Payroll reports play a significant role in the field of business administration. These comprehensive records serve as a cornerstone for financial management and employee satisfaction and provide a transparent view of an organization's compensation distribution. In this article, we embark on a journey to unravel the What, Why, When, Where, Who, and How (5W1H) of payroll reports.

>>>> Find out about: HR Software

What is a Payroll Report?

At its core, a payroll report is a detailed document that outlines the financial transactions related to employee compensation. It encompasses various aspects of compensation, including earnings, deductions, taxes, and contributions. The report provides an in-depth breakdown of how much each employee is paid and the composition of those payments. In essence, it paints a clear picture of the financial relationship between an organization and its workforce.

Payroll report definition

Why are Payroll Reports Essential?

Payroll reports play a multifaceted role within an organization, each aspect contributing to its essential nature:

Legal Compliance: Payroll reports are a means of adhering to legal and regulatory requirements. These reports ensure that an organization follows tax laws, labor regulations, and other financial compliance standards.

Employee Transparency and Trust: Transparent communication about compensation builds trust between employers and employees. Sharing detailed payroll reports fosters an environment of openness and helps employees understand how their earnings are calculated and disbursed.

Financial Planning: Both employees and organizations benefit from payroll reports in terms of financial planning. Employees can gauge their take-home pay and plan their budgets, while organizations can forecast labor costs and allocate resources effectively.

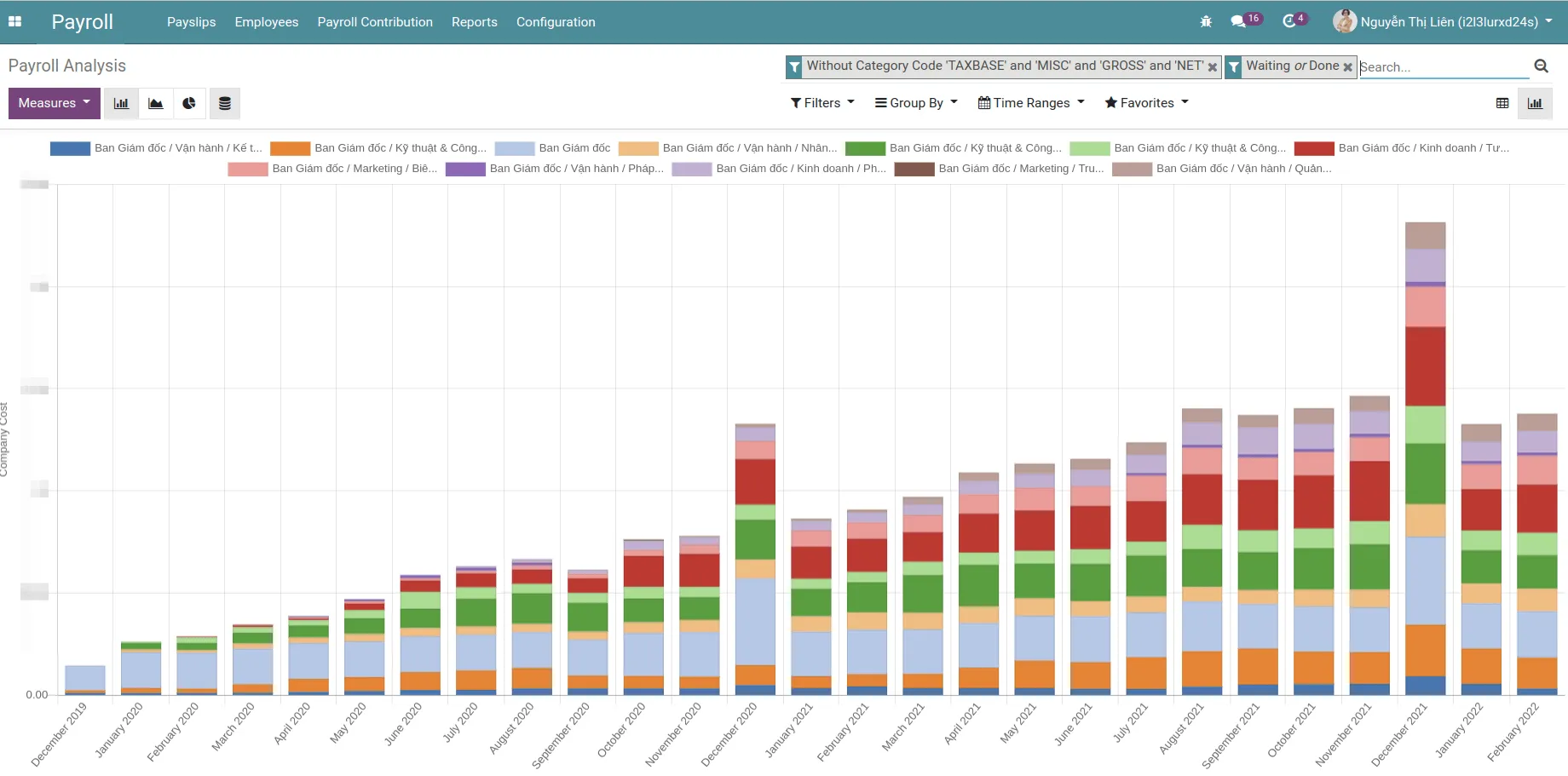

Data-Driven Insights: Payroll reports offer insights into employee performance and compensation trends. This data aids in identifying top performers, analyzing overtime patterns, and making informed decisions about promotions or bonuses.

Accurate Budgeting: Businesses allocate a substantial portion of their budget to payroll. Accurate payroll reports aid in budget allocation and help organizations stay financially prepared.

Payroll report example

>>>> See More: What is a Payroll Software? Learn details A - Z

When and Where are Payroll Reports Prepared?

The timing and location of payroll report preparation depend on an organization's structure and practices:

Frequency: Payroll reports are typically prepared on a regular basis, often aligned with the organization's payroll schedule. This could be weekly, bi-weekly, monthly, or yearly.

Location: Payroll reports are generated within an organization's payroll system. This system could be on a paper base, Excel, or software depending on the level of technology application of each organization. With the advent of digital technology, these reports can be accessed and generated electronically and automatically.

>>>> See also: Payroll Automation Made Easy with Viindoo Payroll Software

Who Prepares and Who uses Payroll Reports?

The responsibility of preparing and analyzing payroll reports falls on several key players:

Payroll Specialists: These professionals are tasked with calculating and processing employee compensation accurately. They ensure that all earnings, deductions, and taxes are properly accounted for in the payroll report.

HR Department: Human Resources personnel play a role in ensuring that employee data, such as hours worked and leave taken, is accurately recorded for payroll calculations.

Finance Team: The finance team uses payroll reports to budget for labor costs and analyze expenditures. They also ensure compliance with financial regulations.

Management and Decision-Makers: Business owners, managers, and decision-makers use payroll reports to gain insights into labor costs, employee performance, and overall financial health.

How to Prepare and Analyze Payroll Reports?

The process of preparing and analyzing payroll reports involves several steps. This section will specify each step with examples using Payroll Software - Viindoo Payroll Software for your clear understanding:

Gather Data: Collect information such as employee work hours, overtime, base salary, bonuses, and any payroll deductions.

- Employee work hours: can be calculated by recording employee timesheets, attendance checking, or deducting leave hours from duty working hours

Example: Viindoo Timesheets Application records employee work hours

Example: Work hours recorded on payslips in Viindoo payroll software

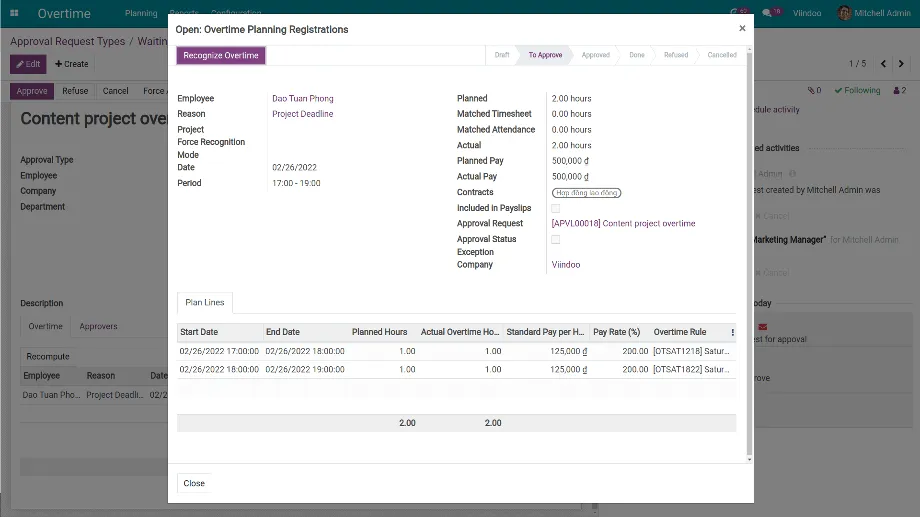

- Overtime: is defined as time spent working after the usual time needed or expected in a job and normally paid with higher rates than usual working time. To record this, organizations normally use the overtime requests and approval process for the planned overtime hours and then track the actual overtime hours by comparing the actual check-out time with the usual check-out time.

Example: Overtime records in Viindoo Overtime Management Application

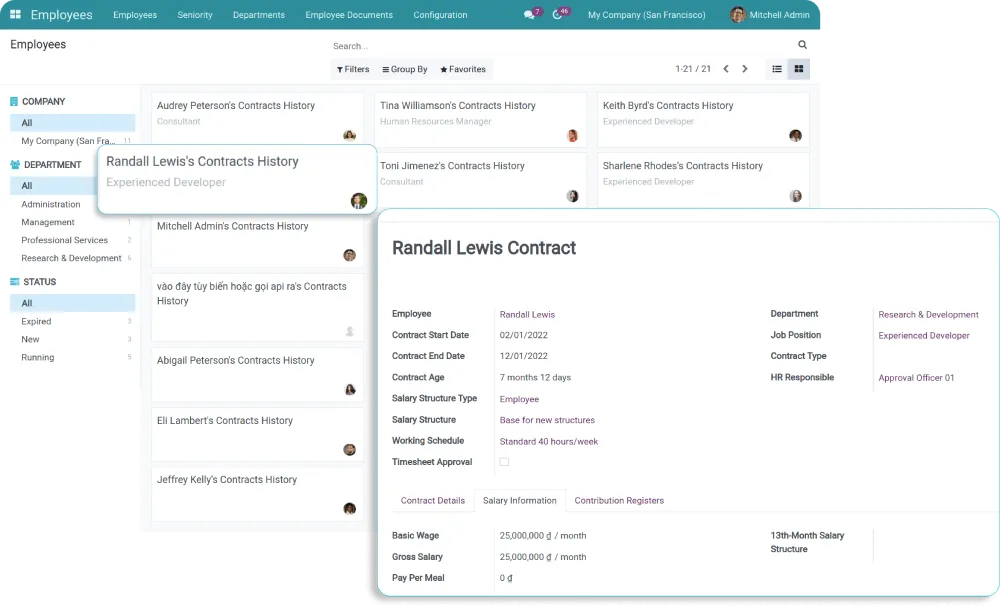

- Base salary and bonuses: are normally agreed upon between the organization and the employee, and expressed in the labor contract.

Example: Salary and bonuses in formation recorded in Viindoo Employee Application

- Payroll deductions: are amounts of money that are taken by an employer from an employee's pay, for income tax, insurance, etc. These deductions are usually regulated by local laws and do not change frequently.

Example: Insurance deduction registration for employee in Viindoo Payroll software

Payroll calculation: After gathering data, this is the important step to get the different pieces of the payroll reports. Organizations can use employee payroll templates in Excel or Word files or an automated payroll system such as Viindoo Payroll.

- Calculate Earnings: Calculate gross earnings for each employee based on hours worked and compensation structure.

- Deduct Taxes and Contributions: Deduct taxes, social security contributions, health insurance premiums, and any other deductions from gross earnings.

- Compute Net Pay: The net pay, or take-home pay, is the final amount that employees receive after all deductions. Calculate this amount for each employee.

Example: Automated payroll calculation in Viindoo Payroll software

Generate Report: Use tools like payroll software to generate a detailed payroll report that breaks down earnings, deductions, taxes, and net pay for each employee.

Example: Payroll report detailed for each employee in Viindoo Payroll software

Review for Accuracy: Thoroughly review the report to ensure accuracy in calculations and data entry. This can be done by reconciling the total amount with the corresponding detailed transactions.

Viindoo software allows user to check the detailed transactions of each amount in payroll report

Employee Communication: Distribute the payroll report to employees, explaining the components and answering any questions they may have. Normally, organizations send pay slips to their employees period by period, but in this way, employees hard to compare and recognize abnormalities across periods. Instead, organizations can use payroll software that allows employees to access and view all of their own payslips and reports like Viindoo payroll software.

Employees can access their own payroll reports in Viindoo Payroll software

Strategic Analysis: Management and finance teams analyze the data within the payroll report to gain insights into labor costs, trends, and areas for improvement.

Example: Payroll reports in Viindoo Payroll software

>>>> See also:

- Types of Salary Structure: Exploring the Best Options for Compensation

- What is salary allowance? Regulations on salary allowances 2023

FAQs

What should be included in a payroll report?

It should include accurate and up-to-date information such as employee information, earnings, deductions, taxes, contributions, and payment history.

How often should you review payroll reports?

You should review them regularly corresponding to your payroll period to ensure that they are accurate and error-free. This can help you identify any issues early on and prevent further errors or discrepancies.

Can I use a manual system for payroll reporting?

While it is possible to use a manual system for payroll reporting, it can be time-consuming and prone to errors. Consider using an automated system to streamline the process and reduce the likelihood of errors.

How much does Viindoo Payroll software cost?

Viindoo Payroll software is free forever for first application with unlimited users. Checkout here: https://viindoo.com/pricing

Conclusion

The payroll report is a pivotal document that bridges financial management and employee relations within an organization. It answers the 5W1H—What, Why, When, Where, Who, and How—regarding employee compensation. With its multifaceted role in ensuring legal compliance, fostering transparency, aiding financial planning, providing data-driven insights, and enabling accurate budgeting, the payroll report stands as a testament to the intricate interplay between finance and human resources. By understanding its nuances and leveraging its power, organizations can pave the way for efficient compensation management and informed decision-making.

The ultimate Payroll Management System

FREE FOREVER

Accurate and automated Payroll Management System