Community

Accounting

Finance & compliance

Accounting & Financial Reports

Real-time Balance Sheet, P&L, Cash Flow, ledgers, and aging reports with configurable rules, drill-down, and exportable packs for auditors, managers, and banks.

Features

Core capabilities

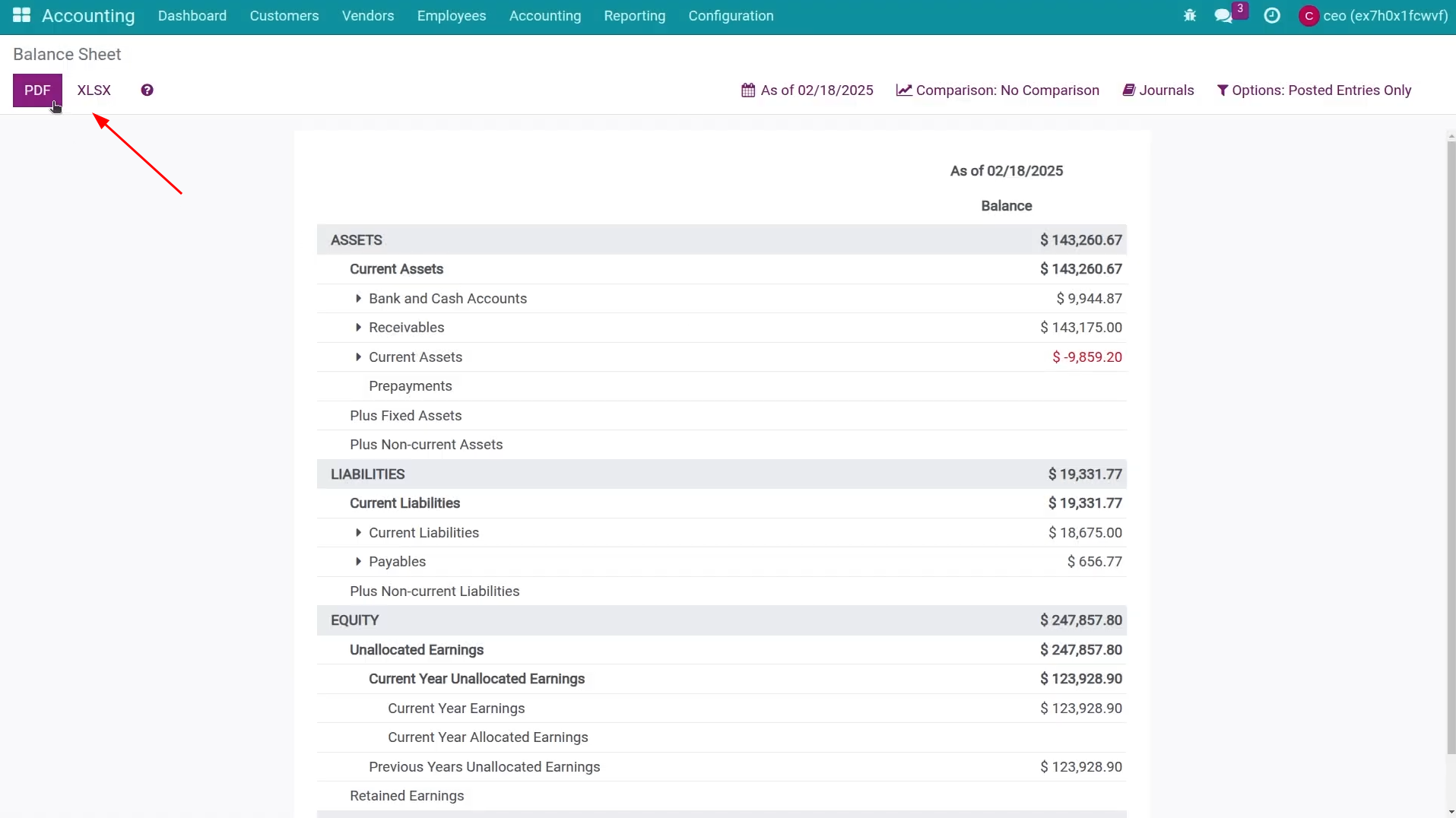

Statement reports

Balance Sheet, Profit & Loss, Cash Flow, Executive Summary, and Tax report with period comparison.

Audit trail

General Ledger and Trial Balance with drill-down to journals for reconciliation.

Partner aging

Partner Ledger plus Aged Receivable/Payable accessible on contact forms.

Configurable criteria

Define formulas, data sources, and display options per report item to follow GAAP/VAS/IFRS policies.

Real-time data

Reports update automatically from posted entries; compare by week, month, year.

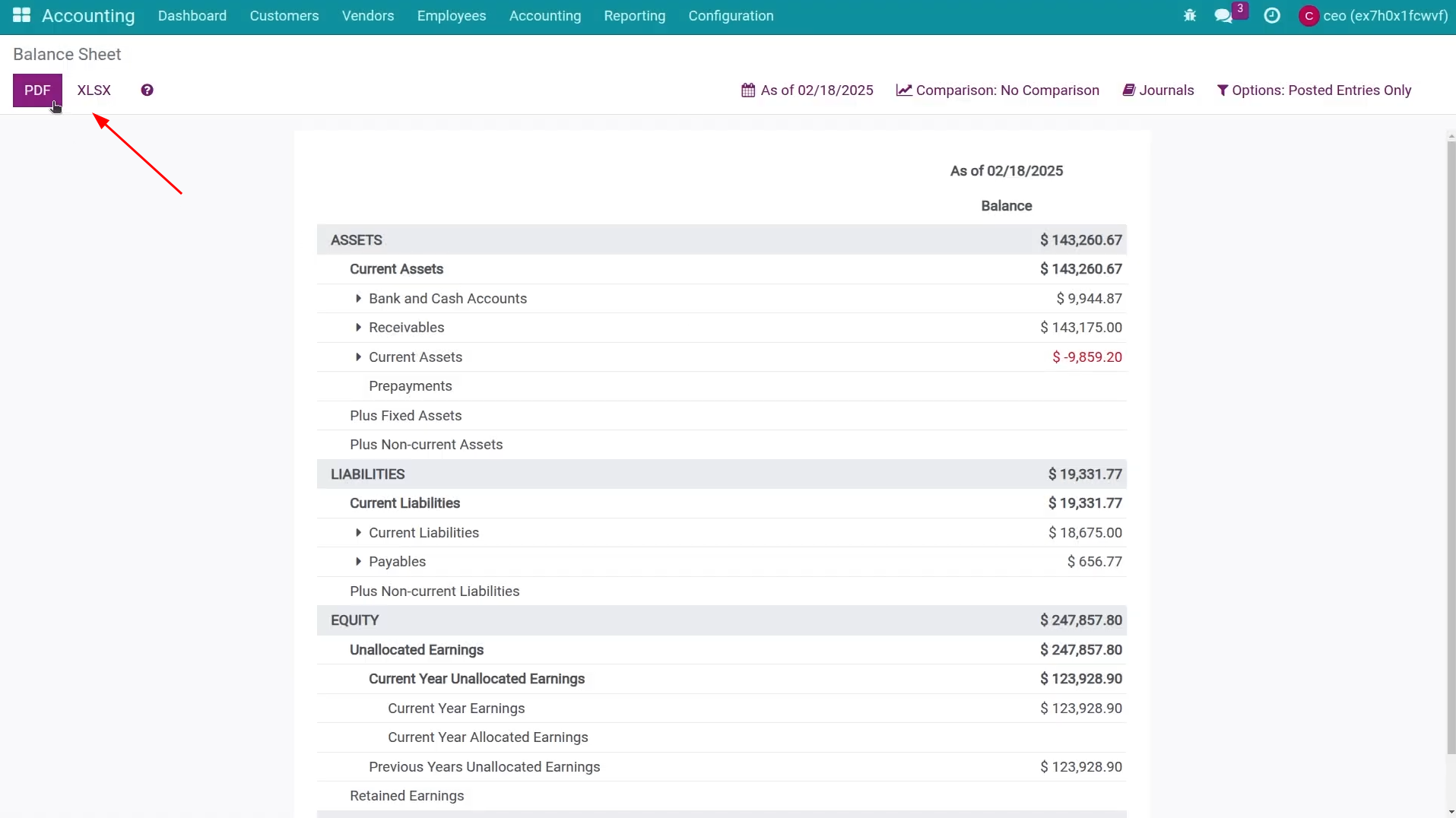

PDF/XLSX export

Print or download for management packs, audits, and banking submissions.

Why it matters

Benefits

1

Accuracy by design

Standard formulas, controlled access, and drill-down reduce manual errors.

2

Faster period closing

Generate full packs in minutes; no spreadsheet copy-paste before reviews.

3

Compliance ready

GAAP/VAS/IFRS-friendly layouts and audit trails reduce compliance risk.

4

Decision support

Compare periods, track aging, and validate balances from contact views.

5

Secure controls

Only authorized users can adjust criteria or view sensitive ledgers.

Warning

Avoid report conflicts

To avoid conflicts when using this Accounting Reports module, please uninstall Odoo's default Accounting Reports if it is installed.

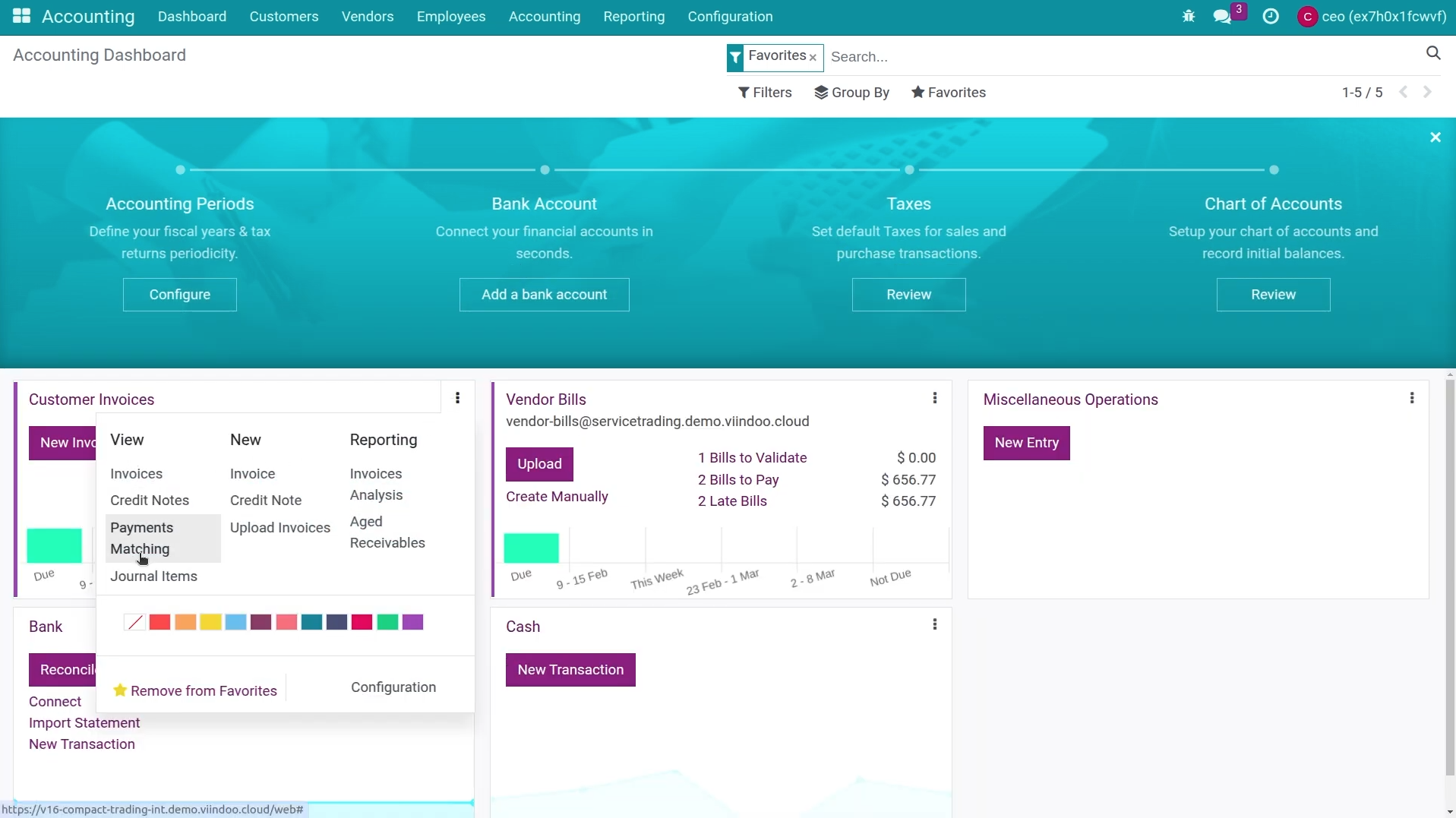

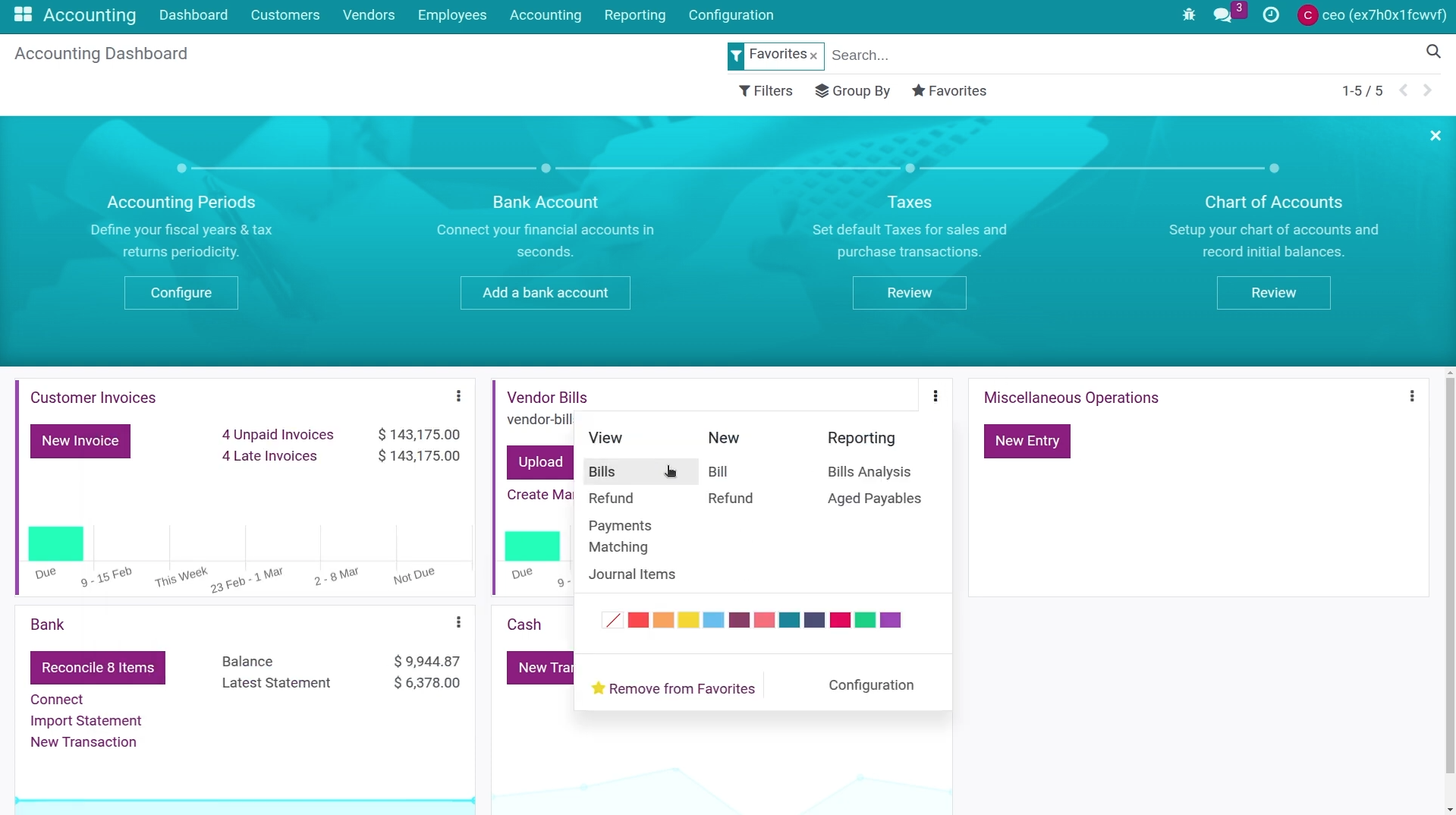

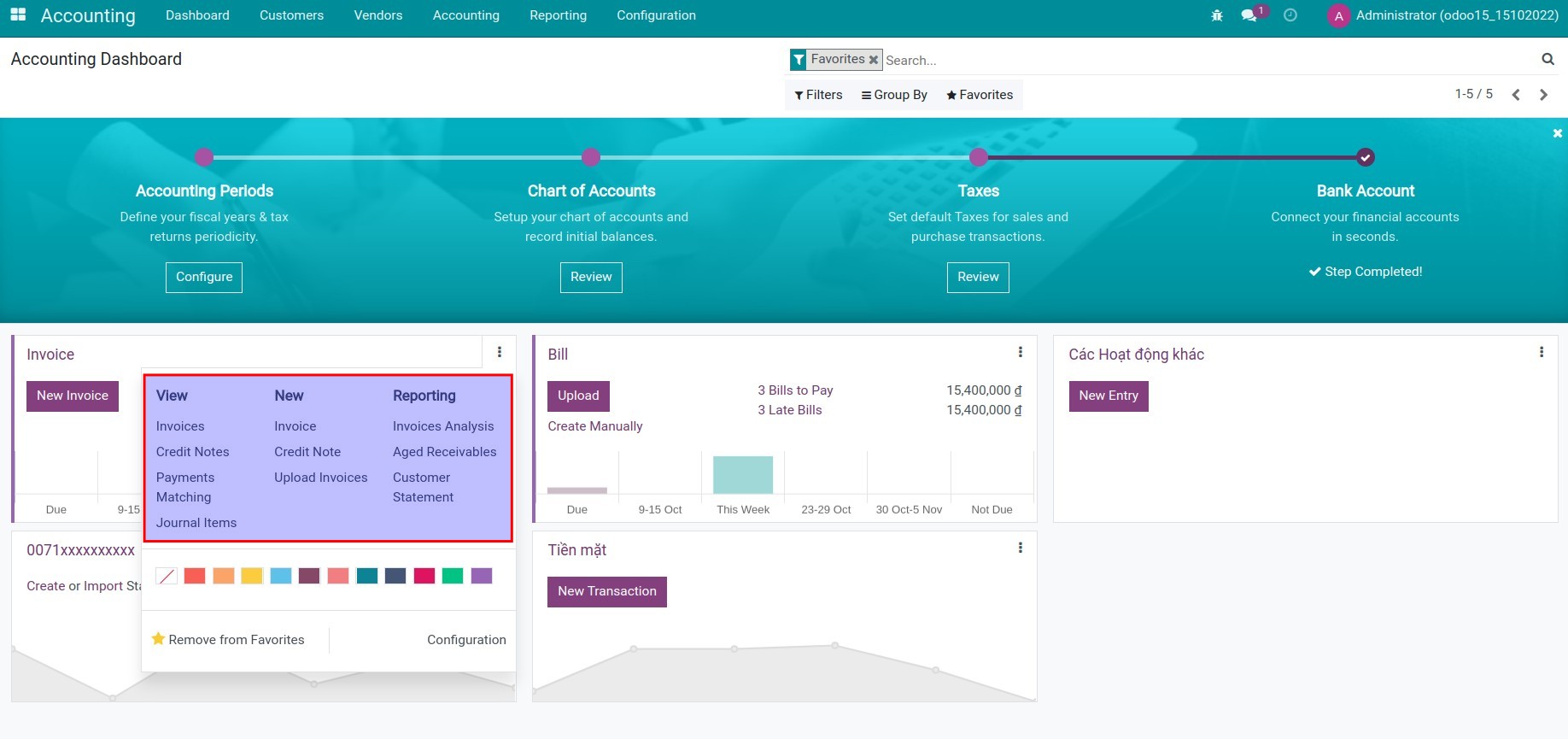

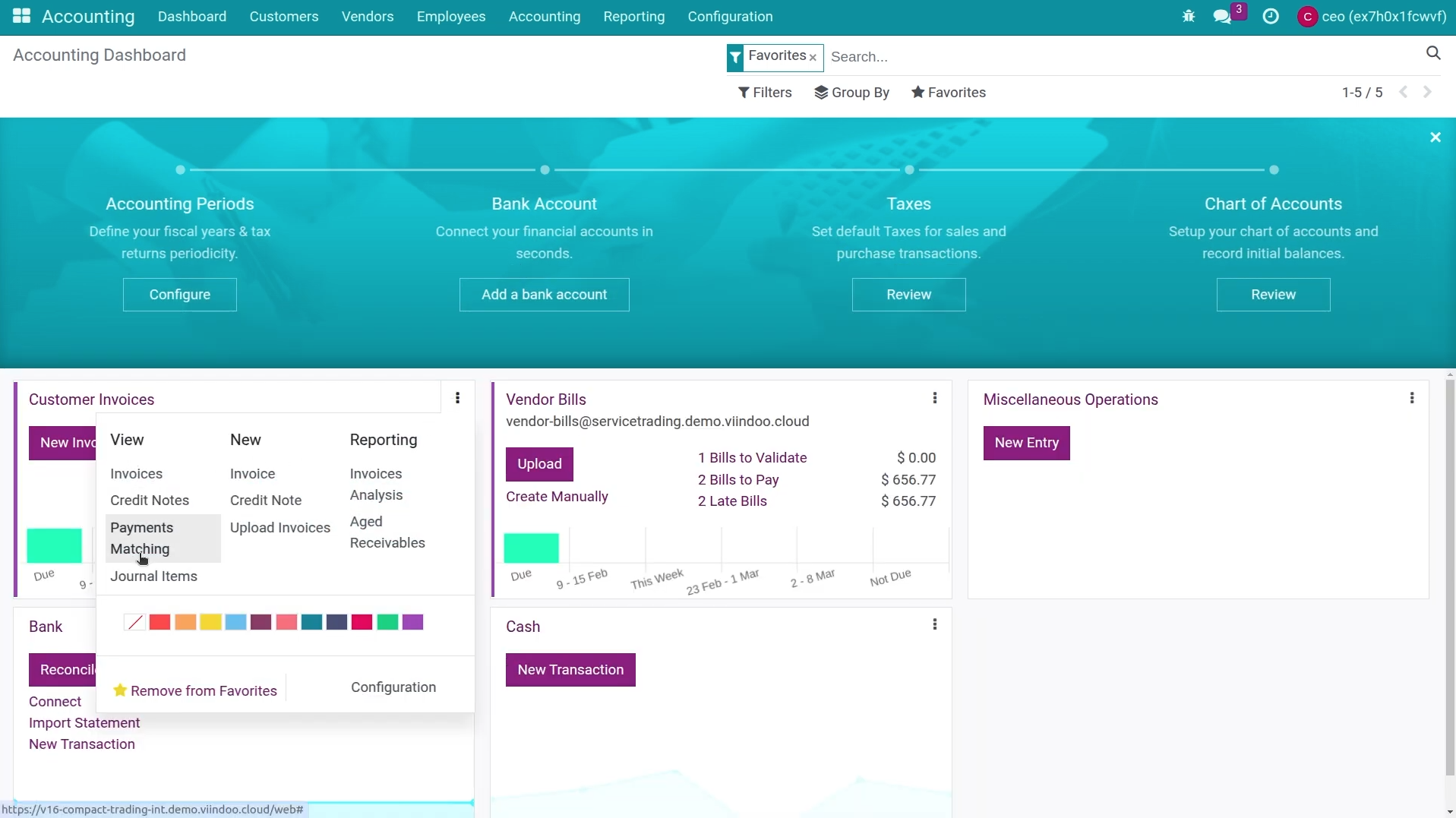

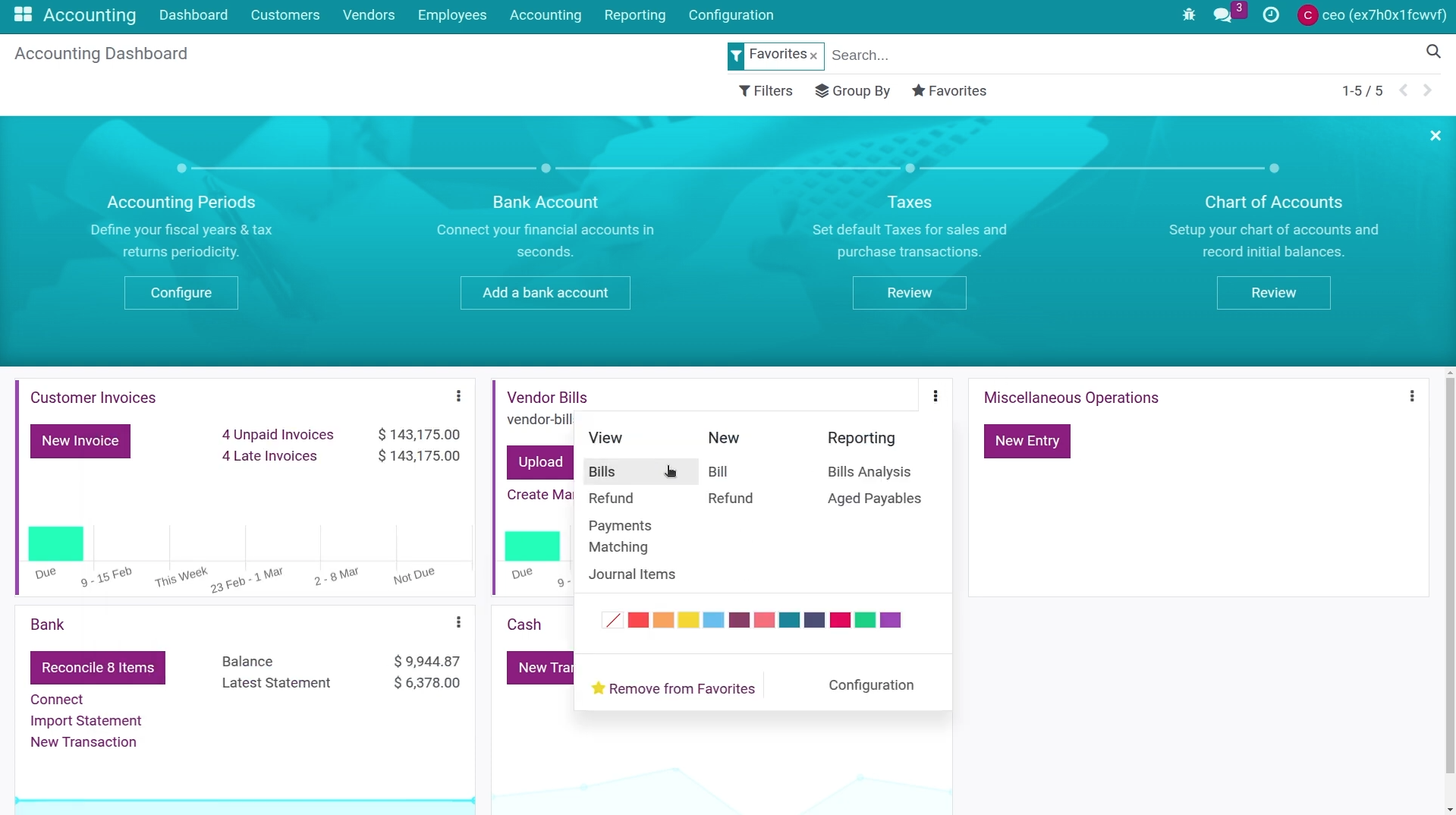

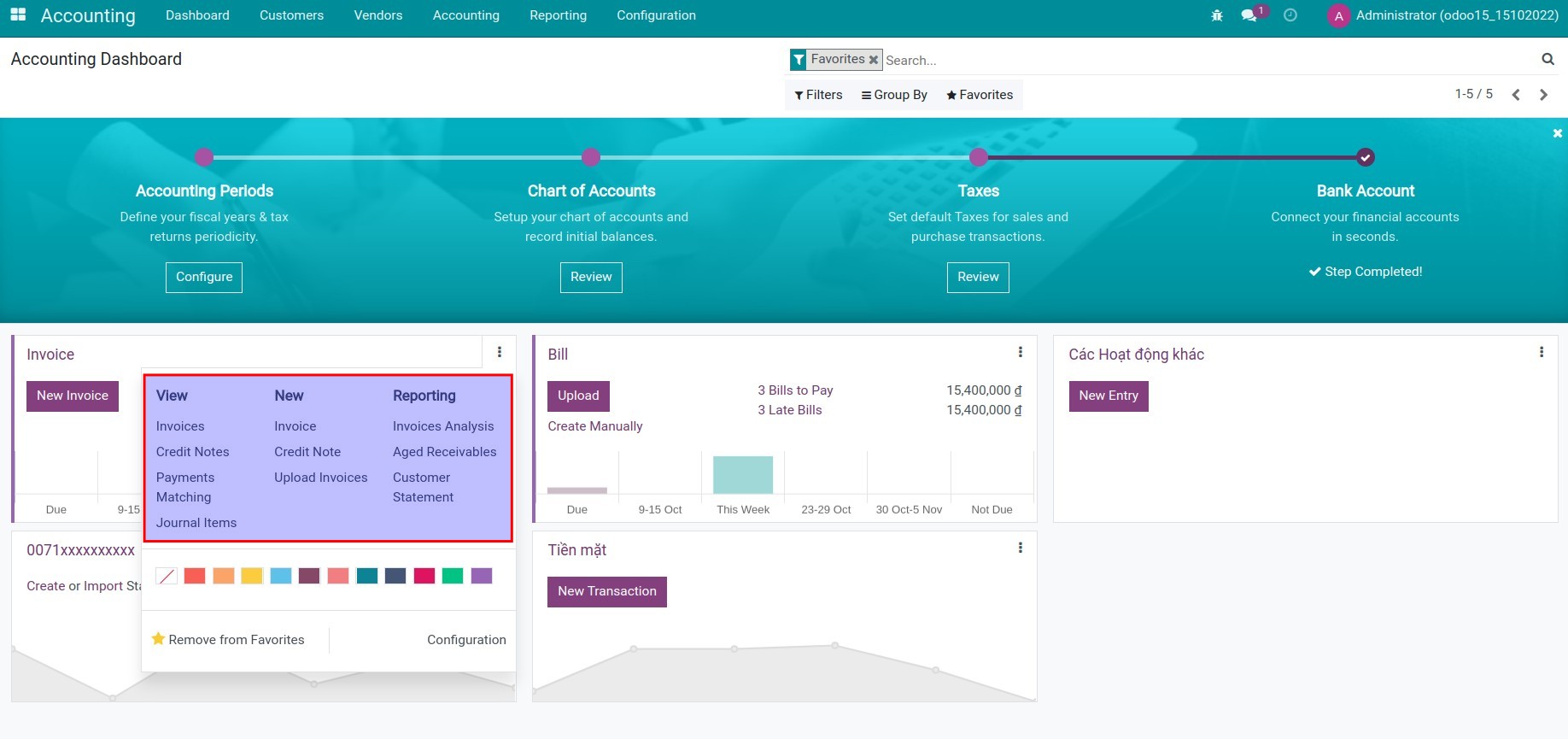

Allow view and create information related to journals on Kanban

Journal Kanban: create and view entries directly from dashboard

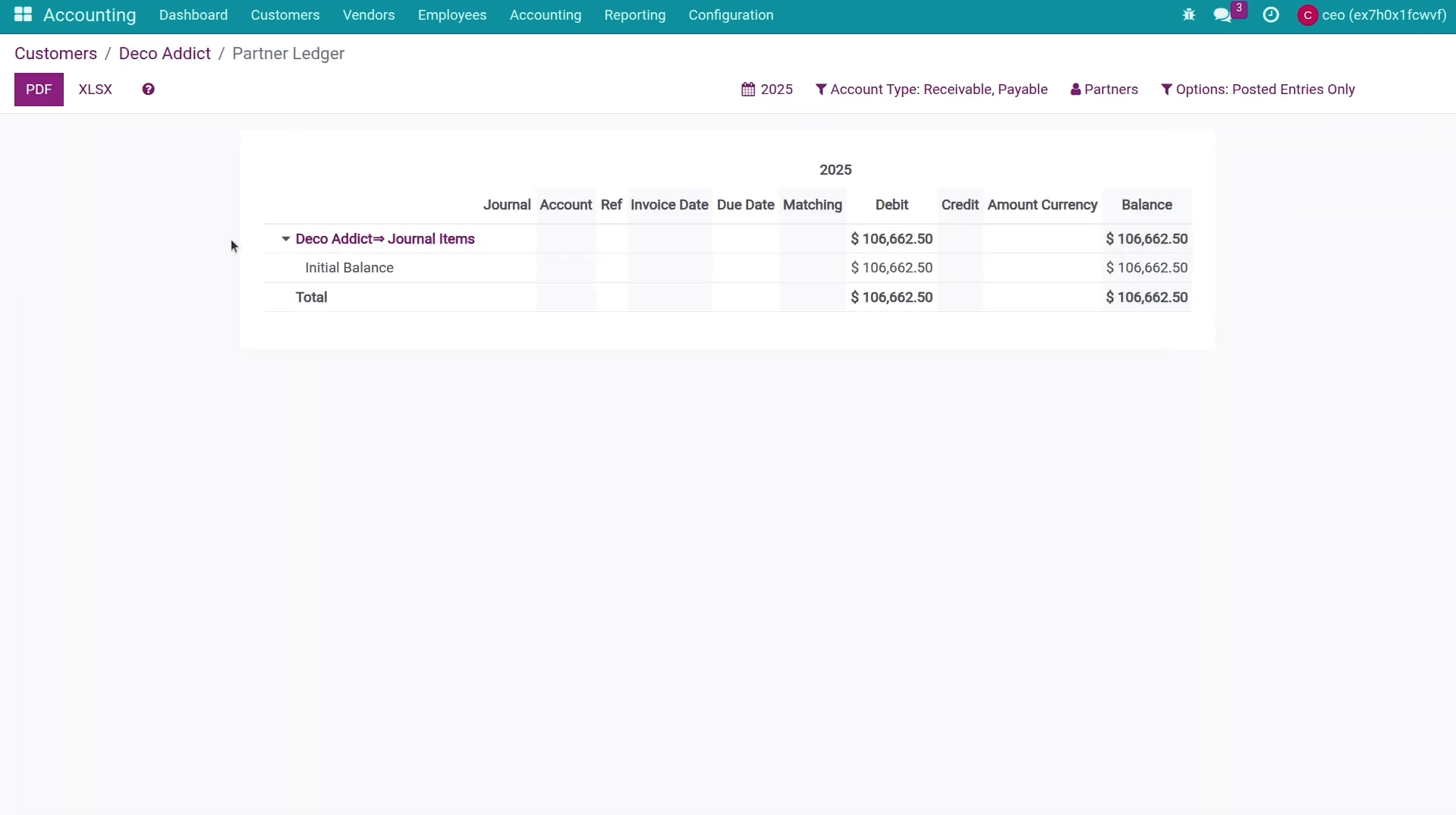

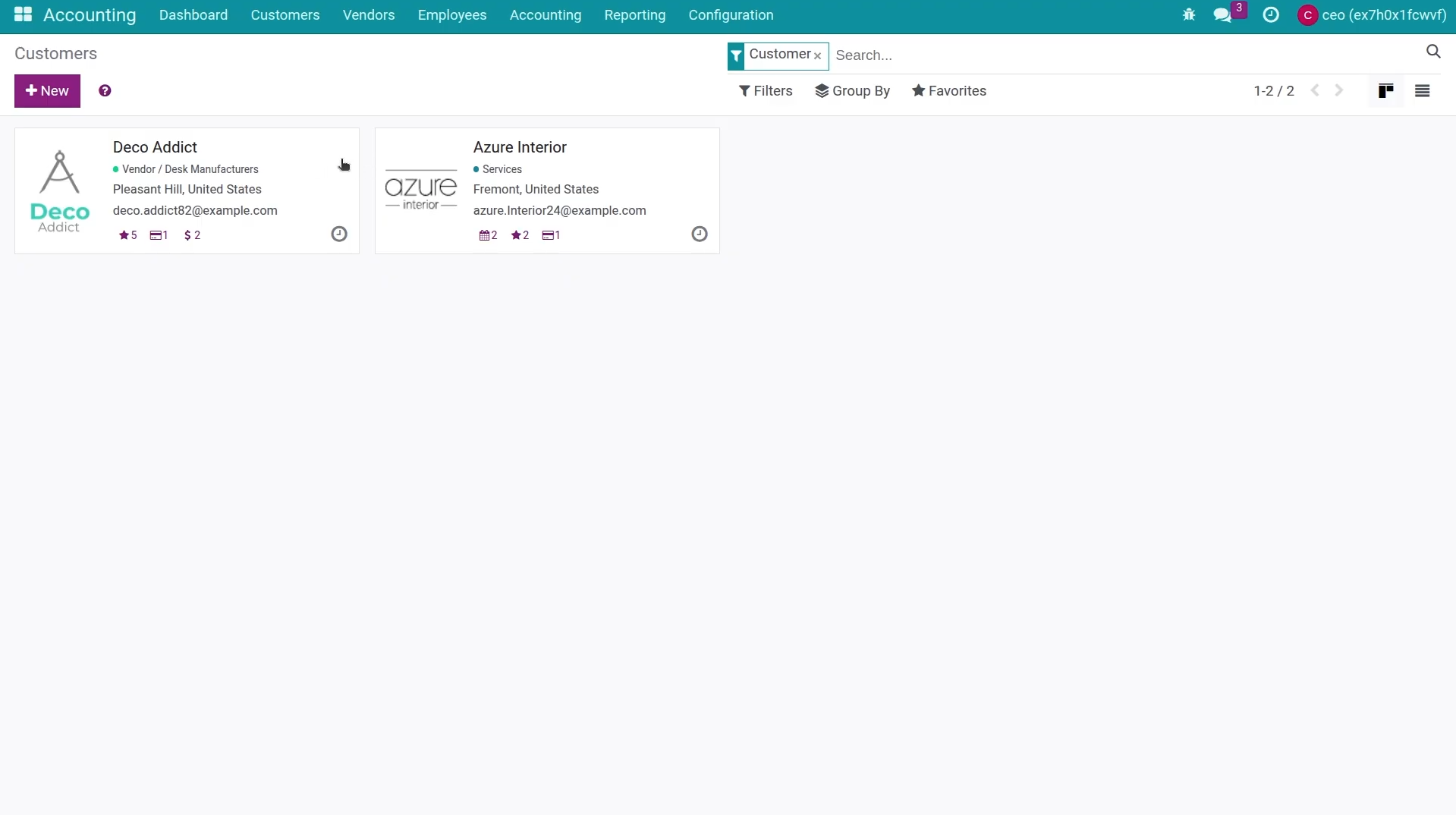

View customer option

View vendor option

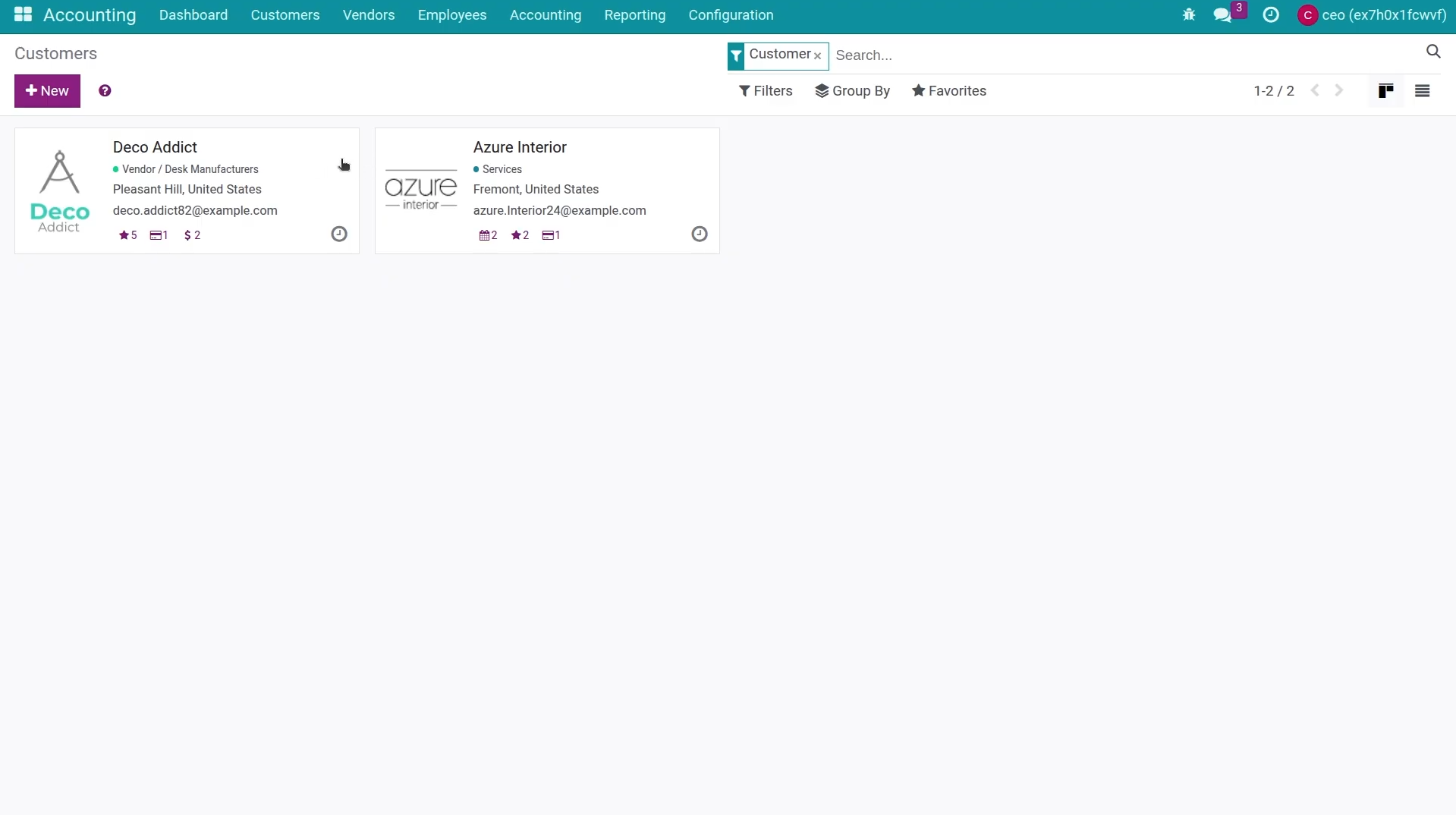

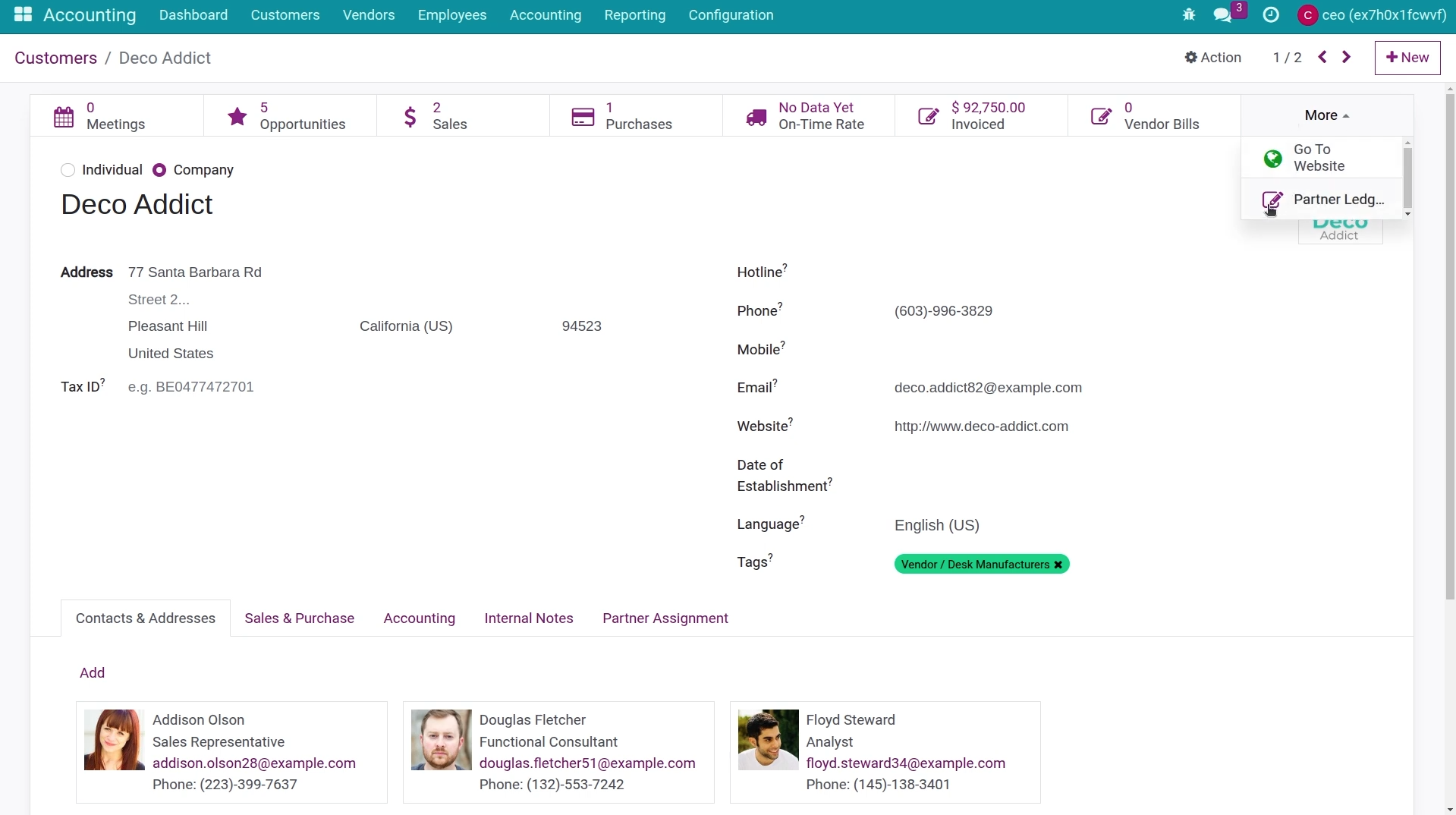

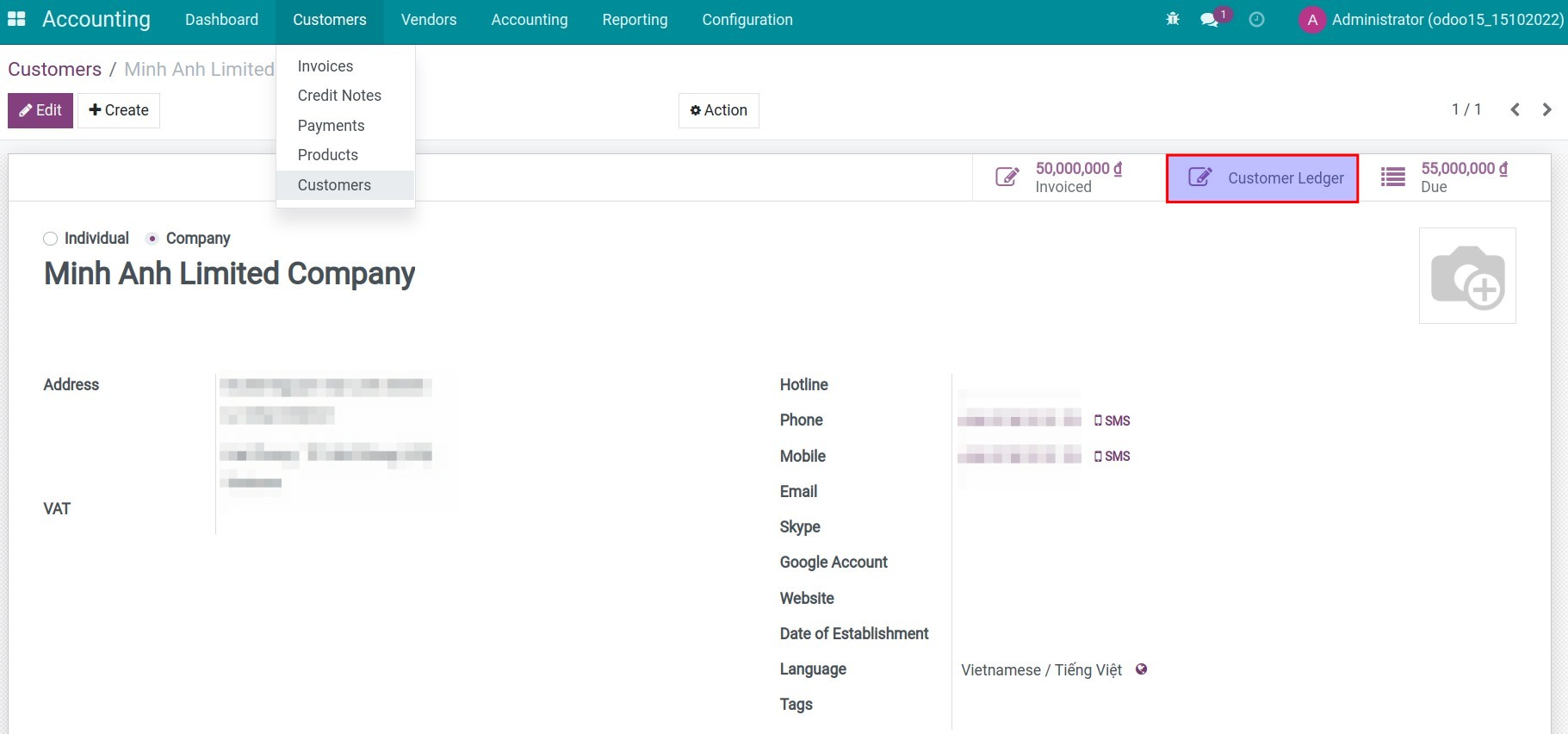

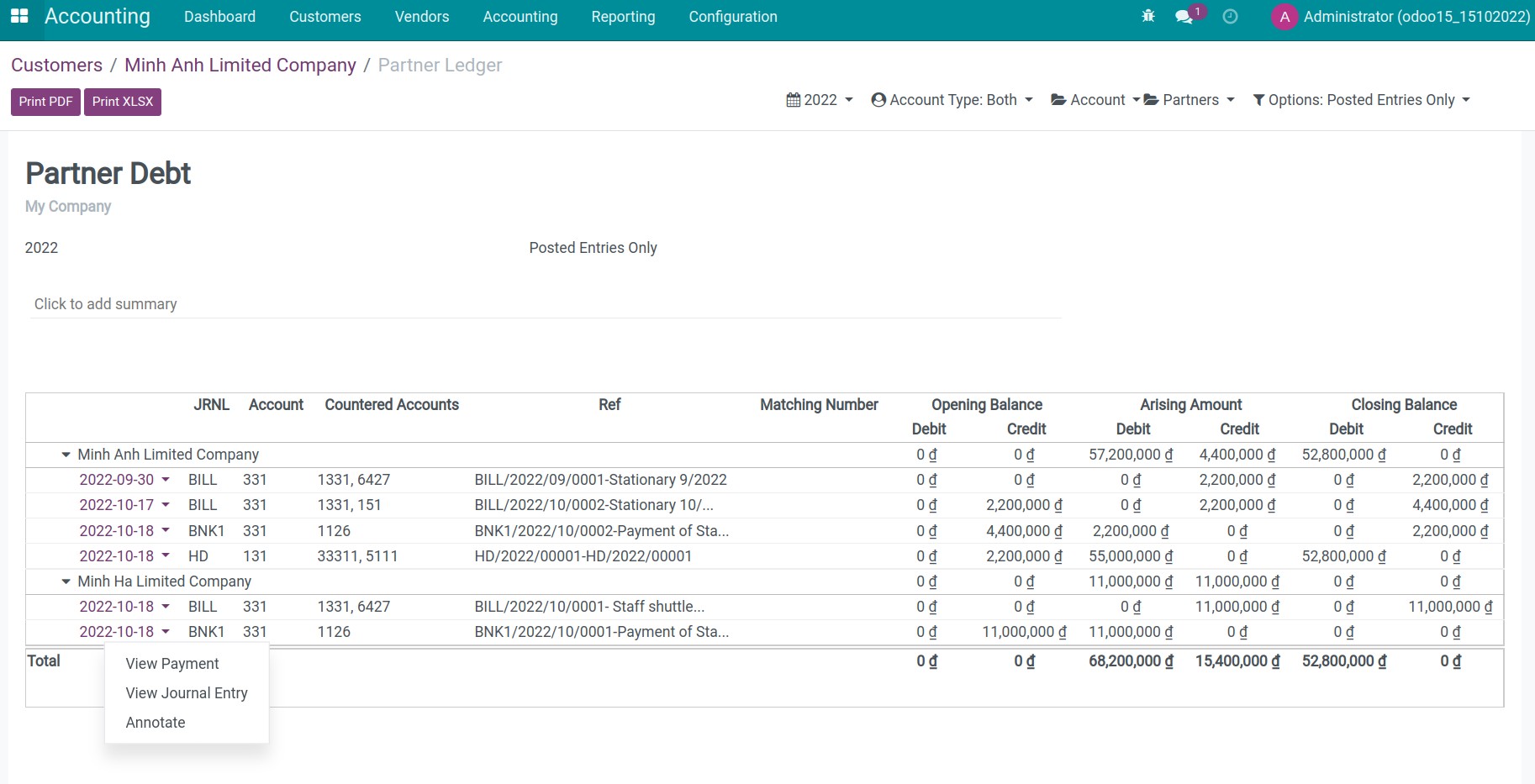

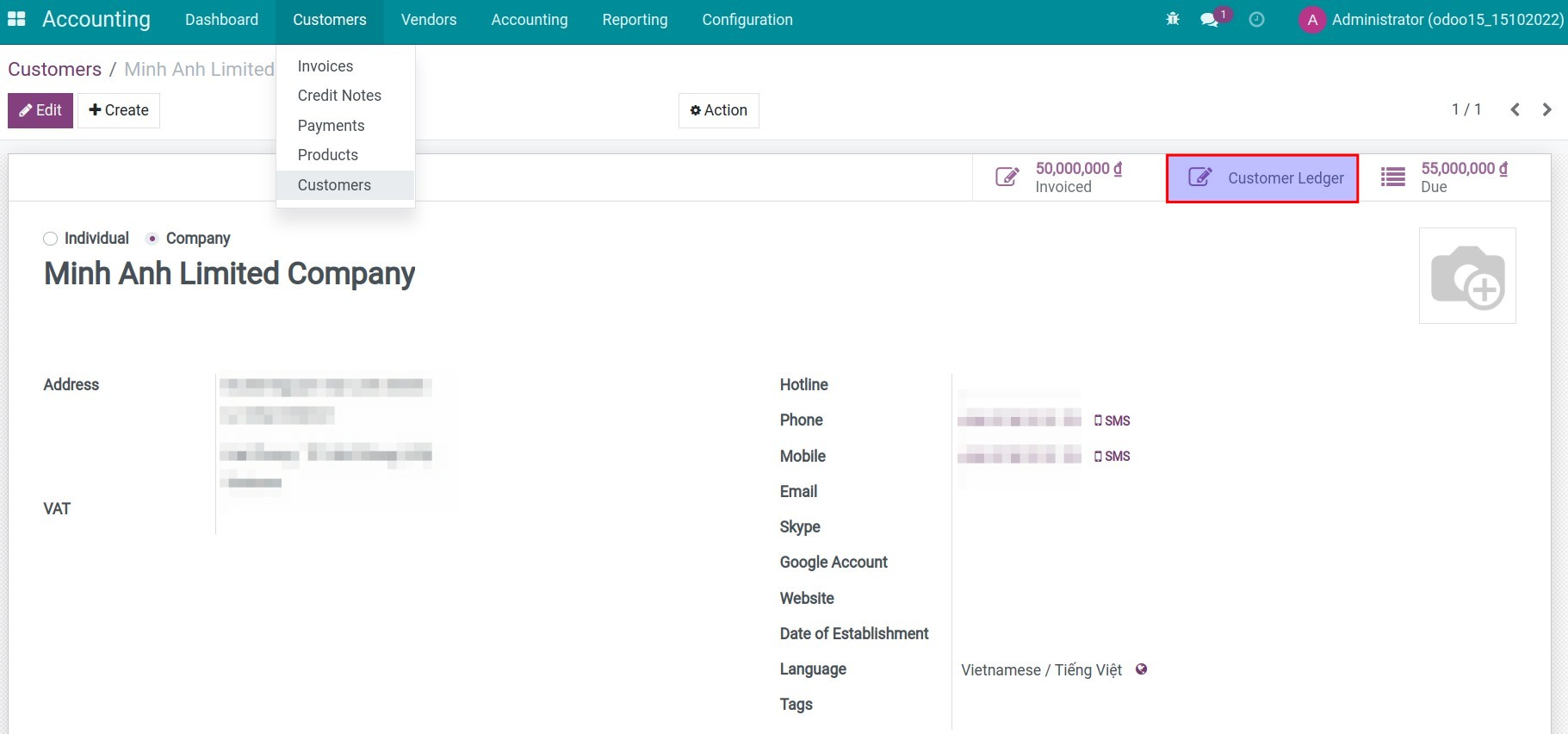

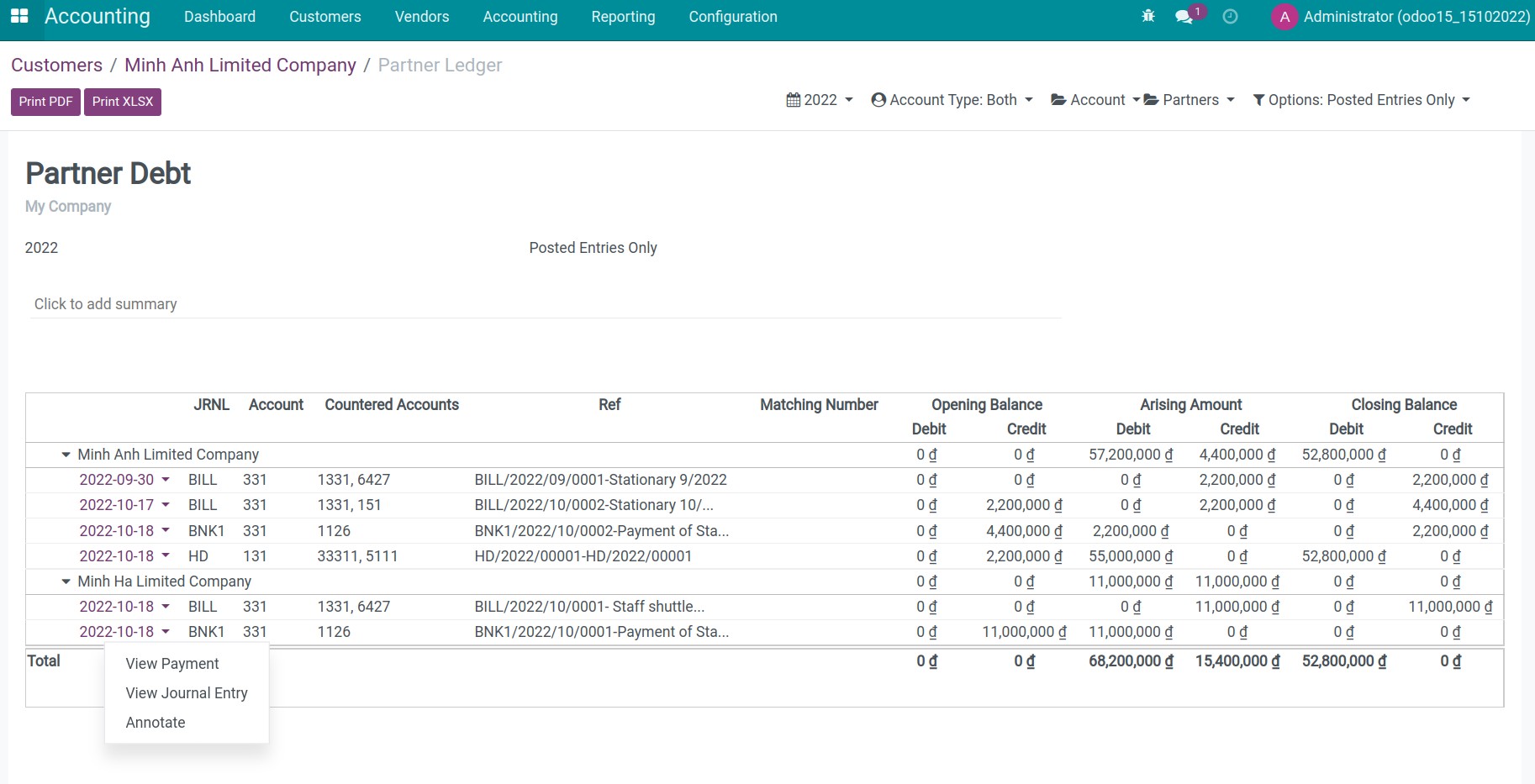

Manage payable and receivable in partner's contact

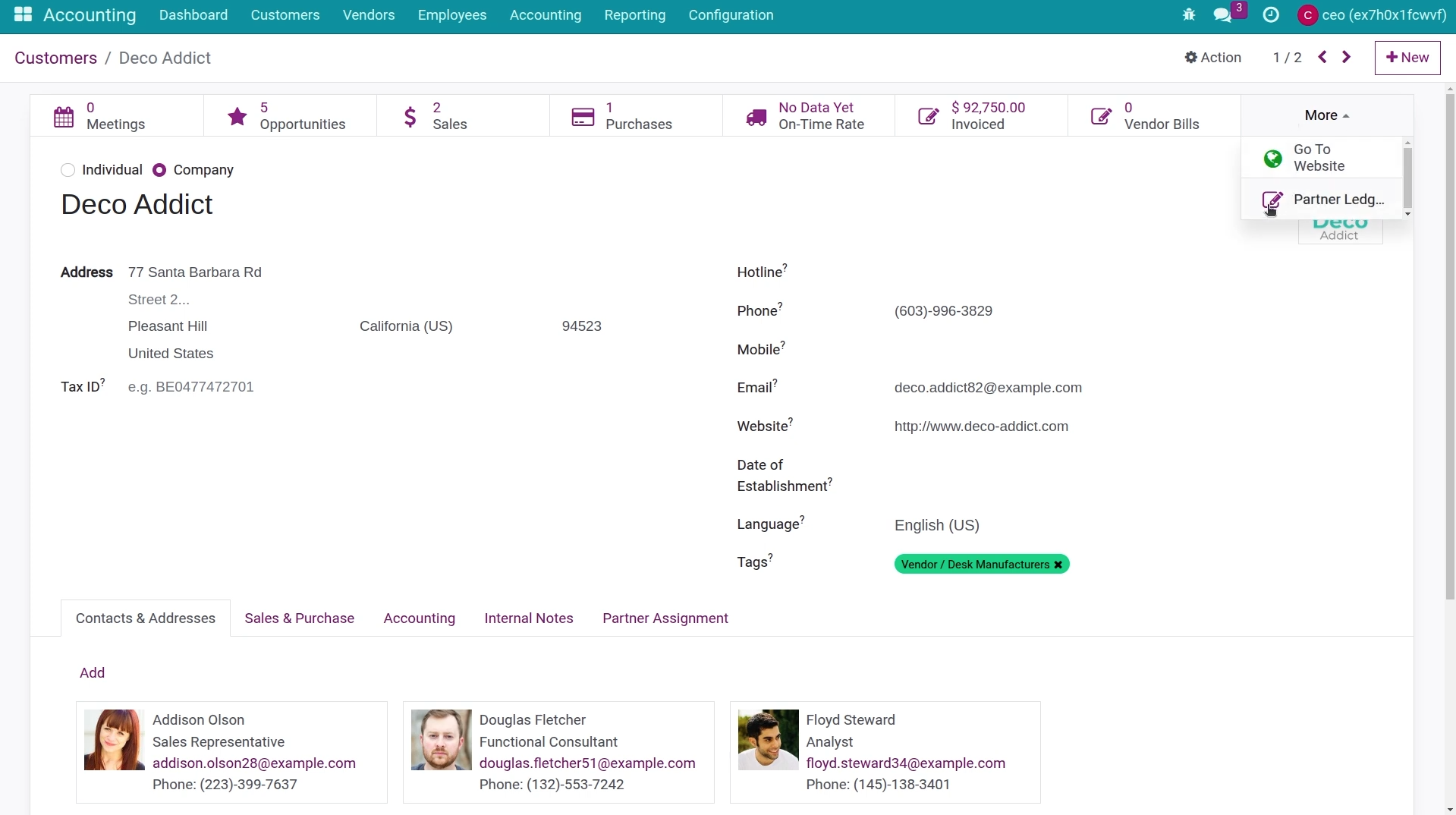

View receivable/payable aging on contact

Click on partner's contact

Select Partner Ledger smart button

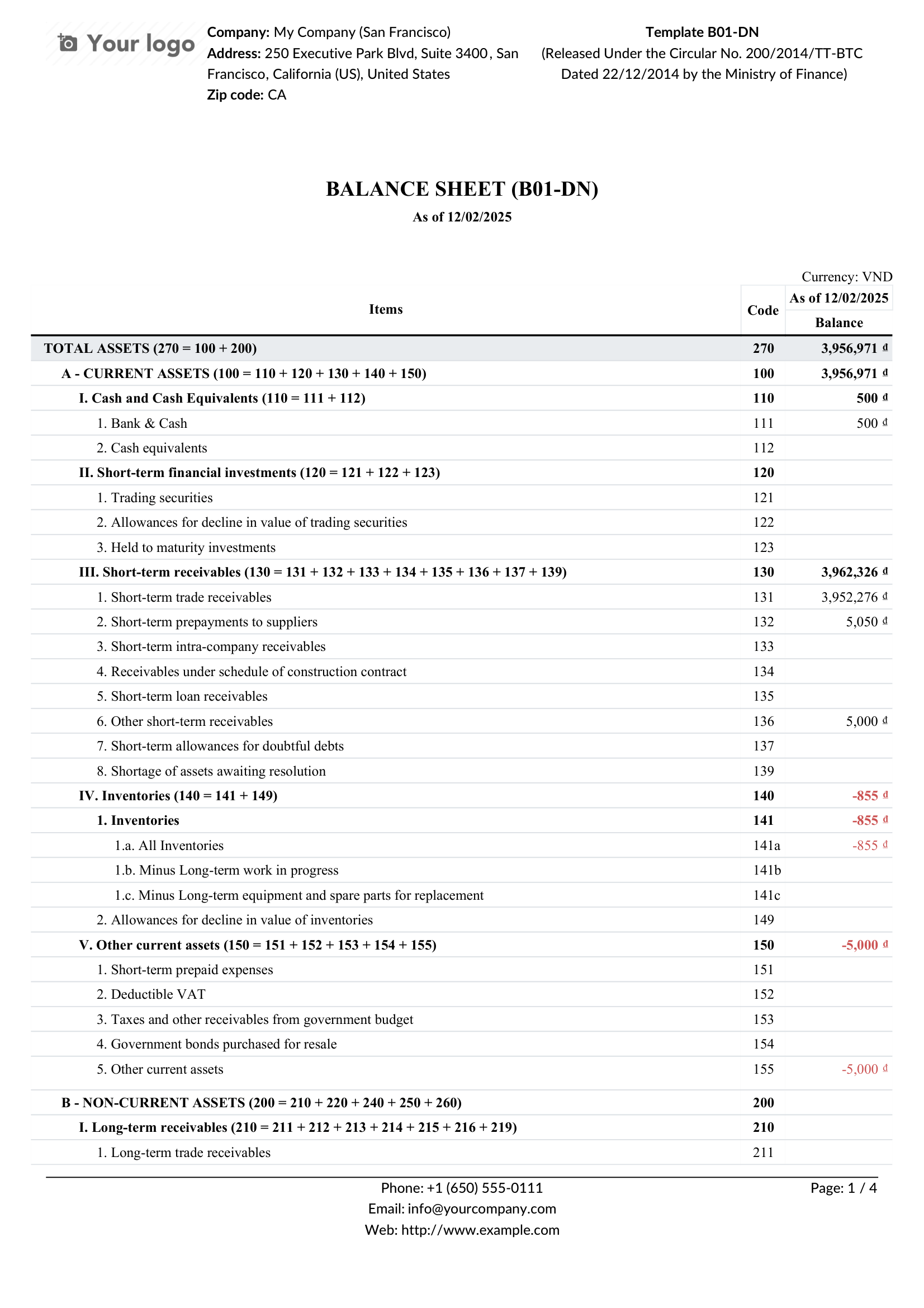

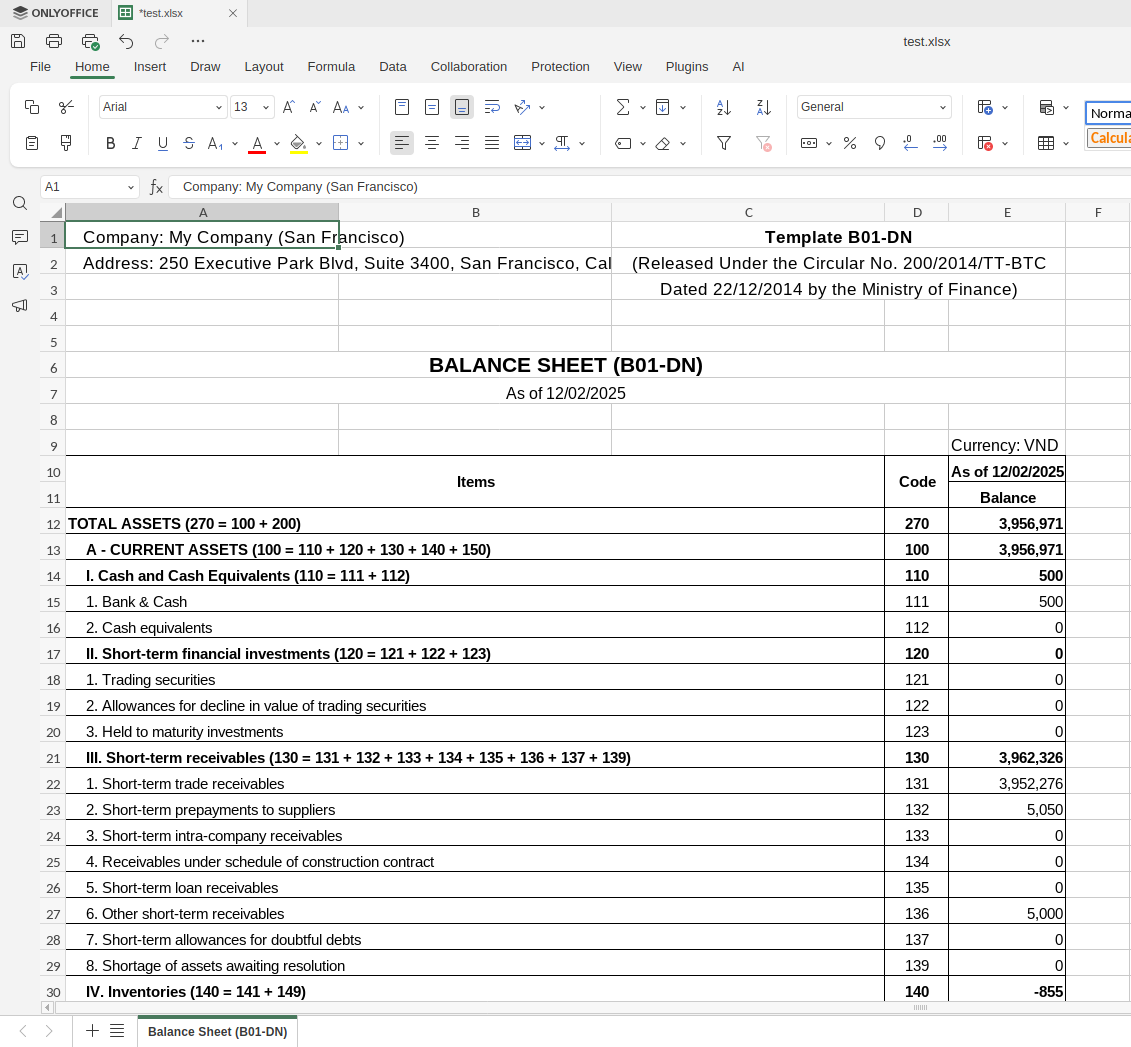

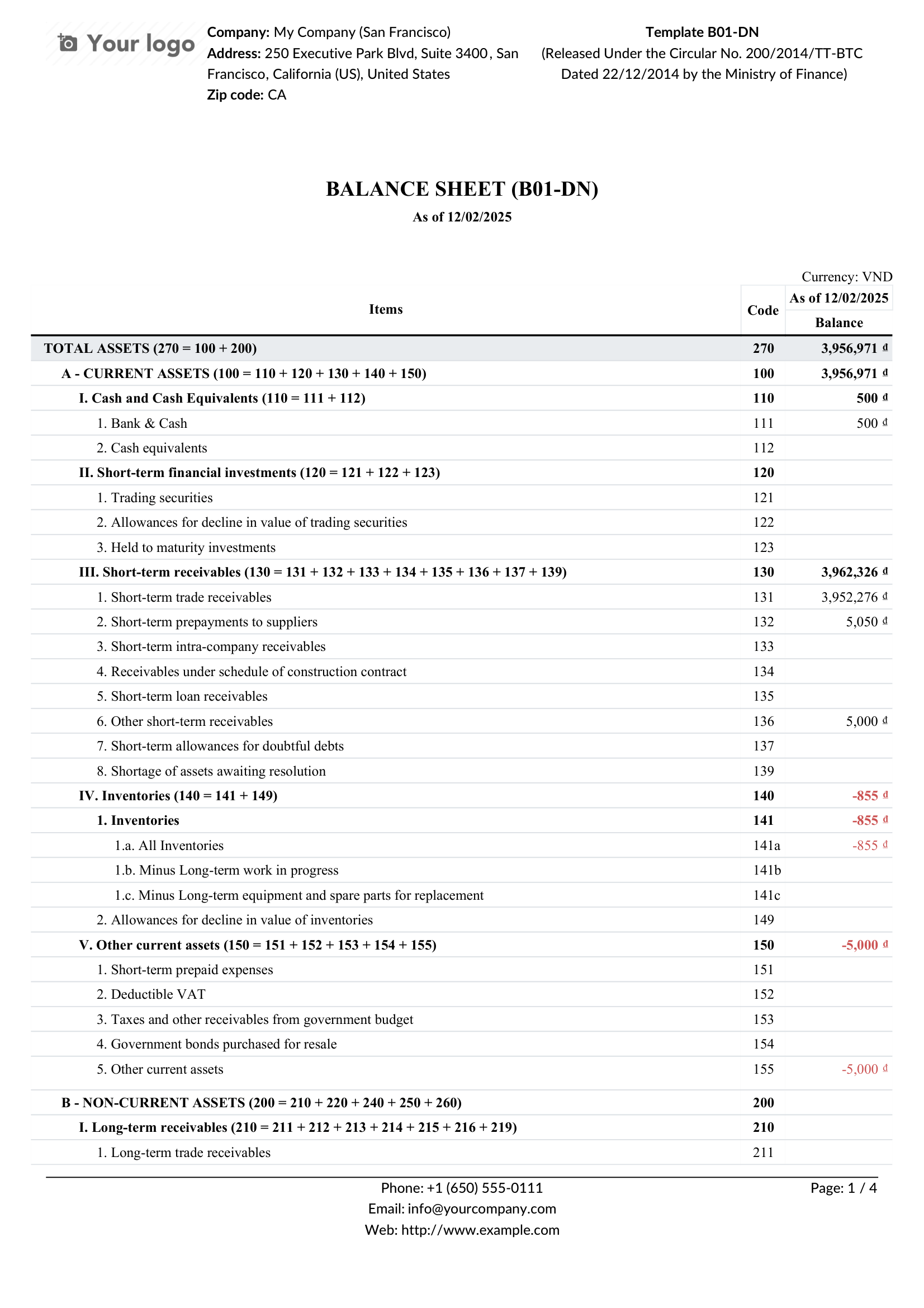

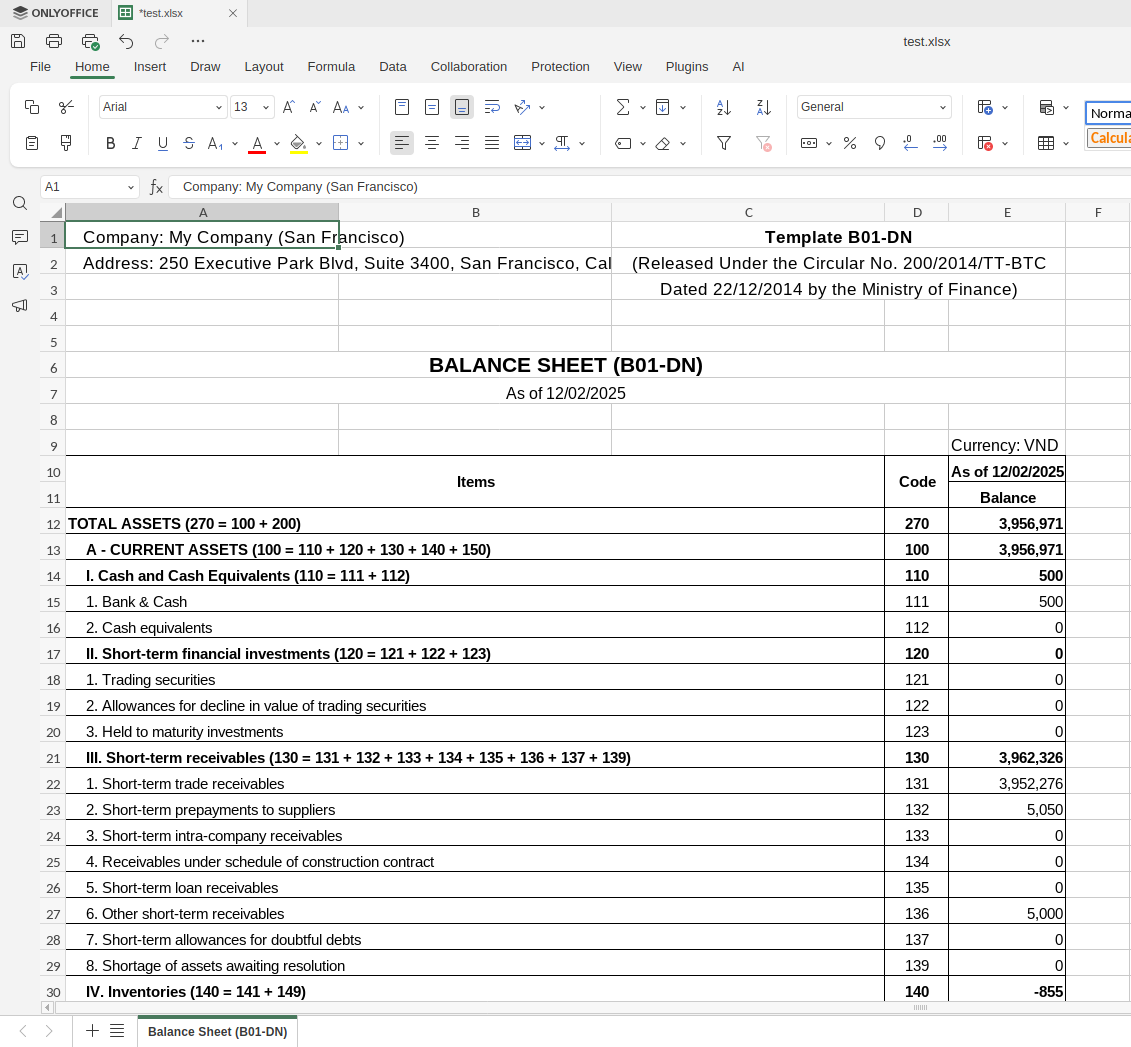

New report views with custom template

Custom templates for financial statements

Allow printing and downloading reports in PDF, XLSX format

Export financial reports to PDF or XLSX

Choose PDF or XLSX format to download

PDF Format

XLSX Format

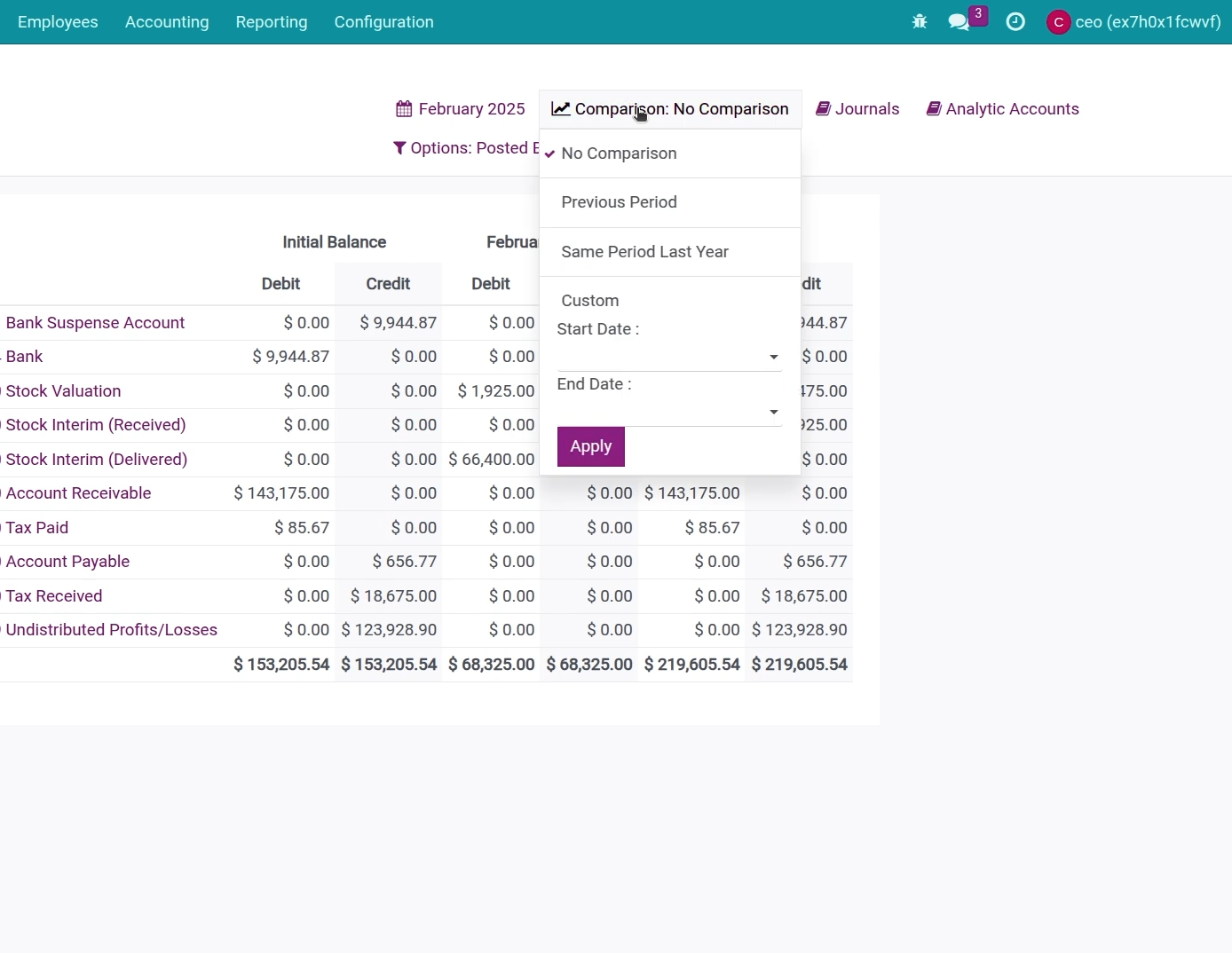

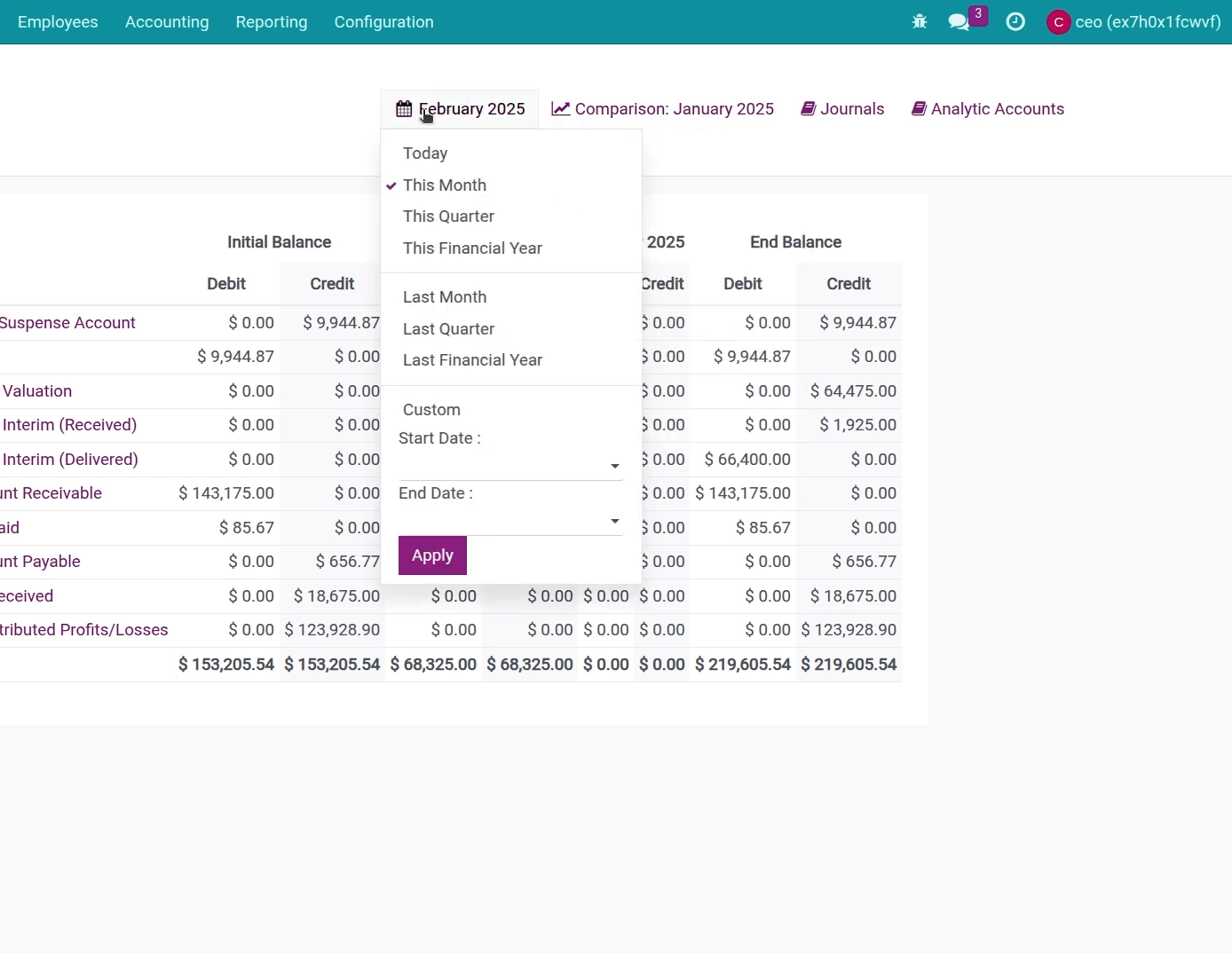

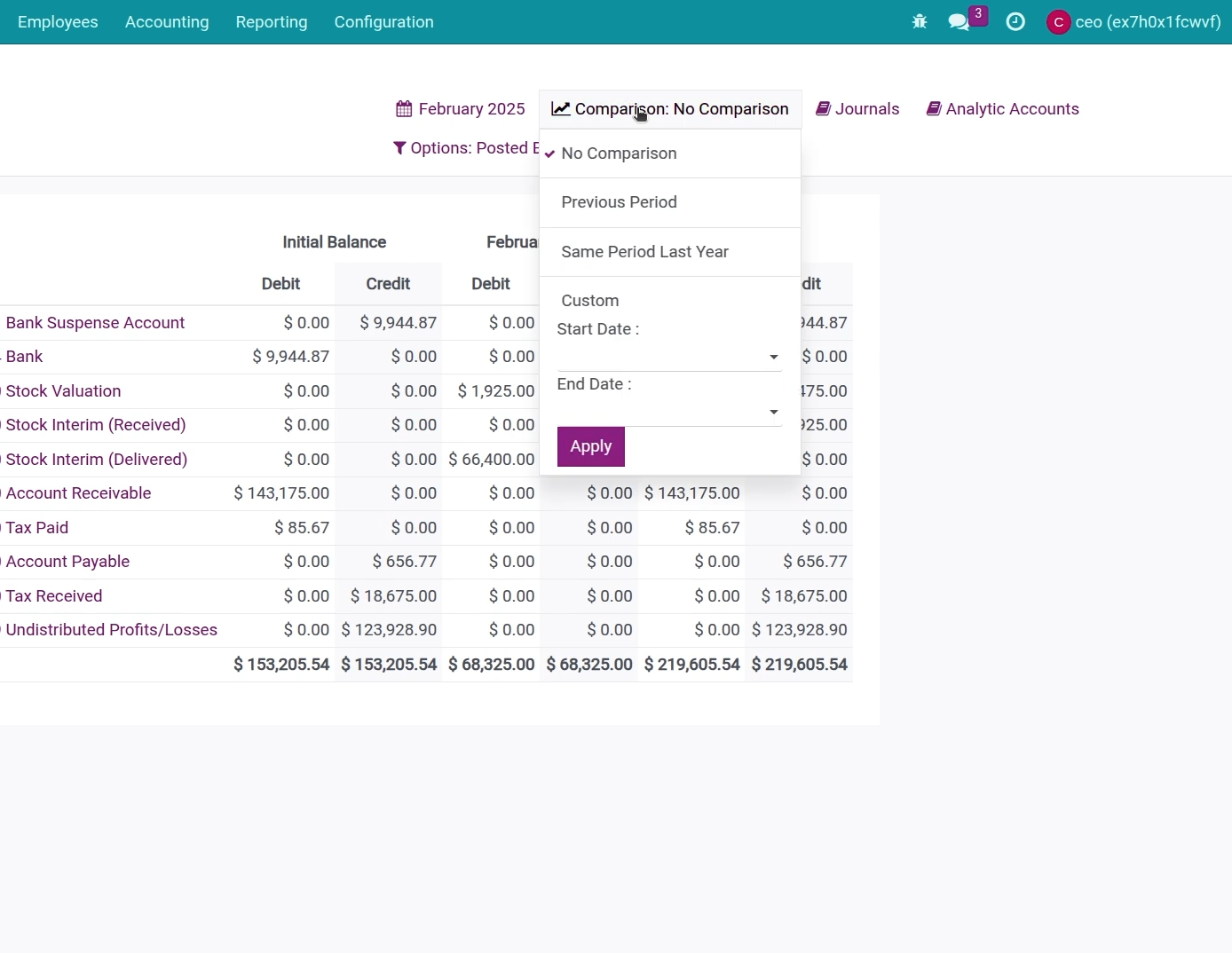

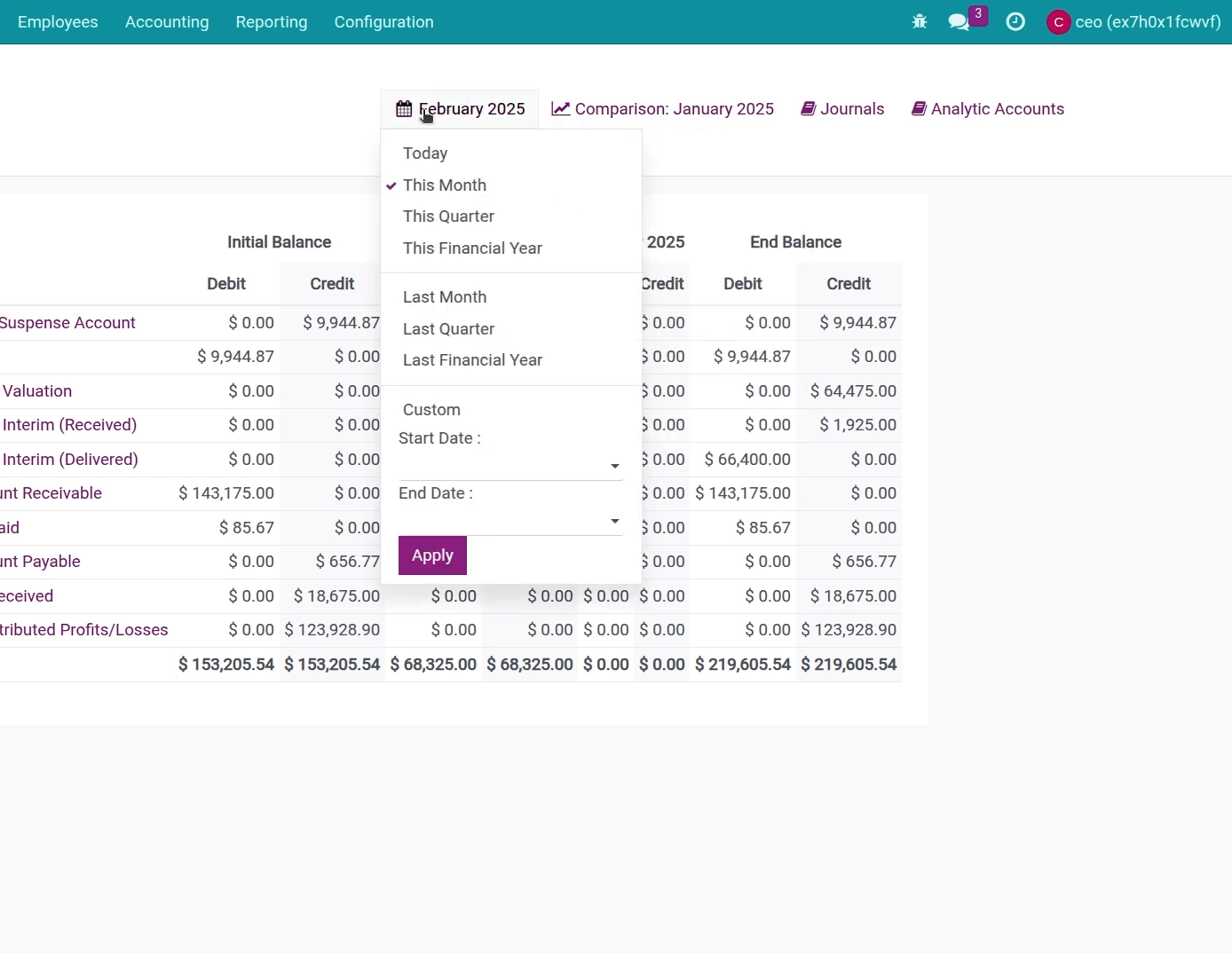

Filter and compare data of different report types according to the selected period (week/month/year)

Compare by period with interactive filters

Period compare

Date compare

Pre-Sales Question

Need help before purchasing? Share module name & version, edition (CE/EE), and the issue (trial, payment, installation). Attach screenshots if possible.

sales@viindoo.com

Support

For assistance, include your order number, issue description, expected resolution, and images/videos that replicate the issue.

apps.support@viindoo.com

Technical requirement

- Install the Accounting app as a prerequisite.

- Uninstall Odoo default Accounting Reports to avoid conflicts.

Changes log

- v1.1.0 – Initial release for Odoo 16 with financial statements, audit reports, partner aging, configurable criteria, and PDF/XLSX export.

Audience

Who should use this module?

Finance managers

Need timely financial packs for board meetings and banking discussions.

Accountants & auditors

Require drill-down ledgers, aging, and traceable criteria for audits.

Controllers & FP&A

Compare periods, monitor margins, and validate receivable/payable status.

Installation

- Navigate to Apps.

- Search with keyword to_account_reports.

- Press Install.

Note: To have a full feature-related observation of this module, you need install Accounting app.

Instruction

Instruction video: Accounting Reports

1. View the journal-related information in the dashboard menu.

Go to Accounting app > Dashboard, choose any kanban. Each kanban card is correlative with one journal in the Accounting app at this interface.

2. View the receivable report on the customer's contact.

Go to Accounting app > Customers > Customers, press Customer Ledger.

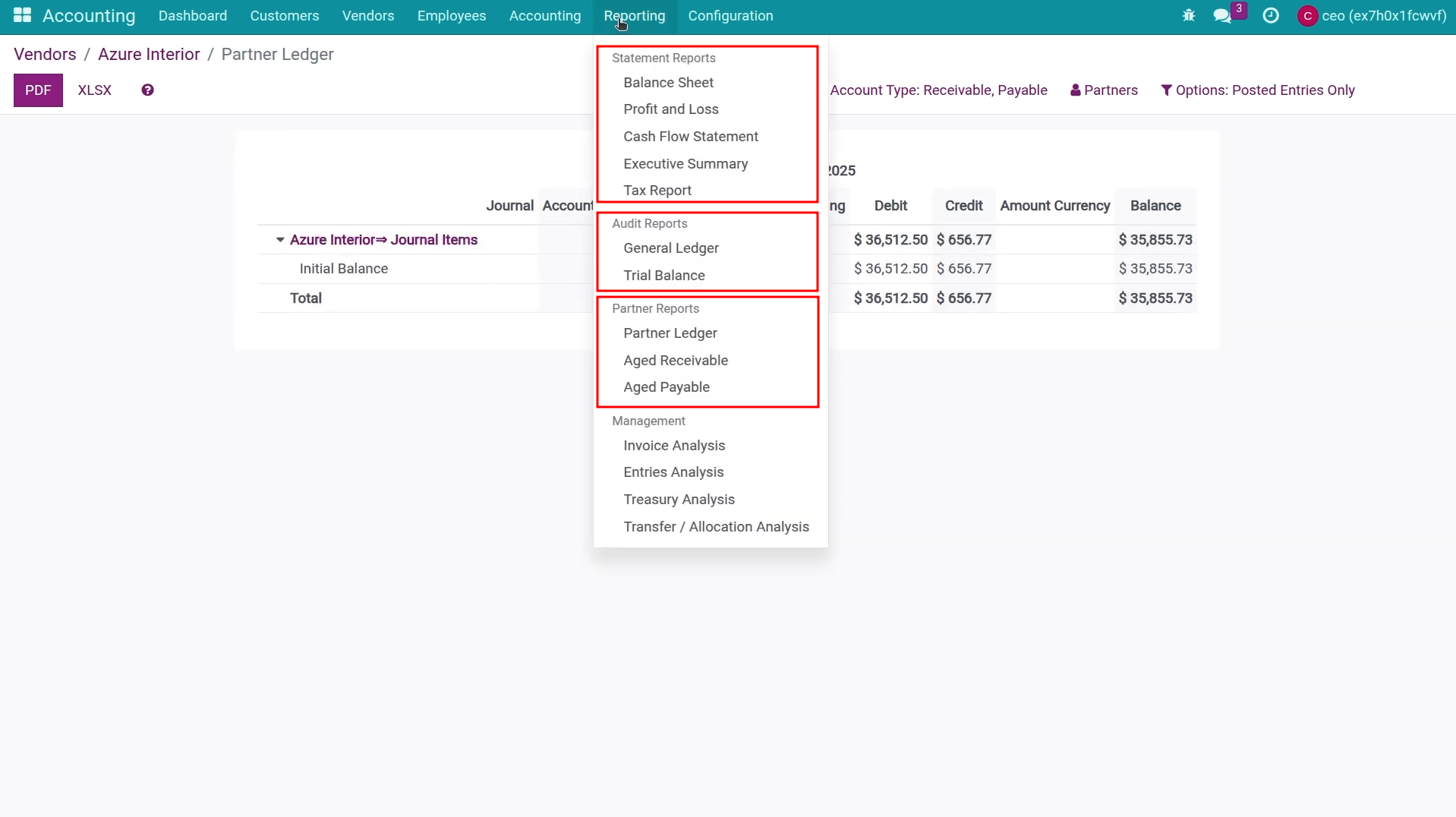

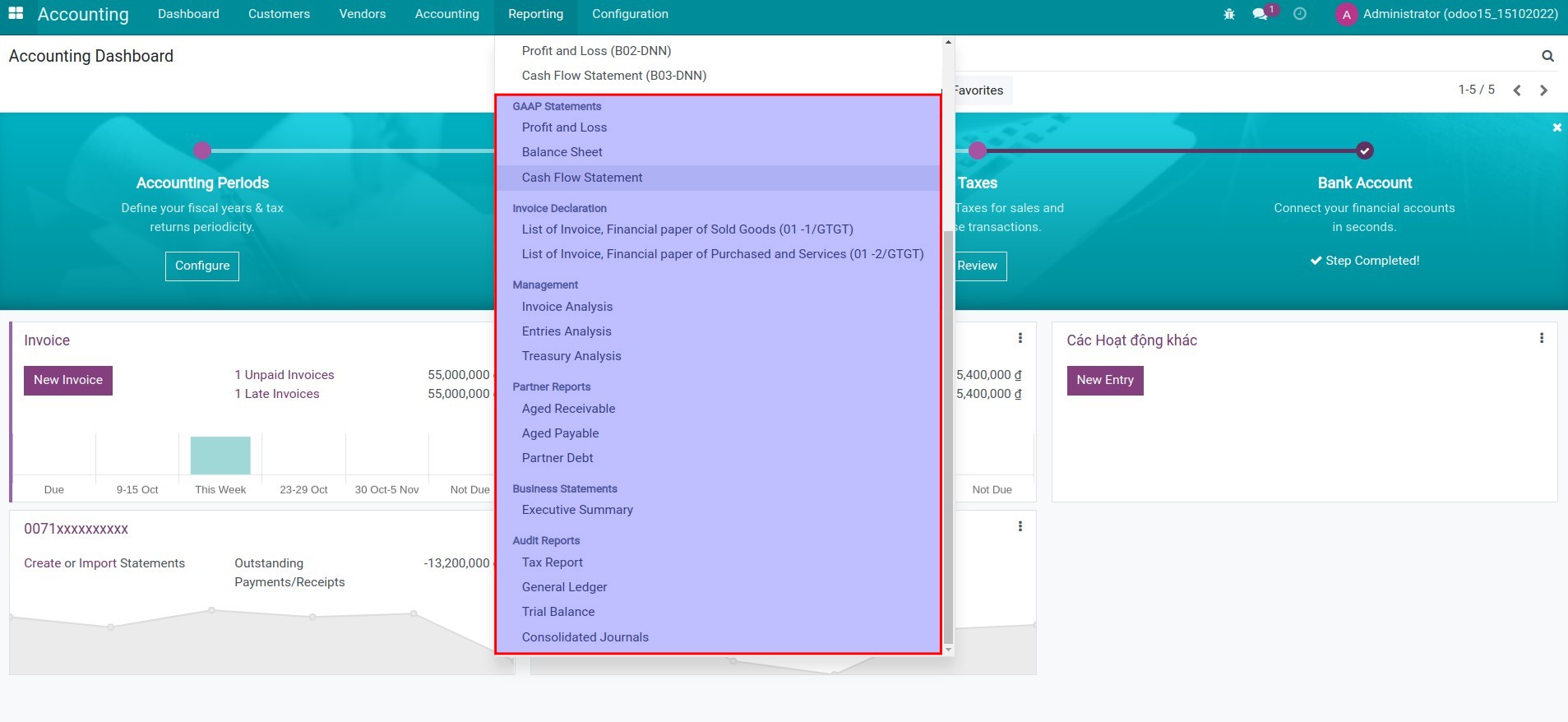

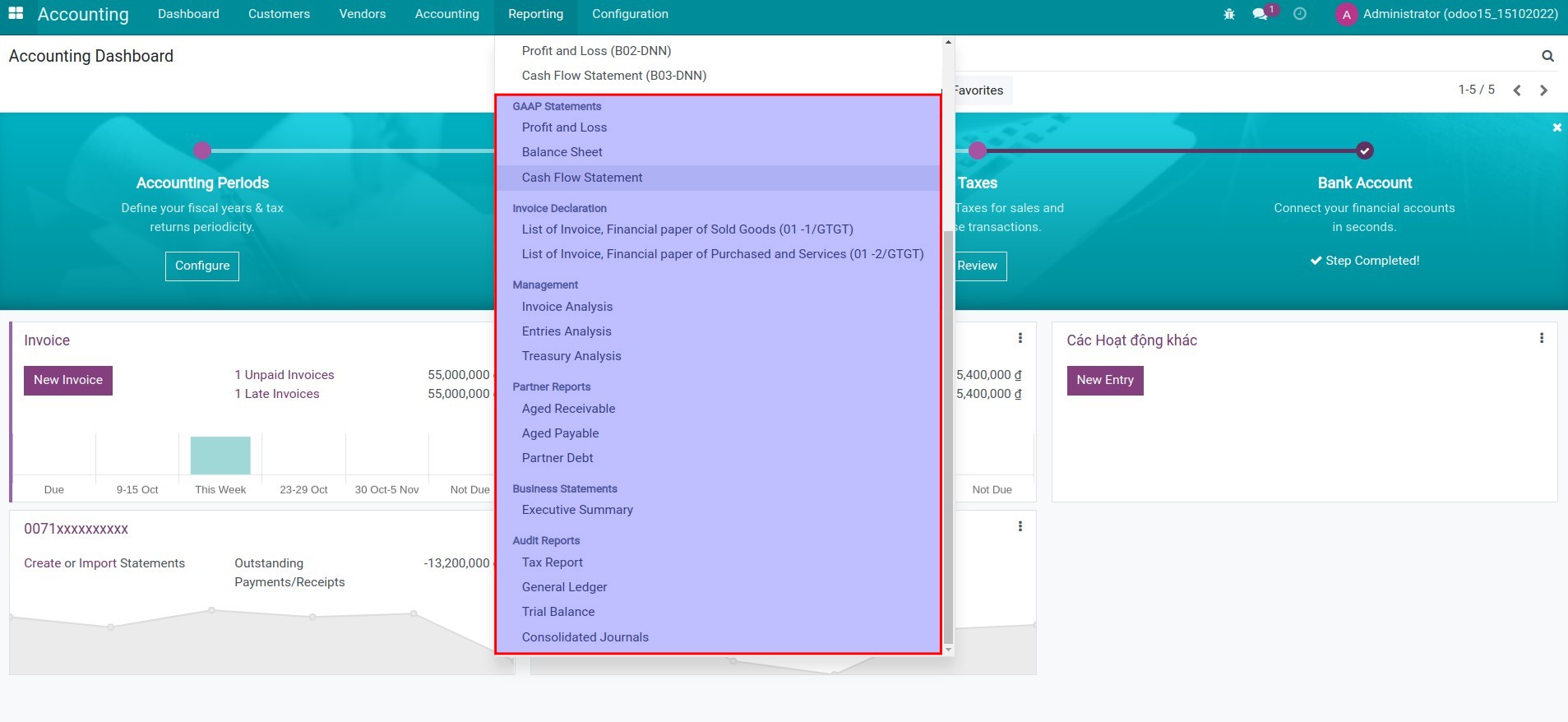

3. View the accounting reports.

Go to Accounting app > Reports.

- GAAP Statements:

- Profit and Loss;

- Balance Sheet;

- Cash Flow Statement.

- Management reports:

- Invoice Analysis;

- Entries Analysis;

- Treasury Analysis.

- Partner Reports:

- Aged Receivable;

- Aged Payable;

- Partner Debt.

- Business Statements (Executive Summary).

- Audit Reports:

- Tax Report;

- General Ledger;

- Trial Balance;

- Consolidated Journals.

- Note: In order to observer the financial reports according to Vietnam Accounting Standards (VAS), you need install module l10n_vn_viin_account_reports.

This software and associated files (the "Software") may only be

used

(executed, modified, executed after modifications) if you have

purchased a

valid license from the authors, typically via Odoo Apps,

or if you

have

received a written agreement from the authors of the

Software (see the

COPYRIGHT file).

You may develop Odoo modules that use the Software as a library

(typically

by depending on it, importing it and using its

resources), but

without

copying any source code or material from the

Software. You may distribute

those modules under the license of your

choice, provided that this

license

is compatible with the terms of

the Odoo Proprietary License (For

example:

LGPL, MIT, or proprietary

licenses similar to this one).

It is forbidden to publish, distribute, sublicense, or sell

copies of the

Software or modified copies of the Software.

The above copyright notice and this permission notice must be

included in

all copies or substantial portions of the Software.

THE SOFTWARE IS PROVIDED "AS IS", WITHOUT WARRANTY OF ANY KIND,

EXPRESS OR

IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF

MERCHANTABILITY,

FITNESS FOR A PARTICULAR PURPOSE AND

NONINFRINGEMENT. IN NO EVENT

SHALL THE

AUTHORS OR COPYRIGHT HOLDERS

BE LIABLE FOR ANY CLAIM, DAMAGES OR OTHER

LIABILITY, WHETHER IN AN

ACTION OF CONTRACT, TORT OR OTHERWISE,

ARISING

FROM, OUT OF OR IN

CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER

DEALINGS IN THE

SOFTWARE.