Demo video: Accounting Customization

What it does

This module provides a few customizations for the Accounting app and serves as the basis for further expansion of other modules.

Technical Customizations

In some cases, we need to know if a tax is a value added tax. So adds a new field Is VAT to the model `account.tax.group` and the model `account.tax` for that purpose.

Add the VAT Counterpart Account field to the Company information. This field will be automatically updated by l10n modules.

- VAT Counterpart Account

- Income Refund Account on Product Category

- Expense Refund Account on Product Category

- Other Receivable Account on Partner

- Other Payable Account on Partner

- Employee Advance Account

- Gain Currency Conversion Account

- Loss Currency Conversion Account

- Borrowing Loan Account

- Lending Loan Account

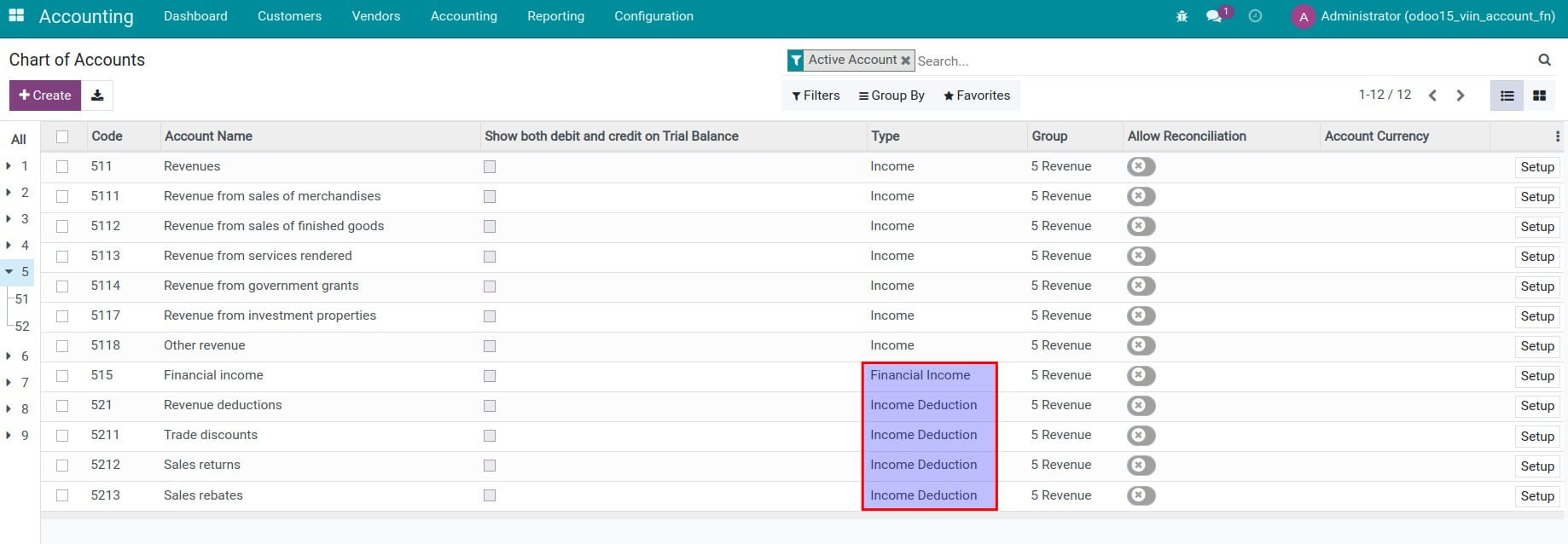

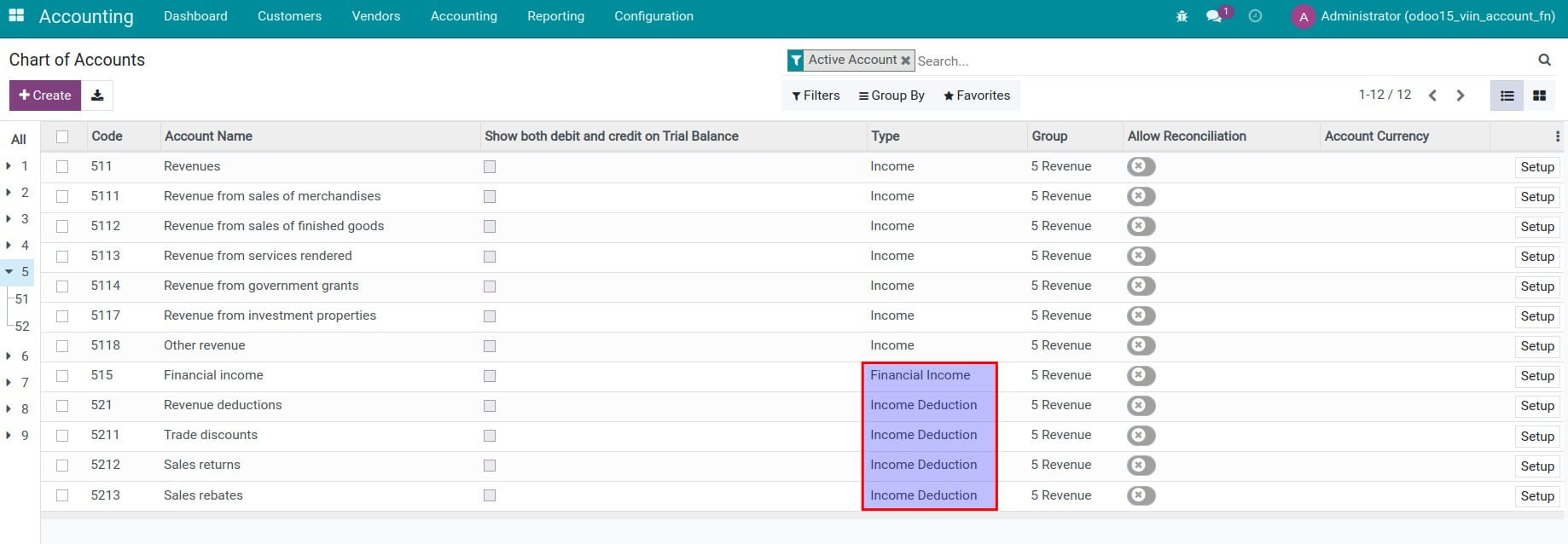

New Account Type

- Financial Income, xml_id: to_account_financial_income.data_account_type_financial_income

- Income Deduction: xml_id: to_account_income_deduct.data_account_type_revenue_deduct

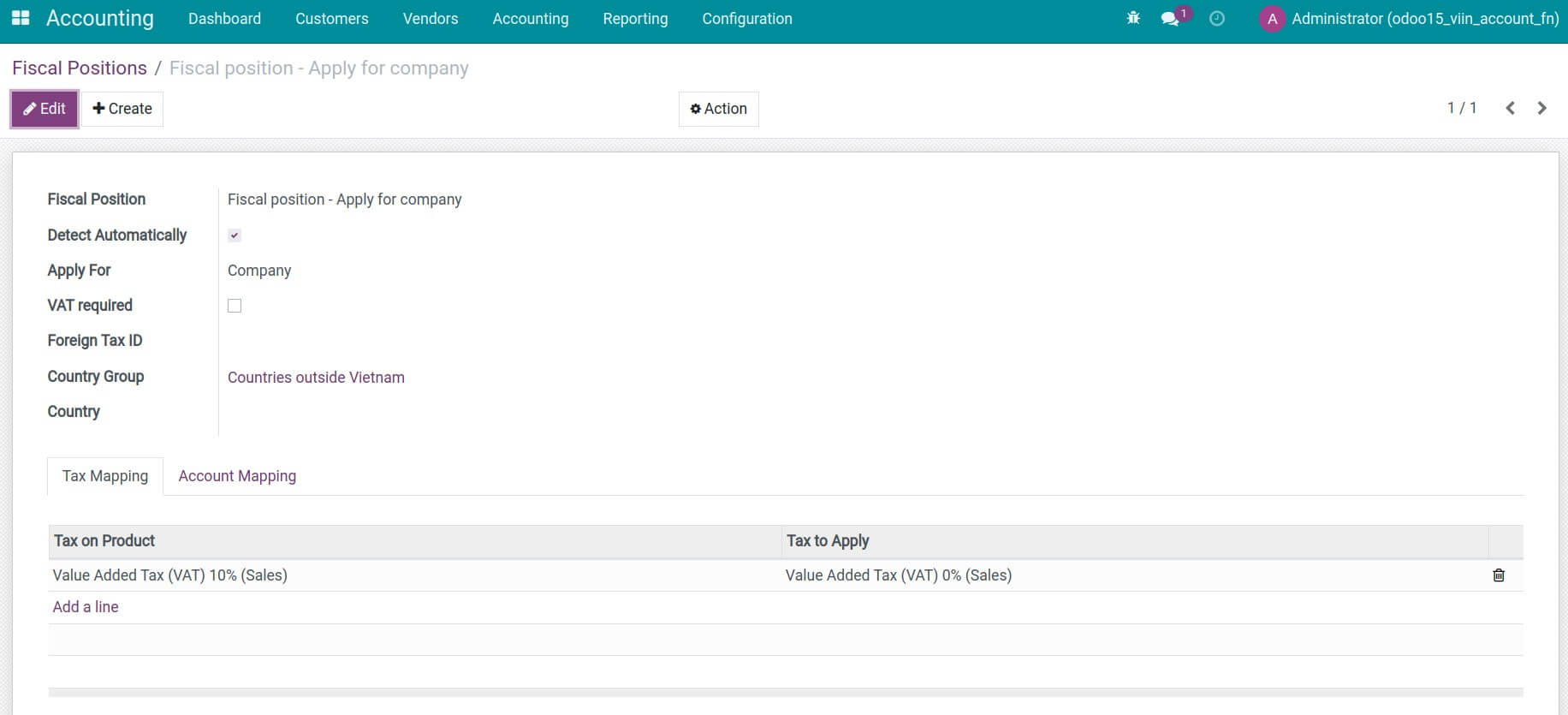

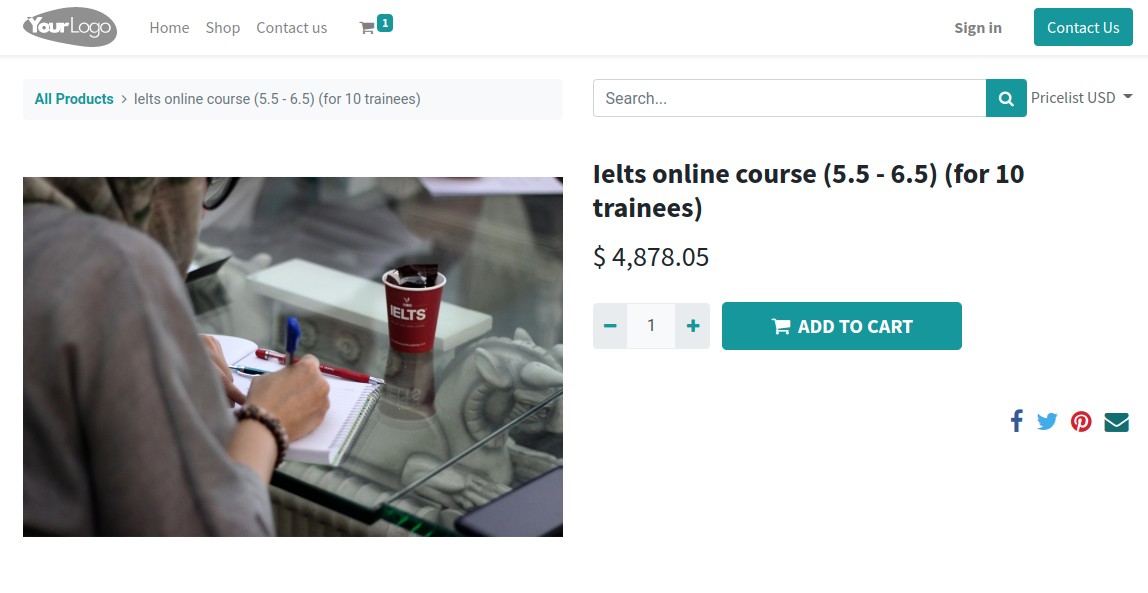

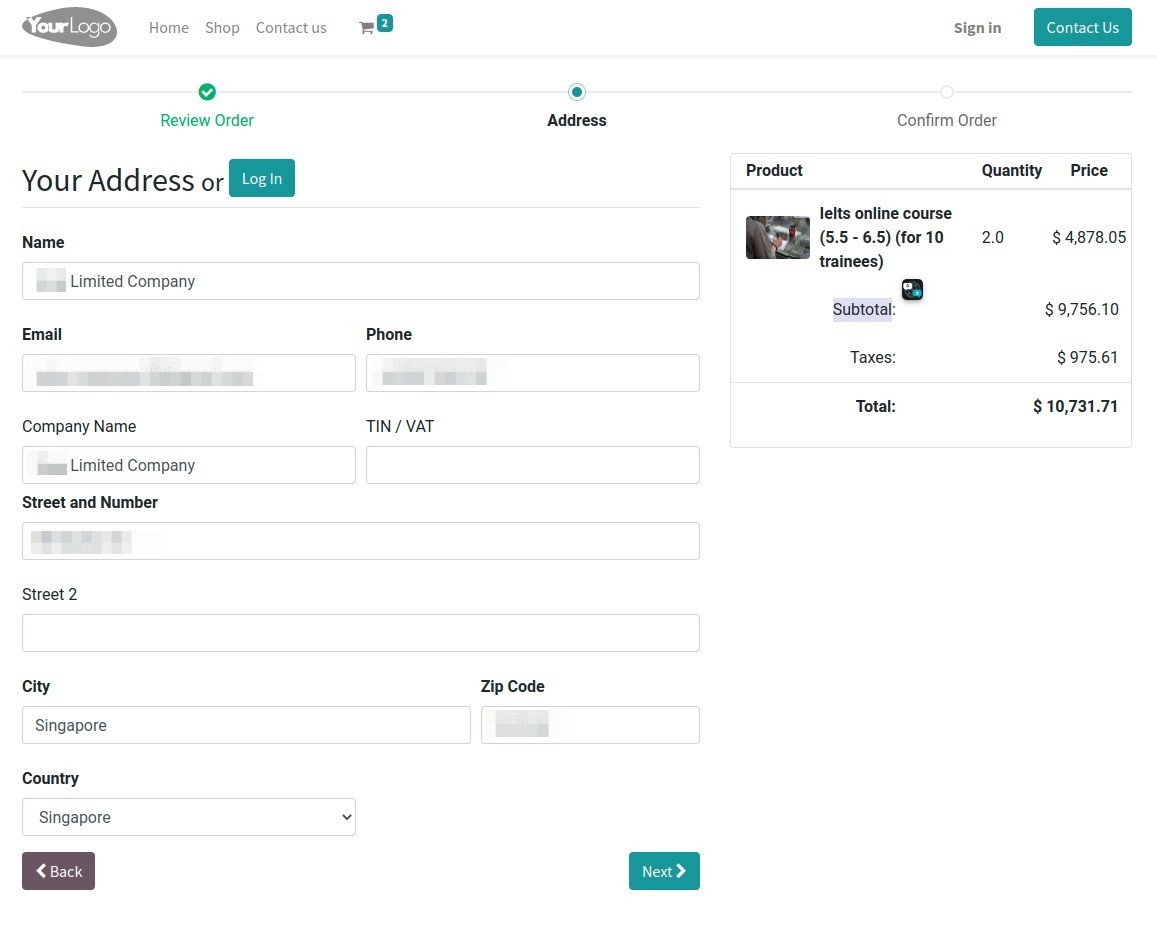

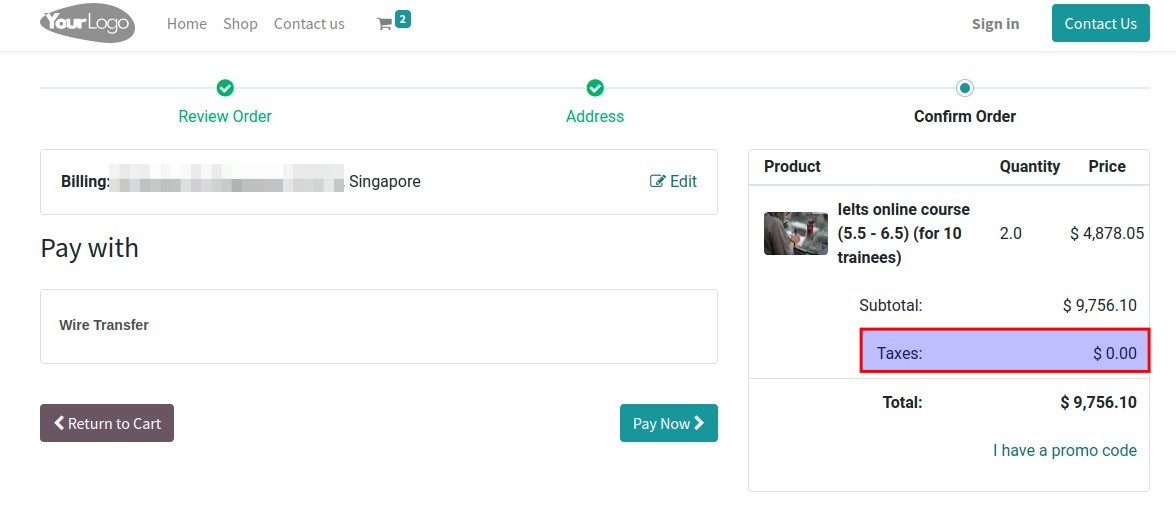

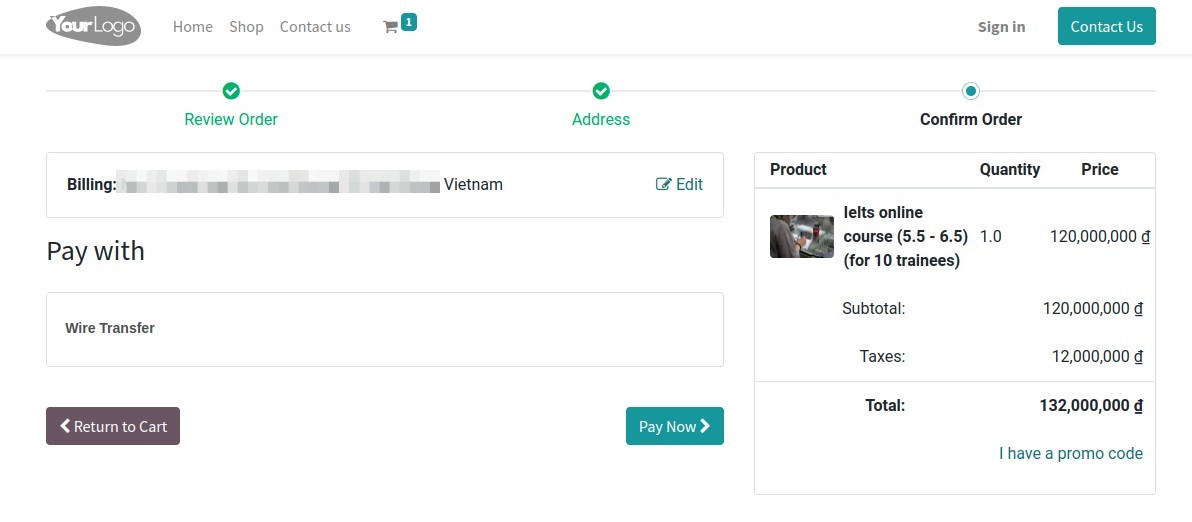

Automatically recognize individuals/companies to apply a suitable fiscal position. E.g: a VAT rate of 0% will be applied to the customer who is a company located outside of Vietnam when they purchase products on your e-Commerce website.

Add the notebook tag to the payment form which other modules can inherit when there's a need to add new pages to this form.

Track reversed account journal items and journal entries in convenient way.

Support searching and grouping journal items by analytic accounts.

Add paid and unpaid information to invoice details (purchase / sale / refund)

Flexible account code validation: Administrators can disable strict account code validation through system parameters. This allows for more flexible account code formats when needed for specific business requirements. For example, normally the system would reject account codes like "112-BIDV" or "112_BIDV" because it contains special characters (hyphen or underscore), but with this feature enabled, such codes are allowed. The system only accepts letters, numbers, and dots (.) by default. To disable validation, set the system parameter account.disable_check_account_code to True in Settings > Technical > Parameters > System Parameters.

Note: When setting up this feature, the implementer must understand the impact of this setting on the accounting system.

Who Should Use This Module?

This module is suitable for businesses implementing the accounting module as part of their enterprise management system.

With its comprehensive features, the module ensures operational consistency and integrates seamlessly with the organizational structure of the business.

Supported Editions

- Community Edition

- Enterprise Edition

Installation

- Navigate to Apps.

- Search with keyword viin_account.

- Press Install.

Note: To see full features of the viin_account module, you need to install the Accounting app.

Instructions

Instruction video: Accounting Customization

New account type

The Financial Income and Income Deduction are new account types added to the Chart of Accounts. This will support building data compilation rules for each target on the financial report right on the Accounting software.

This software and associated files (the "Software") may only be

used

(executed, modified, executed after modifications) if you have

purchased a

valid license from the authors, typically via Odoo Apps,

or if you

have

received a written agreement from the authors of the

Software (see the

COPYRIGHT file).

You may develop Odoo modules that use the Software as a library

(typically

by depending on it, importing it and using its

resources), but

without

copying any source code or material from the

Software. You may distribute

those modules under the license of your

choice, provided that this

license

is compatible with the terms of

the Odoo Proprietary License (For

example:

LGPL, MIT, or proprietary

licenses similar to this one).

It is forbidden to publish, distribute, sublicense, or sell

copies of the

Software or modified copies of the Software.

The above copyright notice and this permission notice must be

included in

all copies or substantial portions of the Software.

THE SOFTWARE IS PROVIDED "AS IS", WITHOUT WARRANTY OF ANY KIND,

EXPRESS OR

IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF

MERCHANTABILITY,

FITNESS FOR A PARTICULAR PURPOSE AND

NONINFRINGEMENT. IN NO EVENT

SHALL THE

AUTHORS OR COPYRIGHT HOLDERS

BE LIABLE FOR ANY CLAIM, DAMAGES OR OTHER

LIABILITY, WHETHER IN AN

ACTION OF CONTRACT, TORT OR OTHERWISE,

ARISING

FROM, OUT OF OR IN

CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER

DEALINGS IN THE

SOFTWARE.