Employee payroll template is a statistical file that helps the human resources department to properly manage the employee's salary and bonus. How can businesses create the most accurate employee payroll file? Let'sVindoo See some sample payroll right below.

>>>> Refer Now: Payroll software

1. The information required in the employee payroll form

Normally, employee payroll template includes the following basic contents:

- Staff information: The employee's name must be included in the payroll file. Attached is the information about the position, contact method (phone number, email, ...).

- Basic salary: This is the main part of the salary that the employee receives according to the commitment with the employer. This salary does not include bonuses, allowances and other payments.

According to Decree 90/2019/ND-CP in 2020, the regional minimum wage has increased compared to Decree 157 years ago. Specific changes are as follows:

- Region 4: minimum salary 3,070,000 VND/month, increase by 150,000 VND/month

- Region 3: minimum salary 3,430,000 VND/month, increase 180,000 VND/month

- Region 2: the minimum salary of 3,920,000 VND/month, an increase of 210,000 VND/month

- Region 1: the minimum salary is 4,420,000 VND/month, an increase of 240,000 VND/month

- Actual working day: This metric is to determine the total real time each employee has worked. Employees will be paid based on this actual number of working days.

- Allowance: There are two main types of allowances, including those that need to be insured and those that do not need to be insured. In which, the allowances that do not require insurance are housing, meals, gas, and phone bills. Allowances that need to be insured are position allowance, responsibility allowance, area allowance, toxic/dangerous allowance, and heavy duty allowance.

- Nominal Income: This is the theoretical total amount that the employee will be entitled to, including all base salary and allowances.

- Actual gross salary: This is the portion of the food that does not take into account other expenses that the employee receives. This part of salary has deducted advances and insurance. Calculate actual salary in 2 ways as below:

- Method 1: Salary is calculated based on the working day of the month

Wages received = (Nominal income/Number of workdays) X Actual number of workdays

- Method 2: Salary is calculated based on the number of working days in the enterprise regulations. Suppose, the enterprise has a regulation that the number of monthly working days is 28, the calculation is as follows:

Food received = (Nominal income/28) X Actual number of working days

- Personal income tax: If the employee signs a contract with the company, they need to pay this tax for a period of 3 months or more.

- Insurance salary: The enterprise deducts from the employee's salary according to each type of insurance.

- Real field: This is the official salary that employees will receive at the end of the month. Wages include the total of all wages above minus advances, insurance and personal income tax.

The payroll form must include all the necessary information

The payroll form must include all the necessary information>>>> Don't Miss: HR Software

2. Simple employee payroll template

Here is a total of 8 employee payroll template the best standard that many businesses use today.

Download the 6 simplest employee payroll templates right now at This.

Sample 1: Salary slip form for each employee word file

Employee salary slip form word file

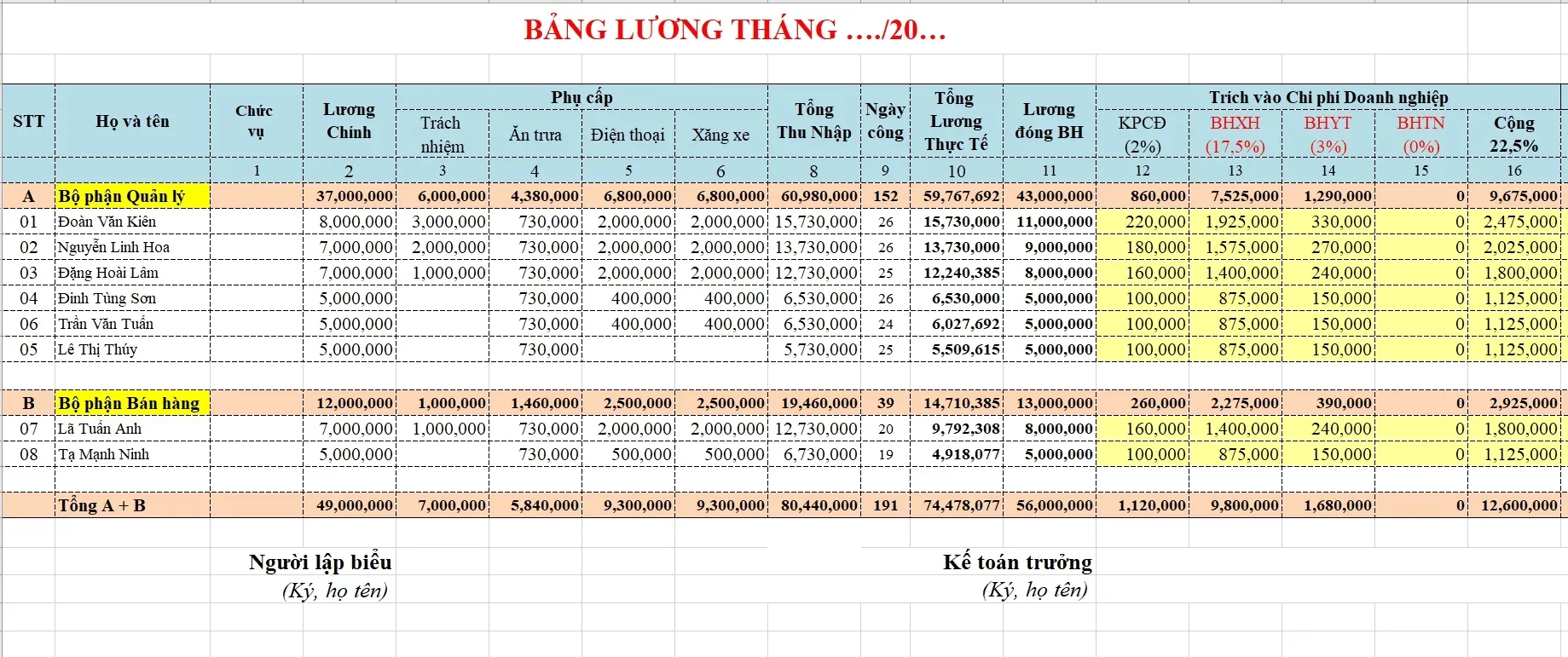

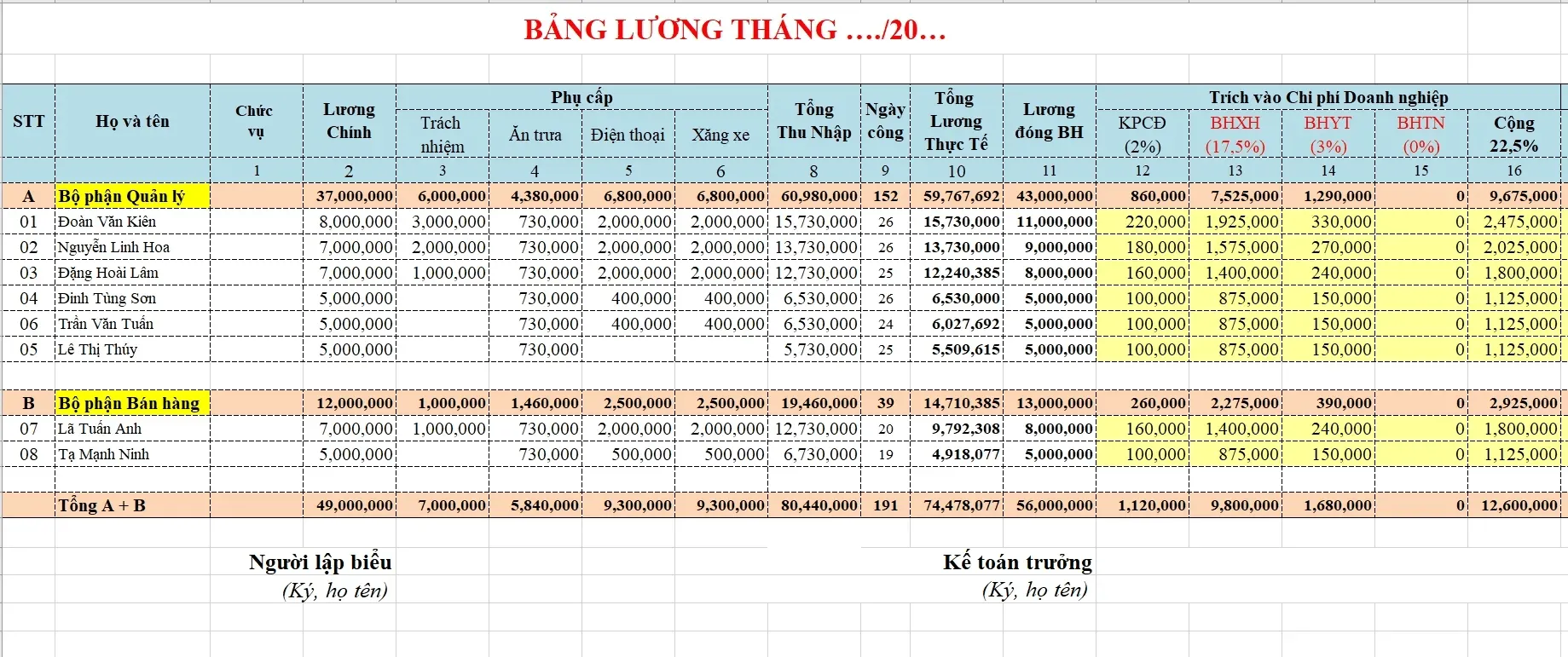

Employee salary slip form word fileForm 2: Simple employee payroll template

Simple payroll template

Simple payroll templateSample 3: Employee payroll form word file

Word file employee salary

Word file employee salaryForm 4: Payroll of office staff

Sample salary sheet for office staff

Sample salary sheet for office staffForm 5: Employee salary sheet template in excel

Salary slip template for each employee excel

Salary slip template for each employee excel>>>> Don't Miss:

- Payroll Automation : Unveiling the 5W1H

3. Download 3P Excel payroll template

Calculating salary according to 3P rule to determine the income of sales department employees. This rule is based on three basic factors: position, business performance and personal capacity. Designing3P Excel payroll template also based on these three core factors.

Download now: This

Basic Excel employee payroll template

Basic Excel employee payroll template>>>> See More: New and most accurate way to calculate personal income tax

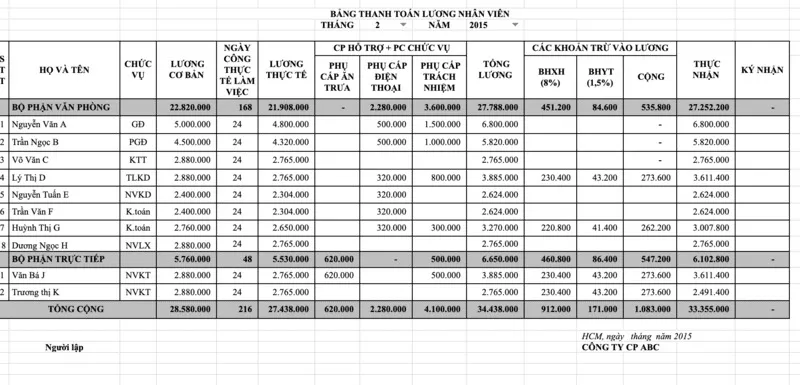

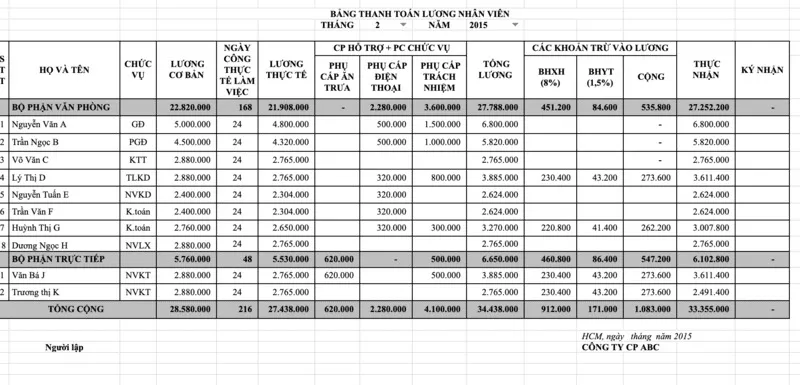

4. Salary payment form according to Circular 133

Salary payment form according to Circular 133 for small and medium enterprises. This payroll template has accurate content, helping businesses optimize the process of managing and controlling salary and bonus.

Please download now: This

Employee salary form according to Circular 133

Employee salary form according to Circular 133>>>> Don't Miss: Demystifying Payroll Reports: Unveiling the 5W1H

5. Excel file for salary payment according to Circular 200

The excel form for salary payment according to Circular 200 is form No. 02-LDTL in Circular 200/2014/TT-BTC. This template has easy-to-understand and accurate content, helping businesses today do a good job of managing salaries for employees.

Download now: This

Employee salary form according to Circular 200

Employee salary form according to Circular 2006. Employee payroll form

The employee payroll template must be accurate and detailed to help businesses control expenses as well as stabilize the general financial situation. We invite you to take a look at some of the free samples below.

Download now: This

Basic employee payroll template

Basic employee payroll template7. Sample salary sheet for sales staff

Salary payment form for business employees with full content and details of basic salary, salary bonus, PIT, insurance,...

We invite you to download the payroll template file for sales staff at This.

Salary sheet template for business staff

Salary sheet template for business staff8. Employee payroll template word file

File word employee payroll used by many businesses. This payroll template is detailed, easy to understand and easy to manipulate.

Access to immediately download the employee payroll file in word at This.

Employee salary form detailed word file

Employee salary form detailed word file9. Set up automatic payroll with Viindoo Payroll

Compensation management is one of the core tasks in the HR department. This operation directly affects the overall work efficiency. However, nowadays the use of employee payroll template Free fee has shown many shortcomings such as being time-consuming, inaccurate salary calculation, lack of transparency, and error proneness,...

Understanding this difficulty, Viindoo provides your business with automatic Payroll Management Software -Viindoo Payroll. This will be an effective right hand, helping HR and accounting personnel improve work performance as well as reduce risks when managing monthly salaries.

Viindoo Payroll is a salary management software in the human resource management ecosystem of Viindoo HRM. Viindoo Payroll provides comprehensive solutions for human resource management, timekeeping, and payroll for all types of businesses.

Outstanding Features of the Software Viindoo Payroll:

- Automatic salary calculation for each employee and department at the enterprise

- Integrate with accounting applications, support recording of debt and salary entries

- Integration with applications Viindoo Others include Attendance Software, expense management software, Overtime Management software,...

Discover Viindoo Payroll Software

Automatically calculate salary and eliminate manual work. Flexible salary structures for every business needs.

FAQs

How can I benefit from using an employee payroll template file?

Using an employee payroll template file can provide several benefits. It simplifies the payroll process, reduces manual errors, ensures accurate calculations, saves time, and helps maintain consistent payroll records.

Are these templates customizable?

Yes, employee payroll template files can be customized to meet the specific needs of your business. You can add or remove columns, modify formulas, change formatting, and incorporate company branding elements to align with your payroll processes.

Are these templates suitable for different types of businesses?

Yes, various types of businesses can use employee payroll template files, including small businesses, startups, and even larger organizations. The templates provide a foundation for managing employee payroll and can be adapted to suit the specific requirements of your business.

Can I calculate taxes and deductions using these templates?

Yes, these templates often include built-in formulas to calculate taxes and deductions based on the provided inputs automatically. However, ensuring that the tax rates and deduction formulas are accurate and current for your jurisdiction is essential.

Are these templates compatible with payroll software?

Employee payroll template files in Excel or Word format can be used independently without payroll software. However, if you use payroll software, you can extract the necessary data from the template and import it into the software for further processing or integration with other systems.

With the above post, Viindoo have fully compiled the employee payroll template most used today. If you have any questions about how to manage employee salaries, do not hesitate to contact us immediately Viindoo to be answered.

>>>> Continue With: