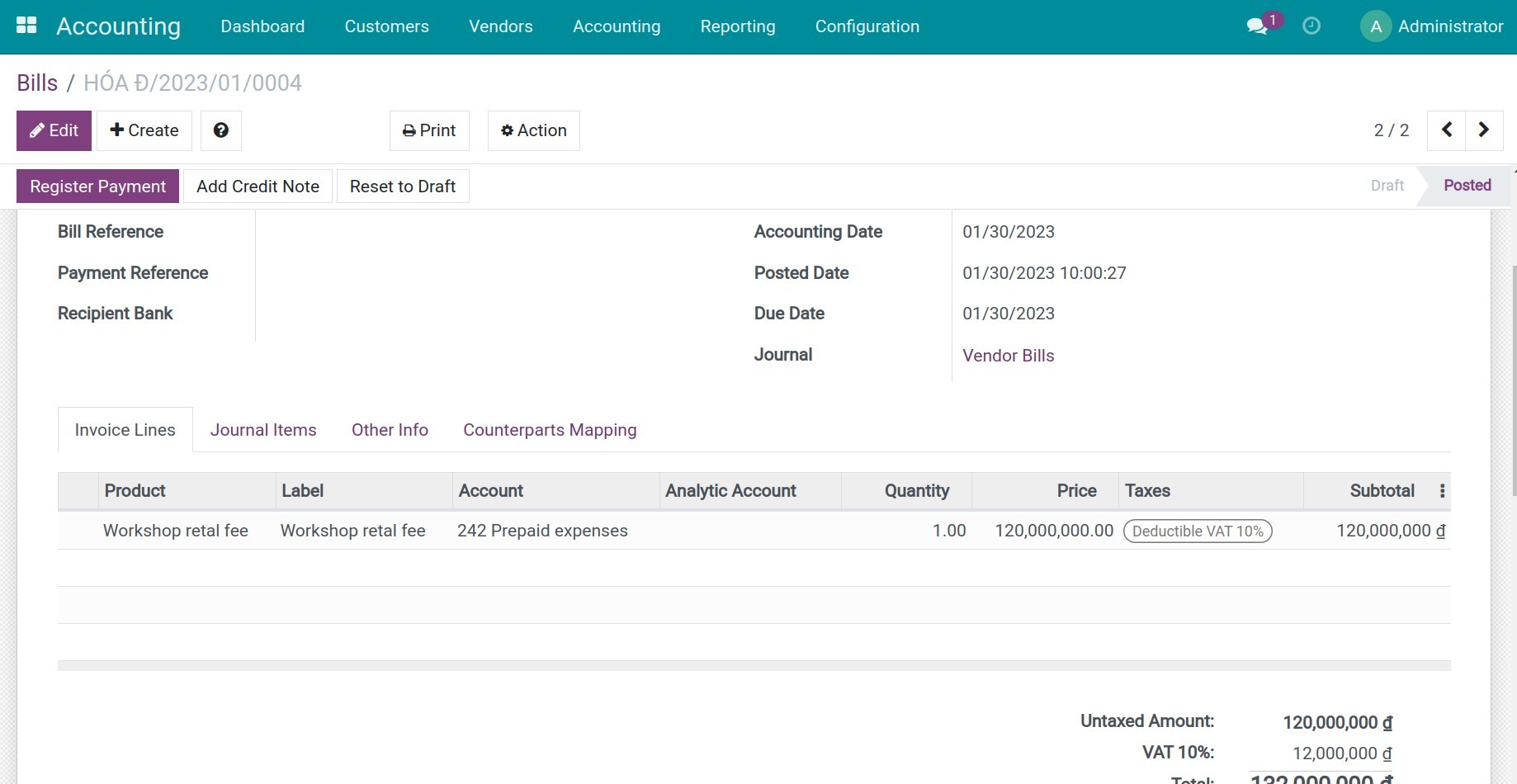

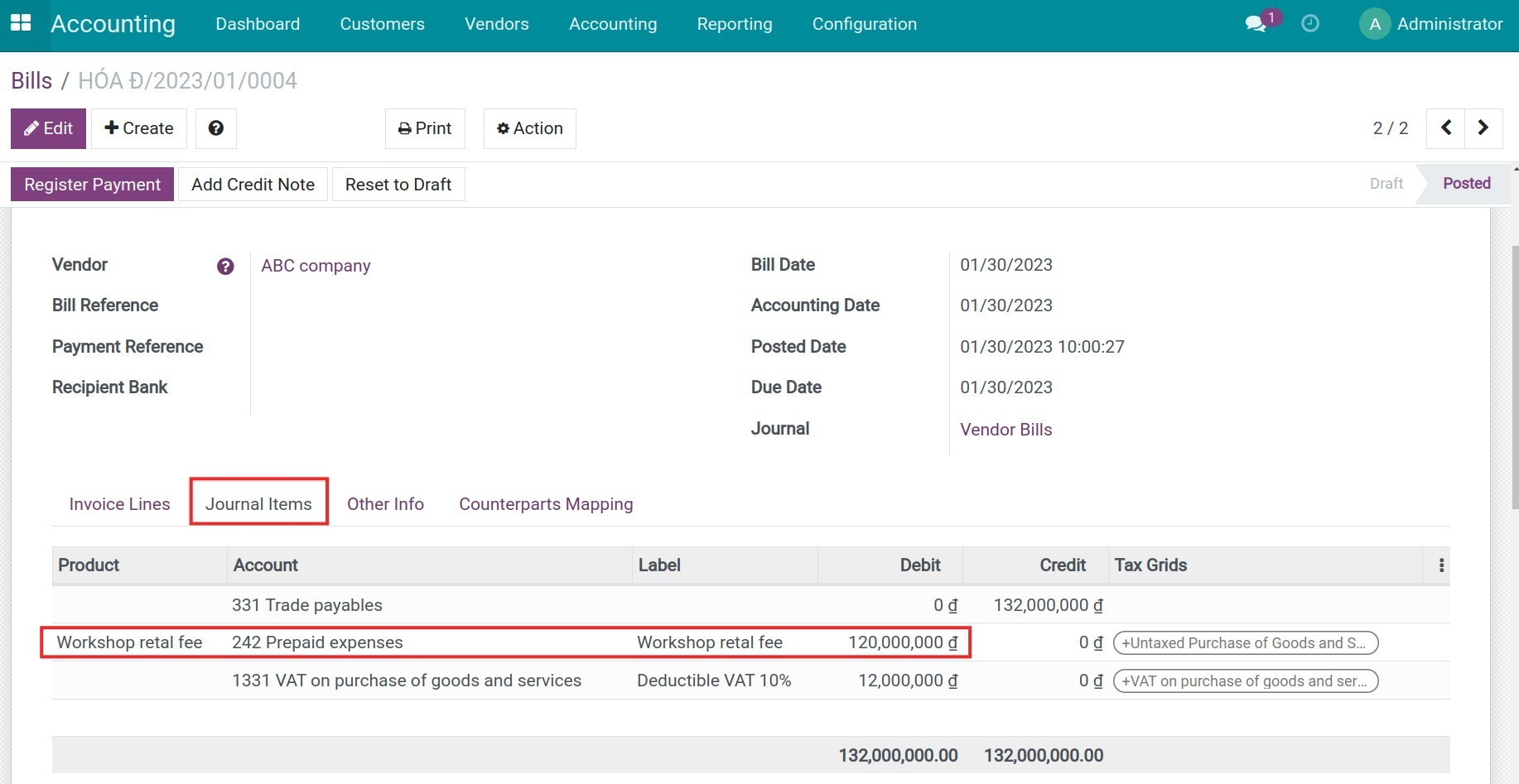

Defer revenue/cost

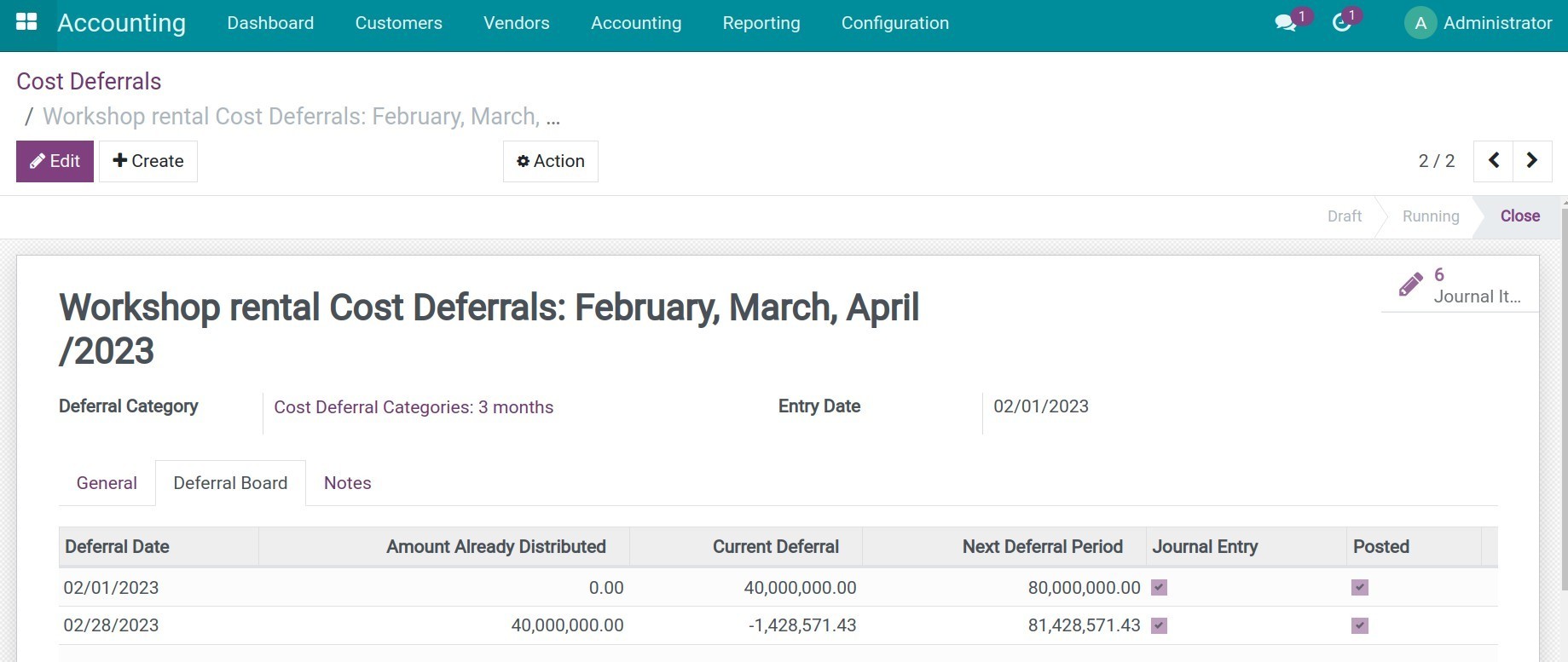

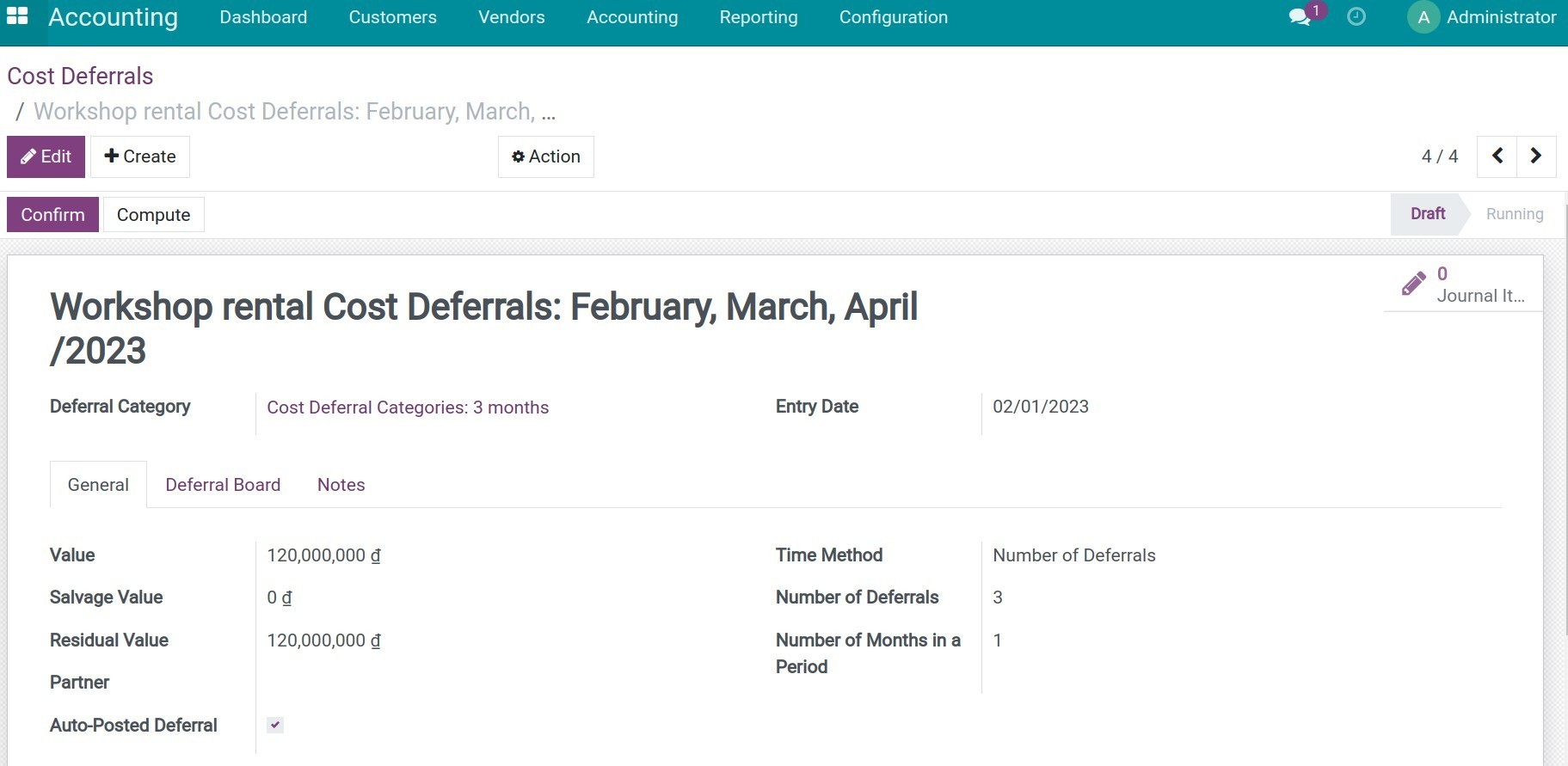

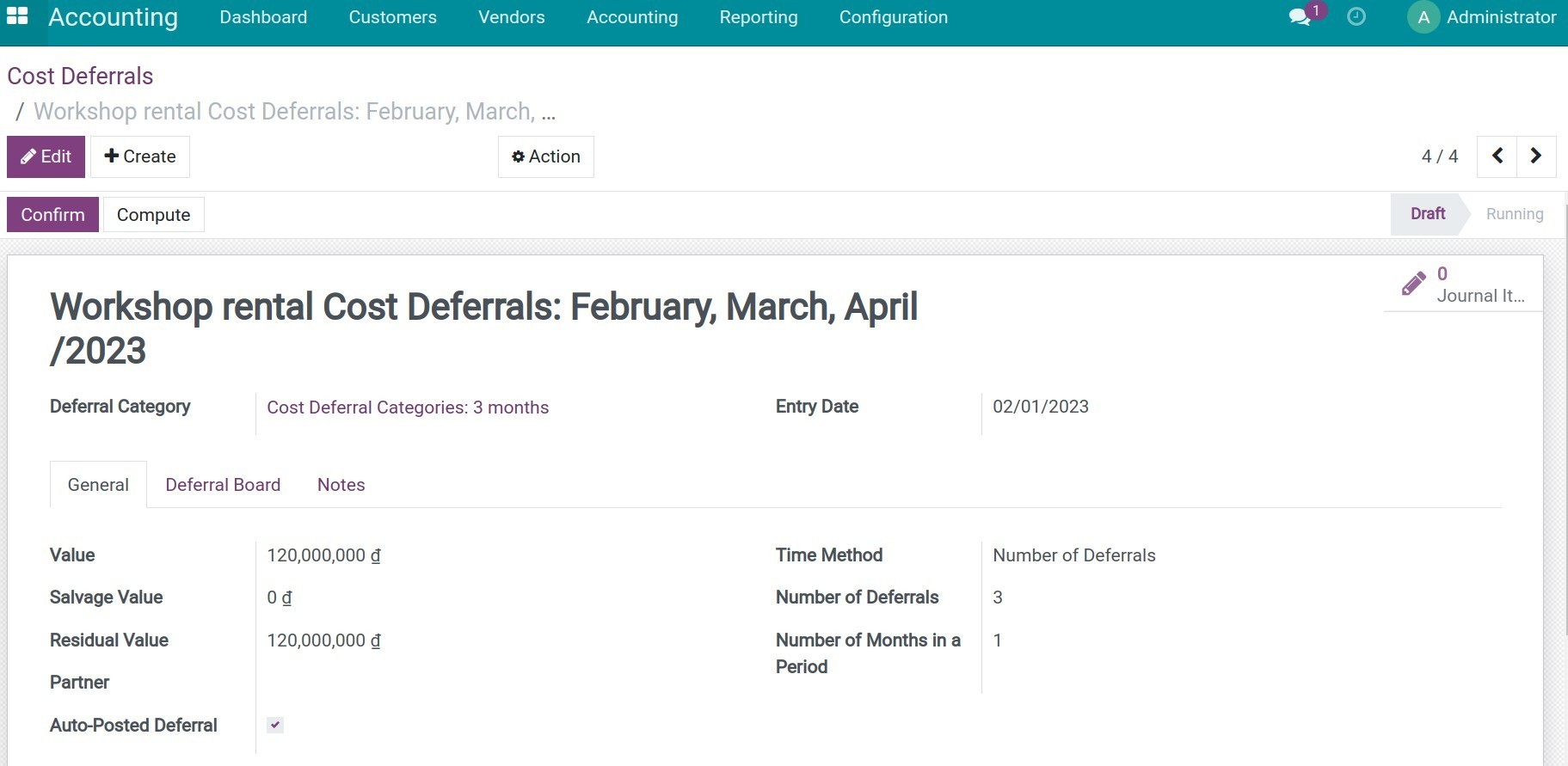

You defer the revenue/cost recorded above by navigating to Accounting > Accounting > Cost Deferrals/Revenue Deferrals > Create.

You select Deferral Category and enter Entry Date, then, on the General tab, please enter the following information:

- Value: the value of revenue/cost you want to defer corresponds to the revenue/cost you have recorded above.

- Salvage Value: the salvage value of the revenue/cost you want to defer.

- Residual Value: the value is automatically recorded following the formula: Residual Value = Value - Deferred amount.

- Partner: choose a partner to record the revenue/cost.

- The remaining information will be automatically recorded based on the settings of Revenue/Cost Deferral Categories.

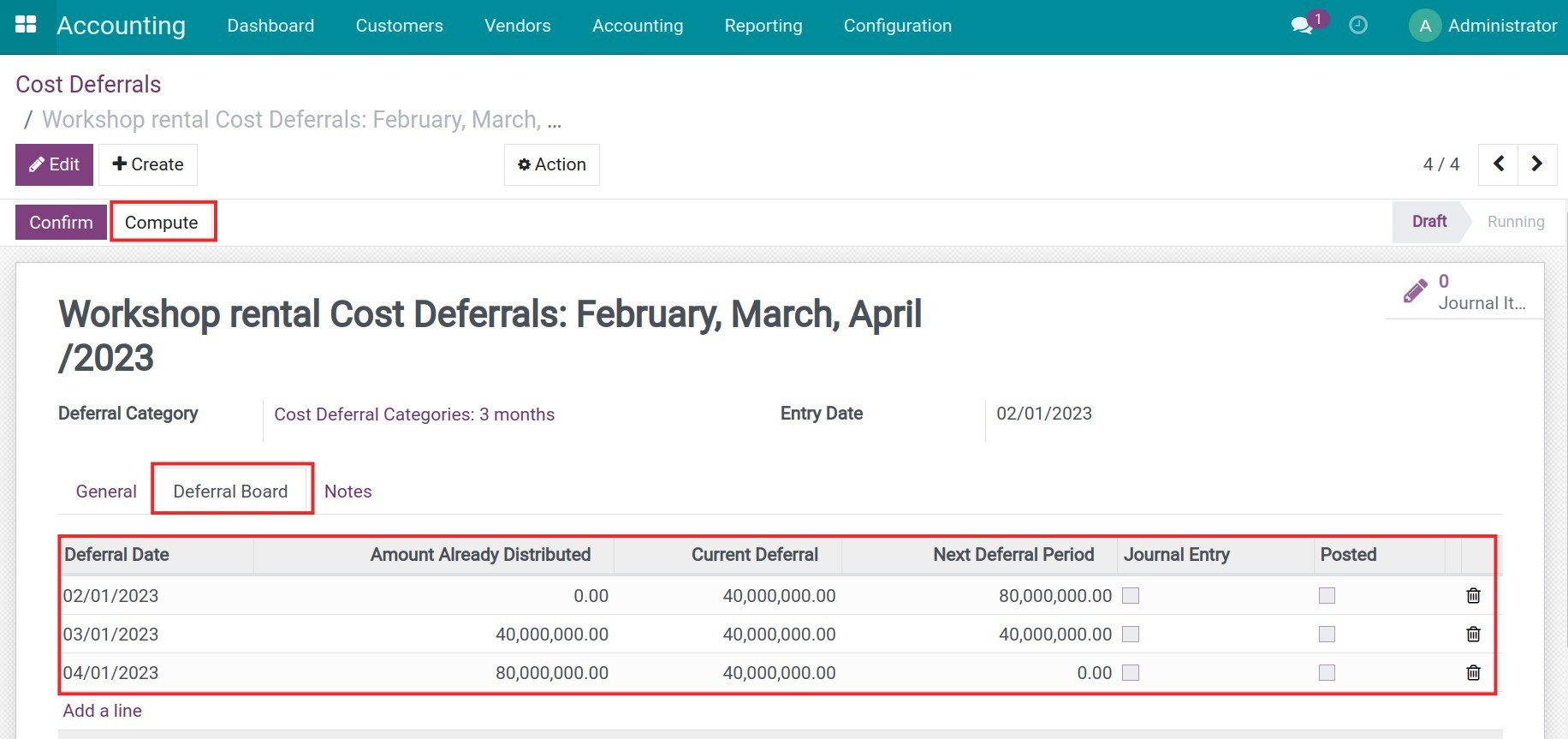

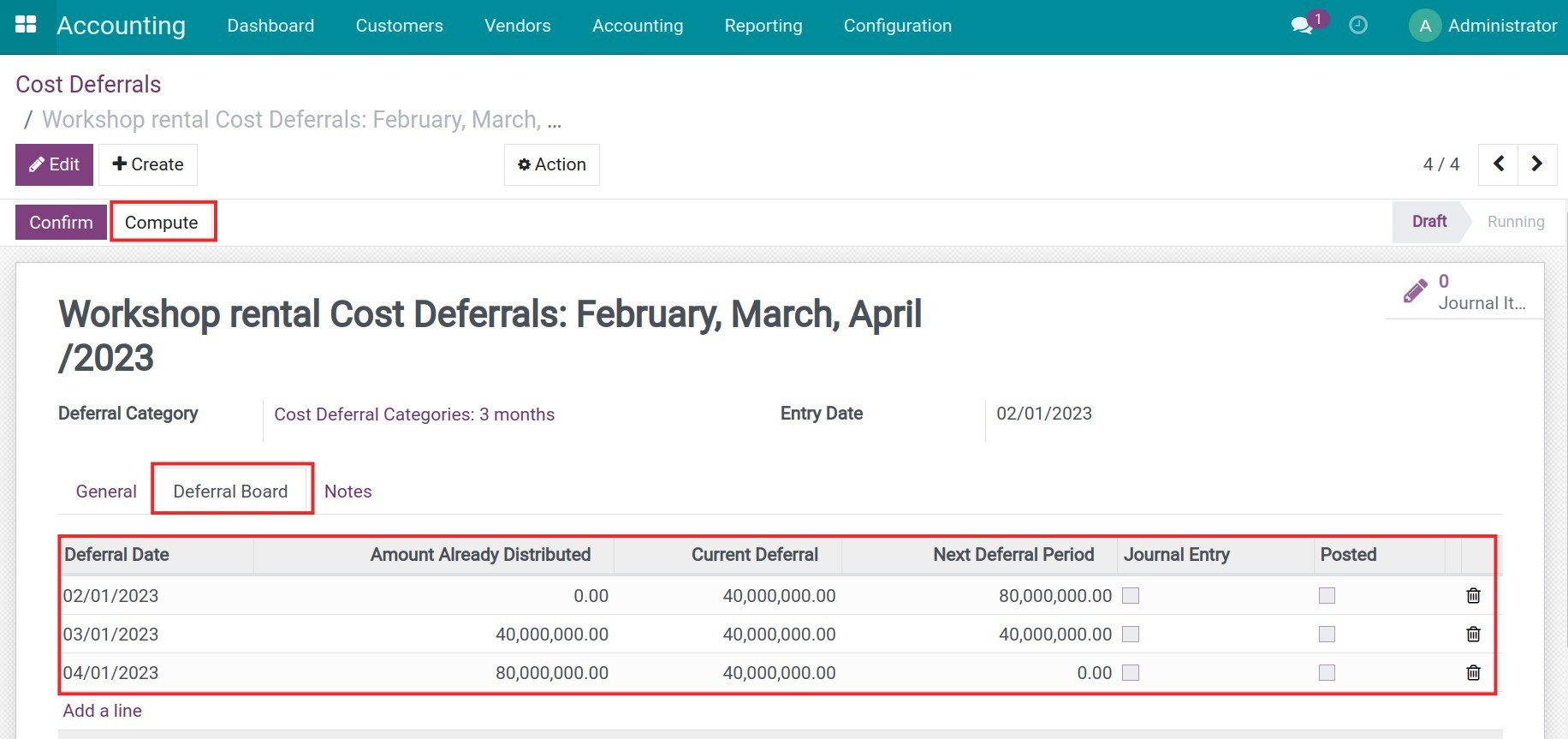

You press the Compute button to generate the deferral lines in the Deferral Board tab.

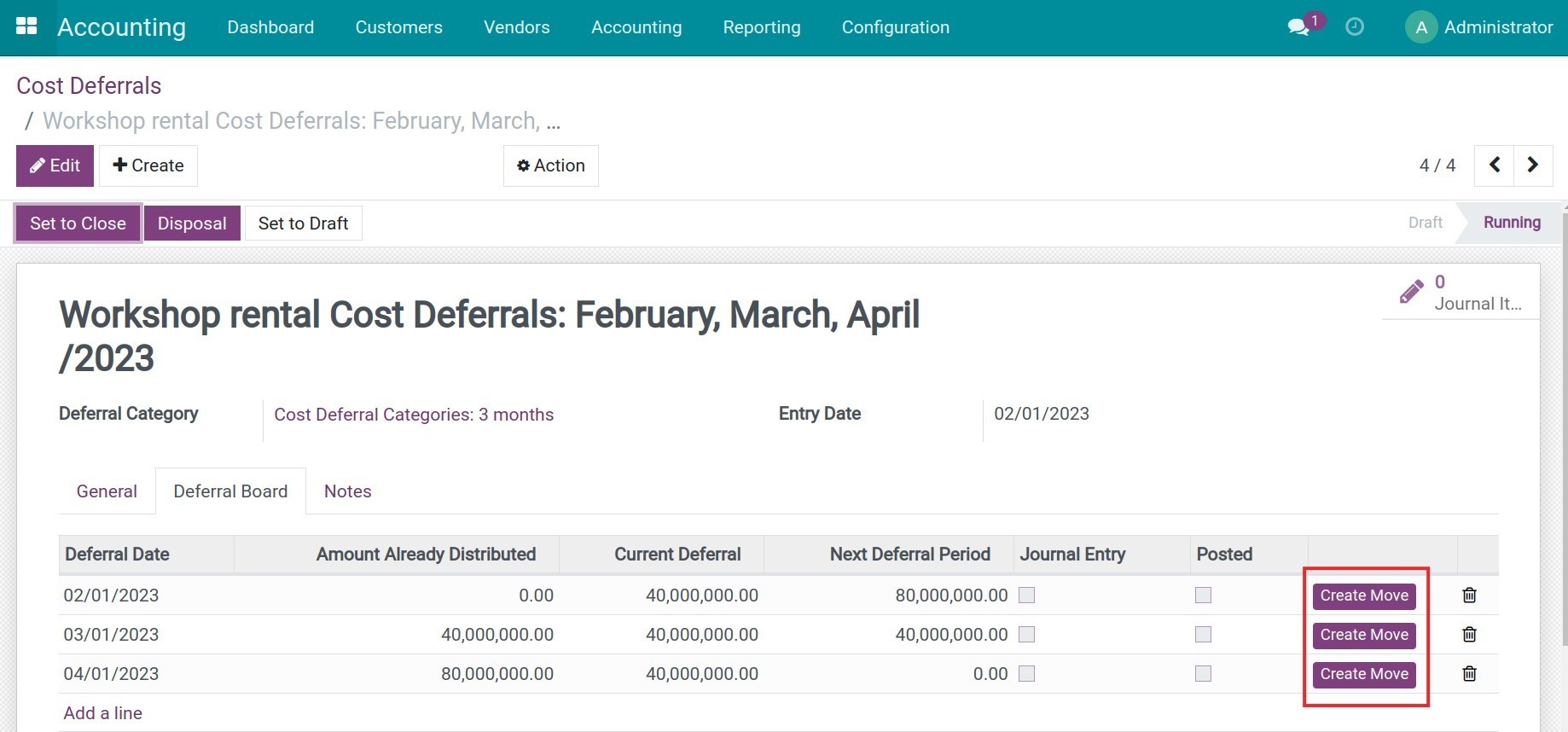

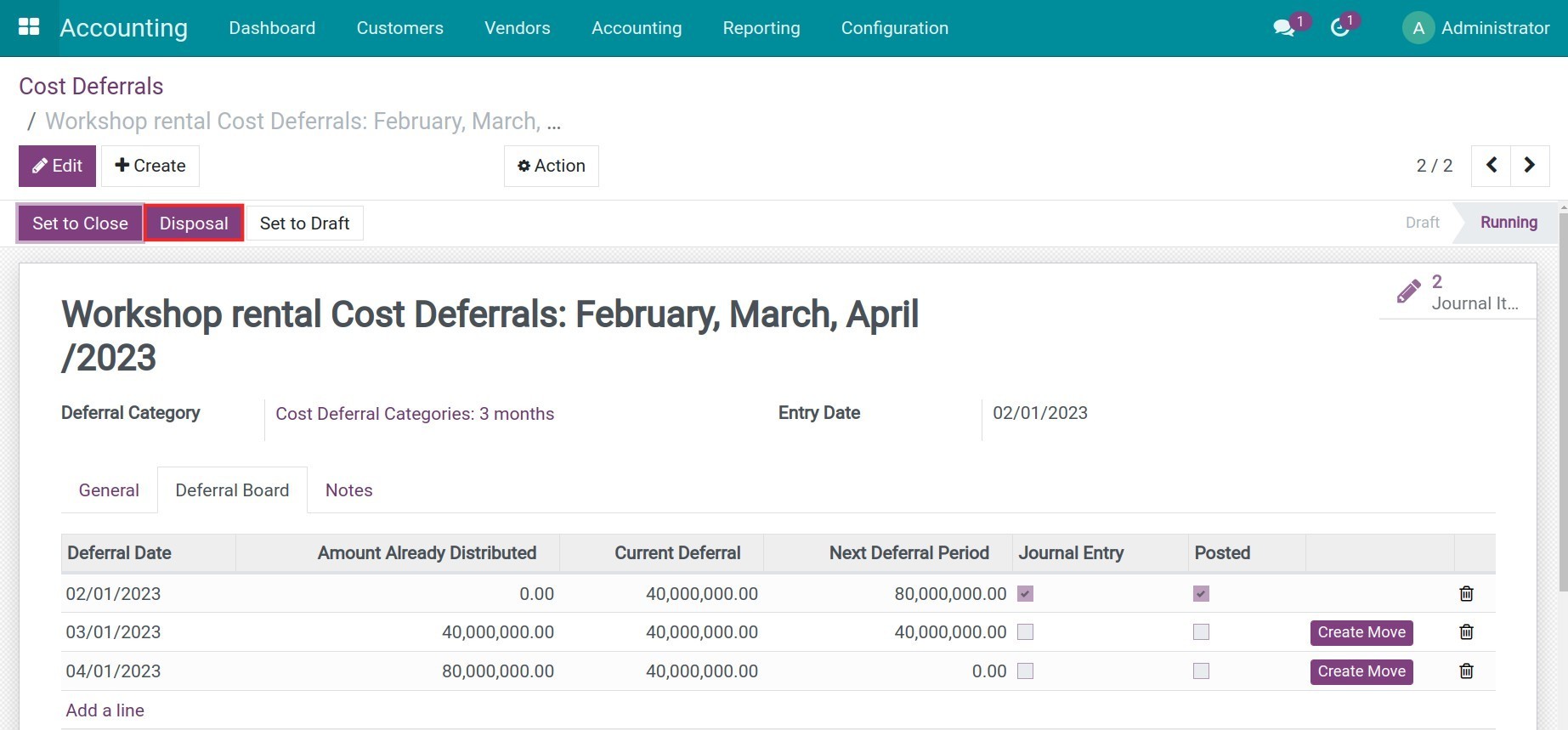

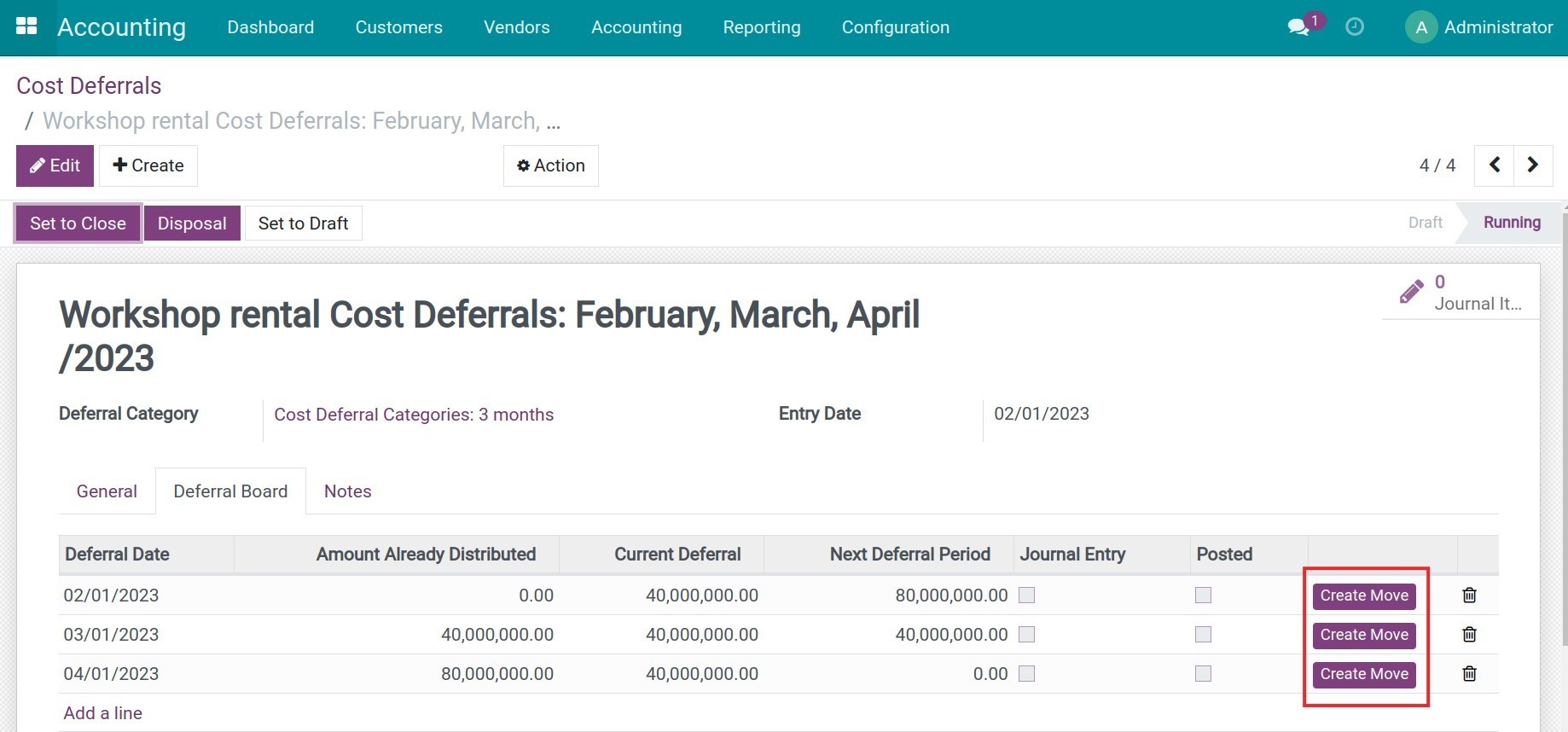

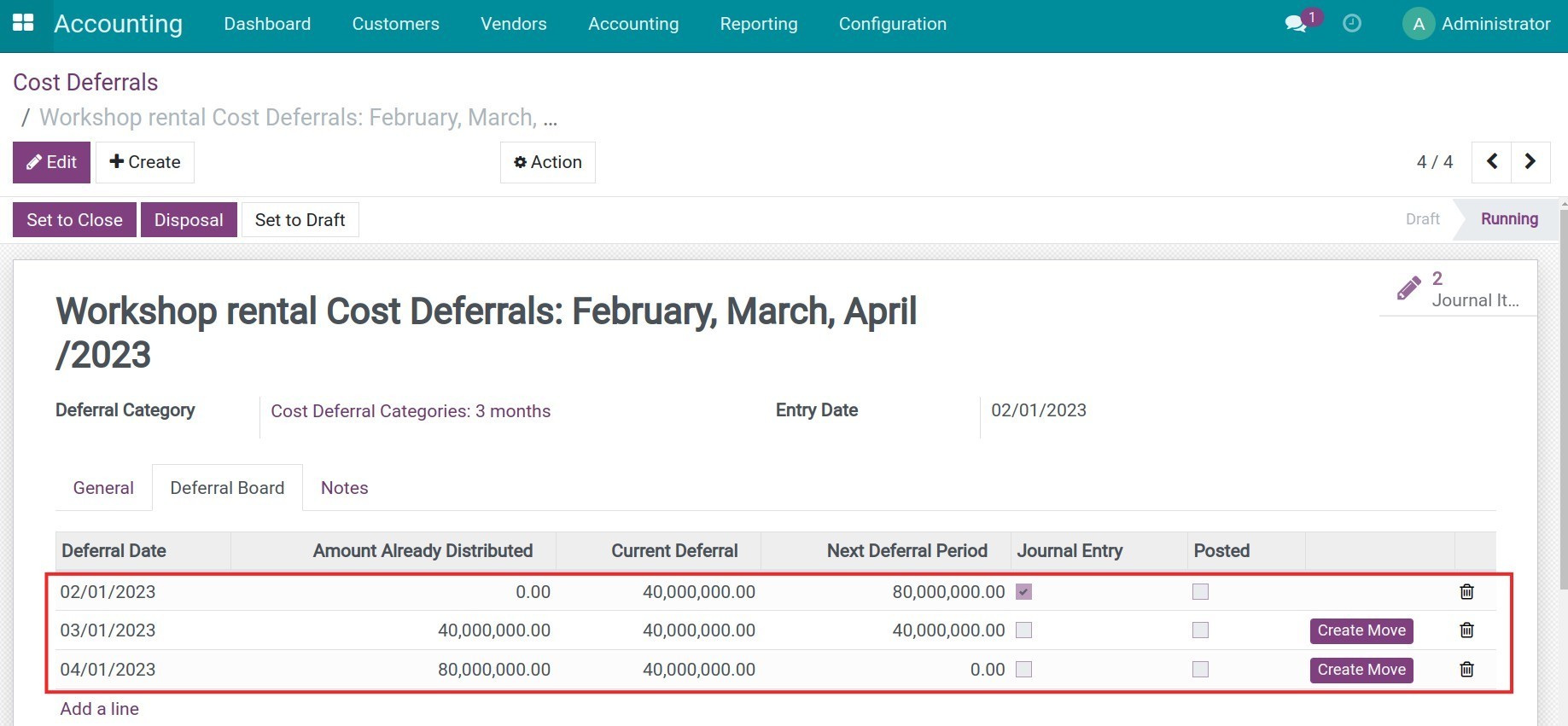

After checking the information, you click Confirm, the software will generate a Create Move button that allows you to create a journal entry for each deferral line.

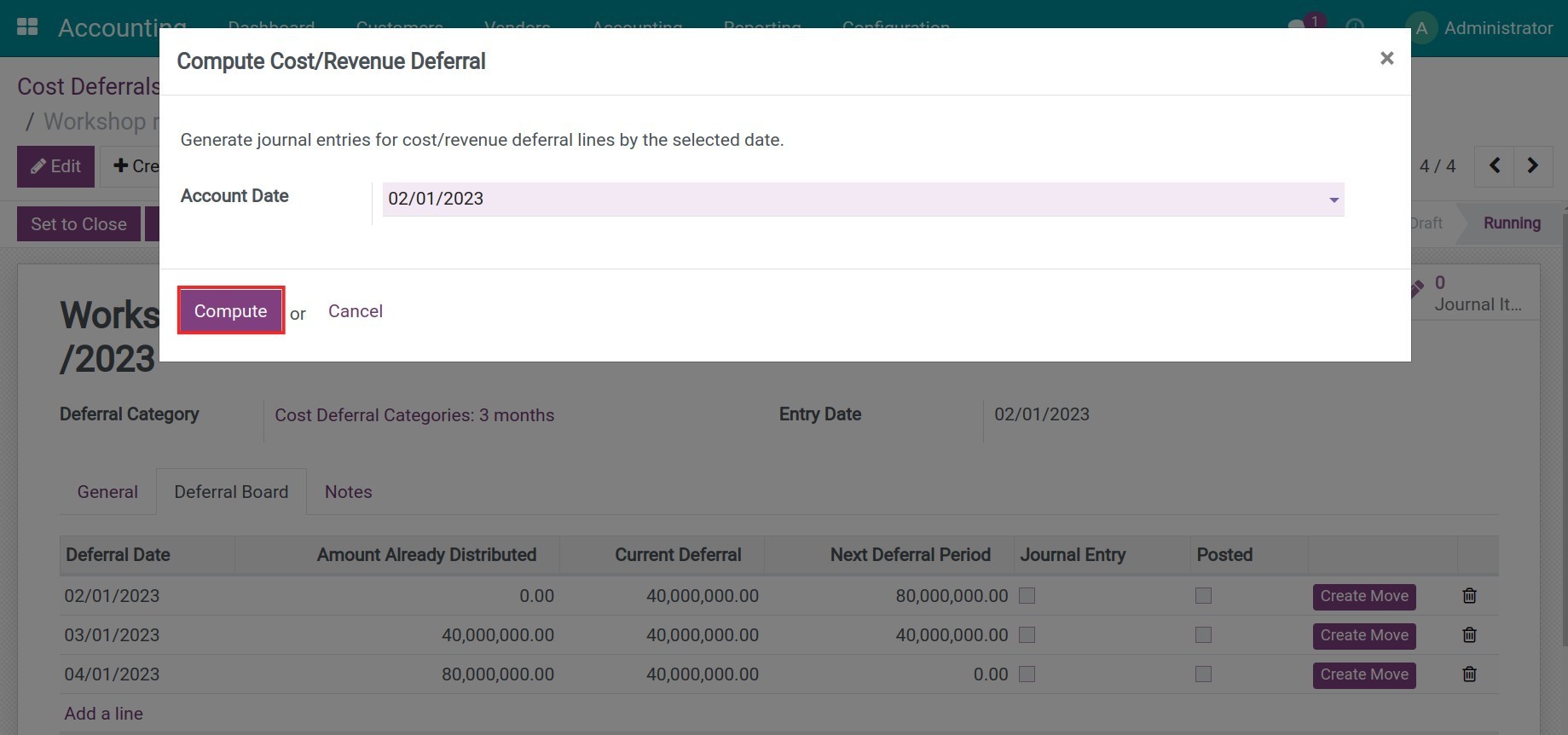

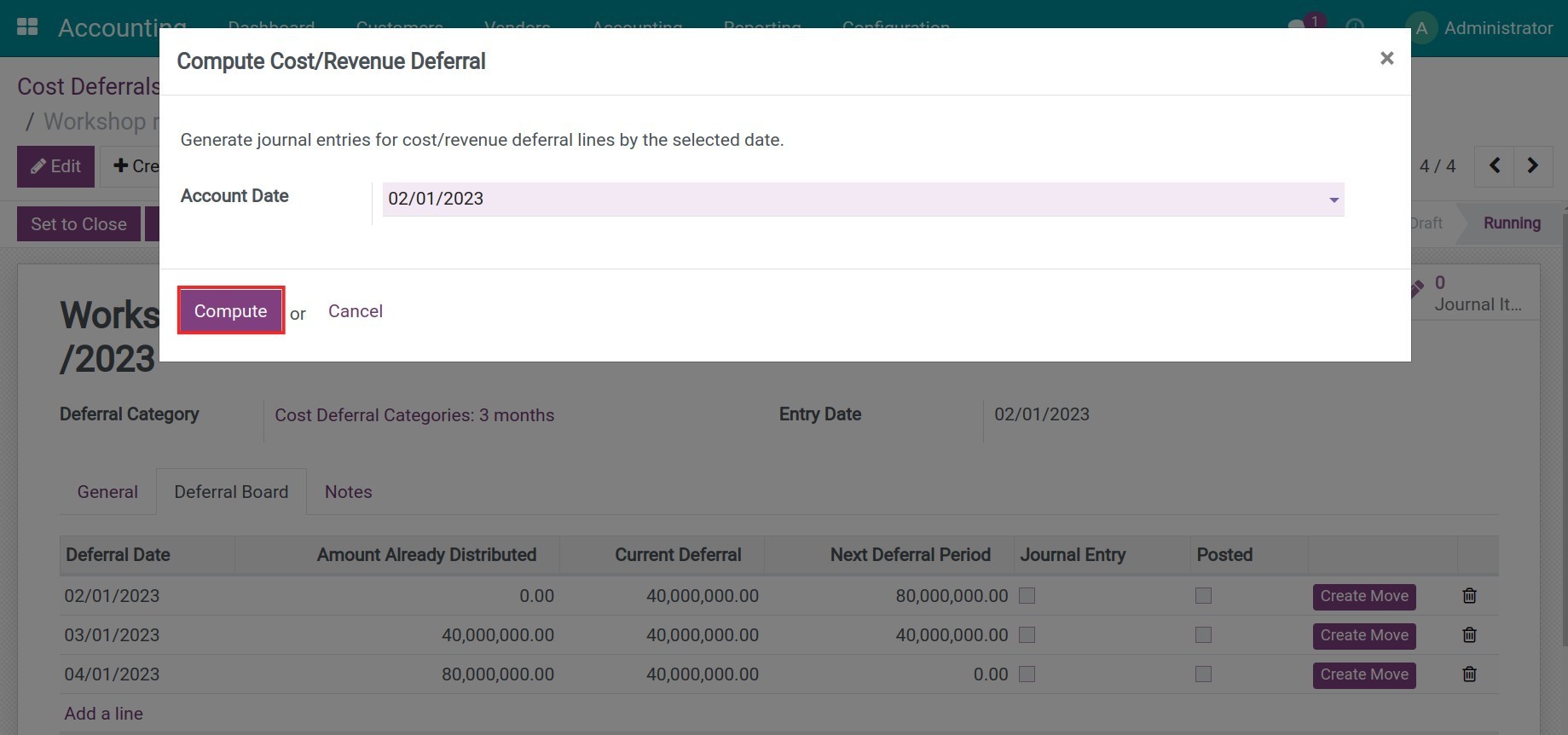

The software supports the feature to help you reduce the creation of entries by navigating to Accounting > Accounting > Compute Cost/Revenue Deferral, entering Account Date, then clicking Compute.

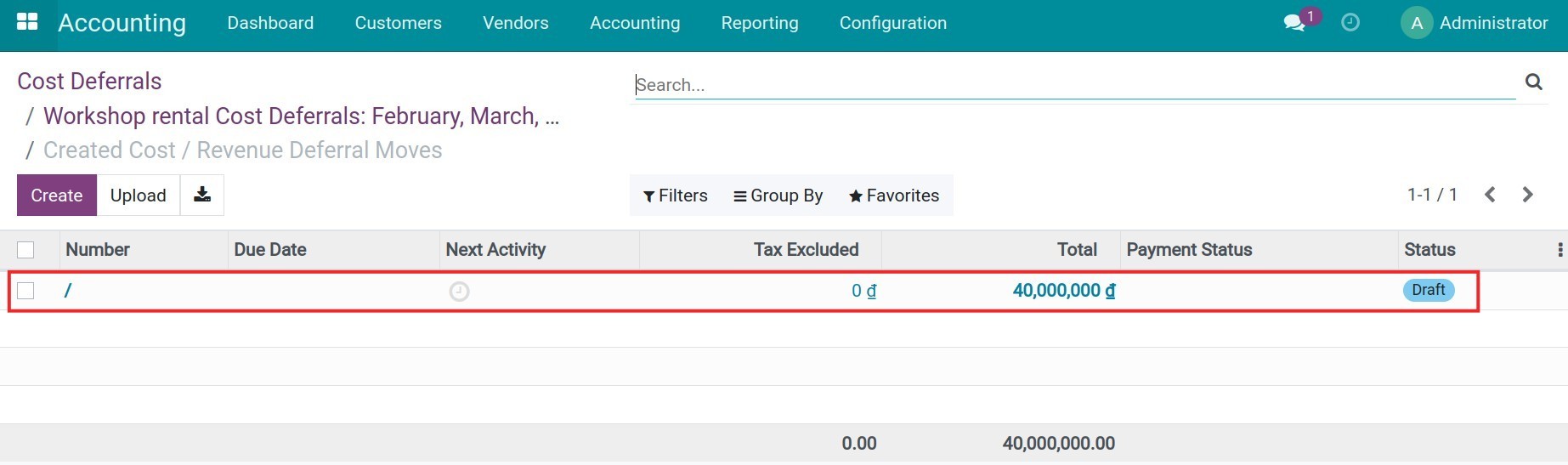

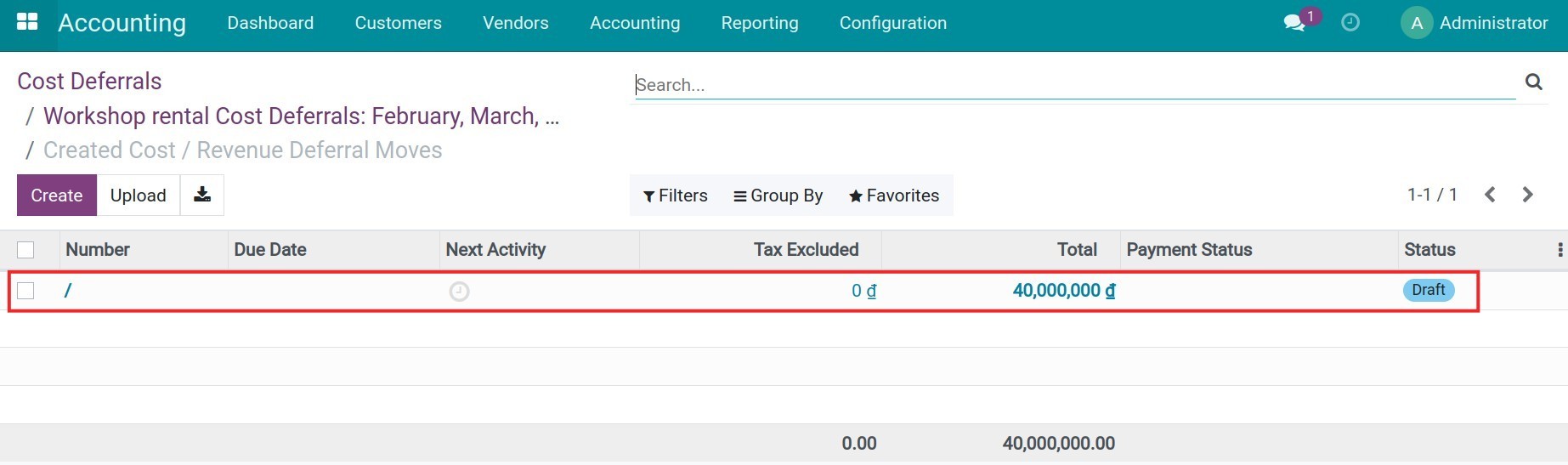

The screen navigates you to a view for automatically generated entries.

Note: In case you check Auto-Posted Deferral, the generated entry will be automatically entered into the journal immediately. Otherwise, the entry will be in Draft status, you have to post the journal.

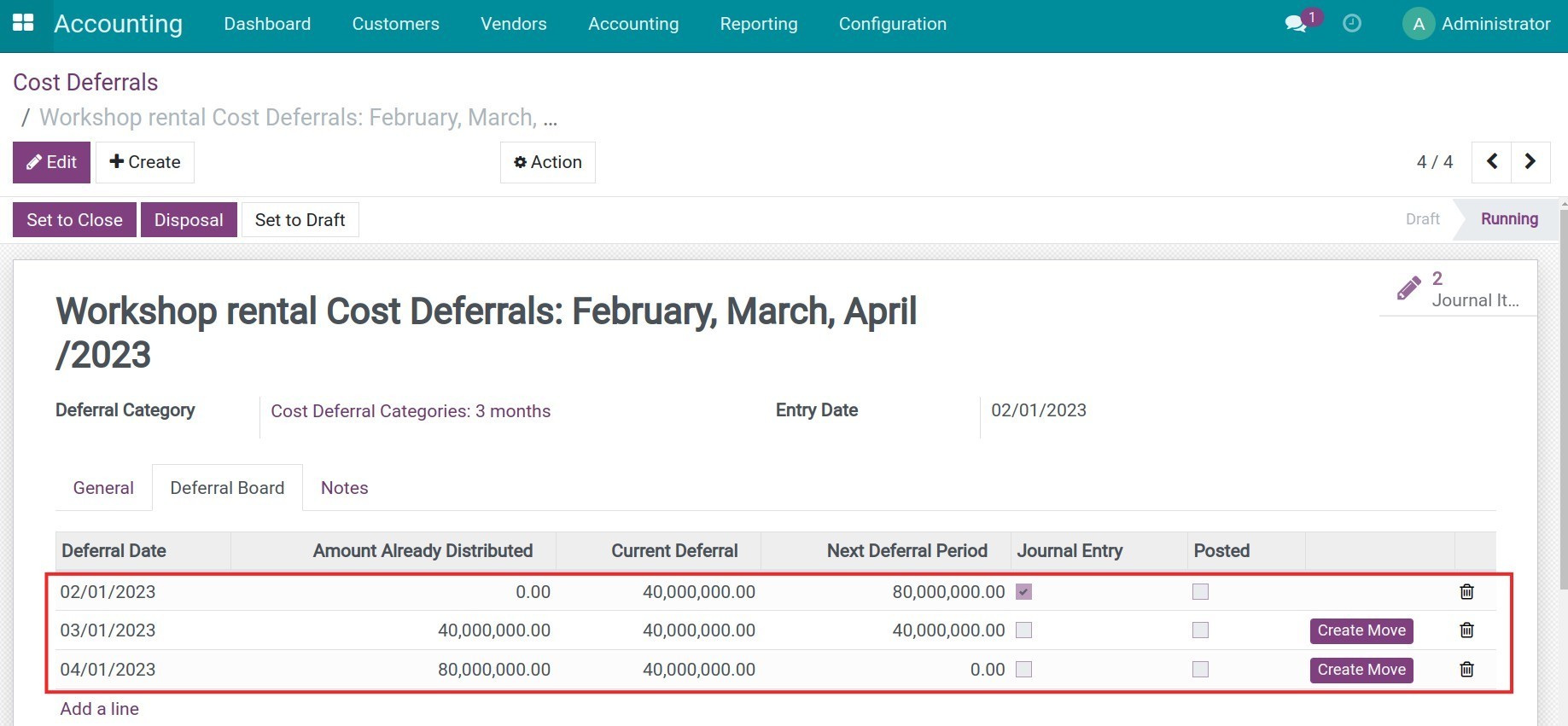

Returning to the deferral view, you will see the deferral lines updated with the respective journal status.

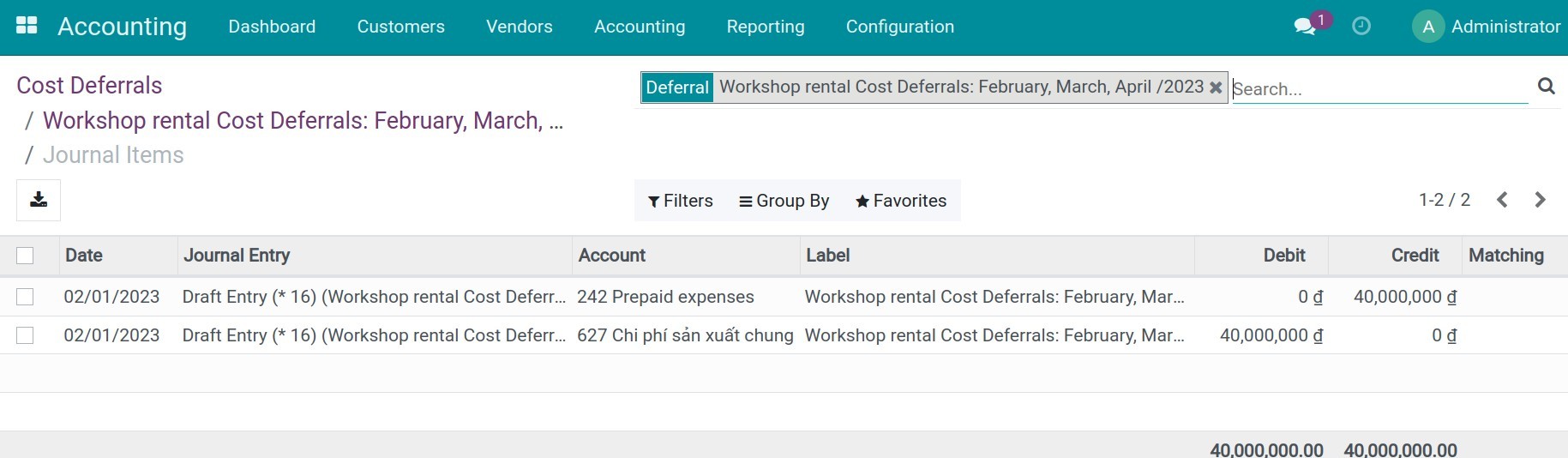

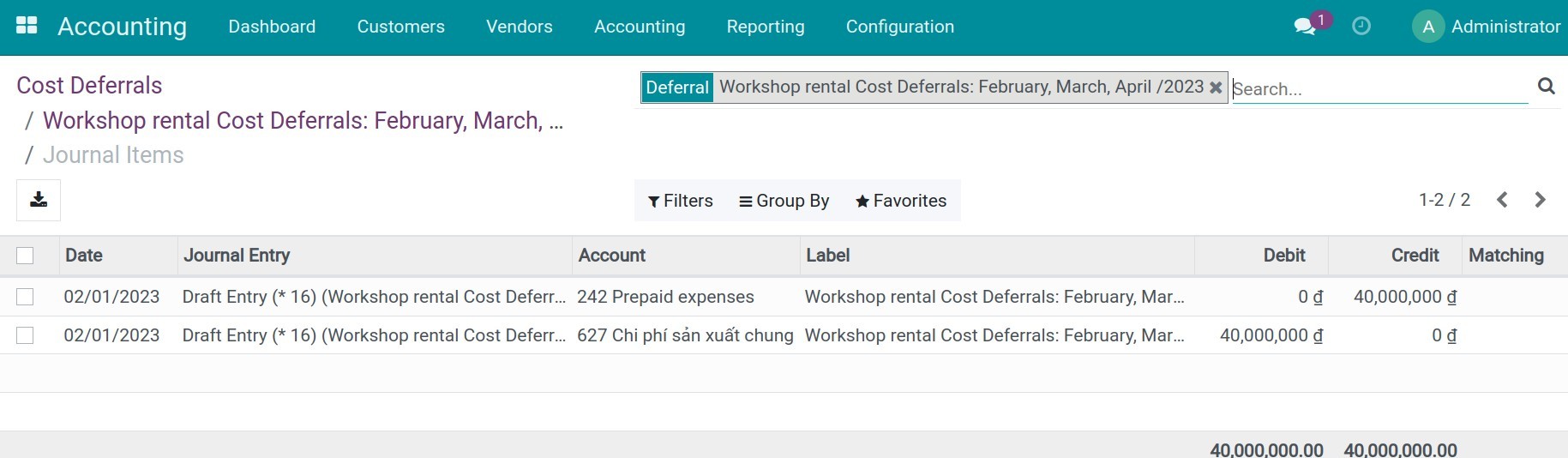

You choose Journal Items to check arising entries.

Periodically, you will compute this revenue/cost deferral so that the software generates a deferral entry.

Liquidate revenue/cost

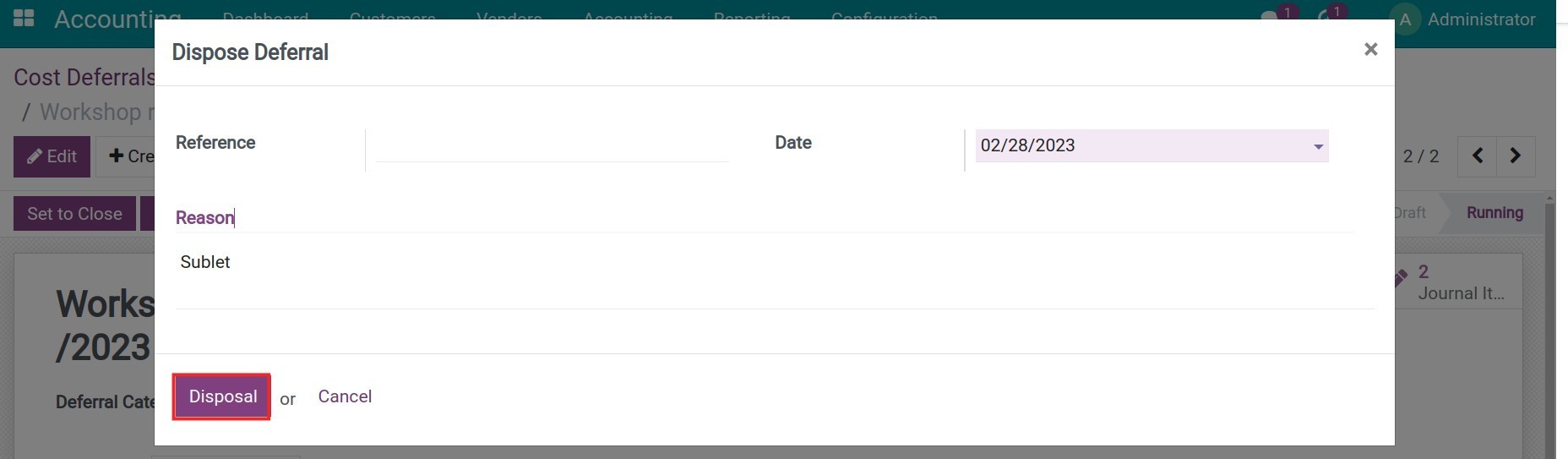

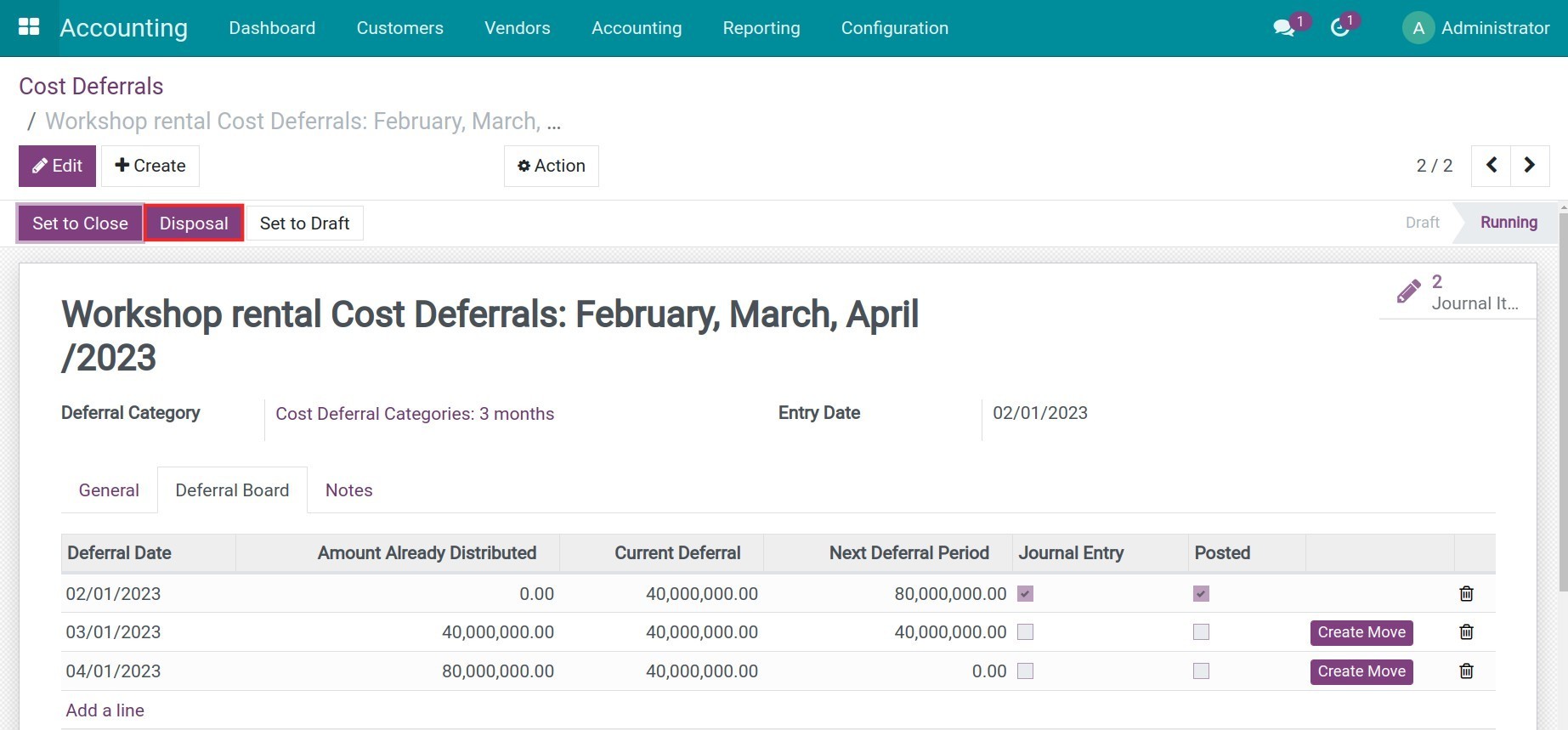

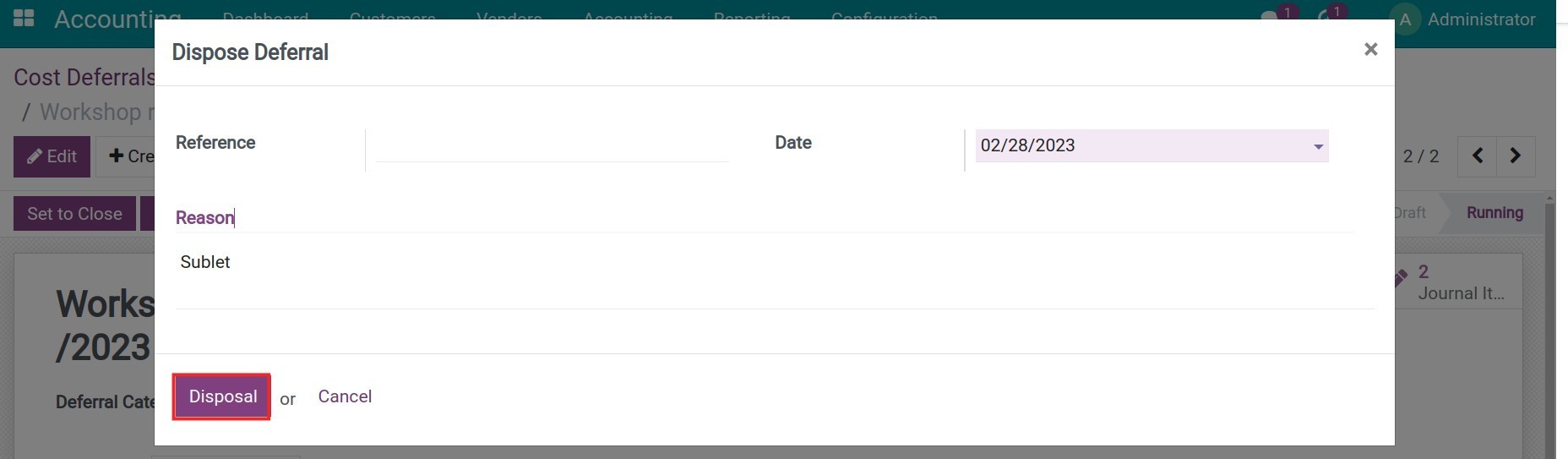

To liquidate this revenue/cost (Example: customer buys a 3-month course but after studying for 1 month, they no longer need to study. You pay the cost of renting an office for 3 months, but in the 2nd month, rent it out to another person,...) then right on the deferral view, click the Disposal button.

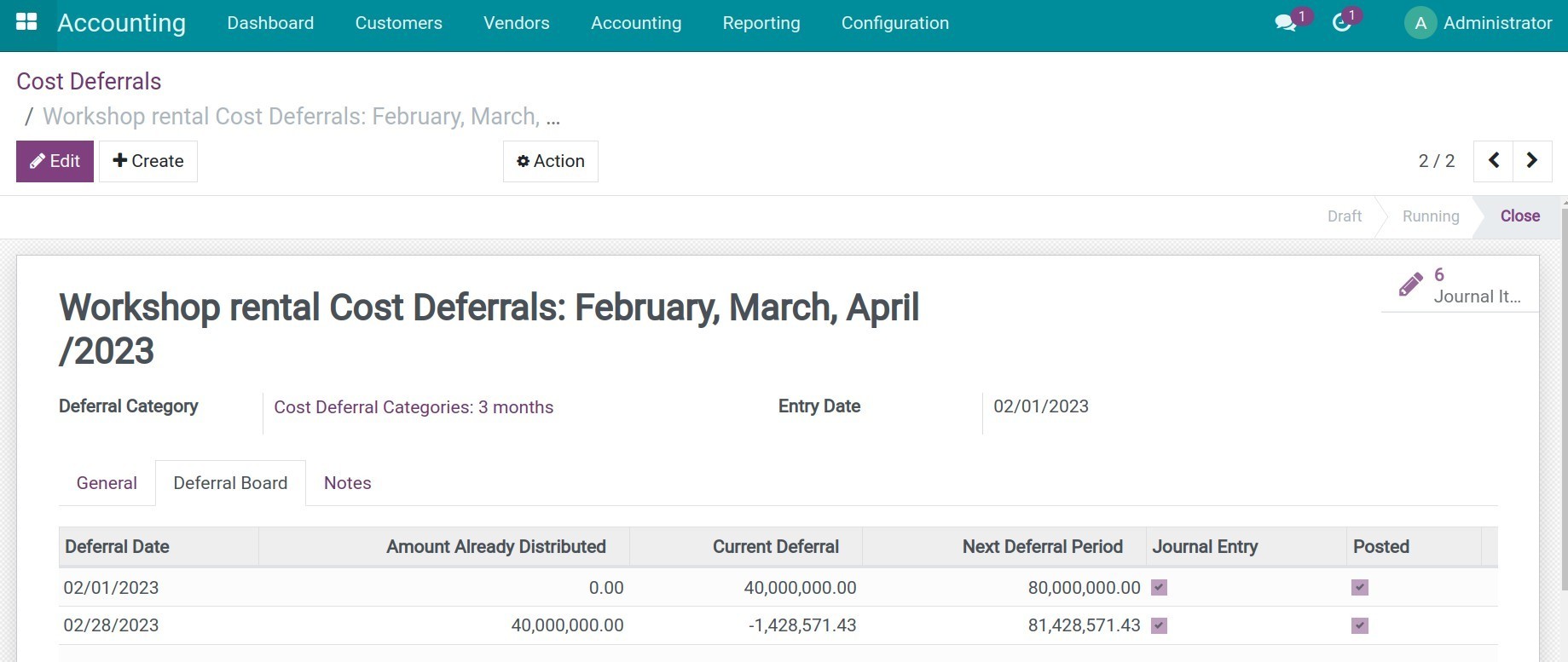

You enter Date, reference and note then click Disposal.

The software will calculate to record the disposal deferral value.