Revenue Forecasting is a vital instrument for businesses aiming to thrive and expand in the competitive landscape of today's market. It plays a pivotal role in predicting future earnings, enabling companies to make informed choices regarding investments, marketing strategies, and various critical aspects of their operations. Within this article, Viindoo will delve into the various techniques and models employed in revenue forecasting, underscore its significance, and explore effective methods for its execution.

What is Revenue Forecasting?

Revenue forecasting is the process of predicting the amount of revenue a business will generate over a specific period, usually one year. It involves analyzing historical data, current trends, market conditions, and other relevant factors that affect revenue. The goal of revenue forecasting is to provide accurate predictions that businesses can use to plan and budget accordingly.

What is Revenue Forecasting

Revenue Projection vs. Forecast

While revenue projection and revenue forecast may sound similar, they have distinct differences. Revenue projection refers to an estimated amount of revenue a business expects to earn based on assumptions about the future. It tends to focus on goals and targets rather than actual data. On the other hand, revenue forecasting uses historical data, market trends, and other statistical methods to predict future revenue. It provides a more accurate picture of what a business can expect to earn in the upcoming period.

| Revenue Forecast | Revenue Projection | |

| Definition | A hypothetical estimate of future revenue based on a variety of assumptions, such as historical data, market trends, and future plans. | A best estimate of future revenue based on current conditions, plans, and intentions. |

| Purpose | To explore potential scenarios and inform strategic and operational decisions. | To guide day-to-day decision-making and track progress towards financial goals. |

| Time horizon | Typically longer-term (e.g., 3-5 years or more). | Typically shorter-term (e.g., quarterly or annually). |

| Flexibility | More flexible, as it allows for different assumptions and scenarios to be tested. | Less flexible, as it is based on current conditions and plans. |

| Use cases | To support strategic planning, investment decisions, and risk management. | To track progress towards financial goals, budget for expenses, and make informed tactical decisions. |

Popular revenue forecasting methods

There are many different revenue forecast models that businesses can use. The best model for a particular business will depend on a number of factors, such as the type of business, the industry, and the availability of data. Some of the most common revenue forecast models include:

Pipeline Revenue Forecasting

This method relies on the sales pipeline, estimating revenue based on deals likely to close. It's particularly useful for businesses with longer sales cycles, offering accurate forecasts based on historical sales performance.

Example: For a B2B software company, the sales team maintains a pipeline of deals at various stages, from initial contact to closure. By analyzing historical data on conversion rates at each stage, you can estimate which deals are likely to close in the upcoming quarter, providing a pipeline revenue forecast.

Bottom-Up Forecasting

This approach uses detailed product and customer data to predict revenue. By analyzing data from various channels and pricing tiers, businesses create accurate forecasts based on specific drivers. Bottom-up models align forecasts with business goals.

Example: Suppose you run an e-commerce company with multiple product categories. You collect data on customer demographics, website traffic, and conversion rates for each category. By analyzing these data points separately, you can create a bottom-up forecast for revenue by predicting sales for each product category and aggregating them to determine total revenue.

Top-Down Forecasting

In contrast, top-down forecasting starts with a macro view, examining the total addressable market and potential market share before deriving revenue projections. This approach is valuable for assessing overall market potential.

Example: Imagine you're launching a new smartphone in a competitive market. You start with a top-down approach by examining the total addressable market for smartphones in your target region, estimating market share based on competitors' performance, and then projecting your revenue by multiplying your expected market share by the total market size.

Moving Average

Moving average forecasts analyze short-term trends by examining revenue data over months or quarters. This method suits seasonal businesses, helping them manage cash flow and make strategic decisions based on historical fluctuations.

Example: Consider a retail business specializing in winter sports equipment. Using a three-month moving average, you analyze sales data for winter products over several years. This allows you to identify seasonal trends, such as increased sales in November and December, helping you forecast future revenue for these months.

Linear Regression

Linear regression assesses relationships between variables like sales and profit to identify how they affect revenue. It's valuable for identifying issues in growth strategies, such as stagnant profits despite increasing sales.

Example: A software company uses linear regression to understand the relationship between its marketing expenditure and monthly revenue. By analyzing historical data, it identifies a strong positive correlation between increased marketing spend and revenue growth. This model helps predict revenue based on marketing budget changes.

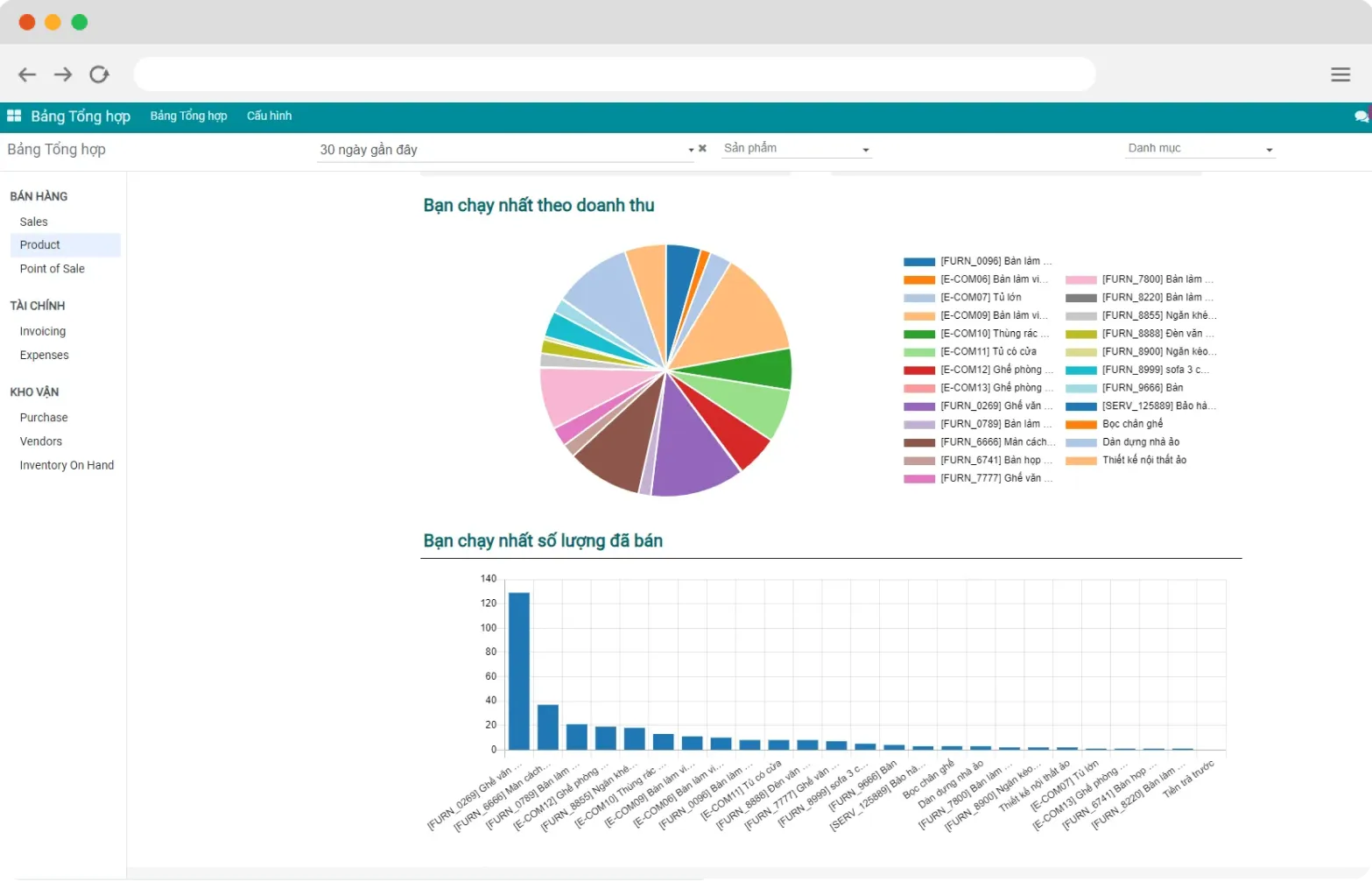

Revenue forecasting in Viindoo Software

Straight-Line

This simple model assumes consistent historical growth rates will continue in the future. While straightforward, it may not always be the most accurate due to changing circumstances.

Example: A small bakery has experienced consistent annual revenue growth of 8% over the past three years. Using the straight-line method, they project an 8% growth rate for the upcoming year. While it assumes continuity, this method provides a starting point for planning.

Advice for Effective Revenue Forecasting

Here are some tips for effective revenue forecasting:Effective Sales software

- Use a variety of data sources. This will help you to get a more complete picture of your business and to identify any potential risks or opportunities. Some of the data sources that you may want to consider include historical sales data, customer data, market research data, and economic data.

- Understand your revenue drivers. What are the factors that have the biggest impact on your revenue? Once you understand your revenue drivers, you can start to track them and develop forecasts that take into account changes in these factors.

- Use the right forecasting model. There are many different revenue forecasting models available. The best model for your business will depend on a number of factors, such as the type of business, the industry, and the availability of data. The best way to choose a revenue forecast model is to consider the specific needs of the business. Businesses should also consider using multiple models to get a more accurate forecast.

- Update your forecast regularly. Your revenue forecast should be a living document that is updated regularly to reflect changes in market conditions and in your own business performance.

- Use Software Tools: There are many software tools available that can help you with revenue forecasting. These tools use advanced statistical modeling and machine learning algorithms to make accurate predictions.

Discover Viindoo ERP Software

Automate revenue forecasting optimizes sales strategy and enhances cash flow with strategic decision-making based on precise analytics.

FAQs

Revenue forecasting is essential for making informed decisions about budgeting, staffing, marketing, and other areas of a business.

There are several methods for revenue forecasting, including qualitative methods, quantitative methods, and mixed methods.

A business should update its revenue forecast regularly, ideally on a monthly or quarterly basis.

Improving sales velocity is usually a long-term effort that requires strategic planning and consistent execution. However, some tactics, such as reducing sales cycle length or increasing win rates, can have a more immediate impact.

Conclusion

Revenue forecasting is a critical component of business planning and decision-making. By accurately predicting future revenue streams, businesses can make informed decisions about resource allocation, growth opportunities, and profitability. While revenue forecasting is not an exact science, following a systematic approach and using reliable data can help businesses make more accurate predictions and achieve their goals.