Demo video: Vietnam - Overtime Payroll with Accounting

The Vietnam - Overtime Payroll with Accounting module simplifies payroll management by integrating overtime salary rules with the Vietnamese Chart of Accounts. It automates journal entry creation, eliminates manual data entry, and ensures compliance with local accounting standards.

Key Features

- Seamless Integration of Overtime Payroll with Vietnamese Accounting:

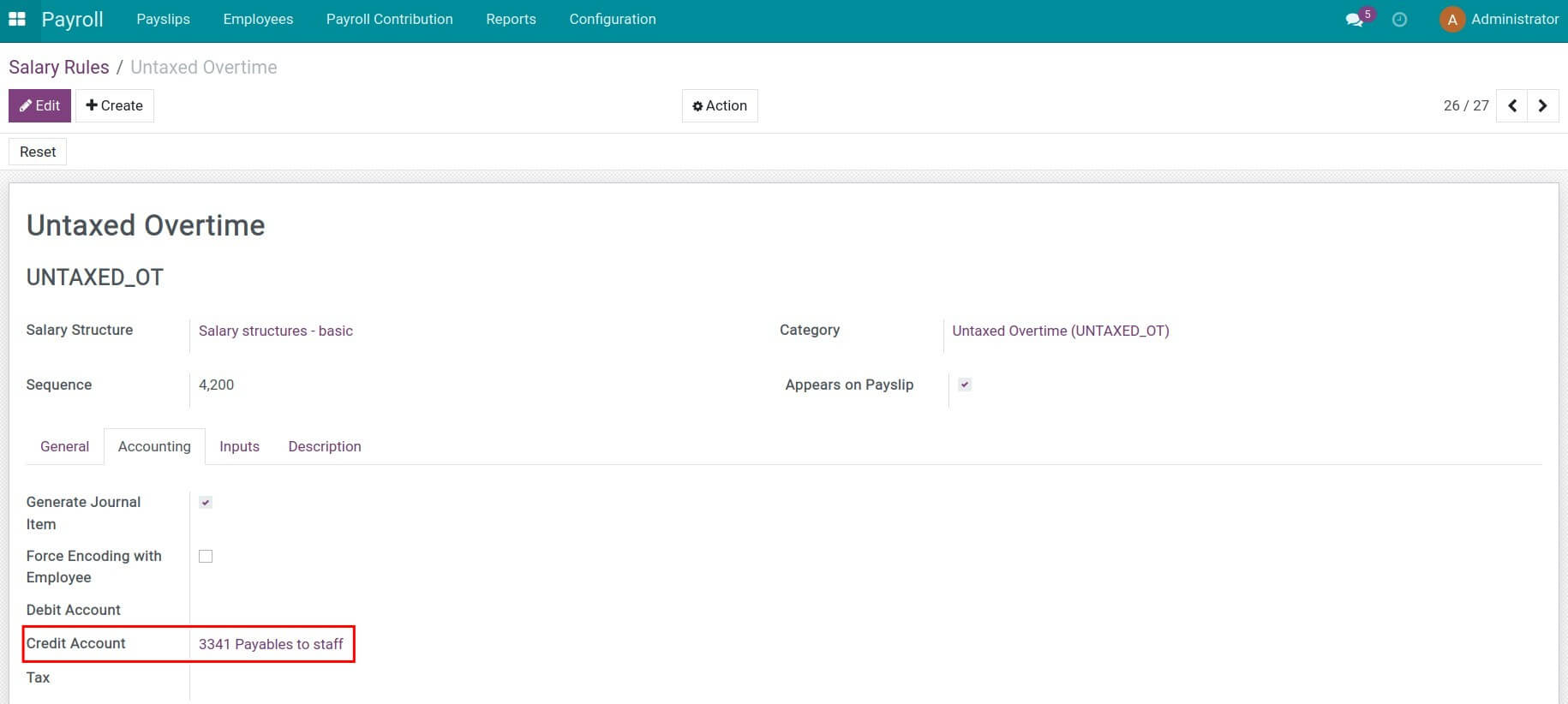

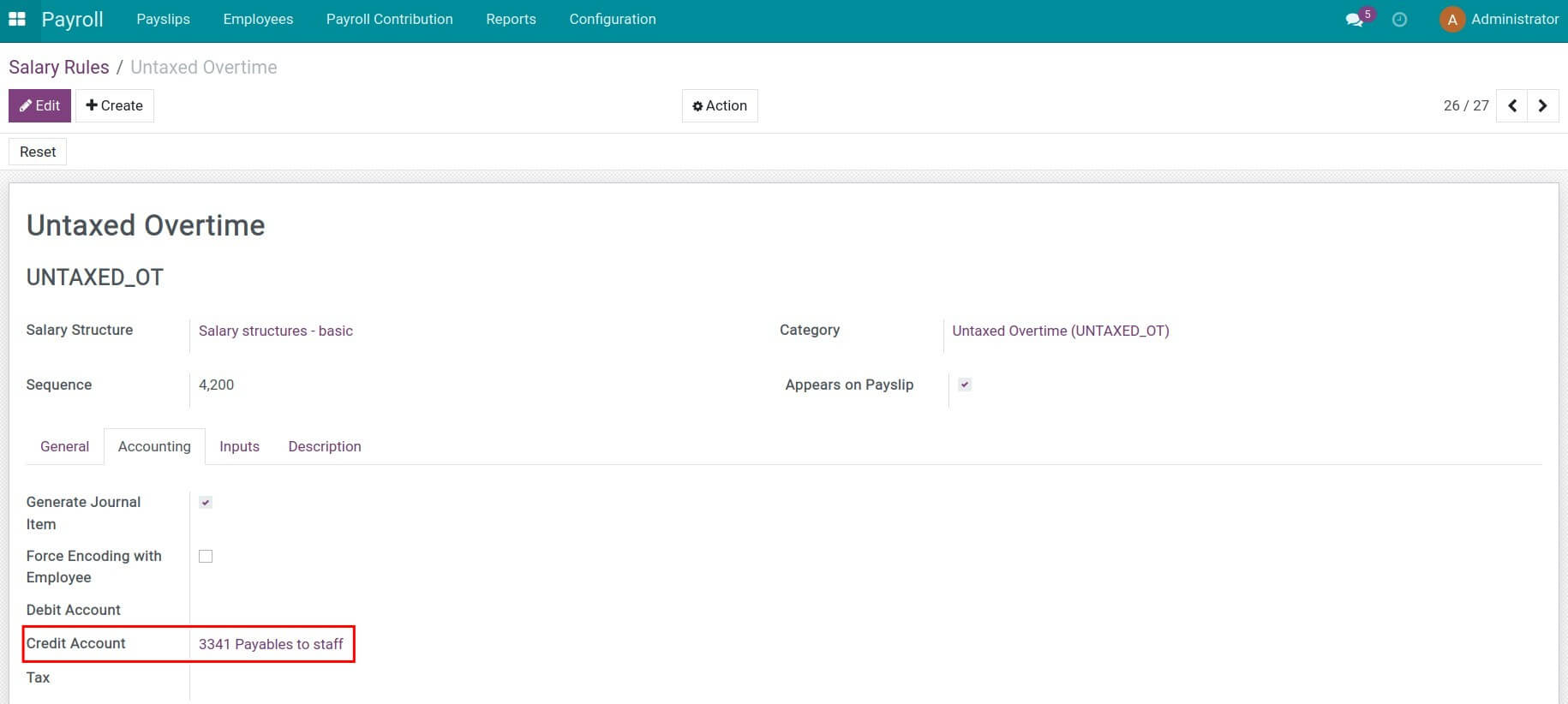

- Pre-configured credit accounts for overtime salary rules:

- Circular 200: 3341 - Payables to staff.

- Circular 133: 334 - Payables to employees.

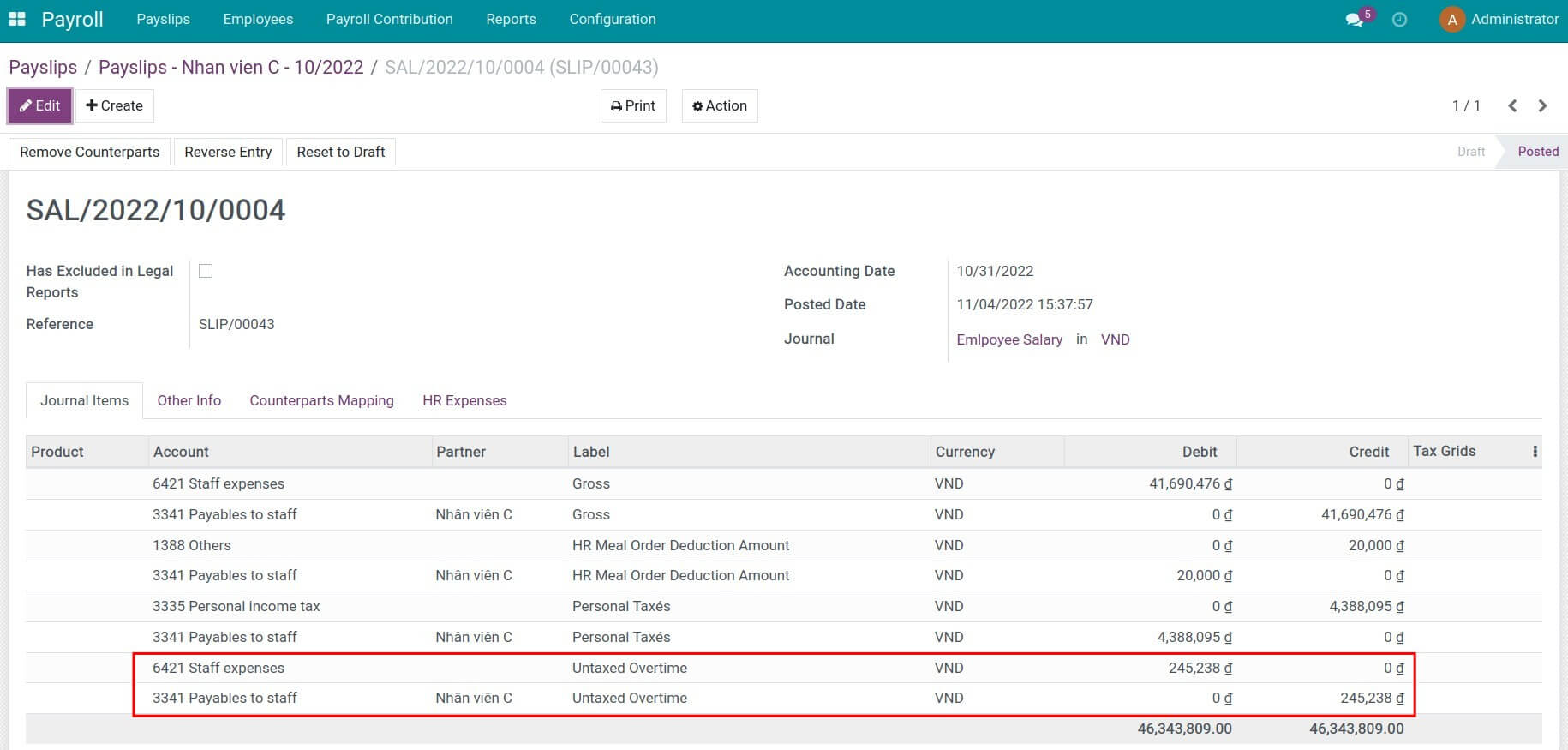

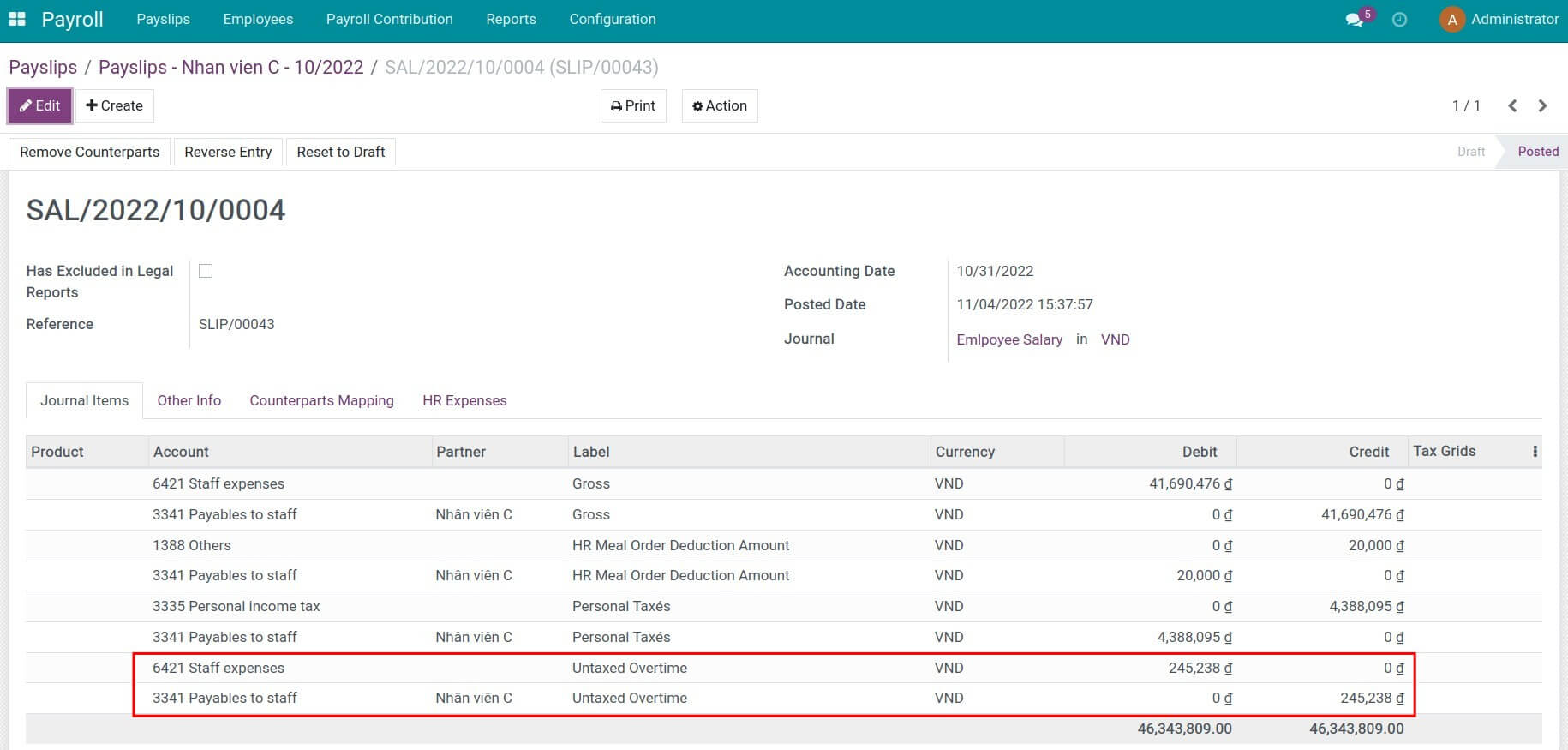

- Automatically generates journal entries when a payroll or payslip is confirmed with the corresponding account.

Business Value

- Enhanced Efficiency:

- Eliminates manual accounting tasks for overtime salary processing.

- Saves significant time by automating journal entry generation.

- Improved Accuracy:

- Reduces errors in payroll accounting by automating data linkage with Vietnamese accounting standards.

- Ensures compliance with local accounting regulations (Circular 200 and 133).

- Cost Optimization:

- Streamlines overtime payroll management, reducing administrative overhead and operational costs.

Who Should Use This Module

- Vietnamese Enterprises:

- Companies that need localized payroll solutions integrating with Vietnamese accounting standards.

- Accounting and Payroll Teams:

- Professionals handling overtime payroll and requiring automated accounting journal entries.

- Teams seeking to reduce manual workload and improve accuracy in payroll accounting.

- Enterprises of All Sizes:

- Suitable for SMEs and large corporations needing efficient payroll and accounting integration.

Editions Supported

Community Edition

Installation

- Navigate to Apps.

- Search with keyword l10n_vn_viin_hr_payroll_account_overtime.

- Press Install.

Instructions

Instruction video: Nhãn cho video

1. Default Untaxed Overtime Work salary rule settings

2. Basic salary rules configuration

3. Overtime and compute overtime salary

Refer to the instruction in the viin_hr_overtime_payroll module.

4. Generated accounting entries after salary payroll/payslip confirmation

After confirming the payslips/payroll, check the generated journal entries:

This software and associated files (the "Software") may only be

used

(executed, modified, executed after modifications) if you have

purchased a

valid license from the authors, typically via Odoo Apps,

or if you

have

received a written agreement from the authors of the

Software (see the

COPYRIGHT file).

You may develop Odoo modules that use the Software as a library

(typically

by depending on it, importing it and using its

resources), but

without

copying any source code or material from the

Software. You may distribute

those modules under the license of your

choice, provided that this

license

is compatible with the terms of

the Odoo Proprietary License (For

example:

LGPL, MIT, or proprietary

licenses similar to this one).

It is forbidden to publish, distribute, sublicense, or sell

copies of the

Software or modified copies of the Software.

The above copyright notice and this permission notice must be

included in

all copies or substantial portions of the Software.

THE SOFTWARE IS PROVIDED "AS IS", WITHOUT WARRANTY OF ANY KIND,

EXPRESS OR

IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF

MERCHANTABILITY,

FITNESS FOR A PARTICULAR PURPOSE AND

NONINFRINGEMENT. IN NO EVENT

SHALL THE

AUTHORS OR COPYRIGHT HOLDERS

BE LIABLE FOR ANY CLAIM, DAMAGES OR OTHER

LIABILITY, WHETHER IN AN

ACTION OF CONTRACT, TORT OR OTHERWISE,

ARISING

FROM, OUT OF OR IN

CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER

DEALINGS IN THE

SOFTWARE.