Demo video: Vietnam - Account Asset

Key Features:

- Fix depreciation computation according to Vietnam Accounting Standards.

- Support assets sold/disposed in the way in compliance with VAS.

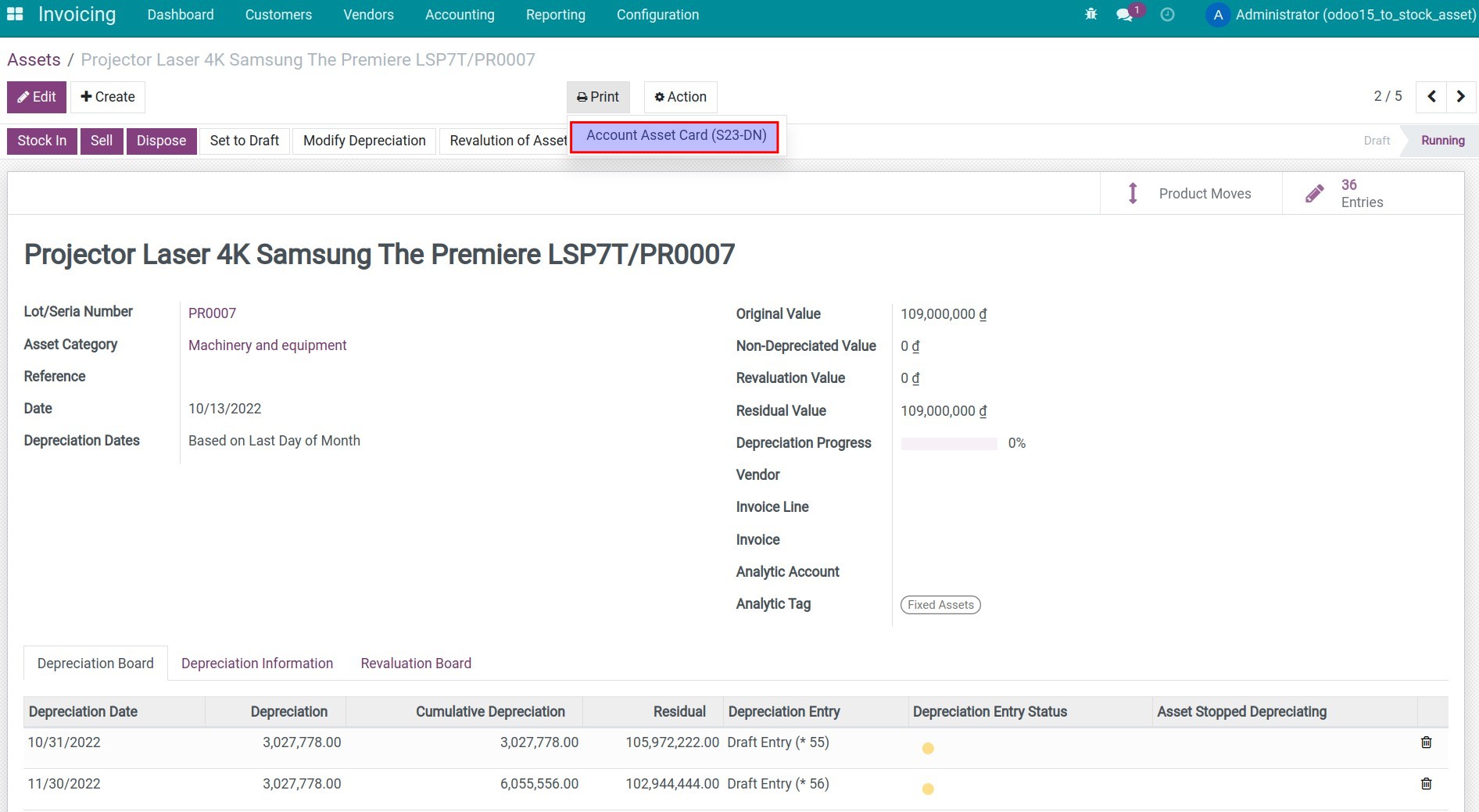

- Support printing Accounting Asset Card (S23-DN) of Financial Ministery.

- Support attach analytic tags on the journal items in order to build up the financial report as Vietnam Accounting Standards (VAS).

Example of a Full Process Demonstration (with sale/disposal activity)

Assumes the asset is purchased at the price of 1200 (in company currency).

1. Validate Vendor Bill when purchase Asset:

2. Payment:

3. Move asset into stock:

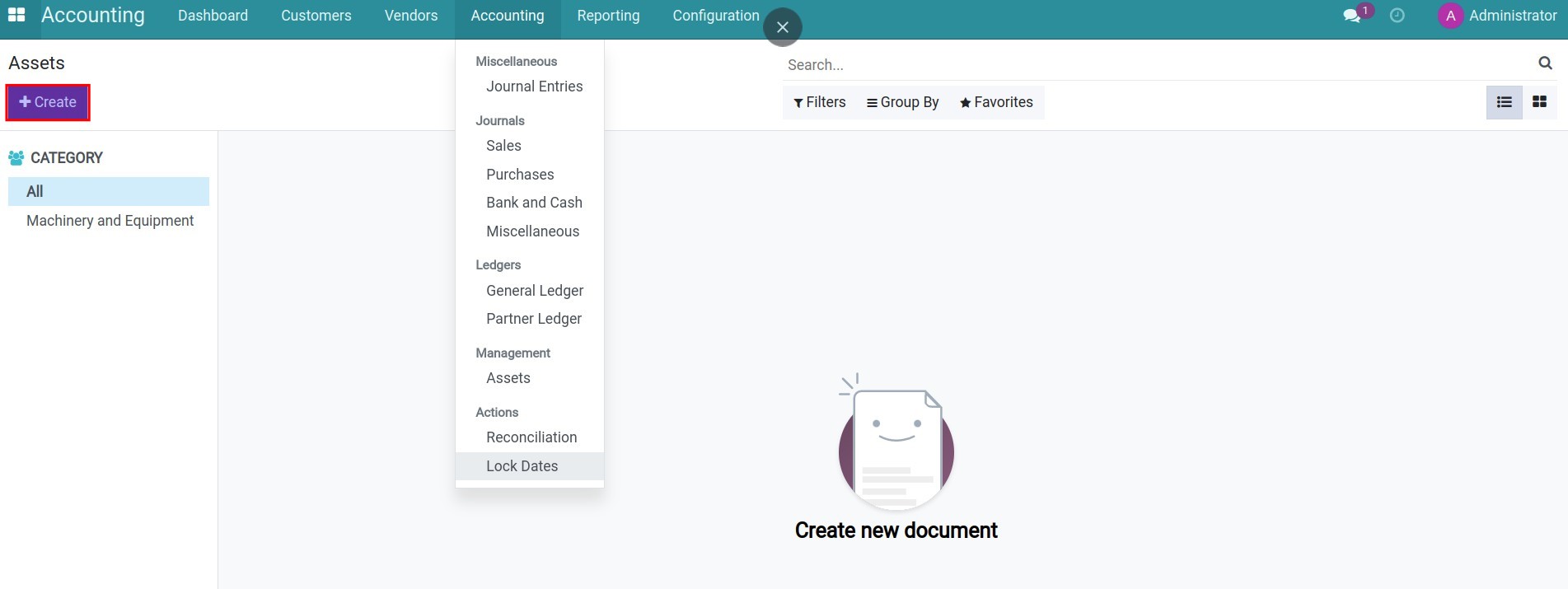

4. Asset Depreciation:

5. Asset Disposal/Sale:

6. Validate Customer Invoice (assume sold at 2000 VND):

7. Payment:

8. Asset Out from the Stock:

Balance:

- 811: 1100 (debit)

- 214: 0

- 211: 0

- 711: 2000 (credit)

- 151: 0

- 131: 0

- 331: 0

- 111: 800 (debit)

- 642: 100 (debit)

Editions Supported

- Community Edition

Installation

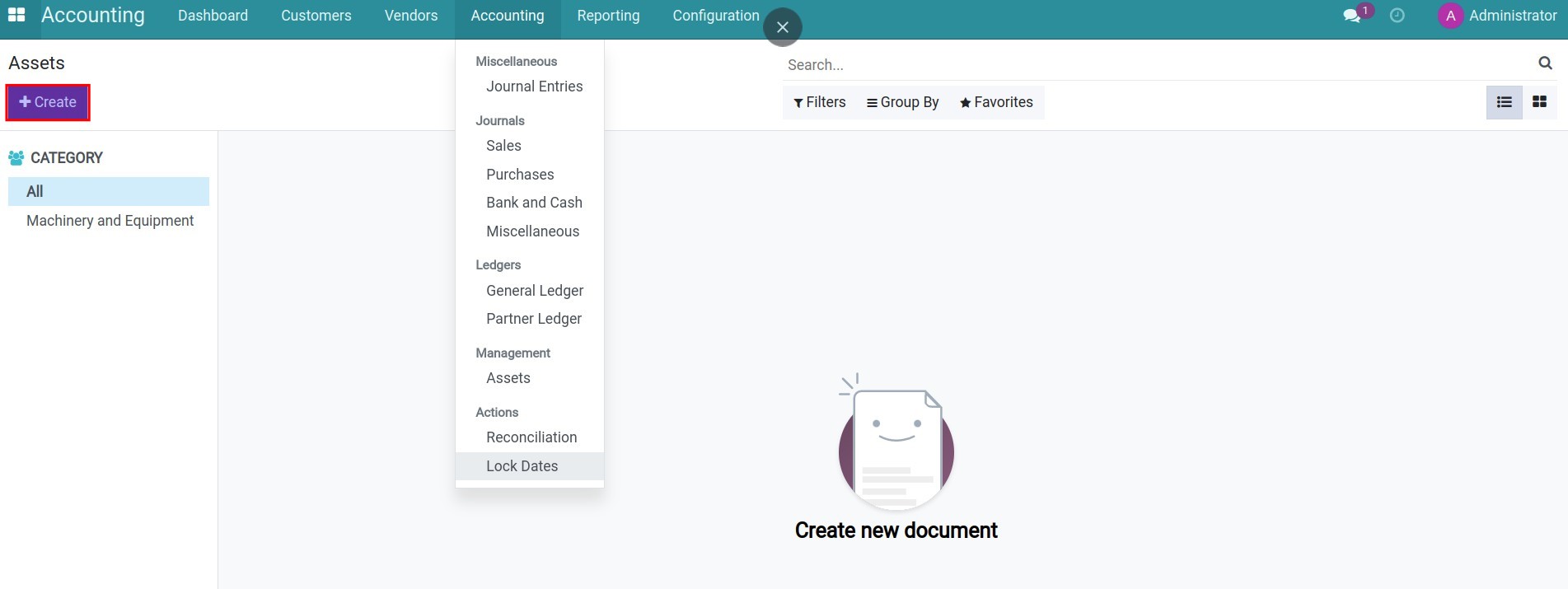

- Navigate to Apps.

- Search with keyword l10n_vn_viin_account_asset.

- Press Install.

Instruction

Instruction video: Vietnam - Account Asset

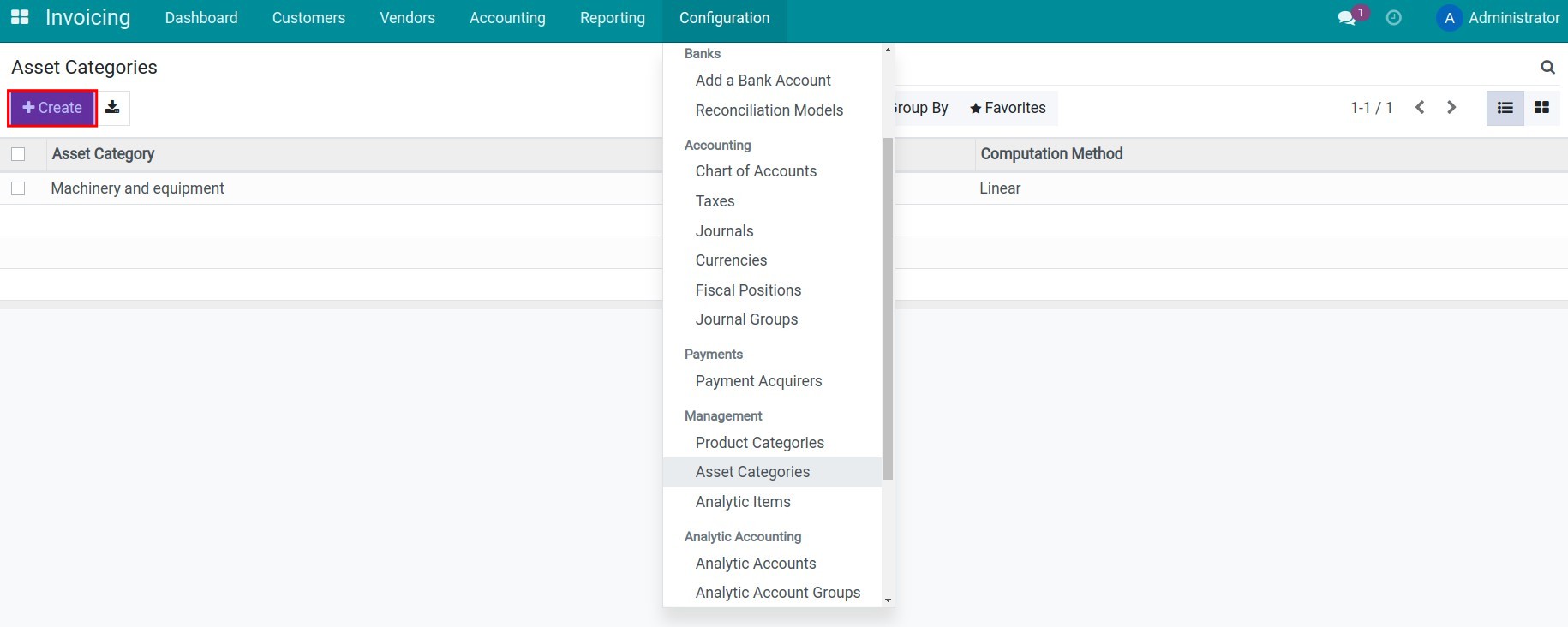

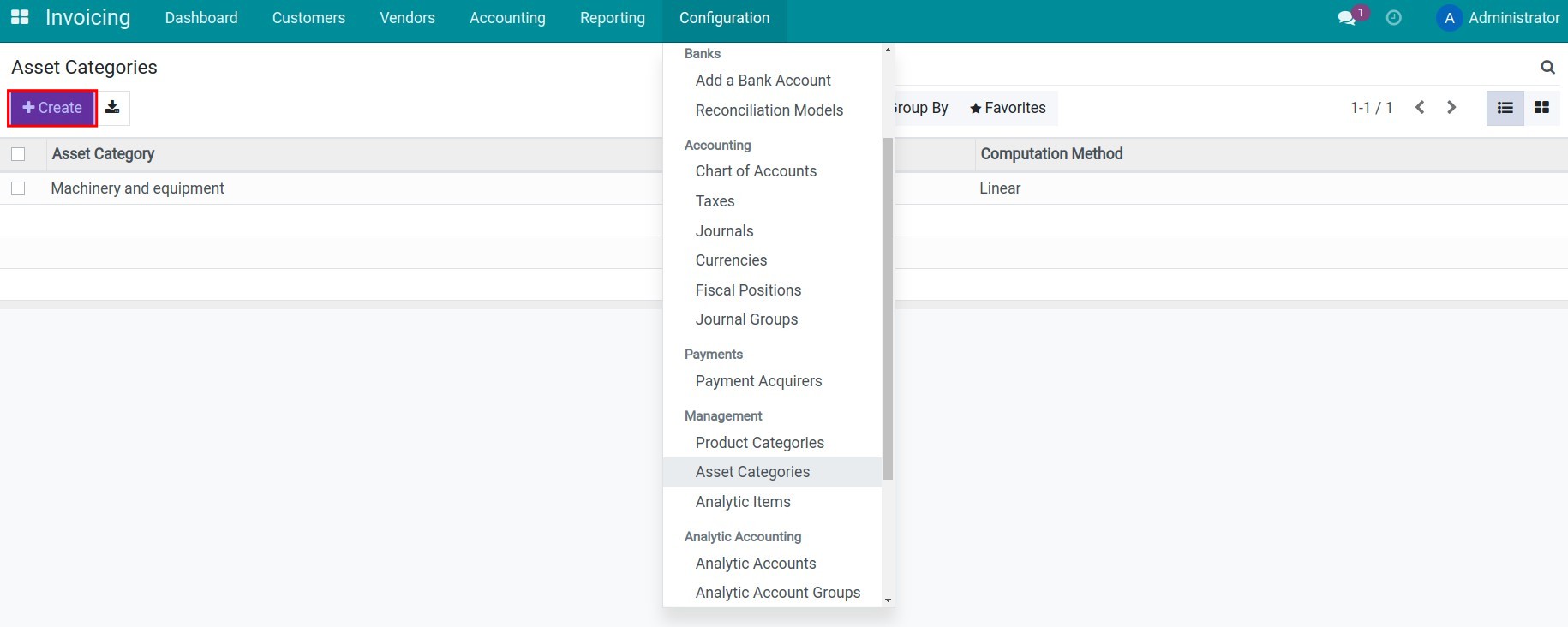

Step 1: Configure accounting accounts and depreciation method for the Asset Categories as Vietnam Accounting Standards (VAS).

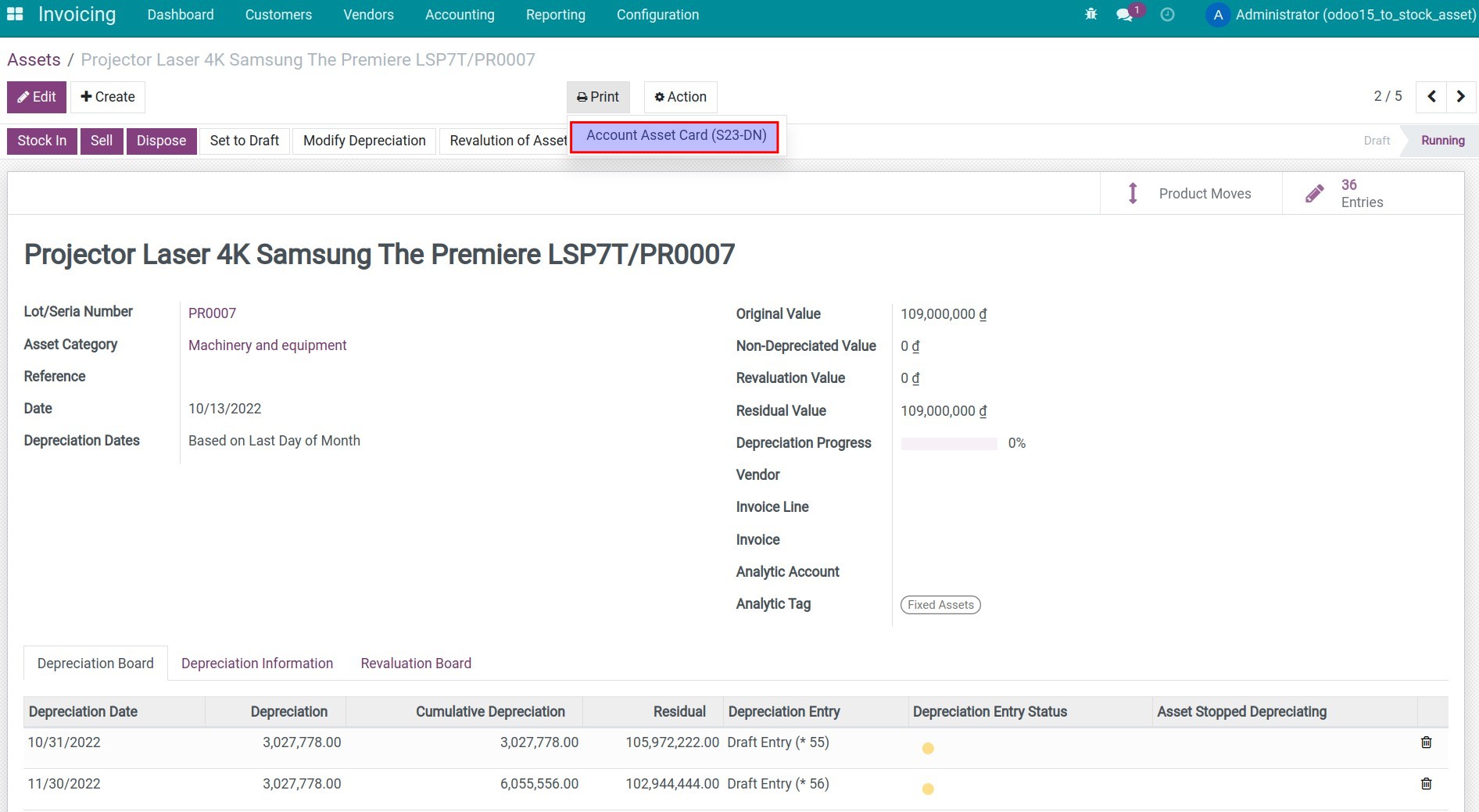

Step 2: Create an asset and configure depreciation information.

Step 3: Print Account Asset Card (S23-DN).

Note:

To create an asset category, you need to go to the Invoicing app > Configuration > Settings, search and activate Analytic Accounting feature.

After installing module l10n_vn_viin_account_asset, the system will automatically create some of the analytic tags. They are attached to the journal items in order to gather data on the financial statements as VAS.

- Example: Your company buys a computer with a value of 10.000.000 VND. It is allocated to an employee.

Journal entry as follows:

Debit 242: 10.000.000 (Analytic tag is Long-term prepaid expenses)

Credit 331: 10.000.000

This software and associated files (the "Software") may only be

used

(executed, modified, executed after modifications) if you have

purchased a

valid license from the authors, typically via Odoo Apps,

or if you

have

received a written agreement from the authors of the

Software (see the

COPYRIGHT file).

You may develop Odoo modules that use the Software as a library

(typically

by depending on it, importing it and using its

resources), but

without

copying any source code or material from the

Software. You may distribute

those modules under the license of your

choice, provided that this

license

is compatible with the terms of

the Odoo Proprietary License (For

example:

LGPL, MIT, or proprietary

licenses similar to this one).

It is forbidden to publish, distribute, sublicense, or sell

copies of the

Software or modified copies of the Software.

The above copyright notice and this permission notice must be

included in

all copies or substantial portions of the Software.

THE SOFTWARE IS PROVIDED "AS IS", WITHOUT WARRANTY OF ANY KIND,

EXPRESS OR

IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF

MERCHANTABILITY,

FITNESS FOR A PARTICULAR PURPOSE AND

NONINFRINGEMENT. IN NO EVENT

SHALL THE

AUTHORS OR COPYRIGHT HOLDERS

BE LIABLE FOR ANY CLAIM, DAMAGES OR OTHER

LIABILITY, WHETHER IN AN

ACTION OF CONTRACT, TORT OR OTHERWISE,

ARISING

FROM, OUT OF OR IN

CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER

DEALINGS IN THE

SOFTWARE.